Harry S. Dent Jr.'s Blog, page 69

November 20, 2017

Why It’s Important to Cut Through the Hype to Find the Real Gems

I could do with fewer headlines. Or maybe I just want less yelling.

I could do with fewer headlines. Or maybe I just want less yelling.

I remember a time, long ago, maybe in mid-2016, when CNBC didn’t spend 15 minutes straight talking about politics. But now, as I wake up every morning in the five o’clock hour central time and sip coffee, the hosts pour over daily political headlines and then squabble.

Afterward, they recount the president’s early morning tweets, which often include exclamation points. And this is on a financial news channel! After exercise, I eat breakfast and finish my morning with the papers, which once again scream at me with headlines about possible foul play and dirty deeds.

I understand why this happens. They all need me. They need my attention. They need me to watch the shows, receive the papers, and scan my eyeballs across their websites.

It’s nothing personal. Or rather, it’s everything personal. They must do whatever it takes to command my attention so they can stay relevant.

I get why the media resorts to hype. But every once in a while, it’d be nice if they’d stick to real news, just relating what happened instead of trying to sway me one way or the other. It will never happen, of course, because no one would buy the paper or tune in.

Who wants to watch a CNBC host say, “Not much is going on today, so we’re going to fill our time with cat videos from YouTube.”

And not many people will pay for a paper that goes from 30 pages to six. Still, it would make my life much easier by stripping away the noise.

Such a move would be too much of a revolution for many people. They’ve grown so accustomed to the emotional appeal for their attention that they have lost sight of what can really make a difference.

It reminds me of a scene from John Grisham’s book, The Firm. The lead character, Mitch McDeere, technically cooperates with the FBI, giving the agency what it needs to prosecute mob lawyers. But he doesn’t do it by giving up the mob. Instead, he provides records that prove mail fraud.

As the character tells an FBI agent, “It’s not sexy, but it has teeth.”

That should be a mantra in the news cycle and the financial markets today. Sexy has its place, but we’ve allowed the sensational to run amok. Our financial world now includes cryptocurrencies, sort-of money ideas that don’t exist but still command four-figure prices.

More than anything, I think that shows we’ve moved to the surreal world, based on financial hype, news hype, and the always-present political hype.

We’ve driven the markets to all-time highs, even though inflation remains modest, to say the least, and GDP is limping along, albeit assisted last quarter by auto replacements after Hurricane Harvey. Now is the time to take a step back and ask, “Is it really worth that?”

I don’t know if regulatory reform will keep pushing things higher. I don’t know if real tax reform or anything else they argue about on CNBC will pass.

But I do know we have to keep investing.

We have to keep looking for the smart ideas that have the best chance to grow, but aren’t based on air. After eight years of central bank intervention, it’s a tall order. It’s the sort of thing John Del Vecchio, our in-house forensic accountant, does well.

He spends his days specifically looking for undervalued companies that have great potential, but are currently flying under the radar. He doesn’t care about the hype. In fact, if a company has hype, it most likely doesn’t fit the bill.

Clearly John isn’t interested in developing fodder for cocktail parties. He simply wants to buy companies that go up in value.

Like Mitch McDeere’s legal charges, it’s not sexy, but it has teeth. In times like these, that’s a great thing.

Click here to sign up for John’s free broadcast right now.

Rodney Johnson

Follow me on Twitter @RJHSDent

The post Why It’s Important to Cut Through the Hype to Find the Real Gems appeared first on Economy and Markets.

November 18, 2017

What Could Be Bigger Than a Super Bowl Commercial?

Where is Media More Digested Than in Super Bowl Commericals?

Where is Media More Digested Than in Super Bowl Commericals?Before I get into media companies, I want to talk to you about something that’s been on my mind recently. Something that’s swirling all around us, all day long.

But first let’s pan out a bit. I doubt this will come as a surprise to you, but every day a lot people walk through Times Square.

On its busiest days, Times Square sees as many as 480,000 people come through, and, according to its website, “Times Square stays busy late, with over 66,000 pedestrians entering the ‘Bowtie’ between 7 p.m. and 1 a.m.”

Oh, and on New Year’s Eve there are roughly 1,000,000 people crammed into that small space — that does not sound fun to me, but to each their own.

Buying billboard space in Times Square makes a very obvious sort of sense: a lot people means a lot of eyeballs means a huge amount of exposure for whatever it is you’re selling.

According to The Wall Street Journal, it costs between $1.1 million and $4 million a year if you want to buy one of those billboards. That’s not too far off from buying a 30-second spot during the Super Bowl, which has a base price of around $4.5 million and will likely only climb higher for years to come.

Now, 111 million people in the United States alone watch the Super Bowl, and so, again, it makes sense that you’d want to put your clever commercial in front of all those people and hope your cleverness leads to more sales.

But no matter how familiar those towering billboards and ironic commercials are, they’re less and less a part of the future landscape of advertising.

If you’re walking through Times Square or sitting on the couch with your friends watching the big game, odds are you’ve got a smartphone on you. Maybe you snap a photo of the Manhattan skyline and post it to Facebook; maybe you text some friends about a dumb commercial, or even laugh about it on Twitter.

With every thumb twiddle, you’re leaving a digital footprint. Depending on what browser you’re using right now, odds are some company is keeping track of how long you stay on this webpage and where you go from here.

It’s a little creepy, sure, but it’s the new normal.

OK, let’s focus in now.

Have you ever done a little online shopping while at work (it’s OK, I’m not going to tell anyone) and then, while at home, seen an online ad for those shoes or that pair of headphones you were looking at earlier?

What about on Facebook? My feed is littered with ads to random websites I’ve visited at one time or another. I barely notice anymore.

One estimate I found said that around 40 billion devices are going to be connected to the internet by 2020.

Forty. Billion.

And so for marketers and advertisers, of all levels, finding out where these people are and how to advertise to them is the name of the game. Cracking that code — and I mean really, truly cracking it — could mean billions to the right company. There might be one out there already, hidden in plain sight.

Let’s pan out again, though, for a gaze at the bigger, money-making picture.

The Bloomberg Era

You’ve probably heard of Michael Bloomberg, the billionaire former mayor of New York City. What you may not know is how he made his fortune.

Investment and business research, along with journalism and the publishing world writ large, used to be firmly grounded in the world of paper. Computers began helping in the 1960s, ’70s, and ’80s, but it wasn’t until the 21st century that the Internet Age accelerated the marginalization of the printed word and the hegemony of the pixelated word.

For the financial world in particular, the first enduring revolution came with the “Bloomberg Terminal,” a computer software system that keeps track of, in a word, everything.

With an annual subscription, Wall Street wizards and wannabes could get all the information they needed through one powerful machine housed on their desks, obviating the need for legions of interns to scour the web and printed sources of data.

“Everything,” in this context, means precisely that: From headlines in India to what the Venezuelan bolivar trades at in South Africa to every single media mention of a small miner in a remote corner of Australia that’s not even public yet.

Bloomberg met a huge need so well that it grew subscriptions at a dizzying rate. Everyone in the financial world has a Bloomberg terminal or is close to one. There are more than 300,000 subscribers worldwide, and they pay about 20 grand per year. In 2011, the Bloomberg terminal made up more than 85% of the company’s revenue.

Michael Bloomberg is a very, very rich man because he found a solution to a problem no one thought could be solved.

That’s the siren song of the entrepreneur: a practical solution to a hard problem. You probably can see where I’m going with this.

The Hidden Profits I’m Uncovering

My work as a forensic accountant takes me all over the financial map. I pour over data and earnings reports and run my models to find hidden gems in the markets. That might sound a little boring to you, but it’s my passion.

My passion recently brought me to a company deeply entrenched in the world of online marketing and advertising. Before I knew it, my brain was filled with terms like “earned media” and “social software.” If you’re glazing over now, I’m with you.

But I might have found the Bloomberg machine of earned media — in other words, a company that can unlock the door to online advertising and marketing. Its business model is to sell its one-of-a-kind answers is standard for the software industry — long lead times for customer adoption and then recurring revenue from annual subscriptions.

The truism about software is that once you’ve sold a product to a company it’s hard for them to switch. That’s why it takes a long time for the customer to make the decision to buy — it knows it’s committing to a long-term relationship.

Given that every software company is calling on businesses left and right for this pot of gold — and even though this company has and is about to release an even greater solution to every CMO’s attribution need — what confidence would anyone have that management knows what it’s doing and that it can execute?

Consider this. The consulting firm Bain & Company has said that a 5% increase in a software company customer retention leads to a 25% to 95% increase in profits. And I found that this company’s management, which has tended to be non-promotional (read: they’re not blowhards), has said it expects a 600-basis point — six percentage points — increase in retention rate from now to 2021. That’s huge.

To me, this sort of play is hidden in plain sight. When it comes to media companies and their coverage, there’s more than enough attention paid to gaudy billboards and funky commercials and “viral” campaigns that seem to go nowhere fast. The company I found is playing the long game, and I think you’d be really interested in hearing the whole story.

In fact, next Tuesday I’m hosting a special video broadcast that highlights several new profit opportunities just like the one I told you about.

It’s free to attend, and I’m pretty eager myself to share this knowledge with you. You can register to attend his free live event right here.

Good investing,

John Del Vecchio

Editor, Hidden Profits

The post What Could Be Bigger Than a Super Bowl Commercial? appeared first on Economy and Markets.

November 17, 2017

You Have to Follow the Money

John Del Vecchio really is a nice guy, I promise.

John Del Vecchio really is a nice guy, I promise.

But he doesn’t smile a lot.

Maybe it’s because he grew up in upstate New York, where you can go weeks in winter without seeing the sun… or maybe it comes from the years he spent working as a forensic accountant and as a professional short seller.

But John definitely has a serious, no-nonsense demeanor about him.

And let me tell you from experience, you don’t want to be on the opposite side of a trade as him.

This seems almost ridiculous now, given the company’s dismal performance, but many moons ago I was bullish on International Business Machines (NYSE: IBM). The stock looked cheap on paper and paid a high and growing dividend. And, perhaps best of all, the legendary Warren Buffett had recently taken a large stake in the company. It looked like a can’t-lose investment.

Until I mentioned it to John…

John spent a good 20 minutes dissecting my investment thesis point by point… until there was nothing left.

“They’re cooking their books, Charles,” John told me bluntly. “And there’s no cash flow to support all those dividend hikes.”

I feebly protested, mumbling something about recurring revenue streams and long-term service contracts, before John raised his hand to silence me.

“Sure, they’re growing their earnings per share, but there is no actual cash flow to support it,” he said. “They’re borrowing money and using it to reduce their shares outstanding. It’s financial engineering… and one of the oldest tricks in the book.”

He paused for effect.

“You have to follow the money, Charles.”

John walked me through the numbers, and I had no choice but to acknowledge he was right. And it’s good that I did, because IBM is down by about a third since we had that conversation.

In the end, it was Amazon.com that killed IBM.

Amazon’s cloud platform, AWS, was vastly cheaper and more practical than IBM’s traditional business services. It was only a matter of time until Amazon knocked IBM off its pedestal.

In retrospect, it seems so obvious that IBM was about to get obliterated by Amazon. But none of us – not even Warren Buffett – saw it coming.

At the time John warned me to steer clear of IBM, he knew next to nothing about Amazon’s AWS or the competitive challenge it faced for IBM.

But by digging into the numbers as he does as Dent Research’s in-house forensic accountant, he could tell that the company was in trouble and that it was using aggressive accounting to cover it up.

Something was wrong. The “why” wouldn’t be obvious for another few years, but by then it would be too late for the IBM bulls.

John has spent most of his career hunting down companies using aggressive accounting to bamboozle their investors. And he’s good at it, or he wouldn’t have survived this long as a professional short seller.

But here’s where it gets fun.

The same tools that can be used to identify bad companies with low-quality earnings can be turned around to find good companies with high-quality earnings.

And, as you know, that’s exactly what John does in Hidden Profits.

He uses six handpicked factors for scoring and ranking stocks: cash flow quality, revenue recognition, earnings quality, shareholder yield, earnings surprise, and valuation.

In plain English, he’s looking for underpriced companies with good management and honest bookkeeping. These are profitable gems, hiding in plain sight.

Companies that use aggressive accounting tactics to puff up their earnings eventually have to face the music. At some point, they run out of tricks and have to come clean. And when they do, it catches most investors by surprise and leads to a bloodbath in the stock price.

But companies using clean, conservative accounting are a lot more likely to surprise with better-than-expected earnings.

Just as John was able to detect the risks to IBM long before they made the news, he’s also able to find promising companies long before they ever pop on the radar of Wall Street analysts.

Company policy doesn’t allow me to personally own stocks that I recommend to readers. But I can tell you that I have bought many of the stocks John recommends, and I shorted Big Blue.

So here’s some good news for you: On Tuesday, John’s hosting a special video broadcast that highlights several new profit opportunities. It’s free to attend, but you must sign up here. I know I’m not going to miss it.

Charles Sizemore

Editor, Peak Income

The post You Have to Follow the Money appeared first on Economy and Markets.

November 16, 2017

Discipline in Life and Trading

I’ve been pretty active all of my life, and, over the past four years, I’ve been working out an average of five times a week. I’m kind of slow and not all that strong, but I have fun and my doctor tells me I’m fit!

I’ve been pretty active all of my life, and, over the past four years, I’ve been working out an average of five times a week. I’m kind of slow and not all that strong, but I have fun and my doctor tells me I’m fit!

As a teenager in high school, I played various sports because I enjoyed them, not because I was particularly great at any single one of them.

But when school ends, we all grow – some more reluctantly than others! – into our adult lives with kids, work, and responsibilities. Life happens, and we sometimes forget to take the time to take care of ourselves. I sure did. And that was despite having three very athletic kids who I’d haul to various practices and games. Two of my kids even competed at the collegiate level.

After my youngest left for college, I found myself with a lot of time on my hands and too many pounds around my midsection.

I tried running, but in Florida’s summer heat, I lost interest quickly.

I joined a gym, but I spent half my time trying to figure out what to do.

Then I bought an exercise DVD with a different workout every day for six days. I finally hit on something here: someone telling me what to do and how to do it. It was fun, and it worked! After six months, I lost 30 pounds, and I felt great!

I was working out of our offices in South Florida when I established my regimen, but, about six months later, I moved back to Tampa. Unfortunately, I didn’t have room in my Tampa house for a DVD workout, so I had to figure out a new plan.

That’s when I discovered CrossFit. If you’ve never heard of it, CrossFit was born way back in 2000 (it feels weird to think of 2000 as “way back”), so it wasn’t as if I found some unheralded fitness secret. But the world then, as it is now, was saturated with fitness and diet “secrets” and “hacks.” CrossFit was, in a way, hiding in plain sight for me, amongst all the options out there.

CrossFit combines weightlifting, gymnastics, and cardio into an intensive workout. It’s a group workout led by a coach who’s making sure you don’t get hurt. While every workout has the feel of a competition, you’re really competing against yourself.

I was hooked! But it’s not for everyone, and I’m not telling you this for any other reason except that everyone should find something that they enjoy to help keep them physically active.

It doesn’t matter if you want to take a walk with your dog, jog, swim, lift weights… whatever. Just do something you enjoy to get your heart beating and your blood flowing.

According to Jocko Willink, a retired Navy Seal commander and the best-selling author of Discipline Equals Freedom: Field Manual, exercise gets your body and your mind in the game.

Willink gets up at 4:30 a.m. and works out. He’s in the habit of waking up and executing a plan he made the night before. He says it’s a mistake to wake up and start thinking about what you want to accomplish and how you’re going to do it.

Willink makes his to-do list the night before. He lays out his workout clothes. He knows what he’s going to do. When his alarm goes off, he gets up and executes his plan.

His idea is that by developing and sticking to tested procedures and guidelines, you’re free to focus on the task at hand and less likely to be distracted by the process. And that prepares you to adapt to the unexpected.

Willink’s great insights on preparing the mind and the body translates into sound advice for investing as well.

As far as investing goes, sticking to tested procedures and guidelines is the only way to succeed. It doesn’t matter if you have your own sure-fire way to beat the markets or if you follow a guru’s strategy.

The only way to make money in the markets is to have a tested plan and follow it.

Here at Dent Research, our editors have at least one thing in common: We have rigorously tested our strategies, and we follow our plans without fail.

I’ve had success developing numerous strategies over the years, and, simply put, there isn’t just one plan that works well – there are many. The key to success is executing the plan. Failure usually comes quickly when you second-guess yourself and aren’t disciplined in following your system’s rules.

If you’re familiar with my Treasury Profits Accelerator service, you’ll know that my plan leverages investor overreactions in the Treasury bond market to profit.

Just last week, Adam wrote about the importance of a detailed financial plan in a 10X Profits piece headlined Written Plans Are Invaluable.

And John Del Vecchio, our in-house forensic accountant, continually analyzes companies to find potentially big profits that are right in front of our noses, but, for whatever reason, we just don’t notice. If he’s got his eye on something, chances are it’s worth looking into.

In fact, next Tuesday he’s going to be doing a special video broadcast that highlights several new profit opportunities that he says are essentially “hidden in plain sight” right before our eyes.

It’s free to attend his special presentation and I’m pretty eager myself to find out what these overlooked stocks actually are. Knowing John, you won’t want to miss it either. You can register to attend his free live event right here.

My overall point is this: We each have our own proven methodology that you can scale to your comfort level and investment objectives.

Don’t make it difficult. Like Jocko Willink says, “Don’t think – just execute your plan.”

Good investing,

Lance Gaitan

Editor, Treasury Profits Accelerator

The post Discipline in Life and Trading appeared first on Economy and Markets.

November 15, 2017

How Not to Be the Disadvantaged Underdog in this Game

It’s a classic David and Goliath story…

It’s a classic David and Goliath story…

You’re sitting in your study, flipping through the pages of a Wall Street Journal or Investor’s Business Daily, trying to figure out which stocks you should buy.

You have limited capital to invest, limited time for research, and, most challenging of all, a nagging suspicion that, when it comes to stock-picking, you’re bringing that proverbial knife to Wall Street’s gun fight.

Sorry to say, but it’s true… you are the severely disadvantaged underdog in this game we call investing!

But that doesn’t mean you’re destined to lose. Remember, the story of David and Goliath is all about the “little guy’s” triumph.

To win, though, you’ve got to think outside the box.

You can’t match Wall Street’s spending power, experience, or expertise. So, as best-selling author Michael Lewis put it, you’ve got to master The Art of Winning an Unfair Game.

You’ve got to play “Moneyball.”

In case you somehow missed the now cult-classic 2011 film, Moneyball, based on Lewis’ 2003 book bearing the same name, the story chronicles Oakland Athletics’ general manager, Billy Beane, and his unique approach to assembling a winning baseball team.

Beane was a real-life David. He had just $44 million to allocate to players’ salaries in 2002, while other teams were spending north of $125 million.

But what Beane lacked in spending power, he more than made up for with ingenuity.

Essentially, he figured out the “secret” to finding the league’s most valuable, underpriced talent.

That secret boiled down to two things…

First, Billy Beane valued quantitative data over qualitative information.

Essentially, he trusted statistics over his gut.

This approach was almost unheard of at the time. Yes, baseball is a sport notoriously rife with numerical tallies of players’ performance metrics. But most scouts and coaches weren’t tapping the hidden value in those statistics.

Instead, most scouts stuck to old school, qualitative approaches. They’d simply visit prospects in person and assess the look and feel of their performance. They relied on their experience to guide them through a subjective selection process.

Essentially, everyone was going on gut feel.

Everyone except for Billy Beane… who, instead, relied on hard numbers and objective evidence to evaluate the potential value of prospects.

For instance, Beane figured out that two statistics – on-base percentage and slugging percentage – were more predictive of a player’s value than any qualitative assessment of his size, strength, or look.

So Beane focused on those statistics, which everyone else ignored, while other scouts in the league ran around from city to city trying to judge players by eye.

And therein lies the second strength of his approach… Billy Beane prioritized value over vanity.

Most baseball scouts put too much emphasis on how a player looks on the field – they call it the “eye test.” It sounds crazy, but tall, handsome, alpha males got more attention from scouts simply because they looked the part.

That bias toward vanity isn’t unique to baseball scouts or, really, any other competitive sport… it’s rather pervasive in everyday life. Studies have shown that attractive people make more money, on average, than average-looking people. Again, crazy as it sounds… employers are often willing to overpay for people who look the part.

Instead of falling victim to that bias, though, Billy Beane focused on finding the best value. That is, finding players who were likely to contribute the best performance, for the cheapest price.

Those players were often passed over by other scouts, leaving Beane a trove of underpriced, high-potential recruits to choose from.

I hope it’s obvious by now that you, as an investor, can take a page from Billy Beane’s playbook in your quest to, well, “win an unfair game.”

Remember, you’re out-gunned by Wall Street’s massive spending power and research expertise. If you want to win, you’ve got to play Moneyball!

To do that, you’ve got to resist the urge to buy vanity stocks… stocks that everyone’s all hopped up about, just because they’re “hot” and look the part. You’ll never get a winner’s edge piling into Amazon, Google, or Netflix.

Instead, you’ve got to use a proven, evidence-based approach to finding stocks that everyone else is passing over… stocks that have the potential to perform better than the Amazon’s of the world… stocks that are underpriced, simply because they’re overlooked.

That’s how you’ll get your Billy Beane-style edge. It’s your only chance at winning the unfair game. It’s your ticket to a David-and-Goliath success story.

And of course, we’re here to help you with that!

All Dent Research services embody the spirit of Billy Beane’s “hard numbers” approach. And John Del Vecchio, our in-house forensic accountant, is all about finding underpriced values that aren’t “handsome” enough to capture the eye of vanity-stock buyers. If he’s got his eye on something, chances are it’s worth looking into.

In fact, next Tuesday he’s going to be doing a special video broadcast that highlights several new profit opportunities that he says are essentially “hidden in plain sight” right before our eyes.

It’s free to attend his special presentation and I’m pretty eager myself to find out what these overlooked stocks actually are. Knowing John, you won’t want to miss it either.

You can register to attend his free live event right here.

Adam O’Dell

Editor, 10X Profits

Follow me on Twitter @InvestWithAdam

The post How Not to Be the Disadvantaged Underdog in this Game appeared first on Economy and Markets.

November 14, 2017

Zero Hour: The Greatest Political and Economic Revolution Since Democracy Itself

A look into Harry Dent’s brand new book, Zero Hour: Turn the Greatest Political and Financial Upheaval in Modern History to Your Advantage

A look into Harry Dent’s brand new book, Zero Hour: Turn the Greatest Political and Financial Upheaval in Modern History to Your AdvantageI’ve written 10 books since 1989. Zero Hour, now available on Amazon and in book stores, is one of my most innovative, groundbreaking works yet.

The Great Boom Ahead put me on the map with breakthrough demographic indicators and forecasts that tagged the whole decade of the 1990s.

The Roaring 2000s sold over 800,000 copies and introduced its own breakthrough concept: the “network corporation,” characterized by bottom-up, not top down, management.

Zero Hour brings together all of the breakthroughs I’ve had over the years, and then adds to them with, among other things, the discovery of a rare convergence of three-long term cycles that point to a revolution. A true revolution, like the Industrial and American Revolutions that brought together the twin breakthrough concepts of democracy and free-market capitalism.

It was a discovery only possible with extensive collaboration with my co-author Andrew Pancholi – the only other guy in the world who knows as much about cycles as I do.

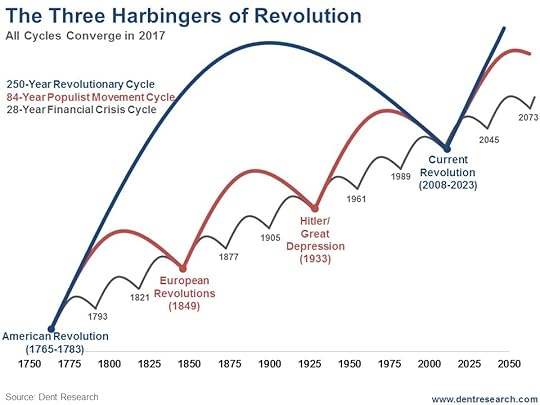

Chart: Megatrend #1: The Three Harbingers of Revolution

Today, we’re seeing the greatest political polarization since the Civil War, a debt and financial asset bubble that makes the Roaring 20s look like child’s play, and income inequality greater than that experienced in 1929.

Today, we’re seeing the greatest political polarization since the Civil War, a debt and financial asset bubble that makes the Roaring 20s look like child’s play, and income inequality greater than that experienced in 1929.But most important, we’re seeing breakthrough technologies, like the internet, and blockchain to come, that will change business and politics as we know them. Biotech and related technologies promise to greatly extend life spans and finally reverse the never-ending demographic decline the world is now facing.

No mainstream economists saw the greatest boom in history before it struck, nor the dramatic collapse of Japan.

None have seen this sweeping revolution, which will go down in history as the one that literally reshaped the world map, politics, economies, stock markets, and lives!

Trump and Brexit are only the first signs of much more to come – and this revolution will not end like it starts – trust me on this.

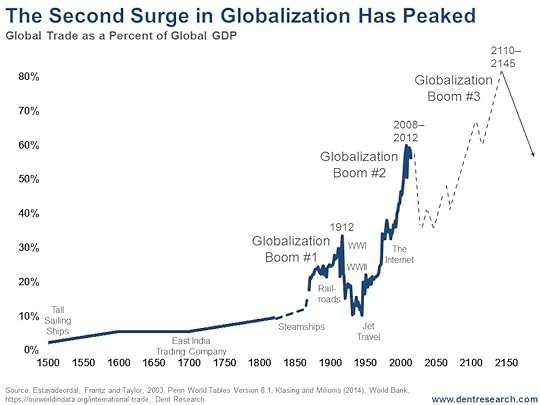

And as if that weren’t enough, look at this megatrend that’s about to descend on the global economy. The second great surge in globalization has peaked and will see a major retrenchment for decades (not just years) ahead.

Chart: Megatrend #2: The Second Explosion in Globalization Has Peaked

The first surge occurred with steamships and then railroads before colliding with World War I, the Great Depression, and World War II… all major political and economic events that no one saw coming!

The first surge occurred with steamships and then railroads before colliding with World War I, the Great Depression, and World War II… all major political and economic events that no one saw coming!Global trade retrenched 60% over 33 years – that’s a big deal!

The technological and network revolution ahead driven the internet and blockchain technologies will finally create the breakthroughs for the third and final great globalization surge that will take the world to 90% urban and middle class.

That’s the economy your kids and grandkids will live in. And it will be dominated by the emerging countries.

You may retire while this revolution unfolds, and at Dent Research we’re here to help you preserve and expand your wealth through it all. To retire well!

But your kids are going to be the ones that become part of this great shift and the potential recipients of the massive opportunities to follow. There’s a caveat though.

There’ll be money to make during the next stock market crash, but the global boom that follows will be nothing like what we experienced between 1983 and 2017.

Everything will not boom largely together as it occurred since World War II. Rather, you’ll need to understand our unique demographic and globalization forecasting tools to know where to set your sites for the groundbreaking opportunities. And I detail those in Zero Hour.

Watch this 90-second trailer in which Andy and I talk about the unprecedented impacts of this revolution.

Then order your copy of Zero Hour now.

It could well change your life and financial future.

Harry

Follow me on Twitter @harrydentjr

The post Zero Hour: The Greatest Political and Economic Revolution Since Democracy Itself appeared first on Economy and Markets.

November 13, 2017

The Tax Burden That We All Share

For almost 20 years I had employees. You never know the pain of human resources until you supervise others and are directly responsible for their workload and overall employment.

For almost 20 years I had employees. You never know the pain of human resources until you supervise others and are directly responsible for their workload and overall employment.

It’s no fun.

As with every office, we had certain rules about decorum. We also had rules that were specific to me.

I’m a bit sensitive to smell, so I asked employees to lay off heavy perfume or cologne. This was harder for the men than the women. Apparently, guys take the Axe commercials seriously, thinking they have to bathe in the stuff.

In the same vein, I didn’t allow tuna fish salad in the office. One of my college roommates often ate the dish and left the dirty bowl in the sink for days. I didn’t, and don’t, need that memory resurfacing as I go through my daily routine.

In addition to the oddball items, I also requested that employees not give me the reasons they wanted to take time off. If they’d earned the time, then it’s theirs to use as they see fit. Explaining the circumstance invites judgment, which can be a problem.

One employee might want to take a day off to get her sick grandmother to the hospital for dialysis because the normal caregiver is ill. Another employee might think his cat looks sad and simply wants to spend the day cuddling with it.

I don’t need to know these things. We have common goals at the office. Let’s leave it at that.

I feel the same way about taxes.

All citizens of the country share some common goals, such as national defense, contract enforcement, and protection of our personal and property rights. Beyond that, things get messy fast.

Our current tax regime is a tangled ball of craziness. Ordinary citizens spend billions of dollars with accountants to verify compliance, while companies spend billions on tax attorneys and accountants trying to beat the system.

The problem isn’t the tax rate. That’s simple. It’s all about deductions and classifying income.

But those considerations are the same as my employees who wanted to tell me why they needed time off. They don’t apply to everyone, so some people will find them valid reasons or deductions, while others will think of them as favoritism… and they’re right.

We give tax credits for kids to promote having children. We allow people to deduct mortgage interest to promote homebuying. There are thousands of other examples where one group or activity is favored over others.

As we consider the current Tax Cuts and Jobs Act, with all of its deductions, loopholes, and motivating credits, I’ve got a simpler idea. Let’s get rid of all of it.

In 2018, our government expects to spend $4 trillion, but the majority of that is for Social Security, Medicare, and Medicaid. Looking at just discretionary spending, the government expects to spend $1.25 trillion. Unfortunately, we also expect to run a $450 billion budget deficit.

Most tax revenue comes from personal income taxes. If we fully paid for our spending this fiscal year, we’d need to raise $1.7 trillion through personal income taxes. Dividing that among the 245 million adults in the country, that’s about $7,000 apiece.

To be completely fair, in my proposal, every person would be required to write a check for that amount. After all, no one person gets more national defense, property or personal rights protection – or anything else – than another. So why should they pay more?

Of course, this won’t work. In addition to asking my retired parents to draw from Social Security to cough up the money, I’d also have to shake it out of my young adult kids, as well as people up and down the income spectrum.

But it’s worth considering because it makes us start from the most basic point possible – what we have in common.

If we moved from an absolute dollar amount to a percentage of income, things get a bit trickier (who works, who doesn’t?), but it still gives us a starting point. From my limited research, we’d all have to kick in about 20%.

Again, no deductions, no exemptions. It’s not my business if you’re raising 13 kids on a farm, or contribute $100,000 a year to a non-profit that studies the possible emotional range of trees. I don’t care if your town has a high property tax, sales tax, income tax, or bad hair tax. We as a population do not have those things in common.

I might think some of those things are great ideas, and I might not. That’s not the point. We should not ask some parts of our nation to support others for causes that are not, without a doubt, for the greater good of the country.

And that’s where the fight starts.

Does child care exist for the greater good? Fostering the next generation sounds like a great idea, but aren’t we penalizing childless couples or childless adults in general?

And what about student loan write-offs? College certainly educates the population, but only 35% get college degrees. Why are the other 65% (plus those who don’t take out loans) subsidizing those that do?

Once we started using the tax code to punish and promote activities, we started taking sides, which seems like the wrong way to approach raising revenue.

If we set the tax code as plainly as I’ve described, we’d kill the tax prep industry. We’d alleviate billions of hours wasted on tax forms, and obviate the need for much of the debates in Washington.

After saving ourselves such time, treasure, and aggravation, we could then see what happens at the regional level. Maybe states in the South and Midwest give property tax breaks for children… maybe not. Perhaps Western states promote research and development through sales tax credits. It’s possible the Northeast focuses on higher education.

Whatever each region, state, county, or city decided to do, they could approach each situation by asking the same question: What do they have in common?

I know this will never happen, but as Congress debates the Tax Cuts and Jobs Act, and I think about gathering my documents to send them to my accountant for what will be the 20th year that he’s prepared my returns, the dream sure is nice to think about.

Rodney Johnson

Follow me on Twitter @RJHSDent

The post The Tax Burden That We All Share appeared first on Economy and Markets.

November 10, 2017

There is No House Money… Only YOUR Money

Have you seen those Voya Financial commercials? The ones featuring cartoon, origami rabbits – one orange and one green?

Have you seen those Voya Financial commercials? The ones featuring cartoon, origami rabbits – one orange and one green?

It opens with the orange rabbit explaining to a man,

“I’m Vern, the orange-money retirement rabbit. I’m the money you save for retirement…”

“Who’s he?” replies the man, pointing to the green origami rabbit.

The orange rabbit answers,

“He’s green money, for spending money today… you know, paying bills, maybe a little online shopping.”

Now, here’s the thing…

Both the “orange rabbit” and the “green rabbit” are identical. They’re both $1 bills.

But Voya wants you to think about them as if they’re completely different animals!

This form of psychological differentiation, or compartmentalization, may be useful in Voya’s goal of getting clients to save for retirement. But when it comes to being a disciplined investor, this line of thinking can be outright dangerous.

Consider the term “house’s money”…

Casino regulars know what I’m talking about when I say “house’s money.”

Whereas “my money” is the money I walked into the casino with, the “house’s money” is the “extra” money I’ve won from the casino that night.

Before I go on, let me say that I’ve never stepped foot in a casino. And while analogies between the two can sometimes be made, good investing is not gambling!] Back to my point…

Many people (mistakenly) think that the “house’s money” is somehow different from “my money” – as if, like in that Voya commercial, one is green and one is orange.

The thing is… it’s not!

And here’s why I believe that…

For one, the house’s money can just as easily be your money as your money is. All you have to do to make that so is walk away from the table.

With such a simple act separating the house’s money and your money, how can they be different things?

More importantly, though, I believe whole-heartedly that it hurts just as badly to lose the house’s money as it does to lose your money.

How many times have you accrued a hefty open profit… and then mentally spent that money on something? You’ve thought, “Great! I can buy that now with the $50k I’ve made so far this month!”

And then, after suffering a hefty giveback of those open profits – aka, the house’s money – you’ve decided you’d better hold off.

I’ve worked with enough investors to know it usually works this way. Human nature leads us to mentally spend our profits, even before we’ve locked them in. Then, when the house takes some or all of those profits back… it hurts!

That’s why I think there’s no such thing as the house’s money.

It’s all your money!

This truth can be psychologically frustrating, and economically destructive, for many investors.

Some investors like to play fast and loose with the so-called house’s money. They may reckon that it wasn’t their money to begin with, so it’s fine if they risk too much and lose it all.

Other investors become psychologically attached to the house’s money, causing them to mentally spend it, and worry excessively about losing it. They’re too conservative with the house’s money, often locking in profits too early, thereby leaving even more money on the table.

Truly, it’s a tricky balance to strike… made worse by the false idea that the “house’s money” is somehow different from your money. Again, it’s not!

I shared this concept recently with my 10X Profits readers, as part of my commitment to turn them into disciplined investing machines!

The solution to seeing the house’s money as “play money,” and doing foolish things with it, involves detaching yourself, emotionally, from the profits you’ve accrued on open positions.

That’s easier said than done, I realize.

So I gave my disciplined 10X’ers two tactics toward this goal.

The first one is simple: check your account balance just once a month.

If you believe, like me, that each time you check your account balance and open positions presents one opportunity to second-guess your strategy and do something stupid… then you’ll agree that checking your positions every day, versus once a month, only sets you up for 22-times more temptation.

If you’re following a systematic strategy, like 10X Profits, you don’t need to make decisions every day. So you shouldn’t be tempting yourself to “check and fiddle” every day!

Keeping tabs only occasionally means you won’t fall victim to the emotional rollercoaster of watching the so-called house’s money swing up and down.

The second tactic is also simple: prepare to “give back” some of the house’s money.

I think education and anticipation is key to keeping a cool head in turbulent markets. If you’ve done your research and prepared yourself for negative scenarios, it’s much easier to stay the course when things get dicey.

When you expect you’ll have to give back some of the house’s money, some of the time, you won’t be as shocked or concerned when it actually happens. You’ll know it’s a “normal” function of investing… and nothing to worry about.

The bottom line is…

It’s psychologically challenging to give back open profits. It’s psychologically tempting to override your strategy when you check your account balance too often.

And that’s why you need an objective, systematic trading strategy… like my 10X Profits

Adam O’Dell

Editor, 10X Profits

Follow me on Twitter @InvestWithAdam

The post There is No House Money… Only YOUR Money appeared first on Economy and Markets.

November 9, 2017

Is the Topping Process in Motion? Key Divergences Starting to Form

In the last update I sent a while back, I was looking for either a top by mid- to late October or the beginning of a topping process into December or January. By the looks of things, it seems that second scenario is unfolding.

In the last update I sent a while back, I was looking for either a top by mid- to late October or the beginning of a topping process into December or January. By the looks of things, it seems that second scenario is unfolding.

My co-author on the new book, Zero Hour (out next Tuesday), Andrew Pancholi, also identified the largest ever turn point in his markettimingreport.com newsletter. He pinned that turn point to mid-October.

Now that we’re in the second week of November, a lot of his subscribers are wondering whether he was wrong. After all, many indices from the Nasdaq to the Dow continue to edge up.

The thing is, turning points don’t always turn on a dime. More often than not, the current will start shifting close to the indicated turning point, but it can take months for the effects to be seen and felt! And the bigger the turning point, the subtler the shift and the longer to play out.

I don’t think Andy is wrong. With each divergence I’m seeing starting to form right now, I think we’re increasingly looking at a major topping process – one that started on the date of Andy’s major turn point – and it’s going to take a few months to unfold.

I’ll illustrate my point with four examples…

Before I do that though, I want to make a distinction between momentum tops or bottoms and actual tops or bottoms, which tend to go just a bit higher or lower.

In the 1987 bubble, the momentum top was in August, but the market moved sideways and only crashed in October – two months later. Claiming a missed turning point because the crash didn’t happen in August is like claiming that golfer Scott Langley didn’t make the putt on the 16th hole back in June 2014 because his ball hung on the lip for 22 seconds!

The 2000 tech bubble top saw the momentum top on January 14, where the Dow topped, and the broader top on the Nasdaq on March 10. Then the first sharp crash of 40% hit into late May.

Andy’s model had its second strongest turn point ever in late 2002, right near the momentum bottom of the crash on July 23. That day, the Dow bottomed intraday at 7,683. Then there was a bounce. The final bottom was only reached on October 9, at 7,282 (5% lower).

That turn signal would have been a great buy opportunity because the markets more than doubled over the next five years!

BUT, it took two and a half months to unfold fully.

The last example is of the top in 2007. There was a momentum top for the S&P 500 on July 19, at 1,555, then a 10% correction, and a final top just barely higher on October 9, at 1,565 (just 0.6% higher). The small caps didn’t make a new high in October and that was a key divergence that signaled such a major top.

My point is obvious: it takes time to move a massive shift. It takes time for the wave to roll ashore, especially when we are looking at a major long-term top or bottom!

As I said, Andy’s model had the largest turn point – due in mid-October – that his model has ever registered.

So, what is happening here? The wave may be building as it rolls toward us.

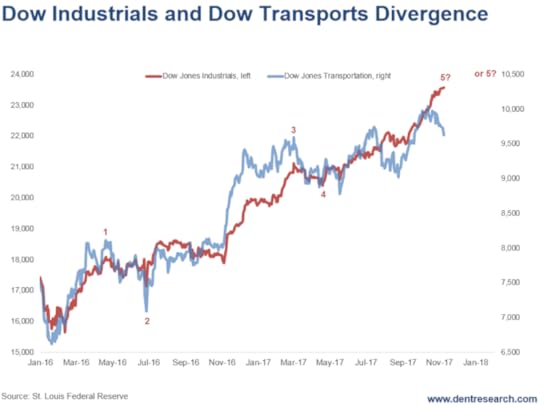

Look at this chart…

The Dow Transports are down 4.5% since a top on October 12, while the Dow Industrials are up another 3%.

The Dow Transports are down 4.5% since a top on October 12, while the Dow Industrials are up another 3%.

That looks like a classic “Dow Theory” divergence in the making.

The Russell 2000 small caps peaked on October 5 at 1,515 and have not yet made a new high to confirm the slight new highs in the Dow, S&P 500, and Nasdaq recently.

This is another major divergence we could be witnessing.

I think we’re approaching the major long-term top that Andy and I have been looking for, and which we talk about in Zero Hour.

I think that wave is coming.

The ideal scenario would be to see a more minor correction into November, and then a rally into December or mid- to late January (when Andy has his next major turn point) without new highs in the Dow Transports or Russell 2000 small caps. Then we could see the great crash begin.

This is not certain yet, of course, but it looks likely…

So, hang tight. We’ll keep you updated.

Harry

Follow me on Twitter @harrydentjr

The post Is the Topping Process in Motion? Key Divergences Starting to Form appeared first on Economy and Markets.

November 8, 2017

What’s Behind Our Upside-Down Bizarro World?

It’s earnings season, and that means plenty of opportunities to make or lose money based on whether companies beat or miss expectations and how investors react to future guidance.

It’s earnings season, and that means plenty of opportunities to make or lose money based on whether companies beat or miss expectations and how investors react to future guidance.

Normally, this is a good time to profit from solid research and preparation. Companies doing well tend to rise, and those that fall short tend to get taken to the woodshed. But something strange is happening this time around. It’s sort of like that alternative Bizarro World that Jerry Seinfeld referenced in the famous “man hands” episode.

Things are strangely the opposite of what they might seem. (Or, if you’re more up to speed on current television, we’re in the “upside down” world of Stranger Things.)

To be sure, there are companies that have missed earnings and seen their stocks get hit, like normal. But more and more, I see the opposite of what the fundamentals might imply.

Take Mastercard Inc. (NYSE: MA). The company exceeded both top- and bottom-line expectations. Business is booming globally. Management is solid and investing aggressively in its future.

The results were met with a thud.

The stock initially popped on its earnings report – only to sell off from there. By midday after the earnings report, the stock was in the red on high volume. Bizarre.

Mastercard is just one of many examples. At our Irrational Economic Summit in October, I highlighted Gilead Sciences Inc. (Nasdaq: GILD) as a stock to play from the long side for the next several earnings releases. The company reported shrinking sales and faces a tough Hepatitis C business. However, the recent acquisition of Kite Pharmaceuticals is a game-changer for the future of cancer therapies, Gilead is already a massive cash flow generator, and it has plenty of room to jack up the dividend.

And, still, the earnings release was also met with crickets, and the stock has drifted lower. Even more bizarre.

At IES I also warned that when, not if, Netflix Inc. (Nasdaq: NFLX) releases a whiff of bad news, the stock is in for a $20 to $40 decline from recent levels. However, Netflix reported subscriber growth that blew away estimates both domestically and internationally. This is the metric that investors have been focused on.

Management also seemingly navigated a price increase without too much trouble. Under normal circumstances, the expectations-topping growth in users would be met with euphoria and push the stock higher by at least 10%.

But guess what: Shares popped after a few hours only to deflate since then.

Are investors starting to sharpen their pencils and figure out that other metrics may matter more for Netflix’s future success than traditional benchmarks? Some of these factors I mentioned in Nashville include huge content liabilities, poor cash flow trends, weak earnings quality, and a premium valuation.

In each situation, the stock performed the exact opposite of what I might expect from analyzing the fundamentals.

What’s causing Bizarro World?

I have a few ideas.

First, there’s very little stock-picking done anymore that drives volume in the markets. Volume is now often being driven by computers looking to make a 10th of a penny off a transaction. High-frequency trading programs have exploded since the last crisis nearly 10 years ago.

Fundamentals don’t matter to computers. Small profits from trading stocks do.

Research from Credit Suisse suggests that as high-frequency trading has become more prevalent, investments in passive indexing strategies have exploded. How does this help cause Bizarro behavior? Because indexes are indiscriminate. They buy all the stocks in the index even if the fundamentals of a particular stock are a disaster.

That’s why you might see a stock down in the morning but then, as index rebalancing takes place near the close of the market, it’s almost as if a magic hand is lifting the share price.

Meanwhile, the share of volume from active managers has deteriorated. I’ve seen estimates that stock-picking accounts for only 10% of the market volume today. That skews stock behavior away from the rational to the unexplainable.

What could cause this behavior to change?

We need a healthy market correction. Typically, short-sellers would step in to buy and cover stocks in a declining market and book profits., But short-sellers have become a rare species in this unprecedented low-volatility bull market.

High-frequency trading programs may step to the side or exacerbate the downside, but in this low-volatility grind higher they’re not helpful to rational stock-pickers. Or index investors might get spooked, and money coming out of indexes might normalize the balance between passive and active managers.

This would help refresh the market and return it to a more balanced position. Then we can leave this Bizarro World behind and finally get rewarded for good research.

Good investing,

John Del Vecchio

Editor, Hidden Profits

The post What’s Behind Our Upside-Down Bizarro World? appeared first on Economy and Markets.