Harlan Vaughn's Blog, page 60

September 23, 2015

Chase Ink Plus Vs. Ink Cash: What Are the Differences?

Also see:

Chase Is Crackin’ Down on Churners

I haven’t written about the Chase Ink cards very much, but I’ve been thinking about picking up a Chase Ink Cash lately. I already have a Chase Ink Plus. It’s possible to get both because they’re technically different card products.

They have a lot in common. But there are a few differences that make or break the value you’ll get from them.

Biggest similarity

Both of these cards earn 5X Chase Ultimate Rewards points on:

Purchases at office supply stores

Phone bills

Cable bills

Internet service

And both of them earn 2X Chase Ultimate Rewards points at gas stations.

The 5X categories are a very beautiful thing.

I earn ~3,000 Ultimate Rewards points a month on average… and September ain’t over yet!

I charge:

My home internet service to the Chase Ink Plus

The internet service for my Airbnbs

My AT&T cell phone bill (which I save 15% on)

And, more recently, I’ve been buying basic cleaning supplies from Staples.com.

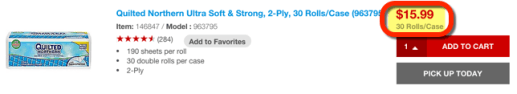

TP at Staples.com

Not everything, because not all of it’s a good deal. But take this toilet paper, for example.

Simple math says $16 for 30 rolls is ~53 cents a roll. That’s a pretty good price!

TP at Amazon.com

A comparable offering from Amazon is $25 for 36 rolls, or ~69 cents a roll. Not bad either, but it all adds up, as they say.

If you find something that is cheaper at Amazon, you can always buy Amazon gift cards at Staples (which you’ll earn 5X Ultimate Rewards points per $1 on), and then buy what you need from Amazon. That way, you still earn as many points, and save money in the process.

Yes, it’s an added step, but it can be worth it to save money and earn points. 5X is one of the most generous category bonuses around, and Ultimate Rewards points can still be very valuable (especially on British Airways and Hyatt hotel stays).

Don’t forget to earn 5% cash back on Amazon purchases at Giving Assistant!

So yes. It’s easy to rack up a ton of points in these categories. For me, 3,000 points a month is nearly 40,000 points a year, give or take. That’s a few free flights, or a few free nights, depending on how I play it. Well worth the $95 annual fee on the Chase Ink Plus.

Which brings us to the differences.

Fee situation

Chase Ink Plus is $95 a year.

Chase Ink Cash is free to have.

And…

Chase Ink Plus has no foreign transaction fees.

Chase Ink Cash has a 2.7% foreign transaction fee.

I’ve written about why you need at least one no annual fee credit card in your arsenal. But the no annual fee card (Chase Ink Cash) isn’t very good to travel overseas with.

That said, it’s worth paying the $95 fee on the Chase Ink Plus because it…

Transfers to airline and hotel partners

Chase Ink Plus transfers to these programs at a 1:1 ratio:

Chase Ultimate Rewards transfer partners

(Aside: I could throw out Virgin Atlantic and Marriott, and be just fine, but some peeps might find a use for their points.)

Anyway, you can NOT transfer points if all you have is the Chase Ink Cash.

To transfer points, you need one of these:

Chase Ink Plus

Chase Ink Bold (not offered any more)

Chase Sapphire Preferred

They all have a $95 annual fee.

These cards don’t have an annual fee, but you can transfer their points when you have one of the cards above:

Chase Ink Cash

Chase Freedom

That other 2X category

Chase Ink Plus also earns 2X Chase Ultimate Rewards points on hotel stays booked directly with the hotel

Chase Ink Cash also earns 2X Chase Ultimate Rewards points on restaurants

Here’s where it gets good. Because you can earn 2X on dining with the Chase Ink Cash, just like the Chase Sapphire Preferred.

I don’t need two Chase cards with this capability, so I could either:

Get the Chase Ink Cash, and toss the Chase Ink Plus

Get the Chase Ink Cash, and toss the Chase Sapphire Preferred

That way, I’m only paying a $95 annual fee one time instead of two.

Wild card is the other 2X category with the Chase Sapphire Preferred: travel.

Which is where the Citi ThankYou Premier comes in, with its 3X earning in this category. I’ve been curious about ThankYou points for a while, so I’m thinking of dumping the Chase Sapphire Preferred, and supplementing travel purchases with a Citi ThankYou card.

There are lots of cards to choose from and each of them will fit into your groove and spending patterns in different ways.

And, like me, your situation could change in a couple of years, and you might want different cards.

Limits

Chase Ink Plus lets you earn 5X on $50,000 spent on purchases in all the combined 5X categories.

Chase Ink Plus lets you earn 2X on $50,000 spent on purchases at gas stations and hotels combined.

And…

Chase Ink Cash lets you earn 5X on $25,000 spent on purchases in all the combined 5X categories.

Chase Ink Cash lets you earn 2X on $25,000 spent on purchases on gas stations and dining combined.

If you plan on spending more than $2,000 per month on office supplies, phone service, and cable, get the Chase Ink Plus because it has a higher limit.

Or, get both. Max one out, then the other. If you pay $95 for the Chase Ink Plus, you can add the Chase Ink Cash to your wallet for free, and keep earning 5X in those categories.

Sign-up bonus

Right now, you’ll earn:

60,000 Chase Ultimate Rewards points with the Chase Ink Plus after you spend $5,000 on purchases within the 1st 3 months of account opening.

30,000 Chase Ultimate Rewards points with the Chase Ink Cash after you spend $3,000 on purchases within the 1st 3 months of account opening.

Both are very respectable sign-up bonuses! And both are 10,000 points more than normal. Which is why I’ve been thinking about picking up another one.

But beware, Chase is cracking down on churners. So if you get either (or both) of these cards, keep them for at least a year!

They’re both available via my links with the higher sign-up bonus. Under “Card Type” just look for the name of the bank, and they’re near the top. And thank you!

Bottom line

I got the Chase Ink Plus for Out and Out back in 2013. I had no revenue, and no employees (apart from me, obvi). I applied with my SSN. Chase didn’t approve me right away.

I called and answered a few questions, and was approved over the phone. I’ve had the card since (and it’s still a World Elite MasterCard!).

So you don’t need huge revenue or an EIN. Just be truthful on your application.

You can apply using your credit profile, but after that, it won’t show up on your personal credit report.

And if you get the Chase Ink Cash, which is free to have, keep it forever to build your relationship with Chase!

Hope this was helpful – let me know if you have any questions about either card or how they work!

And thanks again for using my links if you decide to pick one up!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!

September 22, 2015

Must Haves of Travel: Rose Petal Water

Also see:

Must-Haves of Travel: Coconut Oil

Must-Haves of Travel: Apple Cider Vinegar

Must-Haves of Travel: Activated Charcoal

Must-Haves of Travel: Affordable Razors!

I know, I know. There are a lot of “must-haves” now. So much to keep track of.

I have to get super judicious about these.

Side note: the new Jewel album is SO GOOD. It’s called “Picking Up the Pieces” and it’s a throwback to 1995. It’s supposed to feel like it came right after “Pieces of You” (hence the similarity in the titles).

HER VOICE. Sounds so good. Some of it’s a little emo and histrionic, and has me in kind of a mood. But the songs are gorgeous. Please listen to it!

As another aside, there’s a last.fm plugin in the right-hand sidebar so you guys can always creep on what I’m listening to. Feel free to add me there if you have an account!

Anyway, rose petal water.

ROSE PETAL WATER

I love to use natural remedies for skincare, in my hair, and pretty much everywhere.

But the first time I got a bottle of rose water and used it as a toner was a little piece of heaven.

This stuff right here

The smell is incredible, for one. So light, and complex, and lovely.

It’s very hydrating, which is great for:

Flights!

Dry environments

Wintertime

Use as a toner after a hot shower (absolute bliss!)

People also use it for:

A light chemical-free perfume

A hair rinse

Bathwater scent

Aromotherapy

Scent in any homemade skin products, like face masks or scrubs

I know it sounds kinda crazy, but read the reviews!

When I got the bottle, I casually spritzed a little on as a toner. And then I practically bathed in it, it smelled – and felt – that good.

How to travel with it

I don’t have any huge hack or anything.

I just went to the dollar store on the corner and got a couple of spray bottles in various sizes. These 2 have served me quite well:

The bigger one for ACV, the small one for rose petal water

Something like this would probably work very well for all sorts of uses.

I like one that’s a little bigger for 5 to 7 day trips, and a slightly smaller one for weekend trips. Both of them easily fit in any bag or carry-on.

I fill them up, and toss them in a clear plastic Ziplock bag. Flash forward to the airport, where I breeze past security with TSA PreCheck, and then to wherever I’m staying – I use these to get ready in the morning and before bed at night. Then bring them home and put them in a cabinet, where they lie in wait for the next trip.

Easy peezy.

But why?

I like this brand because it’s 100% rose petal water. It’s made with rose petals and water. That’s it.

If you put it in the fridge and spritz it on in the morning, it 1. feels amazing on a hot summer day and 2. is perhaps the most refreshing thing on the planet.

If you have sensitive skin, dry skin, dark spots, zits, or just want an amazing toner that’ll leave you lightly scented and super soft, AND that’s all-natural, this stuff really can’t be beat.

Here are a few more health and beauty uses, and even more than focus on the culinary aspects (haven’t gotten that far yet!). But so far I’m loving it as a toner/body spray.

Bottom line

So yeah. My new thing. Rose water, rose petal water, whatever. This stuff. Heaven in a bottle.

For travelers, this is an excellent way to tone, refresh, and hydrate skin. It also has cleansing properties that keep your skin healthy, too.

I’ve been using rose petal water in addition to my coconut oil/apple cider vinegar routine, and must say, I’m very happy with how it’s going.

That’s all for now, back to the new Jewel album.

Whatever you’re doing, make it a good one!

Oh, and let me know if you’ve used rose petal water, or have any natural products you like to use!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!

Reminder: Get Your Club Carlson Free Night E-Cert (If You Haven’t Already)

Also see:

Club Carlson: Dead to Me

Club Carlson eliminating free night for award stays on June 1st

Man, I was a Club Carlson fanboy for a while there. You couldn’t get me out of Club Carlson hotels when they offered the BOGO for cardholders of the US Bank Club Carlson Visa Signature.

And then, they brutally snatched the benefit away, leaving peeps (and their brand) in the dust.

It was a too-big-for-their-britches move during which they artificially inflated their points currency, and made themselves completely irrelevant when compared to the big players… but that’s just one man’s opinion.

The upshot was they started apologizing in the form of free night e-certs good at any Club Carlson property.

Except there was one snag. Not everyone got them.

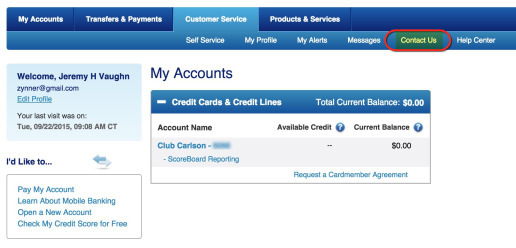

But, you can email US Bank via their online platform if you didn’t get one!

How to do it

So easy.

On the US Bank website, click “Contact Us.”

La la la

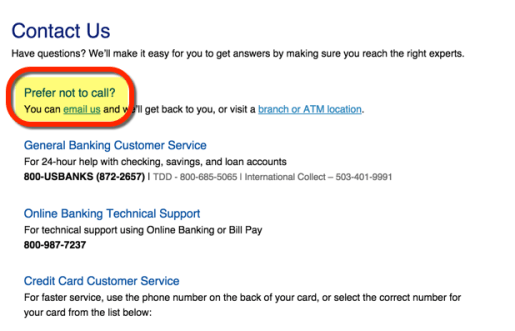

Then, you’ll see a heading that says, “Prefer not to call?” to which the answer is DUHHHHH!

I don’t want to talk to anybody, thanks

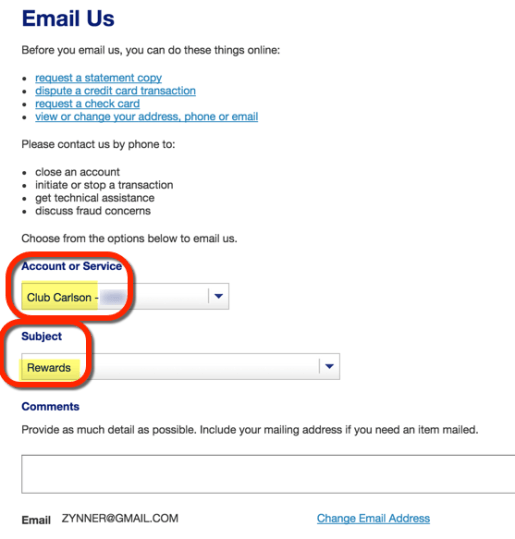

Select your card from the drop-down menu, and for subject select “Rewards.”

I didn’t provide that much detail

All I wrote was, pretty much:

“Where my e-cert at?!”

Seriously. I think I wrote 2 short sentences.

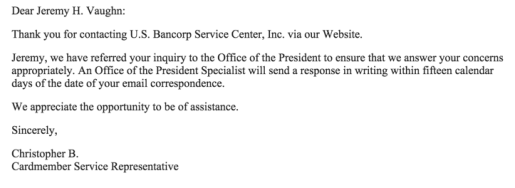

I wrote them on September 2nd, and got the standard blah-blah-blah form email as a reply:

Yada. Yada. Yada.

Anyway, flash forward to today.

I got this in the mail:

They gave me it!

So, I’ll be getting that free night after all.

And, you should to0! If you have the US Bank Club Carlson Visa Signature card, you should write to US Bank and ask them to credit your Club Carlson account with a free night e-cert.

Why this is cool

I have ~76,000 Useless points… er, I mean, Club Carlson points.

Because the BOGO is gone, the e-cert recreates the effect at inflated European properties, which is basically all of them.

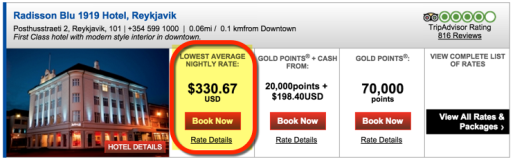

Take, for example the Radisson Blu 1919 Hotel in the center of 101 Reykjavik.

~$331 a night in October

It’s 70,000 Club Carlson points a night, which I have. But with the e-cert, I can get another night free.

What does this mean?

I saved over $300 by writing a 2-sentence email!

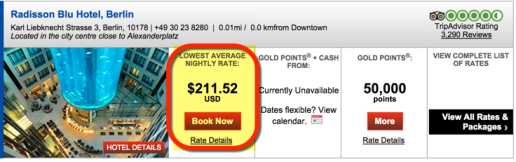

This is only 1 example. Many Club Carlson hotels in Europe are comparable in price and quality, like the Radisson Blu Berlin with the crazy aquarium, which is over $200 a night.

Over $200 a night in Berlin

Or how ’bout $250 a night at the Radisson Blu Warwick Hotel in Philly, Penn.

Not during the Papal visit, obvi

Bottom line

My US Bank Club Carlson Visa Signature card renews in November. I’m going to swipe the 40,000 point anniversary bonus, and cancel that card so hard.

But at least I’m coming out of it with some points, and an e-cert that basically recreates BOGO for me one last time.

If you haven’t already, log in to your US Bank account, and request that e-cert. They’re slow as Christmas about replying, but when they do, it’s usually good news.

Your e-cert can easily be worth a few hundred bucks (or least a couple hundred), depending on where you use it. But getting $300+ for writing an email for a minute is very worth it!

So if you haven’t already, get your free night e-cert while the gettin’s still good!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!

September 21, 2015

Chase Is Crackin’ Down on Churners

While reviewing the new T&Cs of the:

Chase Ink Cash

Chase Ink Plus

Chase Sapphire Preferred

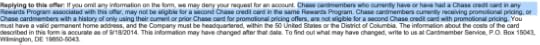

…I noticed some new language I hadn’t seen before:

Chase cardmembers who currently have or have had a Chase credit card in any Rewards Program associated with this offer, may not be eligible for a second Chase credit card in the same Rewards Program. Chase cardmembers currently receiving promotional pricing, or Chase cardmembers with a history of only using their current or prior Chase card for promotional pricing offers, are not eligible for a second Chase credit card with promotional pricing.

Here’s a screenshot:

It’s under “Replying to this offer”

Why this is interesting

Before, Chase specified a time period of 24 months since you’d last received an offer. And now, that’s gone.

It’s simply, “a history,” and “have or have had a Chase credit card in any Rewards Program associated with this offer” AKA what Chase says, goes AKA no appeal if you’re denied.

Another day, another offer

This comes hot on the heels of increased sign-up bonuses for the Chase Ink Cash and Chase Ink Plus (a post on their differences coming soon).

Those are small business credit cards. But Chase also applies the new rule to the Chase Sapphire Preferred, a personal credit card.

This is a trio of Ultimate Rewards-earning cards. As of now, the Chase Freedom still has the old/normal T&Cs.

What this means

Ultimately, Chase is watching your card activity. And if they see anything they don’t like, like:

Closing a card too soon after earning the sign-up bonus

Already having an Ultimate Rewards card

Any “history” they deem unacceptable

…they can give you the boot.

But what this new language really is intended to discourage is churning: opening a card, earning the sign-up bonus, and then canceling it.

It’s a bold step for Chase, and the next logical one for them after denying peeps for having 4 or 5 inquiries from any credit card company within the past ~2 years.

Their restrictions are increasing, and it’s getting harder than ever to get a Chase credit card. And especially an Ultimate Rewards credit card.

And, meanwhile, Chase isn’t adding any new transfer partners… In fact, they’re most likely losing Amtrak…

Wondering what this means for Chase, Ultimate Rewards, and future transfer partners.

Bottom line

If you’ve churned, or are thinking about churning, a Chase card: don’t apply for a new one.

For a limited time, you can earn 10,000 more Chase Ultimate Rewards points on the Chase Ink Cash and Chase Ink Plus… if you meet Chase’s definition of a good “history.”

Curious if this type of policy will carry over to other card issuers, and what it means for Ultimate Rewards as a program, and Chase as an issuer.

Marked as developing. Take note, and don’t bother appealing if you’re denied for a Chase Ultimate Rewards credit card.

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!

September 9, 2015

Awesome Things, Value From Hilton and Hyatt Points, Win SPG Points, and a New Finance Blog

A guy named Neil is working on a list of 1000 things that are… awesome. And no corner of life is left unexplored.

He’s got 161 left to go, so there’s plenty to read and lot more to look forward to. Instantly added it to my feedly. I think anyone can find something they appreciate there.

2. Virgos are having a great month

If you’re a Virgo, this is a pretty good time to be alive. For the first time in 12 years, Virgos are experiencing a solar return.

Susan Miller explains this much better than I do

What’s that mean? I’ll let Susan Miller explain it. But it basically means this year is dipped in gold for the Virgo-folk out there.

I’ve experienced a turning point this month already, and things are always on the up and up.

I check in with Susan each month on Astrology Zone, as her horoscopes, whether you’re “into” astrology or not, are simply a delight to read. Her voice is so kind and knowledgeable. Love it.

3. TPG digs into Hilton

Richard from The Points Guy wrote a thorough and detailed post about Hilton points.

A great read!

I didn’t know about Hilton Points & Money awards, tbh. It’s no Starwood Points & Cash, where you can routinely get 4+ cents per dollar of value. But it’s a good option to have if the value proposition works out.

Which kind of unleashes why I’m liking my little stash of Hilton points now: they’re so easy to earn. Compare that with Starwood, whose points accrue at the pace of a diseased crawl.

I appreciate the thought and effort that went into this post. Added it right into my Evernote.

Oh, and definitely agree about Hilton Gold status. Worth having even for occasional Hilton visitors.

4. 1 best thing about each points and miles program

Also see: AA Award Chart

Travel Is Free endeavored to find the best use of points for each mileage program.

I’d have to agree, mostly.

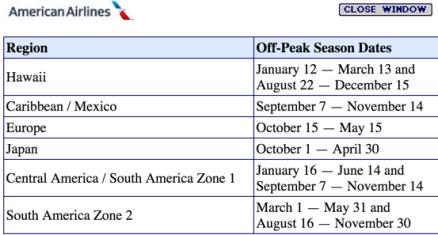

AA off-peak dates

I personally think the best use of AA miles is off-peak to the Caribbean and Mexico for 12,500 miles each way, though the dates are more limited. With Europe, off-peak is over half the year and 20,000 miles each way.

Why? Simply because of prices. Flights to the Caribbean can be freaking expensive.

I’d also argue the best use of Hyatt points is low- and mid-tier properties, not the hotels that go for 25,000 points per night.

In his example, you’ll pay 25,000 points for a room that goes for ~$1,000+ per night AKA 4 cents of value per point.

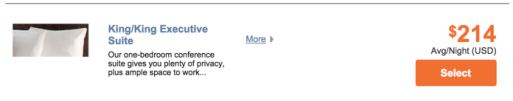

I’d rather use points at low-tier hotels

I’d rather use 5,000 points for a Category 1 hotel like the Hyatt House Dallas/Uptown (review coming soon!) that goes for ~$200 a night.

And get the same value

But ya know what? That’s still ~4 cents of value per point.

So it’s a case of different strokes for different folks. As always, it depends on what you value.

And yeah, I’d totally spend that many points for a special occasion or super romantic getaway. But for regular travel with Hyatt, I like to stick to the lower end, like when I stayed at the Hyatt Regency New Orleans, Hyatt French Quarter, or Hyatt Regency Boston.

I agree with him about Hilton, though. I’m quickly finding you can get damn near 2 cents of value from a Hilton point, especially at Category 1 and 2 hotels.

There are good uses for Hilton points… and value to be had!

A night at the Hampton Inn & Suites Mexico City is $159 or 10,000 Hilton points. So… ~1.6 cents per Hilton point. Which is very good all on its own.

But, with Hilton’s 5th night free on award stays, you’d pay 40,000 Hilton points for a stay valued at ~$800, which is right around 2 cents per point.

Considering the sign-up bonus on the Citi Hilton Visa is 75,000 points right now, and has no annual fee, you could nearly get 2 five-night stays at Hilton Category 2 hotels and get ~$1,600 worth of value per the quick off-the-cuff example above.

That’s a really good deal for any sign-up bonus, and especially for points that are generally considered useless. I like finding the value in things, and, as Warren Buffet says, when everyone else zigs, you gotta zag!

Oh, and because it’s a Citi card, be on the lookout for new Citi Offers soon!

5. Sex Health Money Death

A new personal finance blog. I know what you’re thinkin’ – not another one!

The spirit and tone of Sex Health Money Death is refreshing.

In the race toward FIRE, this blog stops and says, “What’s it all for?” and “Why?” – in a darkly hilarious way, which makes it all the better.

I love the feeling of catching a well-written blog at the beginning. If you’re into personal finance, definitely give this one a read-through!

HT: Thank you to George from Travel Blogger Buzz for turning me on to this!

6. Starwood’s Open the World Game

Even though I don’t care about Starpoints, I’ve been giving this little game a go each morning (it goes through September 30th). Apparently, you can win Starwood points or “instant prizes.” So far, I’ve turned up nothing.

Hey, ya never know

Who knows, maybe I’ll hit the jackpot and have a stay so amazing it makes me rethink Starwood.

Until then, I’ll ride my little Hilton/IHG/Hyatt train while the gettin’s still good.

Good luck if you play – let me know if you win anything!

#truth

Oh, and check out these hilariously depressing motivational posters. I lol’d.

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!

September 7, 2015

Citi Offers to Compete With AMEX Offers “Soon”

Also see:

Seriously tempted by the 75,000 point Citi Hilton Visa offer

I wish I got a better screenshot of this.

But it comes up right after you pull up the Citi mobile app after the September 7th update:

The mobile app calls the new feature “Citi Offers”

The other screen was much more effusive, and promised new “Citi Offers” on eligible cards at certain merchants – just like AMEX Offers. The only timeline Citi offered was “soon,” but I wouldn’t be surprised if the new feature hit in the midst of the holiday shopping season.

Benefits for consumers

I’ve been hoping another credit card company would compete for with AMEX for the lucrative “offers” market.

I kinda thought it might be Chase, who’s been a bit lagging with transfer partners and earning options recently.

Citi and AMEX have both really stepped up their game. Especially Citi and their ThankYou points program (which I need to look into stat!).

If this becomes a reality before Small Business Saturday, AMEX will have some serious competition in the offers market.

You know what I always say: when banks compete, you win.

In fact, I’ve been hoping for this sort of turnaround given the health of the economy.

Points redemption options are plummeting, hotels are packed, and planes are flying full. But at least we can save some money in other ways.

All-in-all, this new development should be a net win for shoppers.

I’m looking forward to seeing who Citi partners with, what the offers look like, and if there’s any duplication of partners between Citi and AMEX (which would be awesome to see them duke it out).

Bottom line

Be on the lookout for Citi Offers – a direct competitor to AMEX Offers.

I’m super excited about this. Not only because I just got the no annual fee Citi Hilton Visa, but because between this new feature and Citi Price Rewind, people might have the chance to save a LOT of money with their holiday shopping.

I hope this becomes a reality before November. As of now, all Citi will say is “soon.” But because it’s part of the most recent mobile app update, my inclination is that it’ll be sooner rather than later.

I’ll post more deets as they become available!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!

Activate Cash Back for Discover It Q4 Bonus Categories (Amazon.com, Clothing & Department Stores)

Also see:

Discover It Is an Amazing Cashback Card (For the 1st Year at Least)!

Get an Easy $600 with the Discover It Card

Yay! Just got Discover It and Citi Hilton 75K cards!

I’ve loved having the Discover It card so far. It offers an unparalleled 10% cashback in rotating quarterly bonus categories – the 1st year at least. In fact, if you max out the categories each quarter, the card is good for an easy (and completely free!) $600 cashback.

The card has no foreign transaction fees and no annual fee. I’ve written about the importance of having at least 1 no annual fee credit card. And this one is a very worthy candidate for that slot.

Discover It’s Q4 bonus categories

I’m pleased to see the new Q4 bonus categories, which are:

Amazon.com (again)

Department stores (again)

Clothing stores

The quarter runs October 1st through December 31st, so it’s great for cashback on holiday shopping. You’ll get 10% cashback at Amazon.com for a 2nd quarter in a row. That’s amazing!

New cardmembers get double cashback on the 5% bonus categories (so 10% cashback). You’ll get 5% cashback after your billing statement closes, and the doubled cashback after your 12th billing cycle.

Discover It’s excellent Q4 categories are ideal for holiday shopping

To get double cashback, you’ll need to apply by September 30th (and the card is available via my links – thank you for using them!)

I recently got this card and am really glad I did!

To sweeten the pot

A couple of other things sweeten this deal even further.

The cashback at Discover Deals goes as high as 10%

You’ll get double cashback even via the Discover Deals shopping portal, where the rate is routinely 10% cashback – even on the bonus categories.

So, you can get as much as 30% cashback (5% back for bonus categories, and 10% back for shopping on the portal, both doubled) – and it’s stackable with other promos and discounts, which is an incredible deal.

Get an incredible 15% at Amazon.com

And, through the new Giving Assistant shopping portal, you can get a further 5% cashback at Amazon.com, which is NOT available through Discover Deals.

In total, you’ll get 15% cashback when shopping at Amazon.com, which is pretty sweet, especially for holiday shopping.

I made a small purchase on Amazon.com via Giving Assistant, and the cashback posted within 3 days

I’m surprised to see Amazon.com repeated as a bonus category for Discover It 2 quarters in a row. It seems Discover is being aggressive about their cashback offerings, which is amazing for consumers.

I’m all for anything that saves me money on stuff I’m going to buy anyway.

And remember you can use Paribus to get even more cashback at Amazon.com if the price drops lower.

Bottom line

If you have the Discover It card, you can now sign up for the Q4 5% cashback categories, which include Amazon.com, and department & clothing stores.

The holidays will be here before you know it. Personally, I love getting cashback from Amazon.com with this card. And the new Giving Assistant portal is offering 5% cashback right now, which is even better.

This is quickly becoming one of my go-to cards, which is surprising considering I’ve only had the card for about a month.

It’s been in my wallet since the day I received it and hasn’t left, because I find myself accessing it so frequently. If Discover keeps it up with the cashback in easy-to-use (read as: easy-to-spend) categories, it’s a definite keeper.

The double cashback is good for new cardmembers through September 30th, so if you don’t already have this card, thank you for considering signing up through my links!

Oh, and you’ll get 12 or 18 months with 0% APR, just in case you need to float your purchases for a few months. Just be sure to keep track of when you opened the card so you never pay a dime of interest!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!

August 29, 2015

ABC + FIRE! (In which life is all acronyms.)

Also see:

Getting FIREd Up

I’ve been looking forward to writing this post for a few months by now. Now here it is!

Yesterday, I made the final payment on my credit cards. Now, I don’t owe a cent of credit card debt!

As you guys know, I charged those puppies up to:

Get my Airbnbs started

Meet minimum spending requirements

Earn more points and miles

Stay afloat (#independentcontractor)

There was a point, a real and scary one, where I felt I’d certainly overleveraged myself.

I wrote about the feeling in Smart Debt: Is carrying a balance ever a good idea?

Side hustle of the millennium

And I definitely felt I’d nearly crossed the line into plain ol’ dumb debt.

Digging out of credit card debt is by far one of the most psychologically strenuous exercises I’ve faced. And that moment where I saw the interest get charged felt so wrong, my stomach turned. But I knew I could shoulder a couple of months of interest to make it all back, plus more.

Still, it sucked.

And today is the official turning point where I go full-force into FIRE.

What is FIRE?

FIRE stands for “Financial Independence, Retire Early.”

This is FIRE, too :p

It’s a long-term goal with actionable short-term steps.

My credit card debt was an out-of-control flaming emergency.

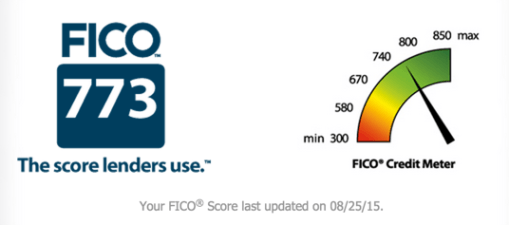

And credit score has already responded

I still have student loans, to the tune of $53K, and it’s time to take a hybrid approach to paying those down, saving, and investing all at the same time.

I went down to Dallas earlier this month to take a look at some investment properties down there. The numbers seem to work. And I’m thinking about snapping something up in the next few months.

With FIRE, the ultimate goal is to have the option to work or not work, without being dependent on it.

The actionable steps now that the credit cards are done are:

Set up an emergency fund (maybe with my new Aspiration Summit account?)

Save a down payment for a property

Max out Roth IRA (with the help of the Fidelity AMEX, of course)

Possibly make a move soon

Save, save, save, and keep reinvesting

OK, so what’s ABC?

I no longer work in real estate.

But every day in the office, I heard “ABC.”

Always

Be

Closing

Which reminded me of this:

So I changed it to:

Always

Be

CELEBRATING

My kind of ABC

Which is much more positive. Hey, it’s all about mindset, right?

But it’s a good one. I make sure I always have something to celebrate.

And taking the first steps into the FIRE mindset definitely qualifies for ABC!

Birthday plus solar return

I’m a huge fan of Susan Miller’s Astrology Zone. (If you’ve never read it, carve out an hour. She writes a tome each month!)

This is a great time to be a Virgo, because Jupiter just came back to the sign – to stay for nearly 13 months!

Jupiter?! Oh, there you are!

For those not into astrology (I’m not super into it, but it’s fun to think about), that means it’s a great time to pick yourself up and really go for it, especially if you’re a Virgo.

My birthday was this past week (on August 26th), so now I’m a year older and feeling energized. In fact, I’ve already made progress toward my goals and it feels great!

I missed the Reach for the Miles meetup this month because of b’day stuff. (Missed seeing Stefan, Mike, and other points junkies!) But I’ll be at future meetups. And if you’re in NYC, be sure to join the group to be notified of the next meeting!

Bottom line

I’ve been working super hard to pay off all my credit cards, and it’s finally done!

I don’t really have any nuggets of wisdom other than make your mind up to do it – make the decision – and then freakin’ do it.

It sucks but it’s necessary. Because you sweep away all the energy that’s holding you back and create new things to look forward to.

Now I’m a year older and this is the year of ABC + FIRE. Already can’t wait to see what this upcoming year brings.

Stay scrappy out there and have a great weekend!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

New American Airlines FoundersCard Benefit: 10% Off Transatlantic Fares & 5% Off Domestically

Also see:

FoundersCard Membership: Is it worth it?

Details about FoundersCard benefits (Cathy Pacific, Avis, hotel discounts)

Assessing the Benefits of FoundersCard

FoundersCard

At the risk of turning Out and Out into the official FoundersCard blog, I wanted to share their new American Airlines benefit. It changes quarterly, and some of them have been really good (they’ve had 5% off domestic fares before, and just had a free Platinum Status Challenge this past quarter).

10% off transatlantic fares is a new benny!

They’ve never had 10% off fares to the UK and Europe before, so this could be useful to some.

FoundersCard + American

If you have a business class fare (or heck, even an economy fare) to Europe, you could easily save $70-$100+ on a $700-$1,000+ round-trip ticket. 5% off domestically is nice, too.

A few T&Cs to keep in mind:

The discount will not be applied to any government or airport imposed taxes, fees, or charges (duh)

Discount is only valid on published, round-trip fares

You must book on AA.com

You must purchase your ticket by November 1st, 2015

And travel by January 6th, 2016

There are blackout dates around Labor Day, Thanksgiving, and Christmas/New Year

You can use the benefit as many times as you want. You can request the 5% off code directly through the website (they’ll email it to you instantly), but you must call to get the 10% off code.

About FoundersCard

FoundersCard has a few key relationships I really value (this one with American Airlines, free Gold elite status at Hilton, 15% off AT&T cell phone bills, free TripIt Pro for a year, and a few other goodies).

It’s $395 a year, which I mostly recoup from getting 15% off my AT&T bill. Everything else, like free breakfast and late check-out at Hilton hotels, free TripIt Pro, and discounts like this one, are gravy.

If you have a few trips with American Airlines coming up, especially to Europe, 10% off could easily add up to cover the cost of the annual fee. And then you’d have all the other perks left to enjoy, so it might be worth it for a few peeps.

Bottom line

I was looking forward to seeing what the new American Airlines benefit would be, and this one is the best yet.

Too bad there are blackout dates for the holidays, but every airline has blackout dates around the holidays, so I can’t really blame ’em.

Check out my posts about if FoundersCard is worth it, some of the overall perks, and specifically the ones about travel.

Feel free to sign up using my link. I can also email invites so you can preview the website. Just comment below or email me.

Happy Saturday!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

August 27, 2015

New App Alert: Mercez Helps You Pick the Right Card to Use Abroad

Also see:

New App Alert: AirHelp. Know Your Options When You Get Bumped from a Flight

A Few Apps + Sites I Like to Save Money

Mercez

Add this to apps you should download.

I love handy travel apps and saving money, and this one really impressed me.

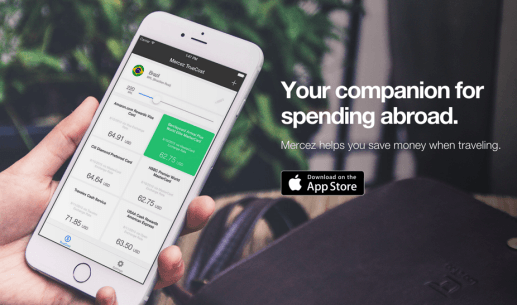

Mercez lets you add all your credit cards, and then tells you which one has the best exchange rate abroad!

What’s Mercez?

It’s a small app, about ~9MB, that lets you add all your credit cards. They’re all there. Seriously.

Then, you can select the country you’re in and how much you want to spend.

Mercez tells you the exchange rate on each card and highlights your best option.

How cool is that?

I randomly selected a few cards: a Visa, MasterCard, Discover, and AMEX card. All of them have NO foreign transaction fees except the AMEX EveryDay Preferred, which has a 2.7% forex fee.

I entered in a country on the Euro, Belgium, and a random amount of 614 Euros to see what would come up.

All of the cards, to my surprise, had different exchange rates. Nothing earth-shattering, but you can save ~$22 by using the Chase Sapphire Preferred as opposed to the AMEX EveryDay Preferred (another win for Chase).

The app doesn’t seem to track the forex fees on the individual cards, which kinda sucks. It would be awesome if they could build that into the service at some point.

The Chase Sapphire Preferred even beat out the other 2 no forex fee cards, including the Barclaycard Arrival Plus by about $17. If you’re going out and eating out a lot in another country (which duh, you are), this could add up to save you some serious cash on your trips overseas.

Color me impressed!

It’s a free app so you have literally nothing to lose by downloading it. For now, you’ll just have to remember which of your cards do NOT have forex fees.

A quick poke around on their website shows they’re working on a couple of new features for the app (Swap for currency exchange and Lifeboat, presumably to track your options for returns/damaged goods overseas), so it’s very much a work in progress, which is really cool.

It’s nice to see some transparency brought into this area. I’ll definitely keep the app on my phone to compare options next time I travel internationally.

The only other thing to consider is category bonuses, as it might be worth spending an extra buck or two if you really want the points at restaurants, gas stations, etc.

Bottom line

Mercez is a cool little app that’ll help you save money overseas by telling you the best exchange rate based on the cards you have and the country you’re visiting.

They’re based in Atlanta, and seem to be working on a few more features to add to the app in the coming months. If you travel and have a smartphone, this is a great app to have.

Very useful!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com