Harry S. Dent Jr.'s Blog, page 71

October 24, 2017

Bubble Denial… Just as It May Finally Be Peaking

As I have commented recently, my mainstream media interviews have almost totally dried up – even with Fox Business. The last three I have done have been more about my on-the-ground experience in Puerto Rico!

As I have commented recently, my mainstream media interviews have almost totally dried up – even with Fox Business. The last three I have done have been more about my on-the-ground experience in Puerto Rico!

It makes perfect sense though. Bubbles always suck everyone in before they implode. The financial media, like CNBC, become cheerleaders for the bubble. Bears turn to bulls. And almost everyone goes into bubble denial.

But mark my words here: This third and final bubble (fourth if you count 1987) is now the biggest and most obvious bubble in this boom since 1983. And it’s as overvalued as at the top of 1929!

And the fact that no one wants to hear about it is an ominous sign that it may well be peaking!

Everyone is getting a free lunch…

… stock prices are much higher than fair value; same with real estate prices…

… mortgage and car loan rates are the lowest ever…

… business borrowing costs are almost negligible.

Higher net worth, lower living costs – what’s not to like?!

And if that’s not enough, now people, especially business owners and major corporate executives, are going to get some major tax cuts. Some as high as 87%!

No one wants it to end.

So, everyone goes deeper into bubble denial.

What people conveniently forget is that bubbles like this make our unprecedented income inequality worse because inflated financial assets greatly favor the top 0.1% to 10% that owns the great, great majority of them.

Another thing they forget is that the deeper into denial they go, and the higher the bubble inflates, the bigger the crash when it finally all unravels. More people get hurt because they were suckered into a fool’s game.

It was everyday people that got slaughtered in the China stock bubble crash in late 2015. They got in the latest and could least absorb the loss. It happens that way every time.

Now, when this bubble bursts, the markets will shed points in a jagged way, dropping sharply with violent bear market rallies as well. Remember, as I always say, nothing moves up or down in a perfectly straight line. But when all is said and done, my target for the Dow is 5,000 to 5,500 by early 2020. That’s a loss of 79% from here. We may even lose more, dropping as low as 3,000 to 4,000 into late 2022 or so. That would equate to an 87% loss.

I think there’s a good chance that this bubble is finally topping here in late October just as people are in the maximum bubble denial. Or it could be the beginning of a topping process that shows itself more in January forward.

Firstly, Andrew Pancholi’s model at www.markettimingreport.com has the strongest turn point in decades this month.

Secondly, the rising bearish wedge pattern I’ve been pointing to in recent months is right where it could top – and these tend to be terminal topping patterns. Here’s an update to this chart...

On October 23 we were right at the top of this channel in a 5th wave up. Often at such a top there will be a “throw over” just above the top trend line. That is already happening today. In this more likely Scenario 1, the market could turn back down.

The first blue dot would mark a break back down into the wedge and strongly suggest such a throw-over top. The second blue dot would mark a break back below the bottom trend line in the wedge and further confirm that top and suggest sharper move down.

Scenario 2 would see the break above the top channel line this week and then likely a retest of that top line in a mild pullback. But then it would hold there and continue to advance towards 24,000 – 25,000, where it could very well finally top by sometime in January.

No bubble can go on forever. They defeat themselves with their own extremes.

So, ask yourself: Do you want to be in the stock market if Trump finally bombs “Little Rocket Man?” Remember, the trigger for the 1987 bubble crash was the declaration of war against Iran.

But war is just one possible trigger. There are dozens of others just waiting to spring. The markets haven’t been this risky since March 2000 and September 1929.

The thing is, once this bubble bursts, it opens up once-in-a-lifetime opportunities for you in stocks, real estate, and commodities (including gold). It gives you access to all of these assets at the lowest prices you’ll see in your lifetime.

However, to be able to take advantage, you must first preserve your assets now. And it

helps to find an investing strategy or service that can help you find profit opportunities in up or down markets.

I talk about this, and more (including the reasons why this bubble will burst, despite what everyone is saying), in the special video I’ve prepared for you. It airs tomorrow, October 25, at 4 p.m. To watch it, you must first register. You can do so here.

Harry

Follow Me on Twitter @HarryDentjr

The post Bubble Denial… Just as It May Finally Be Peaking appeared first on Economy and Markets.

October 23, 2017

The Market is Irrational, and I’m OK With That

John Maynard Keynes is widely considered one of the most influential economists of the 20th century and the founder of modern macroeconomics theory – but I don’t agree with a lot of his body of work.

John Maynard Keynes is widely considered one of the most influential economists of the 20th century and the founder of modern macroeconomics theory – but I don’t agree with a lot of his body of work.

After all, virtually every government in the world uses Keynes’ theories to justify perpetual budget deficits in the name of fiscal stimulus. (I suppose in Keynes’ defense, he also advocated that governments run budget surpluses when the economy is strong so as to balance the budget over a full economic cycle. Someone might need to remind Congress of that…)

But while I have my differences with Keynes as a policy wonk, I actually tend to agree with him when it comes specifically to the markets.

After losing his shirt in a currency bet gone wrong, Keynes famously commented, “The market can remain irrational longer than you can remain solvent.”

I’m reminded of those words when I look at today’s stock market.

According to FactSet, S&P 500 earnings grew 2.1% last quarter, and revenues grew 5%. Those aren’t exactly numbers that make you want to light your cigar with a burning $100 bill.

Now, Hurricanes Harvey and Irma clearly had an impact last quarter, but earnings and revenue growth for full-year 2017 are only expected to be 9.1% and 5.8%, respectively. Those aren’t terrible numbers, but they’re hardly enough to justify today’s valuations. The 12-month forward P/E ratio just hit 18 – its highest level in 15 years.

But if you’re thinking about betting against this market, I would tread very carefully. This is starting to feel a little like the 1990s again…

Do you remember when former Fed chairman Alan Greenspan warned of “irrational exuberance” in the stock market? Contrary to popular belief, it actually wasn’t near the top of the dot-com bubble. He uttered those words in December of 1996… more than three full years before the bubble finally burst.

Greenspan was right, of course. The market already looked frothy in 1996. But it got a lot more frothy before the whole thing crashed and burned. Had you shorted the market at the time of Greenspan’s quote, you would have been wiped out. The S&P 500 nearly doubled between then and the eventual peak.

I’m the first to admit that I don’t know when the music stops. But I’m also perfectly fine with that because my colleagues and I are prepared whether the market goes up, down or sideways.

As a case in point, Adam O’Dell has used intermediate trend following strategies to make money for his Cycle 9 readers since 2011. And his newest offering – 10X Profits – has generated fantastic profits trading volatility itself. Whether the S&P 500 doubles from here or crashes tomorrow, Adam’s algorithmic trading models should keep trucking along, doing what they do best.

I could make the same claim for Rodney Johnson and Lance Gaitan’s trading services. Rodney’s Triple Play Strategy runs a concentrated stock portfolio based on momentum indicators. It rides hot stocks higher and avoids the laggards. And Lance routinely generates triple-digit gains trading options on bonds. Neither of these strategies depends on the market going higher from here.

And then there’s me. My beat is generating dividends, and the recommendations in my Peak Income letter sport an average dividend yield of 7%.

Of course, a nasty bear market can erase many years’ worth dividends, so I’m very strict about setting and raising stop-losses to protect our gains along the way. Should the bear start to growl tomorrow, my readers would walk away with minimal damage to their nest eggs.

Harry’s research suggests that the market could head south before the end of 2017. (To hear more about that in Harry’s own words, sign up here for free to catch his special presentation on Wednesday.)

If it does, I say bring it. We’re ready.

But if that irrational market just keeps getting more irrational, I’m perfectly fine with that as well.

We’ve already booked solid returns this year. So long as the market keeps throwing fastballs down the middle, I’m happy to keep swinging.

Charles Sizemore

Editor, Peak Income

The post The Market is Irrational, and I’m OK With That appeared first on Economy and Markets.

October 20, 2017

Here’s the Thing About Irrational Exuberance

Harry Dent is truly an “outside-the-box,” “big picture” thinker.

Harry Dent is truly an “outside-the-box,” “big picture” thinker.

He’s fiercely independent.

He’s the ultimate contrarian.

And he tells it like it is – good, bad, or ugly.

I’ve been Harry’s “right hand” investment guy for six years now and many people say we’re the perfect complement to each other.

Harry’s expertise is in long-term cycles, many of which are predetermined by demographics and the predictable decisions people make during the various stages of our lives. And he’s honed the uncanny ability to see things that everyone else is blind to, often well in advance.

My expertise is in actionable investment strategies – ones that take advantage of investors’ irrational decision-making processes, particularly in the short run.

And that’s where there’s a sublime overlap in Harry’s and my work. I’m a student of what’s called “behavioral finance.” But nobody understands human psychology, and therefore investor psychology, as well as Harry does.

Consider Harry’s description of how people very irrationally deny the natural “ups and downs” of life. It’s one of my favorite “Harry-isms.”

He says, and I’m paraphrasing here…

“Everybody expects life to get easier all the time. We just want to get better… and better… and better… and better… and better… and then go to heaven… and STAY THERE!”

I love that. It’s so true!

But that’s not reality, is it?!

Life is full of ups and downs. And so too are the markets – even if the last several years have felt like an easy, one-way ride to heaven.

And that’s why Harry and I work so hard to arm our readers with knowledge and strategies for both sides of the financial market rollercoaster.

The best way to describe Harry’s and my unique and complementary approaches comes from the legendary father of value investing, and Warren Buffett’s mentor, Benjamin Graham.

Like Harry and me, Graham was well aware that the irrationality factor routinely drives market prices far too high… and far too low… than is justified by the intrinsic value of companies.

Graham’s famous saying goes…

“In the short run, the market is a voting machine. But in the long run, it’s a weighing machine.”

Given enough time and sufficient rationality, market participants will “weigh” the value of a company and subsequently adjust the market price of its shares (through buying and selling) until the value of the shares equals the value of the company.

That’s the longer-term, “weighing machine” function of the market.

And very often, when Harry is seeing things in the economy and markets far ahead of everyone else… he’s anticipating the day when the weighing machine is properly balanced – even when it’ll take an unimaginably nasty crash to get there.

So, while starry-eyed investors extrapolate the recent past and see “heaven forever,” Harry stays committed to telling it like it is.

The other side of the Benjamin Graham’s maxim speaks to financial markets’ function in the short run. He appropriately describes it as a voting machine because, in the short term, the price of a financial market is largely determined by how popular it is – as irrational as that sounds.

Investors vote with their dollars… buying stocks when they feel good and selling stocks when they feel scared.

People are more irrational than we’d like to admit. And in the short term, the popular vote can change rapidly and often. It can also become very one-sided – owed to our irrational “herding” behavior – which can push the prices of financial markets far beyond their intrinsic values.

That’s when you get the “irrational exuberance” that former Federal Reserve chair Alan Greenspan first referred to in December of 1996.

And here’s the thing…

You can’t simply dismiss or thumb your nose at irrational exuberance… just because it’s irrational. As perverse as it seems, irrationality is a real force that has a very real effect on the performance of real investors.

Consider how long the stock market remained “irrational” between Greenspan’s calling it that and the final peak of the dot.com bubble: 39 months!

That’s a long time!

Eventually, of course, the long-term “weighing machine” function of the market worked properly. By 2002, technology companies were trading at prices that more appropriately reflected their intrinsic values.

But in 1995… and 1996… and 1997… and 1998… and 1999…

Well, that’s when the short-term “voting machine” function of the market was dominant… as “irrational” as it now appears with the benefit of hindsight.

So, what’s a prudent investor to do in situations like these?

We’re now a full eight years and counting into the “most-hated bull market ever.”

Should you sell?

Should you buy?

There’s no simple answer, of course.

Harry remains adamant that his forecast will come to pass. He’s created a video to explain why. This will air on Wednesday, October 25. To watch, you must register, which you can do here.

Between Harry’s long-term cycles and visionary contrarianism… and my actionable, shorter-term focus… we believe we’re the perfect pair to guide you through the volatile ups and downs ahead.

Adam O’Dell

Editor, Cycle 9 Alert

Follow me on Twitter @InvestWithAdam

The post Here’s the Thing About Irrational Exuberance appeared first on Economy and Markets.

October 19, 2017

Pick a Platitude

I just turned off the television. There wasn’t anything wrong, there was just… nothing. As I go through my day, I stay tuned to CNBC, albeit with the sound down low, simply to have background activity. But today, I just can’t get there. I keep asking myself the same question when I hear their comments… so what?

I just turned off the television. There wasn’t anything wrong, there was just… nothing. As I go through my day, I stay tuned to CNBC, albeit with the sound down low, simply to have background activity. But today, I just can’t get there. I keep asking myself the same question when I hear their comments… so what?

Usually I enjoy some of the banter, and I recognize that most of the people floating across the screen are very smart and accomplished. But I don’t feel edified. In my head I’m playing an endless loop of old quotes and comments that ends up sounding like a game of “Pick a Platitude.” It goes something like this:

While history doesn’t repeat, it rhymes… The markets can stay irrational longer than you can stay solvent… When the tide goes out, we’ll find out who’s been swimming naked… It’s never different this time…

I think these words are my natural defenses to what seems like a constant barrage of explanations as to why the markets will remain high no matter what happens.

And why shouldn’t that be the case?

Price earnings ratios are well above the long-term average. Robert Shiller’s more effective cyclically adjusted price earnings ratio (CAPE) is also running hot. But it’s been like this for years, with no serious pullback, so why even talk about valuations?

They don’t matter, right?

The sun came up in the East today, and the markets moved higher.

Sure, there’s a good chance of war. Or rather, more wars. We’ve been in an armed conflict for 16 years… so long that we no longer consider Afghanistan to be a military hot zone. Now we’ve got a real chance of spilling blood and treasure on the Korean Peninsula. Rocket Man Kim tests missiles and nuclear weapons, we play war games off his coast with stealth bombers and special forces.

What could go wrong?

The markets go up, just as they should.

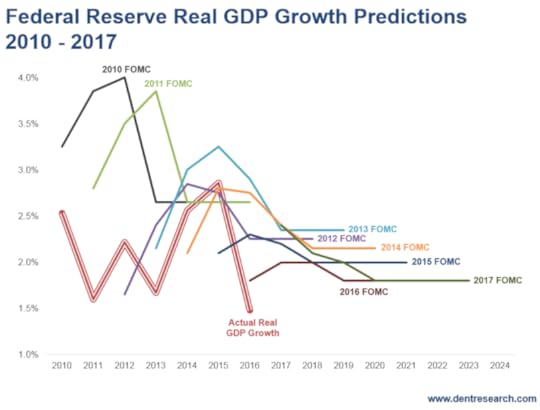

And then there’s my favorite. Slow economic growth. Even as the Federal Reserve printed $3.5 trillion and held interest rates at zero for years, we could barely manage 1.5% to 2.5% growth. As the chart shows, the Fed consistently forecast better days ahead, which never happened.

But why do we pay attention?

But why do we pay attention?

Low growth is an inconvenient puzzle, not a problem. This must be true because the markets went up.

Which all leads back to the platitude playlist in my head.

Investors were nervous ahead of the 2016 presidential election, for all the reasons listed above.

The markets seemed untethered from reality.

Then Trump surprised the world, and we had to change the list of possible outcomes for the next four years. Instead of more regulation, we’d have less. Instead of fighting business leaders, the White House would be a partner for growth. Suddenly, things appeared brighter. I wrote as much last fall, noting that Trump’s election gave investors a new reason for hope, and clearly most people in the markets felt the same way. The major stock indices have tacked on more than 20% since then.

But does it make sense?

Are we, to paraphrase Irving Fisher, at a permanently high plateau? Do P/E ratios, CAPEs, geopolitical events, and GDP growth rates no longer matter?

Color me skeptical.

Earnings season is about to get into full swing, and I expect solid profits from Corporate America. We’re also in the all-important fourth quarter, when Americans spend the most, which should be super-sized after the hurricanes.

But then what?

Maybe we return to the new normal, the one hammered out of the past decade that includes central bank intervention of historical proportion, with more than $15 trillion of new money printed around the globe to bail out banks and support asset prices. In that case, we can rest easy, assured of higher prices for all.

Or maybe we return to just normal, that old world where valuations matter and long-term growth is a concern, because we have to figure out how to pay for our retiring populations and healthcare while keeping our indebted youth afloat.

In such a scenario, the platitudes move to the fore, and the personalities on CNBC start talking about how such a turn was inevitable because, as we all know, asset prices revert to the mean. Which is another platitude.

I guess it’s good to remember why such statements become platitudes in the first place – the words contain wisdom that withstands the test of time.

Rodney

P.S. “Mainstream” financial news outlets like CNBC, Bloomberg, or Fox Business are generally fine for keeping up to date on the daily happenings on Wall Street. But they often fall short in keeping viewers ahead of major market events coming down the pike.

That’s probably why Harry isn’t getting many calls these days to do appearances on their shows. Because if he’s not joining in on the irrational exuberance surrounding this seemingly endless bull run – they don’t want to hear from him!

You can say he’s been “blackballed”… or at least ignored. Maybe it’s just a case of blissful ignorance. But the bottom line is – the proven research that Dent has been built on isn’t getting its equal time from the big players.

And that’s dangerous.

It’s also why Harry’s decided to circumvent the mainstream media and give you the opportunity to hear why he’s standing by our forecast for a major market downturn.

He’s making a special video presentation next Wednesday, October 25th at 4 p.m. EST. It’s available exclusively to Dent Research readers and it’s totally free to attend, but you must register to be there. You can do so quickly and easily right here.

The post Pick a Platitude appeared first on Economy and Markets.

October 18, 2017

A Single Grain of Sand

Brexit. Markets up.

Brexit. Markets up.

Shock election of President Trump. Markets up.

Drum beats of war with North Korea. Markets up.

Hurricanes Irma and Maria. Markets up.

Wild fire incinerating Northern California. Markets up.

There is nothing – nothing – rational about the Dow breaching 23,000 yesterday. Yet it did. (And in short order it’ll come up against a resistance level, which I’ll tell you about in a few moments.)

But then that’s the nature of bubbles.

And that’s what makes them so hard to predict.

They go up, and up, and up, and up, and up… until one day they reverse. It takes just one spark to ignite the gas. One thorn to pierce the flimsy exterior of irrational exuberance. Just one grain of sand to trigger the avalanche.

But identifying that one grain of sand before time is impossible.

That doesn’t mean the bubble won’t burst. It will implode – not gently correct – and all those holdouts for that extra 2% or 5% will have their asses handed to them because when it all goes belly up, there’s no getting out in time to avoid significant damage. Closing the barn door after the horses have bolted is useless!

That’s why we hold our Irrational Economic Summit every year. To highlight the extreme irrationalities of our investing world right now. To provide updates on forecasts, mine in particular, and to help attendees find the best opportunities that don’t put them in harm’s way for a couple of percent gains (and there are dozens of these opportunities).

This year’s conference in Nashville, Tennessee was incredible, and we lived up to our promises. We had a diverse range of speakers that kept attendees and experts engaged. For me though, two things stood out the most…

The first was Michael Terpin, who talked to us about Bitcoin and blockchain technologies. He’s been involved in cryptocurrencies since the beginning, when Bitcoin was 1/10 of a cent. Now it’s near $6,000. It went up $400 on the day he spoke. It was up another $600 the next day. Crazy stuff.

The second was a conversation I had with another of our guest speakers who was a Marine for a while. In the lobby of the Nashville Airport Marriott conference center, he asked: “Did you guys know that three stealth bombers just took off from the Nashville airport, heading west?”

Of course we didn’t! It wasn’t reported in any media we follow (and we haven’t seen or heard anything about it from the ever trustworthy, impartial media – note the sarcasm).

Turns out, The Donald might just do what he says and strike North Korea (not a nuke, but still a strike)! And that might well trigger the crash that’s coming.

Hearing Andrew’s news made me glad I’d re-issued the warning I had on the first day of the conference. During my presentation, I talked about the greatest political and economic revolution since democracy itself… a revolution we’re currently living the early years of.

I also reviewed my four fundamentals, which still all point down together into early 2020.

That’s the danger period for the market, between now and early 2020.

That’s when there’s the highest chance of the major stock crash that I’ve been predicting… where we could see the Dow sink to 5,500.

All it takes is a missile strike on North Korea… or a real-estate crash in China… or a major default in Italy…

Any one grain of sand!

As I mentioned earlier, the Dow broke through 23,000 yesterday, despite seemingly endless bad news. The question now is: how much higher can it go? The answer? The market’s irrational. There’s no telling. But I do have a guide…

I shared this chart with attendees at the Summit last week. It shows a rising bearish wedge. The top of that wedge is currently 23,200.

If stocks can’t break through that resistance level, we could see them drop back to 22,000. If they break below that, it would suggest we’re breaking down out of that wedge and that increases the chances that we’re seeing a top here. If, however, the Dow breaks above the top trend line, that’s a bullish sign.

The other thing I warned about in my presentation last Thursday is the problem I alluded to earlier: once the bubble bursts, we’re likely to see a 41% crash in 2.6 months. Here’s a chart of all major bubble crashes over the last century. See for yourself…

Naturally, with markets at all-time highs (and breaking records daily), there were a lot of questions after my presentation about why my forecast hasn’t come to fruition yet.

Am I just plain wrong?

What’s the hold up?

My answer to that is, part of the problem is that bubbly markets are irrational (as I elaborated on above). They’ll go up until they’ve suckered every last person in and then, when no one expects it, the wheels come off the bus.

The other problem is that central banks the world over have engineered things so that there is literally nowhere else for investors to go but into the stock markets. Interest rates are near zero, bond yields are near zero. Desperate, soon-to-retire Baby Boomers need to do something to survive their golden years. Corporations need somewhere better to put their cash.

And so the markets go up.

Yet I remain firm on my prediction that we’ll see a massive – historical – market crash ahead.

Fundamentals haven’t changed.

Nothing substantial has changed.

And bubbles go until they blow.

Sadly, the media is sick of hearing this story from me – even if it remains true. So, they’ve blackballed me. I don’t get calls for interviews nearly as often. People just don’t want to hear it. They’re in heaven, and that’s where they want to stay. They don’t want to see the hell that’s steadily creeping up on them.

That’s why I’ve decided to circumvent the mainstream media and give you the opportunity to hear for yourself why I’m standing by my forecast for a major market downturn.

I’m finalizing a special video presentation that’ll broadcast next Wednesday, October 25th at 4 p.m. EST. It’s available exclusively to Dent Research readers and it’s free to attend. All I ask is that you register here to watch it and that you don’t miss it!

Like I said: I don’t know what grain of sand will cause the avalanche, or when that grain will fall. But I remain adamant that the avalanche is inevitable.

Now, more than ever, be careful in the markets.

Harry

Follow me on Twitter @harrydentjr

The post A Single Grain of Sand appeared first on Economy and Markets.

October 17, 2017

The Clash of Megatrends That Leaves Consumers Without a Chance

I think Dilbert is hilarious. The comic strip’s creator, Scott Adams, has incredible insight into everyday life.

I think Dilbert is hilarious. The comic strip’s creator, Scott Adams, has incredible insight into everyday life.

More than a decade ago, he showed the cartoon’s title character in a grocery store. A clerk asked Dilbert, a white-collar, micromanaged engineer by day, if he wanted to sign up for the store’s loyalty card so he could save on purchases.

His reply went something like this: “So you want my personal information, which you’ll then use to track me and market to me, and in return I get the manufacturers’ rebates that I’ve always received? And if I don’t give you my data, then you keep the money?”

It illustrated that classic moment when a consumer realizes he or she is boxed in.

Now, loyalty cards are everywhere.

If you don’t have one for your local grocer, you spend hundreds of dollars more than you should every year, because the store keeps the discounts and rebates.

In recent years Adams has turned his attention to the language of persuasion.

He was one of the first to predict Trump’s election success. Not because he favored Trump’s policies over anyone else’s, but because he recognized that candidate Trump’s language was meant to incite, and to persuade with emotions (Lyin’ Ted, Low Energy Jeb, etc.) instead of explain cold policy statements.

It worked.

I’ve often thought about Adams’ study of persuasive language as I looked across the spectrum of everyday life.

And, now more than ever, it struck me that we have front-row seats to the collision of two megatrends that have permeated our daily lives: the widespread use of video, and persuasion.

As with most things, together these forces can be used for good or bad.

The video part has been long in the making.

For decades we’ve delivered content over the internet, but most of it was static. The information wasn’t engaging or consistently updated. For that to happen, we needed much faster connectivity. As we moved from modem, to DSL, to cable modem, to fiber optic, video streaming nationwide became a reality.

Hence the viability of Netflix.

But we also got fabulous benefits aside from entertainment and media consumption.

Salman Khan started his now-famous Khan Academy in 2006 with the goal of bringing online learning tools to students. If you don’t know of it, definitely check it out. He has put together a collection of the best instructors teaching a range of concepts from economics to math, at all levels.

Khan Academy seeks out instructors with fabulous communication and illustration skills, and makes them available via YouTube videos. Imagine having the best algebra instructor, instead of the gym coach at your local high school, teach you about quadratic equations.

The appeal of Khan Academy is immediately obvious to anyone who has encountered barriers in learning, like taking a college class taught by a graduate teaching assistant for whom English was a second language. The website has helped my children for years.

But there are other messages that people want to put in front of us, many aimed at separating us from our cash.

I recently bought my younger daughter a used car. Her current ride, a Ford F150 4×4, had developed rust, which never ends well. So we quickly found a replacement. (Yes, it’s another F150 4×4, but it’s what she likes.)

I wrote a check for the difference between vehicles, but still had to sit down with the dealer’s finance manager.

At one point my daughter asked about the thick, black device that he seemed to be using as a desktop. He told us it was a computer monitor and cost $18,000, and that a third-party sold it to the dealership, not the parent company automaker.

When operational, it will display the different things consumers can add to their car purchases, like warranties and dealer add-ons.

I thought about this, and asked if the display simply showed documents, or video? He answered the latter, and that all buyers will be required to watch it.

Bingo.

Now I knew several things.

The dealership had contracted with a third-party to provide a presentation for each after-market possibility, like warranties, that had the highest probability of success. There’s no doubt that such video presentations, like candidate Trump’s election musings and the videos on Khan Academy, are full of the persuasive language described by Scott Adams.

I’m also certain that this language has been tested in focus groups and used in beta-test situations nationwide to prove its effectiveness. Why else would a dealership shell out almost $20,000 for a display system that will do the same thing the finance manager is supposed to do?

I explained to my daughter that the point of the system was to guarantee that the selling process had the highest chance of success, and to ensure that it wasn’t left to the skill level and whims of each finance officer.

I also told her the eventual goal was to cut headcount, which reduced payroll. I said all of this as we sat with the finance manager filling out forms.

He assured me there was no way to get rid of finance people. The dealership was much too busy.

Those were famous last words from a guy who never presented me the option of an extended warranty on a used vehicle.

That screen, and those videos, are intended to replace him and persuade me.

Technology is bringing the best sales techniques to every situation.

As consumers, if we don’t continually educate ourselves on what we need and what we can decline, we don’t stand a chance.

Meaning we’ll all end up with extended warranties and after-market undercoating.

Rodney

P.S. Speaking of video, although not the kind intended to persuade you, but rather help and inform you, did you miss any part of our Irrational Economic Summit? Click here to get access to our archive kit now.

The post The Clash of Megatrends That Leaves Consumers Without a Chance appeared first on Economy and Markets.

October 16, 2017

Did You See the Moonwalking Bear?

We wrapped up our fifth annual Irrational Economic Summit on Saturday. What an experience!

We wrapped up our fifth annual Irrational Economic Summit on Saturday. What an experience!

This morning, when I opened my email, I had this note from LIVE Stream viewer Murray B.:

What a brilliant event again by you all…

My thanks to everyone involved for a great event, with common-sense speakers from many backgrounds, confirming that we really are on a calamitous path, coming to everyone on the planet, with no solution this time.

The “Great Financial Crisis,” as it is termed, was wrongly named, as it really was only a warning of what is to come very soon. Like a tsunami. Unstoppable.

I cannot believe the utter stupidity of central bankers believing that a debt problem can be solved with much more DEBT, blindly following some experimental Keynesian model into oblivion, without seeing the WRONG WAY signs.

Mr. B, thank you for the note. It was a wonderful way to start Monday morning.

As I said in my last email, we still had Andrew Sandoe to speak after lunch on Saturday and then a couple of workshops to close us out. As the senior partner and chief investment officer at Fidelis Capital Management, Andrew spoke about why value investors consistently win.

It was the presentation he wishes he’d gotten when he started investing. He would have avoided years reading and learning about strategies that ultimately had a low likelihood of succeeding.

His goal on Saturday was to help you avoid wasting time.

His first recommendation: Of the 43,279 investing titles you could find at Barnes & Noble, there are only THREE worth reading…

Andrew went on to prove that with value investing, you can achieve greater returns for less risk.

He also shared three rules for successful stock buying and the one golden rule to ALWAYS follow.

Then he played a YouTube clip to demonstrate how fallible humans are. Simply by me asking you if you saw the moonwalking bear, I’ve ruined the test for you. But he played the video for the 400 people in the Nashville Airport Marriott, among whom only three had seen it!

To hear all the details for yourself, access to Irrational Economic Summit archive kit now (access to this kit will close on Wednesday night so if you don’t have your username and password by then, then you’re out of luck).

Andrew wrapped up with one suggestion and three takeaways:

Google and then watch Charlie Munger’s speech “24 Sources of Human Misjudgment.”

Value investing beats all other strategies on both an absolute and risk-adjusted basis.

Quantitative value returns beat fundamental value.

Ted Williams, arguably the greatest hitter who ever lived, literally wrote the book on the science of hitting. His empirical advice: Only swing in the red or the orange.

It was a fascinating, enlightening talk.

Before we wrap up the on-the-ground reporting for this year, let’s quickly recap what we heard Thursday, Friday, and Saturday…

On Thursday, October 12:

Harry Dent kicked off the conference with his presentation on how you can turn the greatest political and financial upheaval in modern history to your advantage. He talked about some of his key insights, one of the most important of which is that three revolutionary cycles are converging for the first time since the late 1700s, when we saw the emergence of democracy and free-market capitalism, the steam engine, and the Industrial Revolution. In short, Harry’s recommendation is to get out sooner rather than later. It’s what Baron Rothschild credits for his success. But he doesn’t believe you should run for cover. Instead, there are opportunities out there to take advantage of now… and even after the crash has started.

Brendan Kennedy, CEO of Privateer Holdings, shared one such opportunity when he took the stage after Harry. His goal: to explain how to invest in legal cannabis. His message: Do it carefully… but do it!

Michael Terpin, founder and CEO of Transform Group, presented via Skype. Michael is Harry’s go-to bitcoin expert. His message was about how to invest in what’s forecast to soon be a $5 trillion asset class. This is scary for many people, but what few know is that there will only ever be 21 million bitcoins. The other thing is, you just never know with disruptive technology. For more details from his talk, including the first product bought using bitcoin and why cryptocurrency is really the equivalent of digital gold, watch the archives.

Stephen Sandford, author of The Gravity Well, took the stage to talk about the final frontier and how close the opportunities really are. This talk really struck a chord with the audience. There’s just something so captivating about space, and most attendees still remember Neil Armstrong’s first step on the moon and the Challenger disaster. He had a warning: Let’s not make the irreparable mistake the Chinese did when they turned back their world-renowned sailing fleet.

On Friday, October 13:

Rodney Johnson talked about the next phase of energy. As he explained, oil was once the ticket, but batteries are now changing the world. Once we can store energy, we get control, and that’s going to make some people very angry. It’s truly energy, money, and control, and Rodney walked us through the history of oil to prove it.

Raoul Pal, founder of RealVision TV, talked about the global risks according to the “Masters of the Markets.” He started by sharing a very interesting video, which I recommend you watch if you missed it. It was about the drumbeats that Raoul and his contacts are hearing right now.

Adam O’Dell’s message was about how primal fear kills investor performance (quite appropriate considering Raoul’s message)… and what you can do to overcome it. His message: Understanding and conquering fear is the key to your success as an investor.

Mark Gordon, CEO of Odyssey Marine Exploration, shared details of an unbelievable nightmare he had to endure, and the invaluable lesson it taught him about surviving adversity.

Lacy Hunt discussed five different hypotheses for the economy. He’s the only economist that Harry trusts, and he’s been a regular at our conferences over the years. There were an incredible number of fascinating facts. Make sure you watch the recording of Dr. Hunt’s presentation to hear it all.

Andrew Swan, founder of LikeFolio, talked about how social data is transforming investment research. He started out with a story about Pat Day and how the Hall of Fame jockey would go to the back end of the track every day of his career so he could see how the horses were feeling. As readers of Harry, Rodney, Adam, Charles, John, and Lance, you’re like Pat Day, who said, “You’re in this to win this!” Then he told the story of Pappy Van Winkle bourbon and how, over the course of one year, the liquor store that sold the brand went from being unable to move it to holding a raffle for the rights for 30 of the 1,500 people standing outside to buy the remaining bottles! And you could see this coming if you’d been watching Twitter trends!

Barry Potekin, VP of the Rutsen Meier Belmont (RMB) Group, took the mike to talk about managed futures, addressing the big question, if not now, when? His point is that the world is changing, and it’s changing fast. There are genies popping out of the bottles all the time now. So stay nimble and agile.

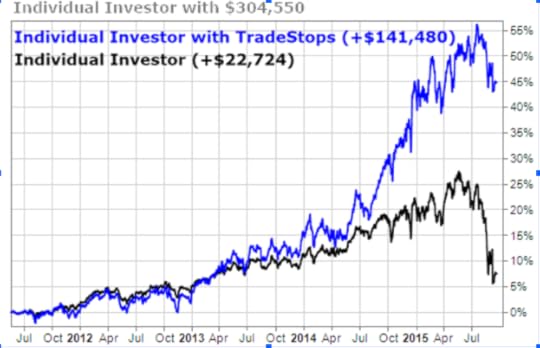

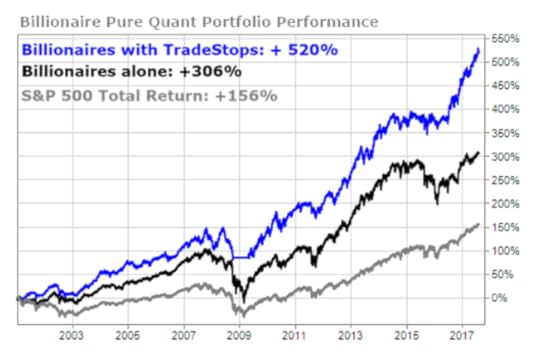

Richard Smith, founder and CEO of Tradestops – a platform that all of our Dent Research editors use to manage their respective portfolios’ stop loss levels – stood up to talk about the billionaire quant portfolio that beats the market by more than 330%. Sounds too good to be true, but it is a fact! And Richard provided all the evidence and then some…

Andrew Pancholi is the man who almost out-cycled Harry at last year’s Irrational Economic Summit. And he’s co-author of Harry’s latest book, Zero Hour, which is out on November 15. He shared the most amazing details about the cycles underway that you’ve just got to watch it for yourself.

On Saturday, October 14:

John showed guests and LIVE Stream viewers how to find hidden profits… He started with the number 761. Every minute of every day, the company John talked about produces 761 units. So how can it offer hidden profits, especially if it produces 400 million of these iconic units each year? Well, John explained.

Lance revealed how to profit from interest rate volatility… He started by arguing that the Federal Reserve is out of control (which is good for those profits he later talked about). And he gave an interesting history of central banks and how the Fed was created. All of this was to explain that the Treasury market is far from boring… that small moves in yield can create big price swings… that a big move in price means a bigger in the ETF… and that a big move in the ETF means an even bigger move in the option.

Charles showed more passion for finding income in a low-yield world than anyone I’ve ever seen talk about this topic. He shared a story about the difference between his grandfather and his father retiring. The former retired with not a care in the world. He was financially secure. The latter is in a very different situation. Boomers retiring today are completely on their own. The horrifying news is that most financial plans are toast, especially if they’re prepared on the assumption of 4% withdrawal levels in retirement. Studies done by two different research firms found that with such plans there’s a 30% to 57% chance that you’ll run out of money. So, he set out to help attendees find yield without hunting for it.

Howard Lindzon, founding editor of Peloton, talked about spotting trends earlier and getting ahead of the SaaS (software as a service) wave… and he certainly has experience with both! He shared eight market truths, which you can listen to here.

That’s it.

Our fifth annual Irrational Economic Summit is done and dusted! And it was a huge success.

A big thank you to all of those involved in its organization: Amanda Klein, Megan Johnson, Kelly Secoura, Stephanie Gerardot, and Shannon Sands (to name but a few).

A big thank you to all the speakers: Harry, Rodney, Charles, Adam, Lance, John, Andrew Pancholi, Andrew Sandoe, Brendan Kennedy, Dr. Lacy Hunt, Michael Terpin, Stephen Sandford, Raoul Pal, Mark Gordon, Andrew Swan, Dr. Richard Smith, Barry Potekin, and Howard Lindzon.

A big thank you to all those who joined us in Nashville and who watched via LIVE Stream.

And a big thank you to you for reading this on-the-ground reporting.

Until the sixth annual Irrational Economic Summit in Austin, Texas, this is Teresa signing off.

Teresa

The post Did You See the Moonwalking Bear? appeared first on Economy and Markets.

October 14, 2017

What the Cycles Are Saying About 2017 and 2018

Teresa vd Barselaar, reporting LIVE from the IES 2017

There’s just one day left of the 2017 Irrational Economic Summit, and I speak for all of us when I say, “We’re exhausted!”

The amount of information being shared here, at the Nashville Airport Marriott conference center is, quite honestly, overwhelming.

One attendee told me, “This is very good, quality information. Overall, the blend of subjects makes this very interesting. Each speaker brings a special theme, perspective, and way of thinking. That makes this conference constantly interesting.”

Shana T. said, “It’s like skimming the surface of a huge cage here. We’re scooping off that thick layer of icing and now we’re dying to dig into the cake itself!”

Tim C. noted, “This is the second Irrational Economic Summit I’ve been too. I was in West Palm Beach last year. It’s all interesting. The only reason I’m here is to hear when to get out of this market!”

At lunch, Adam O’Dell told me, “The speakers this year are fascinating. It’s the most diverse collection of ideas we’ve ever brought to the table.”

Every year we’ve improved on the year before. Just imagine what the Irrational Economic Summit in Austin Texas next year will be like!

This morning we’re scheduled to hear from John Del Vecchio, Charles Sizemore, and Howard Lindzon. More on what they have to say later today.

For now, let’s recap what the speakers shared with guests and listeners Friday afternoon…

At 1:45 p.m. Central Time, Andrew Swan, Founder of LikeFolio, kicked off the afternoon session talking about how social data is transforming investment research.

Actually, he started out talking about Pat Day and how the Hall of Fame jockey would go to the back end of the track every day of his career so he could see how the horses were feeling. As readers of Harry, Rodney, Adam, Charles, John, and Lance, you’re like Pat Day, he said: “You’re in this to win this!”

Then he told the story of Pappy Van Winkle bourbon and how, over the course of one year, the liquor store that sold the brand went from being unable to move it to holding a raffle for the rights for 30 of the 1,500 people standing outside to buy the remaining bottles!

And you could see this coming if you’d been watching Twitter trends!

LikeFolio has an agreement with Twitter that sends a copy of every tweet posted to its servers. It then analyzes each tweet to determine how a product name is being referred to (positive or negative) and if there’s an intent to purchase. The result of that information is a significant advantage over Wall Street. It gives an edge by seeing the shifts in consumer spending patterns before anyone else!

Proof is in the pudding.

LikeFolio projected that Apple Watch would sell nine million to 14 million units in 2015, well below analysts’ expectations. They were laughed off the stage for that call, which turned out to be spot on!

The company also warned that Decker’s UGGs (shoes) weren’t going to do well in the upcoming holiday season. It didn’t. You can listen to all the details here.

You can also get the LikeFolio app, from which you can subscribe to alerts that will tell you when Andy is warning about a company or signaling an upturn. And it’s all free.

When Barry Potekin, VP of the Rutsen Meier Belmont (RMB) Group, took the mike, it was to talk about managed futures. The big question is, if not now, when?

His point is that the world is changing, and it’s changing fast. There are genies popping out of the bottles all the time now. So stay nimble and agile.

Also, diversify; it’s impossible to know what will trigger the next crisis.

Richard Smith, Founder and CEO of Tradestops – a platform that all of our Dent Research editors use to manage their respective portfolios’ stop loss levels – stood up to talk about the billionaire quant portfolio that beats the market by more than 330%.

Sounds too good to be true, doesn’t it? Only it absolutely is true, and Richard provided all the evidence and then some…

Just by managing your portfolio better, you can increase your profits many-fold. For example…

To hear the rest of what Richard said, watch the recording now. Of particular note are the stories of the billionaires who made massive mistakes that were completely avoidable.

And remember, here are the rules to best the billionaire portfolio:

Stay out of the red zone.

Keep average VQ below 40%.

Only buy is trade is positive on entry.

Maximum number of entries is 25.

Minimum number of entries is 10.

Keep portfolio risk-balanced at each step.

Replace stopped out position with next buy.

Finally, it was Andrew Pancholi’s turn to take the stage. Andrew is the man who almost out-cycled Harry at last year’s Irrational Economic Summit. And he’s co-author of Harry’s latest book, Zero Hour, which is out on November 15. I edited the book for Harry and Andrew, and I’ll tell you: Andy’s grasp of cycles is rivaled only by Harry’s. He proved this again yesterday afternoon.

Did you know that the Berlin Wall stood for 28 years? It was also 28 miles long!

Andy loves ALL the details!

Here are some those details that he shared on Friday afternoon…

2017 is a major tipping point. It’s the nexus where three major cycles – the three

Harry shared in his presentation on Thursday – collide!

As we get into the next decade, Russia will see the 250-year anniversary of the Pugachev’s Rebellion Peasants’ War. Russia is going to change dramatically!

There is a mathematical order to all events.

A key cycle is a 72-year cycle. If you take the 1929 crash and add 72 and that takes you to the 2001 equity tops. Back 72 years and we saw the 1857 panic.

The next one in the cycle is 144, and this one is particularly strong in commodity markets. 1720 was the South Sea Bubble and the Mississippi Land Crisis. 144 years later was the civil war. Cotton was trading at two cents to three cents per pound. The war broke out and prices exploded to $1.99 per pound! 144 years later we had the commodity boom.

The 100-year cycle is also interesting. In 1907 there was the Rich Man’s Panic. In 2007 we had the Global Financial Crisis. In the half cycle of 50 years, there were runs on banks in every case.

Andy then shared his macro case for 2017, and it was chilling.

One of the attendees, who was sitting behind me, commented, as Andy was taking the stage, “This guy is brilliant! You’ve got to listen to him.” By the end of Andy’s talk, I’m sure everyone in the room felt the same way!

After the speeches in the main ballroom wrapped up, speakers and attendees split off into various workshops. I couldn’t get to each one, of course, having only one body. But LIVE Stream viewers, and anyone who gets access to the Irrational Economic Summit Archive Kit, were and can watch them all! And watch them you must!

Rodney talked about earning profits in an uncertain world.

Barry talked about how the sun should shine on silver soon.

Harry and Andy held a panel discussion.

Richard Smith talked about how to beat the billionaires.

Andrew Swan explained how to take action on investments using social data.

And Zack Hutson (of Privateer Holdings) shared details about how to invest in legal cannabis.

All of the workshops were recorded and you can watch them in the Irrational Economic Summit Archive Kit, available here.

This afternoon I’ll review the speakers and events from this morning’s session, but, so far, it’s safe to say that the Irrational Economic Summit 2017 has been a huge success.

What’s been your highlight of the conference so far? Write to me at economyandmarkets@dentresearch.com or leave me a note via Twitter or on our Facebook page.

Until tomorrow morning, then, reporting live from the Irrational Economic Summit 2017…

Teresa

The post What the Cycles Are Saying About 2017 and 2018 appeared first on Economy and Markets.

October 13, 2017

The Energy Revolution Is in Motion

What a morning!

We’ve watched such an incredible lineup of speakers so far that it’s hard to believe there are even more great presentations to follow this afternoon

The guests are amped, and so are the speakers.

Rodney Johnson kicked us off this morning, bright and early, talking about the next phase of energy.

As he explained, oil was once the ticket, but batteries are now changing the world. Once we can store energy, we get control, and that’s going to make some people very angry.

It is truly energy, money, and control, and Rodney walked us through the history of oil to prove it. It’s a true tale fraught with greed and political chicanery. In the 1970s, this led to oil going from $3 dollars a barrel to $12… in six months! Many of you remember that pain.

Today the race is on the find alternatives, and it looks like batteries are about to make the revolution.

Lithium-ion technology still has issues, like exploding devices, but the bigger problem is that it doesn’t work like we need it to for the next phase.

The problem with Tesla is that its batteries still take a long time to charge.

However, battery power is getting cheaper. Today it’s about $140 per kilowatt hour. But we need it at $100.

In walks…

The solid-state battery. That’s the ticket! And Rodney explained it all. You can listen via the IES Archive Kit, which you can access here

The technology will impact cars (watch out for Toyota here)…

It’s impacting power storage in our homes…

It’s improving mowers (E-go, Ryobi, Snapper), home appliances (iRobot, Dyson), cell phones, and laptops and tablets! (Dyson even recently announced it’s making an electric car!)

But none of this means oil is dead. You’ve got to listen to Rodney’s explanation.

The really cool part is who wins in this energy revolution. Well, YOU AND I win. We pay less for the power we need, and it’s going to get cheaper! We also win with the investment opportunities that are already popping up. Albemarle Corp. (NYSE: ALB) – a lithium miner – has been in the Boom & Bust portfolio for about a year now and is up about 70%. Rodney discussed the other opportunities out there (as well as the losers).

Based on the audience’s reactions during Rodney’s presentation, his message resonated!

Next was Raoul Pal, who talked about the global risks according to the “Masters of the Markets.”

He started by sharing a very interesting video, which I recommend you watch if you missed it. It was about the drumbeats that Raoul and his contacts are hearing right now.

Clearly, something’s wrong. All of the famous investors are watching something, and they’re scared. They talked to Raoul and his team about it…

Kyle Bass warns that if you see the markets crack a little, buckle up. Among other things, he points to the geopolitical situation (as does Harry) and how it’s all coming to a boil.

Jesse Felder says that investors are taking on an incredible amount of risk for the prospect of zero potential reward over the next 10 years. There are many parallels today to the early 2000s experience, he said.

Jim Rogers announced that we’re about the see the worst bear market of your lifetime, and it’s likely to start next year, maybe even this year!

Mark Yusko says we’re at a very important junction. He said a year ago that things were looking bubbly, but now it’s even worse, and it’s time to get cautious.

As Raoul demonstrated, experts are worried about the stock markets… they’re also worried about the economy…

He shared a U.S. Leading Indicator chart, and it’s terrifying.

It was interesting to note that all of these men were saying the same things Harry has been saying for a while now (about debt and bubbles and demographics, etc.)!

There are so many warning signs that it’s almost like we trying to swim through a growing swarm of deadly jelly fish!

I found Raoul’s talk very distressing. It left that uneasy feeling in the pit of my stomach. How about you? If you’re watching in person or via LIVE Stream, what thoughts did you take away from Raoul this morning?

Let me know by emailing me at economyandmarkets@dentresearch.com

Adam O’Dell took the stage after Raoul. His message: how primal fear kills investor performance (quite appropriate considering Raoul’s message)… and what you can do to overcome it.

To start, we need to ask ourselves why we’re investing. In his experience, we do so for two reasons: two make money or to feel smart. Only one of those reasons is a good one!

So, if you invest to make money (which is the only reason you should invest), then the only question you should ask is, what moves market prices? Adam offered a list of about 10 price movers. But then he noted that none of these things actually move prices and explained why.

There’s only one factor that moves market prices all of the time, and Adam did a magic trick to demonstrate.

Definitely a presentation worth watching if you missed it.

In short, understanding and conquering fear is the key to your success as an investor…

A recent study by Dr. Andrew Lo found that professional traders (people who do this for a living and aren’t even using their own money) experienced the physical symptoms of fear during periods of heightened volatility!

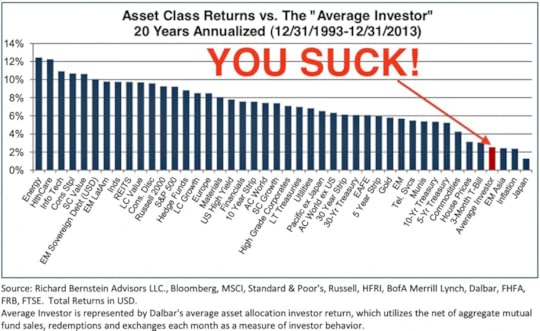

A Dow Bar study shows that fear actually KILLS investor performance. See for yourself…

If you’re a buy-and-hold investor because you let fear control you, your success as an investor is entirely dependent on luck! You didn’t decide when to be born, yet that determines what bear or bull markets you endured as an investor.

There’s a “Dying While Broke” paradox: You MUST invest in risk assets, yet we psychologically CAN’T (thanks for our fears). But there is a solution, and that is to invest in risk assets using a system! Specifically, that system must eliminate your emotions and your decisions.

After a much-needed coffee break, where guests flocked to Adam, Raoul, and Rodney to ask questions and just chat, Mark Gordon took the mike and wowed us with tales of the deep!

Mark shared a nightmare that was you wouldn’t think could be real, but it absolutely is, and it taught him an invaluable lesson about surviving adversity.

His company, Odyssey Marine Exploration (Nasdaq: OMEX), is a leader in deep-ocean exploration. In 2012, it made it into the Guinness World Book of Records for one of its campaigns, during which Mark’s team recovered hundreds of millions of dollars of silver.

He posed this question: Imagine that you woke up one morning to discover your company and investment was only one-third of its value the day before… imagine the Federal government was basically gunning for you.

That’s what happened to Mark, on June 4, 2009, after his company had recovered tons of coins from the ocean floor. They code-named the recovery “Black Swan” (rather ironically). The “Black Swan” should have realized his company massive gains from their efforts. Instead, it landed them a $1.2 million fine!

While it damaged the company, it didn’t destroy it. And Mark explained how he and his team turned their fortunes around. He shared five action steps to take to pivot to success.

Mark’s speech was inspirational. He made it clear that anyone can pivot to success! And he detailed four baskets to consider when studying investments in this sector.

Finally, Dr. Lacy Hunt stood up to talk about five different hypotheses for the macro economy. Dr. Hunt is the only economist that Harry trusts, and he’s been a regular at our conferences over the years.

He was a favorite of the audience as well.

Did you know…

The personal saving rate (everything we earn, less our consumer expenses, less taxes, plus interest earned) has been 8.5% since 1900. In August 2017 that rate was only 3.6%!

Our economy is no longer growing, in terms of household income, at the rate it traditionally did. Since 1956 the average rate of growth was 2.1%. In the last 12 months that growth rate was only 0.6%!

Monetary policy is very asymmetric today. A lot of easing does little, but a little tightening will go a long way! If the Federal Reserve executes QT (quantitative tightening) for just one quarter, money supply growth will sink from 5.3% to 4.2%. If it did it for 12 months, money supply growth will sink to -2.8%!

There were just too many fascinating facts to repeat here. Make sure you watch the recording of Dr. Hunt’s presentation to hear it all.

Friday afternoon brings us Andrew Swan, Barry Potekin, Richard Smith, and Andrew Pancholi. I’ll report back to you Saturday morning on what they shared with attendees and LIVE Stream viewers.

If you’ve been unable to watch via LIVE Stream, or join us in Nashville, make sure you get your username and password for the Irrational Economic Summit 2017 Archive Kit. With it, you’ll have access to everything said and done at this year’s summit – on demand!

Until tomorrow morning then, reporting live from the Irrational Economic Summit 2017…

Teresa

P.S. Remember, whether you’re on the ground with us here in Nashville, or watching from the comfort of your own home (or office), talk to us. Ask questions, engage with your peers and us on our Facebook page or on Twitter.

You can email me at economyandmarkets@dentresearch.com

You’ll find our Facebook page here.

And our Twitter handle is @economymarkets.

For any social media interaction, use #iesnashville.

P.P.S. Thanks to Gary K. for his email yesterday. He wrote, “Harry Dent was excellent, as usual. Lots of charts and new information on live stream. I enjoyed Brendan Kennedy on legal cannabis also.”

The post The Energy Revolution Is in Motion appeared first on Economy and Markets.

One of the Greatest Mistakes in History

Note: Before we get into our review of yesterdays’ speakers, an apology. Thankfully, the gremlins seem to have stayed away from the technology. Unfortunately, they found their way into my emails to you. In my first email to you yesterday I said Harry was talking at 1:25 p.m. (EST). That was wrong. We’re in Nashville, so we’re on Central Time. And then the second email I sent yesterday had the wrong subject line, which must have been just as confusing. Nothing like keeping you on your toes! Hopefully, the Gremlins are done messing with me. Now, on to this morning’s email…

Note: Before we get into our review of yesterdays’ speakers, an apology. Thankfully, the gremlins seem to have stayed away from the technology. Unfortunately, they found their way into my emails to you. In my first email to you yesterday I said Harry was talking at 1:25 p.m. (EST). That was wrong. We’re in Nashville, so we’re on Central Time. And then the second email I sent yesterday had the wrong subject line, which must have been just as confusing. Nothing like keeping you on your toes! Hopefully, the Gremlins are done messing with me. Now, on to this morning’s email…

Yesterday was certainly exhilarating!

Day One of our fifth annual Irrational Economic Summit was an unprecedented success… thanks not only to the four incredible speakers who took to the stage in the afternoon, but also to all the attendees here at the Nashville Airport Marriott and those watching via LIVE Stream.

Remember, whether you’re on the ground with us here in Nashville or watching from the comfort of your own home (or office), keep the conversation going. Ask questions and engage with us and your peers on our Facebook page or via Twitter.

You can email me at economyandmarkets@dentresearch.com

You’ll find our Facebook page here.

And our Twitter handle is @economymarkets.

For any social media interaction, use #iesnashville.

During the breaks, I flitted around the room like a social butterfly (unfortunately there was nothing graceful about it) to hear what guests thought and felt about the conference so far. Here’s what I heard…

“Both Harry and Brendon presented interesting concepts and ideas of where we can look for opportunities in the chaos.”

Amy Stifter

“So far the conference is very good. I’ve been coming to the Irrational Economic Summit for three years now. I’m a network member, so I can read about much of the information they share here, but I come to meet the people. It’s a psychological uplift for me more than it is an economic or investment one.”

Barry Segal

“Harry’s information is powerful and there’s so much of it, but he talks so fast. I kept wanting to ask him to go back a few slides so I can take a better look!”

Pierre King

Clearly, LIVE Stream has the advantage of allowing you to see the archives so you can go back and listen again and again. Still, the experience on the ground is different –more fulfilling. Hopefully you’ll be able to join us next year.

Now, let’s look at some of the highlights from what Harry, Brendan, Michael, and Stephen shared with attendees and viewers on Day One of the Irrational Economic Summit.

After Rodney’s introduction and the speakers each walked across the stage to say “hi,” Harry Dent took to the podium to talk about how you can turn the greatest political and financial upheaval in modern history to your advantage.

As he mentioned on Tuesday, his new book will be out on November 15! It’s called Zero Hour: Turn the Greatest Political and Financial Crisis in Modern History to Your Advantage. And, as he promised, he gave attendees and LIVE Stream viewers a sneak preview of the most important points of the book.

He started with a forecast: “With what lies ahead, I predict that those who come to conference in Austin next year will wish they’d come to this conference!”

Then he went on the talk about some of his key insights, one of the most important of which is that three revolutionary cycles are converging for the first time since the late 1700s, when we saw the emergence of democracy and free-market capitalism, the steam engine, and the Industrial Revolution.

Harry’s been warning about a 250-year cycle for many years, but fellow speaker Andrew Pancholi has two additional cycles that reinforce this even more. (Andy will talk at 4:10 p.m. Central on Friday.)

The implications of these cycles are critical during the next few years and for decades to follow. There is a massive social and political revolution underway, and it’s just beginning. In January 1933, Hitler promised to make Germany great again. In January 2017, Trump promised to “Make America Great Again.”

Harry was clear that he isn’t comparing the two, but he did emphasize that both leaders rose on the back of populist movements that changed the world.

For me, the highlight of Harry’s talk today was his sunspots discussion. As he said, “Sunspot cycles is the best thing I’ve found since 1988. It targets downturns and crashes and averages about 10 years, although the cycles can stretch from eight to 14 years! And the research shows that every recession since 1850 correlated with sunspot downturns 88% of the time. That’s no coincidence.”

Then he shared this chart…

Very telling.

Very telling.

In short, Harry’s recommendation is to get out sooner rather than later. It’s what Baron Rothschild credits for his success.

But he doesn’t believe you should run for cover. Instead, there are opportunities out there to take advantage of now… and even after the crash has started.

That’s why we have Adam O’Dell and Rodney Johnson and Charles Sizemore and John Del Vecchio and Lance Gaitan on the Dent Research team. It’s also why we brought together the speakers we have for this conference.

Brendan Kennedy, CEO of Privateer Holdings, shared one such opportunity when he took the stage after Harry.

His goal: to explain how to invest in legal cannabis.

His message: Do it carefully… But do it!

In 1969, only 12% of American’s believed cannabis should be legal. Now it’s a very different situation, with more than 93% of Americans agreeing it should be legalized for medical purposes, 61% conceding it should be legal recreationally, and 70% thinking states should have the right to set their own cannabis laws.

Every year in the U.S., $30 billion to $50 billion worth of pot is cultivated. That’s more than corn, which comes in at $23 billion.

Research and development underway right now is making legalized medicinal cannabis even more important. Studies are looking at the impact of vaporized pot for helping sufferers of COPD (chronic obstructive pulmonary disease) to breathe more easily. It’s helping victims of post-traumatic stress sleep better at night and deal with their condition. Cancer patients undergoing chemotherapy are also using it to cope with nausea and vomiting. And it’s reducing seizures for children with epilepsy.

Attendees had dozens of questions when Brendan was done. They wanted to know about the dangers to children of ingesting pot and how banks are overcoming the challenge of handling money acquired through the cannabis industry and where to invest now!

Interestingly, Brendan explained that if you have four shot glasses on a table – one containing ingestible cannabis, one bourbon, one sugar, and one aspirin – of all of those for the child, the least dangerous is the pot. Sure, the kid would feel horrible for 24 hours, and you’d need to take him or her to the hospital, but the other items could kill him. Cannabis, in over 5,000 years of use, has no recorded deaths by overdose!

If you want to know where Brendan suggested you invest now, sign up for the LIVE Stream, which includes the archives and presentations from each speaker.

Next up, at 4:15 p.m. Central, was Michael Terpin, founder and CEO of Transform Group. Michael is Harry’s go-to bitcoin expert. He also lives in Puerto Rico, where Harry met him.

Michael was unable to be in Nashville with us – he was in Bordeaux, France – but he recorded via Skype to talk about bitcoin, blockchain, and initial coin offerings, and then we called him to answer attendee questions. He, too, had tons of questions to answer from the crowd, which the speakers really appreciate.

His message was about how to invest in what’s forecast to soon be a $5 trillion asset class. This is scary for many people, but what few people know is that there will only ever be 21 million bitcoins. We know a certain amount was burned by a group called Counterparty, who wanted to create a coin of their own. But the currency is limited in size by its own algorithm.

The thing is, as Michael said, oil was controversial and volatile when it was first being brought to market because it was flammable and difficult to extract. Cars were controversial because they were dangerous. In fact, the first cars had to have someone walking in front waiving a flag to warn a car was coming. Even personal computers were unbelievable. No one could understand why you’d want to take a computer home after working on one all day.

His point: You just never know with disruptive technology.

For more details from his talk, including what the first product was that was bought using bitcoin and why cryptocurrency is really the equivalent of digital gold, watch the archives available via the LIVE Stream.

Finally, our keynote speaker this year – Stephen Sandford, author of The Gravity Well – took the stage to talk about the final frontier and how close the opportunities really are.

This talk really struck a chord with the audience. There’s just something so captivating about space, and most attendees still remember Neil Armstrong’s first step on the moon and the Challenger disaster.

He started with a story…

A hundred years before Columbus sailed, the Chinese launched the greatest fleet the world had seen. It consisted of 300 ships and 28,000 sailors, marines, businessmen, you name it.

The largest ship had four decks above the water. It could have held Columbus’s Santa Maria inside it.

The Chinese ruled the seas, from Korea to Africa.

But then, after seven great voyages, they pivoted and turned inward. Their fleet shrank. Pirates took over the Indian Ocean. China’s economy stagnated for the next 500 years.

They had great short-term reasons for turning back. Ships and crews cost money. And they had other priorities. One of those was to build the Great Wall. But the main reason was that they were done. They’d done what they set out to do, which was to impress their enemies and allies.

What if, instead, they’d kept exploring? What if they’d developed better technologies? What if they’d beaten Columbus to the New World?

The Chinese made one of the greatest mistakes in history. They set a goal with nothing beyond that. And America has made the same mistake. Luckily, it’s not too late for us to rectify it.

While he was doing a book signing, I caught up with Stephen and asked him what his number one message is for conference attendees and viewers. He replied…

“I want this community to understand the benefits of an audacious space program and to inspire them to invest in the space economy.”

When I pulled Harry aside to ask what was the highlight of today from him, he said, “I learned more about blockchain and bitcoin technology in one hour from Michael Terpin that I did reading an entire book from the respected Don Tapscott. You’ve gotta listen to Michael’s presentation again and take notes!”

(You can hear Michael’s presentation via the LIVE Stream, which will contain archives of this entire event.)

That wraps up the review of our Thursday afternoon. Tell me, if you’re here in Nashville with us or watching via LIVE Stream, what was your highlight from yesterday? Let us know on Facebook or Twitter using #iesnashville. Or email me at economyandmarkets@dentresearch.com.

I’ll be back later today with a review of this morning’s speakers, which include Rodney Johnson, Raoul Pal, Adam O’Dell, Mark Gordon, and Lacy Hunt.

Reporting live from the Irrational Economic Summit 2017,

Teresa

P.S. One comment we got today on the LIVE Stream chat summed up today’s conference beautifully. The viewer simply said, “Enlightening.”

The post One of the Greatest Mistakes in History appeared first on Economy and Markets.