Life lessons from my risky ticket reselling attempt (so far)

The post below is in reference to this post about ticket reselling.

Since last week, I’ve been spinning out because of this whole Travis Scott ticket reselling fiasco. Like, literally been saying some variation of, “Harlan, what did you DO?”

Well, today I did some 0% APR balance transfers and cashed out some stock (which I have never done before in my life) to take some pressure off the situation.

Somewhere in there, I realized how fortunate I am to have financial tools that can get me out of a mess—including the one I made for myself.

Or maybe I’m just intellectualizing the whole thing to feel better about something that was profoundly dumb and risky.

Pic for attention (on one of my walks)

Either way, I’ve learned a lot about my risk tolerance, evolving money philosophies, and how I’ve shifted to a place of security. Yes, security. Even after all that.

Lessons learned from ticket resellingWhat was I thinking, buying concert tickets (which I know nothing about) to Travis Scott shows (whom I’ve never heard of) to flip for miles and points (which is inherently risky)?

And why I did I smash that “Buy” button so hard?

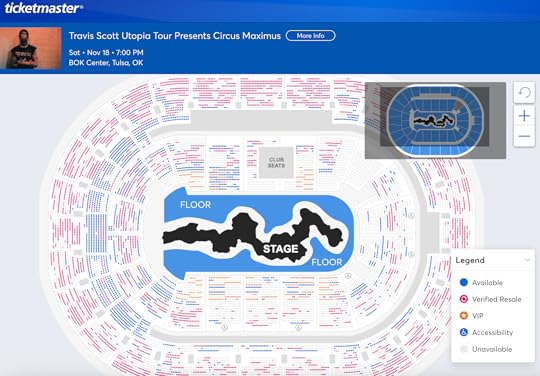

This is a navel gazing portal: the Ticketmaster website

So you know me, over here neurotically refreshing the various shows to which I bought (so many) tickets. They’re starting to sell—slowly—but there are still lots of open seats. Too many for my liking. And none of my tickets have sold despite pricing them as low as possible to recoup my losses.

Any lower, and I will be taking a financial hit. Ugh.

By now, the charges have hit my various cards and seeing the amounts makes my stomach churn.

I took several walks to ponder the situation. I thought it over for a few days. And here’s what I’ve done in response.

0% APR balance transfersPretty much all my credit cards constantly have 0% APR offers for me: a testament to my prior responsible credit usage. (I’m always getting those blank checks in the mail, too.)

I reviewed offers from Bank of America, Barclays, Citi, Discover, and maybe a couple more. Many of them had a 4% or 5% transfer fee and promo periods of three to six months. And many of these cards have low-ish limits.

But then, Bank of America showed me a 0% APR offer for 13 months with a 3% balance transfer fee on a card with a $21,000 limit. I didn’t want to charge up any one card and throw off my utilization ratio too much.

I lined up my cards and sent them all over: boom, boom, boom.

Soooo… I’ve never sold any of my stock. I’ve always saved and never spent any of it. Until today: I finally cashed some out.

I had a balance on a business card (which doesn’t show up on my personal credit report, but does charge monthly interest) that I didn’t want to have.

I sold enough to cover the balance. It’s a mutual fund, so I have to wait until the trading day closes to get funds.

If that ain’t the truth

What a feeling. What’s all this money good for if I can’t use it to get myself out of a jam? Whatever returns I’d earn would be much lower than the APRs on credit cards.

It hurt, it burned to sell my precious stock. But I’m committed to never paying a dime of interest on my credit cards. More on this in a bit.

Consolidated savings accountsI’ve had a Citi Accelerate account for years. I don’t even remember why any more. And I’ve always kept at least $500 in there to keep it free.

That ended today. I transferred everything out and will close it on Monday.

I took this opportunity to use one main savings account: my Amex Personal Savings, which has the same APY as the Citi Accelerate account and no minimums. Consolidating feels good!

Plus, Citi’s wonky IT has always low-key bothered me.

Like using points, it’s OK to spend moneySpending money on dumb stuff hurts like actual physical pain.

It’s similar to when I spend points to book travel. There’s always that “oh GOD, there go my hard-earned points” moment that’s also pretty tough.

But then I remember I can always earn more points. And take more trips. And I have to spend the points to take the trips. Duh.

Like that, I can earn more money. I can replace the savings and stock. That’s wasn’t the end of my supply. It just felt like it was.

The scarcity mindset ran deep.

Some of my trips kinda sucked, tbhYeah but what about the fact that I spent money on something so totally dumb?

Well, some trips I’ve spent oodles of points to take haven’t been great, either. I love travel and of course I want every trip to be amazing and meet my expectations.

Once I went to Iceland and it rained the ENTIRE time

Have you ever gotten to the hotel or place or whatever and been like… “Oh. This is it?” THAT moment.

I want to spend money on things that are wonderful and bring me some measure of happiness, but the fact is not every cent is going to do that.

There will be more trips. And there will be other things to buy (or save for) that are much better than this.

What am I saving all this money for?I’ve tried for so long to be “Mr. Financial Independence” that I’d rather save everything than buy the extras, the upgrades, the stuff I want now.

I mean, I buy quality items and occasionally splurge because “YOLO treat yoself” but really place much emphasis on saving.

But this week, I actually had panicked moments that I figured I could use savings to solve. So I did.

Literally with NEVER adding another cent

I already know I could never save another cent and still be fine in 30 years. I’m just always so stuck on my $500K goal and saving that it’s the last option I consider. Really limited thinking.

I’ll use whatever tickets I do sell to further fix thisAll of this assumes the tickets are a total loss, but of course they won’t be. They’ll sell for something. Maybe (much) less than I’d like, but it won’t be a total wipeout. And anything could happen.

Travis could release a new single or the tour could start and more people will want to go or all the shows could get canceled and refunded. Literally anything could happen.

So whatever I get back, I’ll use to repay the balances, buy more stock, etc.

What I’ve done so far helps me today, short-term. What I get back over the next months will help my future self.

Ticket reselling bottom lineI used my available resources to pay a kindness—to myself. And saw how many tools are really in my kit. And how many options I have.

What’s the point in having all these backup plans if I never use them?

Nothing about this is ideal. But I won’t pay any fees or interest (other than the 3% balance transfer fee and many a long-term capital gains tax). With interest rates on many premium credit cards touching 30%, I’m positive this is the less-painful way to go.

This ordeal has shown me that I:

Have many options availableCan deal with crappy financial situations with relative easeHave a low-as-hell risk toleranceReally, truly do hate paying interest that muchCan think long-term even under pressureIt pains me that this will affect my net worth, at least short term, especially as I approach the one-year countdown to my $500K savings goal.

Also:

I was able to respond from a place of deeply earned securityI’ll probably recover financiallyAcknowledging my privilege in all this and grateful for thatAnd wow, I will never resell concert tickets again because this past week of constant anxiety has been terrible!