Harry S. Dent Jr.'s Blog, page 42

October 4, 2018

Running Out of Affordable Homes

Bubbles are self-defeating. Their success is what eventually kills them.

The same is true for cycles.

Take the urbanization cycle for example…

As a population urbanizes, people get wealthier. But more affluent urbanites have fewer kids and that slows future demographic growth for the next generation.

Real estate is the latest bubble/cycle to prove this point…

At first, the faster home prices go up, the more people buy (usually with a mortgage). But at some point, fewer and fewer people can afford the prices that are outstripping economic growth and incomes.

And fewer people want to sell a winning hand, so there’s less inventory.

That’s exactly where we are today across the U.S.

And it’s worse in Canada and Australia (especially since they didn’t have a bubble burst in the great financial crisis). Their prices and consumer debt ratios are far higher than ours.

The situation has gotten so bad in Australia that Greg Owen of GOKO Management has asked me to come back to his country six months earlier than I normally would! Prices are cracking with increasing speed in what once seemed like a Teflon real estate market thanks to high Asian immigration and foreign speculation.

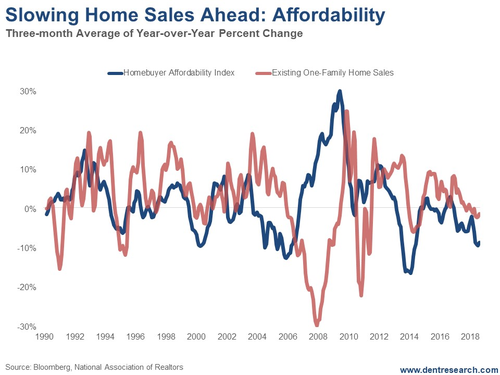

Here at home (in the U.S.), this chart shows that home sales are slowing, even though the economy is doing better after Trump’s tax cuts.

This is happening because there aren’t enough affordable homes available for sale!

Last time around, home sales peaked late 2005 into early 2006, long before stocks peaked and the economy slowed into recession. Back then, the catalyst was a combination of high prices and increasing defaults. This is currently the case in Australia, with one million out of nine million households in mortgage distress!

In the last year, U.S. homes have become 10% less affordable due to rising prices and higher mortgage rates.

They’ve become 40% less affordable since early 2009, despite the boom and lower rates the last few years.

And Who Buys Most of the Homes?

People age 27 to 43… and right now that’s the Millennial generation, which just so happens to be having the hardest time buying a home.

Check it out…

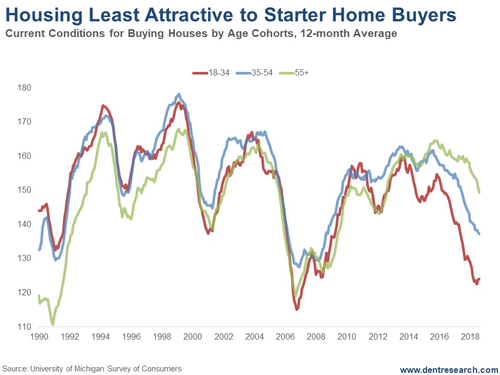

This chart shows that the home buying comfort index has fallen the most for the 18-to-34-year old group, which contains the prime starter home buyers (the peak is around age 31). Their index has dropped 33% from 158 to 122.

For the prime trade-up buyers in the 35 to 54 age group (with their peak at age 41), it has dropped 14%, from 160 to 138.

Unfortunately, the 55-plus age group doesn’t matter much (possibly the only time I could say this for the Baby Boomer generation), except for the smaller percentage of vacation homes. Even their home-buying comfort levels have dropped 10%, from 162 to 146.

Weakness in home sales is dragging down the most-bubbly economies – Hong Kong, China, Canada, Australia, the U.K., and to a lesser degree, the U.S.

This is another sign of a looming recession, which could turn into a depression this time around now that central banks have largely run out of ammunition in the fight to prevent the Depression of 2009!

Harry

Follow me on Twitter @harrydentjr

The post Running Out of Affordable Homes appeared first on Economy and Markets.

October 3, 2018

Start the Trade War Without Me…

The September Institute for Supply Management (ISM) manufacturing index came in at 59.8, lower than August’s 61.3 and below the 59.9 forecast.

But that’s still a strong number. Along with positive developments on a trade war front, it was enough to send stocks and Treasury yields jumping at Monday’s open.

The ISM index – a forward-looking survey of more than 300 purchasing managers on orders, inventories, employment, and production – is a good look at the overall health of U.S. manufacturing.

The September reading – and the silence of the world’s most important central bank – suggest President Trump’s trade war is not yet impacting the economy.

As I noted last week, the Federal Reserve did raise its overnight interest rate, as promised. The target range for the federal funds rate is now 2% to 2.25%, up a quarter-point.

It’s hard to read silence, as Fed Chair Jerome Powell wouldn’t answer reporters’ questions about the possible effects of a trade war during his post-Federal Open Market Committee meeting press conference last week.

So, there’s no official word on when new tariffs might show up in economic data, such as inflation. Perhaps the official view is that it won’t be an issue for long.

Indeed, who knew that, over the weekend, Canada would finally agree to President Trump’s new North American free trade terms?

My sense following Powell’s press conference is that the chair is only as confident as he has to be in current Fed policy. And that means he’ll react to changes in incoming data.

Of course, that could be a problem. At the same time, that could create opportunity… a lot of it.

That’s why we’ll be watching Friday’s release of the September jobs report. Forecasters see a slight dip in non-farm payrolls as well as a smaller increase in hourly wages.

But what if it’s far worse than the market expects? That kind of “uncertainty” is good because it often creates overreactions and mispricing in the U.S. Treasury market.

And we can profit from it.

At the same time, by the time data drift, it might be too late to steer the ship and avoid a serious economic downturn.

Corporate, government, and consumer debt are at record levels. Higher interest rates mean higher costs of carrying that debt. So, sales and profits will get hit. Tax revenues will shrink. And consumers will get squeezed even harder.

All this adds up to “recession.” That’s what the Fed risks with this late-cycle money-tightening “normalization” plan.

If it happens, the Fed won’t be able to cut rates far enough, fast enough.

At that point, the American economy may well be on the path to possible deflation.

But, ultimately, we only care about movement, not direction.

And that means we profit when policy is confused, like right now…

Slowflation

The August Personal Income and Outlays report, released by the Bureau of Economic Analysis last Friday, was a bit weaker than expected.

Personal income was up 0.3%, consistent with July’s increase. But it was slower than the 0.4% consensus expectation.

And core inflation – or the prices of everything except food and energy – didn’t move. They were expected to rise 0.1%.

The personal consumption expenditures index – also known as the PCE Index – dropped to 2.2% year over year. The core index stayed at the Fed’s 2% target.

Weak Wake

August new home sales came in slightly below the estimate of 630,000 units. More concerning is the downward revision to July’s figures. There were 21,000 fewer units moved than initially thought.

That’s on top of a 2.4% decline in median prices, as builders are apparently starting to offer discounts.

New home sales are big. Buyers fill new homes with furniture and appliances, and they finish off the property with landscaping and other personal touches. That’s the “ripple effect” to our economy.

And that ripple is getting smaller and smaller.

Lance

The post Start the Trade War Without Me… appeared first on Economy and Markets.

October 2, 2018

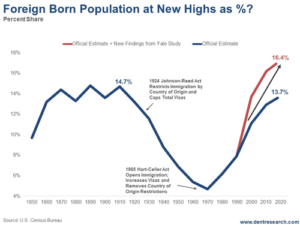

There Are Way More Illegal Immigrants in the U.S. Than Previously Thought

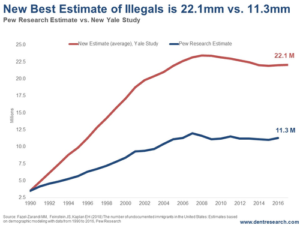

For years one of my very favorite research firms, Pew Research, has been estimating that the illegal immigrant population in the U.S. is between 11 million and 12 million.

Its research is based on The American Community Survey. But there’s a BIG problem. You’re trying to survey a group of people who are trying to hide. So, what do you do?

Well, three Yale-affiliated researchers – Mohammad Fazel-Zarandi, Jonathan S. Feinstein, and Edward H. Kaplan – have devised a much more sophisticated approach to counting these illegals. They’re using complex modeling from an array of actual data like immigration rates, death rates, deportations, and visa overstays.

They want to know who’s came into the country and who’s left.

It’s better than guestimating, but their model also suffers from incomplete data, so even these three great minds must make some estimates.

Still, their results were shocking (while being unsurprising)…

Fazel-Zarandi, Feinstein, and Kaplan believe, with a 95% probability, that there are between 16 million and 29 million illegal immigrants currently calling the U.S. home. The average: 22.1 million!

Wait, what?!

That conservative side of 16 million is 42% higher than the current estimate of 11.3 million.

The average is almost double, at 96% higher.

The high range of 29 million is 157% higher or 2.6 times.

Despite this huge jump in numbers, the new AND the old estimates both point to the greatest growth in illegal immigrants in to the U.S. during the 1990s and early 2000s. And both confirm that we’ve seen a mild decline from the peak. (The Pew study shows the numbers peaked in 2007 at 12.0 million, which means we’ve seen a loss of 700,000. The new Yale study shows a peak in 2008 at 23.4 million, putting the loss since then at 1.3 million.)

If this new study is more accurate, and I see no reason to believe it’s not, it would mean that we have a total foreign-born population, including legal immigrants, that’s higher than the 1910 peak of 14.7% of our total population. Today, this group makes up 16.4% of our total population.

Kind of late to build a wall, don’t you think?

I recently saw the President of Mexico declaring that more people have been leaving the U.S. than coming to it for years now. Why is this happening? Because there are better jobs in Mexico and because the U.S. economy has been sluggish and increasingly hostile to immigrants.

The thing is, none of this is a surprise to me. I’ve been predicting for many years now that we would see a dramatic decline in immigration for decades ahead. It’s happening, and we haven’t seen the worst of our Economic Winter Season yet.

What would surprise me is if President Trump doesn’t start throwing these new numbers around soon…

Harry

Follow me on Twitter @harrydentjr

The post There Are Way More Illegal Immigrants in the U.S. Than Previously Thought appeared first on Economy and Markets.

The “New NAFTA” Isn’t The Holy Grail of Trade

Well, this is getting exciting!

We just got an agreement this morning with Canada and Mexico to replace NAFTA, which has driven the markets higher.

I thought the Trump-induced trade war with China would have resolved by now as well. At the beginning of the summer I forecast that the president would talk big, beat on a couple of trade partners with some tariffs, then quickly reach a negotiated truce and claim victory.

It hasn’t turned out that way.

Striking a deal with our old NAFTA buddies is definitely a good thing, but it’s not the Holy Grail of trade.

Yes, Canada and Mexico are larger trade partners than China, but China is the biggest threat by far by coercing companies into sharing trade secrets and dumping products in our markets. But we’ve not reached a deal with the Middle Kingdom, not even close.

Trump made the equity markets wretch a couple of weeks ago when he announced that he has another $267 billion worth of tariffs ready to go, after the $200 billion that he’s been working on.

But this is still just the opening act.

President Trump isn’t a protectionist, he’s an equal opportunity guy.

As soon as he gets a concession from China he’ll eliminate the tariffs and claim victory. It’s just a question of when, and what happens next.

As soon as the tariffs with regard to China come off, the equity markets should shoot even higher, especially the industrials, which generate about half their revenue overseas as well as purchase raw materials internationally.

By weighing on the markets with tariffs, President Trump has created a coiled spring that’s ready to leap higher.

But he’d better hurry. His moment in the sun could quickly melt if the Chinese trade war lasts into November.

The Democrats are on the war path (just look at the theatrics of the Supreme Court nomination hearings), and they have one very uniquely styled scalp in mind.

The Senate is unlikely to change, but if history is any guide, Madam Pelosi will once again wield the speaker’s gavel in the House of Representatives. Mid-term elections are historically not friendly to the sitting president’s party.

There’s not much about Trump’s agenda that Pelosi will want to keep, and she certainly won’t help him push through any further reform of government agencies.

Beyond what can be accomplished by executive order, the Trump train will come to a dead stop on the tracks somewhere between stations.

I write about this and what it will mean for the markets in the October issue of Boom & Bust, which we just sent to subscribers last week.

Without more love from Washington, companies are likely to take a cautious view of the future. Times are good right now after extracting $1 trillion from taxpayers in the form of corporate tax cuts and getting some love from the administration on the Clean Power Plan, but we’re just two short years from the next president election.

With the Dems aiming for the president, and him providing them with plenty of ammunition, who knows what will happen?

An implosion or two seems quite possible.

So what’s an investor to do?

Do you bet on the upside, estimating that the trade war will end and you’ll enjoy a nice run? Or do you move to the sidelines and protect what you’ve earned and let the markets fall as they may?

Neither. Or rather, both, but in their own time.

The investment environment today is a great example of why we need to have a plan for every investment we make. That’s the starting point for Adam’s Cycle 9 Alert, Lee Lowell’s Instant Income, Charles’ Peak Income, and every other investment approach we offer at Dent Research, and it should be yours as well.

Before you buy a security, you should know what would make you sell it, such as a pre-determined stop-loss level. By taking care of that on the front end, you save yourself a bunch of second-guessing and worrying when things get dicey.

So make a plan, grab some popcorn, and sit back to watch the fireworks over the next couple of months. It should be entertaining, to say the least.

Rodney

The post The “New NAFTA” Isn’t The Holy Grail of Trade appeared first on Economy and Markets.

Longing for the Good Old Days

Do you remember the good old days? When I was a kid, the family who lived too far to visit often would send me birthday and Christmas cards. The Christmas cards were my favorite. They were often filled with money or a Toys R Us gift card.

In school, they encouraged us find a pen pal. They taught us how to address the envelope, write a letter, then send it off – a skill I’m sure the younger generation no longer possesses.

Do you remember those days?

Days when we had to write letters, not type them. When phone calls were preferred over text messages. When popping in unannounced for coffee was still acceptable.

I’d like to hear your stories. Share them with me at economyandmarkets@dentresearch.com.

I still remember the first “important” letter I wrote…

I was about 10 or 11 at the time. My parents had bought me a game for my new Sony PlayStation 2. After I’d dumped hours of my Christmas vacation into the digital space, I began thinking about how the game could be so much better…

So, I wrote a letter to Bandai Namco, the games’ developer.

Roughly two months later, I got a response. They thanked me for writing, for my ideas, and for my passion, but unfortunately, they couldn’t implement my suggestions due to legal issues.

Of course, I was disappointment, but still excited that I’d gotten any response at all.

Nowadays, you’re lucky to reach a human when attempting to contact a company for any reason as all.

Of course, technology has been beneficial to us. It’s forwarded medicines, means of production — even though it removed a demand for jobs in certain sectors — and it has granted us the ability to gather information at the touch of a button. It’s also made the world a smaller place (from a communications perspective).

But with the rise of technology, there has also been a loss. I’ve touched on this before.

Children are being exposed to the different media sites at younger ages each year. One young girl, Coco, was only six years old when she became an Instagram sensation. That kind of exposure isn’t healthy for the young ego… or for any aged ego.

And while communication is easier than ever, people are becoming increasingly socially inept because their experience is online and not face to face. Does anyone in the younger generation even go to the bar to meet new people anymore?

Tweet, Tweet

And nowadays we watch the social media platforms like vultures circling a dying animal…

Like it or not, Trump has become the “god” of Twitter. His rhetoric fits with the 280-characters-or-less Twitter mentality. The fact that he has 53.7 million followers says it all…

It’s a realm where fact is hard to separate from fiction due to the amount of information that is available at the tips of our fingers.

But here at Dent Research, we’re only concerned with the facts.

As of now, the U.S. economy is (mostly) stable. How long it will stay that way, though, is in question. And it’s a question Rodney has tackled a few times in Economy & Markets, and most recently in the October issue of Boom & Bust.

The mid-term election is concerning…

The trade war is concerning… Both Harry and Rodney have written about this recently, here and here.

For now, we watch… and we wait (while remembering those good old days)…

Here’s What You Missed…

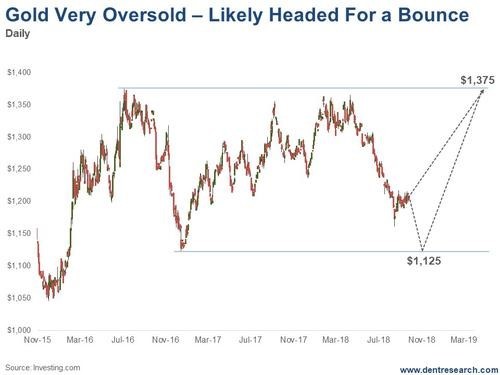

Get Ready for Gold to Bounce Once More

By Harry Dent, Founder, Dent Research

You know by now that I think gold is above all a commodity, and in a bubble that was more extreme than stocks… a bubble that’s been bursting since September 2011, but…

The Fed’s Newest Double Standard

By Rodney Johnson, Senior Editor, Economy & Markets

Collectively, we just got screwed again, and I bet most people didn’t even know it. It happens so many times, particularly at the hands of the Federal Reserve, it’s hard to keep track.

The Fed Makes No News

By Lance Gaitan, Editor, Treasury Profits Accelerator

There were no surprises from the Federal Reserve today.

Top 10 Cities Pricing the Middle Class Out of Real Estate

By Harry Dent, Founder, Dent Research

Right now, the American dream of owning a home is getting further and further out of reach for much of the middle class.

That’s all for this week.

Take care, take care.

The post Longing for the Good Old Days appeared first on Economy and Markets.

September 27, 2018

Top 10 Cities Pricing the Middle Class Out of Real Estate

Right now, the American dream of owning a home is getting further and further out of reach for much of the middle class.

And as this historic real estate bubble grows even larger, middle-class households all over the country are really feeling the pinch in terms of cost-of-living.

Take the San Francisco metro area for example, where a household needs an annual income of at least $188,000 to afford an average two-bedroom house or apartment, assuming no more than 30% of income is spent on housing.

That’s insane!

The problem is that the median income in the San Francisco metro area is only just above $96,000, which makes housing unaffordable by over 80%!

And this isn’t even the worst example of unaffordability in the U.S.

In our latest infographic, we look at the 10 metro areas in the U.S. most cost-burdened by renting or owning a home.

All the areas included on this list are also included in U.S. News & World Report’s most recent Top 20 Most Desirable Cities.

With a real estate bubble this inflated, a painful correction is due to hit. Click the image below to find out what areas of the country will fall the hardest in the next year or two.

Harry

Follow me on Twitter @harrydentjr

The post Top 10 Cities Pricing the Middle Class Out of Real Estate appeared first on Economy and Markets.

September 26, 2018

The Fed Makes No News

There were no surprises from the Federal Reserve today.

The central bank did raise its overnight interest rate, as promised. The target range for the federal funds rate is now 2% to 2.25%, up a quarter-point.

It’s the Fed’s third such move of 2018, with another forecast before year’s end. The present plan still includes another three rate hikes in 2019.

The Federal Open Market Committee’s post-meeting statement did include one surprise, the removal of the word “accommodative” as it applies overall monetary policy.

I guess that means things are getting back to “normal” again.

The Fed’s estimate for gross domestic product growth in 2018 brightened slightly to 3.1%. Inflation should remain around its 2% target for the foreseeable future. And unemployment looks set to drop to 3.7%.

Well ahead of today’s move, Treasury yields ticked up into the 3% range.

The yield on the long bond tested four-year highs near 3.25%, while the 10-year hit a seven-year peak near 3.09%.

Maybe China was selling from its stockpile of U.S. government debt.

Whatever the reason, my system triggered a trade alert, identifying the move as an overreaction.

Yields backed off after the initial move higher and then jumped again, the 30-year re-testing 3.25%, the 10-year touching 3.11%.

These were interesting moves.

Inflation data is weakening, but rates are moving higher.

We’ve seen similar spikes since Donald Trump’s victory in the November 2016 election.

The long-term yield has bounced above 3.20% a handful of times.

We’ll see if it’s there to stay…

But let’s face it: Markets are getting jittery, and traders are overreacting to… just about everything.

Good; this is the type of action we want. Overreactions create mispricing.

And mispricing creates opportunity…

Is the Foundation Cracking?

Today’s Fed decision soaked up most of the attention that wasn’t focused on the Supreme Court confirmation soap opera playing in D.C.

But there are some interesting and important things happening in the housing market.

August new home sales came in slightly below the estimate of 630,000 units. More concerning is the downward revision to July’s figures. There were 21,000 fewer units moved than initially thought.

That’s on top of a 2.4% decline in median prices, as builders are apparently starting to offer discounts.

New home sales are big. Buyers fill new homes with furniture and appliances, and they finish off the property with landscaping and other personal touches.

This stuff ripples through the economy.

And the ripples are weakening.

Existing home sales missed expectations for the fifth month in a row. Instead of a small increase, sales were flat. Single-family and condo re-sales were both unchanged.

Existing home sales were down 1.5% compared to August 2017, unchanged from last month. Average home prices were down 1.7%.

August new home starts and permits were another mixed bag.

A “housing start” means a builder has begun excavation, that construction will likely be completed, and the home will come to market for eventual sale.

Starts were up 9.2% on the month, well above expectations.

Permits – an indication of intent to begin excavation – were down 5.7%, a big disappointment.

A beat in permits isn’t as meaningful because builders can always pull the application and not build. But a miss suggests builders aren’t confident in future new home sales.

A Spike to Like

Overall, recent housing data aren’t all that comforting, especially since mortgage rates continue to climb. Weakening demand is not a good sign for home prices.

As home prices fall, so goes household wealth. And that’s a big negative for the economy.

The Fed is expected to hike rates again in December.

But, if housing continues to weaken and that spreads to other parts of our economy, another hike could be the catalyst to a big downturn.

And that means a serious spike in volatility, particularly in the Treasury market.

Lance

The post The Fed Makes No News appeared first on Economy and Markets.

The Fed’s Newest Double Standard

Collectively, we just got screwed again, and I bet most people didn’t even know it. It happens so many times, particularly at the hands of the Federal Reserve, it’s hard to keep track.

A new bank called The Narrow Bank, or TNB, recently applied for an account with the Fed.

This would give the bank recognition by a local reserve bank, in this case New York, and access to its services, like distribution of currency, check processing and other forms of electronic payments.

The application is short, and TNB checked all the right boxes.

The Fed normally approves applications within a week. TNB’s application sat for a year. And then the Fed denied it for undisclosed procedural concerns, whatever that means.

It doesn’t really matter why the Fed says it rejected TNB, the reason seems obvious enough.

The new bank was going to cut into the profits guaranteed to banks by the Fed, taking away some of the Fed’s power and slapping big banks in the face at the same time.

You can’t expect them to go down without a fight. They lobbied, er, worked hard for this money!

It all goes back to the financial crisis, the beginning of the best years ever to be a banker, but not a saver, and it’s part of what David Stockman writes about in his Deep State Declassified newsletter.

In 2008, Fed Chair Bernanke asked Congress to speed up the Fed’s authority to pay interest on excess reserves (IOER).

Before then, if a bank parked funds at the Fed, it earned zero. Banks were required to hold some funds at the central bank, but required reserves were limited, totaling less than $100 billion before the crisis.

When Congress approved the Fed’s request in 2008, it gave the central bank the ability to give banks a gift – interest for nothing.

Before the change, banks had to either lend out their funds to borrowers to earn a return, or lend their excess funds to other banks, who then lent out the funds.

Either way, the money made it to the hands of people who wanted to borrow. After the change, banks no longer had to lend money to the little people.

They could simply park any excess funds at the Fed and earn just as much as if they lent it to another bank. Who in their right mind would risk lending money to another bank when the Fed would pay the same interest?

And it gets better. For years after 2008, short-term rates sat at 0.0% to 0.25%. So the Fed paid banks about 0.125% for doing nothing, and banks paid depositors absolutely zero.

Well, here we are, four years after the Fed began raising rates, which now sit at 1.75% to 2.00%. A bank holding deposits at the Fed will earn about 1.95%, whereas Bankrate notes the national average for a savings account is 0.09%.

Notice the discrepancy? If the Fed, which uses our money to buy bonds and earn interest for itself, is paying banks 1.95%, then why are depositors earning a mere 0.09%?

Because that gives banks the fattest guaranteed profit possible for doing nothing. This allows the Fed to guarantee that banks will be profitable and can build their capital accounts, and it’s all done by stealing money from savers.

TNB threatened this cozy deal, it wanted to start a bank that took money only from large depositors and then parked the funds at the Fed.

TNB, named for its single-minded business model, intended to pay a hefty portion of the IOER to its depositors, keeping a little bit for itself.

Clearly this would have drawn funds from other banks, which presumably would have to raise deposit rates to compete, and might even have to throw more crumbs at small account holders.

But nope, the Fed killed the deal, even though law says the central bank must approve any proper master account application.

TNB has sued the Fed, and maybe it will win. The guy behind TNB worked at the central bank for decades, so he knows how the game is played. But maybe he won’t.

The Fed has time, and trillions of dollars of our money on its side.

If you want to find out more about the shenanigans of the government, and how it doesn’t typically work in your favor, check out Stockman’s Deep State Declassified, and be sure to catch his presentation at the Irrational Economic Summit next month in Austin.

Rodney

The post The Fed’s Newest Double Standard appeared first on Economy and Markets.

September 24, 2018

Get Ready for Gold to Bounce Once More

You know by now that I think gold is above all a commodity, and in a bubble that was more extreme than stocks… a bubble that’s been bursting since September 2011, but…

Gold and bitcoin are two examples of bubbles bursting that are NOT following my bubble model as well as most. Both, thus far, are basing out at higher levels than I expected.

I still see gold moving substantially lower – to at least the $700 per ounce mark that it crashed into in 2008 – when the next global crash sets in. At worst it could crash towards its bubble origin in mid-2005, around $400. At that point it would be the best buy since 2000-2005, with the 30-year Commodity Cycle to follow into 2038-2040.

I’ve already warned that gold was due to fall further when it broke a key trend line back in early June… and it fell over $100 since.

But now it’s getting extremely oversold, as Lee Lowell noted in The Rich Investor last Thursday. Gold is due for a significant bounce again, but likely after one more move down to stronger support around $1,125. That’s why Lee showed two ways to play this bounce in the next several months using options.

So, here’s the two most likely scenarios we’ll see in gold ahead…

Most likely, gold will head down one more time. That would likely be stimulated by a rise in the dollar again, which has retreated from 107 down to 103 near support while still clearly in a more bullish trend.

Gold’s strongest support would be at the December 2016 low around $1,125. At that point it would be severely oversold. Then we could see a bounce back to recent highs of $1,375, and possibly a bit higher to $1,400 or so. That would complete its bear market rally back from $1,150 in December 2015. (A while back I warned we would see this rally, despite being bearish on gold.)

This will give investors interested in gold one more chance to profit by buying near term. Or playing options, as Lee suggests.

It will give long-term holders of the precious metal one more chance to sell or lighten their gold portfolio before the larger bear market trend towards $700 or lower resumes.

If gold does head back to around $1,125, prepare for a multi-month move up.

If it instead heads back above $1,230, then you can ride the gold train on its way up for a few months or so.

Harry

Follow me on Twitter @harrydentjr

The post Get Ready for Gold to Bounce Once More appeared first on Economy and Markets.

For Time’s Sake

The idea of working less than 40 hours a week and still managing to live comfortably seems absurd to me in today’s America.

So, when I learned that our very own Lance Gaitan has a “Two Hour Work Year” strategy, I was… how do I put this… dubious, to say the least.

On average, my cousin works about 54 to 56 hours each week when college classes are in session.

A friend of mine recently picked up a second job just to make ends meet. By Sundays, she’s worked close to 60 hours that week, if not more.

Another friend typically doesn’t have a single day off unless she requests it. Between working at a hospital during the week and bartending on weekends, she just doesn’t have time to sit back and relax. It’s something we talk about often when she calls; how tired she is, and how she feels that she just can’t get ahead.

As for me, on several occasions I to have worked two or three jobs at a time just to cover my overheads, and to be able to try and stash some of the extra money away (which seldom happened). I’ve tended bar, served, bussed tables, freelanced in the labor industry, freelanced for writing, worked as a stockroom manager, run a snowball stand, etc., etc., etc.

Only recently have I allowed myself the leisure of down time, and even now, faced with yet another move into a new apartment and all that ensues with that endeavor, I still don’t feel comfortable with that decision.

This is just how it is nowadays for my generation.

With a massive amount of debt and mostly stagnant wage increases, more often than not people are relying on second jobs to help them make ends meet.

But Lance has found a way to make consistent and safe gains over time to help supplement income. And once I’d studied his research and understood how his strategy works, all the disbelief melted away.

Besides, even if you’re comfortable in life as a Millennial, a Boomer, or otherwise, a little extra money on the side never hurt, right?

With the Two-Hour Work Year, you could earn as much as a low-paying second job, but without all the, well, hard work.

As a Network Member, you’re already subscribed to Treasury Profits Accelerator, which is the strategy that allows you the benefits of a two-hour work year. So be sure to watch out for Lances weekly updates and trade recommendations.

Now, here’s what you may have missed this week:

Did You Agree to This Tax? [Video]

By Dave Okenquist, Senior Research Analyst, Host of Economy & Markets TV

Dow 30,000 or 6,000?

By Harry Dent, Founder, Dent Research

Why This China-U.S. Trade War Could Last 20 Years

By Harry Dent, Founder, Dent Research

Trump, Treasurys, and You

By Lance Gaitan, Editor, Treasury Profits Accelerator

The Hardest Part of Forecasting

By Harry Dent, Founder, Dent Research

That’s it for me.

Take care, take care.

Coty

The post For Time’s Sake appeared first on Economy and Markets.