PSA: Don’t Make This Mistake With US Bank Altitude Reserve Travel Credits

Upon logging into my US Bank online account, I noticed something weird.

I have a decent amount of points from using mobile pay at Costco for 3X points (a 4.5% return because each point is worth 1.5 cents toward travel). And I have my Real-time Rewards threshold set to $10.

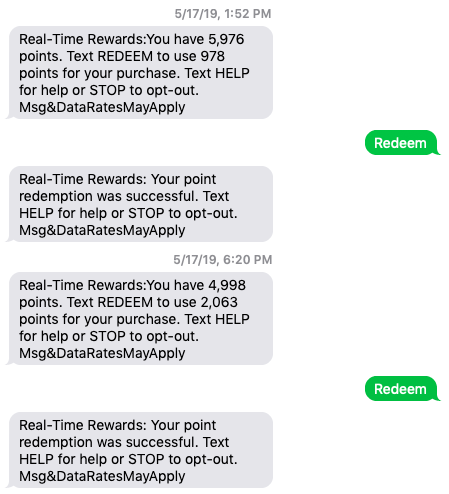

So when I make a travel charge over $10, I get a text asking if I’d like to redeem points to “erase” it.

Just say the magic word and your charge is gone. (The magic word is “Redeem”)

I used this for a few Uber rides recently. Great, great, love it.

But then… I noticed my $325 annual travel credit had recently reset – and doubly covered the charges.

~$82 of charges got double credited – one from Real-time Rewards, the other from my travel credits

Not only did I redeem points for those charges, but somehow it ate up ~$82 worth of my travel credits, too. If I’d known this would happen, I would’ve saved my points.

So when your travel credits reset, DO NOT use Real-time Rewards to erase your charges. You’ll end up paying double!

Oh, and US Bank was beyond lame when I alerted them to what happened. So lame that I’m thinking of dumping this card altogether – after I drain the remaining credits and points, of course.

US Bank Altitude Reserve travel credits don’t play well with Real-time Rewards redemptions

I called to explain what happened. The phone agent didn’t pick up what I was layin’ down. I was like… basically, I used points AND my travel credits on a single purchase. I “paid” twice.

“Can you either put the points back in my account, or reverse the travel credit?”

Either would’ve been fine. Instead, they submitted a request to “research” it. And said they’d send a letter within 5 to 7 business days. Why should I wait a week to correct an obvious error? Whatever. Sure, that’s fine.

A week later, I got the letter. (Yes, a paper letter in the mailbox.)

It said they could not put the points back because I authorized the redemption, and there was no way to reverse the automatic travel credits. I should’ve kept it, but I was so miffed, I threw it in the dumpster next to the mail area.

I don’t understand why I had to wait a week, or why it wasn’t obvious to them I was double-credited.

While it’s only ~$82, it got me thinking about my overall card strategy. And something’s gotta give.

Smell ya later, sucka

Because I recently pondered if I had too many ultra-premium rewards cards with big annual fees. And also:

I just upgraded to the Amex Hilton Aspire with 150,000 Hilton points and I’m so freaking excited because

My Chase 5/24 status gives me a new Chase slot to play with next month

I’m thinking about downgrading my Chase Sapphire Reserve and getting a new Ink Business Preferred

And maybe one more personal card

Sayonara, it was real

I could probably push US Bank a little harder. But you know what? Nah.

I recently paid the annual fee on May 24, so I have time to use the remaining credits and points.

Then I’m gonna close it.

While I firmly believe:

This is the best card for Costco shopping (and mobile payments)

Its perks completely cover the annual fee

Real-time Rewards are revolutionary

I don’t use it much beyond Costco. And if I have a Chase Freedom Unlimited, well, I can just use that to earn 1.5X Chase Ultimate Rewards points when I shop there.

Plus, yeah, I just got that Amex Hilton Aspire (click here, then “View all cards with a referral offer), so that’ll keep me occupied in ultra-premium card land. Thanks to Frequent Miler for spelling out the upgrade deets (no hard pull, same account information, and won’t affect 5/24!).

Also, what a lame response from US Bank. I was an early adopter of this card and never had an issue with it until now. This was the first time I asked for help – and they told me to scram. So I’m walking out on my lil feets… and shifting my overall points strategy to:

Citi ThankYou points and Amex Membership Rewards points for award flights

Hilton points for hotel stays

Chase Ultimate Rewards points for Hyatt stays here and there – I find myself moving away from UR points these daze (!), but that’s another post…

Bottom line

Def not happy that ~$82 bucks worth of my travel credit were wasted for nothing. If you have this card, be careful to avoid using Real-time Rewards until your travel credit is used up – otherwise you’ll use your travel credit AND your points for a single purchase.

I’ll prolly get Uber gift cards via MIleagePlus X to quickly eat up my remaining travel credit and points balance, and call it a day on this card.

I’m about to fall under 5/24 and can get new Chase cards, plus I just got an Amex Hilton Aspire card. If US Bank is gonna make it hard for me to use my rewards, I’ll take my business elsewhere.

Just a heads up so the same thing doesn’t happen to you!

I am also entertaining any thoughts about the “state of the game,” random travel observations, and bank customer service in general (