Harlan Vaughn's Blog, page 54

March 1, 2016

Yup, FoundersCard Still Offers Caesars Total Rewards Diamond Status Through 2017

Also see:

Free Caesars Total Rewards Diamond Status with FoundersCard

Assessing the Benefits of FoundersCard

18 FoundersCard Travel Benefits (Status, Discounts, and Freebies)

FoundersCard

The title says it all.

I’ve written about FoundersCard a lot over the years. Some peeps think it’s phooey, others love it. I’m in the latter camp.

The selection of ancillary benefits reads like a round-up of the best of the best from co-branded cards (free TripIt Pro, Hilton Gold elite status, Cathay Pacific Silver elite status, 10% off British Airways flights).

The one benefit I’m consistently asked about is Total Rewards Diamond elite status.

It still works

Link: Total Rewards Diamond elite status

I’m by no means at expert at gambling, nor do I visit Las Vegas very often, but having status at your casino of choice gets you a lot of great perks, similar to hotel loyalty programs.

With Total Rewards Diamond elite status, you get:

Room discounts

Access to priority lines at check-in and restaurants, which can save you a lot of time

Diamond Lounge access

No resort fees

$100 off a Celebration Dinner

So, the perks can be meaningful as far as getting value and saving time. Worth getting FoundersCard for it? That’s up to you to decide.

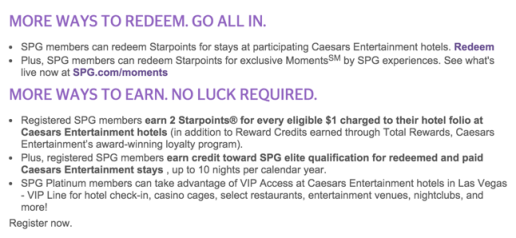

SPG and Caesars have a partnership

Don’t forget, you can earn SPG points when you stay at Caesar’s (and vice-versa) thanks to their partnership. So that might be another draw for some.

Get Caesars Total Rewards Diamond status through FoundersCard

There was some confusion about whether or not this benefit would stick around in 2016. But, I can confirm, it definitely still will.

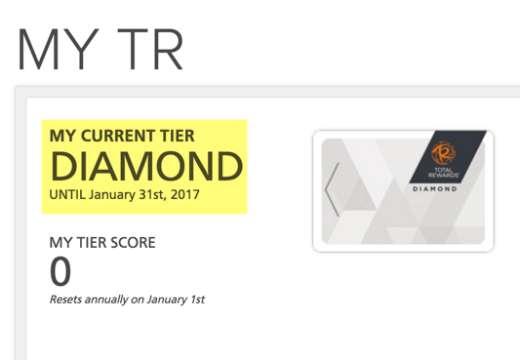

I’m Diamond at Caesars through January 31, 2017

I didn’t have to do anything to renew my status. It looks like I was auto-renewed because I still have my FoundersCard, and from when I signed up in 2014.

More on FoundersCard

I’ve assessed the benefits of FoundersCard, and find it’s worth keeping it because it fits in with services I’m either interested in or already use. But just like it has a following of staunch supporters, it also gets its fair share of smearing.

The card costs $395 a year to have. But right off the top, I save at least $300 a year on my AT&T phone bill. Then get a few freebies here and there that easily recoup the other ~$95. So the rest, like the Caesars Total Rewards Diamond status, are gravy.

It’s a card geared toward young urban professionals (yup, I’m a yuppie), who like start-up culture, travel benefits, boutique shopping discounts, and the like. But mixed in, there are some real gems.

Like anything, you get more value out of it the more you use it. And, FWIW, I’ve found the benefits easy to use and redeem. They even have an app you can use to connect with your membership.

You can apply via my link. That page won’t show you much, though, so be sure to check it out more via the articles linked above. And check out my post that breaks down a lot more if it’s worth it to have.

Bottom line

One of the FoundersCard benefits peeps seem to hone on is the Total Rewards Diamond elite status.

I’ve been renewed through the end of January 2017, so I can confirm it is still indeed a perk of the card.

FoundersCard has a fun program going on. I’ve enjoyed being a member and have no plans to cancel, especially because they keep adding perks and haven’t really taken any away. So it feels secure (for now at least). And I look forward to seeing what they cook up next.

As always, don’t hesitate to ask me anything about the discounts or deals I’ve written about FoundersCard.

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!

United Miles Versus Singapore Miles: Which Star Alliance Partner Awards Are Cheaper With Each Program

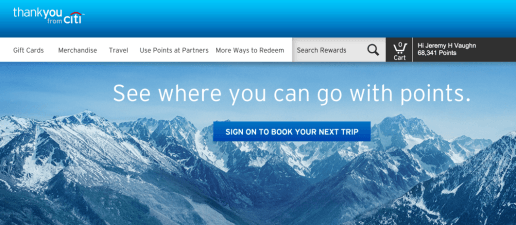

I’m getting more into Citi’s ThankYou program recently (because Citi ThankYou points are so easy to earn).

And while I can’t totally abandon Ultimate Rewards (for access to United Airlines, British Airways, and Hyatt), I’ve been thinking of award flights where collecting Citi ThankYou points instead of Ultimate Rewards might actually make more sense.

Why Singapore Airlines miles?

Link: United Airlines Star Alliance award chart

Link: Singapore Airlines Star Alliance award chart

If you like to fly Star Alliance partners, there are a few times you’ll pay fewer Singapore Airlines miles than United Airlines miles.

So many ways

Ultimate Rewards points transfer 1:1 to Singapore Airlines’ KrisFlyer program. And so do AMEX Membership Rewards points, Citi ThankYou points, and SPG points.

Ultimate Rewards points transfer to United Airlines, too. So you’ll have your pick of either program (Singapore or United).

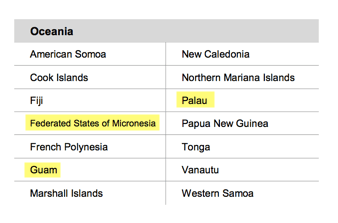

Star Alliance partners – the airlines with no/low fuel surcharges are highlighted

But, huge note, Singapore Airlines passes along fuel surcharges. I highlighted the airlines where you’ll avoid the worst of the fuel surcharges.

That’ll make a lot of European, Middle Eastern, and African Star Alliance partners a lot less shiny. Unless you feel its worth it to pay them, and save your Ultimate Rewards points for something else. If anything, it’s worth it to check the price on your route. If it’s ~$100 or so, it might be economical to pay and save Ultimate Rewards points/United Airlines miles.

And, if you’re going to pay fuel surcharges to Europe, you might come out ahead with Flying Blue promo awards – especially if you can get a good deal.

Here’s the full breakdown of when it’s better to use Singapore Airlines miles, purely from a mileage perspective. I bolded the awards priced the same or cheaper than United Airlines miles.

Mainland US and Alaska to: United Airlines Miles, in Thousands, Each WaySingapore Airlines Miles, in Thousands, Each Way

Mainland US and Alaska12.5

25

3512.5

20

30

Hawaii22.5

40

5017.5

30

40

Mexico/Central America/Caribbean17.5

30

4017.5

30

40

Northern South America20

35

4530

50

70

Southern South America30

55

7030

50

70

Europe30

70

11027.5

65

80

Northern Africa40

80

13037.5

57.5

75

Central/Southern Africa40

80

13045

72.5

110

Middle East42.5

80

14037.5

57.5

75

Central Asia42.5

80

14052.5

97.5

132.5

North Asia35

80

12045

87.5

100

South Asia40

80

13052.5

97.5

132.5

Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Sinagore, Thailand, Vietnam 40

80

13055

97.5

112.5

Japan35

75

11045

87.5

100

Oceania35

75

11055

97.5

127.5

Australia/New Zealand40

80

13055

97.5

127.5

Note: You have to call Singapore Airlines at 800-742-3333 to book a partner award flight.

When is it better to redeem Singapore Airlines miles?

Let’s break this down a little more. You will save:

5,000 miles each way in Business and First within the US. And pay the same as United in econ

In every class of service to Hawaii on United (5,000 each way in econ, 10,000 each way in Business or First)

15,000 miles each way in Business to Southern South America. And pay the same as United in First

5,000 miles each way to Europe in econ or Business. And 30,000 miles each way in First

7,500 miles each way to Central/Southern Africa in Business. And 20,000 miles each way in First

In every class of service to the Middle East (5,000 miles each way in econ, 22,500 miles each way in Business, 65,000 miles each way in First)

In every class of service to Northern Africa (2,500 miles each way in econ, 22,500 miles each way in Business, 55,000 miles each way in First)

7,500 miles each way to Central Asia in First

20,000 miles each way to North Asia in First

10,000 miles each way to Japan in First

You will pay the same price as United to Mexico, Central America, and the Caribbean. So use Citi ThankYou points for these awards if they’re easier for you to earn.

Singapore Airlines has some funky regional definitions that work to your advantage in certain situations.

Canary Islands, anyone? United categorizes it as Northern Africa

For example, if you want to visit Spain’s Canary Islands, you’ll save a lot with Singapore miles, because it’s considered part of Europe. Whereas United (rightfully) calls it Northern Africa.

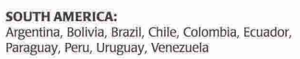

There’s no distinction between Northern and Southern South America

Singapore considers South America as one big region, which saves you a bit on Business Class awards to what United calls Southern South America, including Argentina and Chile.

United considers Guam, Micronesia, and Palau to be Oceania. But Singapore calls it North Asia

You’ll also save marginally on certain First Class flights to Oceania.

The biggest takeaway is how much you can save on:

All domestic award flights

All flights to Hawaii

All flights to Europe, if you can minimize fuel surcharges

Business andFirst Class flights to South Africa

All flights to Mexico/Central America/Caribbean, if you can minimize fuel surcharges

More resources

While researching this, I found a few other posts and resources you might find useful:

Here’s Everything You Need to Know About Singapore Airlines KrisFlyer – A Good Alternative to United MileagePlus – Pursued Adventures

Best Use of Singapore Airlines KrisFlyer Miles – Travel Is Free

Master Charts to Avoiding Fuel Surcharges (YQ) – Travel Is Free

Comprehensive Spread Sheets of Eight Star Alliance Award Charts: Cheapest Awards to Every Region – MileValue

Did you know Singapore Airlines partners with Virgin-brand airlines?

Drew from Travel Is Free has a nice breakdown of when to use Singapore Airlines between regions – including outside of the US. He also talks a bit about using Singapore Airlines miles for flights on Virgin America, Virgin Atlantic, and Virgin Australia. Again, beware fuel surcharges.

And here’s the link to the Virgin-brand airlines’ award charts. Just scroll down to the “Downloads” section on the right side – they’re linked individually there.

Bottom line

United Airlines has NO fuel surcharges on all of its partner award flights, which is one of the main draws of the program. And, that makes Chase Ultimate Rewards points worth collecting.

But if you want to fly with the mainland US, Canada, Alaska, or Hawaii, you’re better off using Singapore Airlines miles.

And if you like to fly in premium cabins, there are instances where you can save 100,000+ miles round-trip with Singapore Airlines miles (Middle East and Northern Africa, for example). Saving that many miles, yeah, could make it worth paying fuel surcharges.

At this point, an Ultimate Rewards/Citi ThankYou hybrid sounds good to me. Because each program has cards with 3X/5X categories – and that amps up the earnings. And, to me at least, AMEX Membership Rewards is choking on dust (except for maybe ANA and Aeroplan in a few circumstances).

As with all miles posts containing a lot of numbers, it’s all theoretical until it’s applied – until you can see the route you want and how much it’ll cost with taxes and fees.

Food for thought.

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!

February 29, 2016

Review: Air France Lounge JFK @ Terminal 1

Also see:

Just Booked: Martinique $317 Round-Trip and Non-Stop on Norwegian

Booking Martinique: My Experience With Citi Prestige Concierge and 4th Night Free Benefit

Hotel Review: La Pagerie, Les Trois Ilets, Martinique

Before I headed down to Martinique to stay at the Hotel La Pagerie (with the 4th night free!), I had to get to JFK to experience my first Norwegian flight, departing out of Terminal 1.

What lounges are there? The Air France Lounge and the KAL (Korean Air Lines) Business Class Lounge – Priority Pass gets you into both.

I’ve been to the KAL Lounge before and was underwhelmed. Plus, the Air France Lounge was literally right next to my departing gate (Gate 1). Perfect!

I got free admission for me and up to 2 guests thanks to the Priority Pass I got with Citi Prestige. But day passes are between $35 and $50, depending on time of day. I brought Jay with me, so I peg this visit for at least $70, and have updated the Citi Prestige by the Numbers page to reflect this visit.

The lounge

This lounge has been open since October 2014, so a year and change.

Even though it’s ~10,000 square feet, the entrance is very narrow, and there was a huge rush of people leaving, so it took forever to get checked in. Again, it’s right next to Gate 1.

The desk agent spent a long time with my Priority Pass card, but eventually had me sign a machine and gave us the wi-fi password. She shooed me away to a corner while she processed the card, then called me back over.

Once inside, we sat down our things and scoped the place out.

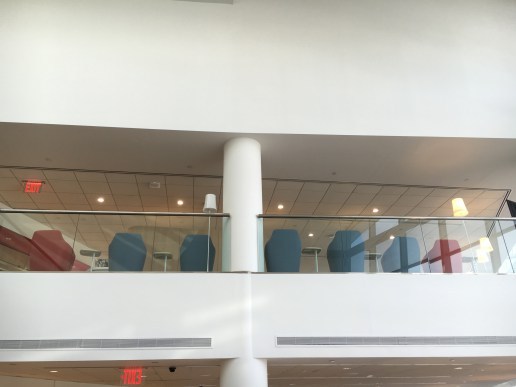

Seating beyond the entrance at the Air France Lounge

More seating, and looking forward the steps to the second level

Our bright, sunny corner

Alternate view

Looking to the second level

The ceilings here are super high. And the walls are floor-to-ceiling glass, so it’s extremely well-lit inside.

The wi-fi was very fast. But then again, there weren’t many people there when I visited. Whatever the case, I enjoyed the fast speeds in uploading the photos I took.

There were magazines to take. And apparently there’s a Clarins “wellness area” where you can book spa treatments, but I didn’t notice it. Although I did spot a business area with a phone, computer, and fax machine in case you needed to print out or send any documents.

The place was designed to look ultra-modern and sleek, including the seating. With chairs, in particular, that often translates to uncomfortable. While they’re nice to look at, in practice, they weren’t too comfortable to sit on.

If you want more space, or can’t find an outlet, you could venture upstairs – it looked very sparse when I visited.

The food

No lounge is complete without food, and the Air France Lounge serves full hot meals.

They also have a self-serve bar (yesssss my fave!), with a decent selection of wine and liquor.

Self-serve bar

Veggies, juices, yogurt

Hot food area, with soups, entrees, crackers

Beer and soft drinks, snacks, and coffee

Coffee and snack area

The food was very good. They had lox, two types of soup, cous cous, a pasta dish, and some steamed veggies. There were also a few sweet treats and pastries. And juice, coffee, chips, soft drinks, and beer.

Because I knew the food on Norwegian wouldn’t be free, I snuck a bag of chips and a beer into my backpack to have on the flight.

Overall, they have a good selection of snacks to choose from.

My only “complaint” is the size of the glasses. They are tiny! They couldn’t have held more than 5 or 6 ounces. So I had to keep going back for refills. That sounds minor, but it’s mildly inconvenient in the moment.

Bottom line

All-in-all, a solid lounge. I would chill there again.

Oddly enough, I wish it were a little less bright in there. Along with floor-to-ceiling windows, they also have skylights. The amount of sunlight in there, I can’t believe I’m saying/typing this, is a bit much.

The seats are also not the most comfy. And getting checked took longer than expected.

Those things aside, there is ample seating spread out all over. The food selection is great. And I love the self-serve bar and the selection of beers, juices, and soft drinks.

The wi-fi was fast, and there were plenty of outlets around the perimeter of the rooms.

Apparently, you can book a spa service at check-in. I didn’t see this or notice it mentioned anywhere else, so if you have some time, be sure to ask for the menu.

For a lounge that was recently remodeled, they did a great job.

And, for peeps with a Priority Pass, between this and the KAL Lounge – pick this one. It’s much better, if only for the food and drink selection. And there’s much more seating here.

I’ll head here again if I ever fly out of T1 @ JFK.

Let me know if you’ve been to this lounge!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!

Hotel Review: La Pagerie, Les Trois Ilets, Martinique

Also see:

Just Booked: Martinique $317 Round-Trip and Non-Stop on Norwegian

Booking Martinique: My Experience With Citi Prestige Concierge and 4th Night Free Benefit

I’m Prestigious! Getting Citi Prestige and First Impressions of the Card

The ticket to Martinique cost $67 out-of-pocket ($317 fare – $250 Citi Prestige airline credit). And I booked Hotel La Pagerie through Citi Travel Concierge and got the 4th night free.

Citi Prestige saved me a boatload of cash on this trip. Safe to say I love this card.

Grounds of the Hotel La Pagerie

Arrival and check-in

Link: Hotel La Pagerie

I arranged transport from the airport for 50 Euro each way (100 round-trip). But considering car rentals for the 4-day period were nearly ~$400, I opted to pay a taxi and save the extra cash.

We landed around 7pm. Our driver met us outside.

And after a loooong time in Martinique’s terrible traffic, we finally arrived to Hotel La Pagerie.

First impressions driving in:

Holy crap Les Trois Ilets is so cute

It’s so hot here

So glad there’s stuff to do within easy walking distance

Lobby and check-in desk at Hotel La Pagerie

There was a live band playing in the lobby when we arrived, so I had to scream/write everything down. It was kind of an interesting check-in.

There were lots of people hanging out in the lobby, slurping down tropical drinks and wearing loose, flowy clothes. I couldn’t wait to get out of my winter gear and jeans and join them.

Check-in was easy enough, considering. I paid for the stay with the Citi Prestige card. They already had room keys and welcome letters.

Zika!

They advised us to take precautions against the Zika virus.

This is a boutique hotel: no elite status, no welcome amenity, no free breakfast. Free wi-fi, thankfully. It actually felt good to be away from brand standards and let go of those expectations.

The room

It’s a big hotel, but the setup is pretty simple. The buildings wrap around the central pool area – it’s a big rectangle. That means depending on where you start, you may have to walk down a few long hallways, which is what happened to us.

Hallways of Hotel La Pagerie

The hallways are all open-air, so the night breeze felt awesome. So humid, too!

We got Room 524 and headed up. The grounds were very well-kept. And there were lots of nice touches with the decor. You can tell someone really paid attention to the details. It felt like a popular hotel, but that management has maintained it well for a long time.

View upon walking in

Lavazza coffee machine

Desk

The bed

Seating area

“Third wheel bed” lol

As is usual in beach destinations, the floors were tiled throughout.

The decor in the room was light wood and white with lime green splashes – very cute and tropical.

We had a king bed with lots of extra seating, including a pair of comfortable chairs, a desk, and an extra bed/couch. We called it a “third wheel bed” because it was the perfect little nook to curl up and sleep.

There was a Lavazza coffee machine with plenty of coffee.

Bathroom (and my silly self) :p

Damana toiletries

Toilet

The bathroom was stocked with soap and body lotion from Damana. All orange blossom scented. Instead of shampoo and body wash, they had an all-purpose pump in the shower labeled “hair and body wash.” (I felt your pain, Stefan!)

But it was very clean and had plenty of counter space and a couple of shelves, which was perfect.

Balcony

We also had a balcony with a couple of wicker seats overlooking the pool. The breeze felt so good out there. Note that every room here has a balcony.

The wi-fi in our room was pretty weak. And I noticed it was stronger near the center of the hotel (where the pool was). So to get wi-fi, we had to sit out on the balcony, which was fine.

But it you get a corner room or one far from the wi-fi, that could be really inconvenient.

Also note you can only add 3 devices to the wi-fi per room. So if you’re traveling with someone, and you both have a phone and a laptop, you’ll need to get an extra wi-fi code. Something to be aware of because you can nip that in the bud when you check in.

Overall, the room was very comfortable and clean. I loved the bright colors. And aside from the usual tourist-on-vacation noises, it was very quiet.

The pool and its politics

We had a view of the pool.

Night

Day

The pool area was extremely scarce on layout recliner thingies. European tourists would wake up at the crack of dawn and start throwing their towels down, claiming a spot all day while they were out sight-seeing and having lunch.

I’d never really experienced that before, but it seemed really… rude? To block a spot all day for yourself? And it wasn’t just 1 or 2 spots that were blocked. Half the seats would be taken and there would only be a few people in the pool.

Vitamin D, get in me

It wouldn’t be a problem if they have lots of spots. And because of the building setup, not every part of the pool always got sun.

Nearly every spot was taken each day I was there. So it got kind of uncomfortably competitive at times. A few times, I thought people were going to fit over a seat.

In any case, once I learned how to play the game, I was able to lay out in the ~90 degree BLAZING HOT sun. And it felt awesome after having such a gloomy winter in the Northeast this year.

Also, the poolside bar had terrible service. There are 2 ways to access it: walk up or swim up.

Obviously, swim up is awesome. But the servers acted like going over to the swim up side was the most laborious task ever. So we gave up after sitting there for 10 minutes or so, and didn’t really try again.

The pool here is a missed opportunity. Maybe they just don’t care?

In any regard, be prepared to fight for a spot around the pool, because the pool politics here are complex. Which is something you might not want to deal with on vacation.

The hotel

Overall, it was nice enough.

Lobby seating next to the bar

There was an in-house restaurant with yummy but expensive food and drinks. And a lobby bar with incredibly strong drinks. Still, you’ll do better to simply walk across the street and access the dozens of other restaurants instead.

It took a while to get someone’s attention when I realized I’d need another wi-fi code. And when I got someone to help, they scolded me for keeping the “Do not disturb” sign on the door. I mean, I had plenty of towels and toiletries and coffee, so I thought I’d reuse or conserve what I already had.

“The maids need to clean every room, every day,” they told me. OK… So the next day, I left the sign off the door and let them make up the room.

The whole exchange struck me strange. They seemed to want to put the maids to work or something. I dunno. I’ve never been told to take the “Do not disturb” sign down before.

In any regard, after a long wait, I finally got an extra wi-fi code.

Bottom line

Hotel La Pagerie in Les Trois Ilets is fine. The hotel is well-located in a popular tourist area. But I wouldn’t stay here again because I wouldn’t stay in Les Trois Ilets again.

I’m glad I experienced it, but the area was far busier and, at times, chaotic, than I expected. Not that I had (m)any expectations, anyway.

There is a lot going on in Martinique. It’s very easy to take taxis everywhere. Transportation is expensive (taxis and car rentals).

Consider checking a bag if you want to use a lot of sunscreen. Because it costs about $25 for a small bottle of it in the pharmacies and shops on the island. Yeah. Price gouging at its finest.

Martinique, in general (and this includes the hotel) has the crowds but not the infrastructure to support heavy tourism.

Traffic was terrible. The pool area was crowded. Long lines and waits for service. Food is reasonably priced, and yes, there are lots of baguettes and pastries available.

I’m glad I went down for a few days. Got a cheap ticket, got a tan, saw a little more of this big world we live in.

But color me unimpressed with the French Caribbean. I probably won’t go back.

Have you been to the French Caribbean (Martinique or Guadeloupe)? Am I being too harsh on it? Feel free to share your experience!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!

What’s with all the crap promotions lately?

As I look out onto the barren fields where credit card crops once grew, I mourn the loss of Chase (with the 5/24 rule). Of Citi (when they shut down so many peeps’ accounts). And definitely of AMEX (1 bonus per lifetime? Um, OK). Barclays and Bank of America are both one-card wonders (Arrival for sign-up bonus and Alaska Visa, respectively).

I don’t know about you, but I’ve received a lot of terrible offers lately. Here are the best of the worst.

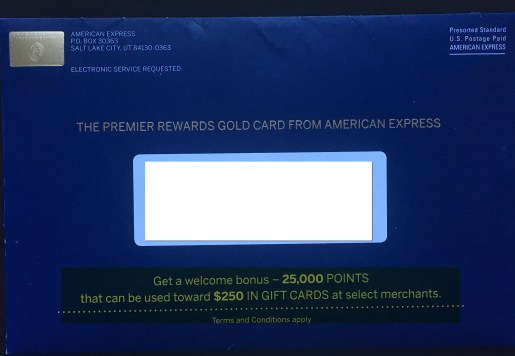

AMEX

25,000 AMEX Membership Rewards points?! No way?

AMEX sent a thick matte envelope with an offer for 25,000 AMEX Membership Rewards points with the AMEX Premier Rewards Gold card.

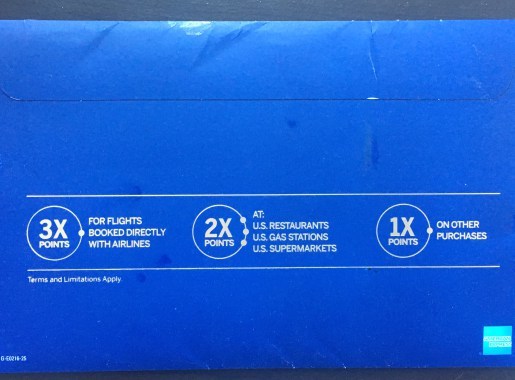

They even made sure to include the points-earning lingo!

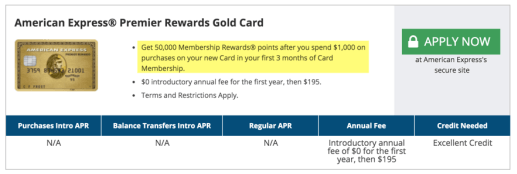

But, you can get double that from CardMatch:

The CardMatch offer is for 50K points

All I did was enter my info and a plethora of great AMEX offers came up.

The 100K offer is still available, too

You can also still get 100,000 AMEX Membership Rewards points on the AMEX Platinum Card on CardMatch. And the minimum spend is only $1,000 within the first 3 months.

Considering you can only get an AMEX sign-up bonus ONCE PER LIFETIME, you should always hold out for the best and highest offers.

For the AMEX Premier Rewards Gold, it’s been as high as 75,000 points to sign-up. But I love that AMEX sent me a lot of nice paper to tell me about a crappy offer. I took those pics above and tossed that nice promotional mailer (into recycling).

Chase

This one was so bad, I didn’t even snap a pic. Straight to da garbage!

The offer was for 7,500 bonus Avios… after spending $7,500.

I got a hearty laugh out of that one. It was basically for 2X Avios on all spending, but you had to spend that amount or more.

Random picture to break up text and give you a small visual break

For $7,500 in spend, I could do much better. I can get 5X Avios points for spending on the Chase Ink Plus card. Or 2X with the Chase Sapphire Preferred. Or… lots of other ways. Meeting the minimum spending on better cards, perhaps?

This offer was worth exactly nothing.

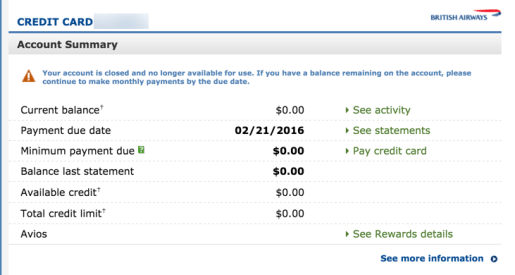

But, it was a nice reminder to cancel the Chase British Airways card. I called them right after and closed it because the annual fee was about to be charged. And you should cancel this card, too.

I confirmed with the rep I could sign-up for the card again and earn 100,000 more Avios. And considering I will probably only get one more Chase card until they start the 5/24 rule for all cards, including co-branded and business card, I’m so torn about which one will be my last hurrah.

Barclays

Check this Reddit thread for more info. But I got the offer, too.

0% APR to charge a Carnival cruise to my Barclaycard. “Promotional team really killing it.” Lolerz.

US Bank

This one is actually kind of OK.

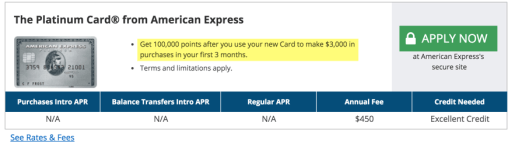

250 Club Carlson Gold points, eh?

What got me was how badly US Bank wanted to give me more credit on my US Bank Club Carlson Visa (notice it’s the no annual fee version because I downgraded that ish). They emailed and mailed about it several times before I finally looked into it.

There was no hard pull involved, and it’ll help my debt-to-credit ratio. So I finally took the bait and did it.

As a “bonus,” I got 250 Club Carlson Gold points. That’s worth… $1? I guess I’ll take it, but couldn’t this have been automated?

Just curious… has anyone else been hunted down by US Bank about this?

Bottom line

There have been a few more pretty terrible offers I can’t even remember. And of course a few good ones thrown in here and there (which you’ve read about on BoardingArea).

I was struck by how the marketing machines behind these huge companies think sending these offers to customers is a good idea. Of course, they’re hoping un-savvy customers will think they’re actually good offers.

For some reason I love hearing about terrible offers. It’s the points equivalent of watching FAIL videos on YouTube.

Anyhoozers, have you gotten any bad promotions lately in your accounts, email, or snail mail? Oddly enough, I’d love to hear about them.

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!

Loving Citi More Than Ever – Time to Cancel Other Cards?

The credit card landscape is shifting fast:

Chase will apply the 5/24 to all its cards starting in April 2016, including co-branded and business cards

Citi has been shutting peeps down for usage they don’t like (multiples of any 1 card, money order payments, etc.)

Barclays had a good product with the Arrival Plus card, then butchered it. That was pretty much the only good card they had

US Bank is useless

Bank of America is only good for the Alaska Visa

Wells Fargo is a cantankerous little beast

There are a few other niche cards, like the Fidelity Visa and BBVA NBA card, worth looking into, but not many

Card offers come and go. Benefits change. Mergers happen and shake things up. Revenue-based elite status throws a wrench into points-earning calculations.

Could ThankYou become the go-to?

Lately, I’ve been using my Citi cards for most of big purchases. And my trusty Chase Sapphire Preferred for dining.

Non-bonused spend goes on the Fidelity AMEX (I still have the AMEX version). And that’s pretty much it. All the other cards I have are for niche benefits or very specific spending (Chase Hyatt Visa, for example).

Recently, I went ahead and canceled the Chase British Airways Visa.

Bye, you useless thing

And downgraded my US Bank Club Carlson Visa Signature to the no annual fee version just to keep the credit line and history intact (here’s my recent offer to increase my credit line in exchange for 250 Club Carlson Gold points).

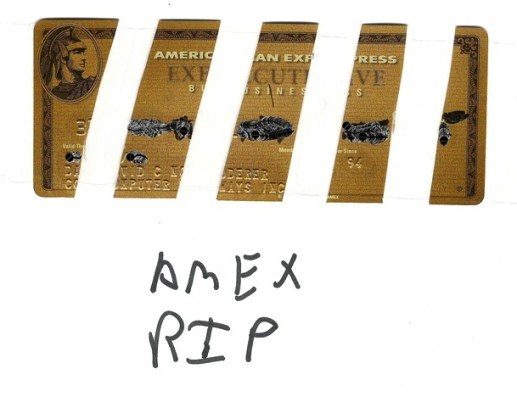

Poor AMEX

AMEX in particular keeps taking the hits left and right:

Costco gone to Citi

JetBlue gone to Barclays

SPG merger with Marriott gone to Chase

But they’ve thrown a few punches, too. Terrible sign-up bonuses and restricting all cards to 1 sign-up bonus per LIFETIME.

Dead to me

You could reward customers with a bonus every few years, at least. Once per lifetime seems unnecessarily harsh.

I explored the topic of switching away from AMEX and over to Citi a few months ago.

As I shift more spend to Citi (and specifically to my new Citi AT&T Access More card – which is also the best card for shopping at Costco), I’m now thinking of canceling other cards to earn ThankYou points. Because I haven’t been hitting 30 transactions per month on my AMEX EveryDay Preferred card, which means no 50% bonus.

And let’s be honest, Membership Rewards is kind of a mess.

What’s coming and going

I’m loving my Citi cards more than ever. Citi Prestige is the gift that keeps on giving and Citi AT&T Access More is amazing for online shopping. I still use my Chase Sapphire Preferred for travel other than airfare and hotels, and for dining.

Picture of bae

Until Citi adds a meaningful domestic airline partner, ThankYou won’t be my program of choice. I still use Ultimate Rewards for British Airways, United Airlines, and Hyatt transfers the most.

I might get one more Chase card before the 5/24 rule goes into effect, with the understanding it will likely be my last.

And other cards have to go, including:

AMEX EveryDay Preferred (not worth the $95 annual fee if I’m not triggering 50% bonus)

Barclaycard Arrival Plus (no better than a 2% cash back card now. $89 annual fee not worth it)

Chase British Airways (already canceled. When they cut 1.25 points on purchases, it became useless)

US Bank Club Carlson Visa (no more BOGO and $75 annual fee – downgraded)

I’d like to add the Citi ThankYou Premier to my staple at some point. And maybe another AAdvantage card just for the miles. Wouldn’t mind the extra Hilton points with the AMEX Hilton Surpass, either.

Or the Chase British Airways card for another 100K Avios. This will likely be the last Chase card I get. :/

But that still leaves Citi cards getting the bulk of my actual ongoing spending. Which is kind of surprises me.

My favorite way to redeem Citi ThankYou points is for flights on American Airlines through my Citi Prestige card.

And I need to look into Singapore Airlines’ KrisFlyer a little more… because there are good values for domestic award flights, and flights to the Caribbean. Citi ThankYou points are also crazy easy for me to earn. So it might be worth paying a little more for award flights because of how easy it is to accumulate them.

Bottom line

Citi cards have become the dark horse in my wallet lately. And increasingly, I’m finding it’s more worthwhile to cancel other cards, like the AMEX EveryDay Preferred, or downgrade them, like the US Bank Club Carlson Visa, and keep Citi cards in rotation.

The Citi AT&T Access More card has unexpectedly become my jam.

And I’m loving getting free flights on American Airlines to earn Alaska Airlines elite status with Citi Prestige.

I’m also finding lately I want more Citi cards than Chase or AMEX or any other bank… which is also something new.

Have any Citi cards moved up in your wallet? Are there any others you’re looking to downgrade or cancel?

And… any thoughts on Citi’s ThankYou program? What would you like to see change or added?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!

February 28, 2016

Bank of America Sending 30K Offers for the Alaska Airlines Card Already

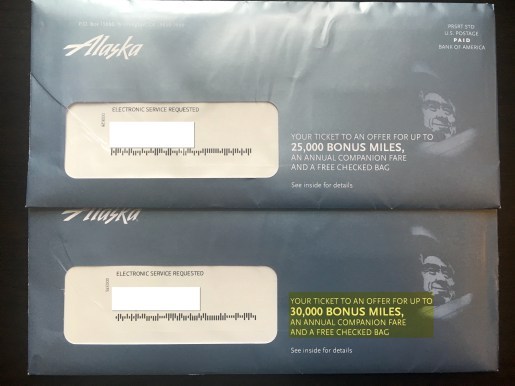

The same day Doctor of Credit broke the news Bank of America will increase the sign-up bonus on the Alaska Airlines Visa to 30,000 Alaska miles upon approval in May, I got that exact offer in the mail. But it’s already active.

One of these is not the same…

Actually, I got two offers. One for 25,000 miles. And another for 30,000 miles upon approval.

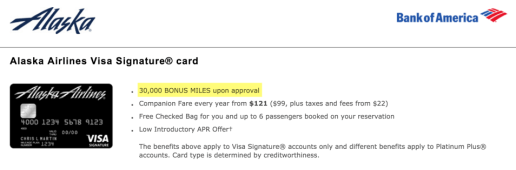

Throw in a $100 statement credit and it’s a deal

I typed in the link to the offer (alaskavisanow.com lol) and typed in the promo code in the letter. Sure enough, it works for immediate sign-ups.

If there had also been a $100 statement credit, I would’ve pulled the trigger.

Get a better offer anyway

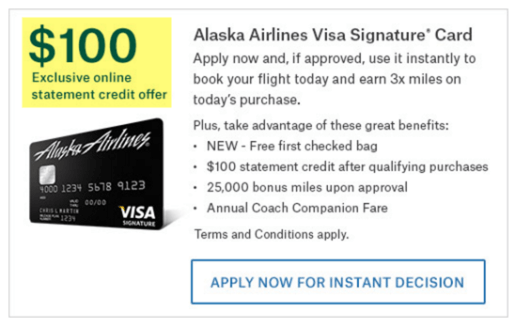

25K + $100 credit lives on

For reference, you can still find the offer to earn 25,000 Alaska miles upon approval and a $100 statement credit after spending $1,000 within the 1st 3 months of account opening by making a dummy booking at alaskaair.com. Just click through to the payment screen to find it.

Oddly enough, I recently opened this card (this month actually), so I was surprised to get 2 different offers for a card I opened less than a month ago. Unless Bank of America’s mailers were scheduled over a month in advance, which is quite possible.

Comparing the two

Is 5,000 extra miles worth $100?

If you value Alaska Airlines miles at 2 cents each, then yes, absolutely. But it would be even better to get both. That’s what I’ll hold out for. Because I think we’ll see a new offer on this card in the next few months.

But the miles are award upon approval, so if you need a quick top-up in your account, it’s a no-brainer to take the offer for more miles.

Mileage Plan

I’m excited about the prospect of earning elite status on Alaska Airlines this year. For the 8 months left in 2016, I’m crediting everything to Alaska.

Now, I don’t have that many paid flights. But Alaska Mileage Plan is the only distance-based (as opposed to revenue-based) loyalty program left. And you earn more miles and elite status faster with Alaska Airlines.

If you value American’s system-wide upgrades and complimentary upgrades, you won’t find much use in Alaska’s program. But if you fly American and Delta here and there, it’s a nice way to bank miles into one account.

All this to say, with the Bank of America Alaska Airlines Visa, you’ll get a companion fare each year. And if you have status, you can get an upgrade (and so can your companion from what I understand). Might be a nice way to take a trip to Hawaii (or anywhere else Alaska flies in the US).

I’m flying to Texas this week and it’ll be my first time crediting a flight to Alaska. So I’ll look forward to exploring Mileage Plan more. And who knows, maybe even earn some sort of status in the process.

Bottom line

Keep an eye on your mailbox! If you want 30,000 Alaska Airlines miles quick and easy, Bank of America is sending mailers for this increased offer. Lots of peeps on Reddit report getting this offer, too.

Personally, I’ll hold out for 30,000 Alaska miles and a $100 statement credit in May (hopefully).

This is a decent deal considering you earn the miles upon approval. And it’s nice to see Bank of America actually promoting their cards.

Hopefully there’s more where that came from.

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!

February 9, 2016

The best card for shopping at Costco is… Citi AT&T Access More?

Also see:

Confirmed: RadPad Earns 3X ThankYou Points With Citi AT&T Access More Card

Is the Citi AT&T Access More Card + RadPad a Viable MS Option?

I’m Prestigious! Getting Citi Prestige and First Impressions of the Card

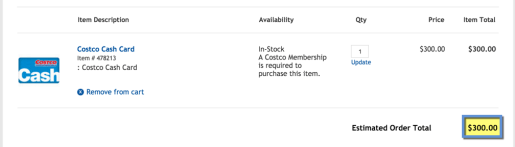

In my wanderings with the Citi AT&T Access More card, I learned you’ll earn 3X Citi ThankYou points per $1 spent at Costco.com – including gift cards.

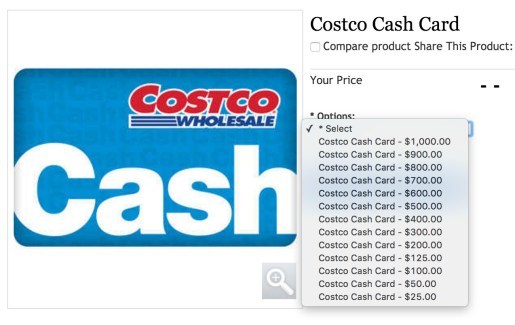

This $300 Costco cash card earned 900 Citi ThankYou points with the Citi AT&T Access More card

It got me thinking… is the Citi AT&T Access More card the best card to use for shopping at Costco?

Buy Costco Cash Cards online

You can purchase Costco Cash Cards of up to $1,000 directly on the Costco website.

You can buy Costco Cash Cards in amounts from $25 to $1,000 online

Costco stores only accept cash and AMEX cards as payment (until this summer, when they’ll switch over to Visa). But regardless of what they accept in-store, you can use any major credit card to purchase Costco Cash Cards online.

So your options are wide open.

But most cards only earn 1 mile or point, or 2% cash back back at Costco (online or in-store).

That’s why I’ve been using the Fidelity AMEX card (which will become a Fidelity Visa this summer). So either way, I’m guaranteed 2% cashback from Costco.

But the Citi AT&T Access More card ups the ante – to 3% back.

You’ll earn 3 Citi ThankYou points per $1 spent at Costco.com. Those points are worth 1 cent each on their own. And even more when you combine them with another card, like Citi Prestige or Citi ThankYou Premier – up to ~5% back.

Their value goes up even more – because you can transfer them to travel partners. Or, in the case of Citi Prestige, use each point for 1.6 cents toward American Airlines flights – my favorite way to redeem Citi ThankYou points by far.

What’re the drawbacks?

You must purchase the Costco Cash Cards online to get 3X Citi ThankYou points.

It can be hard to figure out which denomination to buy. I usually spend around $300 on my Costco runs, so I figured that would be a good amount to try. If I go over, I’ll be sure to have an AMEX handy to cover the difference.

And if not, I can just hang on the Cash Card. It sucks to have to keep up with it, but there are worse things to deal with.

7 to 9 business days

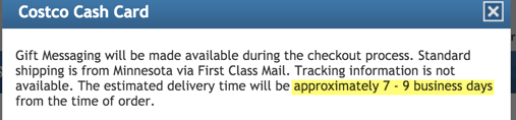

For me, the biggest downside is that it takes 7 to 9 business days to get the card in the mail. Yup. Counting the weekends, you can be waiting for up to 2 weeks.

So it requires some planning/keeping up with cards. I usually make a Costco run about every 6 weeks, and I have my little routine pretty down pat. So it’s not too much of an issue to order a new Cash Card when I’m ~2 weeks away from making a run.

Consider return protection and warranties if you’re buying something large, like an appliance

I was also kind of worried about not having credit card purchase protection. Or extended warranties.

But the Costco return policy is so good that I’m not worried about it. That said, if you’re making a big purchase, like an appliance, computer, wedding ring, etc., it’s worth looking into this issue more deeply.

I generally buy massive amounts of food and cleaning products, so I’m not too concerned with getting a warranty or purchase protection. But it’s worth thinking about for important big-ticket items.

Bottom line

Until now, I’ve been earning 1 mile or point per $1 spent at Costco – or 2% cashback. But the Citi AT&T Access More card offers 3% cash back at a minimum – and much more when you combine the points with another Citi card that earns ThankYou points (like ~5% back with Citi Prestige).

For me, this sets a new standard of earning points. It’s easy to purchase Costco Cash Cards online to trigger the 3X earning.

The biggest drawback is that it takes ~7 to ~9 business days for the cards to arrive in the mail. No instant gratification here!

But if you can manage that, and keep up with the Cash Cards, this is the best return that I know of for Costco shopping.

Oh! And Living Social has an awesome deal for Costco membership right now!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!

Confirmed: RadPad Earns 3X ThankYou Points With Citi AT&T Access More Card

Also see:

Is the Citi AT&T Access More Card + RadPad a Viable MS Option?

I’m Prestigious! Getting Citi Prestige and First Impressions of the Card

Hello from sunny and HOT Martinique! I’m at Hotel La Pagerie (which I booked with the 4th night free through Citi Prestige).

Quick update because I just received my first statement on my brand new Citi AT&T Access More card.

I didn’t go for the Citi ThankYou Premier to get the full 3X on all travel including gas. Instead, I hedged my bets and got the Citi AT&T Access More card.

The main draw for me was paying rent through RadPad and earning 3X Citi ThankYou points.

And because I also have Citi Prestige, each point is worth 1.6 cents toward American Airlines flights (including codeshares). So even with RadPad’s 1.99% fee, I’d still get close to 3% back of value (4.8% – 1.99% = 2.81%).

Which is awesome – and better than a 2% cash back card obvi.

I outlined the numbers in detail here. And commenters on both Doctor of Credit and Reddit said RadPad earns 3X Citi ThankYou points per $1.

But I just had to confirm it for myself. It really does!

My 3X Citi ThankYou points experience

Link: Citi AT&T Access More card

Link: Apply for Credit Card Offers

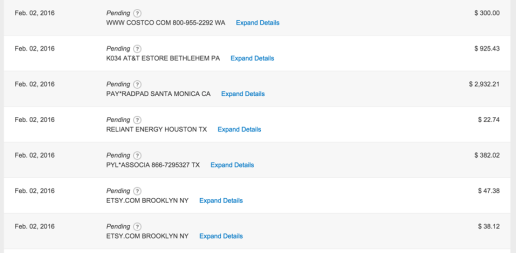

I made a variety of purchases before I left for Martinique to see what would (and wouldn’t) count for the 3X “online retail website” category. Thankfully, it’s very broad!

I had charges from various merchants in February:

Everything I bought on the card the 1st billing cycle. Random assortment of merchants, including RadPad, Amazon, and Costco

The list is pretty good though. I earned 3X points at:

RadPad

Amazon

Costco

AT&T

Etsy

My HOA association (paid monthly dues)

I did not earn 3X points on Reliant, which is an energy provider. But Citi specifically says utility companies are excluded, so fair enough. However, it’s free to pay it online with a credit card, so I’ll switch to my Fidelity AMEX next month to get 2% cash back instead.

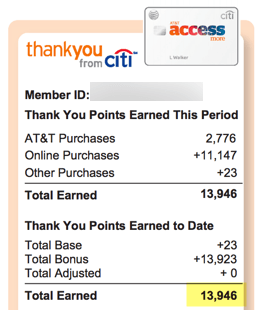

I earned 3X on everything except the ~$23 energy charge and got ~14K points this month

Earning 3X points at RadPad is awesome! Much better than 1% cashback with the PayPal Business Debit MasterCard.

In total, I earned 13,946 Citi ThankYou points this month. That’s worth ~$223 toward flights on American Airlines.

And score – the HOA dues on my new place in Dallas count for 3X, too!

It’s all in the pairing

Even if you only had the Citi AT&T Access More card, you could cash out your Citi ThankYou points for 1 cent each and still come out ahead of the 1.99% fee from RadPad.

And remember, you’ll earn 10,000 bonus ThankYou points when you hit $10,000 in spending per year. With RadPad, that’s going to be super easy to hit – which more than offsets the $95 annual fee.

But the good stuff happens when you pair it with another Citi card, like the Citi ThankYou Premier or Citi Prestige card.

If your rent is $1,000, you’ll pay $20 to RadPad as a fee. But earn 3,060 Citi ThankYou points worth – at a base – $30.60.

Or ~$49 on American Airlines flights when you have Citi Prestige. Or ~$38 toward travel when you have the Citi ThankYou Premier.

Any way you pick, you come out ahead. You “profit” ~$29 with Citi Prestige and ~$18 with Citi ThankYou Premier after the RadPad fee.

That’s per $1,000 of rent. So you can scale it up or down to figure out how much you can earn.

Bottom line

I’m officially going to be jammin’ on my new Citi AT&T Access More card for as long as I can.

I’ll do a separate post on my experience getting the phone and $650 statement credit from Citi (hint: it all worked fine and was super easy).

This card is ideal if you are a heavy online shopper and/or pay rent through RadPad.

The $95 annual fee isn’t waived, but once you hit $10,000 in spending, you get 10,000 bonus Citi ThankYou points – which offsets the fee. It should be pretty easy to hit that mark if you go the rent route.

The real magic is when you have Citi Prestige or Citi ThankYou Premier. Because then your points earn outsized value that more than cover RadPad’s 1.99% fee for MasterCards (which this card is). If you want to pick up either, thank you for using my links!

I’m going to switch all my rent payments to this because it’s wayyyy more lucrative than just earning 1% cashback. Or even PayPal My Cash cards (except when meeting minimum spending requirements).

I plan on crediting all my American Airlines flights to Alaska Airlines this year. That means a lot of paid flights. But with my new Citi AT&T Access More card, all my flights will be pretty much covered. My only regret is not getting this card sooner.

Of course, you can also transfer the Citi ThankYou points to travel transfer partners like Singapore Airlines or Flying Blue to get even more value than what’s listed here.

Let me know if you have questions, or an experience with the Citi AT&T Access More card!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!

February 4, 2016

Coco Luxe: Coconut oil on-the-go for $12. Worth it?

Also see:

Must-Haves of Travel: Coconut Oil

Must-Haves of Travel: Apple Cider Vinegar

Must-Haves of Travel: Activated Charcoal

I’ve written about how awesome it is to travel with coconut oil. So when Coco Luxe asked me if I wanted to review their product, I thought, why not. I travel with coconut oil anyway, so I took it to Barcelona.

The big draw with Coco Luxe is that it comes in a 3.4 ounce tube. It clears TSA and all you have to do is throw it in your bag. So, the convenience factor.

Their cute logo :)

Full disclosure: They sent me a free tube in exchange for an honest opinion. And if you purchase a tube, I get a percentage of the sale. Now, putting all bias aside…

About Coco Luxe

Link: Buy/Learn About Coco Luxe

The tube came within a couple of days, in a small padded envelope. The contents:

Coco Luxe package

It’s the good stuff, too. You always want your coconut oil:

Organic

Unrefined (raw)

Extra virgin

Cold-pressed

When it’s pasteurized and processed, a lot of the healthy lauric acid and naturally-occurring antioxidants are killed. But, this is the good stuff.

And it smells yummy. Better than any other brand I’ve tried (and I’ve tried/smelled ’em all!). It literally smells like a coconut cookie.

According to them, they source their product from, “A Remote Pacific Tropical Island Where The Water And Air Are Pure And Unpolluted.” Maybe Fiji?

Many uses

Coconut oil has a laundry list of uses from skin moisturizing, mild sunscreen (around 3 SPF), or oil pulling.

I use it mostly as a moisturizer, lip balm, and occasionally put a dab in my hair (makes it not-so-frizzy and gives it shine).

It’s also great to use around the sensitive eye area. It’s gentle enough to use as an eye cream, or ladies, as an eye makeup remover. It helps smooth out lines, too. And if you use just the tiniest dab, it makes a good primer.

Because it can replace 2 or 3 (or more) other items, it’s a staple when I travel.

Especially if I’m going from high humidity to a dry climate. And, air travel is extremely dehydrating for your skin (and in general). So I use it post-plane, too.

Fits snug in the palm

It fits in most standard-size clear plastic baggies. It’s a tall, thin tube, and doesn’t take up too much room. I packed it and got through security without any issue.

Then took it to Barcelona. Where I used the entire tube. If you’re a heavy coconut oil user like me, it’ll last you about a week.

Thoughts on Coco Luxe

As mentioned, the main draw here is the convenience factor. Lots of peeps ask me how I pack coconut oil with it leaking everywhere.

The answer is: I spoon some into a small tupperware container, snap on the lid, and give it its own plastic bag in case it pops open somewhere along the way.

I’m partial to Spectrum coconut oil brand. You can get 15 oz of it for only $12.50.

Coco Luxe costs $12 and comes with free shipping in the US.

So, is it worth it?

If you want a simple option, yes. Or if you just want to try a new brand and see how you like it.

I’m fine with traveling with my little container. But there is something nice about having it in a squeezable tube. They also guarantee it’s leak-proof (no leaks here!).

You can run it under hot or cold water to make it softer or firmer. And because the tube is long and thin, it’s easier to get a consistent texture, whereas with a square container, it’s a little more difficult.

I’ll probably stick with Spectrum coconut oil for at-home use. And get Coco Luxe when I want to treat myself. Or take the tube and not have to worry about bringing home the empty container.

Also, if you’re new to coconut oil, Coco Luxe is a great one to start with because it smells so good. And it’s a small quantity, so if you hate it, you won’t have a big tub of it to get through.

It would also make an excellent gift if you know someone who is into natural living, healthy foods, or up for trying something new.

All-in-all, I’d use it again on certain trips or with a specific purpose in mind. Even just to have a good-smelling treat.

And you can’t beat the convenience. If that’s your main concern, this is an excellent product.

Bottom line

Adventures in coconut oil. I loved having it in Barcelona. It made a great traveling companion. And the actual coconut oil is super high-quality.

Give Coco Luxe a try if you want a high-quality and good-smelling pre-packaged coconut oil.

And if you want to stretch your dollar and get the max value from your purchase, stick with Spectrum coconut oil.

Both are worth trying. Both are great products. I’ll keep Spectrum as my go-to at home and use Coco Luxe for certain occasions.

If you’re new to coconut oil, or want a low commitment, Coco Luxe is a great place to start.

Let me know what you think!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!