Harlan Vaughn's Blog, page 23

July 31, 2018

CityPass: Save up to 50% on Popular Attractions in 13 Cities

CityPass is a service I personally recommend to peeps when they stay at my Airbnbs and ask for fun stuff to do around Dallas.

Within Dallas, a $49 adult CityPass includes 4 attractions. Two of them are set. And you get to pick the other two. In this way, you build a little package for yourself. It’s fun, and saves you money when you travel. The Dallas package (for example) saves 40% on the 4 places you visit.

I loved spending time at the Dallas Botanical Garden as part of my CityPass ticket

The CityPass tickets filled up a weekend with places I’d been meaning to visit for a while.

CityPass has deals for 12 US cities and Toronto. If you visit a place on the list and want some fun touristy things to do, check what’s included for that city. They also have discounted tickets for kids and some cities have theme parks, aquariums, and much more to choose from!

CityPass savings

Key Link: CityPass

CityPass has packages in 13 cities:

Atlanta

Boston

Chicago

Dallas

Denver

Houston

New York

Philadelphia

San Francisco

Seattle

Southern California

Tampa Bay

Toronto

Visiting one of these cities (or Toronto)? See what’s offered with a CityPass

The specifics and savings vary depending which destination you want. Some packages are completely set, some are mix ‘n’ match, and some let you pick from a list of attractions.

Savings are all in the double digits and run all the way to ~50% off, in the case of Chicago (51%), Philly, (up to 48%), and Seattle (47%).

I did the Dallas package (40% savings) with a friend and loved it!

Here’s what comes with the Dallas CityPass

I chose the Dallas Zoo and the Dallas Arboretum from the last 2 on the list in the image above.

Having 4 fun things to do over a weekend was perfect. We spent a couple of hours and each spot, which kept us on the move and seeing new parts of the city.

At each attraction, there’s either dedicated CityPass check-in, or you can use expedited entry.

I bought my CityPass online. When I got to the first place I wanted to visit, they scanned the QR code on my phone and gave me a booklet. You have 9 days to use all your tickets – which should be plenty of time. I used all mine over 3 days.

My CityPass experience

I moved to Dallas a couple of years ago. And intended to visit the Perot Museum of Nature and Science for a while. I’d also heard about the beautiful downtown views from Reunion Tower.

So when a friend came to visit for a birthday weekend, I suggested we get the CityPass to have some fun things to do. It ended up being a fun time. And I got to play tourist in my adopted town.

Learning about Pangea at the Perot nature and science museum

I liked the variance of the places – from museums to outdoors and nature to beautiful views and interesting exhibits.

Up close with the giraffes at the zoo

Because a couple of places were outside, we made sure the weather would be nice before we bought the CityPass. It would’ve been possible to do everything inside, but we really wanted to visit the zoo. We got lucky and had amazing weather that entire weekend.

Gorgeous views of downtown at sunset from Reunion Tower

At $49 for 4 attractions, that comes to ~$12 each, which is a fantastic deal. We got general admission and a 3D film about exploring Mars as part of the deal at the Perot museum.

This one visit would’ve set us back $26 each

Admission to the botanical garden is $15, so the savings weren’t as substantial. But with everything in the package considered, we ended up saving about half off the entry fees.

I found the ticketing and getting the booklet to be super simple. If you have a few people in your group (or kids), it’s easy to check in together and present all your tickets at once – that definitely saves time over having to pay individually.

Check your city of interest

Again, each package is different. The best way is to click around and see what’s included with each one.

The Chicago CityPass includes SO much good stuff

Plus, there are discounts for kids. So if you want to explore museums, rides, or parks in a city of the list, you can save there, too.

Here are 2 more that stuck out to me as being really kid-friendly:

SoCal includes Disneyland 3-day Park Hopper and Legoland

Tampa Bay has Busch Gardens, two aquariums, and the zoo

I’d never seen the attractions included in the Dallas package bundled and discounted in that way before. So for me, it definitely saved money and gave me plenty to do and see. I highly recommend checking into each city’s offerings.

Bottom line

Key Link: CityPass

Sometimes it’s fun to do the touristy stuff and get them out of the way. In my case, I used CityPass as a way to know my hometown better.

CityPass has package deals in 12 US cities and Toronto (full list above). If you’re heading to a place on the list, definitely see what’s available because some of the packages represent savings of ~50% off what you’d normally pay.

I found the service straightforward to use. And beyond that, ended up getting an annual membership to the Dallas Arboretum because I loved it so much.

I recommend CityPass all the time to peeps visiting Dallas. If you’re planning to visit popular attractions, this could be a way to see more when you travel and save time and money doing it.

Have you used CityPass? Did you enjoy it as much as I did?

July 30, 2018

LAST DAY: $499 FinCon Passes – This September in Orlando!

Looking for inspiration, truly great networking opportunities, and a ton of personal finance information in one jam-packed 4-day event?

I attended FinCon 2017 in Dallas. As soon as it was done, I immediately registered to attend Orlando 2018, though I didn’t know how I’d fit it in at the time.

Flash forward to now. In 2 short months, I’ll be in Orlando for a week of CardCon, FinCon, and maybe even Disney World (when in Rome, right?).

8 Easy Tricks to Earn & Redeem Chase Ultimate Rewards Points

This one’s for my friends who say, “I never earn enough points to get a travel reward,” or, “Points are useless once you have them.”

The truth is you don’t have to invest a ton of time into learning how to use your points. You can do well by using 1 or 2 tricks to earn and redeem for travel.

And if you do that, you will still come out way ahead of most people.

I used Chase Ultimate Rewards points to stay in San Francisco this April

These “tricks” require very little finesse – just that you pay attention. Perhaps now is a good time to form a habit loop?

Even if these methods are ALL you ever learn, they’re an incredible place to begin. And once you’re comfortable, you can build from there – baby steps.

4 ways to EARN Chase points

1. Sign-up offers

First up, sign-bonuses are a super easy way to earn Chase points. A few popular offers right now are:

Chase Sapphire Preferred50,000 Chase Ultimate Rewards points

• $95 annual fee• $4,000 on purchases in the first 3 months from account opening

• The best card for beginners• Compare it here

Chase Freedom15,000 Chase Ultimate Rewards points

• $0 annual fee• $500 on purchases in the first 3 months from account opening

• A great first Chase card• Compare it here

Chase Ink Business Preferred80,000 Chase Ultimate Rewards points

• $95 annual fee• $5,000 on purchases in the first 3 months from account opening

• Amazing small biz card with best-ever offer right now• Compare it here

Chase Ink Business Cash50,000 Chase Ultimate Rewards points

• $0 annual fee• $3,000 on purchases in the first 3 months from account opening

• Excellent 5X categories and best-ever offer right now• Compare it here

It’s important to know you will NOT be approved for these cards if you’ve opened 5+ cards from ANY bank in the last 2 years. But if you’re starting out, that shouldn’t be an issue.

And the Chase Sapphire Preferred is still the best card for beginners.

To earn the biggest bonuses, you need to spend $3,000 to $5,000 dollars in the first 3 months you have the card. If that sounds like a lot, it’s not.

Once you divide it out, it’s $1,000 to ~$1,667 per month. When you can use services like Plastiq to pay bills like rent, car payments, insurance, and utilities, it’s pretty simple to meet the requirements to earn the bonus.

2. Bonus categories

Every Chase card has a spending purpose. For example, the Chase Sapphire Preferred earns 2X Chase Ultimate Rewards points on travel and dining.

I earn a crap ton of Chase points for dining. Notice I don’t use the card much for non-travel and non-dining!

And the Chase Sapphire Reserve (compare it here) earns 3X on travel and dining. I pretty much ONLY use the card for the bonus categories! If it’s not travel or dining, that card doesn’t get to come out and play.

Luckily, the bonus categories are broad – so I still use the card nearly every day. Travel includes things like parking, tolls, car rentals, Airbnb, and Lyft rides. And dining includes coffee shops, bars, and fast food.

Bonus categories are so important. Know and use them to earn extra points, like shopping for groceries

The Chase Freedom has rotating quarterly bonus categories to earn 5X Chase points. This quarter, through September 30th, 2018, you can earn 5X Chase points for gas station purchases, Lyft rides, and at Walgreens (on up to $1,500 in spending for the combined categories).

Past quarters have been for grocery stores, Amazon, warehouse stores like Costco, and mobile phone payments. If you go to the limit, that’s 7,500 Chase points per quarter (1,500 X 5).

And over a year, that’s 30,000 extra Chase points!

3. Combine points from multiple cards

Jumping off the last point.

Once you have a couple of Chase cards that cover most of your bonus spending, you can then combine all your Chase points into one account – the one that lets you transfer points to travel partners.

Pair Chase cards to earn even more points

I combine all of my Chase points to my Sapphire Reserve account. And from there, to travel partners for free or really cheap travel.

Off they go into the main account

Combining your points to get the maximum value per point is the simplest and easiest trick in the book. If you have a Freedom or Freedom Unlimited, you can unleash the power of transfer partners by picking up a Sapphire Preferred, Sapphire Reserve, or Ink Business Preferred.

4. Shop through the Ultimate Rewards shopping portal

Link: 15 Cashback Shopping Portals Compared: Payments, Bonuses, & How They Work

Did you know Chase has its own shopping portal, only available to peeps with Chase Ultimate Rewards cards?

If you haven’t been clicking through the Chase shopping portal, you’ve been missing out

As of now, the portal lets you earn bonus Chase points at 365 of the most popular online merchants – all for clicking a link before you start shopping.

Even better, the bonuses can stack.

For example, when department stores are a Freedom 5X category, you’ll earn 5X Chase Ultimate Rewards points at department store sites like Kohl’s, Macy’s, or JC Penney.

And you’ll also earn a bonus from clicking through the portal! If the portal offers 5X points (again, just an example), you’ll end up with 10X points per $1 spent.

In any case, it never hurts to rack up more Chase points. They’re arguably the most valuable points around. Just be sure to check Cashback Monitor so you always get the most points or cashback for your online shopping.

4 ways to REDEEM Chase points

Once your pile of points grows, you’ll inevitably start to wonder what you can do with them.

There are many ways, but here are 4 of the absolute easiest. Again, if these 4 tricks are all you ever learn, you will still come out ahead of the vast majority.

1. Transfer to Hyatt for free hotel stays

I jam on this one all the time. For those who say nothing is ever available with points, the good news here is Hyatt doesn’t have blackout dates for award nights. As long as a standard room is available for cash, you can book it with points.

You won’t pay taxes & fees when you book with points.

Last week I was in Austin for 4 nights at the Hyatt House Austin Arboretum. I used 32,000 Hyatt points (transferred from Chase) to pay for the stay.

I saved ~$655 on a 4-night stay in Austin last week

I ended up paying $0 – and got a rate of 2 cents each for my points.

Fenwick loved the dog park at the hotel

2. Transfer to Southwest for flights

Another easy one. Southwest doesn’t have blackout dates, either. And the number of points you’ll need is tied to the cost of the flight.

I found lots of flights from Dallas to New York

That means if you can find a cheap ticket, you can either pay cash, or use a low number of points. I could use ~7,200 Southwest points to fly to New York next month. These fares are around $120, and each point is worth ~1.6 cents.

Keep in mind if you have the Chase Sapphire Reserve (compare it here), you can book flights through Chase for 1.5 cents each. You’ll earn points when you fly – and the flights count toward elite status.

Note: You have to call Chase to book Southwest flights with Ultimate Rewards points.

Depending which card you have, you can do well if you like to fly Southwest. And often, you can pay fewer points for an award flight than the standard 12,500 miles each way most other airlines charge.

3. British Airways for short flights on American

Link: British Airways Fifth Freedom Flights Bookable With Avios

I cannot overstate this enough. My friends think it sounds crazy to use British Airways points to book American Airlines flights. But that’s really how it works, because they are airline partners.

Within the US, “short flights” are those under 651 miles.

Take, for example, Memphis to Dallas – a short flight with (sometimes) high ticket prices.

I found a flight for this weekend – say, if my mom wanted to spontaneously come see me (she’s in Memphis and I’m in Dallas).

$315 for a one-way!

At $315 just for the flight out, it looks like mom won’t be coming out this weekend, eh?

Decent, but… nah

If you used American Airlines miles, you’d pay 7,500 miles plus an extra $75 for a close-in booking fee for that same flight. Plus you’d need to have American Airlines miles.

But, you can still access this flight with Chase points – and only $5.60 in fees – by booking it through British Airways instead. You can search directly on the British Airways website.

Same number of points, and much less cash!

That’s because British Airways doesn’t charge close-in booking fees. So you can book the same $315 flight for 7,500 British Airways Avios points and ~$6. Of course, double the prices for a round-trip – but it’s still much cheaper than other airlines would charge for similar award seats.

I’ve used this trick to book flights between Dallas and Austin, too. Basically any short but expensive flight on American Airlines – this is a powerful and handy trick to have in your arsenal.

4. United flights to Hawaii via Singapore

Link: Singapore Airlines’ Star Alliance award chart

You can transfer your Chase points to Singapore to save on flights to Hawaii. You’ll pay:

35,000 Singapore miles round-trip in coach

60,000 Singapore miles round-trip in Business

80,000 Singapore miles round-trip in First

Split the cost in half for one-way prices.

Cheap flights to Honolulu!

30,000 miles to one-way fly to Hawaii in Business Class is pretty good! And much cheaper than United charges on their own flights (50,000 miles for a one-way!).

I always think about Hawaii

I’m considering another Hawaii trip this fall or winter… and I’ll personally check this particular award for my trip. You can search on Singapore’s site.

I mention Singapore miles specifically because they’re a transfer partner of all 4 main transferrable points programs (Chase, Amex, Citi, and SPG). So chances are you can cobble together an award with Singapore miles.

Check out their award chart – there are other sweet spots like 7,500 miles to fly around the west coast on Alaska, 27,500 miles to Europe in coach, or of course flights on Singapore Airlines, voted the best airline in the world again this year!

Bottom line

Sapphire Preferred – Compare it here

Sapphire Reserve – Compare it here

Freedom – Compare it here

Freedom Unlimited – Compare it here

Chase’s Ultimate Rewards program has been a solid points program for years by now – and its value remains to this day. I understand the frustration of feeling like you can’t earn enough points to do anything meaningful, only to find they’re hard to redeem once you earn enough.

But 2 of Chase’s partners don’t have blackout dates (Hyatt and Southwest) and others require the smallest bit of searching around. Your patience will be rewarded in spades of free travel. And these tricks are easy ways to cut right to real value.

Any questions? I’m happy to point you in the right direction!

July 17, 2018

Last Summer, Bumped off Delta Flight. This Fall, Free Business Class Flights to Mexico City

This time last year, I was hiking through the mountains of Glacier National Park in Montana. I wrote about how I booked the trip and the one and only time I’ve ever had to use rental car insurance to file a claim.

I also got to stay at Granite Park Chalet with my dear friend Angie for 3 nights of mountain views, good company, and sneaky shots of whiskey before bed.

This Thursday (7/19): Join the Dallas Frequent Flyer Meetup at Sundown!

It’s that time – this Thursday, July 19th, Out and Out is hosting another Out for Miles frequent flyer meetup in Dallas!

This one is in the trendy Lower Greenville neighborhood, close to 75 and 635 for those coming from all points.

Join us for a great happy hour in a relaxed venue this Thursday

We’ll be there a little before 6pm to welcome everyone. There’s a fantastic happy hour until 7pm with cheap drinks and light bites.

Out for Miles event details

Link: Join Out for Miles

Link: RSVP here

We’ll be at the big table in front of the bar – you’ll see it right when you walk in. Grab a pint – we have a lot of points news to talk about like:

The impending Marriott/SPG changes on August 1st

Chase shutdowns and their new “partnership” with Amex

What you bought for Prime Day

July 13, 2018

Yay! A Huge 89-Point Jump for an Authorized User’s Credit Score!

Or, Lighting Strikes Twice!

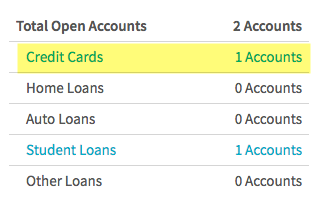

I shared how my brother’s credit score jumped 100+ points in a month after I added him to one of my credit cards. He had literally nothing on his credit report.

Last month, I added an authorized user to a 5-year old (no annual fee!) credit card with a $13,000 credit limit. The statement closed on July 3rd. And on July 11th (a week later), we pulled his credit report.

My AU’s credit score went up 89 points in under a month

His new score (according to Credit Sesame) is now 732 – 89 points more than it was this time last month! (FWIW, it was the same on Credit Karma, too.)

After adding my brother, and now with this new experience, I’m convinced how beneficial it can be to add authorized users to old cards with a high limit. And why it’s so important to have a couple of cards with NO annual fees in your wallet.

This AU had one negative mark, but all my info transferred

Link: Check your credit score for free on Credit Sesame

Whereas my brother had NO credit at all, this authorized user had one negative mark – a collection account for ~$400 from December 2016.

Because of it, his score was 643, which isn’t horrible – but not great.

I added him to my Fidelity Visa, which I’ve had for ~5 years by now. I once called it the best cashback card in the universe (although you can do very well with Discover It, too).

Before, he had zero credit accounts and one student loan. I was impressed that all my credit card details transferred to his account – as if they were his.

Now there is one credit card showing – the one I added him to

Further, our credit ages blended to form an average. This is why having a no annual fee card is so important – because you can keep it forever to age all your other accounts!

Blended age of credit history

All of my credit line and utilization details transferred, too. So if you want to really help, add an authorized user to a card you use sparingly. Under 10% is a good mark.

The $13K line showed up as being his

At the time, there was a promotion to spend $500 on the Fidelity Visa (which has a $100 sign-up bonus right now!) and get a bonus $25 in points (on top of the normal 2% cashback, for an effective 7% cashback, which is awesome). I always go a little over, so I spent $523 on that card last month. Sure enough, I earned the bonus points – and the spending shows on his account, too.

All of this transferred after one credit cycle. A week after the billing period closed, the information showed up on my authorized user’s credit profile. Really cool.

Add AUs to old accounts with high limits (and preferably no annual fee!)

Link: No annual fee credit cards

Why would you want to do this?

When I added my brother, it was to help him buy a car and get his own apartment. For the new AU, it was was to offset the one blemish on his account.

In both cases, I wanted to help people I knew and trusted to get ahead with better credit.

Having good credit – and a high score – is so important for:

Preferred rates on mortgages

Renting an apartment

Getting a new car with a note or lease

Applying for rewards cards

Building credit history early

Refinancing private student loans

The best way to help is to add users to cards that:

Are 5+ years old – the older the better!

Have high limits – over $10,000 preferably

Don’t have annual fees – that way you’re NOT on the hook to pay a fee while their credit profile gets an update

Keep in mind, Chase and Citi do NOT ask for SSNs – the information is based on address. So if your AU doesn’t live with you, it’s best to add them to an Amex, Bank of America, Barclays, or US Bank card. That’s important to remember – those banks all DO ask for an SSN.

Bottom line

I love all the benefits I’ve gotten from having excellent credit. I got my mortgage when rates were low. And bought a new car with a great interest rate. I’m nearly always approved for new card accounts instantly. And any time credit is a factor, it’s never a worry – which is awesome (my score is currently 768).

I’m to the point where I can help others by adding them as authorized users (AUs) to my oldest card accounts with high limits and no annual fees. When I added my brother, his score got a healthy 100-point jump.

And this week, I added another AU, whose score jumped 89 points despite one collection account from ~2 years ago.

I’m now a believer this really works – each time, I saw results after only 1 month.

If you have friends or family you (trust – although you do NOT have to give them the card) and want to help, the benefits can help them get a new car, a home, or rewards cards of their own. I recommend Amex, Bank of America, Barclays, or US Bank cards that are 5+ years old with $10,000+ credit limits for maximum, fastest results.

Have you had a similar experience? Would you add someone to your card account to help their credit score?

July 12, 2018

3 Days in Iceland: What You Should Know About Your Stopover Trip

It’s easier than ever to spend three days in Iceland:

WOW! Air frequently has $99 one-way sales to Iceland (and around $200 coming home)

Icelandair lets you add a free stopover – up to 7 days – on your way to mainland Europe

American, Delta, and United all fly there seasonally from their hubs

Of course, with all this competition, fares are rock bottom. I’ve seen them as low as $287 round-trip to visit the Land of Fire & Ice.

Planning a visit to Iceland? You should – it’s easier than ever

I say Iceland deserves a full week to appreciate. The weather is unpredictable and if you hit a rainy patch, that’ll be unfortch. That said, if you’ve never been it’s beyond worthwhile to add a bonus side trip to Iceland. A friend asked what to do with 3 days in Iceland, to which I said…

Even three days in Iceland is expensive

Link: What to Do in Iceland: West Coast

Link: What to Do in Iceland: South Coast

The rumors are true: Iceland will drain your wallet. The myths about $35 burgers, $10 beers, and $23 cocktails are all true. Their currency, the krona, is strong. The dollar is comparatively weak. Plus, Iceland is hot right now – can you blame them for jacking up prices?

Getting there is the easy part

Honestly, getting there is the cheapest part. But there are ways to save.

Grocery stores

You’re not going to Iceland for the food, which is mostly burgers and fish. They have great burgers and fish, but you’re going to Iceland for the nature. Find a grocery store – a Kronan or a Bonus – and stock up on bread, chips, sandwich fixins, and snacks.

A beer with THIS view? Yes, plz! But do save at grocery stores

Of course, you should have a pint of their local beer – Viking or Gull – and try some of the freshest wild-caught salmon in the world.

But considering you’ll be in a car much of the time, and restaurants may be far, you’ll want to have some stuff from the grocery store, anyway.

Iceland now has a Costco! So if you’re a member, a drive to the suburb of Kopavogur may be in order to get everything you need at warehouse prices. It’s only 12 minutes by car from the city center.

Rental cars

Link: Plan Iceland

Link: Iceland Car Rental

Expect to pay between $50 and $100 per day to rent a car – obviously dependent on your dates, availability, when you book, etc. I typically see the best prices from Iceland Car Rental. And Plan Iceland is another great resource to save some money.

You’re gonna wanna rent a car to see most of the iconic nature scenes in Iceland, like the Glacier Lagoon (Jokulsarlon), black sand beaches, and dozens of waterfalls.

Another huge thing to note is Iceland is obsessed with stick shift cars. If you want/need automatic, there’s an upcharge and also a shortage. So book early and shop around if it’s a dealbreaker (I know it is for me).

Hit the ground running

Link: Flybus

Here’s the “tea.” Those overnight flights to Iceland are a bitch and a half. You arrive at 6am after not sleeping all night. You’re tired. The airport is small and well-signed, but you still have to navigate, find the rental car booth, and you’re probably hungry.

First step: breathe.

July 6, 2018

Does Your Biz Spend $8,000+ a Month? Get 125,000 Points, $700+ in Credits, Lounge Access, Elite Status…

Who’s never had the small business version of the Amex Platinum Card? *raises hand*

This card doesn’t count against your Chase 5/24 status. But I didn’t include it on my list of 7 best cards if you’re over 5/24 because:

It will only appeal to a small segment of people

The minimum spending requirement to earn the welcome offer is $25,000 (!) in the first 3 months of account opening

But there are several huge reasons to get this card, namely 100,000 Amex Membership Rewards points as a welcome bonus. Plus it comes with a long list of benefits – and the annual fee is only $450, a full $100 less than the personal versions! To get the deal, you must apply by August 8th, 2018 (about a month away!).

I always make sure to eat full meals and enjoy a couple free cocktails at Amex Centurion Lounges

The annual fee is NOT waived the 1st year. But man, if you make good use of the lounge access and annual statement credits… it’s a total GOAT.

Amex Platinum business 100K card offer

Link: Amex Platinum small business card – learn more here!

Elephant in the room comes first. You get so much with this card. But to unlock the full sign-up bonus, you need to spend $25,000 on purchases within the first 3 months of account opening. It breaks down to:

Earn 50,000 Amex Membership Rewards points after you spend $10,000 AND

Earn an extra 50,000 points after you spend an additional $15,000 all on qualifying purchases within your first 3 months of Card Membership

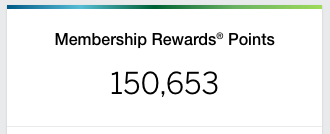

I like having a lil stash of Amex points

Again, this offer ends on August 8th, 2018, so you have roughly a month to think it over. I know I will.

While the spending requirement sounds huge, it breaks down to ~$8,333 per month to earn the full 100,000 Amex Membership Rewards points. Plus, you’ll end up with at least 125,000 points when you factor in the spending (and even more if you spend in bonus categories).

Amex has some valuable airline transfer partners (I’ve highlighted my faves)

Link: Amex Membership Rewards transfer partners

When you transfer your points to partners, you can get:

Business Class flights to Europe, Asia, South Africa, or New Zealand (depends on how far and where)

Dozens of short-haul flights around the world – 27, to be exact @ 4,500 British Airways Avios points for flights under 651 miles outside the US

3 round-trip coach flights to Hawaii on United via Singapore Airlines (at 35,000 Singapore miles each)

Round-the-world in Business Class via ANA

I love using points to fly for free in metal tubes

My friend Spencer has an excellent overview of these rewards. Any of them could be worth $1,000s of dollars on their own, which already makes it worth paying the annual fee the 1st year.

So. Many. Bennies.

I’ll do a cross-section. This card comes with:

$200 in airline fee credits per calendar year (so you can get it in 2018 and again in 2019 – $400 total)

10 Gogo passes to use in-flight per calendar year (10 in 2018 and 10 in 2019 – worth $320 total)

The credits are useful if you’ll, well, use them

That’s $700+ in credits right there – without counting the Global Entry credit for $100, which would add even more if you need/want to use it.

Of course, these credits are only valuable if you’ll use them! I used my airline credits for $400 in Southwest gift cards.

All fun extras to have.

You also get:

Access to unlimited Boingo Wireless

Gold elite status with Hilton and Starwood

Access to Fine Hotels & Resorts

Plus, you can access Amex Centurion Lounges. I go to the one at DFW all the time (the best one!). For me, this alone is easily worth the price of admission. Not only that, but you can use the card to enter Delta SkyClubs and Priority Pass lounges.

I knowwww… every premium card comes with a Priority Pass these days. But the Centurion Lounges are really a special treat – and you can only access them with an Amex Platinum (or Black

July 5, 2018

7 Cards to Consider If You’re LOL/24 (No Chase on This List!)

There’s zero doubt Chase cards are the best to get first. Their products have high sign-up offers, excellent ongoing benefits, and strong category bonuses.

But… Chase shutdowns are increasing – even if you haven’t opened a Chase card in recent past. And, they have aspirations to use their 5/24 rule for ALL their cards. (Which is ridiculous, especially for the co-branded cards because you want people to actually get them, right?)

I’ll have to accept this was the last Chase card I might ever get

June 29, 2018

Tomorrow: I’m Chatting Live With The Credit Card Nerd on YouTube @ 3pm CT!

Set a reminder! There’s a new podcast in town. The Credit Card Nerd hosts a weekly discussion of points & miles news every Saturday at 3pm CT.

And tomorrow, I’m the featured guest on the fourth episode!

Watch me and Chase talk shop on Saturday, June 30th @ 3pm CT

We’ll go over lots of recent news, my latest trip to the Faroe Islands, and take your questions – live!

Out and Out on Credit Card Nerd Podcast

Link: The Credit Card Nerd + Out and Out Live Podcast

When Chase from The Credit Card Nerd reached out and asked if I wanted to talk about points & miles live on his new podcast I said yes yes yes!

And tomorrow’s the big day!

Join us on the live streaming podcast on YouTube tomorrow, June 30th, at 3pm CT.

We’ll discuss recent points news including:

New Amex Platinum Card Saks $100 credit

Frontier credit card refresh

New Chase application rules and teaming with Amex to limit Marriott sign-up offers (!)

United Polaris lounge in Houston (IAH)

The brand new Chase World of Hyatt card

That crazy Iberia 90K Avios points promotion

…And more!

We’ll also talk a bit about my latest points redemption to visit Iceland and the Faroe Islands.

Watch our convo live on YouTube and chime in with comments and questions!

And follow us on our social media accounts for fun news and updates:

Chase on Instagram: @creditcardnerd

Harlan on Instagram: @harlanvaughn

Harlan on Twitter: @harlanvaughn

See you tomorrow!