Harry S. Dent Jr.'s Blog, page 68

December 4, 2017

The Blue and Red Split Continues to Widen, Especially after Trump

In our November 2016 issue of Boom & Bust, I looked at the extensive Pew Research report on the growing political polarization in the U.S.

In our November 2016 issue of Boom & Bust, I looked at the extensive Pew Research report on the growing political polarization in the U.S.

It was election time and the country was torn in two.

The key chart I shared showed that the difference between the median republican and the median democrat had grown from 17% in 2004 to 33% in 2014 – doubling in just 10 years.

The difference between the most politically engaged was a whopping 55%!

Well, recently Pew has updated this research and the results show that the polarization is just getting more extreme.

Now the difference between the median republican and the median democrat has grown to 36% (doubled in just three years), while among the politically engaged, that chasm has grown to around 60%.

Between 2004 and 2014, the shift was driven a bit more by republicans leaning more to the right. That is the trend that Trump took advantage of to win against the odds.

Since 2014, the shift has come from democrats leaning more to the left, particularly recently in reaction to Trump’s extreme rhetoric.

But why am I telling you this in an investment newsletter?

I’m telling you here because it’s all part of a supercell of cycles rolling over us, and it’s going to not only reshape our economy, but how we invest as well.

In my new book Zero Hour, I show that the U.S. is more politically divided than any time since the Civil War.

The Roaring 20s bubble burst and Great Depression saw similar levels of income inequality as we have today, with the top 1% controlling 50% of the wealth. But our political polarization was not as extreme back then as it is today… so income inequality is not the main cause of our division (which is why Bernie Sanders wasn’t as successful as Trump).

Instead, today what divides us include concern about jobs and wage losses thanks to foreign and immigrant workers… taxes… healthcare… all of which Trump played big time.

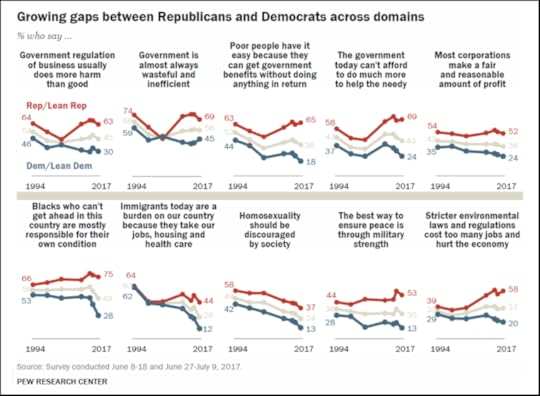

Here’s the chart from the recent Pew survey that brings the divisions today into 10 key questions.

As you can see, the greatest polarization – with a 47% difference between republicans and democrats – lies in two points:

As you can see, the greatest polarization – with a 47% difference between republicans and democrats – lies in two points:

Poor people have it easy because they can get government benefits without doing anything in return. Republicans have risen to 65% agreement on this statement while democrats have fallen to 18%. The democratic trend down here has been stronger and more recent.

Black people who can’t get ahead in this country are mostly responsible for their own condition. Republicans have risen to a whopping 75% agreement on this one, while democrats have dropped to 28%. The democratic drop, again, has been sharper, especially in the last two years, likely due to reactions to Trump’s statements and numerous stories about police brutality against blacks.

There is a 45% difference on a similar point: The government today can’t afford to do much more to help the needy. 69% of republicans agreed with this statement while only 24% of democrats do.

The two points where there’s the least difference and where the chasm has narrowed some are:

Homosexuality should be discouraged by society. This got a 13% approval from democrats and a 37% approval from republican. That’s a mere 24% difference.

Most corporations make a fair and reasonable amount of profit. 52% of republicans agreed with this statement compared to only 24% of democrats. That’s a 28% difference.

Then there is the big Trump issue: Immigrants today are a burden on our country because they take our jobs, housing and healthcare. Forty-four percent of republicans agreed with that statement, but only 12% of democrats did, marking a difference of 32%!

I also think the point on the military is telltale. It said: The best way to ensure peace is through military strength. Fifty-three percent of republicans agreed while only 13% of democrats did, marking a 40% difference.

There’s an eleventh question that wasn’t included in the chart: Islam as a religion is more likely to encourage violence among its followers. To that, 65% of republicans agreed while only 27% of democrat did. The difference between the two parties has increased from 11% in 2002 to 38% in 2017!

These wide and growing differences in views, and Trump’s clear tendency to enhance such divisiveness, clearly augurs for some sort of movement to split into a blue and red America. And we’re not the only country seeing such splits…

But can such radical changes to the map really be possible? Read all about it here, in Zero Hour.

Harry

Follow me on Twitter @harrydentjr

The post The Blue and Red Split Continues to Widen, Especially after Trump appeared first on Economy and Markets.

December 1, 2017

When “Show Me Now!” Becomes “The Sky Is Falling!”

I don’t know about you, but for me, pretty much everything between Thanksgiving and Christmas is a blur. Family, traveling, shopping, cooking, family, more traveling — it’s a lot in a short amount of time.

I don’t know about you, but for me, pretty much everything between Thanksgiving and Christmas is a blur. Family, traveling, shopping, cooking, family, more traveling — it’s a lot in a short amount of time.

I think it’s worth taking a moment to look back on the year behind and forward to the one ahead…

As you may have heard, it’s been an exceptional year for the bulls – and maybe the longest year ever when it comes to political firestorms. I hope you successfully avoided any knockdown, drag-out fights over turkey and football this year, and wish you the best of luck for Christmas.

I don’t doubt that this year’s holiday cocktail parties will be filled with no small amount of joy as folks boast of their stock and bitcoin gains. I might even hear some of that myself at the upcoming Dent Research party.

As a professional short-seller, I think the last 13 months since the presidential election were the hardest I have ever seen – and that’s saying something.

I began my journey on the short side in 2000. Since then, there have been two bloody bear markets and a couple of sharp rebounds. I survived each rebound quite well, but, for the last 13 months or so, the market has been very unforgiving to short-sellers who make bearish bets on deteriorating fundamentals.

The warning signs have only gotten worse. But who knows what they mean for 2018.

I wrote during the last earnings season that there’s very little stock-picking done at a level that actually drives volume in the markets. Volume is now often created by computers looking to make a 10th of a penny off a transaction. High-frequency trading programs have exploded since the last crisis nearly 10 years ago.

As I said: Fundamentals don’t matter to computers. Small profits from trading stocks do. In other words, big market moves are rarely the result of clever people sitting in a room and yelling into phones. Faceless algorithms are the real beasts of burden, here.

That might not make for good chatter by the cooler or at the cocktail party, but it’s the elephant on the exchange room floors.

Research from Credit Suisse suggests that as high-frequency trading has become more prevalent, investments in passive indexing strategies have exploded. Since indexes are indiscriminate, they buy all the stocks in the index even if the fundamentals of a particular stock are a disaster.

This means it often doesn’t matter if a short-seller pinpoints a failing stock; on its own, it’d be ripe for a profit on the short side, but since it’s bundled up in an index, it gets to tag along for the ride.

I guess it’s not that crazy, then, that market sentiment has been so high, and stubbornly so. In past issues I’ve noted that the Ned Davis Sentiment Index has exceeded 70, which historically has been met with market losses before investor sentiment becomes too pessimistic.

While it might be different this time, I’ll bet alongside the historical averages – because while the drivers of markets change, human nature never does.

The Davis sentiment index has backed off slightly from 73.5 to 70.8. We can only see the top in the rearview mirror once sentiment normalizes. But if 73.5 ends up being the top, it will be the third-most excessive mark ever.

The next warning sign is that volatility has hit 50-year lows. I really don’t know how low it can go, but it can’t go to zero. Plenty of hedge funds have made huge gains betting against volatility, but they’ve done it in typically leveraged fashion.

With so many people leaning in one direction, anything that spooks the market could lead to a massive snapback in volatility and quickly evaporate those gains.

Liquidity has been awash in the market as central banks have been extremely accommodative to the markets in recent years. But now, at least at the margin, liquidity is being reigned in. It’s almost a certainty that the rate of change of liquidity will fall in 2018 – and perhaps dramatically.

(It can seem impossible to figure out where the hidden gems are right now, with off-the-chart valuations and bizarro-world financials wherever you look, but you might be interested in this little presentation I put together about how you still find serious gains in this crazy market.)

Valuations are also extreme. The median price-to-earnings ratio (P/E) on the S&P 500 is around 24. This compares with the 54-year average of about 17. It’s also approximately 1.5 standard deviations above normal, and it implies an “overvalued” market based on historical measures.

While that’s not the highest level of P/E ratio ever compared to the late 1990s, the median price-to- sales ratio is at the highest level ever at 2.5 times. That’s about three standard deviations above the norm. You don’t have to be a math whiz to know that three standard deviations are way outside of normal bounds. Bad things happen when the rubber band is stretched that far.

Despite these warning signs, momentum favors the bulls. The trend is up, so it does need to be respected, albeit grudgingly.

So why have any short positions on at all?

If the market keeps marching higher, despite all of these warnings signs that valuations are stretched and market sentiment is too bullish, what’s in it for the short seller? In the short term, it’s painful to have hedges on, as they detract from performance. We very much live in a “show me now” world where very few think and plan for the long term.

But consider hedges as insurance. You have insurance for your house, but it’s unlikely to burn down. You have insurance for your car, but people don’t get in an accident every day.

Few people have insurance for their portfolio. Ultimately, it helps smooth the ride. Most people can’t stomach the big losses that come with a bear market, even though they know that, over time, the market trends higher.

The proof is in the actions of investors. At the 2009 lows, which was the ideal time to plunge head first into the markets, investors had the lowest allocation to equities.

Now, with everybody bragging about their gains, it’s best to start thinking about risk and how to manage it.

Good investing,

John Del Vecchio

Editor, Hidden Profits

The post When “Show Me Now!” Becomes “The Sky Is Falling!” appeared first on Economy and Markets.

November 30, 2017

Written Financial Plans are Invaluable

Stop what you’re doing right now.

Stop what you’re doing right now.

Grab a piece of paper and a pen. (No smartphones! Pen and paper.)

Now, write the following words at the top of your blank page, centered: “2018 Comprehensive Financial Plan”

Am I making you uncomfortable yet?

Don’t worry… you’re in the same boat as a lot of folks I know. You may even be allergic to the task of financial planning.

But with January just around the corner, now’s a great time to take stock of what went well for you in 2017 and, more importantly, precisely how you’ll chart your course in 2018.

You see, you should stop thinking of yourself as an “investor.” Investing is only part of what you do… if you’re doing it right, that is.

Rather, start thinking of yourself as the captain of your financial future

Investing is the sexy part of that role.

But according to one financial firm’s recent commercial, there are two other parts to the all-encompassing role of Financial Captain – planning and protecting.

Those are the not-so-sexy parts. In fact, I personally find them downright boring. Absolutely necessary, but still, very… very… boring!

Raise your hand if you’ve ever found yourself getting childishly excited while talking through the riders on your long-term care policy.

Yeah, me either!

Raise your hand if you spend Friday nights calculating the differences in retirement withdrawal rates under varying inflation scenarios.

I’m willing to bet not many hands are up right now.

Most people I know enjoy spending time on investments – finding the best ones, buying and selling them, and tallying their returns. But far fewer appreciate the value of time spent on financial planning.

Yet, a successful captain must be well-rounded and equally focused on all major components of his role.

Think of investing as sailing. You must plan your route, which includes choosing a specific destination, charting a course, and making alternate plans for when things go wrong.

You must sail the ship, of course. That’s the fun, sexy, part.

And you must protect your ship – against anything, from mechanical failure to natural disasters to pirates.

Plan.

Invest.

Protect.

Think about it this way…

If you’re a silk merchant in England, expecting a shipment of goods you’ve ordered to arrive by sea on December 1… and by January 1 there’s no sign of it and no word from the ship’s captain…

Can you assume definitively that the captain doesn’t know how to sail?

Of course not!

His failure to arrive at port may be due to poor sailing skill, sure, but the failure might just as easily be attributed to poor planning, or his failure to protect the ship from pirates.

The captain’s sailing skills may have nothing to do with the failure to deliver.

The same goes for the “captaining” of your financial future, I think.

How much of a kick in the teeth would it be to be successful at investing, but still live a subpar financial life just because you failed plan and protect?

Would you believe that most people in America don’t have a written financial plan that accounts for each of these important areas?

According to a survey the Certified Financial Planner (CFP) Board of Standards commissioned:

38% of Americans have a financial plan aimed at addressing one or two major goals (i.e. retirement or college savings), but “no comprehensive plan to put it all together.”

33% of Americans have an even more limited financial plan, accounting for either one major savings goal, or a household budget, but not both. Further, they had no plans to develop a comprehensive financial plan within a year.

10% of Americans have done “virtually no financial planning of any kind.”

That leaves just 19% of Americans who have a comprehensive, written financial plan.

The CFP Board’s study concluded that those with a comprehensive financial plan enjoy a number of benefits, including increased confidence in their financial decision-making abilities, increased success in saving money and meeting major savings goals, and higher incomes.

The study found that comprehensive planners reported higher confidence and satisfaction, regardless of their income bracket… proving that written financial plans are not merely luxuries of the ultra-wealthy.

The bottom line is… everyone should have a written, comprehensive financial plan!

Standard financial planning generally covers the following topics:

Goal setting, budget creation, establishment of emergency fund, debt payoff planning, retirement planning, planning for other major goals (i.e. college savings), insurance coverage and, finally, estate planning.

And while each of those is important, they’re somewhat outside the Dent wheelhouse, since we focus on unique, value-add investment research and services.

Services like my own 10X Profits, which we first launched this time last year.

10X Profits is all about trading volatility booms and busts… for BIG profits!

But, while my model has proven to be uniquely powerful, I still encourage 10X’ers to develop a comprehensive trading plan, which outlines precisely how they’ll implement it.

This exercise has transformed them from shoot-from-the-hip “investors,” to true “Captains” of their financial futures.

To learn more about 10X Profits and how to develop your own 10X Plan, click here.

It’s time for you to transform your financial future.

Adam O’Dell

Editor, 10x Profits

P.S. You heard everyone’s darling FAANG stocks lost some $78 billion on Wednesday?! Well, coincidentally, I included analysis on the FAANG stocks in the Special Report I just released to my 10X’ers. Guess what? My 10X Profits model generated annual returns more than 3-times stronger than the best “FAANG” portfolio. And the 10X model requires just two ETFs!

The post Written Financial Plans are Invaluable appeared first on Economy and Markets.

November 29, 2017

All the Banks Deserve Are Crocodile Tears

It’s official. Lending institutions are having a tough time making loans.

It’s official. Lending institutions are having a tough time making loans.

Don’t get me wrong, they still make money the old fashioned way: by borrowing from us through deposits on which they pay almost no interest, and then lending it long term to anyone that qualifies. But they’ve had to jack up their other fees because the traditional business plan just isn’t cutting it.

You and I are still keeping tidy sums at the bank, even though they pay us about half the rate of inflation, guaranteeing a loss of purchasing power. But few people, and even fewer businesses, want to take out loans.

Compounding the issue, the Federal Reserve keeps bumping up short-term interest rates, forcing banks to begrudgingly increase the pennies they throw at depositors, while long-term interest rates remain steady or even drop a bit.

As short rates rise and long rates fall, there’s not much in the middle left for lenders.

Excuse me, I think I’m getting choked up. I might even cry crocodile tears.

After the financial crisis, the Federal Reserve guaranteed bank profits by first lending them enough of our money to ensure their survival, and then pushing short-term rates to zero. Depositors were lucky to earn 0.10% on their money, while loans still cost 3.5% to 4.0%.

To make matters worse, the Fed printed gobs of money and paid the banks interest to hold the extra funds on their books in the form of Interest on Excess Reserves, or IOER. This allowed banks to earn extra cash without doing business with other banks that might make questionable loans.

Essentially, banks made something for nothing, while you and I got nothing (no interest) for something (our deposits).

This went on for years as banks in the U.S. cleaned up their balance sheets. Eventually, the Fed started raising rates ever so slightly. Over three years, rates have inched up to a mere 1.50%. You won’t get that on your deposit account, of course, but you might eek out 1% or so.

On the flip side, long-term rates remain stuck, with the 10-year bond paying 2.34% and the 30-year bond hovering around 2.77%.

The shrinking difference between short-term and long-term rates leaves little net interest margin, or profit, for banks. That’s not ideal, of course, but hey, if they can make it up on volume, things will still be all right. Only, there is no volume. Or at least, not as much as bankers expected, and that’s a problem.

Bank lending to businesses recently registered its lowest growth since the first quarter of 2011. Overall, the annual growth rate for U.S. bank loans just touched the lowest level since the end of 2013, as the growth rate fell for the sixth consecutive quarter.

Bank loans are still expanding, but at an ever-slower pace. This wasn’t supposed to happen.

With the economy growing, however slowly, and a pro-business administration in the White House, bankers expected strong loan growth. For the life of them, they can’t figure out why people and businesses don’t want bank loans.

I have a possible answer. Because we hate them.

As business owners, Harry and I ran millions of dollars’ worth of credit card transactions through a bank in the 2000s. That bank took bailout money to survive.

In 2010, my banker called me and said he had to verify my financials so the bank would keep doing business with me. I pointed out this was quite ironic since I remained in business and profitable when he and his firm needed my tax dollars to stay afloat.

That phone call sticks with me, as does the zero interest I earned for years on my deposits, and the lower-than-inflation rate of interest I earn today. I’m in no hurry to give banks more money.

On the business side, companies have options. With interest rates so low, it makes more sense to sell bonds where possible and essentially become your own bank. And many other institutions, such as hedge funds and insurance companies, are lending directly to firms, cutting into bank business.

It’s hard to feel sorry for companies that helped bring the country to its financial knees, needed bailout bucks, were guaranteed profits through the use of taxpayer funds and on the backs of depositors, and now wonder where all the business has gone.

Maybe they’ll get a break in the months ahead as the Fed shrinks its balance sheet. Perhaps, as the Fed buys fewer bonds, long rates will tick up a bit, giving bankers a break. But if it doesn’t happen, I don’t think any of us will shed any real tears.

In the meantime, I’m avoiding the financial sector, unless I’m going to use the Treasury Profits Accelerator service run by Lance Gaitan. He does a great job exploiting small interest rate changes to generate significant returns, and I have no problem giving him a shameless plug. Click here to learn more.

As for the banks, they’re business is stagnating, and they can’t figure out why nobody likes them. If they’d only ask, I’m sure we could all give them several good reasons.

Rodney Johnson

Follow me on Twitter @RJHSDent

The post All the Banks Deserve Are Crocodile Tears appeared first on Economy and Markets.

November 28, 2017

Gold $5,000

No. I’m not flip-flopping!

No. I’m not flip-flopping!

As I told subscribers to our Boom & Bust monthly newsletter in November, I stand by my forecast that gold must still lose about 65% of its current value before we hit the bottom of this latest commodity cycle, around 2020 or 2023. And when the markets unravel, as they must, gold will tumble, just like it did in 2008. It’s NOT a safe haven in a deflationary environment, like it is in an inflationary one!

But I also told them that after this cycle has wrapped up and we head into the upward swing of the next one, then gold will soar, along with several other very specific commodities.

The next iteration of this cycle just ahead should prove to be the biggest boom in commodities yet.

There’s a trick to this though…

The general commodity index (CRB) has one of the most clockwork-like cycles I’ve ever seen. It’s a full cycle of 30 years. But, the commodities within that index don’t cycle as smoothly, some presenting much more up and downside potential than the broader index.

Also, the overarching cycle is much more consistent on the upside than the downside. The tops we saw in 1920, 1949 to 1951, 1980, and 2008 to 2011 are very consistent, right at that 30-year mark, give or take a year.

The bottoms are more variable.

After the 1920 top, commodities bottomed in 1933, trending down for 13 years. However, after the 1951 top, the index only bottomed again in 1968 – 17 years later! And after the 1980 peak, commodities took 21 years to bottom out, although most of the losses occurred into 1986. The first six years of that downward leg of the cycle were brutal before prices wafted more sideways and a bit farther down until 2001.

Despite all of that, the commodities cycle is one of the most reliable in my arsenal. It really doesn’t get better than this on its longer-term cycle for peaks. See for yourself…

The dual 2008/2011 peaks led this commodity bubble burst around the world and looks close to a bottom in the years ahead.

The dual 2008/2011 peaks led this commodity bubble burst around the world and looks close to a bottom in the years ahead.

The first peak in mid-2008 was driven mostly by energy, industrial metals, and agriculture. The second peak in early 2011 was thanks mostly to precious metals and some industrial metals like iron ore or copper.

While gold has not yet hit my next target of near $700 an ounce (range of $650 to $750) – and mark my words, it will – I do believe we’re reaching the end of the commodities downturn, which will wrap up likely by early 2020 and by 2023 at the latest. The biggest clue is the 80% crash in crude oil and iron ore.

2023 is the most natural bottom from a 2008 peak, forming a 15-year down cycle. But we may see some signs of new life earlier because this downturn has been so extreme thus far… and because the demographic force of emerging countries will directly impact commodities. They will likely turn up sooner than major developed countries like the U.S.

Regardless, a major commodity boom is set to start between 2020 and 2023, and will run into 2038 to 2040. And, from all indications, it’ll be a major boom. I’m talking as much as 4.8 times, which is bigger even than the largest bubble since the late 1800s into 1980, that clocked in at 3.15 times.

Gold bugs are right. We may well see $5,000 per ounce, but only during the next commodity boom. First gold has some excess weight to shed.

A Warning

Commodities have the most extreme of cycles. That’s why the best traders make their hay in this sector. Sudden changes in weather, or natural disasters like hurricanes or fires, or mining strikes can cause sharp short-term fluctuations, often like an exploding bomb!

That’s why I suggest that you don’t trade alone in this volatile arena. Find someone with a proven system to help guide you.

And here at Boom & Bust we’ll point you in the right direction using my decades of cycles’ analysis and research into demographics and urbanization trends… and Charles’ expertise in value investing!

There are particular commodities that perform best in a world driven more by the fast-growing and urbanizing emerging countries. And that driver really is the key to the next commodities boom.

Although most commodities, from agriculture to energy, go up and down in longer-term, 30-year cycles, there are differences in our ability to ramp up supply (elasticity) when demand accelerates.

It’s easier (and cheaper) to cultivate more land for crops or livestock than it is to drill deeper wells for oil or dig deeper mines to extract the industrial metals like iron ore, coal, lead, nickel, or copper.

So, as the emerging world dominates growth in the next global boom, it will require more basic commodities like rice and corn and rubber. But precious metals, industrial metals, and energy will also have a place.

The best way to forecast such future needs and appreciation potential is to see how different commodities performed in the last commodity cycle boom from around 2001 into 2008/2011.

Harry

Follow me on Twitter @harrydentjr

The post Gold $5,000 appeared first on Economy and Markets.

November 27, 2017

How to Prepare for Higher Rates

It was already a busy month just two weeks into November when we released the latest issue of Peak Income to subscribers.

It was already a busy month just two weeks into November when we released the latest issue of Peak Income to subscribers.

Before embarking on a trip to Asia, President Trump had nominated Jerome Powell to replace Janet Yellen as Chair of the Federal Reserve, and not long after Republicans in the House of Representatives introduced a tax reform bill that could, well, change a lot of things. The Senate has since followed suit with its own proposal.

For our purposes in Peak Income, both bits of news are positive for our income-generating approach, as I detail in the issue. While tax reform is still very much a fluid situation, I want to share with you today about why the Fed news is particularly well suited for us.

Tapping Powell as Fed Chair is seen as more of the status quo. He’s a member of the Fed’s Board of Governors and was widely viewed as the safe choice and the pick that Wall Street wanted. That’s good for us. We’ve done just fine under Yellen, and I expect more of the same under Powell.

John Taylor, the other Fed Chair finalist and a respected economics professor at Stanford University, was seen as a lot more dogmatic about raising rates at this point in the business cycle.

He suggested that rates should be three times higher than they are today (3.75% versus 1.25%). Had Trump nominated Taylor over Powell, things would likely have gotten dicey in the bond market. But we don’t have to worry about that.

I think Powell will likely continue Yellen’s slow, gradual approach to normalizing monetary policy.

But the market is expecting Yellen to give us one more rate hike on her way out the door.

And I’m betting that Powell will want to prove his bona fides by giving us at least one rate hike immediately after taking office in February.

No Fed chair wants to start the job looking weak, so a quick hike will allow Powell to establish authority.

We should expect short-term rates to go higher for a while.

Yet, rather than rise in anticipation of this, floating-rate funds have spent virtually all of 2017 drifting lower.

This creates a nice opportunity to capture a high current yield today while getting the potential upside of floating rates essentially for free.

We already have a little exposure to floating-rate securities via a fund that we’re up about 14%, and I expect more gains to come.

But this subsector is attractive enough to warrant the addition of another position, and I’m recommending one of the largest and most liquid funds in this space.

The great thing about this floating-rate fund is that it’s a nice addition to a fixed-income portfolio because they tend to have minimal correlation to the broader bond market.

Consider the past year.

Most bond prices tanked after last year’s election, as the market expected the incoming administration’s policies to be inflationary. But, within months of Trump taking office, bond prices started to firm up again, as it became more and more obvious that the wheels of government would continue to turn slowly.

For most of 2017, bonds have performed exceptionally well, taking a lot of investors by surprise. (Though not us, I can proudly say; I’ve consistently written over the past year that the post-election bond rout would be a blip and nothing more.)

Yet floating-rate securities have experienced precisely the opposite. Prices surged after the election in anticipation of the higher rates that would follow imminent inflation. When inflation failed to materialize, money started to leak out of the sector.

Today, a year after the election, the fund I’m recommending to my subscribers is right back where it started. It’s a great value that I expect to return anywhere from 17% to 27% and give you consistent income, a bedrock of anyone’s retirement plans.

You can think of this floating-rate investment like a free bonus option. If rates stay more or less unchanged, the “option” expires worthless. That’s OK, as we didn’t exactly pay up for it at today’s prices.

If the Fed pushes short-term rates significantly higher, great! Our “option” kicks in.

In one case, we win… and in the other, we don’t lose. Those are odds I’m happy to take.

Charles Sizemore

Editor, Peak Investor

The post How to Prepare for Higher Rates appeared first on Economy and Markets.

November 24, 2017

The Black Friday Choice

Sixty years ago, the Philadelphia police dreaded the days after Thanksgiving.

Sixty years ago, the Philadelphia police dreaded the days after Thanksgiving.

People piled onto Market Street downtown, marveling at the new Christmas window displays, while football fans filed in for the Army-Navy game. Both groups created traffic snarls and other headaches for the local PD.

Traffic patrol officers started calling it Black Friday and Black Saturday, noting all the problems and long work hours. Local reporters assigned to the traffic beat picked up the lingo, running Black Friday headlines.

This happened long before anyone described the day after Thanksgiving as “black” in reference to retail profits.

It’s fitting that the media gave us Black Friday, since they perpetuate some of the myth.

Today we don’t have to brave weather and other people to get a good deal. All we have to do is log in and click. Price comparisons and huge selections are at our fingertips. We can choose to be part of the crowd if we want, but that’s what it is – a choice.

I don’t know anyone who camped in front of a retail store last night, hoping to be one of the first people through the door on Black Friday.

I know it happens, because I see it reported on the news, naturally. But all the stories about shopping that we see are more a function of what does and doesn’t happen elsewhere in the world on the day after Thanksgiving…

Jeff Crilley, a former TV reporter turned public relations pro, wrote a book years ago about free publicity. He instructed professionals such as financial advisors to approach reporters through email and phone calls with ideas about trending topics on slow news days, like today.

This greatly improved their chances of a reporter trying to find something, anything, to talk about. If it worked, the professional would get the best free advertising available: quotes in the news where he was portrayed as an expert.

Beyond knowing your topic and having something to say, the strategy relies heavily on reporters who have zero to talk about today, which is a problem.

Newscasts can’t have dead airtime, or report that “Nothing happened today, so please quit watching,” so on this day they troll through stores looking for people acting like idiots. Someone is always willing to oblige, which is yet another choice.

Later today, we’ll be treated to video footage of someone in a store kicking grandma, pushing kids out of the way, or playing tug-of-war with another customer over the latest must-have gadget marked down 93%.

We’ll be embarrassed for them, and yet keep watching. After all, judging society is a spectator sport and, you guessed it, another choice.

Most of us will be doing this from the comfort of our home, or that of a loved one (or even not-so-loved one), hopefully surrounded by people we mostly like, enjoying each other’s company and relaxing during this long holiday weekend.

Christmas is still far enough away that we can pretend to have a plan to buy gifts in plenty of time. And if we don’t, Amazon is desperate to provide same day delivery.

Even the worst procrastinator who doesn’t like to hunt for a parking spot at the mall can wait almost another month before really starting to worry.

For now, on this not-so-black Friday, I hope you can make the choice that gives you the greatest comfort.

Have a beverage with friends and family.

Watch football.

Read economic missives on the internet.

Go shopping – and box with grandma – if you wish.

You might even find yourself flipping on the evening news, hoping to catch a sensational video or two.

Just remember, what we see on the evening news is puffed up to be the most outrageous situation, because they don’t have a choice. They’ve got to put something on the air, even when occasionally the most reasonable newscaster would tell us to simply tune out.

Have a great weekend.

Rodney Johnson

Follow me on Twitter @RJHSDent

The post The Black Friday Choice appeared first on Economy and Markets.

November 23, 2017

This Thanksgiving Goes to Corporations: Thanks for the Greatest Free Gift in History

It’s no f’ing wonder!” I yelled to no one in particular the other day when my researcher, Dave Okenquist, shared with me a chart he’d just come across!

It’s no f’ing wonder!” I yelled to no one in particular the other day when my researcher, Dave Okenquist, shared with me a chart he’d just come across!

“We’ve died and gone to heaven thanks to these guys! They’ve given us the greatest free gift in history!”

The dog tucked its tail between its legs and made a hasty retreat.

“Thank you so much you a-holes! Now we’re going to pay an even bigger price when the wheels come off this f’ing bus and everyone realizes we’re not in heaven after all!”

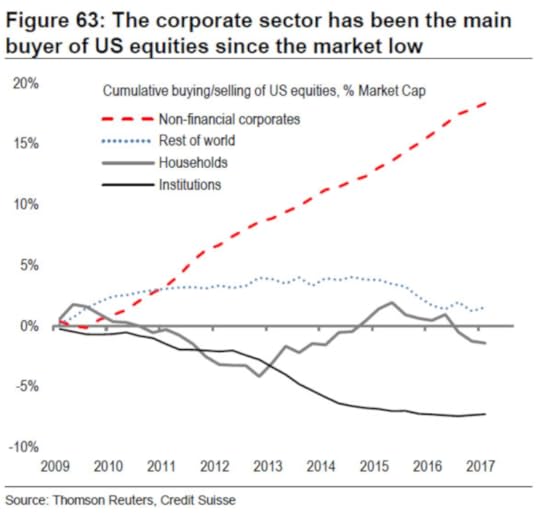

The chart proved that this rally since 2009 is built on a whole lot of nothing! There are no fundamentals behind it. All that’s happened is corporations have been buying back their own stocks with the near-free money the Fed and other central banks put on the table.

So, on this Thanksgiving Day, let’s give thanks to the Fed and those corporations for this unprecedented bubble!

They’ve gotten the biggest “free lunch” in history.

And now they’re eyeing Trump’s tax cuts like cannibals at a human meat market, despite their corporate profits having hit as high as 11% of GDP. Those profits have been just 6%, on average, since the 1950s!

“Oh, if these companies that have been buying back their own stocks with free money only got MORE free money,” I continued raving to no one, “then they’d expand their capacity and create new jobs!”

I was being sarcastic, of course!

We’re at 4.1% unemployment. That’s about as low as it gets.

We’ve hired back all of the lost jobs from the great recession. Our workforce will actually decline for several years ahead and then only grow, at best, at 0.2% for decades to come.

Our productivity has dropped from 3% in the past to 0.5% now; and it’s still falling… because we’re aging as a society.

How many old people do you know who get more productive and innovative as they age past 50 or 60?

“Why didn’t we realize earlier that we could just grow our economy by printing free money?” I was still yelling at the wall. I could hear the dog trying to bury itself under something in a room nearby.

“Why should we have to innovate or work?! What idiots we were until John Maynard Keynes came along in the 1930s. Thank God for him! When there are downturns, the government can just run deficits or print money to offset them. We just grow without recessions and then retire and go to heaven! Couldn’t get better!

“Damn, why did I even make the investment to go to college and business school?!

“And the next step in the endless something-for-nothing stimulus scheme is to just stop fooling around. Let’s just start sending $10,000 or $20,000 checks to every household!”

At which point I’d finally wound myself down (although, as I typed this email to you, I did bang to keyboard harder than was entirely necessary).

Look at this chart that explains why the stock market has been so strong in a low growth economy. Dave found this on ZeroHedge.

So, here’s the new economy since demographics and debt tanked in most places from late 2007 forward:

So, here’s the new economy since demographics and debt tanked in most places from late 2007 forward:

Governments issue unprecedented amounts of debt – and buy their own bonds to keep interest rates low, to be able to issue more debt affordably.

Corporations use unprecedented low long-term interest rates – at near zero for risk-free rates adjusted for inflation – to buy their own stocks back and increase their earnings per share, even if their earnings are not growing.

Damn again!

We’ve been idiots for thousands of years to think we had to work and innovate and invest to create growth. All that suffering? When we just needed central banks!

Trouble is, it doesn’t work that way in the long run! Eventually it all heads south.

History is going to look back at this period as a time characterized by the worst financial policies in history… and possibly the worst stock market crash. And we’ll all be mortified, especially central bankers and economists!

History will show that the next several decades created the greatest political and financial revolution since democracy met free-market capitalism in the early 1700s.

That’s the new theme of my new book: Zero Hour. Get it now.

In it, I prove that this dream world that the Fed and corporations have created won’t last for much longer… and I show what will bring it crashing to the ground.

Ultimately adversity creates innovation and progress!

Now that’s something we should truly be thankful for!

Happy Thanksgiving,

Harry

Follow me on Twitter @harrydentjr

The post This Thanksgiving Goes to Corporations: Thanks for the Greatest Free Gift in History appeared first on Economy and Markets.

November 22, 2017

There’s More Than One Way to Kill a Bull (Market)

I like to call Peru the Texas of South America.

I like to call Peru the Texas of South America.

It has nothing to do with footwear (the Texas cowboy boot is vastly superior to the Peruvian horseman’s boot) or cuisine, though I might have to give Peru the nod on that one… A good lomo saltado, a traditional Peruvian stir fry, might actually be worth killing for.

No, it has everything to do with attitude. In the eyes of a Texan, everything is bigger and better in Texas. Everything. No exceptions. And we all talk about Texas constantly. It’s just what we do.

Well, Peruvians feel the same way about Peru. Everything in Peru is better… the food, the women, the sunshine… even the bullfighters! And when you marry a Peruvian like I have, you’ve effectively committed yourself to a lifetime of regular visits to Peru.

Last month I found myself in Lima, the country’s capital, during the Feria del Señor de los Milagros, the city’s annual bullfighting festival.

My sister-in-law had an extra ticket for the corrida, the Spanish word for bullfight. (She’s a Millennial and it was critically important that she have selfies to add to her Instagram feed, and she didn’t want to go alone.)

So I spent my Sunday afternoon in the bullring.

While my sister-in-law might’ve been more interested in watching the strapping young matadors strut around in tight pants, I was really looking forward to the fights. I can’t call myself a true aficionado because that would imply a level of knowledge and expertise I don’t have.

But there’s something otherworldly about a bullfight. The tradition, the music, the artistry… even the blood. It’s something you have to see to understand.

There were three matadors that Sunday – an older, more established Spaniard and two younger, up-and-coming Peruvians – and each had very different styles.

Enrique Ponce, the Spaniard, played it conservatively.

Like all matadors, he had his moments of flair, and his technique was consistent and solid. But he’s also 45 years old, has a beautiful wife and child at home, and he’s a multimillionaire. He wasn’t interested in taking excessive risk and getting himself gored. He has far too much to lose.

Andrés Roca Rey was a lot more aggressive.

He’s 21, and despite being gored in five consecutive fights last year, still seems to believe he’s indestructible. And considering he managed to escape all five gorings without serious injury, perhaps he actually is indestructible. Who am I to say?

His signature move – and let me go on the record as saying this is utterly insane – was to move the cape from his right side to his left behind his back while thrusting his crotch in the direction of the charging bull. He’s lucky the bull didn’t make him a eunuch.

I’ll give the kid credit though. He put on one hell of show.

Not to be outdone, 22-year-old Joaquin Galdós had one of the best showings of his career, finishing the afternoon with three ears.

His technique was perfect. He mesmerized the bull with his cape work, and when it came time to deliver the death blow with his sword, he did so with surgical precision.

For the uninitiated, when a bullfighter performs exceptionally well, the president of the fight will give him an ear as a trophy. And if it’s a truly spectacular performance, in very rare cases the president will give two ears.

Well, Galdós won an ear with his first bull and came close to getting a second. The audience demanded it, only to be denied by the president.

But there would be no denying after Galdós faced his second bull. The president awarded him both ears, and he walked out of the ring showered with flowers and hats thrown down from the crowd.

It was the Texas equivalent of scoring five touchdowns in a Friday night high- school football game or slugging three home runs in a baseball game.

Now, I have no interest in fighting a bull with a sword. That’s insane.

But all of this talk about fighting bulls does bring up certain parallels to the market.

If you’re not aggressively buying tech stocks and Bitcoin, you’re effectively fighting the bull. Unlike a matador, you don’t actually have the power to kill the bull, but if you’re attempting to short this market, he most certainly can kill you.

A bullfighter is probably the wrong analogy here. A better one might actually be an American rodeo cowboy… a group of gentlemen that might be even more insane than Spanish matadors.

A rodeo cowboy isn’t looking to kill the bull. He’s looking to ride it, at least for a short time. He’s eventually get thrown off, and he knows that going in. Buy you can bet he’ll ride that bull as long as he can.

That’s essentially what we’re doing in Boom & Bust and our other trading services.

We know the bull will throw us off eventually – which Harry talks about in his new book, Zero Hour – and that time is probably coming sooner rather than later. In the meantime, we’re riding this as long as we can, and making solid returns along the way.

Charles Sizemore

Portfolio Manager, Boom & Bust

The post There’s More Than One Way to Kill a Bull (Market) appeared first on Economy and Markets.

November 21, 2017

How to Find Substance In the Age of Hype

I hope you’re as ready as I am to settle into some good food, good company, and some good time off from the daily grind.

I hope you’re as ready as I am to settle into some good food, good company, and some good time off from the daily grind.

We’re almost there… just a few more days to go!

If you’re like most Americans these days, you’re probably hoping your Thanksgiving is devoid of politics. Nothing sours quality time quicker than ill-timed soapboxing.

Catching up on life and love and everything in between should be enough to fill a day of giving thanks, but, just in case you’re stuck with an awkward pause or a tipsy uncle, I do have a few suggestions.

Honestly, I’m still chuckling to myself over the fun little discovery I made a few weeks ago. I found that if you could have hypothetically invested in the careers of either Emilio Estevez or Brad Pitt, the former would have been a better bet… by a longshot!

How crazy is that?!

Sometimes the best bets are hidden in plain sight. That’s something my colleagues have been getting at over the past week, and it’s been a joy to follow along.

Adam made the great connection between “moneyball” – the term for Billy Beane’s groundbreaking quantitative analysis of professional baseball – and investing.

Beane found players who failed the “eye test” but nonetheless put up the kinds of numbers that win games. That’s not unlike my own work as a forensic accountant. I don’t care if a company just picked up some famous spokesperson or got some nice media hype.

It’s all about the data.

Lance talked about how he wound up getting into CrossFit. It seems there’s no end in sight to diet and fitness options. Everywhere you look, someone’s promising the next silver bullet.

But Lance keyed in on an overlooked and crucial piece of the puzzle: sticking by your plan. How often are we presented with the beginnings of a good idea, only to fizzle out down the road? Apply that to whatever area of life you want, the same dynamic applies.

Lance found what worked for him by filtering out the noise and sticking to his guns – sorry, Lance, couldn’t help myself with that pun. And have fun working off the turkey on Friday!

You may have caught Charles talking me up on Friday. That meant a lot, as he’s one of the brightest guys I know. He talked about how I set him straight on International Business Machines (NYSE: IBM) a while back. Like I said, sometimes the brightest names on the big board are just fool’s gold (no matter how big and blue they may be).

I told him the fundamentals weren’t against IBM and, well, I was right.

On Saturday I (politely!) gatecrashed Teresa’a space to talk Times Square and the Super Bowl. Maybe you could get some mileage out of quizzing your guests on the average cost of a Super Bowl ad or the amount of foot traffic in Times Square.

And, yesterday, Rodney cut through the incessant political chatter to look at what Trump has actually accomplished so far and what the road ahead looks like.

Again, sometimes clearing away the noise is the most important thing you can do before assessing your next move, no matter what that may be.

As you well know by now, we live in a time where hype and spectacle get the most attention. Cryptocurrencies-of-the-month come and go; some company promises to cure this or that disease; another tech startup promises to “disrupt” some mundane thing – say, convenience stores – and, in the process, reinvents the damn vending machine.

It’d be funny if it weren’t such a sad summary of a big part of our culture.

I think my abilities as a forensic accountant are even more important nowadays. I can’t stand the dumb stuff. It’s all about hard data to me: inventories, receivables, sales, costs, cash flow, earnings, dividends… creating value.

I’m the kind of guy who doesn’t even notice if someone says something controversial on an earnings call, like what happened with Papa John’s. I’m the guy constantly scribbling down and taking note of the stuff the matters.

Right now, I’ve got my eye on three companies that are primed for real profits down the line, and I think you’d be interested in hearing about them. In fact, a little later this afternoon, I’m hosting a special video broadcast that highlights these opportunities that are essentially “hidden in plain sight,” creating value right before our eyes.

This isn’t a gimmick, nor is it some pie-in-the-sky penny stock. You’ve probably heard of these companies before but never thought of them as sound investments. That’s why I keep saying they’re hidden in plain sight.

My little presentation is free, and you can register right here.

Happy Thanksgiving, and good investing!

John Del Vecchio

Editor, Hidden Profits

The post How to Find Substance In the Age of Hype appeared first on Economy and Markets.