Citi Prestige: No Luck Getting a $350 Annual Fee In-Branch, and Why to Apply ASAP

Also see:

Swapping AMEX for Citi: Bye Platinum, Hello Prestige? And Bye, EveryDay Preferred, Hello ThankYou Premier?

Complete the Hyatt Diamond Challenge in 9 Nights With the Citi Prestige Card

Citi Offers to Compete With AMEX Offers “Soon”

Wanted to share my experience about trying to get a reduced annual fee on the Citi Prestige card.

Like lots of peeps, I’ve been kinda/sorta intrigued by this card for a while now. Today, I woke up and decided I’d go apply in-branch. Because I’ve heard some folks have had luck getting a $350 annual fee as opposed to a $450 annual fee, which is obviously awesome and preferable.

So I strapped on my little booties and walked down to the branch on 86th St in Bay Ridge, Brooklyn.

I waited to speak with a banker and started it off with, “How much is the annual fee on the Citi Prestige card?”

The convo

He printed out some info about the card from Citi’s intranet, which I of course immediately scanned into my phone.

Here’s the doc:

$350 annual fee!

NO language about needing a Citigold account!

It said the annual fee was only $350, but had a superscript to refer to the fine print.

But I didn’t find anything that would disqualify me.

It said,

“As of October 1, 2015… the annual fee is $350.” NO language about needing a Citigold account, and nothing that I could see was off. Plus, I thought, I have this document in case I get charged $450, because it’s pretty much guaranteeing I can get the card for $350.

Sign-up bonus of 50,000 Citi ThankYou points after spending $3,000 within the first 3 months of opening the account (which is worth $800 toward American Airlines flights – 1.6 cents per points x 50,000 = $800).

Fine. Sign me up!

The womp-womp

I was getting excited to get the card! I asked the banker to please double-check the annual fee on the actual application.

He assured me he was still seeing $350.

Very cool.

I started to fill out the authorization form when he said, “Hmmm. Never seen that before.” A box had popped up saying something to the effect of, “Enforce the $450 annual fee unless the client has a Citigold checking account.”

I asked if he’d seen that message before, and he said he hadn’t. So I don’t know if this is a new thing or what.

Then I asked if there was any way to get this card with a $350 annual fee aside from the Citigold option.

He said, no, there wasn’t. So I took the papers and told him I’d think about it.

The Citigold option

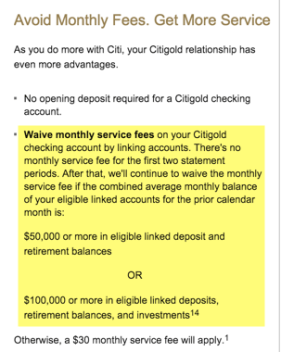

Link: Citigold checking account fees

I don’t want a Citigold checking account. You guys know I’m super into no-fee checking accounts like the Fidelity Cash Management account and Aspiration Summit checking.

It’s just so ouch

You can get Citigold checking for free if you have $50,000 in the account, or $100,000 in a linked deposit, retirement, or investment account.

While I’d love to have that much in a checking account, it’s just not gonna happen. And I don’t want to switch my retirement/investment accounts to Citi just to save $100. That’s an incredible hassle, plus, I don’t even have that much to throw around.

If you don’t meet those conditions, the Citigold checking account is $30 a month, or $360 a year. It’s not economical to pay $360 to save $100.

You also get a 15% bonus on the Citi ThankYou points you earn from the Citi Prestige card when you have a Citigold checking account (I’m assuming the sign-up bonus doesn’t count).

Even if you earn 100,000 Citi ThankYou points in a year, that’s an extra 15,000 Citi ThankYou points. At 1.6 cents each toward American Airlines flights, that 15,000 points is worth $240.

Which still doesn’t cover the cost of having a Citigold checking account.

So, I tried, but I think I’m gonna cut my losses and go with the $450 option.

After all, it’s still the same annual fee as the AMEX Platinum Card, and you’ll get waaaay more out of it than $450 anyway.

The perks

An Admirals Club membership usually costs $500 a year (less if you have American Airlines status).

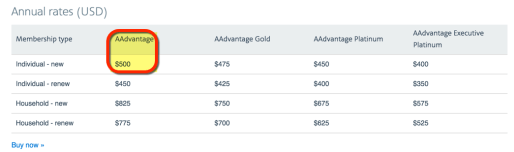

$500 for new members

And a Priority Pass membership runs $400.

Citi’s version is actually better

But with Citi Prestige, you don’t have to pay the guest visit fee of $27 for up to 2 guests or your immediate family. So it’s actually better than what you’d buy directly from Priority Pass.

You also get 3 rounds of golf each year via Golfswitch. Note that this benefit is only for you, not for the people you play with (unless they have the Citi Prestige card, too).

And you get the 4th night free on hotel stays when you book through Citi Concierge. Any hotel you can find on Carlson Wagonlit, their travel agent, is book-able with the 4th night free.

It includes all-inclusive resorts and nearly all hotel chains. And, your elite status is recognized and you still earn elite stay credits and points. I plan on using the hell out of this benefit. Assuming you use it once or twice a year, you can recoup the annual fee easily.

My favorite perk that’s giving me panic

But my fave perk of all is the $250 annual airline credit.

You can use it on any airline each year.

But not calendar year. Or cardmember year.

No, Citi is much more specific about when this resets.

This statement credit is an annual benefit available for purchases appearing on your billing statements from December through the following December. Pending transactions that do not post in your December billing cycle will count towards the next year’s Air Travel Credit.

So what does this mean?

If you sign up, like now, your statement will run mid-November through mid-December, but it should be considered the “November statement.”

And in mid-December, the perk will reset again, and you’ll have most of 2016 to use the credit again.

So you can get $250 on the November statement, and $250 again right after that (or in 2016), to effectively get $500 in airline credits. This alone will cover the annual fee.

But only do it if you want to buy a ticket as soon as you get the card in the mail.

Otherwise, wait until December or January to get the card.

Although if Citi releases Citi Offers for You any time soon, it’ll be a fun added perk to the card. I hope they come out with it before the busy holiday shopping season.

So now I’m all panicked about whether or not I want to buy a $250+ plane ticket if I were to apply now.

It might be a fun excuse for a trip.

$300 round-trip to the French Caribbean. Whoa.

Norwegian has a sick fare sale right now from the US to the French Caribbean. Fly there now through March 2016 for, oh, $300 round-trip. (I’m seriously considering this, btw. Might make a fun trip report.)

It’s a 5 hour flight from NYC, but for a $57 ticket (after the $250 airline credit), I think I could survive it.

Martinique in February… YAASSS!

Especially if I use the 4th night free perk to get a free night a hotel. That would pretty much put the card to work (and recoup the annual fee!) right away.

Or you could, I dunno, buy a ticket home for Xmas, or buy gift cards to use later.

Bottom line

I was excited to get Citi Prestige for $350 today, but it seems Citi has put the kibosh on that little workaround.

Even still, $450 for a card with a long list of perks and benefits isn’t bad. It’s easy to more than recover it if you travel even semi-regularly.

If you decide to pick up this card, thank you for clicking through my links (yes, the best public offer is available there).

I’m a bit perturbed by the annual airline fee credit, because it runs from the December statement to the following December statement, NOT on a calendar year or cardmember year cycle.

Considering it’s nearly mid-November, you should apply sooner rather than later if you want to get $250 credit twice in a row.

If you don’t want to take a trip, you can always buy $250 in gift cards and use them for later. Then you’ll have nearly all of 2016 to get the $250 credit again.

I might have too many drinks today and go ahead and snap this card up. And then call AMEX to cancel the Platinum Card and downgrade my EveryDay Preferred.

Remember Citi will only let you get 1 card a day, and you need to wait 8 days between applications. And you can’t get more than 2 cards in a 65-day span! (Weird rules, but worth knowing if you want the Citi Prestige/ThankYou Premier combo, or another Citi card.)

Has anyone had any luck locking in the lower $350 annual fee? And what do you think, apply now or wait till January?

You know which way I’m leaning!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!