Harry S. Dent Jr.'s Blog, page 46

August 14, 2018

Rent the House You Live in… Buy One Far Away to Rent Out…

I enjoyed two recent articles by Andrea Riquier at MarketWatch.

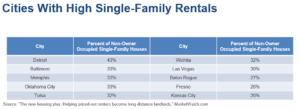

The first was “The new housing play: helping priced-out renters become long-distance landlords.”

It was a strategy aimed at people living in unaffordable areas – like San Francisco, Los Angeles, Miami, or New York…

By renting there to avoid both high purchase costs and a major bubble burst (when it inevitably comes), you free up your borrowing power to buy a house in an affordable area where renting for income is more lucrative, and far less risky.

These are places with high percentages of single-family rentals, like Denver, Las Vegas, or Kansas City.

With the exception of Baltimore, these cities are not on the expensive coasts. But rather more towards the center of the country.

They have more middle- or lower-income families that are struggling, and can’t afford to buy even in these less over-valued areas. With the exception of Denver – to a degree – none of these are bubble cities that are likely to crash and crucify you.

In a second article called “Pick your poison,” Riquier shows that there are two ways to make money in real estate. And they tend to be more mutually exclusive.

Look at this chart that rates areas by quality of life.

The “A” areas appreciate the most at 21% annually. That’s about twice as much as the “B” and “C” areas.

The worst – “F” areas – have slightly negative appreciation rates at -0.4%.

Not at all the place to buy!

But the “A” areas are actually the worst at this time, as they are out of reach of most buyers and will get hit the worst when this second – and final – real estate bubble bursts.

Now, look at the average rental returns.

They’re the highest in the poorer “F” areas at 10.1%, which is damn good. Rentals don’t vary as much as appreciation, and are still good at 7.9% in the “A” areas.

But there, again, your risk is that the property falls by 30% to 50% while you own it and wipes out many years of rental gains.

The rental appreciation rates are also higher in the lower quality areas. There are now online companies – Roofstock, Home Union, Investability, and OwnAmerica – that help you identify, purchase, and manage such long-distance rentals.

One of the best sites at this point appears to be Roofstock.com. They charge a 2.5% brokerage fee to the seller, and 0.5% to the buyer.

That’s cheaper than the standard 6% commission.

Roofstock reports their clients are averaging 10.3% rental yields since its inception.

Teaming up with people you know in such areas is another way to do this.

Here’s the ultimate strategy, and you should do this now before the next crash while it’s easier to borrow.

In that crash, rentals will tend to hold up. Housing prices will fall. Use your equity and cash flow from owned rentals to buy the far cheaper foreclosures (often by just taking over the payments at a discount) then rent them out for even more profits.

This is what smart money did during – and after – the 2008 crisis.

Hedge funds and individual investors bought single family houses for cheap then rented them out for strong, positive cash flow.

And it gave them the potential to both buy more as the downturn progressed and to sell down the road when the market was better.

Single-family rentals attract older, more family-oriented renters that stay twice as long as in apartments (three years compared to one and a half years on average). They’re less likely to default or cause problems – like burning down the house…

You can choose to sell the houses in a better market later down the road, and your renters may become the buyers.

Or you can just keep renting them out at stronger returns from buying them so cheap to finally buy the house of your dreams in a once-expensive city of your choice!

Harry

Follow me on Twitter @harrydentjr

The post Rent the House You Live in… Buy One Far Away to Rent Out… appeared first on Economy and Markets.

August 10, 2018

Middle Class, Beware

In San Francisco, a household now needs an income of $188,000 to afford rent for the average two-bedroom house or apartment with 30% of the household income spent on housing.

The problem is that the median income is only $103,801.

Housing is 81% out of reach!

And this is true across the country as well.

It takes an hourly wage of $22.10 to afford the median two-bedroom apartment versus the actual median wage of $16.88.

That makes it 31% out of reach. And the median cost for a two-bedroom apartment three-times minimum wage.

The most expensive state is Hawaii at $36.16 compared to the $16.16 actual hourly wage earned, making it 123% out of reach.

Meanwhile, the lowest is Arkansas at $13.84 needed, and an actual hourly wage earned of $13.05. That is only 6% out of reach.

Then there’s Puerto Rico at only $9.24 an hour to afford that median two-bedroom versus $9.76 of actual wages.

Finally, an affordable place to live as a U.S. citizen.

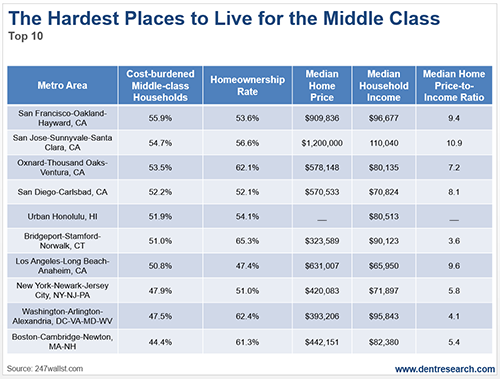

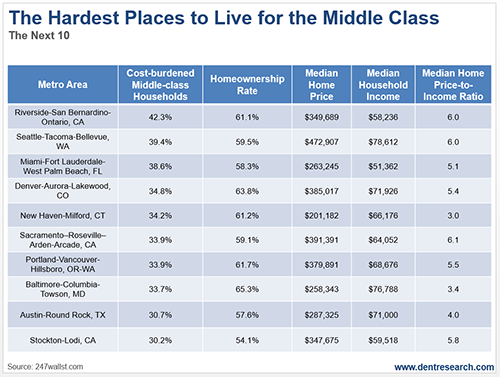

The next two tables summarize a recent survey that ranked cities by the percentage of households that are cost-burdened by renting or owning houses.

This means that they spend over 30% of their income on housing.

They also have some good information on incomes and housing affordability.

The top five for cost burdens are San Francisco (55.9%), San Jose (54.7%), Oxnard/Thousand Oaks/Ventura (53.5%), San Diego (52.2%), and Honolulu (51.9%). Four of these are in California – no surprise.

And Hawaii has always been expensive.

The lowest out of these are Stockton (30.2%), Austin (30.7%), Baltimore (33.7%), Portland (33.9%), New Haven (34.2%), and Denver (34.8%). It jumps to 39%-plus from there.

Austin and Denver are rated high for attractiveness as well.

Housing for ownership is least affordable in San Jose at 10.9-times median income. Los Angeles comes in at 9.6, with San Francisco at 9.4, and San Diego at 8.1.

Honolulu is not quoted here on home prices, but other surveys put its price-to-income ratio at near 10 times, similar to San Francisco.

Conversely, the lowest home ownership rate is in Los Angeles at 47.4%, with both high prices and lower incomes.

Only Miami has lower.

Both of these high-cost rental cities have the lethal combination of expensive housing costs and modest median incomes.

New York is at 51.0%, with San Diego (52.1%), San Francisco (53.0%), and Honolulu (54.1%) all in the same range.

The most affordable price-to-income ratios for home ownership are in New Haven, Connecticut, at a fair 3 times as much, Baltimore at 3.4, and surprisingly, Bridgeport/Stamford at 3.6 times.

A painful housing correction is due to hit.

And it’s precisely the medicine the economy needs to allow the ‘American Dream’ to stay alive for the up-and-coming Millennial generation.

It’s us – the older Baby Boomers – that will feel the brunt of things if we don’t get out of the way.

The post Middle Class, Beware appeared first on Economy and Markets.

August 9, 2018

The Greek Tragedy Is Far From Over

Last week, Greece received $17 billion from its creditors, representing the final installment of the country’s third bailout since 2010.

This is the last one.

Really. Stop laughing.

There’s no doubt the Southern Mediterranean country has endured a lot of pain over the last eight years.

To revamp their economy, the Greeks cut back on public pensions, increased taxes, and swept away some of their debt overhang.

The results have been impressive.

After watching their GDP fall by as much as 25% from pre-recession levels, the Greek economy has grown over the last two years and the government has posted primary (meaning before debt payments) surpluses.

That’s awesome, but it’s not enough.

This is a tragedy that seems to have no end.

The Greeks and their creditors claim the bailout can end because the ailing country has mended and has a sustainable path.

But the details tell a different story.

To make the numbers work, the Greek creditors gave the country a short-term pass on much of its debt, which includes a 10-year extension on previous loans, and a 10-year moratorium on interest and amortization.

Essentially, Greece is OK as long as it doesn’t have to pay back very much. But even that’s not a sure thing.

Greece must run a primary budget surplus of 3.5% until 2022, and then a 2.2% primary budget surplus after that.

As a refresher, NO ONE does that.

Maybe a country, like Germany, runs a bit of a surplus for a year or two. Maybe a country, like Australia, runs a decent surplus for years.

But a 3.5% surplus for several years, followed by 2.2% indefinitely?

And this in a country with 20% unemployment, a difficult workplace environment, few exports and an aging population.

Not a chance.

To make matters worse, Greece is starting behind the eight ball.

The country currently carries 180% of debt-to-GDP, and has raised taxes to the point that it’s driving the economy back underground.

Starting this year, professionals earning 5,000 euro per month, about $5,500, must pay 75% in combined taxes and security contributions.

That income level is a mere $66,000 per year, which is decent, but not excessive.

Imagine if three out of every four dollars you made had to be sent to Uncle Sam.

And that’s not all.

Greek banks haven’t recovered.

In 2016, non-performing loans made up just over 50% of all loans in Greek banks. That number dropped to 43% earlier this year, and the ECB wants to see bad loans at 35% by the end of 2019.

But that still means that more than one-third of all loans in Greek banks aren’t performing!

With capital ratios at a generous 10%, the Greek banking system remains dead broke.

Not everyone is blind to the situation. The IMF refused to participate in the last few rounds of lending to Greece, noting that without more loan forgiveness the country couldn’t pay its debts.

Everyone knows this, but the other lenders – the European Commission and the ECB – have bigger problems.

They can’t ask investors holding Greek bonds to take a haircut because those investors include other central banks in Europe as well as some of the largest private banks, all of which have their own capital problems.

As long as they keep the debt on their books, even if they allow Greece to take 100 years to repay it, they can claim that the debts are in good standing.

It’s a game of musical chairs.

When the music stops, not everyone will have a seat.

When the Greek economy finally breaks down, it’s possible the country will finally call it quits on the euro.

When that happens, even the ECB will have to admit that this is a tragedy, not a triumph.

P.S. Back here stateside, our Adam O’Dell is getting ready to celebrate the five-year anniversary of his Cycle 9 Alert trading service with a special event he’s calling the “Seven-Figure Summit.”

He just bagged a 430% gain in the service, so now’s the perfect time to hear what he has to say.

Click here to for more information and to sign up for free.

The post The Greek Tragedy Is Far From Over appeared first on Economy and Markets.

August 8, 2018

Central Banks Do the Tighten Up

The Bank of Japan (BoJ) shook the global credit markets last Tuesday.

Even Treasury bond investors perceived the BoJ’s tweaks to its monetary policy as a signal that the transition away from extraordinarily accommodative measures may be coming.

The BoJ introduced forward guidance and will allow the 10-year government note to trade in a slightly wider band.

The central bank didn’t change its plan to purchase assets (quantitative easing) or key interest rates.

With core inflation hovering around 0.8% and the BoJ targeting 2%, don’t expect the central bank to scale back its security purchases anytime soon.

Harry has written about Japan’s demographic problems for decades and has explained why there’s really no way for the central bank to fix these issues.

I’m not sure why global interest rates shot higher in response to the BoJ’s tweaks, but they did.

The market’s animal spirits sometimes work in mysterious ways.

London Calling

Last Thursday, the Bank of England (BoE) increased its key interest rate by 25 basis points to 0.75%.

The move didn’t come as a surprise. At 2.4%, inflation had crept above the BoE’s 2% target. That said, the Brexit fallout could damage the UK’s recent economic recovery.

Further rate hikes aren’t expected until next year, if the recovery continues and if the Brexit process is resolved in an orderly fashion.

Those are a couple of big “ifs,” but the markets didn’t react much to the BoE’s actions.

Exporting Inflation

What do we take away from the BoJ and BoE’s recent policy decisions?

The Federal Reserve’s efforts to normalize monetary policy and shrink its balance sheet have started to export inflation to economies around the world.

Will it persist?

It’s too soon to tell, but we’ll keep an eye on the situation – and alert you to any trading opportunities that emerge.

The Fed Holds Steady

As expected, the Federal Reserve held rates steady at its most recent meeting.

However, market participants did receive a signal that another hike is on the horizon.

The Fed upgraded its view of the economy from “solid” to “strong” and noted that consumer spending has “grown strongly.”

That’s based on the robust, preliminary estimate of economic growth that came out last Friday.

It’s not a lock that the Fed will hike interest rates in September, but the market has already priced in another bump.

Meanwhile, the housing market has started to show some initial cracks in the foundation. That trend bears monitoring.

Trading Tariffs

Aside from worsening housing data, President Trump’s escalating war of words and tariffs with China and the rest of the world remains a big concern and creates a lot of uncertainty.

Stocks sold off sharply last week, after Trump threatened to increase the 10% tariff on $200 billion worth of Chinese goods to 25%. His reasoning: China is playing currency games to negate the original tariffs.

Inflation Watch

Last Tuesday, the U.S. Bureau of Economic Analysis released data on personal income and outlays for June.

Consumers continue to spend, but incomes have increased at a similar pace – 0.4% on the month. Both figures were in line with expectations.

The Fed’s preferred inflation gauge – the personal consumption expenditures (PCE) index – pulled back in June.

Month over month, inflation grew by 0.1%, as expected.

However, core inflation, which excludes volatile food and energy prices, came in at 0.1%, which was below the consensus estimate.

On a year-over-year basis, inflation fell to 2.2% from 2.3%. Core inflation also slipped to 1.9% from 2%.

The market didn’t react to the PCE data, perhaps because the Fed’s policy statement was slated to come out that afternoon.

I expect a big reaction if this week’s consumer inflation data falls short of expectations.

Manufacturing Slows

A slowdown in manufacturing didn’t move the markets, either.

The Institute for Supply Management’s (ISM) manufacturing index fell from a blistering 60.2 in June to 58.1 in July. As a reminder, readings above 50 indicate an expansion in manufacturing activity.

Orders slowed, but demand remained strong. Backlogs weakened somewhat, and production eased. However, U.S. manufacturing industries appear to be in good shape.

Not surprisingly, participants in the ISM survey cited the trade wars as a major concern.

The Main Event: Employment Data

The July employment data released last Friday turned out to be a mix of good and bad news.

Whereas the consensus estimate called for the U.S. to add 193,000 non-farm jobs last month, payrolls increased by only 157,000.

On the plus side, the Labor Department tacked on 35,000 new jobs to June’s non-farm payrolls, taking some of the sting out of the disappointing July data. The unemployment also rate fell to 3.9%, as expected.

Wage gains were more important to the Fed and market participants.

The good news is that monthly hourly earnings met expectations, growing by 0.3%; the bad news is that last month’s earnings growth estimate was cut in half to 0.1%.

Year over year, earnings grew by 2.7%, the same as last month.

Overall, the jobs report was just okay and probably won’t prompt the Fed change its policy course.

Lance

The post Central Banks Do the Tighten Up appeared first on Economy and Markets.

August 6, 2018

The Suburbs Are Back

Lately, I’ve been focusing a lot on real estate.

There are starting to be clear signs of extremes in pricing, and high rent burdens.

Cities are starting to crack on the high end.

It’s what I’ve forecasting – that this second bubble burst would start on the high end and work down. Unlike the last bubble, which started on the low end with the subprime defaults.

Millennials are increasingly becoming the buyers. They’ve been a bit reluctant to do so due to tighter lending and the lingering pains of the last crash… yet they are finally buying in, as they can’t wait forever.

But prices are so high in most cities that buyers are turning back towards the suburbs.

So, what do the new Millennial’s want?

Good school systems.

Quick and easy commutes.

Low crime rates – like always.

But now, more than ever, charming and walkable town/central areas.

I was at a wedding north of San Francisco, and was hanging out in Sebastopol and Petaluma. Talk about perfect little suburbs… And both within a reasonable commute of San Francisco.

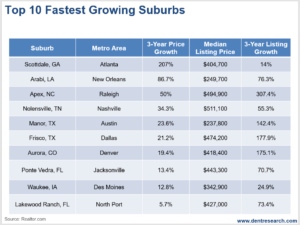

Here are the top 10 up-and-coming suburban areas – most you’ve likely never heard of – ranked by Realtor.com.

This list is based off a number of factors ranging from growth to affordability to ease of commute.

The point is, these represent the type of suburban areas that are doing the best in this market.

Keep in mind – as I continue to remind you we’re in the late-stage of this second bubble – that this is not the time to be rushing out and buying.

But if you do have to buy, buy in areas that aren’t as overvalued. Or in areas where you can get a great deal on the purchase.

Most importantly, these are the types of places you or your kids want to buy in the next crash and downturn. They’ll have most appeal to Millennial buyers down the road.

Number six on this list, Frisco, Texas, is just outside of Dallas.

An associate in our company wanted to buy there during the first bubble.

She had a great deal on a foreclosure, but knew I was cautious on real estate.

When she asked me about it, I told her to go ahead, as Texas was the least overvalued major city in that bubble. And Frisco was an up-and-coming suburb with a 30-minute – give or take – commute to downtown Dallas.

Frisco is now one of the hottest suburbs, with median prices at $474,200.

That investment clearly paid off despite riding out the previous crash, which was more minor there.

It’s now typical of such hot suburbs with median home prices in the $400,000 to $500,000 range. Roughly twice the median in the U.S.

Now, I’d like to draw your attention to the two most affordable of these “hot burbs” as examples of the type of places to look for.

The first, at number five, is Manor, Texas.

It’s just 12 miles outside of Austin with a 10- to 15-minute commute to downtown Austin in light traffic, all on freeways. And Austin is one of the hottest and most desirable cities, as I covered in Thursday’s .

It’s also right off of the new I-45 with a 75-mph speed limit (which means most are cruising at 85). There’s little traffic, and it’s just a two-and-a-half-hour trip into Dallas.

The median home price there is a very average $237,800.

Then there’s Arabi, Louisiana, at number two.

Just seven miles outside of downtown New Orleans, right off Highway 39, which connects into I-10. It’s probably about a 10-minute commute in light traffic… Not too shabby.

Median prices there are a mere $249,700.

At number eight is Ponte Vedra, Florida.

It’s like the Hamptons of northern Florida. And is just outside of Jacksonville.

I spoke there twice and loved the area.

If you’re wondering where number 10 on the list, Lakewood Ranch, is… it’s just 20 minutes outside of Sarasota, which I consider the most attractive, affluent retirement area in Florida. With a 50-minute commute to Tampa, and 45 minutes to the nearest major airport, I’d say it’s an easy spot to be.

This is clearly the time to have restraint in buying, as I’ve been saying.

But it’s a great time to scope out the areas to pounce on when the crash sets in and bargains start to appear.

Especially when it comes to foreclosures.

These suburbs are hot, and may be the best potential investment for you, and more so for your kids.

Harry

Follow me on Twitter @harrydentjr

The post The Suburbs Are Back appeared first on Economy and Markets.

August 3, 2018

The Real Estate Bubble [Video]

Over the past month or so, Harry has been relentlessly giving you coverage on the current state of real estate.

He’s looked at the demographic trends that go hand in hand with the current bubble, determining that, without a reset, the economy will weaken over time.

He’s covered the “dream on hold,” the reasons for it, and the potential outcome of this occurrence in a two-part series.

And he’s highlighted the lighter bits of this bubble… like which cities are most desirable, and which out of those desirable cities are well worth your money.

It’s an important economic factor that will have a powerful impact in the years to come.

What it boils down to is that the artifice propping up our economy cannot last. It cannot sustain itself year after year.

And the cracks are becoming more visible.

However, economists in the U.S. choose to ignore them.

Instead, they push onward, full steam ahead, without looking back, or to either side, or off into the distance…

Rents are increasing.

Mortgage rates are also on the rise.

People are spending almost their entire paychecks on a place to live.

It’s completely untenable.

That kind of lifestyle cannot, and should not, last.

Our real estate bubble is just a symptom of a larger problem that lingers just over the horizon.

Harry’s coverage of this shifting market will continue. He has much to say about what’s happening.

Click here, or the video below, to listen in.

The post The Real Estate Bubble [Video] appeared first on Economy and Markets.

August 2, 2018

The Most Desirable Cities in the U.S.

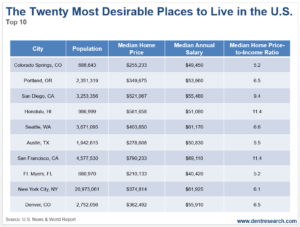

There was an update to the rankings of the most desirable cities to live in the U.S. by U.S. News & World Report.

Colorado Springs sprung into first place for the first time. I’ve been there, and can understand why they picked the place.

It’s beautiful, at the foot of dramatic mountains (Pike’s Peak), close to the glorious Broadmoor Resort, and only one hour from one of the most attractive larger cities, Denver, which comes in at number 10 on the list.

I’ve broken these into two tables so you can read the key stats.

And I rank them in the order that U.S. News & World Report did, not according to affordability.

Do I advise buying in any of these places near the top of the second great real estate bubble since 2000?

No.

Though there are a few possible attractive deals.

But if you’re moving and must buy, there are places that are more affordable and have lower risk than others…

More importantly, the best and most overvalued cities – like San Francisco – will tend to be the better buys when this inevitable second (and final) bubble crash sets in. That’s very likely to begin within the next year.

The original ranking was for the top 25. But I found the top 20 to be inclusive enough of the best places.

There are great things about all of these places, and they all deserve to be on this list. At a point, it becomes a matter of personal preference.

The most affordable – in order of median price to median income valuations – are Myrtle Beach (visit there every year with my family) at 4.0 times, New Orleans at 4.2, Port St. Lucie at 4.4, Phoenix at 5.0, and Nashville, Fort Myers, and Colorado Springs at 5.2.

Austin comes in at 5.5.

Phoenix is a standout for a large city (fifth largest in the country).

While Austin does this for medium-size city, and Myrtle Beach for a small city.

For big city people, New York is the place at 6.1 times, just not in Manhattan.

San Francisco is the worst at a whopping 11.4 times, followed by L.A. at 9.9. They have the highest state income taxes in the country.

Boston and Seattle are also more reasonable large cities at 6.2 and 6.6, respectively.

Chicago is the third largest city, and the most affordable by far, but it doesn’t make this list due to quality of life. Outside of brutal cold, high winds, and heavy crime on the south side, it’s downtown and best suburbs are very attractive.

My choices – given my clear propensity for warmer climates – would be Austin, Charleston, Asheville, and Phoenix.

Sarasota, Florida, which is a high-end retirement community one hour from the Tampa airport, is another place of appeal to me.

Its median house price is $234,000 versus the median income of $42,000, or 6.3 times. They have a Whole Foods, Trader Joes, and a great gourmet food store.

That’s quite good for a city with only 265,000 people. Something you won’t find in Myrtle Beach.

Again, I stress that these are the places you want to buy in the long-term when the crash finally sets in. It could take several years to hit a bottom like the last crash, and prices are likely to crash more like 40% to 50% nationally compared to the 37% last time.

But some great deals could come in the first few years of it.

The more expensive cities like San Francisco, Los Angeles, and Honolulu will still be the most expensive. It’s just that they will drop more, and are likely to be better bargains in the long term…

But don’t expect price appreciation in the coming decades to be anything like it was from 2000-2018.

That’s not likely to ever happen again. At least, not in our lifetimes…

The continual increase of dyers is offsetting buyers, and will for decades to come.

So, buy real estate because you love the house and want to live in that place.

Buy to rent only if you can do so for sustainable and positive cash flow.

Otherwise, don’t buy real estate at all…

The time of buying any real estate to get rich is over!

Harry

Follow me on Twitter @harrydentjr

The post The Most Desirable Cities in the U.S. appeared first on Economy and Markets.

August 1, 2018

A Deal With the Deficit Devil

Second-quarter U.S. GDP jumped by an annualized 4.1%, putting a spring in the step of the Trump administration and the congressional leadership.

And why not?

Those two groups are responsible for turbo-charging the U.S. economy through tax reform, which cut taxes by more than $1 trillion, putting a ton of cash in the hands of corporations and consumers.

Businesses increased their fixed investment, but many public companies used the funds to buy back their stock.

Consumers purchased cars and ate out a bit more.

Economically, we feel good and we look good, even as we fight trade wars with our major trading partners. But this beauty comes at a cost.

The latest tax reform slashed business taxes, simplified personal income taxes, and even lowered tax rates on individuals.

Given that we already ran a budget deficit, cutting government income means that we’ll run higher deficits.

When the tax bill passed, the U.S. Treasury, Congressional Budget Office, and various other government bodies estimated that we’d see twelve-figure deficits in 2020 or so.

They were wrong. We’re ahead of schedule. It looks like we’re tracking for such a deficit today and will definitely run that far in the red next year.

There was a time when $1 trillion annual deficits would cause us to howl in protest. No longer. We’ve grown accustomed to big numbers, numb to their corrosive effects.

We didn’t buy our current economic growth spurt. We didn’t even work for it. We financed it.

The amazing part is that Congress had to contort the tax bill to fit into budget reconciliation so that the legislation could pass the Senate with only 50 votes.

Since the reform requires no responsibility and promises to give away other people’s money, how could any of them be against it?

The old trope is that we’re mortgaging our children’s future.

I don’t think it will take that long to feel the effects.

This is more like a credit card where the bill will become a problem in a few short years, we won’t have to wait a generation. We’re not starting at zero.

We already had national debt of $20 trillion before tax reform. Some people argue that $4 trillion of that is owed to ourselves through the Social Security and Medicare trust funds.

Fair enough, but we still owe the money, so in my book it’s still a debt.

Without greater productivity, increased GDP will be a passing thing. As growth eases back to the long run estimate of 1.9% over the next year or so, we’ll look back and wonder what we bought with our tax reform.

A few more cars and a load of calories. Perhaps higher prices on stocks because of corporate buybacks.

And we’ll still owe the debt.

Estimating when the higher debt will catch up with us is a fool’s errand.

Being foolish, I thought that the $1 trillion-plus deficits at the end of the last decade would scare people to the point of demanding fiscal responsibility by Congress.

I was wrong. Many of us wrung our hands, but the Fed kept interest rates in line by purchasing trillions of dollars’ worth of bonds, so we suffered no obvious financial wounds. The issue faded away.

Now the Fed is shedding bonds. We’re fighting with our trading partners, the very countries that end up with our currency because they sell stuff to us and then use those greenbacks to buy our bonds.

The European Central Bank has signaled that it will end its bond buying program. The Bank of England has discussed higher interest rates.

The bond world, where deficits matter, is rapidly changing.

In a few short years, bond sellers of all stripes – governments, corporations, etc. – will have to rely on traditional buyers such as pension funds, insurance companies, mutual funds, and individuals to support their debt habits.

Those buyers are more cautious and rate conscious than central banks, which typically means higher interest rates.

And we’ll be running even bigger deficits.

Because the tax reform passed through budget reconciliation, it must be deficit neutral over 10 years. The architects accomplished this by raising taxes on individuals starting in 2021.

At that point, we’ll have slow economic growth and at least another $3 trillion in debt, so our government will be paying interest on more debt, likely at higher rates, and raising taxes to boot.

I’m glad to see higher GDP. I hope it sticks around for a while. But I’m concerned that we looked into an economic hole, picked up our shovel, and dug faster.

Rodney

The post A Deal With the Deficit Devil appeared first on Economy and Markets.

Buckle Up for Volatility?

Stocks have struggled to make new highs in recent weeks.

What’s going on with the economy?

With the help of the Federal Reserve’s extraordinary policy measures, U.S. gross domestic product (GDP) has expanded slowly over the past nine years.

The U.S. economy grew at a 4.1% rate in the second quarter, the fastest pace since 2014. That wasn’t bad, but the consensus estimate called for a 4.2% expansion.

Spending grew by 4% over the first quarter, while income increased at a 2.6% pace. Prices moved up 1.8%.

The market wasn’t impressed. Stocks fell on the news. Treasuries rallied, and yields declined.

What’s Next?

Here’s the big question that investors must consider: What will fuel future growth?

Corporate earnings are a question mark because of the murky outlook for global trade.

Remember that the surge in second-quarter GDP reflected, in part, a rush to export before tariffs were in place.

Volatility is on the rise in the stock market, but investors appear to be focused on earnings, as opposed to fretting over every trade-related tweet.

Of course, some companies have warned that trade issues could result in weaker earnings down the line.

The Fed’s post-crisis actions have helped to inflate asset prices and foster economic growth.

But the central bank has started to remove these supports, hiking interest rates steadily and shifting from quantitative easing to quantitative tightening.

I believe the main reason that the Fed plans to hike rates further isn’t to get ahead of inflation.

Rather, the central bank aims to have the necessary policy tools available when the economy slows.

The First Domino to Fall?

Housing is starting to show signs of weakness.

In June, sales of existing homes fell for the second consecutive month, declining 0.6% sequentially and 2.2% year over year.

Although the median sales price increased, inventories also expanded, which is good news for buyers.

I’m not sure how prices went up when sales volumes slipped and inventories increased. But I don’t expect prices continue to rise if sales slow and mortgage rates move higher.

What concerns me about recent weakness in the real estate market is that we’re in the peak sales season!

New-home sales also dropped 5.3% month over month, while the median price dipped 2.5%. On a year-over-year basis, sales of newly built homes ticked up 2.4%. The median sales price, however, slipped 4.2%.

Existing-home sales make up the bulk of real estate transactions, but new-homes sales are more important because of the “ripple” effect from sales of appliances, furniture, and related items.

Monday’s June pending home sales were up slightly on the month but still down 2.5% on the year.

Brace for Volatility

As I’m writing this installment of Economy & Markets, the Fed’s monetary policy arm, the Federal Open Market Committee (FOMC), is meeting.

No policy change is expected when the FOMC issues its statement on Wednesday afternoon, and Fed Chairman Jerome Powell won’t host a press conference.

If the Fed doesn’t surprise the market, the focus will shift to the July employment report, which comes out on Friday.

Wages are expected to increase slightly, while the consensus estimate calls for the economy to add 190,000 non-farm jobs.

If wage growth disappoints, Treasury bond yields could retreat. Lower-than-expected job growth might move stocks lower.

All this adds up to continued volatility in Treasury markets, so be ready for the next trading opportunity!

You can prepare for and profit from surprises in the financial markets with Treasury Profits Accelerator.

Lance

The post Buckle Up for Volatility? appeared first on Economy and Markets.

July 30, 2018

Trump’s Trade Wars Will Hurt His Supporters

There’s ideology.

And then there’s reality and outcomes.

Unfortunately, the trade war overtures in the name of fairer competition, disfavors jobs in the red states far more than in the blue ones.

In Thursday’s issue, I looked at how curbing immigration is likely to be a major factor tipping us into the next recession.

That recession will turn into a depression, given the extreme bubble economy created by QE policies, and – now – tax cuts.

Trump quickly learned in 2016 that the top Republican voters’ “hot buttons” were immigration and unfair foreign trade agreements.

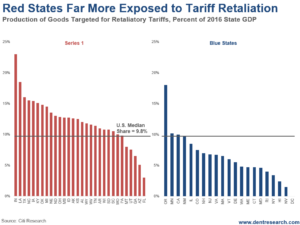

These were the far right’s concerns. But his trade policies will hurt the red states more, as the chart below demonstrates.

The far left campaign of Bernie Sander’s was more about the 1% taking all the gains, and the corruption of Wall Street…

As it turned out, everyday voters cared more about those hot button topics than the rich getting richer.

And more of the everyday blue-collar democratic voters leaned towards the right on Trump’s issues. That’s how key swing states in the Midwest were won, earning the electoral college despite losing the total vote.

The red states have exports of $2.1 million versus blue states at $1.7 million. That’s 24% higher for red state exports.

But the numbers get worse…

When you look at exposed jobs in red states at 3.9 million versus 2.5 million in the blues states, things don’t look so good.

The red states have 56% more exposed jobs than blue states.

The chart below shows the states that have a higher median exposure of 9.8% of GDP to the tariff retaliations expected.

There are 23 out of red 30 states with above that 9.8% median job exposure to foreign tariff retaliations.

The highest is Indiana at a whopping 23%, and that’s Pence’s home state.

Texas – the largest – is at 16%.

There are only four out of 20 for the blue states, with Oregon the highest at 18%.

And the largest, California, near the median at only 10%.

Also, notice how there are 30 red states against 20 blue. The red are generally more rural, while the blue more urban, which means less territory, but higher density (and hence more liberal).

It was the rural leaning states that gave Trump the edge in winning the white swing voters there at more like 80%.

And it also favored him in the electoral college, which favors space over density.

Red states – being more numerous and affected – had an especially large impact on the Senate. Each state gets two, regardless of population (unlike the House).

The red states with the highest exposure to GDP, in order, are: Indiana, Louisiana, Texas, North Carolina, Iowa, Kentucky, Oklahoma, and Michigan.

The blue states are: Oregon, Minnesota, California, and New Mexico.

So, we’ll see how those swing voters feel when they start losing their jobs…

And a recession – an eventual depression by my forecasts – will clearly hurt the incumbent president and his party.

This will very likely happen by early 2020, just ahead of the next major election.

I always stated that whoever won in 2016 would not be re-elected in 2020!

When the 1929 crash and Great Depression set in, a businessman (Hoover) had been elected in 1928 as a Republican…

And who won big in 1932? Well, you should know the outcome of that by now…

Harry

The post Trump’s Trade Wars Will Hurt His Supporters appeared first on Economy and Markets.