Harry S. Dent Jr.'s Blog, page 56

April 5, 2018

Mixed Messages

Two weeks ago, the Federal Reserve decided to hike rates again. This was no surprise.

What was surprising, however, was the subsequent drop in long-term rates and the further flattening of the yield curve. New Fed Chair Jay Powell said he expects to continue hiking rates as planned, with two more this year, three more in 2019, and a couple more hikes in 2020.

On top of that, the Fed hasn’t changed its plan to shed nearly $3 trillion from its balance sheet.

Powell and the rest of the Fed decision-makers think the economy will continue to be robust since employment has been and (they believe) will continue to be strong. And consumer inflation should hit the Fed’s 2% target this year.

As I’ve often wondered in this space, with a growing economy and an improving employment market, how is it that inflation is only inching higher?

Powell didn’t (or couldn’t) explain during his first press conference, and that’s where the mixed messages began.

Long-term yields slumped in the aftermath of Powell’s presentation last Wednesday, which means the market didn’t buy what he tried to sell. The economy isn’t going to grow much more if inflation doesn’t move higher with it, and the jobs market won’t strengthen if wages don’t go up.

Last Thursday’s release of the Fed’s preferred inflation measure (the personal consumption expenditures prices index excluding food and energy prices, or the “core” PCE price index) for February didn’t do much to move any needles.

The month-over-month uptick was in line with expectations at 0.2%. But the year-over-year increase of 1.6% exceeded expectations. Personal income (up 0.4%) and spending (up 0.2%) were both in line with expectations.

Once again, the data didn’t impress the market, and, once again, yields fell.

The long-term Treasury yield fell to 2.97%, and, at the same time, the Dow Jones Industrials Average was up more than 300 points! Treasury bonds are overbought, and I expect a snap-back to higher yields very soon.

Volatility continues to pulsate, as it has over the last week or so. Stocks were up, then down, and then major indices were up sharply. That is, until Monday, when the bottom fell out.

When stocks dropped off a cliff and investors flocked into the safety of Treasury bonds, yields moved back down to two-year lows from last week.

In the meantime, investors are on edge waiting for more fallout from President Trump’s trade war. China is responding with counter-tariffs and has vowed to “fight to the end.”

It’s too early to determine how this will all shake out. Trump has a habit of backing down, but he might feel that it’s time China’s unfair trade policies – which are in conflict with U.S. business interests – need to end.

Until then, you can prepare for and profit from surprises in the financial markets, and specifically in the Treasury bond market, with Treasury Profits Accelerator.

Till next time,

Lance Gaitan

The post Mixed Messages appeared first on Economy and Markets.

Real Estate’s #1 Weakness

Right now, Millennials are the largest cohort of homebuyers in America.

And even though they’re waiting longer to get married, start a family, and buy a home… and they’re more likely to skip buying a starter home and opt for a larger property…

They have almost ZERO interest in the massive McMansions the Baby Boomers built. Those behemoths cost a fortune to maintain, they typically lack the desirable open floor plans and high-end amenities Millennials want, and they’re usually located in hellish suburbia, far away from the hip neighborhoods and fun activities.

This is the #1 problem real estate faces right now, right alongside being completely unaffordable.

According to Realtor.com, large, single family homes – which range from 2,900 square feet to 4,000 square feet – are the largest 25% of all homes listed on its site. Yet they get 12% to 45% less views than the typical home in each market! Also, these homes are selling up to 73% slower.

Besides, even if Millennials wanted to buy these McMansions, they’d be hard pressed to afford it…

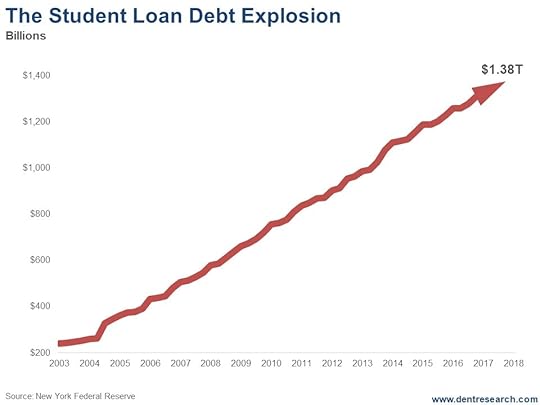

The average college graduate in 2016 owed $37,172 in student loans.

AND they’re still new to the workforce so their wages are capped by their lack of experience, all of which makes it near impossible for them to get bank approval for outsized mortgages.

This has led to limited supply in the housing market, which has pushed prices higher.

There isn’t a housing shortage. There’s a shortage of affordable housing in desirable areas.

This situation cannot and will not last. I explain why, in detail, in my newest eBook, Real Estate Doomsday: How to Protect and Grow Your Wealth During the Greatest Real Estate Crash in History.

Harry

Follow Me on Twitter @harrydentjr

The post Real Estate’s #1 Weakness appeared first on Economy and Markets.

April 4, 2018

Why the Amazon Hate?

Note: I currently hold Amazon in one of my portfolios.

Antitrust laws are aimed at companies that charge below-market prices (predatory pricing) to drive out competition, and then raise prices later to recoup the losses while enjoying a monopoly.

Amazon doesn’t fit the bill.

From time to time, the company prices products below market rates as it enters a new area, but that’s typically not how it funds operations.

Instead, Amazon charges sellers a percentage to access its platform, and then uses company revenue to fund growth in other areas until it generates sufficient revenue.

Some of this growth has worked out fabulously well, like moving from books to a wide range of products and services and creating Amazon Web Services (AWS) for cloud computing. Some efforts, like Amazon’s Fire Phone, were less successful.

There’s no doubt that along the way consumers have benefited tremendously. We pay less for goods and services specifically because Amazon exists. The e-commerce giant not only allows us to see prices across sellers, it also allows us to skip the hassle of in-store shopping.

If you don’t need something immediately, why fight traffic going to the mall, only to get door-dings in your car and find that the size/color/model of the item you were after is out of stock?

I’m not saying Amazon is a company run by altruistic saints. Bezos and company are profit motivated, and can end up on the wrong side of competitive practices (see their negotiations with Hachette).

But at the core, all the constant talk about Amazon… isn’t about Amazon, it’s about moving from physical stores to the internet, and how that centralizes shopping.

Online shopping revolutionized how we approach consumption. The internet – not Amazon, but the internet itself – provided the platform that erased the premium attached to availability.

The web has erased the bottlenecks inherent in store shopping. This is fabulous for consumers because the cost of that premium is now assigned to where it should be – those shoppers that want something immediately.

If I need a cable for my computer, I can probably find it at Best Buy and be back home in less than two hours. It might cost me a few dollars more than buying online, but I can get it now. So I pay more. If I can wait, then I get it cheaper. It makes perfect sense.

As for taxes, we’re the scofflaws, not Amazon or any other online seller. Sales tax is not owed by sellers. It’s the responsibility of buyers. But I’ve never met anyone who voluntarily filled out a sales tax form for his state to declare the value of items bought online on which sales tax wasn’t charged.

The government charges retailers with collecting the tax because it’s too hard to go after hundreds of millions of tax cheats every year.

Amazon now charges sales tax on every item it sells as a company in all states that charge a sales tax. The company does not do so for items sold on the platform by third-party retailers. It’s not Amazon’s job to do so.

There’s a lot of work to be done on this front.

Each state could develop a database that provides retailers the appropriate tax for any ZIP code within the state, and commit to updating the database every six months or some other schedule.

Retailers could then easily access the databases, charge the appropriate tax, and send it to the state to be distributed to local authorities such as transportation districts, improvement districts, counties, cities, etc.

Without such a database, the thousands of individual taxes that must be collected will remain the responsibility of the consumer, who isn’t stepping up to say that he owes the money.

And then there’s delivery. President Trump said recently that Amazon doesn’t pay enough to the U.S. Postal Service to deliver packages.

Is it Amazon’s fault if the delivery rate is set too low? Raise the rates.

Amazon obviously chose the USPS because it’s the cheapest. If it costs more than FedEx, I’m certain that Amazon will switch to FedEx… or build its own delivery service.

The USPS loses money on every delivery not because of the cost of getting a package from point A to point B, but because the service carries legacy pension costs that are underfunded. This is a story that plagues many government entities around the country. (Yes, I know, the postal service is private… but only sort of).

As Amazon grows, consumers win, which kills the current antitrust conversation. That’s the end. Unless, of course, the law changes.

Lina Khan of Yale University recently outlined how antitrust laws could be amended to capture Amazon, notably by taking into account predatory pricing where losses are recaptured on unrelated products and considering vertical integration as a negative without considering prices.

The essential argument is that Amazon is too big, so let’s find a way to cut it down to size, or at least limit the company’s growth. If this point of view gains traction, you can be sure of one thing – you’ll pay more.

Instead of attacking the company for making the most of opportunities, we should instead try to bring our lagging institutions – such as state and local taxing authorities and the USPS – into the digital age.

The post Why the Amazon Hate? appeared first on Economy and Markets.

Here’s a Few Ways to Stick It to the Tax Man

I have some good news and some bad news for you.

We’ll start with the good news: We got much overdue tax relief last December with the Tax Cuts and Jobs Act of 2017. Most Americans – and particular those with high incomes – will see a significant reduction in their tax bill.

Now for the bad news: It’s not going to be of any use to you until this time next year, when you’re filing your 2018 taxes. For 2017, you’re still paying taxes at the old rates, buddy.

I hate paying taxes with an ideological zeal, and I do everything legally permissible that I can to lower my tax bill. Earlier in my career, I would skip meals in order to scrimp together enough cash to max out my 401(k) and IRA.

Thankfully, I don’t need to do that today, and I’m not suggesting you should. It’s probably not healthy to be as obsessive compulsive about tax avoidance as I was.

But all the same, it’s in your best interest to lower your tax bill – because every dollar you keep out of Uncle Sam’s grubby paws is a dollar that can grow for you over time.

How to Save Some Cash

So, with the April 17 tax-filing deadline now less than two weeks away, let’s try to find a few ways to save you some cash.

If you work a regular nine-to-five job, it’s too late to contribute to your company 401(k) plan. To quote Austin Powers, that train has sailed, baby, yeah.

But you can contribute up to $5,500 to an IRA or Roth IRA any time up until the April 17 deadline, and $6,500 if you’re 50 or older. (If you’ve already filed your taxes, no problem. You can amend your return. Just make sure you make the contribution by the April 17 deadline.)

I should make a few points here. If you already have access to a company 401(k) plan, you generally can’t make a tax-deductible contribution to a traditional IRA.

You can, however, make a contribution to a Roth IRA, assuming you’re under the income limits. You don’t get an immediate tax break with a Roth contribution, but you do potentially get a lifetime of tax-free compounding. Plus, you’re not subject to required minimum distributions in retirement and all of your withdrawals are tax-free.

In tax year 2017, your ability to contribute to a Roth starts to get phased out at an income of $118,000 ($186,000 for married couples filing jointly) and disappears completely at an income of $133,000 ($196,000 for married couples filing jointly).

If you make too much money to qualify for the Roth IRA, congrats! That’s what we call a “high-quality problem.” But you still might have options at your disposal. You can potentially make a non-deductible contribution to a traditional IRA and then immediately convert it to a Roth IRA.

Yes, it’s legal. It’s a loophole created by Congress in 2010 that effectively circumvents the income restrictions on the Roth IRA.

But if you’re going to go this route, I do recommend getting help from a financial planner or CPA because there are a few landmines you have to watch out for. (For example, you’d need to move any existing pre-tax IRA dollars to your 401(k) plan to avoid getting ensnared by the pro-rata rule.)

So kids, be careful when trying this at home.

If you own your own business or work as a contractor, your options are better. You can’t contribute to an Individual 401(k) plan unless you had already created the plan as of December 31. But you can open and fund a SEP IRA and dump as much as $54,000 into it for tax year 2017, depending on your income.

Of course, it plays to plan ahead. If you haven’t already, start socking back the cash for 2018 too. You can dump $18,500 into your company 401(k) plan this year, not including employer matching. IRA contribution limits haven’t changed this year, but the maximums for SEP IRAs and Individual IRAs was raised to $55,000.

The market is off to a rotten start this year, but don’t let that discourage you from sticking it to the taxman. Dollars stuffed into a retirement account don’t have to be immediately invested. You can simply pocket the tax break, leave the contributions in cash, and wait for the dust in this market correction to settle.

The post Here’s a Few Ways to Stick It to the Tax Man appeared first on Economy and Markets.

April 3, 2018

[Video] Harry Dent Market Update: Making Sense of the Volatility

Harry joined Economy & Markets TV’s Dave Okenquist with a midday update on the markets. We’ve seen wild swings in stocks over the past six weeks. Every day brings crazier and crazier headlines that induce panic on Wall Street.

The Fed’s signaled that it’s going to keep raising rates and unwind its balance sheet even if stocks slip. Meanwhile, the White House seems to think stock prices are high enough to implement policy changes that will shake up markets, at least in the short term.

We’re hearing grumblings about possible antitrust action against e-commerce giant Amazon. And, of course, the biggest impact on the markets comes from news on escalating actions that could lead to a trade war with the world’s second-biggest economy, China.

But allowing for small shocks to the markets is a dangerous game because there’s no guarantee of containing the damage.

Harry spotted a possible scenario for stocks that resembles one of the worst market crashes in history.

In this scenario, the market tanked so quickly and so deeply, that traders had no chance of getting out in time… unless they had a plan, a message that Harry stressed yet again in my chat with him today.

The post [Video] Harry Dent Market Update: Making Sense of the Volatility appeared first on Economy and Markets.

The Real Estate Doomsday Map

Jeff was a small business owner in New Hampshire. One Tuesday afternoon, his neighbor called…

“You need to get home NOW! There’s a dumpster in your yard, a padlock on your door, and a bunch of guys are ransacking your house!”

Completely panicked, Jeff dropped everything and raced home. When he got there, he found most of his family’s possessions either in a heap in the front yard or tossed inside the dumpster.

Without warning or notice, the bank had foreclosed his house and sold it at auction just a few days earlier. In a single afternoon, the life he’d worked so hard to build for his wife and three daughters was gone!

It’s a story we heard all too often following the 2008 housing crisis.

Unfortunately, despite what you’re hearing from the mainstream media about real estate today – how it’s booming and can only go up from here –it’s a story we’re going to start hearing again and again in the coming years.

Some people have benefited from the record breaking bull market and housing recovery. But it’s been mostly the richest Americans who own most of the financial assets.

Hundreds of millions of Americans who don’t belong to the 1%, who were crushed in the last crisis, haven’t been able or willing to participate in the recovery. For them, things haven’t gotten better. They’ve gotten worse.

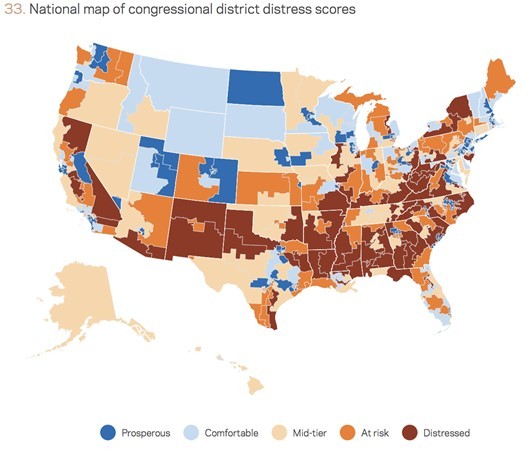

See all that blue?

See all that blue?

It’s not who voted for Hillary. Instead, those are the prosperous parts of America where there’s been strong economic growth, new jobs, rising home values, and higher pay over the past two decades.

It’s no surprise that most of that prosperity is concentrated in the fast-growing western cities and tech hubs… like San Francisco, Seattle, and Austin, TX.

But see all that orange and red?

That’s the other America this “recovery” left behind… the old industrial cities that were once the engine of our economy.

Where today, residents are more likely to die sooner, have more frequent health problems, flat or decreasing home values, and earn less money with fewer job opportunities.

Where more than 38 million American households can’t afford their housing… an increase of 146% over the past 16 years.

Where nearly seven million homeowners are either underwater on their mortgage, or barely above break even.

Where one in five households are currently broke or in debt.

And possibly the scariest statistic of them all…

Where nearly half of all Americans say they don’t have enough money to cover a $400 emergency expense. That means even a tiny bump in the road, like an unexpected medical expense, the loss of a job or decrease in pay, a slight increase in the everyday cost of living, or an increase in their mortgage interest rate would send millions spiraling into the same situation as Jeff.

And that 1%? They’re in for a shellacking of their own because they are so heavily invested in over inflated financial assets.

So, forget all the fake news you’re hearing about the real estate market being safe again because of the shortage of inventory and record home starts…

Forget about the record highs in the stock market…

And most definitely forget about all the promises the White House and Congress have made.

The truth is, we’re already starting to see the cracks deepening in stocks and in this fake “housing recovery” all across America. And that’s why I’ve written my newest eBook, Real Estate Doomsday: How to Protect and Grow Your Wealth During the Greatest Real Estate Crash in History. In it, I explore those cracks to show you how unstable this situation really is, and I detail which real estate markets across the country face the highest risk.

Harry

Follow Me on Twitter @harrydentjr

The post The Real Estate Doomsday Map appeared first on Economy and Markets.

April 2, 2018

The #1 Reason Our Healthcare Is So Costly

One of the Baby Boomers biggest concerns about retirement is the cost of healthcare.

It’s a big problem.

I have a concierge doctor, who I pay a fixed annual fee. This gets me free visits and discounts on blood tests and other things I need. On top of that, I have a high–deductible insurance policy that only covers unexpected costs over $6,000, like if I have a heart attack or something.

I’m accountable, which means I feel the expenses for my healthcare day to day, week to week, and month to month. I pay for my visits and expenses with a credit card linked to my HSA account. There’s no bureaucracy, there’s no paperwork, and there’s no confusion over what’s covered or not under the typical plan.

And there’s no illusion that healthcare is free after I’ve paid my premium!

As a result, I don’t go to the doctor just for anything… just because it’s covered on my healthcare plan! Millions of others do, though. Why wouldn’t healthcare costs be spiraling out of control when people have no incentive to monitor and control their costs?

And doctors must cover their asses against endless lawsuits, so they over-test and over-diagnose everything…

What the hell?!

Why should people win the lottery when doctors make a one-out-of-a-thousand mistake?

There’s a reason our healthcare costs about twice as much as it does in other developed countries…

Our system is full of B.S. special interests and insurance bureaucracy that adds layers and layers of costs!

Every step of this chain of special interests is locked in by decades of lobbying efforts.

Insurance companies are NOT in the insurance business. They’re in the bureaucracy business, charging for endless paperwork in what should be a straightforward, pay-for-service-as-needed industry.

But the trend of direct primary care, where people pay a monthly fee for doctors that give them more attention at a fixed and predictable cost is gaining traction.

There’s also a higher level of service – concierge medicine, where you may pay $200-plus per household a month. Like I said, that’s what I have. It’s well worth it because I get visits whenever I need them, and, more importantly, I enjoy preferred access to specialists like cardiologists and internists when I need them.

My primary-care doctor is more accountable to fewer patients and has a more predictable revenue stream.

My high-deductible insurance plan is exactly that: my insurance against the unpredictable.

Of course, health insurance has become a hornet’s nest kicked between Democrats and Republicans since President Trump’s election.

As far as Obamacare is concerned, what idiot couldn’t figure out that if you suddenly added tens of millions of new people to a system with near-term fixed professional skills and healthcare facilities you’d see costs skyrocket?!

It’s Econ 101 stuff: supply and demand! Or in this case, inelastic demand.

There’s no market with less rationality and greater cost disincentives than our very own U.S. healthcare system.

And there’s no way to fix this perverted, special-interest-driven system. It needs to break down and be re-created from the bottom up… period!

That starts with consumer-driven, direct primary care systems that make both doctors and consumers accountable for real service. Insurance is only for the more extreme scenarios, so it doesn’t add endless bureaucracy to the system… not to mention endless incentives to go for the “all you can test buffet.”

Insurance companies will, of course, hate this plan. How would they make as much money without their inherent bureaucratic B.S.?!

I didn’t set out to organize my healthcare the way I did, but many others do. I just did the logical thing.

I am the revolution.

And it’s going to take a revolution to change this overly bureaucratic and complicated industry, where every special interest has carved their fees, costs, and B.S. into stone.

It’s time to shatter those stones.

Harry

Follow Me on Twitter @harrydentjr

The post The #1 Reason Our Healthcare Is So Costly appeared first on Economy and Markets.

March 30, 2018

Opportunity: Gold on the Move

Paper assets are struggling this year.

Both the S&P 500 and 10-year Treasurys are down around 3%.

Meanwhile, gold prices are on the move.

Shares of the SPDR Gold Trust (NYSE: GLD) are up nearly 4% in 2018. And I’m forecasting another 7%-plus gain over the next two months.

The once-loved precious metal was left for dead for the past several years. But a recent rally is bringing it back to life.

If you missed out on that move, here’s your second chance to make good gains in gold…

Gold rallied from $117.50 to $129.50 between mid-December and the end of January – a roughly 10% gain in just six weeks.

That “too-far-too-fast” move was naturally followed by a pullback, forming a chart pattern called a “bull flag,” highlighted by two blue lines above.

Bull-flag patterns typically resolve with a bullish breakout. And when they do, you typically see a “second-chance” rally of equal or greater magnitude as the rally that preceded them.

In this case, GLD rallied $12 before forming the bull flag (from $117.50 to $128.50).

GLD made a bullish breakout last week, when fears of Trump’s global trade war prompted it to leap higher and clear the top of the bull flag, at $126 a share.

Projecting another $12 run, from $126, gives us a near-term target for gold of $138. That’s a potential gain of 7%-plus, which could take just a month or two to capture.

If you’re finding yourself even a little worried – about stocks, inflation, or geopolitical unrest – now’s a great time to add a gold hedge to your portfolio.

You stand to gain 7% or more as we head into summer.

I have my Cycle 9 Alert subscribers in a bullish gold play. They’re already up 20%. And if we hit our $138 target by June, we stand to make gains of up to 200%.

Adam O’Dell

Editor, Cycle 9 Alert

Follow me on Twitter @InvestWithAdam

The post Opportunity: Gold on the Move appeared first on Economy and Markets.

March 29, 2018

The Problem with Social Security — And the Only Solution for It

I need a grandkid.

I want grandkids. I’m in my 50s now, and I’ve paid for my kids and put two through college (the youngest is still there, and should graduate on time).

Now is the time when I should be showering grandkids with lavish gifts, allowing them to do anything they want, and then handing them back to their parents when they’re tired, full, and cranky. I can’t wait! But I have to wait. Because I’ve only got one married kid, and she’s not interested in children anytime soon.

This is a problem for me. But it’s also a problem for the nation as a whole.

While I like to think that my grandchildren will be so intelligent, good-looking, and talented as to command nationwide importance, it’s really about something much less complicated.

We need my grandchildren, and millions more like them, to grow up and pay taxes. Without them, many of our systems will break down. Social Security is a case in point, because it’s already bankrupt. It just hasn’t reached the end of the line yet.

In 2017, 42 million retired workers received $57 billion in Social Security benefits. Another $10.3 billion went to disabled workers, and almost $7 billion went to survivors (widows, widowers, and children).

Almost 90% of Americans over 65 receive Social Security Benefits, with roughly 23% of married couples and 43% of singles over 65 relying on those checks for 90% or more of their income.

The program is very important to our social fabric and is the main reason we beat poverty among the elderly.

And the program is broke.

Social Security, since 2010, has brought in less than it pays out. Only interest on its $2.8 trillion trust fund keeps the program from sliding backward. That won’t last long. In 2021, the trust fund will start to dwindle, and it will be tapped out by 2035. That might sound like along way off, but it will happen before a baby born today graduates from high school.

After that, we’ll only bring in enough to pay about 75% of the benefits we’ve promised. To pay 100%, we’d have to raise the payroll tax from 12.4% of payroll to 17%. We could also tax those who earn high incomes on all of their earnings, but then we’d have to pay them more in benefits as well.

But there is another path, which seems much more likely.

We’ll cut benefits.

I don’t expect Congress to chip away at the monthly check of 75-year-old single people who have no other income. Instead, our faithful congressmen will look around and determine that those with other assets and income, so-called fat cats, can afford to give up some of their benefits.

Never mind that they paid for those benefits over their working lives. The slashing of their Social Security checks will be for the greater good… whether they want to make the sacrifice or not.

Unfortunately, if you’re investing in the markets or saving for retirement you probably fit Congress’ definition of a fat cat, because 39% of workers report that they and/or their spouse have absolutely nothing saved for retirement. Zip.

These will be the people that get trotted out in front of congressional committees, lamenting how they will suffer if their benefits are slashed. Our hearts, and our cash, will go out to them. And we’ll get smaller checks.

Short of dramatically raising taxes, there’s no way to change the path.

We simply don’t have enough workers entering the economy to boost Social Security revenue over the next 15 to 20 years.

So do yourself a favor. With markets at record highs, look through what you own and ask yourself, “Will this provide me with a stream of income that will help with expenses in retirement?”

We all need to ask ourselves that question, because I’m certain Congress isn’t concerned about how I fund my golden years.

As for the 2040s and beyond, there is a way to start rebuilding the Social Security safety net. We could have more children today.

It’s hard to see how we could replace the 25% of lost Social Security tax revenue quickly, but any additional growth to the population would be welcomed by the nation.

I hope my kids are reading this. I could use a grandkid… or two.

The post The Problem with Social Security — And the Only Solution for It appeared first on Economy and Markets.

March 28, 2018

Yields drop after Fed hikes rates

Last week was interesting, to say the least.

It was highlighted by a Federal Open Market Committee (FOMC) meeting, more White House shake-ups, a budget deal, and more tariffs.

Along with all that, the Dent Research team met in snowy Baltimore for brainstorming sessions.

I was a bit distracted during Wednesday’s meetings because rates were moving higher ahead of the FOMC meeting. The markets were expecting a rate hike, so yields crept up ahead of the 2 p.m. (EST) decision.

The Fed hiked the federal funds rate target range by a quarter-point, as expected, from 1.5% to 1.75%. It also released updated forecasts.

The Fed now expects the economy, as measured by GDP, to grow at an annual rate of 2.7% during 2018, up from a prior forecast of 2.5%. GDP growth in 2019 will be 2.4%, up from a previous estimate of 2.1%. Job gains are expected to push the unemployment rate down to 3.8% this year and 3.6% in 2019 and 2020.

Core consumer inflation, as measured by the PCE index, is expected to hit 1.9% this year and 2.1% next year and into 2020.

The Fed still expects to hike rates two more times this year, three times next year, and a couple more times in 2020. Balance sheet reductions will total $20 billion this month and $30 billion next month. So no change in that plan.

At first glance, the Fed statement appeared hawkish, or even aggressive, in its forecast and planned rate hikes. The market initially sold off Treasury bonds, sending yields higher. But when new Fed Chair Jerome Powell took to the podium to recap the written statement and to answer questions from the press in record time, the markets weren’t so impressed.

I bolded and italicized my summary of the Fed’s inflation expectations because that’s the part that confused the markets. With a growing economy and further gains in the jobs market, how is it that inflation is barely moving higher?

The new Fed chair didn’t or couldn’t explain, and maybe there’s still confusion as to why.

Treasury yields started to drop again, and with Thursday and Friday’s sharp selloff in the stock markets, yields dropped even more. Money flooded back into safer Treasury bonds as stocks were sold.

Take a look at the chart below:

The long-term Treasury yields made an intra-day high of 3.15% on Wednesday, just after the hike. But once Powell’s press conference ended, they started dropping. Yields sit at 3.07% early Wednesday morning.

I’m actually surprised yields didn’t move even lower since the two-day drop in the Dow Jones Industrials was more than 1,000 points. In any case, we could see yields start to move higher into Thursday’s inflation data.

The Fed’s preferred consumer inflation gauge will be out Thursday morning. Along with February personal income and outlays, the personal consumption expenditure (PCE) price index will be released.

The core PCE price index, which excludes food and gas, has been running at 1.5% on the year, which is well below the Fed target of 2%. If we see inflation ticking higher here, yields will likely move higher.

That’s good for me and my readers, since we profit from surprises in the financial markets, and specifically in the Treasury bond market, with Treasury Profits Accelerator.

Good investing,

Lance

The post Yields drop after Fed hikes rates appeared first on Economy and Markets.