Harlan Vaughn's Blog, page 19

December 10, 2018

Dog Owners! Get Acorns & Earn Automatic Cashback to Invest With Rover & BarkBox Purchases – Just Link Your Card

It’s always nice to earn unexpected rewards for expected spending. That’s exactly what happened to me this week.

After I dropped my pup off at his sitter’s house (who I booked on Rover), I got an email saying I just got a $25 bonus from Acorns. And when I checked my account, I saw another 5% back from his monthly BarkBox!

This is free, easy money if you use either service with regularity. All you have to do is link your card within your Acorns account. Nothing to activate!

But of course me being me, I had to go and stack it to the Nth degree.

December 1, 2018

Dealing With Travel Setbacks: Faceplanting & Montezuma’s Revenge in Mexico City

Visiting Mexico City for the first time was a dream come true. What happened in Mexico City… was not. To put it mildly.

I’ve traveled near and far and surely gotten colds or allergy attacks. Or tripped in the street or something. All par for the course.

But as I laid in bed the last full day of my 4-day trip, I couldn’t help but think… this isn’t how I thought it would be.

Even still, it’s been one of my favorite destinations so far.

Got banged up Mexico City, dang

Also, falling in front of hundreds of people really sucks.

And, he’s down

I got to Mexico City on a Thursday night. And the next day, less than 24 hours later, found myself face down in the middle of La Rambla (one of the main thoroughfares) in Zona Rosa, bleeding from several areas.

It’s not a great story. I ran into one of those little concrete traffic dividers – one second I was up and walking around and the next, on the ground.

Right away, I felt dozens of hands all over me, and me – stupid American with all the fear mongering about Mexico in my head – the only thing I could think was, “Great, now I’m getting pickpocketed. There goes my wallet and phone.”

Then I realized several people helped me up. My glasses flew into the street and blood ran into my left eye. Alone in another country, I noticed my hand was really really scraped and both my knees were bloody and soaking through my pants, which were ruined from falling. Damn.

Treating yourself to delicious, opulent meals helps a LOT

A few people helped me to a convenience store where I grabbed bandages and disinfectant. Then went into a restaurant and washed myself up.

The next day, most of my body was in throbbing pain. I took a few Aleve and set out despite it. My left knee freaking hurt and I had a big bandage wrapped around my right hand, but dammit, I was determined to see Mexico City.

A few wanderings

I went to the big city park, Chapultepec, and the modern art museum, where I got to see Frida Kahlo paintings, and works from many other Mexican artists.

Love this painting – The Two Fridas

And went to Mercado Sonora, one of the biggest witch markets in the world.

Mercado Sonora was endlessly fascinating and shocking

And I even made it to the Historic Center of old Mexico City.

There was a concert in the gigantic old square the night I visited

Oh, and I had amazing Mexican food for pretty much every meal. I love Mexican food, and enjoyed the authentic recipes with variations I’d never seen in the US.

Everything was so fresh and delicious. I wanted a good time as long as I could get around reasonably easily. Ubers all over the city were $6 at most. And I even made it to a few bars in Zona Rosa.

But then another thing to deal with

So yeah, falling sucked. But I pushed through it.

But then, on top of that, I got the worst case of upset stomach I’d ever had in my life. I won’t go into details. Suffice it to say, I didn’t want to venture outside for fear I’d not be around a bathroom.

I’d heard of this: Montezuma’s Revenge. A bug that affects travelers, especially to Mexico. Despite drinking bottled water and avoiding raw produce and street food, I somehow picked it up.

Between that and my entire body screaming with every step, I wasn’t sure if I could make it to a pharmacy. I saw one on the map only 2 blocks away, and made it to get medicine. Then ran back immediately to patch myself up. I had sweats and chills, my bloody hand needed new bandages every few hours, and on top of that, could barely hold down water.

So I spent my last day in bed, immobile except to walk to the bathroom and back to bed.

Dealing with travel setbacks

Of course, if it had been easier to walk, I would’ve gone to a pharmacy sooner. And if I hadn’t gotten a stomach bug, I would’ve ambled my way through Mexico City anyway.

But both of these at once? I was down for the count in a new city. At some point, I accepted I’d just have to give it a Round Two in the future.

I didn’t get to Frida Kahlo’s cobalt blue house, the ancient Aztec pyramids, and many other cool places around the city. I couldn’t everything in 4 days anyway, so went into it knowing I’d have to hit the highlights.

I’m coming back for you, MEX

However. Everyone I met was so completely kind. When I couldn’t speak specifically about what I needed, people came to translate so I could get medicine. Several people helped me up off that street. A few sat with me while I washed up and when one guy asked how I felt, I just laughed sheepishly and said, “I need a beer.”

He said there was a chill bar around the corner and we grabbed a drink together. Then he made sure I got in my Uber.

It would’ve been easy to give up and cut the trip short. But I stayed and made the most of it. I even thought about extending the trip until I felt better, but wanted to get back and patch myself up.

What I did see fully convinced me to visit Mexico City again. I already can’t wait to go back and explore. What an amazing, amazing place.

Bottom line

Link: Last Summer, Bumped off Delta Flight. This Fall, Free Business Class Flights to Mexico City

To be sure, any type of travel setback sucks: delays, missed connections, hotel issues, and all the rest. I’ve dealt with my share of that. This trip was the most difficult I’ve ever had.

Falling and getting sick would be a downer during any trip, but felt particularly demoralizing because I’d looked forward to visiting Mexico City for so long.

It’s all in your attitude. I got dangerously close to saying “Eff this” many times. Especially in the sweatiest, grossest moments.

I made the most of it, got out and about as much as I could, and somewhere along the way, accepted it for what it was. It put me in the moment in a big way. And for all the setbacks, became one of my favorite trips so far.

Me and you Mexico City: rematch in the near future. So yeah, that was my Mexico City trip.

Have you had major setbacks during a trip? What did you do to deal?

November 22, 2018

Targeted: 20% Off (up to $100) at Amazon When You Use 1 Amex Point – Easy Savings!

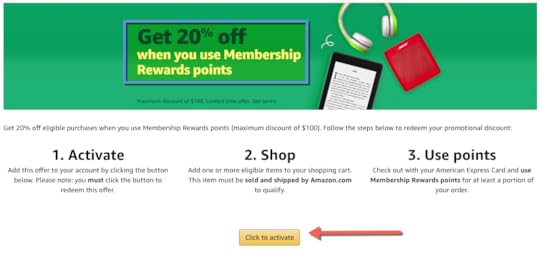

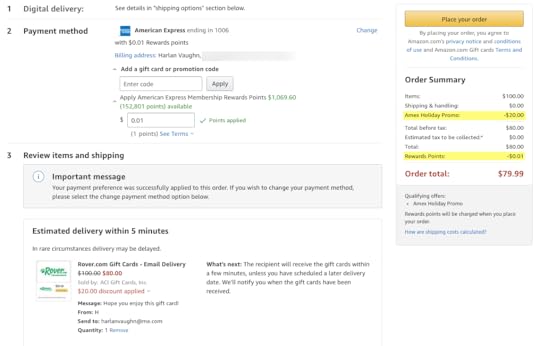

Too good not to share. When you shop at Amazon, you can get 20% off items sold and shipped by Amazon when you use 1 Amex Membership Rewards point as part of your payment method – if you’re targeted.

The discount is good for up to $500 in purchases, which means you can save a maximum of $100. But you can only use the discount once, and it’s good through December 23, 2018 – so use it for a big purchase this holiday season! Although Amazon could pull it way before that date.

Click the page and “Click to activate” 20% off at Amazon

Easy win if you shop at Amazon!

Save up to $100 (20% off) at Amazon with this promotion

Key Link: Click to activate 20% off at Amazon

Here’s how it works:

Click here to see if you were targeted

If so, “ Click to activate ” like in the image above

Use 1 Amex Membership Rewards point when you check out to save 20% on items sold and shipped by Amazon, on up to $500

Use it by December 23, 2018, although Amazon can pull the deal at any time – so the sooner the better

I can confirm this works for third-party gift cards but NOT Amazon gift cards

You can use this deal to save on third-party gift cards like:

AMC

iTunes

Lowe’s

and many others!

You could also buy gifts, stock up on home supplies or pet food, or save 20% on tons of other stuff.

Nice and very easy discount if you can get it. The timing for this one couldn’t be better with Black Friday and Cyber Monday these next few days.

Amp up the savings

Here are 2 services every Amazon shopper should have. Signup for:

Honey – browser extension that alerts you for lower prices and applies coupons automatically to save money, great for Amazon shopping

Paribus – watches for price drops and claims late shipment adjustments on your behalf – completely free to use

Bottom line

Key Link: Click to activate 20% off at Amazon

If you have a card that earns Amex Membership Rewards points, it’s a no-brainer to see if you can use 1 Amex point to get 20% off at Amazon.

The only downside I can see is you then have to use an Amex card to pay for your shopping, and Amex doesn’t have price protection – nor does Amazon honor price drops.

You can still use Honey and Paribus to help you save – though I wouldn’t buy anything that comes with a warranty or anything like that. But for stocking up and buying gifts, this is a fantastic discount that’s easy to use.

I plan to get dog food, paper products, and a few gifts – things like that are perfect for this deal.

Happy holidays!

Before You Buy! Use a Shopping Portal & Get FREE Money When You Shop Online (Quick Recap of Current Bonuses)

Black Friday slash Cyber Monday is coming fast. Not only can you earn free cash, points, or miles, but use a shopping portal to get extra bonus money just for signing up and clicking a link before you shop.

Here’s a recap of current portal bonuses if you’re a new member, and a few apps that will give you free money when you shop.

If you’re going to buy stuff anyway, always get something back from it. Even if it’s a few bucks here and there, it all adds up!

Don’t miss out on bonus points for your troll doll purchases

Here’s a list of current bonuses!

Try a New Shopping Portal and Earn Free Cash

Link: 15 Cashback Shopping Portals Compared: Payments, Bonuses, & How They Work

Shopping portals are sites that award you free cash, points, or miles when you click through their links before you begin your online shopping.

You can earn rewards for shopping at nearly every big merchant. Always check Cashback Monitor to see which site will give you the most for your purchase.

That said, some portals give you a first-time use bonus, or a bonus for spending a certain amount, if you’re a new member. And when you include it, the value can actually be stellar.

Cashback portals offering free cash for new members

Here are 10 shopping portals with bonuses for signing up right now:

Acorns – $5 for signing up, then earn free Found Money when you shop at 40+ merchants

BeFrugal – $10 for signing up, shop at 5,000+ merchants

Dosh – $5 instantly added to your account when you link a card. One of my favorite apps!

Ebates – $10 after your first purchase at 2,500+ merchants

ExtraBux – $20 when you signup, can shop at 3,000+ merchants

Giving Assistant – $5 instantly added to your account

Ibotta – $10 when you download the app. Another fave!

Mr. Rebates– $5 when you signup

RebatesMe – $10 instantly added to your account when you signup

Swagbucks – $3 when you earn $3 from shopping at 1,500+ merchants

In particular, I like Dosh and Ibotta when shopping for everyday items like groceries because you can get deals in-store, too. The others are online only (for the most part).

Airlines portals to earn extra miles

If you don’t want cash rewards, or are close to an award trip, you might use an airline portal to earn miles instead. The main ones are:

Delta

American

United

Southwest

Alaska

JetBlue

As of now, I don’t see any special offers for shopping other than the usual miles per $1 spent.

Sometimes they run promotions, and I wouldn’t be surprised to see one pop up over the next month or so. Keep watch if you’re interested.

Bank portals for free points

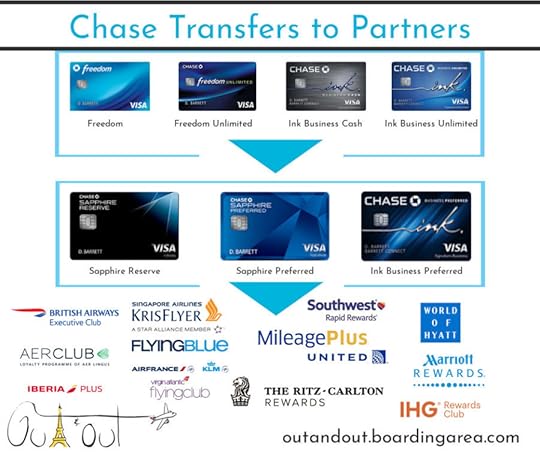

The most notable is the Chase Ultimate Rewards shopping portal that gives you extra points if you have a Chase Ultimate Rewards card. Barclays also has a shopping portal.

But depending if another cashback portal offers a bigger percentage of cash, or if you can earn bonus miles from an airline portal, you might decide not to use these.

That said, transferable points are the most valuable around so you just gotta run the numbers and go for what you personally prefer the most.

Don’t forget Earny, Honey, and Paribus

Here are 3 services every online shopper should have. Signup for:

Earny – automates price protection on many credit cards, and monitors for late shipments – costs 25% of refunded difference

Honey – browser extension that alerts you for lower prices and applies coupons automatically to save money, great for Amazon shopping

Paribus – watches for price drops and claims late shipment adjustments on your behalf – completely free to use

I like Earny, Honey, and Paribus to complement my online shopping habits

These are excellent additions that offer protection for your shopping. I’ve used them all for years and have saved $100s in price drop credits and refunds for late shipping (even it’s only late by 1 day).

Bottom line

If you plan to shop online at all this holiday season, get free cash for shopping through a portal! Many of them will give you bonus money just for signing up, or making a purchase, if you’re a new member. I’ve rounded up the current bonuses above.

If you prefer airline miles, keep an eye out for a portal bonus at some point in the next few weeks. And check Cashback Monitor to check the best earning rates across every portal at a glance.

Now would be a good time to score a lot of bonuses in a row. Here’s my full comparison of 15 cashback shopping portals.

And if you shop online with regularity, definitely get on board with Earny, Honey, and Paribus. They’ll add value when there are price drops or extra coupons – or late shipments.

Free money for shopping – these are the easiest wins around!

November 21, 2018

10 Must-Haves of Travel: The Ultimate List to Stay Healthy & Confident Anywhere in the World

Once upon a time, I had a series called “Must-Haves of Travel” where I shared items I always throw in my carry-on. They’re small, awesome, versatile, and duh, you should take them everywhere. These products are geared for when you’re on the go.

I thought it’d be fun to compile them into one definitive list, with a couple of extras added as a bonus. If you’ve been reading the blog for a while, you’ll see a few things I can’t stop blabbing about.

November 18, 2018

40+ Easy Ways to Meet Credit Card Spending Requirements

Credit card spending requirements are getting higher all the time. Not only that, but banks also want you to use your cards for ongoing spending to meet spending thresholds to earn elite status, bonus miles, and other rewards.

“Top of wallet” is a term we hear a lot in this industry because every issuer wants their card to be, literally, at the top of your wallet. So they incentivize spending with category bonuses, special offers, and promotions.

To meet credit card spending requirements, use your card for:

Everyday expenses like utilities, groceries, eating out, cell phone service, oil changes, and subscription services

Semi-regular expenses including dental cleanings, home warranties, memberships, and club dues

Gifts for birthdays, graduation, weddings, and holidays

Charitable contributions

Business expenses if your employer will reimburse them

Nearly any bill or service from a company or individual via Plastiq

Annual and quarterly tax payments

Meeting minimum spending requirements is top of mind for lots of peeps – and top of wallet for credit card companies

I’ll expand on these categories and give you 40+ ideas to meet your spending in a flash!

The sooner you get your spending done, the faster you’ll get your rewards

It sounds daunting to spend $1,000s in a short timeframe to trigger a sign-up bonus. But, like anything, once you break it down into small steps, it doesn’t seem as bad.

The biggest thing to keep in mind about credit cards is to never spend more than you have. And to pay your bill in full at the end of each billing cycle. Basically, treat your credit card like a debit card.

If you have trouble managing, there’s a service called Debitize that will literally turn your credit card into a debit card.

The gist is to use your new credit card for all your expenses, because it adds up fast. And you can use Mint.com to see how far along you are with your spending at any time.

I always recommend spending slightly more than you need to account for any refunds or returns.

Use your card for daily expenses including your voodoo supplies to meet spending requirements faster

And remember, annual fees and statement credits do NOT count your minimum spending requirement!

Finally, the clock starts ticking the moment you are approved for a card. Not when you activate it, not when it comes in the mail, not upon your first purchase. When you’re approved.

With all this in mind, here are ways to get that spending done!

Everyday expenses

1. Utilities

Many utility companies let you pay for electricity, gas, water, sewage, trash pickup, and much more with a credit card.

I pay my electric bill with a credit card each month

And if they don’t, Plastiq will send a paper check on your behalf for a 2.5% fee (more on that later). If you go this route, be sure to give it enough time to post before your due date.

2. Groceries

Make a run to Costco or Sam’s Club, or stock up at your local grocery store, and take your new card with you. Most folks spend between $200 to $500+ (depending on family size) on groceries each month – capture this spending!

Take your new card on a grocery trip (remember, Costco only accepts Visa cards in-store)

Remember to use Ibotta and Dosh for cash rebates while you’re at it!

3. Dining

Eating out is one of my biggest expenses, as it is for lots of peeps. If you’re out with others who pay with cash, offer to put the whole tab on card and put the cash in your pocket.

When your meal tastes like your next award trip

Don’t forget to signup for a dining rewards program to earn free cashback, points, or miles, on your check – including tax and tip!

4. Cell, cable, and internet service

Use your card to pay (or pre-pay) for the wires that keep you connected to the outside world.

Most media companies let you pay online or over the phone. These are easy ways to get a little closer to your minimum spending requirements.

5. Take care of your car

Time for a tuneup and oil change? If you’ve been meaning to get your car detailed, washed, or serviced, use your card to pay for it.

You could even get new tires or a fun accessory like a cell phone clip to help you navigate or hold your phone for Bluetooth tunes.

6. Netflix, Hulu, Spotify, and other subscriptions

Separately, these subscriptions aren’t much. And together, they add up.

Put your subscriptions on autopay

Keep your accounts up-to-date with the card you’re earning a bonus on.

7. Gym membership

If you pay for yoga classes, Peloton, Orange Theory, CrossFit, Camp Gladiator, or any other workout regiment, put the expense on your credit card. And please go often to get your money’s worth!

8. Health insurance

I’m a freelancer, so I’m on the ACA plan. I switch payment to whichever card I’m working with to whittle down that minimum spending.

If you have health insurance through an employer, this won’t apply. But you can always pay for expenses through your FSA or HSA with a credit card, and get reimbursed for it. Those expenses can add up fast.

9. Tollways

Here in Dallas, we have the NTTA (North Texas Tollway Authority) that operates toll roads, like the Dallas North Tollway. You can load your transponder with a credit card, and set it to auto-load once you fall below a certain amount.

If you have to pay for tolls to commute, might as well earn some points for it.

$3,000 or 225,000 Airline Miles From ONE Sign-Up Bonus – But They’re Not for Everyone

Capital One shook things up this week when they announced mondo 200,000-mile sign-up offers on their Spark Miles and Spark Cash cards. And on the Spark Miles card, those rewards will become transferable to 12 airlines starting December 2018, which is stellar. It’s always good to have more options – especially with flexible rewards programs.

In fact, peeps looking for a single-card solution to most points dilemmas finally found their match. You can redeem the points for 1 cent each, and with the Spark miles card, transfer them at a 2:1.5 ratio to useful airlines like Air Canada, Etihad, and Qantas.

They’re excellent deals if you want a rewarding small business card without hassle. You’ll end up with $3,000 or 225,000 airline miles after the minimum spending is complete.

The required spending and opportunity cost are high with this one

But they’re NOT for everyone. I’ll explain why.

$3,000 or 225,000 Airline Miles After a Boatload of Spending

Key Link: Capital One Spark Cash for Business – learn more here

Key Link: Capital One Spark Miles for Business – learn more here

Who wouldn’t want a chance to earn $3,000 in cold hard cash from a single sign-up bonus? Especially one that can also translate to 225,000 airline miles?

On the Capital One Spark Cash for Business, you’ll earn a $500 cash bonus when you spend $5,000 in the first 3 months of opening your account. Then an additional $1,500 when you spend $50,000 in the first 6 months.

With either Spark card, you’ll have $3,000 to spend – and in the case of the Spark Miles card, 225,000 miles to play with

And with the Capital One Spark Miles for Business, you’ll earn a bonus of 50,000 miles when you spend $5,000 in the first 3 months of opening your account. Then an additional 150,000 miles when you spend $50,000 within the first 6 months.

Those are gigantic bonuses, but then again – so is the spending. It breaks down to ~$8,333 per month for 6 months.

These cards are aimed at small business owners. If you have a bout of spending coming up for things like equipment, computers, or other upgrades, you can more easily meet the minimum spending.

The differences between the cards

Both cards require the same big spending to hit the maximum reward thresholds. The Spark Cash card is a pure cashback card, whereas the Spark Miles card earns rewards to offset travel purchase, or to send to 12 different airline programs.

The earning rate on both is the same – 2X.

1. Capital One Spark Cash for Business

Capital One® Spark® Cash for BusinessUp to $2,000 Cash

• Limited time offer

• Limited time offer• $95 annual fee, waived the 1st year• $500 cash bonus when you spend $5,000 in the first 3 months of opening your account

• An additional $1,500 when you spend $50,000 in the first 6 months

• Earn an unlimited 2% cashback on every purchase

• No limits on how much you can earn• Learn more here

This card is all about cashback. The rewards you earn are redeemable in any amount for any purchase. You can’t beat the simplicity with the rewards program – and the site and app are intuitive and user-friendly.

Granted, other 2% cashback cards have no annual fee, but there are often “gotchas” when it comes time to use your rewards.

I see the annual fee you pay starting the second year as a convenience fee more than anything. And the sign-up bonus you can earn would cover the annual fee for 32 years (remember, the first year it’s $0)!

You’ll earn $1,000 from 2% cashback on the $50,000 you’ll spend to earn the $2,000 sign-up bonus. So you’ll end up with $3,000 to do whatever the heck you want with.

2. Capital One Spark Miles for Business

Capital One® Spark® Miles for BusinessUp to 200,000 miles

• Limited time offer

• Limited time offer• $95 annual fee, waived the 1st year• 50,000 miles when you spend $5,000 in the first 3 months of opening your account

• An additional 150,000 miles when you spend $50,000 within the first 6 months

• Earn an unlimited 2X miles on every purchase

• No limits on how much you can earn• Learn more here

The rewards you earn from are worth 1 cent each toward nearly any travel purchase. Whereas the Spark Cash card earns straight cashback, this one is better if you want to redeem for travel like flights, Airbnb/hotel stays, Uber rides, cruises, or pretty much anything else related to travel.

Wanna visit Austin to see 6th Street? Use Spark miles toward your flight, hotel stay, Uber to downtown, or even the parking. It’s all about travel

And starting December 2018, you can transfer the miles at a 2:1.5 ratio to:

Aeromexico

Aeroplan (Air Canada)

Alitalia

Avianca

Cathay Pacific

Etihad

EVA

Finnair

Flying Blue (Air France & KLM)

Hainan Airlines

Qantas

Qatar Airways

So you’ll earn 2 Spark miles or 1.5 airline miles per $1 spent.

If you meet the full $50,000 in minimum spending, you’ll earn an extra 100,000 Spark miles, and wind up with 300,000 Spark miles. They’re worth $3,000 toward travel purchases.

I used Etihad miles to book a Business Class award seat on Brussels Airlines from New York-JFK to Brussels!

Or if you transferred them to an airline, you’d have 225,000 miles (300,000 X .75). That’s enough to fly in First or Business Class to nearly anywhere in the world – or several award flights in coach, which can be worth much more than $3,000.

Capital One rules & policies

Capital One is a conservative bank, and won’t approve more than 1 application per 6 months. That’s if you can get an approval.

I’ve applied for a couple of Capital One cards the past few years and gotten auto-denied both times. The last time was actually for the Spark Cash card when the bonus was “only” $1,000, so I’m hesitant to apply again.

No love from Capital One here

The other reason is because Capital One pulls from all 3 credit bureaus (Equifax, Experian, and TransUnion). So without a firm sense I *might* be approved, I don’t want 3 new credit inquires on my report.

They seem to deny peeps with lots of cards opened recently. That said, they also tend to be lenient with small business applications.

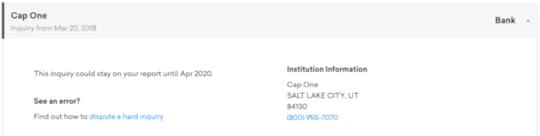

All the best airlines have other transfer partners

The big earthquaking news is CAPITAL ONE HAS TRANSFER PARTNERS ZOMG. But you can access these partners (which the exception of Finnair and Hainan) through other programs:

Aeromexico – Amex

Aeroplan (Air Canada) – Amex

Alitalia – Amex

Avianca – Amex and Citi

Cathay Pacific – Citi

Etihad – Amex and Citi

EVA – Citi

Flying Blue (Air France & KLM)- Amex, Chase, and Citi

Qantas – Citi

Qatar Airways – Citi

And I wouldn’t call Finnair or Hainan notable losses. There are plenty of Amex and Citi cards that let you earn points to transfer to these same airlines – AND to other, more useful programs.

I’m hopeful Capital One will snag a truly great transfer partner in the future, though.

You can do better with category bonuses

The Spark cards earn a flat 2X on every purchase (1.5 miles for the Spark Miles card). This simplicity is both beautiful and limiting.

I personally spend the bulk of my money on travel and dining, so I’d rather earn bonus points for those purchases. For the odd purchase where I only earn 1X, I’m either meeting minimum spending or making up for it with category bonuses.

Blue Business Plus Credit Card

10,000 Amex Membership Rewards points

• $0 annual fee• $3,000 in eligible purchases on the Card within your first 3 months of Card Membership

• This is by far the best card for 2X points on all spending• Learn more here

The Amex Blue Business Plus card (learn more here) earns 2X Amex Membership Rewards points on up to $50,000 in purchases per calendar year. That’s a hard limit for some small businesses, but there’s no annual fee as opposed to the Spark cards’ $95 annual fee (after the first year).

Chase Freedom Unlimited 15,000 Chase Ultimate Rewards points

• $0 annual fee• $500 on purchases in the first 3 months from account opening

• Earn a flat 1.5% back on every purchase

• Great for everyday spending• Compare it here

And the Chase Freedom Unlimited earns a flat 1.5X Chase Ultimate Rewards points on all purchases.

You need to pair Chase cards to earn more points, but it’s so worth it

You have to pair it with a premium Chase card (with an annual fee) to transfer to travel partners. But Chase has much better transfer options, like United, Southwest, and Hyatt. And the cards with an annual fee all have category bonuses.

Opportunity cost

Spending $50,000 on one card means you’re not spending $50,000 on another card – or meeting minimum spending on other cards. Sure, you might gain $3,000, but you could meet the minimum spending on several cards for that much spending.

And if you spend a lot in certain categories, you could be missing out on a huge amount of bonus points.

$50,000 is a LOT of spending – and you could maximize it in other ways

There is always an opportunity cost in this hobby – this deal just seems like a very big one. If your business is handily spending $8,000+ per month, you could earn 6 to 10 card bonuses instead of one, with a potential value of way more than $3,000.

It’s more to manage, but in terms of sheer spending, $50,000 can get you a lot more than this.

So who should consider the Capital One Spark cards?

If you:

Have no trouble spending $50,000 in 6 months

Want supreme simplicity from a rewards program

Want to commit to one card and one bonus for half a year

Like Capital One’s cards and ecosystem

Want to access the new travel partners

Don’t want to overcomplicate your wallet, travel goals, or award strategy

This card has niche appeal – but not as narrow as it seems at first look. Tons of small businesses spend enough to earn this bonus quickly.

And Capital One has its fans. The website is easy to use and the rewards program couldn’t be simpler. Many peeps find value in that – and see the transfer partners on the Miles (NOT the Cash!) card as a fun extra instead of a limitation.

Bottom line

Key Link: Capital One Spark Cash for Business – learn more here

Key Link: Capital One Spark Miles for Business – learn more here

The more I look at the offers on the Capital One Spark cards, the rawer the deal gets. The numbers are eye-popping:

$3,000 to spend after meeting the minimum spending (on anything with the Spark Cash, toward travel with the Spark Miles)

225,000 airline miles to transfer with the Spark miles card

$50,000 in tiered spending over 6 months to earn the full bonuses

These are excellent offers from a single signup bonus. You can, of course, do better with multiple card offers and category bonuses. But that adds complexity.

If you’re a small business owner and want to keep it simple (and can complete all the spending), these offers are bar none. Go for ’em.

Remember, you can access most of the transfer partners with Amex or Citi. And we don’t yet know how fast the transfers will take – that will be important to know.

Finally, other cards or card pairs can get you similar earning rates. But again, if you want simplicity, it’s hard to top these offers. They’re for a niche crowd, and for that crowd, get them while you can. These deals are for a limited time with no end date yet announced.

What do you think of the revamped Capital One Spark cards?

November 6, 2018

’Tis the Season for New Credit Cards – and Price Protection!

November is here, and in a couple of short weeks, it’ll be Black Friday. Peeps tend to naturally spend more during the holiday season for presents, travel, and organizing parties.

While there’s a moment of calm, consider you can turn all your holiday spending into 1,000s of points & miles by opening a new credit card and using it to meet minimum spending requirements over the next month or so. If you apply now, it’ll arrive in time for the biggest shopping season of the year.

Plus, with all the sales and deals going on, consider a card with 60- or 90-day price protection – and automate it – to save even more money.

Turn those Amazon purchases into award travel! Now’s the time to jump on a new card offer

Here are a few worthwhile sign-up offers, and how to set alerts for price drops.

Holiday time now = an award trip in 2019

Link: Get a new travel rewards card

Yeah, November and December are expensive months. If you’re buying gifts, making last-minute trips to earn elite status, or attending/hosting holiday events, it all adds up. So make it work in your favor.

If you’re planning to spend anyway, earn a sign-up bonus for your efforts. And use the points or miles you earn now to go somewhere fabulous next year.

Of course, you should only get a new card if you can pay it all back after each billing cycle. Because paying interest negates any rewards you earn.

With all this in mind, here are some awesome offers going on now.

1. Chase Sapphire Preferred

Chase Sapphire Preferred 50,000 Chase Ultimate Rewards points

• $95 annual fee• $4,000 on purchases in the first 3 months from account opening

• The best card for beginners• Compare it here

If you’ve never had this card, and haven’t opened 5+ cards in the last 2 years, this is *the* best place to start. The 50,000 Chase Ultimate Rewards points you’ll earn for completing the minimum spending are worth at least $625 toward travel – and that’s at the low end.

Stay at the Hyatt Ziva Puerto Vallarta for 20,000 Chase Ultimate Rewards points per night (transferred to Hyatt)

If you transfer the points you earn to travel partners, the sky is the figurative and literal limit!

Access 14 transfer partners with Chase Ultimate Rewards points

Here’s how to earn and redeem Chase Ultimate Rewards points. And here are 7 easy ways to use the sign-up bonus you’ll earn.

I still recommend this card to peeps because of the strong sign-up offer, ease to earn ongoing points, and excellent ancillary benefits, like primary rental car insurance (which has saved my butt before).

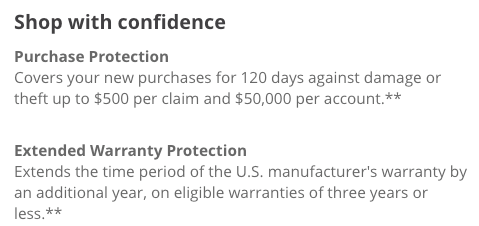

You won’t get price protection, but rather purchase and warranty protection

This card does NOT have price protection, so it’s up to the merchant to refund you the difference. But you will get purchase protection, and an extra year of warranty protection on warranties of 3 years or less.

That can be helpful if you’re buying a big-ticket electronic item, or something with lots of moving parts that might need repair down the road.

These, coupled with the excellent sign-up bonus, are perfect for holiday shopping.

October 29, 2018

STOP Leaving Your Money in Checking Accounts! Make It Earn FREE Interest Instead!

When I pull cash out of an ATM, the receipt always says I have something like $100 in my account. Yeah, in my checking account.

The truth is I keep my checking account balance low on purpose. Because money in a checking account ain’t doing nothing but sittin’ like a bump on a pickle (#SouthernSayins).

I want my money to work for me. Every day, for years. Compound interest is a wonderful tool that can work for you – or against you. So make it work FOR you!

At the very least, keep your money in an interest-bearing savings account. Pay your bills from checking, then transfer the excess to a high-interest savings or investment account.

Compound interest is one of the most powerful forces in the universe

Whatever you do, stop using checking accounts to park your money!

Get an interest savings account and/or an investment account to earn free interest

Link: Best IRA Accounts: 8 Companies Compared (Self-Directed, Apps, & Roboadvisors)

My financial strategy:

Keep monthly expense money in a checking account (here are the best with no fees)

Pay bills from that account

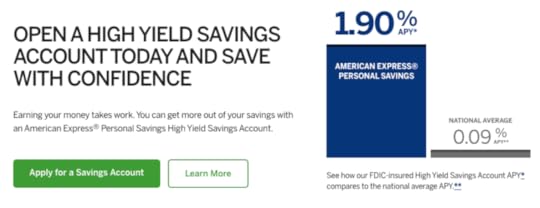

Whatever’s left over, send half to a high-yield savings account (Amex Personal Savings has 1.9% APY!) and half to an IRA account (here are the best)

Repeat monthly to pay bills, budget, and build short-term and long-term savings

1.9% is a fantastic return for long-term savings or an emergency fund

And all of this is free to have and keep. You should have a free checking account, a free savings account, and Fidelity has several funds with NO fees or minimums.

Your money can literally earn more FREE money just by parking it in the right place. Even saving $10 a week would give you $520 at the end of the year ($10 X 52)!

If you saved it in an account with 1.9% interest for 12 months, you’d get another $10 added to that. And that could be the beginning of a healthy emergency savings account.

If you have extra money, put it to work for you. Never keep large sums in a checking account for extended periods.

Plus, it’s a good idea to have something in a savings account or saved toward retirement.

But that’s a lot of effort!

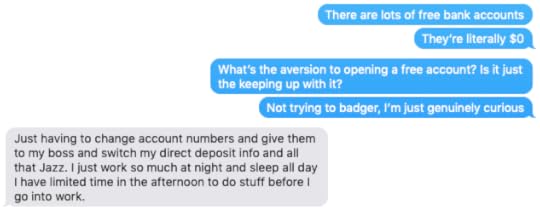

I’ve been trying to get my younger brother set up with a Fidelity Cash Management account – for months. I offered to set it up and let it sit there until he’s ready to use it. It’s free to get and there are no fees. But he doesn’t want one.

Finally, I asked him – why? Is it the psychological toll of having multiple accounts? Too much trouble to set up or switch auto-payments? Why keep a bank that charges fees when there are multiple free options?

Convo with my bro about switching his bank

He didn’t want to switch his account numbers and works a lot. I get it. But there’s no way I’m letting a bank charge me to access my own money.

I’d rather spend the few minutes it takes to switch account numbers one time than pay a monthly account fee for months and months.

Going back to that same $10 you could save – if you pay $10 per month in bank fees, that’s also $520 a year you’re giving to a bank to hold your money. Why on earth wouldn’t you rather have that earning interest in a savings account instead if you’re parting with it anyway?

Adding credit cards to the mix

To take it to the next level, an even better thing to do if you like to travel would be:

Save money for a trip

Get a travel rewards card and use points or miles for the trip instead

Put the money you saved into savings or retirement account

Now that’s really saving money on travel!

Yes, credit cards are yet another piece of your overall financial puzzle (and everyone should have one). But it comes down to, more than anything, your mindset.

Your money mindset can make or break you. I LOVE MONEY and using credit card rewards to get free travel!

For those who think it’s too much trouble, I’d say… anything worth doing is gonna take work.

And when the end result is saving money or getting luxurious vacations for pennies on the dollar, the end definitely justifies the means.

Bottom line

I am all about:

Saving time

Saving money

Traveling for free or really freaking cheap

Everything I write here boils down to one of those principles.

And yes, I use a lot of apps and stack deals and open new credit cards to earn bonuses because that’s fun for me. And I’ll admit: it’s a lot to keep track of. Mint.com is a literal godsend for seeing everything in one place, and I use FileThis to send all my statements to my Evernote account for easy review and storage (both excellent tools!).

I want all my money working for me. I never pay a dime of interest on my credit cards. And I’ll never pay junk fees to access my cash.

Get a a free checking account, park cash in a free interest-bearing savings account, and invest the rest in a retirement account. In this way, your cash always works to earn you more money with the power of compound interest. Never pay it – earn free interest instead!

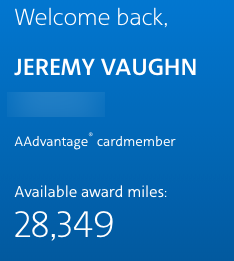

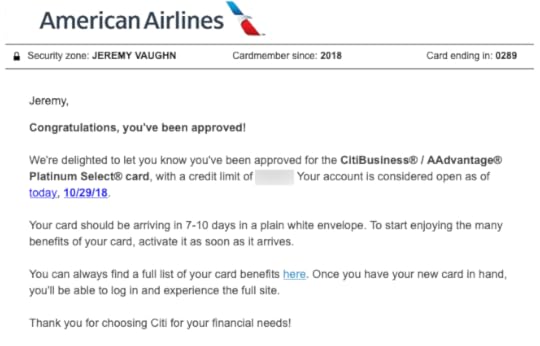

The Best Offer With the Most Miles for Those Over 5/24 (70,000 AA Miles, Small Biz Card)

Lord help me, I just got another new credit card. This one’s too good to pass up if you’re over 5/24 and have small business income.

You can earn 70,000 American Airlines miles with the CitiBusiness American Airlines Platinum Select card after meeting reasonable minimum spending requirements. I just signed up and got instant approval!

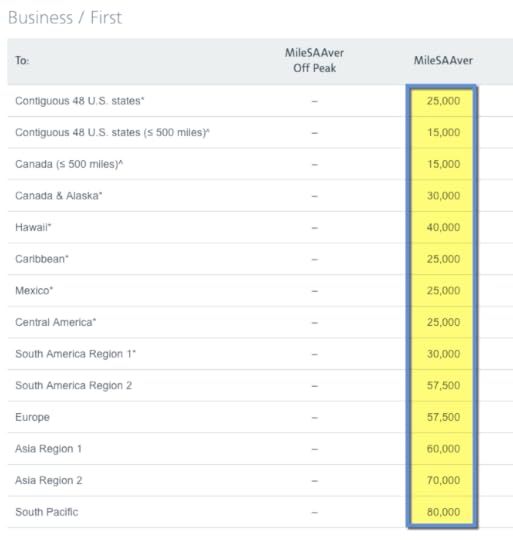

70,000 American Airlines miles is enough to visit:

4 countries in Asia (China, Hong Kong, Japan, South Korea)

Northern South America

Literally anywhere in Europe

The Caribbean, Mexico, or Central America

And it’s nearly enough for 2 round-trip coach award flights to Hawaii!

That fateful moment when you open yet another new credit card

I was running low on AA miles. But now that you can book Air Tahiti Nui and Qatar flights on the AA website (along with other partners), it’s easier than ever to use your miles. You do NOT have to fly on American Airlines – use your miles for partner flights instead!

I’m so close to an around-the-world trip on Cathay Pacific with Alaska miles, and Qatar with American Airlines miles, that I can taste it.

Plus, you can make mortgage payments via Plastiq with this card because it’s a MasterCard, so it’s easy to meet the minimum spending in no time! (That’s how I plan to complete the spending requirements.)

Citi AA 70K miles with the CitiBusiness American Airlines Platinum Select card

For a limited time, you can earn 70,000 American Airlines miles after making $4,000 in purchases within the first 4 months of account opening. That breaks down to $1,000 per month for 4 months, which is totally doable.

My mortgage is $1,500, so I’ll easily meet this minimum spending in under 3 months by making the payments through Plastiq. (You get $500 fee-free dollars if you sign up with my link.)

You’ll also get:

2X American Airlines miles per $1 spent on American Airlines flights

2X American Airlines miles per $1 spent at telecommunications merchants, cable and satellite providers, car rental merchants, and at gas stations

1X American Airlines mile per $1 spent on other purchases

The $99 annual fee is waived the first year. And there are no foreign transaction fees.

Realistically, I don’t see myself keeping this card long-term. But it doesn’t count toward 5/24. And if you’ve opened OR closed other Citi personal AA cards in the last 2 years, you can still earn the bonus on this card.

Plus, it’s the highest bonus of ANY AA co-branded card right now. I mentioned back in July this is a good card to get if you’re LOL/24, and now, I’ve just gotten it myself.

I love instant approvals

This is my first Citi small business card, and the application was super simple. I applied as a sole proprietor with my SSN, and was instantly approved.

Oops

I’m low on AA miles at the moment after using 54,000 miles to fly to Japan in Business Class earlier this year. And after earning the bonus, I’ll have 74,000 more AA miles (including the minimum spending), for a total of over 100,000 miles to burn.

What can you do with 70,000 American Airlines miles?

Link: AA award chart

American’s been on a roll with adding partners for online bookings. Directly on the AA site, you can book:

Air Tahiti Nui

Alaska Airlines

Fiji Airways

Finnair

Hawaiian Airlines

Iberia

Qantas

Qatar

Royal Jordanian

and more!

I really liked flying on Fiji Airways to the South Pacific

70,000 American Airlines miles is enough for a one-way Business Class class flight to nearly ANYWHERE in the world:

You can fly pretty much anywhere with this 1 sign-up bonus

Considering these flights can cost $1,000s if you pay cash, this is a screamingly good deal. My Business Class flights to Tokyo would’ve cost $15,000 had I paid out-of pocket.

As it stands, you can fly to:

China, Hong Kong, Japan, or South Korea for 65,000 American Airlines miles off-peak round-trip in coach

One-way to Northern South America for 60,000 American Airlines miles in Business Class (or 40,000 American Airlines miles in coach)

Anywhere in Europe for 60,000 American Airlines miles round-trip in coach

The Caribbean, Mexico, or Central America (like Costa Rica, Guatemala, Nicaragua, or Panama) for 25,000 American Airlines miles off-peak round-trip in coach!!!

Anywhere in Hawaii for 40,000 American Airlines miles round-trip in coach during off-peak

Feeling like a trip to Venice? You can do that with this 1 sign-up bonus. Then take the train to Florence or Milan!

Where I wanna go

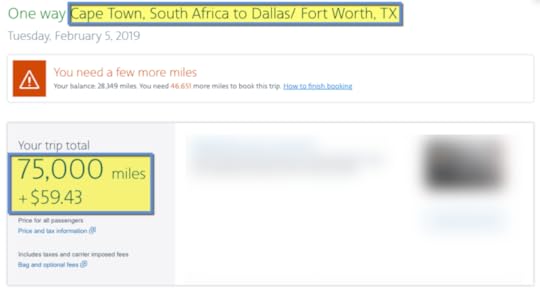

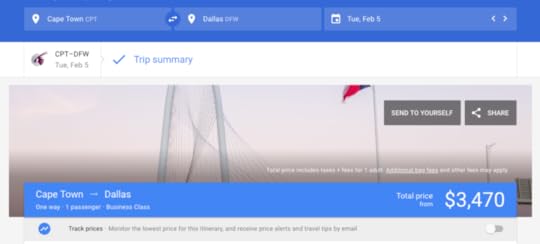

You can fly all the way from Africa to the US on Qatar in Business Class for only 75,000 American Airlines miles. This bonus is almost enough to fly between the 2 zones (only 1,000 miles short)!

Fly in Qatar Business Class to or from Africa for only 75,000 AA miles

Because you’ll have at least 74,000 American Airlines miles after meeting the minimum spending requirements (and more if you spend in the bonus categories).

This flight would cost $3,400+

It’s actually pretty cheap to fly all that way, considering. But I’d much rather use miles than pay $3,470 – and in this case, the miles are worth nearly 5 cents each, which is a stellar value.

I’ve been dreaming of piecing together a trip to Hong Kong and Cape Town on Cathay Pacific and Qatar, so this bonus finally puts that goal within reach.

Getting flights like this and being able to book them directly online from one sign-up bonus is amazing. I can’t wait to see Africa for the first time with my own eyes.

Walk along the shores of Mexico (and take 2 peeps with you) with one excellent sign-up bonus

Or you could get 3 trips to the Caribbean or Mexico in coach – or anywhere in the mainland US!

There’s no reason why this one sign-up bonus can’t be worth $1,000+ if you use it judiciously – or even a few thousand.

I personally don’t like getting low on AA miles. And with this bonus, you only have to spend $1,000 a month ($250 per week) to trigger the sign-up offer, which is easy for most people.

Bottom line

This is the best bonus for peeps over 5/24, trying to stay under 5/24 (because this card will NOT appear on your personal credit report), and small business owners, going on right now. It’s the highest bonus you can get that meets all those conditions.

Being able to earn 70,000 American Airlines miles with only $4,000 in spending spread over 4 months is easy (especially with Plastiq payments for rent or mortgage payments) – and the bonus can be worth several thousand bucks.

Squeee!

I just got card today with instant approval and want to plan a trip to South Africa in Qatar Business Class!

As long as you have a side hustle aiming to earn a profit, you can apply with your SSN as a sole proprietor. I’ve found AA miles easy to use, especially now that you can book most airline partners directly on their website.

If you’re looking for a great offer and an easy bonus to earn – this is it. It’s for a “limited time” so I’d recommend getting it sooner rather than later to be on the safe side.

How would you use 70,000 AA miles?