Harry S. Dent Jr.'s Blog, page 70

November 7, 2017

Napoleon’s Dream Will Ultimately Drive the Dollar

The European Community is a stultified, lumbering mass of bureaucracy. It’s fitting that the organization operates from Belgium, a country frozen in time because of political infighting.

The European Community is a stultified, lumbering mass of bureaucracy. It’s fitting that the organization operates from Belgium, a country frozen in time because of political infighting.

The European Community, which aims to bring economic integration among its member states, is also something else – a resounding success.

It started in 1957 with founding members Belgium, France, Italy, Luxembourg, the Netherlands, and West Germany, and eventually 12 nations were incorporated into the European Union in 1993.

They stopped killing each other, live under common rules, and many share a currency. This was Napoleon’s dream about a century and a half earlier, even though he couldn’t make it happen.

But now the weak links in the chain, like Spain, Italy, and Greece, are starting to give way. Eventually they will fail, even as member nations and the transnational organization spend time and treasure to keep the group intact.

As that happens, the euro will lose some of its luster, driving investors back to the buck.

The Napoleonic Wars began in 1803 and lasted more than a decade, drawing in many European nations on both sides. While the Americans were busy establishing their new country and fending off the British in the War of 1812, the Europeans played unwinnable war games that left everyone damaged and in debt.

There were so many large-scale wars during this period that historians don’t name them all. They simply refer to them as successive versions with different coalitions. The years of continental war ended with the seventh coalition at the battle of Waterloo, which led to the Treaty of Paris in 1815.

But for a brief moment in time, Napoleon ruled most of Europe. He de-emphasized the Catholic Church and fiefdoms, enforced the rule of law, and increased trade. He brought ideas of individual rights to areas of Eastern Europe. But he still did it through force, and was still a foreigner, so it was bound to end.

After the Napoleonic Wars, Europeans continued to squabble. Using Wikipedia, I counted 21 different wars involving at least two European nations from 1815 through 1899. Even though they’d begun to consider individual rights and liberties, they were still killing each other.

And that’s before the World Wars.

Cooler heads prevailed in 1951 when the next Treaty of Paris was signed. It created the European Coal and Steel Community, providing a multi-country framework for trade involving two of the main resources needed for reconstruction. The treaty also tied together the economic fortunes of France and Germany, greatly reducing the chances of war.

The next step in European cooperation was the Treaty for European Economic Community in 1957, which put the region on the path to where it is today, a conglomeration of 28 countries that allow for the free flow of people, capital, and goods, where most also share a common currency.

The drums of war are faint. No one thinks the Germans are entertaining ideas of taking territory from France, and the Italians aren’t looking to pick a fight, either.

Today the arguments come down to one thing – money.

The Germans think they share too much of the economic burden of the group, while the Greeks believe they have good reason to repudiate their debts. The Italians and the Spaniards are hoping no one looks too closely while their banks lumber along with bad debts that arguably outstrip their capital.

And that’s just on the international level.

Internally, as has come to the fore recently, the Catalans want to leave the Spanish fold and the Lombards and Venetos want greater autonomy from the Italian central government.

The common cry is that these wealthy regions pay more into the federal system than they get in return. Even the Flanders are getting feisty in Northern Europe.

The current calls for greater independence show just how far the Continent has come.

Small regions have no fear of invasion or oppression if they gain true autonomy.

Their government officials only seem concerned with trade and capital, implying we’ve reached a point where divisions are reduced to matters of commerce.

Maybe, maybe not.

There’s still security in large numbers, and combining forces with those of similar (although not identical) cultural norms and views remains the best way for preserving our different ways of life.

But back to the Europeans…

As they travel farther down their different roads, ever diverging from the singular path, they erode some of the power amassed by joining together. Trade and travel arrangements will become more cumbersome, and they will chip away at their international standing.

The biggest potential loser is the euro, which was conceived to fight the dollar. As nations in the economic bloc pull away from the center, fracture internally, or both, the common currency will lose some cache.

The greenback will be there to pick up the slack.

In a way, the incredible security felt across Europe, which feeds demands for greater independence and local control, will eventually lead to weaker ties and a diminished economic standing, complete with a tarnished currency, compared to the dollar.

Rodney Johnson

Follow me on Twitter @RJHSDent

The post Napoleon’s Dream Will Ultimately Drive the Dollar appeared first on Economy and Markets.

November 6, 2017

Happy (Belated) Guy Fawkes Day

Remember, remember the Fifth of November,

Remember, remember the Fifth of November,

The Gunpowder Treason and Plot,

I know of no reason

Why the Gunpowder Treason.

Should ever be forgot.

Guy Fawkes, Guy Fawkes, ’twas his intent

To blow up the King and Parli’ment.

Three-score barrels of powder below

To prove old England’s overthrow;

By God’s mercy he was catch’d

With a dark lantern and burning match.

Hulloa boys, Hulloa boys, let the bells ring.

Hulloa boys, hulloa boys, God save the King!

–Traditional English nursery rhyme

Yesterday, November 5, was Guy Fawkes Day. While it doesn’t get a lot of press on this side of the Atlantic, it really should.

It’s the day that the English remember one of their most notorious villains (or one of their most celebrated heroes, depending on their mood or ideological leaning).

In the early hours of November 5, 1605, Fawkes was found hiding under the House of Lords with a cache of gunpowder large enough to turn the building into a pile of rubble. He had planned to take out the entire English government — king, ministers, parliament and all — during the State Opening of Parliament. Now that’s one way to cut government spending!

Fawkes was tortured and executed, of course. Kings tend to frown on attempted assassinations, after all. But he is remembered, in typically dry English humor, as “the last man to enter parliament with honest intentions.”

Today the English celebrate Guy Fawkes Night with fireworks displays and by burning effigies of Fawkes or of contemporary political figures… but it’s always a little ambiguous as to whether they’re celebrating the foiling of the gunpowder plot or the spirit of rebellion behind it.

More than anything, it’s an excuse to have one too many beers and light things on fire… something that every red-blooded American should appreciate.

It’s pretty frustrating to follow politics these days. We’re 10 months into a new administration, and there has been a lot of drama suitable for reality TV… yet very little real policy progress. Healthcare remains unreformed and as unaffordable as ever, and even corporate tax reform – which should be an easy slam-dunk with Republicans in control of both the White House and Congress – appears to be getting bogged down.

And not to throw the Republicans under the bus here; the Democrats haven’t exactly been models of maturity and responsible governance either. They seem to prefer rolling around in the muck with Trump to coming up with sensible policy alternatives.

But as tempting as it might be, I’m not going to recommend that you follow Guy Fawkes’ lead by putting barrels of gunpowder under Washington D.C. and lighting the fuse. (And let me tell you, it is tempting…) That’s the sort of thing that will get you locked up in Guantanamo for the rest of your life.

Instead, I invite you to turn off the cable news and focus on something far less depressing – like making money.

Stocks are expensive today, as I wrote back in early October, and we are very likely in late stages of this bull market. But stocks were also ridiculously expensive in late 1996 when former Fed Chair Alan Greenspan warned of “irrational exuberance,” yet the S&P 500 still proceeded to nearly double again before finally crashing in early 2000. Some of the best profits come at the tail end of the bull market, when the fear of missing out is the strongest.

That’s why we remain fully invested in Boom & Bust. As I write this, we’re up nearly 80% in one of our long-term thematic picks, and up nearly 40% in another.

I’m continually raising our stop-losses, as I have no intention of getting greedy and letting those gains slip away. Eventually, this market will crack, and it won’t be pretty. But, for now, this is a raging bull market, and we’d be fools not to take advantage of it.

Enough about business. Here’s a belated happy Guy Fawkes Day to all of the libertarians, anarchists and other assorted good-hearted ne’er-do-wells out there. I hope you didn’t get in too much trouble.

Charles Sizemore

Portfolio Manager, Boom & Bust

The post Happy (Belated) Guy Fawkes Day appeared first on Economy and Markets.

November 3, 2017

And Trump’s Pick for Fed Chair Is…

Like I said in Nashville, I don’t believe any of the choices for Federal Reserve Chair will matter in the short run. Whoever leads the Fed will have to be able to form a consensus with the 12 Fed presidents and the Board of Governors. They won’t be able to foist big changes on policy when they take the reins.

Like I said in Nashville, I don’t believe any of the choices for Federal Reserve Chair will matter in the short run. Whoever leads the Fed will have to be able to form a consensus with the 12 Fed presidents and the Board of Governors. They won’t be able to foist big changes on policy when they take the reins.

Going into Thursday’s formal announcement, the front-runner for the job was Jerome Powell, who currently serves on the Board of Governors and is a current voting member of the Federal Open Market Committee (FOMC). He served in the George H.W. Bush administration, and prior to that, he worked as a lawyer and investment banker.

President Trump officially nominated him for the position yesterday afternoon.

Powell is the first Fed chair in 40 years not to have earned a Ph.D. in economics. He’s a lawyer by trade – but maybe that’s not so bad considering the former chair’s confusion over what drives inflation! Of course, Powell admitted that inflation was below target and that it was a mystery as to why in an August CNBC appearance.

Powell is a Republican, but he was appointed to the Board of Governors by President Obama. And, according to required financial disclosures, his net worth is in the range of $21 million to $61 million, which makes him the richest Fed chair ever.

So much for Trump’s promise to “drain the swamp!”

Hidden in Plain Sight: “Phase A” Companies Soar!

They’ve been around for years, but most people have no idea how to collect a “Phase A” payout.

However, a 20-year Wall Street insider is now revealing how to spot the hidden tags that ID the exceptionally profitable companies handing them out.

Which to buy… which to avoid… and better yet, which ones are poised to mimic historical gains as high as 3,221% over the coming years!

Click here for details essential to the future of your wealth.

Remember early last year, when candidate Trump accused the Fed and Chair Janet Yellen of keeping interest rates artificially low to help fellow Democrats in the previous administration?

President Trump’s tune changed, as he recently said that he thinks Yellen’s done a good job. So, even though he didn’t reappoint her, his choice suggests that it’s just politics as usual.

As Fed chair, Powell will most likely continue the same policies of slow and deliberate normalization of both the balance sheet and interest rates.

More importantly, when the economy inevitably slides into a recession, Powell will most likely resort to quantitative easing, as his predecessors did. That’s not all that comforting a though, as he even admitted last year that QE didn’t stimulate the economy as much as the Fed though it might. That’s why, he explained, the Fed has been so slow to increase interest rates.

So, Jerome Powell is President Trump’s pick for the next Fed chair. That means monetary policy won’t change much in the short or even the medium term. The markets seem happy with the choice, and Treasury rates have dropped over the last few days because Powell was widely expected to be the choice.

Now we’ll just have to wait and see if the Senate will confirm him.

You can prepare and profit from surprises in the financial markets, and specifically in the Treasury bond market with Treasury Profits Accelerator.

Good investing,

Lance

The post And Trump’s Pick for Fed Chair Is… appeared first on Economy and Markets.

November 2, 2017

Should You Be In Or Out of This Market?

I have a lot of empathy for investors these days.

I have a lot of empathy for investors these days.

It feels like we’re in one of those “damned if you do, damned if you don’t” sort of situations.

Stock valuations are high after eight years of bullish trends. But bonds yield next to nothing. And many would argue that the geopolitical climate has never been more fragile and unsettled.

The action-oriented question all investors are struggling with is:

How do we make money, today, while also guarding against an ever-uncertain tomorrow?

My answer to that isn’t sexy. But it IS actionable.

You see, successful investing requires a healthy balance of patience and action.

As I told my Cycle 9 Alert readers recently, Wall Street’s “-isms” can lead you down a bad road if you take the advice to extremes.

For instance, consider these competing nuggets of wisdom:

“Cash is a position,” and

“You’ve got to be in it to win it.”

The former implies that being out of the market (i.e. “in cash”) is OK. The latter implies that if you aren’t fully invested, somewhere… you aren’t really an investor.

So, which is it?

I’ve learned over the years that a “middle-ground” option is usually more favorable to the extremes.

For my Cycle 9 readers, that means staying fully invested most of the time (we adhere to trend-following risk management rules)… keeping a diversified portfolio… and limiting time exposure to any one trade.

It also means we don’t force new trades, just for the sake of trading. As I told readers last week, “Sometimes the best trade is no trade.”

As I said, successful investing requires a healthy balance of patience and action. Waiting patiently for the right opportunity to get into the right investment is almost always rewarded.

But the balance between patience and action doesn’t just apply to the buy side of the equation.

Every good trade is made of a good buy and a good sell.

That’s why you shouldn’t take “hot stock tips” – the guy or gal who gave it to you won’t be around to tell you when to sell, so their advice is useless, at best, or harmful, at worst.

I designed Cycle 9 Alert to give crystal clear buy signals… and a well-defined exit plan, allowing us to balance patience and action.

But the mixed signals from the financial industry don’t stop at when you should or shouldn’t buy into the market. It extends to what you should do with your current positions.

You might have heard the phrase, “You can’t go broke taking profits.”

How about, “Let your profits run”?

So which is it?

I’m sure you can remember a stock you sold for a nice profit… only to see the rally continue on without you. Just as sure as I bet you can remember a stock you sold for a nice profit… very close to its peak.

The point is, the decision to take profits can cut both ways. Sometimes you’re glad you did. Other times you’ll regret it.

Again, I’ve found the best success in a common sense, “middle ground” approach.

My research shows there’s a high-probability, high profit-potential “sweat spot” following my Cycle 9 algorithm’s buy signals. It lasts for two to four months.

After that window of time, the chance of continued success drops to 50/50 – odds we’re happy to leave to other investors.

That’s why our protocol calls for taking half of our profits after one or two months, if we’re able… then closing the full trade after three or four months, regardless of the outcome.

Doing this allows us to routinely capture the “meat” of strongly profitable moves without overstaying our welcome, so to speak.

Essentially, we strike a healthy balance between “you can’t go broke taking profits” and “let your profits run.”

And this approach is my action-oriented answer to the question we began with:

How do we make money, today, while also guarding against an ever-uncertain tomorrow?

Continuing to trade with the still-bullish trend resolves our requirement for patience and bravery, which we need to make profits in risk assets.

Taking our profits (or cutting losses, when occasionally necessary) after two to four months meets our requirement to manage risk and adapt to changing market conditions.

This balance of patience and action has worked out quite well in the six years I’ve been running Cycle 9 Alert.

In early March, for instance, I recommended a bullish play on a European stock ETF (FEZ). Shares of the ETF climbed 15.4% during our three-month holding period, handing us a 213% profit on our options trade.

It was tempting to hold out longer for even bigger gains, but my system said it was time to sell… and so we sold.

Now, almost five months after our exit, shares of FEZ have just drifted sideways.

The point is… we caught the “meat” of the move, locked in our profits, and moved on.

We struck a healthy balance between patience and action.

Adam O’Dell

Editor, Cycle 9 Alert

Follow me on Twitter @InvestWithAdam

The post Should You Be In Or Out of This Market? appeared first on Economy and Markets.

November 1, 2017

The Fourth Cycle

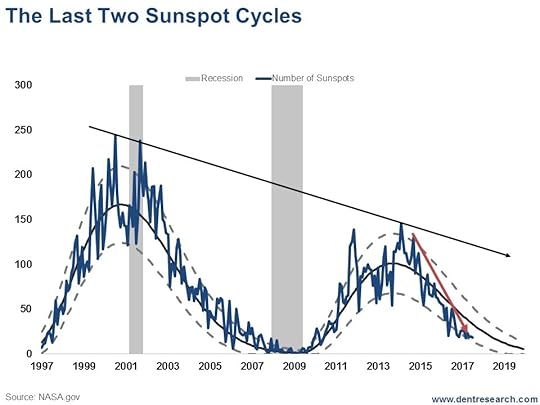

One of the hardest things I’ve had to stake my name to was the concept of how sunspot cycles ebb and flow about every 10 years and the effect they have on our economy and stock markets…

One of the hardest things I’ve had to stake my name to was the concept of how sunspot cycles ebb and flow about every 10 years and the effect they have on our economy and stock markets…

I’ve already got the label of “crackpot,” so giving skeptics more meat to chew on was tough. I did it anyway because I’d done my research (as I always do) and knew that we’ve had major or minor recessions about every 10 years!

They occurred in the early 1960s, early-to-mid 1970s, early 1980s, early 1990s, early 2000s, and between 2008/2009.

Another is due just ahead, between 2018 and 2020 by my forecasts.

This isn’t coincidence. There’s something behind this: sunspots.

Ned Davis, a great cycles guy, came up with the Decennial Cycle, which forecast that the first few years of every decade would see recessions and minor or major stock crashes.

I followed his cycle for decades, and it worked…

Until the early 2010s.

That’s when I expected we’d see a large crash, given the massive peak of the Baby Boom spending cycle in late 2007.

Yet we only got a minor crash into late 2011. There was a large crash from late 2007 into early 2009, but not on this cycle.

So, I went back to the drawing board.

What had gone wrong?

What had I missed?

While working on this problem, I came across an article in Barron’s, written by one of the largest fund managers at PIMCO. He was touting the sunspot cycle, saying how it had saved him from the 2000-2002 tech wreck.

I dug into this phenomenon, which scientists can track back to the 1600s accurately, and I found that 88% of the recessions back to the mid-1800s (where there is good data) occurred in the downside of these sunspot cycles!

Damn!

And better, 100%, 11 out of 11 major financial crises, occurred in the downside of this cycle – like the one I’m forecasting just ahead.

In short: Ignore this cycle at your peril.

Sunspot cycles are simple: sun and energy.

The more there is, the better people feel, just like sitting on the beach and soaking it in energizes us.

The less sun and energy there is, the more depressed people feel. Just hang out in Seattle during the long rainy season if you want a taste of this.

That’s why, despite other more fundamental cycles, people will be more bullish in a rising sunspot cycle than a declining one. There is literally, on average, 20% more radiation (and rainfall from evaporation) at the top of such cycles than at the bottom.

After many months of documenting past correlations, I finally presented this to our best audience at one of our annual Irrational Economic Summits.

The reception was skeptical, to say the least.

Then an emergency room nurse stood up. She and her policeman husband, she said, clearly observe the spike in erratic behavior, crimes, and accidents during the extra light reflected just during a full moon!

That’s when the audience started to take me seriously!

The sunspot cycle can oscillate between eight and 14 years. That makes this one of the more challenging cycles to implement into my hierarchy. It’s not as clock-work as most of the others. But that’s OK because scientists are very good at predicting this cycle!

Here’s an update on the last two sunspot cycles…

The last one peaked in March of 2000, right at the top of the tech bubble! There was a first crash into late 2002 and then the Great Recession from 2008-2009 came at the very bottom of that cycle.

The last one peaked in March of 2000, right at the top of the tech bubble! There was a first crash into late 2002 and then the Great Recession from 2008-2009 came at the very bottom of that cycle.

And it’s typical to see recessions and stock declines right after the peak, or near the bottom.

The sunspot cycle into the next top, in February 2014 was the most extreme I’ve measured, clocking in at nearly 14 years long.

That’s what threw off Ned Davis’s Decennial Cycle in the early 2010s.

The most recent sunspot cycle didn’t see the normal crash just after the peak thanks to unprecedented central bank QE and stimulus.

But you can see that we’re now quickly approaching the low end of this cycle starting in late 2017… the same place where the last Great Recession hit from early 2008 into mid-2009.

Now this cycle is projected, by the best scientists, to bottom around early 2020 or so.

That’s when my Geopolitical Cycle and the worst of the Baby Boomer’s Spending Wave bottoms!

My point here is this: If we’re going to see a major downturn and bubble burst, it will come between now and early 2020 or so.

That’s when you need to protect your assets.

Harry

Follow me on Twitter @harrydentjr

The post The Fourth Cycle appeared first on Economy and Markets.

October 31, 2017

How to Keep Your Retirement Years Golden

I got a nice reminder of why I do what I do a few weeks ago when I met my dad for dinner.

I got a nice reminder of why I do what I do a few weeks ago when I met my dad for dinner.

As we sat down to eat, I could tell there was something he wanted to tell me, but he didn’t want to just blurt it out. But, after a few minutes, he couldn’t wait any longer.

“I spoke to your sister earlier today, so she’s already gotten the news. I’ve decided it’s finally time,” he said. “I’m going to retire at the end of this year.”

This news didn’t come as a total surprise. He’s talked about hanging up his hat for a couple years now, and he’s definitely an appropriate age for retirement. But I could tell that he really struggled with the decision. This was not something he chose to do on a whim.

I could also tell that he was apprehensive about it.

He’s in a good spot financially. He lives modestly. He’s paid off his house, he’s already drawing Social Security, and he’s accumulated a decent nest egg over a lifetime of work.

But walking away can be psychologically difficult, particularly for men, who tend to base their identity and sense of self-worth around their careers. When they quit working, they often have a hard time figuring out what to do next.

It’s a major step into the unknown… and it’s scary.

When you’ve been gainfully employed for nearly 50 years, it’s jarring to suddenly have your primary source of income dry up. And this isn’t the 1970s.

Very few Americans enjoy the security of a traditional pension. They’re on their own at a time when the yields on bonds, CDs, and most dividend stocks are near all-time lows.

So, again, this is why I do what I do: analyzing, thinking, and writing about the markets. There are tens of millions of Baby Boomers approaching that same fork in the road that my father just reached. If I can make that transition into retirement a little easier (and a little more comfortable), then I’ve done my job.

I write Peak Income, my income-based investment newsletter, under the assumption that you could put your entire retirement nest egg in the plan.

I try to manage the risk in such a way that, were you to invest your total portfolio in Peak Income’s recommendations, you wouldn’t be at risk of taking major losses. And indeed, right now, 20 of our 23 positions show positive returns.

But I would never recommend you put your entire portfolio in any single strategy, no matter how much I like it, because I’ve been doing this long enough to know better.

Even investing gods like Warren Buffett and George Soros are humble enough to spread their bets among different strategies. It would be reckless not to.

So, with that said, where does Peak Income fit into the mix?

My rule of thumb is 20% to 25%. I recommend limiting your exposure to one single strategy to no more than about 20% to 25% of your portfolio. This isn’t a hard, scientific number. But it is a level I consider prudent.

The investments I recommend in Peak Income are generally quite safe, particularly given how tight I keep our stop-losses. Chances are good that we’ll never take a large loss.

But, like anything that trades on the stock market, they’re prone to occasional bouts of volatility. And, as we saw in 2008, no matter how much research you do, there can always be some new risk that comes out of the blue.

So, again, this is why it makes sense to diversify, and not just among stocks or funds within a portfolio. You should also diversify among strategies.

Speaking of that, I’m hoping to have some good news to report within the next few months.

I’ve already hinted a few times that I’m working on a new project for my readers, coding out a new model that combines the best of value investing with the best of momentum investing.

Early results look very promising, and I hope to have an announcement soon.

Charles Sizemore

Editor, Peak Income

The post How to Keep Your Retirement Years Golden appeared first on Economy and Markets.

October 30, 2017

The End of the Road for Tesla?

Tesla, the nifty electric car company, and its larger-than-life founder, Elon Musk, proved something.

Tesla, the nifty electric car company, and its larger-than-life founder, Elon Musk, proved something.

People around the world will pay gobs of money for very cool electric cars, even if they have limited range and take forever to charge. Americans in particular love new gadgets, and Teslas are the biggest gadgets of all.

Musk and company also proved something else.

Investors love a story.

We ache for far-reaching dreams based on beating the odds and a cowboy, go-it-alone point of view. Nothing says “I see the future and you don’t” like driving a Tesla.

But dreams don’t come cheap.

Musk plowed a chunk of the fortune he made from building PayPal into his new venture, and has sold a lot of equity shares in Tesla. He’s also tapped the debt market.

Tesla now owes just under $10 billion to bondholders.

That’s a pretty big nut for a company that loses money on every unit sold. Something about making it up on volume comes to mind.

Unfortunately for Tesla, the world doesn’t stand still.

Chevy made the ill-fated Volt to compete in the electric car market, and when that failed it rolled out the Bolt to similar acclaim, or lack thereof. I know Ford makes an electric car, but it’s so boring I can’t remember the name. I guess I lack focus.

Nissan, an early player in the space, offered the most practical, if unloved, Tesla competitor. It’s called the Leaf.

None of these early misadventures have any hope of grabbing the attention of too many new car buyers, but their offspring will…

From Volts, Bolts, Focuses, and Leafs, we’ll get new versions of electric cars from major auto companies that solve the riddles of range anxiety and charging time, all in packages that, while probably not Tesla-inspired, still look good enough to drive every day with pride.

And they’ll be offered at prices comparable to their internal engine combustion counterparts… that should send shockwaves through the Tesla crowd.

The tough road ahead for Tesla is part of a larger energy story. It’s what I discussed last month at our Irrational Economic Summit in Nashville.

We’re on the cusp of moving to a world based more on electricity than internal combustion, and not because we’re worried about pollution or the scarcity of fossil fuels.

Instead, the shift is happening because we’re making strides in energy storage, specifically batteries.

As we improve our ability to efficiently store energy, we exponentially expand our possible uses of electricity. We targeted this theme in June of last year in our flagship newsletter, Boom & Bust, and our stock recommendation has since gained north of 70%.

The current state of the art for rechargeable consumer batteries is lithium-ion, which uses a liquid solution as the medium separating the positive and negative ends of the battery.

Your cell phone has a lithium-ion battery. So does your laptop.

A Tesla carries roughly 7,000 of the little power packs. They can be charged thousands of times, and hold a good chunk of energy, but we need more.

Toyota thinks they’ve found a better mousetrap.

The Japanese automaker claims to have perfected a solid-state version of the lithium-ion battery, which should be smaller and lighter, while storing more energy and taking just a few minutes to charge. This all comes as the price per kilowatt hour continues to fall, bringing the cost of electric cars closer to that of vehicles that run on gasoline or diesel.

If Toyota has cracked the code for such an advance, then it can be widely applied. We can use the new batteries in cars, vacuum cleaners, phones, semis, boats, lawn mowers, everything.

And, luckily, we’ve got a new-found source of cheap electricity to power it all: natural gas.

Imagine generating power through hyper-efficient natural gas plants, using dirt-cheap fuel recovered through fracking, and then storing all that power in cost-effective batteries large and small nationwide.

It would be, or rather, will be, an energy revolution.

It won’t happen overnight.

Gasoline-powered cars aren’t slowly rolling to the junkyard. But it will happen.

And along the way there will be plenty of winners and losers. GM, Ford, Toyota, and Nissan will most likely gain a new lease on life, giving consumers that weren’t in the market for a new ride a reason to visit the showroom.

But other producers, like Tesla, will find it hard to compete.

The company has a beautiful product, but can it be more than a niche player when its competitors have global supply lines, thousands of dealers, and gobs of cash on the books?

Maybe.

Perhaps, as the cost per kilowatt drops, Tesla will turn the corner on profits. But, at that point, it’s just another upscale car in a crowded market.

When your choice of posh electric rides expands from one, a Tesla, to many, such as Mercedes, Porsche, Bentley, BMW, and every other nameplate, it’s possible, just possible, that Tesla takes a backseat.

Repaying $10 billion could take a long time.

Rodney Johnson

Follow me on Twitter @RJHSDent

The post The End of the Road for Tesla? appeared first on Economy and Markets.

October 27, 2017

Can We Live Without a Central Bank?

It’s no secret that I’m not a big fan of the Federal Reserve. In fact, I said as much just a couple weeks ago in Nashville, Tennessee, at the Irrational Economics Summit.

It’s no secret that I’m not a big fan of the Federal Reserve. In fact, I said as much just a couple weeks ago in Nashville, Tennessee, at the Irrational Economics Summit.

Our central bank has been around our entire lives (well, unless you’re over 100 years old!), and many believe it’s a necessary evil, like paying taxes and tolerating our government.

Since its inception, Fed officials have led us to believe that its main functions are regulating banks, deciding on monetary policy to help guide the economy through booms and busts, and keeping the financial system chaos-free. Its purposes are, of course, in the public’s best interest.

Well, if you’re convinced that’s true, the Fed’s strategy worked.

The Fed isn’t a government agency, and it sure wasn’t created in your best interest. (Especially if you consider how close we are to economic downfall.)

Before the Federal Reserve System was created in 1913, there were three failed attempts to launch a central bank in the U.S.

They all failed because the money they created out of nothing was for the sole purpose of funding the government. This led to high inflation and resulted in a currency of dubious value. The public realized that notes issued by those central banks declined in value, and then sentiment for the central banks evaporated.

Thomas Jefferson, one of the Founding Fathers and the third President of the U.S., was a vocal critic of central banking. He argued that it was unconstitutional, and that even if it were, it would lead to the nation’s ruin.

Jefferson’s second term ended in 1809, and the end of the second attempt at a central bank followed two years later.

But it didn’t take long for Congress to intervene after the War of 1812 and start the Second Bank of the United States, the third try at a central bank on these shores. This time, Congress gave the bank the mandate to provide a stable currency, which ushered in monetary policy for the first time.

And, after creating high inflation in the first couple years by issuing notes to the U.S. government, the bank was forced to “put the brakes on inflation” by severely tightening lending requirements. That sent the economy into a major depression.

Our seventh president, Andrew Jackson, was much like Jefferson, as he was against central banking here in the U.S. He saw firsthand the inflation the central bank created and resulted in putting the nation’s economy into a depression. Jackson also believed the bank was unconstitutional. But the tipping point was his objection to the fact that the bank had major foreign ownership and influence.

Jackson won reelection by a landslide in 1833, vetoed legislation to renew the central bank’s charter, and finally ended central banking. Two years later, he paid off the national debt. That’s a feat that hasn’t been accomplished since!

Believe it or not, the United States survived and thrived for nearly 80 years without the help of a central bank.

Then the Panic of 1907 happened, which saw a stock market crash as well as bank failures. A few very powerful bankers and politicians saw an opportunity (they always do): to harness the anger created by the panic and whip up support for monetary reform.

In 1910, six men who represented as much as a quarter of the entire world’s wealth met in secret to formulate a plan to stop growing competition in banking by taking control of reserve requirements and obtaining a monopoly over the nation’s currency while transferring the risk to the taxpayer.

But, first, they had to convince Congress that the plan was to protect the public.

I’m not sure how they convinced Congress that protecting bank profits and transferring the risk to the taxpayer is protecting the public. But, 104 years later, we still have the Federal Reserve System acting in the public interest…

Actually, I’m pretty sure that Congress saw the benefit of having the ability to raise money created out of nothing without having to raise taxes! Whether our representatives actually believed that it was in the public’s best interest is another question altogether.

Despite what Janet Yellen said earlier this year – that she doesn’t believe we’ll see another financial crisis in our lifetime – the Fed has no control over economic booms and busts.

In the 80 years without a central bank, there were 19 (panics, recessions, and a depression). In the 104 years with our current central bank, there was the Great Depression and 18 recessions, including the Great Recession of 2007-09.

The big difference is that now the Fed is bailing out banks and protecting bank assets by rescuing major corporations while putting it to the taxpayer. It all makes for a pretty bleak picture, something Harry’s been hammering for a while now. If you missed his recent video, check it out here.

You can prepare and profit from surprises in the financial markets, and specifically in the Treasury bond market, with Treasury Profits Accelerator.

Lance Gaitan

Editor, Treasury Profits Accelerator

The post Can We Live Without a Central Bank? appeared first on Economy and Markets.

October 26, 2017

Brad Pitt or Emilio Estevez: Picking The True Hot Stocks

If you had to invest in a movie, would go in on a film starring Brad Pitt of Emilio Estevez?

If you had to invest in a movie, would go in on a film starring Brad Pitt of Emilio Estevez?

If you’re like most people, you’d say Brad Pitt. He’s a huge star! It doesn’t get any bigger than Brad Pitt. Why not hitch your wagon to the Brad Pitt express? As for Emilio Estevez, is he even acting anymore? Is he a bartender at the local pour house?

Well, you’d be surprised to find out that Brad Pitt is the least profitable actor in Hollywood. Yep, that’s right! A recent study by PartyCasino that looks at the box office receipts of movies back to 1980 shows Pitt is a total dud, returning just $0.10 for every dollar budgeted for his films.

Robert De Niro and Johnny Depp aren’t too far behind. They’re sort of like the FAANG actors of Hollywood. There’s plenty of hype surrounding them, but also dubious returns, and, often total headaches too.

The FAANG stocks (Facebook, Apple, Amazon, Netflix, and Google) remind me of Brad Pitt. The Brad Pitts of the stock market appear sexy and receive all of the glossy press. They have good hair. They dress nicely. They look like they should be super profitable. But, at the end of the day, those stocks are more like horror movies than big-budget blockbuster action thrillers.

It often ends badly.

Remember the Nifty 50 stocks?! The Eastman Kodaks and the Polaroids of the world? How about the Four Horsemen of the Internet? Many of those stocks have either imploded or have ceased to exist. They sure looked good, right? They were the Brad Pitts of their time.

According to research from the investment bank Jefferies, just 14 stocks accounted for 20% of the stock market’s gains since 1924. Most of them are household names like General Electric Co. (NYSE: GE), Johnson & Johnson (NYSE: JNJ), and Wal-Mart Stores Inc. (NYSE: WMT). Few of the hot stocks of the past have made it into the upper echelon of the stock market. Most are Johnny Depps and are barely profitable.

Just as I avoid Johnny Depp movies like the plague, I avoid Johnny Depp stocks.

I search for hidden profits among companies that may not be household names. Often, they’re hidden in plain sight.

At Hidden Profits, we’re looking for the Rose Byrnes and the Regina Halls of the market. These are the two most profitable female actors since 1980. Truth is, I couldn’t pick them out of a lineup. I enjoy movies, especially documentaries. While Rose Byrne’s name rings a bell, I really have no idea who she is.

But she’s been hidden in plain sight for years. Her movies are uber profitable.

And, as I point out right off the bat, Emilio Estevez is the most profitable male actor. Let me say that again:

Emilio Estevez is the most profitable male actor in Hollywood!

And that’s without a fraction of the hype and headlines that someone like Brad Pitt gets. So how do we go about finding the Rose Byrneses and Emilio Estevezes of the stock market at Hidden Profits?

First, we focus on companies that pay you, the shareholder, first. Many CEOs and CFOs are in it for themselves. They have big mansions to fill with goodies. They need to extract as much as they can from the companies they manage. But not all management teams are like that (no, seriously). There’s a handful of operators that return cash to shareholders with a dump truck.

That’s where we start our focus. We also want them to have incentives aligned with shareholders. The better they do for us, the better they do for themselves. Many of these management teams have incredible long-term track records and significant ownership in the companies they manage.

Next, they have good earnings quality. We don’t want management teams pulling the wool over investors’ eyes to hide deterioration in their business. Every business experiences a bump on the road on the path to prosperity. We want open and honest dialogue with shareholders.

Third, valuation matters. We want to buy $1.00 for $0.75 or less. Typically, there’s a misunderstanding about a business that provides an opportunity to get in on the cheap. If the story is all roses and champagne, then there’s no edge in buying the stock everyone else already knows is performing well.

Last week I presented one such stock at the Irrational Economic Summit – a Rose Byrne opportunity. The company operates truly iconic brands. The owner-operator is a self-made multi-billionaire with a huge economic interest in the stock. His last 12 deals have generated an internal rate of return of 60% annualized.

But the company he manages has been bankrupt before, so we’re talking about a turnaround story. Plus, the company went public in an unconventional way, which meant Wall Street didn’t get paid. If Wall Street doesn’t get paid, then Wall Street doesn’t like you. There’s almost universal bearishness on this stock.

A little positive news may go a long way to propel its price higher. Of course, you could just ride the trend on the latest cybersecurity play, some gaudy Brad Pitt flick with a lot of guns and explosions and CGI, but I’m putting my money on Emilio Estevez.

If you’d like to know more about this stock and other shareholder yield gems, try Hidden Profits at no risk here.

Good investing,

John Del Vecchio

Editor, Hidden Profits

The post Brad Pitt or Emilio Estevez: Picking The True Hot Stocks appeared first on Economy and Markets.

October 25, 2017

The Truth About Harry’s Research (And What He’s Saying Now)

In 1997, Prudential Securities gave Ralph Acampora a 1962 red Corvette. Two years earlier, he’d forecast the Dow would reach 7,000 by 1998, and it happened a year early, in February of 1997.

In 1997, Prudential Securities gave Ralph Acampora a 1962 red Corvette. Two years earlier, he’d forecast the Dow would reach 7,000 by 1998, and it happened a year early, in February of 1997.

Everyone was ecstatic. I had worked at the same firm for years, but had recently left, driven away by the same Ralph Acampora.

It wasn’t personal. I’ve never met him. Instead, it was a piece of research I saw him use when backing up his famous forecast.

Ralph is a market technician – he’s self-described as “the Godfather of Technical Analysis” on Twitter – who regularly draws charts by hand. But in long-format presentations he often dove into the details of “why.”

To partially explain the market’s relentless march higher, he presented a chart of the number of 46-year-olds in the U.S., presumably at their peak in spending, overlaid with the S&P 500.

I had seen that somewhere before. After some digging, I realized it was the bedrock of someone else’s research. It belonged to Harry Dent.

I’ve now worked with Harry for more than 20 years, and had a front-row seat to some of the craziest times in financial market history.

We’ve been more right than wrong across the spectrum of economic and market predictions.

Now we’ve come to another make-or-break point.

When things unfolded as Harry forecast in 2008, governments tried to turn the tide. Now we’ve had nearly 10 years of unprecedented market intervention coordinated by central banks around the world, but those days are almost over.

With the Federal Reserve shrinking its balance sheet and the European Central Bank reducing its bond-buying program, central bank action will move from a tailwind to a headwind.

We’ll be left to rely on the real economic foundation.

Referring back to Harry’s research, it could get ugly. It’s not that Harry wants things to go south; he just follows his research, and the next chapter calls for a downdraft before we can start the long Millennial-based growth cycle.

Harry famously wrote in 1989, with the Dow at 2,500, that the market index would eclipse 6,000 to 8,000 by 2006. He noted that American consumption, driven by the Baby Boomers, was in the second inning of a long ballgame.

People called him crazy. He was just getting started…

In 1993, Harry published The Great Boom Ahead. In the updated 1995 version, with the Dow around 4,000, mortgage rates at 7.5%, and 30-year Treasury bonds at 6.5%, he laid out very specific forecasts for the next 12 to 15 years…

The Dow would surpass 8,500 by 2007. Inflation would remain below 3% because of high productivity. Oil prices would stay low. Japan’s equity markets would continue to fall. Bond yields would drop, with mortgage rates falling below 6% and variable rates in the 3% to 4% range. The U.S. and, to a lesser extent, Europe, would regain economic dominance, and China and Mexico would experience spectacular booms.

He got some things wrong.

The Dow crossed his top target before the end of the 1990s, making him reconsider the top end of the research. He expected gold to remain dormant, which it didn’t, and oil took off in the mid-2000s. Still, overall Harry’s predictable spending and demographic research led to an amazing number of correct forecasts.

But they didn’t stop there. It wasn’t all sunshine and roses. The good times would come to an end.

Relying on the same demographic and spending data, Harry estimated the economy would roll over between 2008 and 2010 as the Boomers aged and the smaller Generation X took over the top spending slot.

The equity markets would drop more than 50%. Interest rates would fall below 3%. Productivity would slow dramatically. Real asset prices, including housing, would drop, and developed nations would enter a long period of civil unrest over inequality.

Hmm. Not 100% accurate, but pretty good. And, remember, Harry made these forecasts in the 1990s.

In the years we’ve worked together, I’ve been on stage a thousand times explaining our research, what worked, and what didn’t.

The building blocks remain in place, which we know from the U.S. Consumer Expenditure Survey. Consumers spend more as they age until their late 40s. Then, with the kids gone, they focus on preparing for retirement. They don’t want the same stuff they did in their younger years, and the Fed can’t coax them with lower interest rates to take on more debt.

By measuring the number of consumers at each age and stage of life, you can estimate the general ebb and flow of the economy. It’s simple – and brilliant.

But the future is not set in stone. Americans spent like crazy in the early 2000s, as predicted, but the earnings didn’t flow to U.S. companies and drive our markets to dizzying heights. Instead, the money flowed through American firms and found its way overseas. We minted millionaires in China.

When the markets dropped in 2008 and 2009, the federal government showed up with a recovery plan, just as Harry predicted. But the Fed also showed up, with a much bigger checkbook. So did the ECB, the Bank of Japan, the People’s Bank of China, the Bank of England, and a host of others.

The coordinated efforts created a bid for just about everything. We didn’t think citizens would allow such incredible amounts of newly printed reserves and continued deficit spending. And yet, here we are.

Now things are changing again. We’ve grown tired of central bank intervention, even though, so far, we’re still numb to the effects of deficit spending. And yet, all of those efforts couldn’t push GDP growth above 2% or so. Even the Fed’s long-term forecast is 1.8% growth.

Maybe that’s a win.

Maybe, without such incredible intervention for so long, facing the stiff headwinds that Harry has forecast for so many years and that he will talk more about in a free video today, we’d be in much worse shape. As the Fed drains liquidity and other central banks step aside, we’re about to find out.

It won’t last forever.

The economy is slogging through mud today as the Boomers retire en masse, but by the mid-2020s the Millennials will be firmly in control, raising their kids and spending their money, driving us higher, just as Harry forecast in the mid-1990s.

We simply have to get there.

Rodney Johnson

Follow me on Twitter @RJHSDent

P.S. Don’t miss your last chance to sign up for Harry’s special 100% free presentation that will debut at 4 p.m. ET today. He’ll detail everything that the mainstream media isn’t talking about and why this overinflated, bull market can’t last forever.

The post The Truth About Harry’s Research (And What He’s Saying Now) appeared first on Economy and Markets.