Harlan Vaughn's Blog, page 66

June 3, 2015

Ibotta: Get Cash Back When You Shop

So… I’ve been getting into coupons lately. And ways to get cashback or maximize my spend as much as possible. I recently wrote about Paribus, which has already saved me some money on Amazon purchases.

And today, in my internet wanderings, I kept seeing this app mentioned over and over: Ibotta.

I’ve already added it to the Services I Like page, but wanted to do a quick article about it, too.

What the hee haw is Ibotta?

Ibotta is pronounced like I-bought-a… get it? It’s an app that uses your location to alert you to deals when you shop.

You “unlock” savings on the app. Then you use your phone’s camera to upload a picture of the receipt. After it’s approved, Ibotta gives you cash which you can transfer to PayPal or Venmo… and then to your bank account.

Some of the cashback is 10 or 20 cents… Yawn. But some of it is a buck or 2. Not yawn: that can add up.

I was a little skeptical about installing

Yet. Another. Freaking. App

on my phone… but I’m glad I did it. As soon as I got to the store for the first time after setting it up, I already had a few bucks in my account.

You can transfer cash out once you hit the $10 mark, or you can redeem for gift cards. I just want the cash, baby.

Although their gift card selection isn’t too shabby. And $1 equals $1, so no points conversions to keep track of.

Gift cards on Ibotta

Where can you use the app?

Oh man. So many places. That was another of my concerns.

The list of stores is so long that surely you can find a few that will interest you. They have lots of local grocery chains, as well as big box stores, drugstores, and everything in between.

Among our faves:

Costco

CVS

Kohl’s

Amazon

Any gas station

Any liquor store

Rite Aid

Walmart

Sephora

Full list is here!

What can you buy?

The categories cover quite a lot of ground.

Groceries

Apparel

Beauty and wellness supplies

Electronics

Beer, wine, and spirits

Home/office items

Baby and kids items

Arts and crafts supplies

Pet items

Sports and fitness items

The biggest category is groceries, followed by beauty and wellness supplies.

Which is good because the only thing I buy in the stores any more is groceries, simply because they’re perishable. Most other things I order online to take advantage of shopping portals, manufactured spend, and maximizing points and miles. Although Ibotta also acts as a shopping portal (more on that in a sec).

Dishwashing liquid and beer at Whole Foods… and some nice cashback amounts!

But with groceries, I can pay with a points-earning credit card, and then earn cashback on top of that.

Again, some of it will only get you 20 cents or so, but it’s concentrated on basics: think bread, milk, orange juice, tomatoes… stuff like that. Best of all, the “basics” can be any brand. So you can score an easy $1 or $2 for selecting your items on the app and then snapping a pic.

Once you “unlock” all the offers, you can select them all and upload one receipt. So it really can add up fast.

A few other cool things

The more you use the app, the more opportunities you get to earn even more cash back. You can hook it up to your Facebook and add people to your “team.” Once your team hits a certain threshold, you get even more cashback.

And for their “preferred partners” all you have to do is scan your loyalty card on the app and then shop… no receipt uploading necessary. You still have to unlock the offers via the app, though. And you can stack the cashback with any other sales, coupons, etc. that the store has going on. This can make some items nearly free.

I particularly like that Rite Aid is a preferred partner.

Drawbacks

I like that you can get some of the offers online. Some of the offers are 10% cashback… better than other portals. Like when you shop on Nike.com and spent $100, you can get $20 back… 20%!

An awesome payout at Nike.com

When you buy online at The Body Shop, you get $5 cashback when you spend $30. But you have to click through Ibotta.

The Body Shop is an Ibotta partner

By clicking through Ibotta, you’ll lose the ability to use the Chase Ultimate Rewards shopping portal, where you’d get 5 Ultimate Rewards points per dollar. For the same $30, you’d get 150 Ultimate Rewards points. I actually value $5 more than 150 Ultimate Rewards points, but maybe I’d rather have the points. So just know that they want to replace your portal.

That’s really about the worst of it, though. Some of their offers are awesome – highest payouts I’ve seen for some.

Also, you can’t get cashback on gift cards, but that’s kind of a given.

Bottom line

I’m loving taking Ibotta out when I shop and getting cashback for things I’m going to buy anyway, on top of the points I’m earning, the coupons I’m using, and the sales I’m shopping.

Once you hit the $10 mark, you can withdraw cash to PayPal or Venmo and then put it in your bank account.

The app works when you unlock offers by watching short videos, answering a question, or completing a simple activity.

I’ve already gotten a few bucks back from things I was going to purchase anyway, so there’s really very little down side to installing this app on your phone.

When you click my link to sign up, you’ll become a part of my team – and vice versa – and we can help each other earn a few extra bucks here and there, which is pretty cool.

The company has been around since 2012, but this is the first I’ve heard of them. They’re based in Denver, which is cool, and their website and app are both easy to navigate and understand.

Is anyone else using this app already? How’s your experience so far? Would love to hear about it!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

May 25, 2015

Reminder: Club Carlson Program Changes in One Week! Book awards by May 31st

Also see:

Club Carlson eliminating free night for award stays on June 1st

Club Carlson: Dead to Me

The time draws near.

RIP

I managed to burn most of my Club Carlson points during my trip to Ireland earlier this month (reviews of Radisson Blu Royal in Dublin and Radisson Blu in Galway are up so far). But I also had a paid stay at the Radisson Blu St Helens and ended up earning ~44,000 Club Carlson Gold Points between that and the room charges in Dublin.

Nearly enough for 2 nights at a Category 5 property… if booked before next week

Book now, change later?

The terms and conditions of the Club Carlson program suggest you can book dates now, and change them later – if you call their help desk. I’ve had to call in before and had short waits and helpful service reps each time.

Cancellations or changes can be processed via Member Services or clubcarlson.com only (hotels cannot modify or cancel award bookings). Points will be credited back to the Member’s account provided the hotel’s cancellation policy was followed.

The Radisson Blu 1919 Hotel in Reykjavik is open for booking until May 2017

However, per this thread on Reddit that may or may not be the case.

In the email communication about the change, all Club Carlson said was that we’d get new Terms & Conditions on June 1st.

Club Carlson email communication

Still others think it will be up to the individual hotels (see comments on that link).

Or book now, cancel later

Of course if you know your dates and can lock them in now, that’s preferable. Especially since who knows how lenient they’ll be with changes to award bookings.

Considering most hotel schedules are open through 2016 (and some into 2017), you should have no trouble burning your points if you choose to do so.

Some hotels are bookable for nearly 2 years out

The Radisson Blu 1919 Hotel in Reykjavik is $434 per night for dates in July 2015. Your 44,000 Gold points are worth $868 if you have the US Bank Club Carlson Visa – but only for another week.

The Radisson Blu 1919 hotel in Reykjavik is a great deal for another week. After June 1st, not so much.

After June 1st, this property – as well as nearly 70 others in Europe – are jumping up to a Category 7, and will require 70,000 Club Carlson Gold points per night. By that time, you’ll need 140,000 Club Carlson Gold Points (!) for a 2-night stay, which is a staggering increase.

I’m actually going to burn my points for 2 nights here on the off-chance I get back to Iceland in the next year. If standard room rates are available, I should be able to change my dates and maybe have Club Carlson honor the terms under which the room was originally booked.

And if I cancel, or they won’t honor it, no biggie. I’ll get the 44,000 points back anyway, though they won’t be worth nearly as much this time next week.

Bottom line

Club Carlson went from being “the little hotel program that could” to Hilton-esque in its devaluations, which is too bad. They don’t have the footprint like IHG or Marriott nor the polish of Hyatt or Starwood.

They have some lovely European properties… but they’re going the way of the dinosaur, as far as award bookings are concerned.

I’m burning every point that I can this week, in hopes that I’ll be able to switch my dates later.

My strategy is to keep the US Bank Club Carlson Visa for until I get one more annual bonus of 44,000 Club Carlson Gold Points. Then, I’ll get back the annual fee and cancel the card once and for all.

Club Carlson is dead to me. Starting June 1st, anyway.

Has anyone else had success in changing dates of an award stay with Club Carlson? Do these devaluations change your hotel strategy moving forward?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

May 24, 2015

Hotel Review: Radisson Blu, Galway

Also see:

Hotel Review: Radisson Blu Royal, Dublin

Special Guest Review: Exploring Ireland’s Radisson Properties

After getting the rental car out of the tiny garage at the Radisson Blu Royal in Dublin, I used Google maps to guide me out of the city and onto the highway that would take us the short drive into Galway (a little over 2 hours).

A pretty straightforward drive across Ireland’s midsection

We’d heard really mixed reviews about Galway, and were excited to explore the town for ourselves.

All was going smoothly until the home stretch into the city of Galway.

Arrival and check-in

Radisson Blu Galway

The city is changing the entire flow of traffic, and the directions I’d pulled up were no longer accurate. One-ways were rerouted, or closed, and the road that the Radisson Blu is on (Lough Atalia) had horrible traffic. I had to figure out the reroute while driving on the left side, in a city I’d never been to… and I had to pee so bad OMG.

The roundabouts are the worst.

We finally got parked at the Radisson Blu after a few false turns. As soon as I got in, I found the bathroom, then went to check in.

There was some sort of convention there I guess, as there were all these teenagers draped and strewn about all over the lobby. But we checked in relatively quickly and the desk agent was beyond nice.

Again, we were upgraded to a “Business Class” room which included free breakfast.

Hallways of the Radisson Blu Galway

The hotel is about a 10-minute walk from the pedestrian area of town where most of the shops and restaurants are concentrated. From there, it’s another 10-minute walk to the other side of the River Corrib where the “real” Galway is located – lots of authentic pubs and shops over there.

The room

Room 315

Nothing too fancy, a touch dated, but clean and a nice size. Not as updated as the Radisson Blu Royal in Dublin, but everything you need is in there. They even had a Nespresso machine, which was a nice touch.

View upon walking in

Bed

Desk

Seating area

View of the bay, and of the rerouted Lough Atalia

View from the window

Nespresso machine

Fridge

Closet, safe, ironing board, hangers

The bathroom had the usual This Works toiletries.

Bathroom

Toiletries

Overall, very clean and nice. And considering I’d paid for the 2 nights with 44,000 Club Carlson Gold Points, a total steal.

The property

Judging from the room and hotel exterior, I was expecting something a little more from this property. After all, it was the “Hotel & Spa.”

Francois from the Dublin Royal Blu told us RAW, the sushi restaurant here had some of the best sushi in all of Ireland and that we must try it.

So we did.

The sushi was no doubt beyond amazing. But the service put a damper on it.

Sushi in Ireland @RAWGalway #nom pic.twitter.com/FwayJyjI17

— Harlan Vaughn (@harlanvaughn) May 1, 2015

We must’ve waited over 30 minutes to get the check. It got to the point where I considered walking out of the restaurant. While we were sitting there, both servers completely disappeared into some back service area. And getting the actual check in hand was such a procedure. So. Great food, terrible service. I hope my experience was isolated.

We made sure to explore Galway a bit. We hit up the local pubs, bought some touristy gifts for friends, and crossed the river to see the other parts of town.

The weather was on and off drizzly, but the patches of clear sky more than made up for it. We had lots of good, local craft beers and a few tasty snacks.

Around Galway

After a long day of exploration by foot, we decided to go back to the Radisson and have a quick bite and a lie-down. We went to the Atrium restaurant on the ground floor. I ordered the chicken tikka masala and Jay ordered… the fish and chips? Something pretty basic.

Pints came out quickly, but then we waited nearly 45 minutes for the food – again. I asked the server, “How much longer?” She said it was being plated “right now” and would be out within minutes.

15 minutes later… still nothing. I asked for the check. “It’s coming out right now!” she said again. At that point I didn’t care. I told her to cancel it and that I refused to pay for it.

If it’s gonna take an hour, just tell me an hour. Don’t tell me it’s coming out “right now” and then make me wait even longer. She said that the dish I’d ordered took a long time to prepare… apparently an hour. Yeah right. Just lie after lie from this server. WTF?

So – I tried both restaurants at the Radisson Blu in Galway. And both of them sucked. I hope others have better luck that I did!

Breakfast

The breakfast was fantastic. Lots and lots of options, ample seating, and the dishes were quickly replaced. It took a second for the servers to bring out the coffee though – what the hell is going on with the service at this hotel?

But I was glad to have free breakfast.

Fresh fruits and yogurt

Cereals

Pastries, cakes, and rolls

Cold cuts and cheese

Fruits

Juices

My breakfast selections

A nice selection of hot and cold items, including all the Irish classics. I loved the salmon, roasted tomatoes and mushrooms, and breakfast potatoes.

I believe the breakfast was 15 Euro – which might be worth it if you’re really hungry and plan to have a few coffees.

Ring the alarm

When we got to bed the first night we were there, we were exhausted from the drive and walking around all day. Around 3am, we heard a REALLY LOUD alarm go off in our room. It jolted both of us up from a dead sleep. We panicked a little, obviously, and called the front desk. All is OK, they told us. Accident.

Well, that sucked, but whatever.

The second night, it happened again. TWICE. Once at 1:30am and once at 6am. Needless to say, I barely slept, and had to drive the next day through yawns. We asked what in the actual hell is going on? Again, via phone. “Another guest keeps tripping the alarm.” Then turn it off! Or make it harder to trip. “Is this happening in every room of the hotel?” “Yes, unfortunately.”

So when I went to check out the next day, there were a lot of pissed-off looking people, including me.

After the terrible service in the restaurants and the fire alarm, I was ready to get out of there. The desk agent asked how the stay was. “Really bad,” I told him honestly. He did that thing where he pretended to listen, gave no answers, and tried to brush us off. But I insisted. “I want our points back. I wish I hadn’t stayed at this hotel.”

He gave us the email of the Customer Relations Manager, who was magically away on vacation that week.

Well, it took forever for her to respond to us. We had to follow up several times. And in the end, we got 10,000 Club Carlson Gold Points back. Whatever.

Bottom line

Nice room, good location, beautiful interior. The stay, overall, was really bad. Lots of apathetic employees, from the servers to the desk agents to the managers.

Unless they get their service act together, I can’t recommend this hotel. And again, I hope my experience was isolated. Stay at another Club Carlson property… or another hotel chain altogether.

Has anyone else stayed at this property? How does your experience compare? Would genuinely love to know.

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

Quick tip about booking NYC or DC flights with Avios

There are a few cities that have multiple airports, so this tip could work for:

New York (JFK, LGA, EWR) – NYC

Washington, DC (IAD, DCA, BWI) – WAS

Chicago (ORD, MDW) – CHI

London (LHR, LGW, LCY) – LON

Paris (ORY, CDG) – PAR

Tokyo (NRT, HND) – TYO

I encountered this when searching BA.com for space to get to Boston from New York.

When I search for award space, I usually just type in “NYC” – because I’m open to JFK or LGA. So I rarely specify an airport.

But BA.com will not give you the complete picture of award space if you don’t specify an airport.

Make sure you search city code and airport code

Here’s what comes up when I simply search “NYC-BOS” for award space next week.

The search starts with “NYC”

Decent amount of space

OK, so not dismal. Like, I’d probably be fine to choose 1 of these flights from the list.

BA.com isn’t showing you the full picture of award space.

If you go click the “Change” button at the top and specify “LGA” as your departure airport, you get many more options.

The “Change” button lets you easily switch between airports

Now specify an airport. I chose “LGA”

And then…

Many more flights!

A couple of other notes

This utility is useful in a couple of ways.

First, if you are open to multiple airports, putting in a city code can sometimes show you space that you maybe didn’t think of. Like if you’re willing to fly out of JFK, LGA, or EWR

If you want to fly New York-Paris, for example, start with “NYC.” Especially if you’re OK to fly out of EWR. Then you can switch between JFK and EWR easily to see all of the available space

If I’d started out the example search above with LGA, I wouldn’t have known that I had two JFK flights to choose from, too

Being able to switch between airports gives you a better picture of space at each airport – and sometimes more options

This tip works with any city with multiple airports whose Oneworld space shows up on the British Airways website (That was a long sentence with a lot of prepositional phrases.)

5/25: Update regarding award space availability – and further proof that this works

A couple of people noted that NO econ award space is available is my example screen shots above. My fault, really. I picked a date a few days into the future in the original 5/24 post.

I ran another search today and selected a date about 2 weeks away – June 10th – and found award availability was great on nearly every flight – with over a dozen flights to choose from.

The search starts with “NYC” again (for June 10th)

OUT AND OUT - Investing. Positivity. Oh, and travel.

OUT AND OUT - Investing. Positivity. Oh, and travel.

May 23, 2015

Trip Report: Aer Lingus NEW Business Class DUB-BOS

Also see:

Trip Report: Aer Lingus NEW Business Class BOS-DUB

Happy to continue my Ireland series after the good news that the country is moving to legalize gay marriage. I saw the signs up everywhere when I was there to “Vote Yes” or “Vote No” and it seems that they’ve collectively decided to lead the 21st Century. Congratulations to Ireland!

If you’re interested in the new Aer Lingus business class product, you’ll want to also read my review of the BOS-DUB flight.

The key difference is that BOS-DUB is a red-eye whereas DUB-BOS is a daytime/lunch flight.

After an amazing flight over, I was excited to see how the finer points of service would differ during the day flight.

Flight details:

Aer Lingus Flight 137

May 5th, 2015

Depart: 11:50am

Arrive: 1:45pm

Duration: Duration: 6H, 46M

Aircraft: Airbus A330-200

Distance: 2,983 mi

First impressions

Business class cabin

It was nice to see the cabin in the daylight. The colors they’ve chosen for the cabin (light and dark gray with splashes of emerald and lime green), really pop. It’s a really nice ode to the “Emerald Isle.”

The flight attendants on this flight were far more practical and “get ‘er done” than on the flight over. The one flight attendant was all about business, which is fine. But the flight over was more relaxed.

Whereas amenity kits and menus were distributed after takeoff on the flight over, on this flight, they’d already placed both on the seats before we boarded.

Aer Lingus business class amenity kit

Aer Lingus business class amenity kit contents

The FAs still made sure to ply us with pre-departure beverages. I had a mimosa and Jay had champagne.

Pre-departure drinks!

The seat

The same seat as the flight over. I didn’t make use of the lie-flat function on this flight, but I did turn on the back massage and kicked back with my feet up. What a feeling!

My seat, 4G

More of the biz class cabin and seats

If you’re traveling solo, I’d recommend getting a single seat on either side of the cabin. That way, you’ll have both privacy and aisle access.

And if you’re flying with a partner, all the other seats that are next to each other are pretty much the same. The only difference is the aisle access. I like being in the middle so that I could get up and “move about the cabin” whenever I wanted to. The 3rd and 4th rows are good – close to the bathrooms but not so close to the service area.

Oh, and plenty of leg room!

Meal service

This is really what I wanted to focus on, as it would be the single biggest difference from the flight over: lunch instead of dinner.

I’ll show you the menus, then the food pics. Lunch was served shortly after takeoff, then afternoon tea was served about an hour before we touched down at BOS.

Menu cover

Appetizer menu

Main courses

Afternoon tea service

Red wine selections

White wine selections

There was also an amuse bouche. And, like last time, I ate all of it before I could get a picture. LOL. Before I knew it, it was gone!

I ordered the mozzarella salad for an app, salmon for main course, and the Italian red wine to go with the meal.

Mozzarella app and salad

Salmon with roasted tomatoes – yum lycopene!

Red wines

After the main meal, we were offered raspberry fool for dessert and coffee or tea.

Basically a tart

Flash forward a few more hours, and then I had cheese board, a coffee, and a Bailey’s. When in Ireland…

Cheese board and afternoon tea (Not pictured: Bailey’s)

I must say, for flight food, the meals were damn yummy. The salmon was tender and flavorful. The wines were well-chosen and very tasty. Even the little things like the side salad and dinner rolls were good. I was impressed with the quality of the meal service on both flights.

Not only that, but the pacing and presentation were both straightforward, not fussy, but still elegant.

In-Flight Entertainment

Slightly different selection than the flight over. There was “Birdman” and “Into the Woods” and a few other recent releases, as well as films shot in/focused on Ireland, of course.

The screen is pretty large, and can be controlled by remote or by touch, which is pretty cool.

There was a reading light attached to the seat, and “mood lighting” that could be switched off to make it really dark so you can see the screen more clearly.

We were also given noise-canceling headphones to use for the flight. I opted to just wear the headphones and type out some blog posts.

How I Did It

I found Aer Lingus award availability on United.com, then called British Airways to redeem 50,000 Avios for the round-trip ticket.

This particular award (BOS-DUB) was a sweet spot in the Avios program for a long time. Unfortunately, the award has increased to 75,000 Avios round-trip. Even still, for a nice seat in the sky and a direct flight to Dublin, it’s pretty good. Especially as business class tickets can be thousands of dollars.

Also, Dublin is quite a nice hub for European air traffic. You can fly into Dublin and then it’s a quick flight to anywhere in Western Europe.

Even though the value proposition of this particular award isn’t as good with Avios, it’s still worth it if you really want to visit Ireland, and if flying out of Boston is easy for you. So there’s that, at least.

Overall

I loved being able to experience the refreshed Aer Lingus business class while it was still new. You could tell the flight attendants were proud of the refresh and the aircraft. And you know what? They should be. We have a lovely flight that was relaxing and smooth. Couldn’t ask for much more.

And you know what else? Congrats to Ireland on their major democratic victory, and on being the 1st country to vote gay marriage into legislation. Simply wonderful.

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

Gratitude / Life Changes

The times, they are a-changin’ (aren’t they always?).

Ah, the open road…

Thank YOU!

I’m having a great time keeping up with the points and miles community here, and hopefully adding helpful information where I can. So I just wanted to take a moment to say thank you to everyone reading.

I’m continually blown away by the kindness of my readers and how many awesome people there are who are as into points and miles and credit cards as I am.

I’m continually blown away by the kindness of my readers and how many awesome people there are who are as into points and miles and credit cards as I am.

My links

Also wanted to say thanks for hitting up my referral links lately. They’ve been there for a sec, kinda hanging out in the sidebar. I was accepted into the CreditCards.com referral program – which is awesome because I don’t have to swear allegiance to any card(s) in particular. Most of the good ones are there, though. So thanks for clicking when you’re considering opening a new card. It’s a nice bonus for sure, and I appreciate the support!

Oh, and I have a page of Services I Like, too. I do posts from time to time about a cool service (like Paribus or Evernote), then I’ll post the referral link. I only add services I really love, so thanks for using those links, too!

Life stuff

Sunset in ABQ

So this kinda goes hand-in-hand with the call-out of the referral links. I’m slowly but surely doing these things with my life:

Building up this blog

Doing more freelance writing

Slowly making an NYC exit plan

Paying down my debt and saving up for a house simultaneously

These past 6 months, I’ve had to get a lot of different projects off the ground by leveraging my own money (See Smart Debt: Is carrying a balance ever a good idea?). I’m happy to report that these projects are going well. There have been some hiccups and unforeseen stuff, like there’s supposed to be with new ventures, and I plopped down my credit cards to keep the momentum going.

Sure, I earned some points in the process. But it was mainly a gamble. And I straddled the fine line between Smart Debt and plain ol’ Dumb Debt. So I’d like to ameliorate that.

Then, I’d like to save up a nice down payment for a house somewhere that’s… Not New York. I was thinking a cabin in the woods in Vermont, or a little house in northern New Mexico, or… I’ve been tossing around a few places.

Mountains and lake in Vermont

I’d like access to American Airlines at the nearest airport, an easy mortgage, and enough services that I can still do my art projects on the side. So that could be a lot of places. Definitely a small to mid-sized city. That’ll be a huge and welcome change.

Future travels

Getting back to travel, I’d like to focus domestically this summer. Yeah!

I was thinking of visiting Chicago, and/or flying into Vancouver, and making my way down to NorCal with stops in Seattle and Portland. It’s been far too long since I’ve visited Chicago, and I’ve never been to Oregon…

And this winter, I was thinking of an extended visit to Central America, a region I’ve never explored.

In general, I’m assessing my priorities and figuring out what I can do with this writing and blogging stuff. I’m working to fit everything in and to grow everything together.

Bottom line

So that’s it. Just wanted to say thanks for using my links – it’s been a real boost and a great support for me these past couple of months, especially as I figure out what’s next and how to grow from here.

Thank you – one of the most powerful phrases there is!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

May 17, 2015

My experience renting a car in Ireland (Woof!)

Also see:

Trip Report: Aer Lingus NEW Business Class BOS-DUB

Woof

verb: to declare something bad, ugly, terrible, or nasty.

interjection: use as an expletive to express disgust or surprise.

Can be a replacement for damn that sucks!

Upon landing at DUB, I knew the next step was to go pick up the rental car.

So here’s how I did it (made the booking not picked up the car).

The booking

I ran a quick search on the Chase Ultimate Rewards website – they generally have fantastic rates on rental cars. That’s how I got such a good deal in Hawaii. Keep in mind that they ONLY service airport locations and you MUST pick up and return to the same location.

They quoted me at ~$325 for a 6-day rental. Not bad.

But when I hopped on kayak.com to compare and they had rentals pricing out at 9 Euros per day. And 85 Euros for the 6-day rental (~$97). Now that was a screaming deal. I booked a car at Dollar via priceline.com.

My Kayak to Priceline to Dollar car rental booking – 85 Euros

My only criteria were:

4-door (for ease of getting luggage in and out)

Automatic transmission

Unlimited kilometers (I wanted to drive a lot)

So, I did it. I thought I’d gotten a better deal than what the Chase Ultimate Rewards site was displaying.

Now that I’m back safe and sound, I’m not so sure any more.

Pickup

To get to the car rental pickup area, you have to take a shuttle about 5 kilometers down the highway to a pretty isolated lot, but still on the airport grounds.

I thought when I got there, I’d put down a credit card so they could put a hold on it and kinda… drive away.

My convo with the desk agent

“You’ve driven on the left before?”

“Yes. In New Zealand.”

“And how are you on the left side? Are you…?” *made swooshy motions with her hands*

“Yeah, no. I’m fine. I’ll be fine.”

“Which insurance would you like?”

“None, it’s included with my credit card.” (Chase Sapphire Preferred now includes all countries under their primary car rental insurance.)

“Uh oh. Have you ever tried to file a claim with a credit card company?”

“Well, no. And I don’t wanna find out. I’m sure they’ll be fine, though.”

This is when an older gentleman piped up. He explained that it would be a nightmare for me to get Chase to help me with any type of mishap while I was in Ireland. “Happens all the time to you Americans. Everyone always thinks it’ll be OK and it never is.”

But I insisted on waiving the coverage.

“30 Euro admin charge to take the insurance off.”

WHAT?! Ridiculous.

“And if you waive it, we have to put a 5,000 Euro hold on your credit card.”

WHAT?!?! That’s over $5,700!!!

“Yeah, but if you pay 125 Euros, the hold is only 2,000 Euros (~$2,300). And if you pay 250 Euro, there is no hold.”

So for me to waive the coverage would cost me 30 Euros. And they kept pressing me. Finally, just to get the hell out of there, I paid the 125 Euros, and let them put the 2,000 Euro hold on the card, which burned me HARD.

“You’re making the right decision,” the older man said. “That way if you get into an accident, you can pay the deductible, hand us the keys, and walk away.”

“Do uhhh… accidents happen a lot in Ireland?”

“It’s what I spend every day filing claims for.”

Woof!

Dozens of dents, dings, and scrapes that I didn’t want to be responsible for!

Dozens of dents, dings, and scrapes that I didn’t want to be responsible for!

They took me out and made a big production about me examining the car. It had a LOT of scrapes and dings on it, so I took out my phone and recorded dozens of pictures in the Evernote app (this is another great use of Evernote for travelers!). There was no way they were gonna pin those on me when I returned it.

If you see anything like that on ANY rental, whip out your phone and snap some pics. It’s worth the 2 minutes that it takes to walk around the car once and record any big issues.

The driving experience

Beautiful country, narrow roads. And lots of traffic! ;)

The roads in Ireland are NAR-ROW. And the trickiest part is getting around in town. Once you’re on the highway, it’s just like driving anywhere else. For me to drive to Dublin to Galway to Cork via Limerick and back to Dublin, the roads were fine.

And no accidents!

Outside Blarney Castle. Pretty much the same roads as in Medieval times

But I did see, at times, how the roads could be confusing. And they definitely do NOT get points for their signage. So be careful out there (as always, when driving in another country)!

And have lots of coins for tolls if you plan on driving from one city to another. A few of the toll booths accepted my Barclaycard Arrival Plus, but a few of them also didn’t.

Bottom line

Getting to the Radisson Blu Royal in Dublin and seeing that hold on my account made my “good deal” booking with Kayak feel like a terrible deal after all. Especially after finding out about the admin charges and basically being bullied into getting insurance I didn’t want.

Things to look for when renting a car/driving in Ireland

Always check the Chase Ultimate Rewards travel portal as their prices tend to be the BEST for airport rentals. And, surprisingly, the AA Car website gives out some really decent rates too

You will most likely have to put some monstrous hold onto your credit card, so be prepared for that

And be prepared to pay a bullshit fee if you don’t want their insurance (“admin charge” my A!)

Take lots and lots of pictures of anything you see on the car. Mine had lots and lots of dings and scrapes

Pre-plan your driving as much as possible. It’s easy to miss signs in Ireland – signage is really not their strong suit

Now, my questions. Would I have been charged those ridiculous fees if I’d just booked through Chase Ultimate Rewards (Update: it seems so. See link at the bottom.)? Because the price ended up being the same after the insurance payment. Although I saw disclaimers about extra fees charged by the rental car agency and now that I’m back, have read many reports of huge credit card holds. And man, I wish I’d Googled that before I left!

Has anyone else rented a car in Ireland? Are there any tips for next time? Would love to hear from someone more seasoned – and would love to share this info with readers. Please comment below if you know anything about renting a car or driving in Ireland.

Update: This is an amazing resource – A Comprehensive Guide to Renting a Car in Ireland

Stay safe and scrappy out there!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

May 16, 2015

Is the Fidelity Amex the best cashback card in the universe?

Sorry for the hyperbole slash clickbait-y title. I thought I was being on trend.

But seriously, I love this card. I’m close to being obsessed with it:

Cut the Crap: The Fidelity Investment Rewards Credit Card is THE BEST cash back card!

The 10% Plan: Save 10 Percent of Everything You Make

One More New Credit Card: Fidelity Investment Rewards American Express

We all love our points and miles. But I’ve been reading about straight cashback cards for a sec now, and the poor Fidelity Amex always gets swept under the rug.

Well no longer. This card is a gem. It has so much going for it. And it might just be the ace in the back pocket of cashback cards, which by default makes it the best cashback card in the universe.

Let me extoll the ways

Here are a few things this card has going for it.

It’s an American Express card not issued by Amex

That’s pretty rich right there because you can use it to load up your Serve account. There are no cash advance fees and Serve reloads code as a purchase. Load up $1,000 a month and get a smooth $20 for free. After a year, that’s $240 for a few minutes of effort.

Now that REDbird is dead, take the free money!

The fact that it’s an Amex also makes it eligible for Sync offers, Small Business Saturday, and Amex purchase protection.

It’s a fascinating little card

An American Express card issued by a Bank of America subsidiary and linked up to Fidelity? What?! I’d love to know how this card was born.

I’m pretty sure that Bank of America will eventually manage this card. They have a few other Amex cards that they issue, so that’s not news. What is puzzling though is that Bank of America offers many of the same services that Fidelity does (brokerage accounts, IRAs, checking accounts). By having this card, they would essentially deflect business away from their own products, which is bizarre. I don’t claim to understand it, but I do find it fascinating.

It doesn’t have an annual fee

The Barclaycard Arrival Plus is $89 per year. It’s a fine card, has a portal whereas the Fidelity Amex no longer does, and the redemption is mad easy, which is great. But for me, not having an annual fee and being able to earn an easy $240 far outweighs the portal and the points redemption in 1 category.

I won’t even mention the Discover It cards, or the Citi Double Cash. There’s really no comparison as they are straight cashback cards whereas the Fidelity Amex has something far greater.

Rewards are tax-free and can grow tax-free… forever!

Really think about this. This really blows my mind. This is the ace in the hole right here.

You are earning free money that you never pay tax on when you contribute it to a Roth IRA, which you also never pay tax on. Roth IRAs are supposedly funded with post-tax money, meaning you’ve already paid the taxes to the government, and then you don’t pay taxes when you withdraw it.

But that’s the kicker. You never pay any sort of tax on the Fidelity Amex rewards. It’s free money, unfettered by taxes, and the rewards can be auto-swept into a Roth IRA, which will also grow tax-free for perpetuity (until you withdraw it).

That has got to be the single biggest and most valuable draw for this card.

Even if all you do is load up your Serve account, you’d have over $10,000 after 20 years @ 7% growth, which is really realistic actually.

Fidelity Amex hypothetical growth

$240 a year for 20 years is $4,800. But by investing it, you come out with nearly $11,000. That’s more than double the cash that can be withdrawn tax-free. Assuming these calculations all hold, this 2% cashback card suddenly comes a lot closer to being a 5% cashback card, which is awesome. The catch is that you have to wait 20 years. So you really have to think about Future You vs You Right Now, which is hard for some people to conceptualize.

But also consider that if you’re maxing out your Roth IRA this year, $240 for free and untaxed is a nice extra – especially if you’re funding it with mostly post-tax money.

And that’s only assuming $1,000 per month with Serve reloads. You can obviously spend more on the card and can add up to $5,500 this year to a Roth IRA.

It happens automatically

This cannot be overstated. Your rewards, once you reach 5,000 points, are auto-swept into your Roth IRA (or checking or brokerage) account. You set it up once and it just… happens. No effort on your part. You can, of course, change it at any time. But if you set it up once and forget it, it happens for you without any extra steps required. Automation is powerful.

It has a signup bonus right now

Yep, a $50 signup bonus.

It’s not huge or anything, only $50, but that’s $50 more than you usually get for opening this card.

Also, the minimum spending requirement is only $500 and you have 60 days to do it. You could knock that out with 3 days of Serve reloads and then pocket that cashback, too.

It will age your credit reports

Since it’s a no annual fee card, you can feel good about holding on to this one forever. The longer you have it, the more it will help to age your accounts and improve your credit score.

I’d recommend using this with Serve while the getting is good, but even when that goes away, you can still hold this card and it’ll help you even if you never use it again.

It has promos… sometimes

FIA, the issuer of this card, is so cute. They try to have promos and spend bonuses sometimes. They’re usually nothing to write home about, so it’s cute in the little-engine-that-could kind of way.

But who knows, one day they might run a really awesome promo… and give you more free money to invest tax-free.

The cons

Gasp! There are cons?! Well, yeah. But they’re not terrible, actually. Here’s what I’ll say. FIA makes it hard to MS. They flag everything as fraud. In the Vanilla Reload days, I got it to the point where I could go to CVS without fear of them flagging it, but it took many calls and a little time.

Also, it has a foreign transaction fee. It’s only 1% and earns 2% cashback on everything, so you get 1% back when you use it internationally. But it’s not a good prospect. There are better cards to travel with. But still, 1% is better than using a debit card.

The cashback thing might not last forever. At present, it’s been extended until early 2016 and then? Who knows. It’ll most likely be renewed, but there are no guarantees.

Still, I feel like FIA will want to maintain this product. And I’d also like to be grandfathered in if they ever change the core offering of the card in any way.

Bottom line

Ah, the FIA Fidelity Amex. I love this card.

When I’m not using points and miles credit cards, or the Barclaycard Arrival, meeting a minimum spend, or taking part in a promo, sure… I’ll throw a little spend on this card to earn some free money that will grow tax-free and eventually be withdrawn tax-free after taking advantage of sweet, sweet compound interest for 30 (or so) years.

And that reason alone is why this is the best cashback card in the universe.

So what do you guys think? Is this card awesome or am I drinking the Kool Aid? Does anyone else like this card as much as I do?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

Enroll in Citi’s 60-Day Return Guarantee Program

I was trolling around on the Citi website today and decided to look through my Citi AAdvantage Platinum Select Amex benefits. Lots of good things in there. I like this card because it’s an American Express card not issued by Amex and is no longer open for enrollment. I can use it for Amex Sync offers, Small Business Saturday, and possibly to load up my Serve account (haven’t gotten that far yet).

As I got to the “Shopping benefits” section, I noticed there was one for which I had to manually enroll in on the website.

The 60-Day Return Guarantee program

There it was, hanging out there in the corner like a creep.

Citi 60-Day Return Guarantee program

Enrollment screen – good for a year

I clicked on it, and there was a little button that said “Enroll.” If I enrolled, it would be good for a year.

So I did it. Why not. Then I was told about the benefits:

How to use the Citi 60-Day Return Guarantee

The benefit is good for $250 per claim and up to $1,000 annually. Things returned must be new and unopened. Fair enough. Really not so shabby at all. But then I thought…

WHERE DO I SEND THE STUFF?

Apparently to their office in Ohio lol. But whatever. Then I was like… uhhhh… do I pay for the shipping (I think so)?

And then I started to think if I’d ever wanted to return something after a merchant’s return period had run out. Or what if I bought something while traveling and can’t get it back to the shop? Or what if the store doesn’t allow returns?

It hasn’t happened a lot, but here and there… yeah, definitely. Maybe once or twice a year. As long as I put the entire amount of the purchase on this card, I could return it and get the money back. Nice.

This is old news

So I thought I’d stumbled upon something new and exciting but nope. This thing’s been around since 2012. Practically Stone Age for the points and miles crowd.

I wanted to mention it here because I’d never heard of it in all my excavations about terms and conditions. Maybe it’s been around so long that it’s not mentioned any more? In any regard, it lives!

Discover, Chase Sapphire Preferred, and Chase Freedom all have similar programs. And the one for the Chase Sapphire Preferred, anyway, is up to $500 per item and you have 90 days to return it. A month more and double the protection that Citi offers.

Chase Sapphire Preferred return protection

However, I couldn’t find much online on the Chase website, so kudos to Citi for making it so easy to find and understand.

Also, apparently, you have to enroll manually for this benefit with Citi – it is not an automatic feature of Citi credit cards. So I wanted to toss it out there in case it might help someone and they’d like to enroll.

Bottom line

Citi has a program that I didn’t know about before today called the 60-Day Return Guarantee.

They’ve kinda hidden under the “Card Benefits” section of the their website, near the bottom. You have to find it and manually enroll to receive the benefit for 1 year for free.

Has anyone else, um, heard of this? Has anyone ever actually used this perk – or something similar offered by another credit card? How was your experience?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com

May 15, 2015

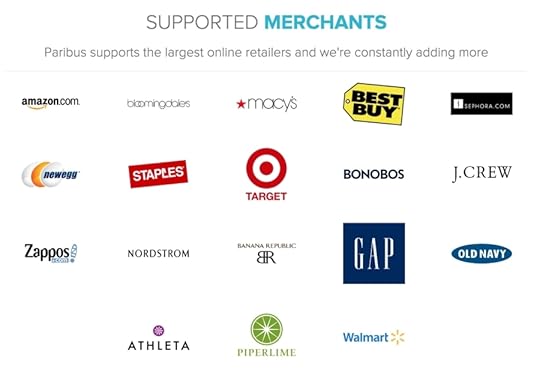

Use Paribus to Get Money Back If There’s a Price Change

I forget where I saw the link. I think I clicked through something from Twitter and fell into the rabbit hole of the internet. But it ended up being a good thing, because I found this new service called Paribus.

What it is and how it works

How Paribus works

Paribus is a service that monitors price changes for you at 18 (so far) popular merchants. If there’s a price drop, Paribus submits a price adjustment claim on your behalf. And the merchants included are some good ones:

Amazon.com

Athleta

Banana Republic

Best Buy

Bloomingdale’s

Bonobos

Gap

J.Crew

Macy’s

Newegg.com

Nordstrom

Old Navy

Piperlime

Sephora

Staples

Target

Walmart

Zappos.com

All the Paribus merchants

To get started, you can sign up for free. You connect the email account where you get your receipts, and link your Amazon account. It scours your inbox for receipts and keeps a log of your purchases.

All my Amazon purchases

If there’s a price change on anything you bought, they automatically ask for an adjustment for you. If they’re successful, they keep 25% of the cash, and send the rest back to you. You link a credit or debit card to your account and they’ll issue the refund in the form of a statement credit (they use Stripe as a payment processor).

Even though they charge you a quarter of the loot, the fact that it happens automagically means easy – and maybe unexpected – money coming your way.

The fact that it’s free to sign up makes it a no-brainer. And I must say I’m impressed with the merchants they are starting with. Obviously, Amazon.com is a huge one. But I do shop at a couple others on the list from time to time.

I could see this being super useful around the holidays when so many prices are being slashed left and right for Black Friday shoppers.

Keep in mind that Paribus still has to follow the price adjustment rules of each individual merchant.

The CamelCamelCamel angle

CamelCamelCamel is a website that tracks items for sale on Amazon.com. They keep records of historically low prices for everything. So you plug in the item you have your eye on and it tells whether or not the price might drop based on previous trends.

If you buy your things from Amazon while they’re at their lowest, you won’t have to even utilize Paribus. You’d simply save the money upfront, which is always good too. But even if the price of something you bought drops even more, Paribus would be there to get a price adjustment for you.

I can see these 2 services being super useful for savvy web online shoppers when used in conjunction with one another.

Bottom line

Thought I’d share what I learned about Paribus. It’s free and easy to sign up, so you really have nothing to lose.

Does anyone else already use Paribus or CamelCamelCamel to track prices and shop? Would love to hear thoughts about either service as I am still new to both. And of course any others that are super handy slash in the same vein as these. Let me know in the comments below!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com