Harry S. Dent Jr.'s Blog, page 47

July 27, 2018

What’s to Come

Major forces with big implications for the U.S. are starting to take shape.

And Harry sees that shape as something awfully similar to what came about back in the 1920s.

Between the political push on immigration and the tariffs that have been imposed…

Back in 1924, Congress passed the Johnson-Reed Act. It limited the number of immigrants allowed into the U.S. by establishing a quota. Once the quota was hit, none were allowed in.

And, before that, to help slow the number of incoming immigrants, Congress established literacy tests, among other barriers to entry, which required immigrants to demonstrate a certain level of proficiency before gaining passage through our borders.

The Smoot-Hawley Act was the cherry on top of already high tariffs, which then sparked trade wars.

It was a reaction to increased protection for declining prices due to overproduction.

As a result, the U.S. was viewed as “isolationist”… all for the sake of keeping the economy strong and healthy.

And, now, Trump has dipped his toes in both pools, all for the sake of strengthening the economy.

But both of those instances of American protectionism were predicates for Black Tuesday and the Great Depression. It was pushback against the natural cycle of any economy.

Now, there is growing divergence between “Main Street” in the U.S. and an increasingly globalized economy. The ground below is stretching thin.

Eventually, all things fall through. And with the foundation weakening, economies, too, will fall.

But it doesn’t have to be all bad…

In the video below, Harry reacts to the current trends and happenings in our markets, economy, politics, putting it all in context of globalization.

He touches briefly about our Irrational Economic Summit, where he and numerous other brilliant minds will be speaking about just those trends and happenings and much more.

And he touches on trends yet to come, too…

Click here, or the video below, to hear what Harry has to say.

The post What’s to Come appeared first on Economy and Markets.

July 26, 2018

The Clamp Down on Immigration

There was a great article in Bloomberg Opinion by Noah Smith.

It starts off reminding us that we’re doing similar things now as we were in the late 1920s, before the 1929 crash and Great Depression.

During a major bubble, the Fed started tightening in 1928.

In 1930, Smoot-Hawley was passed. It raised import duties, which set off a trade war.

That trade war actually started indirectly with World War I and didn’t end until after World War II. Though it saw its worst during the Great Depression with the direct tariffs.

I look at that peak and deceleration in my new book, Zero Hour, as well as what I see as a second major peak.

Trump is only the beginning…

Like Smoot-Hawley, a trade war will naturally be accelerated by a coming global depression when countries naturally get more defensive and protectionist.

So, major alarms should already be going off.

And Smith suggests that the biggest blow was from curbing immigration.

Back in the last major bubble cycle, immigrants saw an all-time peak as a percent of population in 1907 at 1.29 million.

By the second peak in 1914 (World War I), there were 1.2 million. Immigration was up massively from 1898 into 1907, mostly from Europe.

Then legal immigration plunged to 110,000 into 1918, during World War I.

After a bounce back to 825,000 in 1921, immigration plunged after a second peak in 1924 at 700,000.

Why?

There was a bomb on Wall Street, and numerous other incidents of immigrant unrest.

The Italians and Irish were blamed, and resented, back then.

The Johnson-Reed Act (or the Immigration Act of 1924) was passed to curb immigration – and it did.

Housing prices, permits, and starts peaked a year after that legislation in 1925, and started heading down sharply – helping to precipitate the inevitable great crash.

Once the economy finally broke, immigration continued straight down into the bottom of the Great Depression, when it hit a mere 23,000 – near zero – in 1933!

In the current cycle, illegals already peaked in 2007.

That population is down 4% since, with more leaving than entering.

Immigration overall peaked back in 1991 at 2.2 million. Then again in 2002 at 1.7 million before crashing again.

Immigration hit a low in 2013 at 1.2 million, and has bounced only slightly since.

The strong anti-immigration push – illegal and legal – is likely to start another steep wave down that could help ignite a recession. That, inevitably, will turn into a depression, given the unprecedented bubbles and stimulus of this era.

This, to me, has a more imminent, fundamental, and lasting impact – as it’s demographics.

I agree with Smith on this being the most critical factor today, as it was back in the late 1920s.

Immigrants need housing. Mostly rentals, at first, leading to more purchases later down the road.

They produce and buy goods and services.

They mostly move into larger cities that are magnets for growth and innovation.

Noah Smith uses a 2016 study from economists Philipp Ager and Casper Hansen that showed a negative impact on manufacturing, and the rise of lower wage jobs (to replace immigrants) in cities most impacted by falling immigration rates.

The most likely prediction I have for the next depression currently is between 2020 and 2023.

Right on that 45-year cycle that repeats every two cycles, or 90 years in great resets like the massive economic lows of 1843 and 1933. After those two long term peaks, the largest two bubbles in U.S. history crashed into depressions – as always occurs.

And stocks will repeat 90 years after the 1929-1932 stock crash, likely in late 2019 through late 2022.

The present rally is looking less likely to peak later this year (although the jury is still out on that, and more evidence is building for a peak later this year).

Currently, our nation has again decided to fight immigration more seriously at the wrong time…

And started trade wars while raising rates rapidly, thinking the economy is strong enough to handle it!

This is adding to the Baby Boomer Spending Wave crash from 2008 to 2023, which only unprecedented QE and stimulus has offset so far.

That’s the only reason for any apparent economic strength, not underlying fundamental trends.

There’s a limit to such stimulus – now tax cuts – due to the law of diminishing returns, as any drug addict well knows.

Once the economy does finally break, immigration will drop like a rock making the whole downturn even worse.

And the trade wars will grow exponentially.

Just like in the early 1930s…

Will you be ready?

Harry

Follow me on Twitter @harrydentjr

The post The Clamp Down on Immigration appeared first on Economy and Markets.

Treasury Yields Break on Through To The Other Side

The past week brought its fair share of drama.

Although equity and Treasury markets exhibited signs of nervousness, volatility actually subsided.

Trade wars between the U.S. and other countries continued to dominate the headlines. But these disputes haven’t moved markets all that much.

Global economic growth may slow because of diminished trade, the International Monetary Fund (IMF) warned last week.

Commodity prices, especially oil, dropped in response to the potential for weaker-than-expected economic growth.

Action in the Treasury market suggested that investors remain cautious. Volatility was relatively muted in this asset class, at least until Friday.

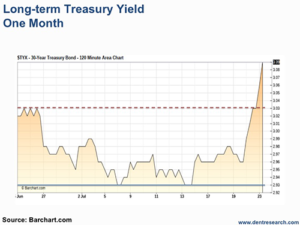

Thirty-year Treasury bonds yielded less than 3% for over three weeks, fluctuating between 2.93% and 2.98%. That’s despite inflation creeping higher.

Friday’s move broke through resistance, and Monday’s follow-through propelled yields beyond 3%. Hello, volatility.

Russia Dumped, China Backed Up the Truck

Last week, the Treasury Department released a monthly report indicating that Russia’s holdings of U.S. government debt fell below $15 billion in May.

This sell-down occurred quickly. Russia held over $96 billion worth of Treasuries two months ago.

In hindsight, Russia’s rush for the exits may have contributed to 30-year yields spiking to 3.24% in May.

The same report showed that foreign individuals more than made up for central bank selling in May. These market participants added $26.7 billion in Treasury securities.

Meanwhile, despite China’s burgeoning trade dispute with the U.S., the country was a net buyer of Treasury securities.

China added $1 billion worth of Treasuries to its hoard in May, bringing the total to $1.183 trillion.

If Russia dumping roughly $80 billion worth of Treasury bonds drove yields significantly higher in May, imagine what would happen if China decided to pare its exposure dramatically.

It’s not a pretty thought.

I hope the Trump administration considers that potential nuclear weapon as the trade war heats up.

We’ll continue to monitor the Treasury Department’s news releases for any changes in China’s appetite for U.S. government debt, though this data does involve a two-month lag.

Back in the U.S.A.

June retail sales came out last Monday morning and met expectations for a monthly increase of 0.5%. Core sales, which exclude autos and gas, disappointed, increasing by only 0.3%.

The real action occurred in the May figures, as the Commerce Department revised the headline and core numbers higher by about two-thirds.

In June, gas, auto, restaurant, and personal care sales were points of strength. Categories that suffered sharp sales declines included department stores, clothing, and electronics.

Federal Reserve Chair Jerome Powell testified before Senate and House committees last week and, once again, expressed concerns about low inflation and wages.

Housing data released last Thursday revealed a sharp decline in starts and permits.

Remember, starts and permits give us a preview of future new-home sales because builders don’t usually start construction until they’re confident that the finished product will sell.

Starts fell 12.3% in June, while permits tumbled 2.2%. The only good news was that single-family starts were up 0.8%, rebounding from a 2.3% decline in May.

One bad month doesn’t make a trend or mean that housing has reversed.

New-home sales are important to the economy because of the “ripple effect” they produce.

Think of all the things it takes to make a new house a home: furniture, appliances, decorations, and landscaping spring to mind. All these businesses benefit from the sale of a new home.

Sales of existing homes had been relatively flat, before diving 0.6% sequentially in June and 2.2% year over year. This weakness could prove to be an early warning about the housing sector.

That’s the third month in a row where sales fell short of expectations.

If next week’s new-home sales come in light, markets could react.

All this adds up to continued volatility in Treasury markets, so be ready for the next trading opportunity!

You can prepare for and profit from surprises in the financial markets with Treasury Profits Accelerator.

Happy trading to you,

Lance

The post Treasury Yields Break on Through To The Other Side appeared first on Economy and Markets.

July 25, 2018

Oil Will Be An American Weapon

I took a gap year after college, and I decided to spend the winter in Jackson Hole, Wyoming.

When I left from just south of Houston, I drove 700 miles the first day and spent the night in… Texas. Amarillo, to be exact.

Texas is a big state.

When you enter Texas from Louisiana on Interstate 10, there’s a sign that reads “877 miles to El Paso.”

The people of the Lone Star State like to say that everything is bigger in Texas. Bigger trucks, bigger houses, whatever. Well now they can add something else to the list.

Bigger oil.

Granted, Texas has always had oil, but with the fracking revolution, more of the black gold is flowing than ever before, and the pace is set to increase yet again.

If Texas was an independent country (which many people here would like to see), by next year it would be the third-largest oil producing nation on the planet, behind only Russia and Saudi Arabia.

Now, granted, the numbers aren’t close.

Russia and Saudi Arabia are expected to pump between 11 and 12 million barrels a day next year, and Texas will produce less than six.

But still, the increased production in Texas will put it ahead of both Iran and Iraq.

In fact, so much oil is moving through the Lone Star State that the Intercontinental Exchange will offer an oil future based on Houston prices sometime this quarter.

Until now, the closest pricing was in Cushing, Oklahoma, which is the traditional place to measure inventory and prices. But in 2015 President Obama lifted the 40-year ban on U.S. oil exports and we started shipping oil overseas, mostly through Houston.

In June, U.S. oil exports touched a record high of three million barrels a day.

They’ve since settled back to two million barrels per day, but that’s still a lot of oil.

Shale producers across the country are pumping out almost 11 million barrels per day, which means the U.S. will produce a record amount of oil this year.

So much oil has strained the transportation system. Producers cannot get their product to market, which leads to price gyrations.

Recently, oil prices in Midland, Texas, were $12.99 less than at Cushing simply because of the excess supply sloshing around West Texas. But that’s OK. We’ll work out the kinks in the process.

A quick review of the Texas Railroad Commission report on new pipeline construction in 2018 shows more than 500 miles of just crude pipeline construction underway. And yes, in Texas the Railroad Commission overseas oil and gas. Go figure.

When the kinks are worked out of the system, Texas in particular and the U.S. as a whole will be among the biggest energy players in the world. As we gain dominance other producers lose their place of privilege.

This will mean that we have fewer reasons to be involved in squabbles in the Middle East, where countries have been laughing at us for more than 50 years as we talk about democracy and freedom and then ship them U.S. dollars that they use to attack our allies and oppress their own populations.

As oil became the fuel that powered the world, it also became a weapon to be used as suppliers saw fit.

Well, the world is about to see what happens when the U.S. doesn’t need energy from other nations and can choose to turn its attention elsewhere.

Something tells me they’re not going to like it, and that suits me just fine.

Rodney Johnson

The post Oil Will Be An American Weapon appeared first on Economy and Markets.

July 24, 2018

[Video] Interview With IES Speaker Neil Howe

Our IES Is All About That

We are living through the greatest economic experiment in history.

How long can the economy go while avoiding recessions through massive, non-stop money creation and infusion into the economy?

And when will the side effects of such an economy be seen?

By late August, this will be the longest-lived bull market without a 20%-plus correction.

The last one was late 1990 and into early 2000. But that’s not the most remarkable fact…

This bull market has occurred during a period where demographic trends and debt loads have been the worst in history.

Is this a grand innovation in economics that fulfills the long quest for the “Fountain of Youth” (an economy without recessions)?

Or is it just total BS – merely something for nothing policies.

You know my stance on that by now!

There are two increasingly clear scenarios now that this bubble is getting into its final stages – with tax cuts right at the worst time in history for them – according to our most powerful cycles:

Our projected late 2017 top on major cycles did occur. Stocks peaked on January 26, and are moving sideways this year, just as gold did between late 2011 and late 2012 before its collapse.

Another round of tax cuts, along with a temporary reprieve in the trade wars ahead, brings a final rally into our second great cycle peak around late 2019. On a 90-year cycle, that’ll result in our greatest depressions and resets from late 2019 to 2023, just like back in late 1929 to early 1933.

I’ll go over arguments for both cases, and show you which one I favor as of late October.

And we’re likely to see some fireworks between now and then, which could bring more clarity.

I’ll also give a summary of all of the key factors in our economy that economists simply cannot explain, and that our research CAN, starting with inflation (which they have absolutely no clue about) and all the way up to money velocity!

I’ll go over this, and more, at this year’s Irrational Economic Summit.

But I won’t be doing this on my own.

Some of the top minds will be there as well.

Like every conference, Dr. Lacy Hunt will be there. He is the ONLY classically-trained economist – and in great depth – that also has his feet on the ground as a real-world bond fund manager. He has one of the best “under-the-hood” indicators I’ve found, and can explain it in simple common-sense terms. He can tell you which countries are productively investing for the future and which are not.

And guess which two lead the shit list: China and Japan!

After being unable to attend last year, David Stockman is returning. He’s a great complement to our views and research, with strong political and financial expertise, along with real-world experience that includes once being the Budget Director for Reagan. In his bestselling book, he calls this era “the corruption of capitalism.” I call it “killing the golden goose.” He’s passionate, and the one of the only outside speaker that has gotten a standing ovation at any of our conferences that I can remember.

You won’t want to miss what David has to say…

As if that isn’t enough, we also have…

Neil Howe, the co-author of the ground-breaking book, Generations.

Oh, did I bow down and kiss the earth when that book came out in 1989. The whole terminology for naming generations like the “Millennials” comes from his work. He brings the whole socio-political side of generation cycles to complement our financial and economic dimension, and sees us in a revolution he calls “the fourth turning.”

And, of course, you know I stress that the biggest cycle hitting today is the greatest political and social revolution since the advent of democracy itself nearly 250 years ago.

That’s why I had to have him and Stockman at this conference…

George Friedman, author of the ground-breaking book: The Next 100 Years, will be there.

He’s a world-renown geopolitical expert. And someone we’ve greatly anticipating, and have finally been able to get for the first time.

If this isn’t a time of geopolitical turmoil – and coming into the worst of our 35-year Geopolitical Cycle in the next few years – I don’t know what is.

Don’t miss him.

To bring a technological perspective, we’ve Kevin Ashton, our keynote speaker.

He coined the term “The Internet of Things,” which best describes the current revolution in technologies, that will both transcend and enhance the last one. He’s the author of How to Fly a Horse, which gives you an idea of how this speaker uses simple, compelling stories to explain a complex topic.

Economic, political, geopolitical, and social trends…

We cover it all at this year’s IES in Austin, Texas, on October 25 through the 27.

I consider this to be the most important conference we’ve ever had.

Being at such a pivotal point between late this year and next year, it’s important know what’s happening, what is to come, and how to make it through when the shit hits the fan.

If there ever was a time to plan and strategize for your future – this is IT!

Two classmates of mine from Harvard Business School have come before, and are coming again this year. The difference is they’re telling our other classmates to come as well. They feel this is such a critical time to hear our very contrarian message – yes, even contrarian to the gold bugs…

And Austin is my favorite city to hang out in.

We’ll be right smack downtown within walking distance of everything.

So, stay an extra day or two and soak up some culture that the city has to offer. Maybe we’ll run into one another, and talk for a bit.

It’ll be a great time of the year. I can’t stress enough the importance of this conference, and my excitement for it.

So, keep an eye on your inbox over the next couple of days for more on IES. You won’t want to miss out what we have to offer…

Harry

Follow me on Twitter @harrydentjr

The post Our IES Is All About That appeared first on Economy and Markets.

July 20, 2018

The Backlash Against Globalization

There’s a big thing happening here, and many have understated it.

Some have flat-out ignored it.

In his latest bit of business, Trump met with Putin in Helsinki.

And there’s been a whirlwind of commentary and backlash regarding the matter.

Sure, it may not have been one of Trump’s finer moments. He may have wavered between one comment and another, claiming one thing then denying it altogether.

For a man who has “the impulse control of a grease fire,” it’s no surprise.

Though the meeting has implications of its own, this is not the problem…

Neither is the crackdown on trade with China, among other nations…

Or the clamp-down on immigration, which is being handled terribly…

These all feed into the larger issue at hand.

Globalization is under siege. And Trump is leading the charge in America.

He’s serving as the American equivalent to Brexit.

What many fail to recognize is the impact, along with benefits, that globalization has had on the U.S.

Of course, there are those nations who have taken advantage of our policies and past presidents…

And Trump serves as the restoration to some semblance of fairness in the world of global trade.

But how will his methods affect America, and the larger problem at hand, the economy?

Harry digs into this situation in his latest rant.

Click here, or the video below, to hear what Harry has to say…

The post The Backlash Against Globalization appeared first on Economy and Markets.

July 19, 2018

The Death of a Dream, Part 2

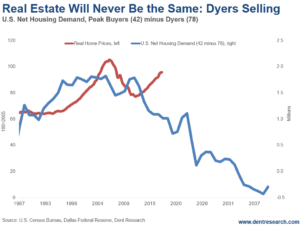

In I showed how Japan’s first and more massive real estate bubble peaked in 1991. And then showed how it crashed right along our bubble model into 2013.

The difference was, it never bounced. Even when its Millennial generation came along to buy houses again.

A rise of “dyers” (sellers) were offsetting the rise of Millennial buyers.

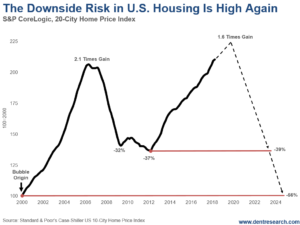

Now let’s look at the U.S. bubble – or our double bubble.

Our first bubble peaked after peak demand from Boomers (2003) in early 2006 on a 41-year lag. Ant it crashed. The demographic downturn we predicted set in after 2007. Right when the sub-prime lending crisis blew up.

It took six years to build, and six years to crash into 2012. That’s down 34% versus Japan’s whopping 70% over 13 years.

Massive QE and ultra-low mortgage rates created a second – now artificial bubble – that has recently eclipsed the first one. And it looks almost identical in its size and buildup time – six years from 2012 into 2018.

This bubble will burst within the next year.

Its target is the low of 2012, and likely the low of early 2000. That creates a 40% to 50% downside in the next six years, into 2024-2025 or so.

So, what has happened since the first serious real estate downturn since the one from 1925 through 1933?

According to a study by the online apartment service RENTCafé, since 2007 ownership has dropped by 3.6 million and renters have gone up by 1.9 million.

Yes, that means more Millennials living with parents, and rising homelessness.

The causes are obvious: Much tighter lending standards, remarkably low supply – especially of affordable, less profitable starter homes – along with soaring prices and valuations…

Home prices have gone up 35%, while rent is up only 20% in the last five years, making home prices 75% more expensive than rental prices. Both are way above wage gains, which have been near nil.

Overall, the bubble and crash thus far are not nearly as bad as Japan.

Our demographics aren’t as unfavorable, but still very much so given the new model of subtracting dyers from peak buyers.

In this case, peak buying in the future is at age 42 for the U.S. and age 78 for dyers, as we don’t live as long as the Japanese on average.

So, even if we hit a bottom by 2025 when the highest numbers of Boomers die, prices will still be likely flat to down a bit into 2039 or so.

There’s a big difference from Japan’s demographic spiral.

Net demand does not turn negative until 2032 – so we won’t have tens of millions of empty homes like Japan.

Builders will be even more cautious next time around, as will buyers, at first.

Millennials will ultimately choose to buy just to control their own house and destiny, even though appreciation is unlikely to top modest inflation.

“The Dream” of getting rich off of real estate will be dead by 2024, and no longer considered “on hold.”

The demand for vacation and retirement homes will peak last for the aging Baby Boomer generation around 2026. That would be the best time to sell those homes, if you don’t near term, to avoid a bigger crash ahead.

The best thing you can do is convince your kids to wait until at least 2024 to buy – and be happy renting until then.

They should look to other financial investments to build their wealth. Whether it be stocks in the booming emerging nations (like India and Southeast Asia). Or the next great commodity boom that’ll favor metals.

Or, let Adam, our Chief Investment Strategist here at Dent Research, lend you a hand in preparing for what’s to come. Using

Whatever you do, just know that the dream of owning a home for profit is dead…

Harry

Follow Me on Twitter @harrydentjr

The post The Death of a Dream, Part 2 appeared first on Economy and Markets.

“The Amazon Tax”

Recently the Supreme Court overruled previous decisions that said states couldn’t require companies without a physical location in their state to collect sales tax.

Now, online retailers must collect sales tax based on the consumer’s location, no matter where the retailer resides.

Before I get to what this means to Amazon (Nasdaq: AMZN) and others, it’s worth recalling that just because states could not force out of state retailers to collect the tax, it was always due.

Most consumers don’t realize that sales tax is not the responsibility of stores, it is the responsibility of consumers.

States just demand that retailers collect the tax at the time of a sale because it’s easier than chasing down millions of consumers.

For out of state purchases, as well as any other purchase on which tax was not collected, like at a garage sale or swap meet, consumers are required to file a form each year declaring their purchases and paying the appropriate tax.

Of course, no one does, and that’s the problem.

If we were law abiding citizens, the fight over sales tax on internet sales would be a moot point. Since we’re tax scofflaws, the courts stepped in, recognizing that we’re cheating state and local governments out of billions of dollars in revenue.

States should pick up an extra $8 billion to $13 billion in tax. That sounds like a lot, but it’s not.

In 2016, total sales tax revenue across the U.S. totaled about $375 billion. An extra $10 billion adds roughly 2.5%, which is way less impressive than talking about numbers in the billions.

As for Amazon, the company will be just fine, thank you very much. The e-commerce giant already collects sales tax on all the goods it sells directly, so no problems in that area.

However, third-party sales make up about half of all Amazon sales, and those retailers must start charging sales tax.

This might ding sales a bit in the short run, but it’s not like consumers will suddenly rush to shop at local stores simply because they are paying sales tax online.

After all, we already paid sales tax at the local store.

And there’s so much more than sales tax driving us to shop online.

Last week I needed a new pair of earbuds for swimming. These aren’t the sort of thing available at Target. I’m pretty sure my local Best Buy and Academy don’t carry them either. But I don’t know, because I didn’t drive over there to check.

It was wildly more convenient to order a pair online at Amazon and have them delivered to my door than spend at least an hour driving around, hoping I’d find the selection I wanted.

Online shopping combines convenience, price comparison, and inventory selection that physical stores can’t match. Requiring retailers to collect a tax already levied on physical stores does nothing to remove these benefits, it simply levels the playing field in one area.

Back to Amazon for a moment.

The company announced that it would collect sales tax in all 45 states that levy the tax by April 1, 2017. Last year, online retail sales increased by 16%, and such transactions grew from nearly zero in the late 1990s to 13% of all sales. Amazon captured 44% of online sales last year.

Third-party sales rose from 48% in 2016 to 50% last year and are tracking at 52% this year. But that’s not because of sales tax. Instead, Amazon is attracting more sellers to its platform where more clients are Prime members because of convenience and shipping.

We’ve fundamentally changed the way we shop, using online sales to broaden our search for both products and knowledge. Clipping us for sales tax, which we owed anyway, won’t cost much and won’t change our evolving shopping patterns.

So don’t cry for Amazon, or Wayfair, or any other online firm over sales tax. They never owed it anyway.

But you might shed a tear for the demise of your personal tax evasion.

While I don’t know many people that actively cheat on their taxes, I know more than a few who were happy to neglect sales tax in certain instances.

Those days are over, but at least you still get home delivery and can shop at 2 a.m. from your couch.

The post “The Amazon Tax” appeared first on Economy and Markets.

July 18, 2018

Economic Seesaw: Inflation Up, Spending Down

Is the global trade war heating up, or has President Trump positioned America to make itself great again?

Despite his bluster and penchant for causing angst among enemies and allies alike, Trump’s tactics seem to be working.

China seems ready to negotiate on trade, while Europe seems to have conceded on increasing military spending to support NATO.

In contrast to most politicians, he’s a man of action (and tweets) – not just empty promises, regardless of the feathers he ruffles.

Trade worries will likely lead to more volatility in the markets.

But don’t forget about the inflationary pressures creeping into the equation.

Creeping Inflation

The U.S. Labor Department released the June producer price index on Wednesday.

Headline inflation came in at 0.3% on the month, topping the consensus estimate of 0.2%. Year over year, wholesale prices climbed by 3.4%. That’s an acceleration from last month’s 3.1% increase.

Excluding food and energy, producer prices ticked up 0.3% on the month, in line with expectations. For the year, inflation came in at 2.8%, up from 2.6% in May.

The market doesn’t pay as much attention to wholesale prices as consumer prices. However, these increases eventually will be passed on to the consumer.

The June consumer price index (CPI) showed signs that some pricing pressures have started to filter through.

CPI inched higher in June, but the headline rise of 0.1% fell short of expectations for a 0.2% increase.

Core prices, which exclude food and energy, ticked up 0.2%. On a year-over-year basis, consumer inflation came in at 2.3%, slightly higher than the consensus estimate of 2.2%.

Spending Slows

On the surface, retail sales improved in the month of June, with overall spending matching expectations for a 0.5% increase.

Last month’s headline and core (excluding auto and gas sales) figures were also revised 62.5% higher.

However, core retail sales ticked up by a measly 0.3%, falling short of the consensus forecast for a 0.5% increase.

Auto sales held up well during the month. Maybe consumers were trying to get a leg up on potential tariffs.

Personal care and building materials also fared well last month. Clothing, sporting goods, and general retail merchandise were down sharply.

Retail sales account for half of consumer spending, which accounts for two-thirds of the U.S. economy. The Federal Reserve and the markets pay close attention to trends in spending.

Bottom Line: Inflation has finally entered the picture, which should make the Fed happy about its actions up to this point.

But as last week’s jobs report showed, wage inflation remains muted.

The Market in 3 Sentences

The escalating trade war between the U.S. and China has made market participants cautious, contributing to the flattening yield curve.

On the plus side, corporate earnings are healthy, manufacturing is in full gear, consumers are still spending at a pretty good clip, and, if trade issues are ironed out, we could see a real bounce in long-term yields.

All this adds up to potential volatility Treasury markets, so be ready for the next trading opportunity!

You can prepare for and profit from surprises in the financial markets with Treasury Profits Accelerator.

Happy trading to you,

Lance

The post Economic Seesaw: Inflation Up, Spending Down appeared first on Economy and Markets.