Harry S. Dent Jr.'s Blog, page 84

May 8, 2017

It’s Time to Kick This New Mafia in the Balls

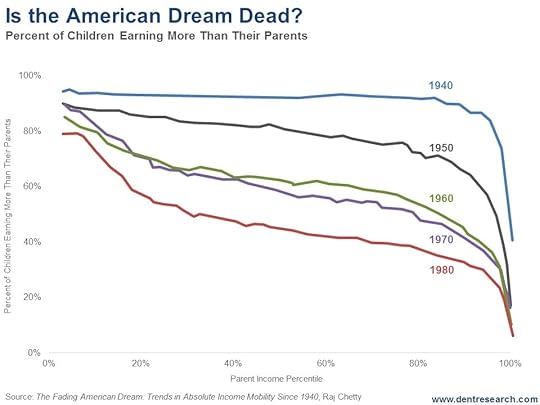

Just look at this chart!

If you were born in 1980, you only have a 50% chance of making more money than your parents.

But if you were born in 1950, you had a 79% chance, according to research that Raj Chetty and his team of economists did.

That’s one hell of a drop!

Upward mobility in the U.S. has almost halted. Of course, this is no news to us… and we can point a finger to at least one of the culprits.

Our colleges and universities.

They have essentially become strongholds for a new mafia, one that dons academic caps and gowns!

As I told 5 Day Forecast readers last Monday, the “Intelligentsiosi” have become bloated, greedy and mad with their own success.

Glowing campuses with grand buildings and exquisite landscaping…

Endless tenure and dreamy retirement plans for overpaid paper pushers, and sometimes professors as well…

Uncontrolled bureaucracy…

It’s all become a statue to their egos!

Unfortunately, there are two sets of victims of these crimes.

The first are the students trying to get a start in life. The poor suckers must clamp an iron ball of debt around their ankles just to get through the front door of these higher education institutions… unless their parents are rich enough to fund these stratospheric costs.

If the ball doesn’t drown them right out school, then they lug it around for decades while they slowly chip away at it.

It’s no wonder upward mobility is vanishing faster than crack in a whore house.

The second set of victims is the rest of us and the American economy!

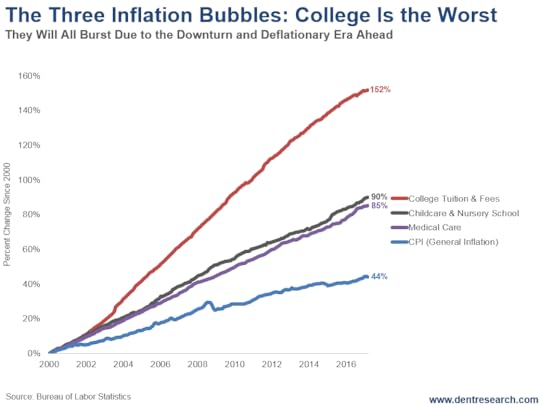

The situation is now so far out of hand as to boggle the mind. In fact, our healthcare costs, which are twice as expensive as anywhere else in the world, now pale in comparison to how our education costs are rising. See for yourself…

There is no conceivable, valid justification for such inflation!

There is no conceivable, valid justification for such inflation!

Education is an information industry!

As we meander through the tail end of the information revolution, the costs of accessing any information continue to decline rapidly. Yet the cost of a college degree is still rising like a rocket to the moon.

What the hell?!

People like me and many leading-edge experts could be streamed across college campuses at nominal costs, adding to what’s on offer from the local professors… and how could they be better than the best experts in the world when appropriate?

Computers and technology cost exponentially less today than a decade ago.

TVs and books tend to cost less as well.

So why the hell are costs for education still rising?!

Can’t these Intelligentsiosi see that their actions are robbing Americans of the opportunity for social and economic improvement?!

Upward mobility in the U.S., once one of the easiest accomplishments in the developed, is now ranked as one of the hardest.

Europeans and Canadians don’t have this problem. Their education costs aren’t so horrific, nor are their healthcare costs.

What happened to enabling more Horatio Algers?

Empowering penniless immigrants or citizens so they can rise to success against all the odds?

It seems to me these “wise” guys are more interested in landscaping than the American dream.

Back in the ’90s, when I lectured to successful small business owners at TEC (now Vistage) and YPO (Young Presidents Organization), most were self-made millionaires… not trust-fund brats.

Innovation depends on the ability of the lowest to rise to the top. It survives best from adversity.

Successful people tend to become complacent, so their kids often stumble when they’re adults. Just look at Lindsey Lohan. Perfect example.

But by withholding the opportunity for higher education – by putting the price tag way out of reach of anyone but the wealthy – we’re killing the golden goose.

It will be the end for our great country if we don’t have a revolution in education, at the very least.

Luckily, we WILL have a revolution.

Right now, the 250-year political and social revolution is converging with our economic winter season. The last time this happened was in the late 1700s. The result was democracy and capitalism – the two greatest breakthroughs of modern history.

Yes!

I’m talking revolution!

The real deal.

The three greatest impediments to democracy and capitalism are:

1) Special interests, that have taken over democracy.

2) Central banks hi-jacking free markets.

3) Unaffordable higher education, and healthcare.

I graduated from Harvard, but I refuse to send a penny of my substantial charity contributions to them. Still, they have a foundation and fund that is off the charts. So why do they have to charge so much for tuition?!

They do it because they can.

These bad fellas have had the Baby Boomers by the balls for decades. Now they’re holding Millennials hostage: “Pay up or live in your parents’ basement for the rest of your life!”

I can’t wait for the broader bubble to burst because it’ll will cascade across sectors, industries and the world.

It will finally bring everything back down to reality!

Mark my words: A revolution is coming in higher education and everywhere else. It will be painful.

And it can’t come soon enough.

Harry

Follow me on Twitter @harrydentjr

The post It’s Time to Kick This New Mafia in the Balls appeared first on Economy and Markets.

May 5, 2017

Could this be the Straw that Breaks the Market’s Back?

The thing about financial markets is that the companies that dominate change… the leaders of those companies and the personalities that capture the market’s attention change… regulations and regulators change…

The thing about financial markets is that the companies that dominate change… the leaders of those companies and the personalities that capture the market’s attention change… regulations and regulators change…

But human nature never changes.

And we have short memories.

Today, investors are stepping into the same traps that burned them in prior market cycles. Specifically, the margin-debt trap.

As calculated by the New York Stock Exchange, margin debt is at an all-time high.

All. Time. High.

At the end of March, margin debt topped out at nearly $537 billion. Even in today’s world, that’s still a lot of money!

But, that’s not the whole story.

The actual credit balances are a negative $231 billion. That compares to negative $152 billion in March 2016.

But, how does this compare to the last two major butt kickings investors got this century, when stock markets were overvalued and investors too bullish and loaded up to their eyeballs in margin debt?

It’s not even close.

In the 2000 Tech Bubble, credit balances were a negative $179 billion ($52 billion less than current levels) by August of that year. Those negative balances expanded right up until the point the market tipped over.

The trend in negative credit balances called the top in the market.

We all know how that ended.

By June 2007, negative balances topped at $79 billion. But, by October of 2007 they had turned flat.

A year later, as Lehman Brothers was imploding, they were flat again.

Today, credit balances are consistently 10-times higher from month to month than they were leading up to the Financial Crisis!

TEN TIMES!

We are in the mother of all bubbles.

And under these circumstances, it only takes a small hiccup to empty the tea cup and wipe out investors’ accounts.

Margin calls exacerbate the downside. Always have. Always will.

Adding fuel to the tinder is the Securities and Exchange Commission’s recent, bizarre move.

They’ve allowed the operation of funds that offer 400% the daily return of the market.

There are a lot of flaws in levered exchange-traded funds (such as how daily rebalancing impacts the returns) but the fact that there’s demand for a four-times levered product shows that the lunatics are now running the asylum.

“Happy Days,” the wonderful show on TV during my formative years, went downhill after the episode where Fonzie jumped a shark. With an all-time high in negative credit balances and investors clamoring for even more leverage, the market has officially jumped the shark.

It’s not going to end in happy days.

That is, unless you know how to play this market. Here’s how my Forensic Investor readers are going to do it.

John Del Vecchio

Editor, Hidden Profits

The post Could this be the Straw that Breaks the Market’s Back? appeared first on Economy and Markets.

May 4, 2017

Learning From the Greatest Hitter Who Ever Lived

Ted Williams was arguably the best hitter in the history of baseball.

Ted Williams was arguably the best hitter in the history of baseball.

The Boston Red Sox leftfielder finished his 19-year professional career with a lifetime batting average of .344 and an on-base percentage of an incredible .482, and this despite taking time off in the prime of his career to fight in World War II and the Korean War.

He also won the Triple Crown, meaning he led the league in batting average, home runs, and runs batted in… and he did it twice.

To put that in perspective, there’s only been 16 Triple Crown winners in the history of baseball, and two of those belong to Williams. And to cap it off, Williams was also the last Major League Baseball player to bat .400 in a season.

It’s safe to say that Ted Williams knew a thing or two about hitting a baseball.

And he was generous enough to share some of his secrets in his 1986 book, The Science of Hitting, which I strongly recommend for any baseball fan with an appreciation for history.

Interestingly, we can apply a lot of his same insights to investing.

To start, both baseball and investing are “sports” in which it pays to study. Sure, Williams was probably born with better eyesight and better reflexes than you or me. But that’s not why he was the greatest hitter in history.

Williams was the best because he was willing the approach the game analytically, study his opponents and – perhaps most importantly – practice.

More than a half century before Billy Beane used statistical analysis to revive the struggling Oakland Athletics (as recounted in Michael Lewis’ book Moneyball), Williams might have been the first “quant” in professional sports.

Williams carved the strike zone into a matrix: seven baseball lengths wide and 11 tall. His “happy zone” – where he calculated he could hit .400 or better – was a tiny sliver of just three out of 77 cells. In the low outside corner of the strike zone – Williams’ weakest area – he calculated he’d be a .230 hitter at best.

The “happy zone” will vary from batter to batter, but Williams understood exactly where his was, and he wouldn’t swing if the pitch was outside of his zone.

Likewise, investors need to have the self-awareness to know when the market is favoring their specific trading style.

When it is, it makes sense to swing for the fences. And when it’s not, you don’t have to swing at all.

Williams was notoriously patient and disciplined at the plate, which is why his on-base percentage was so high.

He had control over his ego and his emotions and wouldn’t swing because the defense – or even the spectators – was taunting him. He finished his career behind only Babe Ruth in bases on balls (walks).

And in investing, it might be easier. You can watch pitches go by until you see one you like. As Warren Buffett famously said, there are no called strikes in investing.

While professional investors have enormous career pressure to look like they’re “doing something,” individual investors don’t have to worry about a boss firing them. They can afford to be patient and wait for a perfect trading setup.

Williams, an eventual Hall of Famer, was chastised in his day for talking too many walks by none other than the legendary Ty Cobb. Well, frankly, Williams could call “scoreboard” on Cobb.

Cobb finished his career with a slightly higher batting average (.366 versus .344) but his on-base percentage trailed Williams’ by a much wider margin (.482 versus .433).

But perhaps the best lesson from Williams is this:

If there is such a thing as a science in sport, hitting a baseball is it. As with any science, there are fundamentals, certain tenets of hitting every good batter or batting coach could tell you. But it is not an exact science.

While it pays to take a detached, scientific approach to investing, it is absolutely not an exact science. Given the role that human emotions play, it’s probably closer to a social science like psychology than to a hard science like chemistry or physics.

That’s why it’s always important to give yourself a little wiggle room when you invest, what Benjamin Graham called his margin of safety. Structure your trading so that being “mostly right” is good enough.

That’s the approach I take in my income service, Peak Income. By focusing on high-yielding funds, I don’t have to get the timing exactly right, and, like Williams, I’m not swinging at every part of the strike zone.

I’m paid handsomely via high dividends to wait for my value thesis to play out. And by buying funds trading at deeper-than-usual discounts to net asset value, I massively increase my margin of safety.

What’s more, the bends and twists of the bond market over the past few years have given me quite a few fat pitches to swing at.

To find out more, baseball fan or not,

Charles Sizemore

Portfolio Manager, Boom & Bust Investor

The post Learning From the Greatest Hitter Who Ever Lived appeared first on Economy and Markets.

May 3, 2017

Time to Think Like a Surfer

[image error]I took up surfing in my early 30s.

It didn’t last long. But I learned a tremendous amount from the experience (least of which is that I suck at surfing).

Well, it’s time to think like a surfer.

Your sole focus is to catch the wave.

The best surfers can see the waves building, just like we can in the markets, but they only care about where the biggest, best waves will crash. That’s where you get the ride.

And if you catch the biggest wave in the right place, you get the ride of a lifetime.

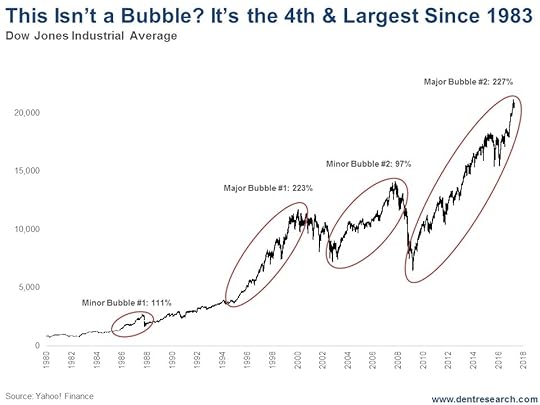

Look at this fourth and largest wave building in the stock market. It’s the wave of a lifetime for investors, and it’s rolling onto our shores right about now…

Remember, all the action comes when the wave crashes, not as it’s building. As the swell grows around you, you can go with the flow and harness the energy of the wave with little effort. That’s when you become one with the universe, sitting there on your board, surrounded by dark water, rolling up and down as the power builds beneath you. That’s why surfers get addicted.

Then, at the perfect moment, all the wave’s pent up energy releases in a roaring spray of water and power.

That’s where we want YOU to be when the greatest market wave of your lifetime comes crashing to shore!

That’s when the greatest profits come.

That’s when the greatest innovations spring up.

The smartest people (I include surfers in this group) and the greatest innovators understand this. They don’t look at a good economy as the best opportunity for success. Seeds of radical innovation only grow in the most challenging conditions.

That’s why the best traders are most often short sellers rather than long buyers… just ask Paul Tudor Jones or George Soros.

That’s why people who are prepared for the crash make out like bandits in the aftermath.

While writing my latest best seller, The Sale of a Lifetime, I created a bubble model for stocks. It follows the Masters and Johnson male orgasm study of the late 1950s.

Bubbles build exponentially and then burst twice as fast, deflating back to their point of origin (or close).

Exactly like the ocean waves that surfers spend their lives hunting for.

And precisely what smart investors spend their lives waiting for!

Central Banks have extended this wave beyond all expectations, but it’s now showing signs of peaking. It looks like it’s getting ready for that big crashing later this year.

You can either paddle out past where this massive 40-foot wave (at least you’ll be safe)…

Or you can ride it all the way down and create extreme wealth.

This is one of those defining moments.

The choice is entirely yours.

But know that our best investment services are designed to not only to profit from the upside (as the swell builds), but to also rake it in during the downside, when it comes crashing down like Holy Hell!

Harry

Follow me on Twitter @harrydentjr

The post Time to Think Like a Surfer appeared first on Economy and Markets.

May 2, 2017

Pick Your Neighborhood Carefully

To make good on a promise to my wife, a native Texan, we just completed our move from Florida back to Texas.

When we left the Lone Star State in 2005 (on her birthday, no less), she told me she’d like to move back when the kids had left the house. With the youngest now a freshman in college, it was time.

We could live anywhere, since my work doesn’t require a geographic center. So last fall we narrowed the search for a new home by considering climate, natural beauty, proximity to a major airport and health care, and travel time to relatives.

I didn’t quite have spreadsheets and critical path models laid out, but pretty close.

In the end, we settled on the Houston area.

As things go sometimes, we didn’t exactly give equal weight to each of our original criteria.

Houston’s climate is sticky, and oil production facilities often obscure the natural beauty. However, we’re close to major airports and, most importantly, family is less than an hour away.

Once we picked out the area, we had to find a neighborhood and a house.

We ruled out many very quickly, and focused on just a few that seemed to fit our lifestyle. We eventually found an active community with a lot of outdoor activities that’s near water. As I’ve mentioned in the past, I like to sail.

And the neighborhood has another redeeming quality – it’s just over the line that separates Harris County, the home of Houston, from Galveston County.

Living on the Galveston side of the line doesn’t change the humidity or the proliferation of oil storage tanks, but it does allow me to avoid some things like the pension crisis that’s currently burning in Houston.

The city’s pensions, covering firefighters, municipal employees, and police, are underfunded by roughly $3.2 billion, with more than half of that, or $1.7 billion, owed to municipal employees alone.

As time goes on, the city falls deeper in the red. Eventually, they’ll have to deal with it, which will mean wringing concessions from all parties, including Houston and potentially Harris County taxpayers.

That’s a game I didn’t want to play.

How these pensions ran off the rails is a story for another day, but like so many others around the country, today they’re in a ditch. And I don’t want to be on the hook for pulling them out.

Instead, we live just over the border in a county that, while not totally free of pension problems, chose a different path almost 30 years ago.

There’s still a police pension in Galveston County and, as you might expect, it’s only 45% funded. But the bulk of employees are under a different plan.

The voters in Galveston, as well as Brazoria and Matagorda counties, opted out of Social Security for municipal employees and set up individually-funded pensions.

The program has worked so well that it’s considered a model for the nation.

The Alternate Plan, as it’s called, requires employees to contribute 6.1% of their pay, while the counties contribute 7.8%.

The funds go to individual accounts, where most of the assets are conservatively invested by First Financial Benefits, which guarantees a return of 3.75% to 4.00%.

Like Social Security, the Alternate Plan provides life insurance, has a feature that pays income for life, as well as some other bells and whistles, but there are major differences.

Social Security provides more salary replacement in retirement to workers who earn less, making it a progressive system.

The Alternate Plan buys an income stream for each worker depending on his individual contributions (along with those of the county on his behalf). And the payout under the Alternative Plan isn’t capped.

If your contributions would buy an income stream of $10,000 per month for life, as would happen for someone who earned $125,000 for 25 years, then that’s what you get. Under Social Security, the maximum monthly payments this year are $2,369. Period.

At its core, the Alternative Plan funds an insurance policy that each employee can customize to his individual needs.

This allows the employee to take a lump sum at retirement, or receive higher payments over a short period of time (10 years is common). Neither of these options are available with Social Security.

If these attributes sound familiar, it’s because I’ve discussed this sort of personal pension several times.

Any move we can make toward decentralizing retirement systems and putting them in the hands of individuals is a step forward. As we’ve seen nationally and locally, when third-parties manage pension funds, things often go awry, and provide weird incentives.

When politicians offered pension sweeteners instead of wage increases to public employees two decades ago, they probably didn’t think they were signing the financial death warrant of their own cities and counties, but that’s exactly what happened.

And they did it because it was easier to push the responsibility into the future, and onto future politicians and workers, than to deal with the pain at the moment.

To end the cycle, we’ve got to take a bold step, just as Galveston, Brazoria, and Matagorda counties did decades ago, and put responsibility back where it belongs. Back in the hands of individuals. (This is what Charles’

While most of us will never work for one of these three counties (though I now live in one of them), or any public entity for that matter, we can still take the same steps: building our own private pensions.

In the insurance world, these are called deferred income annuities, and can be purchased or added to annually as we go through our working lives.

By taking this approach, I can rest assured that I control my private pension. And I can relax in my new neighborhood and enjoy a great financial decision that the voters here made 30 years ago.

Rodney Johnson

Follow me on Twitter @RJHSDent

The post Pick Your Neighborhood Carefully appeared first on Economy and Markets.

May 1, 2017

Why Price Is All that Matters

Last week I held a Q&A session for a select group of Dent Research and Cycle 9 Alert readers.

Last week I held a Q&A session for a select group of Dent Research and Cycle 9 Alert readers.

One question really got me fired up. It’s still ringing in my ears, in fact.

“How can none of it matter?!” asked one well-informed reader.

“At a time of such geopolitical uncertainty,” he continued, “with anti-establishment politicians winning elections in the U.S. and Europe…”

“…with wars underway in the Middle East and about to break out in Asia…”

(That’s all true, by the way.)

“How can it not matter what’s happening in the world!?”

To put this astute reader’s question into context, I had given a presentation earlier in the week explaining, essentially, how I consistently find short-term profit opportunities… “No matter what the broad market is doing… no matter what’s going on in the world,” I said.

I of course backed it up with proof, showing the numerous double- and triple-digit profits I’ve pointed my Cycle 9 Alert subscribers to over the last five years.

But that wasn’t the provocative part, to this reader.

What really seemed to get his goat was me telling all 14,000 attendees that “fundamental” factors, like P/E ratios, and “macro” factors, like geopolitical tensions… anything and everything you read in the news, I said, “None of it matters!”

If you missed my Q&A session, you can check it out here. I give what I think is a pretty impassioned answer to this reader’s question, explaining how my algorithm finds double- and triple-digit profit opportunities no matter what’s going on in the news.

Let me also explain here what I mean when I say, “None of it matters.”

My wife and I recently sold a used couch on Craigslist. And the experience was a perfect illustration of two trading “commandments” you must know.

They are…

Commandment #1: Only price matters

Trading Commandment #2: Nothing else matters

What Is a Used Couch Worth?

So my wife and I bought a new couch recently.

Since the old one was still in good condition, we decided to try selling it on Craigslist.

We offered it for $100.

That’s the price we agreed on, despite my wife spending the prior week trying to convince me it was worth much more. She had all these reasons, of course… “It’s a good manufacturer…” “That micro-fiber is the easiest to keep clean…” “It’s sooooo soft!”

Even, “I love that couch.”

But that’s about where we began to butt heads, my wife and I.

You see, as an investments guy… I know that something is only ever worth what someone is actually willing to pay for it, today, “cash and carry.”

My wife was thinking in terms of theoretical value. She was telling me what the couch should be worth. But her assessment was subjective, for one, and biased, to boot… given her self-professed “love” for the thing.

Long story short, the couch wasn’t worth $100.

We lowered the price to $80 and got one email, but no sale.

Then we lowered it to $50 and got three emails… and later that day, one warm body, with two $20s and a $10, took my wife’s beloved couch away… and taught her an important lesson: Something is only ever worth what someone is willing to pay for it.

That was true for our used Craigslist couch. And it’s just as true in financial markets, where buyers and sellers must agree on a price before a trade can be made.

My longtime Cycle 9 Alert readers know this trading commandment well. I’ve long told them that price is the only thing that matters.

When we make those double- and triple-digit profits, it’s simply because we bought at one price… and later sold at a higher price. We of course aim to buy low and sell high.

And when we take a loss on a trade, it’s only because we bought at one price… and later had to accept a lower price, even if we thought the security we bought “should’a, would’a, could’a” been higher.

This is rather obvious, and nearly patronizing, for some readers to hear. But it’s always surprised me how tightly most investors hold on to the notion of fair value – what a stock should be worth – even to their own detriment.

I’m also surprised to see how many everyday folks try to invest based on the news and world events – as if they have some informational advantage, or intellectual advantage, over the big boys on Wall Street. (Hint: They never do).

That’s why I love to bring new readers into my Cycle 9 Alert service. I get an absolute thrill from sharing my expertise in time-tested systematic strategies with readers… watching them learn and appreciate the value in my way of thinking and investing… walking alongside them as they overcome limitations and achieve true success.

My longtime Cycle 9 subscribers know well the most important trading commandments:

#1: Only price matters

#2: Nothing else matters

We’ve locked in more than 70 profitable trades in the last five years based on these commandments alone.

And since our strategy is designed to capitalize on human nature – on the mistakes of other investors – I’m confident we’ll find at least another 70 profit opportunities ahead.

If you missed the Q&A session that prompted today’s discussion, we’re offering limited-time access to it here.

To good profits,

Adam O’Dell

Editor, Cycle 9 Alert

Follow me on Twitter @InvestWithAdam

The post Why Price Is All that Matters appeared first on Economy and Markets.

April 28, 2017

The Case Against Gold

Early last week, you may have seen Harry’s latest message about gold (and silver too). He’s got some pretty strong evidence that the metals are due to take a tumble.

Early last week, you may have seen Harry’s latest message about gold (and silver too). He’s got some pretty strong evidence that the metals are due to take a tumble.

In fact, he said now would be a good time to drop any gold you’re still holding. “Get rid of it,” he said, and he detailed exactly why.

Since I tend to agree, and never really understood some people’s intense fascination with the yellow metal anyway, I figured it’s a good time to share my opinion too.

There will come a time to buy gold with both fists, but this isn’t that time.

Gold bulls tend to frame their arguments around three major points:

Gold is an inflation hedge.

Gold is a hedge against currency manipulation.

Gold is a crisis hedge.

I actually concede the first two points. Gold is a decent store of value during times of inflation or currency devaluation. But that’s insurance we don’t need right now… a little like buying life insurance after you’ve died.

Let’s look at the numbers.

Since 2008, the Core PCE Inflation Rate – the Fed’s chosen inflation gauge, which excludes food and energy – has consistently been under the Fed’s 2% target. It’s trended higher for about a year and a half, but it’s still well below 2012 levels… let along pre-crisis levels.

Whenever I mention core inflation, I hear howls of protest. After all, by excluding food and energy, isn’t the Fed effectively cheating?

Not exactly.

If we’re going to have a Fed… and if we’re going to give them a price stability mandate… then stripping out food and energy is the only sensible way to calculate it.

Let’s pick a grocery store item at random: a gallon of milk. (Yes, I’m the one person left in America that still puts milk – actual cow milk and not soy, or almond milk, or yogurt, or whatever happens to be trendy at Whole Foods at the moment – in his cereal. It almost feels naughty… and it tastes so sinfully good.)

In any given trip to the same grocery store, I’ve paid as little as $2.00 or as much as $6.00 for a gallon, with no real trend. The price bounces around based on very short-term supply and demand conditions.

You can’t – and shouldn’t – base monetary policy on something that volatile and noisy. So the Fed is only being reasonable when it excludes it.

So, inflation is tame at the moment. But it’s still bubbling under the surface, just waiting to explode higher, right?

Again, not exactly.

In fact, I’m a lot more worried about chronic deflationary forces.

Just this week, I read a story that British farmers are looking to invest heavily in robots to replace the cheap Eastern European labor that’ll no longer be available post-Brexit.

Over the long term, robotic labor is vastly cheaper than human labor, which ultimately means lower prices as human labor is squeezed out.

Look closer to home, at Amazon, Uber or any one of many smartphone apps.

Technology has made so much possible. But this is massively deflationary, not inflationary.

So I agree that gold is a fine inflation hedge. But until this automation revolution runs its course – and we’re still in the early stages – gold bugs are paying a high price to hedge against a nonexistent threat.

But what about currency manipulation? I agree in principle that gold is a hedge against a weaker dollar. But I see nothing right now that indicates the dollar will weaken, for a variety of reasons.

The final argument for gold – that it’s a crisis hedge – always makes me chuckle under my breath. Seriously.

If the financial system ever truly blew up – or let’s say the apocalypse happens and the future resembles “Mad Max” and “The Walking Dead” – we’re all going to be fighting over canned goods, ammo and gasoline. Gold really isn’t going to get you very far.

Being less dramatic, think back to 2008. When the bottom fell out and the market crashed, the price of gold crashed right along with it. The only things that held their value were the U.S. dollar and U.S. Treasurys.

If you worry about a crisis brewing, by all means, prepare for it.

Keep cash on hand and keep your debts manageable; people who had dry powder made out like a bandit in the aftermath of 2008.

And if you’re convinced the end of the world is nigh… well, I suppose you should stock up on canned goods, ammo and gasoline and store it all in a bunker in Idaho, complete with a lifetime supply of tinfoil hats.

But in no scenario do I see gold really having much value as a crisis hedge. Because as we saw in 2008, whatever value gold might’ve had in the past, today it’s just another financial asset.

And it’s perhaps time not just to drop any gold stores you have right now, but maybe even make a bet against it. Click here to see how we’re doing it.

Charles Sizemore

Boom & Bust Portfolio Manager

The post The Case Against Gold appeared first on Economy and Markets.

April 27, 2017

The $4.5 Trillion Gift

Let me tell you a little story. Let me tell you a little story. It starts in November 2008 when the Federal Reserve launched an $800 billion bond-buying program to lower lending costs for borrowers as well as home buyers. The program was called “quantitative easing” (QE), which sounds like gentle and vague academic talk. This was on the heels of the financial meltdown earlier that year, and it didn’t end until October 2014 – a hair under six years.

Let me tell you a little story. Let me tell you a little story. It starts in November 2008 when the Federal Reserve launched an $800 billion bond-buying program to lower lending costs for borrowers as well as home buyers. The program was called “quantitative easing” (QE), which sounds like gentle and vague academic talk. This was on the heels of the financial meltdown earlier that year, and it didn’t end until October 2014 – a hair under six years.

By then, the Fed’s balance sheet grew to about $4.5 trillion in assets – assets, mind you, it created out of thin air. Well, let me clarify: The assets weren’t created out of thin air, just the money to pay for them, although to me that seems like a distinction without a difference.

The Fed Chair at the time, Ben Bernanke, announced an end to QE in June 2013, but after a rather large stock market drop (known as the “taper tantrum”) within a three-day period, he decided to hold off. It would be the current Fed chair, Janet Yellen, who would finally end the program in 2014.

So, from 2008 through 2014, the Fed used every tool it had to fight deflation, create jobs, and grow wages. The unemployment rate finally shrank to 4.5%, and inflation grew to its 2% target (just this year).

And so the Fed can argue that low unemployment and stable prices are the result of its policies – eight years’ worth of artificially low rates along with QE.

They can argue it, but I’m not buying it!It starts in November 2008 when the Federal Reserve launched an $800 billion bond-buying program to lower lending costs for borrowers as well as home buyers. The program was called “quantitative easing” (QE), which sounds like gentle and vague academic talk. This was on the heels of the financial meltdown earlier that year, and it didn’t end until October 2014 – a hair under six years.

By then, the Fed’s balance sheet grew to about $4.5 trillion in assets – assets, mind you, it created out of thin air. Well, let me clarify: The assets weren’t created out of thin air, just the money to pay for them, although to me that seems like a distinction without a difference.

The Fed Chair at the time, Ben Bernanke, announced an end to QE in June 2013, but after a rather large stock market drop (known as the “taper tantrum”) within a three-day period, he decided to hold off. It would be the current Fed chair, Janet Yellen, who would finally end the program in 2014.

So, from 2008 through 2014, the Fed used every tool it had to fight deflation, create jobs, and grow wages. The unemployment rate finally shrank to 4.5%, and inflation grew to its 2% target (just this year).

And so the Fed can argue that low unemployment and stable prices are the result of its policies – eight years’ worth of artificially low rates along with QE.

They can argue it, but I’m not buying it!

In December 2015, a little more than a year after QE ended, the Fed hiked rates by a measly quarter point because, by all accounts, the economy had turned the corner and it was time to normalize rates. Remember, not only did the central bank surprise the markets by hiking, but it implied it would hike another four times in 2016.

Well, the market was down slightly at the end of 2015 after the Fed hiked but turned sharply lower after the New Year. When all was said and done, the S&P 500 was down nearly 12% by early February. And that ended the Fed’s hope for multiple rate hikes in 2016.

Finally, in December of last year, in its one and only act of 2016, the Fed hiked rates again. In its statement, the Fed once again implied multiple hikes in 2017. But this time, the markets didn’t collapse, the sun still came up the next morning, and the Fed pulled the trigger and hiked again last month.

The Fed statement reiterated in March that it’ll continue rolling over maturing Treasury securities and continue reinvesting principal payments on all the debt it’s accumulated. What wasn’t mentioned in its March policy statement (but was in the minutes released earlier this month) was that it intends to start reducing the size of its balance sheet.

That’s huge news! The Fed will start unwinding the massive $4.5 trillion balance sheet.

In case you didn’t know, the Fed sends the U.S Treasury all earnings (less expenses) from the interest bearing bonds they paid nothing for. From 2005 to 2008, the Fed sent on average, $30 billion per year to the Treasury. Since the Fed’s balance sheet climbed, so did payments to the Treasury. From 2014 to 2016, the Fed sent, on average, $95.5 billion to the U.S. Treasury – or more than triple what sent eight years earlier!

But what happens when the debt the Fed holds matures? You guessed it! It will send the balance along with the interest earned to the U.S. Treasury.

What happens to interest rates when the balance sheet shrinks? That’s an even better question, because that will effectively be a rate hike. Eventually, the Fed won’t be reinvesting proceeds to buy more securities (Treasury bonds). And if the market doesn’t pick up the slack, yields will move higher.

So far, the market hasn’t had a tantrum like I mentioned earlier, and the Fed is hoping to avoid a market overreaction by using its preferred tool: talking.

A number of Fed officials have been testing the markets by talking up the intention to taper reinvestment in the balance sheet and to keep hiking rates as planned.

Fed Vice Chairman Stanley Fischer thinks that since the market didn’t react much to the minutes (that mentioned the taper), that it’s less likely we will face major market disturbances.

Kansas City Federal Reserve Bank President Esther George, in a March interview with Bloomberg, mentioned she’s in favor of normalizing rates and the balance sheet this year as long as the economy is healthy enough to do so.

According to the Financial Times, Boston Fed President Eric Rosengren said he’s prepared to begin the process of reducing the balance sheet and gradually normalization of rates.

I’m not sure if the market’s ignoring the Fed since rates haven’t reacted much or because the rest of the world (including the Bank of Japan (BOJ) and the European Central Bank (ECB)) is still increasing its purchases. Since 2008, the ECB more than doubled its balance sheet, while the BOJ has more than tripled its own. The Fed’s balance sheet has quintupled in that period, so maybe the markets think foreign purchases will continue for a while.

In any case, the Fed will have $426 billion in Treasurys mature in 2018 and $357 billion in 2019. That’s going to be a lot for the market to absorb if the Fed stops reinvesting.

But it’ll be a heck of a gift to the U.S. Treasury!

When the Fed finally starts reducing its monstrous balance sheet, market volatility will spike, and that’s good for Treasury Profits Accelerator readers!

We make money when the Treasury bond markets overreact!

Good investing,

Lance Gaitan

Editor, Treasury Profits Accelerator

The post The $4.5 Trillion Gift appeared first on Economy and Markets.

April 26, 2017

Case Study: A Buyable Cycle in Action

Harry Dent and I made big waves yesterday when we screamed “BUY!”

Harry Dent and I made big waves yesterday when we screamed “BUY!”

14,000 or so readers tuned in to our Dent Research Exclusive Event, in which we shared our secrets to finding “hidden cycles” in the stock market – whether it’s going up, down or sideways.

These are buyable “hidden cycles,” we’re talking about here.

Because even though Harry’s long-term cycles have been pointing to trouble ahead, he knows you’d be a fool not to take advantage of the shorter-term buyable cycles I’m able to find in any market – with help from the proprietary system I designed five years ago, of course.

Take for instance the lucrative buyable cycle I recommended to Cycle 9 Alert readers in early March…

Did you know that European stocks are up a whopping 10% in the last month and a half!?

I know… I know…

The euro zone is a mess in many ways. And it’s facing three consequential “Trump style” elections this year – so who would think to touch Europe with a ten-foot pole, right?!

I felt the same way back in early March, when my Cycle 9 Alert system triggered buy alerts all over Europe (note: I’ll share the full text of that Trade Alert below).

That didn’t stop me from recommending the trade, though.

There was a buyable cycle in Europe, starting in early March, and we just had to take advantage of it!

And even though I knew things were heating up – in a good way – in Europe, I had no idea just how strong the returns would end up being.

Since my “Buy Europe” recommendation, on March 7…

Spain is up 14.9%…

France is up 11.5%…

Italy is up 10.8%…

The Netherlands is up 9.8%…

And Germany is up 7.9%.

Meanwhile, global stocks are up a milder 5.7%.

U.S. stocks?

They’ve done nothing, with the Dow Jones Industrial Average and S&P 500 up a measly half a percent (yup – 0.5%).

Bottom line: European stocks have been crushing it, beating every other flavor of stock market around the world.

And that’s the type of buyable short-term cycle Harry and I are committed to finding our readers.

I shared this opportunity with you in Economy & Markets in mid-March. A week earlier, I issued a specific trade recommendation to my Cycle 9 Alert subscribers (full text below).

For them, this buyable cycle in European stocks has already generated a locked-in 40% profit… with open gains now exceeding 110%!

There have been dozens of opportunities like this over the last five years. More than 70 to be precise. There will be countless more.

Have a look at the actual Cycle 9 Trade Alert below.

And if you missed it yesterday,

Editor’s Note: The following is the actual Trade Alert sent to Cycle 9 Alert subscribers on March 7, 2017, edited for length. Please don’t share this anyone else. It’s premium content.

Most important: The trade listed below is NO LONGER a buy. Please do not attempt to enter this trade. We are showing you only to illustrate the power of the buyable cycles Adam tracks and uses to help subscribers profit.

“Buy Europe”

2016 was the year of unexpected outcomes.

Brexit shocked everyone in June. And then Trump did the same in November.

But you should know, 2017 will be no different.

The Netherlands will elect its next prime minister next week. France will hold presidential elections in April and May. And then Germany will take center stage in September, when Angela Merkel runs for a fourth term.

From what I can tell, each of these elections have one candidate who rhymes with Trump’s populist, “let’s shake sh*t up” modus operandi. And I suspect that, like Brexit and Trump, no one really knows who will win these elections nor which way the market will go in their aftermath.

But as I shared with you a few weeks ago – in my piece, Our Algorithm Saw it Coming – the Cycle 9 Alert buy signals that triggered just before Trump’s highly-unexpected win were big winners!

The point is… election results in 2016 were far from certain, but trusting Cycle 9 buy signals was the right way to go. We should expect the same this year.

And one thing is certain… Cycle 9 Alert buy signals are popping up all over in Europe.

The bullish moves in European stocks have accelerated in recent weeks, triggering Cycle 9 buy alerts in each of the following markets:

Germany

France

Netherlands

(Cough: the three countries with scheduled elections this year)

Italy

Spain

Sweden

Switzerland

Admittedly, it should feel a bit uncomfortable buying Europe, essentially, just before what could arguably be the biggest year of political uncertainty ever for the euro zone.

But that’s what our algorithm is saying to do. And so we should do it!

The best target for this opportunity is a geographically diversified basket of European stocks. I’m recommending a play on the SPDR DJ Euro Stoxx 50 ETF (NYSE: FEZ), which includes exposure to France (36%), Germany (34%), Spain (10%), the Netherlands (7%), along with Italy, Belgium, the U.K., Finland and Ireland (at less than 5%).

[EDITOR’S NOTE: This recommendation is NO longer a buy. Do not make this play now.]

I’ll mention briefly that the chart pattern on FEZ is a trader’s dream.

There’s a massive support level, at $30, that goes all the way back to 2009. Price have bounced higher off this $30 level a total of six times in the last decade – including in February of last year (after the worst January in history)… and again in July (after the Brexit vote).

Essentially, shares of FEZ have been bottoming out in the $30 range for the past 15 months… and now they’re moving strongly higher.

This bottoming-out pattern has even formed what’s called a “reverse head and shoulders” pattern, which suggests shares of FEZ could make a beeline move – from $35 a share to $40 a share – in short order.

Let’s make a play on European stocks climbing the so-called “wall of worry” that lies ahead in three major elections.

Action to take: Buy to open the August 18, 2017, $35-strike call options on the SPDR DJ Euro STOXX 50 ETF (NYSE: FEZ) with a limit order set for….

[EDITOR’S NOTE: Again, this recommendation is NO longer a buy. Do not make this play now.]

To good profits,

Adam O’Dell

Editor, Cycle 9 Alert

Follow me on Twitter @InvestWithAdam

The post Case Study: A Buyable Cycle in Action appeared first on Economy and Markets.

April 25, 2017

Let’s Stiff the Government Together

I’m downright fanatical about lowering my tax bill.

I’m downright fanatical about lowering my tax bill.

In my youth, I would quite literally skip meals so I could scrounge up the cash to max out my 401(k) plan with pre-tax dollars at work. And even when I didn’t skip meals… well… in retrospect I might have been better off if I had.

I lived with an equally cheap roommate my first year out of college, and the two of us once subsisted for a week on a large tub of red beans and rice that he acquired from some guy he met from Louisiana. (It was actually pretty tasty for the first two days.)

Yes, it was spartan. But because of that discipline and the funds I was able to divert from paying taxes, I’m now years ahead of most of my peers in the retirement savings race.

I don’t have to scrimp like that anymore to max out my 401(k) plan, thankfully. But I’m still always on the hunt to make good money while legally stiffing the government.

These days, I have

munis on my mind. And, no, that’s not the title of an old country song. (Or rap song for that matter.)

A lot of people wrote off tax-free municipal bonds upon Donald Trump’s election, the conventional wisdom being that with a Republican-controlled Congress and president, new Trump policies would potentially stoke inflation and spending.

Bond yields shot higher. With a single party in control of everything – and advocating tax cuts – gridlock from the previous administration would likely evaporate. Or at least that was the thinking.

A few months later, it’s becoming more and more obvious that that isn’t happening.

The current crop of Republicans in Congress are bigger budget hawks than those of the George W. Bush years, and thus far they’re doing a better job of showing restraint. At least for now. And bond yields across the board have fallen as a result.

The other issue is taxes.

If Trump were successful in implementing tax reform, the thinking went, then the tax-free payouts offered by muni bonds would be relatively less attractive.

Here too expectations are mellowing.

The failure of Trump and the congressional Republicans to agree on the repeal of Obamacare has cast doubt on their ability to deliver on tax reform.

And it’s looking like Trump’s tax reform plans are going to be more modest and delayed for longer than originally thought.

I’d bet we get a tax cut, but one that ends up a little smaller than promised and is phased in over a longer period of time.

This is a long way of saying the muni bond market overreacted and is now repricing itself based on newer, more modest expectations.

And this is where I’m excited for Peak Income subscribers to take advantage.

I’ve gradually gotten more aggressive in our model portfolio since the election, and it made sense. Investors are clearly feeling better about taking risk, so the right move was to get more aggressive, even though if you’ve read my work before, you’ll know my colleagues fashion me a tightwad.

In January, I upped our exposure to REITs, in February I introduced an allocation to convertible bonds, and last month I jumped into emerging-market and high-yield bonds.

That said, we’re all about generating safe steady income, and the munis in our portfolio right now are positioned to do just that.

They’re trading at a healthy discount, and I’ve got just the recommendation this month for a tax-free muni fund that I expect to deliver very respectable returns, upwards of 14%.

Charles Sizemore

Boom & Bust Portfolio Manager

The post Let’s Stiff the Government Together appeared first on Economy and Markets.