Harry S. Dent Jr.'s Blog, page 72

October 12, 2017

The Real Deal or Real Hype? We’re About to Find Out…

I wish you were here!

The excitement is palpable.

The silence, as we listen to the experts on the stage at the Nashville Airport Marriott Conference Center, is heavy with focus.

The buzz between speakers and around the coffee pots during breaks vibrates with passion.

People are here to better understand…

…the markets…

…the economy…

…the dangers…

…the opportunities…

People are here to discover…

…investment strategies that work now…

…investment strategies that will work in the future, regardless of what the markets do…

…like-minded individuals who also seek a better way to grow their wealth and improve their investment success…

Well, they’ve come to the right place, because that’s exactly what they’ll find during the next three days here in Nashville.

Our mission: to uncover the real deals and expose the hype!

This morning, shortly before we kicked off our fifth annual summit, I emailed you with some housekeeping details. Keep that email handy so you can look at the agenda and see who’s up for the morning or afternoon.

If you’re watching via LIVE Stream, then you’ll know who’s up next or what time to check in if you want to watch any one speaker in particular.

You’ll also find the schedule on our website, https://irrationaleconomicsummit.com/, and, of course, on the LIVE Stream home page.

In my email this morning, I also told you that I’ll be reporting all the exciting details and events over the next three days. So be sure you don’t miss any of my emails. They’ll arrive in your inbox twice a day until Saturday night.

Right now, we’re having a coffee break before…

…Michael Terpin talks to us about bitcoin, blockchain, and initial coin offerings (ICOs)… and how to invest in what will soon be a $5 trillion asset class.

Earlier we heard from Brendan Kennedy. He’s the CEO of Privateer Holdings and the go-to expert on investing in legalized cannabis.

And Harry wowed attendees and viewers before that with his talk about the greatest political and financial upheaval in modern history and how to turn it to your advantage.

Thankfully, I’m a skilled typist and was able to take pages and pages… and pages… of notes.

Wrapping us up today is Stephen Sandford, author of The Gravity Well. He’s going to talk about the opportunities above us, in space.

I’ll share all the tidbits I can tomorrow morning, once I’ve had a chance to sift through those copious notes and pull it all together into something cohesive. But, for now, I wanted to give you a better idea of who’s talking this week and to explain why you should be listening to them.

Besides Harry Dent (who spoke at 1:25 Central today), Rodney Johnson, Adam O’Dell, Charles Sizemore, John Del Vecchio, and Lance Gaitan, we’ve also got…

Brendan Kennedy, who spoke this afternoon at 2:45 p.m. Central), is CEO of Privateer Holdings, the world’s first private equity firm investing exclusively in legalized cannabis. He and his company sit on the cutting edge of what could soon become America’s next great boom industry. And his goal is to become the worldwide leader in “corporate pot”.

Brendan Kennedy, who spoke this afternoon at 2:45 p.m. Central), is CEO of Privateer Holdings, the world’s first private equity firm investing exclusively in legalized cannabis. He and his company sit on the cutting edge of what could soon become America’s next great boom industry. And his goal is to become the worldwide leader in “corporate pot”.

Brendan and the Privateer team have so far raised $82 million to launch a portfolio of global, responsible, and mainstream cannabis brands leading the future of the industry – including portfolio companies Marley Natural, Leafly, and Tilray, which quickly became the largest single supplier of medical-grade cannabis in Canada.

It’s clear that the potential in legalized pot could be massive. And Privateer is staking its claim at the forefront of the industry with some lofty ambitions.

Michael Terpin, who will speak at 4:15 p.m. Central, is the co-founder and chairman of BitAngels, the world’s first angel network for digital currency startups. BitAngels currently has over 600 members and has made more than 25 investments in bitcoin and other cryptocurrency companies.

Michael is one of the leading “go-to” experts on bitcoin, and he’s spoken all over the world on it, including Bitcoin 2014, Satoshi Roundtable, South by Southwest, and TEDx Hollywood.

He sees a huge future in bitcoin and other cryptocurrencies for a variety of reasons, as he told the Business to Freedom podcast earlier this year.

Michael is also the co-founder and managing partner of bCommerce Labs, the first technology incubator fund focused on e-commerce companies for bitcoin and the blockchain, and a partner at Flight VC, where he helps run the AngelList Bitcoin Syndicate with legendary super-angel Gil Penchina.

Stephen Sanford, who’s scheduled as the last speaker for today, was just nine years old when he watched Neil Armstrong take one giant leap for mankind onto the moon… igniting his love for science, engineering, math, and technology.

After getting his Master of Engineering, Stephen spent 28 years working at NASA, including stints at the Johnson Space Center in Houston and NASA headquarters before becoming the director of space technology at NASA Langley Research Center in Hampton, Virginia.

After retiring from the agency in 2014, he began writing his dynamic must-read book The Gravity Well: America’s Next, Greatest Mission, which details the benefits of a better funded space program.

His view of space is the same as our view of investing – that the region beyond Earth is a steep, rugged terrain filled with challenges but also… vast wealth.

Stephen calls the expanse of knowledge we gain from chasing our space dreams the “knowledge ore.” And he’s calculated that for every dollar spent on space, that “knowledge ore” brings back as much as $8!

Lacy Hunt is Executive Vice President of Hoisington Management Company, where he manages over $5 billion of assets on behalf of pension funds, endowments, insurance companies, and other entities.

He holds a hard line against the excessive debt that grips the global economy. And he shares our view that government has furthered our current predicament. Instead of using sound fiscal solutions to “right the ship,” we’re fanning the flames by taking on more debt and aggravating the problem.

Howard Lindzon is a world-renowned angel investor, venture capitalist, and entrepreneur whose vision was key to the launch of Ticketfly, Buddymedia, Golfnow, Lifelock, StockTwits and many more.

He’s also shepherded lucrative deals with Uber, Twitter, Ebay, Pandora, Comcast, and CBS Interactive, to name just a few. These deals have collectively been worth over $1 billion to him and his partners. He’s one of the most sought-after social media experts in the world today.

Andrew Pancholi is General Partner and Portfolio Manager at Fidelis Capital Management and creator of the Market Timing Report. And he’s Harry’s “go-to” man when it comes to timing the markets. He’s also maybe even a little more obsessed about cycles than Harry himself!

Back in April 2014, he flew from London to meet Harry and the team at an emergency gathering, which is now known as “The Good Friday Meeting.” There he warned Harry, Rodney, and the others of the imminent collapse of the euro, stating not only the EXACT date it would happen but also giving them the price within a handful of ticks.

It really pays to listen to what Andy has to say. Not only has he accurately time the collapse of oil, but he also forewarned of the UK’s financial challenges a full six months before Brexit. He also called the commodity bull markets in 2008 and 2010.

Mark Gordon will take us to the sea. He’s the President and Chief Operating Officer of Odyssey Marine Exploration, a Nasdaq-traded company engaged in the exploration and archaeologically sensitive recovery of deep-water shipwrecks.

He adamantly believes in following your dreams…and at this year’s Irrational Economic Summit, he’ll explain not only how you can do this…but how you can finance it as well. It starts with making smart investments.

Odyssey uses innovative methods and state-of-the-art technology to conduct extensive deep-ocean search and recovery operations. Its discovery and excavation of the Civil War-era shipwreck the SS Republic made international headlines, and resulted in the recovery of over 51,000 U.S. gold and silver coins and nearly 14,000 artifacts.

Raoul Pal is CEO and Co-Founder of the multimedia empire Real Vision Group and The Global Macro Investor, which is an elite macroeconomic and investment strategy research service for the world’s leading hedge funds, pension funds, banks, and sovereign wealth funds.

But that’s not enough to Raoul. On top of that, he’s an advisor to government organizations and a consultant for several family investment offices globally!

He wrote The End Game, the most-read financial article in the history of the internet. He helped make the successful BBC TV series “Million Dollar Traders,” where he undertook the financial market and investment training of the contestants.

Talk about bringing together the greatest minds if the most exciting industries!

Remember to watch via LIVE Stream if you’re not with us in Nashville, and watch out for my email tomorrow morning. I’ll be sharing details of what Harry, Brendan, Michael, and Stephen had to say.

Until then, live from the Irrational Economic Summit 2017…

The post The Real Deal or Real Hype? We’re About to Find Out… appeared first on Economy and Markets.

T-Minus 2 Hours and Counting Until the 5th Irrational Economic Summit

The registration area of the Nashville Airport Marriott conference center is already buzzing with activity and we’re still two hours away from the start of this year’s Irrational Economic Summit. Reception only starts in an hour, but clearly speakers and attendees alike are excited.

The registration area of the Nashville Airport Marriott conference center is already buzzing with activity and we’re still two hours away from the start of this year’s Irrational Economic Summit. Reception only starts in an hour, but clearly speakers and attendees alike are excited.

Just a couple of short announcements before we start…

If you’re a Network member, you should be receiving your login details for LIVE Streaming within the hour. If you don’t hear from us by noon, then please reach out to your network liaison, Courtney Ghee, or email me at economyandmarkets@dentresearch.com and we’ll make sure to get you the information you need before the conference.

If you’re attending the conference, we’re all excited to meet you. At registration, we’ll give you the Irrational Economic Summit program that contains the agenda and details of all the speakers you’ll meet over the next several days (I’ll give you the agenda below as well, so you can view it in your email when your program isn’t handy). You can sign up for the LIVE Stream, which includes the archives, anytime throughout the conference.

If you’re planning to just watch the conference via LIVE Stream, make sure you’re signed up now so you don’t miss anything.

Remember to follow us on Twitter (@economymarkets) and on Facebook (https://www.facebook.com/EconomyMarkets/).

Use #iesnashville for any online comments.

And please be sure to keep the conversation going with us. Email me at economyandmarkets@dentresearch.com or tag me on any of your online comments. My Twitter handle is @Teevdb.

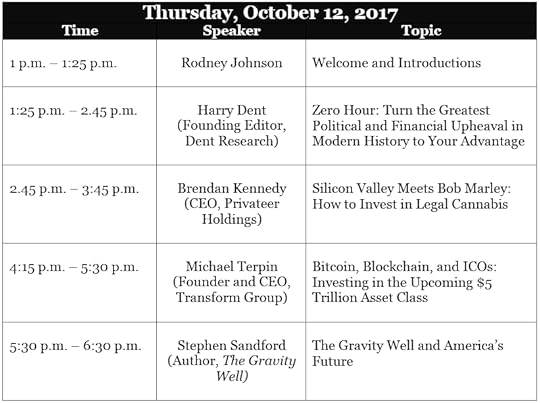

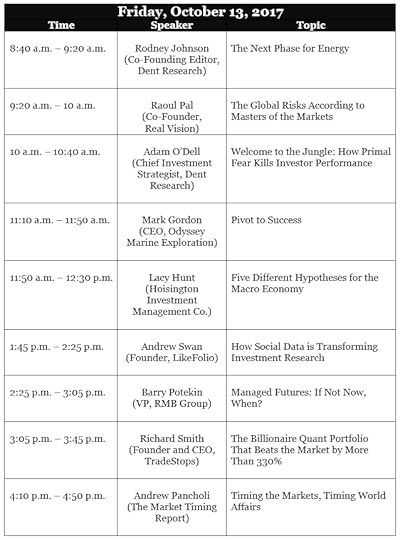

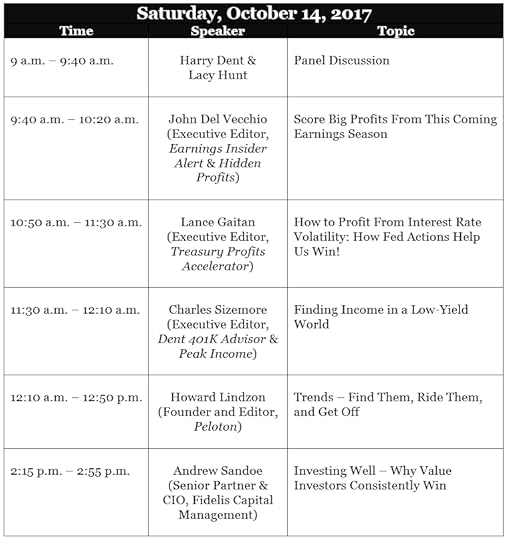

Now, as promised yesterday, here’s the event schedule (all times are Central, because that’s the local time in Nashville)…

After Stephen Sandford’s talk, he’s doing a book signing. Remember to bring your copy so he can sign it after you shake hands.

After Stephen Sandford’s talk, he’s doing a book signing. Remember to bring your copy so he can sign it after you shake hands.

Afternoon workshops from 5 p.m. to 5:45 p.m. include:

Rodney Johnson: Earning Profits in an Uncertain World.

Barry Potekin: Sun Should Shine on Silver Soon.

Harry Dent and Andrew Pancholi: Discussion.

Workshops from 5:55 p.m. to 6:40 p.m. include:

Richard Smith: Beat the Billionaires.

Andrew Swan: Taking Action Using Social Data.

Zack Hutson of Privateer Holdings: How to Invest in Legal Cannabis.

And finally…

Workshops in the afternoon, from 3:15 p.m. to 4 p.m. include:

Workshops in the afternoon, from 3:15 p.m. to 4 p.m. include:

John Del Vecchio: Hidden Profits’ 500% Profit Opportunity.

Andrew Sandoe: Investing Well – Why Value Investors Consistently Win.

Lacy Hunt: Contemporary Advancements in the Theory of Monetary and Fiscal Policy.

Workshops from 4:20 p.m. to 5:05 p.m. include:

Adam O’Dell: How to Trade Volatility Booms & Busts… for 10x Profit.

Charles Sizemore: Value and Momentum: A Taste of Things to Come.

Richard Smith: Beat the Billionaires.

As you can see, this is going to be a jam-packed three days, so stay tuned for updates from me… and don’t forget to write.

Reporting to you live from the 2017 Irrational Economic Summit,

Teresa

P.S. Here’s that link again to sign up for LIVE Streaming. Do it now so you don’t miss anything.

The post T-Minus 2 Hours and Counting Until the 5th Irrational Economic Summit appeared first on Economy and Markets.

October 11, 2017

Some Housekeeping Before We Start our Irrational Economic Summit

By Teresa vd Barselaar at Irrational Economic Summit 2017

By Teresa vd Barselaar at Irrational Economic Summit 2017

Tomorrow at noon Eastern we kick off our fifth Irrational Economic Summit at the Nashville Airport Marriott in Tennessee!

People from all over the country have already begun streaming in to meet, greet and learn from each other and the panel of 16 industry experts and business gurus we’ve got lined up.

Harry will be the first speaker up at 1:25 p.m. (EST) and he’ll be talking about how to turn the greatest political and financial upheaval in modern history to your advantage.

Next will come Brendan Kennedy. He’s CEO of Privateer Holdings and he’ll be talking about how to invest in legal cannabis.

At 4:15 p.m. Michael Terpin, Founder and CEO of Transform Group, will take the stage to tell attendees and LIVE Stream viewers about how to invest in the upcoming $5 trillion asset class – Bitcoin, blockchain, and Initial Coin Offerings.

Our keynote speaker this year is Stephen Sandford, author of The Gravity Well and former director of space technology at NASA Langley Research Center. He’s going to be discussing how the stars will make America great again… and the investment opportunities this will present to you.

And after his talk he’ll do a book signing, so if you’re joining us, remember to bring your copy of The Gravity Well along.

If we’re not joining us in person, make sure you’re watching via LIVE Stream. And read your emails from me each day.

I’ll be your eyes and ears on the ground this year and will be contacting you at least twice a day until the end of the conference to keep you apprised of events and revelations!

But I don’t want this to be a one-sided affair.

I want to hear from you. Often. Whether you’re attending in person, watching via LIVE Stream, or following my daily emails.

Ask questions and share insights, especially as you listen to the speakers. I’m just one person. I won’t be able to catch it all, so I’m relying on you to help.

You can reach me at economyandmarkets@dentresearch.com.

And follow me and the rest of the team on Twitter and Facebook. Engage with us there, using #iesnashville.

Our Twitter handle is @economymarkets.

Our Facebook page is here (Economy and Markets)

Tomorrow morning, before we start, I’ll email you the agenda so you can see what’s coming up over the next three days. You can also find that information on our Irrational Economic Summit website.

One last piece of housekeeping: If you’re not joining us in person in Nashville, be sure you’re signed up to watch IES via LIVE Stream.

Before signing off for today, I have one more piece of information to share. On Saturday, I asked you to tell me what the one thing was that you’re looking forward to most about the Summit. I put that question to the team and speakers as well. Here’s some of the responses I got…

The One Thing…

Harry Dent said:

I’m most excited about Michael Terpin’s presentation on Bitcoin and cryptocurrencies. The more I learn about this blockchain technology the more I see it as a long-term trend that may cure the internet’s security problems, especially on financial transactions. I see the internet hitting a wall over hackers and security, sooner rather than later. This has the potential for faster, more secure, and lower costs financial transactions, the second phase of the Internet Revolution.

From Mark Gordon:

I’m excited to share stories and exchange ideas with conference attendees! Although as a presenter my role is to impart knowledge, I usually find that I gain valuable knowledge and insights from my sidebar exchanges with attendees. Given the power-packed lineup of presenters and the quality of the attendees expected at this year’s Irrational Economic Summit, my expectations for both delivering and gaining take-home value are extremely high!

Rodney Johnson said:

Pot. Not to smoke it, but to understand the different angles available for getting involved in the industry, particularly for medicinal purposes. Cannabis can provide relief from a wide range of health issues without any of the psychotropic side effects, and at a very reasonable cost. As the Boomers get older, I think they’ll demand more reasonable care options, and this will fit the bill.

Lance Gaitan wrote:

Since my outlook on Treasury bonds is short-term, I’m looking forward to hearing Lacy Hunt’s view on the long-term outlook for Treasuries. I hope to get his insight as to the future of the Federal Reserve’s Board of Governors (especially who he thinks will be appointed Chair).

Lacy Hunt said:

For me, it’s always about the interaction with the participants. IES attendees are knowledgeable investors and they take investing seriously. They ask challenging questions that help me to move my thought process forward. I’m anxious to hear what’s on their minds.

Charles Sizemore said:

I’m really looking forward to unveiling a new stock trading model for our readers. We’re taking the best of value investing and combining it with the best of momentum investing, and the results are powerful. We’ve never had a market like today, so standard financial advice isn’t likely to work.

Andrew Pancholi said:

Last year’s conference was great. While I enjoyed listening to the other speakers, I found the attendees to be fascinating. So this year, I’m most looking forward to meeting those who’ll be in Nashville with us.

And some of the emails I got over the weekend (thanks all who wrote in)…

From Pamela L.:

I won’t be attending live this year, but look forward to seeing the live stream on Odyssey Marine Exploration in deep-water mining, and Brendan Kennedy from Privateer Holdings investing exclusively in legalized pot.

Ciaran M. wrote:

Some things I’d like to hear more about are whether or not we should be worrying about global and sovereign debt and how we should protect our portfolios against it? Also, algorithmic trading programs: Does an individual investor without these tools stand a chance in the markets? And should a gold-backed crypto currency be an important part of a portfolio?…

Ash P. said:

As a new Network member, the one thing I’m most interested in is meeting the team face-to-face. I use almost all the team’s research services in my family’s financial planning so I’m looking forward to connecting with them one-on-one. That said, there’s plenty of other interesting people on the agenda and I look forward to listening and learning from them.

From Ralph B.:

There’s going to be a great venue of speakers at this conference, but I’m really looking forward to meeting the guys I count on for direction with Dent Research’s numerous portfolios, on a daily basis.

And from Ted M.:

By far, the most interesting topic for me is the Gravity Well and space exploration. Second place is Lance Gaitan’s profiting from interest rate volatility.

For me, that one thing I’m most looking forward to if you.

I’ll be back again tomorrow morning, live from the Nashville Airport Marriott.

Teresa

P.S. Thank you to all who started the Irrational Economic Summit conversation with me on Saturday.

The post Some Housekeeping Before We Start our Irrational Economic Summit appeared first on Economy and Markets.

October 10, 2017

Major Long- and Short-Term Turning Point Ahead

First things first: My new book is out on November 15, just one month after our annual Irrational Economic Summit which starts this Thursday. It’s called Zero Hour: Turn the Greatest Political and Financial Crisis in Modern History to Your Advantage.

First things first: My new book is out on November 15, just one month after our annual Irrational Economic Summit which starts this Thursday. It’s called Zero Hour: Turn the Greatest Political and Financial Crisis in Modern History to Your Advantage.

So, when I take the stage in the conference center at the Nashville Airport Marriot hotel at 1:25 p.m. local time (central), I’ll give attendees and LIVE Stream viewers a sneak preview of the most important points of the book.

And my co-author, Andrew Pancholi, who spoke to acclaim at our last IES conference, will be back again as well. He’ll be elaborating on the major long- and short-term turning point that he sees on the cards right now.

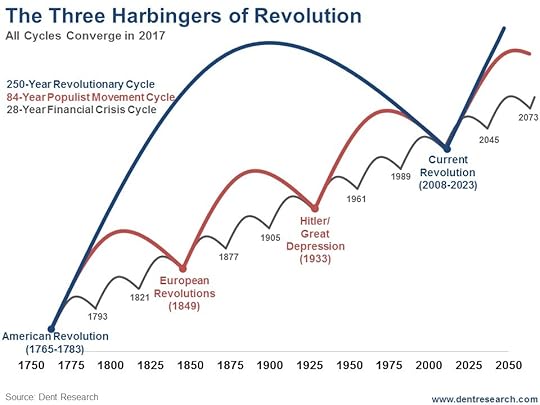

Here’s the key insight: Three revolutionary cycles are converging for the first time since the late 1700s, when we saw the emergence of democracy and free-market capitalism, the steam engine, and the Industrial Revolution

I’ve been warning about a 250-year cycle for many years, but Andy’s two additional cycles reinforce this even more.

Just look at this chart:

Oh, do Andy and I have a lot to say about the implications of these cycles in the critical next few years and for decades to follow.

Oh, do Andy and I have a lot to say about the implications of these cycles in the critical next few years and for decades to follow.

And did you know that globalization has peaked and could see decades of retrenchment ahead?

Brexit and Trump are only the beginnings of the backlash.

After the first great surge, global trade declined 60% between 1913 and 1945 – WWI, the Great Depression, and WWII.

Then there’s the never-ending bubble that keeps chugging ahead despite one bad news event after the next…

Well, it’s starting to look very toppy.

In the short term, stock patterns are looking ominous, just when Andy has his largest turn point signal ever later this month… and you have to hear about his unique short-term model.

Look at this chart of a rising bearish wedge since February 2016, which was accelerated by the Trump Rally (which we confirmed in early November) that seems to be coming to an end.

The classic sign of a top is that the small caps start underperforming the large ones as the dumb money rushes into the big-name companies. Well, that’s not happening yet. But another sign is a rising wedge that is steep and becomes more and more narrow. This occurred for junk bonds in 2013, when we called the top to the day.

There are two likely scenarios ahead, which I’ll discuss on Thursday, but I’ll tell you now that we’re likely finally seeing a topping process between now and January.

So, in the short term, beware.

Over the next decade or two, brace for the greatest political and social revolution since the advent of democracy itself.

A 240-year bull market is peaking and the reset should be the greatest we’ve seen in modern history – as was the boom. This revolution will set the stage for the next long-term bull market that will urbanize and modernize the entire world.

See you in Nashville.

Harry

Follow me on Twitter @harrydentjr

P.S. Remember, if you’re unable to attend the Irrational Economic Summit this year in person, you can still watch it all via LIVE Streaming. You’ll find all the details here.

The post Major Long- and Short-Term Turning Point Ahead appeared first on Economy and Markets.

October 9, 2017

How I’ll Escape the Madness of the Crowds This Week

Some days I just scratch my head.

Tesla CEO Elon Musk overpromises and underdelivers almost every single quarter, and yet the company’s stock goes up. Is losing money on every sale even when taking government subsidies really a winning business strategy?

Let’s all drive Teslas. That’ll show the skeptics! Then the company will… oh, wait, that wouldn’t work. Tesla would still lose money!

But, hey, some people clearly love the company, because they keep driving its price higher.

Investors are driving many Tesla-type stocks to dizzying heights, and maybe they’re right. Maybe I’m stuck in the backseat when it comes to new ideas.

Or maybe people simply chase anything with a green arrow next to it, hoping to pad their retirement accounts because their income isn’t high enough to put more in savings.

By that measure, rising stocks will keep rising, until they don’t. And then everyone searching for other green arrows on TV or the internet will squeeze through the exit, shaving off some of their value as they go.

Once a year I get to escape the madness of the crowds.

If you’re like most people, you’re probably kicking yourself right now for missing out on the massive (and alarmingly fast) gains marijuana stocks and cryptocurrencies are handing early investors. But on Oct 12th-14th, these 14 industry insiders reveal how everyday investors can still cash in on these rapidly growing (and hugely disruptive) trends.

Click here now to get access to these potentially life changing presentations.

It’s not a yearly pilgrimage to the beach or a mountain retreat. I take a laptop on such excursions (as I presume most of you do as well).

No, I’m referring to our annual Irrational Economic Summit, which takes place this week in Nashville.

We named it that because our economic and monetary policies in the U.S. are built on the premise of people acting rationally, like spending down all of your cash when interest rates fall below the rate of inflation.

But no one behaves rationally.

We hold back, and then we jump in without looking. We buy the wrong things. We chase green arrows instead of great ideas.

IES, now in its fifth year, gives us a chance to bring in some calming words of wisdom – think Dr. Lacy Hunt of Hoisington – as well as bright minds that challenge us to think of new markets and ideas.

This year our lineup includes experts on cryptocurrencies, cannabis, and underwater mining, among other speakers like me, Harry, and the rest of the Dent Research crew.

That’s diverse.

I’m a crypto-skeptic. But with the market on fire, my job is to dive deep in the pool and see what I find. You can be sure I’ll report back.

As for cannabis and underwater mining, these are obvious, but untapped markets.

Marijuana relieves pain caused by cancer, glaucoma, muscle fatigue, epilepsy, and many other illnesses and symptoms.

We don’t study the drug because of a wrong-headed classification by the U.S. government made half a century ago. It’s high time (excuse the pun) we revisited this idea and put the health of the nation first.

I’m not talking about recreational use; that’s a topic for state legislatures to tackle. I’m referring to the strains that don’t affect your mind, but can provide welcomed physical relief, as I wrote in an issue of Boom & Bust earlier this year.

Underwater mining is one of those, “Duh,” things. Water covers more than 70% of the earth, and whatever we find in dry land formations also exists under water. Why aren’t we doing more to safely extract commodities? One of our speakers will fill us in on that very industry.

If you’re unable to attend the summit in person in Nashville, we’ll miss you, but you also can catch the conference via our live stream. I suggest you check it out.

I’m looking forward to the next several days.

They’ll give me a chance to re-center and, at least for a little while, ignore the insanity that I see every day in the markets.

Along the way, I’ll get a glimpse into some of the biggest economic changes that lie ahead, based on solid demand and profitable solutions.

Now that should be refreshing.

Rodney Johnson

Follow me on Twitter @RJHSDent

The post How I’ll Escape the Madness of the Crowds This Week appeared first on Economy and Markets.

October 6, 2017

Seafloor Mineral Exploration: The New Gold Rush

Managing Editor’s Note: We’re just six days away from the start of this year’s Irrational Economic Summit in Nashville. Mark Gordon, CEO and President of the marine exploration company Odyssey will be speaking on Friday, October 13, at 11:10 a.m. Today, we give you a sneak preview. Enjoy.

P.S. If you’re no able to be with us in Nashville in person next week, we’ll miss you! But don’t worry. We’ll be LIVE streaming the entire event. Get the link for that here now.

By Mark Gordon, Odyssey CEO and President:

In the early parts of the 20th-century, people started to realize that there were likely huge oil deposits under the seafloor. So, pioneers began offshore oil extraction in the late 1950s thanks to developments in technology that made operations as economically feasible as land-based mining.

In the decades following, offshore oil drilling became the primary supply to satisfy worldwide demand for this vital resource.

The same industry formation is quietly underway in a similar resource arena: offshore mineral deposits.

Over the past 2,000 years, mankind has nearly exhausted the mineral resources available to mine on the 30% of earth’s surface that’s dry. As the worldwide population continues to grow exponentially, it’s crucial to explore alternative methods of extraction of these much-needed resources. After all, they’re vital to building societies’ infrastructure and feeding the population.

Deep below the ocean’s surface lies billions of dollars’ worth of gold, copper, zinc, phosphate, and other precious commodities.

Thankfully, now these valuable assets are readily findable and accessible through robotic technology that allows us to extract these deep-ocean mineral resources in an economical and environmentally sensitive way.

At present, only a handful of companies are poised to take advantage of the abundant mineral resources found in the deep ocean. Nautilus, Deep Green Resources, Lockheed Martin, and us at Odyssey Marine Exploration.

At present, only a handful of companies are poised to take advantage of the abundant mineral resources found in the deep ocean. Nautilus, Deep Green Resources, Lockheed Martin, and us at Odyssey Marine Exploration.

The technology we have today for offshore mineral mining is far superior and more cost-effective than anything we had before. And we’re simply adapting existing technology faster, accelerating the attractiveness of seafloor mining. The same methods used in ocean dredging for many decades are already applied globally in seafloor aggregate and diamond mining.

It’s exhilarating and promises to be very lucrative!

There are many benefits of seafloor mining over terrestrial mining…

Mining ships can move to different types of deposits or sites to suit market conditions without infrastructure loss or additional capital costs.

Once on site, there’s usually less overburden to remove on seafloor deposits compared to similar terrestrial mines, saving both time and money.

Finally, water is the most efficient, lowest-friction medium and least costly for mining and shipping ore.

Another key advantage to offshore mineral exploration is that it’s accomplished without disruption to nearby population since there’s no need to displace people or animals during operations.

Besides, offshore mineral extraction is not only more economical, it also leaves a lower carbon footprint compared to most terrestrial based mining operations.

So where’s the potential?

Seafloor massive sulfide (SMS), phosphorite, and polymetallic/manganese nodule resources in water depths ranging from shallow (

At the Irrational Economic Summit next week I’ll share details about how we pivoted our shipwreck exploration business in the face of massive adversity to be in a position to take advantage of the emerging opportunity presented by offshore minerals and I hope to impart a lesson on how you can pivot to success as well!

For now, know this: An investment in ExxonMobil in 1980 would yield a 2,134% return today as the offshore oil and gas industry continues to boom due to the constant advancements in technology that allow rigs to drill deeper and cover larger portions of area quicker.

Offshore mineral resource exploration is in the pioneering stages now, offering an interesting and attractive opportunity for investors looking to capitalize on an industry that is on the cusp of a major breakthrough.

Mark Gordon

CEO & President

Odyssey Marine Exploration, Inc.

The post Seafloor Mineral Exploration: The New Gold Rush appeared first on Economy and Markets.

October 5, 2017

I Stuck With My System and It Paid Off Big Time

We’re closing in on the fifth iteration of our annual Irrational Economic Summit in Nashville, Tennessee. Like every year, it’ll function as an escape, a time to put our heads together and make sense of what’s been going on, and an opportunity to try to figure out what the future has in store.

We’re closing in on the fifth iteration of our annual Irrational Economic Summit in Nashville, Tennessee. Like every year, it’ll function as an escape, a time to put our heads together and make sense of what’s been going on, and an opportunity to try to figure out what the future has in store.

There will be good conversations, cocktails, and, well, work – I’m on the docket to deliver a presentation and a workshop, so my plate is full leading right into day one.

And, in a sense, all this prep work is a way to remove myself from day-to-day ruckus of the news cycle. A breath of fresh air, if you will – though I understand if the idea of work isn’t so refreshing to you!

It is to me, because it’s how I make sense of the world as a forensic accountant. Instead of headlines and punditry, I look at the data. Instead of running on emotion, I stick to my systems. And that might be one of the most important things to take to heart these days…

Stick to your system if you want to see it succeed. Don’t get suckered into the emotional seesaw. Short-term losses can give way to serious gains if you can stomach the ups and downs.

I should know, because my Earnings Insider Alert readers and I went through the same thing.

Earlier this year, I added a whole new component to my research service that specializes in shorting stocks. Yep, I added options recommendations. And, to a lot of regular investors, options are code for “risky” or even “only for the crazy.”

But I know my system and what it’s telling me about the markets. Yes, we’re still in a long-standing bull market, one that collected “all-time highs” like trophies on a shelf. But the data keeps telling me something else…

After a review of my short positions over this record-breaking bull market, I noticed that much of the profits on the shorts were from earnings-related announcements. Much of the losses were due to the same bull market that pushed expectations higher and higher.

And, so, after a bumpy start, we hit pay dirt…

My readers had a shot at gains of 250% and 208% in a short amount of time. That’s serious money right there.

I stayed with the system, and it paid off. Here’s what it’s telling me now…

As the broader market indexes continue to push to new highs (even with more nuclear-level brinksmanship between Trump and North Korea), aggressive short-sellers keep adding to their positions. Another 2.3% of assets was plowed into leveraged short funds not too long ago. Until they get wiped out, the markets could push higher. (These speculators are a contrary indicator.)

The bad news for the markets is that corporate buybacks have touched an eight-year low this quarter. Buybacks have been a key driver of stock returns in this bull market since 2009. The slowdown in corporate activity ultimately will make it very difficult for the market to sustain recent gains.

At IES, I’ll talk about how I look at the data and what sort of factors jump out at me. If you’re not planning to go, I highly recommend opting for the livestream. You’ll be privy to an incredible amount of expertise from the comfort of your own home. Actually, the thought leaves me kind of jealous…

You’ll hear me go into detail about some of the most critical data points in my system. You’ll learn about how companies manipulate their income statements; how receivables, inventories, and payables factor in; and how I determine if earnings are translating into cash flow.

Cash is king. It always has been, and, if I may employ another dusty axiom, you’ve got to follow the money. That’s what I do, day in and day out. I think it’s worth a listen…

I hope to see you in Nashville!

Good investing,

John Del Vecchio

Editor, Hidden Profits

The post I Stuck With My System and It Paid Off Big Time appeared first on Economy and Markets.

October 4, 2017

Instead of Throwing a Single-Finger Salute at the Fed…

For the longest time now, everybody and their brother has cursed the Fed for essentially taking the “free” out of “free markets.” And there’s nothing that makes us, as investors, more uncertain or uncomfortable. Right?!

For the longest time now, everybody and their brother has cursed the Fed for essentially taking the “free” out of “free markets.” And there’s nothing that makes us, as investors, more uncertain or uncomfortable. Right?!

We know the Fed’s interference has changed the game … but what the hell are we supposed to do about it (especially now that they’re raising rates)?!

Many of the experts we’re bringing to our annual Irrational Economic Summit this year have strong opinions about the Fed. And it’s well worth your time to hear what they have to say.

As I see it…

The Fed is to blame for the next financial crisis (whatever shape that may take, and whenever it should finally appear).

But, instead of crying about it, I’m more concerned with profiting off the Fed’s intervention.

You see, you essentially have two choices heading into the next global financial crisis…

You could do exactly what you did ahead of the last global financial crisis in 2008.

Or, you can arm yourself with a far-superior survival strategy… a strategy I’ll be discussing in detail at next week’s conference in Nashville.

Mind you… I don’t actually know what you did ahead of 2008. And I don’t know exactly how you fared through that confusing, tumultuous period.

But I know what a majority of “typical” investors did… and I know that if they had used my survival strategy… well, they’d be a lot richer (and happier) today.

Let me show you what I mean…

I want to share a chart that shows the power of the “survival strategy” I’m talking about.

And then I’ll explain how this strategy exploits a Fed-driven phenomenon.

Here’s the chart…

Get this…

Get this…

A $10,000 investment in the S&P 500, made in January 2005, is now worth about $23,400 – a total return of 134%.

Meanwhile, a $10,000 investment in my “survival strategy” is now worth around $1,751,000 – a total return of more than 17,000%!

Which would you rather have?

It’s a pretty obvious choice, I think!

Clearly, my survival strategy is able to “weather the storm” better than a passive investment in the stock market… and clearly it’s able to generate far stronger returns, capitalizing on the boom-and-bust nature of today’s markets.

And that’s all thanks to the Fed (not despite them)!

You see, the Fed is now on a course of raising interest rates. And they’re doing it while almost every other central bank in the world is lowering interest rates.

This is precisely the “central bank policy divergence” that I began speaking about at our Irrational Economic Summit in 2014. I knew the day would come… and now that day is here!

What’s more, I knew back in 2014 that this divergence in global monetary policy would likely have two effects.

It would confuse the snot out of people, for one. And it would set stock markets around the world on divergent paths – creating a wide spread between the “big winners” and “big losers.”

It took a while for this theme to fully develop. But consider where we are today…

Over the last quarter, the best-performing stock market in the world is up 26%. And the worst-performing stock market is up just 0.4%. That’s a fairly large spread, at more than 25%.

The spread between top- and bottom-performing global stock markets is being driven by the divergent policy actions of central banks around the world. And my research shows this metric is a predictive indicator for how “risk-on” and “risk-off” markets will perform.

This is what I was talking about in my Irrational Economic Summit speeches since 2014. And this is why I think you should consider a “survival strategy” approach ahead of the next financial crisis.

I’ll be covering the ins-and-outs of my strategy during this year’s conference. As far as I know, it’s the only strategy that’s able to capitalize on central bank shenanigans. And so far this year, we’re up more than 40% in live trading.

I’m sure there will be plenty of “single-finger salutes” thrown the Fed’s way at our Irrational Economic Summit.

And while that’ll be a lot of fun… I want to make sure you’re prepared to profit off the Fed, too!

Adam O’Dell

Editor, Cycle 9 Alert

Follow me on Twitter @InvestWithAdam

The post Instead of Throwing a Single-Finger Salute at the Fed… appeared first on Economy and Markets.

October 3, 2017

Embrace Uncertainty and Discover How to Profit From It

Over the past week-plus past week, my colleagues have written about a fair number of “What If…” situations.

Over the past week-plus past week, my colleagues have written about a fair number of “What If…” situations.

Charles took a sober look at the possibility of nuclear war. Adam wondered about a serious spike in oil prices. Charles had a little fun with the question, “what if it’s the 1990s all over again?”

If you missed any of these great articles, you can find them all right here.

There are always going to be “What If…” scenarios to consider.

I think any good investor – really, anyone with a stake in the world around them – would do well to keep the big picture in mind.

And it all but goes without saying you can’t prepare for everything, no matter how diligent you are. The best-laid plans can go to pot in the blink of an eye. Uncertainty is constant, from the way today’s barista makes your coffee to wondering if your retirement account will be worth anything five, 10, or 30 years down the road.

In my line of work, I’ve come to embrace uncertainty. More specifically, I follow volatility – uncertainty’s angry sibling.

My corner of the world is all about the Federal Reserve and the Treasurys market. Yes, the plain old Treasurys market, about as boring as it gets for your casual market-watcher. You might see the Fed mentioned in your daily skim of the news, maybe you noticed a tiny percentage change in rates.

You know these rate changes are important. The Fed is, after all, our central bank. It’s supposedly the heart of our economy, the biggest in the world. But, at the end of the day, if you’re looking to grow your wealth at a faster rate than the tiny percentages you see associated with the Fed, you’re looking elsewhere.

Well, I’m here to tell you, you’re missing something.

You see, when the Treasury rates move up or down by a few tenths of a percentage point, that means billions and billions of dollars flowing through our economy are affected. Sometimes a bad jobs report is the reason we see a change; sometimes it’s Twitter-based nuclear brinksmanship.

Uncertainly breeds volatility which means fluctuating rates. But this is where the profits come in…

This brings up to options. You can’t buy options on Treasurys directly, but they’re such a good way to generate solid returns in a short amount of time that I had to find a way in.

I needed a proxy that would closely track the 30-year Treasury bond. After lots of trial and error, searching and tweaking, I hit upon two exchange-traded funds (ETFs): ProShares UltraShort 20+ Year Treasury (TBT) and iShares 20+ Year Treasury Bond (TLT).

And, simply put, I recommend puts and calls on TBT and TLT.

That’s it.

You might find it strange that I’d just up and tell my specific investment strategy. Gurus hold to their strategies like their first born; employees sign non-disclosure agreements; the word “proprietary” gets thrown around a lot.

I don’t mind.

The key here, of course, is knowing when to get into these plays and when to get out.

It’s pinpointing the right investor overreactions to play off of, and then positioning yourself to have a shot at maximum profits.

You could simply trade the TBT and TLT straight up. You might even made a little profit on it. But options transform small-ball gains into something more much more substantial.

Here’s an example with TBT from my track record…

Over a two-day span, you could have netter a 7.22% gain in two days. Certainly nothing to sneeze at. It beat the market 5 times over!

But it can’t compare to the 94% gain you could have grabbed using options over the same 48 hours. That’s 120 times more than you would’ve made on just TBT alone.

That’s just one example. There are many others.

Which is why I embrace uncertainly. The “What If…” questions don’t really scare me (well, except for the idea of nuclear war, which should terrify everyone). The markets will inevitably overreact to these big and complicated events, and, when they do, my readers profit.

It’s kind of simple, actually, and it’s a proven approach to the markets.

Stay tuned tomorrow for a deep dive into some of the science behind my approach and how it even relates to the father of gravity, Isaac Newton himself!

Good investing,

Lance

The post Embrace Uncertainty and Discover How to Profit From It appeared first on Economy and Markets.

October 2, 2017

The #1 Trigger for Rising Rates, Volatility and a Deflationary Crisis

If you’ve read any of my work, you know I think the iceberg that will ultimately sink the global Titanic is China. It has the greatest overbuilding and debt bubble in history, not to mention the obvious real estate and stock market bubbles.

But the Chinese government has too much control over its economy to just let it slide. No. China won’t be the first domino to fall. Rather, the dubious honor may go to lovely and charming Italy.

Italians are fun, laid-back people. I love visiting the country.

But would I bet on it?

No way!

Italians think they’ve died and gone to heaven, but it looks more like hell’s sneaking up on them!

Outside of Greece, Italy has the highest government debt: 130% of GDP and rising. Greece’s government debt is at 180%, but at least Greece keeps getting bailouts, which it can get because it’s small enough to have little impact on the euro.

But what if Italy starts defaulting?

Scratch that. What happens when Italy starts defaulting?

Default it will!

The country has the great majority of the bad loans in the eurozone. Look at this chart.

Of the worst countries in the eurozone, Italy dominates bad loans in the banking and private sector. It has 29% of the total, or $324 billion in bad loans – and that number continues to rise.

Major bank stocks there have already plummeted the most in recent years and are on government life support.

What makes Italy so dangerous is that French banks have the most outside exposure to these bad loans, with Germany taking second spot.

But ultimately Germany has the greatest exposure to a fall in Italy. It is the strongest exporter in Europe, especially to the highly indebted southern European nations.

The euro made that imbalance both possible and attractive. Strong exporters in northern Europe had more favorable exchange rates under the common euro, and the weaker importing nations could borrow more cheaply than under separate currencies.

Since Germany’s exports are 46% of GDP, it has a strong incentive to keep floating these southern importers while criticizing them and forcing austerity at the higher political levels. It’s called Target 2 loans. The German central bank (and others) simply defers payments from companies in Italy to some flexible future date.

It’s like a company that gives more credit to their customers just to keep them buying… even though eventually those patrons will be able to repay a penny.

Look at this next chart.

Of the $839 billion in Target 2 loans from Germany’s central bank, half, or $418 billion, are to Italy alone.

Given the potential to default on these loans and on foreign bank loans, Italy is strongly incentivized to leave the euro and default, just like Iceland did when it faced an equally dire situation.

A default, a much weaker local currency and higher inflation (from rising import costs) would mean that Italy’s sovereign bonds would see a massive spike in rates. During the euro crisis, they went from 3% to 7%. This time it would be much worse!

But here’s the most important point. Sovereign bonds around the world are overvalued with often negative yields long term (when adjusted for inflation).

Yet continued strong ECB bond buying and QE has put the Italian 10-year bonds yield at 1.85% versus U.S. Treasuries at 2.2%!

That’s insane!

Italy is bankrupt, and we are the best house in this bad global neighborhood. Yet Italy’s bonds are stronger than ours and yielding less.

How much badly could risk be miscalculated?!

When Italy gets in trouble again and bond yields spike, that will cause bondholders to question all sovereign bonds, even the trusted U.S. ones.

The bond bubble will seem to have topped and burst… but NOT.

Talk about volatility!

Bond yields could spike up across the world creating a global crisis and stock crash, and then, after a while, deflation will set in from the collapse of bubbles and debt deleveraging. Deflation will then cause the best sovereign (and corporate) bonds to fall in yields to even lower levels than today’s unprecedented lows.

The bond bubble will continue next time for fundamental reasons, not artificial.

We’re on a financial assets roller coaster ride and the exciting (treacherous?) section is just ahead. And it’s going to be even hairier in traditionally safer and more stable bets like U.S. Treasury bonds.

Wall Street has a new consensus view that such yields can’t go much lower and will rise modestly for years ahead, with mild rising inflation… a typical soft-landing view.

They will be wrong as usual, just like they’ll be wrong on China.

Fortunately, we have solutions and we’ll share the details with you on Wednesday.

Click here to read more “What If…” hypotheses and to add our special event to your calendar.

Harry

Follow me on Twitter @harrydentjr

The post The #1 Trigger for Rising Rates, Volatility and a Deflationary Crisis appeared first on Economy and Markets.