Harlan Vaughn's Blog, page 57

December 6, 2015

A Step Beyond Foreign Transaction Fees: Bank Exchange Rates Affect How Much You Pay Abroad

Also see:

New App Alert: Mercez Helps You Pick the Right Card to Use Abroad

Booking Martinique: My Experience With Citi Prestige Concierge and 4th Night Free Benefit

The other day, when I wrote about my experience booking a hotel room in Martinique, I pulled up the Mercez app to see what exchange rate I’d get on $1,118 Euros with the Citi Prestige card.

Lots of cards advertise “no foreign transaction fees” which means they don’t add extra fees to the amount they convert.

Mercez tells you the real rate for each of your cards

But what’s interesting is not all banks convert cash at the same rate.

The amounts can add up, especially if you spend a lot (or live) abroad.

Rates according to Mercez

For simplicity, let’s look at the exchange rate of 1000 Euros into dollars.

1000 Euros = ~$1,088 dollars

According to Google, you’d spent ~$1,088 if you on a purchase of 1000 Euros.

A 3% foreign transaction fee (FTF) on that amount is an extra ~$33, so it’s easy to see why people want to avoid paying them.

Even if there are no FTFs, the bank that issues your card won’t necessarily give you the going exchange rate.

AMEX, Chase, Citi, and Discover all convert the same amount differently

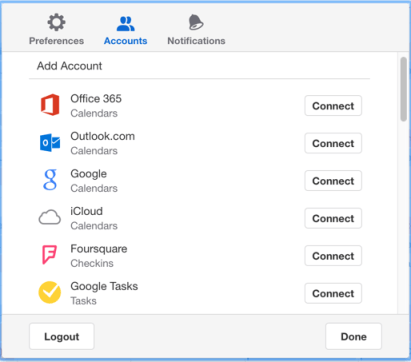

Mercez is a slim iPhone app that lets you plug in your cards, and tells you the final cost in USD of various foreign currencies.

Because I’m heading to Europe soon, and paying for a hotel room in Martinique (it’s on the Euro because it’s a French island), I wanted to see which could would give me the best rate.

I plugged in:

AMEX EveryDay Preferred (which includes the card’s ~3% FTF)

Chase Sapphire Preferred

Citi Prestige

Discover it

All of the cards have different bank exchange rates.

The best exchange rate comes from Citi Prestige, which is lucky because I’ll save money and get the 4th night free in Martinique.

The runner-up was Discover it, which met the current exchange rate almost to the cent.

But surprisingly, the Chase Sapphire Preferred actually had the worst bank exchange rate – a full $41 more than Citi Prestige.

Mercez includes FTF fees in its calculations. You can see the difference between the AMEX Hilton and AMEX Platinum is ~3%

That’s because each card handles the exchange based on different issuers.

For example, the Chase Sapphire Preferred transfers are processed by Visa, Citi Prestige is processed by MasterCard, while Discover and AMEX handle the exchange for their own cards.

Even still, using a credit card for foreign purchases is still better than exchanging cash.

In this case, you’d spend a full $140 more than the best credit card exchange rate (Citi Prestige) if you had to exchange your US dollars into Euros.

Bottom line

While I like the idea of “no foreign transaction fees,” that’s only the beginning. Each bank has its own exchange rate. And who processes the transaction also influences the final amount you’ll pay (Visa, MasterCard, AMEX, or Discover).

The Mercez app for iOS is all of ~9MB, so it hardly takes up any space on your phone. It supports nearly every card you can think of, and tells you this information for whatever amount you want to spend.

It’s worth a download if you spend a lot overseas, or if you plan an extended trip. Lots of transactions can really add up over time.

Anyway, thought this would be interesting to share. For real road warriors, I’d call this app a must-have.

Of course, it doesn’t take into account bonus points on certain categories. So even if you want a certain type of points, you still might be curious about how the bank exchange rate compares overall.

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!

5 Hyatt Category 4 Hotels Where the Hyatt Card Annual Free Night Rocks

Also see:

Las Vegas is great for Hyatt Gold Passport Members

Confession: I didn’t love the Park Hyatt Paris-Vendome (A Review)

I’ve had some pretty good experiences with Hyatt points, even though the way they handled their recent Hyatt Diamond promo was a disaster. #jaded

Anyway, one can have a finite number of Chase cards, but I choose to renew the Chase Hyatt card year after year.

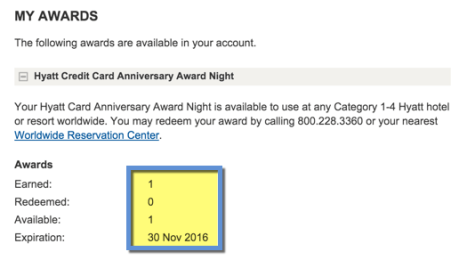

That’s because you get a free night certificate when you renew the card each year, and it’s good at Category 1 through 4 hotels. So obviously, I try to use them at Category 4 properties to get outsized value.

Last year, I gave my free night away to Jay’s grandparents for a night at the Hyatt Regency St. Louis at The Arch (which is a Category 2), because the certificate was about to expire and it was their anniversary. Jay and I both have the Chase Hyatt card, so we gave them 2 nights at the hotel. They loved it!

New year, new options!

I just renewed the card again and paid the $75 annual fee, so I thought I’d take a spin through the Category 4 hotel list to see where I might use the annual free night in 2016.

I found at least 6 hotels where you’ll recoup the annual fee 4x over… or more. It got me thinking.

Never change

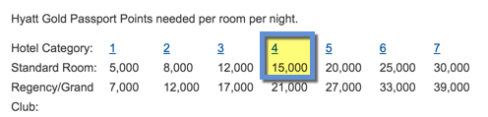

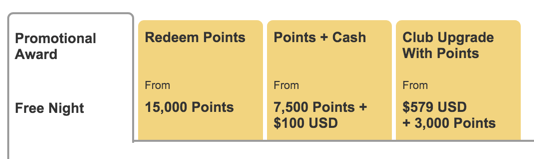

Oh, and because these are all Category 4 hotels, you can also redeem 15,000 Hyatt points for a free night. In many cases, you’ll get over 4 cents per point in value!

5 Hyatt hotels worth 4x or more than the annual fee on the Chase Hyatt card

The annual fee on the Chase Hyatt card is $75. So I aimed to get quadruple the value on that. All these hotels are $300+, with a couple being much more.

This card is worth keeping if only for the annual free night. Use it judiciously – it’s a great way to enhance a trip. Here are a few ideas on how to use it.

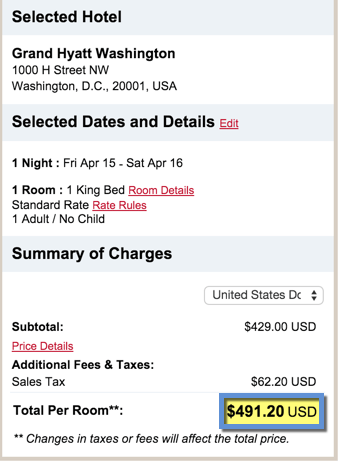

1. Grand Hyatt Washington

Maybe it’s time I transfer some Chase Ultimate Rewards points over to Amtrak (tomorrow’s the last day – December 7th!) and hop on a day train down to DC.

Nearly $500

Nights at the Grand Hyatt Washington are ~$491 after taxes. It would be fun to go down in April to see the cherry blossoms and visit some of the incredible museums there.

Perfect springtime trip

If you paid in points, you’d get over 3 cents per point in value. Or, over 6x the cost of the Chase Hyatt card’s annual fee.

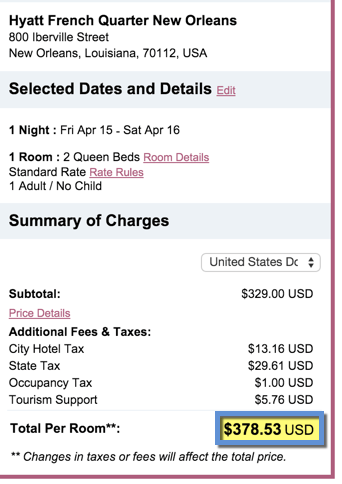

2. Hyatt French Quarter New Orleans

The Hyatt French Quarter New Orleans is seasonal. Really seasonal. Rates here can be either next to nothing, or through the roof.

You’ll obviously want to pull the trigger on the free night during the expensive periods, like when events are in town (Mardi Gras, Jazz Fest, Southern Decadence).

~$379 for a night in April

I randomly pulled out a date in April 2016, and saw rates for ~$379 a night. Considering the Chase Hyatt card is $75 a year, that’s a great trade-off.

Plus, there are often fare deals to NOLA. If you want to go, it might be worth keeping your free night in case of a deal.

Enjoying a Hurricane in NOLA

Here’s my review from when I stayed there last year.

FWIW, the Hyatt Regency New Orleans is also a Category 4, but it’s a little further from the Bourbon Street action. The Hyatt French Quarter New Orleans is a block and a half from Bourbon Street, and close to Magazine Street shopping, and the cute trolleys.

Depending on why you’re visiting, either are great option. Oh, here’s my review of the Hyatt Regency New Orleans, too. I loved the in-house bar there – great local craft beers!

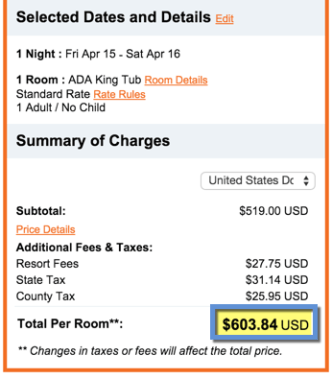

3. Hyatt Regency Coconut Point Resort and Spa

I’m not a fan of Florida, really, but holy crap. Nights at the Hyatt Regency Coconut Point Resort and Spa are ~$604 after taxes!

Save a heap on a Florida vacation

That’s crazy.

Points + Cash is a great deal here, too!

The hotel is spread over 26 acres, and the grounds look gorgeous.

You’ll have a nice strip of beach and a few pools to choose from. Even I like a good pool.

It’s near Naples, so you can fly into Fort Myers and drive down.

Could be fun if you want to stop over on a road trip to see the Everglades, Fort Lauderdale/Miami, and the Keys. In any case, points, Points + cash, or the annual free night, you stand to have an excellent deal on your hands.

Hmmm… I’m kinda talkin’ myself into it!

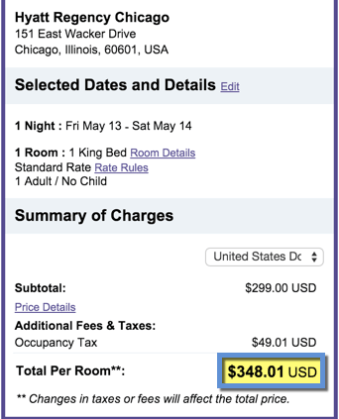

4. Hyatt Regency Chicago

My heart is in Chicago. Man, I love that freaking city. I actually looked into buying a house there, but with all the taxes (income, property, and sales), I simply couldn’t justify it (I chose Dallas instead). But I am way overdue for a visit to the Windy City.

Save ~$350 in Chicago

Rates at the Hyatt Regency Chicago are about $350 a night, and you’ll be walking distance to the Mag Mile, Red Line trains, buses, “The Bean,” and The Loop.

Writing about Chicago makes me superbly sentimental. But suffice it to say I won’t be there for the next few months. They can have the winter!

The dates I pulled are in May 2016. Chicago summers are resplendent. Go go go if you’ve never been.

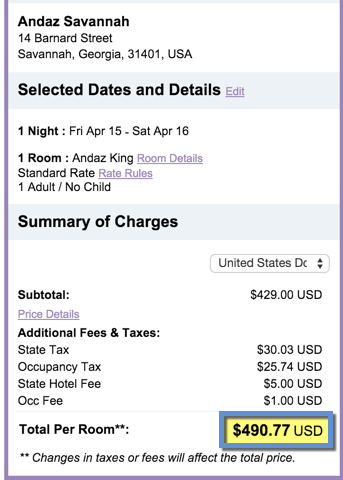

5. Andaz Savannah

Ah, Savannah. You bewitching and mystical little city nestled on the Georgia coast. I’ve never know really what to think of Savannah, other than something great is definitely going on there.

Save ~$500 to experience Southern charm

Nights at the Andaz Savannah are almost $500. Because it’s an Andaz, and because it’s Savannah, I’d expect this property to be dripping with Southern hospitality with a funky twist.

I sometimes see cheap flights to Savannah on jetBlue on The Flight Deal (worth following them!), and one of these days I swear I’ll bit the bullet and visit again.

I love the smooth sway of this tucked-away Southern city

When I was there last, I loved the shops, food, and the layout of the city. It definitely has a certain feeling to it.

Combine this with a trip to Charleston further up the coast for a gastronomic tour of the “New South.”

Don’t expect beaches on the Georgia coast though – it’s surprisingly swampy. You’ll find more snakes and alligators than beaches, although you can find them if you look hard enough.

The willow trees are a testament to the moist climate. Try to visit in Spring or Fall if you can – summers there are hot hot hot.

Honorable mentions

Park Hyatt Toronto

Hyatt Regency Boston

Grand Hyatt Melbourne (Here’s my review.)

Grand Hyatt Berlin

Can be good values, depending on time of year and your travel plans.

Bottom line

Wow, all of these hotels are in the US – didn’t plan on that!

I wasn’t sure where to add this in, but you still get 2 free nights at ANY Hyatt hotel when you open the Chase Hyatt card.

Other bloggers just love to dote on the Park Hyatt Paris-Vendome, but I had a less-than-stellar experience there and wish I’d saved my 2 nights for somewhere else!

My favorite perk of the Chase Hyatt card is definitely the annual free night cert you can use at a Category 1 through Category 4 property.

I just renewed the card and am excited about the possibilities. Each hotel on this list is worth quadruple the card’s annual fee, or more.

If you’re interested in this card, it’s available through my links – thanks for using them!

Now I’m thinking about a day trip to DC in April…

Do you have a favorite Hyatt hotel to redeem your annual free night?

Or does a hotel on the list stand out as being the #1 pick?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!

December 5, 2015

Hotel Review: Hyatt House Dallas/Uptown

Also see:

Hotel Review: Hyatt Place Austin/Arboretum

Complete the Hyatt Diamond Challenge in 9 Nights With the Citi Prestige Card

After staying at the Hyatt Place in “Austin”, I headed to Dallas to do some house-hunting.

Picking up the rental car was a nightmare, but once on the road, I was at the Hyatt House Dallas/Uptown in about 25 minutes.

The parking garage is beyond a gate where you have to swipe your room key, and there are maybe 4 parking spots outside the hotel, as it’s located off a major thoroughfare (Harry Hines Boulevard), which, if there are more than a few people checking in, creates a huge, annoying queue.

Thankfully, I got a spot, grabbed my wallet, and headed to checkin/get a room key within a couple of minutes.

Checkin and arrival

After flying and driving, it hit me that I was super thirsty once I saw the water for sale near the checkin desk.

The desk agent greeted me warmly, and quickly found my reservation.

He acknowledge my Hyatt Platinum elite status, which is completely useless except for random scenarios like this checkin.

I didn’t know parking was an extra $14 a day, and had a 3-night stay… an extra $42.

For some reason, I thought it would be included as the hotel isn’t in downtown Dallas or in a particularly clogged area. Whatever, I asked if he could add it to my Chase Hyatt card along with… abottleofwaterI’msothirsty.

He validated my parking, gave me a room key, and said there would be no charge for the parking, and to enjoy the water. In fact, he gave me another bottle to take to the room!

I was bowled over by the gesture after getting through a flight and driving and parking and finding the place. It was very kind, and I was grateful. It really is the little things.

So, checkin could not have not any smoother. And the gracious service from checkin continued through the entire stay.

Hallways of the Hyatt House Dallas/Uptown

Everyone, from the cleaning staff to the bartenders to the other desk agents were attentive and professional the entire time.

The room

The hotel itself was cute. The carpet had rugs/streamers printed on it, and furniture stenciled onto the wall. I can’t stand popcorn ceilings, but other than that, clean and easy to navigate.

My room, #328

I had room #328, which I found after parking in the garage. There is direct hotel access from every floor of the garage, which was great. Easy access for getting in and out.

View upon walking in

Kitchen

Fridge

Coffee area

Living room

View from living room

First impressions: a nice, apartment-style setup.

The kitchen had most everything you’d need to cook and eat a full meal, including a dishwasher, toaster, coffee pot, utensils… I was impressed. You could definitely stay here for a few days without having to go out (if you really wanted to).

It was little strange how the desk was right next to the door, and the kitchen. I probably would’ve put it nearer to the window, in the living area, but it wasn’t a huge qualm.

The bed

Looking into the bathroom

Bathroom

Toiletries

Bathtub

Closet, hangers, shelves

View of the bed, from the bathroom

The bed was king-sized, soft, and really comfortable. The room overlooked the pool (which I didn’t get to use nearly enough!), so was really quiet. Not much natural light, but I wasn’t in there much during the day anyway.

The bathroom had the usual KenetMD products.

The decor, including the table, tiles, counters, couch, and fixtures didn’t exactly scream modern or updated. But they were all functional.

This hotel seemed to be made for holing up for a few days in Dallas and gettin’ things done.

To that end, there were lots of comfortable seats in the room, and the hotel wifi was blazing fast.

The hotel staff did a great job keeping the property clean, and the room was no exception.

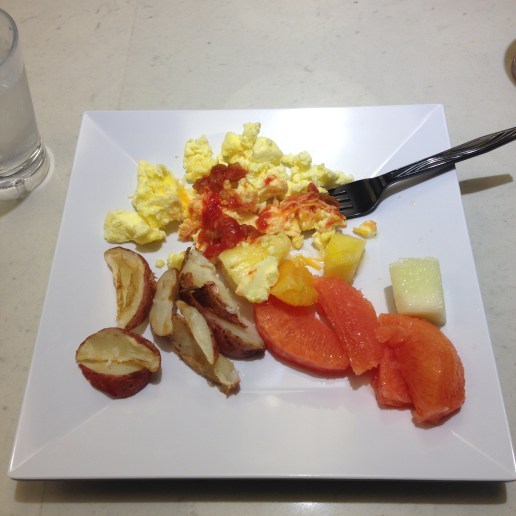

Breakfast

One of the selling points for Hyatt House hotels is that breakfast is included in the room rate.

There’s a small buffet and a few hot items, and plenty of seating near the lobby.

The hotel bar doubled as a made-to-order cooking space in the morning where you could request omelettes.

Hyatt House cereal, pasties, waffle machine, and milk

Quick shot of fruit, yogurt, utensils (sorry it’s blurry!)

Hot items including sausage, eggs, potatoes, and bacon

Plenty of open seating

My breakfast selections

It was a little strange that the breakfast room was situated directly in front of the checkin desk with little separation. Seems like they could’ve made this a whole other little room way back in the planning stages.

The business center and entrance to the pool are also off this room, so it was very much a hub of activity.

Anyway, considering the breakfast was free, they did a great job of replenishing the items, and it never got too crowded unlike some hotels where breakfast is a stampede.

The coffee was piping hot and there was plenty of it. And the hot items were a nice way to get something in the ol’ tummy before starting the day. It was middle-of-the-road stuff, and was just fine. There was actually something kind of zen about unwinding with all the people swooshing by.

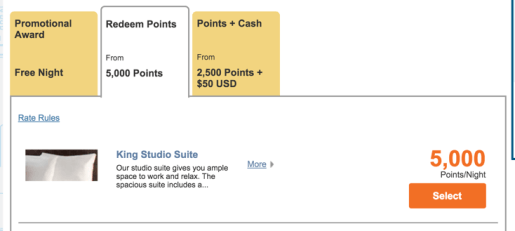

How I did it

I stayed here for 3 nights. Because this is a Category 1 hotel, it costs only 5,000 Hyatt points per night.

Nice!

Rates here start at $89 + taxes and fees.

When I stayed, the base room rate was $200 – and more with taxes added.

I had some Hyatt points already, and topped off my account with a quick transfer from Chase Ultimate Rewards. 3 nights cost 15,000 Chase Ultimate Rewards points – far better than $600+!

In total, I got a value of 4 cents per point here.

Had the room rate been ~$100, I would’ve paid in cash or Points + Cash.

I went during Mega Fest (?) so rates were higher than normal.

Dallas!

The hotel is located very close to downtown Dallas, and was only 5 minutes from where I went house-hunting.

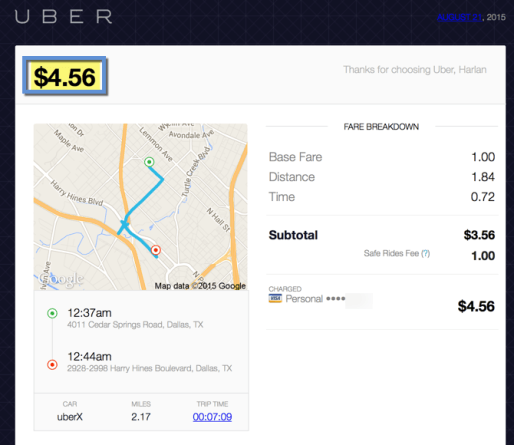

Plus, it was easy Uber-ing distance from all the gay bars!

The Tin Room gets my vote for most unique Dallas gay bar

Dallas is a cheap, cheap Uber city.

Have you ever seen an Uber receipt for less than $5?

I was shocked when the rides to the bars were less than $5. So I took Uber around a lot even though I had a rental car. It made for a much better bar experience, knowing I could get home safely without paying a lot!

During the days, I wrote, looked at houses, and got things in order. So, mostly business with a little excursion each night.

Bottom line

The Hyatt House Dallas/Uptown was well-located for what I needed to do in Dallas. It’s near the fun and trendy parts of town like McKinney and Cedar Springs, and under 10 minutes to downtown.

It’s my own fault for not checking the parking price, but it’s $14 a day extra to park in the garage… most hotels in Dallas in that part of town won’t charge you anything, so it’s something to note.

The hotel itself isn’t exactly a bastion of modernity or anything, but it’s functional, and very clean. And the wifi is fast.

Breakfast is included – you’ll get the basics and a nice start to the day. And the coffee was actually very good.

But by far it was the staff that made this hotel memorable. A great checkin experience, and attentive service the entire time. That, more than anything, would be my reason for staying here again.

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!

December 3, 2015

PayPal My Cash Cards With Credit Cards at CVS Still Working, but YMMV

Also see:

Confirmed: CVS accepts credit cards for PayPal My Cash reloads in NYC

How to pay bills with PayPal My Cash + Business Debit Card + RadPad + Evolve Money

Get an Easy 1% Cash Back on Your Rent and Other Debit Card Purchases

Out and Out reader Jack commented:

Had trouble today for the first time loading my PayPal my cash card with a credit card at CVS.

Once the lady scanned the PayPal My Cash card the computer prompted her as CASH ONLY. She refused my credit card.

Did they finally hardcode?

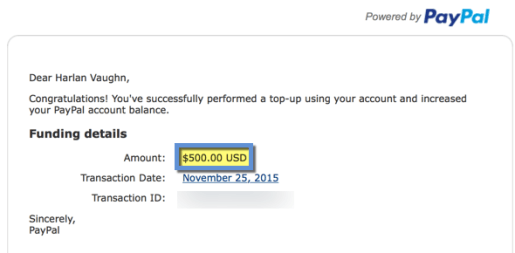

I wanted to follow up because I had a similar experience here in New York City.

I went to a CVS on Houston Street, handed over 2 PayPal My Cash cards, and requested $500 on each, for a total of $1,007.90 after activation fees.

The cards scanned without a problem, and the total popped up.

I swiped my new Citi Prestige card, hoping to help meet the $3,000 minimum spending requirement this way, and then pay with rent with RadPad and the PayPal Business Debit MasterCard.

Like Jack, I got a similar prompt on the register. I asked if she wouldn’t mind just trying to swipe the card. It wasn’t declined. It simply didn’t process.

She said it looked like cash only – no credit cards allowed.

So I set out to try a store in southern Illinois over the Thanksgiving break.

Success! But it’s very YMMV

Same as always, I went to the register, stated my business, and it came time to pay. Always kinda nerve-wracking when they start looking at your credit card.

But the cashier was friendly, and mentioned that people load up their PayPal My Cash cards all the time at that location.

I pressed “Credit” on the payment machine, swiped my Citi Prestige (again, that moment where the bank may decline the transaction), and the receipt spit out.

Easy.

Worked perfectly! Two fully-loaded PayPal My Cash cards

So easy, in fact, that I went in after Thanksgiving to do it again.

Boom – paid with my Citi Prestige and met the minimum spending

I had no problem loading the cards online at paypal.com/cash.

The funds posted instantly

I loaded up $500 each day for a few days in a row until the cards were empty.

What’s it mean?

It’s obviously not hard-coded into the CVS system. Not if some stores are still loading them up.

But it does mean you’ll need to find a CVS where it’s possible to load up. There doesn’t seem to be a pattern to which stores allow credit cards and which do not.

It still definitely works. But it does seem to’ve gotten more difficult.

Is it worth it?

This is great for meeting minimum spending requirements and generating some extra points and miles.

Plus, when you use the PayPal Business Debit MasterCard, you earn an easy 1% back on purchases, which covers the activation fees on the cards. So the points and miles are literally free.

In that regard, yes, it’s totally worth it.

But you should NOT for any reason withdraw the money to your bank account. If you do, you can very likely have your account frozen by PayPal, and it will be a long process to get the money back. And you could lose your PayPal account.

So only do this if you intend to use the PayPal balance for purchases, or the PayPal Business Debit MasterCard. Paying your rent with RadPad is still a solid method for spending the funds.

What else is left?

A friend of mine reports success in loading a Serve account with a Vanilla Visa gift card at a Dollar General store (this is also possible at some Family Dollar stores, too).

Better yet, you can buy Vanilla Visa gift cards with a credit card at Dollar General or Family Dollar – and then load them to your Serve account there, too. A one-stop shop for MS!

Take caution though, and do NOT withdraw the money from Serve to another bank account because AMEX will shut your account down, especially for higher amounts.

Serve has a robust bill pay function (you can pay anyone or anything) so you shouldn’t have any issues with spending the balance.

Bottom line

PayPal My Cash cards live on at CVS, but myself and a few others have hit snags at certain locations. But not at others. I had success this past week with loading up 2 cards for $500 each in 1 transaction.

No doubt it’s getting tougher, though. Best thing is to find what works for you, and rinse + repeat for as long as the gettin’ is good.

A few peeps report success buying and loading Vanilla Visa gift cards at Dollar General and Family Dollar stores, so that might be another avenue worth exploring, especially if you have access to several locations.

I’ve heard Rite Aid is 50/50 for loading Serve with gift cards, too.

So that’s the current state of PayPal My Cash cards.

Please report your experiences in the comments!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!

Clear the Clutter: 5 Apps to Organize Your Digital Life to Create Clarity

I had to take a stand. My digital life was becoming unwieldy.

I’d groan when another email came in. It took multiple clicks to find events on different calendars. Multiple email accounts.

Information spread out in too many places. Not enough good stuff, and too much trouble to find anything enjoyable.

I was beginning to stagnate in the sheer stuffness of it all. Actually, I was stagnating. I got there.

Ahhh, yes… Clean simplicity leads to increased productivity, fewer errors, and a clearer mind

I pared my digital life down to a few basic apps. It’s been a few days now and I’m already used to my new workflows.

Better yet, the space in my mind allows me to think more clearly, make fewer mistakes, and get my work done faster.

I’m not a productivity blogger, but I do like to be productive. Maybe this’ll help you, or at least turn you on to a few new ways of doing things.

The clutter has GOT to go

Lots of studies have been done about how clutter affects your mental health, and even the very operation of your brain.

The idea is you get so caught up in all the things you’ve surrounded yourself with, that you’re unable to focus on anything else.

I’m in the home stretch of closing on my new place in Dallas in under 2 weeks.

I had papers for days, files clogging up my desktop, dates on like 6 different calendars to keep track of, and not to mention the hubbub of oh, work and life in the background. You know, the usual.

I wish I had an image of what my desktop looked like before. It was a disaster.

And my browser! I had 20 different tabs open (like I’m sure most people have) for different email accounts, web-based calendars, article ideas, things to read later, etc.

My physical clutter still has a ways to go!

Baby steps. My desk is still a mess. I’ve got estimates, appraisals, inspection results, insurance docs, random mail, and other bits and baubles strewn about.

I’ll get to that next. But here are the 5 apps I used to get my digital life under control.

5 Apps to GTD (Get Things Done!)

1. Airmail

Link: Airmail

Email email email. This is the only app I paid for. It’s $10, and the others on the list are free.

But it’s worth it because I have different email accounts for:

Personal stuff

Online shopping

My Airbnbs

Work

At one point this week, I was switching between house closing docs coming to 1 email, work emails to another, and replying to an Airbnb guest on yet another tab.

With Airmail, no more. It’s all consolidated in an easy-to-read format.

All my accounts in 1 place, color-coded and with icons selected by me

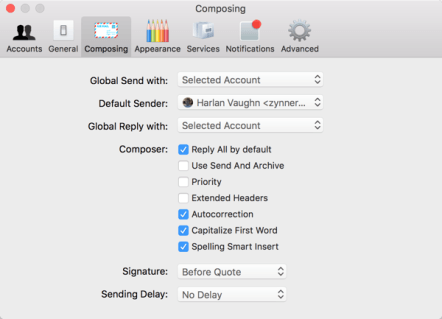

It plays very nicely with Gmail, keeping labels and the ability to “star” posts intact. It’s also task oriented in that you can tag your emails with “To do” or “Read later” or other tags. I don’t think I’ll use it to manage tasks as labels are plenty for me, but it’s nice to know you can customize nearly every option.

You can customize nearly everything about the way you experience your inbox

What I like most is I can view each email account separately, or in 1 big ol’ pile. My preferred method? The big ol’ pile!

It’s easy to search, and plugs in directly to Evernote, Dropbox, Google Drive, and lots of other apps – including apps that Gmail itself doesn’t integrate with. So that’s nice.

I’ve also swapped the open tabs for 1 app with 1 notification badge, which frees up my browser and keeps email away from my field of vision – perfect for getting more stuff done with fewer distractions.

When it comes time to going through emails, you can click through them quickly.

The email list is on the right, and the full text is on the left. So easy to go down the line, read them all, and reply where needed. No more clicking back to the inbox and then on each individual email.

The residual amount of minutes I’ve saved in the past few days make me wonder why the hell I didn’t get this app sooner. But now that I have, I’ll never go back to the web-based version.

Alternates:

Mailbox

Postbox PC and Postbox Mac

2. Sunrise

Link: Sunrise

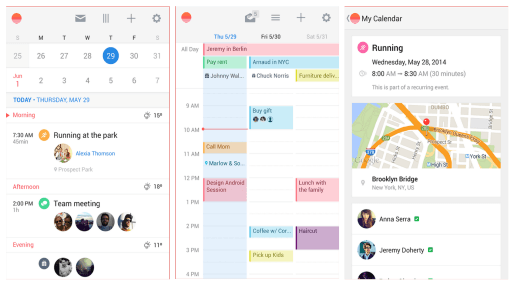

Sunrise is deceptive and brilliant in its total simplicity. There aren’t many options, but that doesn’t matter. All your calendars are finally in 1 place.

Work, personal, holidays, Facebook, birthdays, Meetup. It even imports your travel plans from TripIt. (And come to the next New York points and miles Meetup! Join the group, then add it to your new calendar.)

The app is available on any browser, your iOS/Android phone, or Mac app – and it syncs across every platform

I like that it syncs up across platforms, so I can add something on my phone and see it later on my laptop. Or on any browser.

It supports pretty much any calendar you have

My biggest gripe about calendars is how fussy they all are. Google Calendar is a whole different breed from Outlook or Apple iCal, for example.

If your work calendar is on Outlook and your personal on iCloud or whatever, it used to be impossible to get them into one place.

But Sunrise lets you plug in nearly any calendar, as many as you want, and syncs the data together.

You can set alerts and reminders, and as mentioned, add lots of different apps and sites to it.

I have about 6 different calendars that I manage day in and day out, so for me, this is a total game-changer. I’m so glad I found it.

Alternate:

BusyCal

3. Evernote

Link: Evernote

Also see:

Evernote Review: Remember Everything

7 Awesome Uses of Evernote for Travelers

26 More Awesome and Creative Uses for Evernote

I’ve written a lot about Evernote. I simply love it. It’s an indispensable part of my organizational system.

I use it for everything including travel plans, sharing docs, keeping a daily journal, to-do lists, blog ideas, checklists, credit cards, goals, finances, photo storage, scanning receipts, and so much more.

To say I use it every day is an understatement. I use it all day, every day.

Anybody can find Evernote useful for something

In fact, Evernote is probably my #1 app. It’s a digital version of my brain, my file cabinet.

There’s been so much digital ink spilled about this app, but suffice it to say it’s capable of a lot.

And it’s the measuring stick I use to select new apps. “Does it plug in to Evernote?” If the answer is no, I move on.

I add all of my receipts, photos from trips, snippets of ideas, interesting articles… pretty much everything I find. It’s like my personal Google.

It syncs across all platforms, is accessible on pretty much everything, and is enriched by tags, location services, and notebooks.

The next closest app is OneNote. Some people like that better. But I like Evernote, so I’m sticking to it.

If you read and save a lot of articles, check out Pocket. It’s a handy tool to have for cataloging inspiring articles, maybe this one?

4. Swipes

Link: Swipes

Swipes hooks up right to Evernote, so you can make a note with a to-do list, then import it to check things off as you get them done.

Or you can make a to-do list in Swipes, and have the tasks repeat on any type of schedule you want (daily, weekly, monthly, etc).

Line ’em up, knock ’em out

There is something so satisfying about making a to-do list, then swiping them off throughout the day.

You can add reminders and alerts, snooze your tasks, or move them to another day.

This app is for those days where you have a zillion things to do and you just need to write it all down and go down the line. Maybe that’s every day for some peeps, but I find I have those types of days pretty randomly.

Within each task, you can add “steps” to get there.

For example, if your task is to pack, you can have each item, or sets of items, as a step (credit cards, passport, toiletries, socks, etc – then check them off as you pack them).

I’m not fully “sold” on Swipes yet, but they’re adding more integrations including Google Calendar, and it already syncs flawlessly with Evernote. I might try to use it more, but for now, I only turn to it when I’m feeling overwhelmed.

That said, having a tool to help when when I’m flustered is worth its weight in gold, so I’ll definitely keep it around.

5. IFTTT

Link: IFTTT

IFTTT stands for “if this, then that,” and it’s basically the icing on the cake of all the other apps, because it connects them based on their mutually beneficial functions.

For example, if I take a new photo with my iPhone, I can back that photo up directly to Evernote. The trigger is a new photo, and the action is backing it up – and IFTTT facilitates that.

IFTTT is worth exploring because of all the cool things you can connect to it

I use IFTTT to manage my social media, back up my blog posts (including this one!), text me the weather each morning, and keep a record of all my faved tweets on Twitter – that’s just the start.

There’s a ton you can do with IFTTT. The best way to start is to poke around their recipes section. Before you know it, you’ll have the internet working for you!

IFTTT is definitely level-2 type stuff, but it’s worth getting to know it. Frequent Miler did a cool post about how to use it to register for AMEX Offers. Believe me, that’s just the beginning!

Bonus

Speaking of getting control over your email, use Unroll.me to “roll up” your email subscriptions into one easy-to-ready daily digest. It automatically pulls out the emails that you choose – and adds them to your digest for you to read once a day.

I can’t say enough about how much time their service has saved me. And I get to scan all my emails to see which ones are worth reading, and which ones aren’t worth the time. This is perfect for hotel and airline email newsletters (because sometimes there are good ones), or any type of interesting-but-not-urgent alert you receive in your inbox.

FileThis pulls in any kind of monthly statement, and organizes the documents for you!

And FileThis is freaking amazing. It pulls in all your statements from credit cards, Amazon, your utility company, or from anywhere else where you get monthly bills, and puts them into a place of your choosing like Evernote, Google, Drive, email, or in their own cloud storage.

I have Chase, Barclays, AMEX, etc., plugged up to this and I can easily scan all of my credit card statements for errors, to make sure I got my points and payments cleared, and see if there are any changes, credits, and all that. I love it.

I also get my utility and internet bills delivered.

FileThis is a step beyond paperless. It’s the digital filekeeper you don’t know you need. Once you sign up, you’ll be hooked. Guarantee it!

Oh, and remember to sign up for Paribus and Giving Assistant if you already haven’t – save money when you shop online!

Bottom line

If you work online a lot, or just want a way to keep your stuff more organized, these apps are an asset.

I almost instantly felt the clutter leave my mind once I figured out what worked for me.

These apps in particular helped me a ton:

Airmail

Sunrise

Evernote

Swipes

IFTTT

Unroll.me

FileThis

Hopefully they will help you organize your travels, miles, points, calendars, emails, time… and mind.

I’m open to new and better ways of doing things. If you know something that works better, or that should be on the list, please let me know in the comments!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!

Booking Martinique: My Experience With Citi Prestige Concierge and 4th Night Free Benefit

Also see:

Just Booked: Martinique $317 Round-Trip and Non-Stop on Norwegian

I’m Prestigious! Getting Citi Prestige and First Impressions of the Card

I’ve been getting to know the ins and outs of my new Citi Prestige card, including the perk I was most excited about: the 4th night free benefit.

Yeah, I could deal with that

Here’s how it all worked with getting the 4th night free in Martinique, where I plan to visit in February thanks to Norwegian’s new non-stop service from JFK (and Boston and BWI!).

Finding the hotel

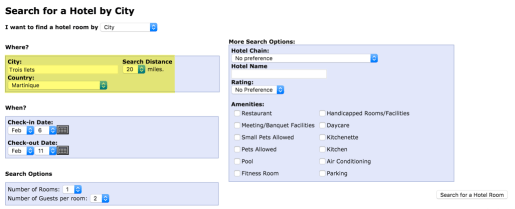

Martinique isn’t exactly a hot spot for chain hotels, so that meant a local, non-chain hotel. I looked on the Carlson Wagonlit website to see what was available.

I found about 10 hotels on the Carlson Wagonlit site

About 10 hotels popped up, none of them chain hotels.

I searched all of them on TripAdvisor and narrowed it down to the Hotel La Pagerie.

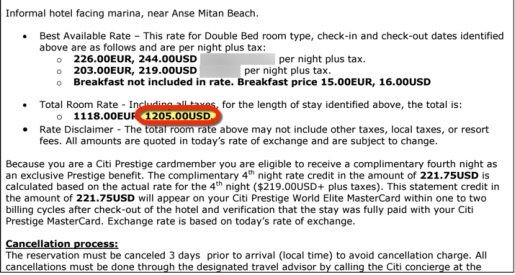

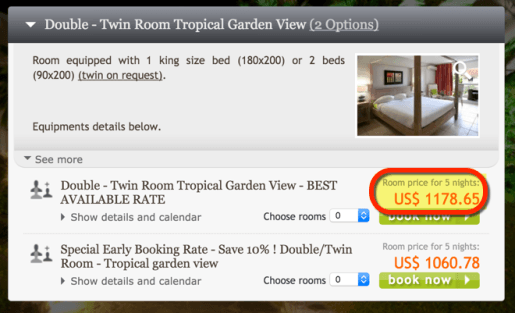

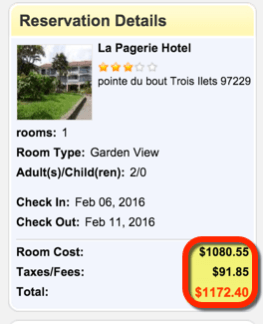

Citi quoted me $1,205 USD for 5 nights

Then I called Citi Travel Concierge to see what they could do.

Some observations

First of all, I wanted to stay 5 nights. But even still, the 4th night is always free. They break the rate down night-by-night.

I got lucky, because the 5th night was actually the cheapest.

And second, the Citi/Carlson Wagonlit/MasterCard travel agent told me that while lots of hotels are searchable on the Carlson Wagonlit site, not all of them are listed. So it’s still worth it to ask them to find every option just in case.

After I called, I got a price breakdown from Citi Prestige Concierge in about 12 hours.

I noticed the amount they had for the 4th night free credit was actually wrong (see image above). When I called back to book, the agent was able to fix it. It sounded like they just manually type in the amount – it’s not automated.

I paid $1,205 for 5 nights, but will get $244 (the price of the 4th night) back as a credit.

That’s $961, or an average of ~$192 a night for 5 nights in Martinique! Not bad!

Plus, I’m splitting it with Jay, so that brings it to ~$96 per person per night – even better.

Did I get the best deal?

I was worried (perhaps paranoid) that Citi wouldn’t give me the best prices.

And they didn’t. But they weren’t that far off the mark, and the 4th night free benefit more than made up for it.

I found the same dates on the hotel’s site for ~$1,179 – a $26 difference.

There was a modest discount from booking the 5 nights directly with the hotel

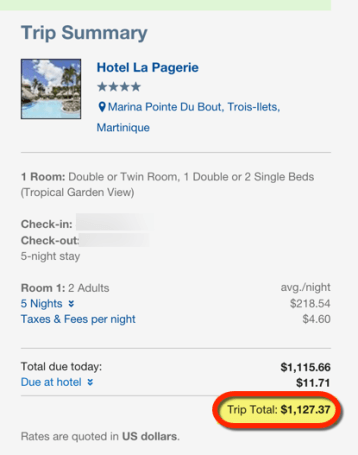

Then I checked Travelocity.

~$1,127 for the same dates

They had the same dates for $78 less!

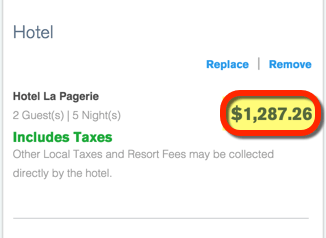

The Chase Travel Portal showed the price as more expensive – ~$1,287, or an extra $82.

Chase priced the dates out at a much higher cost

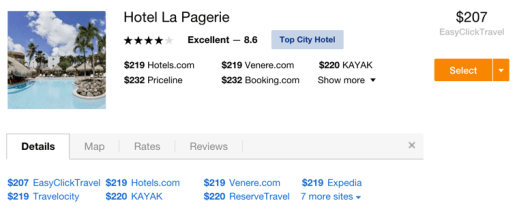

Then, last one I promise – this is how crazy I was about shopping for the best deal – I checked Kayak.com because they typically have great search tools.

Kayak’s rates didn’t include taxes and fees

I saw the dates available for $207 a night, or $1,035. A significant savings above all the others from Easy Click Travel.

Actually not a better price, and very much not worth the hassle

But that company had terrible Yelp reviews, and it actually wasn’t that much less than booking the nights directly with the hotel, which is usually preferable anyway, because the Kayak prices didn’t include taxes and fees.

In the end, I’ll pay $961 by booking through Citi. I could’ve saved $26 or $78 by booking elsewhere, but the $244 I’ll get back more than covers that.

Plus, I’ll get 3X Citi ThankYou points for the full amount of the reservation, including the 4th night which will be credited back to the card.

The extra 732 Citi ThankYou points I’ll earn on $244 is worth ~$12 toward American Airlines flights in the . It’s not a lot, but it really does all add up!

Bottom line

A bit of a funky experience in that you have to call, get the hotel priced, then call back again to book.

But, that said, it’s not like I was on hold for long, and they got the quotes back overnight. (I called in the evening and had a quote the following morning).

In the end, I got the best deal on a local hotel in a place where there aren’t any chain hotels.

I’m excited to keep using and maximizing this benefit for all it’s worth!

I’ve added this to my Citi Prestige by the Numbers page where I’ll track all the fees and credits for the 1st year to see how much this card actually saves me. There’s not much there yet, but keep an eye on it, because I’ll track everything.

If you want to apply for this card, thank you thank you for using my links to click through and sign up.

Overall, the benefit is easy to use. Just keep an eye out to make sure they apply the correct amount as a credit since it seems to be manually entered. And keep in mind that while the Carlson Wagonlit website has most options, not everything is included there.

Still, most hotels are and it’s usually enough to give you an idea of what to expect. This benefit is unlimited, and you can apply discounts, earn points, and have your elite status recognized.

Final verdict: I’m in love.

Let me know if you’ve had a different (or similar) experience getting the 4th night free!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!

November 28, 2015

Save (or Earn!) Money at Amazon and More This Holiday Season

Also see:

Easily Save Money at Amazon.com With Paribus and Giving Assistant

Giving Assistant Dropped 5% Cash Back at Amazon… But You Should Still Use It When You Shop There

A Few Apps + Sites I Like to Save Money

I’m in holiday shopping mode, and enjoying the many shopping deals available right now.

If you see a good deal, maximize it even more.

Irresistible, really

For example, I ordered some stuff from The Body Shop today and stacked:

10% cash back from Discover It (which will double to 20% after the 1st 12 billing cycles)

10% off from The Body Shop rewards club membership

$25 off earned from the rewards club membership

Plus, I got a tote bag stuffed with products for $35… including a product I wanted that usually costs $36 on its own. And free shipping and samples.

All-in-all, I spent $63 on $200+ worth of stuff. Plus, I’ll get back $12 because I clicked through the Discover Deals shopping portal ($6 back this billing cycle and $6 back after the 12th). That’s my kind of deal!

Here are a few other ways to save before Cyber Monday sucks you into a shopping frenzy.

1. Paribus

Link: Sign up for Paribus

Get price adjustments with zero effort

Yes, I talk about this site a lot because it’s still largely under-the-radar but totally shouldn’t be.

Paribus scans your emails (and you can link it to your Amazon account) to check if the products you bought are eligible for a price adjustment.

If a lower price is found, they request the price difference on your behalf, and the money is refunded back to your card.

All of this happens automatically, and the only notifications you’ll get are when a better price is found.

They usually charge 25% of the price difference, but if you sign up with my link, you’ll pay 20% instead.

Paribus supported merchants

I like it mostly for Amazon, but lots of other popular merchants are supported, like Target, Staples, Gap, and NewEgg.

Get your money back if a price drops! Especially during the holiday season with so many sales going on. This is my #1 tip for online shopping this holiday season.

2. Giving Assistant for Amazon

Link: Sign up for Giving Assistant

If you shop at Amazon and can’t receive cashback for the category your products are in, help others instead.

Giving Assistant has NO category restrictions

Be sure to check Amazon on Cashback Monitor to see if you can get any cashback for what you’re buying. The usual categories are clothing, jewelry, and a couple of others.

You usually won’t find cashback on electronics, games, and most other random items.

The reason you should sign up for Giving Assistant is because you definitely won’t earn cash back on gift cards, but Giving Assistant has no category restrictions on the 2% charity donation.

Lots of folks are going to buy $1,500 worth of Amazon gift cards with their Chase Freedom thanks to the amazing 10% cash back (10X Ultimate Rewards points) at Amazon through the end of 2015.

There are hundreds of charities to choose from

On a $1,000 Amazon gift card purchase, you stand to gain either $100 cash back or 10,000 Chase Ultimate Rewards points. And clicking through Giving Assistant would donate $20 to a charity of your choice.

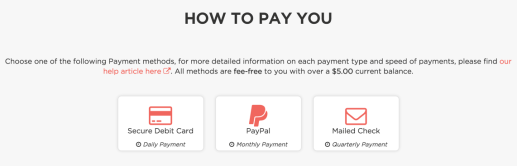

If you ever earn cashback in the future, they’ll send it to your debit card account

Plus, who knows, maybe one day they’ll add Amazon as a cashback category. There are over 1,000 stores on the website, and getting the cashback is very easy. Anything you earn is sent to your debit card.

Oh, and you get $5 for signing up, so it’s a total no-brainer.

I maxed out my Chase Freedom with Amazon gift cards. If you choose to do this, consider clicking through Giving Assistant to give 2% of your purchase to a charity. Helping others during the holiday season feels like the right thing to do.

3. Portals for everything

Almost every major portal has bonuses for holiday shopping. Commit to one and earn more miles, points, or cashback.

I’m all over Discover Deals because of the double cashback for new Discover it cardmembers. But check Cashback Monitor to make sure you’re always getting the highest payout before you begin your shopping.

Here are a few popular mileage shopping portals, in no particular order:

Delta

American

United

Southwest

Alaska

JetBlue

Chase Ultimate Rewards

Note that points earned in the Southwest shopping portal do count toward the Southwest Companion Pass.

Buy online as much as possible to earn the most amount of miles.

4. Ibotta for random stuff

Link: Sign up for Ibotta

I went on a Costco trip, and then bought a few random items at CVS (including PayPal My Cash cards, but that’s another post), and earned a few bucks through Ibotta, which is an app where you submit your receipts when you purchase certain products.

Install a free app, and earn money on stuff you probably already buy

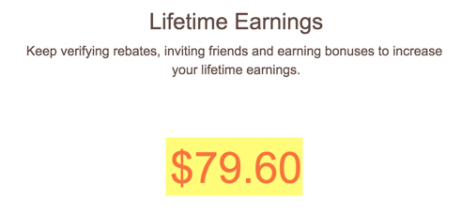

It doesn’t seem like much, but since I first wrote about it back in June, I’ve earned nearly $80 pretty effortlessly.

The biggest downside is you have to manually “unlock” the discounts on each individual item, but this can be done after you buy them, and on a case-by-case basis. I usually just look over the app with my receipts nearby and unlock a discount if I bought an item with an offer. So I don’t really go out of my way to earn more money.

For a free app on your phone, earning a few extra bucks here and there is awesome!

5. Citi Price Rewind

Link: Citi Price Rewind

This only applies for folks with Citi personal credit cards, like oh, Citi Prestige, but Citi Price Rewind can be a boon, especially during the holiday season.

You’ll need to register each item separately (and pay with your Citi card obviously), but it’s quite easy and can earn you a statement credit if Citi (or you!) find a lower price on an item within 60 days.

You can get up to $300 per item, up to $1,200 each year – and that’s per account.

If you buy anything with your Citi credit card (perhaps in conjunction with Citi Smart Savings), it’s a good idea to track it. Keep an eye out for sales too, because if you catch it, you can submit a claim with your own proof.

In my experience, it’s easy to get Citi to match a lower price – but most of the time it happens automatically when Citi finds a lower price for you.

A great idea especially for electronics, appliances, or big ticket items where you want more purchase protection or suspect it’ll go on sale either during the holiday season or right after.

Bottom line

Stack the discounts, save money.

It’s easy to get impulsive during the holiday season with all the spending involved.

Take a few minutes to set up a few things to save you money, mostly automatically:

Paribus

Giving Assistant

Shopping portals

Ibotta

Citi Price Rewind

I’ve been combining shopping portals, category bonuses, discounts, promotion codes, and sale prices to save a heap – both on stocking up for myself, and on gifts for others.

There are lots of these types of services in the world, so feel free to tell me about any I missed.

Thank you guys for reading, hope you had a great Thanksgiving!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!

November 15, 2015

Just Booked: Martinique $317 Round-Trip and Non-Stop on Norwegian

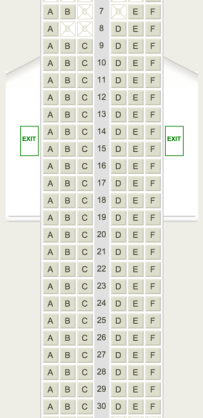

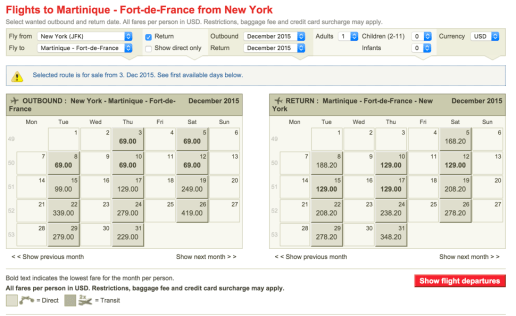

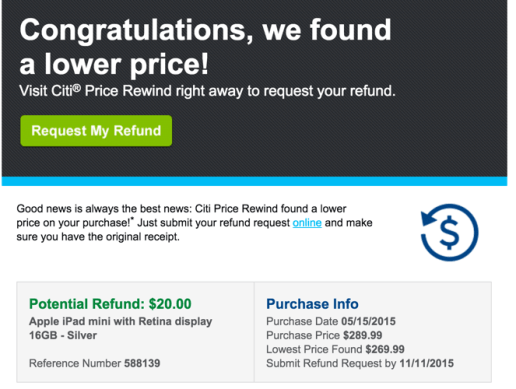

Hot off the heels of my trip to Barcy in January, I’ll be heading to the French Caribbean island of Martinique in February 2016!

So excited!

There’s quite a good sale going on right now, and as I looked through the fares a few weeks ago, I thought wow, these will sell out quick!

But, they didn’t. And when I saw the fares start to increase, I pulled the trigger on this one.

The flights are wide open

I usually wouldn’t book 2 trips so close together, but this sale, combined with the $250 airline credit on my new Citi Prestige card, formed a perfect storm of BOOK THE TRIP.

Why I did it

My biggest regret about 2015 was not taking more trips.

I became so immersed in my Airbnbs that I spent all my time preparing for other travelers (which, not complaining at all, it’s been wonderful).

I made it to Dublin, which was amazing, but other than that, this year was quiet for me on the travel front.

I will change that in 2016.

Amazing deals are still available, as low as $200 round-trip

I’m planning to relocate to Dallas at some point, and looking at Alaska Airlines as my new go-to loyalty program.

I also strategically just got Citi Prestige to take advantage of the $250 airline credit 2 months consecutively. And the 4th night free benefit.

Plus, hello? To get out of the New York winter!

Fares on Norwegian are between ~$200 and ~$300+ round-trip. In December, you can find fares for $198 from:

Baltimore

Boston

New York

I’m closing on my house on December 15th (fingers crossed!), so I didn’t want to add a trip in before or after that – so pretty much the whole month of December.

Fares in January and February are still a great deal, though, and there’s also this:

YES PLEASE

It’ll be over 80 degrees in the French Caribbean and it definitely won’t be over 80 degrees in the middle of the frigid Northeastern winter.

My ticket was $317 round-trip.

And after the $250 I’ll get right back, only $67 round-trip for non-stop flights.

The flights are ~4 to ~5 hours each way. Plus, I’ve never flown Norwegian (so more things to blog about here).

And, I’ve already emailed Citi Travel Concierge for hotels to use the 4th night free perk, and will report back on my experience with it. I’m thinking about this hotel: Hotel La Pagerie (it’s available on the Carlson Wagonlit website).

It’ll also be reason enough to update my Citi Prestige by the Numbers page where I’ll track all of the value I get from the card.

A cursory look tells me hotels are ~$200 a night. But for my 5-night trip, I’ll only pay for 4 of them, so ~$400 for my half.

My ticket was ~$67 net effective after the $250 airline credit.

All-in-all, a mid-winter trip to a warm Caribbean island for under $500. I couldn’t pass that up!

BOOK THE TRIP

It’s also a part of the mantra I want to adopt moving forward:

BOOK THE TRIP.

When in doubt, book the effing trip. Life’s too short not to be enjoyed, and I’ll regret not doing this much more than doing it.

It’ll be a new experience, my first time in the Caribbean, first time on Norwegian, and a great reason to get excited during the winter. Plus, I get to put my new Citi Prestige right to work.

I can’t wait!

Bottom line

Count me in on a trip to Martinique in February on Norwegian.

Flights were (are!) so cheap, so non-stop, and so round-trip that I couldn’t say no. It’ll give me a chance to give my Citi Prestige a work-out, and I’m super excited about seeing a new part of the world, trying a new airline, and getting a fantastic deal on a mid-winter break from New York’s winter.

And I don’t know what I’m in for.

If you’ve had an experience with Martinique or Norwegian, or you have a rec for where to stay, let me know!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!

November 14, 2015

Get an Easy 1% Cash Back on Your Rent and Other Debit Card Purchases

Also see:

How to pay bills with PayPal My Cash + Business Debit Card + RadPad + Evolve Money

Confirmed: CVS accepts credit cards for PayPal My Cash reloads in NYC

Get Instant Access to Aspiration Summit, the Best Checking Account in America

I have to thank Out and Out reader Greg for pointing this out. He says:

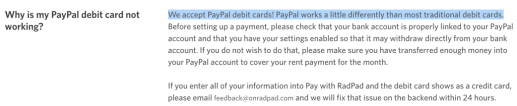

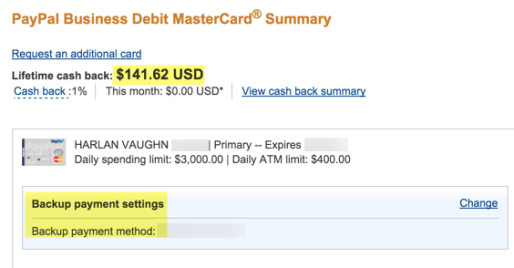

I have a Paypal Business Debit MasterCard that earns me 1% cash back on “credit” purchases. I don’t fund it, I just use it to pay almost all of my bills and have it linked to my bank account.

I get my 1% cash back on everything, don’t have to worry about my Paypal balance (as long as my bank balance is good), it makes me feel like I’ve added a layer of protection to my bank account, and it buys me some float time from when I make a purchase until it clears my bank account.

I don’t do “debit” transactions with it BC I don’t get 1% cash back and and money is immediately withdrawn from my bank account… Unless of course my Paypal account still has a balance left from my monthly cash back reward, then that is deducted before anything hits my bank account.

After doing a little digging, Greg is absolutely right!

I wrote about how to pay rent with RadPad and the PayPal Business Debit MasterCard.

You can add in PayPal My Cash cards purchased from CVS to earn points and miles, too. As long as you load up your account and ONLY take the money out through a purchase made from the PayPal Business Debit MasterCard.

RadPad and PayPal play well together

And yes, RadPad specifically codes as a purchase and earns 1% cash back.

In application

Link: RadPad for rent payments

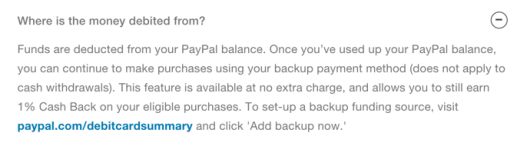

RadPad is free to use with debit cards. And the PayPal Business Debit MasterCard is free to get, too.

Here’s how to get 1% cash back:

Sign up for RadPad

Get the PayPal Business Debit MasterCard

Add your bank account as a backup funding source and keep your PayPal balance at $0

Pay your rent on RadPad with the PayPal Business Debit MasterCard

PayPal will pull the funds from your bank account because your balance will be $0

At the end of the month, you’ll earn 1% cash back from running the purchase through your PayPal Business Debit MasterCard

You don’t have to have any money in your PayPal account

I have gotten the 1% cash back from paying my rent through RadPad many times, but only used RadPad when I had enough in my PayPal account.

I’ve gotten about $140 in cash back this year so far

Now I know you don’t have to have a balance at all in your PayPal account. Which leads me to…

Try a combination of PayPal MyCash cards and your bank account

So I thought, OK, what if I bought $1,000 in PayPal MyCash cards and loaded them up, but my rent is, say $1,500?

You’d still earn 1% cash back ($15)

$1,000 would come out of your PayPal balance

$500 would come out of your bank account

Interesting…

When you load up PayPal MyCash cards to the $500 maximum, you’ll pay a ~$4 activation fee. Considering you’ll earn 1% cash back from the PayPal Business Debit MasterCard, you’ll get $5 back. And the points and miles are yours to keep.

I think I’ll try to stock up on PayPal MyCash cards this weekend and give this a go.

It’s a good way to meet minimum spending requirements, earn points and miles, and pay bills that only accept debit cards – and you get 1% cash back on purchases you run through as a credit purchase.

If your rent is $1,500 per month, you’d earn $15 x 12 = $180 over the course of a year. RadPad is free, the debit card is free… it’s literally free money.

But before you do this, please read Frequent Miler’s cautionary tips. Never, never load the MyCash cards and move the money to your bank account. Only use the balance for purchases!

Pay other bills this way

I’ve been paying rent directly out of my bank account like a chump recently, and it kills me to think I could’ve earned cash back on all of it.

If there are any other bills that must be paid with a bank account or debit card, maybe a utility company, you can use the PayPal Business Debit Card to get 1% cash back. While not a lot, it’s certainly better than nothing!

Bottom line

Maybe you already knew this, and I’ve been slow on the uptake, but this is an easy way to score some cash back for paying your bills, especially rent.

I love RadPad and the PayPal Business Debit MasterCard, and it seems possible to throw PayPal MyCash cards into the mix to earn some points and miles, too.

At the very least, if you’ve been paying rent out of your bank account, pay it with RadPad instead.

Be careful if you add in PayPal MyCash cards. Make sure you only withdraw the funds through debit card purchases. DO NOT withdraw it to your bank account after you load them to PayPal because you WILL get caught.

I’ve never had a problem with PayPal or the MyCash cards, so exercise caution here.

If you don’t want to mess with the MyCash cards, no problem, stick to RadPad and the debit card and earn some free money when you pay rent.

What do you guys think of this?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!

I’m Prestigious! Getting Citi Prestige and First Impressions of the Card

Also see:

Citi Prestige: No Luck Getting a $350 Annual Fee In-Branch, and Why to Apply ASAP

Yes! Instantly Approved for Citi Prestige!

I got my Citi Prestige card this week and wanted to share the experience. Because it was an experience getting this card.

And I can’t wait to dig in to to all the perks this card has to offer!

Here are my first impressions and things I noticed right away.

The 2-package process

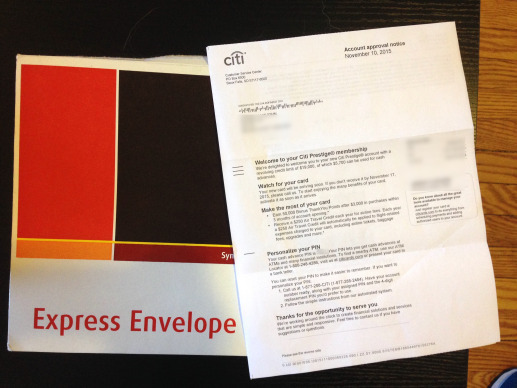

Early in the day, I got an envelope delivered from UPS.

Oh good, I thought, it’s here.

Um, thanks?

There was literally 1 page in the package. No card.

An “account approval notice.” Thanks, Citi. I already knew that from when I was approved online, and from the subsequent email you sent right after. But it’s nice that you spent money on a UPS express delivery service to send me another letter about it.

Soon after, a FedEx box came, too.

Round 2

And it was quite a process to dig out the thin little plastic card inside of it.

Inside the box was another box.

A beautiful matte box with the Prestige emblem

Granted, it was a sturdy matte-textured box, with a flap to open it.

Beautiful marketing materials

Once you flip it open, you get to another box.

A box in a box in a box

Within that box was a plethora of paper: benefits guide, T&Cs, more T&Cs, rate information, oh, and in an envelope, the card.

Nice package of welcome/introductory guides

Very thorough guide to the perks of the card

As I flipped through the guide, I kept thinking, wow, how neat.

Did you know, for example, the $500 trip and baggage delay benefit starts after only 3 hours? And that flights purchased with Citi ThankYou points are specifically included?

(I want to do a whole post series on this soon.)

The whole package contents

All-in-all, lots of paper and packaging for one little ol’ card.

You’d think that for all the effort they put into the packaging, they could’ve sprung for a heavier card made of stronger materials, like the Chase Sapphire Preferred (which “just” comes in an envelope).

I kinda don’t want to keep all this hullabaloo and clutter, but another part of me doesn’t have the heart to immediately discard of it. I’ll at least keep the benefits guide and the T&Cs, just to have in my file cabinet.

The Citi Prestige card!

Now I can finally be one of the cool kids and post a pic of my new Citi Prestige card.

It’s the new design with the stripe on the back of the card, and it comes with a chip-and-siggy embedded into the front.

Your ticket to Admirals Clubs

On the back, you’ll find your name and card number, as well as what the folks at the Admirals Club will be looking for when you go for a visit.

Your lounge access is denoted here. Note this benefit is only for the primary cardholder. If you add an authorized user, they’ll have to be with you to get into the lounge.

Your Priority Pass membership card will show up a few days after – there’s nothing you have to do to make it happen. It will arrive automatically.

The website

I activated the card, then made sure to set it up on my Citi account online.

Couldn’t sign in right away

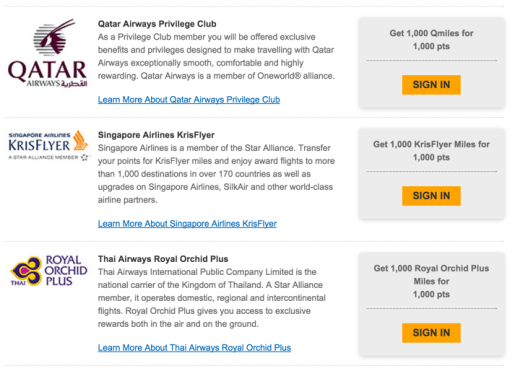

I headed over to ThankYou.com to explore the new points system.

I could see all the transfer partners, but when I pressed “Sign In,” I got an error message:

No bueno

Which was fine, I didn’t expect it to really sync up moments after adding it to my online account.

But the next day, it did show up. So if you notice that, it’s nothing to worry about.

I had a great time going through the seemingly never-ending perks and benefits on the card.

Cit Smart Savings is a cool new perk, too

Including Citi Smart Savings, which seems embryonic right now, but intended to directly compete with AMEX Offers.

Save up to $1,200 a year ($300 per claim) with Citi Price Rewind

And don’t underestimate Citi Price Rewind, especially with the holidays coming up.

They’ll track the items you pay for with your Citi card for 60 days. If the price drops, you’ll get a credit up to $300 per item and $1,200 per year.

This is super handy for appliances, electronics, and anything else you think will go on sale in the next couple of months. Which, during this time of year, is absolutely everything.

Citi saved me $20 on a purchase this year

Note this benefit is per card, so you could theoretically get a ton of value out of this.

I got $20 back from an iPad purchase earlier this year. Citi did it all for me, and credited my account within a month.

What now?

I need to use the $250 annual airline credit like, now. I’m thinking of booking a trip to the French Caribbean for next year.

Amazing

Tickets to Martinique are ~$300 round-trip right on Norwegian. But only $50 for me after getting $250 back! (Or, I just buy American Airlines gift cards.)

And, because of the timing on this, I can turn around and get another $250 next month. That’s why I said to apply ASAP or wait until next year.

And you bet your tookus I’ll be using my 4th night free benefit! (Be sure to look on the Carlson Wagonlit website to see which hotels you can book with the 4th night free.)

With this card in particular, I’m swapping out the AMEX Platinum for it (what a weird sentence that is).

I’m hyper-focused on value. Getting the most out of it.

So much so I’ve created a new page, Citi Prestige by the Numbers, to document exactly how much value I get from this card.

I’ll update it every time I use the card, and I’ve added it to the home screen under the “Credit Cards” tab. So keep an eye there to see how much I save (and how much you can potentially save).

If anything, I’ll save $500 this month and next with the $250 annual airline credits alone. After that, I’ll have recouped the annual fee and will be into pure savings mode. Can’t wait!

If you’re interested in this card, thank you for applying through my links!

Bottom line

Receiving this card felt like a special experience, so I wanted to share it with you guys.

It’s a beautiful card, very well put-together, and Citi’s attention to detail really shines.

The list of perks is dizzying, but I’m excited about unraveling them one-by-one and documenting the savings as I go along.

The only thing I’d change is: I wish the 3X category was for all travel and not just airfare and hotels.

It’ll be a nice complement to my Chase cards, though, and I’m now firmly in a Chase/Citi combo with my credit cards for regular spending. I’ll keep my AMEX cards – for now- for AMEX Offers and to maximize the perks until the annual fees are due, but after that, sayonara sucker. Unless they really step their game up in a big way, and soon.

Let me know your thoughts about Citi Prestige, and if you have any questions, ask away – I’ll do my best to dig up answers!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!