Harry S. Dent Jr.'s Blog, page 78

July 31, 2017

Pot is the New Alcohol: A Money-Making Business

Pot is what alcohol used to be.

Pot is what alcohol used to be.

It’s an industry ready to take off, but one that’s still finding its way, and one whose progress is not exactly encouraged by the federal government. It’s a little bit like Prohibition 2.0.

The alcohol industry – now eight decades after states ratified the 21st amendment and ended prohibition – generated $475 billion in economic activity and $110 billion in wages in 2014.

Across the United States, more than 4.5 million people work in alcohol-related jobs. Alcohol production, distribution, sales, and service is one of the biggest industries in the country.

We’re a long way from the 13-year saga of prohibition. But it didn’t end overnight.

In March 1933, President Roosevelt signed into law the Cullen-Harrison Act, which legalized the sale of “near beer,” containing 3.2% alcohol or less, as well as similar alcohol-lite wine.

The ratification of the 21st amendment repealed the 18th amendment and, at the end of 1933, ended the U.S.’s decade-plus run of alcohol abstinence.

Sort of.

Prohibition resulted from many years of groups fighting for temperance to curb alcoholism, family violence, political corruption (related to saloons, taxes, licensing, and revenue), and a general debasement of society.

In one big way, it worked.

By 1933, the percentage of American adults that consumed alcohol had been cut in half. But there were side effects.

With alcohol illegal, production, distribution, and sales went underground. With modern communications (telephones) and delivery (cars and trucks), organized crime took over the trade and flourished.

In 1925, five years after prohibition started, roughly 50,000 speakeasy clubs operated in New York City alone. With all of that commerce off the books, cities and states lost tremendous revenue.

As the Great Depression took hold, people from all corners started calling for the end of prohibition…

Consumption was lower than before, but not eradicated. And the trade created criminals. By making alcohol legal again, tax revenue would flow back to governments and crime would drop.

Sound familiar?

Passing the 21st amendment didn’t make alcohol legal nationwide. States and local governments could still restrict the industry as they saw fit. The last state to end prohibition was Mississippi… in 1966.

Today, there are still “wet” and “dry” towns across the country, and locations considered “moist,” that have some restrictions on alcohol sales and consumption, like days it can be sold or requiring memberships in private clubs.

Welcome to the crazy patchwork of regulations and licenses – and slow rollout – that await the marijuana industry.

The Marijuana Revolution

Eight states have legalized recreational marijuana, about 20 approve its use for medicinal purposes, and the rest have either no approval or very strict terms.

Unlike with prohibition, today the federal government is the laggard.

The Obama administration chose not to prosecute marijuana related crimes that were deemed legal in states.

The Trump administration has signaled it will take a harder line, although it has yet to cross swords with states like Colorado by prosecuting someone there for possession or a retail outlet for distribution.

Given that 57% of the country wants the federal government to decriminalize marijuana and only 37% want to keep it illegal, chances are that we’ll see marijuana follow alcohol in the years ahead.

And just as alcohol added $258 million, or 9% of all federal revenue, to the coffers in 1934, Colorado has now taken in just over $500 million in tax and fee revenue since legalizing recreational pot in 2014. And that’s just one state!

The big changes will mean big opportunities.

Legal marijuana already employs more than 150,000 people, and the industry is expected to generate more than 250,000 new jobs in the next three years.

As I noted in a Boom & Bust article this spring, more people work in the marijuana industry than in all U.S. car dealerships.

And while we might think of the pot industry as a bunch of people saying “Dude!” and eating Doritos, it’s more about horticulture, harvest, storage, efficient distribution, and retail locations.

In short, it’s business. With business, especially one that’s growing at such a rapid pace, comes opportunity.

Today the field is clouded by the U.S. government, which keeps out any company or industry that has interstate interests or needs a federal license by threatening prosecution.

This allows small startups to establish themselves.

There are many tiny companies focused on marijuana, and even a marijuana stock index. But the nature of small stocks is explosive growth and outsized risk. It takes a fair amount of research to know who is real and who is likely to go up in smoke (pun intended).

That’s why we’ve invited noted marijuana industry expert Brendan Kennedy to our Irrational Economic Summit in October to give us the inside scoop. He is the CEO of Privateer Holdings, the world’s first private equity firm investing exclusively in legalized cannabis.

With the industry in its infancy, this should be a fabulous time to get in before it goes mainstream.

For a closer look at the every growing marijuana industry, and the potential investment opportunities it may present, check out our latest infographic: Is the Grass Getting Greener?

Rodney Johnson

Follow me on Twitter @RJHSDent

The post Pot is the New Alcohol: A Money-Making Business appeared first on Economy and Markets.

July 28, 2017

Mid-Year Update: Bitcoin Up 190% and ICOs Soar

Managing Editor’s Note: On Tuesday, Harry wrote to you about the bitcoin craze and the recent contact he’s made with cryptocurrency expert Michael Terpin. Michael will be speaking at our fifth annual Irrational Economic Summit in October, in Nashville, Tennessee, so today we have a note straight from him.

From Michael Terpin, Co-Founder, and Chairman of BitAngels

As we melt into the last half of summer, it’s a good time to see how bitcoin and cryptocurrencies are faring in 2017, given that bitcoin was the top-performing asset class in six of the past seven years.

At the start of this year, CoinDesk (the largest business-to-business blog for the blockchain industry) asked me to write a piece with my predictions for 2017.

It did this because I’m a serial entrepreneur in marketing and technology, best known for founding the first Internet-based company news and financial disclosure newswire, Marketwire. I’ve prided myself on starting businesses early in important nascent markets (Web, 1993; social media, 2003; bitcoin/blockchain, 2013).

Along the way, I founded or co-founded the first bitcoin angel group (BitAngels, 2013), first cryptocurrency fund (Dapps Fund, 2014), first bitcoin syndicate on AngelList (2015), one of the first token creation incubators (bCommerce Labs, 2015), and I’m currently part of the investment committee at Alphabit Fund (2017), the first fully-regulated digital currency hedge fund.

I’ve also been running the largest PR and advisory firm in the blockchain sector, Transform Group, since 2013, and the first and largest global conference series for cryptocurrency and digital asset investors, CoinAgenda, since 2014. (Harry often complains how difficult it is to pin me down to catch up! Now you know why.)

Well, when I sat down to write this, bitcoin was up 190% for the year. And the overall market for “public blockchains” (the digital assets that are tradeable on cryptocurrency exchanges) is up more than 400% since January 1.

Bitcoin market insiders, like me, saw this coming, as last July was the second “halving” – a technical event that cut the supply of new bitcoins entering the market in half while demand has been consistent in its rise.

In case you didn’t already know, only 21 million bitcoins will be created over a 140-year period. Nearly 80% of them have already been produced!

But let’s look at my key predictions I made in January and how they’ve turned out so far…

Prediction #1:

The “1 percent” will take notice of the cryptocurrency markets.

Clearly, family offices have gotten into the game this year, investing more than $1 billion in new token crowdsales (commonly referred to as initial coin offerings or ICOs, even though in most cases, they’re not regarded as securities under existing U.S. law.)

We can easily track the overall market cap of public blockchains in real time via sites like CoinMarketCap and CoinCap.io. Since January 1, it’s risen from $20 million to $95 million (briefly eclipsing $110 million a month ago before some profit-taking kicked in).

Family offices got into the game as well.

At our most recent CoinAgenda Europe conference in Barcelona, billionaire Mike Novogratz, who made waves this year by revealing he had invested 10% of his wealth into cryptocurrency, had his family office’s digital fund manager, David J. Namdar, speak alongside David Drake of DFJ Capital, and Chance Barnett, co-founder of the equity crowdfunding site, Crowdfunder, and now the ICO accelerator, Coin Circle.

I’d say I nailed that prediction!

Prediction #2:

The price of bitcoin would surpass $2,200 (it was $998 when I made the call).

Clearly this has already happened.

I also noted it would be linked with the “war on cash,” and India, Venezuela, and other jurisdictions have not reversed course on this, leading many people globally to look at non-governmental forms of value exchange and storage.

Gold and silver prices are also up this year, but bitcoin and other digital currencies are up much more, in large part because they’re the only alternative safe haven investments that are digital and can be moved around the world in seconds, regardless of where one lives, as long as there’s an internet connection.

Prediction #3:

ICOs and other token distribution efforts will “continue, increase and diversify.”

This prediction was the one that was most fulfilled. Three years ago, there were only half a dozen significant (more than $1 million raised) token crowdsales. The largest one, Ethereum, raised $18 million at 30 cents per token (today’s price per token is $196, making it one of the best investments since bitcoin’s earliest days with a three-year return of 65,000%).

This year, there has been more than $1 billion raised in a little over six months, including $225 million by Tezos, $200 million by Eos, and $153 million by Bancor.

We’re beyond a bull market for ICOs right now. It’s more like a stampede, from which I predict a flight to quality with only the best teams and backers raising the vast majority of money in the second half of the year.

With some of the top-performing ICOs up (such as FirstBlood, Golem, Gnosis, Qtum, and SingularDTV) as much as 5,000% in less than a year, it’s no wonder that more money keeps pouring in.

Like most bull markets, this will continue until the first indication that a sell-off has begun. This almost happened earlier this month, when bitcoin dropped to $1,800 and the overall public blockchain market dropped 40%, but it has since recovered most of its retracing and appears to be ready for another run.

Starting in the fall, I’ll be writing a new series of informational white papers, newsletters, and seminars for Dent Research. So watch out for that. And I’m also speaking at this year’s Irrational Economic Summit, so please join us.

Michael

Disclosures: Michael Terpin is an active investor in digital currencies and assets, and has provided public relations and advisory services for more than 100 blockchain companies, including Bancor, Eos, Ethereum, Gnosis, Golem and Qtum. No companies mentioned in this article paid for their inclusion; they were included because they were relevant.

The post Mid-Year Update: Bitcoin Up 190% and ICOs Soar appeared first on Economy and Markets.

July 27, 2017

How to Pick Winners in the New Space Race

In the pre-dawn hours of Saturday, October 12, 1957, a cold north wind blew through the streets of Baltimore. The temperature hovered around 40 degrees, but many of the people standing outside weren’t concerned about the chilly air.

In the pre-dawn hours of Saturday, October 12, 1957, a cold north wind blew through the streets of Baltimore. The temperature hovered around 40 degrees, but many of the people standing outside weren’t concerned about the chilly air.

They trained their binoculars on the sky. A small, glowing object streaked through the darkness and changed their world forever. Footage shot from down below by a local TV cameraman ended up on the national news.

The Russians, just a few days earlier, launched Sputnik 1, Earth’s first artificial satellite. It circled our planet every 98 minutes, traversing the United States seven times a day, and was visible with binoculars just after sunset and just before dawn.

But Sputnik 1 was small, about the size of a basketball. Successfully putting the satellite in orbit was important, but it held nothing more than a radio.

Then came Sputnik 2, launched a month later.

This satellite weighed more than 1,000 pounds and contained a living animal, a dog named Laika, a stray from the streets of Moscow that became the first animal to orbit Earth. Her presence far above, and circling at thousands of miles an hour, put the Russians firmly ahead of the U.S. in extraterrestrial milestones. And scared the snot out of everyone!

Could they spy on us?

Could they launch missiles from up there?

No one knew exactly what it meant for our adversary’s capabilities, but we knew that we couldn’t wait around to find out.

The U.S. launched its first unmanned satellite just months later in January 1958. The space race was born.

We all know about Neil Armstrong taking the first human step on the moon in 1969 and the many accomplishments of NASA, but sometimes we fail to see how such accomplishments dramatically improved our lives, even if they came at great cost.

It can come down to something as simple as the joy in finding an out-of-the-way historical marker, or as complicated as determining your position in the middle of the ocean.

Road directions used to be the domain of those who could read a map and apply that knowledge to the real world. It required combining the skills of memorization, visualization, and depth perception. Some people had it, many did not.

The dynamic could make family road trips entertaining, or an exercise in frustration that ended in tears, depending on who sat in the copilot’s seat. As my family traveled when I was a kid in the 1970s, it became a point of pride to provide accurate directions as we traversed the country.

This skill was highly valued in our household because our father was a captain in the merchant marines who had learned to determine his location on the high seas through celestial navigation. It seemed cool to use a sextant to measure the angle of the earth to known stars, but that wasn’t how he estimated his position when at work.

At the time, he used a radio navigation system called Loran-C, which was a further iteration of the original Long Range Navigation system used in World War II.

Loran used hyperbolic, low-frequency radio signals and a receiver to allow triangulation navigation. It required the installation of emitter stations around the world, and either receiving radios used with maps to estimate coordinates or special radios programmed to spit out longitude and latitude. It was cumbersome.

But the military had something else.

As Sputnik 1 flew by, U.S. engineers estimated its position by listening to the signal emitted by its radio transmitter. This prompted the reverse question: Could you estimate your position on Earth using signals from known satellites?

The answer was “Yes!”

But first those satellites had to exist.

In the 1960s, the U.S. military used satellites to pinpoint the location of submarines, but the process was still inconvenient. In the 1970s, the U.S. government decided to put effort into a satellite-based system for navigation and in 1978 launched the first Navigation System with Timing and Ranging (NAVSTAR). It was considered a state secret and not available for commercial use.

That changed in 1983 when the Russians shot down a South Korean airliner that accidentally veered into its airspace. President Reagan decided to make GPS navigation available for free to anyone who could receive the signal.

Once equipped with GPS receivers, anyone within range of several satellites could know where they were, at least in terms of longitude and latitude. The system rolled out in 1989 and became fully operational in 1993.

Just Look Where We Are Now

Today we use GPS in our smartphones to guide us to a local bar, a kid’s soccer game in an unfamiliar town, or even an airport or shipping port on the other side of the planet.

Imagine the savings in fuel, vehicle wear and tear, and even family relations from having GPS! And it all exists because NASA launches satellites equipped with timing and range capabilities.

An interesting part of the arc of GPS is that many of the original devices, produced by companies like Garmin, TomTom, and Magellan, have fallen out of favor. Most people don’t need two GPS-enabled gismos, and we’re going to keep our phones.

It just shows that even though a company is on the cutting edge of technology, it can still be cut out of the value chain.

I love stories about how exploration, whether out of fear, wonder, or greed, leads to improvements in our quality of life. These changes give us a chance to live better, and can also give us an opportunity to invest in the next big thing.

We’re exploring these themes, and more, at Dent Research’s fifth annual Irrational Economic Summit, October 12-14 in Nashville, Tennessee.

We’ve lined up guest speakers that include Stephen Sandford, who spent 28 years as a NASA engineer before taking a leadership role at the NASA Langley Research Center. He was nine years old when Armstrong first stepped foot on the moon, and now says we’ll have a base there in the near future.

And while often we look to the skies, there’s just as much to uncover back on Earth, notably under the seas. Mark Gordon of Odyssey Marine Exploration will talk about that. (Think pirate ships and minerals on the ocean floor.)

Our goal is to take you out of the box of conventional thinking, and possibly identify the next wave of technology that will change our lives, and lead to profitable investments. Just like Sputnik ultimately did 60 years ago.

Rodney Johnson

Follow me on Twitter @RJHSDent

P.S. What are your memories of the great space race? I’d love to hear them. Email me at economyandmarkets@dentresearch.com, or let’s catch up in Nashville.

The post How to Pick Winners in the New Space Race appeared first on Economy and Markets.

July 26, 2017

Catch a Glimpse of our 2017 Irrational Economic Summit

On Monday we began a two-week series to highlight the truth about some of the hottest topics on the Street…

On Monday we began a two-week series to highlight the truth about some of the hottest topics on the Street…

Cryptocurrencies.

Space Ex.

Legalized pot.

Fin-Tech.

You name it.

We’ve brought together experts at the top of their fields in each of these areas to share their insights with you over the coming days and weeks.

More importantly, all of them will be speaking at our Irrational Economic Summit in October. There, you’ll get a deeper dive into their research and findings, learn how to make some serious money from the real trends and get all your questions answered along the way.

Here’s a sneak preview:

Harry

Follow me on Twitter @harrydentjr

P.S. Book your ticket now before the event sells out. We’ll even take $500 off the price to sweeten the deal. Get all the details here.

P.P.S. As we were preparing to send you this email, Michael Terpin called me about yesterday’s SEC statement about “the DAO” (a failed German cryptocurrency from one year ago that the SEC stated may have violated U.S. securities laws but it wouldn’t take any action on). It turns out that many in the media have falsely reported this advisory will apply to ALL initial coin offerings. Michael wanted me to tell you this is absolutely NOT true. Just more proof that trusting mainstream media can be dangerous to your wealth.

The post Catch a Glimpse of our 2017 Irrational Economic Summit appeared first on Economy and Markets.

July 25, 2017

Cryptocurrencies: Fad or Long-Term Trend?

Bitcoin. Blockchain. Ethereum. Veritaseum. Litecoin. Ripple. ICOs.

Bitcoin. Blockchain. Ethereum. Veritaseum. Litecoin. Ripple. ICOs.

It seems like nowadays you can’t listen to or read the news without hearing something about cryptocurrencies. And it looks like investors are going crazy over it.

Ripple has gained 3,000% this year.

More than $1 billion has been raised in Initial Coin Offerings (ICOs) so far in 2017.

Unsurprisingly, here at Dent Research, we get dozens of questions from subscribers wanting to know if this is another tulip bubble or the real deal.

Unfortunately, I’m not well versed on any of the cryptocurrency stuff, so I was thrilled when I met Michael Terpin in Puerto Rico. He moved down here for the Act 20 and 22 tax programs that are luring investment managers and publication firms from the U.S. (I’ll write more about that in a future Leading Edge.)

Michael is about as heavily involved in this space as you can get. He co-founded BitAngels, a digital angel platform for startups, and bCommerce Labs as a tech incubator.

And he’s agreed to answer that question – are cryptocurrencies real hype or the real deal? – at our fifth annual Irrational Economic Summit this October.

Thus far we’ve seen incredible volatility in currencies like Bitcoin and Ethereum. The former soared above $3,000 recently and then fell back to $2,245 before surging back to $2,758. Such volatility excludes it from becoming a true currency just yet.

However, this industry appears to still be in its infancy and is likely a part of the next tech revolution that will peak around 2055 on my 45-year Innovation Cycle. As we move into that peak, digital currencies could join the ranks of technologies like biotech and nanotech that will sweep into the mainstream… changing the way we work and live.

I don’t know a hell of a lot about bitcoin and blockchain, but I do know that we need a more efficient way of creating currency to meet the need for transactions instead of central banks recklessly issuing currency to cheat and artificially stimulate their economies.

I think central banks will fail miserably in their endless stimulus games and create a worse crisis than 2008, because you don’t get something for nothing and that’s the game they’re playing.

I see central banks losing the faith of the public, and that will ultimately open a gap for larger cryptocurrencies to fill. Money would simply be created bottoms-up from the actual need for transactions. No more manipulation and taking over the free market systems.

But I am going to leave it to Michael Terpin to share his expertise, experiences, and insights with you at our Irrational Economic Summit this October 12-14.

Join us in Nashville, Tennessee, to hear what he says about this cryptocurrency craze. Is it real hype or the real deal? Michael will tell you.

Harry

Follow me on Twitter @harrydentjr

P.S. If you reserve your seat now to see Michael and the dozen other fantastic speakers we’ve got lined up for you at this year’s Irrational Economic Summit, we’ll slash off $500 from the ticket.

P.P.S. Cryptocurrencies is a source of some internal debate here at Dent Research. Rodney Johnson doesn’t believe they’ll amount to anything significant, and he’ll share his views with you on the subject in August. In the meantime, Michael has something to tell you this Friday, so watch out for it as we tackle the hype and empower the truth.

The post Cryptocurrencies: Fad or Long-Term Trend? appeared first on Economy and Markets.

July 24, 2017

How to Refresh Your Information Filter

“Hype” is short for “hyperbole,” that often noxious rhetorical device tactically deployed to get you to buy something – be it an idea, a product, or a service – you otherwise wouldn’t.

“Hype” is short for “hyperbole,” that often noxious rhetorical device tactically deployed to get you to buy something – be it an idea, a product, or a service – you otherwise wouldn’t.

It’s the essence of argumentum ad passiones – an emotion-based appeal that rests on feelings rather than facts.

Appeal to emotion is a critical method messengers use to overwhelm our information filters.

We humans are wired, for example, to love bad news. It’s part of our survival instinct — and if properly understood, it can help prolong our lives.

As psychologist Daniel Kahneman has written, “By shaving a few hundredths of a second from the time needed to detect a predator, this circuit improves the animal’s odds of living long enough to reproduce.”

Failure to understand our fear response can also have negative consequences.

We’re off to a rough start in the 21st century – an era so far marked by the deadliest and most destructive attack on American soil in our history and a destabilizing, once-every-hundred-years financial crisis and economic downturn.

The former unleashed the worst tendencies of our national security state, reflected domestically in the sacrifice of basic civil rights such as privacy and internationally in the form of the endless Global War on Terror.

The latter exposed the craven incompetence of fiscal and monetary authorities, whose responses were and are shaped by a neoliberal Washington Consensus, serving American Empire, enriching the rich, leaving Main Street to suffer.

At the same time, over the last several centuries of human history violence has steadily declined.

That, as Steven Pinker writes in The Better Angels of Our Nature, “may be the most significant and least appreciated development in the history of our species.”

We are, according to Pinker, living in a more peaceful period than any other.

“News,” Pinker recently told Julia Belluz of Vox, “is a misleading way to understand the world. It’s always about events that happened and not about things that didn’t happen.”

News is a drug, and the mainstream media are your dealers.

They know we’re wired to pay attention to negative news. They use this knowledge to draw our attention to their advertisers.

They’re not necessarily lying about the world. All that bad stuff is actually happening.

It’s just that there’s no context. The picture is incomplete, unbalanced.

But now we know. And your mindset is critical.

Get to What’s Real

Will marijuana go mainstream in the next five years?

Will cryptocurrencies upend the financial system as we know it?

Will man set foot on Mars in our lifetimes?

Those are loaded, revolutionary, and overwhelming questions.

They also frame what could be fantastic fortune-makers for investors equipped with the proper information filters.

That’s what we’re going to do at the fifth annual Dent Research Irrational Economic Summit: provide information that will help you get past hyperbole and recognize real opportunities.

Brendan Kennedy is CEO of Privateer Holdings, the world’s first private equity firm focused entirely on legalized cannabis. Brendan will talk to you about his vision for “corporate pot.”

As Brendan recently told TechCrunch, “Our thesis was that this will be a mainstream consumer product used by mainstream Americans, and they will be looking for mainstream professional brands that don’t insult or offend them.”

Michael Terpin is co-founder and chairman of BitAngels, the world’s first network of angel investors whose interest is exclusively in digital currencies.

Michael will provide invaluable context for the rise of cryptocurrencies, including bitcoin, and the potential of blockchain technology.

And Stephen Sanford is a former NASA engineer. He’s also the author of The Gravity Well: America’s Next, Greatest Mission.

Stephen’s going to walk us through what it will take to get back to the Moon and, eventually, to put a human on Mars. He’ll also explain the enormity of the economic opportunity awaiting us in space.

Those are just three of the speakers you’ll hear from this October 12-14 in Nashville.

Harry Dent, Rodney Johnson, Adam O’Dell, Charles Sizemore, John del Vecchio, and Lance Gaitan, will also be there to help you cut through the noise.

So will past IES stars like Lacy Hunt and Andrew Pancholi.

And we’ll have new voices, too, including technology investor and entrepreneur Howard Lindzon.

“One of the most salient features of our culture,” writes American philosopher Harry G. Frankfurt in his widely circulated 2005 essay, “is that there is so much bullshit. Everyone knows this. Each of us contributes his share. But we tend to take the situation for granted. Most people are rather confident of their ability to recognize bullshit and to avoid being taken in by it. So the phenomenon has not aroused much deliberate concern, nor attracted much sustained inquiry.”

Well, Dent Research’s Irrational Economic Summit is an effort to fill this deficit of sustained inquiry.

Our goal is indeed to persuade – but with due regard for truth.

Over the next several issues of Economy & Markets, we’ll focus on identifying corrosive hyperbole and identifying real opportunities.

Stay tuned.

David Dittman

Editorial Director, Dent Research

The post How to Refresh Your Information Filter appeared first on Economy and Markets.

July 21, 2017

The Boomers Are Aging Fast… Time to Make Money Now

If you’ve followed my writing for any length of time, you know how much respect I have for Harry and his demographic work.

If you’ve followed my writing for any length of time, you know how much respect I have for Harry and his demographic work.

Believe it or not, Harry, and his approach to forecasting, gave me the confidence to help launch Peak Income – an income newsletter – at a time when most investors were terrified of yield-focused investments.

The consensus two years ago was that inflation and higher bond yields were just around the corner, which would’ve meant a rough ride for the kind of investments I recommend.

In retrospect, that claim seems almost absurd. Inflation is still dead on arrival and bond yields have gone mostly sideways for the past two years.

But, back then, investors were legitimately concerned about the alternatives unfolding.

It was my knowledge of demographic trends, learned from my years working with Harry, which allowed me to go against the grain and start scoring very respectable returns for my readers.

Right now, as I wrote in the July issue of Peak Income, I’m following his lead again. My approach this month has to do with the power of perhaps the greatest demographic trend of all: the aging of the Baby Boomers.

We’re talking about the economic power of the nearly 110 million people born between the late 1930s and 1961, and how to generate a steady flow of income now, and later.

Specifically for my Peak Income readers this month, we’re looking at the “landlords” of the places – skilled nursing facilities, senior housing, and hospitals – that many Boomers will likely spend time in in the coming years.

Take a look at the “Nursing Home Wave.”

The chart below takes the number of Americans born every year, adjusted for inflation, and pushes the data out 84 years – the peak age for nursing home spending – so we can forecast peak demand for nursing homes.

A few things jump off the page immediately.

This simple demographic model shows that demand for nursing homes has actually been in decline for over a decade. But 2017 represents the absolute nadir of the chart. From this point on, demand for nursing homes is set to rise virtually every year until the mid-2040s.

This demographic model is not intended to be as precise as a sniper’s bullet. I prefer to think of it more as a shotgun. You point it in right direction, and it’s likely to hit its target.

But what this model tells us is that demand for senior care is set to rise for a long time to come.

Now, there are factors that can complicate an investment in this space.

In the healthcare landscape right now, despite constant debate about repealing and replacing Obamacare, most health insurance stocks are sitting near new 52-week highs. And Americans certainly aren’t getting any younger or healthier.

Demand for healthcare has never been stronger… and it’s only going to get stronger still with the aging of the Boomers.

At the same time, the sector of investments I target this month have taken a beating as of late.

I don’t know exactly the reasons why. I suppose there’s the perpetual worry about Medicaid reimbursement. Nursing home and assisted-living facility operators live under the constant threat of having the fees they collect for their services slashed at the government’s whim.

When Medicaid decides to cut its reimbursement rate, there’s really nothing a nursing home can do. They either accept the lower revenue… or close their doors.

But not even Medicaid fears can explain the weakness in this sector.

If you’ve invested for any length of time, you know that the market often makes little sense.

But that’s OK.

In fact, it’s good that the market is irrational. Were it perfectly rational all the time, like Spock from Star Trek, there wouldn’t be any profit left for us.

This investment yields close to 8% right now, and if it gets back to its 52-week high, which I see as a very good possibility, you can expect returns of 30% on top of the dividend.

Click here to learn how to take advantage right now.

Charles Sizemore

Editor, Peak Income

The post The Boomers Are Aging Fast… Time to Make Money Now appeared first on Economy and Markets.

July 20, 2017

2 Simple Steps to Beat U.S. Stocks

Americans like to buy American stocks.

Europeans prefer European stocks.

And Chinese investors… well, you guessed it, they go heavily into Chinese stocks.

This is the essence of a phenomenon called home country bias.

As investors, we feel most comfortable buying the stocks of “our own” domestic companies. And we routinely under-allocate to foreign stocks.

That means U.S. investors are likely invested in…

Apple… not Samsung

Google… not Tencent

Amazon… not Alibaba

Intel… not the Taiwan Semiconductor Manufacturing Company

Verizon… not America Movil

Coca-Cola… not Fomento Economico Mexicano

I’ll note that we recommended an investment in Fomento to our Boom & Bust subscribers. Generally, though, we know well U.S. investors’ preference for U.S. stocks.

Let’s be honest… it feels uncomfortable investing in a foreign company… and it’s worse when you can’t even pronounce its name! Right?!

But sticking too close to your home turf – in the name of comfort, or otherwise – could be costing you a lot of money.

Each of the foreign companies listed above are beating the pants off their U.S. counterparts so far this year.

Samsung is beating Apple (49% to 29%)

Tencent is beating Google (57% to 23%)

Alibaba is beating Amazon (75% to 36%)

Taiwan Semiconductors is beating Intel (24% to -6%)

America Movil is beating Verizon (36% to -21%)

Fomento Economico Mexican is beating Coca-Cola (35% to 7%)

So, what’s an American investor to do?

Two simple things…

The first step is to acknowledge there’s nothing “special” about U.S. stocks.

They aren’t pre-ordained to be the investment world’s best market all the time. Sometimes U.S. stocks outperform foreign stocks. Other times, it’s the other way around.

U.S. stocks will always feel more comfortable to U.S.-based investors. Reinforcing that preference, currently, is the fact that U.S. stocks have indeed outperformed foreign stocks for a long while now. From the March 2009 bottom through the end of 2016, the S&P 500 gained a massive 225% while emerging-market stocks were up just 82% and foreign developed markets just 46%.

But as I first warned in March, there’s no guarantee U.S. stocks will always outperform foreign stocks. The reality is that U.S. stocks are more likely to underperform ahead, as they’ve done so far this year.

Once you acknowledge that there’s nothing special about U.S. stocks, you’re halfway toward finding lucrative opportunities all around the world.

The second step is simply figuring out the best way to invest in foreign stock markets. And, as I see it, that decision is a no-brainer…

You should invest in ETFs.

Look, finding the “next Apple” in China is no easy feat.

Frankly, most investors don’t have what it takes to be stock-pickers in their home markets, let alone foreign markets. So most ordinary folks are better served investing in a diversified basket of foreign stocks and calling it a day.

ETFs make that easy and cheap to do.

Take for instance the iShares MSCI Mexico ETF (NYSE: EWW).

Around 22% of this ETF’s assets are invested in America Movil, Verizon’s counterpart, and Fomento Economico Mexican, the “Mexican Coca-Cola” that we recommended to Boom & Bust subscribers – both up around 35% this year. But it’s also invested in roughly 60 other Mexican stocks, ranging from banks and cement companies, to airlines and real estate investment trusts.

This ETF gives you a simple way to “buy Mexico” – with one click of the mouse, and for a measly 48 basis points. So far this year, that’s been a good buy.

Mexico (EWW) is the top-performing stock market ETF among the 15 countries I track in Cycle 9 Alert and 10X Profits.

Shares of the ETF are up more than 31% year-to-date. That’s three-times better than the S&P 500 (SPY)!

Chinese stocks are also having a great year. And because it’s daunting to buy individual stocks out of China, the iShares China Large-Cap ETF (NYSE: FXI) offers a diversified, low-cost, and simple way to gain access to China’s market.

Shares of the iShares China ETF are up 20% this year, nearly four-times the return we’ve seen from U.S. small-cap stocks so far.

The bottom line is, you’re missing a world of lucrative opportunities if you’re restricting your portfolio to U.S. investments only.

According to private equity firm KKR, China’s economy will account for a full 35% of global GDP growth in 2017. Emerging-markets outside of China will contribute an additional 41% of global growth.

Meanwhile, U.S. economic growth will be just 10% of the global pie this year.

That should make you think twice about loading up on U.S. names… and make you take a second look at global stock market ETFs, from China to Mexico and beyond.

Adam O’Dell

Editor, Project V

Follow me on Twitter @InvestWithAdam

The post 2 Simple Steps to Beat U.S. Stocks appeared first on Economy and Markets.

July 19, 2017

The Right Formula for a Multi-Bagger

You don’t need me to tell you that the sports world is practically made of money. From eye-popping salaries to endorsements on top of endorsements, it’s an endless stream of cash.

You don’t need me to tell you that the sports world is practically made of money. From eye-popping salaries to endorsements on top of endorsements, it’s an endless stream of cash.

For us Monday-morning quarterbacks and armchair general managers, we can only shake our heads, right? How could we possibly make any money alongside our favorite teams and players?

Truth is, we’re a long, long way off from a publicly traded sports team – although, if you’re a football fan, you might be interested in the strange rise and fall of Fantex, the “athlete stock exchange.”

In fact, I’m not sure we’ll ever see that happen. Can you imagine a blockbuster trade getting torpedoed by a shareholder revolt? Granted, “shareholder revolt” probably sounds great if you’re a Knicks fan (or a Jets fan, or a Lions fan… you know I could go on!).

The Green Bay Packers are an oddball in this sense. They’re a publicly owned non-profit, and the team has in fact “issued” hundreds of thousands of “shares” a few times over the years.

So why the scare quotes?

Well, the answer’s right there in the fine print: “Common stock does not constitute an investment in ‘stock’ in the common sense of the term. Purchasers should not purchase common stock with the purpose of making a profit.”

It’s a head-scratcher, but, basically, the “stock” is pretty much worthless. Even if the Packers were sold, the stockholders wouldn’t get any of the profit.

All in all, it’s a feel-good type of situation for the fans.

But something funny happened recently.

One of the most savvy media moguls of all time purchased an entire sport. And not just any sport – it’s one of the most popular competitions in the world.

In terms of total fans, soccer takes the top global spot in terms of popularity. It’s not hard to understand why eight top marketers paid $75 million each — $600 million total — to sponsor the most recent World Cup in Brazil for just seven days.

At the same time, advertisers paid around $75 million to buy about 20, 30-second spots during the Super Bowl broadcast, the biggest single-day sporting event in the world (and also one the biggest marketing events, too).

The NFL is tops when it comes to views (as in, eyeballs focused on the TV), but you might be surprised what comes in at number two. And, in fact, my most recent issue of Hidden Profits goes deep into this sport and how you can in fact invest alongside it.

You might recognize the name John Malone. He’s the head of Liberty Media, which has its hands in so many companies and ventures it’ll make your head spin.

Malone is a notoriously deft businessman. He’s gone toe to toe with Rupert Murdoch, and Al Gore once called him Darth Vader. His resume is studded with success and profits.

Well, he just became the sole owner of the second most-watched sport in the world. And, in typical Malone fashion, he’s created a way for everyday investors to get in on the action.

This is a high-probability opportunity with the real chance to be a multi-bagger down the road. You need to read this story right now, before you’re left in the dust.

Good investing,

John Del Vecchio

Editor, Hidden Profits

The post The Right Formula for a Multi-Bagger appeared first on Economy and Markets.

July 18, 2017

Why a Major Revolution Is Brewing

I have written many articles on how extremely polarized our politics has become in the last decade. I’ve dedicated several Leading Edge newsletters to the topic. I talked about it at our 2016 Irrational Economic Summit. I even discuss it briefly in my new book, Trump, Brexit, and the Next Civil War, which will be available around mid-August.

I have written many articles on how extremely polarized our politics has become in the last decade. I’ve dedicated several Leading Edge newsletters to the topic. I talked about it at our 2016 Irrational Economic Summit. I even discuss it briefly in my new book, Trump, Brexit, and the Next Civil War, which will be available around mid-August.

I talk about it so much because it’s related to the mega 250-Year Revolution Cycle sweeping over us right now. We’ll feel the effects of this cycle for decades to come… which I detail in my new book.

But today I want to show you another aspect of this divide.

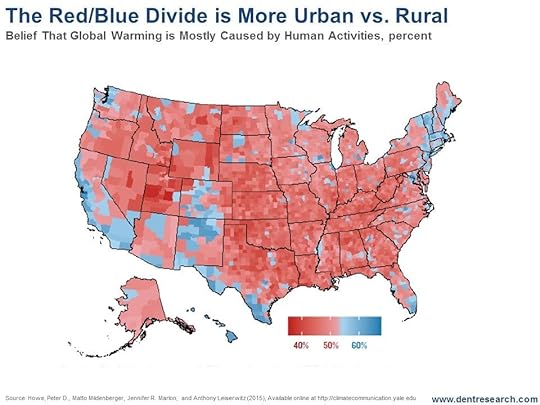

Look at this chart.

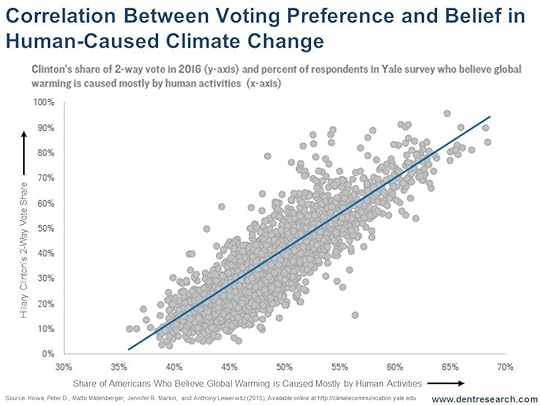

There are a number of partisan issues that delineate the differences between red and blue voters, and this is clearly one of them. The chart on red versus blue voting in the last presidential election is nearly identical to this one.

When you look more closely, you can see that the red/blue split in our country is more a rural/urban split. Roughly 20% of our population lives in major cities, 60% in suburbs, and 20% in rural areas. Those closer to the larger cities tend to lean more toward liberal views.

Even in the largest red state – Texas – Dallas and Houston residents tend to be more liberal, although not as liberal as Austin, with Willie Nelson as its mascot.

The rural areas are more conservative. It’s no surprise that states like Nebraska, Kansas, Oklahoma, West Virginia, Kentucky, Tennessee, Wyoming, and Alaska were red states during last year’s election. They have huge swathes of rural land.

This is important because of this…

For the longest time after the election, there was all this debate about why Clinton lost. The truth is that Trump won the rural white vote by margins of 80%-plus… much higher than Clinton won the traditional working class and voters living in the inner-cities.

I saw a show a while back about a rural county in Alabama where Trump got 89% of the vote! The formerly blue states that turned red for Trump, like Pennsylvania, Ohio, Michigan, and Wisconsin have large rural, red areas!

The strong rural red leaning also explains why the Republicans were favored twice by the electoral college. It favors land mass a bit more than voter density – as does the two senators per state, which gives low population rural states like Wyoming more representation.

I’m not taking sides here. I lean red on some issues (more fiscal) and blue on others (more social). But the current split across the country is an unsustainable imbalance. The U.S. is the most politically polarized of the major developed countries, and it has the highest income inequality that just adds fuel to the polarization fire.

These imbalances block upward mobility, which is a fundamental cornerstone of democracy, innovation, and progress, as is the ability to compromise for effective political change.

We have a revolution coming on a convergence of my 250-Year Revolution and Andrew Pancholi’s 84-Year Populist Revolution cycle. America is going to be at the center of this. This revolution will be as big – if not bigger – than the one that brought us democracy, and the Protestant Reformation in Europe before that.

Watch out for the release of my new book. As a loyal subscriber, you’ll have exclusive access before it goes to the general public in 2018.

Harry

Follow me on Twitter @harrydentjr

The post Why a Major Revolution Is Brewing appeared first on Economy and Markets.