Harlan Vaughn's Blog, page 22

August 15, 2018

GIVEAWAY: Enter to Win a Basic Pass to FinCon 2018 Next Month (Worth $600+)!

Join me at FinCon 2018 next month!

For my birthday weekend next week, I’m giving away a Basic Pass to the event which is September 26th through 29th, 2018, in Orlando!

The entries begin today at 5pm Central Time and end on August 22nd, 2018, at midnight Central Time!

GIVEAWAY: Enter to Win a Basic Pass to FinCon 2018 Next Month (Worth $600+)!

Join me at FinCon 2018 next month!

For my birthday weekend next week, I’m giving away a Basic Pass to the event which is September 26th through 29th, 2018, in Orlando!

The entries begin today at 5pm Central Time and end on August 22nd, 2018, at midnight Central Time!

GIVEAWAY: Enter to Win a Basic Pass to FinCon 2018 Next Month (Worth $600+)!

Join me at FinCon 2018 next month!

For my birthday weekend next week, I’m giving away a Basic Pass to the event which is September 26th through 29th, 2018, in Orlando!

The entries begin today at 5pm Central Time and end on August 22nd, 2018, at midnight Central Time!

GIVEAWAY: Enter to Win a Basic Pass to FinCon 2018 Next Month (Worth $600+)!

Join me at FinCon 2018 next month!

For my birthday weekend next week, I’m giving away a Basic Pass to the event which is September 26th through 29th, 2018, in Orlando!

The entries begin today at 5pm Central Time and end on August 22nd, 2018, at midnight Central Time!

GIVEAWAY: Enter to Win a Basic Pass to FinCon 2018 Next Month (Worth $600+)!

Join me at FinCon 2018 next month!

For my birthday weekend next week, I’m giving away a Basic Pass to the event which is September 26th through 29th, 2018, in Orlando!

The entries begin today at 5pm Central Time and end on August 22nd, 2018, at midnight Central Time!

GIVEAWAY: Enter to Win a Basic Pass to FinCon 2018 Next Month (Worth $600+)!

Join me at FinCon 2018 next month!

For my birthday weekend next week, I’m giving away a Basic Pass to the event which is September 26th through 29th, 2018, in Orlando!

The entries begin today at 5pm Central Time and end on August 22nd, 2018, at midnight Central Time!

Get a Year + 3 Months of 0% Interest (Including $0 Balance Transfers!) With This Amex Card

0% APR intro offers are common, especially for purchases. And you can usually transfer a balance from another card – but you’ll pay fees in the form of a percentage of the amount you transfer. The more you transfer = higher fee.

So when I saw a deal for 15 months of 0% interest on purchases including NO fees on balance transfers, that caught my attention. Then I realized it was with an actually useful Amex card – with a decent welcome bonus. It’s the Amex EveryDay card – learn more here.

Offers like these aren’t as exciting as getting tens of thousands of bonus points. But they can give you a lot of breathing room – especially if you need to plan for a big purchase, or catch up to avoid paying hundreds in interest fees. In this case, for well over a year.

I know I’m gonna need a new HVAC system – to the tune of $6,000 – in the next couple of years

I’ve taken advantage of similar offers in the past. And this one would be a great way to consolidate some balances. Especially if you’re over 5/24.

Amex EveryDay balance transfer offer

Key link: Amex EveryDay card – learn more here

Link: 0% APR cards

When I think of “balance transfer card” I think of Chase Slate. (Their marketing for that card is genius.)

Thing is – it’s not a great card to actually spend with. Meaning once its usefulness has expired, you’re left with a blah card that earns no rewards – and you’ve taken up a Chase slot.

Also, if you’ve opened more than 5 cards from ANY bank in the past 24 months, you won’t be approved for it. And if you want to transfer the balance from an existing Chase card, you can’t make a transfer to another Chase card. So you need a card from a different bank.

15 months and NO fees is pretty amazing

The Amex EveryDay card earns:

2X Amex Membership Rewards points at US supermarkets (on up to $6,000 in purchases per year, then 1X)

1X Amex Membership Rewards point on all other purchases

There’s also a welcome bonus of 10,000 Amex Membership Rewards points after you make $1,000 in purchases in your first 3 months (that does NOT include balances you transfer – has to be new purchases).

There’s been some talk that Amex has dropped (or loosened) their 4-credit-card limit. Plus, Amex is spectacular about moving credit lines around.

If you have other Amex personal cards, you can add those credit lines to whatever you get with this card. I’ve personally done it many times – just call them to move things around.

And while the rewards structure isn’t the most exciting, it does earn rewards for spending – and keeps your other Amex Membership Rewards points alive and transferrable to travel partners. Plus, this card doesn’t have an annual fee – so you can keep it year after year to help age your overall credit and boost your score.

0% for 15 months and $0 transfers?!

The other cool thing about this offer is there are no fees for balance transfers, as long as you initiate the transfer within 60 days of opening the card. Most cards charge 3% to 5% of the balance you want to move – which can add up fast if you have a large balance.

For example, you made a purchase or transfer in September 2018, you wouldn’t pay any interest as long as you pay off your balance within 15 months – or by November 2019.

I took out a huge chunk of my student loan with a 0% APR offer

That’s helpful if you need to plan for a big purchase like:

Home repairs (I need a new HVAC system soon)

Moving expenses

Medical bills

Car repair or down payment

New appliances

Payments on a student loan, car note, or other bill via Plastiq

The best part about this card offer isn’t the welcome bonus – instead, it’s the breathing room you give yourself to get caught up for a little while. So while it’s not luxury trips with free award seats in fancy planes, that certainly doesn’t make it any less valuable if it helps you get ahead.

Balance transfer offer terms

Amex says:

No transfer will be processed if: (1) any requested transfer is less than $100; (2) the total amount of all requested transfers exceeds the lesser of $7,500 or 75% of your credit limit; or (3) charging the requested transfers to your Card account would cause your total account balance to exceed your credit limit.

So the limit you can transfer to this card is $7,500 – and that’s if your credit line is at least $10,000 (but again, Amex is good about shifting credit lines between personal cards).

Credit cards are tools

Why? Because money is a tool. Nothing more or less. You exchange your time for money. And then exchange money for experiences or objects.

Like any tool, if you use it properly you can create something solid and beautiful. Or, you can totally mess everything up.

A hammer can nail boards together to build a home. Or you can destroy an entire structure with it.

The good or bad isn’t inside the hammer – it’s within the person using it. So it goes with credit cards.

I have 30 credit cards and see them as tools in a drawer. They have no energy on their own – it’s my job to supply a purpose

Used properly, credit cards can earn you rewards, help control your cash flow, and unlock travel you never thought possible.

On the flip side, credit card debt is a downward spiral, man. If you’re not careful, you’ll wind up owing much more than when you started.

What I’m saying is: don’t take a 0% APR offer as a license to spend like crazy. See it as an opportunity to give yourself time and space to plan your finances.

Bottom line

Key link: Amex EveryDay card – learn more here

Link: 0% APR cards

The 15 months with 0% APR and $0 balance transfer offer on the Amex EveryDay card is strong for many reasons – and improves upon researching. For one, it’s an Amex card (obviously) but that means it won’t take up a Chase slot and is NOT affected by your 5/24 status. The card earns rewards and even has a modest welcome bonus.

Finally, Amex is great about moving credit lines around.

You might move a balance to this card for any number of reasons: to avoid interest or annual fees, consolidate, or free up another card for spending. And having 15 months to repay without interest is a nice amount of time to catch up on a big purchase, like a home repair or move.

I haven’t seen offers like this with Amex cards before. It’s a good opportunity and a good deal. It’s not a license to spend money you don’t have – but used properly, can be a great way to improve your overall financial situation.

Have you used 0% balance transfer offers before? How’d it turn out for you?

August 11, 2018

For Advanced Players: The Citi ThankYou Premier 60,000 Point Offer Is Easily Worth $900

Dang, I just checked my credit file, and it looks like I closed my last Citi ThankYou Premier card in June 2017. I still have my Citi Prestige card open (and can’t wait to see how they refresh it this month).

According to Citi’s rules, I’m not eligible to earn another bonus on a ThankYou card because I’ve opened OR closed a ThankYou card within the last 24 months. But man, if you’re eligible to apply for this offer, there is absolutely no reason you shouldn’t hop all over it – especially if you’re over 5/24.

I have some FOMO about this offer. Because this offer is an easy $900 toward travel.

I use Citi ThankYou points all the time – including for flights to Belgium to stroll the gorgeous river that runs through Bruges

Here’s my expert analysis.

August 3, 2018

Is It Worth Getting (or Converting to) the Chase Ink Business Preferred Just for 3X Plastiq Payments?

There’s a bit of a known secret about the Chase Ink Business Preferred card – you earn 3X Chase Ultimate Rewards points on ALL Plastiq payments (that is, the ones you can use a Visa card for).

I currently have the old Chase Ink Plus card (no longer available) that earns 5X at office supply stores, and on cable, internet, and phone service.

But month after month, I find myself spending way more on Plastiq payments than on “office supplies” or my internet bills. I’m heavily considering converting to the Ink Business Preferred to get that sweet 3X. When I run the numbers, I know I can earn more Chase Ultimate Rewards points this way. But, I’m afraid:

Chase will change the 3X any second now

Of losing the Chase Ink Plus card – once I convert, I can never go back

Is it worth a risk long-term for a short-term gain? Ah, isn’t that always top of mind with this hobby (and everything, really)?

I’ve had the Chase Ink Plus since it was a MasterCard… but if I covert, it’ll go the way of my Blockbuster card: SO TOTALLY OVER

Along the same thinking, would it be worth opening the Chase Ink Preferred to earn 3X on Plastiq payments… for as long as the gettin’s good?

Chase 3X Plastiq payments

Key link: Chase Ink Business Preferred – Compare it here

Key link: Sign-up for Plastiq and get $500 in fee-free payments

With the Chase Ink Preferred (compare here), you can earn 80,000 Chase Ultimate Rewards points when you spend $5,000 on purchases in the first 3 months from account opening.

That’s worth $1,000 toward travel booked through Chase – or potentially $1,000s more when you transfer points to Chase’s valuable transfer partners.

Pair Chase cards to earn even more points

You’ll also earn 3X Chase points on the first $150,000 spent in combined purchases each anniversary year on:

Travel

Shipping purchases

Internet, cable and phone service

Advertising purchases made with social media sites and search engines

Earning 3X Chase points on rent or HOA dues is super sweet

For whatever reason, Plastiq codes to earn 3X Chase points on every payment you can make with a Visa card, including:

Rent

Tuition

Student loans

Car note

Insurance

Utilities like electricity

HOA dues

Annual memberships

Taxes

Note: You can NOT use Visa cards for mortgage payments. Only MasterCards or Discover cards.

Plastiq charges a 2.5% processing fee. But considering Chase points are easily worth 2 cents each, that’s like getting 6% back – or 3.5% back after factoring in Plastiq’s fee. Either way, it’s hugely worthwhile to use this card for all your Plastiq payments.

Keep in mind, you need some sort of business income to open this card. And you will NOT be approved if you’ve opened more than 5 new cards in the last 2 years.

So is it worth it?

If you’ve already had any Chase Ink card for more than a year (I’ve had my Chase Ink Plus for many years by now), you can also product change to this card – which is what I’m considering.

I’ve used Chase points to travel the world, like gorgeous Prague

The idea of earning 3X Chase points on thousands in spending each month is too good to pass up. But, the coding could revert to 1X at any time – and leave you high and dry with a card you don’t want to use.

Reddit hope

I have some hope this will stick around because of a recent Reddit AMA with Platiq’s CEO. Someone pointedly asked:

There’s a lot of worry around here that the more the media picks up on the Chase Ink Preferred card coding Plastiq as 3X, the sooner that perk will go away. Personally I can’t believe that Chase would be unaware of this. Can you confirm whether the 3X coding is intentional on Chase’s part?

To which he replied:

If you look at past discussions by Chase, including their public earnings calls/transcripts, they have mentioned several times how they were intentionally aggressive with, say, the CSR card and its bonus when it came out. This was despite analysts asking them about the huge cost, which Chase more/less summarized as “not a big expense” for their longer term goal of retaining the customers as part of the overall bank (i.e. card is just an entry vehicle to relationship with Chase banking). Point is, these bonuses are a rounding error as part of a broader strategy. I can also confirm that Plastiq is 100% following VISA and Chase rules in how we are processing these payments, so there are no surprises to anyone. Of course, as we have seen in the past, many issuers change their offers/bonuses from time to time.

So Chase knows about this, Plastiq is following the rules, and neither Chase nor Visa mind about the coding. In this light, I think it may stick around. But then the question becomes: how many months would I need to break even with this card vs other cards with 5X bonus categories?

I loved seeing Vienna and Slovakia on another Eurotrip – with Chase points

For me, I’d break even pretty much right away. But still, I hesitate to lose the 5X categories. I guess, worst case scenario, I could ride the gravy train until it ends, then convert to the Chase Ink Cash (compare it here) to have the same 5X categories again – albeit at lower spending thresholds. GOD I’M SO TORN.

As with everything, it’s gonna be case-by-case. But I do think it’s totally worth it to get 3X for as long as you possibly can. Chase knows about it and doesn’t seem to care – for now.

Bottom line

Key link: Chase Ink Business Preferred – Compare it here

Key link: Sign-up for Plastiq and get $500 in fee-free payments

I love Chase Ultimate Rewards points and making payments through Plastiq to earn bonus points. I won’t earn 3X on my mortgage payment, but the idea of 3X on all other payments, like my car note, insurance, Airbnb rents, and more – is too good to pass up.

In fact, it may be worth it to open a new Chase Ink Business Preferred card (compare here) or convert a existing Ink card to hop on the 3X train for Plastiq payments.

I need to look at my monthly and yearly earning and decide if it’s worth it. Rough numbers tell me it’s highly worthwhile. But I dunno – what do you guys think? Solid bet – or too risky?

August 1, 2018

Did Fidelity Just Become the Best Investment Bank? 2 New FREE Funds!

Very cool news from Fidelity today. This Friday, August 3rd, 2018, they’ll introduce 2 new total market funds with ZERO management expenses and NO minimums to start investing.

Plus, they’ve slashed fees and minimums on several other funds, effective immediately. I just logged into my account and already see lower expenses.

I wrote about the best IRA accounts and which banks let you start investing right away with a single $1. What’s cool with Fidelity is you can pair your IRA with the Fidelity Visa, which earns 2% cashback on every purchase. Then sweep the cashback rewards into one of these free index funds. The card is free to have – so it’s literally free money to invest into free funds.

Fidelity just made a bold move with 2 FREE funds

Everyone should have an IRA account. Here’s more info on Fidelity’s new mutual funds.

Fidelity Zero index funds

Link: Fidelity’s new fund pricing

On August 3rd, 2018, Fidelity is starting 2 brand new index mutual funds:

Fidelity ZERO Total Market Index Fund (FZROX)

Fidelity ZERO International Index Fund (FZILX)

No minimums or fees with these new funds

They’ve also cut expense ratios on hundreds of other funds and removed transaction fees on others. Very, very cool.

If you earn free cashback rewards with the Fidelity Visa, and use them to purchase these free funds, you can invest in an IRA for free. With the traditional IRA, you get a tax break for contributing. Or with the Roth version, never pay any fees or taxes if you wait to withdraw.

First thing I noticed was both of these funds are for stocks. A total market index fund is a great core investment – it’s most of my portfolio. It would be awesome if there could be a free bond fund. Although, I don’t think that could really ever happen.

Fidelity slashed fees and minimums on its other low-cost funds, too

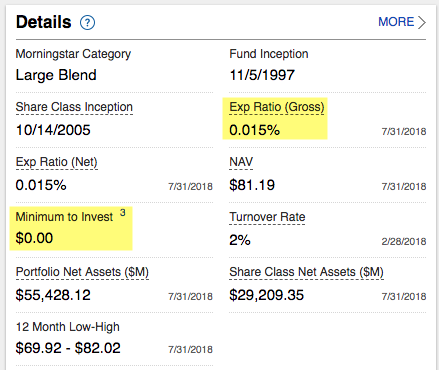

I’m currently heavily invested with the Fidelity Total Market Index Fund (FSTVX). Yesterday, the fee was 0.035%. Today it’s 0.015% – and the minimum to invest is completely gone.

The expense ratio is so close to zero now that I won’t sell off and buy into the new Total Market fund. But going forward, I will invest into the new Zero fund – and keep my Long-Term Treasury Bond index (FLBIX), now with .03% expense ratio and no minimums (very cheap for a bond fund).

Overall, I think the stock symbol says it all: Fidelity Zero ROX (FZROX)!