Harry S. Dent Jr.'s Blog, page 67

December 18, 2017

What Really Drives the Housing Market

In the summer of 1992, my wife and I lived in Dallas. I had just turned 26 and had two years of marriage under my belt. My career was moving along, but I wasn’t making much money. And I was in grad school.

In the summer of 1992, my wife and I lived in Dallas. I had just turned 26 and had two years of marriage under my belt. My career was moving along, but I wasn’t making much money. And I was in grad school.

This is the point at which my wife informed me that we should have a baby. Clearly, with little or no savings, no time to spare, and not much life experience, we needed to bring another soul into the world.

Oh yeah, and before we have a child, she told me we needed to own a home. We bought our first place at the end of that year, almost eight months before our first child was born, using an FHA loan and what little savings we had.

Just three years later, I planned a career move that would take me to Tulsa, Oklahoma. We put our home on the market and began house hunting in the new town.

Our home sold in two days, and the job opportunity suddenly fell through.

I had to scramble for both a new job and a new home. That was OK, because our family now included two kids.

Six years later we had three children and my wife was itching for more space, both inside the home and out. She found a fabulous community north of town and the perfect home. For a couple of weeks we owned two residences but everything worked out.

Three years later, our business took me to Florida, where I bought another home, almost at the top of the market in 2005. I knew things were out of control, so we chose a more modest house than we otherwise would have purchased. We sold that home in 2010 then rented for a brief six months.

My wife told me that renting didn’t suit her because she couldn’t renovate. I thought that was a feature, not a bug, but I understood. We quickly purchased a home in a great area of Tampa… before moving back to Texas five years later after our last child left the nest.

That’s the story of my homeownership life. I bought homes out of want and need, which I think describes most of us.

Here’s what I didn’t do: Calculate the value of the property tax deduction; calculate the value of the mortgage interest deduction; compare those, along with other deductions, to my standard deduction based on the size of my family to determine if itemizing made sense in future years; then use that analysis to figure out if I should purchase a home and how much I could pay.

I’m certain there are people out there who do this, but I’m a numbers guy, and I didn’t do it. And none of my numbers-oriented friends do it. And my wife certainly didn’t care about such things. Instead, we all approached home ownership the same way, based on our age and stage of life.

Based on our 30 years of research and analysis at Dent Research, I know that most consumers approach life just like I do. We don’t ignore financial factors; we’re not stupid.

We just understand that if you lived life according to exact financial calculations, making nothing but quantitative, rational decisions, you’d miss out on many good things.

We wouldn’t drive nice cars, since basic vehicles provide the same thing (transportation between two points). We’d only buy homes if price appreciation and tax deductions outweighed associated costs, including the opportunity cost of doing other things with our capital.

I think if I tried to follow this logic my wife would hate me. I know my kids would, and I’d probably have a little self-loathing to throw in as well.

That’s what makes all the hand-wringing over eliminating or curbing the home mortgage deduction so laughable.

Such calculations aren’t what drive most homebuyers. It’s where they are in their life cycle!

Do they have kids? They need more room. Are the kids school age? They need good schools or close proximity to private institutions. Have the kids left? They need less space. Are they retiring? They might want something near the shore. No spreadsheets on interest rates and tax deductions can top such considerations.

If you want proof, just consider the last five years. Since real estate bottomed in late 2011, home prices have shot higher while interest rates remained in the basement.

If we all based our homebuying decisions on financial calculations, home ownership should be at the highest rate in history, or more than 69%. But it’s not.

In fact, we’re still languishing around 64%, just off of the 25-year low of 63% registered in the second quarter of last year. Interestingly, as prices moved higher, home ownership dipped.

Of course, there are other considerations, such as affordability and availability. But the point remains that we base most of our consumption on major lifetime milestones, like getting married, having children, becoming empty nesters, and retiring.

That’s why we’ve focused our research on such predictable consumer spending patterns. We want to know where consumers are headed next.

We get there by determining the next big change in their stage of life, not by calculating tax savings on potential mortgage deductions.

Rodney Johnson

Follow me on Twitter @RJHSDent

The post What Really Drives the Housing Market appeared first on Economy and Markets.

December 15, 2017

What Tax Reform Could Mean for Stocks

There’s an old joke that the Founding Fathers wisely chose a patch of land located along the Potomac River as the site of our nation’s capital because it’s a place so miserably humid in the summer and so bitterly cold in the winter that our elected representatives would choose to stay away most of the year, thus have fewer opportunities to make a mess of things.

There’s an old joke that the Founding Fathers wisely chose a patch of land located along the Potomac River as the site of our nation’s capital because it’s a place so miserably humid in the summer and so bitterly cold in the winter that our elected representatives would choose to stay away most of the year, thus have fewer opportunities to make a mess of things.

Alas, centralized heat and air conditioning made the swamp habitable, and Washington, D.C., has been infested ever since.

Most of what our government does is, at best, a waste of time and, at worst, downright harmful. But Congress (mostly) got something right in its tax reform package, which the Senate approved earlier this month.

The bill is by no means perfect. It falls far short of its stated goal of simplifying the tax code, which remains as convoluted as ever. And some taxpayers – particularly high-earners in California, New York, and New Jersey – will get hosed and actually end up paying more of their money to government. For most individual taxpayers, the reform package is a nonfactor, neither much of a positive or much of a negative.

But the corporate rate reduction is a very big deal, with significant implications for the broader market and the recommendations I make to my Peak Income subscribers in particular.

America’s largest multinational companies have close to $3 trillion essentially “trapped” offshore. They don’t bring it home because doing so means giving 35% of it to the government. Instead, companies essentially borrow against their offshore cash by issuing bonds.

What do you think will happen to new bond issuance once all of that offshore money starts making its way back home?

It will pretty much grind to a halt. (In case you’re wondering why so many Wall Street bankers have been lukewarm, at best, towards the bill, here’s your explanation. It will all but kill their lucrative bond underwriting business, as their largest customers will no longer need their services.)

The bill also limits the amount of interest that companies can write off on their taxes, which further disincentivizes them to borrow.

So you’re going to have a major curtailing of new bond issues… at a time when demand for income from Baby Boomers is as strong as ever. That’s a recipe for low bond yields and high bond prices for a long time to come.

The situation isn’t quite as extreme in the tax-free municipal bond market, but you’re still likely to see fewer new bond issues coming down the pipeline.

Congress is removing the tax-free status of bonds used for things like sports stadiums and other “special purposes.” Meanwhile, personal income taxes won’t be falling enough to make munis less attractive to high-income Americans. (Remember, the lower the tax rate, the less important it is to have tax-free income.)

A relatively tight supply of muni bonds should keep prices high for the foreseeable future.

But it’s not just bonds that will be affected. Lower taxes means more cash on hand for dividends and buybacks, particularly for the large multinationals looking to repatriate their offshore cash hoards.

We’re talking about a lot of money that’s likely to get dumped into the stock market one way or another.

Anticipation of corporate tax reform has been a major driver of the Trump Rally. This bull market – like all bull markets – will end, sooner, probably, rather than later.

But I also believe this market has at least one last major hurrah left in it, which is what told Peak Income readers when recommending this month’s addition to our income portfolio.

Normally, I recommend safe, stable income plays that you should be able to hold for multiple years… maybe even decades. But this month I’m presenting an opportunity to profit from one last surge in the U.S. stock market.

I’ve said for months that I expect overseas markets to outperform over the next several years, and that’s still my working hypothesis. But over the next six months or so, I expect U.S. stocks to beat the pants off of pretty much everything else.

And so I’ve told readers to target an all-American fund chock full of some of the biggest names in the S&P 500 Index, familiar names like Facebook, Alphabet/Google, and Amazon.com.

I see this as shorter-term trade. We’ll be out of it long before we see a bear market, but we’ll be in it long enough to enjoy a nice payout. This fund trades at a 10% discount to net asset value and yields 11%. A total return in the 20% neighborhood is doable.

Click here to learn more and subscribe to Peak Income today.

In case you missed it, click here to see what I mean.

Charles Sizemore

Editor, Peak Income

The post What Tax Reform Could Mean for Stocks appeared first on Economy and Markets.

December 14, 2017

The Yellow Brick-and-Mortar Road to Profits

Forgive me for starting this article with a little braggadocio, but I think now is a pretty good time to be a Hidden Profits subscriber.

Forgive me for starting this article with a little braggadocio, but I think now is a pretty good time to be a Hidden Profits subscriber.

Yes, the Trump-fueled rally continues to break record after record. Bitcoin is, what, $50,000 a pop? I wouldn’t be surprised. Wherever you look there’s something “disrupting” everything from currencies to cars. Sure, some people are making money in the chaos, but it’s unpredictable and messy.

To add even more fuel to the fire, Congress is close to finalizing a tax bill that would lower corporate tax rates. And not just lower them, but slash them to levels we’ve never seen. Thing is, we have among the highest corporate income tax rates in the world. Not every company pays that highest rate, of course, but the consistently cash-gushing ones do.

Those cash-gushing companies are the ones we love at Hidden Profits, because we choose companies that have what are basically private printing presses. They’re awash in money they don’t need to grow their businesses. In fact, they send that money to their investors.

Now, courtesy of the federal government (for once!), these companies are going to double what they can pay out. My Hidden Profits model pinpoints these companies that pay investors first.

My newest recommendation, in fact, is a brand you know. One of its stores is probably located within driving distance of you, wherever you are.

In an age where Amazon seems hell-bent on buying up entire cities and businesses and our computers are doing all the thinking for us, brick-and-mortar retail seems almost quaint, like something in a Norman Rockwell painting.

But brick-and-mortar retail isn’t quaint. Far from it. Each year, Americans spend about $1 trillion in retail — but online sales account for just a tenth of that figure. That means the old-fashioned dollars haven’t gone anywhere, and this particular ubiquitous retailer is primed to soar in the coming years.

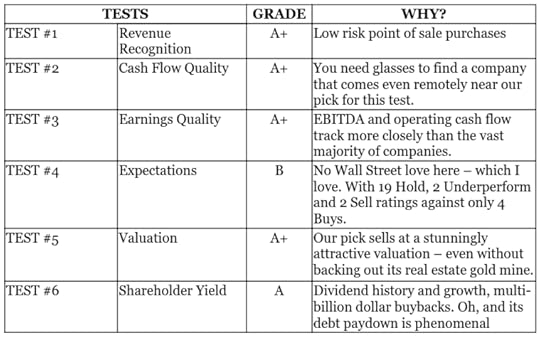

The beauty is that this month’s stock selection is the No. 1 ranked company in my Earnings Quality Model.

Here are some facts and figures:

The rub is that our retailer gets little love from the financial press. The cold shoulder from Wall Street and low expectations are what make the stock compelling. Sometimes it really pays off to be a contrarian and go against the grain of conventional wisdom. I firmly believe this is one of those times.

The rub is that our retailer gets little love from the financial press. The cold shoulder from Wall Street and low expectations are what make the stock compelling. Sometimes it really pays off to be a contrarian and go against the grain of conventional wisdom. I firmly believe this is one of those times.

But I’m not reckless. I’ve been very cautious on equities due to high valuations and extremely optimistic expectations among investors. But, when I see a company that can throw off mounds of cash and pay shareholders first, I dive in feet first.

Retailers have been hammered in recent times, as you know. It really is ugly out there, but ugly stocks can make for beautiful investments. Learn about one right here.

Good investing,

John Del Vecchio

Editor, Hidden Profits

The post The Yellow Brick-and-Mortar Road to Profits appeared first on Economy and Markets.

December 13, 2017

The Republican Party Is Imploding

It finally looks like the Republican party and Donald Trump may get its first victory if the tax reform bill that just passed the Senate gets through the House without too much compromise…

It finally looks like the Republican party and Donald Trump may get its first victory if the tax reform bill that just passed the Senate gets through the House without too much compromise…

But that would be missing the bigger picture.

First, I was warning back in 2016 that whoever won the presidential election would end up wishing they had not. This bubble has been extended to much greater heights and can only stretch so far without destroying itself through its own extremes and imbalances.

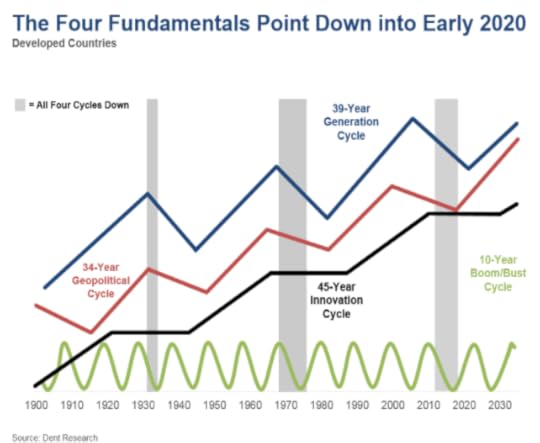

My four fundamental long-term indicators – the Generational Spending Wave, the Geopolitical Cycle, the Technology/Innovation Cycle, and the Boom/Bust Cycle – all point down together, just like they did in the early to mid-1970s and the early 1930s – and we know what happened in those periods: the two worst stock crashes in the last century.

Here’s a chart to illustrate this…

So, no matter who got elected last year, they’re likely to see the next great depression hit on their watch. And there’s no way to get re-elected when the economy worsens during your term! Just ask George H. W. Bush. He got thrown out, despite being a pretty popular president, due to a minor recession in 1990-91.

So, no matter who got elected last year, they’re likely to see the next great depression hit on their watch. And there’s no way to get re-elected when the economy worsens during your term! Just ask George H. W. Bush. He got thrown out, despite being a pretty popular president, due to a minor recession in 1990-91.

What are President Trump’s changes of re-election if he’s in charge when a once-in-a-lifetime crisis slaps us in the face, dumps a catastrophic crash in our laps, and sends unemployment soaring?

Given that central banks have kept the economy limping along for years with something for nothing policies – soon to include tax cuts from Trump just when companies need them less than any time in history – these four fundamentals are leading us down a very dark path.

They don’t guarantee a major downturn, I’ll admit, but they clearly say that one gets much more likely during the next two to five years.

Adding to the growing risk is the President himself.

He issues an almost constant stream of divisive statements and policies. He’s picked fights with every one: other nations, the democrats, and the republican leadership. He recently alienated a huge swath of the Middle East, except Israel, with his pronouncement that Jerusalem is the capital of Israel… Why now pick that fight?

And over the last two years he’s slowly and steadily divided the Republican Party.

The first sign of the beginning of the end of the Grand Old Party was how Trump hijacked it against the establishment interests and the polls. He outsmarted them by realizing they were out of touch with the most-angry people in this country, more rural white people – and that those people are the “swing vote.”

And most recently he came out full bore in support of Roy Moore, despite the numerous allegations of serious sexual misconduct! He needed the man because he needs to keep that 52-to-48 advantage in the Senate.

That’s understandable from a strategic view, but the party just showed it would sell its soul to the devil for that… and now that looks even worse now that such strong last-minute support failed and Jones beat Moore by a hair.

When Trump became President, I predicted that he wasn’t likely to last his first year. Time will tell, but the divisiveness keeps growing and his ratings keep dropping, still scraping the bottom in the low 30s.

And there’s now a billionaire putting out TV ads and displaying them in Times Square calling for impeachment.

Even his ally and past advisor, Steve Bannon, doesn’t see Trump making it to the next election to even run again.

All of this while this stock bubble continues to stretch thanks to short-sighted something for nothing policies.

I’ll be surprised if the stock markets and the economy don’t start to implode by early 2018, right alongside the implosion of the Republican party. The negative trend in my four fundamental long-term indicators make this even more likely.

Harry

Follow Me on Twitter @harrydentjr

The post The Republican Party Is Imploding appeared first on Economy and Markets.

December 12, 2017

Facebook Executives Are Right: Social Media is Downright Dangerous!

I’ve been skeptical about social media’s ability to do “good” in the world since Day 1.

So I find it interesting, now some 13 years after the launch of Facebook, that many industry veterans are questioning its contributions to society, too.

Facebook’s former VP of user growth, Chamath Palihapitiya, has been quite critical, saying recently:

“[There is] no civil discourse, no cooperation; [rather] misinformation, mistruth. And it’s not an American problem – this is not about Russian ads. This is a global problem.”

Facebook’s first president, Sean Parker, has also sounded the alarm, saying top-dog social media companies have succeeded in “exploiting a vulnerability in human psychology.”

It can’t be argued: social media does give everyday folks more access to people and information.

But as I’ve said before, more isn’t always better.

For one, there’s plenty of evidence to show that most people simply can’t process all the information we’re bombarded with on a daily basis. We get paralyzed by sheer volume, and so we come up with “short-cuts” aimed at finding the proverbial “signal in the noise.”

One of those short-cuts is well-known (but nearly impossible to combat) confirmation bias.

Basically, human nature leads us to do two dangerous things in the information world:

We preferentially seek out information that confirms the beliefs we already hold, and

We preferentially believe information that confirms the beliefs we already hold.

Perhaps that’s the psychological vulnerability Sean Parker was referring to…?

Is that the mental glitch that allowed those Russian ads to go viral during last year’s election?

Regardless, social media can be dangerous – for everyday folks and investors, alike.

Of course, so can the “old-fashioned” 24/7 news channels.

In Want to Really Make America Great Again? Stop Reading the News, Ryan Holiday opened up about the agony he felt from his gluttonous consumption of news (mostly political in nature, given the extraordinary presidential election).

Two key points stood out to me…

First, he described the mechanism by which information overload has now become the norm. In his words:

In the 1990s, political scientists coined something called the CNN Effect. The basic premise was that a world of 24-hour media coverage would have considerable impact on foreign and domestic policy. When world leaders, generals, and politicians watch their actions – and the actions of their counterparts – dissected, analyzed and speculated about in real time, the argument goes, it changes what they do and how they do it… much for the worse. [emphasis added]

Think about that! Around-the-clock access to news – and dissections and analyses of that news – is thought to affect the decision-making process of world leaders.

That’s pretty scary if you ask me!

What’s more, the CNN Effect leads to another problem for ordinary people. Mr. Holiday further explains the “narcotizing dysfunction,” which simply means “paralysis by analysis.”

He says, “… the narcotizing dysfunction attempts to explain why highly informed citizens are often surprisingly inactive politically. The answer is that they confuse reading, thinking about chatting about issues (i.e. “consuming”) with doing something about them.”

The idea of “paralysis by analysis,” and the overconsumption of information, is two-fold.

For one, the simple act of analyzing an issue, or problem, gives people the feeling that they’ve done something to address the issue or problem – even if they’ve done nothing more than lie in bed with their iPad and read about it.

Second, having access to more information is not the same thing as knowing the best thing to do with that information. In fact, in many instances, having more information can make decisions and actions more difficult.

We either can’t find the signal in the noise… or we’re exposed to so many viewpoints that we simply revert to our previously-held view (thanks to confirmation bias).

Mind you, the article I’m referencing speaks to the political arena. But the very same influences affect your investment decisions and actions as well.

Longtime readers know I routinely warn against reading too much news.

I’ve talked about how Warren Buffett’s greatest strength is discipline, not genius – and how he, and other successful money managers, maintain discipline to their strategies, largely by ignoring the news.

I’ve also likened my relationship with the 24/7 news cycle to the temptation motorists feel to “gawk” at car accidents on the interstate. I’ve said, “I glance [at the news]… only because it takes too much effort to fight the urge. But then I quickly turn my focus back to the road ahead.”

And I don’t even have a Facebook account!

You see, I’m not telling you to stop reading the news (or perusing Facebook) completely. That’d be a little extreme.

But I am warning you that there is such a thing as too much information. And since the 24/7 news outlets and social media networks are incentivized to get users and clicks and sell advertising, it’s easier than ever to get too much bad information, too, these days.

At the end of the day, I know you’re still going to read the news and checkout your Facebook feed.

But do yourself a favor: limit your consumption, take most of it with a grain of salt and don’t look to CNBC or Facebook for your next “hot” investment recommendation.

Research offers a number of data-driven (and news-ignoring) investment strategies, including my own Cycle 9 Alert and 10X Profits. Both of these strategies will keep your focus on actionable investment opportunities (and off the news cycle and Facebook feed).

To good profits,

Adam O’Dell

Editor, 10x Profits

The post Facebook Executives Are Right: Social Media is Downright Dangerous! appeared first on Economy and Markets.

December 11, 2017

Beware the Student Loan Grinch

If I had to attend mandatory addiction classes, it would be CA, or Christmas Anonymous, for those who look forward to the holiday season just a bit too much and then suffer when it’s over.

If I had to attend mandatory addiction classes, it would be CA, or Christmas Anonymous, for those who look forward to the holiday season just a bit too much and then suffer when it’s over.

December 26 is always a bummer for me because I know Christmas is 364 days away. Of course, at that point, I also know I’m getting closer to taking down decorations, which is no fun for anyone.

In fact, a recent survey by Christmas Lights, Etc. – an online store – found that when it comes to all things Christmas, taking down decorations is the least favorite activity of every age group, except Millennials. For the young set, sticking to a budget is the worst part, with denuding in second place.

It’s fitting that those under 35 would focus on money, since they don’t have much. And at this time of year, the most recent college graduates among them get another reminder of their broke status.

The student loan Grinch is on his way.

When you graduate college – or leave without graduating – student loan providers give you six months to get on your feet. After that, you’re expected to start making the monthly strokes. For those who graduated in May 2017, December brings their first Christmas as working stiffs, and their first installment payment on student loans.

Since two out of three graduates from public universities and three out of four graduates from private institutions carry student loan debt, the vast majority of first-year graduates fall into this category. They join a bulging population of borrowers who have piled on massive amounts of debt in the past 15 years.

This chart compares student loan debt to credit card debt since 2003.

In the last decade and a half, student loan debt has exploded from $241 billion to $1.357 trillion, while credit card debt expanded from $688 billion to $808 billion. Student loan debt grew 463% compared with 17% for credit card borrowing.

In the last decade and a half, student loan debt has exploded from $241 billion to $1.357 trillion, while credit card debt expanded from $688 billion to $808 billion. Student loan debt grew 463% compared with 17% for credit card borrowing.

But before you start to feel bad for the hapless graduates, consider that many of them find a way to ease their repayment pain.

Only 54.4% of borrowers are making payments on their debt. The rest are either still in school (10.2%) or fall into one of several non-payment flavors. The typical graduate gets to breathe easy for six months in a normal grace period, which accounts for 3.4% of current borrowers. Another 9.9% have been granted a deferment and 10.9% a forbearance.

Deferments don’t accrue interest during the payment holiday, and are typically granted when the borrower goes back to school, joins the Peace Corp, loses a job, or has some other employment interruption.

Forbearances are closely related and granted for medical expenses or financial difficulties, but borrowers are responsible for accrued interest.

The always-present “other” category accounts for 1% of loans, leaving the tough-luck crowd in default with 10.2% of all loans outstanding. Just like bad things in your rearview mirror, the last category is larger than it appears.

Defaults might be one-tenth of the total, but one-third of student loans (current students, forbearances, and deferments) aren’t in repayment. If we just count those in repayment and those in default (54.4% and 10.2%), then non-payers account for 15.8% of the total.

When more than 15% of your borrowers aren’t paying back their debt, you know there’s a problem in the system.

And many of those making payments will never pay all that they owe.

In the late 2000s we developed income-based repayment plans and Pay As You Earn (PAYE) programs.

The idea was to better match loan payments with earnings, allowing those who earn less early in their careers to pay less at the same time. Such plans have a termination date, or a get-out-of-jail-sort-of-free date, after which the borrower owes nothing, even if he has not paid off his loan.

Just under half, or 42.5% of those currently paying off their debt, participate in one of these programs. This leaves just a mere 31.3% of student loan borrowers making full payments on their debt.

It’s starting to feel like the Grinch is coming for someone else – student loan providers, which means me and you, the U.S. taxpayers.

We probably won’t feel immediate pain from this twisted saga. The U.S. debt will increase, which will most likely cost us in the form of higher interest payments down the road but won’t limit the number of presents we have under the tree this year.

Graduates with debt, however, will shoulder a burden, even if it’s one they chose. Those paying their loans, paying less than the full amount on their loans, in some sort of forbearance or deferment, or even in default, take this baggage everywhere they go.

Whether walking down the aisle with their future spouse or into the signing room at a title company, the debt comes along. They simply won’t spend as much in their early adult years as previous generations because they used up some of their precious capital while sitting in the classroom.

In this light, the student loan Grinch weighs on the entire economy, curbing the economic benefits of adding the next generation to the working class. Judging by the trendline on the chart, this won’t end anytime soon.

But it seems out of touch with the season to end on sour note.

Since there’s no growing the student loan Grinch’s heart with a sudden rendition of alma mater fight songs, I’ll just refer back to the Christmas Lights, Etc. survey.

According to their data, our favorite Christmas movies are determined by our age, with the older generation preferring Miracle on 34th Street, and the young group leaning, appropriately, toward Jim Carrey’s version of How the Grinch Stole Christmas.

If you want to check out comparisons of who likes to decorate and where, broken down by age and gender, the survey can be found here.

Rodney Johnson

Follow me on Twitter @RJHSDent

The post Beware the Student Loan Grinch appeared first on Economy and Markets.

December 8, 2017

Full Steam Ahead

It’s common knowledge that the Federal Reserve has its tentacles wrapped around the global financial system. Aside from trying to run the U.S. economy on its own, the Fed promotes a stable financial system, champions safe and sound banks, fosters payment and settlements systems that facilitate U.S. dollar transactions worldwide, and advocates for consumer protection, promotes community development, and performs sophisticated research!

It’s common knowledge that the Federal Reserve has its tentacles wrapped around the global financial system. Aside from trying to run the U.S. economy on its own, the Fed promotes a stable financial system, champions safe and sound banks, fosters payment and settlements systems that facilitate U.S. dollar transactions worldwide, and advocates for consumer protection, promotes community development, and performs sophisticated research!

In other words, the people appointed to the top decision-making positions within the Fed wield a lot of power!

I mention all this to underline the fact that there are a total of 12 people charged with guiding our economy. It’s somewhat comparable to the Supreme Court, where only nine justices hold the final say over any and all matters related to the interpretation of the Constitution.

Seven of the 12 people in charge of the Fed are appointed by the president and serve on the Fed’s Board of Governors (BOG).

President Trump recently appointed Jerome Powell, who is currently on the BOG, to succeed Fed Chair Janet Yellen. He also appointed Randal Quarles to fill a vacancy on the BOG. Quarles was also sworn in as the Vice Chairman of Supervision. Trump expects Quarles to lead the way in loosening banking regulations put in place after the Great Financial Crisis.

Late last month, President Trump also appointed Marvin Goodfriend to the BOG. He’s a former Fed official and is currently a professor of economics at Carnegie Mellon University. Goodfriend is a conservative who’s been critical of Fed policies both during the GFC and after.

Even with the recent flurry of activity, there are still three vacancies – one more than the BOG had at the beginning of last year. If Trump wants to fill the Fed with his appointees, he still has a lot of work to do!

According to recent testimony from both Powell and Yellen, the transition will be smooth and policy decisions will stay on track. That includes the current rate-hiking cycle as well as the reduction of the Fed’s balance sheet. Of course, if the economic data changes, so could monetary policy.

Investors, as well as central bankers, study a number of data points and other factors before deciding on a course of action. Since our economy seems to be going in the right direction, investors are more focused on the likelihood of a major overhaul of the Internal Revenue Code. Stocks have been flying high on potential corporate tax reductions.

The Fed’s monetary policy committee focuses on the growth of our economy. It looks at factors that contribute to overall growth, employment, and wages. According to the Fed (its own best friend), its course of action is still stimulating growth. The other side of that coin, of course, is that interest rates are too low and the Fed balance sheet is too bloated.

As long as the economy grows, wages rise, and inflation moves up toward its 2% target, the Fed intends to hike interest rates and shrink the balance sheet until a neutral policy is achieved. “Neutral policy,” in this context, means the Fed does nothing to assist or impede economic growth.

You’re probably wondering when the magical neutral rate is achieved… Or maybe laughing to yourself with the thought that the Fed would ever take its hands off the wheel…

Let’s take a look at the data the Fed sees and take a stab at deducing its logic.

Gross domestic product (GDP) is the broadest measure of the economy, and the first revision of third-quarter data shows the economy grew at an annualized rate of 3.3%. Not too bad since consumer spending helped propel the move higher. There are even higher expectations for spending in the fourth quarter.

For consumers to spend more, they usually have to make more (unless they do what Fed policy encouraged: borrow more). Wages and income have been slow to move up, despite low unemployment, but October’s personal income data moved up higher than expected. That’s good… but we’ll have to see if the trend continues.

The “zero interest-rate policy” – a consequence of the GFC – really didn’t encourage people to borrow and spend more. ZIRP did encourage people to invest in riskier assets, though, and that’s why stocks have been on a tear for years. Free money and trillions of dollars in quantitative easing (QE) didn’t create inflation the Fed expected, either.

To this day, Fed officials are still confused about low inflation.

A healthy economy will eventually show signs of pricing power, or inflation. The Fed’s preferred measure is the personal consumption expenditures (PCE) price index. The core (excluding food and energy) PCE price index was recently measured at 1.4% annually, which is well below the Fed’s target rate of 2%.

One sector of the economy that’s benefited from ZIRP is housing. The housing bubble popped well before the financial crisis because risky home loans – based on no income and no verification – came home to roost. Since then, however, new home sales have been on the rise and made a new, post-crisis high last month. New home sales are a fraction of total home sales but are more important to the economy because of the ripple effect of related sales of appliances, furniture, and other items purchased for a new home.

Even though our economy is rotating into being more service-driven, manufacturing remains an important gauge of our economic health. According to the Institute for Supply Management’s (ISM) manufacturing index, the sector has been in a healthy growth mode since the third quarter of 2016. The ISM manufacturing index is closely watched by investors and the Fed.

So, we can conclude that the U.S. economy is doing OK, except for stagnant wages and stubbornly low inflation. We can also conclude that ZIRP and QE were failures because they didn’t spur inflation or wages. At the same time, neither halting expansion of Fed’s multi-trillion dollar balance sheet created by QE nor raising interest rates back toward a neutral level has put a damper on our tepid economic growth, yet.

The Fed might be able to continue the current path of normalization as long as the financial markets go along. Since global stocks are near record highs as a result of the Fed’s easy-money policies, it’s less clear how the Fed will react to a severe pullback or worse – say, the stock bubble finally popping.

You can prepare and profit from surprises in the financial markets, and specifically in the Treasury bond market with Treasury Profits Accelerator.

Good investing,

Lance Gaitan

Editor, Treasury Profits Accelerator

The post Full Steam Ahead appeared first on Economy and Markets.

December 7, 2017

Free Bitcoin Trading Next Week

As I told my Cycle 9 Alert subscribers on Tuesday, I’m no expert on cryptocurrencies. Still, I’m pretty sure 2017 will go down in the history books as the year of the Bitcoin bubble.

As I told my Cycle 9 Alert subscribers on Tuesday, I’m no expert on cryptocurrencies. Still, I’m pretty sure 2017 will go down in the history books as the year of the Bitcoin bubble.

It’s checking all the “classic bubble” boxes…

Massive price gains. Up a hair more than 1,000% year-to-date!

Trending on Google Search. Bitcoin now garners 7-times more Google searches than Kim Kardashian. And it’s an international hot-topic, with the U.S. representing just the 8th-largest volume of search queries.

Non-investor interest. My wife is asking me about Bitcoin. She has no interest in investing, finance or economics.

New financial products. Both the Chicago Board of Options Exchange (CBOE) and the Chicago Mercantile Exchange (CME) will offer a Bitcoin futures contract, beginning December 10 and December 18, respectively.

Now, you might assume the Bitcoin mania can be kept in quarantine, so as not to infect the already animal spirits-prone psyche of stock market investors.

Sure, free-wheeling traders and speculators are naturally drawn to Bitcoin… just as they were drawn to internet stocks in the late ’90s. But real investors won’t fall victim to the craze… right?

Think again!

Consider this…

The S&P 500 is up a little more than 17% in 2017, and the average year-to-date return of all U.S. industries is around 12%.

Meanwhile, the SPDR Capital Markets ETF (NYSE: KCE) is up 27%!

That ETF is predominantly invested in the stocks of brokerage firms and financial exchanges – essentially, the “gears” of the Wall Street machine.

These include names like Interactive Brokers (IBKR), Schwab (SCHW), E*Trade (ETFC), and TD Ameritrade (AMTD), on the brokerage side. And the Intercontinental Exchange (ICE), Nasdaq (NDAQ), CME Group (CME), and CBOE Global Markets (CBOE) on the exchange side of the business.

While banks make profits on lending, and insurance companies on premiums, capital market players make most of their money on trading fees. The more you trade… the more they make.

Can you see where we’re going with this?

Trading volume in traditional stocks has steadily declined in the wake of the Great Financial Crisis.

Investors have largely kept to the sidelines or gone “passive,” leaving the capital markets firms’ “toll booths” with less activity than they were used to leading up to 2008, and certainly less than they enjoyed in the trader’s paradise of the late ’90s.

Of course, all this leaves them clamoring for a new, “hot” product to offer busy-bee buyers and sellers.

Something like, that’s right… Bitcoin!

As I said earlier, both the CME and the CBOE have gained regulatory approval to offer Bitcoin futures on their exchanges. And in true “introductory-offer” fashion, you can start trading Bitcoin for FREE!

The CBOE’s chairman and CEO, Ed Tilly, made the jubilant announcement yesterday:

“Given the unprecedented interest in Bitcoin, it’s vital we provide clients the trading tools to help them express their views and hedge their exposure. We are committed to encouraging fairness and liquidity in the Bitcoin market. To promote this, we will initially offer Bitcoin futures trading for free.”

Free Bitcoin trading! What could go wrong? Right!?

Bitcoin is an infantile market. So it remains to be seen whether real investors join in on the mania seeded by the early-and-brave crowd.

Bitcoin may prove to be the next cash cow for the brokerages and exchanges.

Or, it could just as easily end up being a big headache, eventually leaving them with a regulatory nightmare and the empty bag of a passing fad.

What’s certain is, throughout all of 2017, capital market stocks have enjoyed the speculative run-up in Bitcoin’s popularity and the possibility it would go “mainstream.”

Have a look for yourself…

The Chicago Board of Options Exchange (CBOE) will be the first traditional U.S. exchange to offer a Bitcoin contract. And while regulatory approval just came in, investors seem to have been looking forward to this day pretty much all year.

The Chicago Board of Options Exchange (CBOE) will be the first traditional U.S. exchange to offer a Bitcoin contract. And while regulatory approval just came in, investors seem to have been looking forward to this day pretty much all year.

With a year-to-date gain of 69.1%, shares of CBOE Global Markets (Nasdaq: CBOE) are up more this year than 485 stocks (97% of them) in the S&P 500.

Of course, the CBOE’s 69% rally may seem pale in comparison to Bitcoin’s 1,000% run. But, when appropriately judged against other common stocks, you have to wonder whether shares of CBOE have gotten ahead of themselves.

Often, it’s the anticipation of a “big deal” that drives stock prices higher, more so than the actual deal. If CBOE’s stock falls victim to Bitcoin’s bubble and investors’ tendency to “buy the rumor and sell the news,” it could be in for a disappointing drop.

That’s why I cautioned my Cycle 9 Alert subscribers on Tuesday against naively falling victim to the Bitcoin euphoria. And I showed them a creative way to potentially profit from the excessive excitement surrounding the CBOE’s introduction of Bitcoin futures.

So, while I won’t tell you what you can or can’t do with your own money… I’ll certainly encourage you, too, to approach this speculative market with a healthy dose of skepticism.

And if you’re interested in trading a proven strategy – one with a profitable track record much longer than Bitcoin’s – click here to gain access to my Cycle 9 Alert portfolio, which currently holds five profitable positions (of 5 total positions), averaging +73%.

To good profits,

Adam O’Dell

Editor, Cycle 9 Alert

The post Free Bitcoin Trading Next Week appeared first on Economy and Markets.

December 6, 2017

Would You Date Chicago?

Over the past decade I’ve dealt with a lot of teen angst. My three kids range from 19 years old to 24, so there have been thousands of stories – some first hand and some from their friends – about romantic relationships and friend drama.

Over the past decade I’ve dealt with a lot of teen angst. My three kids range from 19 years old to 24, so there have been thousands of stories – some first hand and some from their friends – about romantic relationships and friend drama.

Like any good parent, I jumped into such conversations in the early years, eager to share my wisdom and save the young souls from heartache. And, like most parents, I found myself roundly ignored until the relationship in question ended in flames.

Such things have thousands of unique details, but typically come back to the same basic principle. A person who has acted badly in the past is most likely to repeat that behavior in the future. They don’t change, no matter what they tell you. And no, you’re not different in their world, you’re simply next.

That’s a hard lesson. We all want to think that we’re special, and that when someone makes us a promise, they will keep it. When they don’t, even if they’ve broken promises to countless others before us, we’re hurt.

We should approach investments the same way, considering what company executives and business leaders have said and done in the past. With that as a guide, I’m guessing no one would buy the new bonds that the city of Chicago is about to peddle.

The city has a problem. Well, it has a lot of problems, including homicide and drug use. But I’m referring to fiscal issues, where civic leaders have overpromised city funds and underdelivered on securing the necessary bucks.

For over a decade their fallback position was to shortchange the pension system for city workers and teachers, leaving gaping holes of unfunded liabilities. To catch up, the city has squeezed more property tax blood from homeowners while requiring higher contributions from teachers and city workers.

It’s still not enough. The city runs a nine-figure deficit every year, and if it doesn’t meet ever-higher funding targets for the pensions, those retirement schemes will blow up.

To keep all the balls in the air, the city sells lots of bonds. As you might imagine, rating agencies don’t think too highly of these offerings, rating them somewhere between “Don’t sell them to your grandmother,” and, “At least they aren’t Detroit… yet.”

Because Chicago has shown a penchant for financial shenanigans, they pay higher rates of interest on their bonds. But now they have a new schtick. The city has carved out its sales tax revenue, some $660 million per year, and will issue bonds backed by that stream of income.

Suddenly the rating agencies are all smiles. They give the new bonds an AA rating, closer to that of the U.S. government than Venezuela.

But does the Windy City deserve it?

The rating only counts if the city stands by its word, using the sales tax dollars to pay the new bonds first, and then transferring what’s left to the general budget. And what about all the current bondholders, who (correctly) believed that the sales tax dollars were part of the funds available to pay off their bonds?

Now that the sales tax dollars are siphoned off, existing bondholders have to rely on a smaller pot of money from an already questionable borrower. If that sounds bad, it’s because it is.

City officials will quickly point out that the new bond dollars, issued at a low interest rate, will be used to pay off old, high interest rate debt, thereby saving the city money.

That’s true. Today.

What happens tomorrow? The city remains mired in pension debt, and even with the newfound savings will run a budget deficit for the foreseeable future.

It’s not hard to see a time when the city decides it must issue even more bonds, eventually overloading the fiscal boat, capsizing the entire system. Then all the players will find themselves in court, arguing over the dregs of the corpse, deciding who gets the juicy parts and who’s left with the burnt edges.

As investors in Detroit already know, and those who own Puerto Rico debt – both general obligation bonds and sales tax “COFINA” bonds – are finding out, once you get to financial divorce court, the books are already cooked. And you, the investor, were on the menu.

Whatever’s leftover goes to the friends and cohorts of the political players, namely the unions and civil service organizations. All the promises on paper mean nothing.

The best way to avoid this painful and expensive breakup is to never get involved in the first place, which is a piece of advice that’s easy to say and hard to do, even long after we’ve left our teenage years behind.

Rodney Johnson

Follow me on Twitter @RJHSDent

The post Would You Date Chicago? appeared first on Economy and Markets.

December 5, 2017

What’s a Crypto Worth?

I’ll be straight with you. When it comes to Bitcoin, I got nothing.

I’ll be straight with you. When it comes to Bitcoin, I got nothing.

For months, I’ve watched Bitcoin explode higher. And philosophically, there’s a lot I like about cryptocurrencies.

I like the idea of a viable currency that exists outside of government control and outside of the banking system. I like the fact that there is no central bank like the Federal Reserve to debase the currency, inflating away its value over time. And I like that Bitcoin and other cryptos – at least in theory – are anonymous.

But, back in 1998, I also liked the internet. That didn’t mean that it made sense to buy tech stocks with shaky business models at ludicrously high valuations.

The internet was the wild, wild west back in those days, and it showed unlimited potential. It seems almost quaint now, but back then Amazon.com was just an online bookstore, and a lot of investors who really ought to have known better considered Pets.com – with its ridiculous sock puppet mascot – to be a reasonable investment.

I don’t know that Bitcoin will meet the same fate as some of the high-flying tech stocks of the 1990s. But today’s crypto craze has some of the familiar characteristics of bubbles past.

One of my favorite bits of market lore is the story, possibly apocryphal, of how Joe Kennedy, the father of future president John F. Kennedy, avoided the 1929 stock market crash that preceded the Great Depression.

As the story goes, Kennedy immediately liquidated his entire portfolio after getting a stock tip from a shoeshine boy. As Kennedy saw it, if even the shoeshine boys are getting rich in the stock market, there’s no one left to buy… or more accurately, no sucker left to sell to.

I haven’t gotten any Bitcoin recommendations from shoeshine boys, but that’s mostly because it has been far too long since I’ve taken my boots in for a proper shine. They’re disgracefully scuffed up at the moment, and I really ought to have some self-respect and do something about that.

But more than a few Uber drivers and waiters I’ve come across have broached the subject of Bitcoin. And worse, I’ve had quite a few normally risk-averse investors – the proverbial widows and orphans – mention to me that they’d been dabbling in it.

This doesn’t mean it’s going to crash tomorrow, although last week Bitcoin topped $11,000 and then dropped 18% in a flash crash. I’d bet that it goes a good deal higher from here. It certainly has the momentum.

But this is far too crowded a trade for my liking. And it’s hard for me to assign a “value” to cryptos like Bitcoin because there is nothing to value it against.

Is Bitcoin expensive? Or cheap?

I have no idea, and neither does anyone else, despite what they might tell you. There are no “fundamentals.” They don’t exist. There’s no dividend… earnings… assets… There is literally nothing to tether its value to.

Of course, I’ve made similar arguments about gold in the past, as has Warren Buffett. According to the Oracle of Omaha, “The problem with commodities is that you are betting on what someone else would pay for them in six months. The commodity itself isn’t going to do anything for you. … It is an entirely different game to buy a lump of something and hope that somebody else pays you more for that lump two years from now than it is to buy something that you expect to produce income for you over time.”

But at least in the case of gold, there are some industrial uses. And it’s ornamental. It may or may not be the one true and timeless currency (I’ll let the gold bugs debate that), but it seems to make my wife happy when I buy it for her.

And, frankly, gold bullion in your backyard is a lot more anonymous than cryptocurrency held in an online wallet (the IRS is actively pursuing Coinbase in court to get the online wallet company to reveal the wallet owners). And gold will never disappear due to hard-drive failure or a lost password.

Never mind the fact that Bitcoin isn’t really a “currency,” per se, as no one is spending it right now. Its enthusiasts are hoarding it or trading it as an investment asset, not as a spendable dollar replacement. That alone should dampen any enthusiasm that Bitcoin is blazing a trail to a new anarcho-libertarian utopia. Sorry guys. I read Atlas Shrugged in college too, but that’s not what’s unfolding here.

So again, I’m sitting this one out for now.

But if you’re feeling the itch to trade, go for it.

Seriously, don’t let me stop you. As I said earlier, Bitcoin and other cryptos are where the action is these days. And like all bubbles, it’s likely to go a lot higher than anyone – even most of the bulls – believes possible. Dot-com mania was no less ridiculous in the late 1990s than Bitcoin is today, but that didn’t stop a lot of people from making a lot of money.

Just be sure you don’t become a true believer and drink the Kool-Aid. If you buy Bitcoin, do so with the mentality of a trader, and don’t fall in love with it. Be willing to sell when the time comes. Have a trading system and stick to it.

Speaking of that, I was recently discussing trading systems with my friend Richard Smith, founder of TradeStops, and Bitcoin came up in conversation. Richard had some insights as to when to enter and exit a Bitcoin trade based on its historical volatility.

It won’t guarantee you make money in the trade, but you can bet it will keep any losses within acceptable limits. If you’d like to hear more, click here.

And as a side note, Rodney wrote at length about Bitcoin in the December issue of Boom & Bust and had an interesting way to play the crypto craze. Rather than invest in Bitcoin, Rodney found a way to invest in the underlying blockchain technology, which has incredibly useful applications in finance, medicine, and real estate. And probably plenty of other places that no one has thought of yet.

Much as we still continue to benefit from the internet nearly two decades after the first wave of dot-com startups blew up, we’ll likely still be benefitting from the blockchain long after Bitcoin bites the dust.

Charles Sizemore

Editor, Peak Income

The post What’s a Crypto Worth? appeared first on Economy and Markets.