Harry S. Dent Jr.'s Blog, page 75

September 1, 2017

The Not-So-Contrarian Path to a Quick 250% Gain

It’s not possible for me to sit still, so to speak. So when it comes to my work – I’m a forensic accountant by trade – I’m constantly looking for more data and more context for both the micro and the macro views.

It’s not possible for me to sit still, so to speak. So when it comes to my work – I’m a forensic accountant by trade – I’m constantly looking for more data and more context for both the micro and the macro views.

I prefer to stay in the weeds of quantitative research from which I can draw my own conclusions. Research that’s presented with a clear angle gets the side eye from me.

Why? Well, there’s so much ideology and so little methodology these days. It can be difficult to tell if a writer had a conclusion and worked backward to support it. Data can be interpreted in almost any way you want, with the right spin.

So, the more quantitative the research, the more likely I am to trust it.

The top-sheet numbers and the general consensus of the mainstream media will tell you that the markets continue to climb and find new highs. But there are signs that point to something rotten in the state of the markets, something deep in the foundation.

Let’s run through some of my recent findings.

First, fund flow into passive investment strategies has been massive. The money pouring into index-based ETFs dwarfs anything seen over the last 10 years. This has been a huge factor driving virtually all stocks higher because index funds are indiscriminate.

In other words, they have to buy whatever is in the index. There is no judgement call. So, all stocks go up.

Second, as such flows have topped, the correlations among stocks in the S&P 500 are breaking down. Those correlations are now the lowest at any time since 2006.

What that means to me is that while a few stocks may drive the indexes higher, including Facebook (Nasdaq: FB) and Apple (Nasdaq: AAPL), a lot of stocks under the surface are starting to diverge from the broader indexes.

Third, the number of U.S. stocks trading below their 200-day moving averages has dropped below 50% in the last week – despite indexes sitting near their all-time highs. That means more than 50% of stocks are in negative trends, belying the strength in the indexes.

How can that be?

Well, the big indexes are weighted by market capitalization, so a few stocks contribute a disproportionate amount of performance to the index. But, viewed from each stock being equal-weighted, we’re starting to see bearish trends forming below the surface.

Despite all this data, you don’t need to be a total doom-and-gloom bear right now. But it helps to keep one cynical eye on the big picture, because there are serious profit opportunities when you do so. My Earnings Insider Alert readers just booked a quick 250% gain on a stock that, despite a strong earnings report, still fell short of Wall Street expectations.

There’s bound to be more of these plays in the months ahead.

Looking back at my recent research, if you slice the price-to-sales ratios of each company in the S&P 500 into deciles, nine out of 10 deciles are at 30-year highs. That’s another nitty-gritty way of showing how overvalued the market is.

The only ones not reaching a new high are the most richly valued stocks because the bar’s simply too high: In 2000 this was dominated by internet companies with insane valuations. But even 2017’s level is close.

So even if a company is doing well, it still might disappoint Wall Street, just like our recent winner did.

Many market sectors are valued at 50% or more above their 30-year peaks. That’s a cause for concern, because if selling pressure really starts on the indexes, there’s more room to fall than in prior market cycles across all stocks. There’s going to be virtually nowhere to hide, unlike in 2002 when technology stocks took most of the pain.

My Earnings Insider Alert readers hear my take on the markets on a regular basis, but I’ll also dig into and present my research at our upcoming Irrational Economic Summit in October. I hope to see you there!

Good investing,

John Del Vecchio

Editor, Hidden Profits

The post The Not-So-Contrarian Path to a Quick 250% Gain appeared first on Economy and Markets.

August 31, 2017

Abolish the Fed?

We’ve been led to believe that central banks – and especially the Federal Reserve System – was put in place to protect us. That’s a laugh!

We’ve been led to believe that central banks – and especially the Federal Reserve System – was put in place to protect us. That’s a laugh!

Central banks are partnerships created between bankers and politicians. The political side gets spendable money (created from nothing) without having to raise taxes, while bankers get commissions or interest payments in perpetuity. A sweet deal for both sides!

But who gets the shaft? Yeah, you got it: we do.

Let me back up a step though. Did you know that our current central bank is the fourth try at establishing a central bank?

First came the Bank of North America (1781 – 1783). Then came the Bank of the United States (1791 – 1811). And then there was the Second Bank of the United States (1816 – 1836). Why did they fail, and why on earth did we try and try again?

The first central banks failed because the “money” (or notes created) was so susceptible to devaluation and inflation that the public simply lost confidence (can you blame them?). They stopped using the notes (and weren’t forced to) since it wasn’t “legal tender” in the first three attempts.

But as we’re all too familiar with, politicians like spending what they don’t have and bankers like easy money and don’t like to compete for it, so in 1913 Congress passed the Federal Reserve Act, and here we are.

The granddaddy of central banking though is the Bank of England (BOE). The BOE started in 1694 and has financed England through countless wars and has seen innumerable politicians come and go. It’s the standard for and the basis of most central banks around the world today. Napoleon started the Bank of France based on the English model and we followed suit a few decades later.

But how did they (bankers and politicians) get around the U.S. Constitution, which doesn’t allow Congress the power to create a bank?

To be blunt, they deceived the public, and they had a pretty sophisticated plan to do so. A group of six rival bankers and politicians met secretly in 1910. These few individuals, which represented as much as a quarter of the world’s wealth, came up with a plan to get the bank going.

Again, politicians wanted a mechanism for creating a ton of spending power without having to raise taxes. Bankers wanted a lot more, especially less competition. Basically they wanted a monopoly to create and control the nation’s money at the highest of levels.

Of course, they wanted the taxpayer to bail them out when there were inevitable losses.

To execute the plan, they had to convince Congress that the main objective was to protect the public. So, first things first: they didn’t even call it a bank! The conspirators figured their idea shouldn’t be compared to previous failures. Second, they made it look like a government agency but decentralized it so it doesn’t look like it was controlled by Wall Street banks.

Use the anger created by recent bank failures and panics to create popular demand for reforms, they figured. Even speak out against the plan to convince the public that Wall Street bankers wanted nothing to do with it!

It took a couple tries to convince Congress but, voila, the fourth time was the charm! The Federal Reserve System of the United States is still kicking 105 years later!

During the financial crisis of 2008, the Fed bailed out manufacturers, banks, and other financial firms in the U.S. and abroad – all in the name of protecting the public.

Of course, the central bank wasn’t using its money. The public was on the hook for it. How’s that for protection?

Sure, the Fed does some good by facilitating a safe and efficient payment and settlement system throughout the world for all U.S. dollar transactions. Its army of Ivy League doctorates has published some useful research and I even based one of my trading systems on some of its findings.

But even with that army of academia, the Fed has been wrong about most of its forecasts on economic growth, inflation, and even future interest-rate policy. It’s unrestrained when it comes to use of policy tools like quantitative easing and, perhaps worst of all, is accountable to no one.

I can’t emphasize that enough: The Fed is accountable to no one.

The Fed still tries to control the booms and busts of the business cycle, but it’s been known to create or even exacerbate them. Arguably, even the stock bubble we see today is the fault of the Fed’s machinations.

The gains made over the last 10 years or so haven’t gone to the general public in the form of higher-paying jobs and a healthy and growing economy. The gains have gone to those holding the financial assets helped along by Fed policy.

So, do we really need a central bank? I would argue that we don’t, but at the least it does create some of the volatility that my Treasury Profits Accelerator readers profit from!

And if you’re interested in hearing more about the Fed and how you can profit from overreactions in the Treasury bond market, I’ll be speaking at our annual Irrational Economic Summit in October. I hope to see you there!

Good investing,

Lance Gaitan

Editor, Treasury Profits Accelerator

P.S. The $500 discount for a seat at the Irrational Economic Summit this October lasts until Labor Day only. Don’t miss out of this savings, and don’t miss the summit. It’s changed lives, which you can hear about here.

The post Abolish the Fed? appeared first on Economy and Markets.

August 30, 2017

An Early Warning Sign or Another Buy Signal?

Despite everyone’s growing concerns with… well… you name it – the economy, the president, the missiles popping off in Pyongyang – U.S. stocks are having a pretty good year.

Despite everyone’s growing concerns with… well… you name it – the economy, the president, the missiles popping off in Pyongyang – U.S. stocks are having a pretty good year.

Not as good as foreign stocks, as I explained two weeks ago. But still, the S&P 500 is up 9% year-to-date.

That’s roughly the long-term average for annual returns.

So, really, what’s there to worry about?

Stock prices always have the “last word,” in debates over valuation, risk, and the like. And since stock prices are indeed moving higher, it seems like, for now at least, all the worry has been for naught.

Although, fully outside the typical fodder of the news cycle, there is one development I’m watching closely, since it has the potential to either be an early warning signal… or, counterintuitively, a “buy” signal.

Let me explain…

I’m watching what we analysts call “market breadth.”

You see, the S&P 500 is an index of stocks. Its value is calculated based on the closing prices of each of the 500 stocks included in it.

Most people simply glance at the value of the S&P 500 index… and judge it based on whether it’s moving higher or lower.

But market breadth goes one layer deeper, aiming to determine what percentage of the individual stocks within the index are trading in a bullish or bearish manner.

As I explained to my Cycle 9 Alert subscribers yesterday, the percentage of S&P 500 stocks that are trading above their 200-day moving average has been slipping lower in recent months.

And that has some analysts worried.

On March 1, a full 79% of them were trading above this closely-watched line in the sand.

Today, just 59% are holding above it.

That means around 100 individual stocks in the S&P 500 have fallen below their 200-day average in the last six months.

Meanwhile, the index itself is up about 2%… which means fewer and fewer individual stocks are doing the heavy lifting to move the index higher.

Those are the facts… the data, in black and white.

The conclusion we should draw from this data, however, isn’t so clear.

It can be interpreted in one of two ways…

The Negative

The negative interpretation is that this is the beginning of the end.

Logically, since this metric has already fallen from 80% to 60%, today – what’s stopping it from falling further… to 50%, then 40% and, eventually, 10%?

Indeed, by the time only 10% of S&P 500 stocks are above their 200-day average, the broad market will very likely already be in a bear market.

That’s why a divergence between declining market breadth, and a timidly rising index, can often provide an early warning signal of trouble to come.

We here at Dent Research are obviously watching closely for these types of divergences, since we want to give passive investors as much of a heads up as we can.

But that doesn’t mean you should sell everything today and run for the hills!

Far from it… since there’s another equally valid conclusion that can be drawn from reasonable degrees of declining breadth.

The Positive

You see, it’s unreasonable to expect all stocks, across all sectors, to perform superbly all the time.

Even during bull markets, you can find plenty of stocks that are either laggards or downright losers – at least for some period of time.

This is completely natural. And as long as the vast majority of stocks aren’t sucking wind, it’s a perfectly healthy function of the market to have both outperformers and underperformers.

It provides a “cleansing” function for the market, by pushing the prices of out-of-favor stocks lower… until those prices are low enough to attract opportunistic buyers.

And then, most of the time, the broad market continues higher once the laggards are bought in sufficient quantities.

Consider a simple study I ran…

I looked at each instance when the percentage of S&P 500 stocks trading above their 200-day moving average fell below 60% (the condition we’re experiencing now).

Here’s a table showing the average S&P 500 return over the next one to six months, along with the “win-rate,” or accuracy of the buy signal.

As you can see, S&P 500 breadth falling below 60% is not a death knell each and every time. Most of the time, the broad market tends to recover following these cleansing periods.

Which Will it be This Time?

Of course, it’s impossible to say the significance of this signal this time around.

As is often the case with systematic investing, all we can do is “watch and wait” as this situation unfolds. And, of course, I’ll continue to follow the rules of my systems.

You see, Cycle 9 Alert is specifically designed to capitalize on this leaders-and-laggards nature of the market. The fact that 40% of S&P 500 stocks are below their 200-day averages is of only minor importance to my Cycle 9’ers, since those aren’t the type of stocks I recommend they buy.

And since our holding periods are short – typically between two and three months – we don’t have to worry all that much about whether this ends up being the “beginning of the end,” or not.

We’ll simply continue trading the system… which will, inevitably, adapt to changing market conditions, whether positive or negative.

So, while I indeed have my eye on the S&P 500 and market breadth, I’ll continue to run my Cycle 9 Alert game plan no matter what happens next.

To finding profits,

Editor, Cycle 9 Alert

Follow me on Twitter @InvestWithAdam

P.S. We’re having another fantastic, profitable year at Cycle 9 Alert. Click here to gain access to our current portfolio.

The post An Early Warning Sign or Another Buy Signal? appeared first on Economy and Markets.

August 29, 2017

This Emperor Has No Clothes

First, we have to realize that the North Korean regime is so embedded with its propaganda that it enjoys a religious reverence, despite its extremely poor populace. South Korea right next door is 20 times richer, yet…

It has survived 70 years, longer than any top-down regime in the communist world.

But it has an “Achilles’ Heel.” The country’s demographics aren’t as bad as those of Russia…

But they’re still bad enough to make them desperate on top of their extremely low GDP per capita. How long can you keep the “bad dream” going?

The Soviet Union started to fail when people’s satellite dishes brought the American show “Dallas” over the borders… oh, the big bad West didn’t look so bad after that!

Which goes a long way to explaining why North Korea is doing a lot of nuclear saber-rattling.

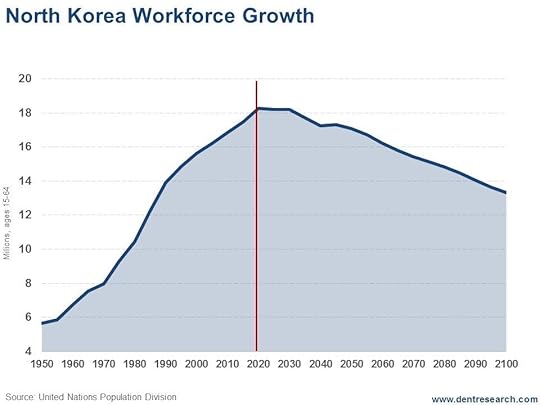

Look at its spending wave of workforce growth for an emerging nation…

Between 2020 and 2030, North Korea’s predictable spending wave is peaking and now has a long, steady drop ahead. The problem is, the country is already as poor as dirt. As it faces a demographic slowdown ahead, the economic pain will be brutal.

Between 2020 and 2030, North Korea’s predictable spending wave is peaking and now has a long, steady drop ahead. The problem is, the country is already as poor as dirt. As it faces a demographic slowdown ahead, the economic pain will be brutal.

And as we’ve seen throughout history, and recently with Russia with slowing demographics and crippling-high military spending: desperate is as desperate does.

Kim Jong-un knows his country is weak. He knows it’s in trouble. And he fears this makes it a target for more successful capitalist countries next door, like South Korea, to ultimately invade, and even possibly China at some point. He does not want South Korea to disrupt his 70-year regime where a few live like kings and drink more Louis XIII Cognac than any country in the world.

Why does China not cooperate with the Western powers and put pressure on North Korea? It desperately needs North Korea as a buffer against South Korea and U.S. forces there. They don’t want them to collapse and put South Korea on their border with all of their U.S. forces and bases. Nor do they want poor North Koreans fleeing over their borders if it collapses.

So Kim does what any desperate person would do. He’s making a show of his only “power,” like a cat that puffs itself up to look bigger than it really is when it’s feeling threatened. “I have a few nukes, and am just crazy enough to set them off if you challenge me in any way!

Does this sound a bit like Saddam Hussein?

He won’t likely ever do that as he would be destroyed in a moment. This “great puff” is all about a deterrent, like Hussein not wanting us to know he no longer had chemical weapons.

In short, North Korea is blustering but it’s a dying country with a weak economy that’s only power is a top-down regime that concentrates on military spending to enhance its leverage.

This will not end well for North Korea, as it did not end well with the Soviet Union… and as it will not end well for Putin ahead.

Top-down governments like Russia, North Korea, and China have no place in the bottom-up information world.

The confrontation between Trump and Kim Jong-un will likely continue to rock markets in the next few weeks – and possibly for a few years – but there’s no way that Kim wins in the end.

He’s the emperor with no clothes, like Saddam Hussein that threatened the “mother of all wars,” and ended up hiding in a trash can… and got hung after that.

Big talking dictators from small countries that threaten major countries rarely do well in the end.

Maybe this 70-year regime is ready to finally lose power after all… we’ll see.

Harry

Follow me on Twitter @harrydentjr

The post This Emperor Has No Clothes appeared first on Economy and Markets.

August 28, 2017

Special Update: Live From Houston

Houston, Texas – It’s not over yet. Hurricane Harvey made landfall on Friday night, and almost no one cared.

Houston, Texas – It’s not over yet. Hurricane Harvey made landfall on Friday night, and almost no one cared.

We had rain. Big deal. Then more rain on Saturday as the storm sat, almost stationary. Harvey lost power and was demoted to a tropical storm.

We went out to dinner, noting the water was over the seawall in some parts of our waterfront neighborhood south of Houston, north of Galveston. Then we had more rain.

Overnight, a weakened Harvey meandered a mile this way and that, pulling moisture from the gulf, dumping it in our laps and homes.

My sister texted at 6:45 a.m. Sunday. Water in their house and rising. They salvaged what they could and took the dogs upstairs to wait.

It kept raining. Water crept toward our home. All we could do was watch.

Again, my sister called. The water was 15 inches high. They turned off the electricity to avoid fires and electrocution. Her 2015 Corvette, electric blue with chrome rims, floated aimlessly in the garage alongside her daily driver, a Nissan Maxima. Their Chevy Tahoe sat in the driveway, with water up to the wheel wells.

The nursing home full of elderly sitting in three feet of water in their wheelchairs is five miles away. Neighbors are helping neighbors. City officials and emergency responders are asking anyone with a boat or tall vehicle to please help. It’s Texas. We have a lot of those vehicles. And they all want to help.

By Monday morning, all 22 drainage ways in the Greater Houston area, from ditches to rivers, were reported at or over flood stage. We expect them to crest at 500-year, or even 1,000-year, flood levels.

Some of that flood water will pass by my neighborhood. Combined with the continued rain, it might get in my house. It might not. All I can do is wait.

Which gives me time to think.

As the rain pours outside and rescue efforts fill the television screen, I see the days and weeks to come. There will be heartbreak and heroics. And then there will be the long effort to restore what was lost.

The energy industry will grab the headlines. It’s Houston, after all. The latest report I’ve seen expects 11% of refining capacity to be offline for weeks. I’ll pay more for gas. For a while. But that’s very short term.

Right now my sister and brother-in-law are cutting out carpet. They are starting to clean up before the storm is over. They’re not alone.

They live in an upper-income neighborhood 20 miles south of Houston, along with hundreds of thousands of others. Harvey didn’t discriminate. We just heard that another subdivision is now under mandatory evacuation. It’s a nice place. Homes from the $200,000s to the millions. It is likely that they will all take on water. And then the owners will return and start cutting out carpet.

This isn’t Katrina. It’s bigger. The damage is spread over a greater area. Harvey is now dumping rain on Louisiana.

The cleanup and restoration efforts will go on for months and years. In the tragedy, I see jobs. I see commerce. I see forces combining to use this for their own ends.

People will need new floors. And furniture. There’s no doubt my sister will have to cut the bottom two feet of sheetrock from the entire first floor of her home and wait for the walls to dry out before replacing. Now multiply that by hundreds of thousands of homes. Home Depot won’t be able to keep up. Think of all the refrigerators that will be replaced, along with dishwashers and TVs.

We should see our unemployment rate fall as close to zero as possible. Any capable person should be able to land a job at least hauling debris, if not actually renovating homes.

And the cars.

GM, Ford and other automakers were struggling this year. This will bail them out. But maybe not all of them.

I’d be surprised if GM CEO Mary Barra, Ford Chairman Bill Ford, and President Trump weren’t in touch over the weekend. The auto execs see a chance to help possibly one million Americans get back on four wheels by putting them in new vehicles, which also helps their bottom lines. The president gets to help Americans while spending relief dollars on a sympathetic cause. It boosts the economy.

And he can make it better. The president can create another “cash-for-clunkers” program that favors cars built on U.S. soil. No one wants previously flooded cars on the used car market, so this helps the entire system.

Those with affected vehicles get bonus cash toward a new car when the turn them in to be destroyed. Maybe the program is limited to Fords and Chevys, but perhaps you can also buy a BMW made in Spartanburg or a Mercedes made outside of Tuscaloosa.

It’s still raining.

And now the wind is picking up. Harvey went back out to sea, and is expected to wander north again, coming right over my house. It might be a good thing, since this would keep the bulk of the rain to our east and north. But that means more flooding in Louisiana. And more north of Houston. That water has to go somewhere.

We’ll spend the next few days dealing with this terrible disaster, and then the next several months and possibly years dealing with restoration and replacement. The money has to go somewhere too.

As the healing and rebuilding begin a few days from now, opportunity will emerge too.

I’ve spoken with the Dent team of experts and they agree that a historic natural disaster like this means it’s almost inevitable that sectors like infrastructure, home improvement, autos and more will get a considerable bump.

I foresee the Dent Research team will be adding several trades from these areas over the next few weeks. The opportunity is just too obvious… and the profit potential too great.

Thanks,

Rodney

The post Special Update: Live From Houston appeared first on Economy and Markets.

August 25, 2017

The Real Story Behind Bulging Bitcoin

Did you make $20,000 today? Well, you could have. In fact, you could have made tons more money.

Did you make $20,000 today? Well, you could have. In fact, you could have made tons more money.

All you had to do was own some bitcoin, the cryptocurrency. As I write, bitcoin is up 47% for the month, jumping by several hundred dollars a day.

What idiot doesn’t want to own this asset?

Oh, that’s right. Me.

Because I don’t see it as an asset. Bitcoin is an imaginary thing with no official backing. There’s no person or entity that stands behind it. The currency is only as good as everyone who owns it or wants to own it.

If more people try to sell, the price will go down. With more buyers, the price goes up.

But here’s the rub. There’s no specific use for bitcoin.

Useless imaginary stores of value that we trade for goods and services? We’ve got that covered.

They’re called dollars, euros, yen, pounds, rubles, etc. Except those useless scraps and digital entries have something bitcoin doesn’t – a legally required purpose.

For every government-issued currency, there’s an entity (the government) that requires citizens use it to pay taxes and generally satisfy government debts, and citizens are required to accept it as payment for any debt. This is how nations protect their currency, by requiring its use on the threat of jail.

Bitcoin has no threat. If no one wants to buy, the currency stops trading and the price goes to zero.

Anyone who hates the idea of fiat money will find their perfect foe in cryptocurrencies. They are the essence of money based completely on faith.

That’s not to say bitcoin doesn’t have use.

The digital coin offers anonymity to buyers. And because it can be “withdrawn,” by using it to purchase actual currency or goods and services, anywhere in the world, bitcoin can travel across the globe without pesky customs officials or bankers observing the movement.

The secrecy and ease of transport make bitcoin very attractive… to criminals. That’s why purveyors of ransomware, the software that locks up your computer unless you pay up, demand payment in bitcoin and send you a tutorial on how to buy it.

But not all who use bitcoin travel on the dark side of life. There are many who love the idea of freedom from government control. That’s great, until something bad happens. Like digital theft, which has already occurred at Mt. Gox. Then oversight becomes a friend.

Beyond libertarians, there are legions of people buying bitcoin simply because it’s been going up. With the currency up several hundred percent since the first of the year, what’s not to love?

And now the currency is riding on a tailwind from other cryptocurrencies.

Bitcoin is called a coin, even though it doesn’t exist. Other cryptocurrencies are also called coins. Some, like ethereum and bitcoin, are meant to be used as currency. Others act like stock.

Companies issue coins in initial coin offerings (ICOs), and use the funds to grow their businesses. Most ICOs can only be purchased with bitcoin. In everything but name, most ICOs are stock offerings paid for in digital currency. And ICOs have raised more than $1 billion this year, with many more on the way.

The flood of ICOs has driven up the price of bitcoin as investors buy the cryptocurrency so they can buy the next new coin. A variety of firms, from software companies to strip clubs, have issued new coins.

But a warning sign is flashing. The SEC just announced that these ICOs look like stock offerings, and the issuers are using coins to bypass all of those annoying filings required when a company sells stock.

Hmm.

If the SEC closes the door on new ICOs simply ducking stock offering requirements, it could severely curtail the business. That would dent demand for bitcoin, and leave bitcoin owners relying on internet pirates, crooks, and the greater fool theory to keep the valuation at current lofty levels or even higher.

It’s possible. And I can see other uses, like people living in unstable nations such as Venezuela using bitcoin to move their funds out of harm’s way. But that seems like a shaky proposition.

It’s also possible that my initial question could change. It might be, “Did you lose $20,000 today? Well, you could have.”

Clearly I’m having a bit of fun with bitcoin, but I do have serious reservations about the currency.

In addition to those I’ve outlined here, I also wrote about this in June. I recognize some of the technology coming out of the space, such as blockchain and ethereum, could prove very useful in years to come.

But the currency? I’m not sold.

We’ll get the lowdown on bitcoin, ethereum, and cryptocurrencies in general at our fifth annual Irrational Economic Summit in October (Don’t miss your chance to save $500 on your ticket right here). Famed cryptocurrency expert Michael Terpin will join us, explaining more of the benefits and answering questions.

Who knows? I might even buy some bitcoin after that.

Rodney

Follow me on Twitter @RJHSDent

The post The Real Story Behind Bulging Bitcoin appeared first on Economy and Markets.

August 24, 2017

The Chinese Global Economic Strategy

In the fall of 1993, I was sitting in class in grad school. We were using case studies to explore business management decisions. My professor walked through the history of Otis Elevators, noting that the company had reached market saturation and had choices to make.

In the fall of 1993, I was sitting in class in grad school. We were using case studies to explore business management decisions. My professor walked through the history of Otis Elevators, noting that the company had reached market saturation and had choices to make.

I was sort of paying attention… sort of not.

Then he called on me.

“Rodney! What should a company do when it reaches market saturation?!”

I fumbled. “Develop a new product or service?”

He thundered back, “Find another market!”

His point was that Otis Elevators had saturated the U.S. market, but had all of Europe to explore. It would be much easier to exploit untapped markets with a product they already provided than it would be to introduce a new product or service they’d need to develop.

I think the Chinese took the same class.

In 2013, the Chinese government introduced the Silk Road Economic Belt and 21st Century Maritime Silk Road initiative, which has been shortened to One Belt, One Road.

The plan was to develop infrastructure to facilitate trade among many players in Eurasia and Northern Africa. Or so that’s what the Chinese government told everyone. The details indicated other immediate goals, with trade as a long-term, add-on benefit.

After the financial crisis, China poured on the monetary coals to propel its economic engine. The county expanded credit at a torrid pace, fueling an unprecedented building boom. Roads, bridges, and condominiums sprung from the ground.

China produced and used more cement between 2011 and 2013 than the United States did in all of the 20th century.

That’s a lot of concrete.

But even in a land of 1.3 billion people, that pace of building couldn’t last.

Eventually, there would be a dramatic slowdown.

China now has empty cities. Not because everyone left, but because they built them and no one came.

Now, as their domestic expansion slows down, the Chinese have created an outlet for all of their resources and construction know-how…

Under the One Belt, One Road Initiative, the Chinese provide the resources, expertise, and much of the labor to build roads, bridges, ports, and other infrastructure in Pakistan, Kenya, India, Malaysia, and even Russia and Greece.

The initiative is expected to touch 68 countries and billions of people.

Of course, many of those countries can’t pay for expensive new ports and roads, but that’s not an obstacle, it’s an opportunity, if you’re the Chinese.

China will not only provide the materials, expertise, and labor, but also the funding! Through the Asian Development Bank and other entities, China is loaning money to foreign nations that then use the capital to buy stuff from China.

And once those projects are completed, guess which country will have a claim on the assets to repay the loans, and also have priority status when it comes to trade?

And the strategy doesn’t end there.

China has another issue that it’s turning into an opportunity.

The country is pretty good at building coal-fired electric plants. But, as one of the vocal members of the Paris Climate Accord, building a bunch of new coal plants creates bad optics. At least, when you build them at home.

The country also already has a lot of electricity generation capacity, and a fair amount of renewable energy. So as with their other spare capacity, they went looking elsewhere.

Over the next 10 years, China expects to build 700 new coal-fired electric plants, but 20% of the capacity will be overseas. While the new plants (with all of the environmental issues that come with them) will benefit the local populations, they’ll also support operations along the trade routes that will carry Chinese goods.

And I’m guessing that the plants in foreign countries will buy their coal from the Chinese.

The strategy is bold, but not without risks. What happens when locals in Pakistan get annoyed with Chinese workers? What happens when a friendly foreign government is toppled by a political foe that doesn’t want to honor previous arrangements?

These legacy issues will be interesting to watch. Will China be better at dealing with them than, say, every other nation in history that’s tried the same thing? We’ll see.

For now, it’s impressive to watch the Chinese implement their plans in so many locations, providing a much-needed outlet for their overcapacity at home.

For anyone interested, the Chinese are touting the initiatives as some sort of global, hand-holding, kumbaya thing that will unite the planet.

They’ve even released videos and songs to promote it, like this one. That way, people can feel good about helping the Chinese cement their hold on global trade for decades to come.

Rodney

Follow me on Twitter @RJHSDent

P.S. Want to hear exactly what Harry, Adam, Charles, John, and I have to say about the markets right now?

Don’t miss our first-ever Investment Action Summit, where we’re giving readers a chance to eavesdrop on our regular internal bi-weekly investment conference call.

We debuted the talk earlier today and don’t worry if you missed it. We’re replaying the event at 7 p.m. ET tonight. Click here to listen.

The post The Chinese Global Economic Strategy appeared first on Economy and Markets.

August 23, 2017

Extreme Racism and Divisiveness Today: Real-Life Macro and Micro Solutions

As a new generation emerges into the workforce, it brings with it revolution, be it technological, social, or political. They have fresh new ideas and their own, unique values, which grow to dominate as the older generation filters into retirement.

As a new generation emerges into the workforce, it brings with it revolution, be it technological, social, or political. They have fresh new ideas and their own, unique values, which grow to dominate as the older generation filters into retirement.

That’s part of what’s going on today in America, where extreme divisiveness and racial stresses threaten to tear us apart. (Another part is that this is all part of a larger 250-Year Revolutionary Cycle, and an 84-Year Populist Movement Cycle, to name just two.)

The last time we experienced such tensions was from the late 1950s into the 1970s, right as the Baby Boomers were flooding into the workforce. That was the heyday of the civil rights movement, with its protests and occasional violence.

Ultimately, these generational revolts result in progress and increased cohesiveness, but that’s hard to see while we’re living through the upheaval.

Last week I woke up to a great interview on CNN with a reformed white supremacist, Frank Meeink, from outside Philadelphia. With a history of violence, he eventually landed up in jail. There he ended up befriending many black men and members of other minority groups.

And guess what? He discovered that they were human too, and had many of the same challenges as he did.

Then, when he was released and struggled to find work, a Jewish furniture dealer was the only person who would give him a chance.

Reformed, today he preaches about the need for us to build bridges between races and socioeconomic groups.

During the interview, he explained why fringe groups like white supremacists exist…

He said it’s all about fear…

Fear of your life being taken away from you by the government.

Fear of losing your job to an immigrant or foreign worker.

Fear of your right to own a gun being denied.

And that creates deep anger… and that can lead to violence. Once you become part of a white supremacist group you separate yourself from everyday people and your prejudices only grow more entrenched. You end up in your own “bubble” of thinking.

Fareed Zakaria (my favorite talk show host on geopolitical commentary), recently interviewed a scholarly expert, Mark Lilla. He said that one of the greatest challenges to building bridges is that the protesting groups believe that no one can understand them because they don’t walk in their shoes. This view only creates more divisiveness.

It’s all self-perpetuating… but not unsolvable.

Dissatisfied ethnic socioeconomic groups need to build bridges by linking their strife and issues to principles that are common, just like Obama did in the most popular tweet EVER after the Charlottesville event.

Quoting Nelson Mandela, he wrote: “No one is born hating another person because of the color of his skin or his background or his religion.” That links to one of the deepest founding principles of this country: “All people are created equal.”

Germany showed that you can have a reckoning with the facts and history. There are no statues of Nazi leaders. Not Rommel. Not Hitler. Instead there are memorials to the murdered Jews. And there are clear prohibitions against swastikas and hate speech.

And, there was a great visionary at the macro-political level – Lee Kuan Yew, the former Singaporean Prime Minister – who solved the racism problem in modern-day Singapore before it could get out of hand.

Although Singapore became a British colony in 1819 under Sir Stamford Raffles, Lee Kuan Yew became its true founding father as he brought it to independence in 1965.

He had two clear and opposite driving principles: meritocracy (capitalism and innovation) and racial integration (democracy and inclusiveness), just as the founding fathers did in America in the late 1700s.

The greatest presidents in the last century were also leaders who had a clear ideology and guiding principles. Teddy Roosevelt. Franklin Roosevelt. Kennedy. Reagan.

Lee Kuan Yew saw the importance of such a globalized and high-trade city to have English as its first and official language, despite the overall dominance of key Asian languages like Tamil (India), Malay, and Mandarin. The first time I went through the Singapore airport all the signs were in English. Nothing in local language subtitles! Where else do you see that?!

He designed Singapore to force racial integration in neighborhoods and sectors. As the case of Meeink proved, when people are forced to live close together and cooperate for the common good of their neighborhood, they realize the humanness of everyone. I doubt there is a more diverse major city in the world than Singapore, and it doesn’t suffer any substantial racial problems.

Singapore is in the very top of GDP per capita PPP (purchasing power adjusted) for developed countries, at $81,443 in 2016. It’s $57,467 in the U.S. and $15,800 average for the world.

It leapt from the third world to the first world in one generation!

Maybe we could learn a thing or two from Singapore in this time of extreme racial division in our country (and much of the world).

Harry

Follow me on Twitter @harrydentjr

The post Extreme Racism and Divisiveness Today: Real-Life Macro and Micro Solutions appeared first on Economy and Markets.

August 22, 2017

Could Yesterday’s Total Eclipse Mark a Major Turning Point?

Were you one of the lucky ones able to witness the total eclipse yesterday, as it moved on its west to east path across the middle of the U.S.? Whether you did or not, there’s probably something about this event that you HAVEN’T heard…

My friend Andrew Pancholi, cycle whiz from London and creator of the Market Timing Report, recently told me that yesterday’s path of totality across the U.S. looked eerily similar to the one that occurred at the beginning of the Civil War… and that this could signal America as the starting point to broader civil wars and political restructurings around the globe.

The last similar July 8, 1918 total solar eclipse occurred just as the 1918 Influenza Pandemic was spreading and World War I was starting to wind down after America’s entry.

It’s estimated that 500 million people worldwide were infected with that flu and 20 million died from it. More than 25% of the U.S. population became sick and 675,000 Americans died. That pandemic claimed the lives of more people than did the first World War.

But that’s not all. There was the “eclipse of the century,” on March 7, 1970, which was right near the beginning of the first major stock market crash after the Bob Hope Generation Spending Wave peaked in late 1968. It signaled over a decade of deepening recessions and stock crashes.

To add to this eclipse cycle…

I have a 250-year Revolutionary Cycle that is rolling over us right now. We saw the American Revolution and Protestant Reformation the last time this cycle was in play.

And Andy has an 84-year Populist Movement Cycle that brought us Hitler in 1933, the 1848-1849 European Civil Wars, and the American Revolution. He also has a 28-year Financial Crisis Cycle.

All of which are converging now into late 2017!

So, we should not only see a massive debt and bubble deleveraging ahead, like we did in the 1930s, but also the greatest political and social revolution since the advent of democracy itself.

That’s why I’ve written Zero Hour, out this November.

So, I’ll say it again. This eclipse could mark the start of a very big turning point.

Just look at what’s been going on…

Look at the Evidence at Hand

There is a huge controversy over President Trump’s statements in recent months, especially around the Charlottesville violence and extreme divisiveness between the far right and the far left.

This divisiveness and polarization between left and right has been building steadily since 2004, as I showed in the November 2016 Leading Edge newsletter. But this issue is clearly coming to a head now.

Now, eclipses that cut right across the middle of the U.S. are rare, and have much greater impacts. But all solar eclipses have an impact somewhere.

The next major solar eclipse forecast for the U.S. is a rare double one. The first one hits the western half of the U.S. on October 14, 2023, and the second hits the eastern half on April 8, 2024.

My demographic cycles suggest we should come out of the worst financial depression since the early 1930s around that time!

After that, there’s a total solar eclipse on the cards for August 12, 2045. That’s the same year my Spending Wave for peak Millennial spending – on a 48-year lag – suggests the long slowdown between its two up waves (2023-36 and 2046-56) would bottom.

And to refer back to the American Revolution, there was a total eclipse over America on July 24, 1778. The Battle of Monmouth occurred two days after that eclipse and was a major turning point for Washington in the war.

I’ve even read that the crucifixion of Christ occurred on a total solar eclipse in 33 AD – to the day.

So, let’s sit back and watch what happens over the coming days and months. All the cycles are warning me that things are about to get very interesting.

Yesterday’s eclipse is just another brick in the path leading up to a major crash… one that’s not far ahead. Andy and I both see a likely top by mid- to late October and more volatility between now and then.

Stay tuned,

Harry

Follow me on Twitter @harrydentjr

The post Could Yesterday’s Total Eclipse Mark a Major Turning Point? appeared first on Economy and Markets.

August 21, 2017

The Right Value for an Overheated Market

“Private equity” can conjure entertaining mental images. I’ve often asked friends to describe what comes to mind for them when I mention the phrase.

“Private equity” can conjure entertaining mental images. I’ve often asked friends to describe what comes to mind for them when I mention the phrase.

Here’s a sampling of what they’ve said: An older man in a fancy suit enjoying a single-malt scotch in a private New England club… who takes perverse pleasure in looting a company of its assets before firing all the employees and selling whatever’s left for spare parts. (It’s the old “buy, strip, and flip” routine.)

Or, perhaps that same guy is enjoying a Churchill cigar while playing a round of golf and casually plotting the same fate for some honest manufacturing plant in the Midwest.

Hey, stereotypes are stereotypes for a reason, and, it’s true, successful private equity fund managers, the people who run companies like Blackstone or KKR, tend to make good money. But they’re generally not the cynical villains they’re made out to be.

In fact, private equity firms fill a critical void in the markets, providing growth capital to companies that would have a hard time getting it otherwise. But more than just growth capital, they also often provide management expertise to the companies they fund, regularly taking an active, strategic and tactical role.

Think of it like this: When you buy a stock, you’re a passive owner. You take no active role in running the business.

Well, that’s not at all how a private equity manager operates. When they plow money into a company, they’re in the trenches with management.

In a nutshell, private equity firms invest in non-public (i.e., not traded on the stock market) companies. The typical investment is a multi-year deal in what you might think of as a “middle market” company, larger than a startup but generally much smaller than your typical public company.

Perhaps the highest-profile company in the world that still depends on private equity funding is the ride-hailing service Uber. But Facebook, Twitter, Snapchat, and a host of other companies you might use on a daily basis all depended on private equity financing earlier in their lives.

I don’t regularly read The Wall Street Journal. Nothing against the venerable old rag, but I don’t find it to be particularly helpful for how I invest.

I’m a value investor, and I enjoy digging through company financial statements for gems. I’m unlikely to find them by reading a recap of yesterday evening’s earnings announcements or a generic analysis of the most recent jobs report.

But I do occasionally skim the Journal’s headlines. This recent one really got my attention:

Investors Pile into Private Equity at Greatest Clip Since 2013

It’s interesting and telling that, as the U.S. stock market hits all-time highs on a nearly daily basis, a lot of smart money is pulling out of the stock market and piling into private equity.

I get it. I’ve said for months that stock-market bargains are getting harder to come by. Things are just overvalued in the U.S., which is why I recommended investing in Europe earlier in the year and why you see guys like Adam recommending recent trades in places like China, Canada, and Mexico.

And while I’m certainly not selling yet, I’m keeping my stop-losses tighter than usual to lock in profits and avoid a potential bear-market mauling.

It’s also worth noting that, with the stock market shrinking (yes, you read that right), private equity is increasingly taking the place of traditional stock market equity.

In the past 20 years the number of companies traded on the stock market has dropped by 37%. Increased regulation following the 2000-to-2002 and 2007-to-2009 bear markets has made it more of a hassle to go public, and many companies are choosing to avoid the game and stay private.

The thing is, very few mom-and-pop investors have access to private equity. But, as I shared with my Peak Income readers earlier this month, rather than recommend they invest in a typical private equity fund – which could involve a minimum investment of tens of millions of dollars and a total lack of liquidity and transparency – I’ve got an alternative.

It’s designed for regular, everyday investors, and gives you access to investing in middle-market American companies. Think Main Street, U.S.A., instead of Wall Street.

What’s more, even if these companies run into trouble, you’ll be protected and still enjoy a constant revenue stream, with an attractive 7% dividend, and special tax breaks to boot.

And from what I’ve seen from this private equity fund, you might even get a couple pleasant surprises to boost your returns too. Its disciplined management team likes to reward its shareholders steadily and responsibly.

That’s hard to beat.

I detail how and why we’re taking advantage of the value in the August issue of Peak Income. If you’re not already a member, subscribe today.

Charles Sizemore

Editor, Peak Income

P.S. For more strategies on how to handle the current markets, join Harry, Rodney, Adam, John, and me at 3 p.m. ET Thursday for what we’re calling the Investment Action Summit.

For the first time ever, we’re giving readers access to our internal bi-weekly investment call, where we go around the horn and talk about what we’re seeing in the markets. It should be pretty fun. Add it to your calendar here.

The post The Right Value for an Overheated Market appeared first on Economy and Markets.