Harlan Vaughn's Blog, page 53

March 25, 2016

My Last Chase Card: Just Applied for Chase Freedom Unlimited

Also see:

I’m dumping the Chase British Airways Visa – and you should, too

Loving Citi More Than Ever – Time to Cancel Other Cards?

Chase will soon (in April 2016) extend their dumbass 5/24 rule to all their card offerings, including co-branded and small business credit cards. And presumably to the new Chase Freedom Unlimited card when it launches online.

The 5/24 rule means if you’ve opened 5+ cards within the previous 24 months, you’ll be instantly denied for a new Chase card. I’m suddenly no longer their target market.

It’s the last week of March, which means this is my last crack at opening up that Chase Marriott Premier card or a Chase Ink Cash, for example.

Instead, I went with the Chase Freedom Unlimited, which will be available for online applications on April 7th, 2016.

However, you can apply in-branch or over the phone right now.

So today, I strolled over to the Chase bank 2 blocks away on my lunch break (I still haven’t grocery shopped since getting back from Vipassana) and applied in-person for the new Chase Freedom Unlimited.

I love how the acronym for this card is, endearingly, FU.

Back at ya, buddy

Ditto, Chase. Ditto.

Why I applied for the Freedom Unlimited (FU)

In short:

1.5 Chase Ultimate Rewards points for all purchases, with no cap!

And, the points transfer 1:1 to Chase Ultimate Rewards transfer partners like United and Hyatt, if you have the Chase Sapphire Preferred, Chase Ink Plus, or Chase Ink Bold.

That’s the best earning rate on non-bonus spend of any card that earns Chase Ultimate Rewards points.

I’d value that earning rate for the long-term above any current (one-time) sign-up bonus because of how flexible Chase Ultimate Rewards points are.

Because I always make sure each of my points are worth at least 2 cents each, so that’s equal to 3% back to me. Which is great for a card with no annual fee.

Even better, it seems that phone and online applications for the Chase FU are immune – for now – from the 5/24 rule. But I fully expect this rule to be enforced by the time it launches online April 7th, 2016.

So if you’re interested, apply in the next couple of weeks!

Not instantly approved

The Chase banker I met with was very up-to-date about the new Chase FU card.

Quick phone snap of the new Chase FU card terms and benefits in-branch

He was, of course, more than happy to process my application.

I’ve heard of many peeps getting approved instantly in-branch, which gave me hope.

But, I was told I’d hear back in 7-10 days regarding a decision. Drat!

Ughhh, you’re welcome for my interest

I did, however, confirm the sign-up bonus of 15,000 Chase Ultimate Rewards points ($150) after spending $500 within the 1st 3 months.

I was really hoping for an instant approval so I wouldn’t have to worry about it. Plus, it’s a Freedom card, which doesn’t require an excellent credit score – and mine is well over 750 at the moment. So theoretically, I should’ve been a shoo-in.

I called the reconsideration line to see if I could usher this toward approval, and the rep was ice cold. Told me the same line about “wait for a decision.” Which is probably better, because at least they didn’t deny me.

Chase really does seem to be tightening up fast.

With that thought, I do believe right now is your best chance to get this card if you’re interested. Call a Chase rep from one of your current cards, or visit a branch to apply. They are definitely aware of this card, and of the new rules.

Bottom line

Really starting to rely on Citi more and more for my spending and credit needs.

Chase is erecting a wall a mile high. AMEX has a once per lifetime rule on all cards now. And even with Citi, I had no luck getting a $350 annual fee on Citi Prestige by applying in-branch.

I’ll let you guys know if I end up getting the Chase Freedom Unlimited card – cross your fingers for me!

Either way, this last dance with Chase is aptly named, for both of us: FU.

FU, too, Chase. I love Ultimate Rewards, but this is just getting gross.

Let me know if you have’ve had any experiences with Chase lately, or the new Chase FU card!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!

Vipassana Part 1: Getting There and About the Course

Also see:

Next Week: Heading to Vipassana to Meditate for Ten Days

Last week, I completed my first 10-day Vipassana course at the Southwest Vipassana Meditation Center in Kaufman, Texas.

Now I’m back in New York and beginning to process the whole experience.

The Wheel of Dhamma

There were so many intangible things. It’s nearly impossible to describe the tactile and transformative qualities. After speaking with a few others about the impacts, I’m realizing how radically different everyone reacts to a course like this.

So I’ll outline my experience. Yours might be similar in some ways, but totally opposite in other ways.

I’ll start with some background and info about Vipassana and the Center I attended. Then, in a second post, talk about the coursework.

And also like, wow.

What’s Vipassana?

Link: About Vipassana Meditation

Vipassana means “seeing things as they really are.” It’s a meditation technique that’s part of Dhamma, the overall path.

The technique involves getting in touch with your bodily sensations as a means of mental purification. With Vipassana, self-observation leads to purification.

In application, that means to simply observe your body in complete silence. Through observation, you become neutral. And that neutrality (equanimity) leads to the realization that everything is impermanent, including any and all sensations you will ever feel.

The beautiful, impermanent grounds of the Dhamma Siri Center

Reaching this state is the aim of a 10-day Vipassana course.

It’s the 1st stop on the overall path (Dhamma), to a transcendental state where you absolve yourself to the infinitesimal nothingness that everything, including the Universe, is made of.

So it’s pretty heady stuff. And the first steps are humble beginnings.

The technique isn’t affiliated with any religion, although it has origins in Buddhism.

There are ~170 Vipassana centers world-wide.

It costs nothing to sign-up. And in fact, you are not allowed to donate until you complete your first 10-day course. From that point, you are considered an “old student” and you are encouraged to donate within your means so the Centers can continue to offer the courses to others.

How It Happened

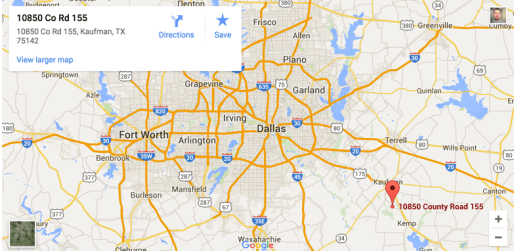

Link: Dhamma Siri Meditation Center in Kaufman, TX

I applied for a course at a Center near my new place in Dallas. Shortly after, I got the news they’d accepted my application for a 10-day course in March 2016.

So I flew to Dallas, and then coordinated with the Center’s shuttle bus. They picked me up at my doorstep and drove the ~40 miles to Kaufman, TX with other meditators. Which is awesome.

All of the Centers are accessible from major cities. The Center in Texas is ~40 miles southwest of Dallas

I’d read reviews on Yelp and did some internet searches, but I was mostly unaware of what exactly would happen there.

I had no idea what I was in for.

Arrival and “check-in”

When we got to the Center, we took off our shoes and registered. They asked us a few times if we were prepared to stay the entire 10 days.

I arrived on a rainy, gray day to the Dhamma Siri Vipassana Center in Kaufman

I filled out a couple of forms, then waited my turn to get a room assignment.

I was given Room #10 in the Men’s “New Student” dorms.

Entrance to the men’s dorm

Hallways of the Dhamma Siri Center

My room, #10

View upon walking in

The rooms are pretty spartan. You get an XL twin-sized bed, a chair and small table, and a shelf for your things. Each room was private and had a bathroom area.

There was also an alarm clock. That was it.

The room was immaculately clean and spotless.

Pano of the entire room

The bed

Bathroom

Shower

View from my window

The grounds were well laid-out and extremely well-maintained. You can tell a lot of care went into building this place.

Men’s dorm layout

And yes, the whole area is radiating with good vibes.

There were a few critters! I spotted a couple of cats, cows, rabbits, and turtles. There were also apparently skunks and snakes in the area, so they advised us to keep to the walking trails, which were either paved or very well-lit.

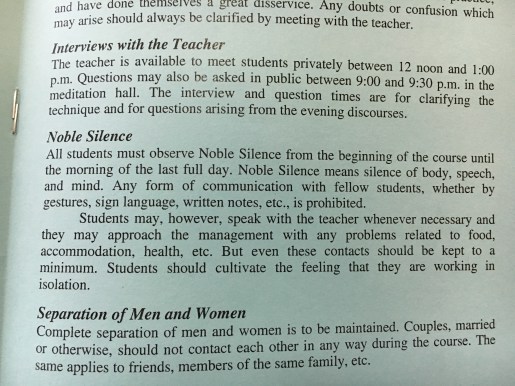

The Vipassana rules

When you apply for a Vipassana course, you must agree to certain rules, or precepts:

No killing

No stealing

No sexual activity

No speaking lies

No intoxicants

Can’t hurt a fly

The “speaking lies” rule was easy to follow because you must also observe Noble Silence: no talking or communicating with anyone else in any way. That includes signs, notes, or gestures.

Noble silence

And moreover, no phones, internet, or computers (!!!). Noble Silence begins on Day 1 and ends at mid-day on the 10th day. You’re also not allowed to have books, talismans, religious items, journals, writing instruments, pictures of home, or anything else that would distract you from meditating.

For some, it could be incredibly hard to give that up. Especially because most of us are either addicted or compulsive about checking our phones and email.

But I was more than happy to give up my phone and the internet. I set up everything as well as I could before I left. I called everyone before the shuttle came to pick me up and said, goodbye for now. And I turned off my computer and internet connection to let the cables sleep.

Also, guys and gals are completely separated. Because they want you to live like a monk. No temptation.

March 7, 2016

Why I Bought a Car With Credit Cards

Also see:

Come in Houston, er, Dallas: Buying a House and a Move Toward FIRE

In Closing: My Experience Buying a House

I’m targeting late April/early May to be out of NYC and in Dallas full-time.

For as long as I can remember, I’ve wanted a silver Subaru Forester. Buying a house and moving to Dallas meant I’d need to buy a car sooner or later.

The budget I had in mind was $6,000 for everything. Tax, title, registration, base price of the vehicle, everything.

I knew car prices tend to rise as it gets warmer, so when I found a great deal on the car I wanted in late February, I went ahead and snagged it.

My new cahhh. I named him Clyde

Oh! And I wanted to pay for it in full. No financing.

Just an in-shape, reliable used car whose only expenses were maintenance, insurance, and gas. Boom.

Buying a car with credit cards

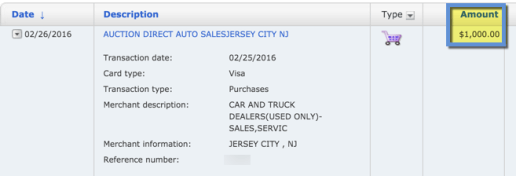

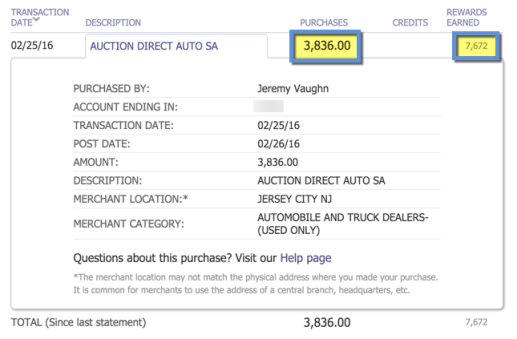

The purchase price was $4,500.

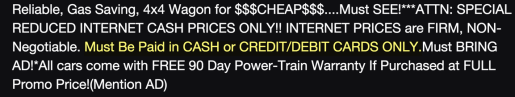

While scanning the ad, I noticed a small but important detail.

O RLY?

So I called to verify and they said yup, but only Visas or MasterCards. So that meant no meeting the minimum spending requirements on a new SPG small biz AMEX.

But here’s what I came up with.

I just got a new Bank of America Alaska Airlines Visa with a $100 statement credit for spending $1,000 within the 1st 90 days.

Perf!

So I’d put $1,000 on it to give myself a $100 discount on a new car.

I’ll take that $100 statement credit now, Bank of America

That left $3,500 to go. I contemplated opening a new card to earn some extra miles. But then I thought of an opportunity to downgrade a card.

Remember how I said to DTMFA with regard to the Barclaycard Arrival Plus card?

Well, my $89 is due in May and I’m going to downgrade the hell out of that useless card!

I had 2,206 Arrival miles. But need 10,000 Arrival miles to offset a $100+ travel purchase.

Again, perfecto

So I needed 7,794 Arrival miles. And charging $3,500 would net me 7,000. That was perfect. And didn’t account for inevitable documentation fees.

I went with that one. In the end, I earned 7,672 Arrival miles for an out-the-door price of $4,836. And now I can get $100 toward a flight, subway pass, train ticket…

In all, this would give me a $200 discount. Plus, I had them knock another $100 off the purchase price when I got to the dealership.

It was already priced well below its full retail value. And thanks to credit cards + negotiation, I got a 6% discount on the total price.

Not a bad deal at all.

Other benefits of purchasing a car this way

The more I thought about it, the more benefits I saw to charging the car instead of using debit, or withdrawing cash.

No, there wouldn’t be a warranty or purchase protection (vehicles are restricted from those coverages), but there would be other fringe benefits, like:

Floating the cost for a few weeks until I could pay the cards off in full

Showing the banks I’m responsible with my cards, and pay them off in time

The bonus Alaska Airlines miles

They also helped in the negotiation. Because they put me in the position to offer full payment up-front. Which led to a lower purchase price.

Extra picture to break up the layout and give your eyes a break from scanning the page. But whoa, isn’t that a good-looking car?

Not to mention the thousands of dollars saved by not financing the vehicle!

Other reasons you might want to use a credit card for a vehicle purchase, or any other large purchase like this:

Meet a spending threshold for elite status, bonus miles, EQMs/MQMs, stay credits, companion ticket, etc. etc.

Meet minimum spending requirements on 1 or more cards

Ease cash flow

Build a positive relationship with the bank

More accurate proof of payment than cash for your records, just in case

And again, the bargaining proposition gets a lot better when you can offer a larger amount up front.

Bottom line

This is obvi very niche, but I feel this story expresses some of my other tenets very well:

Never, ever buy a new car. Always buy used. Pay in full. And take care of it until the wheels fall off.

Negotiate everything. They said their prices were firm. But I’m firm, too. Ask for the best deal.

Credit cards do have an important place in personal finance. This is an example of when they take center stage. It’s not always all about points and miles, although I did earn a nice chunk of both.

Set goals. My god, set goals. Goal-setting is so powerful.

I wanted to spend $6,000 or less for a silver Subaru Forester, including tax, title, base vehicle cost, and registration.

With everything added up, I came to within ~$40 of that amount. The best way to set a goal is to make it as specific as possible. Mine was specific in every detail, including color, make, model, and total price. And it materialized in the exact way I envisioned.

Envisioning is a powerful way to draw your goals to you faster.

And of course, maximize every purchase. :p

So now that it’s all laid out, how’d I do? What would you have done differently?

Would you considering purchasing an automobile with credit cards?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!

March 6, 2016

Review: Bluff Works Travel Pants for Men

Also see:

Out and Out Is in Barcelona! Any Must-Dos? (And Updates!)

Coco Luxe: Coconut oil on-the-go for $12. Worth it?

10 Fun Things to Do in Barcelona

Out and Out was recently in Barcelona. For the trip, 2 very different companies set up collaborations.

The first was Coco Luxe (coconut oil on-the-go, which is one of my travel must-haves).

The other was a company that makes another kind of on-the-go products. And with it came the chance to try new pants!

About Bluff Works

Link: Bluff Works

Bluff Works is an NYC-based company that makes “travel pants for adventure” for men.

They are made of wrinkle-free material. And are good for up to 5 days of wear without a wash.

Bluff Works are made for on-the-go

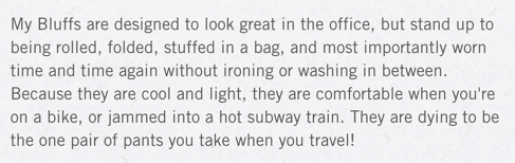

The fabric is breathable, and they dry quickly. Here’s how Bluff Works describes their pants:

“Jammed into a hot subway train” is too real

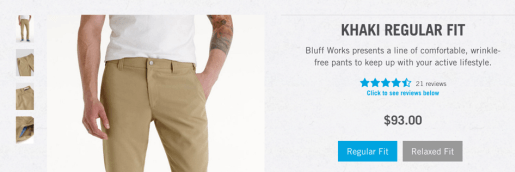

But the main draw is the styles.

They come in khaki, navy, and black. And their modern cuts come in fun colors, too

The pants come in tailored, regular, and relaxed fit.

So when they reached out about giving them a shot, I threw them in my bag and trotted around Barcelona in them. Here’s how they held up.

Getting the Bluff Works overseas

I knew from the start I wasn’t going to go easy on these pants.

After receiving the package from Bluff Works

Straight out of the package, they looked smooth.

Packing the Bluff Works pants

I wadded them up as best (worst) I could and stuffed them into a corner of my Tumi T-Tech Continental.

Here’s how they looked when I got to my Dream Suite at the Alexandra Doubletree in Barcelona:

Totally smooth again!

I was impressed with how well they withstood wrinkling, considering I’d balled them up and shoved them into a corner of my suitcase.

With that, it was time to do a really awkward modeling photo:

With Coco Luxe and Bluff Works, the two collaborations I took to Barcy

Lol, I don’t know what I was thinking. I wanted to commemorate the two collaborations I bought with me to Barcy… or something.

I wanted to bring these pants to Barcelona because they have a pocket within the side pocket – on both sides – that has a zipper. So you can put your credit card, license, or whatever into the pocket inside the side pocket. That’s a great defense against pickpockets.

The back pocket has a zipper on it, too.

It’s not *as* secure as the side pockets, but I don’t recommend putting anything sensitive into your back pockets anyway. I put my hotel key back there because I figured it might distract from my side pockets. And it wouldn’t be much of a loss – the desk agent could easily make another one if it was stolen. So, a bit of a decoy.

Anyway, you can at least see what the pants look like on. I got the steel blue tailored fit chino.

The Bluff Works experience

First of all, the material they use is very rustle-y. It’s not exactly cloth because it has moisture-wicking built-in. And it’s super light and breathable.

But it does make a swishing sounds when it rubs against itself.

Made in NYC

Also, they are very light. They’re better for hot weather, or summer. I can’t imagine wearing these in below-freezing temps, though. Your legs would definitely be cold, as they don’t provide much insulation.

Bluff Works pants out in the wild

All that to say, I really enjoyed wearing these pants around Barcelona. They fit well, kept my important things safe, and never got wrinkled.

Bluff Works says you could wear these hiking, and then go into the office.

They definitely look like a normal pair of khakis. But they hold up a lot better against the elements. They wick away sweat and water. And again, no wrinkles.

There they go, wandering down Las Ramblas

Worth it?

A few things to note.

Bluff Works actually sent me two pairs of pants, which was beyond generous: a pair of tailored fit, and a pair of regular fit.

Oddly enough, the regular fit were wayyyy too tight, even though I ordered the same size in both styles.

Typically, I have an issue with the tailored stuff being too tight.

Bout an inch of difference

The regular fit were about an inch narrower – or a couple of inches tighter in circumference.

Maybe I need to lay off the booze and carbs, but I couldn’t get them zipped or buttoned.

Now, Bluff Works has great customer service, so I have no doubt they’ll gladly replace a pair.

But I didn’t know whether the tailored fit were cut big. Or if the regular fit were cut small.

Meaning, if I’d asked for another pair of the regular fit, and they were the same, that would’ve meant the tailored fit were cut big.

Then, I’d have to send the replacement of the regular fit back, and ask for a bigger size.

That would be 3 transactions in total, with 2 returns to send back and 2 replacements to coordinate.

Since I got these the week before the Barcelona trip, I simply didn’t have time to deal with it. So I recommend ordering an inch or two bigger in the waist to be on the safe side. And just use a belt if they’re too loose.

Bluff Works have a higher-end price tag

Also, they’re not cheap. A pair can run you a little under $100, or a little over $100, depending on what kind you get.

For comparison, you can get a pair from Columbia for ~$40. And there’s another brand called Royal Robbins that sells for ~$80, but they have a very limited selection of sizes on Amazon.

But, I like the overall style of Bluff Works better. And the secret pocket is a nice feature against pickpockets – having your stuff safe could be worth paying more.

Bottom line

I really enjoyed wearing Bluff Works pants. They’ve become a go-to staple in my pants rotation.

They never wrinkle and always look great. I don’t have to wash them or take care of them often. And the secret zippered pocket inside the side pockets is super handy. I also like the colors and styles they have available.

The biggest detractor is the price. But if you want a pair of pants that will hold up for the long-haul, they’re a good investment.

The only thing to watch out for is the sizing. I’d err on the side of caution and get and inch or two bigger than your normal size. Although the Bluff Works team is great about quickly responding to customer inquiries if you needed to swap them out.

Other things to note: not great for cold weather. And expect the material to rustle.

All that said, I’m grateful they gave me the opportunity to review them – thank you, Bluff Works!

If you have any questions about them, let me know!

Guys, do you have any travel pants like this? Would you consider buying a pair?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!

March 5, 2016

10 (More) Cool Things To Do in Barcelona

Also see:

10 Fun Things to Do in Barcelona

Out and Out is excited to present a guest post!

Travels of Adam is written by Adam, who writes about travel with an emphasis on the LGBT community.

Adam got in touch after my post about fun things to do in Barcelona went up. He’s traveled there more extensively, so I thought it would be fun to share his Barcelona tips with you guys.

It’s awesome to have another voice on here! And if you’re a blogger or writer, or have a cool story to share, get in touch because I’d love to share more guest posts!

Without further delay, I’ll let Adam whisk you away to Barcelona.

10 Cool Things To Do in Barcelona by Travels of Adam

Barcelona is one of those cities that’s so easy to return to.

On the Mediterranean coast, a hotspot for great food, beautiful beaches and an unrivaled culture, it’s a city full of life—and, often, love.

As that song by Rufus Wainwright says: nothing really does compare to Barcelona. You have to be there to experience all the beauty of the architecture, not only the magnificent works of Gaudí but the winding alleyways of the Gothic Quarter and the beaches of Barceloneta.

Barcelona is one of the most fun and romantic cities in Europe

To really enjoy Barcelona, check out my guide to the coolest things to see and do. Whether it’s funky ice cream on the beach or a night out at Barcelona’s trendiest bars, there’s something for everyone in Europe’s most beautiful city.

1. Make your own ice cream sundae

At Eyescream and Friends, ordering one of their shaved gelatos is fun and silly. You start by picking a tray, selecting your favorite flavor (like mango or cheesecake), and finish off with your choice of two toppings.

Shaved gelato at Eyescream and Friends

The ice creams all have cute names like Sad Tom, Wild Willy and Miss Fancy, and the finished product looks like a goofy face!

2. Taste the sweets of Happy Pills

No, Happy Pills isn’t a codename for something more nefarious. Actually, this is one of the most adorable candy shops ever. Happy Pills doles out jelly beans and other sweets, much like a pharmacy hands out pills.

Grab a bottle of Happy Pills lol

You can buy different sized bottles of “pills” and even, a little mini-case to showcase your candy purchase.

3. Sample Barcelona’s local craft beer

Home to the local brew Moritz, the microbrewery and restaurant Fàbrica Moritz Barcelona serves excellent tapas (great for groups!) alongside their selection of Moritz beers.

The beer is strictly “Catalan” and is based on recipes from over 150 years ago, plus the restaurant’s menu includes local Catalan and Andalusian food specialities. If you’re looking for a Catalan tapas experience, start here.

4. Get lost in Citadel Park

The Arc del Triomf opens to Citadel Park

One of the greenest spaces in Barcelona, the large 70-acre park has its own lake accentuated by a grand fountain and a waterfall known as Cascada. For fun, you can even rent a rowboat and spend your time leisurely paddling around the lake. Dotted throughout the park are a bunch of playful statues like a giant wooly mammoth. The park is ideal for long walks, sleeps under the sun and having a picnic with friends.

5. Explore the artwork of Miro

While many people come to Barcelona for the artwork of Picasso or Gaudi, the Miro Museum is a fantastic home to the artwork of another great artist: Joan Miró.

Miro’s “Seated woman,” 1931

With works spanning from his early career sketches, to tapestries, bronzes and the paintings he completed during his last years, it’s a fantastic collection of some magical pieces of art.

One of the rooms has photographs of the artist himself and the library is full of books from Miro’s personal book collection. Outside the museum is a garden, filled with sculptures, making it a great rest stop.

6. Have a Gin & Tonic at Barcelona’s Trendiest Bar

Situated in Vila de Gracia, El Ciclista is an intimate, mood-lit, minimalist space, designed with cycling fanatics in mind.

Liking biking and/or great beer and cocktails? Check out El Ciclista in Barcelona

Decorated with a plethora of reused cycling materials, you’ll find bikes hanging on the walls, spoked wheels converted into tables, and door knobs made from handlebars.

Popular with locals, people flock to this bar for their cocktails, local craft beer (they have Moritz Epidor on tap), and most of all, their €5 gin and tonic selections. El Ciclista also frequently hosts live music events and various readings.

7. Burgers on the beach

Makamaka Beach Burger Café has a 70’s-inspired theme, making it a chill place to hang out in Barceloneta for a burger. Popular with both locals and travelers, indoors they’ve got a a cozy bar and then a large outdoor patio (heated in colder months).

Feel the 70s vibes at Makamaka

For a vegetarian option, try the Greenzilla with a mushroom patty, baked tomato, avocado, red chard, wasabi sauce and a sesame cereal bun. Complement this with one of their innovative cocktails like the Sunset Boulevard with dill infused vodka, mandarin syrup, egg white and lime.

The atmosphere here really does feel like a beach bar—understandably so, because the beach is right around the corner!

8. Explore Barcelona’s Gay Nightlife

With a warm climate, Spanish tapas, clothing-optional beaches, a plethora of cultural offerings, and a well-established, friendly LGBT community, Barcelona is a year-round gay destination.

A lot of the gay nightlife in Barcelona takes place in the Xiample neighborhood (sometimes called Gaixample). The Arena Nightclubs (a series of three) are popular every night of the week, while big gay parties like Circuit Festival, Pride and Bear Week bring in LGBT crowds to the city at other times of the year.

For more gay Barcelona tips, check out my Gay Barcelona Guide.

9. Have a cocktail on the beach

The beautiful thing about Barcelona is the laid-back atmosphere.

At the beach, you’ll come across vendors who are all too happy to sell you drinks, both bottled beers or even cocktails (go for the mojito!). They’re usually €5 but if you want to save money, you can also bring your own: head to one of the nearby convenience stores where you can buy your own beer for just €1.

10. Get a bike!

Barcelona has a popular city bike scheme, making it easy to use a bike to get around.

Biking is a great way to see more of Barcelona

There are also tour operators who run bike tours, usually taking in the major tourist sites, the beach and sometimes even with food stops. It’s a fun way to explore Barcelona—especially because the city is quite large and it can be challenging at times to get around.

About Adam

Adam Groffman is a gay travel writer and blogger. He’s recently published Barcelona’s first Hipster City Guide — a guide to Barcelona’s coolest things to see and do. Read his Barcelona guide here, or visit his travel blog for more Europe travel tips.

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!

Next Week: Heading to Vipassana to Meditate for Ten Days

Tomorrow, I’m heading down to Dallas again. I’ll work from there for a few days, and then head to Kaufman, Texas, to begin an experience unlike any I’ve ever had.

I signed up for a Vipassana 10-day meditation session.

During that time, there will be no phone, no internet, no computer, no texting or FaceTime or checking the news. And no talking. Days begin at 4am and run through 9pm. The focus is each day is… nothing.

To think of nothing.

I am excited and terrified. But so looking forward to it.

I am excited and terrified. But so looking forward to it.

About Vipassana

Link: Vipassana Meditation

There are Vipassana centers all over the country (and world!).

The sessions are donation-based (but could be free if you don’t have resources to donate!). Lodging and meals are included. All you have to do is get yourself there.

That’s where the work starts.

It’s hard to get a handle on what exactly happens while you’re there:

There are some some reviews from the Southern California Center on Yelp.

I’m going to the same center Daraius from Million Mile Secrets attended. His review describes it day-by-day.

There’s also a pretty “colorful” article about it on Vice.

The consensus seems to be: it’s a brief but difficult journey, full of sensations, and with (hopefully) life-long lessons on how to reframe your worldview. To see things as they really are.

Expectations

Setting this up was difficult. Once you realize you’ll be completely unavailable for 10 days, you start to realize how much you really do cram into your days.

I’m passing my small business responsibilities to Jay, who is also re-parking my new car.

Work has given me the time off, and I know it’ll be hard for them while I’m gone. I’m grateful for them.

I’ll miss my dog. I’ll probably miss the internet, and writing. Listening to music. Talking lol.

I’m already trying to shake off guilty feelings for leaving. And I don’t really understand why I have them.

I think, as Americans, we place ourselves under such rigid constructs that we feel guilt about leaving for 10 days. As if it’s such a long time.

I’ve been eating veggie this month (you can only eat veggie food there) and I cut way way back on my alcohol intake. I’m famously a boozehound, but I really have let it go except for the most part.

And, I’ve been doing yoga with an emphasis on back-strengthening exercises. I heard it can be painful to hold the posture for days on end.

I still don’t know what I’m hoping to get out of it. Perhaps:

Control of my mind

Mental clarity

Perspective

New skills

Some sort of epiphany or breakthrough?

I’m approaching it blankly and humbly. So whatever happens, will happen.

Bottom line

From March 9th through 20th, 2016, Out and Out will fall silent. Literally. I’ll be at the Vipassana Meditation Center in Kaufman, Texas – meditating. For ten days.

I’ll share the experience as best I can once it’s over. Even now, I find words fail to describe what I’m feeling about the situation. But I’ll be posting until I head out.

If you’ve attended a course, how was it? That’s a short question with a long answer, but I’d love to hear about it all the same.

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!

March 4, 2016

I Got the SPG AMEX with 35,000 SPG Points – Here’s Why

Also see:

Why I Don’t Care About SPG Starpoints

Refer Your Friends to the SPG AMEX and Earn Up to 55,000 Bonus Starpoints Per Year

Yep, I caved. Because I figured now or never.

I wrote about how I didn’t care about SPG points. But I also used to love Club Carlson. And cozied up to Hyatt.

I also used to be “meh” about Hilton, but I’m enjoying being Hilton Diamond this year.

So, things change. And if anything’s changing, it’s definitely the loyalty industry. And it is an industry.

Why now?

I navigated over to the application page, and looked at it for a little while. (How’s that for an image?)

Hook, line, and sinker

And then, I thought, well, 40,000 Starpoints is worth at least 50,000 Alaska Airlines or American Airlines miles.

It’s true. You get 5,000 bonus miles for every 20,000 Starpoints you transfer (if the airline has a 1:1 transfer ratio with SPG).

I figured I’ll have at least 40,000 Starpoints after meeting the minimum spending requirements. Plus, I have to pay taxes this year and, fortunately or unfortunately (depending on how you look at it), I can complete it in one go.

That’s worth it for 50,000 Alaska Airlines miles.

Although, Cash & Points is looking mad attractive the more I dig into it.

Plus, you get the 5th night free on award stays at Category 3 and up hotels.

Nights & Flights looks pretty interesting, too.

Suffice it to say: there are a lot of ways to start using 40,000 Starwood points.

Getting the SPG AMEX

After quickly running the numbers in my head, I had a YOLO moment and started filling out the application.

I chose the business version of the card. Because I have a legit business and kinda do need a dedicated card for it. But really, I just wanted Sheraton lounge access, which is the main differentiator between the two versions . Boom!

And you know how it goes:

Heart goes ba-dum-bump

And then:

Wah

I wasn’t instantly approved. I think it’s because I used my new Dallas address instead of my New York one.

But whatever the case, I haven’t seen a screen that explicitly asks you to call. Usually, it’s up to you to pick up the phone and call the reconsideration line. So that was interesting.

I called the number right away. The rep said they wanted to verify my information. I repeated the address, birthday, etc., and was placed on hold.

The rep came back and said, All done. Approved. You’ll get the email in a few minutes.

The call took 5 minutes. Before we hung up, I got the approval email.

Yay!

And then clicked through to set up online access, and sure enough, there it was:

Shiny new SPG biz account

Expectations

I’m not thinking of switching over to Starwood or anything like that – at least not yet. I want to see what Marriott will do to the program before I commit.

But from this bonus, I’m expecting to get some tremendous values from staying at Starwood hotels. I want my 35,000 Starpoints to be worth at least 4 cents each, or $1,400. To me, that’s worth signing up for.

And, it’s not impossible to wring that kind of value out of them, depending on how you redeem.

The key is not to get analysis paralysis. And to go with the redemption that makes the most sense AND gets the highest value when you’re ready to redeem.

Moving forward, we’ll see what happens. I’ll definitely follow up with how I put these points to use!

Want one?

Link: Get Your SPG Referral Link

Link: Apply for Card Offers

Share your links!

Please, if you want, share your referral link in the comments! Here’s how to find yours. Email an invite to yourself, and then copy and paste the URL on the application page.

You can earn 5,000 Starpoints for each approval, up to 55,000 bonus points. BUT. The person you refer must be approved by March 30th, 2016.

And HUGE NOTE. If you’ve ever had either card, you can NOT get the sign-up bonus again.

If you want to apply for either version of the SPG AMEX (personal or small business) via my links, click here:

Hotel Credit Cards

And, if you want, here’s my link for the SPG small business AMEX which will earn me 5,000 Starpoints.

Again, feel free to add your links in the comments, too. And thank you for reading, commenting, and using my links!

Bottom line

All-in-all, I‘m looking forward to seeing what Starpoints can do. As the hotel landscape shifts, I find myself more open to new ways to get award nights and try new hotel brands.

Plus, this is likely the highest this offer will ever be. So it’s really now or never (or until March 30th, 2016).

While I get myself acquainted with this new hotel program, what’s your favorite way to redeem Starpoints? Any Starwood hotels that absolutely warrant a mention?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!

In Closing: My Experience Buying a House

Also see:

Dallas: Buying a House and a Move Toward FIRE

My posts about FIRE

Is Living In Cities Worth It?

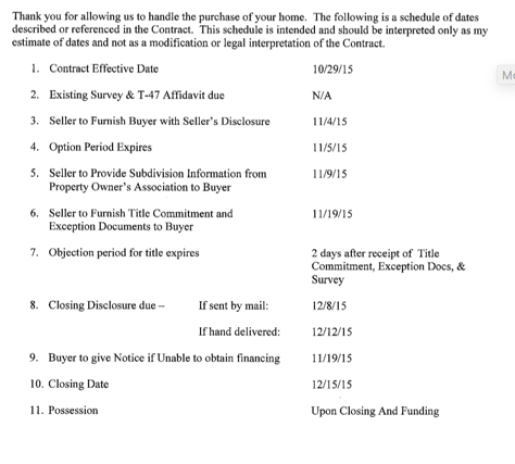

Back in November, I wrote about wanting to close on a house in Dallas. I did, in fact, close on a house in Dallas right on schedule, on December 15th, 2015.

My new living room!

That was almost 3 months ago, but it’s taken me this long to write about it.

A friend of mine said it best. We had lunch when she was scheduled to close on a house a few days later.

“OMG!” I exclaimed. “Are you like, so excited to be closing?”

“Not really, actually. I’m just sort of… ready for the process to be over.”

I didn’t think much of it at the time because I still was excited to be moving toward a closing.

That is, until I got there.

Hurry up and wait

The process started easily enough.

All through late October and November, I stayed friendly with my closing team. They’d ask me for things every week or so, which, I’d never closed before, felt like they were on top of it.

I get that I was closing between a string of holidays (Thanksgiving, Christmas, New Year), and that December 15th was right in the middle of post-Thanksgiving and pre-Christmas craziness.

The “Schedule”

I actually told them from the beginning – we can push this to mid-January. I’m not in a hurry.

Oh no, they said. We must close on the earliest possible date.

Texas has a law that you have to wait 45 days to close. So December 15th was almost 45 days… to the day.

I started out friendly, like I said. Until it got to be December and didn’t feel like… it was actually happening.

And then, it was like everyone woke up. And the shit hit the fan.

The bonanza to actually close

I think I have mild PTSD, which is how my friend must’ve felt when I asked if she was “so excited.” Because near the end, I definitely wasn’t “so excited” about closing either.

Every day, frantic calls. Must have this today. ASAP. This can’t wait! Now now now! #stressy

They had me pulling out files from 3 or 4 years ago, reconnecting with old employers for copies of forms.

They called them all, too. My current and former employers. They verified my employment like 20 times. Eventually, I gave them access to the Evernote notebook with all my bank statements from the past 3 years. It was just easier than having to send them in individual emails with frantic requests. (Thank god for FileThis!)

They wanted to know about every deposit. Some of which, I couldn’t even remember.

It got to the point where they had literally every piece of paper I’ve ever signed in my entire life (at least it felt that way).

The hitch

Two weeks from closing, my loan officer told me they’d have to switch my loan to different, more unfavorable, terms.

“You have the choice of Option A or Option B.”

At that point, the friendliness went away.

“Uhhh, how about the loan terms we agreed upon when you wrote my pre-approval letter?”

“Yeah, about that… [blah blah blah.]”

“Actually, I won’t go with either option. If you can’t close it on the terms we agreed on, forget it. I’ll find another company.”

A few hours later, he called me back, breathless. “Great news! My supervisor says we can push it through with the original terms.”

“Good.” Click.

Wrapping it up

The days leading up to December 15th were stressy AF.

They managed to locate forms they “suddenly needed” up till the very end.

Their data managers called me with my student loan company already on the other end. To verify my student loan. That was a surreal experience. What if I’d, like, been in the shower or something?

They called me at all hours, 7am, 9pm, to ask more questions. They demanded to speak to one of my former employers, who was cool with it.

THANK GOD for being on good terms with old employers

He described them as “very pushy.” When we spoke again, he used more colorful terms.

Then they started combing through my credit history.

And, it was explained to me over and over, but:

They demanded I close my Barclaycard Aviator Red card.

I really didn’t want to close it. I mean, WHY? It had no balance. It had been that way for… months.

But, they’d isolated THAT card as the one they wanted me to close.

Professional!

Above is the exact email my loan officer sent me. With “Sorry but this is the difference b/w getting the condo and not.”

Closing that particular Barclaycard was the make-or-break? Really?

You can see my other accounts, the FIA Fidelity AMEX, and a Citi, AMEX, and Chase card. Dunno which ones or why they shows such weird, round amounts. Exactly $10 on two different cards?

I hemmed and hawed and told them this was the LAST thing that I was willing to deal with on a last-minute basis before closing.

They swore up and down that, yes, this was it. Then called Barclaycard to close the card.

RIP, old friend

“You know once you close it, it’s gone forever, right? You can’t reopen it.”

“Yep, I know. Yes, please close it.”

Then they called me again with Barclaycard on the other end to make sure I’d actually closed it.

At that point, no, I was not excited to be closing. I was just ready for the process to be over.

The closing

I closed in New York. It was too close to Christmas and flights back from Dallas were through the roof.

I met the notary, who was so patient, so thorough. Even with questions and explanations, I was done in 45 minutes.

“So that’s it?”

“The check.”

“Oh, right.” I handed her a cashier’s check made out for the amount of the mortgage, property taxes, fees, fees, and other fees.

She left. The money was transferred. The seller was paid and the loan was funded.

That was it.

Bottom line

I rate my closing experience somewhere between really easy and absolute hell.

It closed on time, smoothly, and for the original terms. It was just every step in between that was like pulling teeth.

I’ll be out of New York between April 30th and May 15th. And from that point forward, living in Dallas. I plan on driving down there – more on that soon.

So what’s next? I’d like to buy another place already. A true investment property.

But I’m torn between buying more property and going really damn hard on my student loan.

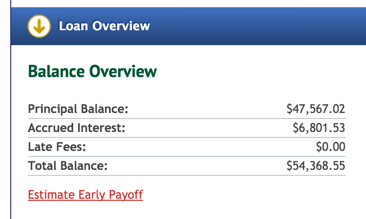

Left to pay on the ol’ student loan *middle fingers*

I still owe about $54K. Which is so stupid. I hate having that hang over me.

Ugh

I made a $1,000 payment on it last week. None of it touched the principal.

It felt like throwing a glass of water on a fire. Useless.

It’s baby steps.

I’ve decided to keep two of my Airbnb rentals and sink the profits into a combination of:

Funding my Solo 401(k)

Paying down this student loan

Saving toward another property

Putting a *little* extra toward my mortgage

It’s all a move toward FIRE. And I’m already looking into new side hustles for when I get down to Dallas.

Just like closing on this house consumed me for a couple of months, now leaving New York is consuming me. There’s SO MUCH to wrap up.

But, here goes nothin’. Dallas, here I come!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!

March 2, 2016

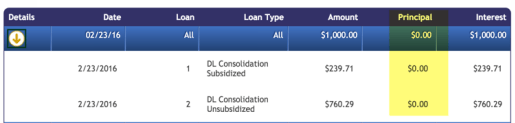

It’s Back! 75,000 Hilton Points for Citi Hilton Visa With No Annual Fee

Also see:

Seriously tempted by the 75,000 point Citi Hilton Visa offer

Yay! Just got Discover It and Citi Hilton 75K cards!

My Top 5 Hilton Category 2 Hotels for Award Stays

If you want to boost your Hilton points balance, you can earn 75,000 Hilton points when you get the Citi Hilton Visa. The minimum spend is $2,000 on purchases within the 1st 3 months of account opening.

75,000 Hilton points for a no annual fee card is a pretty good deal

If I didn’t already have this card, I’d sign up for it. I caved after being seriously tempted the last time this offer popped up because:

75,000 Hilton points is nearly enough for 2 five-night award stays at Hilton Category 2 properties

The card comes with automatic Hilton Silver elite status

You’ll get the 5th night free on all award stays

The card has no annual fee

It helps to build a positive relationship with Citi, who you’ll note is NOT AMEX or Chase

Drugstores, eh?

You’ll earn 6X points on your Hilton stays, which is awesome. (Just don’t use it outside the US, because there’s a foreign transaction fee!)

But this is one of the few cards that still earns bonus points at drugstores.

You’ll earn 3X points at supermarkets, drugstores, and gas stations. And 2X points everywhere else.

Is a Hilton card better than a 2% cash back card at drugstores?

If you spend $1,000 in that category, you’d earn:

$20 cash back

-OR-

3,000 Hilton points

Scale it up.

If you spent $4,000, you’d earn:

$80 cash back

12,000 Hilton points

Back to the Hilton Category 2 example. Those hotels are all $100+ a night and go for 10,000 Hilton points.

So depending on your Hilton status level, travel goals, etc., yeah, you might actually come out ahead with the Citi Hilton Visa at drugstores.

Also, if you like Hilton hotels. Or want to save up for a particular award stay. Or just want to get a good sign-up offer.

Bottom line

Something to consider. I personally value having a no annual fee credit card to age my overall account and help bring up my credit score. And Citi has a bevy of excellent cards, so building a relationship with them is a good thing.

This is also one of the few cards left that rewards spending at drugstores.

Thank you for applying with my links if you decide to pick up this card. (Yes, the 75K offer on the Citi Hilton Visa is there. Just select “Card Type” and “Citi” and you’ll see it).

Will this offer for 75,000 Hilton points tempt you like I was? What’s the main draw for you – the points, not having an annual fee, the drugstore category – or something else?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!

TripBAM Monitors Your Paid Hotel Rates & Alerts You If the Price Drops

Also see:

I’m Prestigious! Getting Citi Prestige and First Impressions of the Card

Booking Barcelona: Citi Prestige + Hilton Diamond at Alexandra DoubleTree

Booking Martinique: My Experience With Citi Prestige Concierge and 4th Night Free Benefit

Ever since I got my Citi Prestige card, I’m finding I have a lot more paid hotel stays. Which means:

It’ll be easier to earn and maintain hotel elite status (at Hilton)

I want to get the best possible price on every day

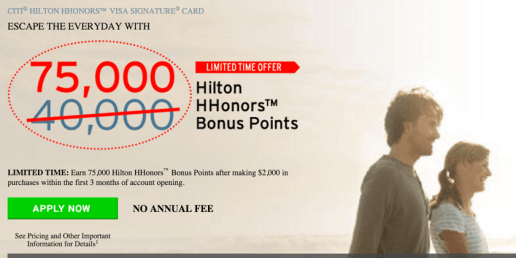

For my upcoming trip to Japan, the hotel rates were pretty high because of cherry blossom season. I booked anyway in hopes the prices would drop. But I didn’t know how to track it except to check manually on the hotel site every day, which sucks because it’s time-consuming.

Enter TripBAM

Link: TripBAM

Bam!

Points & Pixie Dust wrote about TripBAM way back in 2013, but I haven’t seen it discusses lately.

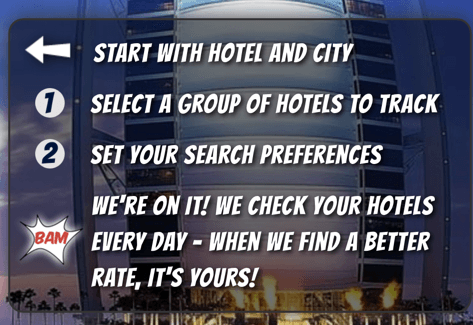

You can specify a hotel or get help finding the lowest price

TripBAM is a service that scans a specific hotel, or a general area, and lets you know when to book at the best possible rate.

I wanted to track price drops at the Hilton Tokyo, so I specified that hotel.

How TripBAM works

TripBAM scans the hotel you select (or the area you want) for lower prices every day, and emails you when it finds a lower rate.

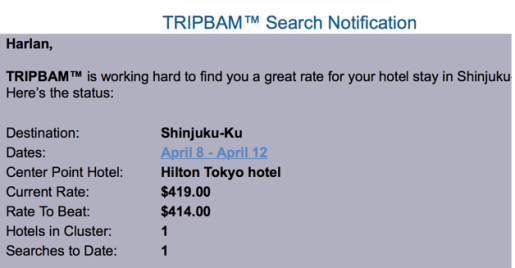

TripBAM was reliable about sending updates via email

I set my search to alert me if the price fell by even $5 per night. Because for a 4-night stay, $20 is $20.

That was on February 24. I converted from Japanese Yen as best as I could – you can only enter rate changes in US dollars. So I was a little concerned if they’d even find anything.

On February 27, they emailed:

The rate dropped!

So I guess the conversion wasn’t as issue.

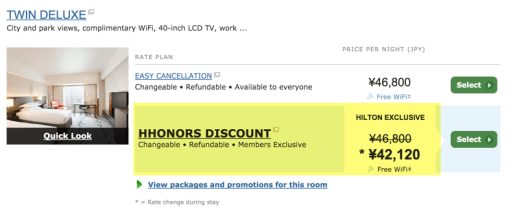

Now, you can put a card on file and have them book your hotel for you. Or you can opt to get an email notification and book it yourself. I chose the latter option.

Hilton had a discount, too!

TripBAM doesn’t take into account any promotions or discounts offered for AAA, AARP, elite status, etc. So, even better, I found Hilton had a discount, too – an extra ~$40 off per night, or ~$160 for 4 nights.

But note, the publicly available rate TripBAM sent me was displayed on the Hilton website. So their info was accurate.

I called Hilton and switched my room rate without any issue – and with the same confirmation number Citi gave me when the booked at the higher rate.

I’m not sure how or if this will affect my 4th night free benefit – but I guess I’ll find out!

Anyhoozers, TripBAM is free to use. So if you have a stay coming up and you suspect the price might drop by even a little, it’s worth it to plug in your info and see if they can find you a lower price.

All told, they saved me about ~$200 (and I’ll still get the 4th night free [hopefully]).

Tingo

Link: Tingo

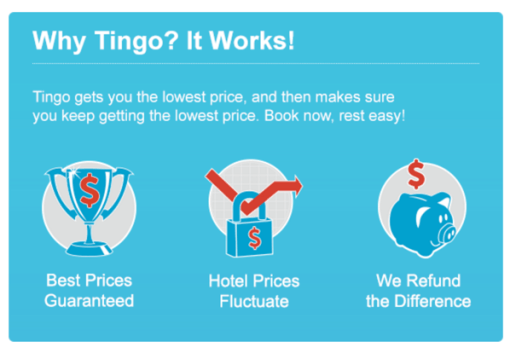

Tingo is a similar site. But the biggest change is that you book your hotel through them (they’re a TripAdvisor company).

I don’t like this because you won’t get elite status benefits and credit when you book through an OTA. And I’d rather book through Citi to get the 4th night free.

Tingo works much like TripBAM

However, if you want to stay at a boutique hotel where status doesn’t matter anyway, this is a really hands-off way to track prices. Although in that scenario, I’d rather use hotels.com and get a portal bonus.

I mention it for completeness, and recommend sticking with TripBAM because it tracks the price for you without any monetary commitment.

Bottom line

I’m all about saving money, especially now that paid stays are outpacing my award stays. That’s an ironic side effect of having Citi Prestige – the increase in paid stays. Too bad for Hyatt, because I haven’t sent them extra business this year.

If you have a paid stay coming up, and you suspect the price will drop – even by $5 a night – let TripBAM monitor it for you.

Their email alerts were timely. And it ended up saving me a nice chunk of change.

Considering the service is free, there’s absolutely no reason to leave money on the table.

I hadn’t heard it mentioned much recently, so wanted to share, especially because it worked so well, and quickly. Plug in your info and see if you can get a better deal.

Have you heard of TripBAM before? Has it saved you money on a paid stay?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!