Harlan Vaughn's Blog, page 61

August 25, 2015

18 FoundersCard Travel Benefits (Status, Discounts, and Freebies)

Also see:

FoundersCard Membership: Is it worth it?

Details about FoundersCard benefits (Cathy Pacific, Avis, hotel discounts)

Assessing the Benefits of FoundersCard

FoundersCard

I’ve written lots about FoundersCard (including the eternal question: is it worth it?).

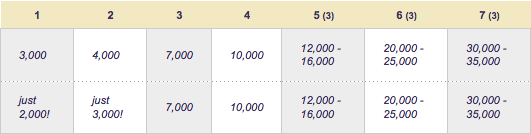

I noticed that lots of the travel benefits offered by FoundersCard are ancillary benefits of having certain co-branded credit cards. So I thought it’d be fun to explore the benefits you can get from having a FoundersCard membership (which costs $395 a year) instead of having a bunch of credit cards.

This post inspired by the Chase British Airways Visa. RIP, fallen soldier.

I love this little card

18 FoundersCard travel benefits, organized by type

Air

1 – American Airlines: Platinum Status – Challenge (new benefit coming soon)

2 – British Airways: 10% off fares from North America and UK

Benefit of: Chase British Airways Visa

3 – Cathay Pacific: Silver elite status and 5%-25% off flights

3 – Cathay Pacific: Silver elite status and 5%-25% off flights

4 – Clear: free for 6 months and $14o annual membership fee

Benefit of: Visa Signature cards

5 – Emirates: 5%-10% off fares from the US

6 – JetBlue: Mosaic elite status after 2 round-trip flights

7 – Qantas: 15% off most fares

8 – Virgin America: 5%-12% off fares

9 – Virgin Atlantic: Silver elite status, fast track to Gold status, and 20% off fares from the US and Vancouver

Hotel

1 – Caesars Total Rewards: Diamond elite status and 20% off bookings

2 – Hilton HHonors: Gold elite status

Benefit of: Citi Hilton HHonors Reserve and AMEX Hilton Surpass cards

3 – HotelTonight: $50 credit and 15% off bookings

Car

1 – Avis: and up to 25% off rentals

Benefit of: AMEX Platinum

2 – Hertz: #1 Club Gold or #1 Club Gold Five Star membership and 15% off rentals

Benefit of: AMEX Platinum

3- Silvercar: free gas refill and 15% off rentals

4 – Sixt: Platinum elite membership and up to 15% off rentals

Benefit of: World Elite MasterCards

5 – Zipcar: waived business initiation or $35 personal setup and $15 driving credit

Travel

1 – TripIt Pro: free for a year, then $39 annually

Current/former (depending on account opening date) benefit of: Barclaycard Arrival Plus

Analysis

AnalysisAs you can see, about half of the benefits are duplicated on credit cards.

And the other half (mostly the fare discounts, but also Caesars Diamond Status, reduced Zipcar membership, and others) are completely unique to FoundersCard.

So consider the annual fee on the FoundersCard is $395. Travel, like finance, is super personal. Whether or not this (and anything) is worth it will be up to you.

If you think you can get more than $395 in value, this is definitely a good deal. And if not, then it isn’t. Simple as that.

I see particular value opportunities in:

Free TripIt Pro

Hilton HHonors Gold elite status (free breakfast, bonus points on paid stays, late checkout)

10% off British Airways fares

Free AA Platinum Status Challenge

Clear membership, if it’s in your airport

Caesars Diamond elite status

Depending on your travel patterns, it’s absolutely possible to get more than $395 back in value.

But this is only the travel benefits.

There are other lifestyle and business benefits that add even more value, and, for me personally, push the value of this card far beyond the $395 annual fee.

Bottom line

The benefits of FoundersCard have been pretty well in place for a couple of years by now, and I don’t think they’ll change any time soon. If anything, I expect they’ll add even more to the mix.

I personally really like the card. That being said, it’s only useful if you know you’ll use the discounts/value the freebies/etc.

The best way to see all the benefits is to take a look around for yourself. If you’d like, email me for an invite to access the visitor’s site.

Or, if you want, you can lock in the $395 annual fee for life when you sign up with my link.

Hopefully this shines a light on some of the FoundersCard travel benefits.

Let me know if you want to know particulars, or don’t hesistate to email me/comment below if you want an email invite or have questions!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

August 24, 2015

New Aspiration Checking Account Has 1% APY and Free Global ATM Use

Also see:

Fidelity Cash Management Account: Why It’s Great

I’m always on the hunt for a great new banking product, so when I saw Aspiration’s new Summit checking account with a 1% APY (NOT APR!), I had to check it out.

Aspiration Summit checking account will earn you 1% APY when you have a $2,500 daily balance

I’ll show you the benefits and highlight one big caveat.

What’s Aspiration?

We’re a new kind of investment firm – built on trust, focused on the middle class instead of millionaires, and founded on the idea that we can do well and do good at the same time.

Very cool.

I’m leary of signing up for yet another new checking account after I found out Radius Bank’s 1% cashback would be useless for me.

Well guess who’s behind this new checking account? Yup, Radius Bank again.

The idea is that once you hit $2,500 in the account, you’ll earn 1% interest on the balance, which compounds monthly.

You’ll also get a free debit card and free access to ANY ATM in the WORLD. Fees are reimbursed monthly.

It’s really only worth it if you can keep $2,500 in the account

If you don’t meet the $2,500 daily balance requirement, you’ll only earn .25% interest… a staggering fall from 1 full percentage point.

Good news for us travel junkies… but there’s still a forex fee. Stick to cash from ATMS and you’ll be fine

But, if you’re looking for an account with no fees and free ATM access, this one may be looking into.

This free account is pretty straightforward, and costs just $10 to open

The fee that jumps out to me is the $33 overdraft fee… ouch! But if you’re planning to keep $2,500 in the account to earn the 1% interest, it should never be an issue.

2 years later, the Summit account was born

Their Twitter account has been around since July 2013, so they’ve obviously been working on this offering for a while. I’m glad the funding for their products has finally come through. It’s always good to see people succeed in their passions.

Thinking of a checking account as a savings account

Because you have to maintain such a high balance, it worth viewing this as a savings account with a debit card instead of a normal checking account.

You’ll want to keep your balance at the $2,500 mark for sure.

The APY is on target with most high-yield online savings accounts, like the ones offered by AMEX and Barclays.

Personal finance is, well, personal, so choose what feels best for you. The Barclays Dream Account has a similar interest rate, but it’s a savings account

If you like the flexibility offered by a checking account and trust yourself to keep enough in there to earn the 1% APY, the Aspiration Summit account could be a great option.

But if you want your savings separate, tucked away, and hard to access, this might not be the right account for you (because of the “temptation to spend” factor).

$50 per year isn’t huge, but it’s better than a sharp poke in the eye!

You won’t earn enough to retire early or anything, but if you want to start a savings fund and want access to it in the event of an emergency, want the option to pay bills, need an account with no fees/no ATM fees, or simply like the product, you might consider checking out Aspiration.

Bottom line

The new Summit account from Aspiration might be interesting to some peeps.

There’s a waiting list to sign up right now. I’ve been on it for a week and will open my account in the next day or two. If I can pass along early access, I’ll be sure to share a link.

1% interest from a checking account is nearly unheard of these days. It’s on par with the best online high-yield savings accounts, like the ones from AMEX and Barclays.

Some will enjoy the flexibility of a savings account, and others will want to keep checking and savings completely separate.

If you can maintain $2,500 in the account to trigger the 1% interest rate, this could be a great, flexible option. And the free global ATM access is a huge plus – especially for those who travel often.

Will you be signing up for this new checking account?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

IHG’s New Fall Promo (My Offer Sucks!)

Also see:

I broke down and got the Chase IHG Rewards Club credit card

Should I go to a different state for my IHG Set Your Sights Promo?

Chase IHG MasterCard Sign-Up Bonus Counts Toward Spire Elite Status!

IHG Accelerate Promo

In case you guys haven’t heard, IHG has a new fall promo called Accelerate.

I won’t be “accelerating” anywhere

This is a GREAT promo if you don’t have an IHG Rewards Club account because you can earn 2 free nights at ANY IHG hotel (1 free night for 2 stays, up to 2).

But if you’re an existing member, or Spire Elite, the offers vary from OK to “thanks for nothing.”

Compared to the “Set Your Sights” offer that had me contemplating travel to another state, this one is kinda meh.

Of the next 4 months, IHG wants me to spend 1 of them exclusively in their hotels

Though you can sign up now, the promo runs through September 1st to December 31st, 2015.

My offer basically said spend a month in IHG hotels and we’ll give you a free stay at a Category 9 hotel (earn ~58,000 IHG points).

So I’m like thanks but no thanks.

I wonder if it has to do with my recent accidental acquisition of Spire Elite status.

Peeps on FlyerTalk have been busy posting their offers today, and they’re all really different from one another. Which is kind of interesting.

Newbies take the cake

But the real treasure is for newbies. If you don’t already have an IHG Rewards Club account, you can earn 2 free nights at ANY IHG hotel when you complete 4 separate stays. ANY!

So… you could spent $75 per night ($300) and then get 2 free nights at a hotel that goes for $600+ a night, essentially turning $300 into $1,200?!

Freaking nuts!

And remember you earn a free night certificate when you open the Chase IHG MasterCard. The annual fee is a paltry $49 and comes with IHG Platinum status, which is usually totally worthless, but does earn 50% bonus points on paid stays.

I recently broke down and opened the card and all I’ll say is that 3 free nights in a year is a lot better than just 1. And if you pick hotels that costs $600+ per night like:

InterContinental Le Moana Bora Bora

InterContinental Park Lane London

InterContinental Paris Le Grand

… you can get damn near $2,000 of value of that – not to mention the vacation experience of a lifetime.

Don’t worry, it’s actually ~$781 per night after taxes and fees

So if you know anyone uninitiated to IHG Rewards Club… and you can make a new account… definitely get in on this! Dang newbies. (Bitter, party of one, right here!)

Bottom line

IHG has a new fall promotion called Accelerate. It’s great for newbies/new accounts but various levels of sucky for current members.

That being said, if you have stays coming up anyway, you might as well register (or let someone else book the room for you).

Keep in mind you should sign up before you stay – IHG doesn’t credit stays after the fact.

This will be helpful for some. Between this promo and wanting to burn Hilton points, I’m torn between where to stay on an upcoming trip.

Does this promo rock your world at all?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

Must-Haves of Travel: Affordable Razors!

Also see:

Must-Haves of Travel: Coconut Oil

Must-Haves of Travel: Apple Cider Vinegar

Must-Haves of Travel: Activated Charcoal

Dollar Shave Club

So this is going to sound like an effing advertisement. And I guess it kinda is.

Yes, they are f***ing great

But. If you haven’t already heard of Dollar Shave Club, you should read about it now.

That’s because they’ll ship you razors each month for really cheap. And they travel well.

What’s Dollar Shave Club?

No more cheap disposable razors that ruin your face (although coconut oil makes a great moisturizer!).

I personally find the 4X to be the best deal

So I’m clearly only using razors for touch-ups these days, but I still keep my Dollar Shave Club razors coming in each month.

It’s $6 a month and I get 4 cartridges with 4 blades each.

What I love is the “easy factor”. When a cartridge starts to look a little rough around the edges, I toss it. Because I know more are always on the way.

Never again

Similar products on Amazon cost $16-$18. So I’m paying 1/3 of that to get fresh blades every month.

Even though the site is geared toward guys, there’s no reason ladies couldn’t sign up for this.

I find that the blades are of such good quality that I have a couple left when the next shipment arrives. But they let you pause it any time to “catch up” if you find you’re stockpiling them.

The credit angle

In addition to getting fresh blades, I’m also helping out my credit.

How?

Because I’m charging $6 per month to an old credit card, I’m giving up 6 miles on most cards for non-bonused spend. Or 12 cents on a 2% cash back card.

So I’m giving up 72 miles per year, or $1.44 on a card like the Fidelity AMEX or Discover It.

But I’m fine with it because I put the spend on a no annual fee card that I never use otherwise (the no-longer-offered FNBO Icelandair MasterCard if you’re curious).

I’ve had this particular card since 2006. It’s not my oldest card – that would be the Chase Freedom – but it’s one I literally never use any more.

But I want to keep it active so it continues to age my overall credit accounts, and thus boost my credit score.

Good credit is a keystone of healthy personal finances

In fact, I checked today, and my quest for a 750 credit score is now complete, according to Credit Karma at least. Boo-ya!

I open new cards all the time, so it’s really important to me to keep the older accounts active as much as possible. Especially because some banks will close your accounts if you don’t use them at least once a year or so.

I spread out my subscription services across different cards for various reasons (mostly to the AMEX EveryDay Preferred to hit 30 transactions a month).

But wait, how did I go from razors to talking about credit? #MiVidaLoco

Oh yeah, a positive unintended side effect of cheap razors is that you can also help boost your credit score. That’s both really random and highly cool.

My Mom loves it

Dudes and dude-ettes, I got my Mom signed up for Dollar Shave Club.

This is significant because she lives in rural Mississippi without an internet connection (can you imagine?!) and finds the service indisposable (lol).

She has it plugged into her regular checking account (no travel rewards cards for her), but she loves the quality of the razors.

My Mom likes it, and that’s the highest review I can possibly give to anything.

They travel well

Every product competes for space in the clear sandwich bags we cram our beauty routines into.

No, razors aren’t liquid, but they take up so little space, you can find a spot for them nearly anywhere.

I actually pack the plastic container the cartridges come in, and toss the handle in separately. This prevents the razors from tearing anything, and the handle is thin and light, so it fits in easily, too.

I have my products down to a few keys items, so I’m super picky about what I pack. Most things I like are light, small, and easy to travel with. Dollar Shave Club Razors are no exception.

Bottom line

Whoa, I’m up to 800 words about Dollar Shave Club? Cool!

In all seriousness, it’s a great service and no hassle. And it comes with a cute little booklet with random factoids and stories each month.

I really like putting the charge on an old credit card (or no annual fee card) to keep it active (some banks will close your accounts after long periods of inactivity), which helps to boost my credit score.

It’s $6 a month for the middle-of-the-road plan, which is about 1/3 less than razors of similar quality that most peeps pay for.

Disclaimer: I get a $5 credit when you sign up with my link. So thanks for keeping me smooth and I hope you enjoy being smooth, too!

Love this company (and the money they save me)! Anyone else already on the bandwagon?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

August 12, 2015

Refer Your Friends to the SPG AMEX and Earn Up to 55,000 Bonus Starpoints Per Year

Also see:

Why I Don’t Care About SPG Starpoints

5,000 Starpoints Referral Promo

Get a Travel Rewards Credit Card

It’s that time of year when there’s non-stop pumping of links for the SPG AMEX.

Now until September 14th, we have to survive on little points news other than 5,000 extra Starpoints on the SPG AMEX.

*yawn*

Why this card?

Sorry, where was I?

Oh, yeah. SPG AMEX. Right. Wake up, Harlan.

I’ve never understood the allure of Starpoints. I mean, I kinda do but I still just… don’t.

Here’s the raw deal.

You get 5,000 bonus miles when you transfer 20,000 Starpoints to airlines.

Which means this card earns 1.25 miles of many airline currencies on non-bonused spending.

But to get 20,000 Starpoints, you’d have to run $20,000 through this card. That’s a lot of money!

And then at the end of it, you get 25,000 American/United/whatever miles?

I guess that’s cool… Although I’d rather just open up an American Airlines credit card and get 50K-75K miles and be done with it. Or find another way to earn the miles that doesn’t involve $20K in spend, or Starwood hotel stays. Unless you just really like Starwood hotels, which a lot of people do.

Starwood hotel categories

Even the Starwood award chart.

So with this 30,000 Starpoints bonus, I may or may not get 1 night at a Starwood Category 7 hotel.

I can totes blow the whole thing on 1 night at a Starwood Category 6 hotel. Easy.

The best Starwood hotel award for the bonus

It seems to me the sweet spot is staying 5 nights at an expensive , like THE WESTIN RESORT & SPA, CANCUN, where nights routinely go for ~$200 a night or more depending on the season.

Why 5 nights? Because the 5th one’s free!

Starwood is one of a few hotel chains (the others are Hilton and Marriott) that give the 5th night free on award stays.

It’s actually not a “free” 5th night, but rather, the cost is averaged across all 5 nights.

There are many, many fabulous Starwood Category 3 hotels all over the world. So . I’m sure you’ll find at least a few that you can get interested in.

Here’s my shortlist with a quick glance (in no particular order):

The Westin Resort & Spa, Puerto Vallarta (fare deal heaven)

Sheraton Prague Charles Square Hotel (been wanting to visit Prague for a while now)

Le Méridien Budapest (what an amazing city)

Sheraton Bratislava Hotel (ditto)

Le Méridien Dallas by the Galleria (Dallas is becoming popular, especially for business travel)

Sheraton Myrtle Beach Convention Center Hotel (simply a great town with great food and people)

Element Bozeman (Montana

Four Points by Sheraton San Diego Downtown (a nice enough place)

Aloft Tempe (believe it or not, there IS stuff to do in Phoenix)

The Westin Nova Scotian (I went to college in Nova Scotia)

THE WESTIN RESORT & SPA, CANCUN (fare deal/spring break)

THE WESTIN GRANDE SUKHUMVIT, BANGKOK (some people love it, some people hate it)

Sheraton Salta Hotel (interesting location)

If any of these places are $200 a night, and you redeem 28,000 Starpoints for them – BOOM! Your sign-up bonus was worth $1,000.

You can wring similar value from , but obviously, you’ll need at least 40,000 Starpoints to play, which isn’t a huge increase.

Or is it?

Starwood points are damn hard to earn

That’s what makes them so valuable.

Unlike other currencies, they aren’t printing Starpoints left and right.

Although I personally predict a Starwood deval in the near future, Starpoints are generally earned through:

Staying at Starwood hotels

At a rate of 1 point per $1 spent on the card WITH NO CATEGORY BONUSES

Interestingly, Starwood has some surprising partners:

Here’s SPG and Delta’s Crossover Rewards.

Delta married for money

The gist is: if you have elite status with either program, you’ll earn 1 point per dollar spent of the other’s currency.

Interesting because Starpoints are so hard to earn and Delta SkyMiles are… not.

In fact, it’s like a marriage of a high and low. Because you really can use Starpoints for valuable stays and Delta SkyMiles… yeah, no.

To continue the high/low theme, here’s Starwood again, this time partnering with… Caesar’s in Las Vegas?

What’s a valuable points currency like you doing in a place like this?

Kinda bizzarre.

But not as weird as their partnership with Emirates.

A fun partnership, if a little out of left field

In fact, the only one that makes sense as brand-for-brand is the one with Uber.

The best partnership has the most limits, of course

But the hitch is you can ONLY earn Starpoints when you’re staying at a Starwood hotel AND riding with Uber. So you don’t get Starpoints on those late-night Uber rides home from the bar. Oops.

Other than these one-off partnerships, good luck trying to find other ways to earn Starpoints (although there are a few for really specific situations that most people won’t find useful).

I have some?

Even a scallywag like me wound up with a few Starpoints despite my active disdain for them. It took a while, but I have ~1,200 or so from random flights and activities.

Although, do I look like a ma’am?!

Even if they don’t know my gender. Why would you assume I’m married, Starwood? Hmmm…? That’s sexist!

And 1,200 Starpoints gets me…

dun dun dun…

Absolutely nothing!

I won’t be staying with them any time soon, not when I have Hilton, Hyatt, and IHG to actively choose from at the moment.

And there are multiple ways to earn Hilton, Hyatt, and IHG points. Even (gasp!) category bonuses.

Would it kill ya, SPG AMEX, to add a bonus category? Congrats on that no foreign transaction fee thing though. #bouttime

As one of the few hotel chains with 5th night free on award stays, though, I have to give them credit where it’s due because that’s really cool.

All this to say…

It’s clearly a personal decision here. And there ARE ways to get huge value from Starpoints.

So with that in mind, if you know someone who’s thinking of opening this card, you can refer them until late 2016.

You’ll earn 5,000 Starpoints per approval, and up to 55,000 Starpoints in a calendar year.

So get crackin’!

Refer the SPG AMEX to your inner circle and earn 5,000 Starpoints per!

Because Starpoints are so hard to earn, this is a tremendous way to earn bonus points if you know someone who’s in the market for the card.

Best of all, it looks like they’ll receive the current offer of 30,000 Starwood points, which is 5,000 more than the usual sign-up bonus. And you’ll get 5,000 Starpoints, too.

I get absolutely nothing if you refer the card in this manner, and you have 5,000 Starpoints to gain.

And of course, if you want to pick one up, feel free to use my links. Click through, and then click “Travel & Rewards –> Hotels” or “Card Type –> Name of Bank.”

BUT, only if you can’t help someone else get 5,000 bonus Starpoints.

If you already have the personal OR business card, feel free to post your email to give or receive a referral in the comments below.

Keep in mind that the spending requirement on the business version of the card is $5,000 in the 1st 3 months (instead of $3,000 like on the personal version)!

Bottom line

I won’t talk your ear off about the various benefits of the cards and all that (that’s obviously well-covered), but just know there’s an offer to refer others to the SPG AMEX personal and business cards. You’ll earn 5,000 Starpoints per referral, up to 55,000 Starpoints per calendar year.

And the offer is good through November 2016.

If you have or need a referral to the card, feel free to post your email below if you’re comfortable doing so.

You can always apply via my links and I am grateful when you do!

Thank you!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

August 9, 2015

AMEX CardMatch Offers Still Available for Platinum, Premier Rewards Gold, Blue Cash Preferred, Gold Delta SkyMiles, and EveryDay Preferred Cards

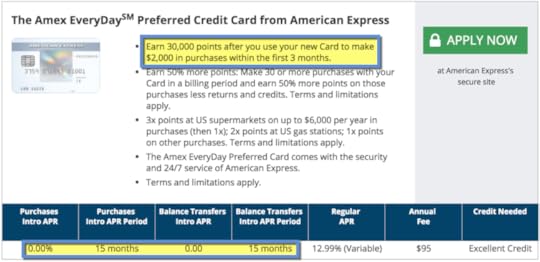

I wrote about an increased offer for 30,000 Membership Rewards points for the AMEX EveryDay Preferred on CardMatch.

Nearly 3 weeks later, the offer is still alive and kicking. And so are other increased offers for AMEX cards.

Here’s a round-up.

AMEX Platinum

Major draws:

Centurion Lounge access

Access to AMEX Fine Hotels & Resorts

$200 annual airline credit

Priority Pass Select membership

100K Membership Rewards points

Typical sign-up bonus: 40K Membership Rewards points

CardMatch sign-up bonus: 100K Membership Rewards points

Annual fee: $450, not waived

AMEX Premier Rewards Gold

Major draws:

3X Membership Rewards points on airfare booked directly with airlines

2X Membership Rewards points at US gas stations and supermarkets

$100 annual airline credit

50K Membership Rewards points

Typical sign-up bonus: 25K Membership Rewards points

CardMatch sign-up bonus: 50K Membership Rewards points

Annual fee: $195, waived the 1st year

AMEX Gold Delta SkyMiles

Major draws:

2X Delta SkyMiles on Delta flights/purchases

1st checked bag free for yourself and up to 8 companions on the same itinerary

Priority boarding on Delta flights

50K Delta SkyMiles

Typical sign-up bonus: 30K Delta SkyMiles

CardMatch sign-up bonus: 50K Delta SkyMiles and a $50 statement credit on a Delta flight

Annual fee: $95, waived the 1st year

AMEX Blue Cash Preferred

Major draws:

6% cashback at US supermarkets, up to $6,000 a year

3% cashback at US gas stations and certain department stores

$250 statement credit

Typical sign-up bonus: $150 statement credit

CardMatch sign-up bonus: $250 statement credit

Annual fee: $75, not waived

Interesting to note: 15 months with 0% APR. So you’ll pay no interest until November 2016 with this offer (if you sign up in August 2015).

AMEX EveryDay Preferred

Major draws:

4.5X Membership Rewards points at US supermarkets (after 30 transactions in a billing period)

3X Membership Rewards points at US gas stations (after 30 transactions in a billing period)

1.5X Membership Rewards points everywhere else (after 30 transactions in a billing period)

30K Membership Rewards

Typical sign-up bonus: 15,000 Membership Rewards points

CardMatch sign-up bonus: 30,000 Membership Rewards points

Annual fee: $95, not waived

Interesting to note: 15 months with 0% APR. So you’ll pay no interest until November 2016 with this offer (if you sign up in August 2015).

Read about my experience getting this card.

How to get these offers

Click through to CreditCards.com.

On the right, click “Free Interactive Tools”

You’ll see lots of tabs at the top. Click the one on the right that says “Free Interactive Tools.”

Again, on the right, you’ll see the option for CardMatch.

Enter in some basic info to generate your offers.

The form takes ~30 seconds to complete

You won’t incur a hard pull by using CardMatch, but you will if you decide to apply for a card.

Bottom line

Just wanted to share.

I’m surprised the CardMatch offers have been around this long, and there’s no telling when they’ll be gone.

These cards are available as of this morning. So if you’ve atchad your eye on one of them, click through to CardMatch to pull up your offers!

Also would be curious to hear if anyone got other offers than the ones listed here. Please comment if you do!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

Discover It Is an Amazing Cashback Card (For the 1st Year at Least)!

Also see:

Get an Easy $600 with the Discover It Card

Yay! Just got Discover It and Citi Hilton 75K cards!

Get a Travel Rewards Credit Card

My new Discover It card came in the mail this week, in very nice packaging.

I activated it online and got about to exploring Discover Deals now that I have full access.

And I might have to change my tune now.

I’ve long heralded the Fidelity AMEX as the best cashback card.

But now I’ll refer to it as the best ongoing cashback card. Because, the 1st year at least, the Discover It has it beat by a mile.

I’ll still get great use out of the Discover It card the 2nd year, albeit much reduced.

The 1st year, this card is good for an easy $600, at least. And I’m even thinking this no annual fee card has the potential for over $1,000 back.

Getting the Discover It card

Discover It packaging – front

Discover It packaging – back

Discover It packaging – the color of the package matches the card

Card, terms, cashback info

Very cool card! Almost a wood grain texture – no info on the front (like the Chase Sapphire Preferred)

Discover Deals

The card is very slick-looking, no doubt about that. And once it was activated, I set about logging into Discover Deals for the 1st time.

Boom!

It was as cool – better – than I thought it’d be.

Keep in mind that you can go ahead and double all the percentages you see.

Until September 30, 2015, new cardmembers get double cash back after the 1st 12 billing cycles.

The doubling doesn’t happen until after the 1st full year. So if you get the card in August 2015, you won’t get the “double” part of “double cash back” until September 2016 – after the 12th billing cycle closes.

So you’ll get a nice haul for the 1st year – and then you’ll get a bit of a cashback windfall. Play the card to its maximum potential and you’re looking at $500 or more on that 13th billing cycle!

I’ll get 10% back from shopping at my beloved Kohl’s.

5% back at Kohl’s

What I think I’ll do is:

Buy Kohl’s gift cards from Staples with the Chase Ink Plus for 5X Chase Ultimate Rewards points

Click through the AAdvantage shopping portal to do so (because they pay out even on gift card purchases)

Then click through the Discover Deals portal to get 10% cash back (after doubling)

Use promo codes, free shipping, Kohl’s cash, and Kohl’s Yes2U Rewards to save even more

Use the Discover It card to pay balance at Kohl’s for 10% more cash back from quarterly category bonus

Bank Ultimate Rewards, American miles, and cash back – and save money while doing it

You could play this strategy for any store, really. And if you don’t have a Chase Ink Plus, you could go right to Kohl’s, Sears, Macy’s, JC Penney, etc. to get portal cash back + category bonus cash back.

In fact, if the portal pays out 10% and you get 5% cash back from the category bonus, you’re effectively getting 30% cashback (10% + 5%, both doubled = 30%).

I told Jay about this and he described it as “insane!”

Pretty much! That’s a fantastic return! And you can stack it with other promos and sales, too.

Lots of department store are at 10% back on the Discover Deals portal

I saw really high payouts for other stores I shop at occasionally.

30% back at shoes.com! They have frequent sales and discounts, too

20% back at The Body Shop is the highest payout I’ve ever seen at this store

For The Body Shop, I could click through the Discover Deals portal and then pay with another card (maybe the 75K Citi Hilton card I just picked up, for example, to meet minimum spending).

But the caveat always is: if there’s any issue with the cashback posting, you’ll have no recourse if you don’t use the Discover It card.

Even still, you get 2% cash back the 1st year anyway on non-bonus purchases with the Discover It card the 1st year. 22% cashback back (10% + 1%, both doubled) is still an incredible deal for online shopping. And 32% cashback in the case of Shoes.com!

Adding it all up

Here’s what really got me going.

Buy a couple of pairs of new shoes from Shoes.com – spend $100 – get $30 back

Spend $50 at The Body Shop – get $10 back

Max out the quarterly categories – get $600 back in a year

Click through Discover Deals and get 20% on all quarterly category spending – get $1,200 more back

Add in purchases here and there with the shopping portal…

It could easily add up to $1,000 – or more – really easily.

Plus I’m sure there will be holiday promotions and random opportunities that pop up.

That’s pretty awesome.

The Discover experience

This is my 1st Discover card, so I was interested to see how it all worked in application.

Getting the card, activating it, setting up the online profile, and downloading the mobile app were all seamless, focused, easy experiences.

The mobile app has lots of powerful functions

The mobile app, in particular, is very robust. You can activate your card, get to customer service, redeem cashback, make a payment, and sign up for promos (and quarterly cashback) right on your phone.

It’s a nicely designed and intuitive app – and the website is equally responsive.

So far, I’m enjoying the “rollout” of the new customer experience. I can see why people rave about Discover. It’s not clunky, and is focused on ease. I didn’t have to click more than 2 times to get to any part of the website or app. Very nice.

I won’t bank with them, though

Discover also offers checking and savings accounts, and you can link your Discover It rewards to them for instant cashback redemptions, which is a nice feature. Currently, the banking accounts are only available if you have a Discover credit card.

But you have to make 100 debit card transactions per month to get the advertised $120 cashback per year.

ONE HUNDRED.

You “can” earn $10 a month ($120 a year), but you’ll have to have 100 transactions per month (!) to get it

I’m sure it’s a nice account and all, but I’m just fine with my Fidelity Cash Management Account with NO ATM fees, and none of that hassle.

The savings account is pretty good is you need one though, and also links up to the cashback rewards.

Actually not a bad rate from an online savings account these days

I’ll stick to my AMEX Personal Savings account, though.

I like that is DOES NOT easily link up to my other accounts. It keeps the savings saved, and I like it that way.

The APY is .90% instead of .95%.

The AMEX Savings Account is truly online-only

With a $5,000 account balance, the difference in the rates would earn you an extra $3 over the course of a year. Not earth-shattering, or worth the hassle of switching, unless you want to easily “bank” the cashback rewards (which could be very substantial!).

And a good option if you need an online savings account – everyone should have one!

After the 1st year

Back to Discover It…

“It” turns into a pumpkin after 12 months.

The 5% cashback in quarterly categories and 1% on everything else… is exactly like the Chase Freedom card, whose points (Ultimate Rewards transferred to Chase Sapphire) I value more.

BUT. I will use this card to maximize the categories – as they do NOT overlap with the Chase Freedom’s schedule, which is nice. Or if they happen to over, great! Once I max out Chase Freedom, I can fall back on Discover It for 5% back.

And 1% cashback… no. I’ll go back to my lagan love, the Fidelity AMEX. 2% cashback there.

Discover It will be a nice fling for the next year.

The thing I love most is the Discover Deals shopping portal. Especially since the FIA WorldPoints Mall closed down earlier this year.

And because it doesn’t have an annual fee, it costs nothing to keep – and might occasionally be very useful.

Bottom line

Holy smokes! I’m newly obsessed with “Discovering” It.

If you don’t have this card and want to pick one up, I highly recommend doing so! You can click through my links (and thank you!).

I’m looking forward to maximizing this card for all it’s worth… and I’m gunning to get $1,000 in cashback, just from the excellent shopping portal alone.

If you sign up now, you’ll also get 10% cashback from Amazon.com until the end of the quarter (which ends September 30th – and so does the double cashback promo for new cardmembers!).

I’ve spoken to a few friends who have the card and all of them have found personalized ways to get value. Considering it has no annual fee and no foreign transaction fees, you have little to lose. And everyone should have a no annual fee card anyway!

Let me know if I missed any ways to maximize cashback on the Discover It card… or if there’s anything to watch out for!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

August 6, 2015

There’s a New AMEX Serve Prepaid Debit Card

Also see:

Exploring Amex Serve for free money and handy uses after April 16th

Bye, REDbird; Hello again, Serve

Seriously tempted by the 75,000 point Citi Hilton Visa offer

It looks like Serve has a new prepaid debit card – and it’s already on the front page of their website.

OBS and NGS (Old Blue Serve and New Green Serve)

AMEX is apparently splitting the “Old Blue Serve” into 2 separate products.

And you can reload the “New Green Serve” at CVS, Family Dollar, Walmart, and 7-Eleven.

$0 “cash reloads” at CVS, Family Dollar, and 7-Eleven… I wonder if you can pay with a credit card?

And New Green Serve has a $4.95 monthly fee – but not if you’re in Texas, New York, or Vermont.

I’m not sure if you can have both products at the same time – or what the split means for Old Blue Serve, if anything.

Aside from the new monthly fee, and the free cash reloads, it looks like the 2 products are exactly the same.

It would be really awesome if CVS took credit cards for the “cash reloads.”

I’d take my new Hilton credit card for a joyride (as it’s one of the only credit cards left that still earns points at drugstores – 3X Hilton points @ $1,000 a month reload limit would equal 36,000 points annually. That’s good for a few Hilton Category 2 hotel stays!).

All of the other terms and conditions – reload limits, ATM fees, etc. are identical.

After switching from Bluebird to Serve then to REDbird, then back to Serve again, I’ll keep my eye on this as it seems like AMEX is still rolling this out. This would be a great way (and convenient) way to manufacture some spend and pay bills you can’t ordinarily pay with a credit card. Especially in the barren wasteland of New York City.

Although if you can’t, I’m perfectly fine collecting my free $240 a year with the Fidelity AMEX.

Mark this one as developing…

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

August 1, 2015

Kohl’s B’day Gift, Free Admirals Club Membership In, Instant FIA Credit Line Increase + Inquiry

Just a few bits and baubles to follow up on recent posts.

1. Kohl’s $10 Birthday Gift

Also see:

Holy crap I love Kohl’s

Confession: I Got a Kohl’s Card

Yay! Just got Discover It and Citi Hilton 75K cards!

August is my birthday month, and Kohl’s got their timing perfect.

Because today, in the mail, was a card/gift from Kohl’s. Right after I mentioned how much I love them this morning.

$10 birthday present from Kohl’s

I also just received my Yes2Rewards this morning as an email, too.

Kohl’s has a great thing going. Their rewards program is more straightforward than Sears Shop Your Way Rewards and their website is way better, they have frequent discounts (usually 30% off) and promotion codes, often free shipping, and now I get a $10 bonus.

I wish their portal payout on the Discover Deals shopping portal was 10% cashback like Macy’s, Sears, and Kmart (it’s 5%).

But free money is great. I can always buy some new sheets and towels for my Airbnbs.

2. Admirals Club Membership Materials Are In

Also see:

Get FREE Airline Lounge Memberships Through Business Programs

If you fly on American Airlines, like, ever, sign up for Business Extra.

Then link your Business Extra account to your AAdvantage account.

When you fly, you’ll earn points. Earn enough points, and you can get a free Admirals Club membership.

I got my membership materials in today. So it does take 4-6 weeks to get them in (although my membership has been active in the system since my signup date).

Admirals Club welcome letter and membership card

There were also some schmancy luggage tags.

Membership card and luggage tag

If you don’t have a Citi Prestige or Citi Executive AAdvantage card, this is by FAR the easiest way to get into the Admirals Club.

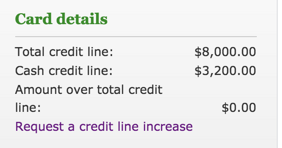

3. FIA Credit Line Increase + Inquiry – Both Instant!

Also see:

Yay! Just got Discover It and Citi Hilton 75K cards!

So I only got 2 new cards today, the Discover It and Citi Hilton Visa.

But then I thought, “Why stop with new cards?”

When I login to the Fidelity AMEX site, there’s a link that says, “Request a credit line increase.”

While I was on a roll, I clicked it.

They asked how much credit I wanted. I’d been approved by Citi for a $7K credit line earlier in the day, so I went for $8K.

Instantly approved for new credit

10 seconds later, I had it. I logged out and back in again, and the new credit line was there.

New limit was updated right away

I kinda wondered if I should’ve gone for higher. But nah, I don’t even need $8K, really.

Not 2 seconds later, I got an email alert from Credit Sesame.

Odd that they report this one right away but not the others from this morning!

It was FIA (instead of, ya know, Citi or Discover).

They use TransUnion, in case anyone’s interested.

Red-handed

I did the same for my Kohl’s account. With a few clicks, I lowered my debt-to-available-credit ratio and am on my way to an improved credit score. I don’t think Kohl’s pulled my credit. If they did, it was soft. I wasn’t asked to confirm any info like with FIA.

Are there other banks that will approve a credit line increase instantly via online banking?

Interesting how these things are reported and work on practical terms.

(And now to give my credit report a break. Next time, I’m gonna get the Citi Prestige.)

Anyone else have anything exciting going on this weekend?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

I Haven’t Washed My Hair in a Month – and It Feels Great!

Also see:

Must-Haves of Travel: Coconut Oil

Must-Haves of Travel: Apple Cider Vinegar

Must-Haves of Travel: Activated Charcoal

Yup!

I know, it sounds kind of weird. I was like, “What the hell am I getting myself into?”

But it’s been a month and I haven’t used any shampoo. And it feels great!

What’s No ‘Poo?

Link: The No ‘Poo Method

Link: No ‘Poo on Reddit

“No ‘Poo” is “no shampoo.” I have no idea why it’s abbreviated to “no ‘poo.” Because it sounds like you’re aren’t ever going to poop again.

But nope! No ‘poo means you cut out shampoo once and for all. And replace it with baking soda and/or apple cider vinegar.

There’s a surprisingly huge section of Reddit devoted to people’s experiences with it. And amazingly, you won’t turn into a dirty hippie!

The idea is that normal shampoo has dozens of chemicals in it, and you’re putting them into your hair every day.

All the crap in an ordinary bottle of shampoo

So I picked up the shampoo I was using and turned it over. Sure enough, there was a whole laundry list of stuff I couldn’t pronounce.

What’s “Hydroxypropyltrimonium chloride?” It sounds like something that’s gone through a lot of processing.

What about “Methylchloroisothiazolinone?” I’m out.

What I did

I don’t know why, but I don’t like the idea of using baking soda. It seems harsh, although others swear by it.

So I made my own version.

Here’s how.

I took an ordinary spray bottle and put in the tiniest bit (maybe a teaspoon) of coconut oil – for conditioning. (This brand is great for skin and hair.)

Then, I filled the bottle slightly under halfway with apple cider vinegar. (This brand is best because it has the good enzymes that make it effective.)

Then I topped it off with filtered water.

It looks something like this:

My new “shampoo” and “conditioner”

I keep it in the shower. When I get in, I give it a shake, then spray it on my hair and let it set in for a few minutes.

To rinse it out, I rub my scalp with my fingers and let warm water run through.

Then, I dry with a towel, style as usual, and get on with my day.

The spray bottle mixture lasts a couple of weeks. (I’m on my 2nd batch after a month.)

Because I use very little coconut oil, the container I have would easily last me a year or more if I just used it for this. But I use coconut for many other things, too!

And the ACV… I get the 32 oz. bottle and that lasts me a month or so. I use it to clean, cook, as a facial toner, etc.

I estimate I’m paying about $4 a month to wash my hair now. Before, I was spending $10+ each on shampoo and conditioner.

How it’s feel?

I never had a “breaking it in” period with my hair. It’s been a good change from Day 1.

I can’t tell any sort of difference between shampoo and no ‘poo, and NO, it does not smell weird.

#BBHMM!!! #eastvillage #Manhattan #nyc #latergram

A photo posted by Harlan Vaughn (@harlanvaughn) on Jul 26, 2015 at 9:41am PDT

(Feel free to follow me on Instagram!)

My hair feels soft and with more body than before, and it’s also lighter in color. I realize before it always felt sort of “dingy.” And it smells like… nothing.

The vinegar scent evaporates on its own, and is then scent-free. Maybe very, very faintly it’ll smell of apples.

Even in the humid, disgusting, stinky, filthy New York City summer, I haven’t had an issue keeping my hair and scalp clean.

Now I’m thinking, if it feels the same – better even – than before, why go back to chemicals?

I don’t feel oily, have buildup, itchiness, or anything like that. And I love to use natural products to replace chemicals whenever I can.

Bottom line

This is just another step in discovering how to get more all-natural products into everyday life. (Remember when I did oil pulling for 6 weeks?)

Coconut oil and apple cider vinegar (this brand and this brand, respectively) have been the crux of my transition. (Shout-out to activated charcoal as a toothpaste!)

Anyhoozers, life has gone on and my hair feels great! Lighter in color, soft, and clean. I’m very pleased with the results so far and will continue with no ‘poo.

I have yet to test it on the road… but I get my chance in 2 weeks! Looking forward to it.

Does anyone else do no ‘poo? Ever heard of it?

Would you try it?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com