Harlan Vaughn's Blog, page 51

April 29, 2016

Just Booked: 2 Nights at Hyatt at The Bellevue for $150 (Worth Over $900!)

Also see:

5 Hyatt Category 4 Hotels Where the Hyatt Card Annual Free Night Rocks

I’ve written about the incredible value you can get with the annual free night from the Chase Hyatt card at Hyatt Category 4 hotels.

A hotel I listed as an “honorable mention” is the Hyatt at The Bellevue in Philadelphia.

For my last weekend as a New Yorker, I’ll actually be in Philly, at this Hyatt. Jay and I both recently got our free night certs and I’ve been itching to burn them.

We got a super deal on a weekend getaway.

Hyatt at the Bellevue

This is an awesome example of how easy it is to get value from the Chase Hyatt card. The annual free night makes it well worth keeping!

By the numbers

I was torn between this property or the Park Hyatt Toronto (which is also a Category 4 hotel).

The X factor was the dog. Luckily, Hyatt at The Bellevue is dog-friendly. Plus, it’s only 90 minutes away, so I can easily drive there for the weekend.

Room rates were $409

The rooms were selling for $409 a night, plus taxes and fees.

~$472 out-of-pocket

All told, it would’ve been ~$472 per night.

Free night cert to the rescue!

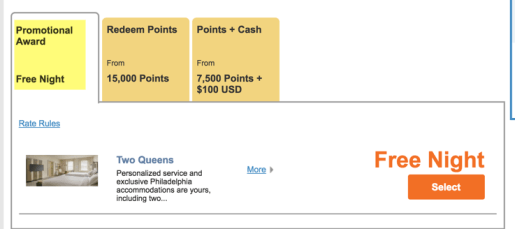

But, rooms were available with points. This would’ve been an ideal points redemption, too, btw (over 3 cents per point in value). But it’s even better with the free night certificate. I love how easy it is to book the award online.

I clicked through and booked the free night within minutes. Then, Jay booked his.

Afterward, we called and merged our reservations and gave a heads up about bringing Fenwick because they have a limited number of pet-friendly rooms available.

We each paid $75 each for the annual fee on the Chase Hyatt card. And both redeemed the annual free night certificate for a room worth ~$472.

Wanna visit the Philadelphia Museum Of Art

All told, a total of $150 for a 2-night stay worth ~$944.

Even if we don’t use our Chase Hyatt cards for a dime of spend this year, paying the $75 annual fee gave us a fun last hurrah weekend trip in Philly at a super nice hotel. It also goes to show why it’s doubly better (literally) to force travel credit cards on your partner lol.

I’m really looking forward to it! Review will come soon.

Bottom line

For all the theory about how you could use your points and miles, I love hearing how peeps actually redeem them.

Mostly, it’s not for super-aspirational awards. It’s to visit relatives, take weekend trips, or give someone a nice surprise.

Last year we sent Jay’s grandparents on an anniversary weekend at the Hyatt Regency St. Louis at The Arch. Was it the best redemption possible? Maybe not, but the certificates were going to expire before we could use them.

And they had a fantastic time there! The staff brought them anniversary gifts of flowers and wine, and upgraded their room. And gave them free dessert at the hotel restaurant.

The Chase IHG card also comes with a free night you can use at any IHG hotel – and that card’s annual fee is only $49, which also makes it a keeper.

Looking forward to staying at the Hyatt at The Bellevue in Philadelphia in a few weeks. It really is the little things.

While we’re on the subject, feel free to share your favorite Hyatt Category 4 hotel!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!

My FoundersCard Membership Just Paid for Itself This Year

Also see:

Assessing the Benefits of FoundersCard

18 FoundersCard Travel Benefits (Status, Discounts, and Freebies)

FoundersCard Membership: Is it worth it?

Peeps are curious about FoundersCard. The many posts I’ve written are amongst my most-Googled. And a good 1/3 of reader emails ask about a specific benefit.

So I thought I’d post an update, as I still have and use mine regularly.

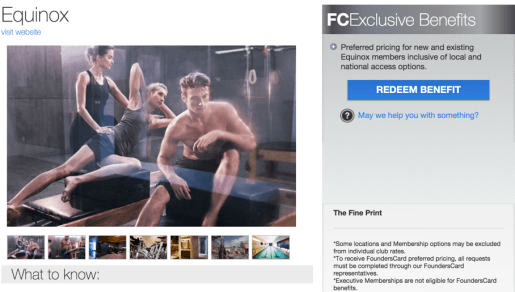

In fact, I just used it to join the Equinox in Dallas – and got $29 knocked off my monthly rate thanks to FoundersCard.

Just saved a bundle to get back into shape

Now I’m not saying “join Equinox!” Instead, I’d say FoundersCard is worth it if you have a particular benefit in mind, like:

15% off your AT&T bill

Free Caesars Total Rewards Diamond Status

Silver status with Virgin America or Cathay Pacific

Gold status with Hilton

10% off British Airways flights

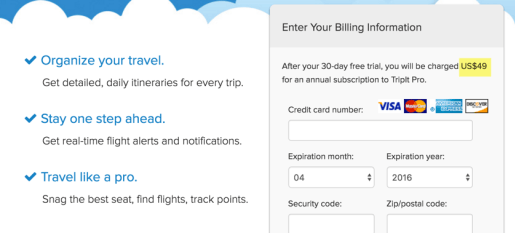

A year of free TripIt Pro

Free Zipcar membership and lower monthly rates

As long as it stays this good, I’m on board

Any one of these benefits can make up FoundersCard’s $395 annual fee if you really maximize it. And more if you can make use of 2 or 3 (or more) of them.

For example, I save about $20 a month off my AT&T bill.

And the TripIt Pro membership I got from my Barclaycard Arrival Plus is about to expire.

Free TripIt Pro saves $49

I’ve grown to love the service and use the app constantly for my travel plans. Would I pay for it? Maybe. But I won’t have to think about it for another year, because the next one is free thanks to FoundersCard.

How I use FoundersCard to save

If I’m gonna pay $395 a year for a subscription service, I’ll be damn well sure I make up for it – and then some.

I just renewed in March. So already this year, I’m saving:

$29 a month off my gym membership ($348)

$20 a month off my AT&T phone bill ($240)

$49 on TripIt Pro

That adds up to $637 saved. Or $242 saved after you factor in the annual fee. Not a bad haul.

That doesn’t include all the little fringe benefits, like hotel discounts, free Entrepreneur magazine subscription, networking event tickets, and lots of other here-and-there type things that’ll pop up over the upcoming year.

All-in-all, I’m extremely happy with the card and will keep it for as long as it’s worth keeping. For the past 3 years, it has been. No regrets here.

OK, the gym thing

Yes, I want to talk about this. I’m a boozehound. I like to have drinks. My metabolism isn’t as lightning-fast as it used to be.

So I want to kick off my move to Dallas with a commitment to get in shape, exercise more, and practice yoga again (and drink less, too).

I looked at a yoga studio near my house, but they charge $109 monthly for a membership.

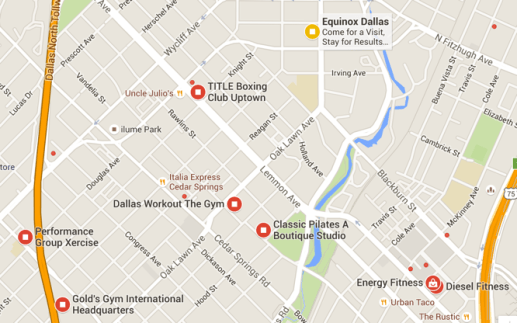

So I searched for other gyms within 10 minutes. If it’s not nearby, I won’t use it. I know that sounds bad, but it’s true. I need convenience if I’m going to stick to a gym routine.

And I wanted one with yoga classes.

My 10-minute radius options

I looked into all of these, and the only gym with daily yoga classes was Equinox. The price was comparable to other yoga studios in the area. With the added benefit of machines and equipment.

And, serendipitously, the FoundersCard discount was icing on the cake. It’s what cinched the decision for me.

But most importantly, I want to write about this to make it real. And to keep myself accountable.

I want to introduce healthy and clean new energy into my life, and this will be a great first step.

Bottom line

This is a deal that worked itself out without too much finessing on my end. If you can find a similar one with FoundersCard, and it works out, go for it. I’d say it’s worth signing up for if you can find 2 or 3 discounts that really appeal to you. Otherwise, skip it.

I also wanted to share how I maximized FoundersCard to cover its cost this year (I just renewed last month), and remind you to maximize not only this offer, but every one you find.

A little here, a little there – it really does all add up.

Feel free to sign up for FoundersCard using my referral link to lock in the $395 rate. And my email is zynner@gmail.com if you have specific questions about the discounts or service.

Also, thanks for keeping me accountable with yoga and getting into shape – for listening. You guys really are the best!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!

7 Hilton Hotels Where 120,000 Hilton Points Are Worth $700+

Also see:

Taking Another Look at Hilton, Hyatt, and Diamond Elite Status

My Hilton Diamond Experience in Barcelona (With Suite Upgrade Worth Over $1,600!)

You know, I think I’ll come right out and say it: I’m turning into a Hilton fanboy.

Words I thought I’d never utter (or type) have come true, almost by default.

The other major chains, Marriott and IHG, aren’t palatable for me. Some peeps love Marriott, and I can kinda see why through my Hilton-colored glasses: free breakfast, they’re everywhere, and their points are easy to redeem (once you have enough of them, same as Hilton).

All I really want – is that so much?

Embedded in there is my raison d’etre: FREE BREAKFAST. That’s the reason why IHG can never win my heart through my stomach.

The smaller chains, Hyatt and Starwood, are great. But when Hyatt snubbed me Diamond status, Hilton gave it to me. Looking back, it was an incredibly smart marketing trick. Because look at me now, a fanboy.

As for Starwood, there’s no use gunning for status with them at this point. Unless you like Marriott. I picked up both SPG cards recently, and I might give them a few paid stays, but the SPG program will be torn end to end starting next year.

Which leaves Hilton by default. The first to devalue, Hilton became the pariah of hotel points.

But I’ve been finding them useful anyway: they’re incredibly easy to earn. I get suite upgrades with some frequency. And I love their Executive Lounges and free breakfast.

Yeah, yeah… the point is?

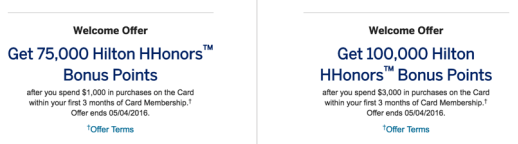

There are two highest-ever sign-up bonuses on the Amex Hilton and Amex Hilton Surpass cards through May 4th, 2016 (next Wednesday). If I hadn’t already gotten 2 SPG cards, I’d get a Hilton card to load up on some more Hilton points.

Yes, you can earn lots of Hilton points. They ARE worth something!

You can earn 75,000 Hilton points on the Amex Hilton card after spending $1,000 within the first 3 months. The card has no annual fee, so it’s free to keep for the long-haul.

Or, you can earn 100,000 Hilton points on the Amex Hilton Surpass card after spending $3,000 within the first 3 months. There is a $75 annual fee, but it comes with Hilton Gold status, which gets you free breakfast.

And, it earns 12 Hilton points per $1 spent at Hilton hotels – the most of any card. (Plus 6 Hilton points per $1 spent at gas stations, restaurants, and grocery stores in the US, and 3 Hilton points everywhere else).

You can find them both here:

View Additional Hotel Credit Card offers here!

The reasoning

With the Amex Hilton card, you’ll have at least 78,000 Hilton points after meeting the minimum spending.

And with the Amex Hilton Surpass card, you’ll have at least 109,000 Hilton points.

From there, it’s a short trek to 120,000 Hilton points, which lots of peeps say is not worth a lot. But I easily found 7 Hilton hotels where that many points gets you a $700+ stay.

I chose $700 because I’m becoming more selective in my card sign-ups. I want every card bonus to be worth at least $500 or I generally won’t consider it.

With both Amex Hilton cards, you get at least that much, depending on how you use the points.

7 Hilton hotels where Hilton points are worth $700+

Here are 7 Hilton hotels on my personal list where Hilton points are worth redeeming.

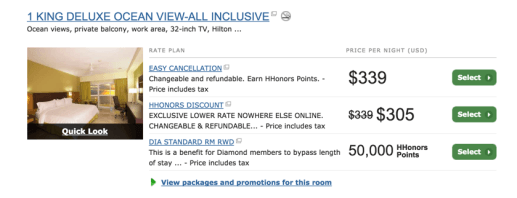

Note: I’m using the HHonors discount paid rate in these examples.

1. Hampton Inn & Suites Chicago-Downtown

Two nights in Chi-Town in June during the annual Gay Pride Parade cost $759.

~$759 for 2 nights in Chicago this summer

The nights are available to book with 100,000 Hilton points, too.

In this case, the sign-up bonus on the Amex Hilton Surpass card is worth well over $700. Free breakfast is always included at Hampton Inn hotels, but your Gold status might score you an upgrade. If anything, you save a good amount.

A quick Kayak search shows me this price isn’t an anomaly. Meaning whichever chain hotel you pick, you’d pay around the same price for these dates. I’d feel good about using my Hilton points in this case.

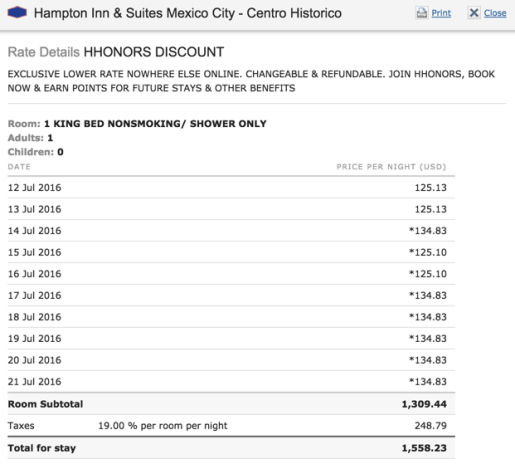

2. Hampton Inn & Suites Mexico City – Centro Historico

Not to get too stuck on the Hampton Inn thing, but this example is just too good. I’ve used it before, and still can’t wait to visit Mexico City, especially since the New York Times rated it the #1 destination to visit in 2016.

Indeed

The value is perhaps too good to last. I should go sooner rather than later. Maybe when I move to Dallas.

You can get 5 nights here for 40,000 Hilton points. Because you get the 5th night free on award stays with any Hilton status – which comes with both of the Amex cards.

10 nights is ~$1,558

Which also means, yup, you can get 10 nights for 80,000 Hilton points.

The same dates cost 80K Hilton points

Of course, you don’t have to redeem all 10 nights here. You can pick a different hotel altogether.

But this goes to show the sign-up bonus on the no-annual-fee Amex Hilton card can be worth over $1,500 – that’s more than worth it if you like to stay at lower-level properties.

I’d like to visit Mexico City this year. And I will most likely use my Hilton points to stay here. The value is just incredible.

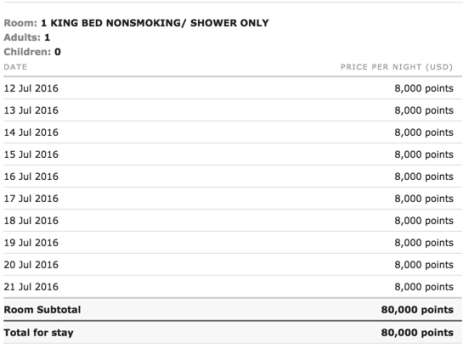

3. Homewood Suites by Hilton Seattle Downtown

I had a blast in Seattle! It’s no doubt getting expensive, so hotel points can go a long way there (and in Portland, or anywhere else in PNW, really).

Save over $700 in Seattle

You can use 120,000 Hilton points to cover a 2-night stay that would otherwise cost ~$730 in downtown Seattle.

Raff

I’m actually dying to visit Seattle again. I was there for 3 or 4 days and I didn’t get near to my fill of craft beers.

Seattle summers are actually splendid

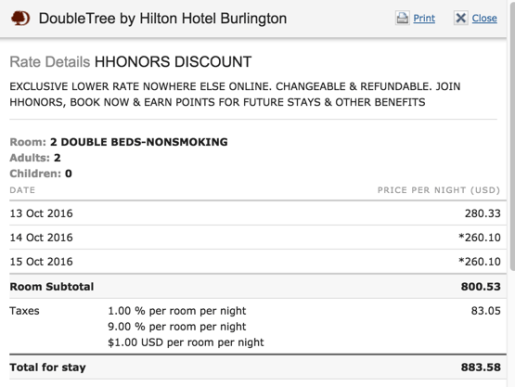

4. DoubleTree by Hilton Hotel Burlington

It’s no secret I have a huge man-crush on the entire state of Vermont, including the gorgeous city of Burlington. It’s the chillest place you’ll ever find, with views of the Adirondacks across Lake Champlain.

Vermont is like home

In the summer, you can hike and road trip. In the fall, the leaves are out-of-this-world stunning. Spring and winter have their strong suits, too (beautiful flowers and world-class skiing).

Save almost $900 with Hilton points for 3 nights in Burlington with 120K Hilton points

Vermont can also be expensive. I found 3 nights in October for 40,000 Hilton points each – that’s right in the middle of peak leaf-peeping season – which would otherwise cost ~$883.

You could easily add this stop to a Vermont road trip. It’s so so worth it. The landscapes, the people, the food – all fantastic. Please visit Vermont if you’ve never been!

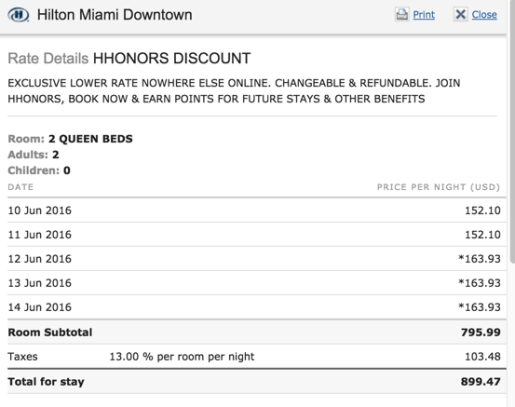

5. Hilton Miami Downtown

I’ve been meaning to squeeze in a Florida road trip for a loooong time.

I’d love to hit up Miami, the Everglades, then drive down to Key West on the Overseas Highway.

5 nights in Miami would run ya $900

I found rooms at the Hilton Miami Downtown for 30,000 Hilton points a night. Thanks to the 5th night free perk, you get 5 nights for 120,000 Hilton points – which gets you a stay worth $900.

With some luck, you’ll get an upgrade to the Executive Floor, or at least get access to the Executive Lounge. If you get the Amex Hilton Surpass, you’ll get free breakfast because of your Gold status – and earn enough points for 5 nights here. Not a bad deal!

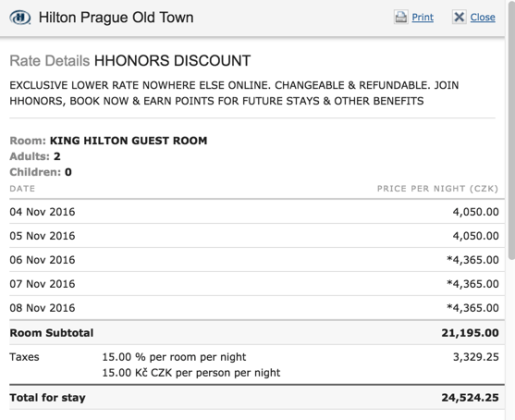

6. Hilton Prague Old Town

Prague’s been on my list for a long time, too.

5 nights cost ~$1,029 or 120,000 Hilton points

I would definitely be down to spend 5 nights in Prague.

Points rates here fluctuate between 30K and 40K depending on the season, but 5 nights in November cost 120,000 Hilton points, again, thanks to the 5th night free.

It’s an incredible deal too, because you’d pay over $1,000 out-of-pocket. This could also be a good way to use Hilton points in the high season, depending on room rates. You can do well in Prague with SPG points too, but keep this one in your back pocket.

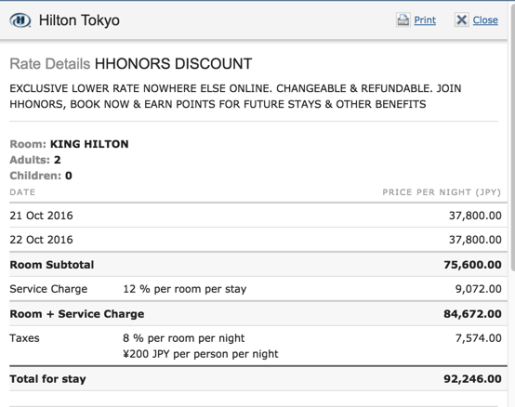

7. Hilton Tokyo

Last, but nowhere near least, the Hilton Tokyo, where I recently stayed during my time in Japan.

YES YES YES

I freaking loved this hotel. I can’t wait to post my review of it!

Two nights here cost 100,000 Hilton points – or $845.

That translates to about $850

I adore the Shinkjuku neighborhood, and the overall location of this hotel. It was an easy walk from Shinjuku station – and easy to get to everywhere in Tokyo.

It also has a stellar Executive Lounge. And the service and staff were just incredible. I would stay here again in a heartbeat.

It’s a great value with Hilton points. In this case, the 100,000 Hilton points sign-up bonus on the Amex Hilton Surpass would get you 2 nights worth well over $800. Not too shabby.

Visit Japan! I was blown away by my time there and can’t wait to go back.

Honorable mention. Hilton Puerto Vallarta Resort (all-inclusive)

50K Hilton points or $305 a night

I wanted to toss this in because it’s on my radar lately. I think I want to stay here.

Rates fluctuate a lot, but you can get 2 nights here worth ~$610 for 100,000 Hilton points. It’s obvi not the best value on this list – but it is all-inclusive. So when you add in your meals and drinks, the points are maybe worth more. Although, you’d get that included in the cash rate, too.

I include it also because it’s almost always available on points and is sometimes really expensive. If you’re at the mercy of award flight availability, or just want to burn some Hilton points, this certainly wouldn’t be the worst way to use ’em.

Bottom line

So those are my picks! Though $700 was my benchmark, many on the list are well over that.

I dare say, in some cases, the value approaches Hyatt and SPG levels (don’t flame me for saying so!).

Hilton hotels are often in places where Hyatt doesn’t have a presence… Barcelona, for example. And I’ve found the HHonors program to be pretty straightforward once you get used to the quirks.

If you want a nice stash of Hilton points, you have until May 4th, 2016 to get two highest-ever sign-up bonuses on the Amex Hilton and Amex Hilton Surpass cards.

You can find them both here:

View Additional Hotel Credit Card offers here!

So, what do you think of my picks and analysis? Anything you’d add?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!

April 28, 2016

Goodbye to All That: In a Month, Dallas Here I Come!

Also see:

Come in Houston, er, Dallas: Buying a House and a Move Toward FIRE

In Closing: My Experience Buying a House

Why I Bought a Car With Credit Cards

It begins: my last month as an official New York City resident.

Movers are booked.

The date is set to wake up and start driving away, all my things loaded in my new Subaru Forester – including the pup!

This little guy has spent his whole life in Brooklyn!

My dog will be 6 this year, and he’s never known much outside of New York. He’s gonna shed SO MUCH in Texas.

My house is sitting there, waiting to be lived in. I even went ahead and joined a gym in Dallas (and got a sweet discount thanks to FoundersCard).

The house

It’s a condo, really. I just call it “the house” colloquially.

Looking forward to decorating, and doing little things, like caulking the shower and hanging blinds. Adding my touches. Being in it. Since I closed in December, it’s kind of been… empty.

Here are some pics:

Living room

Kitchen

Bed

I’ll have a dishwasher. And a king-size bed (for the first time in my life).

Oh and one of these contraptions:

Novel for a New Yorker

I also can’t wait to trick out my balcony with lights and outdoor furniture and a little doghouse.

Balcony

Where future Out and Out posts will be written :)

All-in-all, I’m super excited and looking forward to switching things up.

This next month will be a crazy time, but I’ll do my best to write here throughout.

Not a magic bullet

I’ve moved around a lot in my life. Enough to know it’s not a cure for problems.

Because you’re still you, no matter where you are. And I’m aware nothing’s accomplished by “running away.”

In short, I’m approaching this move with realistic expectations. Not looking for a magic bullet to change my life or my situation.

It’s time, though, for a change. I’ve been in New York for a sum total of ~11 years. It’s given me a lot. It’s taken a lot.

But before I start pontificating on the trials and joys of leaving New York, I’ll leave it to other (better) writers who’ve already covered the topic in deep detail.

I’m hoping to slow down a bit, get started with real estate investing, and simply experience a change of scenery. I also love the Dallas/Fort Worth airport (and the fact that I can fly non-stop to Tokyo from there!).

Plus, everything’s temporary if you give it enough time.

Bottom line

The move to Dallas will be good for me, and by extension, for Out and Out. I’m looking forward to the new travel opportunities that’ll be there – an American Airlines hub, lots of non-stop flights to new destinations, and super close to where I’ll be living in the Oak Lawn neighborhood of Dallas.

I’ll also be in Southwest and Virgin America hubs, which will be interesting as the merger with Alaska Airlines nears – especially given that I’m newly interested in earning elite status with Alaska.

Changes are afoot, and things are wrapping up quickly here in NYC. A month, my god. It’s going to fly.

Thanks to you all for sticking around. Looking forward to the next chapter!

Stay Scrappy

Stay scrappy out there!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!

MileagePlus X App: Earn Bonus United Miles at Amazon, eBay, & More

So I just got the Mileage Plus X app and am kicking myself, because it’s been available for points-earning potential since 2014.

But better late than never. And I’m discovering all these cool uses for it.

Mileage Plus X – oldie but goodie

If you have the Citi AT&T Access More card, you can use it as a payment method on the app to earn a total of 5X miles on Amazon and eBay.

And, a step beyond, you can use it as a defacto shopping portal to get a better payout either in-person OR online.

I got some ‘splainin’ to do!

What’s MileagePlus X?

Link: MileagePlus X for iOS

Link: MileagePlus X for Android

The MileagePlus X app lets you instantly earn United miles for gift card purchases made through the app.

When you select a merchant, United buys you a gift card and gives you the number to use right away.

And yup, the United miles post within seconds. (This would be a great way to quickly reset the expiration on your United miles!)

Let United buy you an Amazon or eBay gift card

There are lots of “in-store” merchants available, too. And a few that are online-only, like Amazon and eBay.

Both Amazon and eBay currently earn 2X United miles per $1 spent via the app.

Add the Citi AT&T Access More card to the mix

Link: Citi AT&T Access More card

But, even better, the purchases made through the app code as online purchases, which means you can also earn 3X Citi ThankYou points with the Citi AT&T Access More card (which is also excellent for shopping at Costco, paying rent, and paying your mortgage).

I’m loving the Citi AT&T Access More card lately. I use it almost daily to purchase things online, and pay my rents and mortgage. Between all of these, I’m racking up Citi ThankYou points left and right!

How’s it work?

Amazon experiment

With the MileagePlus X app, all ya gotta do is pull up Amazon or eBay and set your Citi AT&T Access More card (or any other card) as the payment method.

I bought a $10 Amazon gift card via Mileage Plus X

It instantly generated a gift card code:

Mah code

Alls I did was open up the Amazon app and paste the code in. It was applied instantly to my account:

Hooray!

You can use it right away for shopping.

The eBay gift cards, I assume, work the exact same way.

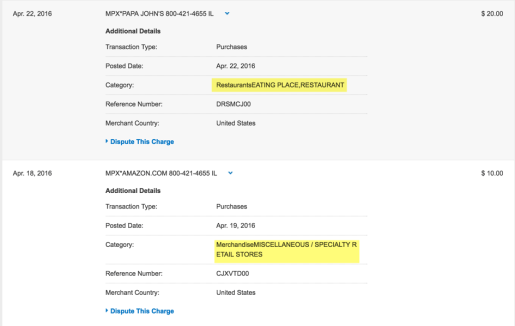

Papa John’s experiment

In addition to Amazon, I also tried one of the “in-store” merchants. You can earn 5X United Miles at Papa John’s.

Some of the “in-store” merchants

I say “in-store” because in reality, you don’t have to be at the store location. I was able to buy a Papa John’s gift card via the MileagePlus X app and order a pizza for online delivery. I simply used the gift card as the payment method.

This is good to know because some of the “in-store” merchants actually have higher payouts on the MileagePlus X app than many online shopping portals!

Take Gap for instance. You’ll earn 5X United miles via the app.

Lower payouts

But only 1 or 2 miles via an online shopping portal – including the United shopping portal!

You can also earn 5X United miles at places like:

Panera

Foot Locker

Petco

And 4X United miles at:

GameStop

Quiznos

Barnes & Noble

You even get 3X United miles at Kohl’s – more than the shopping portals pay out.

It’s a limited list, but if you shop at big retailers often, you can often do better buying gift cards through the MileagePlus X app than clicking through a shopping portal.

How’s it stack and code?

I saw online that purchases made via the Mileage Plus X app code at airfare or travel from United.

Not so in my case.

Amazon as a speciality store, Papa John’s as a restaurant

In my limited trials, the gift cards have coded appropriately to match the merchant.

However, Amazon and eBay both earn 3X with the Citi AT&T Access More card anyway.

But my using the Mileage Plus X app, you have the added benefit of double United miles on top of that.

Papa John’s coded as a restaurant. So you could use your Chase Sapphire Preferred for 2X Chase Ultimate Rewards points. But shop through the app to scoop up 5X United miles too.

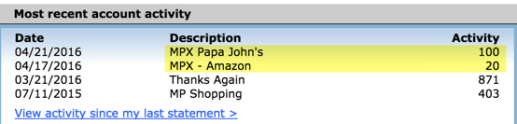

The United miles posted within seconds

In both instances, I had the United miles in my account instantly.

So if you spend $100 at Amazon or eBay and pay with Citi AT&T Access More, you’ll earn:

200 United miles

300 Citi ThankYou points

That’s 5X altogether.

For $100 at Papa John’s on your Chase Sapphire Preferred, you’ll earn:

500 United miles

200 Chase Ultimate Rewards points

A spare tire in the belly area

And 7X altogether.

You can combine and stack appropriate to your card’s earning potential at each merchant (i.e. you could use Citi ThankYou Premier at restaurants – you’d earn 2X Citi ThankYou points in that case).

Other things to note

Because the Mileage Plus X app gift card purchases are coding correctly, I don’t think you could buy Amazon gift cards and expect to be reimbursed with the AMEX Platinum Card. That is, these purchases are not showing up as travel, or necessarily from United. Some peeps say that still works. I’d say YMMV.

Worst case, you might just earn some miles for an Amazon gift card and still have to pay the bill at the end of the month. So only buy gift cards you genuinely want to use/redeem.

Also, I’ve heard some peeps have complained about multiple charges coming through. This issue seems to’ve been corrected. My purchases have posted just fine – no issues here. But it’s something to be aware of.

Bottom line

If you shop frequently at Amazon or eBay, there’s no reason not to download the MileagePlus X app, even if you don’t have the Citi AT&T Access More card (that’s just icing on the cake).

The real draw is racking up lots of United miles with little added time and no added cost – in addition to what you’d normally earn.

In many cases, the Mileage Plus X app pays out higher than shopping portals.

From here on out, it’ll be the first place I check to see where I can earn some extra United miles.

The app has been around for a while, so let me know if you’ve had an experience with it. And feel free to ask a question if there’s something I missed!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!

April 27, 2016

Lyft: Cheaper & Better Than Uber, Now With Cashless Tipping

It took me a long time to get into the whole “Uber” thing. I was always like… why not just take a taxi?

The price wasn’t that much cheaper until recently.

The few times I uber-ed, the main thing I liked was the cashless tipping. The price, all things considered, was equal to a cab (I say/write this in NYC).

Then, they slashed fares.

Underdog extraordinaire

And, I started going to Dallas a whole lot more, without a car. I grew accustomed to firing up Uber as I walked outside and getting a ride to my condo. Again, with the cashless tipping.

I love the simplicity of the bundled fare. You just get out when you arrive, and you’re on your way. The receipt comes via email seconds after the door closes.

…But now there’s no cashless tipping

You can see where I’m going with this.

Basically, Uber is now “unbundling” their service and encouraging riders to tip their driver as they see fit.

After an Uber ride, you can rate your driver. Conversely, your driver can rate you, too.

Last time I rode with Uber, my driver straight up asked me for a tip.

I always ask, “That’s it?” when a ride is complete. I basically want confirmation I’ve closed all the doors, the ride was ended on the driver’s side, and the transaction has gone through smoothly.

“That’s it… unless you’re feeling generou$$$.”

I reached into my pocket and put a bill into his palm. It was an airport ride after all, and I always tip for airport rides. But I’d never been asked for a tip from an Uber driver. “Thanks,” he said. “Five stars.”

The implication being they’re rating you, too. And you have to buy your rating now.

Lyft is better for the drivers

I’m a chatty fella if the driver wants to be. I usually don’t initiate conversations. I don’t want to distract from the task at hand (especially if traffic is bad). But if the driver wants to chat, I’m all for it.

During my last 20 or so Uber rides, without fail, I’ve asked if the driver also uses Lyft.

100% of drivers I’ve asked use and prefer Lyft to Uber.

Why?

In a nutshell, I’ve gathered, Lyft lets the driver keep a higher percentage of the fare. And I guess the payout process is a little simpler for them.

I’ve always used Uber as a matter of popularity. But not any more. Ask your drive next time. I guarantee you they’re using both apps simultaneously.

Not seeing a Lyft drought in Brooklyn

I live in way-out Brooklyn and haven’t had any trouble hailing a Lyft ride these past few weeks.

Why I’m switching to Lyft

All else being equal, I’m starting to see Lyft as an easier, more convenient alternative to Uber. Especially in New York City.

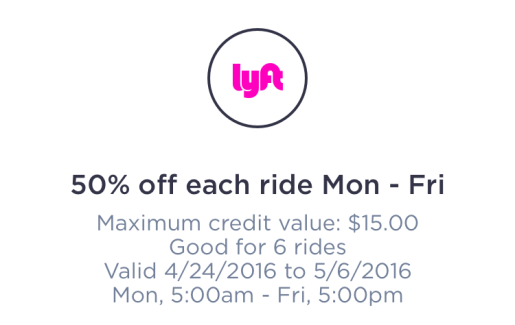

50% off 6 times a week!

The biggest reason is because rides during the week are 50% off! This has been an ongoing promotion for a while, and it is a lifesaver.

You can ride 6 times per week and get 50% off, up to $15 each time.

$16 to go from South Brooklyn to Downtown Manhattan

Last week, I rode all the way to Manhattan for ~$16 with the 50% off promotion.

I gave the driver a little cash anyway, and left a little more tip via the app.

In the future, I’ll select Lyft over Uber because:

Drivers keep more of the fares

It’s truly cashless. Not tip-less. But at least you can leave it through the app

Peeps in NYC get 50% off rides during the week

Even when I’m not in NYC any more, I’ll continue to use Lyft for airport rides and when I go out drinking over Uber.

Uber neutered their program by retrogressing to a cash tip policy. I’m not adamantly against tipping, but I want to keep my transactions as smooth and easy as possible.

Getting out of the car and being done is a huge incentive, combined with the points mentioned above, to make the switch to Lyft.

And because I’m me, it must be mentioned: I want my miles and points by charging my rides to a credit card!

Join me?

Link: Sign up for Lyft

I’m going to experiment with deleting my Uber app and see how it goes with Lyft for a while.

Get $50 toward Lyft rides if you’re new to the app

My feeling is it’ll be the exact same except truly cashless. Which is what I want.

At this point, I can’t see any down sides to this stance. If the driver benefits, and I benefit as a rider (and consumer by saving money), is there a down side at all?

If you sign up with my Lyft link, you’ll get $50 in Lyft credits (and I’ll get $20 in credit for referring you).

Bottom line

Holding companies to their word – and mission – is hugely important. So is voting with your feet and dollars.

For the Uber vs. Lyft debate, it seems Lyft is a win-win for everyone involved.

I must say again, the 50% off deal for New Yorkers is a pretty incredible deal.

At the root of this dilemma, it’s the principle of the matter. It’s not about the tipping. It’s about Uber going back to the system they spent so long trying to tear down.

Well, I like what they created in the meantime. And Lyft seems to be the company that’s upholding their company mission better than they are now.

I’m also fascinated with the digital/remote company culture both companies have created, and how it’s now reverberating and pinging back to them now. Do you prefer one service over the other? Would love to hear your views!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!

Tokyo: Cherry Blossoms, Microbars, Amazing Food, Views, & Wanderings

Also see:

Just Booked: Tokyo and Osaka, Japan in April for Cherry Blossoms

Back in January when I burned some American Airlines miles for a round-trip First Class award ticket to Japan, I had no idea of what to expect from the place.

The trip was my first time there (and in Asia!). I was nervous about getting around, the language barrier, navigating the huge metro system, and figuring out the basics, like ordering food and buying train tickets.

From landing at Narita, to getting to the Hilton Tokyo, to taking the bullet train to Osaka, and everything in between, it could not have been easier.

In fact, over the week I spent in Japan, I quickly fell in absolute love. The cities, the Japanese, and the country’s infrastructure… simply incredible.

Exploring Tokyo

Link: Uncharted Tokyo

The first day, I was jet-lagged AF and woke up around 5am, wired.

I got up around 6am, got ready and enjoyed the free hotel breakfast. Then we headed out into the city of Tokyo!

Before I begin, I wanna give a shout-out to a guide called Uncharted Tokyo.

It’s a Creative Commons file I randomly stumbled across and includes neighborhood guides, how to buy train tickets, tips on how to get around, etc. There’s a wealth of info packed into the 74 pages – I highly recommend downloading a copy for future reference (perhaps in your Evernote archives).

Here are my highlights.

Cherry blossoms

Link: Shinjuku Gyoen National Garden

The first focus was on the cherry blossoms in the city parks. We arrived on April 8th, and got out and about on April 9th – the absolute tail end of peak viewing.

Cherry Blossoms in Tokyo’s Gyoen National Garden

In fact, the blossoms were falling down so hard, it looked like pink and white rain! The ground was blanketed with them. I am so grateful we got to enjoy the peaceful beauty of these delicate blooms.

Gorgeous

It was honestly like a fairytale to see this, and a dream come true. They only appear for 2 weeks or so each year, and timing it is a crapshoot. I’m glad it worked out.

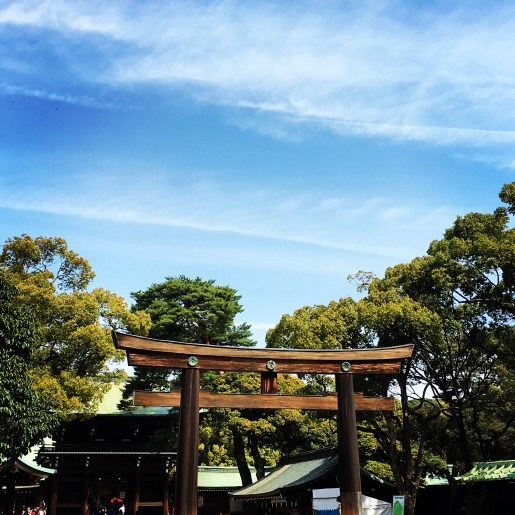

Yoyogi Park / Meiji Shrine

Link: Yoyogi Park reviews

Yoyogi Park borders Harajuku and Shibuya, so depending on what you want to do before or after, that might guide your route.

We started at the top and worked our way down.

Entrance to Yoyogi Park

Somewhere in there, we visited Meiji Shrine, which was incredible.

Meiji Shrine

It’s a vast park, and has lots of pathways and things to visit. I loved the fresh air and seeing all the different shades of green. It’s also a lovely way to get between neighborhoods on nature trails instead of concrete.

Harajuku

Yup, it was as crazy/awesome as I thought it would be.

Actually, the craziest thing was Takeshita Street – the epicenter of the Harajuku style.

Takeshita Street

There were lots of fun shops, and lots of young people. This would be an excellent neighborhood to scout souvenirs.

Outside of this busy strip, there were pockets of calm. And the niche shops begin to appear.

We found lots of cute boutiques and restaurants on the side streets.

Avocado Only – well OK!

Including a place called “Avocado Only.” The food was delicious and the avocado smoothies were out-of-this-world fantastic. I might’ve licked the cup lol.

April 20, 2016

Pay ~$12 for $50 Worth of Mother’s Day Gifts at 1800Flowers.com With Amex Offers

Also see:

The Economics of Quintuple Dipping at Kohl’s

A Few Apps + Sites I Like to Save Money

Get Honey, Save Money! (Browser Extension for Chrome)

I don’t usually post “deals” but I’m feeling mushy and this is a really good one.

If you want to send your Mom (or anyone else) a gift through 1800Flowers.com, there are currently some promotions you can stack for big discounts. Here’s how it works.

Stack it up

Link: TopCashback

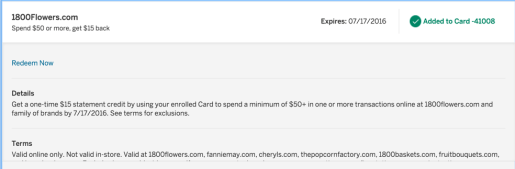

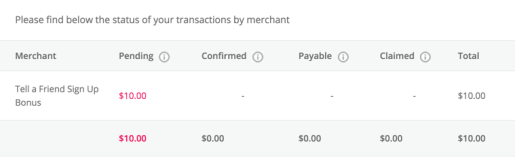

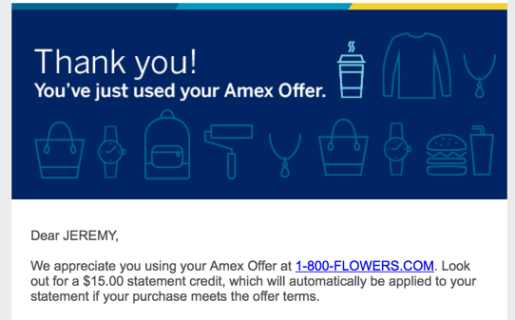

To get the best return, you need to have the Amex Offer for $15 off a $50+ purchase on an Amex card (preferably a business card for OPEN savings). It expires July 17th, 2016.

Amex Offer for $15 off $50+

Then, sign up for TopCashback. When you use my link, you’ll get $10 back for your first purchase in addition to the current 20% cashback offer at 1800Flowers.com (and I’ll get $15 for referring your sign-up).

You’ll get $10 for joining TopCashback

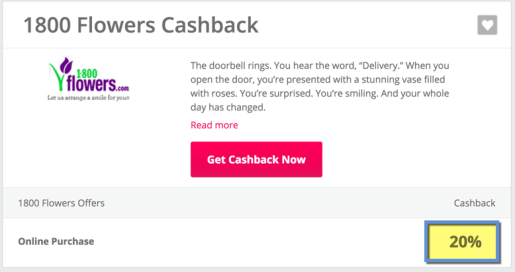

Once you sign up, type in 1800Flowers.com and you’ll see the current 20% cashback offer:

Get 20% cashback, $10 back for your sign-up at TopCashback, and use a 25% promo code

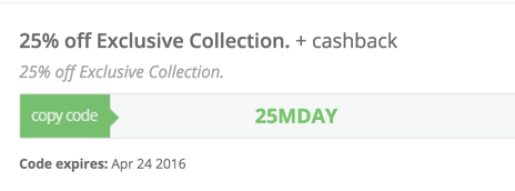

You’ll see lots of promotion codes, including one for 25% off (it expires April 24th, 2016, but there are always lots of codes available). Use a code you find on the TopCashback site. Don’t use any you find elsewhere.

I used promo code 25MDAY

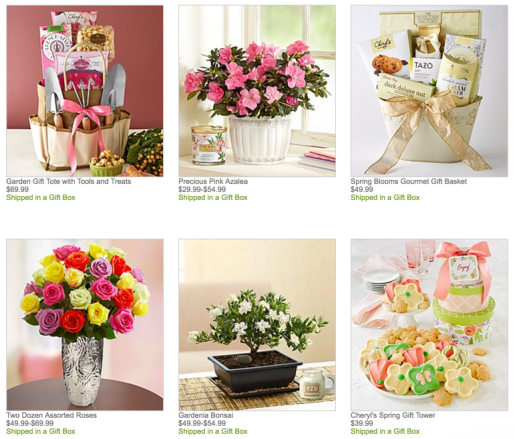

The trick is to find something that’s just over $50 AFTER the promo code is applied. But there are lots of items that’ll get you there:

Lots to choose from

Here’s how it stacks for a $50 purchase:

$15 off from Amex Offers

$10 off for joining TopCashback

$10 off from TopCashback 20% offer

$2.50 back from Amex OPEN savings on business cards

$50 – $15 – $10 – $10 – ~$3 = ~$12

Even if you don’t stack all of these, there’s no reason why you can’t get half off and save $25+ on a $50 purchase.

I bought this item:

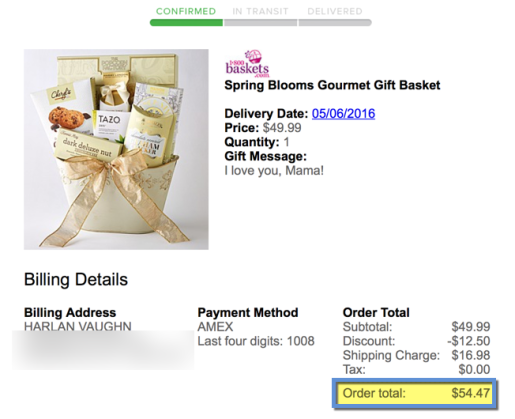

~$54 before all offers

I paid ~$54 to have a gift basket delivered to my Mom the Friday before Mother’s Day (she’ll likely be in church on Sunday and didn’t want to risk a Sunday delivery).

Note that promo codes do NOT work with free Shoprunner shipping. So you have to take it off in your cart. But a 25% promo code should just about cover the shipping charge.

For the ~$54 charge, I’ll get back $15 from Amex, $10 from joining TopCashback, $10 from TopCashback’s 20% deal, and ~$3 from Amex OPEN savings.

Boom! The stack begins

In the end, I’ll get back $38, for a total of $16 on this item.

$16! That’s a great price for a Mother’s Day present. Not to mention, I’ll get 54 SPG points for the purchase from using my new Amex SPG small biz card.

Bottom line

For my purchase, this stack amounts to a 70% discount. And my Mom gets a Mother’s Day gift.

If you order relatively soon, you should be able to snag a delivery date around Mother’s Day (May 8th this year). And save some serious cash.

To recap, you can stack:

$15 off $50+ from Amex Offers at 1800Flowers.com

$10 back from joining TopCashback and making a purchase

20% back from TopCashback

a 25% off promo code (use one you find on TopCashback)

Amex OPEN savings (5% back as a statement credit on Amex business cards)

When you add in the points or miles you’ll also earn, this amounts to a sextuple dip.

This is also a great example of how you can build a stack from Amex Offers. They’re not usually this good, but sometimes worthwhile. Wanted to share this one because it’s timely and awesome.

Also, get your Mom something for Mother’s Day. She deserves it.

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!

April 17, 2016

Review: BauBax Ultimate Travel Jacket

Also see:

Whoa! Check Out This Ultimate Travel Jacket from Baubax

Review: Bluff Works Travel Pants for Men

I wrote back in July 2015 about the “ultimate travel jacket” from BauBax.

I was on the fence about getting one, but Jay got it for my birthday, which was in late August.

And um, I just got it this month. So yes, flash forward 10 months and the jacket has finally arrived.

Just in time for summer when you don’t need a jacket lol.

I threw it in my bag and took it with me to Japan to start exploring its features.

But first things first…

About the BauBax ultimate travel jacket

Link: BauBax ultimate travel jacket

When the box finally arrived, I didn’t know what to expect.

After so much hype, and so many delays, I hoped it would be worth the wait. Ordering something blindly off the internet (and having to choose a size!) is always a bit of a leap of faith.

There you are, you little devil

I ordered a men’s size small, based on their recommendations.

Upon unboxing, the first thing I noticed was how high-quality the fabric felt. It’s very soft, and is lined with soft cotton.

It has lots of pockets and zippers, something I thought would make the jacket look lumpy or bulky, but they did a great job of keeping it smooth.

Extra gloves and a water bottle

As a consolation of sorts, they threw in a pair of pocket gloves and a portable water bottle that folds up and attaches with its built-in clip.

Portable water bottle

I tried the jacket on, and it fit surprisingly well. Then I poked around the features, which include a telescopic pen/stylus, a neck pillow, hand warmers, and lots of pockets (including one lined with koozie material [neoprene] for stowing drinks!).

So many features

I love the neck pillow, which is detachable and lined with velvety soft fabric, and the sunglasses pocket. The hand warmers became a favorite upon wearing.

Many styles

It comes in 4 styles, and several colors, for guys and gals. I choose the blue sweatshirt, cuz that’s how I roll.

Wearing it around

The first few days in Japan were sunny and warm – no jacket needed.

But it got chilly in the evenings, and I threw on the only jacket I’d packed. It fit perfectly. And the pockets and features, instead of being distracting, are so well-integrated that it was fun to discover each one as I went along.

I used the neck pillow on the bullet train from Tokyo to Osaka. So easy to inflate. It was great for filling in the space created when you’re leaning against the wall, trying to grab a quick snooze.

Here are some pics of me trouncing around Osaka in my BauBax jacket.

Hands in the hand-warming pockets

BauBax travel jacket out in the wilderness of Osaka

It looks much like a regular hoodie. You’d never know there was so much designed into it.

From behind

From behind, you can’t tell there’s a whole neck pillow embedded into the hood. But yup, it’s in there.

The hood is also fully lined, and has a fold-out eye mask.

Side view

Detail of the hand warmers

Blowing up in Osaka

Then I blew up the neck pillow, which was hiding in the hood the whole time.

Perfect for a quick PTFO sesh

It deflates in about 2 seconds. All you have to do is press on the valve and all the air squeezes out.

The eye mask is great for blocking light

If you want to go full PTFO mode, you can inflate the neck pillow and pull out the eye mask, which also folds into the hood.

Retracted

Just push it back in when you’re done.

Out and Out in Osaka

I even wore it out in the evenings. Peeps gave me compliments! I loved Tokyo and Osaka, but I’ll save that for a separate post.

Down sides?

Currently, the sweatshirt version I got for $109 costs $149 via Indiegogo. That’s a tidy sum for what’s essentially a hoodie!

I will say that it’s extremely high-quality. The design is solid. And the features, if you’ll use them, can be handy.

You can stow a ton of stuff into the pockets, including your phone, tablet, iPod, passport, etc. It’s good to have those things in front of you on the inside pockets if you need them when traveling in notorious pickpocket havens. They typically won’t come after you from the front. So that’s an added safety measure.

The neck pillow is made of plastic, and you can definitely feel it against you. But, it’s detachable. So I’d recommend only having it in when you think you’ll need it (plane or train rides). And leave it out when you’re wearing it around town.

The only other thing is the pen/stylus, which dangles down from the zipper. It’s kind of long and swings as you walk. But it didn’t bother me. Again, you can always simply remove it.

I found the usefulness of the built-in features far outweighed any cons. And again, the jacket is really soft and very comfy for wearing out.

Other things to note

I was afraid it would pill, shrink, or get wonky somehow after washing and drying. I washed it at home in Dallas, and am happy to report it held up fantastically (and smells a lot better after a week abroad!).

The hand warmers grew on me big time. They add a lot to the feeling of snugness, but they’re not reinforced. So if you tear them, you’ll have to sew them up again.

Also, you do more than you realize with your hands, so this is a high-friction part of the jacket. I can see these wearing out much faster than the rest of the jacket.

It’s not a huge issue, and certainly not a deal-breaker, but it’s worth noting in case you like them as much as I do.

This guy’s video is extremely thorough; it goes over all the features. We have overlapping opinions about many of the features, even though he got the bomber-style jacket.

Bottom line

I love my BauBax travel jacket!

It’s still early yet, but this might be one of my favorite jackets I’ve ever had. I’ll definitely take it on more trips when the weather is crisp again.

It’s light, comfy, packed with features, and well-designed. The $149 price tag is a bit steep, but the quality warrants it.

It’s a huge step up from a basic wardrobe item. And it really is something that can enhance your travels and make you more comfortable in several ways: warmth from the hand warmers and jacket lining, rest from the neck pillow and eye mask, protection from the front inside zippered pockets, and convenience for having all of this so handy.

I wanted to be more critical after the 10-month wait, but I gotta say, I really love it.

This would make an excellent gift. Or be a nice splurge for yourself if you’re into the design and features.

What do you think of the BauBax “ultimate travel jacket?” Let me know if I missed any key points, or if there’s something you wanna know about it!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!

My Experience Getting the $650 Phone Credit With Citi AT&T Access More Card

Also see:

Confirmed: RadPad Earns 3X ThankYou Points With Citi AT&T Access More Card

The best card for shopping at Costco is… Citi AT&T Access More?

Bye to RadPad, Hello to Plastiq for 2% Bill Payment Fees With MasterCard (Including Mortgages and Utilities)

Here’s my experience to add to the mix.

Getting the Card and Buying an iPhone

Link: Citi AT&T Access More card

Link: AT&T cell phone shop

I applied for the Citi AT&T Access More card in late January, and received the card on February 2nd, 2016. That same day, I bought an iPhone.

Here’s the link Citi gives you to shop for a new phone – it won’t work unless you click through from your Citi account because it tracks your purchase, much like a shopping portal. With that in mind, it’s a good idea to turn off your ad blockers so the purchase is tracked correctly.

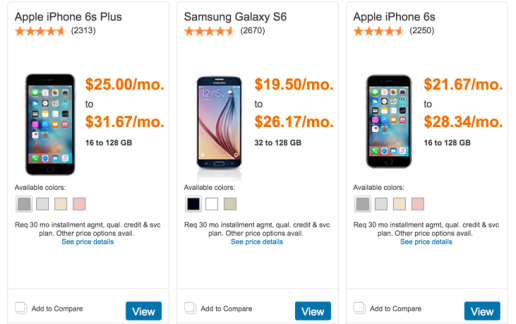

Pick a phone, any phone

The selection of phones is the exact same as if you navigate to AT&T’s cell phone shop.

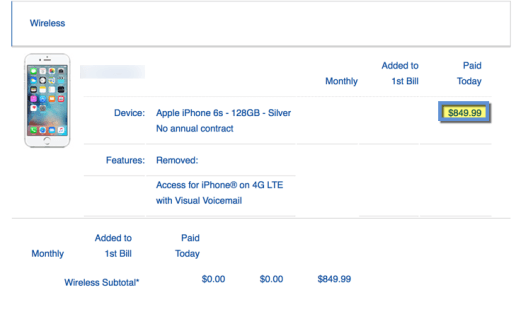

I sprang for an iPhone 6S with 128 GB of memory. The taxes for New York were ~$75. After the phone credit, that’s like paying ~$275 for a brand new phone with a lot of memory to burn through.

Net $200 + taxes for a new 128 GB iPhone

I had an iPhone 5 with 16 GB and was tired of deleting apps/pictures/the entire phone every time it needed an update.

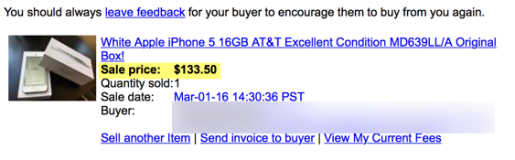

I sold it on eBay for ~$134.

Boo ya

There’s a FedEx ship center 2 blocks away. So I popped in and sent it. It took maybe 10 minutes to list and 10 minutes to ship.

Plus, the sale brought my out-of-pocket cost for the new iPhone down to ~$141 after taxes, which is a screaming good deal.

Do you HAVE TO HAVE AT&T service?

I called Citi in late March to check when my phone credit would post.

The rep sounded like she’d dealt with this a time or two and asked if I’d used the link in my Citi account. Yup, and I disabled ad blockers.

She verified I ordered directly from AT&T, used my AT&T Access More card for the purchase, etc.

“I even already had AT&T service,” I mentioned, “so the 15-day service requirement wasn’t an issue.”

“Oh, we don’t have any way of tracking that anyway.”

It was an off-handed remark. But I don’t think Citi has any way of knowing whether you actually ever got AT&T wireless service. The T&Cs state:

You must activate the phone with qualifying AT&T postpaid wireless service (including voice and data as applicable) and keep the phone, and remain active and in good-standing, for at least 15 days.

As far as Citi and AT&T are concerned, they want you to keep the phone for at least 14 days because after that time, you can’t return the phone for credit.

If that’s true, you could have AT&T unlock the phone you purchase to use on any network. Or, you could turn around and resell it and pocket the extra.

I couldn’t test this because I already had AT&T service. But you could always wait and see if the credit posts without any AT&T service… the T&Cs don’t say you have to activate service immediately when you receive the phone.

Based on my convo with Citi, it seems you’ll get the statement credit so long as you use their link to make your purchase – and that’s the extent of their tracking to earn the $650 credit.

2 months later…

The $650 credit posted on April 11th, 2016 – a little over 2 months (or 2 billing cycles) after I bought the phone, which seems to be the norm.

Boom

The credit posted automatically without any followup on my end.

The card is worth getting even if you don’t want or need a new phone

The Citi AT&T Access More card is worth adding to your repertoire because of the 3X bonus category for online purchases.

It’s the best card for shopping at Costco when other cards aren’t offering 5X bonus categories for it (like the Chase Freedom is doing this quarter).

And, you can earn 3X points on rent payments via RadPad through June 1st, 2016.

Fret not about the nearby end date, because you can replicate the earnings with Plastiq. Even better, you can earn 3X Citi ThankYou points for mortgage payments with this card via Plastiq. So whether you rent OR own, you can do well with this card.

You also get 10,000 bonus Citi ThankYou points when you spend $10,000+ on the card within a year – that easily offsets the $95 annual fee. And you should have no trouble hitting that if you’re making rent or mortgage payments.

Pair with Citi Prestige to get rebates on American Airlines

My favorite way to use Citi ThankYou points is to pair this card with Citi Prestige to buy American Airlines flights. It’s like getting ~3% back, even after Plastiq’s 2% fee for MasterCard payments because Citi ThankYou points are worth 1.6 cents each with Citi Prestige (1.6 X 3 = 4.8 – 2 = 2.8%).

You can find the Citi Prestige card here if you want to pick it up:

Hotel Credit Cards

It’s perhaps my favorite card in the cannon right now because of how much money it’s saved me.

More places to look

Here are other great guides about this card and the $650 phone credit:

Which Merchants Earn 3X ThankYou Points with the AT&T Access More Card: Complete Guide & Resource (Miles to Memories)

All you need to know about Citi AT&T $650 Phone Offer (Doctor of Credit)

Citi AT&T Access More credit card (up to $650 credit with phone purchase) (FlyerTalk)

Bottom line

Getting the $650 phone credit with the Citi AT&T Access More card couldn’t have been easier – it just took a couple of months for all the dots to connect.

In the end, I’m pleased because I got the newest 6S iPhone with 128 GB for ~$141 after the credit and the sale of my old iPhone 5.

I use this card for rent and mortgage payments because they earn 3X Citi ThankYou points under the online purchases category (so do Costco cash cards online). So it’s an incredibly easy way to rack up a ton of Citi ThankYou points.

In retrospect, the new phone was actually gravy. I’d say the card is worth getting even if you don’t bother with the phone credit.

Plus, I don’t think Citi knows if you activate AT&T service one way or the other.

Suffice it to say, there are a lot of possibilities with this card for its $650 phone credit, 3X bonus categories, and Citi ThankYou points earning potential.

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!