Harlan Vaughn's Blog, page 56

January 1, 2016

How I Made an Extra $60K from Airbnb in 2015

Also see:

I rented an Apartment to Airbnb in NYC

Airbnb First Month By the Numbers

Airbnb by the Numbers: Q1 Update

Airbnb by the Numbers: Q2 Update

Airbnb: Us and Them

Side hustle extraordinaire

I’ve written a lot about my side hustle with Airbnb a lot in the past. So I thought I’d follow up, because side hustles are a big part of my FIRE, and a great way to dig yourself out of debt – or earn more income.

In my Q2 update, I estimated I’d make an extra ~$31K off the endeavor in 2015.

I took some knocks here and there, but doubled my original projection. All told, I earned an extra ~$60K from Airbnb in 2015. And most of it went toward debts. In 2016, I’ll earn less but hopefully knock out my student loans once and for all.

Good vibes

Here’s how I did it.

The numbers

The numbers are complex. I have 4 places in total, but split 2 of them 50/50 with my business partner, Chris.

So, 2 of them are 100% mine and 2 are 50% mine. For these numbers, I’m only looking at my side of things.

I added 2 new places in 2015, so those 2 have partial-year numbers available.

And tomorrow, I’m getting rid of 1 (long story… basically it’s no longer worth it).

But the raw numbers tell me I earned ~$60K in profit.

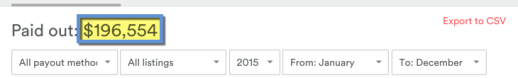

Total payouts in 2016

All of the money from Airbnb, absolutely all of it, was nearly $200K paid out in 2015.

Of that:

$47,730 went to my business partner

$78,050 went to paying rent in NYC (!!!)

$10,754 went to taxes

Which left me with:

$60,020.

Here are the 4 places and their associated rents:

#1: 2300 a month X 10 months + 2875 (rent increase) X 2 = $28,750

#2: 1600 a month X 9 = $14,400

#3: 1300 a month X 7 = $9,100

#4: 2150 a month X 12 = $25,800

As you can see, I had 1 place for 9 months of 2015, and another for only 7.

I paid a lot of rent in 2015.

Where did it all go?

This money is not in my checking account any more, but that doesn’t mean it’s gone. Well, most of it is.

Here’s how I spent it:

$14,000 for down payment on a house in Dallas

$5,500 for Roth IRA

$35,000 to paying off credit cards

The lion’s share of it, was… credit card debt.

In the background of life, I managed to accumulate a ball of debt that would slow down most people. Thirty-five thousand dollars. Geez.

That’s why I got into this whole Airbnb business in the first place – to alleviate that debt, save up for a house, and then knock out my student loans.

This side hustle not only surpassed, but doubled, my expectations. And I’m happy to report I am credit card debt-free now.

And I did buy that house.

I even invested.

2015 was the first year I maxed out a Roth IRA. I contributed the maximum amount allowed. So this money lives on as retirement income, which will hopefully appreciate to much more in the next, oh, 30 years.

And I plan on moving permanently to Dallas in Spring 2015. The $14,000 includes down payment, property taxes, interest, fees, blah blah blah. So some of it was a sunk cost, but some of it lives on as equity in my brand new investment property.

And I’ve already got my eye on investment property #2. In fact, I plan on starting my search for a multi-family duplex in the Dallas ‘burbs.

If only I’d known how much this would end up costing me in time and interest

But I’m not debt-free all the way yet. 2016 will suck up most of the profit toward previous debts, too (which is totally fine in my book! I’m just happy to be rid of them!).

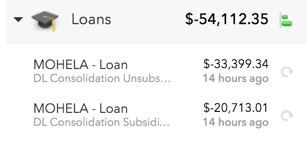

The thorniest of thorns in my side – student loan debt

I still owe a staggering $54K to the US government for student loans.

There are 2 more things I want to talk about real quick.

How did I surpass my goal so much in 2015?

If you read my Airbnb Q2 update, you’ll find find I threw out all of Q1 as a sunk cost. I broke even for 3 months.

I was kinda wondering what I got myself into. And now here I am again, back in another Q1.

I’m expecting the same results this year. 3 months of work for $0 return. But as you can see, it is worth getting through (it starts to turn around in mid to late March).

Q2 gave me hope.

But Q3 and Q4 blew it out of the water.

August and October were my #2 and #1 months this year, respectively. So I had a strong Q3 and Q4.

I got higher margins than I thought were possible, and even hit $10K in profit in October (my best month).

I attribute it to:

Getting the best rates in the high season thanks to good reviews

Low vacancy

Low rents (relatively speaking)

Quick turnover

High rate of communication

Good management (quick and thorough responses and double/triple-checking everything)

Why I DO NOT expect this to continue

The gravy train is slowing down.

One of my rents increased from $2,300 a month to $2,875 a month.

That’s… insane. That’s $7K a year in extra rent! Which severely cuts into my margins.

And, as mentioned before, I’m getting rid of 1 of them.

I expect to get rid of a 2nd in late April because I won’t renew the lease (the building is too difficult for Airbnb).

Finally, I don’t know how much rents will increase in 2016.

New York is a fierce, competitive, and growing market. Both with rents and with Airbnb. So I’m balancing rising cost of doing business with lower prices to remain competitive, which means I earn less.

Even still, With 3 places left, then 2, and maybe just 1 by the end of the year, I expect to keep the Airbnb stream going in 2016. But I do NOT expect to make nearly as much as I did in 2015, realistically.

With the profits, now that my credit card debt is gone, I’ll:

Pay down my $54K in student loans

Max out my Roth IRA again

Save up for investment property #2

Contribute to a Solo 401(k)

But my #1 focus is to eliminate my student loans in 2016. It’s just time. I’m tired of them hanging over me. Even if it’s the only one on the list I knock out this year.

Even if I repeat the success of 2015, I’ll barely get beyond my student loans and spend 90% of the year paying them off. I may have a little left over for my Roth IRA and the other financial goals.

And I’m already planning to create new income streams to help bolster those. And who knows, maybe I can move my Airbnb income down to Dallas with me.

2017 will be the year of real profit, or at least of rapidly building up equity and paying down mortgages.

Bottom line

Was it worth it? To have, on average, an extra $5K per month in income in 2015? Hell yes.

It paid off my credit card debt, bought me a house, and got me on track toward retirement income – all for my FIRE.

While I don’t expect 2016 to touch the levels of 2015 as far as pure profit, I do hope to at least pay off my $54K in student loans this year once and for all (the curse of the millennial generation).

I said it once and I’ll say it again:

If all this Airbnb side hustle does is pay off my student loans, I am 100% OK with that.

Here’s to side hustles, creative problem-solving, taking control, and living dreams in 2016. (Oh, and travel, independence, and freedom of schedule. It’s all tied together, in a roundabout way.)

I’ll report back with an update on how the year is going and progress toward getting rid of student loans once and for all.

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!

16 Points & Miles Predictions for 2016

Happy New Year! I thought I’d hop on the bandwagon with the predictions. So here’s my effort.

OUT AND OUT - Investing. Positivity. Oh, and travel.

OUT AND OUT - Investing. Positivity. Oh, and travel.

December 27, 2015

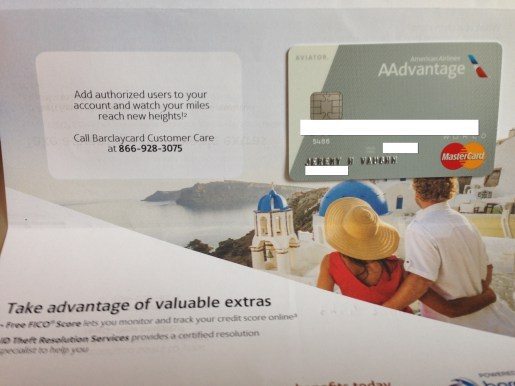

Barclaycard Aviator Downgrade Offer + Q1 Bonus Points at Supermarkets

RIP, Barclaycard Aviator Red MasterCard.

As part of closing on my house, I had to ax this card (I’ll explain why in another post). But, before the boot, I downgraded the card from Red (with an $89 annual fee) to the regular ol’ “Aviator card” (with no annual fee), and got it in the mail just in time to say goodbye.

You are lost and gone forever, oh my darlin’, Clementine

Here are 2 offers I got that might be helpful to some folks. One you have to call to receive, the other is targeted – so be on the lookout if you’re interested.

Downgrade offer

The rep gave me an offer when I downgraded: 5X bonus points per $1 spent on purchases up to $1,000 in any category within 90 days.

The regular Aviator card only offers 1 mile per $2 spent, so it’s an offer for 5.5X total points on up to $1,000. Still, I was going to use it anyway. It’s a solid offer, and worth shifting some spend.

And, I saved the $89 annual fee when I called (it was credited back).

I also confirmed I’d have the option to upgrade the card again the future (back to Red, or to Silver with the $195 annual fee if I so desired).

So, if you want to downgrade (or upgrade) your card, ask if there are any offers available on your account. At best, you could rack up an extra 5,000 American Airlines miles and save yourself an annual fee.

Wanted to share this experience just in case others are in the same boat!

Q1 Offer

I shared my Q4 offer, which was actually pretty good. And now there’s another one.

(Note it was for the Barclaycard Aviator Red card. I received this in the mail yesterday even after canceling it.)

Like other Q1 offers from other credit card companies, it’s only so-so.

Triple miles at supermarkets, movie theaters, and utility companies

The offer is for 2 bonus AA miles, in addition to the normal 1 AA mile earned, per $1 spent at:

Supermarkets

Movie theaters

Utility companies (gas, water, electric, TV, and phone)

The cap is 2,500 bonus AA miles (so $1,250 in spend). Barclays is known to send out a variety of offers, so if you have this card, be on the lookout for a promo.

Also interesting to note this time around – you have to register online at this website and enter promo code “SP0069458“. I don’t recall ever having to register this way – usually it’s just a click-through in an email – so it’s worth a try if you have the card. Worst case, it doesn’t work.

Again, if you weren’t targeted, it’s worth calling Barclays to ask them if there are any offers on your account.

This offer seems like it’d work for cell phone payments. And supermarkets is a fine category for 3X American Airlines miles – especially if you can buy gift cards and load up your Serve or Bluebird account.

I wouldn’t recommend this for most utility companies, as they usually add a surcharge to pay with credit. The fee may not make it worth the extra miles.

Although, if you pay your TV bill with a credit card, it could be worth it if you don’t have a Chase Ink card to earn 5X Chase Ultimate Rewards points.

Bottom line

Overall, an interesting offer. It’s good to see Barclays shaking up their promotional bonus categories and continuing to target peeps to use their products.

Here’s the website to register for the Q1 promo. The code I was given is “SP0069458” – feel free to try it. Let me know if it works for you!

Before I canceled the Barclaycard Aviator Red, I downgraded it to a regular “Aviator” card and got another offer for ~6X American Airlines miles on $1,000 spent within 90 days.

Either way, if you’re racking up AA miles for a redemption before the pending devAAluation of the award chart on March 22nd, 2016, it’s worth it to call Barclays to see if you can scoop up a few extrAA thousand miles.

Anyone else get an offer from Barclays on their Aviator cards? Keep an eye on your email and snail mail if you have any of them!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!

December 26, 2015

Out and Out’s Best Posts of 2015

Wow. Out and Out made huge strides in 2015. A lot happened – and even more will happen in 2016.

Blog traffic tripled this year. In fact December 2015 is the biggest month ever for the blog (and it’s not over yet!). I’m thinking of how to improve things around here even more, and celebrating every step of the way because I couldn’t grow without your support.

Celebrating!

You guys are awesome. I love my readers!

I’ve ironed out many ideas on here and found solid resolutions thanks to tons of community-focused comments. And meeting new peeps at the regular Reach for the Miles meetup has been fantastic.

I hope to continue the momentum and keep improving.

But first, I want to take a moment to pause and look back at where we’ve been this year.

Best of 2015

Here are some of my favorite posts from this year.

January 2nd – Time to Set New Travel Goals

Goal-setting is a powerful tool.

The beginning of the year is an ideal time to take the best from the past year and look forward to the future.

I already have a list of goals for 2016, and I’ll continue to refine them over the course of the year.

SMART goal criteria

Keep setting goals, and make sure they’re “smart.” It works.

January 20th – Confirmed: CVS accepts credit cards for PayPal My Cash reloads in NYC

MS is basically dead in NYC, but there was one place left to chisel, which continues to this day: PayPal My Cash cards. Be careful with PayPal.

And remember you can earn 1% cashback on your rent and other debit card purchases with the PayPal Business Debit MasterCard – no My Cash cards necessary (although you can certainly add that to the mix).

February 28th – My Best Advice: Go Go Go

I have a follow-up post planned that echoes the sentiments expressed here. I also started a tag called “My Best Advice” where I offer just that.

So much about enjoying a good life and being happy is about having the right mindset. So hopefully these posts are helpful, positive reminders of what travel can and is supposed to be – all the points and miles stuff is gravy. And this earth, this planet – is amazing.

March 6th – My Best Advice: Stay Scrappy

Being scrappy is a wonderful quality that unlocks new experiences. It’s incredible what happens when you open yourself to a new idea.

Stay Scrappy

Don’t get stuck. The point is to always be a little uncomfortable. It’s good for ya!

May 6th – The 10% Plan: Save 10 Percent of Everything You Make

This is the best, most effective way to start and build your savings. I’ve known people who have done this, and people who haven’t. Guess who has more saved?

In particular, I applied my own advice and maxed out my Roth IRA for the first time in 2015, which was a great milestone. I promise you, this works!

May 15th – Use Paribus to Get Money Back If There’s a Price Change

I really got into services like Paribus and Ibotta this year. In addition to saving money by holding on to it, I also like to save money by getting discounts and cashback on things I need to buy anyway.

By now, it’s an oldie but goodie

Paribus is a must if you shop frequently on Amazon. I talked about it a lot, but it wasn’t lip service. Combined with Ibotta, Citi Price Rewind, and shopping portals like Giving Assistant, I saved hundreds of dollars this year. Sure, it’s an added step here and there, but it was all worth it!

May 23rd – Gratitude / Life Changes

I must have the best readers in world. And this post came right at the halfway point of the year. In it, I detailed my goals for the following 6 months were:

Building up this blog

Doing more freelance writing

Slowly making an NYC exit plan

Paying down my debt and saving up for a house simultaneously

On this day in late December, I can say I’ve done all those things. My article on Buzzfeed was successful, and I had a guest post on AirHelp. I hope that’s only the beginning!

I’ll also be out of NYC this spring, and looking forward to investment property #2!

June 14th – Getting FIRED Up

I introduced my plan for FIRE (Financial Independence, Retire Early). It’s a long road, but the first steps provided me with a great foundation.

Fi-yah

There will always be more to do with this topic. The key is to know when enough is enough, and not overdo it.

My credit card debt was an out-of-control flaming emergency. And now it’s gone. Next up is to tackle my student loan debt.

Here are all my posts about FIRE.

July 13th – My Top 5 Hilton Category 2 Hotels for Award Stays

Hilton came onto my radar in a big way with a couple of great credit card offers, then they matched me to Hilton Diamond Status.

I’ll be at my first Hilton as a Diamond guest in a couple of weeks and am looking forward to seeing how it all goes. And who knows, maybe this is the beginning of something new.

I do think Hilton Category 2 hotels can be/are a great way to save a lot of money.

July 31st – My Best Advice: “You Can Do Anything You Set Your Mind To”

It’s true. I shared a 23-year-old letter from my grandmother and discussed my beginnings with the Law of Attraction and positive thinking. It’s a sentimental post, but also one of my personal favorites from this past year or any time.

August 24th – New Aspiration Checking Account Has 1% APY and Free Global ATM Use

An extremely popular post that got a lot of dialogue started about which is the best checking account for the frequent traveler.

Aspiration Summit is a new checking account that goes head-to-head with Charles Schwab and Fidelity

Well, the Aspiration Summit account certainly has the best interest rate. My companion post about how to get started with the account was also popular.

I’ve had an account for a few months by now and love it. Better yet, Out and Out readers get to skip the line and have instant access if they want one, too (it’s totally free to open!).

December 3rd – Clear the Clutter: 5 Apps to Organize Your Digital Life to Create Clarity

My clutter-free desktop

I got overwhelmed with everything electronic and decide to overhaul the way I work. It’s been nearly a month, and these 5 apps revolutionized my workflow and time management. Highly recommend all of them!

December 13th – How I’m Using Todoist to Organize My Days and (Travel) Goals

As an addendum to the previous post, I followed up with a few more words about productivity. Todoist and Evernote are probably my top apps now. I’m talking all-day, constant use, can’t-live-without. And both are excellent complements to goal-setting and travel.

Bottom line

It’s with tremendous gratitude that I say thank you for reading this year.

Lots of good stuff is in the pipeline – just need to find the time to type it all up in a readable format!

I hope the posts have been good resources, and given you some ideas about how to work more productively, travel more and with increased confidence, or simply gave you a moment of peace and made you smile at some point in 2015.

Here’s to all of that and more in 2015. Thank you thank you from the bottom of my heart.

Happy New Year!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!

December 19, 2015

3 Days Left to Save Money on Christmas Gifts With Amazon Prime!

Also see:

Save (or Earn!) Money at Amazon and More This Holiday Season

Easily Save Money at Amazon.com With Paribus and Giving Assistant

Activate Cash Back for Discover It Q4 Bonus Categories (Amazon.com, Clothing & Department Stores)

There’s a lot going on with Amazon right now in terms of deals:

10X Chase Ultimate Rewards points (10% cashback with Chase Freedom, if you activated the offer in time)

10% cashback with Discover It (5% back now and 5% back after 12th billing cycle for new cardmembers)

Amazon’s own deals – which are fantastic

The chance to get 10X Chase Ultimate Rewards points (which turn into 10X United Airlines miles, 10X Hyatt points, 10X Southwest points, etc. when paired with the Chase Sapphire Preferred or Chase Ink Plus) is too good to pass up. It’s a big reason why the AMEX Jet.com offer is on hold for me.

3 days left for Prime 2-day shipping

If you’ve put off last-minute gifts, this is a *perfect* weekend before Xmas to knock out last-minute shopping with Amazon Prime membership (you could even buy it today and start using it right away if you really wanted to!).

Tons of good deals

Amazon is serving up the deals. Case in point:

Today’s Deals

Last-Minute Deals

Year-End Deals

Digital Deals

Within each category are some deeply discounted items.

Some deals that caught my eye:

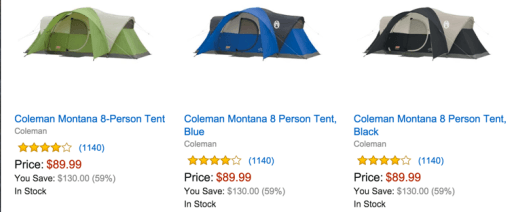

Go camping!

8-person tents for $90

55-inch flatscreen for $800

Kindle Paperwhite for $100

Tons of digital holiday movies for $5 to $10 (own them forever)

All the classics are here

There’s also cooking utensils, clothes, household items, sports gear… really a great selection. If anything, use their guides for ideas.

The gift card angle

Or you can do what I did and buy Amazon gift cards, thus giving yourself a 10% discount front-loaded and you can order whenever you want because the gift cards never expire.

The easiest option

If you max out the $1,500 limit on the Chase Freedom, you’d earn 15,000 Chase Ultimate Rewards points, which is enough for:

3 Nights at a Category 1 Hyatt hotel

1 round-trip short-haul flight under 1,150 miles with British Airways Avios (think New York to Chicago distances)

One-way flight anywhere in the mainland US, Canada, or Alaska with United Airlines miles

~$214+ worth of flights on Southwest

(This is assuming you have the Chase Sapphire Preferred or Chase Ink Plus. Otherwise, you could cash it out for a check or statement credit.)

Amazing

I went ahead and bought a $1,000 gift card a couple of weeks ago. And today I’m finishing up my Xmas shopping. What I don’t spend on gifts, I’ll buy in gift cards.

(You could also send Amazon gift cards to peeps as presents, too.)

But, you only have 3 days left to shop to assure the items arrive before the holiday.

Def sign-up for Paribus before you shop

Link: Paribus

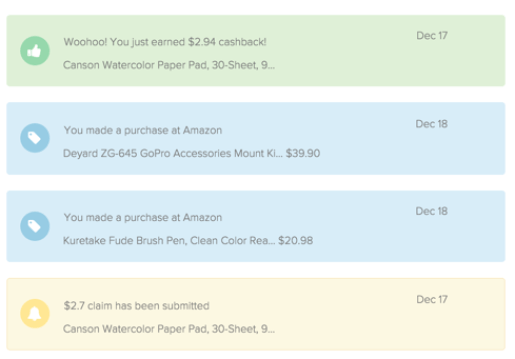

Paribus was made for Amazon shopping around the holidays.

I bought gifts on the 17th, and had a processed claim on the 19th – all with no effort on my part

It scans your Amazon account and automatically requests a price adjustment on your behalf – with zero effort on your part.

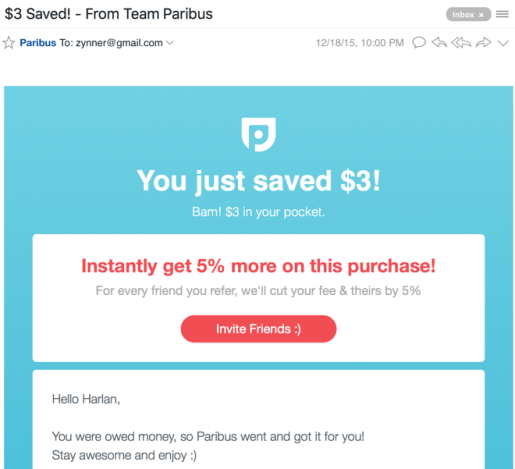

I bought some gifts on the 17th, and got $3 back on the 18th because of a price drop. It’s not a lot, but it all adds up, especially if you shop at Amazon frequently. And for holiday shopping, I’d call it a must.

They charge 25% of the price difference (so for $3, they’d charge .75 cents – you get $2.25 back + any tax you paid on the item). And you can reduce your fee by referring others.

Love these emails!

Definitely, definitely worth signing up for.

Bottom line

‘Tis the season to save a lot of money at Amazon right now with various deals. Stack them with 10% cashback from both Chase Freedom and Discover It and save even more.

Throw Paribus into the mix to get money back when there’s a price drop, and it all adds up very nicely.

The Chase Freedom 10X Chase Ultimate Rewards points deal (if you signed up for it) is just too good to pass up. And worth redeeming ahead of other offers.

You have 3 more shopping days to use Amazon Prime 2-day shipping. Or you can always buy Amazon gift cards to lock in the discount now for items you want to buy at any point in the future.

Hope you find some good deals and enjoy the time with your loved ones! Happy, happy holidays!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!

December 14, 2015

Booking Barcelona: Citi Prestige + Hilton Diamond at Alexandra DoubleTree

Also see:

Booking Barcelona: $747 Round-trip in AA Business Class

Booking Barcelona: A Hilton Points Dilemma

I’m Prestigious! Getting Citi Prestige and First Impressions of the Card

The hotel stay for Barcy is all set. And, I booked it – again – with Citi Prestige. I wrote about my first experience booking a hotel room it for Martinique.

View Additional Airline & Frequent Flyer Credit Card Offers Here

Gonna eat the hell out of that free breakfast

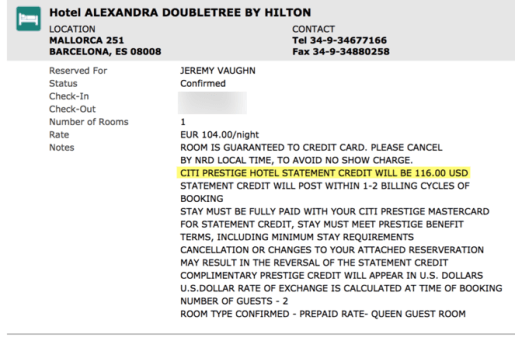

I settled on the Alexandra Barcelona, a DoubleTree by Hilton Hotel.

I’d originally booked the Hilton Barcelona as a Points & Money reward.

Why the switch?

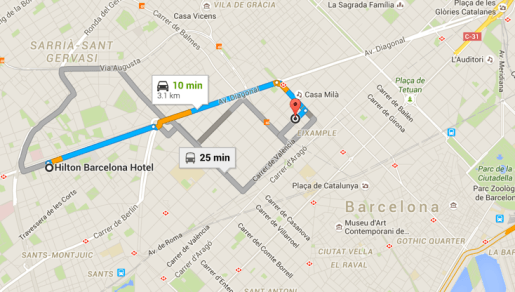

Location, location, location.

Muuuch closer to Plaza de Catalunya

Out and Out readers commented Plaza de Catalunya is the place to be in Barcy. And even though there isn’t an Executive Lounge like the other Hilton hotels in town, I’ll look forward to free breakfast with my new Hilton Diamond elite status.

I also found a good deal for 104 Euros per night. That’s ~$686 for a 6-night stay. But, I booked through Citi Prestige and got the 4th night free, and will be credited back $116.

So it comes out to ~$570, or $285 per person after I split it with Jay. To keep breaking it down, that’s ~$48 a day – and breakfast is included, which I value for at least $20.

I’ve updated my Citi Prestige by the Numbers page where I’m tracking the value I get from this card for a year.

Culture is important

I also wanted to be near plenty of gay bars, the Gothic Quarter, and lots of art museums. The location of the Alexandra DoubleTree was pretty perfect in that regard. It’s also near cafes, shopping, Las Ramblas, and metro stops, so I feel pretty good with the whole deal. I just want to see as much as possible while I’m there.

Plus, I get to keep all my Hilton points for another award stay, or Points & Money stay. I wrote about several Hilton Category 2 hotels that offer a lot of value with points.

(Sorry if I sound like I’m gushing about Hilton. I’m really just excited to be in Barcy is all.)

Booking with Citi Prestige Concierge

I found a “Winter Sale” room rate on the Hilton website for 20% off rooms.

Alexandra Barcelona, a DoubleTree by Hilton Hotel – is that you?

Then, I think I found the Alexandra DoubleTree on the Carlson Wagonlit website. It was mysteriously referred to as simply, “Alexandra.” Clicking “More Hotel Details” or “View Map” turned up error messages.

I called Citi Prestige Concierge, spit out the dates, told them the room type, that I wanted the Winter Sale rate, and confirmed the 4th night free (they found the hotel in their system with no problem).

Even though I was ready to book, they said I could only book right then if my travel was within 5 days. But the agent assured me they’d be fast, as rooms were selling out quickly.

Early the next morning, my coffee fixation was interrupted by an unknown number. Citi Prestige Concierge!

I confirmed all the deets again, and added my HHonors number to the reso.

Boom

About 30 minutes later, I got the confirmation via email, and the room showed up in my Hilton account.

The only perplexing thing is it was supposed to be a prepaid, nonrefundable rate. But it’s been a few days, and still no charge on my account…

Just want that high floor room

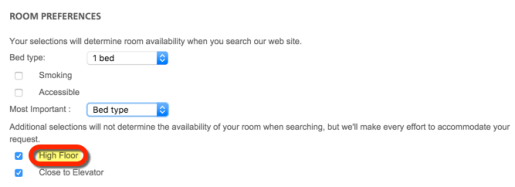

Peeps on TripAdvisor advise the higher the floor, the better at this particular hotel.

So I set my room preferences to “High Floor.” I also like the natural light, and the views (if there are any).

Looking forward to seeing how it all plays out during my first Diamond check-in.

Bottom line

All booked at the Alexandra DoubleTree in Barcelona, with the 4th night free thanks to Citi Prestige.

I feel like I got a good deal on the room, and am looking forward to the “Diamond experience” although TBH, I’m really not expecting much.

Be right there

The main draw for this hotel was the location near Plaza de Catalunya, the 20% Winter Sale room rate, free breakfast, and getting the 4th night free (which was kinda like another discount).

Not only that, but I’ll earn a boatload of Hilton points and a stash of Citi ThankYou points. So, lots of little perks adding up to a be quite a lot.

Finally, this deepens my interest in Citi Prestige… what a terrific card. It’s really become a staple in my wallet. So far, so good. And I’ll keep tracking it. (Thanks for applying through my links if you decide to pick it up, too! Here’s my experience getting the card.)

So now the trip to Barcy is finally set. Flying there in a few weeks in American Airlines business class, then staying at this hotel.

I’d like to plan a day trip to Sitges. That’s pretty much all I have so far.

Let me know if you’ve stayed at this hotel, know anything about the location, or have any tips on what not to miss in Barcelona (I’ll add it all to the Todoist app)!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!

Taking Another Look at Hilton, Hyatt, and Diamond Elite Status

Also see:

Hyatt Category 4 Hotels Where the Hyatt Card Annual Free Night Rocks

Complete the Hyatt Diamond Challenge in 9 Nights With the Citi Prestige Card

My Top 5 Hilton Category 2 Hotels for Award Stays

To begin, I must say I’m disappointed I wasn’t one of the lucky ones to receive Hyatt Diamond status. Although I did luck out with Hilton Diamond status.

I realize I’ll likely sound like a spoiled brat whining about something I didn’t get for free. Especially when others have spent much more time and money to actually earn the status. That said, the way Hyatt handled the Diamond status match – from free-for-all to the later restriction to only match SPG Platinum members, and all the missteps in between- was very mishandled.

Booooo

Hyatt had an opportunity to capitalize on the SPG/Marriott merger and they blew it – unless you got the match, then you win. I likely would’ve gone out of my way to stay with Hyatt more in 2016 and beyond. This whole thing has left such a bad taste behind that it makes me want to actively avoid Hyatt, and only use them for free award night stays.

Although I think what Hilton is doing is genius, at least from a marketing perspective. And, let’s face it: Hilton has a much larger footprint than Hyatt (4,100+ hotels compared to ~600). And Hilton is in every place there’s a Hyatt with few exceptions.

For example, there are NO Hyatt hotels in Barcelona (where I’ll be in a few weeks). But there were 4 Hilton options:

Alexandra Barcelona, a DoubleTree by Hilton Hotel

Hilton Barcelona

Hilton Diagonal Mar Barcelona

DoubleTree by Hilton Hotel & Conference Center La Mola

Furthermore, the next time Hyatt has a Diamond status challenge to stay 12 nights, I won’t even consider doing it (even though you can complete it with only 9 nights if you have Citi Prestige). Why would I spend $1,000 on something so many others got for free?

Anyway, that’s my preamble – just wanted to clear the air here. Again, I completely understand I don’t “deserve” the status in way. It just sucks to see so many get it for free, even though my credentials where enough – at one point – to get me in, too. A case of “early bird gets the worm” if there ever was one.

But now, I’m taking another look at Hilton, as I expect to have more paid stays there, at least for now. And, it’s not as bad as you’d think.

Hilton Diamond Vs Hyatt Diamond

Link: Hilton Diamond Elite Status / Membership Overview

Link: Hyatt Diamond Elite Status / Membership Overview

Points earning

Hilton base points per $1: 10, +5 with “Points + Points” earning style

Hyatt base points per $1: 5

Bonus with status

Hilton: 50%

Hyatt: 30%

Requirements to keep status

Hilton: 30 stays, 60 nights, or 120,000 HHonors Base Points

Hyatt: 25 stays or 50 nights

Major perks

Hilton:

Free breakfast

Guaranteed access to Executive Lounges at Hilton, Conrad, Curio and DoubleTree hotels with a lounge

Upgrades “when available”

1,000 bonus Hilton points per stay at most hotels

5th night free on award stays

Hyatt:

4 Suite upgrades per year

Free breakfast

Upgrade to best available room, excluding Suites

Access to Regency Club or Grand Club lounge

1,000 bonus Hyatt points per stay, or a welcome amenity

Both have a 48-hour room guarantee, late checkout, dedicated phone line, and premium wifi.

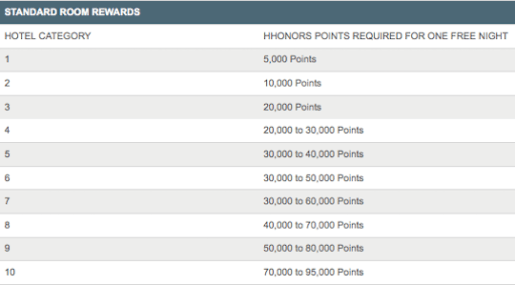

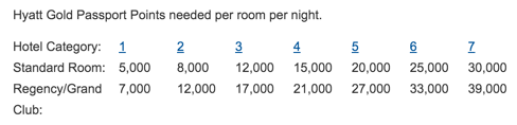

Hotel categories and points required

Hilton:

Hilton Categories

Hyatt:

Hyatt categories

Points on $1,000 stay as a Diamond member

Hilton: 20,000 Hilton points (10,000 base, 5,000 with Points + Points, 5,000 from status) – enough for a 1-night award stay at a Category 3 hotel

Hyatt: 6,500 Hyatt points (5,000 base, 1,500 from status) – enough for a 1-night away stay at a Category 1 hotel

Analysis

There’s a lot to chew on here.

To get it out of the way, the hotel chains are vastly different, and people like them for totally different reasons.

Underwater restaurant at Conrad Maldives Rangali Island

Hilton has some great aspirational properties:

Hilton Bora Bora Nui Resort & Spa, Category 9

Conrad Maldives Rangali Island, Category 10

Conrad Tokyo, Category 10

Hilton Seychelles Northolme Resort & Spa, Category 10

View from Park Hyatt Tokyo

And so does Hyatt:

Grand Hyatt Kauai Resort & Spa, Category 6

Hyatt Ziva Cancun, Category 6

Park Hyatt Tokyo, Category 7

Park Hyatt Paris-Vendome, Category 7 (which I thought was “meh”)

To get a night at a Hilton Category 10 hotel, you’d need to spend $3,500 (3,500 X 15 + 50% bonus = 70,000 Hilton points), assuming you find a low-level award for 70,000 Hilton points. (Here’s the points calculator I used.)

And to get a night at a Hyatt Category 7 hotel, you’d need to spend $4,615 (4,615 X 5 + 30% bonus = 29,998 Hyatt points). Over $1,000 more.

What about earning through credit cards?

Hilton has 4 co-branded credit cards. With the AMEX Hilton Surpass (which has an 80,000 points sign-up bonus right now), you earn:

12 Hilton points per $1 spent at Hilton hotels

6 Hilton points per $1 spent at US gas stations, US restaurants, and US supermarkets

3 Hilton points per $1 on all other purchases

That’s probably the best all-around Hilton card. Pair it with Hilton Diamond status, and you’re earning 27 Hilton points per dollar at Hilton (excluding the 50% bonus).

To get an award night at a mid-tier Hilton Category 6 hotel, you’d need to spend $10,000 on the card (less with bonus categories).

And of course Chase has multiple cards that earn Ultimate Rewards points, which transfer 1:1 to Hyatt. And some sweet category bonuses (5X at office supply stores for starters, which the Chase Ink card).

Still, the base earning rate is 1 point per $1 spent, and you’d have to spend $15,000 for an award night at Hyatt Category 4 hotel. And again, less with bonus categories.

If you have the Chase Hyatt Visa, you’ll earn 3X per $1 spent at Hyatt, which makes 8 Hyatt points per dollar at Hyatt (excluding the 30% bonus).

Pros and Cons

OK, Hilton’s not faring so bad here.

Let’s make an old-fashioned pros and cons list.

Hilton pros:

Ease of earning points

Less spend for award nights

Tons more hotels

Hilton cons:

Diamond status not as meaningful

No suite upgrades

Inflated points currency

Hyatt pros:

Diamond status means free breakfast

SUITE UPGRADES CAN BE WORTH THOUSANDS

Points transfer option is viable and worth it

Don’t have to focus on “just” earning Hyatt points

Hyatt cons:

Very limited selection, although in most major cities and tourist destinations

Platinum status is useless – need Diamond for free breakfast

Harder to earn points, but they’re worth more

What I love about Hyatt is you can feel good about transferring Chase Ultimate Rewards point to Gold Passport. What I mean by that is, their points are on par with most airline programs.

While you can transfer Citi ThankYou points to Hilton, I’d never do it because Hilton points are a horribly inflated currency. You’ll get much more “mileage” with an airline program.

In that regard, you can’t really compare the values. I think of Hyatt points like I do about airline miles. And I think of Hilton points like I think about say, Club Carlson points: it’s their own program, and the value is harder to peg.

Bottom line

There’s still time to request a match to Hilton Diamond status. Email a screenshot of your status with another hotel program to HHonorMyStatus@hilton.com by January 11th, 2016. If anything, you’ll likely get matched to Gold status, which is enough for free breakfast!

Hilton is inflated, yes, but so is all the earning. You actually get award stays at top-tier hotels faster with paid stays, and need to spend less on co-branded cards for award nights.

The biggest argument for Hyatt is you don’t have to focus on earning Hyatt points. You can focus on earning Chase Ultimate Rewards points, and transfer over when it makes sense.

For Hilton award stays, you’d have an opportunity cost. By earning Hilton points, you wouldn’t be earning say, United or Singapore miles. You’d just be earning Hilton points. Which is fine, especially for paid stays.

Perhaps the biggest loss with Hilton, though, is the Suite upgrades. Man, those are sweet. But, you get the 5th night free on award stays, which can begin to make up for it if you redeem enough Hilton points.

But all else being equal, lots of peeps might actually come out ahead with Hilton because it’s easier to earn points, and you get more of ’em. Plus, you can’t deny the footprint: Hilton beats Hyatt in that regard by a mile.

Both chains have great properties, aspirational awards, and their own little quirks.

Of course, if you were one of the lucky ones to get both Hilton and Hyatt Diamond elite status, you have the best of both!

Finally, does hotel elite status really even matter anyway? Hilton could at any time create a new, higher status level. Or Hyatt could devalue. Or any number of other scenarios.

To be honest, I just like free breakfast! And lounge access is a nice perk, too.

Lots of questions remain:

Any other big pros or cons I missed?

Which chain to you intrinsically prefer?

Is Hilton… underrated? Is Hyatt overrated?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!

December 13, 2015

How I’m Using Todoist to Organize My Days and (Travel) Goals

Also see:

Clear the Clutter: 5 Apps to Organize Your Digital Life to Create Clarity

7 Awesome Uses of Evernote for Travelers

26 More Awesome and Creative Uses for Evernote

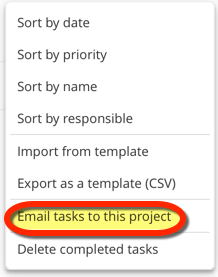

I wrote last week about 5 new apps that are revolutionizing my workflow, the way I approach my days, and overall helping me kick ass with goals and productivity.

I mentioned a to-do app called Swipes that has great reviews.

Come to find out, there are about a zillion apps that all attempt to accomplish the same thing (I know, duh, right?).

To that end, I explored a few more, and for whatever reason, Todoist grabbed me and swept me away.

Not only is it a great place to store to-do lists, but it’s also helping me organize my personal and travel goals.

What’s Todoist?

Link: Todoist

Todoist, like its name implies, is an app and website where you can store your to-do lists.

At the expense of having too many apps (and just more crap) to manage, I was leery about adding another one.

I tried:

Swipes

Wunderlist

Asana

Todoist

At their core, they’re all the same thing. It’s hard to say why a certain setup or layout appeals to you more than another, but Todoist, for me, was simply “the one.”

I liked the minimal layout, the ability to tinker with colors, nested subtasks, and their labeling system.

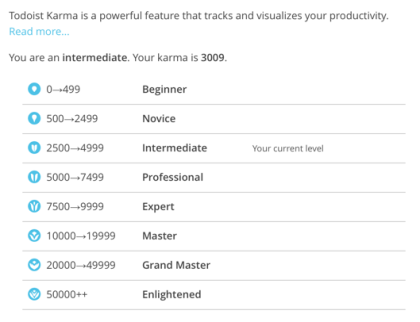

I’m also a fan of their Karma points system (yes, another points program to think about!).

When will I reach enlightenment?

Of course, it’s completely meaningless. Or is it?

Todoist Karma gives you “points” for adding and completing tasks, using advanced features like labels, and meeting your daily goals.

Not only that, but you’ll lose points for not completing tasks or letting them become overdue!

For me personally, it’s a great motivator. I added a few things to my own to-do lists and found myself wanting to do them to earn more “Karma.”

Adding tasks couldn’t be simpler. And you can customize forever if you want to – or leave it as-is.

The reframe

Link: Evernote

I’ve written about how to use Evernote for travel goals and during trips.

Evernote lets you make checklists, and even add reminders – just like Todoist.

They both perform essential functions, but for me the kicker is the reframe.

I think of Evernote as a digital repository, a place to store information.

And I think of Todoist as a place for tasks.

So placing my travel goals in an action-oriented setting spurs my subconscious mind in a way Evernote doesn’t. Because if it’s in Todoist, I have to do it.

That said, I’ll still use Evernote to track my progress.

Because once a task is marked “done” in Todoist, it’s gone (which is great!).

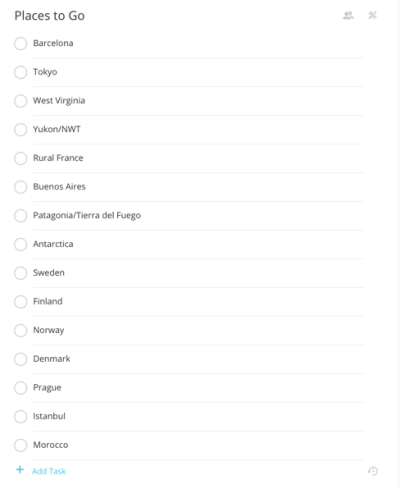

Places to go in Todoist

But Evernote is all about reminding you how far you’ve come. (Which is also great!)

My travel goals in Evernote, with many marked as “done”

I’m heading to Barcelona in a few weeks, and plan on creating a “Barcy To-Do” for the trip.

I’ll research places to go, and add them. In the notes sections, I’ll add addresses, screenshots of maps, and any other info like ticket cost, opening hours, etc.

(Note: The ability to add notes is a premium feature. I paid $29 to unlock more functions, and this is one of them. That said, the free version is more than enough for most!)

Add helpful info to your tasks so you won’t have to look it up when you’re ready to do it

And I can even assign “due dates” although for that I prefer the free-floating “to-do,” with no due dates for lists like that.

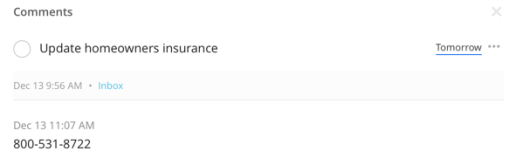

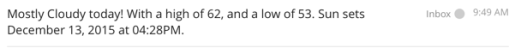

Todoist also lets you forward emails directly to your projects, which are added to your to-do list

Todoist also has a handy email feature where you can add tasks with email forwarding (another premium feature, or just use IFTTT to have the same thing).

Making goals sets your subconscious mind to push you toward your goals. And, they’re SMART.

SMART goal criteria

While Evernote can be smart too, I find Todoist accentuates the “time-bound” in a way Evernote doesn’t necessarily lack, but doesn’t frame as well.

Plan a trip

Say your goal is “Visit Japan.” You can plan a brand new trip with Todoist.

Make a new project, with tasks being something like:

Fly to NRT with 67,500 American Airlines miles in Cathay Pacific First Class

Book 2 nights at Andaz Tokyo Toranomon Hills with 50,000 Chase Ultimate Rewards points transferred to Hyatt

Book 2 nights at Hilton Tokyo with 100,000 Hilton points

Buy bullet train ticket to Osaka

Book 2 nights in Osaka, etc.

And then add things to do once you’re there, like:

Try the best sushi in Tokyo

Have a Sapporo draft beer

Visit National Museum of Modern Art, Tokyo (add hours, ticket price, closest metro stop, directions, and a screenshot of the area in the notes)

Make each item a to-do. Then mark them as done when you’re in Japan.

(Tip: Before your trip, forward over all your confirmation emails to Evernote to have them all in 1 place!)

Other helpful ways to utilize Todoist

Todoist is also kicking my other personal goals into high gear, which I love.

Goals on fleek

I remind myself to meditate, use apple cider vinegar and coconut oil, and I’m also limiting myself to 3 drinks per day on the weekends.

I also set up reminders to clear out a small pile of clutter, and wrote down things I’m thankful for. Gratitude is a huge part of goal-setting, so I make sure to focus on those.

I also added post ideas for Out and Out, monthly bills with reminders, and personal goals for 2016.

The idea is keeping your goals in front of you will keep you on track. To that end, Todoist shows you the things you need to get done TODAY, and if you want, you can see the next 7 days. So it’s very close and fast.

I made a list of books I’d like to read next year, movies to watch, and things I need to do for my Airbnbs. Some tasks are less urgent than others, of course, so for those things, I simply don’t add a due date.

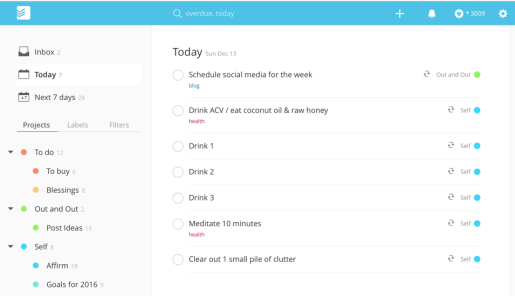

IFTTT + Todoist is awesome

IFTTT also works very well with Todoist.

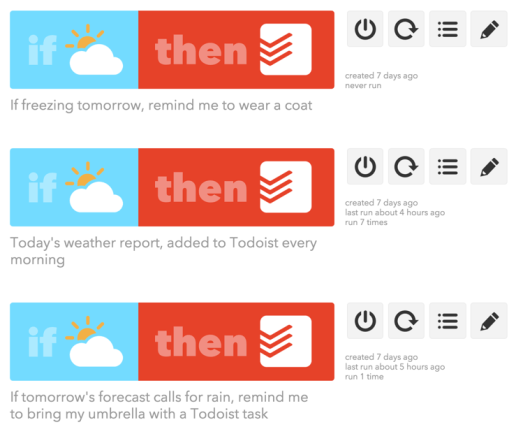

I set up reminders to bring an umbrella when it rains, bundle up on cold days, and add the weather to my inbox every morning at 8am – all of this happens automatically.

Daily weather

Weather reminders

There are lots of other integrations, so browse the recipes to see what all you can set up. IFTTT can also replicate a few of the premium functions if you don’t want to pay for the app (like forwarding emails to your inbox).

And, you can integrate it with your calendar (like Sunrise).

But I don’t see it as a calendar replacement because on your calendar you might mark “Meeting at 11am with ____.”

But on Todoist, you’d put the list of action items like, “Follow-up on email, print meeting agenda, set up conference room, etc.” – things to set up leading up to the event.

Bottom line

Goal-setting is extremely powerful, especially when you give yourself a timeframe, or reframe your goals as things you actually need to do.

I’ve been using Todoist as a tool to get things done day-to-day, and keep me focused on my long-term goals.

There are many apps like it, but I liked the setup of this one the most. Especially the Karma points, which is in line with my goals of gratitude and everyday affirmations.

I still use Evernote to store vast amounts of information. But I’m also enjoying Todoist for its bite-sized chunks of actionable info.

Adding another app to your phone, or another website to think about, might not sound like the most appealing thing, but I’ve found Todoist has efficiently replaced a few of them (like checking the weather).

Most of all, I’m excited about having a new place to store my travel goals. And it’s a nice kick in the arse to get stuff done every day, like clear away a small pile of clutter, or take a few minutes to feel thankful.

Combined with the other apps I found to streamline my workflow, I’m spending more time away from the computer, which has been transformative in its positive effects.

This is all new and fun, so let me know if there’s a cool way you’re already using Todoist (or any other to-do app)!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!

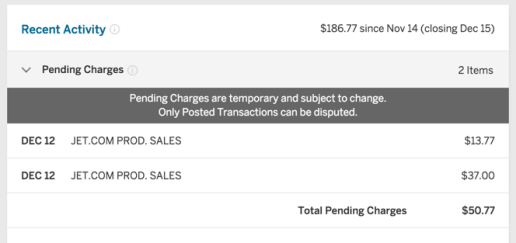

Why I’m waiting to Redeem the AMEX Jet.com Offer

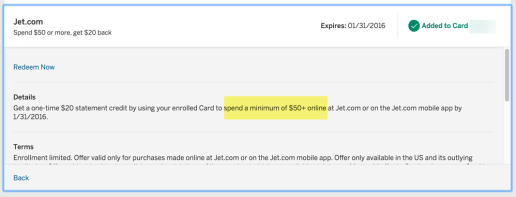

There’s a great AMEX offer for a $20 statement credit when you spend $50+ at Jet.com. Play it right and that’s ~40% off your purchase! (Check your accounts online, or sync via Twitter with #AmexJet.)

But here’s something I noticed.

Funny language

The language is a bit different than usual AMEX Offers

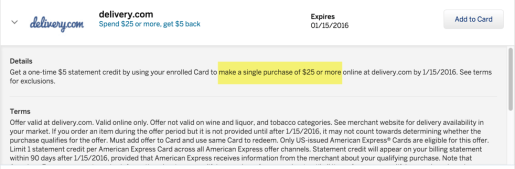

There’s no mention of having to spend $50 in 1 transaction.

Another AMEX Offer with the typical conditions

There are several other AMEX Offers that do say you have to spend the required amount all in 1 go, like the one for Delivery.com.

Why this counts

Jet.com is notorious for splitting up transactions. Usually, I love this, because it helps me hit 30 transactions on my AMEX EveryDay Preferred card. But with this offer, I’m not sure if it helps or not.

I added $50 worth of stuff to my cart, and placed the order.

Usually, AMEX is a big ol’ creep and sends out an email right away. Something to the effect of:

This email usually arrives seconds after payment

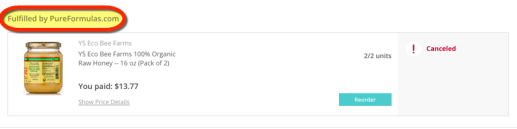

Not this time. I think it’s because Jet.com splits the order into items sold by Jet.com, and items sold by other merchants.

I hit the $50 mark, but didn’t get the email

When I saw that, I thought, uh oh, this might not count. But then when I looked at the terms and conditions of the offer again, I didn’t see anything about needing to make 1 transaction.

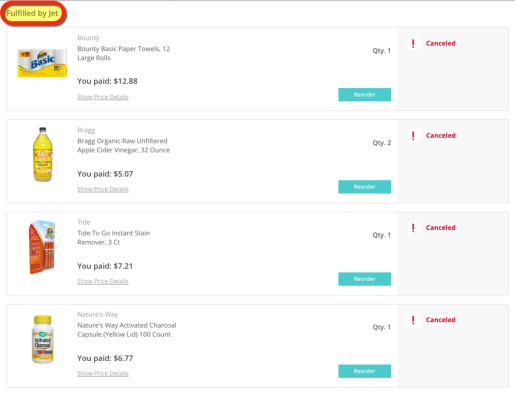

Make sure it’s “Fulfilled by Jet” if you get in on this

I tried to stock up on apple cider vinegar, activated charcoal, and a few other this-n-that items.

Many items are NOT fulfilled by Jet

Going off the totals of the items in the cart, it’s clear Jet.com charges items fulfilled by each individual merchant separately.

I waited about 20 minutes to get the “Great News! You just used your Amex Offer” email, but it never came. So I canceled the order. I’ll try again next month.

Go Amazon for now

Jet.com is an Amazon.com competitor.

And this month, I’m busy buying Amazon gift cards (and donating to charity via Giving Assistant) with my Chase Freedom card to earn 10X Chase Ultimate Rewards points this month. Plus, Discover It is also offering 5% cashback (which will double to 10% cashback for new cardmembers).

I’d rather earn 10X Chase Ultimate Rewards points, especially because:

The Chase Freedom/Discover It bonuses end on December 31st, 2015

The Jet.com offer ends January 31st, 2016

I don’t feel like finding $50 worth of items fulfilled by Jet to see if the offer will trigger or not, and don’t want to risk it when there are other bonuses right now anyway

10X Chase Ultimate Rewards points at Amazon is simply too good to pass up

Update 12/13/15: Readers commented the Jet.com AMEX Offer does work regardless of how Jet splits up the transactions. So if you’ve maxed out the Chase Freedom/Discover It promotions, you should be good to go with the AMEX Offer. That said, I’d still choose the other promotions before this one (at least the Chase Freedom deal – Discover It’s 10% cash back doesn’t compare to 40% off). Suffice it to say, you have options!

Maybe in January I can give the Jet.com AMEX Offer another go. And call AMEX to point out it says nothing about a single transaction if it doesn’t post.

Plus, I’m sure I’ll need things for my new house in Dallas next month.

Until then, I’m sticking with Amazon. The bonuses are too good and the safe bet is better than the “risky” one.

Or, try this

If you do want to redeem the Jet.com offer this month, you could try to target items fulfilled by Jet so you’ll be charged in 1 transaction. That seems like it would work fine.

In my case, I didn’t want to buy items I didn’t actually need for the sake of getting in on a deal. But if everything you want is fulfilled by Jet anyway, it might be a great way to save ~40% on household basics.

Bottom line

Wanted to share my experience in case you wonder why the “Great news!…” email doesn’t come right away.

Doctor of Credit reports AMEX might be limiting the ability to sync the same AMEX Offer across multiple cards.

So perhaps they’re backed up/not sending emails within a few minutes, or just buggy/glitchy right now.

Or maybe I’m waaaay off base as I tend to be sometimes.

In any case, I’m waiting until January to redeem the Jet.com AMEX Offer, all else considered.

The Amazon deals are just too good right now, and I’m unsure the way Jet.com charges items fulfilled by other merchants will trigger the AMEX Offer. Besides, next month is another month, and I’d rather take advantage of other deals expiring sooner.

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!

December 6, 2015

Limited Time: Get $5 When You Sign Up for Ibotta Shopping App and Redeem 1 Rebate

Also see:

Ibotta: Get Cash Back When You Shop

Save (or Earn!) Money at Amazon and More This Holiday Season

A Few Apps + Sites I Like to Save Money

Just a quick tip.

Free $5 for signup up to Ibotta

For a limited time, you’ll get $5 added to your account when you sign up for Ibotta and redeem 1 rebate. (Full disclosure: when you use my link, I’ll get $5 too, so thank you for clicking through with it!)

This is an easy way to get a few bucks, but know you can’t transfer the cash out of your Ibotta account until you reach the $10 mark. You can transfer to your PayPal or Venmo accounts once you do. And it’s relatively easy to earn money with the app.

What’s Ibotta?

Link: Ibotta

I write about, and use, this app quite a bit because I love to save money!

Get rebates back on hundreds of everyday items like food, cleaning supplies, and personal care

It’s worth a download if you use certain store loyalty programs because all you have to do is link them up, and the rest is automatic. All you have to do is “unlock” the rebates by answering short questions or “learning a fact.”

Especially handy for the boozehounds among us

The highest payouts are actually for beer, wine, and spirits. So if you’re planning any holiday parties, your balance will build even faster.

I use the app to buy beer for my Airbnbs, then get cashback. I also use it for cleaning supplies, paper products, and a few personal care items like body wash and shampoo. Sometimes there are good deals for cereal, drinks, gum, and other random stuff. So it’s worth a looky-loo when you have a few minutes to spare.

Also note the cashback you earn is in addition to any store sales, promotions, or coupons. If you’re into stacking discounts, this is yet another way to dip.

More ways to save

It’s easy to spend a lot during the holidays, but you can save a lot, too.

Get $5 for using Giving Assistant for the 1st time

Get another $5 for using Giving Assistant.

Paribus is a must-have if you shop online a lot

And if you shop online a lot, you’ll want to sign up for Paribus, too.

I wrote about Giving Assistant and Paribus before. And please consider using Giving Assistant if you shop at Amazon a lot (especially folks who are buying Amazon gift cards!).

Bottom line

Get $5 in your account when you sign up for Ibotta and redeem at least 1 rebate. This is a limited-time offer, but it’s an easy win.

It’ll probably take you 30 seconds to sign up and a few minutes to redeem a rebate. If you’re hanging around, it’s worth looking into. Especially if you like to stack deals and discounts like I do.

While you’re at it, read my tips about how to save (or earn!) more this holiday season.

Happy holidays!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!