Harlan Vaughn's Blog, page 16

May 2, 2019

Hacking Uber: Earn Points, Cashback, and Credits Every Time You Ride

Updated 5/2/19.

I’ve been riding Uber more lately because they make it so easy to stack multiple offers when you ride.

Oh, Uber. I am “getting there”

And, I’m hopeful they’re slowly but surely turning things around.

With Lyft, you can only earn 1X Delta miles – and 30 JetBlue points on airport trips. Which, meh.

I’d rather earn cashback and Drop points, use travel credits, and get Uber credits for shopping around town. And many times you can stack these deals. You know I love a good stack!

1. Earn points and get cashback with Freebird

Link: Download Freebird

I wrote how easy it is to stack promo codes to save every time you ride with Uber or Lyft with Freebird.

This app is basically the best thing since sliced bread. You can earn points, which you can redeem for cashback directly loaded to your debit card. And often, you can stack promo codes to get even more cold hard cash.

My best tip: get Freebird for free cashback on Uber rides!

Plus, if you have any Uber credits or promo codes, they all stack. If you only save on Uber with one tip in this article, this is it. Download Freebird here.

2. Earn cashback with Pei

Link: Download Pei

Nothing to see here… except more FREE cashback for Uber rides.

Pei also earns cashback when you link your cards and spend on Uber rides

The amount you’ll get from each merchant varies between 1% and 10% cashback, and Uber rates fluctuate too.

That said, the app is free to have and the cashback adds up surprisingly fast. I’m super impressed with it so far – it might even be my fave cashback app at the moment.

3. 10 Drop points per $1 spent

Link: Download Drop

Another easy win. Another app. This one’s set it and forget it.

Raking in the Drop points

You earn 10 drop points per $1 spent on Uber rides. Just download the app (you get $1 if you’re new to Drop), link your cards, and let Drop track the transactions. When you ride with Uber, you’ll see Drop points a couple of days later.

You can redeem Drop points for gift cards to popular merchants like Amazon, Starbucks, iTunes, Groupon… and many more. Beyond download the app and linking your cards, this one is literally effortless. Just make sure to select Uber as one of your 5 ongoing offers. And peek at the app every once in a while to see if you can get a free gift card.

4. Visa Local Offers

This one’s only for select cities, but it’s worth checking in the Uber app to see if you can join.

Uber credits when you link a Visa card

To check, open the app and click “Settings” from the menu in the top left. Scroll down to “Rewards” and see if you can opt-in. If you can, definitely do! Here’s what I see in Dallas:

10% at many merchants

My deals are mostly for restaurants, but Whole Foods caught my eye. There was also a local salon and coffee shop, so it’s not all restaurants. Although it overwhelmingly is.

That doesn’t bother me because I use my Chase Sapphire Reserve for dining anyway. And that’s a Visa.

The way it works is you pay with your Visa card, then the cashback percentage is added to your Uber account as a ride credit. So if you spend $50 on dinner or groceries, you can $5 off your next Uber ride.

And when you stack it with Ibotta and Drop, you get $1 back and 10 Drop points per $1 spent, too. Plus points from using a travel credit card. Pretty easy quadruple dip here. And when you can opt-in, you might find surprise credits in your Uber account for dining out.

And for the love of god, please sign up for a dining rewards program and earn some extra airline miles, too.

5. Travel credits!

I love this one. Lately, I’ve been using my US Bank Altitude Reserve Visa to pay for Uber rides. I have $325 in travel credits to use this year, and by god I’m gonna get my money’s worth.

Luckily, Uber rides count toward the credit. Many cards come with travel credits these daze:

$200 in Uber rides with Amex Platinum Card ($550 annual fee – learn more here)

$300 in travel credits from Chase Sapphire Reserve ($450 annual fee)

$325 in travel credits from US Bank Altitude Reserve ($400 annual fee)

That’s $825 in reimbursed rides each year.

These cards come with hefty annual fees. But in the case of the US Bank Altitude Reserve card, the $325 back in Uber rides brings the $400 annual fee down to $75. Plus, I get 12 Gogo passes for in-flight wifi, 3X points on mobile payments, and I got a sweet $750 sign-up bonus. All in all, a major score.

When you use travel credits, you can also get:

Freebird points for paying with your card

Pei cashback

10X Drop points

A completely free ride

I have a lot of these travel credits to burn. So getting all this back from every ride and the credit card/Drop points is gravy. If you’re in the market for a travel rewards card, thank you for using my links.

6. $2 in Shop Your Way Rewards for every ride

Link: Connect your Uber and Shop Your Way accounts

This one’s automatic and stacks with all the other offers on this page. After you connect your accounts, you can earn $1 in Shop Your Way rewards for every ride you take, up to a max of $20 each month.

Another easy win

There’s literally no effort beyond connecting your accounts, so you might as well get these rewards – they’re free and easy, so why not?

You can use your points to order free merch from Sears

Honorable mention: Hooch

Link: Download Hooch

For the sake of completion, I’ll throw in the Hooch app for those looking to make the absolute most of their Uber rides. You’ll earn 1% cashback for each ride, and like everything else, it all adds up.

Free money, come to meee

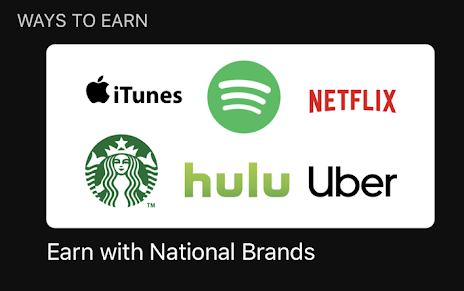

You’ll also earn 1% cashback at iTunes, Starbucks, Netflix, Shake Shack, Spotify, Uber Eats, and Hulu. And you can redeem your rewards for gift cards. I have $18 so far – not bad! And again, this app is free to have.

Bottom line

Gotta say, Uber is making it really easy to rake in extra points, cashback, and credits with a combination of deals out there right now. You can get:

Points for every ride with the Freebird app (and cashback with these promo codes!)

Free cashback when you download Pei and link your cards

10 Drop points per $1 spent with the Drop app

Up to 10% back in credits through Visa Local Offers

Travel credits with certain travel rewards cards

$1 in Shop Your Way rewards for every ride, up to $20 per month

1% cashback when you link cards to Hooch

You also get the points you’d normally earn for paying with the right travel rewards card. And you can stack these in any combination!

At the very least, you should get points from Freebird by booking through their app and cashback by setting up Pei once and letting it go. Visa Local Offers is opt-in and automatic, so that’s easy as well if it’s available in your city.

The other stuff – travel credits and extra credit card points – requires a little more planning, but man… if you can get a good stack going, the Uber savings are pretty great.

Are there other ways to save on Uber that I missed?

Hacking Uber: Earn Points, Cashback, and Credits Every Time You Ride

Updated 5/2/19.

I’ve been riding Uber more lately because they make it so easy to stack multiple offers when you ride.

Oh, Uber. I am “getting there”

And, I’m hopeful they’re slowly but surely turning things around.

With Lyft, you can only earn 1X Delta miles – and 30 JetBlue points on airport trips. Which, meh.

I’d rather earn cashback and Drop points, use travel credits, and get Uber credits for shopping around town. And many times you can stack these deals. You know I love a good stack!

1. Earn points and get cashback with Freebird

Link: Download Freebird

I wrote how easy it is to stack promo codes to save every time you ride with Uber or Lyft with Freebird.

This app is basically the best thing since sliced bread. You can earn points, which you can redeem for cashback directly loaded to your debit card. And often, you can stack promo codes to get even more cold hard cash.

My best tip: get Freebird for free cashback on Uber rides!

Plus, if you have any Uber credits or promo codes, they all stack. If you only save on Uber with one tip in this article, this is it. Download Freebird here.

2. Earn cashback with Pei

Link: Download Pei

Nothing to see here… except more FREE cashback for Uber rides.

Pei also earns cashback when you link your cards and spend on Uber rides

The amount you’ll get from each merchant varies between 1% and 10% cashback, and Uber rates fluctuate too.

That said, the app is free to have and the cashback adds up surprisingly fast. I’m super impressed with it so far – it might even be my fave cashback app at the moment.

3. 10 Drop points per $1 spent

Link: Download Drop

Another easy win. Another app. This one’s set it and forget it.

Raking in the Drop points

You earn 10 drop points per $1 spent on Uber rides. Just download the app (you get $1 if you’re new to Drop), link your cards, and let Drop track the transactions. When you ride with Uber, you’ll see Drop points a couple of days later.

You can redeem Drop points for gift cards to popular merchants like Amazon, Starbucks, iTunes, Groupon… and many more. Beyond download the app and linking your cards, this one is literally effortless. Just make sure to select Uber as one of your 5 ongoing offers. And peek at the app every once in a while to see if you can get a free gift card.

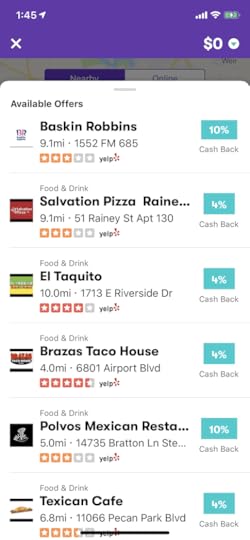

4. Visa Local Offers

This one’s only for select cities, but it’s worth checking in the Uber app to see if you can join.

Uber credits when you link a Visa card

To check, open the app and click “Settings” from the menu in the top left. Scroll down to “Rewards” and see if you can opt-in. If you can, definitely do! Here’s what I see in Dallas:

10% at many merchants

My deals are mostly for restaurants, but Whole Foods caught my eye. There was also a local salon and coffee shop, so it’s not all restaurants. Although it overwhelmingly is.

That doesn’t bother me because I use my Chase Sapphire Reserve for dining anyway. And that’s a Visa.

The way it works is you pay with your Visa card, then the cashback percentage is added to your Uber account as a ride credit. So if you spend $50 on dinner or groceries, you can $5 off your next Uber ride.

And when you stack it with Ibotta and Drop, you get $1 back and 10 Drop points per $1 spent, too. Plus points from using a travel credit card. Pretty easy quadruple dip here. And when you can opt-in, you might find surprise credits in your Uber account for dining out.

And for the love of god, please sign up for a dining rewards program and earn some extra airline miles, too.

5. Travel credits!

I love this one. Lately, I’ve been using my US Bank Altitude Reserve Visa to pay for Uber rides. I have $325 in travel credits to use this year, and by god I’m gonna get my money’s worth.

Luckily, Uber rides count toward the credit. Many cards come with travel credits these daze:

$200 in Uber rides with Amex Platinum Card ($550 annual fee – learn more here)

$300 in travel credits from Chase Sapphire Reserve ($450 annual fee)

$325 in travel credits from US Bank Altitude Reserve ($400 annual fee)

That’s $825 in reimbursed rides each year.

These cards come with hefty annual fees. But in the case of the US Bank Altitude Reserve card, the $325 back in Uber rides brings the $400 annual fee down to $75. Plus, I get 12 Gogo passes for in-flight wifi, 3X points on mobile payments, and I got a sweet $750 sign-up bonus. All in all, a major score.

When you use travel credits, you can also get:

Freebird points for paying with your card

Pei cashback

10X Drop points

A completely free ride

I have a lot of these travel credits to burn. So getting all this back from every ride and the credit card/Drop points is gravy. If you’re in the market for a travel rewards card, thank you for using my links.

6. $2 in Shop Your Way Rewards for every ride

Link: Connect your Uber and Shop Your Way accounts

This one’s automatic and stacks with all the other offers on this page. After you connect your accounts, you can earn $1 in Shop Your Way rewards for every ride you take, up to a max of $20 each month.

Another easy win

There’s literally no effort beyond connecting your accounts, so you might as well get these rewards – they’re free and easy, so why not?

You can use your points to order free merch from Sears

Honorable mention: Hooch

Link: Download Hooch

For the sake of completion, I’ll throw in the Hooch app for those looking to make the absolute most of their Uber rides. You’ll earn 1% cashback for each ride, and like everything else, it all adds up.

Free money, come to meee

You’ll also earn 1% cashback at iTunes, Starbucks, Netflix, Shake Shack, Spotify, Uber Eats, and Hulu. And you can redeem your rewards for gift cards. I have $18 so far – not bad! And again, this app is free to have.

Bottom line

Gotta say, Uber is making it really easy to rake in extra points, cashback, and credits with a combination of deals out there right now. You can get:

Points for every ride with the Freebird app (and cashback with these promo codes!)

Free cashback when you download Pei and link your cards

10 Drop points per $1 spent with the Drop app

Up to 10% back in credits through Visa Local Offers

Travel credits with certain travel rewards cards

$1 in Shop Your Way rewards for every ride, up to $20 per month

1% cashback when you link cards to Hooch

You also get the points you’d normally earn for paying with the right travel rewards card. And you can stack these in any combination!

At the very least, you should get points from Freebird by booking through their app and cashback by setting up Pei once and letting it go. Visa Local Offers is opt-in and automatic, so that’s easy as well if it’s available in your city.

The other stuff – travel credits and extra credit card points – requires a little more planning, but man… if you can get a good stack going, the Uber savings are pretty great.

Are there other ways to save on Uber that I missed?

Hacking Uber: Earn Points, Cashback, and Credits Every Time You Ride

Updated 5/2/19.

I’ve been riding Uber more lately because they make it so easy to stack multiple offers when you ride.

Oh, Uber. I am “getting there”

And, I’m hopeful they’re slowly but surely turning things around.

With Lyft, you can only earn 1X Delta miles – and 30 JetBlue points on airport trips. Which, meh.

I’d rather earn cashback and Drop points, use travel credits, and get Uber credits for shopping around town. And many times you can stack these deals. You know I love a good stack!

1. Earn points and get cashback with Freebird

Link: Download Freebird

I wrote how easy it is to stack promo codes to save every time you ride with Uber or Lyft with Freebird.

This app is basically the best thing since sliced bread. You can earn points, which you can redeem for cashback directly loaded to your debit card. And often, you can stack promo codes to get even more cold hard cash.

My best tip: get Freebird for free cashback on Uber rides!

Plus, if you have any Uber credits or promo codes, they all stack. If you only save on Uber with one tip in this article, this is it. Download Freebird here.

2. Earn cashback with Pei

Link: Download Pei

Nothing to see here… except more FREE cashback for Uber rides.

Pei also earns cashback when you link your cards and spend on Uber rides

The amount you’ll get from each merchant varies between 1% and 10% cashback, and Uber rates fluctuate too.

That said, the app is free to have and the cashback adds up surprisingly fast. I’m super impressed with it so far – it might even be my fave cashback app at the moment.

3. 10 Drop points per $1 spent

Link: Download Drop

Another easy win. Another app. This one’s set it and forget it.

Raking in the Drop points

You earn 10 drop points per $1 spent on Uber rides. Just download the app (you get $1 if you’re new to Drop), link your cards, and let Drop track the transactions. When you ride with Uber, you’ll see Drop points a couple of days later.

You can redeem Drop points for gift cards to popular merchants like Amazon, Starbucks, iTunes, Groupon… and many more. Beyond download the app and linking your cards, this one is literally effortless. Just make sure to select Uber as one of your 5 ongoing offers. And peek at the app every once in a while to see if you can get a free gift card.

4. Visa Local Offers

This one’s only for select cities, but it’s worth checking in the Uber app to see if you can join.

Uber credits when you link a Visa card

To check, open the app and click “Settings” from the menu in the top left. Scroll down to “Rewards” and see if you can opt-in. If you can, definitely do! Here’s what I see in Dallas:

10% at many merchants

My deals are mostly for restaurants, but Whole Foods caught my eye. There was also a local salon and coffee shop, so it’s not all restaurants. Although it overwhelmingly is.

That doesn’t bother me because I use my Chase Sapphire Reserve for dining anyway. And that’s a Visa.

The way it works is you pay with your Visa card, then the cashback percentage is added to your Uber account as a ride credit. So if you spend $50 on dinner or groceries, you can $5 off your next Uber ride.

And when you stack it with Ibotta and Drop, you get $1 back and 10 Drop points per $1 spent, too. Plus points from using a travel credit card. Pretty easy quadruple dip here. And when you can opt-in, you might find surprise credits in your Uber account for dining out.

And for the love of god, please sign up for a dining rewards program and earn some extra airline miles, too.

5. Travel credits!

I love this one. Lately, I’ve been using my US Bank Altitude Reserve Visa to pay for Uber rides. I have $325 in travel credits to use this year, and by god I’m gonna get my money’s worth.

Luckily, Uber rides count toward the credit. Many cards come with travel credits these daze:

$200 in Uber rides with Amex Platinum Card ($550 annual fee – learn more here)

$300 in travel credits from Chase Sapphire Reserve ($450 annual fee)

$325 in travel credits from US Bank Altitude Reserve ($400 annual fee)

That’s $825 in reimbursed rides each year.

These cards come with hefty annual fees. But in the case of the US Bank Altitude Reserve card, the $325 back in Uber rides brings the $400 annual fee down to $75. Plus, I get 12 Gogo passes for in-flight wifi, 3X points on mobile payments, and I got a sweet $750 sign-up bonus. All in all, a major score.

When you use travel credits, you can also get:

Freebird points for paying with your card

Pei cashback

10X Drop points

A completely free ride

I have a lot of these travel credits to burn. So getting all this back from every ride and the credit card/Drop points is gravy. If you’re in the market for a travel rewards card, thank you for using my links.

6. $2 in Shop Your Way Rewards for every ride

Link: Connect your Uber and Shop Your Way accounts

This one’s automatic and stacks with all the other offers on this page. After you connect your accounts, you can earn $1 in Shop Your Way rewards for every ride you take, up to a max of $20 each month.

Another easy win

There’s literally no effort beyond connecting your accounts, so you might as well get these rewards – they’re free and easy, so why not?

You can use your points to order free merch from Sears

Honorable mention: Hooch

Link: Download Hooch

For the sake of completion, I’ll throw in the Hooch app for those looking to make the absolute most of their Uber rides. You’ll earn 1% cashback for each ride, and like everything else, it all adds up.

Free money, come to meee

You’ll also earn 1% cashback at iTunes, Starbucks, Netflix, Shake Shack, Spotify, Uber Eats, and Hulu. And you can redeem your rewards for gift cards. I have $18 so far – not bad! And again, this app is free to have.

Bottom line

Gotta say, Uber is making it really easy to rake in extra points, cashback, and credits with a combination of deals out there right now. You can get:

Points for every ride with the Freebird app (and cashback with these promo codes!)

Free cashback when you download Pei and link your cards

10 Drop points per $1 spent with the Drop app

Up to 10% back in credits through Visa Local Offers

Travel credits with certain travel rewards cards

$1 in Shop Your Way rewards for every ride, up to $20 per month

1% cashback when you link cards to Hooch

You also get the points you’d normally earn for paying with the right travel rewards card. And you can stack these in any combination!

At the very least, you should get points from Freebird by booking through their app and cashback by setting up Pei once and letting it go. Visa Local Offers is opt-in and automatic, so that’s easy as well if it’s available in your city.

The other stuff – travel credits and extra credit card points – requires a little more planning, but man… if you can get a good stack going, the Uber savings are pretty great.

Are there other ways to save on Uber that I missed?

Hacking Uber: Earn Points, Cashback, and Credits Every Time You Ride

Updated 5/2/19.

I’ve been riding Uber more lately because they make it so easy to stack multiple offers when you ride.

Oh, Uber. I am “getting there”

And, I’m hopeful they’re slowly but surely turning things around.

With Lyft, you can only earn 1X Delta miles – and 30 JetBlue points on airport trips. Which, meh.

I’d rather earn cashback and Drop points, use travel credits, and get Uber credits for shopping around town. And many times you can stack these deals. You know I love a good stack!

1. Earn points and get cashback with Freebird

Link: Download Freebird

I wrote how easy it is to stack promo codes to save every time you ride with Uber or Lyft with Freebird.

This app is basically the best thing since sliced bread. You can earn points, which you can redeem for cashback directly loaded to your debit card. And often, you can stack promo codes to get even more cold hard cash.

My best tip: get Freebird for free cashback on Uber rides!

Plus, if you have any Uber credits or promo codes, they all stack. If you only save on Uber with one tip in this article, this is it. Download Freebird here.

2. Earn cashback with Pei

Link: Download Pei

Nothing to see here… except more FREE cashback for Uber rides.

Pei also earns cashback when you link your cards and spend on Uber rides

The amount you’ll get from each merchant varies between 1% and 10% cashback, and Uber rates fluctuate too.

That said, the app is free to have and the cashback adds up surprisingly fast. I’m super impressed with it so far – it might even be my fave cashback app at the moment.

3. 10 Drop points per $1 spent

Link: Download Drop

Another easy win. Another app. This one’s set it and forget it.

Raking in the Drop points

You earn 10 drop points per $1 spent on Uber rides. Just download the app (you get $1 if you’re new to Drop), link your cards, and let Drop track the transactions. When you ride with Uber, you’ll see Drop points a couple of days later.

You can redeem Drop points for gift cards to popular merchants like Amazon, Starbucks, iTunes, Groupon… and many more. Beyond download the app and linking your cards, this one is literally effortless. Just make sure to select Uber as one of your 5 ongoing offers. And peek at the app every once in a while to see if you can get a free gift card.

4. Visa Local Offers

This one’s only for select cities, but it’s worth checking in the Uber app to see if you can join.

Uber credits when you link a Visa card

To check, open the app and click “Settings” from the menu in the top left. Scroll down to “Rewards” and see if you can opt-in. If you can, definitely do! Here’s what I see in Dallas:

10% at many merchants

My deals are mostly for restaurants, but Whole Foods caught my eye. There was also a local salon and coffee shop, so it’s not all restaurants. Although it overwhelmingly is.

That doesn’t bother me because I use my Chase Sapphire Reserve for dining anyway. And that’s a Visa.

The way it works is you pay with your Visa card, then the cashback percentage is added to your Uber account as a ride credit. So if you spend $50 on dinner or groceries, you can $5 off your next Uber ride.

And when you stack it with Ibotta and Drop, you get $1 back and 10 Drop points per $1 spent, too. Plus points from using a travel credit card. Pretty easy quadruple dip here. And when you can opt-in, you might find surprise credits in your Uber account for dining out.

And for the love of god, please sign up for a dining rewards program and earn some extra airline miles, too.

5. Travel credits!

I love this one. Lately, I’ve been using my US Bank Altitude Reserve Visa to pay for Uber rides. I have $325 in travel credits to use this year, and by god I’m gonna get my money’s worth.

Luckily, Uber rides count toward the credit. Many cards come with travel credits these daze:

$200 in Uber rides with Amex Platinum Card ($550 annual fee – learn more here)

$300 in travel credits from Chase Sapphire Reserve ($450 annual fee)

$325 in travel credits from US Bank Altitude Reserve ($400 annual fee)

That’s $825 in reimbursed rides each year.

These cards come with hefty annual fees. But in the case of the US Bank Altitude Reserve card, the $325 back in Uber rides brings the $400 annual fee down to $75. Plus, I get 12 Gogo passes for in-flight wifi, 3X points on mobile payments, and I got a sweet $750 sign-up bonus. All in all, a major score.

When you use travel credits, you can also get:

Freebird points for paying with your card

Pei cashback

10X Drop points

A completely free ride

I have a lot of these travel credits to burn. So getting all this back from every ride and the credit card/Drop points is gravy. If you’re in the market for a travel rewards card, thank you for using my links.

6. $2 in Shop Your Way Rewards for every ride

Link: Connect your Uber and Shop Your Way accounts

This one’s automatic and stacks with all the other offers on this page. After you connect your accounts, you can earn $1 in Shop Your Way rewards for every ride you take, up to a max of $20 each month.

Another easy win

There’s literally no effort beyond connecting your accounts, so you might as well get these rewards – they’re free and easy, so why not?

You can use your points to order free merch from Sears

Honorable mention: Hooch

Link: Download Hooch

For the sake of completion, I’ll throw in the Hooch app for those looking to make the absolute most of their Uber rides. You’ll earn 1% cashback for each ride, and like everything else, it all adds up.

Free money, come to meee

You’ll also earn 1% cashback at iTunes, Starbucks, Netflix, Shake Shack, Spotify, Uber Eats, and Hulu. And you can redeem your rewards for gift cards. I have $18 so far – not bad! And again, this app is free to have.

Bottom line

Gotta say, Uber is making it really easy to rake in extra points, cashback, and credits with a combination of deals out there right now. You can get:

Points for every ride with the Freebird app (and cashback with these promo codes!)

Free cashback when you download Pei and link your cards

10 Drop points per $1 spent with the Drop app

Up to 10% back in credits through Visa Local Offers

Travel credits with certain travel rewards cards

$1 in Shop Your Way rewards for every ride, up to $20 per month

1% cashback when you link cards to Hooch

You also get the points you’d normally earn for paying with the right travel rewards card. And you can stack these in any combination!

At the very least, you should get points from Freebird by booking through their app and cashback by setting up Pei once and letting it go. Visa Local Offers is opt-in and automatic, so that’s easy as well if it’s available in your city.

The other stuff – travel credits and extra credit card points – requires a little more planning, but man… if you can get a good stack going, the Uber savings are pretty great.

Are there other ways to save on Uber that I missed?

Hacking Uber: Earn Points, Cashback, and Credits Every Time You Ride

Updated 5/2/19.

I’ve been riding Uber more lately because they make it so easy to stack multiple offers when you ride.

Oh, Uber. I am “getting there”

And, I’m hopeful they’re slowly but surely turning things around.

With Lyft, you can only earn 1X Delta miles – and 30 JetBlue points on airport trips. Which, meh.

I’d rather earn cashback and Drop points, use travel credits, and get Uber credits for shopping around town. And many times you can stack these deals. You know I love a good stack!

1. Earn points and get cashback with Freebird

Link: Download Freebird

I wrote how easy it is to stack promo codes to save every time you ride with Uber or Lyft with Freebird.

This app is basically the best thing since sliced bread. You can earn points, which you can redeem for cashback directly loaded to your debit card. And often, you can stack promo codes to get even more cold hard cash.

My best tip: get Freebird for free cashback on Uber rides!

Plus, if you have any Uber credits or promo codes, they all stack. If you only save on Uber with one tip in this article, this is it. Download Freebird here.

2. Earn cashback with Pei

Link: Download Pei

Nothing to see here… except more FREE cashback for Uber rides.

Pei also earns cashback when you link your cards and spend on Uber rides

The amount you’ll get from each merchant varies between 1% and 10% cashback, and Uber rates fluctuate too.

That said, the app is free to have and the cashback adds up surprisingly fast. I’m super impressed with it so far – it might even be my fave cashback app at the moment.

3. 10 Drop points per $1 spent

Link: Download Drop

Another easy win. Another app. This one’s set it and forget it.

Raking in the Drop points

You earn 10 drop points per $1 spent on Uber rides. Just download the app (you get $1 if you’re new to Drop), link your cards, and let Drop track the transactions. When you ride with Uber, you’ll see Drop points a couple of days later.

You can redeem Drop points for gift cards to popular merchants like Amazon, Starbucks, iTunes, Groupon… and many more. Beyond download the app and linking your cards, this one is literally effortless. Just make sure to select Uber as one of your 5 ongoing offers. And peek at the app every once in a while to see if you can get a free gift card.

4. Visa Local Offers

This one’s only for select cities, but it’s worth checking in the Uber app to see if you can join.

Uber credits when you link a Visa card

To check, open the app and click “Settings” from the menu in the top left. Scroll down to “Rewards” and see if you can opt-in. If you can, definitely do! Here’s what I see in Dallas:

10% at many merchants

My deals are mostly for restaurants, but Whole Foods caught my eye. There was also a local salon and coffee shop, so it’s not all restaurants. Although it overwhelmingly is.

That doesn’t bother me because I use my Chase Sapphire Reserve for dining anyway. And that’s a Visa.

The way it works is you pay with your Visa card, then the cashback percentage is added to your Uber account as a ride credit. So if you spend $50 on dinner or groceries, you can $5 off your next Uber ride.

And when you stack it with Ibotta and Drop, you get $1 back and 10 Drop points per $1 spent, too. Plus points from using a travel credit card. Pretty easy quadruple dip here. And when you can opt-in, you might find surprise credits in your Uber account for dining out.

And for the love of god, please sign up for a dining rewards program and earn some extra airline miles, too.

5. Travel credits!

I love this one. Lately, I’ve been using my US Bank Altitude Reserve Visa to pay for Uber rides. I have $325 in travel credits to use this year, and by god I’m gonna get my money’s worth.

Luckily, Uber rides count toward the credit. Many cards come with travel credits these daze:

$200 in Uber rides with Amex Platinum Card ($550 annual fee – learn more here)

$300 in travel credits from Chase Sapphire Reserve ($450 annual fee)

$325 in travel credits from US Bank Altitude Reserve ($400 annual fee)

That’s $825 in reimbursed rides each year.

These cards come with hefty annual fees. But in the case of the US Bank Altitude Reserve card, the $325 back in Uber rides brings the $400 annual fee down to $75. Plus, I get 12 Gogo passes for in-flight wifi, 3X points on mobile payments, and I got a sweet $750 sign-up bonus. All in all, a major score.

When you use travel credits, you can also get:

Freebird points for paying with your card

Pei cashback

10X Drop points

A completely free ride

I have a lot of these travel credits to burn. So getting all this back from every ride and the credit card/Drop points is gravy. If you’re in the market for a travel rewards card, thank you for using my links.

6. $2 in Shop Your Way Rewards for every ride

Link: Connect your Uber and Shop Your Way accounts

This one’s automatic and stacks with all the other offers on this page. After you connect your accounts, you can earn $1 in Shop Your Way rewards for every ride you take, up to a max of $20 each month.

Another easy win

There’s literally no effort beyond connecting your accounts, so you might as well get these rewards – they’re free and easy, so why not?

You can use your points to order free merch from Sears

Honorable mention: Hooch

Link: Download Hooch

For the sake of completion, I’ll throw in the Hooch app for those looking to make the absolute most of their Uber rides. You’ll earn 1% cashback for each ride, and like everything else, it all adds up.

Free money, come to meee

You’ll also earn 1% cashback at iTunes, Starbucks, Netflix, Shake Shack, Spotify, Uber Eats, and Hulu. And you can redeem your rewards for gift cards. I have $18 so far – not bad! And again, this app is free to have.

Bottom line

Gotta say, Uber is making it really easy to rake in extra points, cashback, and credits with a combination of deals out there right now. You can get:

Points for every ride with the Freebird app (and cashback with these promo codes!)

Free cashback when you download Pei and link your cards

10 Drop points per $1 spent with the Drop app

Up to 10% back in credits through Visa Local Offers

Travel credits with certain travel rewards cards

$1 in Shop Your Way rewards for every ride, up to $20 per month

1% cashback when you link cards to Hooch

You also get the points you’d normally earn for paying with the right travel rewards card. And you can stack these in any combination!

At the very least, you should get points from Freebird by booking through their app and cashback by setting up Pei once and letting it go. Visa Local Offers is opt-in and automatic, so that’s easy as well if it’s available in your city.

The other stuff – travel credits and extra credit card points – requires a little more planning, but man… if you can get a good stack going, the Uber savings are pretty great.

Are there other ways to save on Uber that I missed?

Hacking Uber: Earn Points, Cashback, and Credits Every Time You Ride

Updated 5/2/19.

I’ve been riding Uber more lately because they make it so easy to stack multiple offers when you ride.

Oh, Uber. I am “getting there”

And, I’m hopeful they’re slowly but surely turning things around.

With Lyft, you can only earn 1X Delta miles – and 30 JetBlue points on airport trips. Which, meh.

I’d rather earn cashback and Drop points, use travel credits, and get Uber credits for shopping around town. And many times you can stack these deals. You know I love a good stack!

1. Earn points and get cashback with Freebird

Link: Download Freebird

I wrote how easy it is to stack promo codes to save every time you ride with Uber or Lyft with Freebird.

This app is basically the best thing since sliced bread. You can earn points, which you can redeem for cashback directly loaded to your debit card. And often, you can stack promo codes to get even more cold hard cash.

My best tip: get Freebird for free cashback on Uber rides!

Plus, if you have any Uber credits or promo codes, they all stack. If you only save on Uber with one tip in this article, this is it. Download Freebird here.

2. Earn cashback with Pei

Link: Download Pei

Nothing to see here… except more FREE cashback for Uber rides.

Pei also earns cashback when you link your cards and spend on Uber rides

The amount you’ll get from each merchant varies between 1% and 10% cashback, and Uber rates fluctuate too.

That said, the app is free to have and the cashback adds up surprisingly fast. I’m super impressed with it so far – it might even be my fave cashback app at the moment.

3. 10 Drop points per $1 spent

Link: Download Drop

Another easy win. Another app. This one’s set it and forget it.

Raking in the Drop points

You earn 10 drop points per $1 spent on Uber rides. Just download the app (you get $1 if you’re new to Drop), link your cards, and let Drop track the transactions. When you ride with Uber, you’ll see Drop points a couple of days later.

You can redeem Drop points for gift cards to popular merchants like Amazon, Starbucks, iTunes, Groupon… and many more. Beyond download the app and linking your cards, this one is literally effortless. Just make sure to select Uber as one of your 5 ongoing offers. And peek at the app every once in a while to see if you can get a free gift card.

4. Visa Local Offers

This one’s only for select cities, but it’s worth checking in the Uber app to see if you can join.

Uber credits when you link a Visa card

To check, open the app and click “Settings” from the menu in the top left. Scroll down to “Rewards” and see if you can opt-in. If you can, definitely do! Here’s what I see in Dallas:

10% at many merchants

My deals are mostly for restaurants, but Whole Foods caught my eye. There was also a local salon and coffee shop, so it’s not all restaurants. Although it overwhelmingly is.

That doesn’t bother me because I use my Chase Sapphire Reserve for dining anyway. And that’s a Visa.

The way it works is you pay with your Visa card, then the cashback percentage is added to your Uber account as a ride credit. So if you spend $50 on dinner or groceries, you can $5 off your next Uber ride.

And when you stack it with Ibotta and Drop, you get $1 back and 10 Drop points per $1 spent, too. Plus points from using a travel credit card. Pretty easy quadruple dip here. And when you can opt-in, you might find surprise credits in your Uber account for dining out.

And for the love of god, please sign up for a dining rewards program and earn some extra airline miles, too.

5. Travel credits!

I love this one. Lately, I’ve been using my US Bank Altitude Reserve Visa to pay for Uber rides. I have $325 in travel credits to use this year, and by god I’m gonna get my money’s worth.

Luckily, Uber rides count toward the credit. Many cards come with travel credits these daze:

$200 in Uber rides with Amex Platinum Card ($550 annual fee – learn more here)

$300 in travel credits from Chase Sapphire Reserve ($450 annual fee)

$325 in travel credits from US Bank Altitude Reserve ($400 annual fee)

That’s $825 in reimbursed rides each year.

These cards come with hefty annual fees. But in the case of the US Bank Altitude Reserve card, the $325 back in Uber rides brings the $400 annual fee down to $75. Plus, I get 12 Gogo passes for in-flight wifi, 3X points on mobile payments, and I got a sweet $750 sign-up bonus. All in all, a major score.

When you use travel credits, you can also get:

Freebird points for paying with your card

Pei cashback

10X Drop points

A completely free ride

I have a lot of these travel credits to burn. So getting all this back from every ride and the credit card/Drop points is gravy. If you’re in the market for a travel rewards card, thank you for using my links.

6. $2 in Shop Your Way Rewards for every ride

Link: Connect your Uber and Shop Your Way accounts

This one’s automatic and stacks with all the other offers on this page. After you connect your accounts, you can earn $1 in Shop Your Way rewards for every ride you take, up to a max of $20 each month.

Another easy win

There’s literally no effort beyond connecting your accounts, so you might as well get these rewards – they’re free and easy, so why not?

You can use your points to order free merch from Sears

Honorable mention: Hooch

Link: Download Hooch

For the sake of completion, I’ll throw in the Hooch app for those looking to make the absolute most of their Uber rides. You’ll earn 1% cashback for each ride, and like everything else, it all adds up.

Free money, come to meee

You’ll also earn 1% cashback at iTunes, Starbucks, Netflix, Shake Shack, Spotify, Uber Eats, and Hulu. And you can redeem your rewards for gift cards. I have $18 so far – not bad! And again, this app is free to have.

Bottom line

Gotta say, Uber is making it really easy to rake in extra points, cashback, and credits with a combination of deals out there right now. You can get:

Points for every ride with the Freebird app (and cashback with these promo codes!)

Free cashback when you download Pei and link your cards

10 Drop points per $1 spent with the Drop app

Up to 10% back in credits through Visa Local Offers

Travel credits with certain travel rewards cards

$1 in Shop Your Way rewards for every ride, up to $20 per month

1% cashback when you link cards to Hooch

You also get the points you’d normally earn for paying with the right travel rewards card. And you can stack these in any combination!

At the very least, you should get points from Freebird by booking through their app and cashback by setting up Pei once and letting it go. Visa Local Offers is opt-in and automatic, so that’s easy as well if it’s available in your city.

The other stuff – travel credits and extra credit card points – requires a little more planning, but man… if you can get a good stack going, the Uber savings are pretty great.

Are there other ways to save on Uber that I missed?

April 29, 2019

Excellent 3X Categories, $300 Bonus, & No Annual Fee: Wells Fargo Propel Amex Review

All sorts of cards are getting my attention with my impending sub-5/24 status looming near.

After I get the Chase cards I want (Ink Business Preferred and Freedom Unlimited are current frontrunners), I’ll turn to other banks, like Wells Fargo and Capital One.

High on the list: the Wells Fargo Propel Amex (learn more here). This card has:

A sign-up bonus of 30,000 bonus points (worth $300 in cash back, travel, gift cards, or other rewards) after completing minimum spending requirements

Really good 3X bonus categories

NO annual fee

Up to $600 in cell phone insurance when you pay your wireless bill with the card

While I usually prefer cards that earn points toward award travel, there’s a lot going for this cashback card – especially considering it’s free to keep long-term. It’s a strong card for active lifestyles, and for peeps who don’t want to pay an annual fee.

Eat out, order in, travel, unwind… the Wells Fargo Propel Amex earns 3% cashback in some of the best bonus categories and has NO annual fee

Let’s take stock!

Wells Fargo Propel Amex Review – A hidden gem with no annual fee

Wells Fargo Propel Amex – Learn more at my CardRatings link

Most cards I use earn miles or points for award flights or hotel stays. But when I slip below 5/24 in July, I can get a card just because it has a decent sign-up bonus. Like the old daze!

With the Wells Fargo Propel Amex, you’ll earn 30,000 bonus points (worth $300 in cash back, travel, gift cards, or other GoFar rewards) after spending $3,000 on purchases within the first 3 months of card opening. Read more about it here.

$300 in rewards is a generous offer for a card with NO annual fee. While that’s reason enough, let’s talk about those bonus categories.

Color me very impressed with the 3X opportunities

You’ll earn 3 points per $1 spent on:

Eating out and ordering in (so restaurants and delivery services)

Gas stations, rideshares (like Uber and Lyft), and transit/commuting passes

April 12, 2019

I’m Finally Gonna Fall Below Chase 5/24: My Credit Card Plan

I have a below 5/24 plan. How’d that happen?

A combination of things. There was a rumor Discover It would remove Cashback Match after the 12th billing cycle – I held back on my 4th application (they didn’t change anything, btw). Bank of America added application rules for Alaska cards – I held back on my nth card.

And I can’t get most Amex cards because I’ve already earned the welcome offer, or Citi cards because of their 24-month “family of brands” rule. Plus, I got busy baby-making.

So when I checked Credit Karma, I had to blink again. For the first time in years, I’ll be below 5/24 as of July 19, 2019 – only 4 months away!

I mean yeah, there are non-Chase cards I’d looove to get (I’m drooling for the Amex Hilton Aspire). But heck, if I’m this close, I may as well keep trending. And you bet I’m running right for the Chase Ink Business Preferred – I hope that sweet 80,000-point bonus is still around!

I mean yeah, there are non-Chase cards I’d looove to get (I’m drooling for the Amex Hilton Aspire). But heck, if I’m this close, I may as well keep trending. And you bet I’m running right for the Chase Ink Business Preferred – I hope that sweet 80,000-point bonus is still around!

When I think of UR points, alls I see is Hyatt hotel stays. First stop: Ink Business Preferred

More broadly, this might be the beginning of a long-needed credit card overhaul.

My Below 5/24 Plan

3 Chase Ink Small Business Cards: Which Is Right for You? (One Bonus Is Worth $1,000)

Q: When one falls below 5/24, what do they do?

A: Fill in around the edges.

As far as Chase cards, I currently have 7:

Ink Plus (no longer available)

Sapphire Reserve

Freedom

Hyatt

IHG

United Explorer

British Airways

That’s… a lot. And I’d be willing to ax a couple to make room for new ones (prolly British Airways and the IHG card).

Ink Business Preferred – you just can’t beat the sign-up bonus of 80,000 Chase Ultimate Rewards points after you spend $5,000 on purchases in the first 3 months from account opening

Ink Business Cash – 50,000 Chase Ultimate Rewards points ($500 cash) after you spend $3,000 on purchases in the first 3 months from account opening

Ink Business Unlimited – Ditto

Freedom Unlimited – Same flat 1.5X earning as Ink Business Unlimited, but a personal card

So my focus is clearly on earning more Chase Ultimate Rewards points.

Here’s my post on how to decide which Ink card is best for your situation.

My next Chase card(s)? I’ll have to have a marg about it (sandy-footed friends welcome)

A few scenarios are possible:

Get Ink Business Preferred (later downgrade to Ink Cash) and Ink Business Unlimited (close Ink Plus) – stay under 5/24

Get Ink Business Preferred (later downgrade to Ink Cash, close Ink Plus) and Freedom Unlimited – hit 5/24 again

Get Ink Business Cash and Ink Business Unlimited, keep other cards – stay under 5/24

But the question remains…

What to do with the Chase Sapphire Reserve?

The Ink Business Preferred offers:

3X Chase Ultimate Rewards points on the first $150,000 spent on travel, shipping, internet, cable, phone service, and advertising, each account anniversary year

1X Chase Ultimate Rewards point on all other purchases

Note that it duplicates one of Sapphire Reserve’s 3X bonus categories – travel. And I can get 5X on dining with another card.

Which would make my beloved Chase Sapphire Reserve obsolete – so I could downgrade it to a Freedom Unlimited. And open the Sapphire Preferred in its place to get another big bonus. That complicates things.

Because I only need to keep one Ultimate Rewards card with an annual fee to keep access to partner transfers. And honestly, I haven’t used my Sapphire Reserve much lately.

April 9, 2019

The 12 Best Card-Linked and Cashback Apps (10 Get You Completely Free Rewards)

Lord knows I love playing around with new apps on my phone, especially in the interest of free, passive cashback just for linking my cards one time.

And other apps can save you money too, but require more interaction. I’m happy to click a few buttons to earn a few free bucks.

There are a LOT of card-linked and cashback apps out there. Here are the 6 best card-linked apps, and 6 best cashback apps.

Between the 12, you stand to gain $95+ right out the gate!

These apps get you ongoing rewards for linking your cards. Set and forget!

Between them all, I’ve gotten back $100s in free rewards in the form of cash and gift cards.

12 Best Apps for Free Rewards

First, a distinction. Card-linked apps require you to link your cards and/or your bank credentials one time. From that point forward, you don’t have to interact with the app ever again if you so choose, except to get your rewards. They’re literally set-and-forget.

The other cashback apps do require interaction, whether that’s activating offers, scanning receipts, or some other task. So while not entirely effortless, I find they’re worth poking around.

Here are my picks!

6 card-linked apps

Acorns

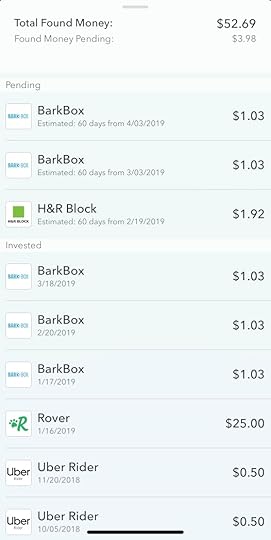

Acorns – $5 free to start investing

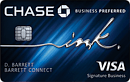

Acorns is an investing app that costs $1 a month. Within it, there’s a feature called Found Money, which lets you earn extra investment money from partners. Some of them are card-linked.

Found Money is mostly a click-through shopping portal, but does have a few card-linked partners

They’re always rotating, but I’ve gotten free cash just for having my cards linked in my profile. Nothing to activate – the cash literally just appears.

~$53 free for doin’ nothin’

While not a crazy amount, I’ve earned ~$53 so far for making normal purchases I didn’t even know would trigger cashback.

Plus, the returns I’m getting from my “Aggressive” blend portfolio are ~7%, which is right where I wanna be when I invest.

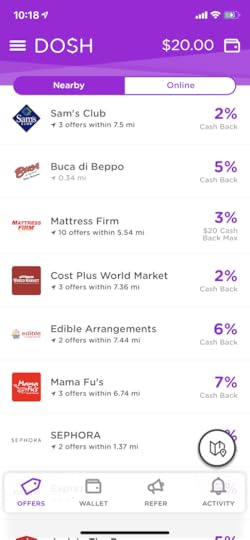

Dosh

Dosh – Get $5 for signing-up and linking a card

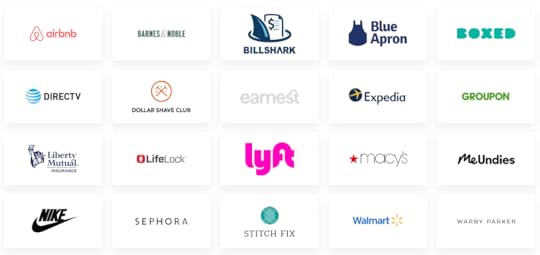

Dosh brands itself as “effortless cash back” and that’s really the case. It’s one of my favorite apps because it’s always popping random cash into my account.

While there’s a shopping portal component to it, you can also earn at nearby businesses when you spend on a card that’s linked to Dosh.

Dosh has a varied selection of merchants

And it’s not just restaurants. I have World Market, Sephora, Sam’s Club, and The Body Shop showing up near me. In the past, they’ve had gas stations. And sometimes have promotions to get 5% cashback at Sam’s Club (which is one of the ways to save every time you shop there), and at other stores.

Drop

Drop – Get $5 free

Drop lets you pick your 5 favorite merchants to earn between 8 and 12 Drop points per $1 you spend. 10,000 points is worth $10. And you can only redeem for gift cards.

I actually spend quite a bit at my top 5 merchants

That said, the merchants and gift card selections are super useful. And the app is free to have.

Drop is always depositing points – I use them for free stuff at Amazon

You can activate other offers and bonuses if you want, but I open it up every few months to cash in for Amazon gift cards and get on with it. Though you need a lot of points to redeem, they really do add up fast – especially if you leave it alone for a while.

Hooch

Hooch – Get $5 free

I wrote about Hooch back when their dealio was a free drink every day for $10 a month. While that’s still on the go, they’ve also added automatic 1% earnings with several national brands, including Netflix, Spotify, and Uber.

Get 1% cashback on many popular categories

While 1% isn’t anything radical on a $10 subscription or cup of coffee, like everything else on this list – it all adds up.

I did not take a $111 Uber ride, for the record

This offering is still new, so I’m not entirely sure how to redeem the rewards or what the minimum is, although it looks like you can get free cocktails, gift cards, or dining certificates. I’m gonna roll with it and see how it goes – but mark this one as very “in progress.”

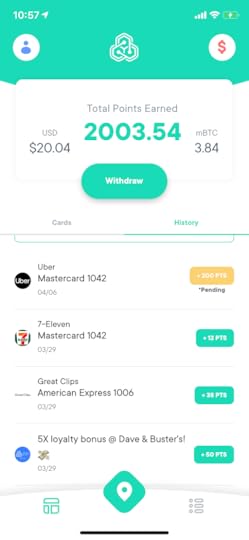

Pei

Pei – Get 500 points ($5) – My code is “2pur1z”

Pei wasn’t doing much when I first installed it, but all of a sudden, I’m earning points like crazy on nearly everything I buy. I’ve gotten $43 in free cash so far, and it’s only been a couple of months. Pretty cool for a free app.

For real, just points rolling in everywhere

Pei’s big thing is you can choose between cash or Bitcoin, but duh, I’ll take the cash.

Earning rates are between 1% and 5% back, depending on the merchant. But wow, there are a LOT of them. I highly recommend giving this one an install. It’s perhaps the most rewarding of them all as of late.

Stash

Stash – $5 free to start investing

I mostly have Stash to compare them with Acorns, but manage to earn enough in dividends to justify the $1 monthly fee. They now have a debit card offering (which isn’t that great). I’m interested to see where Stash goes, and how they’ll differentiate themselves from similar services.

Stash cashback is mostly for restaurants

Anyhoo, they have a card-linked offering with decent cashback rates. I only see restaurants in my area – and a few of them are pretty good. Whatever you earn gets folded into your investment account, so it’s worth linking your cards and getting a free boost here and there.

6 more best cashback apps

The apps above are basically effortless: link your cards and let the rewards build up.

There are others that are equally rewarding, but require more participation. For your consideration…

Cash App

Cash App – Get $5 free when you send $5+

The Cash App is from Square, and a fee-free way to transfer funds between bank accounts. Kinda like PayPal or Venmo, but even simpler.

When you request their free debit card, you can get “boosts” and cashback for using the card. I prefer points & miles (obvi), but will definitely use the app for quick cash transfers to friends.

And you can get $5 in your account when you sign-up and send $5+ to anyone. So you could send $5 to a friend, get $5 instantly in your account, and your friend could send the $5 right back.

Pretty neat app, even if you just get it for the free $5. I ordered the debit card out of pure curiosity, so might write about it more in the near future.

Ebates

Ebates – Get $10 when you make your first purchase

While mostly a shopping portal, Ebates (or Rakuten as they want to be called now

March 21, 2019

Up to $30 Back With Freebird for Taking Uber and Lyft Rides – New Promo Code

Here are the latest Freebird promo codes you can stack for up to $30 cash back on Uber and Lyft rides booked through Freebird.

Here’s how to do it:

Download Freebird

Enter promo codes:

“S897C” – $10 cashback ($5 for each of your first 2 rides)

“WAM20BAM” – $20 cashback ($10 for each of your first 2 rides)

That’s a total of up to $30 cashback!

Freebird lets you book Uber and Lyft rides through their app – and you’ll earn points on each ride. Once you earn 5,000 points, you can cash it out for $10. So you can potentially do even better with these codes when you add points to the mix.

I love using the Freebird app for Uber and Lyft rides

Plus, as I’ve found over the past few weeks, your Uber and Lyft credits should still work!

Freebird powers up your Uber and Lyft apps

Key link: Download Freebird

If you ride Uber or Lyft with any regularity, I’ve found Freebird to be a nice “power up” for those bookings. The prices are the same – as it pulls the quote from those apps directly – and I’ve also had my Uber credits applied even when booking through Freebird.

With Freebird, you earn points + cashback for ordering rides through the app. Here’s my full writeup on Freebird with more information.

I took Lyft rides all around San Antonio recently, including to the River Walk

And now, you can get an extra $30 cashback with promo codes (all listed above).

I am all over this as it’s literally free cashback for doing something you’re already planning to do.

I have no idea how Freebird is making money (presumably through sponsorships from local businesses and liquor companies), but take it while the getting is good – especially if you have trips coming up soon.

It will stack with any Uber/Lyft credits or promotions already attached to your accounts – and trigger any travel statement credits from cards like Chase Sapphire Reserve, Citi Prestige, or US Bank Altitude Reserve. So there’s a potential triple/quadruple stack in here (you know I love a good stack):

Uber/Lyft rewards + credits

Statement credits

Freebird cashback

Miles/points (not with CSR and travel credit, though)

Bottom line

What’s also cool is you can toggle between Uber and Lyft within the Freebird app if you want to check prices with both services. That way, you can pick the cheaper option and still earn the Freebird points and cashback credits.

I’ve been using Freebird for the past few weeks and haven’t had any issues. Receipts and charges still come directly from Uber or Lyft – just note they pull your default payment method from the respective service, so be sure to change it directly within the correct app if you so desire.

And again, I dunno how Freebird will be profitable with all these promotions going on but… get it while you can. I’ve already initiated a few transfers to my bank account and gotten cash money directly in hand – so I can personally confirm it works.

Happy riding!