Harry S. Dent Jr.'s Blog, page 61

February 23, 2018

Chart: REITs are in a Bear Market

It’s official.

The volatility earlier this month pushed real estate investment trusts (REITs) into official bear market territory. During the selloff, the Vanguard Real Estate ETF (NYSEArca: VNQ), a popular proxy for the broader REIT market, closed down 22% from its old highs. And the sector is still down just shy of 20% even after a modest rally.

But, as you can see, the downtrend started long before… and it has a lot more to do with the bond market than the stock market.

In the low-yield post-2008 world, investors have used REITs – which traditionally sport high dividend yields – as a substitute for bonds. As goes the bond market, so go REITs.

Bond yields started rising in the months before the 2016 presidential election and shot sharply higher after Trump’s surprise win. Yields spent most of 2017 easing, which was broadly positive for REITs. But bond yields shot higher again in the last quarter of 2017, as the economy started heating up and investors began to fret about inflation making a comeback.

We’ll see if the much-feared inflation really does make a comeback. But if you believe, as I do, that the spike in bond yields is probably close to running its course, then REITs as a sector might soon be a fertile field for bargain-hunting.

I have no current REIT positions in Peak Income or Boom & Bust. But you can bet that the sector is on my radar screen.

Charles

The post Chart: REITs are in a Bear Market appeared first on Economy and Markets.

Secession Desires in the U.S. Grow

Polls show that one out of four Americans would like their state to secede from the Union!

One in four!

That’s huge.

We’re clearly a divided nation already, with blue states and red states forming obvious blocks along the coasts and across the center of the country.

But what could a split nation look like on a map? I’ll tell you in my latest video, which you can watch now…

I’ll also talk about how this threat of secession isn’t just hot air, but something under serious consideration in one legislature.

And I suggest you read my latest best seller – Zero Hour: Turn the Greatest Political and Financial Upheaval in Modern History to Your Advantage – to discover why we’re at the critical point in our history, and what’s likely to happen next.

Harry

The post Secession Desires in the U.S. Grow appeared first on Economy and Markets.

February 22, 2018

Why You Can’t Talk Anyone Out of a Stock Market Bubble

If there’s anything super-important in life, it’s reproduction. Without it, there’s no life… that’s why sex was designed to be so pleasurable.

But pleasure is an addiction (to all creatures). Everyone has their guilty little pleasure. It might be chocolate or coffee, alcohol or opioids, a foot fetish or talking a lot. Some birds get drunk off of fermented berries. African elephants, monkeys, meerkats and giraffe get drunk eating fermented marula fruit.

Life is hard. We all need an escape valve to relieve the pressure from time to time.

We know that all of these elixirs can become dangerous if we don’t moderate our consumption of them. And if we let the addiction take over, there’s no easy way back. It’s detox or die.

Now you understand bubbles.

They’re what happens when we let the addiction gain control.

Whether it be real estate or stocks or gold or bitcoin, when investments bubble up, we get hooked to the high from gaining something for nothing.

We make 30%-plus a year in stocks compared to the boring 10% average longer term…

We make 15%-plus per year in real estate versus the snooze-fest 3% longer term…

We make 20-times our investment in bitcoin in less than a year!

Who wouldn’t want those kinds of successes?!

Who wouldn’t become addicted to the adrenaline rush they create… to the feeling of power and wisdom they evince in us?

So really, it should come as no surprise that bubbles follow the same pattern as…

Orgasms!

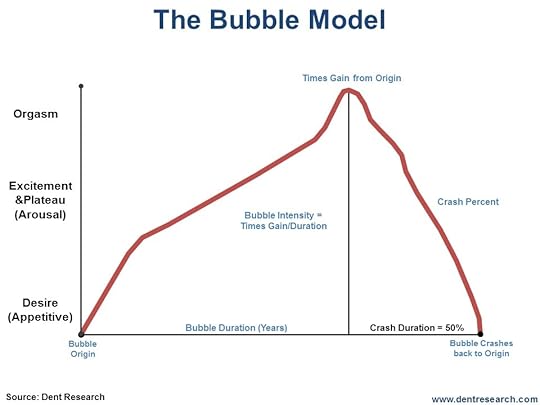

That’s why I created my bubble model, which I wrote in detail about in my latest best seller, Zero Hour: Turn the Greatest Political and Financial Upheaval in Modern History to Your Advantage.

Here’s what it looks like (based on the Masters and Johnson male orgasm model first documented scientifically in the late 1950s)…

There’s desire, then excitement, and finally an orgasmic blow-off.

Now ask yourself: how do orgasms typically end for males?

Very quickly and then we’re, like, dead, for a while. We don’t want to talk or cuddle, we’re done!

Orgasms take a lot of energy and hence, aren’t sustainable.

Bubbles are exactly the same way!

So, here are some simple principles of this bubble model.

First, you can’t talk anyone out of a bubble they are benefiting from because they’re high and happy and don’t want it to end… it’s called being in denial.

Second, stock bubbles tend to burst twice as fast as they build – and the advance is parabolic to begin with.

Third, when they burst they tend to go all the way back to the bubble origin. That’s the point where they diverged from the fundamental trends and took you to that high. But when they end, and collapse, they bring you back to earth with enough force to snap your neck.

I’m talking 80% losses, like we saw after major stock bubbles burst like 1929, the Nikkei in 1989, the Nasdaq in 2000, and the Shanghai in 2007. It won’t be long before we can add the Nasdaq in 2018 to that list.

Look, I’m not saying that we should avoid pleasure. We need it to stay sane.

But I am saying that we shouldn’t become addicted to the pleasure we get from successful investments.

Stay grounded.

Harry

P.S. Adam O’Dell, our Chief Investment Strategist, has found a way to successfully remove emotion from the investing process, so that neither pain nor pleasure drive your actions. He’s used this strategy to great success for several years now, and was voted the best trading research service within Dent in 2017. See how he does it here.

The post Why You Can’t Talk Anyone Out of a Stock Market Bubble appeared first on Economy and Markets.

February 21, 2018

“The Daily Mail Made Our Website Crash – Sorry”

I’m in Australia for the next two weeks.

I speak in Perth on February 24th (Saturday), Melbourne on the 26th (Monday), Sydney on the 27th (Tuesday), Brisbane on the 28th (Wednesday), and Newcastle on March 2 (Friday).

If you want to hear me speak, sign up on harrydentlive.com. And for my Australian subscribers, you don’t want to miss the very timely update I’ll be sharing.

Since arriving on Saturday, the Australian media has been clamoring to speak with me. I did an interview with the widely read Daily Mail. You can read it here. It got such a response that it crashed the organizer of my Australian tour – Goko’s – website.

Although, I will warn you that the Daily Mail overstated my downward forecasts for Australia, which is still the “best house” by far in the developed world of high debt and falling demographic trends.

My favorite interview so far was with Peter Switzer on Sky News TV and his radio program “Talking Money.”

And, luckily, I’ve managed to squeeze in the opportunity to visit the best upscale food court in the world. It’s in Sydney, at Westfield near the park downtown. This picture just can’t do it justice. There are over 40 great restaurants on one floor.

Here’s the place I always eat at when I’m in Australia. It’s called Ragu. It’s an Italian place, with killer Puttanesca pasta.

Here’s the place I always eat at when I’m in Australia. It’s called Ragu. It’s an Italian place, with killer Puttanesca pasta.

Again, whether you’re in Australia or not, tune in to listen to my latest critical update.

Speaking of updates… on Tuesday I emailed paid subscribers an update on U.S. markets. While it contained a typo that we later corrected, here’s the gist of the message…

Harry Dent

FURTHER READING

Remember, You Are Part of the Market

By Charles Sizemore, Portfolio Manager, Boom & Bust

Imagine that you invent a time machine today and that you travel back to the decade of your choice. You use your knowledge of market history to bet on the winners… and to avoid or even short the losers. And you can time your purchases to the day. You’d make a killing… for a while. You’d likely become the richest man in the world within a few short years. But at some point, your exploits would become so legendary that every Tom, Dick, and Harry would copy you. Your trading would become a self-fulfilling prophecy, and stocks you bought would soar because you bought them, and stocks you sold would collapse because you sold them. Eventually, your trading activity would affect the flow of capital to the point that you would change history… and then your knowledge of the future would be all but useless, as that future would no longer exist. The thing is, you can see the same principles at work in the market today.

Markets Change, Human Nature Doesn’t

By John Del Vecchio, Editor, XX

Last week I talked about how the implosion of the short volatility trade was likely not the start of a bear market. A bear market likely needs a major default or bankruptcy, or a painful increase in interest rates. But, it’s probably not the rates you expect. Market pundits watch every move of the Federal Reserve to try and glean what the members might be thinking about rates and the impact it will have on the markets. I think those pundits are looking in the wrong direction.

The Winners in Inflation

By Adam O’Dell, Chief Investment Strategist, Dent Research

While the most recent iteration of “inflation spook” seemed to crystalize with the February 2 wage growth report, early signs of the inflation trade were brewing as early as last December. Since then, the utilities sector (XLU) is down 9.1% – clearly the worst of all U.S. sectors since mid-December. Real estate investment trusts (VNQ) lost 11.7%, putting the sector into bear market territory now that prices are 20% off their July 2016 high! The real winners of the recent inflation trade have been…

Bad Timing

By Lance Gaitan, Editor, Treasury Profits Accelerator

The U.S. government’s borrowing needs are on the rise, and so are interest rates. Now is not the time to increase borrowing. Why? Because it’s going to cost us taxpayers more. But do our elected officials care? Probably not. It’s just business as usual. The Federal Reserve is promising three or four more rate hikes this year, but the government already cut taxes and is now promising to spend more on infrastructure (among other things). So now, it seems, is the time to borrow.

The post “The Daily Mail Made Our Website Crash – Sorry” appeared first on Economy and Markets.

Markets Change, Human Nature Doesn’t

Last week I talked about how the implosion of the short volatility trade was likely not the start of a bear market.

However, it is a nasty reminder that stock prices do, in fact, actually go down from time to time. I think that the record lull in market volatility is over for the foreseeable future. Expect big moves in both directions as speculators react to day-to-day events.

A bear market likely needs a nudge from a major default, a bankruptcy, or a painful increase in interest rates. As far as rates go, market pundits watch every move of the Federal Reserve to try and glean what the members might be thinking about inflation and the impact it will have on the markets.

I think those pundits are looking in the wrong direction.

They should be watching the London Interbank Offered Rate, or LIBOR for short. It’s an important rate because a lot of financial instruments – as is the case with the federal funds rate – are priced off of it.

LIBOR has been rising, so much so that the chart looks a bit like bitcoin. This could be a bad omen. Worse yet, the Fed is well behind the curve.

So what’s the problem?

Well, people with heavily invested portfolios at big banks have used ultra-low interest rates to borrow against their investment holdings to fund other needs. These lines of credit can be used for virtually anything. They may have used the money to pay for day-to-day expenses. Maybe they bought a boat or built a wine cellar. It’s easy money, and it’s cheap – rather, it has been cheap, until recently.

Sound too good to be true? I’ve used one myself.

It was surprisingly easy to access capital.

I have an elderly parent with health issues that I needed to relocate for both better medical care and closer proximity to immediate family. I borrowed against my portfolio and had access to the capital almost immediately. As long as I didn’t use the money to buy stocks, I was free to tap into the line of credit as I needed. Road trip to Austin, Texas, this weekend? Hey, no problem! Want to fire up a private jet to Cabo San Lucas from Dallas? We got you covered.

I used the line of credit for what I would consider a reasonable and fair situation. Rather than get a mortgage on a second home to take care of my parent, I just use the line of credit. It was cheaper and easier, and you’re essentially offering cash for a property which gives the buyer a lot of leverage in the negotiation.

What’s more is that I paid it back in 10 months, and therein lies the rub.

People may be using these lines of credit for all sorts of reasons, with little ability to pay them back if something causes stock prices to fall. Higher interest rates create a cash flow pinch, and falling stock prices create margin calls.

What are you supposed to do in that situation? As a sailing friend of mine once told me, “You can always buy a boat, you just can’t always sell one.” The heavy use of cheap money against stock portfolios will eventually blow up in people’s faces. Markets change, the key drivers of the markets change, but human nature never changes.

In 2015, when I first started researching credit lines, the three-month LIBOR was about 25 basis points. See, the rate fluctuates, and you have to tack on the extra percentage the bank takes as well. A loan that was about 0.85% a couple of years ago is nearly 3% today.

There’s a tipping point which could lead to a massive margin call on stocks when a snafu in the market occurs and these lines are shut down. What that point is, I do not know.

All I know is that we’re getting closer by the day.

Good investing,

John

The post Markets Change, Human Nature Doesn’t appeared first on Economy and Markets.

Bad Timing

The U.S. government’s borrowing needs are on the rise, and so are interest rates.

Now is not the time to increase borrowing. Why? Because it’s going to cost us taxpayers more. But do our elected officials care? Probably not. It’s just business as usual.

Just last week we had confirmation of rising inflation. I’ll get to that in a minute…

The Federal Reserve is promising three or four more rate hikes this year, but the government already cut taxes and is now promising to spend more on infrastructure (among other things). So now, it seems, is the time to borrow.

This week, the U.S. Treasury is selling a quarter of a trillion dollars of debt! And at a time when foreign interest in buying this debt is declining and interest rates are rising!

So far in this week’s Treasury auction, shorter-term bills and bonds are being issued at interest rates not seen since 2008. Of course, that’s based on expectations for rising inflation.

Last week, we saw that inflation moved higher than expected in January.

The Consumer Price Index (CPI) jumped 0.5% in January on the expectation of a 0.3% rise. Core CPI (excluding food and energy) was up 0.3% on the expectation of a 0.2% rise. Year-over-year core CPI ticked up to 1.8%.

CPI is a proven market mover, especially when the data surprises observers.

When I say “proven,” I refer to a New York Federal Reserve study from 2008 that explores how the release of economic data affects asset prices in the stock, bond, and foreign-exchange markets. The authors found that certain announcements generate significant and persistent price responses.

Treasury bond yields show the strongest response, stock prices the weakest.

We’re watching it play out in real time: Treasury bonds spiked higher and remain elevated after last Wednesday’s release of CPI data. Stocks pretty much ignored inflation and poor retail sales by flying higher all week.

Along with the CPI release came very disappointing January retail sales figures.

The expectation was for an uptick of 0.3%, but we actually saw a 0.3% decline. With auto sales and gas excluded, analysts expected a rise of 0.3% – and again sales fell 0.2%.

Retail sales compromise about 50% of all consumer expenditures – and represent about two-thirds of our overall economy. Markets shrugged off the data.

Both the broad January Producer Price Index (PPI) and the core inflation (less food and energy) figures were up 0.4% on expectations of 0.3% upticks. You might have thought that interest rates would jump even higher on that news, but there wasn’t much of a reaction.

Maybe it’s because year-over-year core inflation fell to 2.2%. Generally speaking, though, PPI doesn’t move the markets like CPI.

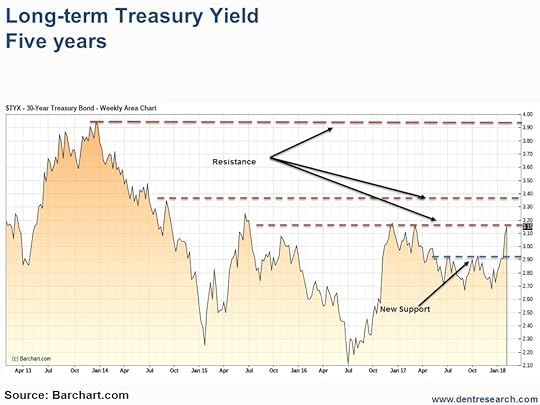

Before the PPI release last Thursday, Treasury yields hit a high of 3.19%, which is right at the resistance level. Take a look at the chart below.

Last week’s January housing starts and permits were sharply higher than December’s, so builders must not be too concerned about rising interest rates.

Last week’s January housing starts and permits were sharply higher than December’s, so builders must not be too concerned about rising interest rates.

As always, new home sales are important to our economy because of the ripple effect they have on other related purchases new-home buyers make, like appliances, furniture, and related items, outside of just purchasing the house.

So far, rising rates haven’t hurt the stock markets or the housing industry too badly, but rising interest rates will certainly hit us taxpayers along with complacent stock investors.

You can prepare for and profit from surprises in the financial markets, and specifically in the Treasury bond market, with Treasury Profits Accelerator.

Good investing,

Lance Gaitan

Editor, Treasury Profits Accelerator

The post Bad Timing appeared first on Economy and Markets.

Remember, You Are Part of the Market

I’m a sci-fi nut… and proud of it!

I’ve attended multiple Star Trek conventions, and I’m not ashamed to admit that I routinely use Spock’s neck pinch to silence my children when they become insolent. Frankly, it works, and who am I to argue with Vulcan logic?

At any rate, I spent the long weekend binge-watching the first season of Travelers, which you can think of as a darker, dystopian version of the 1980s and 90s sci-fi drama Quantum Leap.

In Travelers, what is left of the human race in a post-apocalyptic future travels through time by transmitting their consciousnesses into the bodies of a people living in today’s world. They then use their knowledge of the future to shape history and try to prevent the human race from self-destructing.

Naturally, saving the world requires cash. But being from the future, that’s not a problem. The travelers have knowledge of every recorded horse race in history and can raise cash at will by betting on the horses they know will win.

At least it starts out that way.

The longer the travelers live in the present, the more they alter the timeline. The changes they make – preventing a war here, stopping a disease outbreak there – have unintended and impossible-to-calculate consequences. And suddenly, their “can’t lose” horse picks start losing.

Financial markets work the same way.

Imagine that you invent a time machine today and that you travel back to the decade of your choice. You use your knowledge of market history to bet on the winners… and to avoid or even short the losers. And you can time your purchases to the day.

You’d make a killing… for a while. You’d likely become the richest man in the world within a few short years. But at some point, your exploits would become so legendary that every Tom, Dick and Harry would copy you. Your trading would become a self-fulfilling prophecy, and stocks you bought would soar because you bought them, and stocks you sold would collapse because you sold them.

Eventually, your trading activity would affect the flow of capital to the point that you would change history… and then your knowledge of the future would be all but useless, as that future would no longer exist.

Now, don’t get me wrong. I’d still love to give it a try! But alas, I do not have a time machine at my disposal.

The thing is, you can see the same principles at work in the market even without one.

Warren Buffett’s returns today are respectable, but they are a fraction of the returns he generated back in the 1950s and 60s. Back then, Buffett managed a couple million dollars and was capable of regularly generating 30% to 50% annual returns.

But today, his holding company Berkshire Hathaway is worth half a trillion dollars. Decades ago, Buffett could get in and out of a stock without moving its price. Today, at Buffett’s size, he can’t take a meaningfully large position in a company without instantly becoming one of its largest shareholders.

Plus, given the scrutiny with which Buffett is watched, millions of investors immediately pile into a stock as soon as they know Buffett owns it. Buffett isn’t an impartial observer. He moves the market.

Neither you nor I are time travelers, nor are we running hundreds of billions of dollars in capital like Mr. Buffett. But it’s easier than you might think to fall into the same traps.

Here are a few suggestions on how to avoid them:

To start, be wary of smaller companies or ETFs with limited trading volume. With a thinly-traded stock, it doesn’t take much to move the market. Even a $10,000 position can be hard to unwind in a hurry if you’re trading a penny stock.

Along the same lines, be wary of leverage. It really doesn’t matter how responsible you think you’re being. When leverage is involved, your portfolio is subject to getting wiped out during sudden bouts of volatility.

This is effectively what killed Long-Term Capital Management back in 1998. They effectively got the mother of all margin calls on what would have been, at lower levels of leverage, a sensible and conservative portfolio. It’s also what caused many of the short-volatility funds to blow up earlier this month. Any otherwise safe strategy can be made risky by piling on leverage.

And finally, always remember that, as a trader or investor, you are part of the market that you’re trying to exploit. This is what George Soros called “reflexivity.” Our view of reality (that a stock will go up in value) actually causes that reality to happen.

In other words, a stock rises in value because enough people believed it would rise in value, thus buying it and pushing the price up. True value is an abstract concept and one that doesn’t actually exist in the financial world.

Also, to any of you that might be diligently working on a time machine, please do me one favor. If you’re successfully able to go back in time, please ensure that my beloved TCU Horned Frogs never sign Kenny Hill to be quarterback.

While I understand that tampering with the timeline puts the space-time continuum at risk, you’d be sparing me the pain of watching him lead the Big 12 in interceptions, and that’s clearly worth the risk.

Charles Sizemore

Portfolio Manager, Boom & Bust

The post Remember, You Are Part of the Market appeared first on Economy and Markets.

The Winners in Inflation

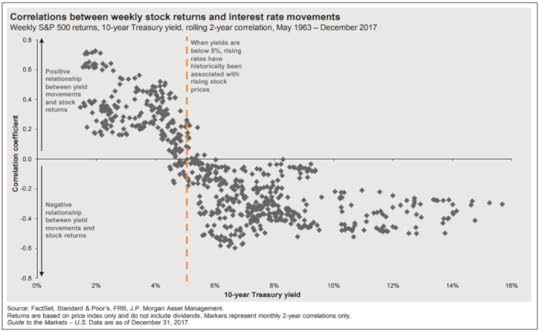

Last week, in a Chart-of-the-Day piece, I wrote about the impact rising interest rates could have on stocks.

There’s a strongly-held belief that higher interest rates always work against stocks. But that’s only half true.

The direction of interest rates is important. But the level of interest rates is just as important. And this aspect of the relationship between interest rates and stock prices is often overlooked.

Here’s the chart I shared. J.P. Morgan consistently publishes it in its Quarterly Guide to the Markets:

The chart plots the correlation between weekly stock returns and interest rate movements. It answers the simple question: “Do rates and stocks typically move in the same direction or in opposite directions.

The answer is: it depends on whether interest rates are above or below 5%.

When interest rates are above 5%, an upward trend in rates has historically weighed heavy on stock prices. This is the story most investors are told… higher rates make borrowing costlier, lending a cooling effect to the economy and investors’ expectations for stock returns.

But when rates are below 5%… an upward trend in interest rates has acted as a tailwind for stocks. Stock prices have historically moved higher, alongside higher interest rates, while rates are under the 5% threshold.

Rates are under 5% today.

The trend of rising interest rates will indeed act as a headwind for stocks… eventually. But it could be a while longer before that headwind kicks in.

Until we hit the 5% threshold, we could easily see stocks continue to rise alongside interest rates.

Some stocks, that is. Certainly not all stocks.

The thing with this sudden return of focus on inflation and interest rates is that it will spur shifts in investors’ preferences. As the threat of inflation grows stronger, and closer, we’ll see shifts away from rate-sensitive sectors – like utilities and real estate – and shifts toward sectors that are typically more robust to higher rates, like commodities.

While the most recent iteration of “inflation spook” seemed to crystalize with the February 2 wage growth report, early signs of the inflation trade were brewing as early as last December.

Since then, the utilities sector (XLU) is down 9.1% – clearly the worst of all U.S. sectors since mid-December.

Real estate investment trusts (VNQ) lost 11.7%, putting the sector into bear market territory now that prices are 20% off their July 2016 high!

The real winners of the recent inflation trade has been commodities!

Every single commodity ETF I track is up since mid-December.

Copper’s up 2.6%.

Silver 3.7%.

Agricultural commodities have gained 3.9%.

Natural gas is up 5.8%.

Gold 6.9%.

Crude oil prices have risen an impressive 8.6%.

And platinum prices have jumped 12.8% higher.

All told, it’s too early to call higher interest rates a “killer” of the bull market in stocks.

But now that higher interest rates and inflation are in focus, you shouldn’t be surprised to see renewed interest in hard assets, like gold and oil.

I’ve recently given my Cycle 9 Alert subscribers two bullish recommendations on commodities, as they’re poised to outperform between now and the end of May. There’s still time to get in… click here for details.

Adam O’Dell

Editor, Cycle 9 Alert

The post The Winners in Inflation appeared first on Economy and Markets.

February 20, 2018

The Link Between GDP and Cryptos

It was the best of times, it was the best of times. OK, that’s not exactly the Dickens quote from A Tale of Two Cities, but even with the recent volatility and inflation jitters, the sentiment seems to fit the mood of the markets today. And what’s not to like?

Tax reform will put more coin in most people’s pockets in the weeks ahead, not to mention fill corporate coffers to the point of overflowing. Based on estimates of future spending and earnings, investors are driving stocks higher from what were already record levels.

But just like a late-night infomercial… that’s not all!

The Bureau of Economic Analysis recently reported its first estimate of fourth-quarter GDP. Personal consumer expenditures (PCE), the primary measure of consumer spending, jumped 3.8%, which gave the overall economy a huge boost, driving GDP growth to 2.6%.

That’s awesome news… until you consider how consumers were able to goose their spending.

To fund their shopping, consumers used a couple of well-known and concerning sources: raiding savings and adding credit card debt.

2017 possibly marked the point at which wages begin moving higher. Private workers enjoyed a 5.2% gain in wages in December, while government workers received a 3.1% boost.

Whether driven by need or want, consumers chose to spend all of those higher earnings and more, dropping the savings rate to 2.6%.

That’s not just the lowest savings rate since the financial crisis, it’s the lowest rate since September 2005, another time when most people thought everything was sunshine and roses…

Economist David Rosenburg calculated that if consumers had maintained their savings rate of 3.3% from the previous quarter, PCE would have clocked in at a modest 0.8%, which would have dropped GDP growth to an almost flat 0.6%.

Adding to the tale of caution, consumers also opened their wallets and pulled out the plastic at the end of 2017. Over the last 13 weeks of the year, consumer credit expanded so quickly that at one point it grew at a 22.5% annualized rate.

Without the dip in savings rate and increased credit card spending, it’s possible GDP might have touched zero at the end of last year, which is a far different story than the one we hear on the evening news, read on the internet, or see in the papers.

As to what people are buying with all the debt, one of our readers, Ray Q., brought up a possibility that has since been echoed elsewhere: cryptocurrencies.

Buying bitcoin or one of the other digital dollars can be a hassle. Purchasers must first establish an account at an exchange, or go through the hassle of setting up their electronic wallet and finding a willing seller.

Then comes the pesky part… paying for it.

Buyers can transfer cold, hard cash into their online accounts, or in many cases, simply make a purchase with a credit card, much like they do on Amazon or any other website. Using a credit card makes the transaction simpler and easy to track, but it comes with issues.

Roughly 18% of bitcoin purchases in December were made with credit cards, and one-fifth of those buyers didn’t pay off their balance at the end of the month. But they aren’t worried.

90% of those who carried their balance forward expect to pay off their debt with their cryptocurrency gains.

Because of that speculative point of view, along with the volatility of cryptocurrencies, Capital One no longer allows customers to buy cryptocurrencies using its credit cards. Discover made the same move in 2015, and Toronto-Dominion Bank limits some transactions.

If consumers choose to save a little more this quarter, or take on less debt, then GDP growth will take a hit and it will reverberate through the financial markets. That brings to mind a different literary reference.

The recent convergence of economic, paycheck, and stock market growth might be “as good as it gets.”

P.S. What do you think? Like Ray did, tell me your thoughts with an email to economyandmarkets@dentresearch.com.

The post The Link Between GDP and Cryptos appeared first on Economy and Markets.

February 19, 2018

Which States Are Growing Fastest?

One of the buzzwords since Trump became president is “growth.” He’s made ridiculous promises about economic growth that he can’t possibly make good on.

But let’s take a look at another type of growth that affects us all: population growth, specifically in the continental U.S.

It should be no surprise that very high-cost states like New York, Massachusetts, Connecticut, New Jersey, California, and Hawaii are NOT growing very fast.

Southern Florida isn’t growing as fast as the northern half due to higher costs of living.

And people generally tend to move away from colder Northeastern and Midwestern states to the warmer Southeast and Southwest.

But, that doesn’t mean that all warm states are growing like gangbusters… or that all cold states aren’t.

Here’s the map that summarizes growth by state for July 1, 2016 to July 1, 2017…

[image error]As you can see, Idaho is growing the fastest, at 2.20% annualized.

The other top 10 also include:

Nevada, 2.00%;

Utah, 1.89%;

Washington State, 1.71%;

Florida, 1.59%;

Arizona, 1.56%;

Texas, 1.43%;

Colorado, 1.39%,

Oregon, 1.39%; and

South Carolina at 1.30%.

I would have thought Texas and North Carolina would have been higher. Washington State also surprised on the upside as Seattle is becoming Silicon Valley 2.0.

Nine states, ranging from Wyoming to Connecticut, have negative growth rates. Mississippi and Louisiana are negative, despite being in the South. New Mexico is also surprisingly low, being surrounded by four high-growth states.

Where you live will affect business growth and real estate values. So, consider that, especially if you’re retiring. Idaho, Nevada, Washington, Florida, and Arizona look like the best places to go to me.

Harry

P.S. We’ll continue this demographics discussion next week when we take a look births over deaths. Did you know that Utah leads natural population growth in the U.S. due to high births while sucks wind with so many retirees? And later in the month we’ll look at international immigration trends that are favoring states like Florida. Stay tuned.

The post Which States Are Growing Fastest? appeared first on Economy and Markets.