Harlan Vaughn's Blog, page 25

May 10, 2018

Chase Avios 100,000 Point Offers: Deals for the Rest of Us

Also see:

Get 6X British Airways Avios Points Everywhere on $20K in Spend – Why I Caved

Is the Chase British Airways Card Worth It for 50,000 Points? Maybe.

I’m down to the wire with card offers I qualify to get. Especially with Chase. But their Avios-earning cards are in the few NOT subject to the 5/24 rule.

If you live in an American or Alaska hub (because you can use British Airways Avios points on both airlines) – you should have one of these cards. That includes peeps in Dallas, New York, Los Angeles, Chicago, Seattle, Portland… pretty much any place with lots of American or Alaska flights. Because on expensive routes, these points are the easiest way to save money.

Most everyone can apply. I got a Chase British Airways card in late 2017 – and definitely LOL/24.

I use Avios to visit Memphis, Austin, and Mexico on the cheap

More often in recent time, I’ve been redeeming Avios points. And when you sign up for a 100,000-point offer, you’re basically earning 6X points on the first $20,000 you spend within a year.

About the Chase British Airways 100,000 point deal

Link: Chase British Airways card – Compare it here

You can earn:

50,000 British Airways Avios points after you spend $3,000 on purchases within the first 3 months from account opening

An additional 25,000 British Airways Avios points after you spend $10,000 total on purchases within your first year from account opening

A further 25,000 British Airways Avios points after you spend $20,000 total on purchases within your first year from account opening for a total of 100,000 bonus Avios

So you have to spend $20,000 within a year to unlock the full bonus of 100,000 British Airways Avios points. That’s ~$1,667 per month. If you’re not working on other minimum spending requirements, that’s not much non-bonus spending.

I’m $18,000 deep right now toward that requirement. And expect to get the final portion of the bonus next month.

Getting 6X points on all that spending is too good to pass up. Especially if you’re no longer spoiled for choice with other issuers.

I used 4,500 Avios to fly from Osaka to Tokyo on JAL

In fact, I’ve been redeeming Avios on the regs lately. I’m in Dallas, so I have lots of American flights to choose from. But you can also use Avios points for Alaska flights (you have to call in to book, though). That combined network is huge.

Where can you fly?

Link: Avios calculator

Link: British Airways airline partners

British Airways partners with every airline in the Oneworld alliance, including:

American

Cathay Pacific

Finnair

JAL

LAN/TAM

Qantas

Qatar

They also partner with Alaska.

From Chicago, you can fly to nearly all of the East coast and much of the Southern and Central US for 7,500 points each way (yellow pins)

It’s easy to check where you can fly. Just enter your airport into this calculator to check.

You can use Avios points to fly:

Under 1,151 miles each way within or to/from the US – 7,500 points each way in coach

Under 651 miles each way outside the US – 4,500 points each way in coach

From Vienna, you can get to much of Europe for only 4,500 points (green pins)

I booked Dallas to Orlando for FinCon 2018 this September. Seats were open on nearly every flight the days I wanted to fly out and back. So I snagged them to treat myself to the conference for only $5.60 each way, plus 7,500 Avios points. I continually find new ways to use them. It’s definitely one of my favorite points programs – it really shines for flights outside the US.

The opportunity to earn 6X points is worth it for most people.

2 more cards with Chase Avios 100K Offer

Link: Chase Aer Lingus – Compare it here

Link: Chase Iberia – Compare it here

Chase has 3 credit cards that earn Avios points. In addition to the British Airways card, they also have Aer Lingus and Iberia cards. And you can easily transfer the points from one flavor of Avios to another. So you can transfer British Airways Avios to Aer Lingus or Iberia Avios (and vice versa).

When it comes to Avios, you can transfer between the 3 airlines in the program (British Airways, Aer Lingus, and Iberia)

These cards are also NOT under the 5/24 rule. And they have the exact same tiered minimum spending requirements to earn 100,000 Avios each.

So depending how many other accounts you have with Chase, you could keep the 6X points flowing for a very long time – depending on your spending habits.

Is it worth it with Plastiq?

Link: Plastiq

You can pay most bills with these Visa cards via Plastiq, including:

Rent

Car notes

Student loans

Utilities

Contractors

I’ve been using my Chase British Airways card to pay my Airbnb rents, HOA dues, car note, and electricity bills for the last 6 months or so with zero issues. Plastiq has a 2.5% fee to pay bills with a credit card.

For $20,000 in spending, you’d pay $500 in fees ($20,000 X 2.5%).

But, you’d earn 120,000 Avios points (100,000 sign-up bonus + 1 point per $1). Is it worth it to spend $500 for 120,000 Avios points?

I value that many points for $2,400 @ 2 cents each (120,000 X .02), so yes – definitely! Although you can often do much better than that with Avios points, depending on the route. If you need an easy way to get through all the spending, it could totally be worth it to use Plastiq to pay bills. Especially if you’re in the home stretch to finish it.

Bottom line

British Airways card – Compare it here

Aer Lingus card – Compare it here

Iberia card – Compare it here

I love Avios points. You should get one of these cards if you:

Live near American or Alaska hubs

Are over 5/24

Have specific uses in mind

Want to pay bills via Plastiq and earn lots of points

Are not meeting any other spending requirements right now

The required $20,000 in spending to unlock the full sign-up bonuses should keep you busy for a while. And earning 6X Avios points per $1 spent is a crazy good deal. I’m wrapping up the spending on the British Airways version right now. But considering you can transfer Avios between all 3 airlines with a few clicks, I will try to open another Avios card when I’m done (assuming these offers stick around for a bit and Chase will give me another card).

None of these cards are under 5/24. So if you’ve opened other cards recently, there’s not much to worry about aside from how many cards Chase will issue you. Of course, if you open one, it will count against your future 5/24 count.

These are offers for the rest of us – nearly everyone can apply, they’re great bonuses, and the points can be incredibly valuable. I’ll apply for another next month.

May 9, 2018

15 Cashback Shopping Portals Compared: Payments, Bonuses, & How They Work

Cashback Monitor is far and away the best site to check the highest payouts (be it points, miles, or cashback) for online shopping. And there are a lot of shopping portals out there.

Each has its “quirks” – from slow payouts to minimum thresholds and different ways of paying. And most of them even give you a little reward just for signing up and shopping – some as much as $10 on top of your cashback bonus.

Always click through a shopping portal when you shop online – but which one should you use?

There are many to choose from – and of course you can earn points or miles from airline or bank portals. Here’s an overview of the 15 most popular cashback portals. And how to pick which one to click through!

15 Cash Back Shopping Portals Comparison

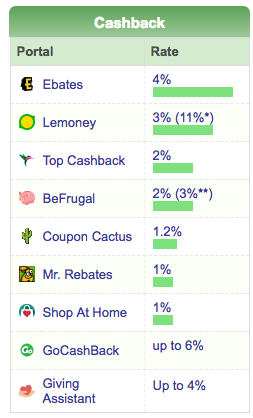

Say you want to shop online at GNC for some vitamins or protein (I picked this one at random). You navigate to Cashback Monitor and type in “GNC.” You see this:

*exploding head emoji*

So, it’s a lot to process. And some of those cashback portals, I’ve never heard of. But whatever. Start at the top – where the best payouts are.

You can get:

15% cashback from Ebates

12% cashback from BeFrugal

8% cashback from Top Cashback or Rebates Me… and down from there

Or, if you want points or miles:

5 British Airways points pet $1

4 points/miles from Ultimate Rewards, Amtrak, Choice, American, or United… and down from there

How do you pick?

First, consider your travel goals. I always love to earn more Ultimate Rewards points. I value them at 2 cents each, so 4 per $1 is like getting 8% back (4 points X 2 cents each).

Or, if you’re close to an award flight on American, that might trump all else.

What about Southwest points? They count toward the Companion Pass. If you’re close, or really want it, you might forego 15% cashback to earn points toward flying with a companion for only the cost of taxes.

So there’s mental gymnastics going with just a skim.

What if you just go for highest?

If you just want the best return, the 15% cashback from Ebates is by far the best payout for this store in this scenario. If you spent $100 at GNC (before taxes and shipping), you’d get $15 cashback. Compare that to 400 Ultimate Rewards points, or 500 British Airways Avios points. I’d rather have the $15. Again, unless I had a travel goal in mind.

May 8, 2018

4 Apps to Effortlessly Save Money and Get Discounts (Set & Forget!)

I know – more apps. Between social media, mobile banking, loyalty programs, and shopping, the last thing most peeps need is another app.

But there are a few apps out there you can set up once – and then, if you want, never look at them again. Even better, these apps earn credits for gift cards, get you refunds, or award cashback for setting them up.

I turn Drop points into Whole Foods gift cards and get free groceries – just for keeping the app installed

I’ve gotten free groceries and Amazon gift cards, deposits into my checking account, and credits on my cards – all from having these apps on my phone.

Here’s an overview. And how they save you money without any ongoing effort.

4 best apps to save money

1. Drop

Link: Get Drop

Drop was the app that got me into “set it and forget it” mode. Since November 2017, I’ve earned over $100 in Drop points, which you can redeem for gift cards to stores including:

Amazon

Whole Foods

AMC

iTunes

Sephora

Best Buy

You can easily earn and redeem Drop points at lots of merchants

When you sign up, you’ll pick 5 stores where you want to earn ongoing Drop points. I picked Uber, Starbucks, Whole Foods, Trader Joe’s, and Amazon.

After you plug-in your bank information, you’ll earn Drop points every time you spend at selected merchants. The app scans your purchases and awards points automatically.

1,000 Drop points = $1. And you can redeem for a gift card starting at the $5 mark (5,000 Drop points).

Plus, they have tons of promotional offers. I wrote about how I got $50 in gift cards for letting someone walk my dog. And other promotions have included 2X Drop points for Plastiq payments.

I earn a few hundred points here and there. Then peek in every once in a while to see how many accumulated. I’m always surprised at how many I have. But then again, I shop at Amazon a lot and grab the occasional coffee at Starbucks.

I’ve scored over $100 in free gift cards from the Drop app

I love redeeming for Amazon and Whole Foods gift cards. They’re issued within minutes after you redeem.

Once you set up Drop, let the points roll in. You can check every so often to add more offers or see how many points you have from setting it up one time.

2. Earny

Link: Get Earny

Link: Use Earny for Automated Visa and MasterCard Price Protection

I wrote about how Earny works. If your Visa or MasterCard credit card offers price protection, Earny will detect price changes from receipts in your email inbox and file a claim – with NO effort required on your part.

Earny automates price protection on dozens of credit cards

Most major banks are supported.

Earny tracks purchases from:

Amazon

Best Buy

Bloomingdale’s

Carter’s

Costco

The Gap Group including Gap, Banana Republic, Old Navy, Athleta, and factory stores

Home Depot

J.Crew

Jet

Kohl’s

Macy’s

Newegg

Nike

Nordstrom

Overstock

Sears

Staples

Target

Walmart

Zappos

I plugged in my Citi AT&T Access More card because it earns 3X Citi ThankYou points for online shopping.

Automatic claims from Earny

Since I set it up, I’ve gotten ~$74 back from random purchases – with zero effort. In return for Earny’s services, they take back 25% of whatever they save you. Considering it’s automated and money I would’ve never seen otherwise, that seems fair.

Moving forward, I’m putting the bulk on my shopping on Citi cards to take advantage of Citi Price Rewind, which comes with all their personal credit cards.

Awesome built-in card perk

Citi puts the onus on you to register your purchases – but Earny also does that for you automatically.

Citi Price Rewind details

The reason I’m moving to Citi cards is because Chase is dropping price protection on all their cards this year. If you shop online a lot, Earny is a must-have.

3. Spent

Link: Get Spent

Spent works a lot like Drop – and lets you earn at many of the same merchants. But instead of gift cards, you redeem for cash to your PayPal account once you earn $20.

Earn Spent points automatically at lots of popular stores

A big part of the app is the shopping portal. But you can add your cards to automatically earn 1% back at 10 merchants:

Amazon

Uber

Whole Foods

Netflix

Starbucks

iTunes

McDonald’s

Lowe’s

Walgreens

7-Eleven

Get 1% back on certain purchases when you link your cards

You can get 1% cashback from Netflix, Uber, Walgreens, and other popular stores after linking your cards, then let the points build. Plus, you get $10 for signing up, so you should reach the $20 cashout threshold pretty quickly.

The app is free to have and use. Free cash money for adding cards and offers to your account one time.

4. Dosh

Link: Get Dosh

Dosh earns cashback at local restaurants and a few big box merchants (including Sam’s Club, Payless, World Market).

What’s cool is you can often double-dip and get miles from airline dining programs AND cashback from Dosh.

Dosh earns cashback at several local food joints

Cash out when you get $25 in your account – the money is transferred to your debit or credit card. Lots of restaurants offer 5% or 10% cashback. So depending on how often you dine out, you can get cash in your checking account or a credit on your card pretty fast.

Dosh is free to have and use. I don’t dine based on what’s on Dosh. But every once in a while, I’ll get a ping that I earned cashback for eating out, which is always a nice surprise. Plus you get $5 in your account just for signing up. Link your cards once and let the cash roll in. Set it and forget it.

Are there drawbacks?

These apps require you to enter your banking and/or email information to scan transactions. I’ve been using these apps for 6+ months and haven’t had any issues. But some peeps don’t want to share their information.

It’s all for data collection and piecing together your spending habits to use for marketing. Personally, I don’t care – it’s not like the banks aren’t already doing that.

If this part of the apps bothers you, it’s best to skip them altogether. As always, do what you’re personally comfortable with.

Bottom line

Drop

Earny

Spent

Dosh

These 4 apps have gotten me free gift cards, credits from price protection, and cashback from normal spending. I didn’t go out of my way to earn any of it. Once you set them up, you don’t have to check again – earning rewards is effortless. And every little bit helps.

To that end, there’s no reason to turn down free cash, merchandise, or credits – unless the data collection piece bothers you. All you have to do is spend a few minutes setting up your accounts. Then never think about them again, except to see if you can redeem for rewards.

Drop in particular has great offers you can activate if you want – so I open that one most often (but you certainly don’t have to). I literally never look at Earny – just see the credits on my cards. There’s also no reason to ever check Spent or Dosh, except to redeem for cash.

Some apps (like Ibotta) require you to constantly interact. But these are easy and effortless.

Which is your fave? Are there other easy rewards apps you like better?

May 3, 2018

Like Discount Shopping? Save Big With These Sites – My 3 Faves

Also see:

A Few Apps + Sites I Like to Save Money

As someone with 3 Airbnb properties, I buy a TON of home supplies: paper products, cleaning supplies, and linens. And I love Kohl’s for bedding, towels, and pillows.

But for regular stocking up, there are a couple discount shopping sites I turn to. I also wanted a share a site I discovered that’s pure fun slash addicting if you like to shop.

Do you use these sites to save? I’m obssessed

Here are 3 go-to sites for discount shopping.

Brandless

Link: Brandless

I heard about this one from my Mom. Here’s the deal: everything is $3. And none of it is branded – only as being brandless.

Everything is $3 at Brandless

They have tons of popular items, like snacks, bathroom products, TP, pantry staples, and so much more. Literally everything on the site is $3.

Tons of household items for cheap

Shipping is free once you hit $39 (13 items). But there’s so much that it’s easy to meet the minimum. Or you can spend under $39 and pay $5 for shipping.

You can also pay $36 a year for a membership that comes with unlimited free shipping (kinda like Amazon Prime).

Brandless donates meals every time you shop

The company’s also committed to giving back through a partnership with Feeding America, which is a nice touch.

My Mom swears by the quality – she actually placed an order as I started writing this. She said she orders cleaning supplies and stuff for home. But she finds some of the food items are actually cheaper at stores like Trader Joe’s or Aldi. She also said if you look through the site, there are some legit great deals. And getting everything delivered to your door is convenient if you don’t have time or don’t feel like getting to the store.

Also, most of the food is organic and non-GMO. And the self-care items are paraben- and sulfate-free. So if you compare prices, make sure it’s apples to apples (meaning compare organic items to other organic items, and so on).

She also said the food quality varies from item to item, but some of it is amazing. And that the cleaning products all smell great and high-quality. Your first order ships free, so you can sample a few items for cheap if you’re curious.

2. Boxed

Link: Boxed

Think of Boxed as Costco without the membership. Everything is sold in bulk. And Amex is pretty good about having regular Amex Offers for Boxed. So you can save even more with a nice stacking of promotions.

Boxed is worth a look if you order in bulk

You can earn cashback on your purchase – usually around 4% back. Check Cashback Monitor to see the current offers (you should do this every time you shop online, for nearly every store).

Get cashback when you shop

I’ve ordered paper goods and cleaning supplies from Boxed a few times and always had a good experience and quick delivery. Like every store, compare prices to make sure you’re getting the best deal.

I recommend waiting until an Amex Offer pops up. If you can earn points on your Amex card, get a statement credit, and earn cashback from a portal, that’s an easy way to save money and get the best price on pretty much every item.

If you’re new to Boxed and want to make an account with my link, you can also get $15 off your first $60+ order – and yes, that stacks with other promotions. So if you time it right, you can make out like a bandit and stock up for super cheap.

Boxed shines for snacks in particular, especially for peeps with kids or lots of visitors (I try to get breakfast bars and snacks for my Airbnb guests, for example). And their store brand, Prince & Spring, is great for basics and easily compares to the big brands.

3. Wish

Link: Wish

Be warned: this one is addicting. If you like to browse and score great deals, this site (or app) can hook you big time.

Literally the devil

They sell everything – and the site is easy to search and user-friendly. It’s basically like a dollar store combined with Ebay and Groupon. The selection is insane and there’s just so much stuff on there. Lots of little novelties and conveniences.

Might as well claim a free item

Even if this isn’t your thing, you get a free item just for signing up. The selection of free stuff is huge. I got a USB charger that plugs into the car, so I can charge my phone while I drive. Only paid 50 cents for the shipping. Can’t comment on the quality (haven’t received it yet) – but a fun little perk anyway. Looking forward to seeing the quality when it arrives any day now.

Bottom line

Link: Brandless

Link: Boxed

Link: Wish

All of these sites have deep discounts and great deals within – you just have to look a little to find them. I love getting a good deal, so I’m happy to take a look at a new service, especially if it saves me money on stuff I need to buy anyway.

While I’m mostly loyal to Costco, I occasionally supplement with other sites to fill in the gaps between trips. Brandless and Boxed are both worthy competitors for stocking up. And Wish is great for mindless shopping fun (plus you get a free trinket when you sign up).

If you’ve used these sites to shop, would you recommend them? Are there others that are better for saving?

April 29, 2018

Get 50 Cents per Uber Ride Through Acorns (YMMV)

Saw this today and wanted to share. You can now get 50 cents back for each Uber ride after clicking through the Acorns app.

Some peeps can still get $1 back after clicking through Ibotta – although it’s no longer showing for everyone. The 50 cents deal is also targeted. So hopefully you see it in one place or another.

Better than nada – but targeted

It’s not a lot. But all you have to do is tap a button and get 50 cents. Plus, there are 60+ other merchants on Acorns’ “Found Money” with great payouts.

Acorns is an app that lets you start investing for as little as $5. Here’s my full review of the service.

Targeted Acorns Uber deal

Link: Sign up for Acorns investment service

File this under “it all adds up.”

I added this to my guide to saving on Uber rides. You can also:

Earn points buying Uber gift cards

Save 3% on Uber gift cards through Raise

Earn 10 Drop points per $1 spent

Get Uber credits with Visa Local Offers (available in the app)

Now get 50 cents back from Acorns or $1 from Ibotta (both targeted)

Considering the average cost for an Uber is around $10, these are nice ways to save!

I’m enjoying the Found Money from Acorns – and now have ~$30 in my account after the initial $5 to fund it.

50 cents at a time isn’t going to make anyone rich. But consider Acorns charges $1 a month for the service, you can easily offset it if you take Uber twice a month.

The money you earn is invested according to your risk profile, which you set up after you download the app. I consider it an easy way to invest a little “fun money” without any big expectations of performance or return. Plus, free is free – might as well take it!

Bottom line

Small amounts, small wins – but better than nothing.

I was jamming on $1 per ride through Ibotta when it just stopped working one day. The end date on the Acorns Uber deal is listed in 2020, so you have some time to take advantage of this, if it shows up for you. And getting 50 cents back on a cheap ride a few times a month is an easy way to offset the $1 fee Acorns charges.

Nothing earth-shattering, but I’m certainly going to collect my 50 cents every time I ride Uber and invest it in some super risky stocks.

April 28, 2018

Weekend Roundup: Office Depot Double Cashback, Pay It Forward, & Cheap DNA Testing

Hi chickadees. Here are a few things that caught my eye on this beautiful, sunny Dallas day. All are time-sensitive to this weekend.

Double cashback at Office Depot

Link: Ebates

Now this is a great deal: through April 30th, 2018, you can get double cashback in store when you link a card through Ebates.

Good deal alert

One of the participating stores is Office Depot for 6% cashback!

Go slow to start

The T&Cs clearly state gift cards are excluded. Though many peeps report earning the cashback anyway. So this is YMMV. I’d say to go slow and only buy a gift card if you need it anyway – and consider 6% cashback icing on the cake.

The other participating stores include:

Bed, Bath, & Beyond

GNC

World Market

The Body Shop

Sally Beauty

And many others. To get the deal, click “Link Offer” from this page and add your credit card number.

If you don’t already have an Ebates account, you can join here and get a $10 bonus when you spend $25+. Going to try this out now that I’m newly into gift card reselling.

If you shop at Costco, you can get a Visa gift card and use it to shop – an easy way to get 5X at Costco if you have a small business card with 5X at office supply stores!

Pay It Forward Day

Link: Pay It Forward Day

Today, April 28th, 2018, is Pay It Forward Day.

What can you do to help someone today?

There are so many ways to help others – many of them are free:

Hold a door

Give a smile

Call an old friend

Send a card with stationary and stamps you already have

Give someone a compliment

Offer your help to someone

The only cost is your time – in some cases, only a few seconds.

Truth

You could also donate some old clothing, send $5 to a local nonprofit, or drop off some canned foods to a food bank. There are so many ways to help others.

I love the idea behind this. Remember, when you help someone else, it comes back to you powerfully. Today is a beautiful reminder.

AncestryDNA for $69

AncestryDNA on Amazon

Ancestry.com

23andMe on Amazon

AncestryDNA Vs 23andMe – Which Ancestry Test Is Best?

Through April 29th, 2018, (tomorrow!), you can get AncestryDNA on sale for $59 + taxes and shipping. It comes to about $69, depending on your state.

Lowest price of the year

I wrote about this service compared with 23andMe and liked them both. For a deeper dive into your background and makeup, I’d go with this one (I got it for my Gramma).

More expensive than AncestryDNA, but also cheaper than normal

And for information on your genetics and health, I’d go with 23andMe – which is also on sale.

Both sales are celebrating DNA Day, which was this past week.

Get free DNA genotypes if you’ve ever done a DNA test

And if you’ve ever tried a DNA service, you can get free DNA genotyping on Promethease through May 10th, 2018.

Oh gods

Be warned though: it’s brutal. My DNA sequence shows higher risk for coronary artery disease and all kinds of other things (some good, some bad). Being armed with this information might be hard for some people. I personally think it’s interesting. The rest of my genome was strong, aside from the heart-related blips. Anyway, something to note before you dive in. Forewarned is forearmed, I say.

Will you get in on any of these deals?

Have a good weekend!

April 26, 2018

I Bought the Wrong Gift Card – Then Broke Even With Points & Raise

My little brother came to visit recently. We went to the mall because he wanted to buy a new pair of shoes – in cash. He’s one of those “sneakerheads” so his purchase was likely going to be around $100.

My little mind started wondering how to get some points out of the whole deal. Then I remembered MileagePlus X!

An app you really need to download

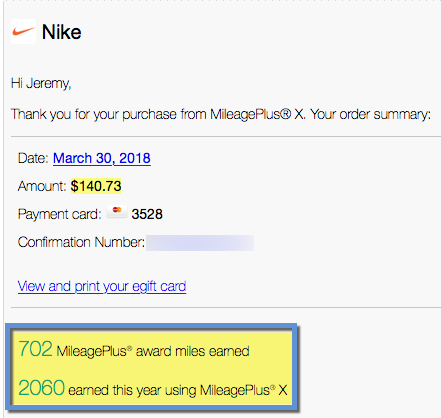

And because I have the Chase United Explorer card (see it here), I knew I could get a 20% mileage bonus on any gift card I purchased through the app – even if I didn’t pay with that card.

We went into a dozen stores – Nike, Finish Line, Journeys, Foot Locker, and a couple of department stores. I’m not much of a mall shopper, so my head was spinning. When he finally decided on a pair of Nikes at Finish Line, I licked my chops and bought a Nike gift card on the MPX app. But realized the second the transaction processed I was in the wrong store. Guh!

My brother paid cash and I… had a Nike gift card I couldn’t use. “It wasn’t that much,” I told myself. But then remembered… I could sell it online. Maybe that would make it OK – and at least break me even – with the points I’d earn in the mix.

I ended up selling the gift card on Raise. Here’s how it went!

My experience selling a gift card on Raise

Link: Raise.com (Get $5 for signing up)

I researched a few gift card reselling sites (CardCash, CardPool, Gift Card Granny, and Raise) and entered what I wanted to sell and my expected payout.

After going through the motions, it seemed Raise offered the highest payout for my gift card and would sell the quickest. I wouldn’t get paid until someone bought the card – and wanted to offload it ASAP, even if it meant losing a buck or two in the process.

Raise had the best combination of payout and sell-ability. They offered me $116.25 for my $140.73 Nike gift card.

That was a loss of $24.48. Dang – a 17% hit! But again, I knew I messed up and had to pay the piper.

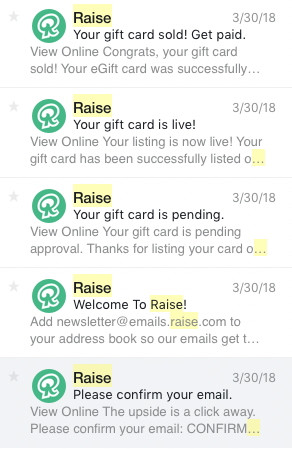

Within a few minutes, I had a new account on Raise, complete with payout info. I entered the gift card details (number, pin, and amount) and set it to sell!

I sold my gift card that same evening

I couldn’t believe how quickly it all went. They made it so easy. Here’s the timeline:

7:56pm – Confirmed my email

7:58pm – “Welcome To Raise!” email received

7:58pm – Gift card sale pending

8:39pm – Gift card live for sale

11:15pm – Gift card sold, payout requested

Within a few hours, the gift card was approved, listed, and SOLD! I honestly couldn’t believe it, as I was expecting it to take at least a few days. So I logged back in, requested the payout, and had it in my PayPal account soon after (you can also request a check or direct deposit).

Boom

So despite losing a little cash, I was happy to have most of the money come back to me. It definitely eased the pain of purchasing the wrong gift card in the first place.

The points haul

That day, Nike offered 4X United miles via MileagePlus X. And I got a 20% bonus. So the gift card earned me 702 United miles, which I value for $14 @ 2 cents per point.

My United miles posted instantly

Those were in my account within seconds. And that alone helped to offset Raise’s fees for listing the gift card. Which is fine, because hey, they have to take a cut, too.

I paid with my Citi AT&T Access More card (no longer available for new signups) and earned 3X Citi ThankYou points on this purchase – so 422 ThankYou points. I value those for $8 @ 2 cents each.

In the end, I:

Paid $140.73 for the Nike gift card

Got $116.25 from Raise

Earned 702 United miles = $14

Earn 422 ThankYou points = $8

In effect, I:

Lost $24.48 in value

Gained ~$22 from 1,124 points earned

So while I wouldn’t ordinarily earn points this way, earning a few more was further balm on the mistake gift card. And in the end, I broke pretty close to even. I lost $2 in the process, after selling on Raise and earning some points.

Lesson learned: don’t be so eager to take cash to earn points. And don’t get too excited and buy the wrong gift card!

Can I push it further?

While this is all well and good, it got me thinking… could I buy discounted gift cards from big box merchants and resell them on Raise – all while earning points?

Cuz if I could get 5X AND a discount, then sell at a small profit or at worst, break right even, it might be worth it purely to get some points rolling in.

I haven’t fully researched the options, merchants, and selling sites to suss out their maximum potential yet… but I’m working on it. This could be a cheap way to boost my points stash!

Chase Freedom Vs Freedom Unlimited: Which Is Better for Your Spending?

Chase has 2 great no annual fee cards that pair nicely with premium Ultimate Rewards cards: Freedom and Freedom Unlimited.

The Freedom card earns 5X in rotating quarterly categories on up to $1,500 per quarter in combined spending. The Freedom Unlimited earns 1.5X on all purchases with no cap.

Really gonna depend on bonus categories and how much you typically spend

Lots of peeps ask which is better. To which I always answer: it depends on how much you like the bonus categories. But there’s a longer answer even beyond that: how much to you plan to spend on the card each year?

Let’s talk about the break even point and which is better for your finances.

Freedom Vs Freedom Unlimited

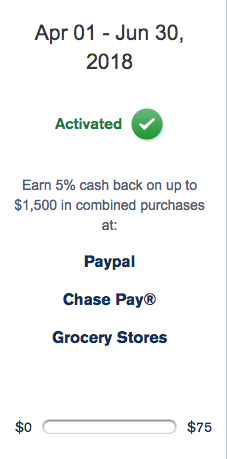

The most important thing to know about the Freedom card is the bonus categories. They rotate every 3 months. And you can earn 5X on up to $1,500 in spending per quarter across all the categories, when you activate the bonus.

So the $64,000 question is: are the bonus categories useful to you?

Freedom has 5X categories

Link: Chase Freedom – Compare it here

In 2018, Q1 bonus categories were:

Internet, cable, and phone service

Gas stations

Mobile payments

At Whole Foods, I got 5X last quarter from Apple Pay and now 5X again for grocery stores

And currently (Q2), they’re:

Grocery stores

PayPal

Chase Pay

I maxed out Q1 easily by using Apple Pay for tons of purchases, like Uber/Lyft, at grocery stores, at the hardware store, and at Walgreens.

I’m a staunch fan of the Freedom card

This quarter, I’m focusing on grocery stores and Chase Pay, though others are doing well using PayPal to check out for online shopping.

Chase makes it easy to track your 5X spending

Plus, Chase Pay is still limited, although it does include Shell gas stations, Starbucks, and lots of local restaurants when you order ahead. So between all the categories, I’ll max it out again this quarter.

Will Chase Freedom keep copying Discover It for the rest of the year?

We don’t know what Q3 and Q4 will have yet. But Chase has been copying the Discover It card hard lately. If that’s any indication, expect restaurants and Amazon/wholesale clubs for the rest of the year. These are incredible categories I can personally max out easily – as I’m sure most peeps can.

Past quarters also included:

Gas stations

Grocery stores

Amazon

Walmart

Department stores

Wholesale clubs

Commuter transportation

Movie theaters

So you never know what’ll pop up! If you spend the full $1,500 each quarter ($500 per month) and activate the bonus, you’d earn 7,500 Chase Ultimate Rewards points (or $75 cashback).

That’s 30,000 Chase Ultimate Rewards points (or $300 cashback) per year. Not a bad return for a card with no annual fee.

Beyond that, you earn 1X on all other purchases. So this card is good for the bonus categories… and not much else.

Freedom Unlimited requires NO thinking

Link: Chase Freedom Unlimited – Compare it here

This cards earns 1.5X on all purchases. Full stop – that’s it.

If you don’t want to think about bonus categories or activating them, this card might be the way to go.

If you spend more than $20K a year in non-bonus categories, the Freedom Unlimited is better

But if you’re torn whether to get this one or the regular Freedom, the number to know is $20,000.

That’s how much you’d need to spend to earn 30,000 Chase Ultimate Rewards points with this card ($20,000 X 1.5).

It sounds like a lot. But it divides out to ~$1,667 per month in spending.

If you’re using the card for everything, it’s fairly easy to hit that target. Although I use other cards for bonus categories and my Blue Business Plus Amex for non-bonus spending.

Realistically, I wouldn’t use the card for that much spending. But you might – especially if it’s your first or only card.

Note: There’s a targeted offer to earn 3X the first year with this card. If you can get it to show, you’d only have to spend $10,000 the first year to earn 30,000 points. But you lose the 15,000-point sign-up bonus and drop to 1.5X after the first year. Run the numbers to see which offer is better for you – especially if you plan to use the card a lot.

So which is better for you?

To earn 30,000 Chase Ultimate Rewards points, you’d need to spend:

$6,000 per year with Freedom ($6,000 X 5), or $500 per month

$20,000 per year with Freedom Unlimited (20,000 X 1.5), or ~$1,667 per month

If you like Freedom’s bonus categories, you get a lot more points for much less spending.

And if you spend a decent amount per month and don’t want to think about bonus categories, go for the Freedom Unlimited.

For this reason, I tell most of my friends to spring for the Freedom. Chase makes it easy to activate the bonus and track your purchases. Plus, when you’re ready, you’ll have a nice stash of Ultimate Rewards points to pair with another card. And that unlocks the ability to transfer your points 1:1 to Chase’s outstanding travel partners, like Southwest, Hyatt, and British Airways (all personal faves).

Pair Chase cards to earn even more points

The Freedom is a good starter card for that reason. Whereas if you had the Freedom Unlimited, you’d have to spend a lot more to earn as many points.

If cashback is your goal, choose neither

Link: Discover It with Cashback Match

Link: Compare multiple cashback cards

Both cards are advertised as cashback cards. But their power lies in pairing them with another Chase card to access travel partners. Which, yes, requires you to get another Chase card. It’s a good points ecosystem to get associated with.

Some peeps don’t want 2 cards or to think about combining points and transferring them. And for them, I’d say there are better cashback cards.

Discover It is a beast of a cashback card worth another look

For 5% cashback in rotating bonus categories, you can easily earn $600 (instead of $300) with the Discover It card instead.

And multiple 2% cashback cards are better than Freedom Unlimited’s 1.5%.

Both cards are part of a long-term strategy

Link: Chase Sapphire Preferred – Compare it here

The Freedom and Freedom Unlimited cards are stepping stones toward a bigger points strategy: that you’ll eventually pair them with a premium Ultimate Rewards card.

And both are an excellent place if you want to:

Ease into the world of miles & points

Avoid annual fees

Earn rewards on all your spending

Build your credit profile

Begin a relationship with Chase

Chase Freedom is one of my oldest cards. And I’ll keep it forever

I’ve had my Chase Freedom for 15+ years by now. And I’ll keep it forever because it has no annual fee. It’s literally a free way to age all the other accounts on my credit profile, which helps boost my credit score.

These cards are also relatively easier to get approved for, if you have a limited credit profile. Plus, once you have a card with Chase, it gives you leverage for another one in the future.

For all these reasons, either card is a great place to start building your credit and travel goals. Plus, you can always switch from one to the other after a year.

I used Hyatt points to spend 3 nights for free in San Francisco

I use Chase Ultimate Rewards points for free or cheap travel constantly. This past week, I spent 3 nights in San Francisco for free thanks to my $300 travel credit and points transferred to Hyatt. So it’s good to get your points balance growing while starting your other goals at the same time.

Keep in mind, you can NOT get most Chase cards (including these), if you’ve opened 5+ cards in the last 2 years. If you’re starting out, that shouldn’t be an issue. But something to note, for sure.

Bottom line

Link: Chase Freedom – Compare it here

Link: Chase Freedom Unlimited – Compare it here

The number to know is $20,000. If you spend more than that per year, the Freedom Unlimited would earn you more points – that’s also assuming you’ll activate and max out Freedom’s bonus categories each quarter.

The Freedom requires much less spending for the most possible bonus points: only $500 per month compared with ~$1,667 on the Freedom Unlimited.

But ultimately, the best one for you depends how much you like the quarterly bonus categories. Typically, they’re super useful and easy to use. Past quarters included grocery stores, Amazon, wholesale clubs, and restaurants.

And both cards should be part of a longer-term goal for credit building or cheap travel. Obviously, both of those are great!

Finally, if your goal is just cashback, choose neither. There are better cashback cards in the world, like Discover It.

Lower spending and a good introduction to points is why I typically steer my friends and family to Chase Freedom. But considering both cards don’t have an annual fee, you really can’t go wrong either way.

Which card do you like better? Do you find Freedom’s bonus categories easy to use?

April 21, 2018

Earth Day 2018: Commit to Using Less Plastic!

Earth Day is TODAY – Sunday, April 22nd this year. And I have a new mantra:

“The only plastic I carry is in my wallet.”

Our earth is full of plastic in oceans, landfills, and accumulated litter. This past year, I committed to eliminating plastic from my life as much as I can by using refillable water bottles, steel straws, and cloth bags.

I’ve made so much progress that I mostly touch plastic to earn points & miles.

I believe we can interact peacefully with the earth and help it heal. There is too much plastic pollution

The travel and hospitality industries are incredibly wasteful. If everyone took a small step to offset plastic use, imagine how much we could save from ending up in oceans, hurting animals, or going into a landfill.

“The only plastic I carry is in my wallet.”

In particular, single-use plastic items are the worst offenders. That includes:

Grocery bags

Water bottles

Straws

Produce bags

Food service wrap

To-go coffee lids

Iced drinks

Utensils

Travel-sized toiletries

There are tons more. Think of all the times you touch a piece of plastic and throw it in the garbage after using it once.

Here are a few simple tweaks that will save so much plastic waste. Since I’ve incorporated these into my life, I’ve turned down plastic so many times. It’s one of those things that’s everywhere once you start to notice it.

1. Refillable drink containers

Link: Hydro Flask

Link: Corkcicle

I’ve gotten into the habit of drinking coffee at home. Not only does it save time and money, but it saves hundreds of cups and lids from being tossed out every year – and that’s just me!

Hydro Flask makes tons of containers for every type of liquid

I like the Hydro Flask brand. They make:

32 oz water bottles (I fill mine up at least 3 times a day)

12 oz coffee cups

Thermoses for hot foods and soups

Everything size in between

These things keep hot drinks hot for 6 hours, and cold drinks frosty for 24+ hours! I put ice in my drink at night and it’s still there when I wake up in the morning.

They’re double-wall insulated, lined with stainless steel, and free of toxic substances. They also have a “powder coat” which makes them easy to grip.

They make every manner of accessory from sippy lids, straws, clips, straps, you name it. But the best part is you can use them thousands of times.

Better than bottled and so much better for the environment

If you get a water filtration system at home (I use this Brita pitcher), you can fill up a 32 oz bottle – that eliminates nearly 3 bottled waters per day. Over a week, you can spare dozens of plastic bottles from going into the trash – and the water quality is just as good.

I like these styles, too

I have another one I use primarily for coffee. It’s 12 oz and fits into my car’s drink holder. I use it to take coffee to the airport or around town. Even better, I can give it a rinse and fill it with water while I’m out. Or if I’m at an airport lounge with a self-service bar, I treat myself to a pre-departure bevvie of my choosing.

April 19, 2018

A $2,100 Trip to San Francisco and Portland for 30 Cents Out-of-Pocket!

This month’s marked with lots of travel. I just got back from a week in Japan. And tomorrow, I’m off to San Francisco and Portland!

I was tallying up my points totals and comparing what the retail costs would’ve been. This trip would’ve cost over $2,000 had I paid cash.

I got 30 cents… will this be enough for 5 days in San Fran and Portland? :p

I should disclose ended up paying a little cash, in addition to my points. 30 whole cents.