Harry S. Dent Jr.'s Blog, page 88

March 13, 2017

Stop Patching Up the Euro

Andreas Georgiou can’t catch a break.

The Greek statistician moved back to his home country in 2010, at age 50, to help right the financial ship. He left Washington, where he had spent 21 years working for the International Monetary Fund, to take over the agency that reports Greece’s financial health.

Part of the problem with Greece is that no one knows exactly how big their problems are, since the numbers weren’t exactly accurate.

Georgiou quickly realized that the country’s budget deficit in 2009 wasn’t 6% of GDP, as Greece’s statistics service had previously said. Or even 10%. He revealed to the world that it was closer to 15%. His calculations followed accounting procedures required of all Eurozone members.

And that was the problem.

His countrymen arrested him, accusing him of overstating the financial woes, leading to austerity and hardship. He could stand the name-calling and personal threats, but when strangers started threatening his daughter, he called it quits and returned to the U.S. where he teaches.

But his troubles aren’t over. Every time his case comes up – and is dismissed, because the accusations against him are bogus – the judge allows for more investigation. So prosecutors simply refile, hounding a man for telling the truth.

That’s the problem with the euro. It’s based on a lie that bankers and politicians keep repeating.

Namely, that very different countries, with different business cycles and views of credit, can all use a common currency without any distortion. Right.

These people have been invading and killing each other for centuries, they speak different languages and have wildly different governing structures. It was never going to work.

But everyone got something out of the arrangement, at least for a little while.

Stronger countries like France and Germany tied their fate to weaker countries like Italy and Greece because it put a lid on their currency, which helped exports.

Weaker countries hitched their wagons to stronger countries because it gave them a lower cost of capital when selling government bonds and making private loans. Car loans in Italian lira carried a much higher interest rate than Italian car loans in euros right after Italy joined the common currency, even though the backing was ostensibly the same.

It was perfect! Right up until it wasn’t.

The Greeks lie about their finances and carry billions of dollars of bad debt.

The Germans refuse to borrow, wanting to save for the future instead.

The Italians pray for a growth miracle to bail out their ailing banks.

If the euro didn’t exist, then the Greek currency would rightfully be in the toilet, the German currency would be the most expensive on the planet, and every other euro member would be somewhere in between.

On the euro, everyone that uses it is holding hands, angry at each other and demanding accountability that will never come.

The powder keg will blow up when a weak link, like Greece or Italy breaks and leaves the euro, or a nationalist like Marine Le Pen in France pulls the plug for political reasons.

The currency of weak countries will immediately fall in value.

When the dust settles, the euro will contain Germany and a few stragglers, and it will soar in price, reflecting the real value of the German economy.

We’ll be right back where we started, with investors correctly doubting everything financial that comes out of Greece and Italy, and the Germans struggling to hold down their currency so they can keep the BMWs and Mercedes’ rolling out the export door.

As difficult as the adjustment will be internally for each country, it will be even worse for foreign central banks.

Those holding euros will have to choose how much of each currency they want to buy as reserves. Or, they could take the easier path. Buy dollars.

All of the craziness I expect on the Continent points to one thing – a stronger U.S. dollar. It won’t reflect a robust U.S. economy or tranquil U.S. politics. Instead, it will represent a bunch of scared investors looking for a safe haven for their assets.

The biggest shame of it all is that this ugly process will have taken a decade to unfold, and will have stolen untold billions, if not trillions of dollars from investors in the form of artificially low and even negative interest rates as central bankers tried to hold the euro together.

Better to rip off the Band-Aid quickly, like Georgiou did, and be done with it.

Rodney

The post Stop Patching Up the Euro appeared first on Economy and Markets.

March 10, 2017

The Ides of March

I know, the Ides of March is usually recognized as landing on March 15 and so I’m a little early! In early Roman calendars, the “Ides” happened near the mid-point of the month and was supposed to be determined by the full moon. According to the earliest Roman calendar, the Ides of March would have been the first full moon of the new year.

I know, the Ides of March is usually recognized as landing on March 15 and so I’m a little early! In early Roman calendars, the “Ides” happened near the mid-point of the month and was supposed to be determined by the full moon. According to the earliest Roman calendar, the Ides of March would have been the first full moon of the new year.

The Ides of March was also sacred to the Roman supreme holy being: Jupiter. In fact, Jupiter’s high priest sacrificed a sheep on the occasion.

But what really marked the Ides of March – and gave it the aura of bad luck – was the assassination of Julius Caesar in 44 BC. William Shakespeare dramatized the event in his play Caesar, during which a mystic warned the emperor to “beware of the Ides of March” just before his demise.

Caesar’s death was ultimately avenged on the fourth anniversary of his murder when his sole adopted heir, Octavian, executed 300 senators and knights who fought against Caesar. Bad luck for them on the Ides of March!

I think mysticism and superstition are a bunch of hogwash but sometimes they can make for interesting chatter or maybe even a good movie! But the reason I warn you (like Shakespeare’s soothsayer) to beware of the Ides of March, is because there are a couple risks in the financial markets to beware of right now.

The stock market seems, at least for now, to be ignoring any possible risk, but Treasury bonds are taking the words from various Fed officials to heart. When the Fed last hiked in December, they promised three more rates hikes for 2017. But since they promised four hikes in 2016 and only delivered one, the markets seemed to initially ignore the threat. That is, until a couple weeks ago…

One of the most effective policy tools of the Fed is talking. In the name of being transparent, the Fed believes it can move interest rates in one direction or another by just talking, suggesting, nudging… Well they can nudge all they want but they also have to be believable too. They lost a lot of credibility last year when their talk fell well short of meaningful action.

Over the last few weeks, a number of Fed officials said a rate hike is likely on March 15. And it’s not just the officials who are usually more prone to hike (we call them hawkish), but also a few that usually are more cautious (dovish) have chimed in that it’s time for a hike.

Interest-rate markets have digested the data which is showing increased inflation near the Fed’s 2% target. Employment data has also been improving and the level suggests that we’re near full employment. Wages have been on the rise, albeit a slow rise, and participation in the labor force is still near 30-year lows but hey, who’s counting?

Actually, even though the Fed’s dual mandate of having maximum employment and price stability has been satisfied, they should still hike even though the full economic picture is still shaky.

As I mentioned in last month’s Economy & Markets, retail sales have been pathetic and the economy barely grew at 2% last year, which doesn’t make for a robust picture of health. I’m sure the Fed is concerned about risking another slowdown or even a recession with a rate hike but their mandate has been achieved.

Aside from economic risks here in the U.S., the Fed has previously cited potential risks from overseas (that haven’t materialized!)for not raising rates.

So, absent any new risk or market instability between now and then, a rate hike seems to be in the cards for March 15. The markets have priced in a likelihood of a near certain hike in short-term rates, which means no rate hike would be more of a surprise to the markets.

The other event that could put a damper on March 15 is the fact that the federal government’s debt ceiling is due to be reinstated. We are only a few days away and President Trump hasn’t even tweeted about it! Do you dare turn back the clock and relive the last debt ceiling crisis that shut down the government? That feels like a million years ago…

In a budget deal worked out in 2015, Congress and the Whitehouse suspended the debt ceiling and authorized any amount of new debt during the remainder of Obama’s presidency. The limit is now Trumps problem and will be reinstated March 15. This will have to be dealt with at some point between then and when the coffers run out of cash (revenue and cash on hand) to pay the bills. That is estimated to be sometime in October or early November.

On March 15, lawmakers will have to start talking about raising the debt ceiling again or maybe even suspending it like they did a couple years ago.

With a Republican majority in both houses and the Whitehouse, I’m sure it won’t be a big problem. And with all the plans to spend more on defense and building the wall along with other infrastructure projects, our political leaders need to act… especially since Trump want to cut taxes to boot!

A looming debt ceiling reinstatement and a likely Fed rate hike are just a couple ominous clouds on the horizon next week. Since the stock markets are perched near all-time record highs, anything that might spook sellers into action is worrisome.

So in this case, it might just pay to beware the Ides of March!

Good investing,

Lance

Editor, Treasury Profits Accelerator

The post The Ides of March appeared first on Economy and Markets.

March 9, 2017

A Bull Market Health Check?

The Dent Research team got together two weeks ago for a quarterly planning session. Of course, we talked about the economy, the markets and how best to navigate these uncertain and volatile times.

The Dent Research team got together two weeks ago for a quarterly planning session. Of course, we talked about the economy, the markets and how best to navigate these uncertain and volatile times.

We still believe that our long-term economic future looks grim, mostly due to the drag of declining demographics, deflation and ever-increasing geopolitical tensions.

But in the short term, and from a pragmatic standpoint, we’ve got to “make hay while the sun shines,” as they say.

And that’s what Cycle 9 Alert has always been about – finding high-probability profit opportunities that we can get into and out off within three months.

I recently shared with my Cycle 9 subscribers an interesting development that unfolded in February. It has major market implications for the next three months… so I thought it was best to share it with you, too!

You see, all major U.S. stock indices are hitting new highs!

All of them!

The Dow, the S&P 500, the small-cap Russell 2000, and even the Nasdaq 100, which made its second monthly close above its March 2000, Dot.com era peak.

The fact that all “flavors” of stock indices are hitting new highs together is a convincing sign of strength, suggesting the bull market is healthy and has legs to run higher… for at least a little while longer.

But I dug deeper to determine just who’s doing all the heavy lifting. Are the stock indices being pushed to new highs on the backs of just a few big-winner stocks? If so, it would shed suspicion on the rally and warrant caution ahead.

Or, are a majority of stocks – of all shades and flavors – equally benefitting from today’s confident and bullish buyers? Because if this is the case, it suggests the bull market has healthy breadth and should continue climbing higher.

I ran a simple study…

On a calendar month basis, I compared the number of U.S. stocks hitting new 52-week highs and the number hitting new 52-week lows.

In February, this ratio of new highs-to-lows was quite strong, at 10.8. That means for every one stock that made a new 52-week low in February, there were nearly 11 stocks that made a new 52-week high.

That’s bullish!

Looking at this ratio historically, the average ratio of new highs-to-lows comes in just a bit above four. Half of the months I sampled were under four, half were above four.

And to determine the predictive value of this metric, I analyzed the three-month forward returns of each group.

Here’s what I found…

As you can see, three-month forward stock returns are more likely, stronger, and less risky when the new highs-to-lows ratio is four or greater.

The win-rate improves from 64% to 75%…

The average three-month return improves from 0.4% to 2.6%…

And the risk of loss is lower, with the worst return improving from -30.1% to -14.3%.

This is great information!

This new highs-to-lows metric is sending us a message: “buyers are back” and they’re buying (nearly) everything.

February was the first month since September 2016 to print a ratio of 4-to-1 or greater… and the first time since July being over 10-to-1.

And my analysis shows that – thanks to the fact that buyers are bidding up a majority of individual stocks – the bull market is likely to stay strong and healthy for at least the next three months.

So even though our long-term forecasts for economic growth are grim, the sun continues to shine on U.S. equity markets, so make hay as long as you can.

The great thing about my Cycle 9 Alert system is we can be bold and bullish when everyone else is scared and conservative. That’s because our short holding period of two to three months allows us to stay nimble and adapt to changing conditions.

And whenever the inevitable crash does come, my Cycle 9 algorithm will automatically shift us into downside opportunities.

To good profits,

Adam O’Dell

Editor, Cycle 9 Alert

Follow me on Twitter @InvestWithAdam

The post A Bull Market Health Check? appeared first on Economy and Markets.

March 8, 2017

European Indices Fire Warnings

[image error]Most people watch the FTSE 100, the leading index in the UK, and the German DAX. The former was the first major index in Europe to make a new all-time high as investors rewarded it for Brexit instead of punishing it, counter to expectations. The latter is finally within spitting distance of making a new high. It just needs to rally another 3%.

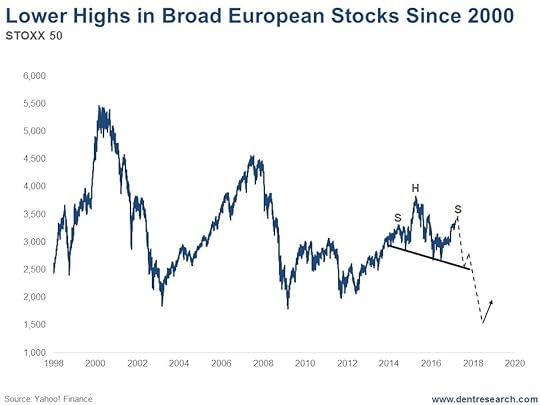

The problem is, the UK and Germany are not Europe. They’re not even representative of the situation on the continent. Just look at this chart, of the Stoxx 50. Think of it as the Dow of Europe. It holds very large-cap stocks across the Eurozone.

Does this tell a different story or what?

The Stoxx 50 didn’t top in 2007. It peaked way back in early 2000, at 5,500. Then it crashed 64% into early 2003 and only made it back to 4,500 in 2007. Then it crashed 62% into early 2009. The rally since then has been even weaker, hitting just over 3,800 in early 2015. Now it sits at just a little more than 3,400, 38% below its 2000 high. There’s slim chance it’s going to hit a new all-time high anytime soon.

There’s something else on that chart I want you to pay attention to. See the “S”, “H”, and “S” I’ve marked? That’s a potential head-and-shoulders pattern that suggests the next crash will take the index to around 1,400 in the next year or so. That’s 75% off its all-time high in 2000!

So, what’s pulling down this index?

France and southern Europe.

Greece is still bankrupt. And it faces yet another default deadline in July.

Portugal has struggled ever since the euro crisis in 2011.

Spain’s economy is growing a bit faster due to stronger demographics, but its unemployment numbers and real estate market are still in the dumps.

Italian banks have 18% non-performing loans, which comprise a third of all the bad loans in the Eurozone. Italy is the next major country to threaten to and/or default. Its FTSE MIB market peaked in 2007 at 45,000 and then crashed 75%. Its rally only took it back to 25,000 in 2015. Now it’s near 20,000, 60% off its all-time high.

Then there’s France.

It’s increasingly a cause for concern, what with its far-right candidate, Marine Le Pen, pushing strongly for Frexit. She’s not likely to win, but she’s progressing and 34% of the French are against the euro compared to the 46% who are for it. Sixteen percent are undecided. (That said, very few expected Trump to win either.)

The CAC 40 in France is the chart I’m most watching closely. It’s been trading in a declining wedge since late 1999.

It peaked back then, right near 7,000. Then it lost 66% in the crash. The next major rally took it to 6,200 in 2007, after which it crashed 61%. The rally since early 2009 has been even weaker, taking it just over 5,200 in early 2015. Now it sits at 5,000, 30% below its all-time high.

I’m watching this chart because its top trend-line is approaching the 5,200 mark and that could present strong resistance. This could limit France, and much of Europe’s advance in this final bubble rally, to as little as 4%. If the CAC can break cleanly above 5,200, then the next resistance level is all the way up at 6,200. A run that high doesn’t sound as likely given France’s tenuous position in the euro.

My point is that, outside of the UK and Germany, Europe isn’t doing well. Neither is Japan or China, for that matter, both of which are near 50% off their all-time highs.

That means this final orgasmic global rally is largely confined to the large caps in the U.S., Canada, the UK and Germany. And, except for the U.S., most are making just slight new highs. That’s a huge global divergence that doesn’t bode well for this third and final stock bubble.

Harry

Follow me on Twitter @harrydentjr

P.S. On Monday, I wrote to my Boom & Bust subscribers about the danger we face right now. That is, when stock bubbles blow, they do so spectacularly. The trouble is, pinpointing that moment when it all breaks down is nearly impossible, thanks to central bank and government interference. That leaves you in a tough position. How long do you hang on in this orgasmic rally? And when do you pull the trigger and step to cash? Unfortunately, we don’t have those answers. But we have the next best thing.

The post European Indices Fire Warnings appeared first on Economy and Markets.

March 7, 2017

The Wall Street Syndicate is Still at Work

Maybe they benefited from divine intervention… or maybe they were just lucky. Either way, the students and staff of St. Francis High School in Mountain View, California must be pretty happy right now.

Maybe they benefited from divine intervention… or maybe they were just lucky. Either way, the students and staff of St. Francis High School in Mountain View, California must be pretty happy right now.

In 2012 the school took a chance, investing $15,000 in a small, little-known app maker called Snapchat. Last week the school sold two-thirds of its shares for $24 million when the stock went public. I’m sure they’re still giving thanks.

Other people took home some dough that day as well. The co-founders, Bobby Murphy and Evan Spiegel, both cashed out $272 million. Their remaining shares make them both members of the billionaire’s club.

All told, the company sold 145 million shares and insiders/early investors sold 55 million shares. The company netted around $2.4 billion to fund expansion and operations, while the individual sellers walked away with the remaining $1 billion.

This part of the story is fun, but it can’t hold a candle to the folks that really got away with all the cash… the syndicate.

The early investors and insiders took a chance on a company that currently generates revenue, but hemorrhages cash. In 2016, Snapchat brought in $404 million and lost $515 million. And there’s no end in sight.

For the uninitiated, Snapchat is essentially a photo- and video-based social networking service. It’s a hit mostly among teenagers and millennials, but parts of other demographics have caught on too. Direct messages, or “snaps,” disappear forever after someone views them. The app also has group chat and story features, and many big media and publishing brands have their own channels within Snapchat.

The company has 158 million daily users, so clearly those involved think there’s a way, perhaps somewhere in the distant future, to turn those eyeballs into dollar signs.

Stock investors that bought shares the day of the IPO also see some hope. The shares priced at $17, but opened at $24. Those buyers who were allocated shares in the IPO before trading opened earned a cool 40% instant profit.

Which brings us back to the mob, er, syndicate.

Long ago, in a galaxy far away, I worked on Wall Street. I learned the ins and outs of investment firms and eventually landed on a bond trading desk. Equity IPOs were part of the learning curve. We had to know how all of it worked.

Back then, attractive private companies – like Snapchat – would interview investment firms and choose a lead underwriter, who’d then put together a syndicate of investment firms to file all the paperwork necessary and handle the initial public offering of shares.

To fetch the highest price, the syndicate would go through the expensive, time-consuming process of generating sales material about the company and then holding dog-and-pony shows around the country to highlight the coming offering. This all culminated in the day of the offering, when the company and the underwriters found out if their marketing efforts were going to pay off.

For this effort, the syndicate of firms earned an eye-popping fee that could run between 5% and 10% of the funds raised. I can’t say the fee earned was in line with the efforts. It always seemed extravagant. But now, things are wildly out of proportion.

On Snapchat, the underwriter charged a “modest” fee of 2.5% of the funds raised, which works out to a mere $85 million. But, as they say in late-night TV ads, “Wait, wait! There’s more!”

In addition to this upfront fee, the underwriters have a 30-day option to purchase 30 million shares at the IPO price of $17, minus an underwriter’s discount. So not only do the mobsters, er, investment bankers, earn the difference between the current price of the shares and the IPO price, they also get an additional break.

At the close of opening day, this would have been at least an additional $210 million, bringing their IPO fee to a nifty $295 million.

Now, let’s review the heavy lifting that Morgan Stanley and Goldman Sachs had to do to snatch this fee from Snapchat. They had to file all the documents required by the SEC, verify holdings of early investors, map out the number of shares the company and insiders would sell, and gauge interest from investors to determine the appropriate price for the shares.

A handful of associates with working knowledge of SEC filings and telephones could have done all of these things

What syndicate members didn’t have to do was introduce anyone in the investment world to Snapchat. The app store on everyone’s smartphones handled that. So the most time-intensive, personality-driven part of the process, the marketing of the company and selling shares to potential investors, was done for them.

And yet they earned almost $300 million. What a job!

These firms will go to great lengths to explain how much groundwork they had to lay ahead of the IPO, and how their research departments will support Snapchat in the years to come. But all that masks the real reason that companies, even ones that seem the newest of age like Snapchat, still use Wall Street. They’re scared that investment bankers will give them the cold shoulder if they cut them out.

If a company goes public without prominent underwriters, it risks such companies refusing to follow the stock in their research department, which precludes the clients of the investment firms from buying the stock.

And then there’s the matter of getting loans from these companies later, or further rounds of stock sales. Essentially, if companies don’t play ball, Wall Street can put financial hurdles in their way for years to come.

It sounds a lot like another syndicate… the one that controls the docks, garbage pickup, and cement in New York.

I’m guessing Murphy and Spiegel, the co-founders, don’t care. They did walk away with more than a quarter of a billion dollars in cash, after all.

But this is one more area, like politics, where I thought the internet was going to dramatically reduce the influence of money. I thought information would flow so freely as to cut out the middlemen, resulting in lower fees and greater access across the board.

That might be true one day, but the Snapchat IPO proves that today it still pays to be a member of the syndicate.

Rodney

Follow me on Twitter @RJHSDent

The post The Wall Street Syndicate is Still at Work appeared first on Economy and Markets.

March 6, 2017

How My Friend Retired at Age 40

I very rarely smoke cigars anymore, but one of the benefits – I would go so far as to call it a health benefit – is that smoking a cigar forces you to sit still and relax for a good 45 minutes. It’s a good way to catch up with someone you haven’t seen in a while.

I very rarely smoke cigars anymore, but one of the benefits – I would go so far as to call it a health benefit – is that smoking a cigar forces you to sit still and relax for a good 45 minutes. It’s a good way to catch up with someone you haven’t seen in a while.

As we lit up and got settled in, David had some interesting news for me.

“I think this might be my last year,” he said from across the table, smoke wafting into the air. “Things are going well at the office. In fact, I just got a promotion. But it’s wearing me out, and I want to spend more time with my family while I’m still young enough to enjoy it.”

Now, I’ve had plenty of conversations like these with colleagues over the years, and it’s perfectly normal. Except for one thing: David is only 39 years old.

My friend will retire later this year at the ripe old age of 40.

And no, he didn’t win the lottery, he’s not a Silicon Valley millionaire, and he’s not a trust fund baby. Far from it. In fact, in addition to his three kids, David financially supports his elderly parents.

I set my Shiner Bock down and shook his hand. I was genuinely proud of the guy.

So, how did David do it? How did a guy with a modest background put himself in position to leave the rat race for good?

It helped, of course, that he and his wife are both college educated and have consistently had high-paying jobs. Though I’ve never asked, I estimate that each of them earn a healthy six-figure salary.

But then, so do most Dallas yuppies, yet I don’t know any others retiring at 40.

David and his wife also both live a modest lifestyle, though not by any means what I would consider spartan. They have a nice 3,500-square-foot home in an affluent north Dallas suburb, but they bought it for a song as a fixer-upper. They’ve made plenty of upgrades over the years, but they were always cost conscious about it. And both of them drive older cars that they originally bought used.

They also always managed to avoid exorbitant daycare costs by relying on family for support. That easily saved them many thousands of dollars per year. And rather than eat and drink in ritzy bars and restaurants, they’ve always been more likely to grill steaks in their backyard and enjoy a bottle of wine at home with friends.

So, that’s great. They make decent money and live below their means.

Anyone who read The Millionaire Next Door could tell you that, given enough time, saving and investing your money will eventually get you a decent-sized next egg. But that’s the slow road that generally doesn’t pay off until you’re in your 60s or 70s.

So… what was David’s secret?

It’s twofold. First, he was willing to take a modest amount of risk when the odds were in his favor, and second, he created durable income streams that will continue whether he goes to the office or sits at home in his bathrobe.

After the 2008 meltdown, David used his savings to buy rental houses at rock-bottom prices. The low prices kept his mortgage balances small and allowed him to pay them down a lot quicker. Today, they’re now all paid off, so every dollar he collects in rent is effectively pure profit, after allowing for taxes and very minor maintenance.

The cashflows from his rental properties are now sufficient to meet his living expenses indefinitely. Home prices could go up, down or sideways and it wouldn’t really matter for his bottom line.

Now, let me be clear on something, I am distinctly not recommending that you run out and buy a portfolio of rental houses. Prices are up in most markets, and yields are down. David himself has no interest in adding to his rental portfolio at today’s prices.

But while I’m not recommending his asset class of choice, I would recommend that you take the same basic approach when evaluating your own investments. Look for something with decent upside potential but little in the way of downside. And focus on assets that throw off a consistent stream of income.

On that note, I have a newsletter dedicated to doing exactly that. In Peak Income, I look for income opportunities that are a little off the beaten path. Click here for more info. And as I’m writing this, all but two of our positions are in positive territory and 12 of our 18 positions are within 1% of a new high.

I can’t guarantee that you’ll retire at 40 like my friend David, but I can definitely help you boost your take-home pay. No matter if you’re in retirement, near retirement or, like he was, wishing that you were.

Charles Sizemore

Portfolio Manager, Boom & Bust

The post How My Friend Retired at Age 40 appeared first on Economy and Markets.

March 3, 2017

A Four-Step Retirement Plan

Ahhhh retirement! Most of us would love to be on a beach somewhere right now sipping a frothy Bahama Mama. But very few of us want to put in the right kind of effort to get us there. Retirement may seem way off in the distant future or even simply an unreachable destination. But, we can get there with just a few steps.

Ahhhh retirement! Most of us would love to be on a beach somewhere right now sipping a frothy Bahama Mama. But very few of us want to put in the right kind of effort to get us there. Retirement may seem way off in the distant future or even simply an unreachable destination. But, we can get there with just a few steps.

Step one is that you must know the magic formula. It’s really simple to understand, but not that easy to abide by.

Here it is:

Income – Expenses = Savings

See, it’s simple! No algebra required. The reason why it’s not easy to abide by is that we live in a culture obsessed with consumption. Consumption is 70% of the economy, after all. The average American has over 300,000 items in their homes. 300,000! All that stuff can’t even fit into our houses, and so the storage unit business is booming! We are a nation of hoarders, it seems. There are even TV shows about hoarders followed by TV shows of people buying storage lockers filled with stuff after those hoarders haven’t paid the bills.

Unfortunately, people don’t save. That’s just the cold hard truth. Statistics show that nearly 50% of Americans could not fund a $400 emergency. Scary!

So, step one is to ditch the consumption culture and save first rather than spend. One way to do this is to max out all of your retirement plans. Since I’m self-employed I have a particularly great plan that allows me to stash away both the maximum 401(k) contributions allowed and maximize profit sharing pre-tax. Then I also have my IRA.

Simply put, since this money goes from my corporate account into my retirement accounts I never see it. So, I pay myself first.

Then I save a portion of my after-tax money as well. That’s not to say I’m cheap and live like a pauper or anything like that. I’ve traveled the world and I enjoy life. But, I don’t have three stereo systems and five flat-panel TVs. Come to think of it, I don’t even own a car!

Step two is to own everything. In case you haven’t noticed from looking at my last name, I’m Italian. I think it’s in my DNA to pay cash for everything, so I use credit lightly. In the 23 years since I’ve had a credit card I have never paid one cent in interest. You don’t get rich paying someone else 15% a year to buy stuff you don’t need with money you don’t have.

Same goes for a house. Why is it good to have a tax deduction for your mortgage interest? Have you ever looked at an amortization schedule? All of the interest is billed up front. I paid off my first home in 11 years. What’s more, I lived in the same place for 15 years despite stretches where my income was more than 10 times higher than when I first bought it. I simply obeyed the magic formula. Just because I made more money didn’t mean I needed to blow it. My digs were plenty fine. Just be happy with what you have! There’s no need to keep up with the Jones’. They’re broke anyway.

Step three is to invest in yourself. Once you’ve saved more than you make and you own everything, a good way to ramp up your wealth is to invest in you! I don’t mean ripping through $100,000 on an online degree that won’t land you a job. I mean develop a skill. Do something other people don’t want to do but need.

My cousin Eldo once told me that if you want to learn how to do something, get an estimate. By that he means if someone tells you it costs $25,000 to paint your house, you’ll become quite handy with a brush in a short amount of time. That’s exactly what I did. I bought a home and renovated it for my Dad. The painters’ quotes were outrageous, and while painting a house is not as simple as filling up the roller with paint and slathering it on the walls, it’s not rocket science either.

By the time I was done, I became good enough to paint other houses. I did an analysis and determined I could make $100,000 annually working 3/4 of the time and undercut the local competition.

Of course, that’s just a fall back option. My largest gains have come from taking small bets on myself, such as developing a product or service and selling that to others. I have made gains far larger than in the public markets and I have never lost money betting on myself.

You can do it too! And it’s worth checking out what my colleague Charles has to say about collecting “automatic checks.”

One problem though is that I cannot compound this wealth. The cash flow needs to be invested elsewhere. That’s where the markets come in.

Step four is to invest in instruments that you can stick with consistently for the long-term. It may be all stocks. It may be a combination of stocks and bonds. Or, you might be an international explorer and find those markets more attractive.

Mine is a combination approach. Part of my process recognizes that I have no idea what’s going to happen in the future. Neither do you. Stocks are expensive but they could stay expensive. Interest rates are low but they can stay there. So, a portion of the portfolio should be in a few asset classes that over time should do okay if held long enough.

The second part of the approach is following trends. What goes up could continue to go up. What goes down could continue to go down. The trend is your friend until the end when it bends. So, by investing in some trends, you’re always in when the market is going up. But, you’re not always in the market. And while you may get whipped around, you most likely will be out when a huge smash occurs.

And the third part is sentiment and valuation based. When there’s blood in the streets, invest. When you attend your holiday parties and everyone is telling you how much money they made in the markets that year, call your broker the next day and reduce your positions or get out altogether.

Whatever you do, the portfolio must fit your personality. There’s four steps to investment success…

Step 1: Stick with your process.

Step 2: Stick with it through thick.

Step 3: Stick with it through thin.

Step 4: Stick with it through hell or high water.

If you can do all of that, you’ll be headed in the right direction to meeting your retirement goals. Bottoms up!

John Del Vecchio

Editor, Hidden Profits

The post A Four-Step Retirement Plan appeared first on Economy and Markets.

March 2, 2017

Making Money with a Mexican Coke Dealer

From Harry Dent: We recently wrapped up our March edition of Boom & Bust and I’ve no doubt it’s going to create a stir. I discuss the controversial immigration issue and that’s possibly one of the quickest way to make enemies right now.

From Harry Dent: We recently wrapped up our March edition of Boom & Bust and I’ve no doubt it’s going to create a stir. I discuss the controversial immigration issue and that’s possibly one of the quickest way to make enemies right now.

Still, the topic had to be covered because it has demographic implications (complications even) that we cannot ignore.

So, I took a deep dive into the immigration numbers to show readers the true nature of the situation. Then I handed the baton to Charles, the Boom & Bust Portfolio Manager, and told him to find an investment opportunity we can profit on based on the environment we currently find ourselves in.

He didn’t disappoint.

His immediate response to me was: “Well, President Trump is building a 2,000-mile wall along the Mexican border… and wants Mexico to pay for it… so I guess it’s time to buy Mexican cement stocks.”

He was joking. Sort of.

He didn’t recommend a Mexican cement stock this month, but he did recommend a stock that should benefit from current immigration trends. Of course, I’m very bearish on stocks after July, so the investment Charles dug up is shorter term in nature, and he’ll manage it closely with stop losses.

It lies south of the border, and I’ll let him share the details…

Let’s Revisit the Immigration Story

As Harry pointed out, Mexican immigration is in significant decline due to fewer job opportunities and stricter enforcement in the United States and due to changing demographics in Mexico itself. Mexico’s traditionally high birth rates peaked in the early 1970s and have been in decline ever since.

In 1970, the average Mexican woman had 6.7 children over the course of her life. By 2015, that number had fallen to 2.3 children, only marginally higher than the number for an American woman. So, smaller families from the 1980s on have led to fewer potential immigrants today.

Urbanization and rising living standards help too; a worker earning a comfortable living in Mexico City or Monterrey has little incentive to pack his bags and make the trip north.

New American immigration restrictions only reinforce the existing trend of more Mexican nationals opting to stay at home.

This creates problems for Mexico’s consumer economy, as remittances from family members working in the United States create a steady stream of cash that gets spent in Mexican stores. But it also creates opportunities, as returning Mexican nationals need basic consumer staples.

So, this month, we’re heading south of the border with a new recommendation in a Mexican coke dealer… though not that kind of coke dealer.

Besides being the largest distributor of a well-known brand, it also owns the largest and fastest-growing chain of convenience stores in Latin America.

Booming While the World Snoozed

You probably wouldn’t associate the past 10 years with a boom in much of anything, as pretty much the entire world has been stuck in a slow-growth malaise. Yet from 2005 to 2015, our latest recommendation to enter the Boom & Bust model portfolio managed to grow its revenues at a 15% compound annual growth rate. And perhaps more impressively, it has raised its dividend at a 26% compound annual growth rate. That means that it’s doubled its dividend ever 2.8 years. Not too shabby!

Those numbers are testament to the crisis-proof nature of this company’s businesses (and to clarify, we’re talking businesses here, not stocks).

It managed to grow its revenues at a very healthy clip during one of the most difficult 10-year periods in modern history. It seems that when the economy gets bad, you might wait longer to replace your car or your TV. But you’re not real likely to forgo a quick trip to the convenience store when you need a two-liter bottle of soda or a box of diapers.

I expect Mexican stocks and the peso to have a nice run over the coming months… they’re certainly due for it. If we get a general selloff in the stock market, as Harry expects we will later this year, we’ll get out. But this is a good opportunity for us to scalp some nice profits between now and then as Mexican stocks and, importantly, the Mexican peso enjoy a nice rally.

If you’d like to be in on the action, get your hands on the latest issue of Boom & Bust.

Harry Dent, Senior Editor, Economy & Markets

Charles Sizemore, Boom & Bust Portfolio Manager

The post Making Money with a Mexican Coke Dealer appeared first on Economy and Markets.

March 1, 2017

The Internet Revolution Comes Home

In early December, I bought a 15-year-old Jeep Cherokee for my kids to drive while they were home from college. It sounds a bit outrageous when I put that in print, but my reasoning seemed sound at the time.

In early December, I bought a 15-year-old Jeep Cherokee for my kids to drive while they were home from college. It sounds a bit outrageous when I put that in print, but my reasoning seemed sound at the time.

With all of them flying home, we’d have extra drivers around for five weeks, and only my car and my wife’s car available. I could have rented one instead of buying one, but the cost was substantial and I would still be the only driver allowed. As long as the old beater held up mechanically, even with registration and sales tax, it would be a better deal to simply buy an old one and then sell it.

The plan seemed perfect… until it didn’t.

The kids put more than 1,000 miles on that Jeep, so it definitely served its purpose. But as I readied the car for sale a few weeks ago, I noticed the dreaded check engine light was on. The car still drives great, and looks great, but that darn yellow light stares at me as I wander around town.

I considered my options…

Sell it with the light on and take a big financial hit, or go through the diagnostic hassle of taking the car to a mechanic and then dealing with repairs?

Then I did what everyone else does these days. I went online.

In less than a minute I found that several auto parts stores would check the “trouble codes” for me for free. Great! Saves me the upfront hassle at a mechanic. But I kept looking, just to see what else I could find.

Within five minutes I found a YouTube video explaining how to see a report of the codes on the odometer for this particular vehicle: “simply switch the ignition on and off three times rapidly, and the code(s) will display.”

Voila! In a matter of minutes on the Internet, I had eliminated at least part of the need for a mechanic.

That is the beauty of the Internet at home.

Beyond Facebook time with relatives we rarely see, reconnecting with classmates from a school we hated 30 years ago, and a bunch of funny cat videos, the Internet allows for instantly accessible pooled knowledge.

The Internet moves a library of information from professionals who experience such encounters on a regular basis, such as mechanics diagnosing vehicles, to consumers who have such a question only rarely. Chances are I’ll never have the need to review diagnostic codes on a 2001 Jeep Cherokee ever again (at least I hope not). But I could this time, at no cost, and with minimal hassle.

As specialized knowledge migrates from the minds of few to the electronic cloud where it can be accessed by the masses, power goes with it.

Armed with my codes and descriptions of what they mean, I’m better able to assess my options. I can compare the cost of repair at different service outlets with a phone call instead of going to just one shop, and I’ll pay less because I know what’s wrong.

In the end, all I needed was a gas cap to stop a small evaporation leak, which proves the value of the information!

This is the same power that moved from brick-and-mortar stores, who used to carry a bunch of inventory, to consumers, who have price-check apps on their phones.

We have the ability to change the power and pricing relationship across many platforms specifically because we have access to knowledge that just 15 years ago was unimaginable.

The outcome is deflation.

Not bad deflation, where slack demand forces retailers to cut prices, leading to falling wages for workers, and hence the start of a vicious cycle. Instead, this is the beneficial deflation, where previously the price of a good or service was partly driven by the inefficiency of captive knowledge or access, which is now available to anyone with a smartphone.

Consumers experience the joy of lower prices because more of the product or service has been commoditized. I don’t have to pay for the diagnostic. I just need the repair.

The mechanic provides a narrower band of service, earning less from me, but presumably the shop is able to service more people. This should lead to fewer mechanics, with the marketplace rewarding the good ones while weeding out the weaker ones.

In turn, I now have more to spend on other pursuits, which is a wonderful thing.

The catch is, some group of mechanics will lose business, and therefore lose income. They might have been bad at their jobs and deserving of such a fate, but it still means falling wages for a group of people.

In economic theory, these workers would soon go to work providing the good or service that consumers buy more of, as they spend less on car repair. But reality is a bit messier than that.

Some will find other employment, perhaps even a few will transition to jobs in growing fields that afford comparable or higher pay. Most will either take less pay to find employment in their local area, or simply fade from the workforce altogether.

The Internet revolution at home is different from the one at work.

As we, the people, leveraged pooled knowledge and electronic communication through the workplace, companies could do more with less, which boosted their profits. This made companies more valuable and expanded GDP.

Placing more power in the hands of consumers can actually cut into company profits as well as curb GDP growth because consumers can choose to keep more of what they earn.

Just because we save on things like auto repair doesn’t mean we must spend the savings. Instead, the funds could be invested or used to pay down debt.

Those options sound pretty good to the two largest generations in our society – boomers and millennials. One group is dealing with student loans, while the other is staring down retirement.

Unlike the boost the economy received as connectivity swept the corporate landscape, I think the results from the consumer Internet revolution will be much more modest, even if it is transformative.

Rodney

Follow me on Twitter @RJHSDent

P.S.

Speaking of retirement, don’t miss Charles Sizemore’s free special presentation on an automatic income-generating area of the markets that you might be overlooking. It’s a perfect spot to target for extra income, whether you’re in retirement, near retirement, or not. Click here for more information.

The post The Internet Revolution Comes Home appeared first on Economy and Markets.

February 28, 2017

Searching for Income in a Market That Yields Next to Nothing: It Can Be Done!

I follow income stocks pretty religiously, though I’ll admit it’s been a while since I’ve looked at tobacco stocks, which are some of the most consistent and well-known dividend payers out there. I sold my last tobacco stock – Marlboro-maker Altria – a few years ago when I took a long, hard look at the dividend yield (then about 4%) and decided it no longer made sense to own as an income stock. At that price, there was a lot of potential downside and very little upside.

I follow income stocks pretty religiously, though I’ll admit it’s been a while since I’ve looked at tobacco stocks, which are some of the most consistent and well-known dividend payers out there. I sold my last tobacco stock – Marlboro-maker Altria – a few years ago when I took a long, hard look at the dividend yield (then about 4%) and decided it no longer made sense to own as an income stock. At that price, there was a lot of potential downside and very little upside.

Or so I thought…

Altria’s stock price has gone nearly straight up since then, and the yield has shrunk to just 3.4%. The stock trades for 27-times earnings… which is a significant premium to the broader market.

Now, I’m not the biggest fan of bubbly tech stocks like Facebook or Amazon. But I can promise you this: I’d much rather pay the current multiple of 38-times earnings for Facebook or even 171-times earnings for Amazon… even though I consider those valuations to be excessive… because I believe there’s at least a chance they could grow into those valuations.

It could happen. But tobacco stocks? Not so much. Big Tobacco operates in an industry in terminal decline. Volumes for cigarette sales fall with every passing year, and the regulatory noose just keeps getting tighter.

Now, there’s nothing wrong with buying a stock in a declining industry, particularly if you’re playing it as a short-term trade. And even as a long-term holding, it can make sense so long as you’re buying them as deep-value stocks, and realizing a decent current return via an outsized dividend. But there’s no scenario under the sun in which tobacco stocks should trade at a premium to the broader market.

None. Nada. Zip.

This goes to show how desperate investors are for yield these days. They’re willing to accept a sub-4% yield on a no-growth company in a dying industry because they can’t find a better yield elsewhere.

Well, the fact is, they’re not looking hard enough.

If I offered to pay you a crisp $1 bill for the 90 cents you have jingling in your pocket… well, you’d probably think I was either crazy or a scamster. Or maybe both.

But if, after inspecting the dollar bill, you determined the deal to be legit, you’d jump on it in a heartbeat.

In fact, you might even run to the bank and take out your entire life savings in dimes in the hopes that I’d give you a dollar for every 90 cents you could throw together.

Why wouldn’t you? It’s free money.

I’m not going to give you a dollar for 90 cents… so, sorry if I got your hopes up. But I will point to some pockets of the market today where these kinds of deals (or better) are on offer.

But first, we need a little background.

If you have a company that’s trading at 90 cents to the dollar, that means it’s trading at a discount to its book value. “Book value” or “net asset value (NAV)” is the value of a company’s assets once all debts are settled. Think of it as the liquidation value of the company.

Now, for most companies, book value is a pretty meaningless number. If you’re a service or information company like Microsoft or Google, the value of your business is in intellectual capital and in the collective brainpower of your workforce. That’s a little harder to put on a balance sheet.

Likewise, the accounting book values of old industrial companies with a lot of property, plants, and equipment – think General Motors or Ford – are also pretty useless, since the numbers on the books reflect historical costs rather than current market or replacement value. And this is further distorted by accounting depreciation.

But while NAV is more or less worthless for most mainstream companies, it’s extremely useful in a few pockets of the market, such as mortgage REITs.

In cases such as these, the book value of the companies is based on the real market value of the securities they own, minus any debt used to finance them. What you see really is what you get.

And this is where it gets fun. At current prices, many mortgage REITs are worth more dead than they are alive.

Mortgage REITs usually trade at healthy premiums to book value, which makes sense. The whole is worth more than the sum of the parts, and you’re paying for management expertise, instant diversification and the REIT’s access to cheap and abundant credit – three things you’re going to have a hard time getting on your own.

Well, today, it’s not uncommon to see these trading for just 80%-90% of book value, implying that you could hypothetically buy up the entire company, sell it off for spare parts, and walk away with 10%-20% in capital gains… all while collecting dividends.

I like mortgage REITs. But there’s another corner of the market I actually like a lot better. I call them “private income funds,” and they allow us to profit three ways:

We make money on the current dividend – sometimes as high as 9%.

We make money when the value of the portfolio it owns rises in value.

And finally, we make money when larger-than usual discounts to net asset value shrink to more normal levels.

All in all, we’re often able to get better returns than what the stock market delivers but with low correlation to traditional stocks. If you’d like to know more, stay tuned, because I’ll soon reveal how to uncover the type of yields I’m talking about, and have automatic checks arrive at your doorstep every month. That way, you can leave the dimes at home.

Charles Sizemore

Portfolio Manager, Boom & Bust

The post Searching for Income in a Market That Yields Next to Nothing: It Can Be Done! appeared first on Economy and Markets.