Harry S. Dent Jr.'s Blog, page 58

March 20, 2018

The Thing About Bond Yields and Interest Rates…

I wasn’t particularly sad to see last month come to an end. Volatility came back with a vengeance and bond yields rose to levels we haven’t seen in a long time.

But perhaps most interesting was the market’s welcome to incoming Fed Chair Jerome Powell. Powell gave an overall upbeat outlook for the U.S. economy… and stocks responded by selling off violently.

Go figure.

It seems that rather than be happy that the economy is healthy, Mr. Market instead fixated on the fact that, given the economy’s strength, the Fed would likely raise short-term interest rates four times this year rather than just three.

Now, frankly, I don’t think it matters much if the Fed raises interest rates 0.75% from today’s levels or 1%. I really don’t think that extra 0.25% is the proverbial straw that breaks the camel’s back. Another 0.25% isn’t likely the be the deciding factor for a company looking to expand production or hire (or fire) more workers.

Yet Powell’s comments sent the Dow down by more than 700 points in a matter of two days..

Even stranger is that longer term bond yields responded by rising.

I know what you’re probably thinking. Why shouldn’t bond yields be up? The Fed has effectively telegraphed that it intends to raise rates.

Well, yes. Sort of.

The Fed telegraphed that it intends to be fairly aggressive raising short-term rates this year. But, remember, raising the Fed funds rate is an anti-growth and anti-inflation maneuver. By raising rates, the Fed is intentionally trying to cool the economy to avoid an uptick in inflation.

Lower inflation expectations should cause bond yields to fall rather than rise. Yet here we are.

Markets often seem arbitrary and illogical, but they make more sense when you consider the human element.

The economist John Maynard Keynes compared the market to a peculiar kind of beauty contest in which the judges vote not for the girl they consider the prettiest but for the girl they expect the other judges will consider the prettiest.

I think that’s what we’re seeing today. Investors are selling bonds and pushing yields higher because they’re afraid other investors will sell bonds and send yields higher.

As a general rule, I consider it a bad move to try and play that game. Instead of trying to guess what your fellow investors will do, look for stocks or funds that are priced to deliver outsized returns. The market will eventually recognize that value and, in the meantime, you’ve collected a nice stream of dividends. That’s what we do in my income-based newsletter, Peak Income.

And, over the long haul, I expect we’ll sleep better and see better returns than the poor schmucks trying to outflank each other.

Our Peak Income portfolio has, by default, become a little more aggressive over the past month, as many of our more conservative bond funds got stopped out due to rising bond yields.

But that’s perfectly fine. We’re getting stopped out precisely because I’m being uber conservative and keeping our stops tight. We can – and likely will – jump back into a lot of these positions as pricing becomes more favorable.

I like collecting a high and growing stream of dividends. But I’m not willing to put my capital at excessive risk to make that happen.

I have a feeling that bond yields will level off soon. It’s entirely possible that we’ve already seen the high and that yields will drift lower. (In fact, I actually bet on exactly that in our sister publication, Boom & Bust.)

But if they don’t, and yields go higher first, that’s OK. We’ve preserved capital, so we’ll have plenty of buying power to snap up solid income opportunities on the cheap.

The post The Thing About Bond Yields and Interest Rates… appeared first on Economy and Markets.

What You Really Need to Retire

When I was young, I was stupid. I wanted money, and lots of it.

I came of age in the 1980s, when BMWs, cocaine, and the movie Wall Street were all the rage. If you didn’t have a bead on a million bucks by 30, then you were a failure. The only goal of working was to amass so much money that you could, in nice terms, tell the rest of the world to “go away.”

So, how much was that? Did I need $1 million? Even at 21, I knew a million dollars wasn’t going to cut it. How about $2 million? Do I hear $5 million? I never decided. Thankfully, life got in the way.

I got married. Had kids. Raised the kids and put them through college. I’ve had professional ups and downs along the way, with skinny years and profitable years. And I’ve also learned that carrying around a financial goal like a millstone isn’t a benefit, it’s a burden.

Because focusing on a number ignores the real problem that almost everyone will face in retirement… turning wealth into cash. And there’s no specific number that can solve that issue.

It sounds easy enough to convert wealth into usable money. Sell something. That’s great, but how much do you sell, and when?

There are a million fancy retirement calculators that help you determine your “number,” that magic level of wealth that will allow you to retire in the style you want, but precious few of them talk about how that number becomes rent money.

Monte Carlo simulators will spit out the probability of you reaching your financial goals. That’s sort of useful, but probabilities mean the risk of failure remains.

And you can find investment programs that show you how things might go if you spend down your nest egg by a certain percentage a year. But what happens if the markets go against you? Do you keep spending, banking on the notion that the markets will rebound? Or do you cut into your standard of living and try to shore up your investments?

These questions haunt all but the richest and poorest among us. And they don’t have to. Instead, we should turn the questions upside down.

I don’t need to solve for my “number.” I need to develop streams of income. I want cash flow that hits my mailbox (or bank account) on a regular schedule, giving me the financial wherewithal to pay for a comfortable lifestyle. If it takes me $800,000 or $4,000,000 to do it, that’s a different story, and will be specific to my situation.

But the focus is on income, not wealth!

As you think about your investments, consider what they mean to you.

Are they growing pockets of wealth for specific purposes, or are they simply an amorphous blob that is meant to somehow provide for you in the years ahead? If the answer is the latter, then I strongly urge to you start planning today on how you will convert your wealth to income, so that it provides what you will need most: cool, hard cash.

Who knows, as I look out at my own retirement, I might even use some of my income to buy an old BMW.

P.S. Our retirement guru, Charles Sizemore, will soon be sharing details about how exactly to generate the income you’ll need for retirement. It’ll be worth checking out so stay tuned to Economy & Markets for that.

The post What You Really Need to Retire appeared first on Economy and Markets.

March 19, 2018

Toys R Us Not Just a Retail Casualty

Toys R Us just joined the unenviable list of top retail failures of the past decade: Circuit City, Linens-N-Things, A&P (the Great Atlantic & Pacific Tea Company), Sports Authority, and Radio Shack (whose downfall we called in 2016).

While there are many reasons for the loss of these once household names, and Toys R Us is citing massive debt burdens as one element in its undoing, there is a much bigger – and more predictable – underlying factor.

Demographics!

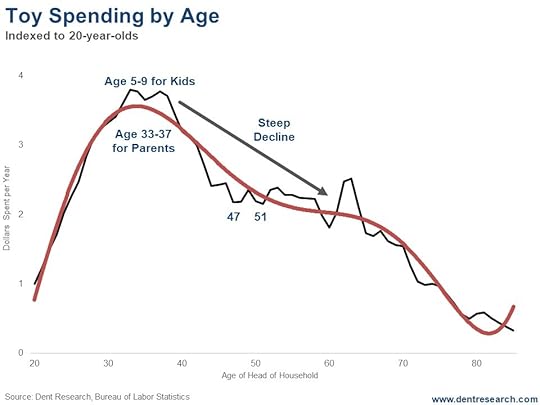

It’s not hard to figure out when toys are most in demand. Age 5 is the peak for kids. There’s a plateau between the ages of 5 and 9. And then a steep drop-off… kids grow up and graduate to alcohol and ecstasy parties instead.

Look at this chart (we have everything from cradle to grave).

And, by the way, for kids, spending on babysitting peaks at the same age as spending on toys: 5 for kids, 33 for their parents.

And, by the way, for kids, spending on babysitting peaks at the same age as spending on toys: 5 for kids, 33 for their parents.

And calorie intake peaks at age 14 (so spending on potato chips peaks at 42 for parents).

And height peaks at age 19…

And those “minor” bills for college education? They peak when parents are 51 years old on average.

Got any other questions about spending peaks? We’ve got the answers!

But back to toys…

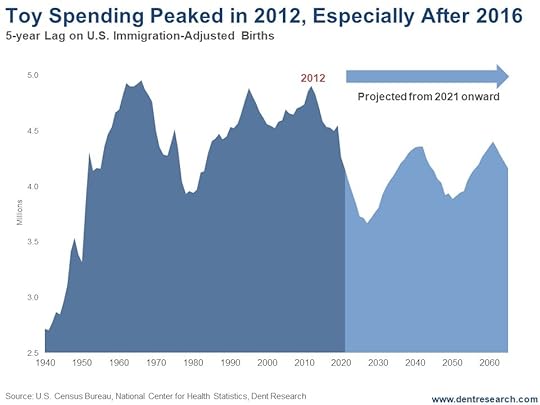

On a 5-year lag, toy spending would have peaked for the Millennial generation in late 2012. With the plateau into age 9, spending would have stayed buoyant into late 2016. After that? Tickets baby!

Toys R Us was a victim of two key trends in our time: debt and demographics.

But probably more important: Toys R Us (and Lego is in trouble as well) is a leading indicator of our entire economy ahead, when endless free money and stimulus hits its nasty hangover.

For Toys R Us, it was a classic leveraged buyout, with $5.3 billion in debt pledged against assets and $7.9 billion in total debt.

Leveraged up to its eyeballs…

And by my old employer, Bain & Company (Bain Capital). If only they’d consulted me before entering a collapsing demographic sector.

Retailers are also leading defaults at three times average for American companies in a shrinking environment… due to slowing demographic trends (more from the aging Baby Boomers) and competition from the almighty Amazon and online retailers… “Heil Bezos!”

Debts will quickly be written off, but demographic trends will continue down into at least 2028.

This is literally a dying industry, but from younger kids, not older Boomers. We’re likely never to see higher birth rates than 2007 again, as I’ve been warning for decades now.

If you’re in the nursing home/assisted living sector, brace for incredible growth in the years ahead, as Baby Boomers age into 2045-plus.

If you’re in a child-focused business, convert childcare centers into assisted living centers. And if you are in the diaper business, focus on adult diapers, not baby diapers.

Demographics will always steer you in the right direction for investment and business.

Harry Dent

Follow Me on Twitter @harrydentjr

The post Toys R Us Not Just a Retail Casualty appeared first on Economy and Markets.

March 16, 2018

What I Told the Germans (Part 2)

Earlier in the month I shared with you the first part of an interview I recently had with a publisher in Germany who’s considering bringing our newsletter to the German people. Here’s the rest of that interview…

Mr. German Publisher: Where do you think that the final reckoning will start? In the stock market? With interest rates? In real estate?

Me: I think the stock market will peak between February and May, if it hasn’t already peaked on January 27, and real estate will follow on a lag. Rising Treasury rates are a “pin” to burst this bubble, along with dangerously volatile cryto-currencies. Rates in Japan and Europe for sovereign bonds are unbelievable underpriced due to strong ECB QE policies. Italian bonds at 1.8% versus U.S. at 2.75%… are you kidding me?!

Note that commodities were the first bubble to burst between mid-2008 and early 2011. The bitcoin bubble burst starting in mid-December 2017. Stocks look to be following suit. Real estate will be last, but likely by mid-2018.

Mr. German Publisher: Do you expect a new euro crisis, in the face of potentially rising interest rates in Europe and the upcoming elections in Italy?

Me: Absolutely. Italy is already bankrupt at the private debt level and has the highest debt ratios at the sovereign level outside of Japan and Greece. AND, their demographic trends get even worse over the coming years and decades (as does Germany’s). How is Germany and the EU going to keep bailing out Italy when their economies weaken ahead due to bad demographics trends and a global crash.

Mr. German Publisher: What do you expect the Dow Jones to do in 2018?

Me: I think that the first crash (not a mere correction) in 2018 will be 40%-plus, taking the Dow down to 16,000 or so. Ultimately the crash will be down to 5,500 on the Dow by 2020 and possibly as low as 3,800 by late 2022. I know that is a serious forecast, but that is what my longer-term indicators suggest. And this is what has happened historically in the winter economic season of our 80-year cycle.

Mr. German Publisher: A crash usually means a recession ahead. Do you have any faith in President Donald Trump’s policy of easy money and low taxes for companies?

Me: I don’t! He’s come in after nine years of QE and free money and lowered tax rates – another free lunch. The problem is that corporations tend to average 18% of GDP in capital investment and don’t respond to lower taxes. They invest when they need more capacity. Companies around the world from China to Japan to the U.S. to Europe have excess capacity right now. They prefer to take the free lunch money and low rates and buy back their own stocks, design mergers and acquisitions, and increase dividends to benefits their shareholders, not consumers, workers, or the economy.

Mr. German Publisher: What development do you see for interest rates?

Me: I see U.S. 10-year Treasury rates going up to around 3.0%, and we’re already close to that. Then I believe they’d drop down to near 1.0% in a deflationary scenario. So, that’s the first place to buy in this down scenario ahead. I call it the Fixed Income Trade of the Decade.

Mr. German Publisher: How long will it take until we have “the worst” behind us?

Me: I would say we don’t pull out of this depression environment until around 2023 or so.

Mr. German Publisher: Are there asset classes that will NOT suffer, but maybe surge instead?

Me: Long-term Treasury bonds in the U.S. and AAA corporate bonds will do best, just like they did in the 1930s.

Mr. German Publisher: Should investors buy of cheap stocks during the crash?

Me: You shouldn’t buy stocks just because they’re down 10% or even 40% in a major bubble burst like this. Stocks are typically down 70% to 90% in such a once-in-a-lifetime major bubble burst. I’m projecting losses of 80% in this burst. Once we get close to that level, then investors can start fishing for bargains again. But, as I explained in my book, Sale of a Lifetime, this time around you can’t just throw darts at a board to find those fortune building stocks. You’ve got to be selective!

Mr. German Publisher: How should I prepare – as an investor and a citizen, father, husband, real estate owner, and employee?

Me: Take your gains from this unbelievable bubble in stocks and real estate and cash in while you still can. Take your money and run! Keep your job and kiss your employer’s ass. Start businesses on the sidelines if you can.

Mr. German Publisher: Do you look to the future with optimism or pessimism?

Me: I study longer-term trends, which are exponential in nature, and I was the most optimistic forecaster in the late 1980s forward. But the biggest demographic and debt trend is reversing. The next global boom will be more in the emerging markets like Southeast Asia and India. It will be very mixed in the developed world… Australia, New Zealand, and Scandinavia will be the exceptions with stronger demographic growth after 2020. And Australia and New Zealand are on the cusp of this Asian boom ahead. Germany has the second worst demographic trends ahead and the worst exposure to the inevitable debt meltdown in Italy and southern Europe. Germany’s demographic trends are the worst in the next several years… nobody sees this coming.

In short, I’m optimistic that there will be plenty of opportunities for investors and businessmen and women to increase their wealth once we’ve had our day of reckoning. The next global boom will not be like the boom of past years. It’ll will be far more muted. But it’ll be there, and we’ll be there to help guide subscribers to the pots of gold.

Harry

Follow Me on Twitter @harrydentjr

The post What I Told the Germans (Part 2) appeared first on Economy and Markets.

March 15, 2018

This Indicator is Flashing Red. Pay Attention!

Millennials get a bad rap. Sure, they’re the generation that grew up with participation trophies, winning prizes for completing the arduous task of showing up. And with help from their Boomer professors, they have successfully shamed institutions of higher learning, where for centuries debate was considered a search for the truth, into echo chambers of conformity.

I’ve also just learned that this generation has promoted E-sports (that would be watching other people play video games) into such a big deal that the category will get its own E-sports arena in Arlington, Texas.

But they also have made contributions, like adding to our lexicon. Nothing sums up a noncommittal, uninterested response like the word, “meh.” It’s not a verbal eyeroll, it’s more akin to bored sigh, something you utter when you don’t care enough to send your very best.

And it perfectly encapsulates my reaction to this week’s economic news. Sure, the headlines were hyperventilating, but they lack punch.

If you like good news, then you probably saw something along the lines of Tax Reform Will Drive the Economy to New Heights, With Corporations Spending Hundreds of Billions of Dollars in America! Or… Larry Kudlow, as the President’s New Economic Advisor, Will Usher in an Era of Prosperity for Taxpayers!

If you were looking for reinforcement of negative ideas, then perhaps you read that Trade Tariffs Will Lead to Trade Wars That Bring Us to Our Economic Knees! Or that The New Spending Bill Will Finally Cause Deficit Fears to Explode!

But there was one important economic detail released this week: the latest GDPNow release from the Atlanta Federal Reserve Bank.

The new estimate throws cold water on the notion of a jump in economic growth, which is something we’ve been harping on for years.

It’s time people pay attention, because rising rates (which the Fed has all but promised) with falling economic activity will put a serious dent in the stock market.

The GDPNow model is the best economic growth forecast I’ve found. It should be on everyone’s economic calendar.

The Bureau of Economic Analysis (BEA) releases its first estimate of quarterly GDP on the fourth Friday after the end of the quarter, so first-quarter GDP won’t be released until the end of April. The first revision of that number is released a month later.

In a digital world based on immediate gratification, we must wait until late May to get a solid read on what happened from January through March. That’s insane!

The Atlanta Fed attacks this problem with what it calls a “nowcast.” The GDPNow model uses up-to-the-minute information to estimate GDP for the quarter, updating regularly until the BEA releases its first estimate.

The GDPNow came out of the gate in January showing first-quarter GDP at 4.2%. Then it shot up to 5.4% when ISM Manufacturing was released on February 1.

It didn’t last long.

After the employment report and auto sales on February 2, the forecast fell to 4.0%. It slipped further after retail trade and consumer prices on February 12, down to 3.2%, then bounced around 3% as different reports came out through the rest of the month.

On March 1, GDPNow shot up to 3.5%, again on ISM Manufacturing, but soon dropped back to 3%.

After the employment numbers last week, the estimate dipped to 2.5%.

The weak retail trade and purchasers’ price index yesterday, along with consumer prices from Tuesday, drove the estimate down further to 1.9%.

Over the course of two months, with economic and market cheerleaders in a tizzy about how we’re exploding to the upside, the best GDP forecasting model I know of has dropped its estimate from a high of 5.4% to just under 2%.

The Atlanta Fed didn’t change its forecast based on hope or some grand idea of what could happen. The analysts at the central bank used hard data.

If something doesn’t change significantly in the next few weeks, we should expect first-quarter GDP of about 2%, well below the rosy forecasts from Washington and Wall Street.

At first, investors might cheer a low number, thinking the Fed will ease off its tightening monetary policy.

Don’t bet on it.

As I cover at length in the April Boom & Bust, the Fed has its own agenda. They need to get back to a neutral monetary policy stance as quickly as possible to prepare for the next downturn. As long their moves don’t kill the economy – and 2% has been the norm for years, so that shouldn’t be a factor – the central bank will stay on course, raising short-term rates and shrinking its balance sheet.

With higher interest rates and tepid growth, equities should take a substantial hit.

The GDPNow model is flashing red. We need to pay attention.

Rodney

Follow me on Twitter @RJHSDent

The post This Indicator is Flashing Red. Pay Attention! appeared first on Economy and Markets.

March 14, 2018

Could This Be More Exciting Than Bitcoin?

Last month at Hidden Profits, we delved into the world of cryptocurrency and blockchain technology. I uncovered a stock selection that operates a real business in the blockchain world and is poised for major returns going forward.

Whatever bitcoin does, this stock could do much better. And, if bitcoin falters, this stock has true underlying value to support the share price.

While cryptocurrency is all the rage, there are opportunities for quick profits in more traditional financial company.

This month we rewind the clock and discuss a financial innovation that’s been around for two decades. Yet it’s poised for a new growth spurt due to changing demographics and the way people invest. Power will increasingly be consolidated in just a few hands.

The March Hidden Profits selection has recently hit a rough patch. As a result, the stock has been spanked, even as the overall market recovers to new highs.

So, what’s to like?

Well, if it were all champagne and caviar there would be little opportunity to outperform the markets. We must uncover the potential where others only see clouds on the horizon.

We must identify the hidden profit.

Here we have an opportunity to own a major player in a growth industry where barriers to entry are becoming more pronounced. If you don’t have scale and distribution in today’s world, it’ll be almost impossible to compete in the future. That’s because regulations and compliance have made it costlier to operate and keep the smaller, more innovative firms at bay.

This company has a legendary investor as a key operator in the business. I’ve expressed my bearishness about the stock market in Economy & Markets before, because it’s well known that valuations are stretched and market sentiment too bullish.

So, this late in the cycle, if I’m going to be long a stock, I want to be riding the coattails of the very best operators – the billionaires that made their billions building something from the ground up, not levering up and borrowing $10 billion to make a quick 10% and pocket$1 billion.

We have that opportunity here. And the best part is that I think this company is ripe for a takeover. As the industry evolves and hits its next phase, the scale and distribution capabilities of our stock pick will be crucial to the major players. It’s simply too attractive to not consider if you’re one of the three of four biggest firms in the industry.

These opportunities do not get ignored for too long.

I think an acquisition could happen sooner than later and if that does indeed happen could lead to a 35% to 50% gain in fairly short order.

Good investing,

John Del Vecchio

Editor, Hidden Profits

The post Could This Be More Exciting Than Bitcoin? appeared first on Economy and Markets.

Is That… Inflation on the Horizon?

Treasury bonds were fairly quiet last week and have been tame so far this week too.

Stocks sold off recently when Gary Cohn, President Trump’s top economic advisor, resigned, reportedly because Cohn and Trump clashed over the idea of a trade war.

Despite the continuing political circus, Treasury yields traded in a narrow range ahead of last Friday’s jobs report. In fact, volatility ebbed significantly, as long-term Treasury yields ranged from 3.11% to 3.15%.

February employment was a mixed bag. Non-farm jobs were up by 313,000, trouncing an estimate of 205,000. The labor participation rate increased to 63% from 62.7%.

Now for the bad news: The unemployment rate stayed at 4.1% on the expectation it would drop to 4%.

And, worse yet, earnings were only up 0.1% on the expectation of a 0.2% increase. The annualized growth in wages fell to 2.6% from 2.8%. That was a disappointment, especially because the Federal Reserve was expecting wages to push inflation up.

Speaking of inflation, Tuesday morning’s release of the February Consumer Price Index (CPI) went pretty much as expected. CPI was up 0.2% month over month, as expected, and 2.2%year over year. Core CPI (less food and energy) was also up 0.2%, as expected, and 1.8% year over year.

According to the Bureau of Labor Statistics, new and used vehicle prices fell 0.5% and 0.3%, respectively, while apparel costs rose 0.3%. Housing also rose 0.3% on the month, while owners’ equivalent rent gained 0.2%.

So far, consumer prices haven’t moved up to the magic 2% level the Fed targeted a decade ago, even though wholesale prices hit 2% last May. The February Producer Price Index (PPI) is out Wednesday. The consensus forecast is for something in the neighborhood of Tuesday’s CPI number, but core PPI is tracking at 2.5% on the year.

Producer-price increases eventually get passed along to consumers, so you would think that the Fed and investors would be concerned with wholesale inflation, but not so. So far, surprises in the PPI have been met with a collective yawn.

Even though employment has been strong and unemployment low, wage growth has been stubbornly low.

That seems to be the missing piece to the Fed’s puzzle.

Even though inflation and wage growth have been muted, I still expect the Fed will hike rates next week. Why? Because policy makers at the Fed still expect wages to move higher, with consumer inflation to follow.

We’ll just have to wait and see.

In the meantime, you can prepare for and profit from surprises in the financial markets, and specifically in the Treasury bond market, with Treasury Profits Accelerator.

Good investing,

Lance Gaitan

Editor, Treasury Profits Accelerator

The post Is That… Inflation on the Horizon? appeared first on Economy and Markets.

Are You On Track For Retirement?

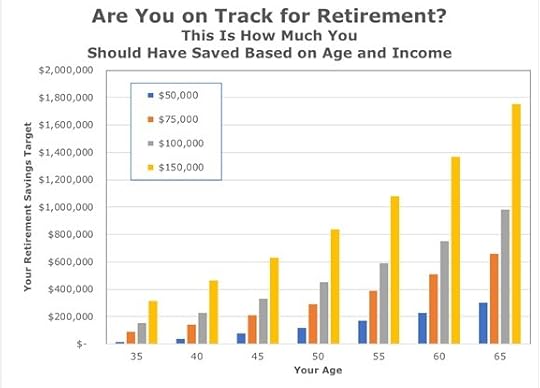

According to the National Institute on Retirement Security, 92% of working households don’t meet the savings target they need to retire at age 67.

Where do you stand?

Look at this chart and let’s figure it out:

If you’re 45 with an annual income of $75,000… you should already have $210,000 set aside

If you’re 50 with an annual income of $100,000… you should be sitting on $450,000 by now

And if you’re 55 and used to living on a salary of $150,000… you should have already passed the million-dollar mark

With that in mind, look at this chart and find your current retirement number – the amount you should have saved as of today.

Then, ask yourself an honest question…

“Am I on track for retirement?”

If the answer is “yes,” then congratulations! You’re officially one of the 8%!

If the answer’s “no,” you’re among the 92% of us who aren’t anywhere close to having enough saved.

But don’t worry. There’s time to catch up. And over the next several weeks, I’m going to show you how.

Charles

The post Are You On Track For Retirement? appeared first on Economy and Markets.

The One Thing You Should Be Most Concerned About For Retirement

The last few days we’ve been asking readers what their biggest retirement concerns are. Teresa will report back with more details on Saturday, but the responses so far show that, number one, people fear they’ll outlive their money. Number two is that rising healthcare costs and deteriorating health will erode their quality of life. And number three is the BIG question mark: will they get the retirement benefits they’ve been promised?

I have no intention of retiring (unless health becomes an issue). I couldn’t possibly survive the boredom. But that doesn’t mean I don’t have any retirement concerns.

While those top three points are critical, I have an even BIGGER retirement concern, and I tell you all about it in this week’s video, which you can watch now.

Research from John Hussman shows that if you buy stocks at today’s levels, you’ll LOSE 2% to 3% a year over the next 10 years. That’s crazy and doesn’t even take into account our more bearish economic fundamental indicators.

What the hell are you supposed to do?

Well, watch today’s video for some immediate insights, and then stay tuned to your Economy & Market emails because we’ll be tackling this question over the course of the next several weeks.

And read what Charles has to say below and see if you’re on track for retirement.

Harry

Follow Me on Twitter @harrydentjr

The post The One Thing You Should Be Most Concerned About For Retirement appeared first on Economy and Markets.

The Value of Having Skin in the Game

I was little sluggish this morning. I picked up a copy of Nassim Nicholas Taleb’s latest book, Skin in the Game, yesterday and I found myself still thumbing through the pages on my Kindle into the wee hours last night.

Taleb is best known for his writings about risk, the role of randomness and specifically about black swans – low-probability but high impact events that wreak havoc on the unprepared.

In fact, Taleb became something of a household name by publishing his second book – The Black Swan – just a year before the 2008 financial system collapse.

But Skin in the Game is little different than most of Taleb’s prior writings. It’s less a discussion of risk and probabilities and more a guide to living a moral life: one with skin in the game.

That means you accept the risk that comes with your actions. You shouldn’t take the upside unless you’re willing to risk the downside.

This seems so obvious, yet it’s remarkably rare in public life. Bankers enjoy multi-million-dollar bonuses in good years… yet resort to taxpayer-funded bailouts when the risks they took come home to roost.

Politicians vote for war… yet do not fight on the front lines like kings of old. Taleb has special scorn for virtue signalers: those who have all the “correct” public opinions about economic or racial equality – and are the first to join a Twitter lynch mob against unpopular opinions… yet wouldn’t be caught dead “hanging out with Pakistani cab drivers or lifting weights with cockney speakers.”

Skin is far too broad to be summarized in a short article, and I don’t want to turn into a regular book reviewer, but I think it’s useful to pass on Taleb’s advice to young people. We can all use the lesson. As Taleb writes:

“Finally, when young people who ‘want to help’ mankind come to me asking ‘What should I do? I want to reduce poverty, save the world,’ and similar noble aspirations at the macro level, my suggestion is:

Never engage in virtue-signaling;

Never engage in rent-seeking;

You must start a business. Put yourself on the line, start a business.

“Yes, take risk, and if you get rich (which is optional), spend your money generously on others. We need people to take (bounded) risks…. Courage (risk taking) is the highest virtue. We need entrepreneurs.”

Hear, hear. I couldn’t agree more.

We already touched on virtue-signaling – something Taleb calls “a mixture of bullying and cowardice.” But rent-seeking is arguably even worse.

Rent-seeking is the essence of crony capitalism.

You seek economic gain without actually creating wealth it or taking any real risk. In centuries past, a rent-seeker might have been a feudal lord who inherited his privilege and used his connections to the king to preserve it.

Today, it might be the banker or corporate CEO that depends on government guarantees or protection from competitors.

A rent-seeker plays the system. An entrepreneur creates real wealth.

And this brings us to Taleb’s final piece of advice: To start a business.

Real entrepreneurs are not smooth talkers with glossy business plans or PowerPoint presentations. If your goal is to start a business and then immediately “flip” it by selling out or going public, you’re not a real entrepreneur. You’re actually a lot closer to rent-seeker engaging in a financing scheme leaving someone else to deal with the mess later.

Real entrepreneurs are doers who put their capital, their sweat equity and their reputation at risk.

If you think you have what it takes to be an entrepreneur, consider putting your name on the door. As Taleb puts it, “products or companies that bear the owner’s name convey very valuable messages. They are shouting they have something to lose. Eponymy indicates both a commitment to the company and a confidence in the product.”

I’ll wrap this up with one closing quote from the book: “No muscles without strength… life without effort, facts without rigor, statistics without logic… virtue without risk… and most of all, nothing without skin in the game.”

The post The Value of Having Skin in the Game appeared first on Economy and Markets.