Harlan Vaughn's Blog, page 63

July 16, 2015

Bumped From a Flight? Get AirHelp.

Also see:

New App Alert: AirHelp. Know Your Options When You Get Bumped from a Flight

Travel Insiders: Travel on the Cheap with “Out and Out”

Out and Out is starting a partnership with AirHelp.

AirHelp is an app for filing claims when you’re involuntarily bumped from a flight

I’ll be doing a few posts for their blog where I’ll talk about travel tips and experiences beyond the usual points and miles stuff.

Check out my first post!: Travel Insiders: Travel on the Cheap with “Out and Out”

What’s AirHelp?

I’ve written about AirHelp before, back in 2014. That was when the app was more Euro-focused.

And while there’s still an emphasis on European airlines and regulations, AirHelp has expanded considerably into the US market.

AirHelp’s goal is to keep up with the rules for delays, cancellations, and bumps of all the various airlines. And to begin helping you the moment anything happens.

Through the app, you can start filing a claim at the airport.

It’s powerful because it lets you take action right away, which is incredible.

They also devote a section of their website to educating you about your rights.

Do you know what you’re entitled to if you’re involuntarily bumped from a flight within the US?

Yeah, I didn’t either.

Here’s the answer, for the record:

After the 1-hour mark, you have a claim

Why download AirHelp?

Think of it as insurance: you hope you’ll never use it, but it’s nice to know you have it.

I recommend downloading the app (it’s a small download) in case you’re ever denied boarding.

Also remember that certain credit cards, like the Chase Sapphire Preferred and AMEX Platinum, come with built-in trip cancellation and delay insurance.

And now AirHelp is another added layer of protection.

They’ll charge you 25% of your claim if they’re successful. It could be worth it because they take care of everything for you. And you can start a claim on your phone.

If you think of other questions, they have a compendium of FAQs that’s worth a looky-loo.

Plus, they’re based in NYC. Hometown love!

Bottom line

Out and Out is thrilled to be featured on AirHelp’s blog with unique content, tips, and stories.

I personally have the app on my phone – and I hope I never get the chance to use it.

AirHelp was built to get you money when the airlines are on their worst behavior. With oversold flights, and delays that happen because it’s raining somewhere in North America, you might want to download the app just in case.

They’ve had great success so far with helping people when they feel powerless. I love the goal and tone of this company and am looking forward to sharing more content in the upcoming months.

Have you used AirHelp? If you’ve never heard of it, will you download the app now?

Don’t forget to follow me on Instagram and Twitter!

And if you need a travel rewards credit card, thank you for using my links!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

Radius Bank + SmarterBucks isn’t gonna work for me (but could maybe help you)

Also see:

Search SmarterBucks & Radius Bank Unlimited 1% Cash Back Toward Student Loan Debt

DTMFA: Barclaycard Arrival Plus. Still a good card?

I was excited to explore this dark alleyway of the internet, because there are so few rewards debit cards left.

No bueno

This one, through SmarterBucks and Radius Bank seemed like it was gonna be a doozy. But, unfortunately, it’s pretty worthless, for me at least. I’m gonna have to DTMFA.

I’ll explain.

Does NOT work with Evolve Money

I was a little disappointed about this because the debit card offered by Radius Bank is a true debit card, unlike say, the PayPal Business Debit MasterCard.

I also wanted to find a way to make Evolve Money useful somehow. But nope, it continues to be a suck, a drain, a waste. There is literally no use for their service, except maybe to meet minimum spending requirements.

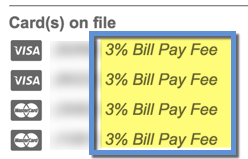

All this to say I was expecting the debit card to be fee-free on Evolve Money. But nope. For some reason, it’s got that 3% service fee tacked on to it.

Look at this little row of uselessness

My thinking/hope was that I could funnel money into Radius Bank, then pay my student loan with my new, real debit card. And then get another 1% applied toward my student loans via the debit card rewards.

There are a few ways to think about how the 1% would have worked. But, it doesn’t. So.

I can’t use it with RadPad – but maybe you can

My other thought/hope was that I could use the Radius Bank debit card with RadPad, a service I really enjoy using.

In theory, in should work.

But, I noticed when I got the debit card there was no daily spend limit included.

I assumed they would be the usual $5,000 per day.

You know what they say about assumptions…

Nope, just me

I asked the customer service lady, uhhh…

– What’s the daily spending limit?

– $2,000.

– Can I raise it?

– No, sorry. You can call us to temporarily raise it.

– It would easier if I could raise it just a little, even to $3,000.

– Here’s a short pier. Take a long walk! (In not so many words.)

Sorry, but the rents I pay with RadPad are all more than $2,000 (as sad as that is).

For me to call each and every time, every month, to get a transaction to go through, and then to risk it not going through, is something I can’t do.

FWIW, the limit on the debit card I use now via my Fidelity Cash Management account (the best!) is $5,000 per day and that’s just great. So I’ll just keep rocking on with that.

Sorry I tried to leave you. I’d like my Stockholm Syndrome back, please. Thanks.

But the upshot is… if your rent is under $2,000, Radius Bank + RadPad might be great. At the upper range, you’d score an extra $20 a month toward your student loans for paying your rent. I was hoping to earn even more than that, but the daily limits don’t jive with what I need.

But if it could work for you, sign up for SmarterBucks, and follow the links to open an account with Radius Bank.

Bottom line

I was hoping the debit card from Radius Bank + SmarterBucks would play nicely with Evolve Money and RadPad.

Unfortunately, Evolve Money imposes a 3% fee on bill payments, rendering the card as useless as a hole in the head.

And with RadPad, well. The $2,000 daily limit on the debit card doesn’t help me at all. But maybe it’ll help you.

I am still praising humble beginnings. And I’m still scrappy. But I’m gonna have to pass on this one.

If you could use a new rewards debit card, consider this one. I wanted to share in case maybe it could be useful for you.

If you’re interested, sign up for SmarterBucks to get started.

Have you heard of Radius Bank or SmarterBucks? Does anyone currently use either?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

July 15, 2015

Grand Opening: Choice Hotels Opens First Cambria Hotel & Suites in Manhattan

The Cambria Hotel & Suites in Manhattan celebrated its grand opening on July 14, 2015.

Cambria is part of Choice Hotels, and the Chelsea location is the first in New York!

Out and Out was excited to attend the grand opening celebration, and to talk with key members of the Choice Hotel senior management team about the hotel and Choice Privileges, the hotel chain’s loyalty program.

Cambria Hotel & Suites Grand Opening in Chelsea

Location: 123 West 28th Street, New York, NY 10001 (between 5th and 6th Aves)

Because the new Cambria is located in New York’s Flower District, most everything was flower-themed. Including the drinks!

Right outside, there was a bar serving blueberry lavender mojitos.

Even the drinks were flower-themed

Blueberry lavender mojitos. I only had one ;)

Inside was packed!

There were 3 more bars. 1 with regular drinks on the 1st floor. A champagne bar in the basement. And craft beers on the roof, beyond the 18th floor.

There was also a buffet with selections from local restaurants, gourmet desserts, and hors d’oeuvres every time I turned around.

Peanut butter and chocolate chip cookies from Ovenly on the roof

There was also an art studio with artists creating new artwork for the lobby.

3 artists created new artworks during the opening

Lovely decorations

But the real highlight was getting to hear the members of Choice Hotel management talk about everything that went into the creation of a brand new hotel in Manhattan. Extremely fascinating stuff.

We got to hear from Steve Joyce, the President and CEO of Choice Hotels, speak about opening the property

Packed house

We also got to hear from Michael Murphy, SVP of Upscale Brands at Choice Hotels, and the owner of the hotel, Rob Chun.

The team behind the new Chelsea Cambria location

Everyone spoke in-depth about how long it took to get the hotel open (3 years), how long it took to build (over a year), and what their goals are with the property.

But what really struck me was how grateful and positive everyone was. It was really nice to hear everyone speak, and to see the humanity behind the business.

And it got me more interested in the Choice Privileges loyalty program.

The property

I snapped some pics of the brand new guest rooms and a few other areas of the hotel.

First, the penthouse apartment with a king bed, and 2 rooms.

King bed in the penthouse apartment

Living room

Desk

Pretty much

And then over to the double queen rooms.

2 queen beds

Seating area

Which pulls out into a bed

Another desk setup

Throughout, lots of clean, modern touches, hardwood floors, TONS of closet and storage space, and bathrooms with walk-in showers.

Showers at the Cambria

The Cambria Hotel & Suites had a soft opening in April, and lots of guest have posted their own photos on TripAdvisor.

It’s also already ranked #54 out of 469 New York hotels. I only see this number going up as it’s a beautiful property!

Oh, and the roof. Always amazing to be high above the city.

View from the Cambria roof deck

Grand opening floral decorations

Rooftop lounge seating

Thoughts about the branding

The amiable guys I spoke with told me they’re specifically targeting both millenials who travel infrequently, and business travelers in town working with any of the companies in the area, like Google, Spotify, or AMEX.

That’s because the business travelers want to be near their work or meetings. And millenials will be drawn to the location and no-nonsense branding of the hotel.

The Cambria slogan is “Where everybody is somebody.” They don’t fuss with priority check-ins, or have meaningless low-tier elite levels.

So they’re trying to grab people who only travel maybe 3-4 times a year, don’t have status, and don’t want to bother with status.

As far as branding, from a millenial’s POV, it’s a little sterile.

I’d overhaul it

And clicking around the website trying to learn about the various elite levels, how to earn and redeem points, and rules of the program was an exercise in clicking and scrolling. I pieced it together just fine, but I could see how others could get frustrated.

For example, I saw that I’d earn bonus points as an elite member.

That’s great! But what’s a point based off of? I’m guessing “X” number of points per $1 spent. That took some clicking around.

And then more clicking to see how I could use the points.

I’d say maybe add some graphics and tables to lay out their info. It’s currently described in long sentences without any paragraph breaks.

I’d like to see this as a table. Or picture

I’d like to see the branding mission extend beyond the hotel and throughout the website, especially for the Cambria brand.

I just simply don’t expect that much from the other Choice Hotel brands:

Choice Hotel’s other brands

But for Cambria and Ascend, the other Choice Hotels brand, I want a little more.

But since they’re targeting people who don’t want to bother with status anyway, perhaps they don’t have to change anything. And just keep focusing on the property instead of where it falls within the overall Choice Hotels umbrella.

Either way, it’s certainly interesting to think about, as the hotel is still brand new.

Huge props tho

They have a whole section on their website for LGBT travelers.

Love this

Including upcoming events, and local gay bars!

And it’s accessible from the hotel’s front page!

It’s a great touch. And trust me, it’s not lost on LGBT travelers.

Very tastefully done, and very appreciated. I’m glad they added a little nod to the history of the Chelsea neighborhood.

The future of Choice Privileges

I guess I didn’t realize how robust the Choice Privileges program actually is.

They have a lot of ways to earn:

Earn Choice Privileges points

And a lot of ways to redeem:

Redeem Choice Privileges points

And apparently they’re adding more – and easier – ways to both earn and redeem.

I haven’t gotten into the ins and outs of Choice Privileges yet.

But after speaking with lots of the higher-ups about the program, I can tell it’s definitely on their mind. And they’re willing to shake things up a little.

I’m looking forward to seeing what they do!

Bottom line

It’s always cool to see how something was created, and to hear the story directly from the people who made it happen.

That happened last night with the new Cabria Hotel & Suites here in New York.

It’ll be interesting to see how Choice Hotels positions themselves in the New York market, and how the Choice Privileges program develops along the way.

And what a treat to discuss strategy directly with the people who oversaw the building of the hotel. I’m sure the property, and any future plans they have for it, will be a success.

Wanted to share this look behind the scenes. Hope you guys enjoyed it.

Thanks to the team at Cambria Chelsea for having me!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

Upgrade Barclays Red Aviator to Silver Automatically Online

Also see:

New Barclays AAdvantage Aviator MasterCard: Will you still get the 10,000 mile anniversary bonus if you upgrade?

If you’re interested in upgrading your Barclays Red Aviator card (not open to new applicants), it might be possible to do so directly in online banking.

View from the Wing reported that Barclays was slowly rolling out the upgrades, and listed some reasons why you may NOT want to upgrade the card.

To Upgrade or to Not Upgrade, That Is the Question

Me, I’m not gonna do it.

Because I have 10,000 American miles coming my way when I pay the annual fee again.

Here’s how you can tell:

Click “View Rewards”

And then…

Click “How my rewards work”

There, you’ll see something to this effect:

I only get one round of 10K. But others get 10K EVERY cardmember year. They should NOT upgrade to Aviator Silver

I’ll get the 10,000 AA miles once and then consider upgrading to Aviator Silver.

But if you don’t see such language, you might consider making the upgrade now.

Check your account

In my account, the offer was on the right side, under Barclaycard extras:

Click to start, then 2 more clicks to upgrade to Aviator Silver!

It just says, “Upgrade your Account Benefits.”

When I clicked through, I was invited to upgrade to Aviator Silver.

Click “Tell me more” to proceed

After I clicked, I got a long list of details. Including that the upgrade would happen on August 7, 2015.

Page 1 of details

Page 2 of details

If I’d clicked “Yes, I accept,” the card would’ve been upgraded and the annual fee charged on November 30, 2015.

Should you do it?

I’m holding off to get my 10,000 AA anniversary miles. But if I didn’t have that coming, I’d definitely be tempted by this offer.

When you upgrade, you get:

3X AA miles on AA flights

2X AA miles on hotels and car rentals

1X AA mile everywhere else

5,000 EQMs when you spend $20,000 annually (can get up to 10,000 EQMs)

$99 companion certificate when you spend $30,000 annually

Free Global Entry (as a statement credit)

So this card is really only worth it if you have a lot of paid flights on American Airlines. Or if you want the opportunity to “buy” EQMs instead of fly to attain/retain status each year. Hey, 10,000 EQMs is 2 round-trip transcons!

$195 is pretty hefty for an annual fee. But no other card earns 3X AA miles, which are extremely valuable (for now). If you can met the various spending thresholds, EQMs are very valuable, too. And the $99 companion cert if a nice bonus – if you can actually use it.

So it’s a personal decision for a niche crowd. Also consider this card is not available to new applicants. So if you can get it now, go for it.

Bottom line

Barclays is finally loosening the requirements to upgrade from Aviator Red to Silver. I was able to do it in 2 clicks directly in my online banking.

This is great news for a select set of people to whom this card caters.

But if you can wring the benefits out of it, like the EQMs, 3X AA miles, and $99 companion certificate, it would be well worth the $195 annual fee.

Do you have the option to upgrade? If you do… will you?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

July 13, 2015

My Top 5 Hilton Category 2 Hotels for Award Stays

Also see:

Seriously tempted by the 75,000 point Citi Hilton Visa offer

I looked through the Hilton Category 2 hotel list to see what gems I could unearth from that piece of barren internet.

I was surprised to find lots of hotels (131, to be exact) all over the US and Europe (and globally). I pulled out my Top 5 picks.

In particular, I’d like to maximize the 5th night free benefit that Hilton gives to all of its elite members.

Here are 5 Hilton Category 2 hotels where I could see myself spending 5 days.

Note: Prices are based on travel in September 2015 and are after taxes as shown on the checkout screen.

1. DoubleTree by Hilton Hotel Bratislava

I had a great time in Bratislava last year. I stayed at the Park Inn by redeeming Club Carlson points. Now that Club Carlson is dead to me, I likely wouldn’t stay there again.

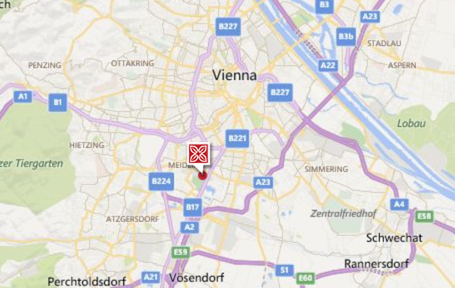

Location of the DoubleTree by Hilton in Bratislava

Instead, I’d go for the DoubleTree by Hilton Hotel Bratislava. It’s not as well-located as Park Inn, but I figure I’d deal like always.

~$553 or 40,000 Hilton points @ 1.4 cents per point

1.4 cents for a Hilton point is pretty good!

I could totally imagine exploring Bratislava for 5 days, with a day trip in Vienna for one of them.

#Bratislava – what a cute town! #Slovakia

A photo posted by Harlan Vaughn (@harlanvaughn) on Oct 4, 2014 at 9:41am PDT

I really liked Bratislava!

2. Hotel Vienna South

Thought this was interesting. It’s slated to join Hilton’s Garden Inn brand in early 2016, but you can redeem Hilton points there now. If I didn’t stay in Bratislava again, I’d definitely stay at the Hotel Vienna South.

Viennese wine on a beautiful day in #Vienna #Austria #wine #Wien

A photo posted by Harlan Vaughn (@harlanvaughn) on Oct 2, 2014 at 5:55am PDT

Unlike the Park Inn situation in Bratislava, the Hilton location is better located in Vienna than the Park Inn is. (What a weird sentence. It makes sense though, yeah?)

I like this location a lot more than the Park Inn’s (which is on the other side of the river)

This hotel would cost ~$764 if I paid in cash. So I’m actually getting 2 cents of value per Hilton point when I use the 5th night free benefit.

I’d get to spend 5 nights in Vienna… and save a lot of money!

Not only that, but the signup bonus on the Citi Hilton Visa is damn near enough to do this twice!

3. Hampton Inn & Suites Mexico City – Centro Historico

Mexico City is one of those cities I’ve always wanted to visit. And ignorantly, I’ve always been intimidated by its size.

I know what I’d like to do, though. The same thing I do in any new city: check out the museums and visit the gayborhood. Mexico City’s gay area is called the “Pink Zone.” Isn’t that awesome?!

Not only that, but gays in Mexico recently got the right to marry (congrats to them)!

The Hampton Inn is in the Centro Historico, which I guess could be cool, too.

Chase IHG MasterCard Sign-Up Bonus Counts Toward Spire Elite Status!

Also see:

I broke down and got the Chase IHG Rewards Club credit card

*Gay gasp!* IHG says I can stay local for Set Your Sights promo

Update 7/13/15: Some peeps are reporting their sign-up bonus is NOT counting toward Spire elite status. I got my Chase IHG MasterCard in February of 2015. If you got the card this year, it’s worth checking to see if the sign-up bonus counts toward Spire status. Also, for some at least, ALL of the spend on the Chase IHG MasterCard counts toward Spire status!

I was all hot-n-heavy for IHG for a second there. I was targeted to receive 80,000 IHG points on the Chase IHG MasterCard and I thought you know what, OK. So I got it, met the minimum spend and then… never used it again.

I logged in today to see how many IHG points I had, and noticed I’d been upgraded? To Spire?

I mean, yeah, that’s cool, but… how?

Then I dug a little and realized…

The sign-up bonus counts toward Spire

I haven’t stayed at an IHG hotel since the fantastic InterContinental in Sydney.

All I did was get the Chase IHG MasterCard, register for the “Set Your Sights” promo, and meet the minimum spend.

But apparently the 80,000 points I earned from the Chase IHG Visa overqualified me toward Spire, which requires 75 nights at IHG hotels or 75,000 elite qualifying points.

All points earned from the Chase IHG Visa, including the sign-up bonus, counts toward Spire status

Here’s literally all of the activity in my IHG this year:

All the Chase IHG MasterCard Activity adds up to all the IHG EQPs I’ve earned this year

And as you can see, after upgrading to Spire, I was given the choice to add 25,000 IHG points to my account -or- gift IHG Platinum status to a friend.

I took the 25,000 IHG points and ran!

Yay-isss!

So when you think about it, I actually got over 100,000 IHG points for opening the Chase IHG MasterCard. Because the bonus alone was enough to earn Spire, and then IHG gave me 25,000 more points.

And, I’ll have the status until the end of 2016. IHG says:

Once you have earned the newest membership status in any calendar year, you will maintain such status until the end of the following calendar year.

So that’s kinda… awesome!

Bottom line

The upgrade to Spire makes me want to plan more IHG stays so I can earn 100% bonus points… and see how good the upgrade situation really is and assess elite treatment.

I might go out of my way to stay at more IHG properties this year, if only for the sake of using IHG points. To be continued…

Was anyone else auto-upgraded to Spire?

Thank you for using my links to get a travel rewards card! Right now, the bonus on the IHG card is 60,000 IHG points after meeting the minimum spending requirement of spending $1,000 on purchases within the first 3 months of account opening.

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

Seriously tempted by the 75,000 point Citi Hilton Visa offer

Also see:

Get an Easy $600 with the Discover It Card

DTMFA: Barclaycard Arrival Plus. Still a good card?

I’m dumping the Chase British Airways Visa – and you should, too

I sense an app-o-rama coming on after pondering the benefits of the Discover It card. And now the Citi Hilton Visa has its highest-ever 75,000 point bonus. I heard this offer was ending on August 31, 2015.

Some cards simply aren’t worth keeping any longer, like the POS that is the Barclaycard Arrival Plus and the completely, utterly, insanely useless Chase British Airways Visa (RIP to both. I’ll bury you next to Club Carlson).

Kinda sorta semi-interesting

But, out with the old, in with the new.

What’s so dang special about the Citi Hilton Visa?

For one, its earning structure:

3 Hilton points per $1 at… drugstores?!

Are they crazy? 3X at drugstores is asking for it, no?

If I max out the $4,000 limit on PayPal My Cash cards, that’s 144,000 Hilton points per year ($4,000 x 3 points per dollar x 12).

Not bad!

Maximizing Hilton points

If I’m strategic, each month I’d earn 2 nights at a Category 1 property or 1 night at a Category 2 property… and there are a lot of Hilton Category 2 hotels all over the US and Europe.

If I’m doubly strategic, I can save up some points and get the 5th night free on a 5-night award stay.

5 nights at a Category 2 hotel costs 40,000 points. So the sign-up bonus alone would be good for 10 nights at Category 2 hotels.

And 20 nights at Category 1 hotels! Useful if you want to go off the beaten path.

I already have Hilton Gold status through FoundersCard, but this card does offer Hilton Silver status automatically, which unlocks the 5th night free benefit.

I wish it offered an ongoing annual benefit for renewal, but since it’s a Citi card, you can’t rule that out. Citi is known to have generous, aggressive retention offers.

Because it’s a no annual fee card, you can get the points and throw it in a drawer if you hate it. And let it age your credit accounts.

A good deal considering it doesn’t have an annual fee – but not as good as the Amex no annual fee Hilton card.

Still, for 75,000 points… I’m thinking of pulling the trigger on this one.

Bottom line

So interesting to see the sign-up bonuses on various cards come and go, benefits get added and taken away, devaluations, and new perks… and how they all tie in together.

If you can live with Hilton’s categories, maximize the Category 1 and 2 properties, and take advantage of the earning structure, this card might be a good one to add to the arsenal.

If you hate it after the initial sign-up bonus, who cares? Throw it in a drawer and let it age your other credit accounts. And Citi is known for retention bonuses, so you might get an annual injection of Hilton points by calling and asking.

I’m thinking of doing it… 5 nights for the price of 4 at a Category 2 hotel costs 40,000 points, so the sign-up bonus on this card right now would be good for 2 such jaunts.

Is anyone else thinking of getting in on this offer?

Thank you for using my links! (And yes, the 75K offer is available there!)

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

July 11, 2015

Is United allowing discounted 1-ways and stopovers on award flights?

I was poking around the United website and messing with the award search cuz duh that’s an awesome way to spend a Saturday night.

I noticed something weird. I’m not sure if it’s a glitch or pricing error or a legit award booking or what.

But I wanted to share it with you guys in case someone has a better answer.

Here’s what I found.

United is discounting First Class round-trip award flights with a one-way added

Here’s what I searched:

LAX-NYC-LAX (round trip)

LAX-IAH (after a stopover)

Pricing at 65,000 miles.

Now, United isn’t supposed to allow free one-ways or stopovers on domestic itineraries any more according to Milevalue (although you can still get a free one-way on international itineraries and mainland US to Hawaii award flights).

So following that logic, 50K is the standard price for a round-trip First Class award.

And a one-way would be 25K.

But instead of pricing as 2 tickets, it’s letting me book all 3 flights for 65,000 miles. A 10K discount.

Round-trip First Class award with a discounted one-way LAX-NYC-LAX-IAH

It gets weirder when I mix cabins. A free one-way?

When I book the 1st flight in economy and the next 2 in First Class, the price it spits out is 50,000 miles.

That means I’m paying for 2 legs at the price of 25K for a First Class one-way.

But what about the leg in economy? It’s free.

A free one-way after a stopover on a domestic award booking with mixed cabins?

Also weird was that I was able to replicate the pricing with partner awards on European award flights.

When I looked into it, I can book something like:

AMS-CDG in economy

CDG-AMS in business

AMS-somewhere else in business after a stopover

It prices at 45,000 miles.

Round-trip awards in business are supposed to be 60,000 miles.

Partner award flights are pricing weird, too. Instead of 60K round-trip it’s 45K

So not only do I get a free one-way, but I get a 15K mileage discount, too.

What else is glitching?

This is as far as I’ve gotten. But I’m wondering if you can add the free economy one-way after a round-trip First Class award flight (I couldn’t find any examples… yet.)

FWIW, I can replicate the discount from the all-First Class example with all-economy flights, too:

This “should” price as 37,500 miles

But it’s more like a 2,500-mile discount.

On the beta website, it prices the 1st leg at 17.5K miles. And then the next 2 at 8.8K miles each.

Same results on the beta site

Bottom line

I haven’t actually booked any awards, so it could all error out before the final pricing screen.

I tried to find info about this on the ye olde interwebs but couldn’t find anything, so apologies if this is old news.

It seems United is pricing 1-ways and stopovers as either free or with a discount. I can force this with partner metal, mixed cabins, and all-domestic itineraries.

Is this a known error… or a new glitch?

Anyone know anything about this?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

Get an Easy $600 with the Discover It Card

Also see:

DTMFA: Barclaycard Arrival Plus. Still a good card?

Is the Fidelity Amex the best cashback card in the universe?

Sorry if that headline sounds clickbait-y but I’m seriously considering getting the Discover It card.

I’m not crazy about the name of the card. It’s hard to refer to “It.”

I might discover… It

– Where’s my “It”?

– Your what?

– My “It!” Discover “It!”

– You’ve lost your damn mind.

But no for reals when I looked at the categories and did the math, I thought how lucrative this no annual fee card could be.

The cashback of the Discover It

Discover offers 5% cash back in rotating quarterly categories on the first $1,500.

So what? The Chase Freedom card has that too. 5% of $1,500 is $75. Over a year’s time, that’s an easy $300.

But Discover will double the cashback after the first 12 billing cycles for:

5% categories

Daily spend

Portal shopping!

Not only that, but the 5% categories are good.

Discover It’s 5% Quarterly Cashback Calendar for 2015

Restaurants, Amazon.com, and department stores? Hell yeah, I can max the crap out of those. So I’ll get $75 each quarter. $300 a year. And then get it doubled to $600 after the first 12 billing cycles. Hellz to the yeah.

The shopping portal is interesting

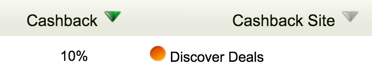

While I can’t access the Discover shopping portal yet, I can see from Cashbackholic that the payouts are up to 10%.

Which would double to 20%.

And if you found the magic combination of 10% portal payout + 5% bonus category, that’s 15%.

Which would double to 30%.

30% cashback is pretty freaking incredible. Especially when you consider that portals advertise discount / promo codes, too.

Like Macy’s.

30% cashback at Macy’s is a good deal!

Even 20% cashback is good. Like at my beloved Kohl’s.

20% cashback from Kohl’s

In fact, there’s a quintuple dip opportunity with Kohl’s:

1st dip: 5% cashback

2nd dip: 5% portal bonus

3rd dip: Double cashback

4th dip: Kohl’s cash + Kohl’s discounts from portal

5th dip: Kohl’s MVC status / free shipping

Say you spend $100 at Kohl’s.

You’d get:

$5 back from Discover It

$5 back from the portal

$10 back from double cash promo

$20 back in Kohl’s cash

Plus whatever discounts you added when you checked out

So that’s… pretty incredible.

Other perks

The Discover It card has:

No annual fee

No foreign transaction fees

Minimum cash back redemptions starting at 1 cent

Free FICO credit score

0% APR for 12 months

Balance transfers are 3%, but this could be a good way to float a balance for a year if you need it

For a card to have no annual fee and no foreign transaction fees is a pretty rare combo.

And for that reason, you can keep the card forever to help age your credit accounts. And to take advantage of any other promos and quarterly categories in the future.

And if you have the Chase Freedom card, you can max out the Freedom 5% categories AND the Discover It categories.

Max them both out the 1st year you have your Discover It card and get $900 back ($600 from Discover It and $300 from Chase Freedom).

For 2 no annual fee credit cards, that’s an amazing deal.

Caveats

Discover isn’t as widely accepted as other cards. But for online shopping, you’ll be fine

Don’t max out the categories on stuff you don’t need just to get the cash back. That makes no sense

Don’t carry a balance unless you’re taking advantage of the 0% APR or have a damn good reason

Some peeps may find it hard to remember the various categories and quarters and bonuses on multiple cards

In fact, going along with the last point, some may prefer the Discover It Miles card instead. It has a flat 3 “miles” per dollar spent AND has the same double miles offer that the Discover It card has.

You’ll also still gain access to Discover Deals to get the great portal bonuses.

Bottom line

I think I’m gonna snap up this card in a couple of weeks. That way, if the 3rd quarter bonuses repeat again next year, I’ll have a whole month to take advantage of Amazon.com and department stores in Q3.

The Discover It card has my attention, especially consider the fantastic double cash promotion for new cardmembers.

The 5% cashback categories are an easy $600 the 1st year. And when you factor in portal bonuses, no annual fee, and many ways to combine it with other deals, it really increases the value proposition of the Discover It card.

Only downside is that there’s no sign-up bonus. But to get an easy $600, I think I can get over it.

Both the Discover It and Discover It Miles cards are accessible via my links – and I thank you for using them!

What’s your take on the Discover It card? Hell yeah or not so much?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

July 5, 2015

Admirals Club Passes Giveaway Winners!

Thanks to everyone who commented on Giveaway: 5 Pairs of Admirals Club Day Passes ($100 Value!)!

I was kinda blown away by the number of comments!

It came down to sheer randomness, literally. I used random.org and picked 5 numbers. The first 5 numbers were the winners!

Enjoy the Admirals Club!

They are:

R Hirsch

JamesP

Allan

Mary

Dee

I’ll be in touch with each of you about where to send your Admirals Club passes. Congrats!

Ways to keep up with the blog

Facebook page

Twitter and Instagram are my personal accounts. I post on those the most so be sure to follow me on both!

I often write about things I find handy or ways to save money. There are two ways to ensure you never miss a blog post:

Subscribe with RSS on a reader like Feedly, Digg, Pocket, etc. (I prefer Feedly.)

Sign up for daily emails. Only receive an email when I post – and if more than one a day, you get only one email. Never any spam.

Ways to support the blog

If you like what you see here, I appreciate any kind of support, whether it’s using my links for services I like, or to pick up a new travel rewards credit card.

I’m aggressively working toward paying off my student loans so any clickage is infinitely appreciated!

Bottom line

It was a pleasure being featured on BoardingArea for the week!

Thanks again to all who entered the giveaway! I hope you’ll continue to follow Out and Out.

Winners, I’ll be in touch shortly about where to send the passes – enjoy the Admirals Club, whichever one you pick!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com