Harlan Vaughn's Blog, page 20

October 29, 2018

Just for Fun: This Cool App Tracks Your Flights & Shows Miles Flown, Countries Visited, & Hours Spent on Planes!

Thought I’d share a cool app. App in the Air tracks your flights, stores boarding passes, and keeps track of loyalty account balances. A couple are paid features, but I don’t pay for the app because the free features are fun on their own.

The paid features are useful for some, but I like TripIt Pro for flight updates, and use AwardWallet to track my program balances. And for free, you can see interesting facts about your personal travels.

Oh, the places you’ll go! Check out App in the Air if you like stats and maps

Here’s what the app can do!

App in the Air for fun travel stats

Link: Download App in the Air

I love data, graphs, and stats. And of course maps and geography. When I was little, I had a world map in my room and spent hours looking at all the countries on our amazing planet.

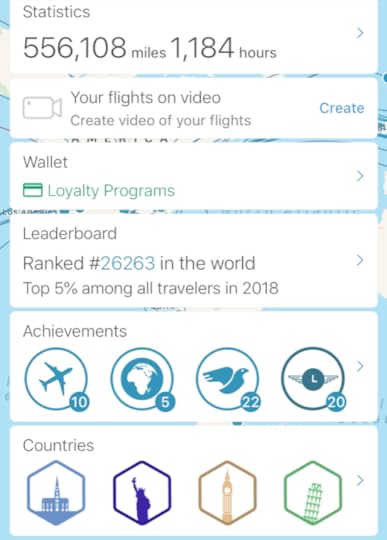

As an adult, I’ve been fortunate enough to see 28 of those countries, according to App in the Air. Which doesn’t seem like nearly enough!

This app tells you:

How many countries you’ve visited (28 for me)

The number of airports you’ve seen (Just 82? Feels like more)

How many airlines you’ve flown (34!)

All the aircraft types you’ve been on (51!)

How many miles you’ve flown (556,108)

How many hours you’ve been in planes (1,184)

I love all the data this app produces

It also awards badges for the number of aircraft you’ve flown in, how many red eyes you’ve taken, flying backward in time, circumnavigating the globe, and more.

My personal stats

And you can see a map of all the flights you’ve taken throughout the world.

All of this is completely free.

The app works by connecting to your TripIt account or email, then scouring for flight confirmations.

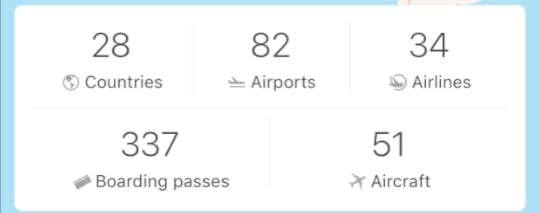

Get ready to scroll. App in the Air shows you every flight you’ve ever taken

Once all your data is imported, you can see graphs by month or year.

2016 was a big year for me. And I don’t really fly United a lot raff

You can also see a map of your flights all over the world, and view them on an AR (augmented reality) globe.

Haven’t been to the Ring of Fire nearly enough

If you geek out over maps, geography, flight stats, or graph data, this is a fun app to have on your phone. I wouldn’t pay for the premium features unless you find them meaningful. And the free stuff is more than enough for most travelers.

I especially like how you can track aircraft (for AV geeks) and countries visited (for those bucket lists).

Bottom line

Link: Download App in the Air

Lord help me, y’all know I love apps. I have a zillion on my phone. Most perform a function, but this one’s all about fun.

In my mind, I’d been to more countries, and seeing the number of hours spent on planes was a little too real. I also haven’t hit a million miles flown, which makes me feel extremely lazy.

But hey, I’ve been to the moon and back (238,900 miles each way), so that’s something.

The app has lots of other functions, but most are paid features. You can track your loyalty programs for free, but I still think AwardWallet does a better job of that.

App in the Air is worth a download if you want personalized travel data, like maps, or want some cool stats.

How does your travel data compare? There are some real road warriors out there, so your maps and stats might put mine to shame!

October 21, 2018

Check Your Business Credit Score for Free – Here’s How, & Why You Want It

If you’ve opened small business credit cards, chances are you have a business credit score – one you might not even know about.

Business cards are totally different animals from personal cards, in their protections and how they’re treated by law. In general, consumer (personal) credit cards give you more protection against unwanted activity, and with extended warranties.

But a small business card can be an excellent way to separate your business expenses and earn bonus points in categories lots of personal cards simply don’t have, like office supplies, cell and cable bills, advertising, and shipping – to name a few.

If you want to open small business cards, it’s good to know where you stand

Here’s more about your business credit score – and how to check it for free.

What’s a business credit score anyway?

I’ve opened lots of small business credit cards these past few years, both in my name as a sole proprietor and with a business entity name. If you’ve opened a small business card, there’s data out there totally separate from your personal credit score.

Although banks ask for your SSN and for you to personally guarantee your business credit line, many small business credit cards do NOT appear on your personal credit report. But it’s not like they disappear.

Instead, there’s a system of metrics to create a whole other score for your small business.

Business credit scores look for completely different patterns than personal scores

There are 2 main systems: Experian, and Dun & Bradstreet.

With Experian, you’re given a grade A through F. And with Dun & Bradstreet, you’re given a score between 80-100, between 50-79, or 49 and below.

With both, higher is better (closer to A or closer to 100).

You’re ranked with if your business has had:

Tax liens

Collections

UCC filings

Bankruptcies

Judgements

Of course, these items can appear on your personal credit report, too. But this score only takes into consideration actions taken against your business.

Use Nav to see your small business credit score

Key Link: Sign up for Nav to see your business credit score

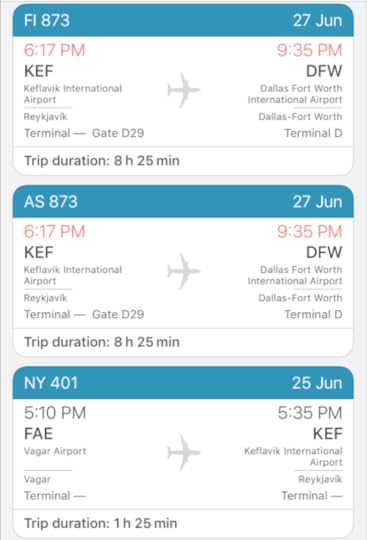

In the past, it’s been expensive or tricky to see your business credit score. But with Nav, I was able to plug in my business information and get an instant credit report. They can pull from both of the main systems.

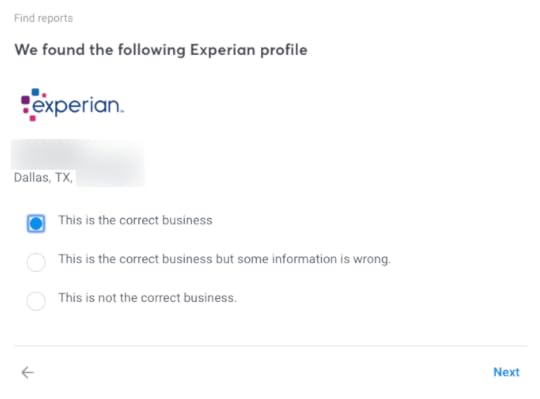

After you sign up for free, Nav will ask you to confirm your personal information. Then, you’ll have the chance to find your business in Experian and Dun & Bradstreet’s systems.

I easily found my business with Experian

After I entered the information, I found my business with Experian. And was given a “B” grade – probably because I only have one type of credit (small business credit cards).

If you’re in the same boat, you’ll likely have a similar result.

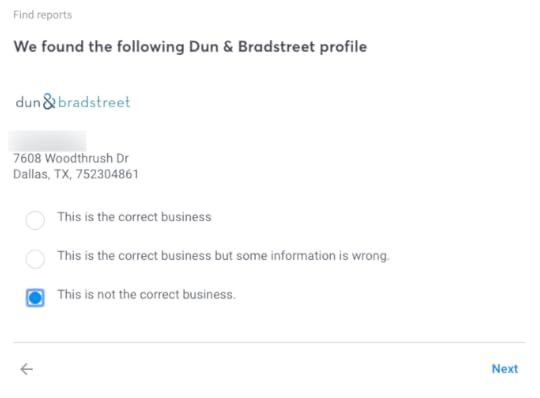

No dice with my Dun & Bradstreet profile

But with Dun & Bradstreet, I couldn’t find my business anywhere. I saw lots of others with similar names, and they showed me dozens of addresses – but none of them were mine.

They were all in Dallas, though (where my business is). I have no idea why it was easy to find myself with Experian, but not with Dun & Bradstreet.

I don’t have extensive business credit history by any means, but I’m glad I was able to confirm the information out there, even if it’s limited.

Why it’s a good idea to check your small business credit score

Simply because lots of small business have similar names. And if you’ve had different addresses and used SSNs and EINs, it’s hard to link them together as one entity.

For example, if your business name is “Joe’s Coffee Shop,” you might be mistaken for “Cup of Joe Coffee” or “Joe’s Coffee Stand” or some other similar sounding name.

Mistakes happen. If two small business have limited history, but similar names, they can become intertwined. And though one of them might be squeaky clean, a judgement or lien on the other can bring them both down.

My small business cards are for Airbnb hosting

And when you go to apply for another small business card, you could be inexplicably denied. Just like personal credit scores, you might have to file a dispute.

But it only takes a few minutes to check your business credit score and it’s free.

Plus, if you ever get to the level where you form an LLC, incorporate, seek business loans, or apply for a business lease – you are definitely going to want to know where you stand.

My businesses are small hobby-based enterprises, but ya never know. And on another level, I kinda just want to know what information is out there and correct it if it’s wrong.

Bottom line

Key Link: Sign up for Nav to see your business credit score

Most of us in the points & miles world picked up a small business credit card at some point. There’s information out there about your small business – and it’s free to check.

What’s also kind of scary is at a certain point, I was asked to match addresses from a long list of other business to go in and view their profile. So the propensity for human error here is kinda frightening.

There’s no good way to serve up a business credit score. After a while, they try to match names and addresses as best as they can. One wrong match can tank your score, even if you did nothing wrong. And that could prevent you from getting more small business cards in the future.

Nav will ask if you want to upgrade or subscribe to monitoring. You don’t have to, and you don’t need a credit card to see your score – so it’s truly free to check. If you have an A or B with Experian, you’re fine.

I’d never heard of Nav before and didn’t know this was even possible until a few weeks ago. It’s certainly interesting. And I’m glad my score was decent despite only having a few business cards.

Here’s the link if you wanna check your own business score.

Let me know if you had a similar experience claiming your business!

October 20, 2018

Right Now Is a Good Time to Use Yearly Credits (Or Get Them 2X!) on Amex Platinum and Gold Cards

October – chilly autumn air, pumpkins, scary movies, the inevitable return of the holidays, then a new year. And for many cards, mainly the Amex Platinum and Gold cards, the last opportunity to use your statement credits. Such is Q4.

And if there’s a card you want, you still have enough time to apply, use the credits for 2018 – then get a fresh batch of credits to use in 2019. You effectively get double the credits for 1 annual fee, which is awesome.

Treat yo self to an upgrade, checked bag, or something extra this year AND next for 1 annual fee!

Here are cards for an end of the year double-dip.

Get an Amex statement credit 2X in 2018 and 2019

1. Amex Platinum Cards

The Platinum Card® from American Express60,000 Amex Membership Rewards points

• $550 annual fee• $5,000 on purchases in the first 3 months from account opening

• $200 annual airline incidental credit

• $200 in Uber credits annually

• 5X points on flights and travel booked through Amex

• Access to the fantastic Centurion Lounges, Delta SkyClubs, and Priority Pass network

• Terms apply

• Learn more here

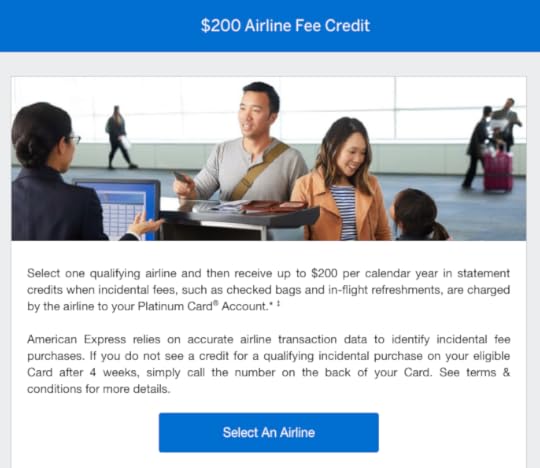

First up is the Amex Platinum Card. It’s a behemoth of a card with a nearly endless list of benefits – including a $200 annual airline incidental credit on an airline of your choice, including:

Alaska Airlines

American Airlines

Delta

Frontier

Hawaiian Airlines

JetBlue

Spirit

Southwest

United Airlines

I always pick Southwest as my airline to upgrade my boarding position, buy drinks in-flight, and more

Though there’s a $550 annual fee, the $200 airline credit certainly helps make up for it. And if you’re new to the card, you can use the credit in 2018 – then again beginning January 1, 2019.

Remember to select an airline before you use the credit

This is also a great card to have around the holidays for lounge access to get away from crowded and noisy gates, and to check bags full of gifts to give or that you received, without thinking about which card to use. Get it all credited back, usually within a few business days. You can select your airline here.

You also get Uber credits – $15 per month, except for December when you get $35. That could be useful to get to the airport for a flight home for the holidays. And it’s a nice end of year bump.

Finally, there’s the $50 Saks credit you get every 6 months (January through June, and July through December). You could use it for a gift, or just treat yourself to something nice.

If you use all your credits between October 2018 and October 2019, you could get:

$400 in airline incidental credits ($200 in 2018 and $200 in 2019)

$200 in Uber credits

$150 in Saks credits (July through December, January through June, then July through December again)

For a total of $750. So the credits outweigh far the annual fee – and doesn’t include the welcome bonus, lounge access, 5X on airfare, and tons of other perks.

By the way, here’s a FlyerTalk forum where peeps share exactly what purchases trigger the airline credit – just search for your preferred airline. And FYI – ALL these credits are use it or lose it. They do NOT roll over!

2. Amex Gold Card

American Express® Gold Card25,000 Amex Membership Rewards points

• $250 annual fee• $2,000 on purchases in the first 3 months from account opening

• 4X Amex points on dining at US restaurants

• 20% statement credit at US restaurants in the first 3 months, up to $100, when you apply by 1/9/19

• 4X Amex points on up to $25,000 per year at grocery stores

• 3X Amex points on airfare booked directly or travel booked through Amex

• $100 airline incidental credit per calendar year

• Terms apply• Learn more here

This credit works the same as the Platinum Card, but it’s $100 per calendar year. If you use the credits in 2018, and again in 2019, that’s $200 to make a dent in the $250 annual fee.

I must say, I’m impressed with the 4X bonus categories on this card. Though I wish they weren’t limited to US-only. That seems terribly short-sighted for a travel card.

But if you dine a lot, or want a card with a huge return at grocery stores, this one is definitely worth a look. Plus, you’ll get 20% back at US restaurants, up to $100, when you apply by January 9th, 2019. That, plus the $200 airline incidental credits, can easily recoup the annual fee in just a few months.

3. Amex cards with spending thresholds

Blue Business Plus Amex

• $0 annual fee

• This is by far the best card for 2X points on all spending• Learn more here

Some Amex cards don’t have statement credits, but rather, limits on the number of bonus points you can earn. Think of them as rebates.

For example, with the Blue Business Plus Amex (check it out here), you can earn 2X Amex points on up to $50,000 spent per calendar year. After that, you’ll earn 1X.

Other Amex cards have similar setups, like:

Amex EveryDay card – 2X Amex points at US supermarkets, up to $6,000 per year

Amex EveryDay Preferred card – 3X Amex points at US supermarkets, up to $6,000 per year

Blue Cash Preferred – 6% cashback at US supermarkets, up to $6,000 per year – learn more about the card here

If you want to earn elite status through spending to score upgrades and free breakfast, you have a few more months to do it

And if you’re gunning to earn elite status credit, or other bonuses for spending, that’s coming to close at the end of December as well. Many Amex cards let you spend your way to elite status, like:

Hilton Honors Ascend Credit Card from American Express – Get a free weekend night when you spend $15,000 in a calendar year and get Hilton Diamond elite status when you spend $40,000 in a calendar year – learn more about the card here

Delta Reserve for Business Credit Card from American Express – Earn 15,000 MQMs toward Delta status and 15,000 bonus miles when you spent $30,000 in a calendar year – learn more about the card here

Other Amex cards have similar rewards for spending, or thresholds for bonus points, so you have a few more months if you’re close to the line.

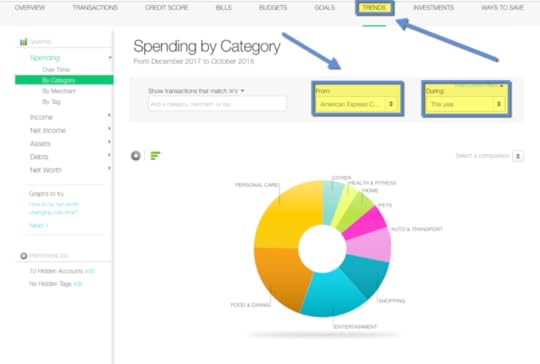

Mint.com will tell you how much you’ve spent this year on any card

I wrote how to use Mint.com to track your spending on any credit card. You can check by clicking “Trends” then filtering by card, and “This year.”

That way you can see exactly how much you have left to go to earn bonus points or meet a spending threshold for a reward.

October 15, 2018

10 Easiest Signup Bonuses to Earn (7 Under $500, 3 With a Single Purchase!)

This one’s for peeps who think they can’t earn signup bonuses because the minimum spending requirements are too dang high.

When you think about, spending $3,000 (the usual spending requirement) is, of course, $1,000 per month for 3 months – or $250 per week. These cards tend to have the highest bonuses.

The problem with bank marketing is they throw out huge numbers and scare people off. But when you break it down, it appears way more manageable.

In any regard, there are plenty of cards with much lower minimum spending requirements. And some of them are genuine keepers!

Or rather, they look high – but most of them aren’t that bad once you break it down

Let’s look at 10 of the easiest signup bonuses you can earn.

10 cards with low spending requirements

If you’re in the “no way, no how” camp for spending $1,000+ to earn a signup bonus, you can still earn miles or cashback. If anything, you’ll see how easy it can be. And when you feel more comfortable, or you’re able to spend more (or have to spend, oy), you can go for a bigger offer that’s way more valuable.

But for now, these deals are easy and/or a great place to begin.

1 and 2. Barclays American Airlines cards – personal and small business

Link: Barclays American Airlines personal and small business card

This is just too good. Best-ever offers and only 1 purchase required. You can earn these bonuses for buying literally any item from any store – a bottle of water, a parking pass, whatever.

Then you’ll have 60,000 American Airlines miles to play with. That’s enough for a one-way Business Class ticket to Japan!

October 11, 2018

10 Best No Annual Fee Credit Cards – All With a 2% or Better Return

Everyone should have at least 1 credit card without an annual fee. When a card is free to keep forever, you never have to second-guess it. And the card works its powers on your credit report to increase available limits, decrease utilization, and help boost the average age of all your accounts.

My oldest credit card is from 2002 and has no annual fee. No matter how many new cards I open, I’ll always have a 16-year-old card to raise the average age of my accounts higher and therefore, my credit score.

When a card has a fee, it’s harder to justify keeping it – unless you get outsized value.

But having a card without an annual fee doesn’t mean you have to give up solid returns. All of the cards on this list can get you 2% back or better.

Discover It is one of the best no annual fee cards – up to 10% cashback the first year. I’ll share my top 10 faves!

Here’s my list.

10 best no annual fee credit cards

For the purpose of this list, I only included cards with the best rewards. Getting 1.5% cashback isn’t good enough for a card to get a spot – unless you can somehow increase the value.

A few of these cards earn points or miles. So know I personally value all my points and miles at 2 cents each, or a 2% return on spending.

That’s because I’d never use my points for award travel if they’re not worth at least that much against the paid price. No points “valuations” here like The Points Guy and others

The 10 Best No Annual Fee Credit Cards – All With a 2% or Better Return

Everyone should have at least 1 credit card without an annual fee. When a card is free to keep forever, you never have to second-guess it. And the card works its powers on your credit report to increase available limits, decrease utilization, and help boost the average age of all your accounts.

My oldest credit card is from 2002 and has no annual fee. No matter how many new cards I open, I’ll always have a 16-year-old card to raise the average age of my accounts higher and therefore, my credit score.

When a card has a fee, it’s harder to justify keeping it – unless you get outsized value.

But having a card without an annual fee doesn’t mean you have to give up solid returns. All of the cards on this list can get you 2% back or better.

Discover It is one of the best no annual fee cards – up to 10% cashback the first year. I’ll share my top 10 faves!

Here’s my list.

10 best no annual fee credit cards

For the purpose of this list, I only included cards with the best rewards. Getting 1.5% cashback isn’t good enough for a card to get a spot – unless you can somehow increase the value.

A few of these cards earn points or miles. So know I personally value all my points and miles at 2 cents each, or a 2% return on spending.

That’s because I’d never use my points for award travel if they’re not worth at least that much against the paid price. No points “valuations” here like The Points Guy and others

October 9, 2018

10 Tricks to Save EVERY Time You Shop at Sam’s Club

If you like big box stores, I completely understand the sentiment. Buying in bulk and getting a month of grocery shopping knocked out in one go saves time and money – both of which are always worth saving.

I ignore the naysayers who over exaggerate what it means to buy in bulk. I have memberships at both Costco and Sam’s Club and use them both equally – especially now that both are around the corner from me at my pied-a-terre in Austin.

Sam’s Club is, in some ways, better than Costco. Both memberships add value to my life

What I like about Sam’s Club:

They have self-checkout

You can scan your items as you go (with the, what else, Scan & Go app) and check out instantly

Receipts are stored digitally online

Club pickup – Costco does NOT offer this

Digital membership card on your phone and in Apple Wallet

Cheaper prices on tires

They accept every payment method, not just Visa

You can easily reorder your most common items

Their app is way better

But they don’t offer free shipping on most items online like Costco does. And their food court offerings tend to be greasy, calorie-laden fiascos whereas Costco seems a *little* healthier. And in general, I find Costco stores to be cleaner and better laid-out. Sam’s Club locations can be hit-or-miss, whereas I feel like Costco has more consistency between the stores.

Also, there are more ways to save at Sam’s Club. A lot more ways. And that might seal the deal for some peeps, especially if both are nearby.

Let’s look at how to save money EVERY time you set foot (or web browser) in Sam’s Club.

10 ways to build your own discounts at Sam’s Club

Remember, you can stack many of these deals to save even more money. And with most, you can set it up once and let it go.

For others, it’s just clicking a link. When you stack, you can save 10+% when you shop – or more. That’s some serious savings on already discounted stuff!

1. Save 2+% with the Dosh app

Link: Get the Dosh app

If you don’t already have the Dosh app, download it immediately! You only need to set it up once. Link your cards. Then, any time you shop at Sam’s Club, you’ll earn between 2% and 5% cashback instantly.

You can withdraw the money once you reach $25 directly to your PayPal or checking account. And you’ll get $5 free just for downloading it.

Who doesn’t want up to 5% cashback?

There’s seriously nothing else to do besides download it and link your cards.

Boom. $20

You can also get $20 if you buy a new membership. Just use your linked card and you’ll get $20 automatically.

2. Discounts with Ibotta

Link: Download Ibotta and get $10 for trying the app

I love the Ibotta app. You can earn cashback on a ton of common household goods.

You have to activate the offers and upload your receipts, but I usually browse the app while I’m in the store.

Sam’s Club + Ibotta = more money for you

They regularly run bonuses and promotions. Sometimes the savings are for a few bucks. That’s a nice savings, especially if you can find multiple items you were already planning to buy.

You can withdraw the funds when you reach $20. And in my experience, cashback is credited within a day. Seriously love this app so much and check it all the time.

3. Get 2% back with Acorns

Link: Get $5 free to invest with Acorns

This one is another set it and forget it.

You’ll get $5 to start investing when you download the app (which I wrote about here).

What’s cool is their Found Money feature, which earns automatic cashback when you link a card and spend at certain merchants – Sam’s Club is one of them.

You’ll automatically earn $1 per $50 spent at Sam’s Club, which is an effective 2% return.

How about 2% cashback to invest in your future? I love the Found Money feature with Acorns

There’s no effort to get the cashback after you link your card.

If you’re a new member, you can also get $10 when you signup.

Here’s another $10 free

And yes, you can stack that with $20 back through Dosh (in #1) and the $5 from both Dosh and Acorns. That’s $40 back from a $45 membership!

4. Use any card to meet minimum spending, or get 5% cashback through the end of 2018

Link: Best Travel Rewards Credit Cards 2018

Sam’s Club takes all major payments, so you can use any card to pay for your purchases. That means you can earn an endless variety of points, miles, or cashback – depending on which card you use.

This quarter, you’ll earn 5% cashback at wholesale clubs with the Chase Freedom (compare it here) and Discover It cards.

Chase Freedom15,000 Chase Ultimate Rewards points

• $0 annual fee• $500 on purchases in the first 3 months from account opening

• A great first Chase card• Compare it here

Get a rebate of your choice because you can pay with any card you want

You can essentially choose your own rebate because you have your choice of cards. But earning 5% cashback on top of all the other discounts you can stack means you can save north of 10% easily – and usually more.

5. Get miles, points, or cashback when you shop online

Link: Sam’s Club on Cashback Monitor

Always always check Cashback Monitor if you shop the Sam’s Club website. Right now, you can get up to 7% cashback with TopCashback and Giving Assistant. Again, that’s on top of all the other discounts!

I use Cashback Monitor to see how much of a rebate I can get

Note this does NOT work for pickup in-store. So it won’t work for perishables like meat, produce, and dairy. But if you need to get something delivered to your home, this is an easy way to earn extra money for simply clicking a link.

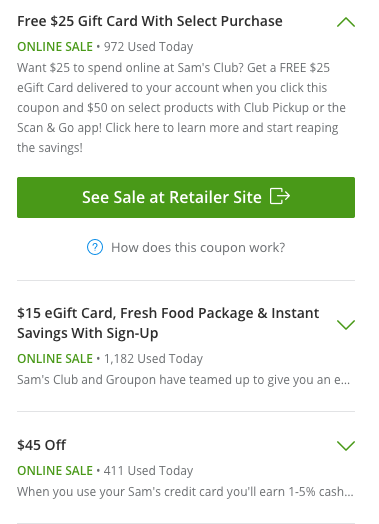

6. Check for discounted memberships and coupons on Groupon or LivingSocial

Link: Sam’s Club on Groupon

Link: Sam’s Club on LivingSocial

Hell yeah, you can usually find some coupons on Groupon.

For example, I found this one on the site:

Easy coupon for checking Groupon

And sometimes, you’ll find discounted memberships. Right now, for example, you can get a $15 e-gift card or $45 off when you buy a membership.

Groupon deals can help you save whether you’re a new or existing member

And on LivingSocial, I found a couple of membership offers:

Both of these packages include gift cards and free food when you signup

For example, you can pay $35, and get a membership (valued at $45), $25 in gift cards, and $20 in free food. That’s a crazy good deal!

I always check both of these for coupons I might not have found otherwise.

7. Check for Amex Offers

If you have an Amex card, check your account, because they’ve had a LOT of Sam’s Clubs offers recently. Like this one:

This is a 20% discount – amazing!

And again, you can stack this with rewards from shopping portals to get up to 30% cashback (20% back from Amex Offers, up to 7% back from shopping portal, and 3+% back in the form of rewards points)!

You can’t beat that with a stick.

8. Get $30 in rewards with a new membership if you’re active or former military

Link:

If you ever served, you can get rewards on your new membership.

I really like this perk

With it, you’ll get lots of gifts:

These are nice thank yous for our military members

You’ll have to decide whether this is the best deal, or if you can do better through Groupon or LivingSocial. But either way, military members can always access this version of membership. Thank you for your service!

9. Get a $15 gift card for new student memberships

Link: Student membership

If you have a .edu email address, you can get $15 to spend when you join Sam’s Club.

That’s a lot of ramen

I wish I’d known about this in college – I could’ve saved so much money stocking up on snacks instead of paying the prices at the school’s cafe. Again, students can get this any time – but other discounts might be a better deal, depending on what’s available when you join.

10. Consider a Plus membership

Link: Plus membership details

You’ll get:

$10 back for every $500 you spend (2% back in the form of a rebate check)

Free online shipping with no minimums

Deeper discounts

Early shopping hours

More gas discounts

It’s $100 per year instead of $45. But here’s what’s cool. If you don’t earn enough in a year to justify the upgrade, they’ll refund the difference and let you keep the regular membership.

If the Plus upgrade isn’t right for you, you’ll get the difference back

It’s highly worth it if you shop the website a lot and don’t want to deal with hitting a shipping threshold each time.

Bonus. Just check the website

Seriously. While researching this article, I found this coupon just sitting at the bottom of the site:

You can find easy wins online

No promotion, no special deal. It was just there as I shopped around. So keep an eye out – there are so many ways to save at Sam’s Club!

Also, you MIGHT get Uber credit

On October 9, 2018, I made a purchase for $46.21 at my local Sam’s Club. Right as I swiped my card, my… Uber (?) app said I earned $2.31 in Uber credit, which is 5% back toward my next Uber ride.

No guarantees, but Visa Local Offers are maybe working via Uber

I tried to find some sort of promotion to share, but nothing came up.

If you link a Visa card, you can earn Uber credits through Visa Local Offers. I don’t know the terms of the Sam’s Club offer, but it worked for me – YMMV. Can’t hurt to link your Visa debit or credit card and see if it works for you.

I ended up getting 5% back from Dosh, 5% back from Uber, and 5% back from my Chase Freedom card – 15% back in total, and it all happened automatically. Not bad at all.

Bottom line

Depending on which deals you use, you can easily save 10%, 20%, up to 30% at Sam’s Club. That’s at the high end. But there’s no reason you can’t reach 10% back every time you shop by stacking some combination of these deals:

2% to 5% cashback with the Dosh app

Ibotta savings when you upload your receipt

An effective 2% back (as a free investment) with Acorns

Rebates with a credit card of your choice – Chase Freedom (compare it here) and Discover It both have 5% cashback this quarter at wholesale clubs

Up to 7% cashback with TopCashback and Giving Assistant when you shop online

Groupon and LivingSocial coupons and discounted membership deals

Amex Offers

and student memberships

Risk-free upgrade to Plus membership for free shipping and additional rebates

Promotions you find on the Sam’s Club website

Between the sales, gas discounts, coupons, and savings from buying in bulk, most peeps can save a lot of money with a Sam’s Club membership. And with a little finesse, you can stack more discounts on top of all that and make good deals even better.

Do you have other ways to save at Sam’s Club? Please share in the comments!

October 7, 2018

Yes! Just Picked up a New Alaska Visa for 40K Miles – How to Get the Offer

The typical signup offer on the Bank of America Alaska Airlines Visa is 30,000 Alaska miles after meeting the minimum spending requirements (usually $1,000 in the first 90 days).

We’ve seen offers for $0 companion fares, a $100 statement credit (tantamount to a 10% discount on the minimum spending), and a few highly targeted offers.

This latest deal is for 40,000 Alaska miles and a $0 companion fare after spending $2,000 within the first 90 days of account opening. There are a few steps to get the offer to show – but it’s worth it for 10,000 extra Alaska miles.

Best public deal there’s been for the Alaska Visa – 40K miles and a $0 companion ticket

I was just instantly approved with a $17,000 credit line and I’m LOL/24. It’s clear by now I’ll never open another Chase card – so I went for it. Alaska miles are among the most valuable out there – and you can use the $0 companion ticket to anywhere Alaska flies, including Hawaii!

Here’s how to get the offer.

Alaska Visa 40K offer with a little massaging

1. Install the Referer Control Chrome extension

Link: Google Chrome Referer Control

Fire up your Chrome browser and install this extension. It’s a 1-click install.

Get the Referer Control plug-in

2. Set the controls

Your screen should look like this:

You want these settings

Where it says “Enter site” copy and paste this URL:

https://secure.bankofamerica.com/appl...

Then click “Custom” and “URL.” Type in:

Because the application must have a referral from the Alaska website.

3. Pull up the app

Now, in a separate browser tab, paste in the application URL:

https://secure.bankofamerica.com/appl...

You should see the offer for 40,000 Alaska miles + $0 companion ticket.

It only takes a couple of minutes to install the extension and paste in a link.

4. Apply

If you already have a Bank of America account, you can sign into your online banking to pre-load for your information. Otherwise, apply as normal. Be sure to add your Alaska loyalty number so your miles go to the right place.

My results

It’s been a hot minute since I’ve opened a new Alaska Visa. Bank of America has new 2/3/4 application rules for this card.

No approvals after 2 cards per rolling 2 months, 3 cards per rolling 12 months, and 4 cards per rolling 24 months.

So make note of the date so you can track your applications.

Instant approval with a nice credit line

I was approved instantly with a decent $17,000 credit line.

Even cooler, Bank of America gave me the option to generate my card number instantly:

You can shop online right away

I haven’t known Bank of America to generate cards instantly before, so this was a nice surprise. It would be awesome if I could get the minimum spending done before the card shows up in the mail.

October 6, 2018

Only Days Left for Citi ThankYou Premier’s Incredible 60,000 Point Bonus (Easy $800 for Travel)

If you haven’t jumped on this offer yet, time’s almost up. Citi will pull the chance to earn 60,000 Citi ThankYou points with the Citi ThankYou Premier card on October 11th, 2018. Each point is worth 1.25 cents toward travel (including airfare, hotel stays, cruises, and excursions), which makes this offer easily worth $800 after meeting the minimum spending requirement.

Even better, the annual fee is waived the first year. So you can see if you like the card for 12 full months before paying. Even then, Citi is excellent about retention offers for bonus points upon card renewal. I get them regularly.

This is also one of the few cards to earn 3X points on gas (and travel).

Citi ThankYou points helped me get to Prague. 60K is the best offer there’s been for the ThankYou Premier

I wish I could get this offer. You’re not eligible if you’ve opened or closed another ThankYou card in the last 24 months. Otherwise, there would be zero hesitation. This is the highest offer ever for this card.

Citi ThankYou Premier Bonus = $800

Until October 11th, 2018, you’ll earn 60,000 Citi ThankYou points when you’re approved for the Citi ThankYou Premier card and spend $4,000 in purchases within the first 3 months of account opening.

This card earns:

3X Citi ThankYou points on travel, including gas stations

2X Citi ThankYou points on dining and entertainment

1X Citi ThankYou point on all other purchases

The $95 annual fee is waived the first year.

I wrote how the signup bonus is actually worth $900 if you meet the minimum spending requirements with 3X categories.

Hop on a cheap flight deal and see Hawaii’s waterfalls

Even if all your minimum spending is in the 1X category, you’d earn 64,000 Citi ThankYou points – which are worth $800 toward travel (64,000 X 1.25).

So no matter how you slice it, you’re gonna get $800 in value – at least – out of this deal.

Citi Price Rewind is worth using

Link: Citi Price Rewind

Link: Earny

I use Citi cards for most of my online/Amazon shopping to take advantage of Citi Price Rewind. This will be especially important in the coming months, with Black Friday and all the holiday sales going on (I know, can you believe it’s almost Christmas again?).

Citi Price Rewind gets you back $200 per item, and up to $1,000 per year, on price drops within 60 days.

Citi Price Rewind saves me a decent amount of money every couple of months

But filing a claim is for chumps. Instead, use an automated service like Earny, which does all the tracking and filing for you. All you ever see are random statement credits. Which is awesome.

Earny charges 25% of whatever you get back. But considering it does all the work for you at major retailers like Amazon, Best Buy, Kohl’s, Target, Macy’s, and Walmart, it’s basically free money you get back (unless you want to do all the price tracking yourself).

Pretty much everything you buy in November or December goes on sale in January, so this is a nice perk to have with an already excellent sign-up bonus. This would be a good card to use for holiday shopping – get gifts and meet the minimum spending all in one go. #twobirds

How to redeem Citi ThankYou points

You can book travel directly on thankyou.com, and use your points to pay for travel. Airfare is treated like a cash ticket, so you will earn miles and elite status credit.

This is NOT true for hotel stays. Hotel chains consider this a third-party booking and typically won’t let you use elite status perks.

So I personally use Citi ThankYou points mostly for flights, or at boutique hotels where I wouldn’t earn points anyway. Again, the bonus is worth at least $800 toward travel after you meet the minimum spending.

You can also transfer your points to:

Avianca

Asia Miles (Cathay Pacific)

EVA Air

Etihad Guest

Flying Blue (Air France / KLM)

Garuda Indonesia

Jet Airways

JetBlue

Malaysia Airlines

Qantas

Qatar Airways

Singapore Airlines

Thai Airways

Turkish Airlines

Virgin Atlantic

These airline loyalty programs are for advanced players, mostly because none of them are domestic (except JetBlue). But you can get good deals to Hawaii, on domestic travel, or sweet spots within each program. There’s no reason why you couldn’t get award flights worth $1,000+ with the Citi ThankYou Premier’s signup bonus. A few ideas:

Singapore Airlines and fly to Hawaii on United for 35,000 miles round-trip in coach (you can book this on Singapore’s site)

Flying Blue for cheap domestic travel on Delta (price varies, but they have a calculator – you can book on the Air France site)

Etihad for cheap hops to/from Brussels for 5,000 or 7,000 miles each way (must call to book and takes about a week for the transfer)

Virgin Atlantic to fly from East Coast to London for 20,000 miles round-trip in coach (there are fuel surcharges, but could be helpful for expensive flights)

Qantas for hops around Australia, or save your points and fly Emirates First Class

Avianca for cheap flights with Star Alliance partners

Bottom line

I have major FOMO about this offer. It’s just so good. The best there’s been, in fact. Before now, it was 50,000 ThankYou points. There have even been periods with NO signup bonus at all.

If you want this deal with 60,000 ThankYou points, apply by October 11th, 2018. You’ll get an easy $800 to spend on travel, and potentially more, depending how you earn and redeem your points.

This is a great starter card for earning ThankYou points, too. Considering the annual fee is waived the first year, there’s really nothing to lose here. And even folks well over 5/24 report instant approvals.

You gonna take Citi up on this offer, or pass?

October 5, 2018

3 Chase Ink Small Business Cards: Which Is Right for You? (One Bonus Is Worth $1,000)

Chase has 3 Ink cards targeted at small business owners:

Preferred

Cash

Unlimited

Each accomplishes a different business goals by way of awarding bonus points in certain categories. And they all earn Chase Ultimate Rewards points – one of, if not the, most valuable rewards currency.

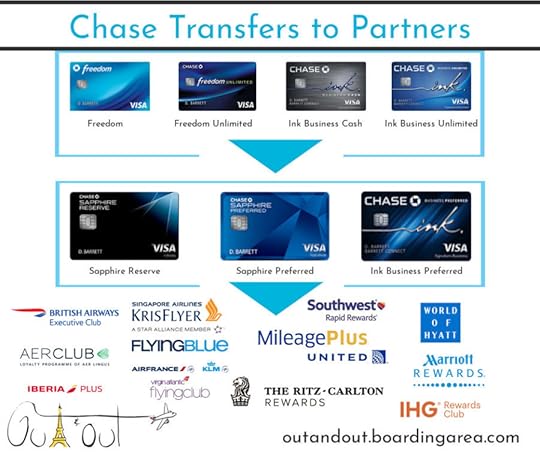

But only 1 of them gives you direct access to Chase’s travel transfer partners (it’s also the only one with an annual fee – the Ink Preferred).

The Chase Ink Preferred (formerly called the Plus) is the only Ink card with transfer partners

Let’s look at what makes these cards compelling.

Chase Ink Business Cards – What’s Alike and Different

Before we begin, every small business should run their expenses through a business credit card. If you’re paying with cash or debit, you’re giving up rewards that could go right back to your bottom line. Or get you an award vacation trip.

My favorite small business credit card is the Amex Blue Business Plus (learn more here – and my review). That card has no annual fee, earns a flat 2X Amex Membership Rewards points on every purchase (up to $50,000 per calendar year), and has direct access to transfer partners.

Cool. So why consider a Chase Ink card? The HUGE sign-up bonuses.

I gifted myself a relaxing trip to Puerto Vallarta earlier this year, all paid with Chase Ultimate Rewards points

They’re worth $500 (for the Ink Cash and Unlimited), or a staggering $1,000 toward travel (with the Ink Preferred).

While that might make you sit up and take notice, be aware Chase won’t approve you for these cards if you’ve opened 5+ cards from any bank in the previous 2 years (except certain other small business cards, including Chase’s own).

Now here’s each card – and who it matches.

1. Chase Ink Business Preferred

Chase Ink Business Preferred80,000 Chase Ultimate Rewards points

• $95 annual fee• $5,000 on purchases in the first 3 months from account opening

• Amazing small biz card with best-ever offer right now• Compare it here

Bonus categories:

3X Chase Ultimate Rewards points on the first $150,000 spent on travel, shipping, internet, cable, phone service, and advertising, each account anniversary year

1X Chase Ultimate Rewards point on all other purchases

Chase Ink Business Preferred bonus categories

The signup bonus of 80,000 Chase Ultimate Rewards points after meeting the minimum spending requirements is worth $1,000 toward travel booked through the Chase site.

That’s because each point is worth 1.25 cents on travel (80,000 X 1.25 = $1,000). And wow, $1,000 for getting a credit card is a lot of money.

This is the ONLY Ink card whose points transfer directly to travel partners at a 1:1 ratio.

Pair Chase cards to earn even more points

Having access to these partners is total gold. My favorite partners are British Airways, Hyatt, and Singapore Airlines.

Hyatt and Southwest are 2 partners with no blackout dates to think about. If a room or seat is for sale with cash – you can book it with points. And you can often get a great deal by simply transferring your points first. Transfers are instant, so you can book as soon as you find the time or date you want.

You also get $600 in cell phone insurance when you pay your phone bill with the card.

You should consider this card if you:

Like the 3X bonus categories and spend a lot on travel, shipping, advertising, or on internet/cable/phone

Want the ability to transfer your points

Don’t mind the $95 annual fee (the points you earn will be worth much more)

You should NOT get this card if you:

Don’t want to pay an annual fee

Aren’t a fan of the bonus categories

That said, this sign-up bonus is so good, it’s worth getting for that reason alone. I mean, $1,000 to use however you want for a trip is amazing.

2. Chase Ink Business Cash

Chase Ink Business Cash50,000 Chase Ultimate Rewards points

• $0 annual fee• $3,000 on purchases in the first 3 months from account opening

• Excellent 5X categories and best-ever offer right now• Compare it here

Bonus categories:

5X Chase Ultimate Rewards points on the first $25,000 spent on internet, cable, phone service, and at office supply stores, each account anniversary year

2X Chase Ultimate Rewards points on the first $25,000 spent at gas stations and restaurants, each account anniversary year

1X Chase Ultimate Rewards point on all other purchases

The Ink Cash earns 2X points on gas and dining, and 5X at office supply stores

The signup bonus is worth $500 as a statement credit, or you can book travel with it. This card has NO annual fee, so it’s free to keep forever.

If you have another premium Chase card, you can combine the points (see image above). But on its own, this card earns cashback in the bonus categories.

Speaking of which, look at them closely because earning points for gas, dining, and office supply stores is unique to this card.

If you’re looking for a good “starter card” which excellent bonus categories, I’d definitely recommend this one!

You should consider this card if you:

Like the 5X and 2X bonus categories and spend a lot on internet/cable/phone, office supplies, gas, or eating out

Don’t want to pay an annual fee

You should NOT get this card if you:

Want transferable points

3. Chase Ink Business Unlimited

Chase Ink Business Unlimited50,000 Chase Ultimate Rewards points

• $0 annual fee• $3,000 on purchases in the first 3 months from account opening

• Compare it here

Bonus categories:

None. This card earns a flat 1.5X Chase Ultimate Rewards points on all purchases

The name of the game here is simplicity. There are no bonus categories to think about. You simply earn 1.5% cashback on every purchase.

And while there are 2% cashback cards out there, many of them are personal – not small business – cards. And a couple of them have annual fees (I’m looking at you, Capital One).

Set it and forget it. This card earns a flat 1.5% cashback and has a $500 signup bonus, so you can get back to important things like naps with puppies

Plus, it’s hard to find a signup bonus of $500 on a card with NO annual fee. That’s a heck of a deal.

There’s not much more to say about this card. And that’s a good thing.

You should consider this card if you:

Want a dead simple rewards program

Don’t want to pay an annual fee

You should NOT get this card if you:

Spend a lot in the Ink Cash’s bonus categories – because it also doesn’t have an annual fee

Want transferable points

All this to say, if you pair this card with a premium Chase Ultimate Rewards card, you’re earning 1.5X Ultimate Rewards points on every purchase – and that’s a sweet deal. But don’t worry, you can always start here and add another one down the road.

Bottom line

Key Link: Chase Ink Business Preferred – Compare it here

Link: Chase Ink Business Cash – Compare it here

Link: Chase Ink Business Unlimited – Compare it here

It might sound complicated at first, but once you break it down, it’s pretty simple.

There are 3 Chase Ink cards – Preferred, Cash, and Unlimited – and they are all worthwhile for small business spending. It all comes down to:

If you want points that transfer or cashback rewards

Want an annual fee or not

Which sign-up bonus you want to earn: $500 with Cash or Unlimited, or $1,000 toward travel with Preferred

How useful you find the bonus categories for your spending

I would personally go for the Chase Ink Business Preferred for the biggest sign-up bonus. You can always change to a different card in a year if you don’t like it and bank a sweet $1,000 trip now.

Which Ink card do you think is best?