Harlan Vaughn's Blog, page 62

August 1, 2015

Yay! Just got Discover It and Citi Hilton 75K cards!

Also see:

No Annual Fee Cards + Personal Finance: Why You Need (At Least) One

Get an Easy $600 with the Discover It Card

Seriously tempted by the 75,000 point Citi Hilton Visa offer

Get a Travel Rewards Credit Card

I took my own advice and got 2 new no annual fee cards.

This morning, I assessed my credit card situation and thought about how I could improve my strategy moving forward.

Both of these cards fit into my financial goals in different ways, and I’m excited to start exploring their features!

Discover It

I wrote about how you can maximize the quarterly 5% categories for an easy $600 with the Discover It card.

Mine

That’s exactly what I plan to do.

The card has:

No annual fee

No foreign transaction fees

Free credit score monitoring

0% APR on purchases and transfer for 12 months

Double cashback for new cardmembers

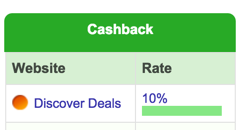

Access to Discover Deals, the BEST shopping portal right now (RIP WorldPoints Mall)

And a slew of other cool perks

Discover Deals has 10% cashback at Macy’s, Sear’s, Kmart, and Ace Hardware (but only 5% at my beloved Kohl’s).

10% from the shopping portal + 5% category bonus X 2 is 30% cashback!

If you can stack the 10% shopping portal bonus and 5% categories, you’ll get double cash back… or 30%!

You can combine that with other discounts and promotions, too. So I’m sensing some shopping opportunities in here. Especially considering Amazon.com is a category.

My Amazon Prime is ready

Because the categories will mostly likely repeat themselves next year, I will (hopefully) get to maximize this 3rd quarter (the best, IMO) TWICE.

And I’m curious to see what the “Holiday Shopping & More” will be.

Boom! Instant approval

This card is offering free money for shopping I’m planning to do anyway. Definition of a no-brainer.

Citi Hilton Visa

This card usually has a sign-up bonus of 40,000 Hilton points. But until August 31st, it’s been increased to 75,000 Hilton points.

This is easily worth over $1,000

I wrote about how to get over $1,000 in value from the increased sign-up bonus by focusing on Hilton Category 1 and 2 hotels, which is how I plan to use these points.

The minimum spending requirement is $2,000 within the 1st 3 months. (And the clock starts ticking when you’re approved NOT when you receive the card.)

Boo-ya! Coming to a Hilton Category 2 near you

I was instantly approved with a $7K credit line.

I’m low on Hilton points at the moment, and I want to warm up to Citi a little more. They seem to be getting more aggressive with their card offerings, and I like that.

My strategy

Here’s my plan: shift all spending to the Citi Hilton Visa card EXCEPT for the 5% categories on the Discover It card. Pay down my other credit cards in the meantime, bank the Hilton points, then focus on my FIRE (which I can’t wait to report on next month).

Within a couple of months, I’ll have my credit cards paid off, 75K Hilton points, and hopefully some cashback coming my way.

And I’m looking forward to toying around with the Discover Deals shopping portal.

My further strategy is to dump this little pile of uselessness:

Once great cards, now a disgrace. C ya again never!

With these 2 new cards, I’m now up to 19.

When the Hyatt Diamond Challenge comes back around, I plan on picking up a Citi Prestige card and completing it in 9 nights.

I was tempted to sign up yesterday, but it didn’t feel like the right time. I would’ve been forcing it. But, it’ll come back and I’ll hop on then.

Bottom line

I still get a rush when I apply for (and get) a new credit card.

Looking forward to exploring the benefits of the Discover It card and the Citi Hilton Visa. Both seem like good (no annual fee) additions to my current arsenal.

And I can keep them both forever at no cost.

This is my first Discover card. We’ll see how it goes. Nothing to lose except an inquiry on my credit report.

Both cards are available (with the best current terms) via my links – thank you for clicking through them!

Does anyone else have either card? Any benefits I missed, or to keep in mind?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

July 31, 2015

No Annual Fee Cards + Personal Finance: Why You Need (At Least) One

Also see:

Seriously tempted by the 75,000 point Citi Hilton Visa offer

Get an Easy $600 with the Discover It Card

Is the Fidelity Amex the best cashback card in the universe?

My Favorite Credit Cards

Get a Travel Rewards Credit Card

Like it or not, in this country you need good credit. It’s as avoidable as death or taxes. As in, not at all.

Starting out with credit cards, you’ll encounter a catch-22: you need good credit to get a credit card, but you need a credit card to build good credit.

No annual fee cards are NOT boring. In fact, they have some innovative rewards!

A good place to start is no annual fee cards.

For beginners

No annual fee cards are typically a bit more lenient than premium credit cards, like say the Chase Sapphire Preferred or the AMEX Platinum Card.

Interest rates tend to be about the same, not that you should worry about them anyway. (Keep reading for how to think about a new credit card.)

My first credit card was the Chase Slate card, which is also no annual fee. It was nothing fancy then (this was in 2002, it actually didn’t exist then. It was a Chase Student card that got product changed over the years), and it still isn’t today.

It’s a very basic card. I asked for Chase to change it to a Chase Freedom card, which I love and use all the time (quarterly, in fact). And now, I have 13, almost 14 years of credit history with Chase.

5% cash back or 5X Chase Ultimate Rewards points. Either way, not bad for a card that costs nothing to have

Now I can call and say, “I‘ve been banking with you for 14 years,” and they’ll bend the rules for me a little. I’ve never been denied for a new Chase card, and they’ve been increasingly generous with their credit limits over the years.

Because it has no annual fee, I’m going to keep it forever.

And no matter how many cards I open, my oldest card will help to increase the average age of all my credit accounts.

No annual fee is THE place to start.

For old pros

If your credit score is over 800 and you have 41 open cards and a 100 million miles, you still need a no annual fee card.

I’m thinking about springing for the Citi Hilton Visa card soon.

Because I can get $1,000 to $1,600+ worth of value from the current 75,000 Hilton points sign-up bonus, which is awesome!

I want to warm up to Citi, and I’m overdue for another no annual fee card to age my accounts and continue to boost my credit score.

All of the cards I’m going to dump soon have annual fees. I had them for a couple of years, and now I’m going to close them (if I can’t product change, that is).

So, it’s time.

I might get 2 of them. The Discover It card is good for an easy $600 for new cardmembers the 1st year. Not to mention that with Discover Deals, you can get up to 30% cash back (stackable with other promotions and discounts) for the quarterly bonus categories.

The Discover It card has 5% bonus categories, double cash back, a kick-ass shopping portal… and NO annual fee

(10% cash back from the Discover Deals shopping portal + 5% cash back for quarterly categories, both doubled after 1st 12 billing cycles.)

Discover It 5% cashback calendar

If you get too bogged down with cards that come with an annual fee, once you start dumping them, the average age of your accounts will go down.

So I like to throw in a no annual fee card here and there and keep them for years. It seems to help everything even out in the long run.

Treat your credit cards like they’re DEBIT cards

When people think of a debit card charge, they think of money coming out of their account right away.

When people think about a credit card charge, they think, “Oh, I’ll pay it back… eventually.”

On another old card, my Icelandair MasterCard, I charge my Dollar Shave Club razors for $6 a month, and have it set to auto-pay. It’s an easy way to keep the card active and I never have to think about it. I don’t want to use it, but I do want its good effects on my credit report.

Got this card in 2007. Rock on, Icelandair!

Other cards I use daily, like the AMEX EveryDay Preferred card, I treat like a debit card. Meaning I know all the money is coming out of my account when I spend it.

And I pay it in full every month.

Treat all of your cards this way to ensure you get the points and miles rewards… and never pay a dime for them!

If the card is no annual fee, even better!

I plan on getting $600 from the Discover It card this year (at least). And $240 from the AMEX Fidelity card.

That’s $840 in free money – that’s rent!

#BBHMM

Getting free money is pretty great. I recommend it to everyone.

My Best Advice: “You Can Do Anything You Set Your Mind To”

I’m just read through an old scrapbook from 1991 to 1993. Yup, I still have some things from nearly 25 years ago.

My little brother hadn’t been born yet, and I wrote a lot of letters to my family. Once I learned how to address envelopes and send letters, I sat down and wrote all the time. And when I got a letter in the mail, I’d get so excited. I thought it was the best thing in the world – to get a letter in the mail.

I was lucky to have a supportive family while growing up in rural Mississippi. My Mom was always there to take care of me, and I still talk to her on the phone constantly.

This letter from my Gramma is over 23 years old by now, and I still think about it

My grandmother taught me about positive thinking early on. I’ll never forget a phrase I read in one of her letters.

“You can do anything you set your mind to.”

It was the first piece of advice that really stuck with me, and it was a good one. The letter came on June 4th, 1992. I was seven years old at the time.

The law of attraction

When I first read “The Secret,” it was like my mind blew wide open. I finally had language and terms for all these things I thought about.

It was like reading feelings finally turned into words after so long. The basic point of the law of attraction is your thoughts become reality. You literally think things into existence.

Me and my Mom in 1989. She was a single parent at the time

But for years, I knew it as, “I can do anything I set my mind to.”

So now, it’s the advice I give others. Truly, it’s My Best Advice.

What else does it mean?

Embedded in that phrase are basic tenets of will and determination, decision, responsibility for your actions, and the consequences of what you wish for yourself.

You can apply it to anything.

Growing up, I always wanted to travel. Even before I new what a “point” or a “mile” was or meant, I traveled. I don’t know how I did it, quite honestly, but my god I did it.

I went to the Grand Canyon, Glacier National Park, Berlin, Paris, Niagara Falls, Toronto, Miami… and many other places.

For the time being, I’ve turned my will to FIRE, which is my plan to get my finances in order. This time next month, I hope to share good news with you guys here on Out and Out!

I’ve made a lot of progress really quickly and I can’t wait to talk about it. Almost there.

What it does NOT mean

You can have all the mental power and will and determination in all the world and some things will simply not happen.

You can wish all day and night that it will be 80 degrees in Paris mid-January. It’s not going to happen.

Say you want to gain muscle. But if you don’t pick up weights, it’s not gonna happen while you sit around.

You CAN do anything you set you mind to. But you have to hold up your end of the bargain.

You have to take action to get the things you want. Good intentions are… good to have. But they need to be paired with action. If a door opens, that’s great. But you still have to get up and walk through it.

And your goals need to be SMART:

SMART goal criteria

We’re all working within our individual limits. Those can be stretched, a little at a time. And occasionally wide open, all at once.

Bottom line

We are all capable of so much.

Hammers can build a house or tear it down.

Hands can touch, heal, caress, or bruise another person.

And your mind can steer you in the right direction… or so far down the wrong one.

I flipped through old letters today. It made me remember where I came from and some of the things I’ve done so far.

When I was seven, my grandmother told me, “You can do anything your set your mind to,” in reply to a letter I sent her. And now here I am, blogging about it. Funny how things work out.

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

July 30, 2015

Complete the Hyatt Diamond Challenge in 9 Nights With the Citi Prestige Card

Random thought of the evening.

I’m going through my cards and want to dump:

Barclaycard Arrival Minus

US Bank Club Carlson Visa

Chase British Airways Visa

And replace them with:

Citi Hilton Visa

Citi Prestige

Discover It

The hitch is that you have to wait ~8 days between applications with Citi, so I’m not sure which of their cards to get first. But I’m warming up to the idea of Category 1 and 2 Hilton hotels – there’s a ton of value to be had there.

Anyway.

Citi Prestige + Hyatt Diamond Challenge

Via The Points Guy, tomorrow is the last day to sign up for the Hyatt Diamond Challenge (something that’s always tempted me). You’ll have 60 days to complete it when you sign up (so until September 30th).

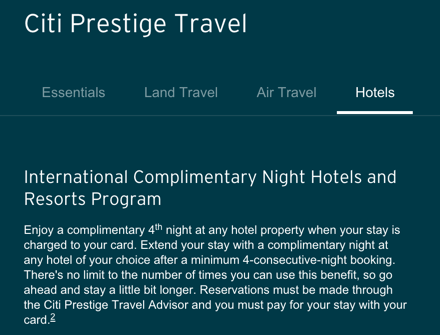

And via View From the Wing, the Citi Prestige card’s 4th night free benefit is “too good” to last. (I agree.)

Hyatt hotels are easily bookable with the Citi Prestige travel program. (Here’s the link to Carlson Wagonlit to search.)

A quick search in Dallas turned up 6 Hyatts, most under $100 a night

If you book a 4-night stay for $100 a night, you’d pay $300 (after the Citi Prestige statement credit).

Do this 3 times in 60 days, pay $900, get Hyatt Diamond status. Any many hotels are available for under $100.

If you have Hyatt stays coming up anyway, this might be something to mix-and-match with cash + points stays.

And hotels booked with the Citi Prestige card do earn elite credit.

What’s Hyatt Diamond status worth?

If you use the 4 annual Suite Upgrades judiciously… a lot.

And if you like free breakfast, that could add up fast, too.

This challenge is best for people who travel a lot and stay at Hyatt hotels. If you travel 15 nights a year, you won’t get much value from status and should probably just stick to the Chase Hyatt Visa and Hyatt Platinum.

But if you stay often with Hyatt, the value could really start to shine.

As a Diamond guest, you’ll get:

A 30% point bonus when choosing points

The best room available upon arrival, excluding suites

Exclusive access to the Regency Club or Grand Club lounge featuring complimentary continental breakfast and evening hors d’oeuvres. Enjoy daily complimentary full breakfast in hotels without a club lounge

A suite upgrade at the time of reservation 4 times annually on eligible paid nights

A special welcome point bonus or food and beverage amenity during each stay

A nightly room refresh

Complimentary premium Internet access where available

Check-in at a dedicated area for elite members

48-hour room guarantee

4:00 p.m. late check out on request

2 complimentary one-time-use United Club passes annually

Guest of Honor, share your Diamond benefits with friends and family when you redeem points for a free night for them in 2015

To sign up for the Diamond challenge, call Hyatt at 800-228-3360.

If you complete the challenge, you’ll get Diamond status through February 2017. That’s 19 months of Diamond-ness!

The Citi Prestige angle

So, I don’t have a Citi Prestige now, but if I signed up soon and booked Hyatt stays, I could start using the 4th night free benefit when the card came in (and Citi can expedite shipping on new accounts if you call them).

But just because you can get the 4th night free doesn’t mean you should.

Hmmmz…

I have a 3-night stay at a Hyatt coming up next month. It would be easy to cancel it, book 4 nights instead, and leave after the 3rd night. Or just stay and enjoy the 4th night… free.

That would already be 1/3 of the Diamond Challenge.

Stay 12 nights, pay for 9 – get Hyatt Diamond status

The catch then is… do I go out of my way to take another trip to meet the challenge? Do I book the cheapest Hyatt just to get status?

Will being Diamond come in handy many times before February 2017?

So I’m wondering how much I’d actually get to enjoy being Diamond with Hyatt. I must say though, the idea of paying for 9 nights instead of 12 is a lot more palatable.

But for some, this combo could be a great way to earn status for 25% less. Not to mention all the points you’d earn in the process (from both Hyatt and Citi).

Bottom line

If you’ve had your eye on the Hyatt Diamond Challenge, the iron is hot. Strike.

If you’re going to pay for it, you can open a Citi Prestige card, get the sign-up bonus of 50,000 Citi ThankYou points, and earn Diamond status with the 4th night free benefit – pay for 9 of the 12 nights. Get the other 3 for free. And you’ll still have $250 in airline credit to use, too (on any airline).

This could be useful for some. You can search for Hyatt hotels on the Carlson Wagonlit website (the one Citi uses to book hotels). And here’s an overview of Hyatt Diamond status.

If you’re thinking of getting a new card, including the Citi Prestige, consider using my links. (And thank you for doing so!)

I’m on the fence about whether to do this or not… I’ll sleep on it.

If you’re in the same boat, tomorrow (July 31st) is D-Day for the Hyatt Diamond Challenge (at least for now)!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

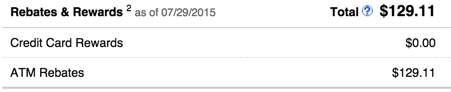

Fidelity Cash Management Account: Why It’s Great

Also see:

Cut the Crap: The Fidelity Investment Rewards Credit Card is THE BEST cash back card!

Is the Fidelity Amex the best cashback card in the universe?

I’ve written lots about the AMEX Fidelity card. It’s such a great addition to any wallet. (Too bad they’ve lost the WorldPoints mall, though.)

Now that the Barclaycard Arrival Plus is a Barclaycard Arrival Minus, I recommend the Fidelity AMEX as a card to take its place.

BUT, before you sign up, remember you can get an easy $600 with the Discover It card – and the double cash back promotion has been extended until September 30th! (I’m signing up this weekend, on August 1st. And it’s available via my links!)

For non-bonused spend – think oil changes, dentist, post office – the AMEX Fidelity card is great. That’s because when you hit 5,000 points, you can redeem for a $50 statement credit to your Roth IRA (which is tax-fee forever!), college savings account… or cash management account.

Why cash management?

Link: Fidelity Cash Management Account

Really, the Fidelity Cash Management Account is a bank account like any other, with a few key differences.

First, there are no branches. But there are also no fees.

And everything is free.

A great, handy, FREE account with a lot of uses

There are no minimums to think about, no X number of transactions required. And you get unlimited ATM withdrawals at ANY ATM in the US.

Note: In practice, however, I’ve gotten ATM fees reimbursed globally. It’s not a stated benefit, but in action, it’s effectively world-wide.

You get free checks (if you still use those), and a free debit card.

I also like that checks deposited via the mobile app clear within a day (or two at the most) and direct deposits show up the next day. Usually mid-morning, and oddly enough at around 10:15 am Eastern Time.

The bill pay functions are as robust as any other bank. You can pay utilities, credit cards, student loans, individuals… all within a few clicks.

I’ve used Fidelity’s bill pay hundreds of times and have never had an issue with on-time payments or a payment not being received. So, after many successful payments, I trust it.

Potential uses

I actually have an account at Chase that I opened in college in 2005. I got a good deal, it’s free, and I’m grandfathered into it for as long as I want it. I value my relationship with Chase because they have the BEST credit cards on the market right now. I’d also like to get a mortgage soon and will see what they offer.

But I’ve been using the Fidelity Cash Management account as an unofficial business account for my Airbnb side hustle. It’s essentially an operating account, in that I only use the account for Airbnb cash flow – and if there’s any left over, I pay bills, or transfer it out. Then reset this cycle each month.

I’ve grown to love having a cash flow separate from my Chase account. It’s easier to manage because it’s independent of my “daily life” cash flow.

Other uses:

Collect reward money from the AMEX Fidelity card

Budgeting a la the envelope method

Transfer money into it when you travel to get cash for free at ATMs

Separate direct deposits from more than one job

Any other reason why you’d want money kept on the side

As a main bank account – make the leap to online-only

This account would be great for the envelope method.

If you’re on a budget and you allow yourself to spend $X on something each month, when the money runs out, that’s it. You could automate deposits into the account and stick to a budget once and for all.

And if you’re traveling beyond the realm of your bank, make any ATM “yours.” Any and all fees related to withdrawing money are reimbursed the same day the withdrawal clears. When you pull out $60, that’s it, regardless of how much the ATM charges.

ATM charges are refunded the same day, with unlimited withdrawals

The other upside is that it’s completely free to have the account. And, obviously, if you invest with Fidelity, this account makes it super easy to make trades, add to your IRA, etc.

Things to be aware of

My biggest concern was, “What if I need to get a certified check?”

Here’s what happens. You go into any bank, ask for a cashier’s check. They’ll usually charge $10 to $12 for the service. Fidelity charges nothing extra on their end.

I’ve only had to do this once or twice under unusual circumstances. Bill pay and ATM access has been flawless.

Even though I have a “regular” banking account, I only ask for a check once in a blue moon. Once I let this idea go, and realized I had the option if I ever needed it, the rest was easy.

There are limits on the account for your first 30 days. You won’t find this written anywhere on the Fidelity website, but there are. You can’t access bill pay and there are extreme daily limits with the debit card.

I recommend opening the account, putting the debit card away, and pulling it out a month later once the initial limits are removed. I guess this is so you don’t open an account, launder a whole lot of money right away, and then close the account. It sucks until after the initial period, then it’s great.

The daily transaction limit is $10,000, and you can withdraw $500 a day at ATMs (which is typical).

When you pay a bill to an individual, the money isn’t taken out until the other person cashes the check. Some banks take the funds out right away, some don’t. This one does NOT.

The ATM policy is easy to understand. NO FEES, ALL REIMBURSED.

They say use any ATM “in the US.” I’ve withdrawn money in Ireland, Italy, England, Canada, etc. and never paid a fee. As long as you use a bank ATM (as opposed to a currency exchange service) and pull out local currency, I think you’ll be fine.

I’ve never not had an ATM immediately credited the same day. I’ve only had to call once or twice. They’re quick to answer and help. But I haven’t had any issues with the account.

I’ve saved ~$130 on ATM fees so far this year

Versus Schwab

The inevitable question is, “How does it compare to the Schwab Bank High Yield Investor Checking Account?”

They’re essentially the same.

Schwab uses a hard pull when you open their account

Fidelity uses a soft pull

Schwab requires you to open an investment account, although you do NOT have to use it – ever – if you don’t want to

Fidelity doesn’t require any other accounts

Schwab used to have a 2% cash back card that linked to the account

Fidelity has a great 2% cash back card that can link to your account if you want it to

Both have no fees

Both reimburse all ATM fees (yes, worldwide)

Both have free bill pay

Both are great if you invest with the respective firms

Bottom line

If I didn’t have such a good deal with Chase, I wouldn’t think twice about dumping them for Fidelity’s Cash Management Account as a bank replacement.

Be sure to read the customer reviews! They’re really insightful.

My favorite use of this account is to utilize the envelope method for budgeting. But I’m using it as an unofficial business account for my side hustle, to keep the cash flow separate. I’m enjoying it a lot, using it this way.

In conjunction with the AMEX Fidelity card, it’s a great account to have, if only to collect the cash rewards. It’s free, easy to manage, and a soft pull on your credit report.

Leave it open for 30 days before you start using it, because they have strict daily limits for new accounts.

Anyone else like/use the Fidelity Cash Management Account? Anything I missed, or any questions about how it works?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

July 26, 2015

Must-Haves of Travel: Activated Charcoal

Also see:

Must-Haves of Travel: Coconut Oil

Must-Haves of Travel: Apple Cider Vinegar

Activated Charcoal on Amazon.com

Activated charcoal FTW

After reading an article by fellow Brooklynite Jenny on Healthy Crush about activated charcoal, I had to try it.

Activated charcoal is made by burning something carbon-based, like wood or coconut shells to remove all of the oxygen. What’s left is a highly absorbent material filled with millions of tiny pores that trap and bind gas and toxins and can carry thousands of times its weight.

That’s really cool.

It comes in capsules and looks like this:

Activated charcoal capsules

Uses for activated charcoal

And it has a ton of uses for the constant traveler:

Helps with gas and bloating from airplane/hotel food

Can help fight jet lag

Helps to normalize your system after eating low-quality or questionable food

Carries out toxins

Particularly helpful after drinking too much alcohol (*raises hand* oops!)

Combats cellular damage and allergic reactions

Good for cellular health, heart health, gas, bloating, detoxification, digestion issues, and anti-aging

I pop a capsule after I’ve eaten something that doesn’t sit quite right, or drink a little too much. Within 5-10 minutes, my system actually feels flushed. I’ve gone from very queasy to feeling normal, which is incredible.

If you have a sensitive tummy, you know that long flights and airplane food can be a shock to your system. I haven’t had the chance to try activated charcoal on such a flight yet – but I’ll be sure to toss a few into my bag just in case.

You can also mix with it with clay and baobab oil for a homemade facial that cleans and moisturizes your skin.

You can… brush your teeth with it?

And – get this – you can use it to brush your teeth!

Activated charcoal as a tooth whitener

I know it sounds super weird – and looks slightly gross – but it really works!

But don’t do it too much or for too long because tooth enamel is porous and you don’t want to overexpose.

I broke open an activated charcoal capsule into a dish, wet my toothbrush, took a deep breath, and started brushing.

My mouth looked like the image above and I had a moment where I thought, “What the hell have I gotten myself into now?”

But afterward, my teeth looked visibly whiter – and felt very, very clean.

Now, I brush with activated charcoal every week or so. And it still feels amazing every time!

One really specific use that might save your life

Because activated charcoal is so highly absorbent, you can use it to suck out venom after a bite/sting (in conjunction with other medical care, of course).

In my online wanderings, I found that people who live in places with sting-y or bite-y creatures (think scorpions, wasps, bees, snakes, spiders) keep activated charcoal on hand at all times to use as a poultice. If you break open the capsule and put it on the affected area, the charcoal works instantly to start binding with and pulling out the venom.

For this reason, you can also use it when you touch poisonous plants like poison ivy or oak. It helps with swelling and itchiness right away.

If you’re planning a hike or trip where poisonous plants or bugs/bees might live, it would be a good idea to have activated charcoal as a complement to your other precautions, especially if you’re highly allergic!

I’m definitely not a medical expert, but it seems like activated charcoal is a versatile substance that can help in a lot of ways.

It’s been used in hospital rooms to help with poisoning for decades.

Other sources

Check out these articles to read more about activated charcoal:

Take This Supplement When You Eat At Restaurants Or Drink Alcohol – Healthy Crush

Top 10 Activated Charcoal Uses & Benefits – Dr. Axe

What Is Activated Charcoal – 6 Uses & Health Benefits – Money Crashers

Activated Charcoal: A Strange Way to Detox – Bulletproof

How to use Activated Charcoal – Wellness Mama

My bounty

Here’s the activated charcoal I got from Amazon.com – be sure to read the many reviews and check out the customer images and videos!

Bottom line

I’m always looking for new ways to add more natural remedies to replace products laden with chemicals or things I don’t understand and can’t pronounce.

Along with coconut oil and apple cider vinegar, I’ve started exploring the uses and benefits of activated charcoal.

It’s a powerful material that binds to gases and toxins and can alleviate bloating, gas, and general queasiness. It’s also surprisingly effective at whitening teeth, and helps with jet lag.

Finally, it promotes cellular health, heart health, and anti-aging. Very cool!

The best way to use it is after you’ve eaten something that isn’t sitting well. Or after you’ve had a drink too many. You can also take a capsule when you arrive in a new time zone to help reset your body after a long flight. Or after a trip away from home as an easy general detox.

Have you heard of – or do you currently use – activated charcoal? Does it sound like something you’d try?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

List of AMEX Cards NOT Issued by American Express

Also see:

Exploring Amex Serve for free money and handy uses after April 16th

Is the Fidelity Amex the best cashback card in the universe?

Spoiler alert. On this list, I find the FIA Fidelity AMEX to be the most valuable. I just love that card so much.

Thank you for being a friend – and for NOT being issued by American Express

And this post is gonna be focused on Serve.

Note: It is possible to send money between Serve and REDbird, or Serve and Bluebird.

So if you’re managing multiple cards, you can get a Serve card, load it up for $1,000 each month, and send it to Bluebird or REDbird to pay bills that normally don’t accept credit cards. Like student loans, utilities, mortgage payments, or anyone else.

List of AMEX Cards NOT Issued by American Express:

BankName of Card

Bank of AmericaAAA Rewards American Express

Bank of AmericaAccelerated Rewards American Express

Bank of AmericaAsiana Airlines American Express

Bank of HawaiiAmerican Express Card with MyBankoh Rewards

BarclaysTravelocity Rewards American Express (no longer offered)

CitibankSelect / AAdvantage American Express (no longer open to new applications)

FIAFidelity Investment Rewards American Express

Read my review of this card.

First National Bank of OmahaAmerican Express

PenFedPremium Travel Rewards American Express

USAACashback Rewards Plus American Express

USAACash Rewards American Express

US BankFlexPerks Travel Rewards American Express

Wells FargoPropel 365 American Express

Store CardBloomingdale's American Express

Store Card (Issued by Wells Fargo)Dillard's American Express

Store CardMacy's American Express

A few reasons why you might want one of these cards

If it’s no annual fee, to age your credit accounts

If the card earns 1 point per $1 spent, earn 12,000 extra points each year by loading $1,000 per month to Serve

If the card earns 2 points per $1 spent (like the FIA Fidelity AMEX), earn 24,000 extra points (worth $240) per year by loading $1,000 per month to Serve

If the bank also issues mortgages (Bank of America, USAA, US Bank), it might be good to have a pre-existing relationship with them if you think you’ll one day want to finance a house with them

In the case of US Bank, you can get a free Gold checking account by having a credit card

The US Bank FlexPerks AMEX has a $49 annual fee, but Serve reload points will more than offset it, and it has some other category bonuses

Easiest points you’ll ever earn… and you can send money between Serve and Bluebird/REDbird

You will NOT earn bonus points on Serve reloads with cards that ARE issued by American Express. But, you can still use Serve to meet spending thresholds. Like earning Hilton Diamond status at the $40K mark on the Citi Hilton Surpass card.

So if you have an AMEX that offers some sort of spending bonus, you might consider loading up Serve to cross the line.

Bottom line

I don’t recommend using a hard pull to open one of these cards (except maybe the FIA Fidelity AMEX – the BEST cashback card out there right now.)

But if you already have one of these cards, or a have a reason for getting one, loading up Serve is a handy way to earn some free rewards points throughout the year.

Seriously. The underwear factor can NOT be overstated. It takes literally seconds to load up, and you can do it in bed on the Serve app.

You’ll also benefit from standard AMEX purchase protection and benefits, like extended warranty and trip cancellation insurance (but be sure to check exactly what’s offered as coverage levels can vary by card or issuer).

The best AMEX cards do tend to be issued by American Express. But you can still use Serve to meet spend thresholds for earning status, elite stay credits, or the like.

Any cards that I missed? If you have experience with any of these niche cards + Serve, please comment below!

And if you’re in the market for a new travel rewards card (or Serve card), please consider using my links. Thank you!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

July 24, 2015

I Use Miles Because I Won’t Pay Revenue Prices… Right?!

Also see:

Just booked: A ~$20,000 Dollar Trip to Paris for FREE? You betcha!

Hawaii: 10 Days and 3 Islands for $100 a Day

Trip Report: Lufthansa First Class YYZ-MUC

My Top 5 Hilton Category 2 Hotels for Award Stays

Correct me if I’m being thick because I definitely have my “forest for the trees” moments.

Meaning of value… are you in there? Oh, there you are.

I read an article on Point Me to the Plane about a flight that got 2.5 cents per Delta mile.

Then the comments read: if you wouldn’t pay cash for the flights, that’s not how much the points/miles are worth.

But… I use points and miles for flights and hotels specifically because I won’t pay cash for them.

In fact, I’ve planned entire trips (like Hawaii, Paris, RTW/Australia, and Eurotrip 2014 in Lufthansa First Class) that I would’ve never paid for if it weren’t for points and miles.

I did NOT pay $7,243 for this flight… but I did pay 40,000 Avios + $453 in fuel surcharges. So what are the points worth?

I thought… that was the “point” of points and miles?

Targeting aspiration AKA value

I always check the cost of my flights before I book with miles.

Why?

To make sure I’m getting at least 2 cents per mile/point in “value” (a dubious little term).

If it’s anything below that, I’d rather pay.

To people who ask, “What would you pay for that flight/hotel?” my answer would be… nothing. Or at least very close to zero. I simply wouldn’t take the trip if I had to pay. I’m never willing to pay for $10,000 flights… but I’ll pay 45,000 miles for it.

There has to be a value threshold

I use retail price because it’s tied to supply or demand.

I have a trip coming up that I actually have to take, (and pay for). But I still checked to see if I can use miles to bring the cost down. Even if it’s just using Avios on a connecting flight.

I always do, Madge

When I noticed the Hyatt House in town was going for $200 a night or 5,000 Hyatt points… I chose to use Hyatt points (and got 4 cents of value per Hyatt point).

I guess this is the rare case where I would have paid if I’d had to and didn’t have any points. But I did, and they were a better value… and a no-brainer. So does that mean the points are then “worth” that amount? Because I’d be willing to pay?

If the same Hyatt House was going for $100ish a night or 5,000 Hyatt points… I’d pay the ~$100. And save the Hyatt points for another time. Because I want them to be “worth” a certain amount.

That’s the same criteria I used to value the current 75,000 Hilton points sign-up bonus on the Citi Hilton Visa. Using points to stay at hotels I wouldn’t pay for.

What other marker do I have to use aside from the retail cost of the hotel?

Another misunderstood term

Travel Is Free put up an interesting post today about opportunity cost. And how that term is also misused.

I get the logic, but also think that this hobby is saturated with so many choices it’s possible to become paralyzed with indecision.

If I click on the AA portal to get 2 AA miles per dollar on $100, instead of clicking through a 5% cashback portal, I’m losing $5 but gaining 200 AA miles.

I’d say the AA miles are worth $4, so I’m getting less – and I know that – but the actual work of getting AA miles into my account is pretty hard to do if I’m not otherwise flying. Getting cash into my account is something I have more control over. So I take the AA miles. Is that an opportunity cost? Absolutely.

Does drinking 1 martini mean I can’t drink 3 beers? Hmmm…

But so is everything. Every choice you make means you’re actively not choosing something. Even not making a decision *is* a decision.

Also, if I have 1M AA miles, I might rather take the $5… it’s all relative, isn’t it?

Very personal

I love this hobby because there are so many opportunities to personalize. That’s what makes it great. And it comes down to travel philosophy.

Agree or not with my ideas (or anyone else’s) about value and opportunity cost, it really doesn’t matter. We all earn our miles in similar ways (running money through a credit card, clicking on a portal, flying). But how we arrive at all of those things, and how we use the miles – and value them – is always going to be different. Sometimes radically so.

Whenever a friend flashes their PNC Travel Rewards card (useless, by the way – don’t get it!), I cock my head and think, “You’re literally carrying around a piece of plastic garbage.” But they love it. And can’t understand why I’d ever pay $95 for the privilege of having a Chase Sapphire Preferred (a piece of expensive metal garbage, to them).

I can tell them they could pay $95 and get 40,000 points instantly worth $400 – at a minimum. Nope. They’d still rather have PNC points. (This is an extreme example, but you get it.)

I wrote a post (going back to value) about a $20,000 trip to Paris.

I priced out the flights – thousands of dollars each way

Stayed at the (just OK) Hyatt Vendome

Just points for the Hyatt Etoile

I didn’t actually “save” $20,00 because I’d never pay that to begin with. So how much would I pay for that trip? Probably $2-3K.

But the flights I took would have cost much much, and my hotel stays definitely had a retail price on them… that people pay all the time.

There are a finite number of flights, seats, and hotel rooms. And they have real prices associated with them.

Is taking a trip that would cost $20,000 retail “worth” that much if you use your points?

Even considering annual fees on the credit cards ($95 for the Chase Hyatt Visa, and $95 for the Chase British Airways Visa), the time I took off from work, and the “opportunity cost” of missing other potential work, etc… it still doesn’t begin to touch the $20,000 mark.

I think the idea of “value” has too many factors entangled into it to say that anything is really “worth” any amount, period. But there has to be some kind of basis.

I mean, would you blow 100,000 Chase Ultimate Rewards points on 2 flights that would cost $300 each? What about $3,000?

This is why I base points of the retail cost… and assign them a value. It’s my own personal valuation.

And it’s great how customizable and personal this hobby is. I love hearing the counterpoints, even if I don’t agree with them – or in some cases, even understand them!

Bottom line

Is some of it sensational and overblown? Yes.

Is some of it misunderstood? Yes.

But there are kernels of truth in everything and I think it really comes down to personal philosophy. Knowing the alternatives adds to the fun/debate, but at some point, a value has to be assigned to everything. And I don’t necessarily think it has to do with what you “would” pay for something.

But that’s just me. Everyone has their own way of understanding and thinking about miles and points, and the opinions on it are absolutely fascinating.

That people go out of their way (literally) to earn points and miles shows me that they must be worth something.

Would love to hear your take on the idea of “free” travel, value, and opportunity costs.

What’s the threshold you cross to redeem your miles? Do you have a set of criteria? Is it tied to the retail cost – or your own personal valuation (or something else)?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

July 22, 2015

Cardmatch Offer: 30K Points for AMEX EveryDay Preferred

Also see:

Just got the AMEX EveryDay Preferred Card

My Experience Getting the AMEX EveryDay Preferred Card

The Points Guy posted about a couple of offers that came up on Cardmatch today:

100K points for AMEX Platinum personal/biz

50K points for AMEX PRG personal / Gold biz

And the commenters mentioned a couple of other offers.

What’s my offer?

So I headed to Cardmatch on CreditCards.com to see what came up… cuz I would’ve totally gone for the 100K Platinum biz offer.

I was targeted for the 100K Platinum personal offer, but I already have that card.

Then I scrolled down and noticed:

30K Points for the AMEX EveryDay Preferred

That’s a good deal!

I’ve written about the AMEX EveryDay Preferred card before.

I got the card with a 15K bonus over a year ago. Just paid the $95 annual fee on it and can say this one’s definitely a keeper (unlike the US Bank Club Carlson Visa Signature, Chase British Airways Visa Signature, and Barclaycard Arrival Plus).

I use the card as intended, mostly at grocery stores and Costco (for now), with a couple of other purchases here and there. (I use Amazon Allowance to help me meet 30 transactions per month to trigger 1.5 AMEX Membership Rewards points per $1 spent.)

I also wrote about my experience getting the card. It’s the only card I’ve ever been straight-up denied for. Until I called AMEX and asked WTF? and then they approved me anyway.

Bottom line

Along with the stellar offers for 100K points for AMEX Platinum and 50K points for AMEX PRG, add this one to the pool.

It’s double the usual sign-up bonus and is a very worthwhile card to have.

Check Cardmatch on CreditCards.com to see if you were targeted (under “Free Interactive Tools” on the right).

I’ve had the card for a year now and really recommend it. It has 0% interest for 15 months to start out, and you can always downgrade it to the no annual fee version after 11 months if you don’t like it.

Were you targeted for anything good on Cardmatch? Was your offer different?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

Whoa! Check Out This Ultimate Travel Jacket from Baubax

Did you hear about the new travel jacket that’s blowing Kickstarter out of the water?

They only wanted to raise $20,000, but as of today, they’ve blown past the $1M mark.

…And I think I want one.

They start at $109 and go up from there.

The Baubax Travel Jacket is loaded with features

It comes in 4 styles (and multiple colors) for men and women:

I’m partial to the blue hoodie myself ;)

All of the styles look functional and comfortable. And the company is based in Chicago. Holla!

I think it’s interesting how they’ve chosen multiple types of fabric and recommend a style based on the temperature where it’s worn.

Different fabrics for each style

And each one is best worn at a certain temp

Of all the features, I think my favorites are the neck pillow and built-in gloves.

And with all the pockets, I could definitely bring along my coconut oil and apple cider vinegar.

Thought this was cool and wanted to share.

A little over $100… not a bad price, considering all the features.

But it seems like time’s running out if you wanna get one. And I can’t make up my mind!

On the fence.

Have you guys seen this jacket? Did you (or will you) get one?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com