Harry S. Dent Jr.'s Blog, page 77

August 4, 2017

Space Exploration and Travel: Is It Crazy… or Inevitable?

Of course, everyone in the Baby Boom generation remembers how uniting and inspiring the early orbits and moon landings were. Such heroic efforts, much like wars, also advance learning and technology, often beyond any expectations.

Of course, everyone in the Baby Boom generation remembers how uniting and inspiring the early orbits and moon landings were. Such heroic efforts, much like wars, also advance learning and technology, often beyond any expectations.

Today we have billionaires and tech leaders from Elon Musk to Richard Branson planning civilian trips around the moon as early as next year… leading the parade to Mars and its colonization… and mining asteroids for precious and rare metals.

This may all sound kind of far out and unaffordable, maybe even wasteful, but one thing I know about leading-edge technologies is that they grow and improve exponentially, and, if viable, ultimately become affordable to the masses.

Who would have thought, when airplanes were first invented in the early 1900s, that today the everyday person could fly halfway around the world in less than 20 hours for just $1,000? Steamships took many months to do the same thing! Today we hardly think twice about the trip!

So, is this sort of out-of-the-box thinking by creative genii hype or reality?

My opinion is it’s both! It starts out as hype. The big dream. The stuff of science fiction. With time, it becomes reality.

Still, I’m skeptical, as I know some of you are, based on your responses to Teresa’s question in the Saturday wrap-up…

The payoffs from space exploration could take a long time to be felt back here on Earth. Likely, none of us will be alive to enjoy any of it.

Also, there’s the old saying, “stick to your knitting.” Just because Elon Musk succeeded in jump-starting the electric car and home battery systems doesn’t mean he can succeed at space travel… ditto for Branson (maybe even more so because he’s much less high tech).

The comedian and political commentator, Bill Maher, recently derided major expenditures on space exploration and the creation of colonies on Mars. He had a long list of advantages of Earth versus our red neighbor, including things like “we have oxygen, Mars doesn’t.”

Besides, why would anyone want to spend 115 days flying to the red planet (the current optimist estimates of how long the trip would take), when you can fly to Arizona in a few hours?

However, free markets should be allowed to decide what makes sense for future investments, even though most early-stage attempts will and do – necessarily – fail.

They don’t do it alone though. Government spending on large scale R&D that even large businesses can’t afford often has huge payoffs for more practical innovations down the road, including the internet and GPS.

And as Stephen Sandford reveals in his book Gravity Well, there are dozens and dozens of technologies we use in our everyday lives now that wouldn’t exist if it weren’t for our desire to travel to the stars.

With all of that said, there are two big questions to consider:

1. How much investment in the space drive is too much?

This question divides us as a nation (as do many things these days). Some believe the money would be better spent elsewhere. Others believe we’re not spending nearly enough. I’m somewhere in the middle. We should explore, innovate, and advance. But we shouldn’t go stupidly overboard.

2. What’s next?

This is the question that Stephen will attempt to answer when he addresses the audience in his keynote at this year’s Irrational Economic Summit in Nashville, Tennessee. And he’s probably the person best positioned to provide realistic answers, having spent decades in the industry.

For me, I’m most interested in hearing about the developments underway for mining rare minerals from the moon or asteroids. How close to reality is that? I suspect that this will really only start to become viable closer to the 2040’s, when the next commodity cycle turns around and heads back down. If we can get at the space minerals in a cost-effective way, it would send prices of those same minerals on Earth into a negative spiral because supply would no longer be finite.

Only time will tell, but I’m dying to hear what Stephen has to share with us. Join me.

Harry

Follow me on Twitter @harrydentjr

The post Space Exploration and Travel: Is It Crazy… or Inevitable? appeared first on Economy and Markets.

Investors Should Not Be Fooled by Delusional DOW Rally

The DOW has been rallying for months, setting record highs and eclipsing 20,000. Life is good.

The DOW has been rallying for months, setting record highs and eclipsing 20,000. Life is good.

Not quite.

This delusional, record-setting rally is the calm before the storm and the final surge before we see a historic collapse and feel the effects of the economic winter season we’re sitting in.

Massive debt bubbles… housing prices falling by 40%… surging unemployment… a ballooning federal deficit as high as $1.5 to $2 trillion… and the misguided belief that policy makers can turn the economic tide.

All classic signs of an economic winter season and a bleak state of financial decay.

How is this possible? Demographics.

Simply put… aging economies cannot grow as fast as younger ones. This impending collapse is demographically impossible to avoid! According to the research of renowned Harvard Economist, Harry Dent, the U.S. population will only grow 0.27% over the next 50 years!

In his latest video presentation, Harry explains the “perfect storm” of economic and demographic realities brewing that will likely lead to “The Greater Depression” and make the next few years some of the most trying times in U.S. economic history. Find out how to protect your financial future, for what lies ahead!

Be sure to catch Harry’s special video presentation here!>>>

Harry

Follow me on Twitter @harrydentjr

The post Investors Should Not Be Fooled by Delusional DOW Rally appeared first on Economy and Markets.

Predicting for Future of Gold

In an Unpredictable Market, the Future of Gold Remains Clear

In an Unpredictable Market, the Future of Gold Remains Clear Even though the markets haven’t behaved logically of late, it would have seemed a slam dunk for gold to rise if Donald Trump won. After all, we faced uncertainty around his policies, rising inflation from infrastructure spending, and higher expected growth rates.

Even though the markets haven’t behaved logically of late, it would have seemed a slam dunk for gold to rise if Donald Trump won. After all, we faced uncertainty around his policies, rising inflation from infrastructure spending, and higher expected growth rates.

But instead, gold has headed back down more sharply. It had its initial rise in the futures market when Trump looked like he was going to win. But since then, it’s reversed course – the opposite of the stock markets.

While I’ve been saying for a long time now that gold still has a lot to lose, a new and interesting dynamic has arisen to add more pressure to the downside.

Arm Yourself with the Knowledge to Prepare for What’s Ahead!

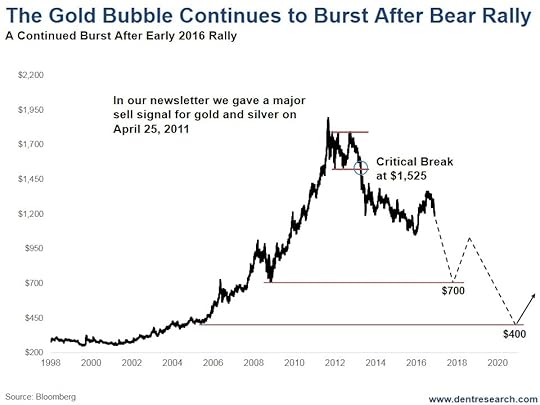

Before I explain, let’s first look at the chart pattern here… This pattern suggests that the rally from late 2015 had seen a clear a-b-c bear market or corrective rally, just as I’d forecast to around $1,400.

This pattern suggests that the rally from late 2015 had seen a clear a-b-c bear market or corrective rally, just as I’d forecast to around $1,400.

The next stop, coming from strong support in the 2008 mini-crash, is $700 and it looks like this move is already well into motion!

A slowing economy, with deflation, would be the biggest reason for gold melting to that level. The fall since the election would suggest such deflation is not very far away.

But we’ll only see this after a significant bounce ahead…

At the beginning of 2016, I forecast that gold was very oversold. It was at $1,050 per ounce in late 2015 and so due for a major bear market rally back up to as high as $1,400. As I said it would, gold did bounce and got to $1,373 per ounce in early July 2016, at which point I recommended selling again. Lo and behold, gold fell rapidly to $1,124 in mid-December.

Gold is now very oversold again, but on a shorter-term basis, and it’s due for a minor rally to around $1,250. But given how oversold it’s become, it could even go back to a slight new high near to $1,400. That could come by mid-February or so.

But my forecast of $700 is still looking increasingly likely by the end of this year… meaning the window to get out is closing.

Remember: This rally will be the last chance for gold holdouts to get out!

The ultimate downside for gold at the bottom of the 30-year commodity cycle, between early 2020 and late 2022, is $400 or lower to erase the bubble that began accelerating in 2005.

That’s when I would start to recommend buying gold again longer term, with a target of $4,000-plus by 2038-2040. The next 30-year commodity cycle could be the greatest ever seen because it will be driven by the demographically growing and still-urbanizing emerging world. Remember, they’re the ones who’ll be producing and consuming most of the gold and other commodities.

Gold isn’t the only market being influenced by demographics in the next couple years. Find out how else your financial future could be affected in the months ahead!

Harry

Follow me on Twitter @harrydentjr

The post Predicting for Future of Gold appeared first on Economy and Markets.

The End of Retail as We Know It

Is this the End of American Shopping Malls?

Is this the End of American Shopping Malls?Sheets of newspaper scratch along the dusty linoleum floor as the wind beats them into the remnants of a bench… or through the open glass door and into the darkened, empty space beyond.

Escalators haven’t run in decades. The air itself looks dusty.

Could this really be the future of the American mall?

Well… yes! It’s bad and it’s going to get worse, but I’m writing today to tell you it was totally predictable!

In fact, just like we forecast that Harley Davidson would suffer, so too did we forecast that retail stores would take it in the nuts as the Baby Boomers moved along their predictable spending wave!

Many “brick-and-motor” stores are suffering so much they’re shutting down.

Yes, the retail, brick-and-mortar, industry is suffering because there are too many stores… because online shopping is growing exponentially… and because shoppers are “moving toward experience…”

And yes, Amazon stock price broke the $1,000 mark at the end of May.

Investors still believe in the Trump magic wand of lower taxes and regulations that first, may not happen, and second will not be as big an impact as economists think because businesses are already over-expanded from the bubble boom and we are back at full employment with lower workforce growth ahead.

But there’s something so much bigger than all of these things going on, and everyone seems to be missing it!

Even the mainstream media is missing what’s right in front of their noses!

Two words: Baby Boomers.

All of these retail store closings and all of these bankruptcies were all baked into the cake when the massive Baby Boom generation peaked in its spending in late 2007.

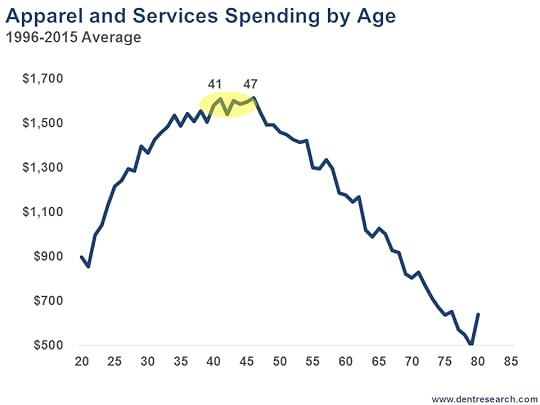

Affluent households spend a lot on their kids and college education, until they’re about 51 years old, after which we see a dramatic drop-off in spending. For the U.S. Baby Boomer generation, this started in 2012 (on average).

Spending on apparel and related services, like dry cleaning, peaks into age 47, which means retailers would have begun feeling the pinch back in 2008.

And if you look at the numbers below, from the annual Consumer Expenditures Survey, that’s exactly when they started to struggle…

It’s no wonder that the major department stores that focus on clothing are declining!

It’s no wonder that the major department stores that focus on clothing are declining!

We are seeing a historical movement in the retail industry to e-commerce.

Yes, online shopping has taken some of the pie, but for clothing retailers that’s not as much the case.

Think about it: You can’t judge the quality of a fabric or design online. You can’t try the outfit on to see how it looks or our comfortable it is.

So, as the Baby Boomers continue to age, clothing retail stores like Macy’s and JCPenny will only suck more and more wind! I’d hate to be in that industry.

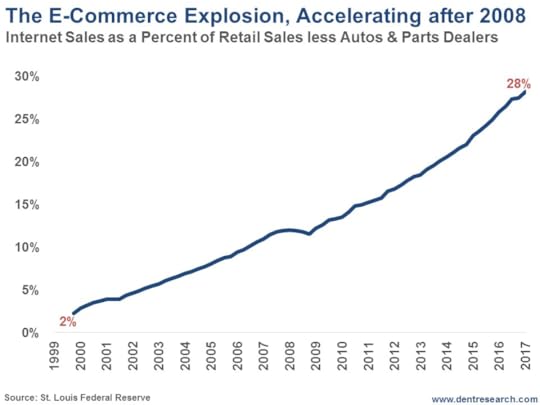

But then there’s the death knell for malls and department stores: The rise of Amazon and the e-commerce sector. In this case, not only do demographics play a role, but so does technology. Look at the data below…

When you take out auto sales (that will eventually move to the Internet, just not yet), e-commerce has grown to a whopping 28% in early 2017.

And Amazon is now looking at both going into groceries and prescription drugs!

Malls are dead! And the clothing and discretionary food purchases were the last stronghold.

One thing is for sure, keep clothing retailers and malls out of your investment portfolios, unless you’re shorting them. In which case, John Del Vecchio, our resident short-seller, can help you.

In his latest bestseller, The Rule of 72, the former Wall Street insider reveals what’s really going on, on Wall Street and explains how you can take advantage of different market conditions and uncover hidden stock profits. Get your free copy here!

Harry

Follow me on Twitter @harrydentjr

The post The End of Retail as We Know It appeared first on Economy and Markets.

Why We’re Headed Toward Gold $700 by 2018

Investors are fleeing to gold in a desperate attempt to weather the recent market volatility… but is this long time “safe-haven” actually poised to collapse wiping out trillions of dollars of wealth in the process?

Investors are fleeing to gold in a desperate attempt to weather the recent market volatility… but is this long time “safe-haven” actually poised to collapse wiping out trillions of dollars of wealth in the process?

While many economists will argue that gold is not in a bubble… and insist it will soar to $2,000, $5,000 and even $10,000, my research has said otherwise. I’ve never been more certain of anything in over 30 years of economic forecasting.

Market volatility, worries over the Europe Central Bank, negative interest rates, and China are among a laundry list of events that are driving panicked masses to buy the yellow metal. But this is only inflating the gold bubble that is poised to pop at any moment.

>>Related: Get Out of Gold IMMEDIATELY and Buy This Instead

I began to pioneer a whole new science of economic forecasting in the early 1980’s which is why I’ve been able to accurately predict almost every major economic event over the past 30 years. —including the collapse of Japan, The Great Tech Boom of the 1990’s, and the 2008 market crash.

This latest prediction is proving controversial among financial circles across the country.

Traditionally investors flock to gold as a way to hedge against inflation but we’re about to see the exact opposite happen.

We are about to experience an economic crisis far worse than 2008 — the full-blown collapse of the stock market and massive deflation.

And that investors who attempt to hide their money in the “safe haven” of gold, could damage their wealth to an even greater degree.

>>Related: How To Get Rich From Deflation

This scenario was practically preordained — as far back as the mid-1990s when the bubble in stocks began and real estate followed and Baby Boomers were heading for their peak spending years into 2007.

When you understand this event, including the fundamental reasons driving it, you need not panic. You will see there’s a tremendous upside to what will unfold over this decade and beyond. After all, when you’re able to know what’s coming – and position yourself accordingly – the years ahead could be prosperous times.

What’s the one investment you need to buy right now to protect yourself, instead of gold is? Click here to watch his new presentation and find out.

>>

Editor’s Pick: Not Even Gold Can Keep Your Money Safe When This Happens

Harry

Follow me on Twitter @harrydentjr

The post Why We’re Headed Toward Gold $700 by 2018 appeared first on Economy and Markets.

American Home Values Are About to Be Cut in Half

Home Values Will Lose 30% – 60% of Their Value by 2018

Home Values Will Lose 30% – 60% of Their Value by 2018

The global financial markets continue to panic amidst the uncertainty of what president-elect Donald Trump will do now that he’s in the White House.

The global financial markets continue to panic amidst the uncertainty of what president-elect Donald Trump will do now that he’s in the White House.

With a republican controlled congress, investors fear that President Trump will be able to make good on many of his campaign promises…

And several analysts are suggesting that his economic plans will quickly send the U.S. into the recession he has promised to dodge.

The U.S. is about to enter into an economic crisis that NO president could have stopped… and it’s all thanks to the collapse of an asset investors around the world thought was safe again…

Real Estate.

Related: Hidden Housing Crisis Poised to Wipe Out Main Street Investors

If you thought 2008 was bad for real estate, or for stocks, or for your business, this is going to last longer and be deeper. It’s not a question of ‘if’ this is going to happen; it’s simply a question of ‘when.’ And the signs I’m seeing are saying it’s going to happen a lot sooner rather than later.

Housing prices and rental prices have skyrocketed over the past several years as investors have been fleeing the volatile markets in search of safe havens.

The “lower for longer” interest rate environment has largely fueled this bubble and the potential December rate hike is beginning to send shock-waves through the broader markets.

The “lower for longer” interest rate environment has largely fueled this bubble and the potential December rate hike is beginning to send shock-waves through the broader markets.

“We’re a market that is run by central banks right now,” said Bret Chesney, portfolio manager at Alpine Global, noting that comments from Fed officials have driven most recent moves in the stock market.

“Central banks have totally taken over the financial markets,” Dent says. “By setting short- and long-term market rates, you affect the valuations of all other assets. Real estate is directly impacted by that. This keeps the economy from re-balancing. These little crashes and corrections and recessions are like a common cold. They come now and then to clear out your system and make you healthier.”

“So the more this doesn’t happen, the more unhealthy you get. The more they push down interest rates and prevent recessions and make the world seem risk-free, the more everybody speculates. People speculate in bubbles everywhere, anyway. The longer stocks go up, the more real estate goes up, the more people ask: ‘Why am I working so hard? Why don’t I get rich speculating?’”

This rampant speculation has lead to the formation of the biggest bubble in human history… and I believe it’s going to finally burst in 2017, wiping out trillions of dollars in the process!

Editor’s Note: To watch Harry Dent’s latest – and highly controversial – interview…click here now

The Dow will drop to 6,000 – and eventually stumble all way down to 3,300…

Gold will crumble to $700/oz…

Housing prices will fall 30-50%…

Everyone – from the ultra-rich to everyday investors – will get wiped out if they’re not prepared!

My forecast most certainly goes against popular opinion, but this isn’t the first time he’s accurately made a call like this.

Every single one of his on-the-money money predictions, like the demise of Japan in the early 90’s, the top of the tech bubble in 2000, the real estate crisis in 2008, and his most recent call of the 2011 peak of gold and silver prices.. have been met with vocal opposition from the mainstream media.

But his research shows that this historic downturn is inevitable. It will also create the single greatest wealth building opportunity of our lifetime.

Investors who see this crash coming and prepare accordingly could make a fortune in a few short years.

To watch Harry’s latest – and highly controversial – presentation… click here now.

You Might Also Like: The 6 Things That Could Trigger The Next Global Meltdown

Harry

Follow me on Twitter @harrydentjr

The post American Home Values Are About to Be Cut in Half appeared first on Economy and Markets.

Income Starved Investors are Flocking to These “Private Income Funds”

Among the bleak retirement landscape, investors are finding lucrative opportunities

Among the bleak retirement landscape, investors are finding lucrative opportunities

Time after time, I hear stories of people “cutting back” to stretch a meager income or make a small nest egg last.

Most retirees (or people planning for retirement) are pinching pennies, fearing their nest eggs will run out soon. Or they’re scratching out “a living” on meager Social Security benefits of $1,300 a month.

Folks just aren’t making enough off of their investments PRIOR to retirement, to live out their golden years comfortably. I go into further detail in my latest video presentation.

While we absolutely have a retirement crisis in America right now… it all stems from an even bigger problem… an income crisis.

But even in this bleak retirement landscape, a savvy group of income seekers have been using an “Automatic Income Calendar” to create a constant cash generator that can last the rest of their lives… and even beyond. Find out how here.

Instead of cutting back or waking up each day worrying about money, these folks are planning dream vacations, buying getaway homes, spending on grandkids and relaxing.

Their automatic income is coming from what I like to call “Private Income Funds.”

And just to be absolutely clear, these are not annuities I’m talking about. These folks haven’t given every dime they have to some insurance company where it’s no longer “theirs” for 30+ years. With “Private Income Funds,” your principal is tucked away in your own investment account, where you can keep an eye on it, and only you can touch it.

And just to be absolutely clear, these are not annuities I’m talking about. These folks haven’t given every dime they have to some insurance company where it’s no longer “theirs” for 30+ years. With “Private Income Funds,” your principal is tucked away in your own investment account, where you can keep an eye on it, and only you can touch it.

In my latest video presentation, I go into further detail on why these “Private Income Funds” are much safer, much more accessible and a far more potentially lucrative way to create a steady income stream that automatically flows directly into your account, month… after month… after month.

The Wall Street Journal recently reported about what I refer to as “Private Income Funds” saying they, “can offer terrific opportunities for the shrewd. Some people who snapped them up during the 2008 crash… have doubled or even tripled their money – sometimes with minimal risk.”

Even Barron’s said that Private Income Funds, “are created to generate steady cash flows for investors.”

Using these funds, investors are on their way to solving the problem of running out of money before, during, and after they retire.

Financial discipline is always a healthy habit. But, just know you don’t have to scrimp and scrounge cash from your regular income just so you can max out your 401(k).

In fact, the video I mentioned earlier, which was initially released to a private audience, has now gone viral as hundreds of thousands are looking for opportunities to generate safe and steady income with access to this just released 2017 “Automatic Income Calendar.”

You can access the full video, free of charge, right here…

The post Income Starved Investors are Flocking to These “Private Income Funds” appeared first on Economy and Markets.

August 3, 2017

One of the Most Dangerous Games Made Safe

In the coming years, we’ll see much more volatility in the market.

In the coming years, we’ll see much more volatility in the market.

The fact that the VIX (or volatility index) has hit its lowest levels ever this year is of course prompting concern that a bear market is lurking in the shadows.

The market boom from late 1982 through late 2007 was based on real fundamentals: the spending wave of the largest generation in history; falling interest rates from rising productivity after the greatest peak in history in 1980 to 1981; the movement of internet and portable computing into mainstream markets.

But since the economy collapsed in 2008, it’s been all about endless QE and stimulus measures to fill the gap of unprecedented debt and slowing demographic trends in spending and productivity.

The retail apocalypse we’re witnessing is more than simply a case of Amazon and internet retailers taking over market share. They only command 8% of the market. It’s really all about the aging Baby Boomers slowing their spending before the Millennials fully enter the workforce and ascend.

Look at this chart on volatility in the stock market. I compared the VIX and the S&P 500.

As you can see, there’s a roughly 10-times ratio between VIX spikes and stock market drops during times of crisis.

As you can see, there’s a roughly 10-times ratio between VIX spikes and stock market drops during times of crisis.

In the last crash in 2008 the VIX went up 7.7 times what the S&P 500 went down. The highest ratio was in late 1987, at 15.4 times. In the brief 1998 crash, it was 8.9 times and the double spikes in 2001 and 2002 saw ratios at 6.6 and 5.5 times, respectively. Even in the 20% crash in late 2011, the VIX went up 11.7 times what the S&P 500 went down.

I mention this because I’m sure you’ve heard us talk a lot recently about Adam O’Dell’s newest trading strategy – the 10x switch – promising unbelievable returns. And seeing as we’re tackling hype everywhere else in Economy & Markets, I thought this a good time to share some non-hype insights into this unique and lucrative niche that Adam has captured.

Turning $10,000 into $100,000 and eventually $1 million is absolutely possible… by playing volatility booms and busts, particularly in an excessively overvalued market that’s looking for the biggest crash since the early 1930s!

The fact is, I think Adam has come up with his most genius investment strategy yet. Just bet on the cyclical booms and busts in the VIX, with a simple and effective strategy. You don’t have to trade individual stocks or sectors, which he is also expert on.

And volatility accelerates up and down both ways in a bear market, which is all the better.

Adam has taken one of the most dangerous games in town and made it safer, easy and accessible to anyone.

I have always warned investors that bear markets are trickier to play than bull markets, although the profits are much higher because bear markets tend to crash twice as fast and hard as bull markets build, especially in bubble booms like this one.

So Adam uses his proven volatility model, which has no market bias, to play both sides of this leveraged equation!

Come and see Adam speak at this year’s Irrational Economic Summit in Nashville, TN.

Harry

Follow me on Twitter @harrydentjr

The post One of the Most Dangerous Games Made Safe appeared first on Economy and Markets.

August 2, 2017

On the Search for Buried Treasure… You Have to Know Where to Look

I earned my scuba diving certification 30 years ago, although I don’t use it very often. It’s not that I don’t like diving, it just takes a lot of time and planning.

I earned my scuba diving certification 30 years ago, although I don’t use it very often. It’s not that I don’t like diving, it just takes a lot of time and planning.

Still, during our family’s years in Florida we took the occasional East Coast trip to dive some of the numerous shipwrecks that aren’t too far off the coast.

And after my younger daughter got certified at 12 years old, we made a trip off of Venice, Florida, where we searched for prehistoric shark teeth.

To find them, you had to know where to look. Local dive captains guard their GPS coordinates for finding likely shark teeth as if what they’re looking for is sunken treasure.

In a way, it is.

The same thing that makes most dive trips all-day affairs is what drives up the value of locations where you can find shark teeth. It’s all about location, because most of the ocean floor is filled with nothing.

At least, nothing of immediate interest.

That’s not the part they show you on the Discovery Channel. Instead, you see beautiful video of bright-colored coral and majestic sea life. That stuff’s down there, but it’s not poking out of every crevice and covering every square inch.

Think about the last time you went in the water at the beach. What did you step on? Chances are, a whole lot of nothing, or rather, sand. That stuff stretches for miles.

Anyone hunting for lost shipwrecks filled with treasure is intimately familiar with this issue. They have to find the wrecks on the vast ocean floor, and then figure out how to get all that stuff back to dry land.

For the past 25 years, one company in the U.S., Odyssey Marine Exploration (Nasdaq: OMEX), has excelled at this task, but they’ve recently changed direction. Not because they ran out of wrecks, but because they ran into an immovable object: bureaucracy.

That’s OK, though. As the company’s CEO, Mark Gordon, recently told me, the pivot away from archeological finds will most likely make the company wildly more successful than it could’ve been otherwise.

Odyssey did everything right. The company registered its underwater finds with the appropriate government authorities, took detailed video of wrecks to preserve their character, and presented historical data and artifacts to governments and museums.

But it wasn’t enough. No matter what assurances Odyssey had before they excavated a site, there was always some government agency or group that sued them afterward. They were interested in taking everything that Odyssey retrieved.

It’s not much of a business to find shipwrecks, retrieve artifacts and stores of gold and silver, and then have it all confiscated. That’s charity.

So Odyssey reviewed its skill set: deep underwater exploration and excavation, extensive mapping of the ocean floor, and a knowledgeable employee base. If they weren’t looking for manmade treasure on the floor of the ocean, maybe they could find something else – the naturally-occurring kind.

For millennia, man has looked for valuable deposits on land. We’ve dug for everything from iron to gold. But dry land is a limiting factor, since 71% of the earth’s surface is covered by water. Now consider that everything found in land formations is also found underwater.

You simply have to know where to look… and how to get it out.

This is Odyssey’s bread and butter. Now the company is on the cusp of a deal that will cement its future.

Recently Odyssey inked a deal to excavate phosphate in Mexican waters. The mineral is a key ingredient in fertilizer, which makes it invaluable for improving crop yields. Mexico has very little phosphate on land, so the country must import it.

When offshore mining gets underway, Mexico will suddenly be able to mix fertilizer that will help feed its population and add a valuable export to its economy.

The last administrative hurdle left for Odyssey to clear is an environmental review. Gordon is hopeful that this will happen, since Odyssey has teamed with a group that’s performed hundreds of dredging operations in Mexico.

Since going public in the 1990s, Odyssey’s stock price has been on a wild ride. It shot above 80 in the mid-2000s before recently dipping to single-digits… and that’s after a reverse, 1-for-12 stock split.

But if underwater mining comes to fruition, Odyssey – and companies like it – could have a bright future. And the world population could suddenly have access to new sources of precious deposits such as rare earth minerals, gold and silver, and of course, phosphate.

You just have to know where to look.

And Mark does. He’s promised to talk more about his company’s days searching for shipwrecks, and give a better picture of the incredible opportunities that lie on the bottom of the sea at our fifth annual Irrational Economic Summit this October in Nashville. Seats are limited. Get your tickets today!

Rodney Johnson

Follow me on Twitter @RJHSDent

The post On the Search for Buried Treasure… You Have to Know Where to Look appeared first on Economy and Markets.

August 1, 2017

Angel Investing: A Graveyard if You Don’t Know What You’re Doing

If there’s one thing I’ve had (painful) experiences with, its angel investing. I invested in 15 early-stage companies, and guess what? I lost most of my money.

If there’s one thing I’ve had (painful) experiences with, its angel investing. I invested in 15 early-stage companies, and guess what? I lost most of my money.

It wasn’t because the product didn’t work or the technologies failed. Typically, the troubles lay in marketing and the difficulty of getting to scale and breaking even.

There’s a saying in the industry that warns: New ventures take twice as long and three times as much as you project.

Well, it even gets worse than that.

Of the ventures I invested in, the one that had the most potential never made a major sale, partially because the customers were municipalities and they tend to be quite corrupt – giving the sale to Billy Bob who butters their bread with all types of free goodies. It’s also because no one wants to be the first to buy from a new company and risk being the fool if something goes wrong.

Another company I made major investments in kept growing rapidly and making progress, but could never get to breakeven because it had to keep upgrading its software. Management underestimated the scale they needed to be profitable.

All too often, companies believe in their products so much that they spend too much on marketing too early on, without diligent testing. They see it as “build it and they’ll come,” but most of the time they don’t, and companies spend too much on marketing too soon. When they do this, they run out of precious and expensive early-stage funding and then have to pay more to get to the next stage, if they get further funding at all.

My point is…

As potentially lucrative and valuable as angel investing can be, there are simply too many things that can go wrong in the early stage that it’s your funeral if you don’t get it right.

So, don’t just jump in without doing your homework, and then doing more homework, and then more still.

And don’t go it alone. Speak to other angel investors, both successful and unsuccessful. Network. Attend our Irrational Economic Summit in October to listen to Howard Lindzon, who’s an angel investing expert extraordinaire.

Until then, here are two summary tips to apply:

Make sure you’re investing in a management team and not just a product.

Don’t underestimate the marketing challenges in the early stages, or the funding necessary to get to breakeven and stop bleeding cash.

Don’t become another fallen angel investor. Learn from others’ mistakes and successes.

See you in October.

Harry

Follow me on Twitter @harrydentjr

The post Angel Investing: A Graveyard if You Don’t Know What You’re Doing appeared first on Economy and Markets.