Harry S. Dent Jr.'s Blog, page 73

September 29, 2017

What If It Just Doesn’t Matter What Trump Does With the Fed?

On paper, it seems like great changes are imminent at the Federal Reserve, ostensibly the center of the world’s most important economy.

On paper, it seems like great changes are imminent at the Federal Reserve, ostensibly the center of the world’s most important economy.

Not only is Fed Chair Janet Yellen’s term almost up, but there are currently four open Board of Governors positions which, to my knowledge, President Trump hasn’t begun to consider.

But the top spot at the Fed gets the most attention, understandably, and there’s enough unsolicited advice for Trump than you can shake a stick at.

The Economist, one of the most respected financial publications in the business, recently ran an op-ed with the title “Why Donald Trump should reappoint Janet Yellen.”

The Philadelphia Inquirer echoed the sentiment with “Three reasons why Trump must reappoint Janet Yellen.”

Back in July, CNNMoney ran an article titled “Behind Trump’s love-hate relationship with Janet Yellen” that detailed the president’s flip-flopping support for the Fed chair. And a recent report in Bloomberg had the president considering at least six different people for her position.

In my opinion, it’s likely that she’ll be re-appointed as chair because her policies have led to record-high prices in stocks – which Trump has, naturally, bragged about – and you generally don’t want to mess with something if you’re getting the desired results and headlines. It seems as if every day brings a new all-time high in some corner of the stock market, even as storm clouds gather.

It should be mentioned that Trump doesn’t have the best record in getting people appointed, especially when they need to be confirmed by Congress. Considering that our political climate includes Twitter-based nuclear brinksmanship and White House statements on professional athletes, there’s no telling if and when Trump will bring wholesale change to Fed or just ignore it completely.

Maybe Yellen will step down early, like Vice-Chair Stanley Fischer did last month, or maybe she’ll just decline a Trump re-appointment.

But, all things considered, it doesn’t really matter.

One the most important Fed undertakings in the short term is the unwinding of its $4 trillion balance sheet – yes, trillion.

That’s a pretty big number, and you wouldn’t be blamed for thinking that offloading such a sizeable asset load is fraught with danger.

Of course, until it starts happening, there’s no telling what the market reaction will be. But the unwinding of the balance sheet is already a planned event that’s been disseminated to the markets, and the markets have been two steps ahead of the Fed for years now. For all its talking points and meeting minutes and policy hints, the Fed doesn’t move the markets nearly as much as it thinks it does.

If it doesn’t really matter what Trump does with the Fed, and if the markets affect the central bank’s policies far more than the reverse, then I wouldn’t be surprised if you wrote off the Fed as one big snoozefest.

You’d be wrong, but not in the way you expect.

I’m the creator of a unique strategy centered on making money off the fluctuations in long-term interest rates.

Those fluctuations often look like a couple tenths of a percent – a rounding error if you’re not keyed in. But they represent enormous sums of capital; they effect entire sectors of the economy. And, most importantly, they frequently come bearing serious opportunities to make money.

I have a system that helps me track these movements, and I’d love to show you a few examples of it in action…

On January 12, 2017, I saw that yields had steadily fallen over the last few weeks and had triggered an alert in my short-term system. This was an opportunity to make money on the quick snap-back higher in yields. This was a classic example of a short-term opportunity…

And, like clockwork, that snap-back happened just a week later…

My readers had the chance to book a 90% gain…

In the middle of June 2017, the Fed finally pulled the trigger on another rate hike. No big deal; the markets were well ahead of the move and had already priced it in. You’d think there wouldn’t be much money to be made on such an unsurprising move.

Well, you’d be wrong!

Investors were getting worried about the bubbly equity market and pushed long-term Treasury yields to new 2017 lows.

When rates snapped back, you would’ve had a shot at a 72% gain in eight days.

In early July, long-term Treasury bond yields had jumped sharply over a week. Interestingly, bonds and stocks were selling off, but this time it looked as though bonds had overreacted.

Why? Because my system triggered an alert…

Less than two weeks later, those long-term bonds came back to Earth, and that meant another quick win for my readers to the tune of 43%

See, a big part of the secret sauce here is volatility. Whenever there’s confusion over jobs reports, or another round of nuclear hot potato on Twitter, or a cryptocurrency crashes and rebounds overnight, you often see a ripple in the Treasury market.

Again, those ripples may look tiny, but trust me, they aren’t.

They mean lucrative opportunities are in play for my readers.

It also means the question of “What if Trump fires Yellen?” doesn’t really matter. The bottom line is – and always has been – this: Investing is a game of uncertainty.

I’m fine not knowing – and not caring – what Trump does with the Fed. The “What if” doesn’t bother me because I like my plan, and I like my system. I know I’ll be fine no matter what happens at the central bank.

But it’s not the only way to approach the market.

In fact, I’m putting together a special event where I’ll explain an approach that will you not just preserve but also grow your portfolio amid volatile markets that result from such “What If…” scenarios.

Click here for more “What If” scenarios and add our special event to your calendar.

I’ll reveal more about my strategy… and how I believe it could very well be the answer to ALL of the “what if?” questions we’ve been asking here in the last few days, on Wednesday.

Stay tuned…

Good investing,

Lance Gaitan

Editor, Treasury Profits Accelerator

The post What If It Just Doesn’t Matter What Trump Does With the Fed? appeared first on Economy and Markets.

September 28, 2017

What if Bitcoin is Fool’s Gold?

How many currencies do you carry in your wallet?

How many currencies do you carry in your wallet?

OK, I’m showing my age. I actually have a wallet. And I carry it. Mostly.

Inside, you’ll find a couple of credit cards, an odd receipt or two, and greenbacks. I live in the U.S., so I use dollars.

But I also carry my smartphone, and I use Apple Pay wherever possible. I’m not geeking out, I just try to rack up points on my cashback credit card, and tapping my smartphone is a lot easier than dragging out my credit card and dealing with finicky swipe readers.

I don’t carry euros or pounds, except for when I travel to countries where those are the main currencies. But for the past five or six years I could’ve carried bitcoin, a cryptocurrency, and actually used it to buy stuff.

There have been, and still are, other digital and alternative currencies besides bitcoin, but it seems to be the most prevalent of the bunch. Still, I don’t have any of it. I don’t see the point.

In its current form, the currency becomes the asset, and that can’t last.

When bitcoin came out during the financial crisis, most everyone I know hated the government. We hated officials because they didn’t regulate the fraudulent bankers before the meltdown occurred, and because they used our tax dollars to bail the criminals out of their financial mess.

The final insult was that none of them went to jail, and we were stuck with extraordinarily low interest rates for a decade to ensure that the banks would survive. (Now I’m getting mad all over again. Better get back to bitcoin.)

The cryptocurrency offered an attractive alternative. Use a digital currency controlled and issued by no one that allowed anyone on the planet to examine all exchanges, eliminating fraud.

In addition, the currency would be available anywhere a consumer could connect to the internet, as well as on physical memory devices if desired.

And only a set number of the units would be produced… ever. No more games with monetary policy. No more bad banking decisions. Just simple, straightforward currency.

It sounds so good! And it is, but some of its main features turn out to be unfixable bugs. The limited supply and fluctuating price kill the deal.

Because there are so few bitcoin available – and anticipated, with a cap of 21 million units to be issued – the mere fact that more people use the currency makes it less affordable.

The more we buy it, the higher the price. Arguably the value of goods and services remain stable, so this means current holders of bitcoin experience a gain in purchasing power. This motivates people to simply hold the currency, not use it as was intended.

Beyond simply units of exchange, currencies are supposed to function as storehouses of value. That means they remain stable when compared to a basket of goods over time, understanding that individual goods, like oil and wheat, can fluctuate dramatically based on factors such as weather and geopolitics.

If the currency itself becomes the asset, consumers will simply hoard the currency. If they don’t use it for transactions, that limits our investment in other, more productive areas.

Today, people are more interested in holding bitcoin for appreciation than using it to replace their home currency.

If there were any way to assure that bitcoin would continue its upward trajectory, everyone would be a bitcoin investor, not a bitcoin user.

But, as we do this, we’re robbing the traditional economy of investment, no longer buying bonds that support cities, or stocks that drive the private sector, or even holding funds in bank accounts that will serve as the basis for a loan for the next borrower.

And there’s the flip side.

As we free ourselves of dollars – or yen, euro, or whatever – those currencies will diminish in value, cutting into the purchasing power of everyone left holding the relics, and also eating away at the value of earned income (assuming it’s still paid in national currency).

Suddenly the world becomes separated into the digital haves and the digital have-nots.

This game continues until people like me have bought all they want… and then something really bad happens. Without continued demand, the price drops.

Suddenly this currency-turned-asset becomes a liability.

And, suddenly, we have a big “What if?” scenario on our hands, the type that my colleague Lance plans to talk about next week. (Click here to put his special presentation on your calendar.)

By then, I, along with everyone else, must decide whether to hold or sell. Many people will sell, causing a panic stampede out of the cryptocurrency, killing its value as an asset.

Then what would it be? A great idea of how to manage a currency that no one will touch because they can’t afford the volatility.

The problem with currency is that unless it grows in conjunction with an economy, it becomes a force for either inflation or deflation.

If we print a lot of it like, say, most central banks on the planet, we create inflation. Everyone understands that today. But if we don’t print enough, money becomes more dear, driving down prices, and money becomes the asset.

This can be just as devastating as inflation… just ask anyone who lived through the Great Depression.

The ideas behind bitcoin are laudable, but it’s not the answer to our currency woes.

Rodney

The post What if Bitcoin is Fool’s Gold? appeared first on Economy and Markets.

September 27, 2017

What If Oil Spikes to $150… Again?

Investors are a worrying bunch.

Investors are a worrying bunch.

We often lie awake at night with negative thoughts – wondering, “What if… sh*t hits the fan?”

Positive musings are fewer and farther between. When was the last time you sat up wondering, at 2am, “What if… a golden opportunity falls into my lap?”

All the successful investors I know somehow strike a healthy balance between fear and opportunity. Our goal is to keep one eye glued to potential landmines ahead… and one eye open wide to lucrative opportunities, potentially unfolding before us.

Either one, alone, isn’t enough.

As Rodney put it on Monday, “You should know what you’ll do with a lot of cash.”

If you don’t have cash in hand, ready for when that golden opportunity lands in your lap – or, if you can’t recognize a golden opportunity in the first place – you’ll never make the big bucks.

Making the task of finding low-risk, high-reward opportunities even more challenging is the fact that some present themselves at inopportune times – specifically, during times of crisis.

Case in point… when oil prices doubled, as the stock market was crashing.

2006 will be forever remembered as the year U.S. home prices peaked.

2007 as the year stocks peaked.

And 2008 as the year Bear Stearns and Lehman Brothers went bankrupt… and nearly every financial asset in the world puked its brains out.

Somehow, the extraordinary rise and fall of the global crude oil market – between 2006 and 2008 – played second (or fourth) fiddle to the housing crisis, the stock market collapse, and the evisceration of Wall Street and Main Street alike.

Few ordinary folks I know talk about the 2007-08 oil market today. Even fewer took advantage of it, as it was happening.

But get this…

Even though the S&P 500 peaked in October 2007, crude oil prices and energy-sector stocks didn’t peak until July 2008 – a full nine months later.

In fact, between July 2007 and July 2008, the energy sector was the only major U.S. sector still holding on to a positive return. Shares of the SPDR Energy Sector ETF (XLE) were up 14% in that time, while on the other end of the spectrum, the consumer discretionary sector had already lost 32%… and the financial sector down 48%!

No doubt, shifting into energy-sector investments as the market was topping in 2007 and 2008 was a great way to mitigate losses that were accruing in every other sector.

Even better, still, were bullish plays on the price of crude oil itself.

Between January 2007 and July 2008, shares of the most popular “oil ETF” on the market today – the United States Oil Fund LP (NYSE: USO) – climbed an unimaginable 180%!

Even catching half of that move, you could have doubled your money in about a year – all while the rest of the financial world was coming crash down around you!

Therein lies the problem, I suppose…

When markets are crashing, most investors just want to survive. There’s little bandwidth left to consider new investment opportunities when you’re gripped with fear and only worried about losing your shirt.

That’s why we’re encouraging you to make a plan, and commit to one of Dent Research’s proven systematic strategies, before things get hairy.

Making big money on bullish oil plays was the last thing on investors’ minds in 2007 and 2008.

But my data-driven (and therefore emotionless) Cycle 9 Alert algorithm objectively delivered a slew of profitable buy signals…

On an energy-sector ETF, between April and July 2007, for a 17% profit

On an oil exploration stock, between April and July 2007, for a 40% profit

On another driller’s stock, between June and September, for an 18% profit

On a foreign oil driller, between November 2007 and February 2008, for a 36% profit

On an oil and gas equipment supplier, between March and June 2008, for a 26% profit

And most lucrative of them all was a consecutive string of “buy” signals my algorithm triggered on the United States Oil Fund LP (USO) – between August and November 2007 (+41%)… between November 2007 and March 2008 (+5%)… and between March 2008 and late-June 2008 (+30%).

The first point is… there were a large number of extremely profitable opportunities in the energy sector in 2007 and 2007, despite the fact that the rest of the financial world was being brought to its knees.

The second point is… it required a good deal of opportunistic, forward-thinking, and a proven risk-management strategy, to capture those sector-specific profits.

And it’s likely to work just the same the next time stocks crash.

It may or may not be the energy sector that shines in the topping stage of this current bull market, as it did in 2007-08. Commodity prices and energy stocks are, indeed, notorious for peaking last – or at least very late – in a boom-to-bust cycle.

And right now, my systematic Cycle 9 Alert strategy is red-hot with “buy” signals all across the energy sector. In fact, I recommended a unique “double-barrel” energy trade just yesterday.

But it is, of course, still open to speculation whether or not stocks are in the process of topping out… whether oil will nearly double, as it did during the last top… whether U.S. Treasury bonds will rocket higher, as North Korea’s “rocket man” unsettles the world… or whether the markets will continue to hum along, in “goldilocks land,” leaving all this worrying and wondering for not.

The bottom line is – and always has been – this: Investing is a game of uncertainty.

The best you can do is consider a number of “What If…” scenarios… make a plan for what you’ll do if and/or when they occur… and, perhaps most importantly, commit to a systematic strategy that objectively moves you in and out of the market’s best opportunities at any given time… with as little emotion and fear as possible.

I like my plan, and I like my system. But it’s not the only way to approach the market.

Indeed, my friend and colleague Lance Gaitan is putting together a special event where he’ll explain another approach that will you not just preserve but also grow your portfolio amid volatile markets that result from such “What If…” scenarios.

Click here for details and to reserve your place for this special event.

Editor, Cycle 9 Alert

Follow me on Twitter @InvestWithAdam

The post What If Oil Spikes to $150… Again? appeared first on Economy and Markets.

September 26, 2017

What If It’s the 1990s All Over Again?

The 1990s were fun.

The 1990s were fun.

The internet was new, as was high-end coffee for most Americans.

You can say what you want about Starbucks, but do you even remember what pre-1990s canned Folgers tasted like? They wouldn’t serve that to prisoners on death row today. It would be inhumane!

The Cold War had just ended, gasoline was dirt cheap, and rock music was in the midst of its most creative decade since the 1960s.

The federal budget was balanced for the first (and last) time in decades. And, best of all, we had the turn of the millennium to look forward to.

So, yes, the 1990s were fun…

But the most fun of all was to be had in the stock market. It was the biggest stock bubble since the Roaring 1920s, and cheap online brokers made the market accessible to the masses. A lot of people got rich in the 1990s…

Let’s flash forward to today. After eight years of nearly uninterrupted bull market, it’s starting to feel a little like the late 1990s again.

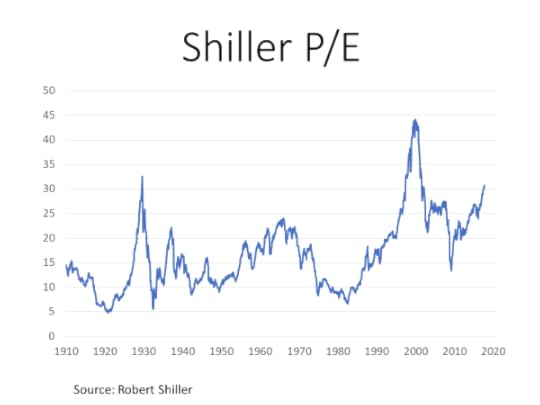

To show you what I mean, let’s take a look at the Cyclically-Adjusted Price/Earnings Ratio (CAPE), or the Shiller P/E, named after Yale professor and economist Robert Shiller. The CAPE compares current S&P 500 stock prices to a 10-year average of companies’ earnings.

Today, the S&P 500 sits at a CAPE of just over 30, putting it at the level of 1929… right before the Great Crash. The CAPE has only been more expensive one time in the entire history of the stock market: the 1990s tech bubble, when it topped out at 44.

To put that in perspective, today’s CAPE is 83% higher than the long-term average…

Of course, before the CAPE hit 44 at the end of 1999, it had to pass through 30. That happened in mid-1997. So, for nearly two and a half more years, the market went from being “crazy expensive” to “even crazier expensive.”

I written for over two years now (see “Flat Returns for the Next 8 Years?”) that stocks are not priced to deliver good returns over the next decade. In fact, if history is any guide, they’re priced to lose money.

But that doesn’t mean they can’t go higher first.

So, what if…

What if we have a repeat of the 1990s and stocks just keep getting more expensive for another couple of years?

Sure, it would be irrational. But it was irrational back in the ‘90s too, and yet it still happened. And it would be just like Mr. Market to do what no one expects him to.

So, again… what if?

Should we just throw all caution to the wind, and buy and hold on for dear life?

Well, you could do that, but I wouldn’t recommend it. After all, we all know how the 1990s bubble ended. The tech bubble burst, and in the ensuing bear market the S&P 500 lost more than half its value.

My recommendation is to ride the market higher but keep your stops relatively tight. That’s the approach I’m taking in both Boom & Bust and Peak Income, and it’s working.

As I write, four positions in the former are sitting on double-digit gains, including one with over a 70% profit. In the latter four of our 22 income-generating positions have gained more than 19%, with six others in double-digits.

I’m talking about total returns, which include dividends, rather than just price returns. Whether the market goes up, down, or sideways from here, getting paid a regular stream of dividend income can help smooth out your returns.

And, perhaps most importantly in these market conditions, try taking a more nimble approach to your trading.

Adopt a strategy that can make money whether the market goes up, down or sideways, and gives you an opportunity to profit from any sudden changes. That’s where my friend Lance comes into play.

He’s got a solution to my “What if?” scenario, whether I’m right and it’s the 1990s all over again, or even if I’m wrong. Click here to sign up for his special event next week where he’ll explain all the details.

Charles Sizemore

Editor, Peak Income

The post What If It’s the 1990s All Over Again? appeared first on Economy and Markets.

September 25, 2017

What If Rocket Man Provokes a War?

Kim Jong-Un, or “Rocket Man,” as our president prefers, always looks like he just ate a sour pickle – unless he’s inspecting a missile factory. Then he looks like an evil character in a B movie, gloating over his plot to rule the world.

Kim Jong-Un, or “Rocket Man,” as our president prefers, always looks like he just ate a sour pickle – unless he’s inspecting a missile factory. Then he looks like an evil character in a B movie, gloating over his plot to rule the world.

I wish he’d move on to the monologue phase, where he talks so long that the hero of the film has time to slip out of his restraints, rescue the girl, defuse the bomb, and put the crazy little man on ice before the authorities arrive.

But what’s going on between North Korea and the U.S. – the former repeatedly testing missiles and nuclear bombs and the latter not standing for it – is no work of fiction.

There’s no hero, and our chances of getting out of the situation without some sort of armed conflict are getting smaller by the day. It didn’t have to be this way.

North Korea used to be a nice place. OK, that might be overstating it. But it used to be a lot better.

Until the early 1980s, they had food, basic services, and a standard of living exceeding that of their South Korean brethren. Ronald Reagan took all that away. He didn’t do it through negotiation or force. Instead, he leaned on their benefactor.

After World War II, the Americans and Russians each controlled part of the Korean peninsula. They bickered over setting up a government for the entire country, but eventually settled for two governments, much like in Germany.

The Russians installed Kim Jong-Un’s grandfather, Kim Il-Sung, as the supreme leader of the North, while the Americans established a kind-of, sort-of democracy in the South.

The North invaded in the South, but, backed by the Americans, the South fought back and conquered much of the North… until the Chinese got involved. The Middle Kingdom helped push the South back, creating a nice buffer between itself and the American-backed forces.

Over the next 35 years, the U.S. guided South Korea on its path to becoming a manufacturing powerhouse, while the North simply took aid funds from any country that hated the U.S., essentially China and Russia.

But Reagan’s gambit to bankrupt the Russians ruined that system of patronage. Eventually the U.S.S.R. (does anyone even remember that acronym?) broke into pieces, and the central government told countries like North Korea and Cuba that they were on their own.

Meanwhile, China decided that selling stuff to Americans was a lot more fun that berating them in propaganda films while their population subsisted on what they could farm by hand.

At that point, then-North Korean dictator Kim Jong-Il needed to find a new way to generate cash. He counterfeited American dollars, sold illicit drugs, and basically ran a black market bazaar.

But that only goes so far.

Eventually, he pursued nuclear power and missiles, and used his progress to blackmail aid from the West.

That sort of made sense. He needed funds and apparently couldn’t run a business the size of McDonald’s, much less a country. So he stole and robbed. It doesn’t win you a Nobel Peace Prize, but it’s a living.

Unfortunately for the world, his son didn’t get the memo…

The recent iteration of Kim Jong has created better rockets and nuclear weapons. So far, he’s demanded that U.S. forces leave the peninsula and stated that North Korea intends to be a player on the nuclear weapon stage. His few allies keep backing away. They love the idea of poking the sleeping American dog, but this goes too far.

The more Jong-Un postures and provokes, the more anxious everyone becomes.

Will he rain fire on Guam? Target a city in Japan? Aim for some place in Alaska? Can we allow him to try, or should we act preemptively?

Either way – if he launches something at a populated area or we choose to disarm him before he causes great harm – it looks like there will be an armed conflict.

I can only hope, if anything, it involves remote outposts with few people. This will truly be a war of provocation, with no reasonable objectives, started by a crazy man. The question is, “Who gets involved?”

The South Koreans don’t want a war with their relatives, but they’re the most likely target. The Japanese can’t abide by a North Korea that shoots missiles over their heads.

The Chinese don’t want North Korea to implode, leading to a refugee crisis that ends with South Koreans and Americans on their border.

The best outcome appears to be a reunified Korea, with the express agreement that U.S. troops remain at or south of the current border, the 38th parallel. That’s easy to say, and hard to do.

Germany showed how difficult reunification can be, even if ultimately successful. But the really hard part is getting to that point. First, we need Kim Jong-Un and his group to go gently into that good night.

I don’t think they will, which gets us back to an armed conflict.

No matter how great or small, such an event would immediately weigh on the financial markets.

With the major U.S. indices at record highs, it seems likely that investors of all sizes would take the opportunity to lock in profits and park their cash in something safe.

This would mean a mass exodus from equities, with everyone trying to squeeze through the door of the U.S. Treasury markets.

The size of the move – in both equities and bonds – would depend on the shape of the conflict. If things look like they will be contained to conventional weapons, perhaps the financial swings aren’t as great. Defensive stocks and energy move higher, but growth names take a hit. I still believe interest rates would fall.

If there’s any hint of nuclear weapons, the move would most likely be severe and immediate. Investors will sell stocks with abandon, building up cash positions and buying U.S. government bonds. The idea will be to hunker down and see what happens.

The Japanese and South Korean equity markets will free fall, and chances are their currencies would also implode. If those countries suffered severe physical damage, the rebuilding process would require rapidly expanding the money supply. The Bank of Japan has done this for almost two decades, but the new pace would be off the charts.

With Seoul, South Korea, less than 35 miles from the North Korean border, chances are that city would be devastated, taking much of the value of South Korea with it.

As an investor, it’s hard to position yourself for such a thing. Do you buy a bunch of put options on equities and buy bonds before everyone else drives up prices? That’s a great strategy, unless the war doesn’t happen, or is so fast that markets barely react.

The better approach is to create a plan, mapping out what you will do if such a thing occurs. Make it one that limits losses, or, better yet, gives you a chance to make money in response to market-moving scenarios like this.

If you work with a financial professional, ask him or her what they will do, to make sure you agree. If you handle your own finances, create some guidelines.

Perhaps you already have stop-losses in place, much like we use in many of our services at Dent Research. If so, revisit them to verify they reflect your current views. And know what you will do with a lot of cash (which can be an awesome friend) if you suddenly sell many positions at once.

Bonds sound good on the face of it, but if rates fall dramatically, with the U.S. Treasury 10-year bond moving from 2.2% down to, say, 1.5% or lower, do you really want to own bonds?

At that rate, they don’t pay very much, and if a conflict brought rates down, then the end of a conflict should drive them higher.

It would be painful to sell equities and pile into bonds, only to get whipsawed.

The upshot is that there is no easy way to play the scenarios created by a crazy man who seems to have little regard for human life. Despite the heated rhetoric back and forth, history tells us that a diplomatic solution will carry the day.

But prudence tells us to plan for the low probability, high impact event. So spend some time considering your alternatives before things get out of hand.

Rodney

Follow me on Twitter @RJHSDent

The post What If Rocket Man Provokes a War? appeared first on Economy and Markets.

September 22, 2017

Spotting Real Estate Bubbles in the Top 15 Richest Cities

There’s an easy way to identify the cities with the big real estate bubbles. Just find out where the richest citizens live!

There’s an easy way to identify the cities with the big real estate bubbles. Just find out where the richest citizens live!

Back in late 2016, writer Peter Reegh put together a list of the 15 cities based on population of the wealthiest citizens, which was published on therichest.com. These same 15 cities remain at the top of this list today (only now more inflated than a year ago), allowing us to immediately know what areas to avoid.

And, once real estate prices have crashed, which I expect they will begin to do sooner rather than later, we’ll have a list of 15 places to find bargain properties!

Here they are, from the “poorest” of the rich to the richest…

15. Istanbul

Not everyone would have guessed this, but it’s the most classic and beautiful city on the strategic cusp of Europe and the Middle East. And, at last count, it’s home to 24 billionaires, which is more than what Tokyo or Seoul has.

14. Tokyo

Tokyo is the perfect example of what happens when a major bubble bursts. The richest people lose the most because they dominate the bubbly financial assets from real estate to stocks. Tokyo’s massive wealth decline shows the downside risk of these richest and most expensive cities.

At its height in 1989, Tokyo would have taken first or second place on this list. It’s only at #14 now, with just 18 billionaires calling it home.

13. Chicago

Chicago is the third-largest city in the U.S., and it’s the financial capital for the commodity markets and the Midwest, so it’s not surprising that it’s on this list.

12. Paris

Perhaps the most classic city in Europe, Paris has bubbly real estate prices to match. It is home to 22 billionaires, less than half that of London. But, then again, London is the financial capital of Europe!

11. Seoul

Seoul is more beautiful and sophisticated than I expected, and it’s home to 30 billionaires.

10. Mumbai

The leading-edge and largest city in India, Mumbai is the country’s financial hub and home to Bollywood. It has 30 billionaires, 60% as many as Beijing. Not bad for a country with less than half the average incomes of China.

It’s also the location of a 27-story, billion-dollar home right downtown.

9. Boston

Boston’s presence on this list is unsurprising. After all, it’s home to very strong finance and healthcare companies.

8. Washington, D.C.

Also, not a stunner, Washington, D.C., is the government center of the U.S., just like Beijing is to China.

7. Beijing

Beijing is the richest city in mainland China, with 50 billionaires. As expected, it’s one of the most overvalued cities in China after Hong Kong.

6. Moscow

This was a bit of a surprise, but it attests to how much wealth and power the 10,000 oligarchs in Russia (and Putin) have amassed.

5. Los Angeles

Compared to New York’s 1 million wealthy, Los Angeles only has 350,000 rich people. But its total wealth is estimated at $1.3 trillion, which is more than what San Francisco boasts. But, then again, San Francisco is more overvalued, as its overall ranking suggests.

4. London

London has the third-highest number of billionaires, 50 of them, and is a magnet for Middle Eastern and Russian investors.

3. San Francisco

There may not be as many billionaires in The City by the Bay as L.A. – just 23 – and it has only $1 trillion in wealth, but San Francisco is the second-bubbliest city in the U.S. compared to average or median incomes.

2. Hong Kong

The Jewel of the Orient has the second-greatest number of billionaires – 60 of them. And its real estate bubble is even greater than New York’s when compared to average or median incomes. It has the highest price-to-income ratios in the world today.

In Hong Kong the rich drive up the cost of living more than anywhere else for the everyday person. And, yes, it is now offering 61-square-foot “closet” condos to compensate.

1. New York

The Big Apple is home to 1 million wealthy citizens and 80 billionaires, dwarfing any other city. It has a total estimated wealth of $3.5 trillion.

The overvaluation in these top global cities is roughly in the order of this ranking. I have been warning rich people in these cities that these paragons of wealth will fall the hardest, and that would include Silicon Valley.

Yet almost all I talk to think that because these cities are so attractive and have such rich citizens, they can’t fall even a little…

History says the exact opposite.

During the Great Depression, Manhattan, then also the #1 “city,” fell the most of any and took the longest to recover by far.

My advice in these uber-cities: RENT, DON’T OWN!

Harry

Follow me on Twitter @harrydentjr

The post Spotting Real Estate Bubbles in the Top 15 Richest Cities appeared first on Economy and Markets.

September 21, 2017

Why It’s Time to Think Like a Roman

Years ago, when I was earning my master’s degree from the London School of Economics, I was known to skip out of lectures a little early on Fridays, throw on a backpack, and do some exploring on the weekends.

Years ago, when I was earning my master’s degree from the London School of Economics, I was known to skip out of lectures a little early on Fridays, throw on a backpack, and do some exploring on the weekends.

With just about anywhere in the U.K. or Europe accessible within a few hours, my decision on where to go was usually made by price. (I was, after all, on a grad student’s budget.)

Train tickets to northern England were cheap, so one September weekend I decided to hike along Hadrian’s Wall, the ancient boundary between Roman Britain and the barbarian north.

The wall stretches for 73 miles, mostly through sparsely inhabited farmland. It’s beautiful – in a harsh, rugged sort of way.

“Why here?” I asked myself as I hiked the Hadrian’s Wall Path.

There were other sites that could’ve worked as a defensive fortification. The island is thinner and a wall would be easier to defend further north in the Scottish lowlands. Or why not simply forget the wall, push northward, and conquer all of Scotland too?

No one really knows why the Romans built the wall exactly where they built it, but I have my own theories.

It came down to an analysis of risk versus reward.

Any military excursion puts lives and treasure at risk. But the added return of pushing into modern-day Scotland was minimal. (And the Scots wouldn’t invent golf or Scotch whiskey for another thousand years.)

Financing a war where the only spoils would be sheep and a craggy, windswept land inhabited by barbarians made little sense. The Romans were far better off drawing lines and consolidating what they already had.

That’s basically how I feel about the high-yield corners of the stock market right now.

It’s not that I think a crash is necessarily imminent; if I did, I’d recommend to my Peak Income readers that we lighten up on our existing income-producing positions, and I am distinctly not doing that…

This is more a feeling that, at current prices, the potential upside of adding new positions might not be worth the potential downside, particularly now that we’re in one of the market’s most dangerous seasonal periods.

Major corrections can come at any time of year, of course, but they tend to happen around September and October.

And, furthermore, we now have 22 open positions in the portfolio, many of which are recent additions. Before I added anything new this month, I thought it reasonable, and smart, to let what we have season a little.

So, in this month’s issue – in a more detailed and comprehensive way than I ever have before – I go through our existing portfolio recommendation by recommendation, to review why we own what we own and what our game plan should be going forward.

If you aren’t already a subscriber, it’s a perfect time to try Peak Income. If you missed it, I give “buy” or “hold” signals for all 22 positions in our model portfolio, and I re-recommend one of my earliest picks, laying out all the reasons for all the moves.

What I also really tried to drive home in the September issue is why bond yields are extremely important to what we do. All income-focused securities tend to react similarly to market conditions, which makes sense. They’re subject to the same buying and selling pressures from investors.

Lower bond yields mean higher bond prices… and higher prices for anything tied to bonds. A lot of our success so far in Peak Income – we currently have three positions with greater than 20% gains, seven others in double-digits, and only one showing a loss – has come from being willing to buy what I call “private income funds” at times when other investors panicked about falling bond prices.

Their overreaction was our opportunity.

Today bond yields are higher than they were two weeks ago, but the trend throughout 2017 has been one of falling yields.

I’m always looking out for catalysts that might cause yields to spike. And, at the moment, our biggest risk, oddly enough, is a functional government.

One of the reasons bond yields have slumped is that Mr. Market is losing faith that the pro-growth Trump agenda, including tax cuts, will pass. Slower growth means lower inflation, which, in turn, means lower bond yields and higher bond prices.

So a do-nothing government actually works in our favor.

I’m not going to suggest we sell everything and run for hills if Congress and President Trump suddenly discover how to work together. But I’d definitely be on high alert for a yield spike and would likely keep our stop-losses even tighter than usual.

That, too, is risk versus reward thinking, and it’s why I sometimes need to remind myself to do as the Romans did.

Charles Sizemore

Editor, Peak Income

The post Why It’s Time to Think Like a Roman appeared first on Economy and Markets.

September 20, 2017

A Sneak Peek at How to Grab Triple-Digit Gains

Our Irrational Economic Summit is coming soon, and there’s an incredible slate of speakers scheduled. Somehow I made my way onto the list, and it’ll be an opportunity for me to discuss my general views on the markets as well as some specific companies that are primed for serious gains.

Our Irrational Economic Summit is coming soon, and there’s an incredible slate of speakers scheduled. Somehow I made my way onto the list, and it’ll be an opportunity for me to discuss my general views on the markets as well as some specific companies that are primed for serious gains.

I’ll take some time to discuss one of my favorite issues of Hidden Profits from 2017, but I can give you a sneak peek – a tantalizing morsel, if you will – now.

Imagine walking down the snack aisle at your neighborhood convenience store. You’re not hunting for anything in particular, but your sweet tooth is howling. Something feels off, but you can’t put your finger on it. All the usual suspects are there — the candy bars, the bags of chips, the sour stuff your kids love so much — but something’s missing. You finally make your choice and head back home, dogged by a curious emptiness.

What I just described isn’t the setup for some sort of silly, psychological thriller. It happened to millions of people not that long ago. The number-one snack in America disappeared from store shelves for several months in 2013, and subsequently every media outlet, from newspapers to TV to online, lamented its absence.

Americans cared more about its missing sweet-baked good, it seemed, than anything else. It didn’t matter if you hadn’t had one of these snacks in years — the absence of a consumer choice struck a nerve in the American psyche.

Now that’s a brand.

But this brand was in dire need of a turnaround, and the kind of people that can execute such a move are few and far between.

But there is a tiny, elite class of executive with that rarest set of skills, who know the questions to ask, the decisions to make, and the buttons to push. These guys and gals don’t spend their lives with one company or even a few great ones. Rather, they favor the underdog, the down-but-not-yet-out business that, with the right touch, can become great — or great again.

This iconic brand landed someone who has the best track record in the consumer acquisition space. He’s a self-made billionaire with unparalleled experience turning around familiar yet ailing consumer brands. He grows revenues, cuts costs, and turns the whole machine into an efficient, smooth operator.

He’s not a one-hit wonder, either. In fact, he’s made more than 80 private equity investments over 30 years. His last 12 deals are reported to have delivered an average internal rate of return of 60% — that’s 60% per year!

When you hear me talk about “hidden profits,” this is the sort of thing I mean. The brand itself may be far from hidden, but this sort of inside-baseball move can be the key that unlocks profits and dividends for years to come.

This is what you’ll hear me talk about at the Irrational Economic Summit next month.

Profit During Earnings Season

In addition to discussing a stock that I think has 500% upside (or more!), I’ll also be conducting a seminar on strategies to profit from this upcoming earnings season.

The beauty of this strategy is that it doesn’t matter if we are in a bull or bear market. What matters is identifying companies that are about to see their stock prices explode or implode based on their earnings reports.

For nearly eight years I’ve been using a proven model to help identify companies that have solid or poor earnings quality. While I mostly focus on shorting stocks, the model is equally useful in identifying companies to own. In real time, the highest-scoring companies have returned more than 27% annually.

What am I looking for?

When it comes to companies to buy, I’m looking for solid cash flow, good revenue recognition policies, friendly shareholder yield, and relatively low expectations.

Stocks to sell – or short – carry the opposite characteristics. I’m also looking for stocks already trading poorly that institutions are starting to sell. That means high volume on down days and stocks trading near or below their 200-day moving averages.

I recently added another tool to our strategy: stock options. After a review of my short positions over this record-breaking bull market, I noticed that much of the profits on the shorts were from earnings-related announcements. Much of the losses were due to the bull market.

Stocks don’t tend to rise 50% on an earnings report. But they can certainly rise 50% between earnings reports as the market continues to march higher.

There are plenty of opportunities where stocks fall 10% to 15% on earnings releases. We’ve had plenty of positions this year that have done so. By using options, we narrow the timeframe and also provide the opportunity to juice the returns when we make the right call.

And, recently, my Earnings Insider Alert readers have seen two opportunities to triple their money!

I’ll walk through these trades every step of the way and, hopefully, leave you with a few extra bucks in your pocket when earnings season gets under way in October.

See you in Nashville!

John Del Vecchio

Editor, Hidden Profits

P.S. We’re just a few weeks away from the Irrational Economic Summit in Nashville. If you haven’t already, get your ticket now to catch me, Harry, and the rest of the Dent Research team in person – plus a great guest speaker lineup, too.

The post A Sneak Peek at How to Grab Triple-Digit Gains appeared first on Economy and Markets.

September 19, 2017

How We All Made More Money and Didn’t Even Know It

Thank goodness!

Thank goodness!

After 17 long years, the median U.S. household income has finally broke above the previous record set in 1999. According to a Census Bureau report released last week, median income increased 3.2% in 2016, to $59,039 after inflation.

That eclipsed the last record of $58,665 set at the end of the 20th century.

Every news source that carried the story seemed to lead with the assertion that we’re finally on our way in terms of rising incomes, and have recovered from the Great Recession.

Well, every source except one – the Census Bureau.

That bastion of statistics, which compiles the very data in question, published the record-setting number with a caveat: don’t compare it to prior years. Hmm.

It turns out that the income numbers have a Barry Bonds (of baseball fame, or infamy) quality about them. The new numbers are indeed the highest on record, but they’ve been juiced.

The former San Francisco Giants outfielder allegedly took body-enhancing steroids to propel himself to the top of the home-run record books.

The statisticians at the Census Bureau just cooked the books. But at least they told us about it.

In 2011 the Urban Institute estimated that the Census Bureau pencil-pushers missed 90% of income from retirement accounts in their calculations.

Reasonably, Americans don’t consider withdrawals from their personal IRAs as income. We generally consider it a reduction of principal because it reduces our account balance. The thinking makes sense to me, but the Urban Institute didn’t ask for my opinion.

In response, the Census Bureau employed a bunch of consultants to help them find those missing dollars. They decided on a two-pronged approach: 1) Ask people what they’ve got in assets, and 2) estimate income if they don’t give you an answer.

If you have a retirement account but don’t remember how much you withdrew, er, received in income, don’t worry. They’ll help you guesstimate. The same goes for interest on things like checking accounts.

I have a couple of small bank accounts that pay interest, but I don’t think about them much. I know the numbers are small. If the Census Bureau asked me and I don’t have an exact number, they’ll start with a range.

After volunteering that I earned less than $1,000 in interest, they’ll parse the records a bit more, getting down to less than $100. After that, they assign me $50 of interest income on my checking account, when I know the real number is somewhere south of $25. Woohoo! I just made more!

Too bad I can’t spend it. Chances are you have the same phantom income swirling around in your bank accounts.

Back to the record, but not-to-be-compared, numbers…

In 2014, median income was flat compared to the year prior. And the figure remained well below the 1999 record numbers.

Then the Census Bureau started asking different questions and providing their own answers.

Suddenly income popped, up 5.2% in 2015, the largest growth on record. Amazing! And the gift of massaged numbers kept on giving in 2016, which added to the gains and got us to the new highs.

But if we look through the headlines, the reality of today looks a lot like yesterday. Median income is certainly higher, but the gains aren’t evenly spread. Some people still capture more of the gains, and they are exactly whom you’d expect.

The top 1% do pretty well, as do the next 39%. All show incomes above that of 1999. Those below the middle, well, they’re still catching up. But this is old news. The real insight comes when we consider the data based on age.

The working stiffs, those under 55-years-old who bring home what we traditionally think of as income, are well off the highs. But those who are near or in retirement have enjoyed double-digit gains.

These groups – empty nesters and retirees – were doing pretty well before the Census Bureau retooled its survey, because the top earners tend to be older. But now that the government includes IRA withdrawals as income, on paper it looks like these groups are raking in the cash.

It will be interesting to see how the politicians and media spin this information as Congress considers tax reform. I’m guessing they’ll toss about terms like income inequality and fair share, which will be ways of justifying that anyone above the halfway point should cough up extra bucks.

If you’re in this group, but don’t think you’re much better off than you were two years ago, don’t worry. The Census Bureau can point out exactly where your phantom money comes from.

Unfortunately, I don’t think the IRS accepts Census Bureau estimates as tax payments. They still want you to show up with cold, hard cash – the type that isn’t juiced.

Rodney

Follow me on Twitter @RJHSDent

P.S. We’re just a few weeks away from our Irrational Economic Summit in Nashville, TN. If you haven’t already, get your ticket now to catch me, Harry, and the rest of the Dent Research team in person – plus a great guest speaker lineup, too.

The post How We All Made More Money and Didn’t Even Know It appeared first on Economy and Markets.

September 18, 2017

Bitcoin and Blockchain: Hype or Fundamental Financial Revolution?

Jamie Dimon, JPMorgan CEO, says Bitcoin is a fraud – likening it to the 17th century tulip bubble – that will eventually blow up. He said he’d fire any trader who traded it.

Jamie Dimon, JPMorgan CEO, says Bitcoin is a fraud – likening it to the 17th century tulip bubble – that will eventually blow up. He said he’d fire any trader who traded it.

Ron Insana, CNBC contributor, says Bitcoin is in a bubble, with investor enthusiasm driving it to a new fever pitch. He’s cited several reasons why it will fail.

Are they right?

Is Bitcoin a modern-day tulip bubble leading greedy investors to the slaughter?

Well… yes AND no.

It’s complicated (which is why I’ve invited Bitcoin expert, Michael Terpin, to speak at our Irrational Economic Summit this October in Nashville).

I agree with both men that it’s a dangerous speculative trade right now. It is in a bubble, but we’re likely not near the top yet.

And, as a currency, Bitcoin is a fraud – it’s absolutely NOT a currency currently – but the underlying technology (blockchains et al.) will revolutionize the way we protect our personal information and the way we transact.

It’s the foundation for the bottom-up economy we’re becoming!

Let’s tackle each point in turn…

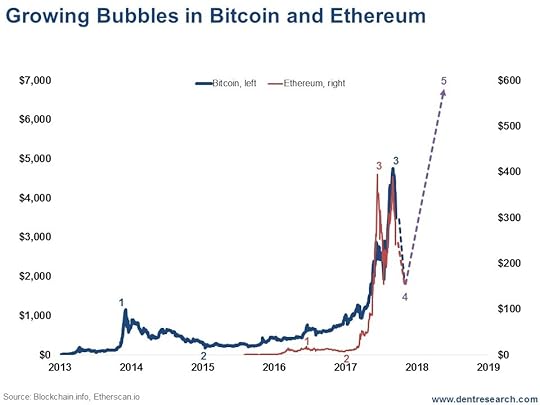

Bitcoin breached $4,000 per unit recently. And it’s gone up and down like a yo-yo! Just look at this chart, which contains both Bitcoin and Ethereum.

The most recent run in both is clearly a bubble. But, apply Elliott Wave Theory to it and it looks like only a third wave up. This means there’s now a fourth wave crash already in motion and then another steep fifth wave up ahead.

And this should be just the first stage of a very long-term boom in the underlying technologies.

The thing to understand here is that these digital coins are trading more like the stocks of these early-stage companies than a credible currency substitute. They are not behaving like currencies… they’re not currencies yet… and they’re certainly not a stable store of value.

But with decades of high growth, scale, efficiency, and consolidation, digital currencies could supplant central banks with bottom-up creation and much more stable values!

I hope I see that in my lifetime. Stick it to the Central Banks! Man alive, I hate them!

That said, in the near term, like Jamie Dimon, I wouldn’t touch any Bitcoin speculation with a 10-foot pole. If it drops back to around $2,000, and if Ethereum gets near $150, then it could be worth a play, but only as a high-risk speculative one for a small part of your portfolio.

Beyond Bitcoin

Cryptocurrencies are one thing. The technologies they’re built on are another thing entirely. And it’s the latter that has really captured my imagination…

For years now I’ve entertained growing concerns about the safety and security of the internet. In 2015, my computer and email was hacked twice in six weeks. My credit cards still get hacked regularly and I’m forced to change them every three or four months.

The internet is great for googling information and communicating through email and Facebook and other social platforms, but hackers are in control like the Russian mob. Online financial transactions, and online personal details, are simply not safe or secure. Equifax recently offered a brutal reminder of this fact.

Blockchain technologies could be the answer here. They could become a new platform for transactions, providing greater transparency, practically unbreachable security, faster speeds and lower costs!

Don Tapscott, a Canadian business executive, author, consultant, and speaker calls it “the Internet of Value or Money.” I discovered his latest great book, Blockchain Revolution, after listening to his 18-minute Ted talk.

To people like Don and me, and even Steve Jobs, information technologies, and now blockchain, are all about bringing power to the people and eliminating centralized intermediaries.

Put the information, the transaction power, the control over our own identity in our own hands and let us deal directly, peer-to-peer. This will allow our economy and businesses to organize around customers and operate from the bottom-up, not the top-down.

Based on the venture capitalists clamoring to back blockchain technologies – $1.1 billion has been invested since 2013 – this is a serious new technology and not some flash in the pan. Yet to compare, internet companies got much more during their early days.

My 45-Year Innovation Cycle sheds some light on this…

There’s a big difference between new technologies in their early stages in niche markets and their later stages moving into the mainstream.

The last such mainstream cycle around personal computing and the internet ran from 1988 into 2010. Before that it was electricity, phones, cars, radios, and TV from 1942 to 1965.

It’s during that move into the mainstream that whole new major industries and leading-edge companies are created and growth and productivity soars.

I see blockchain technology as the next step in the “maturing” internet revolution. It’s not yet a major new industry and job creator. But it could be, one day, as the next mainstream revolution is set for 2032 to 2055.

The internet made information radically more accessible and affordable (if not free).

That’s what blockchain technologies propose to do for financial transactions!

And like Uber and Airbnb, this technology will initially be deflationary. It will lower costs and destroy more jobs than it creates. It will disrupt the centralized, and often corrupt, financial services industry.

But like Wal-Mart and other companies that followed maturing trends with lower costs, this will paradoxically free up spending power for the everyday person and create easier access to the economy and the financial system.

This is part of how we recreate the middle class again, just like we did after World War II.

This is a big and eventually lifechanging deal.

Just don’t speculate on Bitcoin. It’s in a bubble. Not of the tulip bubble proportions, but bubbly enough to burn you.

Harry

Follow me on Twitter @harrydentjr

P.S. Don’t miss Michael Terpin at our Irrational Economic Summit in Nashville. There’s a reason why we scheduled him to speak on the first day of the conference!

The post Bitcoin and Blockchain: Hype or Fundamental Financial Revolution? appeared first on Economy and Markets.