Harlan Vaughn's Blog, page 18

February 8, 2019

Up to $30 Back for Uber & Lyft Rides + Earn Points Every Time With Freebird

I recently discovered Freebird – an app that aims to reduce drinking and driving, and partners with local bars, restaurants, and liquor companies to reward consumers for taking Uber or Lyft rides to their businesses (and back home). Rewards come in the form of points per ride, and cashback when you visit a participating business.

And right now, you can stack 3 promotion codes to get up to $30 back when you connect your Uber and/or Lyft accounts and start riding.

Even better, it pulls prices directly from Uber and Lyft – but booking through Freebird gets you the benefit of earning rewards on every ride.

I’ve been using it for a week or so and I gotta say, it’s pretty cool.

Freebird is an app that connects to Uber and Lyft and rewards you for riding

Here’s how to get the cashback.

What’s Freebird?

Key Link: Download Freebird

When you ride with Uber or Lyft, you’ll earn points by booking through Freebird. Typically, you’ll earn between 100 and 250 points – and 5,000 points are worth $10. So basically you get ~50 cents back per ride.

But points are just one component – you can also earn cashback for visiting local businesses.

If you visit a business on the list, you can get cashback

How it works is:

You link your cards to the Freebird app

Take an Uber or Lyft to the restaurant or bar

Use a card linked with Freebird to pay at the restaurant or bar

The business rewards you with cashback once Freebird detects the transaction (for any amount)

In addition, there are promotions for more points or cashback. For example, right now Don Julio will give you 500 points ($1) to take a ride home – in addition to the usual points you’d earn for booking the ride through Freebird.

On the app’s back end, you can link your Uber and Lyft accounts, and toggle between them. In this way, you can select whichever is cheaper (or whichever one you like better).

Freebird pulls the price directly from Uber or Lyft, so it matches exactly. There is no markup for using Freebird. It’s simply a promotional tool for local businesses and liquor companies.

Stack 3 Promo Codes, Get up to $60 Back With Freebird

Here’s where it gets good.

You can stack any number of promotional codes to earn cashback, and right now there are three.

They are:

“P4899” – $10 cashback ($5 for each of your first 2 rides)

“GOLONG” – $10 cashback through March 18, 2019

“RIDESHAREGUY” – $10 instant cashback

“FREERIDE” – Up to $25 cashback from your first ride (you can pick when you use it)

“ATOMVIP” – Up to $25 cashback for your second ride (ditto)

The first code gets you a flat $5 back for your first 2 rides. But the second code actually reimburse you for the cost of your 2 rides. Meaning if your ride costs $6.82, you’ll get back $6.82. The third code adds $10 to your account on the spot.

If you stack all 3 promotion codes and max them out, you’ll get back $30 total.

When you’re ready to cash out, link your debit card and Freebird pushes the money to your checking account via a Stripe payout.

Afterward, keep an eye out for other new promotions. And continue to earn points by booking Uber and Lyft rides through Freebird. Like right now, you get an extra 500 points for linking your Lyft account.

And definitely use it if you genuinely want to go to one of the businesses offering cashback through the app – that’s easy free cash for doing something you want to do anyway.

Are there downsides?

Freebird pulls real-time prices from Uber and Lyft, but it does NOT see if you have promotions in your Uber or Lyft accounts.

For example, I got a Lyft promo for 50% off a ride. But when I pulled up the price through Freebird, it wasn’t there. So I had to book it directly through Lyft to get the promotional price applied.

Same for Uber. If you have Uber credits, Amex credits for Uber, or a promo code, you’ll need to book directly through Uber to get the right price.

That said, if you’ve maxed out your credits or aren’t trying to use a promotion, there’s absolutely no downside to booking through Freebird.

I ran a couple of test rides on each app, and the price matched what Freebird found. There’s really nothing to lose. And if they keep it up with the points and cashback promotions, there’s a lot to gain, especially when you start using the app.

As a side note, the charge for the ride will appear on your account directly from Uber or Lyft, so be sure to set your payment settings to whichever card you want to use in the respective app (like if you’re trying to use travel credits or earn points for travel).

Bottom line

Key Link: Download Freebird

Sign-up for Uber

Sign-up for Lyft

I’m liking the Freebird app for my Uber and Lyft rides around town. If you can’t get points through Ebates, Acorns, or Ibotta, you might as well take these.

And right now, you can stack 3 promo codes for up to $30 cashback from taking Uber of Lyft rides booked through Freebird.

To add a promo code, click “Profile” then “Promo Codes” and enter these 3:

“P4899“

“GOLONG“

“RIDESHAREGUY“

Once they’re in your account, you can tap them to activate your rebate. And if you don’t have an Uber or Lyft account, you can use my links for free credits there, too (thank you for using them!).

I think I’ll continue using Freebird long-term, because I like their mission to reduce drunk driving. And of course, the points and cashback are great, too.

But if you just wanna score a few free rides, this is an excellent opportunity.

February 1, 2019

FoundersCard Review 2019: Benefits, Updates, Cost – And Is It Worth It?

I’ve been a FoundersCard member for 5 years. Each year, they add more (and more useful) benefits, keep the best ones, and refine their partnerships based on member demand and use.

The upshot is making the most of even ONE perk can outweigh the $395 membership – and the rest is gravy. And when you sign-up with my link, your rate will never go up.

I’ve used the 15% AT&T discount, Hilton Gold elite status, and Caesars Total Rewards Diamond elite status (which is back this year through January 2020!) to cover and exceed the membership cost.

And there are new benefits for 2019!

Wow, has it really been 5 years? Just renewed my FoundersCard membership again

Here’s everything to know before you apply for membership.

FoundersCard Review 2019: Overview

Link: Apply for FoundersCard

FoundersCard is a membership built for small business owners and entrepreneurs. And the benefits reflect that.

But many of them, particularly travel and lifestyle benefits, would be useful to most peeps. Especially if you’re a frequent traveler.

FoundersCard breaks down their perks into 4 categories:

Travel

Business

Lifestyle

Hotels

You can still get free nights at Atlantis in the Bahamas

Over the years, I’ve saved with from discounts with AT&T, elite status and offers for travel, a cheap trip to the Bahamas, and perks like free magazine subscriptions, free TripIt Pro for a year, access to a free private jet flight, and an event in Dallas with drinks and gifts.

Basically, if you can find 2 or 3 perks that make sense, you can do well with a FoundersCard membership.

With that, here are popular benefits in each category.

1. Travel

Airlines

American – Rotating quarterly benefit. Past quarters included free Platinum elite status challenges, a percentage off fares, and Business Extra points

British Airways – Up to 10% off most fares between the US/Canada and the UK (this is a perk of the Chase British Airways card)

Cathay Pacific – Silver elite status and 5 to 25% off flights

Emirates – 5% off fares from the US

JetBlue – Up to 5% off coach fares

Qantas – 8% to 25% off fares between the US and Australia/NZ, depending on flight direction

Singapore Airlines – Up to 5% off select flights from the US

I’ve made excellent use of the American Airlines benefits. And saved money on paid flights, earned elite status from free challenges, and bonus Business Extra points (which I redeemed for lounge access again this year).

If you pay for flights with partner airlines, these are easy savings

You can also save 5% with Emirates, JetBlue, and Singapore Airlines. And 10% off with British Airways. Not huge discounts, but certainly a nice offer. Especially if you get travel reimbursed or fly those airlines a lot.

Hotels

Caesars – Free Diamond elite status through January 2020 (waived resort fees, VIP lines, $100 Celebration dinner, 20% off select room rates)

Hilton – Free Gold elite status through March 2020 (free breakfast, upgrades when available, late check-out, extra points on paid rates)

Hilton Gold elite status is the best of all chain hotels for free breakfast

I don’t get Hilton elite status through a credit card any more, so this is the only way I get it – which is pretty cool.

I love Hilton Gold status for the free breakfast. And if you stay at Hilton hotels often, you can get:

Bonus points

Free breakfast

Late checkout

Room upgrades

Possible lounge access, if you score a Club floor room

And this year, Caesars Total Rewards Diamond elite status remains, which gets you:

4 free nights at the Atlantis hotel in the Bahamas

$100 celebration dinner

Tier status match with Wyndham

NO resort fees

15% off best available room rates

Occasional free nights at Caesars hotels

If you like Caesars hotels, you can save a lot on resort fees and room rates with Diamond elite status

I actually just redeemed 2 free nights at the Horseshoe Tunica in February 2019 for my little brother.

Got an offer for 2 free nights and booked it!

Granted, these rooms only sell for ~$60 a night, but hey, free is free. They’ll get a kick out of being out of the house for a couple days.

And when you go to Caesars casinos, you can skip most lines – and you never pay resort fees. In places like Las Vegas, that can save you a ton of time and money. Plus, if you like Wyndham hotels, you can match your status to top-tier elite status with them.

If you stay at Wyndham hotels, you can check in as a Diamond member there, too

I’ve always found a fun way to use my Caesars status, whether it’s just popping into one of their hotels for a free dinner, or trying my luck getting into the lounges.

Rolling up to the Palm Room with my Total Rewards Diamond elite status

It’s not guaranteed to work any more, and you may have to pay. But if they’re slow, they might just let you in. Never hurts to try – I’ve gotten in a time or two.

Car rentals

Avis – Free Avis Preferred Plus Membership and up to 25% off rentals

Hertz – Free Gold Plus Rewards or FIVE STAR membership and rental discounts up to 20%

Silvercar – 20% off rentals (this discounts also comes with the Chase Sapphire Reserve card)

Sixt – Platinum status and 15% off rentals

Save on your car rentals and get status that lets you walk right to a car and drive away

Again, these are all perks of certain cards. I usually rent through Priceline/Costco/Chase Ultimate Rewards. But it’s worth checking every time for the best deal (and I always do – I sometimes find cheaper rates with Hertz status than I find anywhere else, FWIW).

Other travel savings

Couple extra lil bennies.

ZipCar – Waived setup fees for small business owners, $20 toward your first time, and 20% off standard rates Monday through Friday

TripIt Pro – Free year, then $39 annual rate for 3 years

TripIt Pro has become a must for me

I had a Zipcar membership when I lived in New York and loved saving on the initiation fees. Plus you get $20 in credit and 20% off during the week.

I’m also gotten hooked on TripIt Pro. It’s becomes part of my travel organization and flow thanks to alerts for gate changes, delays, and connecting flights – often before the airline itself will ping you.

There are a few other extras, like a $50 credit with Getaround (for carsharing), 15% off with Carey (a chauffeur service), and $75 off a Sanctifly membership to work out at/near airports. Here’s hoping they keep adding more travel discounts!

2. Business

Shipping, phones, and data backup:

UPS – Big discounts on shipping (up to 47% off)

AT&T – 15% off most voice and data plans $30+, not including unlimited voice and iPad plans

Backblaze – 20% off 1- or 2-year subscriptions (something like this is a MUST for small businesses, or anyone with a computer – I use CrashPlan)

Dell – Up to 50% off select products

If you don’t already back up your computers, you need a service like Backblaze or CrashPlan (which is what I use)

Promotion and documentation:

MOO – 20% off business printing

Constant Contact – 15% off marketing tools and emails

Shopify – 20% off for a year after a 14-day trial, to have your own e-shop

LegalZoom – 20% off (I’ve used this a few times)

BizFilings – 25% off services

Harvest – 15% off

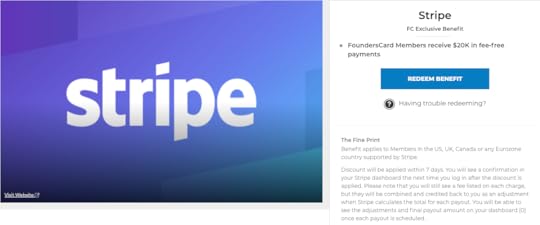

Stripe – $20,000 in fee-free payments (!)

Save on promotional materials, email services, and business filings – indispensable. And the Stripe $20K deal is pretty sweet

I’ve personally used these combined discounts several times. It really does add up. I’ve incorporated LLCs, written a will, and gotten business cards for the blog with the participating companies.

And the $20K in fee-free Stripe payments can pay for a FoundersCard membership all on its own, considering the fee is 2.9% + 30 cents per transaction. On $20,000 in payments, that’s $580 saved – at least.

These are all geared toward building your small business. In that sense, saving cash definitely helps the bottom line.

You’ll find most of the discounts and offers in the business category – and there are lots more. You can poke around with a preview to see them all.

3. Lifestyle

There are lots of discounts in this category:

Trunk Club – $100 credit toward your first shipment

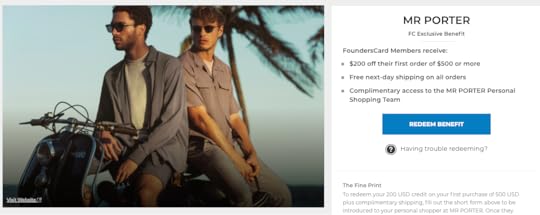

Mr Porter – $200 off your first $500+ order

Entrepreneur magazine – Free 1-year subscription

Inc. magazine – Free 1-year subscription

Dollar Shave Club – $18 in credits toward a razor subscription

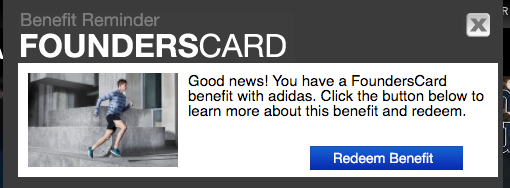

Adidas.com – 30% off most items

Rent the Runway – 20% off

Spafinder Wellness 365 – 15% off gift certificates

ShopRunner – Free membership (although this comes with many credit cards, including all Amex personal cards and some Citi cards)

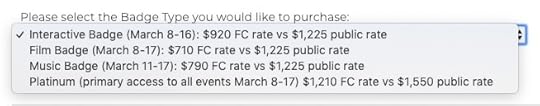

SXSW – Preferred badge pricing

Many gyms, including Crunch, Equinox, and SoulCycle – Preferred rates

Big savings on SXSW passes this year

Most of them are for online shopping at upscale clothing stores. But there’s also gyms, spas, flower shops, coffee, and lots more (60 lifestyle benefits currently).

The lifestyle benefits are full of savings on gym memberships, clothes, and much more

I’ve used them here and there (like Dollar Shave Club and a gym membership). And the free magazines were handy to toss in a bag to read during a flight or layover.

Everything here is a “nice to have” – not crucial, but a fun extra. And again, it adds up if you shop often at a few of the merchants.

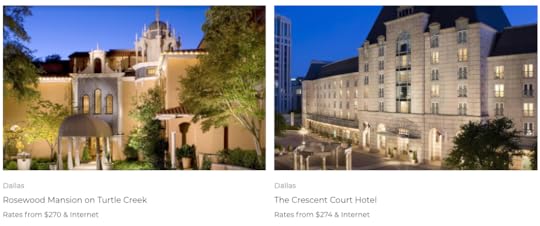

4. Hotels

FoundersCard has relationships with hotel chains and independent/boutique hotels around the world. You can get:

Exclusive members-only rates

Upgrades and extra perks

More flexible cancellation policies

No travel agent/booking fees

For example, at certain Marriott hotels, perks include:

Complimentary welcome drinks

More flexible cancellation privileges

Spa discounts

Free breakfast

Discounts off the standard room rate

You get similar treatment at Park Hyatt hotels – although the specific perks are unique to each hotel.

Even better, you can book directly. So you’ll still earn credit toward elite status and enjoy your elite status benefits. The caveat is that only:

21 Marriott hotels participate (8 W hotels, a few St. Regis, and a couple others)

8 Ritz-Carlton hotels participate (also part of Marriott)

6 Park Hyatts participate

But there are many boutique hotels, including NoMad, Standard High Line, Ace, and YOTEL in NYC. And lots all over the world.

It’s aight

While this is a cool benefit, it’s certainly not all-encompassing. But if you have paid cash stays in a FoundersCard hotel city, you can get a few extras at places that don’t partner with Amex or Chase and their respective upscale hotel programs (Fine Hotels & Resorts and Luxury Hotel Collection).

The selection in Dallas leaves a lot to be desired

I ran a search in Dallas and turned up 2 hotels in the FoundersCard program. New York has 12. Hong Kong has 1.

I don’t consider this a huge money-saver as it’s so limited, but nice to have in your back pocket. And worth checking the prices for paid stays at upscale hotels.

What’s it all worth?

As of writing, FoundersCard is $395 a year with waived initiation fees for Out and Out readers.

If you can make good use of 2 or 3 benefits, it can easily save you that much – and often more.

FoundersCard has a Chrome extension so you won’t miss savings online

For example, my AT&T phone bill is ~$110 per month for 2 lines. I save $15 per month with the FoundersCard discount (applied before taxes). That’s $180 saved per year on something I need anyway – and brings the net cost of membership down to $215.

I have easily saved that much with the:

TripIt Pro discount (free for a year, then $10 cheaper for 3 years)

American Airlines lounge membership from FoundersCard promotions for Business Extra points (I go in all the time for snacks and drinks)

LegalZoom 20% discount ($50+ in savings)

Total Rewards Diamond elite status with $100 Celebration dinner and trip to the Bahamas (huge discounts with this perk alone)

Dollar Shave Club credits ($18 to start)

Also, if you value hotel elite status, you can get Gold elite status with Hilton.

FoundersCard has become an invaluable part of my life, travels, and blogging business

The airfare discounts are also handy to save, if you fly those airlines often.

Using the deals = savings, not using them = not saving

It’s easy to completely cover the cost of the annual membership. But the real value is when you can use the benefits. If you do, you come out way ahead – $1000s ahead, in some cases.

And if you don’t find the discounts useful, then you should skip it.

The goal of FoundersCard is to give small business owners access to discounts typically enjoyed by huge corporations. In that way, it gets you more access, savings, and perks than you’d ordinarily have.

I’ve had my FoundersCard membership for 5 years. And will definitely keep it as long as keep up the value proposition.

Preview the membership here. If you like it, use promotion code “FCHARLAN818” to lock in the special $395 a year rate for life.

Bottom line

Link: Apply for FoundersCard

I hope this is a balanced review of FoundersCard. The upshot is: if you use the benefits, you can do well to recoup the entire annual membership fee – and much more. If there’s nothing that appeals to you, skip it.

I get enough return on my membership with the AT&T discount, which saves me $180 a year (this is irrelevant if you don’t have AT&T, of course). And all the other savings are easy and fun – which is the feeling I get from FoundersCard membership. I love checking the new perks and using the various discounts.

Many of the built-in benefits are ancillary with many credit cards. But here, you can access them without signing up for lots of cards.

As long as the value remains, I’ll keep FoundersCard. The savings are easy, discounts pop up often, and they’re engaged in the end product and user experience. It’s excellent for small business owners looking to access many of the same travel, hotel, lifestyle, and business benefits usually given to large corporations.

Interested? Preview the membership here. And if you want to apply, use promotion code “FCHARLAN818” to lock in the reduced membership rate.

If you have FoundersCard, what do you think of it? Have you gotten outsized value from your membership?

January 27, 2019

8,500 Miles for Spending $1,000 With a Quick Phone Call (Always Do This With Citi Cards!)

I love when an annual fee posts on a Citi card. Because that means it’s time to pick up the phone and ask for Citi retention offers. While Amex is sometimes generous, I’ve found Citi is the best at giving incentives to keep their cards – especially those with annual fees.

I currently have 6 Citi cards (3 AA cards, Prestige, AT&T Access More, and Rewards+). And called because the fee on my Citi Prestige just posted.

While I’m excited about keeping that card this year, I figured I’d ask if they could scoot bonus points my way, especially since I depleted them to go to Puerto Vallarta again.

There was nothing available for that card, but then I asked the helpful agent to check the others.

I call about once every 6 months – every single time, I’ve gotten at least 1, and usually more, worthwhile deals. This time was no exception.

If you have Citi credit cards, it’s always worth calling for a retention offer

Here’s my latest!

Citi retention offers: Spend $1,000, get 8,500 AA miles – done!

So yeah, nothing for keeping the Prestige. But the phone agent threw out an offer that was too good to pass on my Citi AAdvantage Platinum Select card:

Spend $1,000 within 3 months, get 7,500 bonus American miles

That’s in addition to the 1 mile per $1 spent the card already comes with – for a total of 8,500 miles!

So 8.5X AA miles on up to $1,000 – pretty great deal!

The call took ~15 minutes, and was a surprise because the annual fee on that card isn’t coming up for a few months.

At 2 cents each, I value that many miles for $170 worth of AA award flights (8,500 X .02). Citi retention offers are unique to each card account, so your offer might be bigger, smaller, or nonexistent. But It’s always worth it to call and check.

If you have multiple Citi cards like me, I recommend calling once every 6 months or so.

I also got a balance transfer offer on my AT&T Access More card – 0% interest through February 2020 for a 3% fee, which, meh.

Assessing my 4 AA cards

This was also an opportunity to consider part of my card collection, because I actually have 4 AA cards to my name right now (!):

Citi AAdvantage Platinum Select – $99 annual fee

Citi AAdvantage Amex, which I kept for Amex Offers and is no longer available – $85 annual fee

The CitiBusiness AAdvantage Platinum Select I got a few months ago for the 70,000 mile offer (now expired) – $99 annual fee (will cancel next year)

Barclays Aviator Silver – $0 annual fee and will keep forever to help boost credit score

I’m planning to keep one of them for the 10% mileage rebate on up to 100,000 miles redeemed per calendar year (which more than covers the cost of the annual fee).

Worth the cost of admission

I could keep the old Amex card, because the annual fee is a bit lower at $85, and comes with all the same benefits.

But another consideration is MasterCards are more useful with Plastiq payments – especially for mortgages, car payments, and student loans. Because Amex put the kibosh on certain payment types (including mortgage payments – you can only use a MasterCard or Discover card for those).

Check out this ARTIFACT

In no way do I need 4 AA cards. I’ll keep one with an annual fee for the 10% mileage rebate. And have a few months to pick one.

That’ll be an opportunity to address the 28 total cards I currently have. I’d like to get down to 20. That’ll be part of spring cleaning.

January 10, 2019

Awesome Targeted Deal: Up to 50% Off at Amazon With 1 Amex Membership Rewards Point

Talk about an amazing deal – you can get $30 off a $60+ Amazon purchase when you use 1 Amex Membership Rewards point and put the rest on a qualifying Amex card.

This deal is targeted. You can check your account at this link to see if you’re eligible.

It was in my account, so I immediately got a $60 Whole Foods gift card for only $29.99. That’s 50% off!

The deal works on items sold and shipped by Amazon, and excludes digital content. I love easy wins like this.

I can get everything I need for my heavy metal detox smoothie for 50% off with this latest Amazon Amex promotion

Here are more deets!

Amazon Amex $30 Off $60+

Link: Use 1 Amex point, get $30 off – activate here

This deal is good through December 31st, 2019, which makes me think Amex won’t offer it again this year. While that’s a bummer, Chase and Citi have had similar deals recently, so I’m hopeful they’ll pop up. Even Discover sometimes has Amazon promotions.

Be sure to tap “Click to Activate”

Like most Amazon deals, this one’s targeted. If it’s available in your account, you can check and activate it here.

I have a 50/50 chance with these deals for some reason, but when I looked – there it was. I made quick work out of buying a $60 Whole Foods gift card for $29.99 (though many other gift cards are also available).

Boom, half off

Of course, you can also buy any item sold and shipped by Amazon. Just use 1 Amex Membership Rewards point as partial payment, and put the rest on one of your Membership Rewards-earning card.

I used my Blue Business Plus Amex (learn more here) for this deal, and got 2X points for the purchase, as well as the $30 discount.

Within minutes, the gift card arrived in my inbox. Unreal savings – that equates to 50% off. If you have the deal in your account, I’d check and use it ASAP, as sometimes these deals get pulled early.

Bottom line

I love low-hanging fruit like this. Anything that saves money on stuff I’m gonna buy anyway, especially when it’s a 50% discount, is too good to pass up.

And if you shop on Amazon a lot, install the Honey browser extension, which hunts down coupon codes and alerts you to historic prices, as well as cheaper prices from other sellers. It’s helped me often, and doesn’t interfere with shopping portal purchases, in my experience.

Enjoy the savings if you got this deal!

January 9, 2019

The Easiest Path to the US Bank Altitude Reserve (The Best Card for Costco Shopping & Mobile Payments)

Since Costco rolled out Apple Pay to all their stores, I’ve used my US Bank Altitude Reserve card to earn 3X points every time I shop there. That’s because this card earns triple points on mobile payments and travel purchases.

Each point is worth 1.5 cents toward travel (which you can redeem in real-time after they post!), so that’s like getting a 4.5% return on every shopping trip (3 X 1.5). With prices already low, this is an easy way to save even more.

Plus, you can stack coupons through Ibotta for cashback when you buy certain items.

The card has a $400 annual fee, which easily pays for itself. The bigger issue is getting it in the first place – you need to have a “relationship” to even apply.

But there’s an easy and free workaround if you want to open this card.

Getting a 4.5% return on every shopping trip and mobile payment is awesome!

Here’s how to do it!

The easy way to get US Bank Altitude Reserve card approval

Link: U.S. Bank Altitude Reserve Visa Infinite® Card

When you open the US Bank Altitude Reserve card, you’ll earn 50,000 points after you spend $4,500 in the first 90 days of account opening. Each point is worth 1.5 cents toward travel expenses, so you can get $750 worth of travel with this offer (50,000 X 1.5).

You also get:

3X points on travel and mobile payments

$325 in annual travel credits

12 Gogo inflight wifi passes

1.5 cents per point in value toward travel

Real-time points redemptions for travel through text

There’s a $400 annual fee. Between the travel credits, wifi passes (inflight internet is expensive!) and bonus categories, I’ve always come out ahead, even with the fee included.

Especially because I shop a lot at Costco and often use mobile pay. No other card earns this return in these categories, except when the Chase Freedom has certain 5X quarterly bonus categories, then I use that card instead.

You must already be a US Bank customer to get this card

But the Altitude Reserve is “exclusive to US Bank customers” who have had an account for a minimum of 5 business days. They define that as:

Checking or Savings account, Certificate of Deposit, Mortgage, Home Equity Loan, Home Equity Line of Credit, Auto/Boat/RV Loan, Personal and Small Business Loans and Lines, Commercial Loan & Lease, Premier Lines, Private Banking account or U.S. Bank credit card.

The checking account and credit card are the easiest options.

You could always open the U.S. Bank Cash+ Visa (learn more here), which has NO annual fee – or another no fee card – keep it open 5 days, then apply for the Altitude Reserve. But you probably don’t want 2 new cards.

So checking account it is.

US Bank checking accounts are FREE when you have a US Bank credit card

Link: U.S. Bank Gold® Checking Package account

Typically, this checking account has a monthly maintenance fee of $14.95. I think that’s ridiculous, but having an US Bank credit card makes it free.

Open the checking account, let it sit for 5 business days, then apply for the Altitude Reserve

I’ve never used the account, personally. Although it’s actually a good checking account if you need one. I put $1 in the account to keep it active. And get the monthly maintenance fee waived.

You don’t have to use the account. Just put a little money in there to keep it open

So the easiest way to open the US Bank Altitude Reserve card would be to open this checking account, let it chill for 5 business days, then apply.

At that point, you will qualify to open the card and earn the sign-up bonus.

It’s not the most elegant solution, but it’s free and prevents you from opening 2 new credit cards (or taking out a loan).

The checking account waiver should kick in right away. At the very least, you might 1 month of maintenance fees – you could probably call and get it taken off – but I doubt that would happen. Worst case, you pay $15 for a month. Not so bad.

Ramp up your savings

Link: Download Ibotta

Link: Download Dosh

I highly recommend the Ibotta app for grocery shopping. All you do is activate offers on certain products and upload your receipt after you buy them.

And there are many featured items at Costco (and nearly every other grocery store). I’ve saved $100s in the years I’ve been using it.

Ibotta + Costco = more easy savings

And for shopping around town, I recommend the Dosh app. You just link your cards one time, then earn automatic cashback at participating retailers.

With both apps, you’ll get $5 free in your account if you use my links.

They’re an easy and free way to save on things you might plan to purchase anyway.

Bottom line

Link: U.S. Bank Altitude Reserve Visa Infinite® Card

Link: U.S. Bank Gold® Checking Package account

I’m gaga for my US Bank Altitude Reserve card, especially now that I can earn 3X points on Costco and mobile purchases, which equates to a 4.5% return toward travel.

Yes, the card has a steep $400 annual fee, but the perks easily make up for it. The other hurdle is you must have a prior relationship with US Bank (but only for 5 business days) to even apply.

That’s remedied when you open their Gold checking account, then apply for the card a business week later. The checking account will be free with the card, and will qualify you to apply for it. If you’re LOL/24 and looking for a new card offer, the 50,000 points you can earn are worth $750 toward travel.

And for saving on shopping in general, definitely check out Ibotta and Dosh. They’re an easy way to save more at Costco and on other regular purchases.

One final tip: when you check out at Costco (or anywhere), make sure to use a mobile payment – do NOT swipe your Altitude Reserve card or you’ll only earn 1X point. You must use your phone to pay to get the 3X.

Will you apply for the US Bank Altitude Reserve card?

January 8, 2019

How Many $400+ Annual Fee Cards Is Too Much (or Just Enough)?

Right now, I have 3 ultra premium credit cards with annual fees of $400 and up:

Chase Sapphire Reserve – $450

Citi Prestige – $495 (though mine renewed at $450 for one more year)

US Bank Altitude Reserve – $400

That’s $1,345 in annual fees!

The 5 Best Citi ThankYou Transfer Partners Are…

Citi ThankYou points are easier than ever to earn.

I plan to put airfare and dining on my Citi Prestige to earn 5X points per $1 spent, and use my Citi AT&T Access More card (not open to new applicants) to get 3X points for online shopping. Between these 2 cards, I’ll be flush with Citi ThankYou points this year.

And peeps with the Citi Premier can earn 3X points on all travel, including gas, and 2X points on dining.

In that light, I’m giving thought to Citi’s 15 airline transfer partners. But in my eyes, a solid 2/3 of them are total caca.

That means only 5 are worthwhile.

Man, I gotta get back to Hawaii this year. You can use Flying Blue or Singapore miles to get there cheap!

Let’s take a looky loo, shall we?

The 5 Best Citi ThankYou Transfer Partners

Currently, you can transfer Citi ThankYou points to 15 airline loyalty programs:

Avianca

Asia Miles (Cathay Pacific)

EVA Air

Etihad Guest

Flying Blue (Air France / KLM)

Garuda Indonesia

Jet Airways

JetBlue

Malaysia Airlines

Qantas

Qatar Airways

Singapore Airlines

Thai Airways

Turkish Airlines

Virgin Atlantic

Citi ThankYou points transfer at a 1:1 ratio to all of their partners. All transfers must be in 1,000-point increments.

Here are the 5 most valuable – and creative uses.

1. Avianca

To start, there are never fuel surcharges when you redeem Avianca miles, which is awesome. That alone can save you $100s.

Plus, you can book most Star Alliance partners online. Note you’ll pay $25 every time you book an award. That said, there are no close-in booking fees, so depending when you book, it could work in your favor.

Pricing can be wonky. You might pay more – or less – depending what direction you’re flying. Seriously.

Good deals with Avianca miles include:

87,000 miles to Europe in Lufthansa First Class

63,000 miles for Business Class to Europe on LOT, SAS, SWISS, TAP, Turkish Airlines, or United Polaris

25,000 miles within the US (including transcon) in United Business Class

40,000 or 50,000 miles to fly coach to Asia/Australia/New Zealand, or within Asia – sometimes in Business Class!

I loved flying SWISS Business Class from JFK to Zurich

Any time I want to fly on a Star Alliance partner, I check the Avianca site to see how much they’re charging. The deals to Europe alone are just too good.

They also have funky zone pricing within the US. For example, it’s only 7,500 Avianca miles to fly United one-way in coach from Texas to Montana. Or 10,000 Avianca miles from Michigan, New York, or Ohio, to anywhere in Florida. Compare that to the 12,500 miles United would charge you.

You can also transfer 1:1 from Amex Membership Rewards, so it’s easy to pool your points if you need more. Plus, transfers are usually instant.

2. Etihad Guest

While transfers are slow, and usefulness is limited by availability, there are a couple of gems worth mentioning.

For one, you can fly from Brussels to most of Europe (or to there) for 5,000 or 7,000 Etihad miles each way in coach on Brussels Airlines.

If you find yourself in Brussels, this is an easy way to give yourself more options, like taking the train from Paris or Amsterdam, for example (which is exactly what I did). Plus, Belgium is so cute – take a day trip to Bruges!

Etihad’s Brussels Airlines award chart – I flew Prague to Brussels

Another thing that amazes me is Etihad partners with American, and still uses their old award chart before the last big devaluation. It’s all still there:

50,000 miles in Business Class to Japan or South Korea

20,000 miles in coach to South America

17,500 miles off-peak in coach to Hawaii (and only 37,500 miles for Business Class!)

20,000 miles off-peak in coach to Europe

And all the rest!

The issue is, of course, AA’s award space. Well, that and slow transfers to Etihad, which can take about a week.

While I wouldn’t hold Etihad miles speculatively, it might be worth keeping a stash in case you find that perfect award. I was able to book over the phone with no problem.

And Etihad miles expire after 2 years from the date you transfer them. So that’s a while, but you might not feel comfy having Etihad miles sitting around unused for too long.

Of course, you can also use them for flights on Etihad. Oddly enough, it’s better to redeem American miles for Etihad flights, and Etihad miles for American flights.

I mention this one because I’ve had luck with it in the past – maybe you will, too.

Amex Membership Rewards points also transfer to Etihad, in case you need more.

3. Flying Blue

This one’s worth mentioning even though Flying Blue doesn’t have an official award chart because transfers are instant.

So if a flight is super expensive with Delta miles, you can check here instead. And if it works, book it right away.

For example, a one-way coach flight from Atlanta to Paris is at least 37,000 Delta miles:

And they all have connex

Or you could pay 29,000 Flying Blue miles instead:

You’ll pay ~$67 for fuel surcharges, but fewer miles

Plus, they have nonstop options.

Any time I want to see about Delta or a SkyTeam partner flight, I peek on Air France prices. Sometimes they’re reasonable. And the monthly Promo Awards are a steal if they work with your schedule.

I’ve actually been meaning to book a Promo Award to Tel Aviv. The second it works, I’m gonna pull the trigger.

Again, limited uses, but when it works, it’s great.

You can transfer Amex Membership Rewards and Chase Ultimate Rewards points to Flying Blue as well.

4. Qantas

This one’s a hidden gem thanks to distance-based award prices.

Round-trip coach flights under 600 miles on American Airlines (and Qantas) are only 16,000 Qantas miles – even if you have to connect. Yes, you’ll pay 15,000 American miles for round-trip domestic coach flights under 500 miles – but American miles are harder to earn.

Save them and use your Citi ThankYou points instead! This also works for near-international flights, like to Mexico or the Caribbean.

Sweet spot! Although the whole chart is reasonable, IMO

I recently flew from Austin to Oklahoma City with a connection in Dallas for 8,000 Qantas miles one-way. The flights were otherwise $500+. That would’ve been 15,000 British Airways Avios points (because of the connex) or 7,500 American miles.

The only drawback is transfers can take 2 or 3 days. But if you want to fly on American and don’t want to use British Airways Avios points or American miles, this is an excellent option.

The same pricing works on Qantas flights too, in case you wanna “hop” around Australia. (That was a veiled kangaroo joke, forgive me.)

I had a great experience flying Fiji Airways to Nadi, Fiji

It also works for flights on Emirates and Fiji Airways – in case you want to stop in Fiji on your way back home, or fly Emirates for cheap.

5. Singapore Airlines

If you wanna save your United miles, you can use Singapore miles to pay the same prices within the mainland US – and get nice discounts on United flights to Hawaii.

Singapore also partners with Alaska, which unlocks even more ways to get to Hawaii (or around the US), and is zone-based. Remember, Alaska also flies to Mexico and Central America.

Singapore charges per segment for Alaska flights, so nonstops are best. But if a paid flight is expensive, this is an easy way to save.

Of course, you can also use Singapore miles to fly in Singapore Airlines’ magnificent First Class cabin.

Transfers from Citi ThankYou take ~1 day to get to your Singapore account. And if you need more Singapore miles, you can transfer points in from Amex Membership Rewards or Chase Ultimate Rewards.

What about the 10 other transfer partners?

Here’s my brief take on why I avoid them:

Asia Miles (Cathay Pacific) – distance-based, super inflated prices

EVA Air – they charge a ridiculous amount of miles to go literally anywhere

Garuda Indonesia – inflated

Jet Airways – ditto

JetBlue – could be useful for expensive flights, like Mint Business Class, but there’s only one JetBlue flight from Dallas, and it’s to Boston. Plus, points have a set value

Malaysia Airlines – inflated

Qatar Airways – ridiculously high prices, omg

Thai Airways – inflated

Turkish Airlines – have to book award flights in person, no thanks

Virgin Atlantic – fuel surcharges aren’t cute, but some good deals to the UK

Bottom line

The Top 5 Citi ThankYou transfer partners are:

Avianca – cheap prices to Europe in Business Class, and around the US (depending on zone)

Etihad – great deals on Brussels Airlines and American flights, if you can find award space

Flying Blue – save on Delta flights, use Promo Awards for cheap flights to Europe

Qantas – hidden gem for short flights on American, easy to hop around Australia

Singapore – save your United or Alaska miles, or fly in Singapore First Class

The others all have crazy pricing, fuel surcharges, or super niche uses.

And admittedly, the Top 5 have limited uses, too – just not as limited. I’ve personally booked 4/5 of these picks, and have never messed with the ones I excluded. So if I overlooked something great, please share any tidbits of information!

In general, I consider Citi ThankYou points to be 3rd place among the 3 main transferable points programs (1st is Chase Ultimate Rewards, 2nd is Amex Membership Rewards). But there are great deals in there.

I’ll be paying more attention now that Citi Prestige earns 5X on airfare and dining. I slipped it into my wallet this week and am sure I’ll give it a workout – and rack up the Citi ThankYou points like never before.

I also just used the 4th night free perk to save $430 on an upcoming hotel stay, which nearly covers the card’s entire annual fee. But more on that later.

Do you agree with my Top 5 ranking?

January 6, 2019

Booking Puerto Vallarta 2.0: $3,000+ Vacation for 131,000 Citi ThankYou Points, Prestige 4th Night Free, & AA Business Extra

Last February, I spent 3 glorious nights at the Hyatt Ziva Puerto Vallarta. And next month, I’ll spend another 4 nights there! For $0 out of pocket, I used:

131,088 Citi ThankYou points + 4th night free to save $1,721 on the hotel stay

4,000 American Airlines Business Extra points for $1,423 flights

Citi Prestige annual travel credits to cover ~$187 in taxes and fees

The total cost would’ve been $3,331. And I used ALL my Citi ThankYou points.

But after slipping the Citi Prestige card back into my wallet this week, I can build up my balance with new 5X earning on airfare and dining. Plus, they’d been hanging around for a while.

Learn more about the best travel rewards cards here.

This time, I saved over $3,000 to go back to Puerto Vallarta for 4 nights

January 3, 2019

‘Tis the Season to Use 0% APR Cards to Avoid Interest for up to 21 Months (If You HAVE to Carry a Balance)

Happy New Year! I can’t believe it’s 2019! I’m working on travel plans and my credit card strategy – and soon I’ll have gigantic news to share.

If you spent too much over the holiday season, and carrying a balance is inevitable, consider transferring your balance to a new card with a 0% APR period. They vary from 12 months to a staggering 21 months! This will hugely minimize the interest you’ll pay.

Depending which card you get, you won’t have to pay it off until January 2020 at the shorter end – or October 2020 at the longer end. That’s awesome!

Or if you have a big purchase coming up, opening a card with a 0% APR period gives you time to pay it back.

I’ve used both strategies successfully. But beware – pay close attention to the dates (which are listed on every statement you’ll get), or you’ll be right back where you started.

Still, it’s a LOT better than carrying a balance and paying huge interest rates. NEVER carry a balance if you can help it!

Paying interest negates any rewards you earn. Your balance will grow and you’ll get stuck on a debt treadmill – don’t do it!

Here are card options for balance transfers and big-ticket purchases. Because yes, life happens. Just try to control the damage as best you can.

Get unstuck with balance transfer cards

Key Link: Balance transfer card offers

If you know you won’t be able to pay a credit card balance in full, consider transferring the balance to another card. You’ll pay a fee – usually a percentage of the balance – but it’s worth it to pay say, a 3% fee one time instead of 18+% interest over several months, which is what you’ll find on most premium rewards cards.

Again, if you think you’re in danger of carrying a balance.

You can see cards with current balance transfer periods and fees laid out in simple tables at this link.

Earn rewards with these cards after you pay them down! Get award travel, cashback, and much more. But be aware, you will NOT earn rewards on the balance you transfer

Cards with balance transfer opportunities don’t mean giving up bonus categories, welcome offers, and rich rewards. I was surprised some of the best cards on the market had balance transfer options, including:

Card0% APR PeriodBalance Transfer FeeWelcome OfferLink

Capital One Quicksilver Cash Rewards15 months3%$150 cash bonus after you spend $500 on purchases within 3 months from account openingLearn more here

Chase Freedom15 months$5 or 3%, whichever is greater$150 (15,000 Ultimate Rewards points) after you spend $500 on purchases in your first 3 months from account openingLearn more here

Chase Freedom Unlimited15 months$5 or 3%, whichever is greater$150 (15,000 Ultimate Rewards points) after you spend $500 on purchases in your first 3 months from account openingLearn more here

The Blue Business℠ Plus Credit Card from American Express

15 months$5 or 3%, whichever is greater10,000 Amex Membership Rewards points after you spend $3,000 in eligible purchases on the Card within your first 3 months of Card MembershipLearn more here

US Bank Cash+ Visa Signature Card12 months3%$150 after you spend $500 in eligible net purchases in the first 90 days of account openingLearn more here

Chase Ink Business Cash12 months$5 or 5%, whichever is greater$500 cash back (50,000 Ultimate Rewards points) after you spend $3,000 on purchases in the first 3 months from account openingLearn more here

I personally have 3 of these 6 cards. Keep in mind you won’t earn rewards when you transfer a balance. But when you get done paying if off, you’re left with a card that earns points, miles, or cashback – so pick one you want to keep long-term!

Even better, NONE of these cards have an annual fee. So the only fee you’ll pay is to transfer your balance. Beyond that, you can keep them forever as a free way to help age your credit report and boost your credit score.

The 0% APR expiration date is clearly listed on every monthly statement

Just be sure to pay it off before the 0% APR rate expires. You’ll find the date near the bottom of your monthly statement.

If you’re paying high APRs, it could easily be worth it to get 0% APR to give yourself some wiggle room. The one-time fee will be much less than paying interest for months on end.

Citi cards take the cake with up to 21 months of no interest

Citi has 2 cards with excellent 0% rates.

The Citi Double Cash card has 18 months with 0% APR for balance transfers. The fee is 3% of each balance transferred in, with a $5 minimum.

This card earns 1% cashback on purchases when you make them, and another 1% cashback when you pay it off for a total of 2% cashback (hence the card’s name).

21 months with 0% APR is insane!

And the Citi Simplicity card has a 21-month 0% APR period on balance transfers when you complete your transfer in the first 4 months of account opening. The fee is 5% of each balance transferred in, with a $5 minimum.

You’ll also get 12 months with 0% APR on new purchases.

Both cards have NO annual fees. Depending on how long you want to carry a balance and how big it is, either card would go far to get you caught up. I’ve personally had the latter and use it sometimes for Citi Easy Deals.

Or make a big purchase and pay no interest for 12 to 18 months

Key Link: 0% APR card offers

As a homeowner with an aging HVAC system, I rue the day it finally craps out and I have to replace it to the tune of $4,000 to $6,000. You bet when it becomes point critical, I will open a card with a lengthy 0% APR for new purchases to give myself some time to pay it back.

Cards with 0% APR offers can add padding to your cashflow at times you need it most. I used an offer to make a big student loan payment so I could get ahead of the accruing interest on the loan. I ended up saving $1,000s in money that would have gone to interest – without ever touching my principal (which is a thought that kills my psyche, but whatever).

Other big purchases include:

Vehicle down payments

Tuition payments

Home repairs

Auto repairs

Medical bills

Pet surgery

Any other big expense

Again, the big caveat is to pay off your balance before the intro rate expires. The cards in the table above also have the same 0% APR for new purchases.

Bottom line

Key Link: Balance transfer card offers

Key Link: 0% APR card offers

Now’s the time of year where it’s easy to come perilously close to carrying a balance. If you want to collect points & miles, you should never carry a balance because paying interest negates (many times over) any rewards you earn.

But if you have to carry a balance – or just want to with a big-ticket item to ease your cash flow – I recommend opening a new card with a 0% APR offer on either balance transfers or new purchases (or both!).

My gramma had to buy a new stove without much warning right before Christmas

While you won’t earn rewards on balances you transfer, you’ll have an excellent reward card once it’s paid (depending which card you choose). And that’s the kicker – pay it off before the intro rate expires. Many of the best cards with 0% APR also have NO annual fees. So all you’ll pay is the initial balance transfer fee. And then you can keep the card forever to help boost your credit score.

But it can be a slippery slope, so pay close attention and get it paid off ASAP. That said, this route is far easier to get ahead of than getting on a debt treadmill. Used sparingly and smartly, it can give you wiggle room – and time.

Have you used a 0% APR intro rate to avoid interest or make a big purchase?

December 18, 2018

Acorns Found Money: Automatic Cashback With 8 Merchants (BarkBox, Gas, Sam’s Club) & $60+ Free for Completing Offers

File this under semi-interesting. It’s niche, but worthwhile if you spend with any of the participating stores.

Acorns is offering free cashback (Found Money) for spending with a linked card at 8 merchants. Some are set amounts, others are a percentage back in your account.

And, you can earn $60+ for completing offers with their partners – things like free trials and insurance quotes.

I’ve earned $50+ for riding with Uber, filing taxes, and booking a pet sitter. So if these current offers don’t interest you, know they’re always rotating – and something’s bound to catch your interest sooner or later.

Acorns is an investment account that costs $1 per month. But considering how much free cash I’ve earned, it’s already paid for itself for several years.

You get a free $5 bonus when you signup using this link.

Don’t turn down free money! Just link your cards and spend like normal

Here’s how to get free cash coming your way.

Free Found Money with Acorns at 8 merchants (and it’s always changing)

Key Link: Signup for Acorns and get $5 free

Acorns has rotating card-linked offers that earn “Found Money.” After you link your cards, all you have to do is spend at participating merchants and you’ll see free cash automatically appear in your account. Pretty cool, eh?

In the past, I’ve earned $50+ from BarkBox, H&R Block, Sam’s Club, Rover, and Uber.

Here’s my cashback history and a few current merchants

Most Found Money stores require you start your shopping through Acorns – basically, as a shopping portal. But a few only require you to pay with your linked card. And the cash will appear with NO extra effort.

Current card-linked offers are:

Allset – $5 when you dine (I actually hadn’t heard of this before – looks really cool! Get $15 off with code “ BOGX56 “)

BarkBox – 5% back

Chevron – 1% back for $20+ gas purchase

Liingo – $10 back for any purchase (they sell eyeglasses)

Natural Healthy Concepts – 10% back

Sam’s Club – $1 back for $50+ purchase

Sam’s Club Membership – $10 back when you join

Silvercar – $25 back for $300+ car rental

Texaco – $1 back for $20+ purchase

These are good if:

You already subscribe to BarkBox (I do)

Get gas at Chevron or Texaco

Shop at Sam’s Club, or want to join (Stack it with $20 back from Dosh, too!)

Have a Silvercar rental coming up

Want to explore the other merchants for extra cashback

If these don’t appeal to you, keep an eye out – most of them expire in February 2019, and there will no doubt be new opportunities.

Get $60+ more for completing free offers

If you have time to kill, you can complete offers to get more cash added to your Acorns account:

Apple Music – $5 for a 3-month trial

Bestow – $5 for a life insurance quote

ClassPass – $7 for a free trial

Haven Life – $5 for a life insurance quote

John Hancock Vitality – $5 for a life insurance quote

Ladder Life Insurance – $5 for a life insurance quote

Liberty Mutual – $5 for a life insurance quote

Pets Best – $15 for submitting a pet insurance application

Tally – $10 for signing up

24 Hour Fitness – $1 for a free 3-day trial

(I’m not linking these because you have to click through Acorns Found Money to earn the cash.)

I’d be weary of having to keep track of canceling free trials and a zillion calls from sales-starved insurance agents. But if you can set calendar reminders and send calls to voicemail, it could be worth it.

I might actually complete the Pets Best offer for pet insurance. I currently have Healthy Paws, but wouldn’t mind a comparison. Plus, it’s $15 for free.

And others might be cool. The Apple Music free trial, for instance. Or even ClassPass, if you’re into group fitness.

If you completed all these offers, you’d earn an extra $63 for your efforts.

Plus, there are tons of other offers within the Acorns app under the “Found Money” tab. For example, if you’ve never tried Uber Eats, you can get $5 back for your first order.

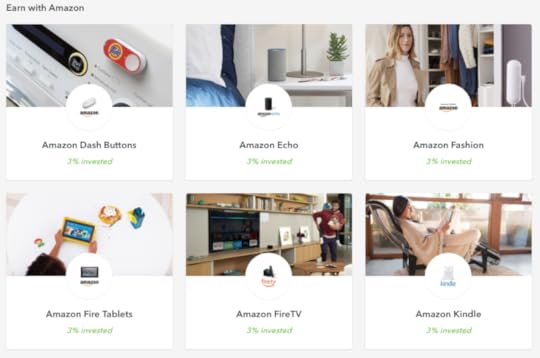

Get cashback from Amazon when you buy a Fire tablet, Kindle, or Echo

I also saw offers for 3% cashback for popular stocking stuffers like Fire tablets, Kindle e-readers, and Echo voice assistants from Amazon.

So it’s well worth browsing around.

Just a word

Remember to always check Cashback Monitor to make sure you’re getting the best deal.

And remember, these are investments.

The upside is they could grow over time even if the initial payout is lower – and the cash you earn is automatically invested. No waiting for a minimum payout or transferring money required.

The convenience and potential earnings could outweigh higher payouts or hassle with other portals. Just had to mention.

Bottom line

Key Link: Signup for Acorns and get $5 free

I am loving the Acorns app! I actually haven’t invested any of my own money – everything I’ve earned is free from Found Money.

It’s worth it if only for the rotating card-linked offers because cashback appears in your account and get invested automatically. And if you’re keen, you can earn another $60+ for completing offers. Might be a PITA, but free money regardless.

Acorns charges a buck per month. But with all the cash I’ve earned so far, it’s more than paid for itself several years over.

On another note, if you don’t have anything set aside for your future, it really is an easy way to begin. Here’s where it ranks among the best retirement accounts.

Enjoy the free cash!