Chase Is Crackin’ Down on Churners

While reviewing the new T&Cs of the:

Chase Ink Cash

Chase Ink Plus

Chase Sapphire Preferred

…I noticed some new language I hadn’t seen before:

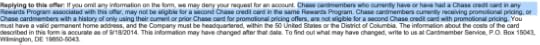

Chase cardmembers who currently have or have had a Chase credit card in any Rewards Program associated with this offer, may not be eligible for a second Chase credit card in the same Rewards Program. Chase cardmembers currently receiving promotional pricing, or Chase cardmembers with a history of only using their current or prior Chase card for promotional pricing offers, are not eligible for a second Chase credit card with promotional pricing.

Here’s a screenshot:

It’s under “Replying to this offer”

Why this is interesting

Before, Chase specified a time period of 24 months since you’d last received an offer. And now, that’s gone.

It’s simply, “a history,” and “have or have had a Chase credit card in any Rewards Program associated with this offer” AKA what Chase says, goes AKA no appeal if you’re denied.

Another day, another offer

This comes hot on the heels of increased sign-up bonuses for the Chase Ink Cash and Chase Ink Plus (a post on their differences coming soon).

Those are small business credit cards. But Chase also applies the new rule to the Chase Sapphire Preferred, a personal credit card.

This is a trio of Ultimate Rewards-earning cards. As of now, the Chase Freedom still has the old/normal T&Cs.

What this means

Ultimately, Chase is watching your card activity. And if they see anything they don’t like, like:

Closing a card too soon after earning the sign-up bonus

Already having an Ultimate Rewards card

Any “history” they deem unacceptable

…they can give you the boot.

But what this new language really is intended to discourage is churning: opening a card, earning the sign-up bonus, and then canceling it.

It’s a bold step for Chase, and the next logical one for them after denying peeps for having 4 or 5 inquiries from any credit card company within the past ~2 years.

Their restrictions are increasing, and it’s getting harder than ever to get a Chase credit card. And especially an Ultimate Rewards credit card.

And, meanwhile, Chase isn’t adding any new transfer partners… In fact, they’re most likely losing Amtrak…

Wondering what this means for Chase, Ultimate Rewards, and future transfer partners.

Bottom line

If you’ve churned, or are thinking about churning, a Chase card: don’t apply for a new one.

For a limited time, you can earn 10,000 more Chase Ultimate Rewards points on the Chase Ink Cash and Chase Ink Plus… if you meet Chase’s definition of a good “history.”

Curious if this type of policy will carry over to other card issuers, and what it means for Ultimate Rewards as a program, and Chase as an issuer.

Marked as developing. Take note, and don’t bother appealing if you’re denied for a Chase Ultimate Rewards credit card.

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!