Harry S. Dent Jr.'s Blog, page 81

June 19, 2017

The Deregulation Revolution Is Real, But Is It Enough?

I’m not much of a fast-food guy. I’ll pull into McDonald’s for an Egg McMuffin when I’m traveling, but typically I stay away from such fare… except for Chick-fil-A.

I’m not much of a fast-food guy. I’ll pull into McDonald’s for an Egg McMuffin when I’m traveling, but typically I stay away from such fare… except for Chick-fil-A.

Occasionally, I’ll lose restraint and drive through the Chicken Shack, but I think that’s part of my DNA. The combination of fried chicken and friendly service is a weakness for most people raised in the South.

But, several years ago, I gladly drove through a nearby McDonald’s for lunch. I wasn’t drawn in by a promotional campaign or the seasonal McRib sandwich.

I was lured by a protest.

The Service Employees International Union (SEIU), an organization that serves as a voice for two million working-class people, had recently started a campaign to raise the minimum wage paid to fast-food restaurant workers to $15 per hour.

In a free market, I’m not a fan of minimum wage.

I believe it acts more as an anchor than a support for workers. If the rate nearly doubled to $15, businesses would be motivated to adopt new technology instead of paying people higher wages. (This proved to be true as McDonald’s recently rolled out self-order kiosks across the country.)

So, on the appointed day when the SEIU called for a boycott of McDonald’s nationwide to bring attention to their cause, I specifically chose to risk indigestion and drive through, to show support for franchise owners.

My counter protest was small, but why not?

The SEIU didn’t win that fight, but they didn’t lose, either. Several states and many cities raised their minimum wages in recent years in no small part due to the union’s efforts.

But the federal government didn’t take the bait. At least, not in Congress.

The last administration provided the Department of Labor with informal guidance to view franchise employees as joint employees with the main business. This meant that the federal government would a view a worker at a McDonald’s in “Anywhere, USA,” as an employee of both the franchisee and McDonald’s corporation.

The effect of this policy was ballooning risk for large corporations with many franchise owners. Big companies, like McDonald’s, would be on the hook for all HR decisions made by franchisees.

Conversely, small business owners that operated one or two restaurants would have to comply with, and pay for, additional oversight and prevailing wages from other, higher-cost regions.

All of this has changed under the Trump administration.

Recently, the Trump White House reversed the previous guidance to the DOL, allowing the prevailing view (that workers are only employees of the franchise owners) to remain.

This is a huge win for small businesses, and highlights why business optimism – as well as market optimism – remains so high.

Despite the crazy headlines and political machinations, the Trump administration, like it said it would, is cutting regulations and not issuing new ones. It’s a welcome change for American companies, large and small.

Business owners would no doubt love to see tax reform, and it would be fabulous for all Americans to develop a working system for healthcare. But simply knowing that Washington isn’t planning its next regulatory tax is a win that shouldn’t be dismissed.

The American Action Forum (AAF), which monitors federal regulations, puts this in perspective.

According to the group, in Trump’s first several months in power, he’s issued 8% of the number of regulations put in place by the Obama administration over the same timeframe. While that’s an eye-catching reduction, the dollars attached are even bigger.

The average cost of new regulations in the first five months of the year of each year since 1994 (covering the Clinton, Bush, and Obama administrations) was $26 billion.

Trump’s new regs clock in at a miniscule $33 million, or just over one-tenth of one percent of the average.

So far, the young administration is hesitant to even consider any new rules. The three previous administrations reviewed 190 rules on average in the first five months of each year, whereas the Trump group reviewed 39.

With this perspective, it’s easier to see why business owners and investors are more bullish on the future than they’ve been in some time.

But they are most likely getting ahead of themselves.

Look at the big picture.

Retirees typically cut their spending by about 37.5%. With 1.5 million Boomers turning 70 each year for the next 15 years, we’ve got a lot of aging consumers that will spend less in the years ahead.

Usually we’d see the younger generation, the millennials, ramping up their spending to take the place of the Boomers. But so far, this hasn’t happened.

Maybe it’s the student loan debt they carry, or the lack of rising wages, or perhaps the memories of what happened to their parents during the financial crisis.

Whatever the reason, the millennials haven’t yet put down the roots that would start them down the path of predictable consumer spending, which could dramatically affect economic growth – and the markets – in the years ahead.

We still hold out hope that the situation will reverse.

Recent home sales data shows that first-time buyers were 38% of the market in 2016, the first time this group has been above the long-run average of 35% in a decade.

Buying a home is part of starting a family, which is the biggest driver of consumer spending, and one that’s hard to turn off.

It will be a few years before we have enough data to know for sure if the baton of consumer spending has passed from the older to the younger generation.

For now, we’ll have to be content with a lighter regulatory burden.

Rodney

P.S. I talk more about why this market has been Trump-proof, at least so far, in the first issue of Dent Cornerstone Portfolio. This is a new service we debuted recently where I streamline the best recommendations across our variety of Dent Research services into one actionable portfolio. Market commentary is part of the offering too.

It’s a service that’s been a long time coming and I’m happy to finally bring it to you. Learn more about it here.

P.P.S. We have another new strategy about to debut from Adam O’Dell. Don’t miss being one of the first to learn about all the details, by clicking here to reserve your spot for his free webinar next Monday.

The post The Deregulation Revolution Is Real, But Is It Enough? appeared first on Economy and Markets.

June 16, 2017

Deflation: There’s an App for That

Once in a while I see a financial news headline so obviously ridiculous, I feel I should look at the writer with pity in my eyes and pat them on the head, the way you might comfort a child that just dropped his ice cream cone on the floor.

Once in a while I see a financial news headline so obviously ridiculous, I feel I should look at the writer with pity in my eyes and pat them on the head, the way you might comfort a child that just dropped his ice cream cone on the floor.

“Inflation is Right Around the Corner, Yellen Insists.”

Of course it is…

In defense of the columnist who wrote the story, these weren’t necessarily his views. He was simply relaying the Fed Chair’s comments from Wednesday.

My real pity is reserved for Ms. Yellen herself. If she actually believes that inflation is on the horizon, she’s clearly not very good at her job. She might even be delusional.

Yellen believes that a firming job market will lead to higher wages and a general increase in prices. And 20 years ago, that would have been true. A tight labor market leads to rising wages, which in turn forces companies to raise their prices to maintain profitability.

But what Janet Yellen fails to understand is that, in this age of technological disruption, labor becomes disposable as soon as it gets pricey.

Consider the unglamorous world of fast-food.

Over the past decade, labor activists have aggressively pushed the “fight for $15,” or a nationwide minimum wage of $15 per hour. This directly affects fast-food restaurants. They tend to hire young or low-skilled workers who earn minimum wage (or close to it).

Hey, I get it. They’re looking out for the little guy. But in pushing for higher wages, they are simply speeding up the inevitable death of entry-level jobs.

Take Panera Bread and McDonald’s.

Both companies have made major investments in kiosks that allow customers to skip the line, and most of their major competitors have either already started doing the same or intend to start soon. (Your local grocery store may have been doing this for years, too.)

It doesn’t stop there.

Starbucks has an iPhone and Android app that lets you order coffee and even pay for it on your phone.

I can order from my neighborhood Domino’s on a mobile app and have my pizza waiting for me in less than 10 minutes.

All of these cases have one thing in common: Cheap technology has replaced a human cashier or order-taker.

When Ms. Yellen talked this week about inflation on the horizon, I also wonder if she’s never shopped on Amazon or one of its online competitors.

As more shopping shifts online (first-quarter e-commerce sales in 2017 increased 14.7% year-over-year, for example), there’s far less demand for physical retail stores… and the army of clerks and cashiers than man them.

Amazon is also quickly making the delivery boy redundant with aerial drones… and driverless cars and trucks will soon squeeze out millions of truck and taxi drivers. All of this works to lower costs, not raise them.

And it’s not just entry-level workers on the chopping block. Goldman Sachs made news this week by announcing that it’s using technology to automate some of its more labor-intensive investment banking tasks.

No one is going to cry over the sight of unemployed investment bankers. But if banking jobs can be automated away, then why not attorneys or even doctors?

You might laugh, but Cologuard, the company behind the do-it-yourself colon cancer test, now allows a cheaper lab technician to screen samples. That’s a lot less expensive (not to mention more comfortable for the patient) than having a highly-trained proctologist perform a colonoscopy.

And the trend applies to music and media too.

Cable TV is dying a slow death. Cheaper streaming options like Netflix have turned the economics of the business inside out. And younger consumers are so accustomed to getting music for free (or close to it), that getting them to pay for it is next to impossible.

You get my point.

Today, more than at any time since the Industrial Revolution, technology is eliminating expensive labor. This is deflationary, not inflationary. And it’ll contribute to the great deflation Harry sees ahead.

It’s also, ultimately, a very positive thing. Efficiency creates a higher standard of living over time, even if the transition can be painful to live through.

That’s a longer story for another day.

For now, suffice it to say that inflation won’t be a problem any time soon. If you’re betting on higher bond yields or higher commodity prices, you’re likely to be sorely disappointed.

In an environment of stable or falling prices, current income is the name of the game. And I write a newsletter dedicated to finding exactly that.

In Peak Income, I look for outstanding income opportunities that are off Wall Street’s radar, and produce consistent returns to help you accomplish your goals. Click here to learn what investments I’m recommending right now.

Charles Sizemore

Portfolio Manager, Boom & Bust Investor

The post Deflation: There’s an App for That appeared first on Economy and Markets.

June 15, 2017

The Fed Decides… No Surprise

The Federal Reserve is one of the most powerful economic engines in this country, if not the world. Its power and influence is such that any meeting or quote, no matter how seemingly banal or inconsequential, can have dramatic consequences (or so it likes to believe!). The Fed meets eight times a year to decide if a change in monetary policy is needed, and yesterday it had one of those meetings.

The Federal Reserve is one of the most powerful economic engines in this country, if not the world. Its power and influence is such that any meeting or quote, no matter how seemingly banal or inconsequential, can have dramatic consequences (or so it likes to believe!). The Fed meets eight times a year to decide if a change in monetary policy is needed, and yesterday it had one of those meetings.

Remember, the Fed hiked rates in December 2015 for the first time since before the financial crisis in 2008. It didn’t raise rates again until December 2016 and then in March. These hikes are supposed to a big deal.

Yesterday’s meeting was important because the Fed was expected to deliver one of these important hikes for the third time in six months and bring interest rates closer to “normal” – despite recent softening economic data, including today’s consumer inflation data which came in lower than expected.

Specifically, the May Consumer Price Index (CPI) actually went negative month over month, and the core CPI (less food and energy) fell to 1.7% on the year. That’s going the wrong way and not at all what the Fed wants to see.

Additionally, May retail sales data was also pathetic. The market expectation was for a slight rise in spending, but instead it fell a substantial 0.3%, and that’s excluding auto sales. Retail sales accounts for half of all consumer spending, so this is, again, not what the Fed wanted to see just ahead of Wednesday’s policy decision.

So what how did all that bad news affect the meeting yesterday?

As you know, the global economy slowed after the financial meltdown of 2008. In response, the Fed lowered its key rate to zero and implemented the much-ballyhooed policy of quantitative easing (QE) in hopes of stimulating borrowing, inflation (prices), and jobs. Following the Fed’s lead, central banks around the world also lowered their key rates to zero (or negative) and initiated their own versions of QE to try goosing their own economies.

But the Fed was only copying the failed policies of the Bank of Japan, which started its stimulus programs over 20 years ago. Japan’s central bank tried everything in the book to fight years of deflation and financial crisis after crisis! Memories are short, but you don’t have to look that far back to wonder why the Fed thought a policy that failed in Japan would work here.

In 2013 the BoJ announced another massive stimulus program that made the Fed’s QE program look paltry. But, by last year, it was apparent the move had little effect on deflation brought on by an aging population that spends less, low immigration, and a low fertility rate… a demographic catastrophe.

But that’s nothing new; Harry has been talking about Japan’s losing battle for years!

But the BoJ isn’t the only major non-U.S. central bank to rely on monetary stimulus. The European central bank (ECB) has its own version of QE and negative rates.

The ECB met just last week and basically confirmed that its EUR60-billion-per-month ($67 billion) bond-buying program isn’t working as expected (surprise, surprise…), and also revised its inflation expectations lower.

Not only is the ECB running out of German bunds (bonds) to buy to stimulate inflation. It’s also failing to stimulate inflation! ECB credibility could be at risk…

OK. Let’s get back to the Fed and yesterday’s decision. Yes, it hiked the federal funds rate by another quarter point, as promised.

The Fed’s explanation about falling inflation is that it’s a temporary phenomenon and it will turn higher by next year. How that will happen is a fair question. The Fed forecasts GDP growth this year at 2.1% and back to 2% in 2018 and 2019.

So the economy still has a pulse, and the Fed still plans to hike another time this year and expects three to four hikes next year…

Another five rate hikes in the next 18 months? I doubt it. Not unless the economy does a U-turn and starts gaining steam. The employment situation seems to be solid – that is, if you just look at the unemployment rate and not the labor force participation rate.

The Fed also plans to reduce its $4.5 trillion balance sheet later this year by decreasing reinvestment in maturing securities.

The Fed’s outlook for the economy seems to be rosy, even in the face of data saying that’s not the case. If the data doesn’t improve like the Fed thinks it should, the path of the fed funds rate will reflect that.

In other words, instead of hikes there could be rate cuts. And if the fed funds rate could go to zero again, and QE could be back! That’s straight from the addendum to the Fed’s most recent policy statement.

We’re either going to get five or so rate hikes in the next year unless the economy tanks. If the latter happens, the Fed could again implement yet another version of its failed QE policy.

Fed Chair Janet Yellen thinks the strong labor market will eventually translate into higher inflation. She doesn’t believe that it’s wise to overreact to a disappointing inflation reading or two, and that even though the 2% inflation target has slipped, it will eventually turn around.

Chair Yellen was asked a couple times if central bank credibility and, specifically, the Fed’s credibility, has been damaged because global inflation is too low. Can you guess what her answer was? Yeah, she doesn’t think their credibility has been impaired.

The bottom line is that it doesn’t matter what I think or what Chair Yellen thinks. The market thinks the Fed is wrong.

Not only are long-term Treasury rates falling. The yield curve continues to flatten, and that’s a much more accurate reflection of the state of our economy. As I wrote last month, a flattening yield curve means the market doesn’t believe there’s much risk of rising inflation or accelerating economic growth.

And sorry, Chair Yellen: that means central bank, and especially Fed credibility, is impaired!

You can prepare for and profit from surprises in the financial markets, and specifically in the Treasury bond market, with Treasury Profits Accelerator.

Good investing,

Lance Gaitan

Editor, Treasury Profits Accelorator

The post The Fed Decides… No Surprise appeared first on Economy and Markets.

June 14, 2017

The Top 7 Cases Against Gold

Gold Optimists Could be Jumping the Gun

Lately, analysts are growing increasingly giddy about gold’s rise in value to near $1,300/oz. Hey, we said it was going to $1,400 after the extreme sell-off down to $1,055. And recently we warned that if it broke above a downward trend line in rallies, it might even go to as high as $1,450, after previously reaching $1,383.

Lately, analysts are growing increasingly giddy about gold’s rise in value to near $1,300/oz. Hey, we said it was going to $1,400 after the extreme sell-off down to $1,055. And recently we warned that if it broke above a downward trend line in rallies, it might even go to as high as $1,450, after previously reaching $1,383.

And that looks more likely now.

But they’re excited for all the wrong reasons.

In the next several months it’ll be time to SELL the precious metal again… not the time to overpay for a relatively worthless investment.

The problem is, many owners are hesitant to part with their gold because of the (misdirected) value they place on the asset. Sure, gold can hold particular sentimental value… but that’s it.

Gold bugs will declare several reasons for investing in and holding onto their stash of the yellow metal. One of the leading tenants they swear by declares gold to be a strong hedge against inflation, dollar manipulation, and crises.

Right now, there is absolutely no evidence of an inflationary threat and absolutely nothing to indicate the dollar’s strong value will weaken. And if you think gold will protect you during times of crisis, just look at the last bubble burst in 2008 – the dollar was the safe bet, not gold.

Again, this is all on top of the fact that a commodity (not a currency) with very little value and very little financial security has been flirting with $1,300 – $1,380/oz.!

The evidence against gold goes much further. In our latest infographic below, The Top 7 Cases Against Gold, we reveal the top seven cases against gold and why we’re approaching the perfect time to part ways with the yellow metal… and maybe even make a bet against it.

Harry

Follow me on Twitter @harrydentjr

The post The Top 7 Cases Against Gold appeared first on Economy and Markets.

June 13, 2017

The Retail Apocalypse We Saw Coming

It’s like a scene out of “Resident Evil.”

It’s like a scene out of “Resident Evil.”

Sheets of newspaper scratch along the dusty linoleum floor as the wind beats them into the remnants of a bench… or through the open glass door and into the darkened, empty space beyond.

Escalators haven’t run in decades.

The air itself looks dusty.

Could this really be the future of the American mall?

Not unless we have a nuclear apocalypse!

As for this retail apocalypse you’ve been hearing so much about…

Well, it’s bad – yes! – and it’s going to get worse, but I’m writing today to tell you it was totally predictable!

In fact, just like we forecast that Harley Davidson would suffer, so too did we forecast that retail stores would take it in the nuts as the Baby Boomers moved along their predictable spending wave!

Yes, the retail, brick-and-mortar, industry is suffering because there are too many stores… because online shopping is growing exponentially… and because shoppers are “moving toward experience…”

Yes, Amazon stock price broke the $1,000 mark at the end of May.

Yes, the Dow is still just over 21,000 likely heading towards 22,000-plus after a near term correction. Investors still believe in the Trump magic wand of lower taxes and regulations that first, may not happen, and second will not be as big an impact as economists think because businesses are already over-expanded from the bubble boom and we are back at full employment with lower workforce growth ahead.

But there’s something so much bigger than all of these things going on, and everyone seems to be missing it!

For all the reports I’ve read on this issue… for all the analyses and insights… the mainstream media is missing what’s right in front of their noses!

The Atlantic came about as close to dammit as it could, yet still didn’t says it. The reporter wrote:

What’s up? Travel is booming. Hotel occupancy is booming. Domestic airlines have flown more passengers each year since 2010, and last year U.S. airlines set a record, with 823 million passengers. The rise of restaurants is even more dramatic. Since 2005, sales at “food services and drinking places” have grown twice as fast as all other retail spending. In 2016, for the first time ever, Americans spent more money in restaurants and bars than at grocery stores.

Yet retail stores across the country are dropping like flies.

I’ve got two words for this reporter and all the other knucklehead mainstream media:

Baby!

Boomers!

All these retail stores closing…

All these bankruptcies…

It was all baked into the cake when the massive Baby Boom generation peaked in its spending in late 2007.

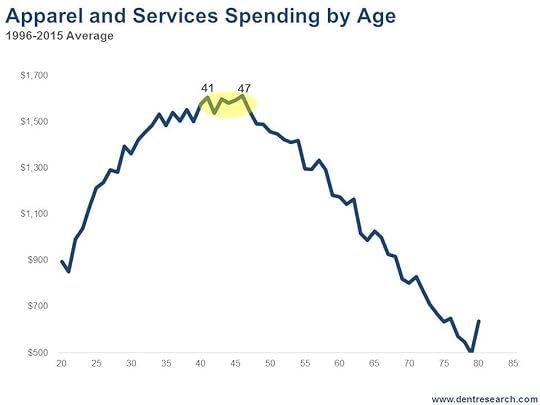

First, they stopped spending so much on home furnishings (on a 48-year lag), and then they stopped spending as much on apparel in 2008, on a 47-year lag.

All predictable!

Here are three simple charts to prove it to you.

The first one is the overall consumer spending chart less housing to get a better fix on the retail sector, and that plateaus between age 40 when spending on housing peaks and age 51, when college tuition peaks.

We get this data from the annual Consumer Expenditures Survey.

We get this data from the annual Consumer Expenditures Survey.

Spending momentum starts to slow down after people peak in their house buying, at about 40 0n average. Into age 46, people spend more broadly… and into 48 on cars, which they use to drive the kids before they leave the nest.

Affluent households spend a lot until they’re about 51 years old, pumping cash into their kids and college education.

The drop-off in overall spending is dramatic after age 51. The U.S. Baby Boomer generation started turning 51 in 2012, and in Europe they hit that age in 2016.

Knowing this is good, but knowing the finer details is better…

We know that spending on apparel and related services, like dry cleaning, peaks into age 47. That means that retailers would have begun feeling the pinch back in 2008.

And if you look back at the numbers, that’s exactly when they started to struggle!

Just look at this:

It’s no wonder that the major department stores, that focus on clothing, are declining!

Yes, online shopping has taken some of the pie, but for clothing retailers that’s not as much the case. Think about it: You can’t judge the quality of a fabric or design online. You can’t try the outfit on to see how it looks or our comfortable it is.

Returns are easier today than ever before, but clothes shopping online remains challenging… especially for the discerning, affluent female (and male) shopper. (I don’t by my clothes online!)

So, as the Baby Boomers continue on their march to old age, clothing retail stores like Macy’s and JCPenny will only suck more and more wind! I’d hate to be in that industry.

But then there’s the death knell for malls and department stores: The rise of Amazon and the e-commerce sector. In this case, not only demographics plays a role, but so does technology. Look at this chart!

When you take out auto sales (that will eventually move to the Internet, just not yet), e-commerce has grown to a whopping 28% in early 2017.

When you take out auto sales (that will eventually move to the Internet, just not yet), e-commerce has grown to a whopping 28% in early 2017.

And Amazon is now looking at both going into groceries and prescription drugs!

Malls are dead! And the clothing and discretionary food purchases were the last stronghold.

What are we going to do with all these malls?

Let them go to ruin, like something out of a “Resident Evil” movie?

Turn them into amusement parks, like in China?

One things for sure, keep clothing retailers and malls out of your investment portfolios, unless you’re shorting them. In which case, John Del Vecchio, our resident short-seller, can help you.

Harry

Follow me on Twitter @harrydentjr

P.S. Do you buy clothes online or in the brick and mortar stores? How about your groceries? Write to me at economyandmarkets@dentresearch.com or visit our Facebook page and send us a message!

The post The Retail Apocalypse We Saw Coming appeared first on Economy and Markets.

June 12, 2017

The Plusses and Minuses of Bitcoin and Blockchain

In October 2015 we held our Irrational Economic Summit in Vancouver. The weather was awesome, and the conference went well. Part of the final session was a Q&A with Harry Dent, myself, and Dr. Lacy Hunt.

In October 2015 we held our Irrational Economic Summit in Vancouver. The weather was awesome, and the conference went well. Part of the final session was a Q&A with Harry Dent, myself, and Dr. Lacy Hunt.

At one point, an attendee asked about bitcoin.

I told the audience in no uncertain terms that bitcoin was effectively dead. Whether it died a quick death or lingered for years, the cryptocurrency could not survive because governments would not allow it.

As I spoke then, one bitcoin cost $250. As I write now, bitcoin trades for $2,601.

If bitcoin is dying as I suggested, it’s making one heck of a final stand!

It reminds me of the actor Paul Reubens’ death scene in the campy classic, “Buffy the Vampire Slayer.” (He’s… still… dying…)

But I stand by my premise.

The exact things that make bitcoin attractive – anonymity, ease of transfer from one party to another, lack of government oversight, accessible in any country without capital controls, not subject to banking regulations – are denounced by national governments.

Think of everything governments stand to lose.

They’d no longer be able to expand or contract credit through money supply and interest rates, effectively losing their ability to steer their economies.

They couldn’t track, control, or tax currency moved out of the country.

They couldn’t snoop into our bank accounts when they suspected wrongdoing.

And there would be almost no way to enforce tax laws regarding payments among private parties. (Think of paying your plumber in bitcoin.)

The world of financial enforcement would turn on self-reporting, leaving cheaters free to cheat.

I can’t see government officials giving up any, much less all, of these tools. The legal and economic costs are too high.

And yet, like most people, it’s what I would dearly like to have.

Unlike my kids, I hold out hope that I can keep some areas of my life private.

I don’t want to be on camera 24/7, and I don’t want the government – or any other entity – knowing what I do with my assets. They are mine. I earned the funds, payed the taxes, and now I’m free to do what I want.

Or, at least, that’s the fantasy in my head.

In reality, I know my kids are right.

Every banking transaction I make is scrutinized as regulators look for foul play.

My picture is taken, and my actions recorded, in most public places and along highways.

Traffic cams note my license plate at various locations so that my path can be reconstructed.

And don’t get me started on smartphones and devices that work off voice commands. You might as well leave your blinds up at night and the door unlocked.

But back to bitcoin.

While its attributes put a government target on its back, there’s one aspect that could be, and should be, adopted by governments around the world.

It’s the process by which bitcoin tracks transactions, called blockchain.

There’s a lot of technical jargon involved at this point, but essentially a dispersed group of administrators who operate nodes (computers connected to the bitcoin network) verify every bitcoin transaction, which is on display for the world to see on a public network.

It’s like a lot of people having a copy of the same spreadsheet, and anyone can add an entry. Every time an entry is made, everyone updates their copy of the spreadsheet. And all the copies are open for anyone to see.

The block is the active part of the transaction, or spreadsheet entry, and the combined series of blocks, or total spreadsheet, is the chain.

The administrators’ computers do this as they solve puzzles, and vie for the chance to earn newly–minted bitcoin with the transaction. In other words, they get paid.

The important point is that since many different entities verify transactions, it’s impossible to fake a transaction or to record a mistake.

Wouldn’t that be nice in daily life?

Case in point: As part of our recent move, I had to register my cars in Texas.

The Department of Motor Vehicles (DMV) rejected one of the titles, which meant I had to make another trip to the local tax office. The officer told me my car was either rebuilt or salvaged, which had to be put on the title.

I knew that claim was wrong, but the officer wouldn’t budge. It showed up on a national database, she told me. It couldn’t be wrong. My only path out was to pay $65, have the car inspected for work, and get a title issued as rebuilt.

I refused.

I got on the phone with the state DMV, who reviewed my title over the phone (which they would not do the first time). They found a coding error, and referred me back to the title office.

When I arrived, the same officer smiled and waved me up to the front. Apparently she had also dug into the issue a bit more after I left (Thank you Officer Sams!), and found a coding error at the local office as well as the state DMV.

So much for no chance of an error.

If we used blockchain for car titles, or in other areas of business, none of this would happen.

What about land titles?

I just paid four figures for title insurance on my new home. With open-sourced blockchain recording of land titles, ownership transactions would be available for everyone to see.

We wouldn’t need title insurance, which would save homebuyers’ millions of dollars.

In the private sector, financial institutions are exploring how to use blockchain for transaction records.

Presumably a banking association would set up a system of administrators to disseminate information, making it virtually impossible for records to be altered.

Of course, this all hinges on the notion that every record is encrypted and masks the party that owns the car, buys the home, or withdraws $300 from his bank account.

Do we trust the government or private companies to safeguard that data and not share it? If our identity is linked with an open-record transaction, then we really are exposed for all the world to see.

I guess nothing is fool–proof… just like my bitcoin forecast from October 2015.

Rodney Johnson

Follow me on Twitter @RJHSDent

The post The Plusses and Minuses of Bitcoin and Blockchain appeared first on Economy and Markets.

June 9, 2017

Pay Attention To What’s Beneath The Surface

The great problem with economists – most people for that matter – is that they don’t look under the hood.

The great problem with economists – most people for that matter – is that they don’t look under the hood.

It wasn’t the tip of the iceberg that ripped a hole in the Titanic’s hull, sinking the unsinkable. It was the mountain of ice beneath the water.

It wasn’t housing prices alone that raised the property market to the ground in 2007/08. It was the foundation of bad loans given to anyone with a pulse.

It’s not the one cockroach you see scurrying along the baseboards in your kitchen that you should worry about…

Neil deGrasse Tyson, the popular astrophysicist, says that 85% of the gravity of the universe is dark matter and dark energy. It’s invisible. We don’t understand it or even know what it is. But we desperately need it in our calculations to arrive at an accurate description of the universe. Without it, none of our models would work.

My wife is a psychotherapist. Professionals in her realm know that our conscious, thinking mind is just 10% to 15% of what’s going on and driving our behavior.

While we can’t change any of this – we can’t make people use more of their brain consciously and we can’t know what dark matter is – we absolutely refuse to keep the hood closed when it comes to the economy or investing. We want to know what’s going on under the surface so we can all benefit.

That’s why the team works so hard to uncover the “unseen” fundamentals that really drive our economy.

Think of it like this…

The daily news, and all the government statistics thrown at us like bananas to monkeys… it’s all just the tip of the iceberg. Just that one cockroach on the wall.

It’s interesting (or horrifying) to see, but if we don’t question it then we could go down with the rest of the passengers on the ship.

Most economists still don’t understand the unbelievable predictability and power of demographic trends that my team and I have been preaching for 30 years now. It’s all there for anyone to “see,” like the currents in the ocean, shaping the floor and moving creatures and objects around, or the wind, carving the face of the Earth.

Yet these “experts” don’t understand why we have major crashes or recessions every 10 years or so… or why every 17 years the geopolitical climate shifts… or why every 45 years we have a surge of new, lifechanging technologies.

And they don’t see the greatest and most obvious bubble right in front of them. When it bursts and we suffer through the worst financial crisis of our lifetimes, they’ll cry “Black Swan!”

But then, that’s why you read us. Why you subscribed to Economy & Markets and maybe some of our other newsletters and trading services… so you can listen to the news and marvel at how they’re missing the details hidden beneath the surface while not joining the flock.

With us, you don’t have to be confused about what investments strategies to use in an increasingly volatile world. We have several – from options trading to equities investing and short selling. All you need do is pick the one that best fits your risk appetite and you’re off to the races.

However, if you want it all, you do face one problem: which investments do you add to your portfolio? You obviously can’t add every recommendation we make across all of our services.

Another problem is how much of your portfolio do you invest in each play.

Well, my long-time business partner, Rodney Johnson, has come up with a new investment model that blends the best of all of our investment recommendations into one, simple, easy to follow portfolio, including allocation sizes.

It’s called the Dent Cornerstone Portfolio. It will contain 17 equity investments, which Rodney will rebalance from time to time to ensure that your money is working for you effectively.

These 17 investments will come from Boom & Bust, Peak Income, Hidden Profits, and Cycle 9 Alert.

There is no options trading.

No short selling.

Just actively managed investments that take maximum advantage of the economic and stock market environments, before, during, and after the crash ahead.

Whether or not you subscribe to any of these investment research services, with Dent Cornerstone Portfolio, you’ll benefit from the best of ALL of them.

And you can rest easy knowing that your investments are geared to prosper from the “unseen” currents shaping our world… and survive them too.

Don’t waste your time watching the talking heads on TV. Listen to this message from Rodney now instead.

Harry

Follow me on Twitter @harrydentjr

The post Pay Attention To What’s Beneath The Surface appeared first on Economy and Markets.

June 8, 2017

What You Need to Know About Fake News, Free Lunches, and Wall Street Earnings

These days we hear a lot about “fake news.” Wall Street is not immune to this “phenomenon.” Indeed, it’s been around for quite some time now, only we realists referred to it as a “free lunch.”

These days we hear a lot about “fake news.” Wall Street is not immune to this “phenomenon.” Indeed, it’s been around for quite some time now, only we realists referred to it as a “free lunch.”

Good luck finding one of those, on Wall Street or anywhere else.

You see, very little is what it seems. For example, just because a company reported $1.00 of earnings per share doesn’t mean it’s true. It could all be a mirage.

Smoke and mirrors.

Yet, because we live in a day and age of 140 characters or less and our attention spans have been reduced to that of a fruit fly, investors see a glossy headline and pile money into a stock only to be burned a quarter or two down the line.

That’s after the real numbers come out, the ones in the Securities and Exchange Commission (SEC) filings practically no one reads that often have hidden “gems” buried deep into the notes of the financial statements.

More and more companies have resorted to “pro forma” financial reporting in recent years. That means their numbers don’t correspond to Generally Accepted Accounting Principles (GAAP).

Rather, management includes or excludes certain items that often favor the company’s bottom line.

That’s about as “fake” as “news” can get.

From 2009 to 2015 the gap between GAAP and pro forma earnings widened considerably. In 2015, S&P 500 earnings fell 12.5%, which was approximately 25% lower than the pro forma reported results.

The “faker” the better…

Since 1999, 62% of companies in the S&P 500 beat earnings estimates. As more companies resort to making up their own numbers, the number of earnings “beats” has risen dramatically. In the third quarter of 2016 it topped 74%!

Financial performance looks much better than it is in reality.

The deeper we get into this bull market the more earnings quality deteriorates.

So what exactly are companies doing to boost their bottom-line figures?

One of the biggest tricks is to exclude stock-based compensation. If compensation isn’t an expense, then what is it?

Many companies resort to acquisitions to obscure true fundamental performance. And restructuring charges and asset write-downs also muddy the waters.

Eventually, these kinds of shenanigans will matter. At the end of the day, an asset is only worth the discounted value of the future cash flows it produces.

No amount of magic financial sleight-of-hand can change that.

What can you do about it?

Your mindset should always be that all companies are guilty until proven innocent. This isn’t a court of law. It’s your money. After you conduct your due diligence, make the company prove to you that its financials are solid and that value exists.

My earnings quality model “truth test” includes analysis of reported revenues, cash flow, earnings quality, and shareholder yield. I also include valuation, because valuation still matters!

If a company is overstating its current revenues by offering favorable terms to customers that accelerate purchases, issues debt to buy back stock and fund the dividend, and artificially boosts its tax rate through complex maneuvers, we have no business buying that stock.

Oh, and this is a real company. I’m withholding the name of the guilty, but it’s one of the biggest companies in the world, and its shares are owned by some famous investors. It’s also been a profitable short in Forensic Investor despite the market hitting all-time highs.

Unlike other fundamental approaches that rely more on revenue or cash flow than earnings, my model looks beyond the reported results to determine where the landmines exist.

I take nothing at face value! My model tries to expose as much “fake news” as possible.

How do we use this to our advantage?

In Hidden Profits, we focus on companies that pay you first. They have respectable earnings quality and management teams dedicated to returning capital to shareholders. Over time, this leads to higher returns and lower risk (you have more money in your pocket, which reduces your initial exposure).

That reminds me of a point to make in general.

As is the case when companies pass off “too good to be true” results, if people promise you huge returns – such as gains of hundreds of percent per year – you should not walk but run in the other direction.

“Fake news” and fake promises will appeal to your inner greed. But, over the long term, investors who succumb to these temptations will be left holding the bag.

Slow and steady wins this marathon.

John Del Vecchio

Editor, Hidden Profits

The post What You Need to Know About Fake News, Free Lunches, and Wall Street Earnings appeared first on Economy and Markets.

June 7, 2017

Stop Reading the News!

Conventional wisdom says that information is good. The more the better.

Conventional wisdom says that information is good. The more the better.

But I don’t agree.

I used to work for a hedge fund manager. He was obsessed with reading news on his Bloomberg terminal. He’d brag about reading hundreds of news stories before anybody else had even rolled out of bed.

To him, more information made him feel smarter and more skillful at trading foreign currency markets, which are notoriously news-driven.

That may have worked for him. But I’m convinced that the average retail investor does worse with their investments the more they read the news.

That should be troubling to you, because we’re drowning in information today.

Think of it this way…

You’ve heard the saying, “The dose makes the poison.” Well, the same goes for information, which is why I’m recommend you stop reading the news!

A while back I shared an opinion piece on this topic with my Project V readers.

In Want to Really Make America Great Again? Stop Reading the News, Ryan Holiday opened up about the agony he felt from his gluttonous consumption of news (mostly political in nature, given the extraordinary presidential election).

Two key points stood out to me…

First, the author described the mechanism by which information overload has now become the norm. In his words:

“In the 1990s, political scientists coined something called the CNN Effect. The basic premise was that a world of 24-hour media coverage would have considerable impact on foreign and domestic policy. When world leaders, generals and politicians watch their actions – and the actions of their counterparts – dissected, analyzed and speculated about in real time, the argument goes, it changes what they do and how they do it… much for the worse.” [emphasis added]

Think about that! Around-the-clock access to news – and dissections and analyses of that news – is thought to affect the decision-making process of world leaders. That’s pretty scary, if you ask me!

What’s more, the CNN Effect leads to another problem for ordinary people.

Holiday further explains the narcotizing dysfunction. That’s paralysis by analysis.

He says, “… the narcotizing dysfunction attempts to explain why highly informed citizens are often surprisingly inactive politically. The answer is that they confuse reading, thinking about chatting about issues (i.e. ‘consuming’) with doing something about them.”

The simple act of analyzing an issue, or problem, gives people the feeling that they’ve done something to address the issue or problem – even if they’ve done nothing more than lie in bed with their iPad and read about it.

The trouble is, having access to more information is not the same thing as knowing the best thing to do with that information.

In fact, in many instances, having more information can make decisions and action more difficult. We either can’t separate the important information from the “noise”… or we’re exposed to too many views and alternatives, making it tough to choose which is best.

Worse, nowadays, we can’t even be sure we can trust the sources we get our news and information from!

Long-time readers know I routinely warn against reading too much news.

I’ve talked about how Warren Buffett’s greatest strength is discipline, not genius – and how he, and other successful money managers, maintain discipline to their strategies, largely by ignore the news.

I’ve also likened my relationship with the 24/7 news cycle to the temptation motorists feel to “gawk” at car accidents on the interstate. I’ve said, “I glance [at the news]… only because it takes too much effort to fight the urge. But then I quickly turn my focus back to the road ahead.”

You see, I’m not telling you to stop reading the news completely. That’d be a little extreme.

But I am warning you that there is such a thing as too much information. And since the 24/7 news outlets are incentivized to fill airtime, increase page clicks and sell advertising – it’s easily than ever to get too much bad information, too, these days.

At the end of the day, I know you’re still going to read the news. I will, too.

But do yourself a favor: limit your consumption, take most of it with a grain of salt and don’t look to CNBC for your next “hot” investment recommendation.

Dent Research offers a number of data-driven (and news-ignoring) investment strategies, including my own Cycle 9 Alert, Harry’s Boom & Bust, John’s Hidden Profits, and Charles’ Peak Income. All of these strategies keep your focus on actionable investment opportunities (and off the news cycle).

Or course, I realize that that’s a lot of information as well. And we know that knowing what investments to choose out of the opportunities we present to you is challenging. In a way, we inflict our own paralysis by analysis on you.

But we’ve found a way to counter that… and we’ve created the Dent Cornerstone Portfolio to help. In this new service, Rodney Johnson will tell you exactly which 17 shares you should have in your portfolio. He’ll pick them from those four services, and he’ll even tell you how much of your portfolio to allocate to each one.

You’ll find all the details here.

Adam O’Dell

Editor, Project V

Follow me on Twitter @InvestWithAdam

The post Stop Reading the News! appeared first on Economy and Markets.

June 6, 2017

A Straightforward Approach to Investing

Pardon my language, but moving sucks.

Pardon my language, but moving sucks.

We recently relocated from Florida back to Texas. My native Texan wife is ecstatic. And I’ve got to admit, the weather has been awesome for the past two months.

But almost nothing about the move was enjoyable, including the process of settling into our new home.

It’s not that we don’t like it. The house is fabulous. But there are things she – I mean, we – think need to be updated or remodeled.

That’s where the fight starts.

Not between the two of us, but between me and inertia. And I don’t always win.

It’s not like standing in front of the paint color wall at Home Depot. This is no metaphor; we actually stand there. As we do, I can feel each second of my life ticking away.

Are there really 97 shades of white? No, I don’t care which one.

I don’t care for paint. I don’t want to paint anymore. Please release me from this retail inferno!

Usually – or always – my wife will roll her eyes at my indecision and make a choice. Then we get the joy of stripping wall paper, prepping walls, taping and masking, and painting.

It’s a lot of work, and often I put off starting because I know how much it will take. But I’m always happy we did it, because the end result gives us what we want.

I think of investing the same way.

There are too many choices.

It’s hard to get started.

And once you’ve begun the process, stopping halfway can be disastrous, and it’s difficult to manage the details.

However, if you do it right, you’ll be happy with the results and sleep better at night.

But you’ve got to overcome the hurdles by using a process that you can live with – and use to sift through or cut out the choices, not to mention the noise in places like the financial media, or elsewhere.

I recently read that Amazon offers more than 1,100 toilet bowl brushes… and many of them have reviews. I don’t know if I’m more concerned with the number of choices or the fact that people take the time to review such a thing.

Either way, buyers have to make decisions. If you mess it up, you throw away a $5 piece of plastic and wire and start over.

With investing, if you do it wrong you have to make up for lost ground, which could take years, if it ever happens. Don’t become paralyzed by too many choices. It’s called paralysis by analysis.

Instead, find a body of research or investment selection process that allows you to narrow the choices from thousands of potential holdings to a manageable universe.

And don’t get married. At least not to an investment.

I often repeat the mantra that “I’m not married to anything but my wife.” If it’s time for an investment to leave your portfolio, let it go. Don’t worry about what could’ve been, or how high it might go after you sell it.

Focus on the security selection process that you have in place.

Investors often lose sight of the goal of investing. It’s not to bring about world peace or save the Delta smelt.

There are ways to work toward those goals, but investing is about earning superior returns and growing one’s wealth. If you like a cause but the stock should be sold, then sell the position and use some of your profits to buy a bumper sticker.

Finally, pay attention to the details… all of the details.

When your investment approach calls for buying, then buy. When it signals a sell, sell.

Too often we get lazy in our investments. Sometimes, when things haven’t gone our way, instead of reviewing the investment selection process to verify that we’re using the right one, we simply stop following the strategy.

That leaves us with the worst of both worlds – a strategy we don’t trust and no defined goals for what we own. Sometimes we lose focus simply because nothing has happened in recent weeks. Our attention drifts. We get distracted by life, or the news of the day.

Whatever the reason, if you’ve strayed from your investment strategy, or find it too overwhelming to follow, now is the time to redouble your efforts and get back on track. The exact moment you find yourself off course is the time to take corrective action.

At Dent Research, we’ve been working for years to address these issues, and recently we’ve developed an elegant solution in the form of a brand-new service.

It’s called the Dent Cornerstone Portfolio.

Pulling from all of our economic and investment research, and spanning all of our investment solutions, I’ve built a portfolio of fewer than 20 positions for subscribers.

Our recommendations will be straightforward, with clear percentages and actions to take, eliminating the problems highlighted above. It streamlines all of the best Dent Research has to offer.

But no matter what investment strategy you choose, do yourself a favor. Follow through.

Your portfolio will thank you, your family will thank you, and it will give you more time for home renovation. Then you can join me in the paint aisle at Home Depot.

Rodney Johnson

Follow me on Twitter @RJHSDent

The post A Straightforward Approach to Investing appeared first on Economy and Markets.