Harry S. Dent Jr.'s Blog, page 59

March 13, 2018

Mother Nature’s Deflationary Forces

I like free stuff. Free delivery, free wireless, free breakfast… you name it.

I think most people share this view, and I know that companies and countries around the world are definitely on board. That’s what makes solar and wind power so interesting.

The basic resources are free. Yes, there’s the bit about environmental concerns, which are very important. But if environmental notions came first, we wouldn’t talk about renewable energy versus fossil fuel. We’d simply convert to green energy and be done with it.

But we don’t. Cost still matters. And while we can stand outside to enjoy sunshine and a nice breeze, harnessing those energy sources takes a bit of cash.

But the cost of capturing wind and solar has fallen dramatically over the past decade, and now the cost of storage is dropping as well. As batteries get better and cheaper, wind and solar will crowd out traditional power generation, driving deflation around the world while increasing our standard of living.

Last year, Crystalline Utility-Scale Solar Photovoltaic energy, one of the cleanest and environmentally friendly methods of generating electricity, cost roughly five cents per kilowatt hour (kWh). This is not the kind of thing you see on your neighbor’s house; it’s a large solar array set up by a power company.

Meanwhile, wind power cost between three cents and six cents per kWh in 2017. Both energy sources fell below the cost of energy from a natural gas combined cycle plant, which operated in a range of 4.2 cents to 7.8 cents per kWh.

This means that it’s cheaper for utilities to build solar and wind facilities than to build natural gas plants, and way cheaper than coal or nuclear.

The Problem is Storage

The problem is storage. Natural gas plants store their energy before the generation process in the gas itself, only using what is needed to run the plant and saving the rest. Because we can’t determine when the wind blows or the sun shines, those plants must operate when the conditions are right and then try to store electricity after it has been generated.

But now storage costs are dropping, which is finally making renewable energy competitive with fossil fuels.

By the end of last year, adding storage to solar energy drove the cost to 8.2 cents per kWh. That’s just above the cost for natural gas, but the number is falling.

With the automotive world and countries around the globe focused on electric vehicles as a way to solve pollution issues, battery technology has become one of the hottest fields in research. I have no doubt that battery capacity will increase dramatically in the next five years.

And when it does, it will bring a wave of deflation, because sunshine and wind will always be free.

Natural gas fired plants still need raw energy, which requires pipelines and massive infrastructure. Wind and solar plants have no such needs. The generation sources must be maintained (wind turbines and solar panel arrays), but you don’t have to figure out where you will get your next shipment of energy.

The sun comes up, the wind blows. Over time, renewable power generation and storage costs will drop, and sunshine and will still be free. Energy costs should be on a long, steady slide lower.

As energy prices fall, the cost of power should take a smaller chunk out of our daily budgets, as well as the cost of producing goods and providing services. Much of the world will be able to devote funding to other needs, and some of the world will get reliable energy for the first time.

Renewable energy makes up about 15% of U.S. electrical generation, so the transition to renewable will take many years as we develop better storage and work through the useful life of existing power sources.

But the change will come, and we’ll be the better for it. We’ll spend less on energy, and create less pollution. Best of all, we’ll get something for free. Who wouldn’t like that?

The post Mother Nature’s Deflationary Forces appeared first on Economy and Markets.

March 12, 2018

Three Major Trends Making it Harder to Retire in America

The other day I was reading a Bloomberg article about how income inequality in the U.S. has hit a disturbing new threshold.

It went on about the fact that wage growth is ridiculously slow, despite our near full employment situation… that African Americans and women are still disadvantaged… and that the wealthiest are accumulating more money than ever.

Really, none of it surprised me. This is one of the issues that boosted Trump into the White House.

It’s also a trend I don’t see changing much in the near future, thanks to the demographic path we’re currently on. And, as I see it, it’s a path that doesn’t end at a beach resort with perfect weather, an all-you-can-eat buffet, and limitless free cocktails.

Never mind the income inequality, the U.S. is careening towards a retirement crisis so epic, there’s no historical precedence.

For decades, part of the American Dream was to work 35 to 40 years for one company, then ride off into the retirement sunset with a healthy pension and Social Security to boot.

But times have changed.

First, the death of pensions in America has caused a dramatic shift where you – and only you – are responsible for your retirement savings.

That’s why, unless you’re sitting on one of the few remaining pensions, knowing where you stand today is critical to finding out whether you can outlive your nest egg.

Second, you simply cannot rely on Social Security alone as your safety net any longer.

While I don’t have your personal numbers, the average Social Security check for 2018 is a pitiful $1,404 a month. And the maximum you can receive each month is just $2,788 for 2018.

When you add up food, gas, medical costs, and other basic living expenses, Social Security just won’t leave much left over to actually enjoy your retirement.

To make matters worse…

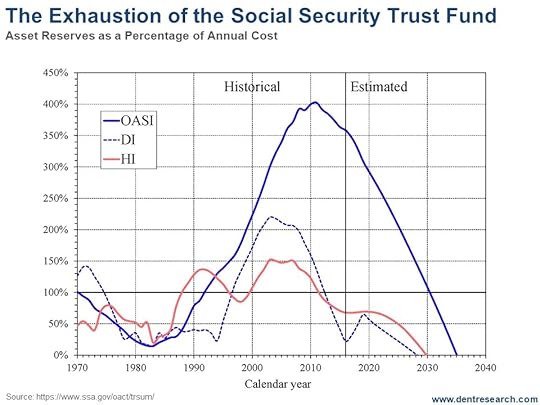

The trustees of the Social Security Trust Fund projected, in their 2017 report, that the excess funds in the account – the total of what you, I, and all current and past workers have paid in – will be exhausted by 2034!

That projection doesn’t mean you’ll get nothing starting in 2034. It means that the program will only have enough revenue coming in to pay out 77% of promised benefits beginning in 2034.

For example, if you were expecting to get $2,000 a month at full retirement, your payout would shrink by about 23% to just $1,540.

That’s a scary scenario if you’ve been counting on Social Security as a core part of your retirement planning.

And finally, the most disturbing trend is this…

You’ll Need to Set Aside $490,000 JUST for Healthcare in Retirement!

People are living longer than ever before. In many cases, much longer… well into their 90s and beyond.

Never mind the fact that Social Security wasn’t designed to pay out benefits for 20 to 30 years, the health issues we have as we get older are more expensive to treat… and they’re the #1 threat to your retirement balance.

According to some numbers I’ve seen, one in four seniors spends the last five years of their lives fighting off bankruptcy from medical bills… and fails. And according to HealthView Services, a software company that projects healthcare costs, “The average 65-year-old couple could pay almost $490,000 in total health-related costs throughout retirement.”

It begs the question: Do you have an EXTRA half-million dollars lying around just for healthcare expenses?

I’ll go out on a limb and say it’s highly unlikely.

To cover expenses like that, you’d need a sizeable income stream during your retirement years… along with a seven-figure portfolio you can draw upon.

Harry

The post Three Major Trends Making it Harder to Retire in America appeared first on Economy and Markets.

March 9, 2018

MLPs Are Still a Steal

It’s been a wild ride in bonds.

Back in September, the 10-year Treasury note yielded just 2%. Today, the yield is hovering close to 3%. While it might not seem like that big of a deal at first glance, we’re talking about a move of nearly 50%.

Rising bond yields means falling bond prices. And it also means falling prices for anything that gets a large chunk of its total return from dividends or interest.

As a case in point, midstream oil and gas master limited partnerships (MLPs) are high-yielding stocks that have traditionally been popular with income investors. Over the past 12 months, the sector is down by 18%, putting it close to bear market territory.

Mr. Market is the temperamental sort, and this looks like a classic overreaction.

Today, the Alerian MLP index, the leading gauge of energy MLPs, yields an almost hard-to-believe 8.01%. The 10-year Treasury yields 2.88% as I write. That means that MLPs as a sector trade at a 5.13% spread over Treasurys.

To put that in perspective, only twice in the past 20 years have MLPs have been cheaper relative to Treasurys – the 2008 meltdown, when the world appeared to be ending, and the 2015 energy crisis.

MLPs have never been this cheap during “normal” market conditions.

I’ve been nibbling at the sector in Boom & Bust and in my income service Peak Income.

Charles

The post MLPs Are Still a Steal appeared first on Economy and Markets.

What the Great Depression Can Teach Us About Trade Tariffs

President Trump has promised this from the beginning. We’ve had bad trade deals with other countries for decades now.

But is slapping on tariffs the way to fix this situation?

In today’s video, I answer that question, drawing from past experiences to get to the real impact that trade tariffs have on an economy.

You can watch it now:

Of course, in the usual fashion, markets can’t seem to make up their minds how they feel about this…

When news first broke about Trumps proposed 25% tariffs on steel and aluminum imports, markets fell out of bed.

Then, when Steve Mnuchin suggested that perhaps the U.S. could work with Canada and Mexico to improve the NAFTA agreement without such tariffs, markets rallied.

And on Wednesday, on news the Gary Cohn had resigned, markets bounced between being in the red and in the green, uncertain where to settle.

It’s anyone’s guess what the markets will do next, but I can tell you that these latest tariff proposals are only the beginning.

As I talked about in my latest best seller, Zero Hour, there’s something much bigger going on here. If you haven’t already done so, read this book now.

And watch my latest video to hear what I expect to happen next.

Harry

Follow Me on Twitter @harrydentjr

The post What the Great Depression Can Teach Us About Trade Tariffs appeared first on Economy and Markets.

March 8, 2018

What Tariffs Would Really Mean

Every day, you plunk out cash to support your neighbors. And they support you. That’s how economies work.

I buy from my local store, which employs people, and I use local services. Even when I buy from Amazon, the stuff has to get here somehow.

We also pay taxes, much of which goes to services that employ and support people in the community. In this instance, you can think of the entire nation as your community.

So, how much of your cash are you willing to give to your neighbors?

Would you part with an extra $50 per month so that others could have a bit higher standard of living?

How about $100 per month?

What if the money went not only to workers, but also to business owners? Would you give them extra cash?

Welcome to the world of trade tariffs.

I’m not saying that tariffs are inherently bad or wrong. When Adam Smith wrote The Wealth of Nations in 1776 and described how free trade made everyone better off, he lived in a world of scarcity.

I can’t imagine that he envisioned a time when nations (cough, China, cough), would use the public coffers to build more steel mills, when they already had a glut of steel, simply to boost employment.

But we have to remain clear on what tariffs accomplish.

If a country is “dumping” a good like steel on the world market, they are selling it much cheaper than it can reasonably be produced.

This is bad for other producers, but good for buyers. Those buyers can earn higher profits, pay higher wages, cut prices, or some combination.

The local steel industry suffers, but steel buyers are pretty happy… and so are their customers and workers.

Putting an extra financial burden on steel means that a steel purchaser, like John Deere or GM, will have to pay more, presumably raising the price of imported steel to the reasonable production cost of domestic steel. This benefits domestic steel companies, but obviously raises the price to buyers like GM and John Deere, who must earn less, pay lower wages, raise prices, or some combination.

Do you want to pay more for a car or tractor, or watch GM and John Deere eat higher steel prices so that steel companies in the U.S. earn more money?

Before you answer, think about the extremes.

Are we good with demanding all steel be made here, which would send steel prices to the moon, or are we good with allowing the domestic steel industry to die and just buy all of our steel from overseas? That makes it harder.

I’d imagine I’m like most people. I don’t want to kill an important domestic industry, but I don’t want the price to skyrocket because the industry has no competitors, either. I’d like Door #3, thank you very much.

Luckily, we have that option. It’s called The World Trade Organization (WTO) and it’s supposed to handle trade disputes just like this. Whether or not the WTO is efficient is another matter.

The president has introduced a new wrinkle by announcing his intent to impose tariffs because of national security. He suggests that steel and aluminum are key industries for our national defense. That’s his prerogative, and I’m not judging whether it’s right or wrong.

Just know that, no matter what you hear, we as consumers, investors, and taxpayers, pay for everything.

Every. Single. Thing.

No one takes a bullet for us. Our fearless corporate and government leaders quickly step aside and let us get shot as they go on and on about principles.

So when we talk about tariffs, or trade barriers, change the words in your head to “more money out of my pocket,” and ask yourself, how much will you give your neighbor?

It could be that you’re willing to pay a bit more to support domestic industry, and to make sure that we keep resources like steel and aluminum available in this country in case of an emergency. Or perhaps you want to see workers in such industries earning a bit more. Nothing wrong with that. Just make sure you know who gets your money, and why.

I don’t think the president wants a trade war.

I think, true to his nature and self-description, this is simply one more negotiating tactic. But like with all negotiating tactics, it’s hard to tell. If we knew he was bluffing or would quickly give in, it wouldn’t be effective.

It could work. The administration announced that there would be no exceptions, and then, before the tariffs were formally introduced, reversed course and said Canada and Mexico might be exempt if they come to the negotiating table over NAFTA. The European Union prepared a list of items on which it will levy retaliatory tariffs, which can be just as painful on American companies by depressing sales of our products overseas.

It looks like things could get complicated quickly. And yet, at the core, things are simple. The more tariffs we have, the more we, as consumers, employees, and investors, will pay.

Let’s hope this game of economic poker ends quickly. I’m tired of paying when other people lose bets.

The post What Tariffs Would Really Mean appeared first on Economy and Markets.

March 7, 2018

Let’s Start a Trade War!

I’ve been back stateside for three days now and already I want to turn around and head back down under.

Jet lag feels about as bad as I imagine detoxing from crack is (thank you, Naomi, for your recommendations to help with this!).

Markets are in no-man’s land, trading in the middle of the rising bearish wedge channel. They’re either not interested or capable of pushing above the top trend line, and they seem equally disinterested in breaking below the bottom trend line.

Gold seems equally stuck.

As does the dollar.

So, we’re basically nowhere.

And then there’s President Trump.

Let’s start a trade war. That seems like a good idea!

Let’s slap a huge tariff on steel and aluminum imports.

Let’s put America first!

I’ll tell you, this isn’t putting America first. Tariffs during the Great Depression didn’t help one bit. In fact, they aggravated the situation.

Already, the EU has responded to the tariff threats with a threat of their own: 25% tariff on a list of U.S. exports, including Levi Jeans and Bourbon.

Canada and Mexico are up in arms.

This is insanity. And it’s not going to end well!

Charles puts this into perspective for us.

Of course, keeping true to form of late, stocks hit the skids for a few hours on Monday when news broke about Trump’s proposed tariffs, and then they pulled themselves right back up as though nothing had happened at all!

It’s completely irrational.

I would say they’re more irrational than women can be sometimes, but it turns out that women make better investors than men, as Adam points out in his most recent Economy & Markets article.

As has become the norm, it’s a case of wait and see with this market. I’ll keep you posted.

Harry

Follow Me on Twitter @harrydentjr

The post Let’s Start a Trade War! appeared first on Economy and Markets.

Calm Before Chaos

It’s been quite a tug-of-war of late. After the late-February spike in yields, Treasury bonds seemed to catch some air as stock investors shed some risk.

Last month, the yield on the long-term Treasury hit a high of 3.23%. By last week, yields had fallen to 3.09%. That’s not so surprising, given that stocks fell sharply and investors moved to the relative safety of Treasury bonds.

President Trump seemed to cause last week’s selloff when he announced the imposition of big tariffs on aluminum and steel imports. International outrage from trading partners and promises of retaliation followed. We’ll see how those countries will ultimately respond, but the market’s reaction in the immediate aftermath was swift and harsh.

There was also significant economic data out last week. The most important to the Federal Reserve were January’s Personal Income and Outlays report and the Institute for Supply Management’s (ISM) Manufacturing Index.

January personal income was up 0.4%, more than the expected 0.3%. Spending was up 0.2%, as expected. The Fed’s preferred inflation gauge, the personal consumption expenditures price index, or the PCE price index, showed a monthly gain of 0.4%, as expected. Excluding food and energy, the core index was up 0.3%, also as expected. The year-over-year change remained at 1.7%, and the core stayed at 1.5%. Other than a surprise income rise, the rest of the data was as expected.

The February ISM Manufacturing Index blew away estimates and came in at 60.8, higher than any analyst estimate. This was the strongest reading in 14 years. New orders and backlogs were also at-14-year highs. Export orders were up sharply to a seven-year high. Capacity, also stressed, is at its own seven-year high. Prices are also up sharply and, again, at a seven-year high. This is also triggering new hiring to keep up pace.

New Fed Chair Jerome Powell testified before Congress last week, and he too shocked the market by saying four more rate hikes were possible this year. He was optimistic about the economy, and his outlook has improved since the December policy meeting. He was encouraged by strong incoming economic data, strength in the labor market, and a pickup in inflation.

So, all of the current data points to a strengthening economy and has the Fed on track to raise rates four more times this year – and then yields dropped?

Like I said earlier, Trump’s announcement of protective tariffs sent stocks lower, and money moved into the safety of Treasury bonds. I see it as a temporary move, since my system is still forecasting higher long-term rates in my medium-range outlook.

As I write, stocks are bouncing and yields have steadied. The stock market seemed to have dismissed Trump’s tariff bluster, but yields look a little more cautious. The long-term yield is sitting at 3.14%, up from 3.09% last Thursday, but well below the high of 3.22% two weeks ago.

Looking ahead, February’s jobs report will be out Friday; the market will focus on wage growth. Next week, we’ll get important inflation data. Then, in two weeks, the Fed will decide if interest rates should go up. (Spoiler alert: They will.)

So, is this the calm before all hell breaks loose?

Maybe. And, come hell or high water, the more volatility we see in interest rates, the bigger the gains in Treasury Profits Accelerator.

Lance Gaitan

Editor, Treasury Profits Accelerator

The post Calm Before Chaos appeared first on Economy and Markets.

Bitcoin is Back! Here Come the Regulators!

Bitcoin has bounced back off its lows after getting absolutely smashed earlier this year. After nearly topping $20,000 in 2017, the price of bitcoin fell back to $7,000 before rebounding to about $11,000.

And, wouldn’t you know it, high-flying prices and insane volatility have caught the interest of regulators.

That’s a good thing.

Wait, wait. Hear me out.

I’m pretty libertarian about things, which means I’m not usually a big fan of regulation. But a space like bitcoin is ripe for ordinary folks getting taken advantage of. You can see it coming a mile away. Recently, the Securities and Exchange Commission (SEC) issued dozens of subpoenas to crypto-issuers and are warning that these offering should be treated like securities.

I have no doubt there are illegal securities offerings. The market is growing exponentially, with 50% growth over all of 2017 in just the first two months of the year. With bitcoin looking like the Wild West, I keep picturing a guy with a desk, a fax machine, and a pager lighting up the phones to sell some sort of crypto-related investment. Formerly, these people were junior gold miner prospectors.

It always ends badly.

With the request for information, the regulators are clearly trying to get ahead of the curve and nip the illegal activity in the bud. This might also make life difficult for legitimate operators, but, hopefully, that’ll only be short-lived. Once the smoke clears, legitimate companies have a better chance to prosper without being dragged through the mud with the frauds.

The other area where the SEC has flexed its muscle is in the exchange-traded fund (ETF) space. The SEC had blocked bitcoin ETFs in the past, but once futures started trading on bitcoin, several ETF sponsors filed to list their funds on exchanges. They could price the ETF based on the futures contracts traded on bitcoin. Previously, it would’ve been impossible for an ETF based on bitcoin to function properly.

I have no doubt that these bitcoin ETFs would’ve garnered billions of dollars in assets quickly after their respective launches. These would be the most successful ETF launches in recent history, if not all-time. What’s more is that if normal bitcoin volatility, which is like a death-defying roller-coaster ride, didn’t whet your appetite, you’d also have been able to purchase ETFs with added leverage designed to juice the returns.

Fortunately, regulators stepped in and expressed deep concern with how these ETFs would function. In short order, the ETF sponsors withdrew their filings. Tons of money in future management fees also went up in smoke.

Our last Hidden Profits stock pick is engaged in blockchain technology. But, instead of changing its name to Sock Puppet Blockchain to capitalize on a trend, it’s actually operating real blockchain businesses. I remain quite skeptical on the currencies themselves, but blockchain technology is real and here to stay.

Even if I’m wrong and bitcoin goes to $100,000, bigger gains will be made in the winners of the blockchain battle.

John Del Vecchio

Editor, Hidden Profits

The post Bitcoin is Back! Here Come the Regulators! appeared first on Economy and Markets.

Women Improve Investment Performance

March 8 is International Women’s Day – so let’s talk about women and investing!

It’s not hard to see that the investment industry is male-dominated.

Fewer than 15% of investment bank traders are women. And according to Credit Suisse’s Women in Senior Management study, the percentage of women on the boards of publicly-traded companies averages just 12.7% globally.

Yet, there’s mounting evidence to suggest women improve performance – both at the corporate level and on the trading floor.

MSCI’s Women on Boards study showed companies with strong female leadership generate stronger return on equity (ROE) – 10.1% versus the 7.4% of their male-only counterparts.

Credit Suisse’s study showed that, among large-cap stocks, investing in companies which have at least one woman on the board leads to five percentage points in outperformance.

Professors Brad Barber and Terrance Odean, in their 2001 paper titled Boys will be boys: Gender, Overconfidence, and Common Stock Investment, showed men trade 45% more than women, leading to a 59% greater reduction in profitability compared to women.

Now, since you can’t argue that women have better access to investment education or training than men, you must wonder if their performance-evidenced advantages are innate.

Are women born to be superior risk-takers?

Many psychologists and evolutionary biologists say, “yes!”

In her 2010 paper, Close Women, Distant Men, psychologist Helen Stancey proved two key findings:

At 20 inches away, women have more accurate eyesight than men.

At 40 inches away, it’s the other way around.

That discrepancy has been chalked up to the fact that pre-historic man evolved to be a hunter, which required tracking and attacking moving prey from great distances.

Meanwhile, the pre-historic woman evolved to be a gatherer. And that task called for locating stationary resources in nearby surroundings, where superior near-distance eyesight was more favorable.

But as I see it, this is just one of the many differences between men and women that can be explained by our evolution-driven past. And most of the differences that come to mind easily have to do with risk taking.

Generally speaking, women are more risk-averse than men.

And, related to that, men are overconfident, more so than women.

To be a successful caveman, you had to take down a wildebeest on the African plains… and to do that, you were better off being overconfident in your ability to do so, and blind to the risk that you might instead get impaled and bleed slowly to death.

Essentially, the best cavemen were bold and brave.

That worked fine for men in pre-historic days. But today, those “alpha male” traits tend to work against investors who try to “hunt” their way through the market.

Just as there were endless threats to the physical safety of pre-historic man, there are endless ways in which financial markets can separate you from your hard-earned cash.

Women tend to have a healthy respect and humility toward the uncertainty and risk inherent in the world… and financial markets.

Men… well, we tend to swing from vines and beat our chests – overconfident in our abilities and under appreciative of unforeseen risks.

The good news is… just because men and women are “hard-wired” in different ways doesn’t mean we can’t learn and implement the “lady-like” traits that improve investment success.

Here are three of them…

#1: Don’t Risk Too Much

Conservative position-sizing is key to avoiding what we call the “risk of ruin” – a.k.a., losing all your money.

Obviously, if you invest everything you have in one trade and something goes wrong… you’ve lost it all. But if you invest a more reasonable share of what you have – say, 10% – and the market throws you a curveball… you’re still in the game, with the remaining 90% intact.

You’ve “lived to fight another day,” as wise traders say.

Of course, finding the position size that’s right for you is a personal matter. But if you join either of my services, Cycle 9 Alert or 10X Profits, I’ll show you how you can get at that number.

Bottom line: If your position-sizing is too aggressive, you’re probably falling victim to your alpha-male tendency to underestimate risk… and you probably won’t survive for the long haul.

#2: Learn to Take a Loss

Some people say men can’t admit when we’re wrong. (And I’ll never admit that it’s true [wink]).

Seriously though, all investors are better served by checking their egos at the door.

Taking a loss on a trade doesn’t mean you’re “wrong.” It doesn’t mean you’re “stupid,” or a “bad investor,” either.

It simply means you lost money on that particular trade. (And if you followed Rule #1, you didn’t lose all of your money).

“No one trade can make or break us,” is the unofficial mantra of systematic investing.

If you can handle the emotional trauma of taking a loss – whether you’re a man or a woman – you’ll be resilient enough to stick to your strategy. And that’s a must if you want to win in the end.

#3: Follow the Rules!

A proven, “rules-based” investment strategy is only valuable if you follow its rules.

That seems obvious, but you’d be surprised by how hard that is for folks who lack the psychological fortitude and discipline required to follow a systematic strategy.

And, of course, there’s evidence to suggest women are better at following rules than men.

One study monitored the trading activity of more than 700 junior investment bank traders. The participants were given specific “rules” that they were told not to break – essentially, times of the day when they were prohibited from making trades.

That study showed the men broke the rules 2.5-times more frequently than women.

And guess what… the excessive rule-breaking led the men to underperform the women in net returns.

That doesn’t surprise me at all!

So that’s the deal, ladies and gentlemen…

As I see it, you certainly don’t need to be a woman to be successful at investing, although it may help.

More importantly, everyone can benefit from being aware of, and avoiding, the most damaging “caveman” traits, like overconfidence and excessive risk-taking.

Adam O’Dell

P.S. Click here to learn more about my Cycle 9 Alert service and how we apply these principles for handsome profits.

The post Women Improve Investment Performance appeared first on Economy and Markets.

The Difference Between Good Inflation and Bad Inflation

It seems that some bad ideas never die.

President Trump rattled the markets last week by unexpectedly announcing his intent to impose a large 25% tariff on imported steel and a 10% tariff on imported aluminum. The market was already trending lower, but the tariff news was enough to make the bottom fall out.

The Dow closed Friday down more than 1,200 points from its highs on the week.

Now, by themselves, I don’t see these two tariffs as being particularly dangerous. Yes, cars and beer cans might get marginally more expensive. But it’s likely that most consumers would never know the difference.

While president, George W. Bush slapped some short-lived tariffs on steel, and Barack Obama did the same with imported Chinese tires.

Most economists agree that both sets of tariffs were mildly negative overall for American employment (jobs gained or saved in the protected industries were lost in other industries due to higher prices) and didn’t really accomplish what they ostensibly set out to accomplish.

The fact that Trump is considering slapping tariffs on steel is a pretty good sign that Bush’s steel tariffs a decade and a half ago did little to revive the domestic industry.

So, it’s not the steel and aluminum tariffs, per se, that caused the market to tank. It’s the fear that something worse is coming: an all-out trade war.

Trump has been known to shoot from the hip, throwing out an extreme idea before eventually reconsidering, backing off, or using it as a negotiating tactic. And based on the market’s action on Monday, it looks like investors are betting that this will be one of those cases. The tariffs may or may not pass, but fears of an all-out trade war seem to be receding.

That’s good. Because contrary to President Trump’s comments, you can never “win” a trade war. There are no winners. Only losers. Trade wars lead to rising prices and lower growth. Or, if you lived through the 1970s, stagflation.

The Fed has been desperate for years to generate a little inflation. The problem is that there are two kinds of inflation… and this is the wrong kind.

Inflation can be “demand-pull” or “cost-push.” Demand-pull is “good” inflation, the kind of inflation the Fed is trying (and mostly failing) to generate. This is inflation that is caused by rising demand. Consider ballooning professional athlete salaries. Stephen Curry makes a staggering $35 million per year playing for the Golden State Warriors because there is high and growing demand to watch him shoot a basketball.

The problem is that tariffs and trade wars don’t create new demand. They simply reduce supply and raise the cost of inputs. This is cost-push inflation, the kind of we had in the 1970s when OPEC restricted energy exports to the West.

A little demand-pull inflation wouldn’t necessarily be bad for the stock market. In fact, it’s the sign of a healthy economy and confident consumers.

But cost-push inflation from trade restriction is a very different animal.

The Dow and S&P 500 lost half their value in the 1973-74 bear market. And the 1930 Smoot-Hawley Tariff – arguably the dumbest financial move in the entire history of the United States of America – turned what might have been a garden variety recession into the Great Depression. The Dow lost 90% of its value before finally bottoming out.

Let’s hope cooler heads prevail and that it doesn’t come to this. I have to believe our leaders aren’t quite stupid enough to go down this particular rabbit hole again. But we should expect higher market volatility to be the norm until there is better visibility here.

In the meantime, you might want to stock up on beer. You know, just in case cans get more expensive.

The post The Difference Between Good Inflation and Bad Inflation appeared first on Economy and Markets.