Yay! Just got Discover It and Citi Hilton 75K cards!

Also see:

No Annual Fee Cards + Personal Finance: Why You Need (At Least) One

Get an Easy $600 with the Discover It Card

Seriously tempted by the 75,000 point Citi Hilton Visa offer

Get a Travel Rewards Credit Card

I took my own advice and got 2 new no annual fee cards.

This morning, I assessed my credit card situation and thought about how I could improve my strategy moving forward.

Both of these cards fit into my financial goals in different ways, and I’m excited to start exploring their features!

Discover It

I wrote about how you can maximize the quarterly 5% categories for an easy $600 with the Discover It card.

Mine

That’s exactly what I plan to do.

The card has:

No annual fee

No foreign transaction fees

Free credit score monitoring

0% APR on purchases and transfer for 12 months

Double cashback for new cardmembers

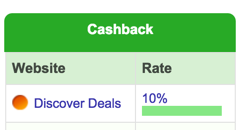

Access to Discover Deals, the BEST shopping portal right now (RIP WorldPoints Mall)

And a slew of other cool perks

Discover Deals has 10% cashback at Macy’s, Sear’s, Kmart, and Ace Hardware (but only 5% at my beloved Kohl’s).

10% from the shopping portal + 5% category bonus X 2 is 30% cashback!

If you can stack the 10% shopping portal bonus and 5% categories, you’ll get double cash back… or 30%!

You can combine that with other discounts and promotions, too. So I’m sensing some shopping opportunities in here. Especially considering Amazon.com is a category.

My Amazon Prime is ready

Because the categories will mostly likely repeat themselves next year, I will (hopefully) get to maximize this 3rd quarter (the best, IMO) TWICE.

And I’m curious to see what the “Holiday Shopping & More” will be.

Boom! Instant approval

This card is offering free money for shopping I’m planning to do anyway. Definition of a no-brainer.

Citi Hilton Visa

This card usually has a sign-up bonus of 40,000 Hilton points. But until August 31st, it’s been increased to 75,000 Hilton points.

This is easily worth over $1,000

I wrote about how to get over $1,000 in value from the increased sign-up bonus by focusing on Hilton Category 1 and 2 hotels, which is how I plan to use these points.

The minimum spending requirement is $2,000 within the 1st 3 months. (And the clock starts ticking when you’re approved NOT when you receive the card.)

Boo-ya! Coming to a Hilton Category 2 near you

I was instantly approved with a $7K credit line.

I’m low on Hilton points at the moment, and I want to warm up to Citi a little more. They seem to be getting more aggressive with their card offerings, and I like that.

My strategy

Here’s my plan: shift all spending to the Citi Hilton Visa card EXCEPT for the 5% categories on the Discover It card. Pay down my other credit cards in the meantime, bank the Hilton points, then focus on my FIRE (which I can’t wait to report on next month).

Within a couple of months, I’ll have my credit cards paid off, 75K Hilton points, and hopefully some cashback coming my way.

And I’m looking forward to toying around with the Discover Deals shopping portal.

My further strategy is to dump this little pile of uselessness:

Once great cards, now a disgrace. C ya again never!

With these 2 new cards, I’m now up to 19.

When the Hyatt Diamond Challenge comes back around, I plan on picking up a Citi Prestige card and completing it in 9 nights.

I was tempted to sign up yesterday, but it didn’t feel like the right time. I would’ve been forcing it. But, it’ll come back and I’ll hop on then.

Bottom line

I still get a rush when I apply for (and get) a new credit card.

Looking forward to exploring the benefits of the Discover It card and the Citi Hilton Visa. Both seem like good (no annual fee) additions to my current arsenal.

And I can keep them both forever at no cost.

This is my first Discover card. We’ll see how it goes. Nothing to lose except an inquiry on my credit report.

Both cards are available (with the best current terms) via my links – thank you for clicking through them!

Does anyone else have either card? Any benefits I missed, or to keep in mind?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com