Harry S. Dent Jr.'s Blog, page 76

August 18, 2017

How to Find Money at the Bottom of the Ocean

More than 70% of the world is covered by water, so why aren’t more people talking about the riches to be found under the sea?

More than 70% of the world is covered by water, so why aren’t more people talking about the riches to be found under the sea?

I don’t know the answer, but that’s OK. It means more profit opportunities for us.

As we’ve mentioned over the last several weeks, we’re all about finding outside-the-box ways to increase returns, which is why we’ve lined up a great guest speaker roster for our Irrational Economic Summit this fall.

In addition to the annual in-person insight provided by Harry, Adam, myself and the rest of the Dent Research crew, we’ve invited experts in space exploration, cryptocurrency, and marine exploration, among other topics, to speak about their uncommon, and potentially lucrative, fields.

We’ll dive into the details (no pun intended) to determine if these endeavors are the real deal, or just hype.

One presenter will be Odyssey Marine Exploration (Nasdaq: OMEX) CEO Mark Gordon. He leads a company that once focused on finding shipwrecks and treasure (legally), but has turned its attention to deep-sea mining.

I spoke with him last month for an interview that we first released to Boom & Bust Elite subscribers. It was an insightful conversation on an interesting concept, so for this one rare occasion, we thought we’d share it here, and offer everyone a taste of the ideas we’ll talk about at the summit October 12-14 in Nashville, Tennessee.

I’ll interview a few more of our presenters, including RealVision founder Raoul Pal and cryptocurrency expert Michael Terpin, exclusively for Boom & Bust Elite subscribers as we get closer to the summit.

In this interview, I spoke with Mark about Odyssey’s history, the company’s pivot to mining, the specific valuables that lay at the bottom of the oceans, and the opportunities and challenges involved in the industry.

Rodney Johnson

Follow me on Twitter @RJHSDent

P.S. If you haven’t already, reserve your spot to the Irrational Economic Summit now and save $500 on your ticket. This early-bird offer will end soon.

The post How to Find Money at the Bottom of the Ocean appeared first on Economy and Markets.

August 17, 2017

Home Country Bias: If You’re Not Convinced Yet, Look at This

The Dow Jones Industrial Average is as American as apple pie.

The Dow Jones Industrial Average is as American as apple pie.

For most U.S. investors, the 30 American companies that comprise “the Dow” are the natural starting point of building a portfolio of stocks.

Names like Wal-Mart (WMT)… Disney (DIS)… McDonald’s (MCD)… Caterpillar (CAT)… and Apple (AAPL).

They feel as familiar to U.S. investors as, well, apple pie feels to an Oklahoman at the county fair.

And since familiarity naturally leads to increased comfort and confidence, U.S. investors routinely over-allocate to U.S. stocks – including many of the household names in the Dow.

But as I explained in March (links in the P.S.), truly successful investors resist the urge to feel comfortable in their stock selections. Instead of seeking comfort, the best investors seek markets that show the best chance of outperforming.

And often, outperformance requires looking outside the United States.

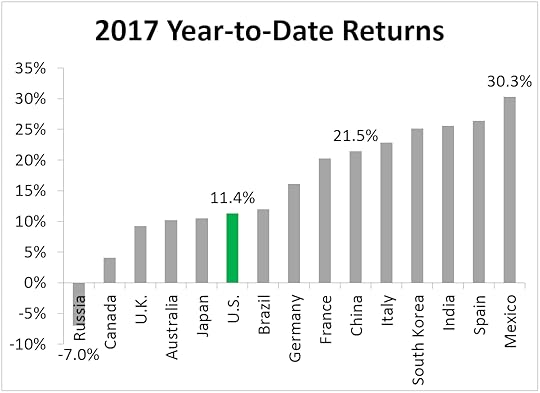

That’s certainly been the case this year, as my Cycle 9 Alert subscribers can attest, and as you’ll see in the chart below.

Everyone on CNBC was celebrating the Dow’s crossing of 22,000 last week. But they neglected to tell you how foreign stock markets have been a far better bet.

I warned back in March that we’d likely see this happen, and I counseled against lazily falling victim to the so-called home country bias.

Stock markets have continued to march higher since then…

The Dow Jones Industrial Average is up a further 5.6%.

But foreign markets have continued to outpace U.S. stocks.

Germany gained 8%… and is now up 16.1% year to date.

Chinese stocks climbed 8.6%… now up 21.5% year to date.

Spanish stocks rose nearly 14%… putting their year-to-date gains at 26.5%.

And Mexican stocks climbed a further 15%… putting them in the #1 spot, up 30% year to date!

Here’s that chart, summarizing the year-to-date returns of the world’s Top 15 economies:

As you can see, most foreign markets have fared better than the Dow in 2017.

As you can see, most foreign markets have fared better than the Dow in 2017.

Chinese stocks have provided double the return.

Mexican stocks have nearly tripled it!

Who would have predicted this?!

Look, I get it… investing in foreign stock markets feels riskier than investing in the All-American names.

But doing what felt riskier (even though it really wasn’t) has led my Cycle 9 Alert subscribers to big money in foreign markets this year!

You see, I’m not a proponent of buying foreign stocks and holding them indefinitely.

Instead, I use a forward-looking algorithm to identify pockets of outperformance opportunity in foreign stock markets – “sweet spots,” if you will.

And so far this year, I’ve identified a number of these lucrative opportunities.

In early March, just a week before I sent you my warning about home country bias, I recommended my Cycle 9 Alert subscribers make a bullish play on European stocks.

They locked in a 41% profit just two weeks later… and a further 213% profit by June 2nd.

Then, on April 4th, I recommended another bullish foreign market play… this time on Chinese stocks.

That play handed my subscribers profits of 49%… 149%… 176%… and 362%… over the following four months.

Then, in early May, I recommended yet another foreign stock market play… this one on Mexican stocks.

Our foray into Mexican stocks handed us gains of 89% and 115% in under three months (and we’re still accruing profits in this position currently).

And finally, I recommended a play on the Canadian dollar in mid-June.

Less than one month later, my subscribers locked in a 130% profit.

Frankly, it’s been an incredible run!

My forward-looking algorithm has identified a number of lucrative “sweet spots” in foreign stock markets… markets that have, indeed, outperformed U.S. markets by wide margins.

But the best part is… I expect the trend of foreign-market outperformance to continue.

That means you still have time to get in if you’re willing to look beyond the perceived comfort of U.S. stocks.

So take off your home-country-bias “blinders” and hop on the opportunities still available in China, Mexico, Canada and beyond!

To finding profits,

Adam

Editor, Cycle 9 Alert

Follow me on Twitter @InvestWithAdam

P.S. Click here to gain access to our current Cycle 9 Alert portfolio. And then you can click here, and here, to read my original warnings against the pitfalls of the home country bias, as well as our infographic.

The post Home Country Bias: If You’re Not Convinced Yet, Look at This appeared first on Economy and Markets.

August 16, 2017

Why You Should Hang Up on the CEO Right Now

Can the “Joe Friday” of lenders generate big returns for your portfolio? This is the question we seek to answer in the latest issue of Hidden Profits.

Can the “Joe Friday” of lenders generate big returns for your portfolio? This is the question we seek to answer in the latest issue of Hidden Profits.

The model behind Hidden Profits is simple and straightforward. We look for companies that pay you first. And since the model went live in 2009, the very best shareholder friendly companies – the A+ rated stocks – have returned 24.7% annually.

Few of these companies are sexy with glossy growth stories. Many are, in fact, boring. But boring can be good — and it can be profitable. This month we focus on a company we call the Joe Friday of lenders. This bank has been a solid operator writing mortgages since the 1930s, and it’s still controlled by its founding families.

Here’s something that might surprise you: Management recently stopped holding conference calls! This may be viewed negatively by Wall Street and investors, but I see this has a huge opportunity.

You see, very little about a business changes day to day. In some cases, very little changes in a quarter or even over a year. But, we live in a day and age of instant gratification and “140 characters or less” opinions.

French polymath Blaise Pascal wrote that “all men’s miseries derive from not being able to sit in a quiet room alone.” That’s a pretty erudite way of saying: not enough’s going on!

Because very little happens day to day or quarter to quarter, the financial media must make something up. Think of all the ways this game is played. It happens in sports during the offseason, where every athlete’s online move is closely examined; it happens in politics, where the 24-hour news cycle has now devolved into the 60-second news cycle.

It happens in markets, too, with eyes and ears pinned to the Federal Reserve. “What will the Fed do with interest rates? Up, down, and how much?” And then there’s business, particularly as it comes to publicly traded companies. Will Ajax Widgets beat, meet, or miss revenue and earnings estimates? And how much will it mean to the stock price?

Alas, one study shows that Wall Street analysts’ estimates are wrong 40% of the time. Why bother, except to be wary of management that plays the expectations game?

Back to the company we found. It’s an “all we want are the facts” story if ever there were one in financial markets. While management of this financial institution isn’t pleasing Wall Street with quarterly conference calls and guidance, what are they doing?

They’re focused on building shareholder value for you.

Can you imagine a company sporting a $4 billion market cap – and in the finance sector, no less – not holding earnings calls? Not trumpeting every positive piece of news as soon as the ink hits the paper?

At least one is out there.

Ever since this company regained its footing after the Financial Crisis, management has been dishing out its prodigious cash to shareholders in the form of massive buybacks and increasing dividends.

And management is buying back those shares at a massive discount to book value while saving on the dividend payment. Meanwhile, existing shareholders pockets will continue to be lined with dividends.

And that’s the big catalyst. A 36% increase in the dividend over the coming year.

Through masterful buybacks and a solid dividend strategy, the yield is poised to be 4.25%, over double what it was two years ago. Another way of looking at this: 20% annual returns without breaking a sweat.

It’s a story that cuts against the grain. Those are the stories that often have the biggest payoffs.

Good investing,

John Del Vecchio

Editor, Hidden Profits

The post Why You Should Hang Up on the CEO Right Now appeared first on Economy and Markets.

August 15, 2017

Why Trump Won & The Peak of Globalization

Fareed Zakaria just put out a special show on why Trump won: He got the rural white vote in unprecedented margins – like 80% plus. Even before Election Day, we put out an infographic explaining why Trump could win despite the polls. Still, even I was a little surprised when he won!

Fareed Zakaria just put out a special show on why Trump won: He got the rural white vote in unprecedented margins – like 80% plus. Even before Election Day, we put out an infographic explaining why Trump could win despite the polls. Still, even I was a little surprised when he won!

I bring this up again now, not to bash Trump, but to highlight the demographic and cyclical explanation behind his victory. And to show that the events that brought Trump into power aren’t done stirring things up. There’s a lot more to come. Trump is only the beginning…

My father was a major political strategist at the state and national level. In fact, he was the architect of the “Southern Strategy.” He got Nixon elected in 1968 with a campaign that touted a vote for Wallace (the strong third-party candidate in the conservative South) was a vote for Humphrey, one of the more liberal candidates ever. He used his uber-conservative senator ally, Strom Thurmond, who he managed his campaigns for over a decade, to counter the southern conservative voters to back Nixon as a counter to Humphrey.

My father told me when I was a kid, that it wasn’t the average voter that decides elections. Rather, it was the swing vote – 15% to 20% – what he called the “all-star wrestling fans.” And don’t think this was meant as an insult. He loved watching the wrestling shows. He loved the drama and the everyday entertainment. I never saw him laugh as much as when he was watching.

I found later in my demographic research that 16% of people regularly watch all-star wrestling… that was an “aha” moment for me.

Globalization Has Reached its Peak

We have been documenting for many years that the top 20%, and more so the top 1% and 0.1%, have been dominating the income and wealth gains since the 1990s, much as they did in the early 1900s into the 1929 peak. Back then, the top 1% controlled 50% of the wealth.

This is simply not sustainable! You can’t have the generals advancing without the troops.

That peak in stocks and the economy in late 1929 led to the Great Depression… and as few have fully noticed, the middle class rose out of that deflationary crisis because it favored them over the upper class for decades, especially from 1945 forward.

And that same pattern will repeat this time around as well, according to my 80-Year Four-Stage Economic Cycle, which shows that we entered the Economic Winter Season in 2008. Central banks have been desperately stimulating to counter the effects of this season ever since. However, they can’t and won’t win this battle against the fundamental trends.

Debt and financial asset bubbles always favor the upper class that owns most of those financial assets. But when those bubbles burst, the rich get hit the hardest, even more than the everyday people, even though they’re the first to lose their jobs. The deflation that follows a burst bubble lowers the cost of living for everyday people and the upper class loses the most in financial assets that deflate.

Everyday people still feel the effects from wage competition with the likes of Asia and immigrants (legal and illegal). I’ve shown in many Economy & Markets articles and Leading Edge issues how the middle and lower middle class have lost in their real wage gains since 2000. This is why these people were (and remain) so angry, and why many voted for Trump.

This is the beginning of the next Civil War, as I outline in more depth in my up-and-coming book Zero Hour. It’s due out mid-November.

The red states and blue states can’t agree on political policies or much of anything else, and there’s a real chance we may see this country split. Europe faces the same potential, map-shattering, change, as does much of the rest of the world.

Globalization is peaking, and could retreat for a few decades, like it did from 1913 to 1945.

It’s been a major driver of growth since World War II. Look at this chart of global trade since the 1500s. It accelerated from the mid-1800s into World War I, then retreated for decades!

Now people are revolting again.

Now people are revolting again.

The everyday person isn’t revolting as much against the wealth of the rich as they are against the impacts of globalization…

The question now is: Is this the end of globalization, or just the pause that refreshes. I answer that question in Zero Hour. Be sure to get your copy when it’s released.

Harry

Follow me on Twitter @harrydentjr

The post Why Trump Won & The Peak of Globalization appeared first on Economy and Markets.

August 14, 2017

The Simple Reasons Why Amazon is Not a Monopoly

There’s a Much Bigger Problem for Retail

There’s a Much Bigger Problem for Retail

I recently Google searched the term “Amazon monopoly.” It returned over 4 million results.

Now, a couple of those hits were links to the Amazon.com product page for the Monopoly board game we all grew up playing as kids.

(I was delighted to see there’s a Game of Thrones edition, complete with a direwolf token and King’s Landing as Boardwalk.)

But the majority of the search results were articles about Amazon’s growing dominance of retail, and its potential threat to competition as a monopoly.

Amazon is big, and it’s getting bigger every day.

But it’s not a monopoly. Not even close.

Let’s play with the numbers a little.

Over the trailing 12 months, Amazon has racked up $150 billion in sales. And not all of those revenue dollars are from its online retail business.

Amazon’s AWS cloud services business accounted for about 10% of its sales, meaning that Amazon’s retail business brought in closer to $135 billion.

That’s a big number. But total U.S. retail and food services sales last year were over $5.5 trillion. Amazon’s $135 billion accounted for a measly 2% of that.

OK, Amazon doesn’t sell cars or operate restaurants (at least not yet). Stripping out auto, auto parts, and food services sales, annual retail revenue in the U.S. is still $3.7 trillion. But even then, Amazon makes up just 3.6% of the total.

Amazon isn’t even the largest retailer in the U.S. That distinction still belongs to Walmart, which brought in just shy of half a trillion dollars last year, 3.5-times larger than Amazon’s annual sales…

My numbers didn’t include sales for Whole Foods Markets, which Amazon recently agreed to acquire. But Whole Foods’ $16 billion in annual sales doesn’t move the needle much.

Amazon is growing like a weed, of course. At its current rate, it will surpass Walmart in size within the next five to 10 years, and maybe sooner. But it’s clearly not a monopoly based on its current market share.

Furthermore, monopoly pricing is associated with higher prices and less competition. It’s really hard to argue that’s the case today.

If anything, Amazon is contributing to the deflationary forces that have haunted the economy for the better part of the last decade. (I wrote about this in a recent issue of Boom & Bust.)

Amazon is changing retail, for sure. We all shop differently today because of Amazon’s innovations over the past 20 years. Those retailers that have embraced technology or found a specialized niche have done well. Those that haven’t, haven’t.

But this isn’t the first time the world, or America, has seen this.

The Problem Isn’t With Amazon…

As ridiculous as this sounds today, Sears was once a model of innovation. Its paper catalogue turned a fragmented local shopping culture into a national consumer market.

Decades later, suburban shopping malls and big-box stores killed traditional Main Street retail.

And now, internet retailers like Amazon are disrupting shopping malls and big-box stores.

It’s competitive capitalism, and it’s the reason we live in a wealthy country today.

That said, the retail economy does have major problem. It’s not Amazon; it’s demographics.

Americans tend to hit their peak spending years in their late 40s and very early 50s, when their kids are still eating them out of house and home.

After your early 50s, you still have another decade before your earnings peak. But you spend less and save more in anticipation of retirement.

Well, the Baby Boomers – the largest and wealthiest generation in history – are now well past their peak spending years. They’re now desperately trying to save for a retirement that, for many, is coming sooner than they’d like.

At the same time, the next big generation – the Millennials – is getting a late start.

Between the setback of the 2008 crisis and its aftermath, higher student loans balances, and lower starting salaries, they’re not able to pick up the slack left by their parents… and they won’t be capable for several more years.

The retail economy will recover… eventually. We expect the 2020s to generally be a good decade for consumer spending.

But, in the meantime, you’re likely to see even more consolidation, as stronger competitors like Amazon fill the void left by those in retreat, like J.C. Penney or Sears.

Just don’t call it a monopoly!

Charles Sizemore

Portfolio Manager, Boom & Bust

The post The Simple Reasons Why Amazon is Not a Monopoly appeared first on Economy and Markets.

August 11, 2017

How to Laugh, Trade, and Profit All at the Same Time?

By David Dittman, Editorial Director, Dent Research

By David Dittman, Editorial Director, Dent Research

“It’s difficult to make predictions,” said (maybe) Niels Bohr, Sam Goldwyn, Robert Storm Petersen, Yogi Berra, or (probably) Danish politician Karl Kristian Steincke, “especially about the future.”

That saying, both wise and humorous, sums up one of the main points Howard Lindzon made during a recent conversation we had about “real hype” and “the real deal” when it comes to financial markets.

Howard is one of the most insightful and irreverent voices talking about markets today.

He’s an entrepreneur, the co-founder of StockTwits. He’s an angel investor, with seed money in multiple FinTech, social, and other “Web 3.0” startups. He’s a venture capitalist, the main face of VC fund Social Leverage. He’s an investor, with a long track record of successful trades.

Most importantly, he’s an “idea” guy. And perhaps his biggest idea is that sharing ideas is the key to success.

Soon Howard, with the support of Charles Street Publishing, will launch his first investment newsletter, Peloton. He’ll also be presenting at Dent Research’s fifth annual Irrational Economic Summit October 12-14 in Nashville.

As his long-term mantra suggests – “investing for joy and profit” – this is about more than simply making money. It’s about making a better life. And you can do both at the same time.

We squeezed a lot into my questions and his answers, including cult-classic comedies, signals and noise, how to look at markets and the world, robots, and “8 to 80” brands.

I hope you enjoy it.

And stay tuned for Peloton, and be sure to join us for the Irrational Economic Summit.

Meet Howard Lindzon

Question: First things first: Is or is not Tony Cheeseburger from “Let It Ride” to horse racing (Tony Cheeseburger Gets Advice, Trotter & Tony Cheeseburger Place a Bet) as CNBC is to market information?

Answer: As the market goes higher, CNBC has to get louder. It can only give you one voice at a time. They’re trying to please all people all the time. Indexing has become so popular that they have to get louder to reach people. There’s very little signal there.

That’s not what investors need.

Investors need curation. They need to hear and listen to good voices. They need consistency. They don’t need one person to be an expert in all things. It does take time to develop a network, but it’s worth the effort.

CNBC is easy, and it’s loud. But it’s not very useful.

Question: So what is the most important source of information for you?

Answer: You need more than one channel.

It’s constantly evolving, but for me it’s my network. I’m always finding new people, tracking down new stuff to read, challenging my own preconceptions, visions, and thoughts.

I do that by engaging with other smart people.

Question: Yours is an essentially positive approach to markets, specifically, and life, generally. Why is it important that investors be optimistic?

Answer: This is basically a glass half full/glass half empty question. To me it’s half full. That’s what I’m trying to focus on.

There’s so much noise about income distribution, the 1%. But at the very top level the pie is getting bigger… So forget about the 1%. If the pie’s getting bigger, there’s an opportunity. The question is: How do I get a piece of it?

Question: To borrow a concept from Howard Marks, what’s the most important thing you’ve learned during your career?

Answer: Speaking of Howard Marks, I’m pretty sure in that book he also said “you can’t predict the future.” It may be fun to forecast, it may be fun to predict. But you’re best off preparing.

And the best way to prepare is to surround yourself with smart people.

Predicting, forecasting…it’s fun but it’s a time suck. Don’t predict, prepare.

Question: You mentioned during our first meeting that your father was an attorney in Toronto, working with Canadian mining companies. I used to edit a newsletter called Canadian Edge, and as part of that work I learned a lot about the old “wild west” nature of Canada’s resource-focused stock market. I wonder if there was some long-term impact from exposure to this type of adventure-capitalism.

Answer: Well, I learned the importance of hustle. I also came to understand the importance of becoming an expert in an industry.

So, yes, there were lessons on the importance of being an entrepreneur, of doing things myself and relying on my instincts.

Question: Wall Street and its traditions are under threat. Low-fee and no-fee platforms abound. Not only that, the way we transact business of every kind seems to be on the verge of a revolutionary phase. Bitcoin is the star, but blockchain is the foundation. Is that a useful way to think about what is or may be happening?

Answer: Bitcoin is the star, but I’m not sure about describing blockchain as the foundation. Blockchain has become sort of “wild west” and confusing. The factions are confusing, like tributaries of the Nile. It’s relatively easy to understand and navigate the Nile, its tributaries much less so.

Bitcoin is, actually, the North Star, the easiest way to participate in this particular disruption. And we want people to participate, not necessarily speculate. Bitcoin is the best participation vehicle right now.

Blockchain is essentially a spine, or a timeline with specific posts marked on it. But now big companies, the big financials, want to create their own blockchain-based systems. So it’s gotten a little messy, less centralized.

I’m more interested right now in the true, central, original vision.

Question: You’ve often said that in the future the only really viable skills will be programming (as in writing executable computer language) and investing (or, more broadly, managing money). As the father of two daughters, one, who plans to be an elementary school teacher, starting her third year of college, the other, who wants to be a surgeon, her second year of high school, I’m highly intrigued by this hypothesis.

Answer: Well, Code Academy can already teach programming on an automated basis. And robots can already do surgery, so…

The most important thing is to be able to program robots, to communicate with them. Automation, robotics…it’s just a modern hammer, one that does way more things, yeah, but we’re still in charge of the hammer.

I try not to worry about that. I look two to three years out, and there’s opportunity there.

Look, spreadsheets were supposed to kill accountants. Robots are supposed to kill jobs. Maybe they just make us productive in different ways. We’re trying to profit off this stuff, not hide in a hole.

That’s the “glass half full.”

Question: In your new book, 8 to 80: The Next 1,000% Stocks and Trends Everyone Can Ride, you write:

Over the next century there will be some incredible new and durable old trends that will deliver amazing opportunities for savvy investors.

We’ll mine asteroids, robots will do most of our work, we’ll interact with intelligent machines in various new ways, we’ll travel to space, and we’ll build cities on Mars. Biotech will change the way we do everything, and it will enhance our life exponentially.

All these trends – and some that may have yet to register – will create hundreds of stocks that will go up 1,000% or a lot more. And these profits will be there for the taking by anyone who knows how to grab them.

So, here’s the money question: How do we learn “how to grab” these kinds of stocks?

Answer: It’s not that complex. It’s just a way of life. We shop, we eat, we read, we listen, we talk. Even in your small group of friends, we’re all using the same stuff, the same brands.

We’re looking for companies that appeal to everyone from age 8 up to age 80. You wait for a market panic, you pounce. When the market’s good, you’re glad you own them.

Over the course of the year, other ideas will resonate. And if the ideas our approach generates appeal to you, you can add them to your portfolio.

Some of these momentum stocks will indeed grow up into “8 to 80” companies. Some will simply make good trades and hand us good profits for as long as a trend is in place.

That’s what Peloton is for.

David Dittman

Editorial Director, Dent Research

P.S. Thanks to Howard for the engaging conversation (as always).

P.P.S. You can hear Howard for yourself, and meet him, at our Irrational Economic Summit, October 12-14. Reserve your seat now to secure the limited $500 discount.

The post How to Laugh, Trade, and Profit All at the Same Time? appeared first on Economy and Markets.

August 10, 2017

Rate Hikes on the Horizon?

Last Friday’s jobs data filled most investors with confidence going into the second half of the year. This week, notwithstanding some disconcerting nuclear brinksmanship, markets remain calm.

Along with the improving employment situation, let’s take a look at other important economic data and see how it all adds up. Investor confidence doesn’t obviate the need for due diligence.

The headline non-farm payroll number grew by 209,000 jobs versus an expectation of 178,000, marking the second month in a row of strong growth. The headline unemployment rate fell to 4.3%, as ex

pected. The labor participation rate ticked higher to 62.9%, though it’s still historically low. And, finally, wages grew 0.3% month over month, as expected, and 2.5% year over year.

Manufacturing data is improving, as shown by a couple data points last week. The important Institute for Supply Management (ISM) manufacturing index was a little higher than expected, and all components showed strength or growth, including employment and orders. And, according to Friday’s jobs report, manufacturing employment grew by 16,000 versus a forecast of 3,000, which seems to confirm the improving ISM data.

New home sales were steady at a 610,000 annualized rate, though that’s still about half of what sales were back in 2005. Prices were down 4.2% on the month, with a median of $310,800.

Existing home sales missed expectations, declining by 1.8% to an annualized rate of 5.52 million. Prices, though, were up 6.5% from a year ago.

The most comprehensive measure of economic growth is gross domestic product (GDP). After a rather disappointing 1.4% growth rate in the first quarter, the second quarter met expectations with a healthier 2.6% rate. However, as has been the case for all the other inflation data we’ve seen, the GDP price index grew below expectations at 1%.

The June Personal Income and Outlays figures were somewhat disappointing again. Income rose 0.1% against a forecast of 0.4% growth. Personal spending grew at a tepid 0.1% but was in line with the consensus forecast. The Personal Consumption Expenditure Index (PCE Index) was up 0.1%, as expected.

The PCE Index, the Federal Reserve’s preferred inflation indicator, is still running far below the central bank’s 2% target at a year-over-year rate of 1.5%.

Last month’s Federal Open Market Committee statement, as expected, included no policy changes. The target range for the federal funds rate remains 1% to 1.25%. And we’re still wondering if and when the Fed will begin to unwind its $4.5 trillion balance sheet.

The FOMC’s statement didn’t give us a tapering date, but officials are now hinting it will start after the September or the December meeting. The policy statement noted that inflation is falling but also that the economy continues to grow at a moderate pace, with solid employment as well as growth in spending and business investment.

The Fed has hiked the overnight federal funds rates twice this year and, according to Fed Chair Janet Yellen’s Senate Banking testimony, another hike this year is still likely.

Yellen and her cronies at the Fed believe falling inflation is temporary, wages will rise, and consumers will spend.

I’m not a fortune teller, and I don’t own a crystal ball. But I’m not so sure I can agree with Chair Yellen. If the economy is sluggish now (and evidence suggests it is), it certainly won’t be helped along with another rate hike and a reversing of quantitative easing through the reduction of the Fed’s bloated balance sheet.

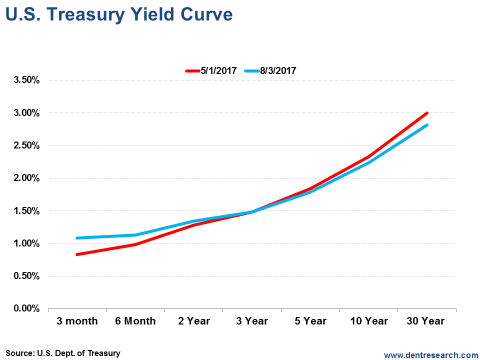

Stocks are near all-time highs, but fewer stocks are accounting for the move up. And the bond market remains cautious. The yield curve shows that expectation for future economic growth is lacking because it’s flattening. Just in the last three months, longer-term interest rates have fallen and shorter-term rates have risen.

But, so far, the curve hasn’t inverted.. When that happens – short-term rates are higher than long-term rates –we are or we will be in a recession.

But, so far, the curve hasn’t inverted.. When that happens – short-term rates are higher than long-term rates –we are or we will be in a recession.

The bottom line is that the data seems to be improving, but inflation is still low and wage growth isn’t putting pressure on prices yet.

The Fed can probably justify hiking rates one more time this year to get ahead of possible future inflation. The Fed can also try and get markets used to the idea of gradually reducing its monstrous balance sheet. So far, however, markets haven’t reacted much to Fed moves or talk.

Our central bankers are walking a tightrope, and their desire to control economic booms and busts are in the balance. Sooner or later markets will react, and it won’t be pretty. Stocks have been buoyed by easy money, while bonds are expressing caution and low expectations for future growth.

A misstep by the Fed or an overreaction to surprise economic data could really shake markets, and that’s good for my Treasury Profits Accelerator readers! Greater volatility usually means more opportunities to make money.

You can prepare for and profit from surprises in the financial markets, and specifically in the Treasury bond market with Treasury Profits Accelerator.

Good Investing,

Lance

Editor, Treasury Profits Accelerator

The post Rate Hikes on the Horizon? appeared first on Economy and Markets.

August 9, 2017

Chicago is America’s Dark Financial Star

The Windy City is famous for a lot of things, including the biting winter breeze off Lake Michigan and blowhard politicians.

The Windy City is famous for a lot of things, including the biting winter breeze off Lake Michigan and blowhard politicians.

Whether Chicago got its pet name from one or the other doesn’t really matter, since both fit.

But soon, the place also called the Second City will be known as something else: The municipal black hole.

It’s only a matter of when, not if, Chicago will consume itself financially, and will start sucking in the wealth of anyone and anything connected to it, just as black holes in space eat the energy of nearby stars.

It’s easy to lay the blame on runaway pension liabilities, not uncommon in cities and states across this country. But Chicago’s trouble is deeper than most, and recent decisions by the state of Illinois will only make things worse.

The Fiscal Times rates over 100 municipalities based on their fiscal strength. Chicago is dead last.

The city has little in reserve to cover unexpected expenses or a drop in revenue. Its general fund balance covers only 6.27% of annual expenditures. Meanwhile, Chicago carries a lot of debt. Its long-term obligations are almost 300% of revenue.

The city spends one-fifth of its budget covering required pension contributions, but it’s still not enough. As of 2015, one of the city’s larger pensions held just 33% of what it needs to meet its obligations. The Municipal Employee’s Annuity and Benefit Fund had $4.7 billion in assets and owed $14.7 billion in benefits.

Mayor Rahm Emmanuel raised taxes to address some of the shortfall, but it won’t right the ship. This pension, along with several others, will drag Chicago under.

The mayor tried to curb pension benefits, but the courts beat him back. Illinois views public pensions as constitutionally-guaranteed, so there will be no compromise. Beneficiaries can demand payments until the city’s bank accounts run dry.

Several states take this same stance, while others take a different view, which will lead to varying outcomes as pensions blow up around the country (I cover this topic in the August edition of Boom & Bust).

After that, who knows? There’s no provision in the bankruptcy code for states, so all we can do is look to previous examples to see how things might go.

Histroy May Not Be in Chicago’s Favor

When we look at Puerto Rico, currently the largest near-state plodding through a near-bankruptcy, it’s ugly.

Bondholders, who are constitutionally-guaranteed their payments ahead of any other payment, including salaries, vendors, rent, etc., have been stiffed.

No one knows how things will end up, but it won’t be with investors receiving 100% of what they’re due, even those who bought dedicated streams of income. That should serve as a warning to investors contemplating bonds issued by Chicago in the months ahead.

The Illinois state government recently passed its first budget in three years.

Buried on page 711 of this monstrosity was a gift to the city of Chicago. The state granted authorities that operate under home rule, like Chicago, to segregate state funds. The Windy City receives about $1 billion of tax dollars from the state, generated by taxes and fees.

Under this ruling, Chicago can put those funds in a separate account and issue bonds backed by that identified stream of income. The move allows the city to claim that the bonds have a better backing than simple general obligation bonds, which are backed by the full faith and credit of the town.

This gives bonds backed by the segregated funds a higher rating and lower interest cost. It saves the city much-needed cash.

But there’s a problem.

Puerto Rico did the same thing with sales tax revenue. Now general obligation creditors claim that all income of the commonwealth should be available to the entire creditor pool, including any dollars the Puerto Rican government self-segregated.

It’s a compelling case. Why should a city, commonwealth, or state, be allowed to identify dollars that won’t be considered when calculating its full faith and credit?

If Chicago follows the same path, the city will remove a significant portion of the funds that back every general obligation bond currently in existence.

I think Chicago’s default is just a matter of timing. When it happens, general obligation bondholders will go after every dollar available. Anyone buying newly-issued bonds backed by the dedicated stream of state-collected tax revenue is taking a big leap of faith.

The Illinois budget deal just happened, so there aren’t any bonds in the works at the moment, but Mayor Emmanuel would be foolish to not use every tool at his disposal to lower financing costs for the city.

Expect such bonds to hit the market in the next six months. Whether or not you roll the dice and buy them depends how comfortable you are navigating near a black hole.

Rodney Johnson

Follow me on Twitter @RJHSDent

The post Chicago is America’s Dark Financial Star appeared first on Economy and Markets.

August 8, 2017

What Makes Women Better Investors

Remember that book, Men Are from Mars, Women Are from Venus? It sold more than 50 million copies in the ‘90s!

Remember that book, Men Are from Mars, Women Are from Venus? It sold more than 50 million copies in the ‘90s!

It brilliantly shed light on some of the biggest differences between men and women in terms of each gender’s typical traits, thought patterns, communication styles, and behaviors.

Sure! It garnered some criticism for perpetuating stereotypes, although I’m sure the author never meant to suggest that all men are problem-solvers, for example, or that all women are good at multi-tasking.

Likewise, I’m not writing today to tell you that all women are better investors than all men…

Only that many of the innate traits typically ascribed to the female gender are highly favorable for investment success.

And so, gentlemen, we should take note…

Are women born to be superior risk-takers?

Many psychologists and evolutionary biologists say, “yes!”

In her 2010 paper, Close Women, Distant Men, psychologist Helen Stancey proved two key findings:

At 20 inches away, women have more accurate eyesight than men.

At 40 inches away, it’s the other way around.

That discrepancy has been chalked up to the fact that prehistoric man evolved to be a hunter, which required tracking and attacking moving prey from great distances.

Meanwhile, the prehistoric woman evolved to be a gatherer. And that task called for locating stationary resources in nearby surroundings.

But, as I see it, this is just one of the many differences between men and women that can be explained by our evolution-driven past. And most of the differences that come to mind easily have to do with risk-taking.

Generally speaking, women are more risk-averse than men.

And, related to that, men are overconfident, more so than women.

To be a successful caveman, you had to take down a wildebeest on the African plains… and to do that, you were better off being overconfident in your ability to do so, and blind to the risk that you might instead be impaled and bleed slowly to death.

Essentially, the best cavemen were bold and brave.

That worked fine for men in prehistoric days. But today, those “alpha male” traits tend to work against investors who try to “hunt” their way through the market.

Just as there were endless threats to the physical safety of prehistoric man, there are endless ways in which financial markets can separate you from your hard-earned cash.

Women tend to have a healthy respect and humility toward the uncertainty and risk inherent in the world… and financial markets.

Men… well, we tend to swing from vines and beat our chests – overconfident in our abilities and under appreciative of unforeseen risks.

The good news is… just because men and women are “hard-wired” in different ways doesn’t mean anyone can learn and implement the “lady-like” traits that improve investment success.

Here are three of them…

1. Don’t Risk Too Much

Conservative position-sizing is key to avoiding what we call the “risk of ruin” – aka, losing all your money.

Obviously, if you invest everything you have in one trade and something goes wrong… you’ve lost it all. But if you invest a more reasonable share of what you have – say, 10% – and the market throws you a curveball… you’re still in the game, with the remaining 90% intact.

You’ve “lived to fight another day,” as wise traders say.

Of course, finding the position size that’s right for you is a personal matter. But if you join either of my services, Cycle 9 Alert or 10X Profits, I’ll show you how you can get at that number.

2. Learn to Take a Loss

Some people say men can’t admit when we’re wrong. (And I’ll never admit that it’s true [wink]).

Seriously though, all investors are better served by checking their egos at the door. Taking a loss on a trade doesn’t mean you were “wrong.” It doesn’t mean you were “stupid,” or a “bad investor,” either.

It simply means you lost money on that particular trade. (And if you followed Rule #1, you didn’t lose all of your money).

“No one trade can make or break us,” is the unofficial mantra of systematic investing.

If you can handle the emotional trauma of taking a loss – whether you’re a man or a woman – you’ll be resilient enough to stick to your strategy. And that’s a must if you want to win in the end.

3. Follow the Rules!

A proven, “rules-based” investment strategy is only valuable if you follow its rules.

That seems obvious, but you’d be surprised by how hard that is for folks who lack the psychological fortitude and discipline required to follow a systematic strategy.

And, of course, there’s evidence to suggest women are better at following rules than men.

One study monitored the trading activity of more than 700 junior investment bank traders. The participants were given specific “rules” that they were told not to break – essentially, times of the day when they were prohibited from making trades.

That study showed the men broke the rules 2.5-times more frequently than women.

And guess what… the excessive rule-breaking led the men to underperform the women in net returns.

That doesn’t surprise me at all!

So that’s the deal, ladies and gentlemen…

As I see it, you certainly don’t need to be a woman to be successful at investing, although it may help. But everyone can benefit from being aware of, and avoiding, the most damaging “caveman” traits, like overconfidence and excessive risk-taking.

Adam O’Dell

Editor, Project V

Follow me on Twitter @InvestWithAdam

P.S. Excessive risk-taking… and excessive fear (the other side of that coin)… are the behavioral phenomenon we capitalize on in my 10X Profits service, where we trade the lucrative “booms and busts” in volatility. Click here to learn exactly how it works.

The post What Makes Women Better Investors appeared first on Economy and Markets.

August 7, 2017

The Shocking Truth About Russia

The Russian drama seems to intensify with each passing hour.

The Russian drama seems to intensify with each passing hour.

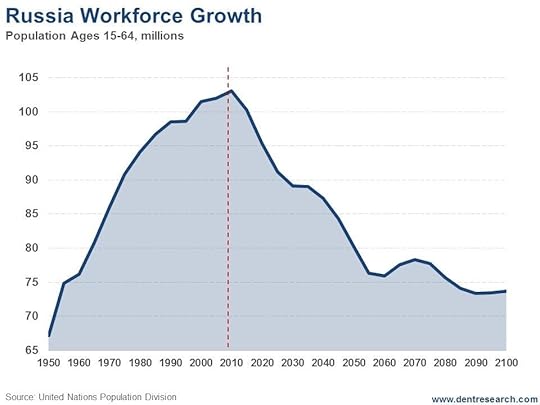

I certainly have my opinion on the matter, as, no doubt, do you. But it’s not my opinion that I want to share with you today. Instead, I want to share two charts that may well shed new light on recent events…

Here’s the first. I warn you, it’s shocking.

As you can see, Russia’s workforce growth rolled over around 2010 and now faces one of the steepest collapses I’ve seen in any country!

Demographically speaking, Russia is up the creek without a paddle. It’s already experiencing tremendous economic pain and faces a worsening situation with each day that passes.

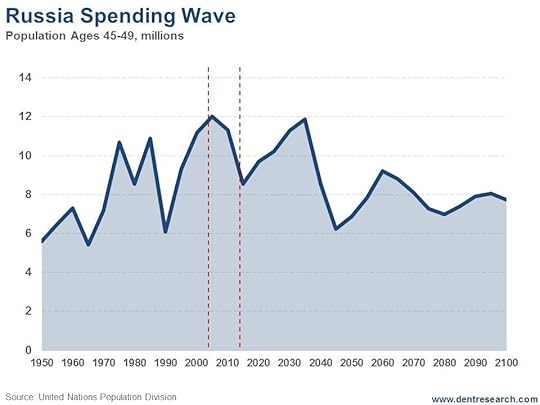

Here’s the second chart, equally shocking…

This is Russia’s spending wave. It looks like a cross section of the Ural Mountains that run through the west of the country. And it’s going to devastate the country’s economy for decades to come… over and over and over again.

In short, the country is in dire shape and it’s led by a megalomaniac who’s desperate to show strength to hide the reality that there is none. It’s like a scrawny, weak, cartoon character who’s wearing an inflatable muscle suit (both Putin and Russia!).

Russian possible interference in our political affairs, and its “silent” invasion of surrounding territories, are desperate attempts to escape its demographic destiny.

There’s also an attempt by the country’s oligarchy to grab has much power and wealth as they can before the wheels come off.

In a July 16 interview on CNN, William Browder, co-founder of a firm that at one time was the largest foreign portfolio investor in Russia, talked about the country’s top-down, mafia-like oligarchy of 10,000 people who have all the money and power. He estimates Putin’s net worth, taking a cut off of this oligarchy, at around $200 billion – twice that of Bill Gates. He makes Chapo, the Mexican drug lord, look like a chump!

Putin is the Godfather of Russia. He benefits from the top-down communist system.

That makes him dangerous!

The country is a ticking time bomb.

Harry

Follow me on Twitter @harrydentjr

The post The Shocking Truth About Russia appeared first on Economy and Markets.