Harry S. Dent Jr.'s Blog, page 92

January 17, 2017

They’re Called Stop Losses for a Reason!

I’ve been making a lot of adjustments to stop losses lately in my Peak Income service as a way of locking in some of our hard-fought gains. Recently I took a moment to explain to subscribers how and why I use stop losses as a risk-management tool. Now I want to give you a glimpse of what I told them.

I’ve been making a lot of adjustments to stop losses lately in my Peak Income service as a way of locking in some of our hard-fought gains. Recently I took a moment to explain to subscribers how and why I use stop losses as a risk-management tool. Now I want to give you a glimpse of what I told them.

There are two elements of every trade – the buy and the sell – and being a successful investor over time means getting both of them right.

Most investors put substantially all of their time and energy into the buy decision, but that’s a mistake. If you’re reasonably patient, buying is the easy part.

I’m a value investor, so I buy a stock or fund when I consider its price undervalued relative to its intrinsic value, its own history, and its peers. I generally like for the stock price to have stabilized and, ideally, to have started a new uptrend.

But beyond that, the buy decision is simply an exercise in narrowing down the pool to the very best ideas and in sizing the positions accordingly.

Selling, on the other hand… that’s the hard part.

Do you sell a stock or fund just because it’s had a nice run and is no longer as cheap as it used to be? Do you sell at some predetermined date? Or do you stubbornly buy and hold forever?

This is where a stop loss becomes so ridiculously valuable. You’ve probably heard the expression “let your winners run.” Well, you should take that advice, because it’s the foundation of most successful momentum and trend-following strategies, such as those run by Dent Research’s own Rodney Johnson and Adam O’Dell. But it works for stodgy old value investors like myself, too.

There is simply no reason to ever sell a stock if it’s performing well. As Adam likes to quote the great Isaac Newton: an object in motion tends to stay in motion. Let your winners run. Chances are, they can end up going a lot higher than you ever imagined they would.

And this is where stop losses really add their value.

Let’s say that you own a stock that has become something of a bubble name (think Tesla Motors, Twitter, or any high-flying story stock of recent years). You know the stock is overpriced… yet it keeps rising every day in spite of it.

So, what do you do?

You place a stop loss order a few bucks below the current price and then raise the price on that stop loss order as the price moves higher.

If the shares are trading for $100, perhaps a stop loss at $90 makes sense… if the shares continue to push higher to $110, perhaps raising the stop to $99 is sensible. Or if you’re really concerned about the potential for a price reversal, you can tighten the stop to just a couple dollars below the current price.

As for setting the precise levels, I’m somewhat subjective here. I’ll generally look at stock charts and choose my stop based on recent price movements, reevaluating the stop as the price moves higher. But other investors use more mechanical rules, such as a trailing stop set at a certain percentage.

For example, you may instruct your broker to use a trailing stop of 20%, which would automatically sell the position if it fell 20% from the highest point it reached since you purchased it. There is no “right way,” per se, just the way that works best for you or your strategy.

I do have one ironclad recommendation, though. I suggest always using stop losses based on closing prices rather than on intraday prices. And if you want to know why, think back to August 24, 2015.

If you recall, that was the day that the market stopped functioning, and several ETFs opened down by 50% or more, even when the stocks in their underlying portfolios were only down 2%-3%. Most ETF prices recovered to their fair value within minutes, but imagine if you had happened to own one and had a stop loss order attached to it? You would likely have gotten sold out at the bottom and lost half your money.

So I repeat, use stop loss order based on closing prices. This massively reduces your risk of getting spanked in a flash crash.

Most brokers don’t have a closing-price order option, so you’ll need to keep track of it yourself or use a third-party service. One that I use myself and would enthusiastically recommend is TradeStops. I enter every trade I place in Dent Research’s Boom & Bust newsletter and Peak Income, as well as my personal trading, into TradeStops. And I get an email alert sent to me when one of my stocks closes below its stop price.

Whenever you see an alert from me telling you that one of our positions was stopped out, you can bet that I myself was alerted by TradeStops.

I also have one last piece of good news for you. TradeStops has a special offer for Dent Research readers, selling the service for 50% off its regular price. If you’re looking to implement stop losses into your trades, I encourage you to give it a look.

Charles Sizemore

Editor, Peak Investor

The post They’re Called Stop Losses for a Reason! appeared first on Economy and Markets.

January 16, 2017

Stop Reading the News!

Conventional wisdom says that information is good… more is better… and even more is best.

Conventional wisdom says that information is good… more is better… and even more is best.

I used to work for a hedge fund manager who was obsessed with reading news on his Bloomberg terminal. He’d brag about reading “hundreds” of news stories before anybody else had even rolled out of bed.

To him, more information made him feel more informed, smarter and more skillful at trading foreign currency markets, which are notoriously news-driven.

That may have worked for him. But I’m convinced that the average retail investor does worse with their investments… the more they read the news.

That should be troubling to you, because there’s been no time in the history of man when access to information and data has been greater. And while advancements in Internet access and information availability have benefitted societies in many ways – it hasn’t all been good. Overconsumption has become a big issue.

Think of it this way…

You’ve heard the saying, “The dose makes the poison.” It means that, basically, anything can be a poison if consumed in large enough quantities. Alcohol. Chocolate. Coffee. Oranges. A little is nice. Too much is poisonous.

The same goes for information, which is why I’m recommending today that you immediately stop reading the news!

And I’m not the only one saying this…

Last week, I shared an opinion piece on this topic with my Project V readers.

In Want to Really Make America Great Again? Stop Reading the News, Ryan Holiday opened up about the agony he felt from his gluttonous consumption of news (mostly political in nature, given the extraordinary presidential election).

Two key points stood out to me…

First, the author described the mechanism by which information overload has now become the norm. In his words:

In the 1990s, political scientists coined something called the CNN Effect. The basic premise was that a world of 24-hour media coverage would have considerable impact on foreign and domestic policy. When world leaders, generals and politicians watch their actions – and the actions of their counterparts – dissected, analyzed and speculated about in real time, the argument goes, it changes what they do and how they do it… much for the worse. [emphasis added]

Think about that! Around-the-clock access to news – and dissections and analyses of that news – is thought to affect the decision-making process of world leaders. That’s pretty scary, if you ask me!

What’s more, the CNN Effect leads to another problem for ordinary people. Mr. Holiday further explains the “narcotizing dysfunction,” which simply means “paralysis by analysis.”

He says, “… the narcotizing dysfunction attempts to explain why highly informed citizens are often surprisingly inactive politically. The answer is that they confuse reading, thinking about chatting about issues (i.e. “consuming”) with doing something about them.”

The idea of “paralysis by analysis,” and the overconsumption of information, is two-fold.

For one, the simple act of analyzing an issue, or problem, gives people the feeling that they’ve done something to address the issue or problem – even if they’ve done nothing more than lie in bed with their iPad and read about it.

Second, having access to more information is not the same thing as knowing the best thing to do with that information. In fact, in many instances, having more information can make decisions and action more difficult. We either can’t separate the important information from the noise… or we’re exposed to too many views and alternatives, making it tough to choose which is best.

Mind you, the article I’m referencing speaks to the political arena. But the very same influences affect your investment decisions and actions as well.

Longtime readers know I routinely warn against reading too much news.

Last month, I talked about how Warren Buffett’s greatest strength is discipline, not genius – and how he, and other successful money managers, maintain discipline to their strategies, largely by ignoring the news.

I’ve also likened my relationship with the 24/7 news cycle to the temptation motorists feel to “gawk” at car accidents on the interstate. I’ve said, “I glance [at the news]… only because it takes too much effort to fight the urge. But then I quickly turn my focus back to the road ahead.”

You see, I’m not telling you to stop reading the news completely. That’d be a little extreme.

But I am warning you that there is such a thing as too much information. And since the 24/7 news outlets are incentivized to fill airtime, increase page clicks and sell advertising, it’s easier than ever to get too much bad information, too, these days. Denzel Washington agrees, as he made clear in an interview late last year.

At the end of the day, I know you’re still going to read the news. I will, too.

But do yourself a favor: limit your consumption, take most of it with a grain of salt and don’t look to CNBC for your next “hot” investment recommendation.

Dent Research offers a number of data-driven (and news-ignoring) investment strategies, including my own Cycle 9 Alert, and my colleague, Lance Gaitan’s Treasury Profits Accelerator. Both of these strategies will keep your focus on actionable investment opportunities (and off the news cycle).

Adam O’Dell

Editor, Project V

Follow me on Twitter @InvestWithAdam

The post Stop Reading the News! appeared first on Economy and Markets.

January 13, 2017

Is the Bond Rout Over?

While the Trump-fueled rally continues, the Fed’s been keeping a relatively low profile lately.

While the Trump-fueled rally continues, the Fed’s been keeping a relatively low profile lately.

Maybe it’s the New Year or maybe it’s just analyzing the incoming data to determine whether last meeting’s hike did the trick. Or maybe it just doesn’t want to rock the boat ahead of the president-elect’s inauguration since the Fed’s not all that popular with him. In any case, since its last meeting and rate hike in December, the Fed and Janet Yellen have been pretty quiet.

Don’t get me wrong, Fed officials are still making scheduled speeches. In fact, just this past week, there were nine of them! It’s just that they seem to be extra guarded.

Perhaps Yellen and her colleagues know they’re mostly powerless when it comes to regime change at the Fed. Waiting is their only play for the time being. Whether they sit on their hands or not, there are movements to keep track of, because those fluctuations can mean big profits.

Not only did the president-elect launch attacks on the Fed and Janet Yellen specifically during his campaign, but earlier this month, Senator Rand Paul (along with eight co-sponsors) reintroduced his Federal Reserve Transparency Act. The legislation is widely known as the “Audit the Fed” bill aimed at preventing the Fed from concealing vital information on its operations from Congress. Fed Chair Yellen believes the Fed will lose independence (and perhaps some power) with passage of the bill.

During the Q&A session after the last Fed meeting in December, Yellen was careful to steer clear of judging the economy based on the recent election result. She did say that she is “a strong believer in the independence of the Fed.” She also mentioned that current regulation to prevent financial crisis has been working and urged the incoming administration to keep it in place.

It’s way too early to tell how the incoming Trump administration will change regulation, the Fed, or even taxes – but interest rates were on the move before the election.

Since early September when my system generated a trend change signal, long-term interest rates have been heading higher. The surprise result of the U.S. presidential

election helped fuel an even sharper rise in yields along with a sure-bet hike in short-term rates by the Fed.

Remember, when interest rates or yields rise, bond prices go down! So, is the bond rout over?

Maybe.

Overall, it was a nice ride while rates rose over the last four months! Treasury Profits Accelerator members had a chance to bank profits of over 147% during that time! Take a peek at the chart below:

The overall economy improved slightly, but didn’t really justify the sharp move higher in rates – and especially the move to new record highs in stocks. Interest rates are starting to price in risk even though stocks are still trying to push higher.

2017 does have a few strong indicators. Housing’s been a bright spot in the low interest rate environment. Consumer spending ticked up recently along with inflation. Job creation has been strong, but the quality of jobs and participation hasn’t been. Wages are creeping higher with a low unemployment rate, pushing inflation closer to the Fed’s 2% target. Nothing to sneeze at.

But it’s not all smooth sailing. Businesses haven’t been investing, corporate profits are still weak, our manufacturing sector barely has a pulse, and the broadest measure of the economy, gross domestic production (GDP), has been anemic.

Trump’s promises of government stimulus and less regulation have pushed stocks to new highs and initially pushed rates higher, but these are only surface-level victories. Without the demographics to support real economic growth, reality will finally set in – and when it does, watch out.

The jobs report was a slight disappointment with new non-farm jobs increasing by 20,000 less than expected. Wages increased a bit more than expected but bounced 0.4% from a very weak 0.1% last month.

The Fed promised three rate hikes this year, but we’re not holding our breath. Remember, they promised four last year at this time and came through just once – in December! Harry’s forecast foresees more pain for bonds down the road. But I’m looking at the short term and, at least for now, the rout is over.

Volatility is higher and that’s great for us because that means more opportunities to profit with my strategy. Regardless of where rates go, as long as there are surprises, we should have a very good year!

Good investing,

Lance Gaitan

Editor, Treasury Profits Accelerator

The post Is the Bond Rout Over? appeared first on Economy and Markets.

January 12, 2017

The Tipping Economy

In this, my 50th year on the planet, I’m officially becoming a cranky old man.

In this, my 50th year on the planet, I’m officially becoming a cranky old man.

As I sat in the Atlanta airport recently on a layover, I decided to grab a bite at Jersey Mike’s Sub Shop. When I swiped my card, the first screen asked if I’d like to add a tip to the total.

A tip? For what?

The young men and women behind the sneeze-guard glass were pleasant, but as far as I could tell they’d done nothing more than perform the service for which they were paid.

I ordered a sandwich. They made it. That was it.

The more I thought about it, I couldn’t think of a way that they might ever earn a tip. The goal of the place is to make sandwiches quickly and accurately. Making that happen is their job.

How could they go above and beyond? Maybe if I choked while eating and one of them leapt over the counter to perform the Heimlich maneuver, then I’d consider tipping (I’m not that cranky). But that’s not exactly the normal course of business.

This led me to a few other thoughts, and this writing.

Why are there tip jars at Starbucks? Don’t they get paid? And why are tips a percentage of the bill? Does it take more effort to pour a $200 bottle of wine than a $40 bottle? Why should I tip $30 on the first one, but only $6 on the second? Better yet, why am I tipping on that at all?

I recognize that many restaurants and bars pay employees a tipping wage. This includes a complicated formula for ensuring that employees make at least the minimum wage.

But there are thousands of other service jobs where tipping is becoming common. I don’t know why this is.

Are their employers a bunch of Scrooges who don’t pay enough and it’s up to generous-hearted patrons to make up the difference? Are we paying so that we get some level of service that other people won’t get?

As far as I can tell (and social experiments back this up), we tip because… everyone else does.

Bellmen, doormen, valets, the barista at Starbucks and the guy in the moving crew all are paid to do their jobs, and yet we typically feel compelled to supplement their income simply because other people do.

What’s worse, as employment law and workplace regulations improve to protect workers against abuse, we’ve steadily increased our tipping, not reduced it.

And this is completely on us as Americans. Even though the practice can be traced to Continental Europe in the 1800s, by and large other societies have phased it out over time.

But here we are, nudged by society – and the workers themselves – to add on a gratuity that feels more like an obligation.

At some level, I’d love to do away with the entire practice, and apparently some people agree.

Several restauranteurs in New York are experimenting with tip-free dining, although I think they are missing the point. The owner of Fedora, a trendy West Village spot, and several others did away with tips. But they also raised their prices 20%.

The idea was to keep server income the same. The restauranteurs were surprised when patrons reacted by ordering less expensive items, keeping their bills in line with their previous bills, before the tip was added.

It comes down to, “Who keeps the money?”

I don’t think the idea is that we should save diners and Starbucks drinkers the hassle of doing math. Instead, we should rethink the notion of paying people on a variable scale for a known amount of work (back to the two bottles of wine for different prices, or two different meals).

I wouldn’t pay people that way in my business, so why would I expect, and encourage, my customers to pay for things that way?

Whatever my cranky-old-man thoughts are on the subject, as a nation we’d better figure this one out.

We have the largest generation retiring en masse, modestly rising incomes, and a lot of new jobs created in the hospitality sector.

We’re quickly morphing into a nation of service workers looking to retirees for a tip. In a sense, it’s income redistribution through social protocol, instead of payment for services rendered.

That doesn’t sound American at all.

Rodney

Follow me on Twitter @RJHSDent

P.S. Whether you tip big or not, your retirement dollars could be at stake in this tipping economy. Make sure to check out Dent Research’s 401K Advisor. Charles Sizemore just last week published our first quarter report, looking at a brave new world for your portfolio in 2017.

P.P.S. I didn’t pay that tip at Jersey Mike’s.

The post The Tipping Economy appeared first on Economy and Markets.

January 11, 2017

Don’t Let Psychology Get the Better of You!

My dad asked me for advice once.

My dad asked me for advice once.

He had bought a condo in Myrtle Beach, South Carolina, several years back and was now wondering whether it was time to sell it and move on.

“Do you want to sell it?” I asked him.

“I’m really not sure. It’s complicated.” He replied.

“Do you want to buy it?” I continued.

“I already own it, Adam!”

“I know! But imagine for a minute that you didn’t already own it,” I continued. “If you didn’t already own it today… would you want to buy it today?”

After a brief pause, he said, “No! I wouldn’t buy it today!”

Well, there’s your answer, Dad…

Without realizing it, my dad had fallen victim to a mental glitch that psychologists call the disposition effect: our tendency to hold losing investments too long, hoping and praying to get back to break-even and avoid a loss.

That’s the urge my dad was fighting when considering whether or not to sell his investment, which hadn’t exactly turned out as he had expected it would.

Long story short… he bought in 2006, expecting to merely flip the pre-construction contract. When that plan unraveled, he began renting out the unit, but couldn’t achieve positive cash flow. Eventually, he relabeled the would-be investment “The Family Beach House” and merely visited as often as he or our family members wanted.

After years of this, my dad wanted to sell and move on. But there was just one thing holding him back… the roughly 10% loss he would lock in if he sold.

I suspected as much, which is why I asked him that question – “Would you buy it today, if you didn’t already own it?”

You see, the following two decisions are economically identical:

Choosing to stay in an investment you already own; and

Choosing to buy an investment you don’t already own.

In both scenarios, you are an owner of that investment tomorrow.

But psychologically, there’s a difference.

When considering a new investment, you don’t have to bother yourself with the psychological baggage of the investment’s past performance. You didn’t own it at the time… so who cares?!

But when considering whether to hold or sell an investment you already own… you have to face the psychological effects of how that investment performed for you. And in turn, you have to label yourself a “winner” or a “loser.” (And we all HATE being a loser, right?!)

So even though the money didn’t matter much to my dad, the psychological pain of adding one more tick mark to the “loss column” was almost too much for him to bear. He even admitted to me, “This deal didn’t go as planned, but I just wish I could get back to break-even.”

That’s the essence of the disposition effect. We feel a strong urge to hold unprofitable investments too long, simply because we can’t stand to admit defeat… and because the pain we feel when we lock in a loss is dramatically greater than the joy we feel when we lock in a win.

Psychologically, we walk away from losses – no matter how big or small – with a bruised ego, diminished self-worth, and a general lack of confidence in our investing prowess.

So we’re willing to try almost anything – mainly hope and prayer – to avoid locking in a loss.

It’s irrational.

It’s not a good strategy.

Yet investors routinely fall victim to the disposition effect (even without realizing it, most of the time).

I recently shared this story of my Dad’s condo with members of my latest research trading service, codenamed Project V.

It’s based on an unconventional market-timing strategy I developed to ride the cyclical waves of fear and greed that routinely pulse through the markets. We buy one ETF when in risk-on mode, and buy another ETF when in risk-off mode. That means Project V readers must be mentally prepared to “flip” positions routinely, buying and selling as conditions change.

And that’s something some people find a challenge, because our psychology – the psychological force of loss aversion – makes it difficult to give up on trades or investments that don’t go our way. The little devil on our shoulder whispers to us, “hold on just a bit longer… who knows, maybe this loss could turn into a win.”

That’s what happened to my Dad, when he couldn’t bring himself to sell his condo (for a small loss), even though he didn’t really want to own it any longer.

And even without their knowing it, loss aversion works against all investors – particularly those who don’t have a disciplined investment system, that tells them exactly when to buy… and exactly when to sell.

Don’t be a victim of your own loss aversion a day longer than necessary.

Adam ODell

Editor, Project V

The post Don’t Let Psychology Get the Better of You! appeared first on Economy and Markets.

January 10, 2017

Gold’s Recent Bounce Is Temporary: The Trend is Still Down in 2017 (and Beyond)

[image error]Twenty-two radio interviews for the new book, 10 of them live.

At this point, my voice is tired. So are gold sellers.

Gold peaked at $1,934 in September of 2011 – the last major commodity to peak in the 30-year cycle that first peaked in mid-2008.

Silver peaked in late April 2011, after retesting its dramatic bubble peak in 1980, at $48. That’s when we gave our first and biggest sell signal for gold and silver.

After gold’s peak in September 2011, its first wave down ended up in a two-year-long trading range that vacillated between $1,525 and $1,800. During that time, I warned that when gold broke below that $1,525 level it was toast… and its major crash from $1,800 in late 2012 to $1,050 in late 2015 was indeed devastating.

Well, there’s likely another wave of that magnitude starting this year… As I’ve said all along, the next major target in gold is its 2008 low of around $700. To get technical with Elliott Wave Theory, that would retest the 4th-wave correction before the largest 5th-wave bubble run into $1,934. I still see gold landing somewhere between $650 and $750 in the next year or so, likely by the end of 2017.

But we’ll only see this after a significant bounce ahead…

At the beginning of 2016, I forecast that gold was very oversold. It was at $1,050 per ounce in late 2015 and so due for a major bear market rally back up to as high as $1,400. As I said it would, gold did bounce and got to $1,373 per ounce in early July 2016, at which point I recommended selling again. Lo and behold, gold fell rapidly to $1,124 in mid-December.

Gold is now very oversold again, but on a shorter-term basis, and its due for a minor rally to around $1,250. But given how oversold it has gotten, it could even go back to a slight new high near to $1,400. That could come by mid-February or so.

We’re currently betting against gold in our model Boom & Bust portfolio, and sitting pretty on that position. To project our profits while waiting for this mini-boom, Charles Sizemore, our Portfolio Manager, instructed subscribers to increase their stop loss in case this stronger rally ensues. But if it does get to near $1,400 again, that will be an even better time to bet against gold.

In the January Leading Edge issue, I’ll look at all major markets through the lens of the smart and dumb traders at the Commitment of Traders Report (www.cotbase.com). Of the commodities it looks at, gold has a bit more bounce potential ahead than oil and copper, but not likely for long. Here’s what that looks like…

The commercial hedgers are the smaller segment – the “smart money” – because they always go against the trends to hedge.

The commercial hedgers are the smaller segment – the “smart money” – because they always go against the trends to hedge.

The large speculators are the “dumb money.” They simply follow the trends up and down and are always wrong at major tops and bottoms.

Gold hit a record divergence in dumb money net long at 320,000 and the smart money net short at 340,000… more so than even at the secondary top in late 2012 before the big crash into 2013-2015.

In other words, that was a bear market bounce, as I forecast at the beginning of 2016.

Gold then dropped 250 points into mid-December and is now bouncing again after being very oversold on a shorter-term basis.

The record divergence of July has not been erased yet. That would require going back to near neutral or slightly negative on this market. Currently the dumb money is still 100,000 long and the smart money 110,000 short.

That means there is much more to come on the downside after this short-term bounce resolves itself – again, likely by mid-February.

Silver had an even larger divergence a bit later into early August and looks to have even more downside potential.

My forecast of $700 gold and $10 silver is increasingly likely by the end of this year and almost certain in the next few years.

This rally will be the last chance for gold holdouts to get out!

The ultimate downside for gold at the bottom of the 30-year commodity cycle, between early 2020 and late 2022, is $400 or lower to erase the bubble that began accelerating in 2005. For silver those targets are as low as $5.

That’s when I would start to recommend buying gold and silver again longer term, with a target of $4,000-plus for gold by 2038-2040. The next 30-year commodity cycle could be the greatest ever seen because it will be driven by the demographically growing and still-urbanizing emerging world. They’re the ones who’ll be producing and consuming most of the gold and other commodities – especially India.

Harry

P.S. All those radio interviews I did today were to promote my latest book, The Sale of a Lifetime. Have you got your copy yet? I’ll send a couple of links to those interviews over the next few days, so you can hear for yourself what I talked about.

The post Gold’s Recent Bounce Is Temporary: The Trend is Still Down in 2017 (and Beyond) appeared first on Economy and Markets.

January 9, 2017

A Grumpy Old Man’s Guide to 401(k) Investing

Perhaps I’ve been spending too much time with my young kids, but I’ve gotten quite good at wagging my finger and speaking in a stern, fatherly voice. I love my kids dearly, but at times the rascals need a little discipline. And chances are, when it comes to making full use of your 401(k) plan, you do too. So, as my glasses slide down my nose, I’m going to put on my slippers, roll up my Financial Times newspaper and shake it in your general direction.

Perhaps I’ve been spending too much time with my young kids, but I’ve gotten quite good at wagging my finger and speaking in a stern, fatherly voice. I love my kids dearly, but at times the rascals need a little discipline. And chances are, when it comes to making full use of your 401(k) plan, you do too. So, as my glasses slide down my nose, I’m going to put on my slippers, roll up my Financial Times newspaper and shake it in your general direction.

You – yes, you there! Sit down and listen up because this is important. And don’t you dare forget this advice. What I’m about to tell you is for your own good.

If you’re not taking full advantage of your 401(k) plan… well, shame on you. Those things aren’t free, you know. Your employer spends a lot of money administering the thing… for your benefit. If you can’t be bothered to log in or fill in the forms to participate, you’re just a derned fool. Do you know how many starving children in Ethiopia would love to have a 401(k) plan like yours?

At my first job, we didn’t have 401(k) plans. I had to settle for the measly $2,000 I was allowed to contribute to an IRA at the time. Well, I maxed out that IRA… and I loved it! But what I wouldn’t have done for a proper 401(k) plan. So, show some gratitude, would ya!

I know, I know. Money saved in a 401(k) plan is money you can’t spend on some new-fangled gewgaw. But if you make decent money, a huge chunk of it is just going to end up going to the tax man.

Stop and use your head for a minute. If you’re in the 28% tax bracket – and if you’re still single (at your age!), you’re in the 28% bracket at an income of just $91,150 – then you effectively earn a 28% “return” on every dollar you contribute to your 401(k) plan from day one. Would you rather that 28% go to the guv-mint? Yeah, that’s what I thought.

You can save $18,000 in a 401(k) plan in 2017. If you get started now, that’s $692 per paycheck. You can do that. Your grandmother used to feed a family of seven growing kids on $692 per year and never complained. So, log in to your plan or call your HR department now and get your contributions on track.

Don’t make me come over there and swat you with this newspaper.

And matching… don’t even get me started on matching. When I was your age, I was lucky if my cheapskate boss matched me even 2%. These days, I’ve seen companies match as much as 6% or 7%. If you’re too big of a sissy to contribute the full $18,000 in salary deferral to your 401(k) plan, then for crying out loud, at least contribute enough to get the full matching amount from your employer. If you don’t, you’re leaving money on the table. And I don’t know about you, son, but I don’t have a money tree in the backyard. When someone offers me free money, I take it.

Ok, I’m going to unroll the newspaper and push my glasses back into place for a moment. In all seriousness, this is the time of year to make changes to your 401(k) plan. If you’re not already maxing out your 401(k) plan for the full $18,000 (or $24,000 if you’re 50 or older), you should really make that a priority. Even if the stock market fails to return a single red cent, the tax savings and employer matching alone make it more than worthwhile.

I realize that not everyone can realistically defer $18,000 of their annual pay. If you’re young, recently started a family or have a non-working spouse, that might not be an attainable goal. But here are a few tips to get you closer.

If you got a raise to start the year, I strongly encourage you to allocate the difference to your 401(k) plan. You were already surviving at your previous pay rate; continue to live your current lifestyle a little longer, and push the salary increase into your retirement plan. Years from now, you’ll be happy you did.

If you generally get large tax refunds every year, consider chatting with your HR department about increasing the number of exemptions you claim. This will cause you to withhold less in taxes, which will boost your paychecks. You can then use higher effective pay to contribute more to your 401(k) plan.

And finally, consider living more modestly. If you rent an apartment, consider getting a roommate or downgrading to a cheaper apartment. Money spent on rent is effectively money wasted. It’s better to use that money to build your future.

Listen to me, son. It’s for your own good.

Charles

P.S. I write the quarterly Dent 401K Advisor newsletter, in which I help readers allocate their 401(k) funds to make the most of the market environment Harry and the rest of us expect to see over the next three months. I recently published the Q1 allocation. Take a look.

The post A Grumpy Old Man’s Guide to 401(k) Investing appeared first on Economy and Markets.

January 6, 2017

How to Play the Bear Market Rally in Commodities

We talk a fair bit about commodities here at Dent Research. That’s largely because Harry’s research has consistently pointed to deflation – not inflation – as the dominant force in this winter economic season.

We talk a fair bit about commodities here at Dent Research. That’s largely because Harry’s research has consistently pointed to deflation – not inflation – as the dominant force in this winter economic season.

Indeed, commodity prices have sucked wind for years now.

Crude oil fell to a low of $36 a barrel last year – a whopping 83% below the July 2008 peak, at $212.

Gold peaked in 2011 and has since lost as much as 46%.

So while everyone and their brother has spent the past five years worrying about inflation – cursing the Fed, of course – we’ve warned that deflation, instead, will drag down asset prices. That includes the price of commodities, which are practically worthless in a deflationary environment marked by weak demand, oversupply, and falling prices.

Harry has consistently said that long-term investors should stay out of commodities. And that’s been a great call for several years now.

But just because commodity prices are stuck in a long, multi-year bear market doesn’t mean you can’t make some nice short-term profits along the way.

As we say: “Nothing moves in a straight line.” And short- to medium-term bear market rallies can be great opportunities.

My Cycle 9 Alert readers have profited from a number of them in recent years.

In 2013, we locked in a 154% profit on a steel manufacturer in just two months.

In 2014, we closed out a trade on an oil refiner, for a 135% profit.

And last year, a silver-miner’s stock handed us a fat, 225% profit in just a few months.

These pockets of bullish opportunities appear every so often in commodity markets, even though the longer-term, deflation-driven trend continues to point down.

Right now, I’m seeing another one of these short-term opportunities. In fact, I just sent a Trade Alert to my Cycle 9 Alert subscribers two weeks ago, alerting them to a commodity play that has the potential to hand us another triple-digit profit, thanks to a convergence of positive factors between now and April.

For one, we’re entering a time of the year that typically treats commodity prices quite well.

My seasonality research shows that the materials (XLB) and energy (XLE) sectors enjoy a tailwind between January and April. The same goes for commodity prices, which tend to be the most bullish during the first four months of the year.

What’s more, my forward-looking Cycle 9 Alert algorithm is already picking up on a ramp-up in bullish momentum all across the commodity complex – from oil to copper to base metals, my system’s buy signals are triggering left and right.

That means the market-beating momentum in commodities is likely to last another two to three months – certainly enough time for a short-term play.

The PowerShares DB Commodity Index ETF (NYSE: DBC) is a “broad-based” commodity ETF, which holds positions in oil, gasoline, natural gas, gold, copper, base metals, and more. And it’s one of the easiest ways to make a diversified, short-term play on commodities – aimed at riding the sector’s seasonal strength between now and April.

I’ve already positioned my Cycle 9 Alert readers in a specific play. They’re up 15%, but since we’re targeting the potential for 100%-plus gains between now and April… there’s still time to get in.

Adam

Editor Cycle 9 Alert

The post How to Play the Bear Market Rally in Commodities appeared first on Economy and Markets.

January 5, 2017

Trumponomics: Shame is the Game

The mainstream media has branded our President-Elect’s economic policies as “Trumponomics.” They have focused on trying to understand who the winners and losers are going to be under this new administration.

The mainstream media has branded our President-Elect’s economic policies as “Trumponomics.” They have focused on trying to understand who the winners and losers are going to be under this new administration.

I’m not a world-renowned economist like Harry Dent. (He’s emphatic that Trump won’t grow the economy at 3% to 4% like Trump says he will, because it’s actually demographically impossible.) So, I can’t tell you the true impact Trumponomics is going to have.

But what I can tell you, as a Marine Corps-trained Command and Control Systems Officer, is that Trump has rewritten the playbook for sending policy messages. And they will affect big companies directly.

He’s already warning the ones that stand in the way. And flipping them on their head.

We’ve seen it plenty of times during the presidential campaign and now in his transition to the office. Trump uses social media, mainly Twitter, to send messages straight to the world.

There’s no media filter. These are his raw, uncut thoughts.

What’s the impact?

The mainstream media has branded our President-Elect’s economic policies as “Trumponomics.” They have focused on trying to understand who the winners and losers are going to be under this new administration.

I’m not a world-renowned economist like Harry Dent. (He’s emphatic that Trump won’t grow the economy at 3% to 4% like Trump says he will, because it’s actually demographically impossible.) So, I can’t tell you the true impact Trumponomics is going to have.

But what I can tell you, as a Marine Corps-trained Command and Control Systems Officer, is that Trump has rewritten the playbook for sending policy messages. And they will affect big companies directly.

He’s already warning the ones that stand in the way. And flipping them on their head.

We’ve seen it plenty of times during the presidential campaign and now in his transition to the office. Trump uses social media, mainly Twitter, to send messages straight to the world.

There’s no media filter. These are his raw, uncut thoughts.

What’s the impact?

His presidential opponent showed a small bit of the potential last year.

Back in September 2015, Hillary Clinton sent a 21-word tweet that cost the biotech sector $40 billion in market in just one day. She said price gouging in the specialty drug market was outrageous, and she planned to take it on. By the end of the day, the Nasdaq Biotech ETF, which tracks the sector, lost 4.5% as a whole.

Trump one-upped Hillary this week when he set a precedent for directly praising or shaming companies that follow, or more importantly, don’t follow, his Trumponomic initiatives.

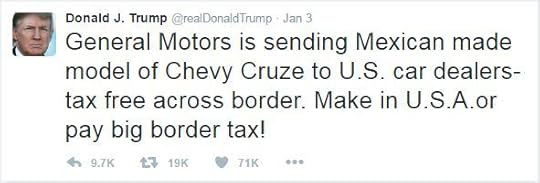

On January 3, Trump sent out the below tweets to General Motors and Ford.

The first, talking about his policies and GM, came at 7:30 a.m.

In the second, just four hours later, he shared news about Ford ending plans for a plant in Mexico, seemingly in response to Trump’s recently tweeted public position.

That’s right, Ford is ending plans for a $1.6-billion plant in Mexico and instead investing $700 in a Michigan plant.

You could call this “reading the tea leaves” of the next administration and making a strategic business move for taxes.

In reality, what Ford really saw was a public relations nightmare. One that was about to be broadcasted to 18 million of Trump’s followers (and more), and they took the high road.

General Motors, though, didn’t get the message. The company got blasted and is about to pay the price, via taxes and poor public relations.

Good or bad, Trump’s setting a new precedent in public shaming that has been unseen from any other president.

The Master of the Deal is breaking new ground rewriting the playbook for negotiations and using every tool at his disposal.

Time will only tell how this tactic will play out, but if it’s anything like the election, it’s going to continue to catch people off guard and turn out to be highly effective.

Tweets might be mightier than the sword.

If you can heed one final piece of advice for the new year, let it be this: Never get into a public argument with someone who has 18 million Twitter followers.

Shaming could follow.

Ben

The post Trumponomics: Shame is the Game appeared first on Economy and Markets.

January 4, 2017

Using the House to Pay for Grandma

I’ve always got the nagging feeling that I’m not saving enough for retirement. Maybe because I don’t even know how much constitutes “enough.”

I’ve always got the nagging feeling that I’m not saving enough for retirement. Maybe because I don’t even know how much constitutes “enough.”

I know most Americans are in the same boat, and — to top it off — Social Security is going broke. Since more than 30% of retirees count on Social Security for 90% or more of their monthly income, this is a huge problem.

But when it comes to financing retirement, at least we’re not Chinese.

In the U.S., Social Security will exhaust its surplus by 2037. At that point, the program will bring in enough funds to pay roughly 75% of the promised benefits, leaving an average annual deficit of around $200 billion. To fix this, we will have to raise taxes, cut benefits, or some combination of the two.

China’s pension scheme will be underfunded by $116 trillion dollars by 2050, and will steadily get worse. The government currently has no plans for how to fix their problem, but a wealthy real estate magnate does.

He is Meng Xiaosu, president of China’s largest state-owned property developer.

Instead of trying to wring new taxes out of the system, he proposes that Chinese retirees take out reverse mortgages on their homes.

These allow homeowners to take out loans against the equity they’ve built up in their homes in the form of monthly payments that last until they die, sell, or move out. At that point, the total of the payments plus interest are repaid using the equity in the home. (I wrote about these extensively in Boom & Bust, May 2014.)

Since the Chinese hold 76% of their personal wealth in real estate, it only makes sense to tap this asset for retirement income. Except for one thing — to make such a program work, there must be new buyers in the years to come to keep home values up.

China currently has 1.3 billion people, with big population bulges in the 45- to 49-year-old range and the 25- to 29-year-old range. Younger age groups are markedly smaller because of the one-child policy. Over the next 35 years, demographers optimistically project the country’s population to remain flat, and then drop by 300,000 people from 2050 to 2090.

As I said, this is optimistic.

Today, Chinese women have an average of 1.6 children. It takes two children to replace both parents, so today the system builds in population reduction. The government recently relaxed the one-child policy, hoping to spur reproduction and slow the population decline, but so far the citizens don’t seem interested…

By holding families to only one child, the Chinese government inadvertently created a system where parents compete for everything for their children, from slots at university to spouses. All that fighting takes cash, so having more than one child would be quite the financial burden.

If couples stay on their current track of having few children, then the rosy projections of a stable population will fade, and the number of Chinese will dwindle even faster than anticipated. Among the weird outcomes from a falling population will be fewer home buyers, a situation that Harry has written about several times concerning Japan.

Fewer buyers should lead to lower home prices, which is a problem for the reverse mortgage industry.

In the U.S., reverse mortgages are guaranteed by the federal government (which means you and me), and there are strict limitations on the amount of equity that can be borrowed. We also have a gently rising population, so over time our real estate market should be at least stable.

In China, reverse mortgages are currently offered by just one company, an insurance firm, with no government backing. Granted, the market is minuscule today, with only 89 reverse mortgages outstanding. But there are 250 million elderly in China at the moment, a figure that’s expected to grow to 350 million over the next 35 years.

As the government looks for a way to pay for them all without breaking the bank, the reverse mortgage industry could take off… for a while.

However, when it becomes apparent that home prices can’t keep pace without the tailwind of population growth, the market should come crashing down.

Of course, reverse mortgages are just the latest twist in an already crazy Chinese property market. Easy credit has fueled speculative buying for years, causing a sizeable real estate price bubble that looks ready to pop.

In the end, the problem remains the same.

As populations age, the citizens transition from net producers to net consumers. Unless there are more workers added (meaning young people) that provide goods and services and pay taxes, or the older citizens have stored up an enormous amount of wealth, it will be almost impossible for the elderly population to maintain its standard of living.

Eventually, the Chinese government will get more involved, probably doing exactly what we must do here to fix our problem: lower benefits, raise taxes, or some combination of the two.

I’d imagine many people in China look at it the same way you and I do. They’re not sure how much is “enough” for retirement. But they’re certain the government will show up wanting more of what they have.

I’d better get back to work so that I can sock some more away.

Rodney

Follow me on Twitter @RJHSDent

The post Using the House to Pay for Grandma appeared first on Economy and Markets.