Yes! Instantly Approved for Citi Prestige!

Also see:

Swapping AMEX for Citi: Bye Platinum, Hello Prestige? And Bye, EveryDay Preferred, Hello ThankYou Premier?

Citi Prestige: No Luck Getting a $350 Annual Fee In-Branch, and Why to Apply ASAP

I just had 3 rum and cokes and bit the bullet.

I’m now the proud owner of a Citi Prestige card.

I was worried about not being instantly approved online because I’ve heard that lots of folks with perfectly good credit have had their applications “denied,” then approved after a few days of waiting, which sounds stress-y.

So, a bit drunkenly but full of courage, I approached the Citi Prestige application.

My experience applying for Citi Prestige

Link: Get a Travel Rewards Card

Is there any screen that gets your heart racing more? Geez!

I decided to just do it, unsure of what to expect.

And then…

Yay!

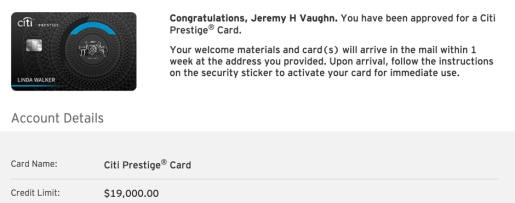

The approval screen popped up. Instantly approved with a $19K limit! I’m beyond excited!

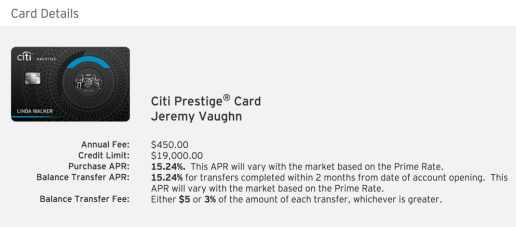

I clicked through a few more screens, and confirmed the annual fee of $450. Which I’m OK with considering it’s not possible to lock in the $350 annual fee any more.

That’s fine, man. I’ll get so much more out of it

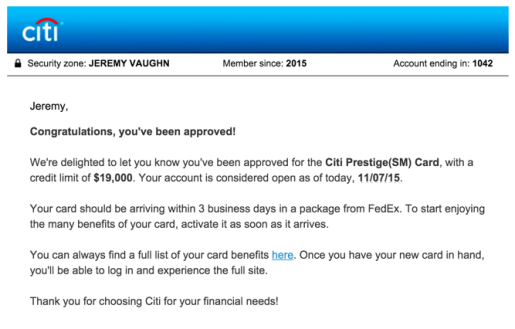

A few minutes later, I got an email confirming the info and telling me to look out for a FedEx shipment within 3 days.

Already planning another trip!

I’m honestly so excited. I’ll use the $250 airline credit right away because it’ll reset next month. Then I’ll get another $250 to use, for a total of $500. That already more than covers the $450 annual fee.

And, I’ll use the 4th night free perk like a mofo.

This card also comes with Admirals Club and Priority Pass lounge access with together are worth $900, and free Global Entry or TSA PreCheck (but go for Global Entry because it includes PreCheck!).

Now that I’ve taken the plunge, I’m already seeing the possibilities with this card.

The 50,000 Citi ThankYou point sign-up bonus is worth at least $800 on American Airlines flights alone! That’s because each Citi ThankYou point is worth 1.6 cents each when you redeem for American Airlines flights – even codeshare flights!

This’ll be a great chance to explore Singapore Airlines’ KrisFlyer and maybe FlyingBlue promo awards.

And overall, I’m excited about learning about a new program and maximizing the perks. Bring it on!

Bye, AMEX Plat!

C yaaa

Now that this deal is done, it’s time to say goodbye to the AMEX Platinum Card.

I can’t have 2 cards with a $450 annual fee, and at this point Citi Prestige is worth more and will get me more benefits than the AMEX Platinum Card.

I’m also going to go ahead and downgrade my EveryDay Preferred to an regular no annual fee EveryDay card to keep my points alive and transferable. So, pretty much, goodbye AMEX. It’s been real (and actually not that great if I’m being honest).

What it all means

Citi is making huge strides recently, and it’s time I took notice.

AMEX, to me, is a floundering brand that isn’t trying any more. That leaves Chase and Citi as the heavy hitters in the credit card points space.

It’ll be interesting to watch them compete (because when banks compete, you win!).

I’ll lose 4.5X AMEX Membership Rewards points at grocery stores, but meh, I buy most things from Costco anyway. And they’re switching to Visa in March 2016. So the AMEX thing wouldn’t last anyway.

Interesting developments are happening, and I’m excited to start using Citi Prestige, its ThankYou points system, and the many perks it has.

Bottom line

Whatever glitch was causing peeps to get kicked out of Citi Prestige applications seems to be fixed. I was instantly approved with a pretty high limit instantly online.

Because you probably shouldn’t hold out for a reduced annual fee, 50,000 Citi ThankYou points online might be as good as it’s going to get for the time being.

Which is fine because you can recoup $500 in airline credits nearly right away.

I was nervous about applying, but I shouldn’t have been. And now I’m looking forward to getting rid of/downgrading my AMEX cards and moving into a Chase/Citi combo for the bulk of my spending (with a little Fidelity AMEX and Discover It thrown in for good measure).

If you decide to sign-up for this card, thank you thank you for clicking through my links!

Would love to hear opinions about Citi Prestige – does it hold the same allure to you as it did (does) for me?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!