Harry S. Dent Jr.'s Blog, page 65

January 19, 2018

When the Ugly Gets Profitable

Whew! What a run!

Whew! What a run!

It’s been breathtaking to see stocks rocket higher in 2018 with almost no selling pressure. It’s the hottest start in decades, investors are scrambling to catch up, and stock and bond exchange-traded funds have seen average daily inflows of $3.3 billion in the first eight days of trading in 2018.

That’s a mind-blowing amount of buying.

Individual investors aren’t the only buyers. Corporations have stepped up their buyback programs – in December, corporate buybacks hit a six-month high at nearly $100 billion. Big buybacks have been a key driver of this bull market since 2009, and at this point it’s a requirement to propel the markets higher.

But the question remains, are investors piling in too late? To say that market valuations are stretched would be an understatement. Take, for example, the median price–to–sales ratio on the S&P 500. It’s at the highest level. Ever.

Back in 2009, when we were coming through the financial crisis and the market was bottoming, you could have picked up the S&P 500 for 0.8 sales. That’s a reasonable level to buy a dollar of sales for less than a buck. It also represented the cheapest level in about 17 years.

Today, you’re paying 2.63 times revenue. That’s rich. And it’s not because sales growth in the S&P 500 is rocketing to the moon. There hasn’t been a double-digit growth rate in a decade. In 2015 and 2016, revenue growth was negative. Yet the market has been in an unrelenting uptrend.

As you would expect with a market that rises nearly every day, investor sentiment has become extremely bullish. One of my favorite polls is the Ned Davis Research (NDR) Crowd Sentiment Poll because it’s a collection of various market sentiment gauges and provides a good sense of market sentiment among different investor groups.

Currently that NDR poll is at 78.9, which is not only a clear sign of “extreme optimism” but also the highest level ever. As an investor, you want to act contrary to the group view on the market, so extreme optimism is a scenario where you want to act defensively with respect to your investments. Right?

Of course, none of this has mattered.

The market has also hit records of low volatility and lengths of time with no meaningful pullbacks. We’re in uncharted territory. These warning signs won’t matter until they do. While the markets change and the factors driving the markets change, human nature never changes.

Right now we’re lulled into a sense of complacency. When that changes, it’s going to get nasty.

But there is a stock out there that’s already gotten a beating and hasn’t enjoyed the huge upward trajectory that’s taken hold of pretty much everything else. In fact, my research once identified this company as one as the worst stock among the 500 largest publicly traded companies in the United States.

Thing is, when you’re at the bottom, there’s only one place to go, and that’s why I’ve selected this stock as this month’s Hidden Profits recommendation. Sometimes ugly stocks make for great investments. After getting hammered, things appear to have bottomed, and improving fundamentals will lead to big margin and cash flow benefits and the stock can trade much higher from here.

This company now has so much room to run, and so much cash flow in its future, that it’s set up to reward investors for the long haul. Wall Street is still bearish on this stock, so we have the chance to get in well before anyone else does. It’s clearing out inventory, investing in important new technologies, and it’s well on its way to doubling or even tripling operating margins.

This is a play for the back half of 2018 and beyond. Read the whole story here.

Good investing,

John Del Vecchio

Editor, Hidden Profits

The post When the Ugly Gets Profitable appeared first on Economy and Markets.

January 18, 2018

Can We Make Sound Financial Decisions Anymore?

I.

I.

Hate.

Central.

Banks.

Loathe them.

They’ve hijacked our economy and the markets and taken away all our power to make sound financial, investment, and business decisions.

Sure, you’ve got to hand it to them: they pulled us away from a depression, thanks to their trillions in stimulus. I mean, QE has had a huge impact on the economy. Two percent growth isn’t great, but it’s a hell of a lot better than a depression.

But in the process, they’ve separated the economy and markets from any fundamentals.

There’s no rhyme or reason why the markets should be as high as they are, yet we are, Dow breaking 26,000…

Demographically, the economy should be slowing down – with the exception of the blip in births that recently hit on a 46-year lag, yet here we are…

Companies aren’t making productive investments in their businesses. Rather, they’re buying back shares, and so prices go up…

Worst of all, there’s no precedent here. There’s nothing to look back on and say, “well this is what happened before, so here’s what we can expect!”

Essentially, there’s no way to make sound financial, investment, or business decisions anymore because the tools we could once use are now useless.

So, in my latest video, I talk about this and explore what kind of world we face ahead. Do demographics matter anymore? What about other fundamentals? Watch now.

The post Can We Make Sound Financial Decisions Anymore? appeared first on Economy and Markets.

January 17, 2018

The Story Behind Asia’s Crypto Squeeze

It seems not everyone is a fan of cryptocurrencies.

It seems not everyone is a fan of cryptocurrencies.

South Korean police and tax officials raided several crypto trading operations in the country last week, looking for tax evaders, money launderers, and generally bad actors.

The government previously informed the crypto community that it thought its activity was little more than gambling and that it could potentially ruin citizens’ financial lives. Officials threatened to shut down cryptocurrency operations around the country, and they now seem to be following through.

This is particularly bad news for Bitcoin and its ilk because Asia, and particularly South Korea, has been one of the hottest areas for trading digital currencies over the last six months.

While this maneuver by the South Korean government might take some of the shine off Bitcoin and other cryptos temporarily, another move by the Chinese government has more bite.

The Middle Kingdom wants to shut down all coin mining in the country.

That’s going to hurt.

Trading or spending Bitcoin (which amounts to the same thing, operationally) and other cryptocurrencies requires those who keep the ledgers, the miners, to perform calculations and share their results with the world.

Over the last month, 80% of the electricity used to mine Bitcoin came from China. This makes sense, because the massive country over built electrical generation capacity as it supported construction. Electricity is cheap. There’s also a lot of land available outside of city centers, and you practically trip over computer components at shipping hubs.

As this group goes dark, other miners around the world will have to pick up the slack. But it’s not clear that there’s enough capacity to do so without significant disruptions along the way.

A couple of facts not widely discussed about cryptocurrencies are that transactions take time to verify, and come with fees paid to miners. As I wrote this, a Bitcoin transaction took eight minutes to verify and charged a median fee of $16.75. As the number of miners drops off, both of those numbers could jump dramatically.

The upheavals in South Korea and China weighed on the cryptos, helping drive Bitcoin below $14,000 and it’s since tumbled lower. But we have to keep in mind that the digital currency, as of this morning, was still trading near $10,000!

That’s pretty amazing for something you can’t touch that has no intrinsic value and no backing. As more countries take a harder look at these digital assets, expect more regulations and bans to follow.

It could be that Bitcoin and its brethren overcome the hurdles and trade higher… or they could collapse under the weight of heightened scrutiny, taking a lot of recent investors down with them.

At this point, there’s still no reason to put in more money than you’re willing to lose, since this use of “fun” money might quickly become no fun at all.

Rodney Johnson

The post The Story Behind Asia’s Crypto Squeeze appeared first on Economy and Markets.

January 16, 2018

This Could Crash 95% This Year

There are two types of stock bubbles – normal stock bubbles of five years or so and shorter-term, more extreme bubbles – and we’re currently in the midst of both kinds.

There are two types of stock bubbles – normal stock bubbles of five years or so and shorter-term, more extreme bubbles – and we’re currently in the midst of both kinds.

Both are characterized by irrational behavior…

A complete break from any fundamentals.

On Thursday, I’ll talk more on Thursday about how this is the case with the stock bubble. But today, let’s compare the cryptocurrency bubble to five other quick-and-nasty bubbles that have wiped out investors in the past. I’m talking, of course, about the tulip bubble, the South Sea and Mississippi bubbles, the internet bubble, and the recent China bubble. All of them have something in common, and that’s really bad news for those latecomers to this Bitcoin bubble.

Listen to my latest video for the details…

The thing with this crypto bubble – and all the bubbles, stock and short-term alike, that have come before it – is that it ultimately results in a shakeout. It destroys all the flotsam and jetsam lurking in the market in question. And it presents once-in-a-lifetime wealth-building opportunities.

Take Amazon for example. During the dot.com boom it went to $113 per share. Then the crash brought it tumbling down to just $5.50 a share – down 95%. It survived though, and today one share goes for more than $1,300. That’s a 240 times gain!

The same kinds of opportunities will present themselves once this crypto bubble has burst. We believe one cryptocurrency in particular is in a good place to survive the shakeout ahead. Think of it as the Amazon of the cryptocurrency world. We recently shared details of this little gem with Boom & Bust subscribers in four new special reports. If you haven’t seen them yet, you can find them here.

Harry

Follow Me on Twitter @harrydentjr

The post This Could Crash 95% This Year appeared first on Economy and Markets.

January 15, 2018

Where to Put Your Money in 2018

It seems I find myself in a bit of a conundrum. I write a newsletter, Peak Income, dedicated to finding profitable income investments at a time when bond yields are rising and income-oriented investments are coming under pressure.

It seems I find myself in a bit of a conundrum. I write a newsletter, Peak Income, dedicated to finding profitable income investments at a time when bond yields are rising and income-oriented investments are coming under pressure.

As I write this, the 10-year U.S. Treasury yields just shy of 2.6%. As recently as September, the 10-year yield was touching 2%. That’s a big a move in a very short period of time.

Hey, I get it. Some of this is understandable. The U.S. economy has picked up steam of late, growing at over 3% in each of the past two reported quarters. And this was before the corporate tax reform package, which promises to give at least a mild boost to the economy.

But what does this mean for bond yields? And does investing for income still make sense in a market like this?

What’s Next for Bond Yields?

Inflation – or the expectations for inflation – is the single biggest factor in determining the direction of bond yields.

On this count, I don’t think we have much to worry about. As Harry has written for years, aging populations are deflationary as older consumers tend to borrow and spend than younger and middle-aged consumers. You don’t see a lot of 70-year-old Americans buying expensive new homes or cars. They’re far more likely to be downsizing and adjusting their lifestyles to stay within their retirement budgets.

On this count, I don’t think we have much to worry about. As Harry has written for years, aging populations are deflationary as older consumers tend to borrow and spend than younger and middle-aged consumers. You don’t see a lot of 70-year-old Americans buying expensive new homes or cars. They’re far more likely to be downsizing and adjusting their lifestyles to stay within their retirement budgets.

But there is far more than just demographics at work here. We’re also in the midst of one of the biggest technological shifts in history.

One of the biggest themes of last year was the “Amazon effect,” and I don’t see that slowing down any time soon. Amazon disrupts every industry it touches, lowering prices and forcing new efficiencies into the supply chain.

But it’s not just Amazon. In virtually every consumer-facing industry, kiosks and smartphone apps are replacing human labor. In everything from McDonald’s to your local airport, expensive humans have been replaced by cheaper machines or software. And should we start to see a hint of inflation, that trend will only accelerate.

Even Bitcoin, despite being one of the greatest bubbles in history, is deflationary. The blockchain ledger technology that supports Bitcoin is the future of data, and the blockchain is vastly cheaper to support and requires far less in security outlays.

Sure, we may continue to see inflation in certain pockets of the economy, like healthcare. Because of its dependence on a doctor’s or nurse’s one-on-one time with a patient, healthcare seems to be the one industry that has (thus far) been immune to the deflationary effects of new technology. But, overall, inflation should be very tame going forward.

What does this mean for bond yields?

They may go a little higher in the short term. But a long-term rise in yields such as that of the 1970s isn’t in the cards.

This is a long way of saying that I expect my income recommendations in Peak Income to do just fine in 2018.

Where Are the Best Bargains in 2018?

I feel good about my U.S. income recommendations this year. But that hasn’t stopped me from looking elsewhere for market gains.

Peak Income does more than just invest in bonds or bond funds. In fact, most of the portfolio is invested in high-yielding stock funds that offer competitive capital gains in addition to current income.

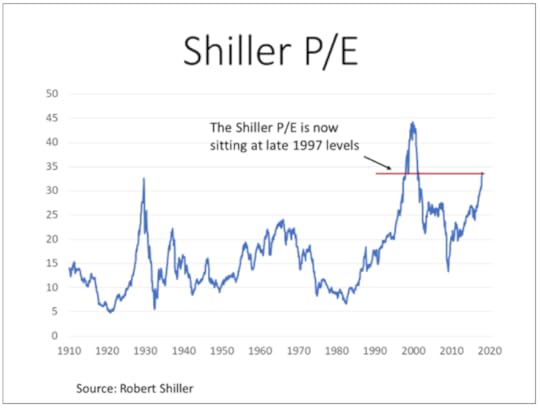

But today, U.S. stocks are looking pricey. After more than eight years of uninterrupted bull markets, the S&P 500 today, as measured by the Shiller P/E ratio, is as expensive as it was in late 1997… in the final years of the dot-com mania.

Expensive stocks can always get more expensive. Fed Chairman Alan Greenspan made his famous “irrational exuberance” comments in late 1996, and stocks went on to double in price again before eventually crashing in 2000.

But that’s not a game I want to play. Rather than trying to squeeze out a little more profit from the late innings of a long bull market, I’m hunting for real value. And across Europe and most emerging markets, stock valuations are cheaper by 30% to 50%.

A cheaper price doesn’t guarantee higher returns. But it certainly puts the odds in our favor.

In the last issue of Peak Income, I recommended a closed-end fund with exposure to China, Taiwan and Hong Kong. It trades at a deep discount to net asset value and yields a fat 8% yield.

An emerging market play like this is not without risks, of course. But in 2018 I see this as our best opportunity to make outsized profits while also collecting a nice stream of income. Click here to learn more about how we’ll do it.

Charles Sizemore

Editor, Peak Income

The post Where to Put Your Money in 2018 appeared first on Economy and Markets.

January 12, 2018

January is a Critical Month for Markets

For more than three decades, my grasp of economic and business fundamentals, demographics, and cycles has allowed me to empower my readers… to let them see ahead of the curve and prepare for booms and busts in the economy, the business cycle, and stock markets long before their peers.

Then something happened that I never believed could happen…

In 2008, when the Economic Winter Season began to take its toll, Central banks stepped up and printed trillions upon trillions of dollars.

Because of the deflationary cycle we should have been experiencing since 2008, their efforts have had a muted effect on the economy. For all the cash they’ve injected into the system, 2% growth on average is pathetic.

But, their efforts have had an outsized impact on the stock market, creating the most unpredictable and dangerous situation for investors that I’ve ever seen.

I mean, markets are totally unhooked from fundamentals.

Stock prices aren’t going up because of the underlying companies’ performance.

They’re not going up because people are spending that much more money.

They’re not going up because the economy is booming stronger than ever.

So why are they going up? Because of the something-for-nothing environment central banks have created.

I explain this in more detail in my latest video… and then discuss what I think we could see next…

The post January is a Critical Month for Markets appeared first on Economy and Markets.

January 11, 2018

Only Start a College Fund If…

Nothing – and I mean nothing – will change your life as dramatically as the birth of your first child. It’s a wonderful moment and one that I hope everyone gets to experience. But it will turn your life upside down.

Nothing – and I mean nothing – will change your life as dramatically as the birth of your first child. It’s a wonderful moment and one that I hope everyone gets to experience. But it will turn your life upside down.

That chic apartment downtown no longer makes sense… nor does that sporty two-seater car. And enjoying that cappuccino on your patio after sleeping in late on Saturday? Yeah, maybe you can do that again in 18 years.

My wife and I decided to move to Peru, where she’s originally from, for the birth of our first son. And, let me tell you, being a Peruvian dad is great. It’s like being an American dad circa 1950. For the first three months of my son’s life, I wasn’t even aware that babies could smell bad. He was always perfectly clean and presented to me like a trophy.

My, how it all went downhill when we moved back to Texas, had no more nannies, and my wife actually expected me to get off my lazy butt and help. It suddenly wasn’t “acceptable” for me to lounge around smoking cigars, chatting it up all day with the neighbors. Oh, well… it was great while it lasted.

An Open-Checkbook Kind of Thing

Perhaps more than anything, starting a family changes your financial priorities. You have expenses you never knew existed… and that massive looming liability of college education.

I routinely get questions about financial priorities following the birth of a child, but without a doubt this is the most common:

Should I start a college fund?

Absolutely, you should start a college fund.

But only after you have already maxed out any 401(k) or IRA contributions for the year.

You ordinarily might look to Educational Savings Accounts (ESAs) and state 529 plans to put some of your income away for your child’s future. These are fantastic ways to save for college.

With them, your dividends, interest and capital gains grow tax-free, so long as you eventually use them for college expenses.

But unlike a traditional IRA or 401(k) plan, you get no tax break for the contribution itself.

Then there’s this dirty little secret: IRA funds can be withdrawn penalty-free to pay for the educational expenses of a child, though you may still owe taxes. If it is a traditional IRA, you would have to pay taxes on any withdrawals. And with a Roth IRA, you would only owe taxes on the part of the withdrawal that was considered “earnings.” In either case, there are no penalties.

Avoiding the Tax Man

As for your 401(k), these funds cannot be withdrawn penalty-free for educational expenses (unless you are age 59.5 or older). But you can roll your 401(k) balance into a Rollover IRA and then use those funds, penalty-free, for your kids’ college expenses. And while I don’t generally recommend borrowing against your retirement plans, the option is there, and it would have the added bonus of not incurring any taxes.

But if ESA and 529 balances can be used tax-free, isn’t that still better than using IRA money?

Based on taxes alone, yes. But there are other factors to consider.

To start, you know you need money for retirement. This is an absolute certainty… as certain as death and taxes. But your son or daughter may or may not need money for college.

They may get a scholarship…

Or may choose to forgo college and start their own business…

Or join the military…

Or, for all you know, join a roving carnival circus!

Besides, at the rate things are changing, who knows if going to college will make economic sense 18 years from now. Or if, as is the case in most of the rest of the developed world, a university education becomes “free,” in the same sense that public high schools are free today. (OK, “free” means funded by the taxpayers – you and me – but you get my point.)

The fact is, there are a lot of unknowns when it comes to educational expenses, so it makes sense to prioritize your savings in your retirement plan first. And you also want to make sure you’re allocating those savings to the right funds. I run a service called Dent 401k Advisor designed to help you position your retirement funds, as well as Peak Income, where I recommend low-risk investments in undervalued parts of the market in order to generate consistent monthly income.

Once you’ve maxed out your 401(k) plan for the year ($18,500 in salary deferral in 2018) and taken advantage of any employer matching, save that next marginal dollar in an ESA or 529 plan. Both are fine savings vehicles. But again, they only make sense once you’ve exhausted your tax-advantaged retirement options.

Charles Sizemore

Editor, Peak Income

P.S. IRA distributions are considered “income” and thus may affect your kids’ eligibility for financial aid. So, make sure you consider that when the time comes.

The post Only Start a College Fund If… appeared first on Economy and Markets.

January 5, 2018

What’s Up for 2018? Inflation and Interest Rates

Here we are in the first week of 2018! As I mentioned in my last Economy & Markets article, I usually focus on short-term overreactions in the Treasury bond market and not long-term forecasting.

Here we are in the first week of 2018! As I mentioned in my last Economy & Markets article, I usually focus on short-term overreactions in the Treasury bond market and not long-term forecasting.

But since Harry and the rest of the Dent Research team have their opinions on where the markets are set to go this year, I’ll take my own stab at it.

Throughout 2017, long-term Treasury rates fluctuated between a high of 3.19% in mid-March to a low of just under 2.68% in September. Those fluctuations were significant enough to produce some nice trades in my Treasury Profits Accelerator service, but volatility was notably absent.

Like in stocks, volatility declined in the Treasury bond market significantly in 2017. That’s a problem for options strategies like mine because if prices don’t move, option premiums decline. Even though my winning percentage was excellent, low volatility hurt performance because the “snap-back” overreactions weren’t as significant as they normally would be with higher volatility.

Federal Reserve policymakers are planning on maintaining steadily increasing interest rate policy or normalizing, based on current projections.

And let’s be realistic, the Fed is usually wrong when it comes to forecasting. I’m not talking policy forecasts, but economic forecasts. Decision makers will likely be forced to change the course at some point next year.

Fed members have continually projected a 2% inflation rate since the beginning of the recovery back in 2009 – and we’re still not there, some eight years later. They’ve recently admitted that they’re confused about what drives inflation.

Better late to the party than never, I guess…

I think the Fed will be surprised that inflation actually picks up more than expected this year. That surprise inflation should create a nice selloff in Treasury bonds that will drive long-term yields to around 4%. I’m projecting this will begin to happen in the first quarter of the year.

I expect that volatility in the Treasury market will increase in 2018 for a few reasons, but there is one particularly big catalyst.

Global sovereign bond markets have been manipulated by central banks for years, and in 2018 we’ll see both the European Central Bank and the Bank of Japan start to slow down or even reverse stimulation programs. When that happens, investors will be quick to sell, and whatever the Fed does won’t matter. U.S. Treasury bonds prices will go lower and yields will jump.

As I mentioned earlier, I expect long-term Treasury yields to hit 4% in 2018 along with a significant steepening of the currently flat yield curve.

Now, after that happens, we could see the yield curve flatten more or even invert. Usually when the yield curve inverts (meaning that long-term yields are lower than short-term yields), we’re in a recession.

Rising rates will spook stock investors and likely trigger a major selloff. I believe we’ll see a major sell-off in both stocks and bonds which, is unusual because money from stock sales usually move to the safety of Treasurys. Volatility will spike across the board when that happens.

You can prepare and profit from surprises in the financial markets, and specifically in the Treasury bond market with Treasury Profits Accelerator.

Good investing,

Lance Gaitan

Editor, Treasury Profits Accelerator

The post What’s Up for 2018? Inflation and Interest Rates appeared first on Economy and Markets.

January 4, 2018

How to Plan for Retirement in 2018

It’s a new year… which means a new set of retirement savings deadlines. So it’s time to do my obligatory beginning-of-the-year nagging.

It’s a new year… which means a new set of retirement savings deadlines. So it’s time to do my obligatory beginning-of-the-year nagging.

Think of it as a New Year’s resolution for your 401(k) plan.

If you’re self-employed, you have until April 17 to make your 2017 contribution to your Individual (Solo) 401(k) or SEP IRA. And all taxpayers, whether regular W2 employees or self-employed, have until April 17 to top off their Traditional or Roth IRAs for the 2017 tax year.

But for the rest of us investing in a good, old-fashioned corporate 401(k) plan, January 1 represents the start of a new savings year.

Now is the time to figure out your budget for the year. The IRS raised the contribution limit on 401(k), 403(b) and 457 plans to $18,500, or $24,500 for employees 50 or older.

And remember, these are just the funds you can defer from your annual salary. Any employer matching or profit sharing is additional.

So…

You likely have 26 paychecks this year. If you want to max out your 401(k) plan and take full advantage of the tax break, you’ll want to set aside $712 per paycheck (or $942 if you’re looking to max out $24,500).

That should be doable. But if you feel you can’t realistically get by on a reduced paycheck, you might have some other options. Many companies pay out bonuses in the first quarter. If you think you’ll be getting a bonus, ask your HR department to pay it into your 401(k) plan.

Really make an effort to make these changes this week. The longer you wait, the harder it becomes to meet your savings goals for the year…

Contribution limits for IRAs and Roth IRAs remains unchanged at $5,500 per year, but the eligibility rules have gotten better.

If you or your spouse have access to a 401(k) or other retirement plan at work, you can still deduct a contribution to a Traditional IRA if your income is less than $63,000 (or $101,000 for a married couple filing jointly).

At incomes higher than $63,000 or $101,000, your ability to deduct starts to get phased out until it is eliminated altogether at $73,000 and $121,000, respectively. In 2017, the phase out ranges were $62,000 to $72,000 and $99,000 to $119,000 for single and married taxpayers, respectively.

The rules for Roth IRAs have gotten better, too. In 2018, you can make a full $5,500 Roth IRA contribution if your income is less than $120,000 ($189,000 if married filing jointly).

The amount you can contribute starts to phase out after those amounts and is eliminated completely at $135,000 for single taxpayers and $199,000 for married taxpayers filing jointly.

So, bottom line, the IRS is letting you keep a little more of your money in 2018. But in order to take advantage of it, you’ll probably need to adjust your contribution levels by logging into your plan’s website or letting your boss or human resources contact know.

How Much Is Enough

I wrote a little bit about this recently, but it’s worth reiterating here as we look ahead to 2018.

If you’re a Baby Boomer, it’s very likely that you have retirement on your mind. Even if you love your job and have no immediate plans to stop working, there is a certain peace of mind in knowing you can walk away when the time comes.

If you’ve regularly maxed out your 401(k) plan (or have even gotten close), you may have hundreds of thousands or even a couple million dollars sitting in your account. But with the cost of living what it is these days, can you be sure it’s enough?

Go get a pen and a pad of paper, and let’s do a little exercise. First, write down a realistic figure of what you expect your retirement expenses to be.

The old rule of thumb used by financial planners is that you’ll need an income stream of around 70% to 80% of your pre-retirement income to fund your retirement.

But if you ask me, that number is completely arbitrary.

What if your home mortgage will be paid off by then? What if your current income is artificially lowered by large contributions to your 401(k)? What if you intend to move to a lower-cost area once retired?

A better way to do this is to take an average of your credit card bills, utilities and other identifiable expenses over the past couple of years.

If you expect that your house will be paid for by the time you retire, you can subtract your mortgage payment from the calculation, but be sure to leave an allowance for property taxes and insurance. Even once the mortgage is paid off, you never really “own” your house.

Once you have that estimate, pad it by at least another 20% to 25%. You likely forgot a few expenses, and it’s better to give yourself a little wiggle room.

Now that you have an estimate for your annual expenses, subtract any guaranteed payments, such as Social Security, a fixed annuity or a private defined-benefit pension plan.

So let’s say you estimate your expenses will be $100,000 per year in retirement and that Social Security and a pension from an old job will cover $40,000. Your retirement savings will need to cover the remaining $60,000. Assuming a 4% withdrawal rate, you’d need a nest egg of $1.5 million ($60,000 / 4% = $1.5 million). And to play it safe, I would want my nest egg to be at least 20% higher than what this estimate would suggest to allow for the possibility of a bear market.

Do the math for yourself. If your retirement savings make the cut, congratulations. You can retire stress-free.

But if your nest egg is falling short, you might need to rethink a few things. Perhaps you’ll need to work longer or downsize your home.

As a better alternative, I recommend you give my income newsletter Peak Income a read. The investments yield between 5% and 10% and we have strict risk management to limit losses. If you’re looking for investment to fill an income gap, click here to learn more.

If changes are needed, you’ll be better off acting sooner rather than later.

Charles Sizemore

Editor, Peak Income

The post How to Plan for Retirement in 2018 appeared first on Economy and Markets.

January 3, 2018

My Forecast for 2018

Stock markets were on fire last year, to the surprise and dismay of many, who, for any number of reasons, were scared to the sidelines.

Stock markets were on fire last year, to the surprise and dismay of many, who, for any number of reasons, were scared to the sidelines.

Who enjoyed last year’s stock market gains?

Not many everyday folks, I suspect, as investors have collectively pulled money out of U.S. equity ETFs and mutual funds in seven of the last 10 quarters.

Yet, despite growing numbers of both bubbly markets and global risk factors, stocks were actually a really good bet in 2017.

All four major U.S. stock indices closed higher. And if you ventured into foreign stock markets – as I suggested here and here – you could have done even better.

“But what about next year?”

That’s the question of the moment.

Well, next year is very likely to be another good one for stocks… particularly U.S. stocks.

Sound wild? Well, that’s simply what the data tell me.

You’re probably seeing a lot of three things this time of year:

weight-loss commercials,

exercise equipment commercials, and

financial market predictions and forecasts.

All three tap into everyone’s desire to “be my best” in the New Year. And all three require you to temper wild claims with a healthy dose of common sense.

So here goes.

It may seem like a cop-out for me to simply say stocks are likely to have a good year in 2018. It’s neither a bold prediction nor a precise forecast.

But, as a colleague of mine noted, “Adam isn’t a ‘forecast’ guy.”

Part of it is simple recognition of my limitations – particularly when it comes to “seeing” things in the future.

More importantly, future outcomes, for me, are all about probabilities, never certainties.

Probabilities can go a long way in helping us know what to expect from financial markets. Probabilities also give us reason enough to overcome the kind of fear that keeps some people out of the game.

Let’s start with the base-case statistics for stocks…

Since 1950, the S&P 500 has produced positive returns in 72% of calendar years.

It’s been even more consistent since 1980, producing up-years 79% of the time.

No matter how you slice the data, equity markets are bullishly biased.

If you could only make one directional bet (bullish or bearish) at the start of every calendar year, you’d do very well always betting on the bullish side.

Doing so doesn’t make you a “perma-bull.” And it doesn’t mean you’re “ignorant” to the risks inherent in risk assets. It simply means you understand and respect the base-case statistics, which strongly support the likelihood of higher equity prices in a majority of years.

But there’s another reason I expect 2018 to be a great year for U.S. stocks, in general, and for a small handful of stock sectors, specifically.

Always the Bridesmaid, Never the Bride

Momentum strategies, like the one I use in Cycle 9 Alert, rely on the tendency for strongly appreciating assets to continue appreciating – at least long enough for momentum investors to profit from the continued bullish trend.

This effect is seen in the so-called “Bridesmaid Strategy,” popularized by institutional research firm The Leuthold Group.

The idea is simple: to forecast next year’s top-performing asset class, look at the past year’s second-best asset class (aka “the bridesmaid”).

The Leuthold Group’s research shows you can beat the average stock market return by 4.8% a year, by simply buying last year’s runner-up.

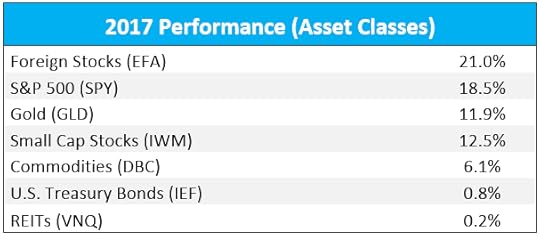

I’ve tallied and ranked the 2017 performance of the seven major asset classes considered:

As you can see, the S&P 500 earned the “bridesmaid” spot in 2017, making it the best bet for outperformance in 2018.

As you can see, the S&P 500 earned the “bridesmaid” spot in 2017, making it the best bet for outperformance in 2018.

This simple concept also applies to a smaller subset of investments – the nine U.S. market sectors.

This doesn’t surprise me one bit, of course, since I developed Cycle 9 Alert six years ago to take advantage of momentum effects within U.S. stock sectors.

Again, all you need to do to hone in on next year’s top contender is identify last year’s second-best investment.

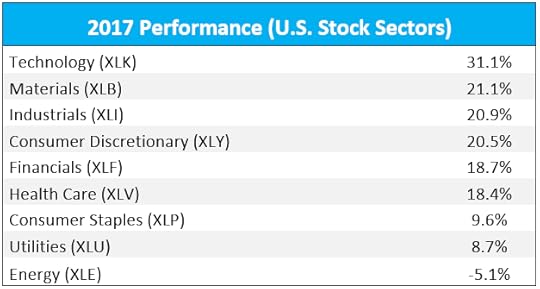

Here’s a ranking of U.S. sectors in 2017:

The materials sector (XLB) officially earned the No. 2 spot, although the industrials (XLI) sector was just a hair (0.2%) behind.

The materials sector (XLB) officially earned the No. 2 spot, although the industrials (XLI) sector was just a hair (0.2%) behind.

Interestingly, materials and industrials are closely related – both are components of the global manufacturing and construction industries.

The Bridesmaid Strategy suggests the No. 2-ranked sector tends to outperform the S&P 500 by an average of 3.9% over the following year.

So here’s my forecast for the New Year:

S. stocks are statistically likely to close 2018 higher,

S. stocks are statistically likely to outperform all major asset classes in 2018, and

the materials and industrial sectors are statistically likely to beat the S&P 500 in 2018.

None of these are guarantees, mind you. I don’t even know if we could call them “forecasts” or “predictions.” And they certainly don’t paint a “wild” picture.

But that’s fine.

My Cycle 9 Alert readers have long proven you don’t have to “see the future” in order to be an extraordinarily successful active investor.

Exploiting favorable odds, in momentum, is more than enough.

Click here to gain access to the first Cycle 9 Alert Leaders and Laggards Board of 2018.

Stay disciplined,

Adam O’Dell

Editor, Cycle 9 Alert

Follow me on Twitter @InvestWithAdam

The post My Forecast for 2018 appeared first on Economy and Markets.