Harry S. Dent Jr.'s Blog, page 41

October 16, 2018

When in Doubt, Jazz it Out…

As you may know, I’m an avid music fan.

Specifically, classical jazz.

I’ve been listening to a lot of Chet Baker recently. The way his melody’s lull you into a trance is hypnotic. That’s why I’ve moved Chet, along with some other smooth jazzers, to my “Relaxation Playlist.”

Listening to jazz helps me unwind after a long, stressful day. Last night, after Wednesday’s and Thursday’s market slide, his voice was crooning around the corners of my new apartment.

Today I’m in the mood for something different. Miles Davis’ Bitches Brew or anything by Dizzy Gillespie. Both keep my mind guessing.

And that about sums it up for the markets this week…

The Dow Drop

At the Wednesday close, the Dow had dropped by more than 800.

It blindsided almost everyone.

It jazz’d us, you could say (in the way that an unexpected musical note pierces the ear).

It woke everyone up. Made them discontent. Moved them to some form of action.

Harry chimed in on the matter on Thursday.

I hate to say he told you so, but… it’s something he’s been predicting for some time.

Then yesterday he sent a second market update after markets popped upward at the open.

As Harry says all the time, when things run smoothly for too long, we get too comfortable and complacent. This week’s chaos has jarred us awake. The thing is, and this is why we work so hard to create the team of experts we have…

You’ve “Gotta Have Faith”

Yes, George Michael. Yes!

When it comes to investing, you’ve “gotta have faith” in your system. Adam talks about this regularly in 7 Figure Trader, 10X Profits, and Cycle 9 Alert. If you’ve chosen correctly, your system will guide you profitably through the good times and even the bad (or, at the very least, minimize the damage during crashes).

It’s something that our editors here at Dent Research – Rodney Johnson, Lance Gaitan, John Del Vecchio, Lee Lowell, and Adam O’Dell – pride themselves on. They burn the midnight oil regularly making sure they’re serving you, our readers, in the best possible ways.

The thing is, you’ve got to stick to the system. You’ve got to listen to the experts. You’ve gotta keep reading.

Before moving on to a wrap of this week’s coverage…

A Quick Word of Thanks

I just wanted to take a moment to thank those readers who responded to last weekend’s Economy & Markets.

I appreciate the responses, regardless of the opinion.

One thing I try to do here, with this Saturday letter to you, is to open a dialogue.

And we listen… to everything you have to say.

George V. and Peter W. gave us some interesting thoughts to chew on. Stephen H., was particularly thorough, and for that I’m grateful.

To cap that, I know that the U.S. was traditionally founded as a republic. Rodney was quick to remind me of that soon after he received last Saturday’s issue.

The point I was trying to address is that there’s a growing divide between Americans. Yet we’d be stronger as a community.

In any case, thank you to those who shared their thoughts with us. I wish that I could respond personal to each of you.

Here’s What You Missed…

The Next Financial Crisis Is Starting in Emerging Markets

By Harry Dent, Founder, Dent Research

The 2008 financial crisis was well overdue, what with predictably slowing demographics, especially in the U.S. at first, and an unprecedented debt bubble in the developed countries.

The Fed Taketh Away… And It’s Not Just Rates

By Rodney Johnson, Senior Editor, Economy & Markets

Over the past month the 10-year Treasury bond yield has jumped from under 3.00% to 3.23%, sending tremors through the equity markets. By now you’ve heard/read/thought about the usual suspects.

Yields Explode, Jobs Don’t

By Lance Gaitan, Editor, Treasury Profits Accelerator

“Normalization” is a smooth-sounding word. But it happens with moves like last week’s spike in Treasury yields.

Dow Down 831 Points Yesterday Is This the Beginning of the End? [Video]

By Harry Dent, Founder, Dent Research

The Dow dropped by 831 points. Harry talks about that drop, and the two possible scenarios that go along with it.

Markets Bounce, But Watch These Warning Signs [Video]

By Harry Dent, Founder, Dent Research

A bounce of 400 points compared to a loss of 1,400… that’s not much of a bounce to write home about, so this is something we’re watching closely. Harry talks more on this and the recent shift in the markets.

That’s all for this week.

Take care, take care.

Coty

The post When in Doubt, Jazz it Out… appeared first on Economy and Markets.

The New Kings of Pot?

The SEC, the government watchdog, and TDAmeritrade, the self-service brokerage firm, recently issued warnings about buying into the pot industry hype.

Watch out!, they tell us. The pot industry is filled with high-flying stocks, overbought companies, and outright scams. Lions and tigers and bears, oh my!

I think we’ll find our way out of the forest, thank you very much.

I wonder how such companies would compare to Pets.com from the 1990s, or Enron, or even WorldCom, for that matter.

Was TDAmeritrade giving investors a heads-up on internet stocks in the 1990s, or all stocks in 2008? And where was the SEC, oh, ever?

This is the same organization that audited Bernie Madoff three times and gave him a clean bill of health, and recently gave Tesla (Nasdaq: TSLA) CEO and Founder Elon Musk a pass on fraud. Very credible sources.

I’m more inclined to go with the facts.

Through the Drug Enforcement Agency (DEA), the U.S. government tags marijuana as a Schedule I drug. That means it is highly addictive, has no known medical benefits, and cannot be safely prescribed at any dosage.

Right.

Through another agency, the Food and Drug Administration (FDA), the U.S. government has just approved Epidiolex, a marijuana-based drug that can minimize epileptic seizures.

The FDA went so far as to send a letter to the DEA calling for CBD, one of the active ingredients in pot, to be removed from any classification under the Controlled Substances Act.

The DEA demurred, tagging Epidiolex as Schedule V, the lowest level, and leaving marijuana as a Schedule I.

Thirty states and the District of Columbia have legalized medical marijuana. Nine states and the District of Columbia have legalized recreational pot.

The national government and the states are on a collision course when it comes to marijuana, and impeding crash means one thing.

Opportunity.

Yes, it’s the wild, wild west of investing. That’s what makes it interesting. This isn’t a cryptocurrency, where you build it and hope that clients will show up later. The market exists, and consumers are demanding access. And it will grow.

Acceptance is growing. Marijuana laws are falling.

Canada launches legal marijuana sales tomorrow.

When the United Sates’ federal laws finally melt away, the business will explode in the U.S., coronating kings of the industry and creating wealth for investors.

The issue, as always, is figuring out what to buy… and when. We’re not there yet, but we’re close.

I’ll be talking about this next week at our Irrational Economic Summit in Austin. (If you’re not going to make it person, be sure to follow on our live stream.)

Today, we’re stuck with Canadian companies that are grossly overvalued, run up in price by investors hoping to get a piece of the action as the world awakens to this industry. Tilray Research (Nasdaq: TLRY) is a great example.

The Canadian firm went public on the Nasdaq last summer. You could’ve purchased shares for about $20. Since then, the stock has run up to $300, and then back down to $120.

Tilray’s recent claim to fame is that the DEA has approved the company to provide pot for research. That’s pretty funny, since many U.S. firms have applied and heard nothing but crickets.

But investors are hungry for any stock in the space, and rightfully so. This market will explode in the next several years. We’re going to be talking about it, bringing you research and insight. No matter what sort of warnings we hear from the powers that be.

The facts tell us that this is a market to follow, so that’s what we’ll do.

Rodney

The post The New Kings of Pot? appeared first on Economy and Markets.

October 15, 2018

Is Trump Right About the Fed Being Crazy?

While Larry Kudlow (Treasury Secretary and Chief Economic Cheerleader) assures us that Trump is NOT interfering with the Fed, our dear president has proclaimed that our Central Bank is “crazy” for raising rates.

From his, ahem, unique world view, he believes they’re trying to wreck his new gravy train economy… the one he created with major tax cuts ($1.5 trillion), major repatriations from overseas ($2 trillion), deregulation, and a lot of positive talk about 4% to 5% growth again…

But, with no fear of sounding like a broken record: sustaining growth rates at that level are demographically IMPOSSIBLE!

With nine years of stimulus and accelerated fiscal BS, we’re running out of eligible workers to hire. That means wage inflation.

But the bigger problem is that natural workforce growth – people ages 20 to 64 becoming contributing members of the economy – is flat to slightly down for the next several years, and even for decades to come.

And productivity is declining from the aging of our workforce and the Baby Boom. It was 3%-plus in the 1980s and 1990s. Now it’s 0.5% and falling towards ZERO!

Once we run out of workers, after hiring back people who dropped out (something I see happening within the next year), there is NO growth in the workforce and no way productivity magically moves back to 3%-plus.

We’re also running out of affordable homes for sale.

Donald’s massive tax cuts have fueled growth and inflation, even if temporarily.

His stimulus plans and the Fed’s steady rate hikes to “normalize” are causing the dollar to rise and global borrowing rates to rise for emerging countries (and they’re the ones who borrowed most of the money, mostly in U.S. dollars after developed countries maxed out in 2008).

Now currencies are collapsing in countries like Turkey, Venezuela, Argentina, and Iran… and even China a bit.

Emerging stock markets are down 20% to 40%, with China’s down 29% recently.

So, here’s the thing, Mr. President: The sudden two-day crash last week had more to do with China’s desperate new monetary stimulus than the rising Treasury bond rates (which I warned was likely coming and will only accelerate ahead) or the Fed raising rates.

It’s YOUR trade war with China – even though it may have merit – that’s most driving your gravy train onto unstable tracks… and it’s your policies that are driving inflation and rates higher.

In fact, the “bloody nose” you’ve given the Chinese could well be the trigger for the next global bubble burst and debt crisis that starts in the emerging world and spreads back to the developed.

As preschoolers are quick to remind us: when you point a finger, Mr. President, you have four fingers pointing back at you!

Trump is miscalculating the risks of his approach.

He wants high growth with rising inflation as a result, but continued flat-to-low rates. That’s not going to happen at this stage.

He wants to save jobs by shifting production back to the U.S., but what about our exports and the global economy if China falls too hard?

What about the inflation from the tariffs that hit smack at the Walmart level and most impact his base supporters?

Besides, late-stage inflation was likely to occur around this time anyway… why add to it?

So, there is no question about it: Donald has fueled everything that’s causing the Fed to merely continue on a path of normalization after the biggest “gift” delivered to us over nine years. They’re being predictable. Donald is the one that’s acting crazy after putting the icing on the never-ending stimulus cake with massive tax cuts…

I’m afraid, Mr. President, you can’t have your cake and eat it to!

Harry

The post Is Trump Right About the Fed Being Crazy? appeared first on Economy and Markets.

October 12, 2018

Markets Bounce, But Watch These Warning Signs

By the end of the day yesterday, the Dow had lost around 1,400 points over two days. This looked and felt a lot like the mini crash we endured at the beginning of the year. In a word: contained.

This morning’s 400-point pop confirms the similarities between the two events.

But, a bounce of 400 points compared to a loss of 1,400… that’s not much of a bounce to write home about, so this is something we’re watching closely.

In particular, there are several danger signs that have our attention. And there’s something else too…

Listen to my latest market update video now for the details of what, why, and what next…

Harry

Follow me on Twitter @harrydentjr

The post Markets Bounce, But Watch These Warning Signs appeared first on Economy and Markets.

October 11, 2018

Dow Down 831 Points Yesterday Is This the Beginning of the End?

What a difference a day makes!

The Dow lost 831 points yesterday.

Is this it?

Is this the start of the greatest crash in our lifetimes?

Listen to my market update video to find out.

There are two scenarios: either we have a sudden crash into late 2018/early 2019 or we survive this correction and continue to new highs into 2019. If the latter, then a massive crash is likely to unfold late next year.

The thing is, we have not yet broken critical levels in the market. I explain what this means to you and what I think we’ll see next in my market update video.

We’ll keep you updated, so watch your inbox closely.

And be sure to read today’s issue of The Rich Investor. Lee Lowell, our options expert, has some important information to share with you about the slide we saw yesterday.

Harry

Follow me on Twitter @harrydentjr

The post Dow Down 831 Points Yesterday Is This the Beginning of the End? appeared first on Economy and Markets.

October 10, 2018

Yields Explode, Jobs Don’t

It was inevitable.

And yet the market is struggling to digest it, and the mainstream financial media is grasping for stories to explain it.

“Normalization” is a smooth-sounding word. But it happens with moves like last week’s spike in Treasury yields.

It’s happening; rates are going higher. And don’t expect Federal Reserve policy to change until something breaks.

Fed Chair Jerome Powell made that clear in two public speeches last week. He doubled down on the confidence he expressed following the September Federal Open Market Committee meeting.

He reiterated his view that the economy is “currently enjoying a remarkably positive set of economic circumstances.” He also noted that even though the current cycle probably won’t last forever, it can continue for “quite some time, effectively indefinitely.”

The current cycle can continue indefinitely…

Well, I’m skeptical. And I expect “normalization” to create many overreactions along the way. And I – along with my Treasury Profits Accelerator readers – plant to profit from them.

According to Powell, Fed interest rate policy is still “accommodative,” and the central bank will continue to hike rates gradually until we reach the “neutral” rate.

I can promise you this: The economy won’t grow and markets won’t go up forever. Something always gives.

We’ll see if we get back to “neutral” before that “something” eventually hits the fan.

Take These Jobs…

The mainstream financial media will struggle to explain what we’ve understood to be the inevitable.

Humans generally love a “story,” to offset their eternal struggle with randomness.

For instance, and it was easy to cite Automated Data Processing’s (ADP) employment summary as fuel for last week’s initial move.

Treasury yields did indeed jump last Wednesday, when ADP did report that the private sector added 230,000 jobs during September. And that did exceed a forecast of 179,000.

Yields followed up with an even bigger bounce Thursday.

But ADP data don’t always track the official Bureau of Labor Statistics (BLS) survey. And, more than that, markets usually only react to the BLS numbers.

In other words, the market simply does not take the ADP report as seriously as a lot of folks appear to want you to.

Indeed, Friday’s BLS report was totally at odds with the ADP report.

According to the government, non-farm payrolls increased by just 130,000 in September. And that’s 50,000 fewer than expected.

August’s new-job total was revised higher by 69,000, though. And the unemployment rate dropped from 3.9% to 3.7%. That’s lower than the 3.8% observers expected, and it’s also the lowest print since 1969.

The labor force participation rate was unchanged at 62.7%.The change in the unemployment rate is a function of how it’s calculated, not so much the pure gain in jobs.

Hourly wage growth was in line with expectations at 0.3%, but it was a slowdown from 0.4% in August. Year-over-year wage growth slowed to 2.8% in September from 2.9% in August.

Overall, the employment market remains relatively healthy. And this report will likely serve as further confirmation of the Fed’s current judgment.

Whether the market and the media read it as such is a different question…

Lance

The post Yields Explode, Jobs Don’t appeared first on Economy and Markets.

October 9, 2018

The Fed Taketh Away… And It’s Not Just Rates

Over the past month the 10-year Treasury bond yield has jumped from under 3.00% to 3.23%, sending tremors through the equity markets. By now you’ve heard/read/thought about the usual suspects.

As interest rates move higher, equity investors searching for income finally (finally!) have a viable alternative to stocks.

As interest rates move higher, consumers using borrowed funds to purchase homes, cars, and stuff on credit cards will have to pay more, which should curb their economic appetite.

As interest rates move higher, stock valuations drop because future cash flows (dividends plus capital gains) are worth a little less than they were before.

As interest rates move higher, investors become fearful of how far they will go, making them risk averse.

All of this weighs on equities.

But don’t forget the Fed is doing more than raising rates, and it’s feeding the frenzy.

The central bank created the equity bull market monster out of thin air when it started printing money to buy bonds in March 2009.

By pledging to purchase more than $1 trillion worth of mortgage-backed securities, the Fed gave new life to banks, which owned a bunch of those bonds. But the Fed wasn’t done.

It kept buying more, eventually amassing more than $4 trillion worth of bonds, driving down long-term interest rates and putting more hard cash in the hands of banks. The Fed then paid the banks interest on their cash, guaranteeing bank profits.

Since the Fed didn’t care at what price it purchased bonds, medium and long-term interest rates dropped like a rock. As long as the Fed, with its printing press bank account, kept buying, then rates remained low.

Today, the Fed isn’t buying. And while it isn’t exactly selling, the central bank is shrinking its balance sheet, and that activity is starting to have an effect.

I wrote about this back in the August issue of our flagship newsletter Boom & Bust, “Will the Fed Finally Kill This Bull?”

The Fed’s bond portfolio includes issues that mature anywhere from a month away to 30 years out. Over time, bonds mature. To keep their balance sheet at the same size, the central bank must use the proceeds from bonds maturing to purchase new bonds.

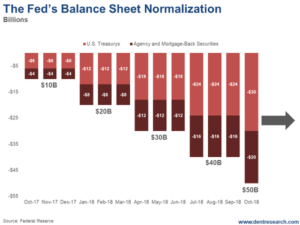

Late last year the Fed announced plans to shrink its balance sheet by reinvesting less bond proceeds than it receives.

They started slowly, holding back $10 billion per month, but have now ratcheted that up to $50 billion per month. Since they began, the bankers have let more than $250 billion worth of bonds roll off, and not replaced them.

Over the past month the 10-year Treasury bond yield has jumped from under 3.00% to 3.23%, sending tremors through the equity markets. By now you’ve heard/read/thought about the usual suspects.

As interest rates move higher, equity investors searching for income finally (finally!) have a viable alternative to stocks.

As interest rates move higher, consumers using borrowed funds to purchase homes, cars, and stuff on credit cards will have to pay more, which should curb their economic appetite.

As interest rates move higher, stock valuations drop because future cash flows (dividends plus capital gains) are worth a little less than they were before.

As interest rates move higher, investors become fearful of how far they will go, making them risk averse.

All of this weighs on equities.

But don’t forget the Fed is doing more than raising rates, and it’s feeding the frenzy.

The central bank created the equity bull market monster out of thin air when it started printing money to buy bonds in March 2009.

By pledging to purchase more than $1 trillion worth of mortgage-backed securities, the Fed gave new life to banks, which owned a bunch of those bonds. But the Fed wasn’t done.

It kept buying more, eventually amassing more than $4 trillion worth of bonds, driving down long-term interest rates and putting more hard cash in the hands of banks. The Fed then paid the banks interest on their cash, guaranteeing bank profits.

Since the Fed didn’t care at what price it purchased bonds, medium and long-term interest rates dropped like a rock. As long as the Fed, with its printing press bank account, kept buying, then rates remained low.

Today, the Fed isn’t buying. And while it isn’t exactly selling, the central bank is shrinking its balance sheet, and that activity is starting to have an effect.

I wrote about this back in the August issue of our flagship newsletter Boom & Bust, “Will the Fed Finally Kill This Bull?”

The Fed’s bond portfolio includes issues that mature anywhere from a month away to 30 years out. Over time, bonds mature. To keep their balance sheet at the same size, the central bank must use the proceeds from bonds maturing to purchase new bonds.

Late last year the Fed announced plans to shrink its balance sheet by reinvesting less bond proceeds than it receives.

They started slowly, holding back $10 billion per month, but have now ratcheted that up to $50 billion per month. Since they began, the bankers have let more than $250 billion worth of bonds roll off, and not replaced them.

Effectively, the bond market lost the biggest buyer. No one likes it when that happens.

The bankers at the Fed try to move in long waves. They don’t like to change course quickly because it can disrupt the markets by sending mixed messages and sew confusion.

With that as background, investors expect the Fed in December to raise the overnight short-term rate from a range of 2.00% to 2.25%, to a range of 2.25% to 2.50%, setting the stage to raise rates another 0.75% next year, and reduce their bond holdings by $600 billion in 2019.

How much higher does that push rates? Beats me.

In addition to the positives and negatives listed above, there are several factors that should hold the Fed back next year.

U.S. and global growth should slow, housing and auto sales are weak, and interest rates in other developed nations remain exceptionally low. Oddly, the U.S. remains the “high yield” offering in the developed world, with our 10-year Treasury bond trading 2.60% higher than German bunds.

But there is always the wild card of U.S. debt. We’re not issuing a little bit more, we’re pumping out gobs of it as we run $1 trillion deficits. As we sell more debt to finance our profligate spending, we run the risk of flooding the market a bit, weakening demand, and pushing up interest rates.

Our long-term view is that rates go lower as economic activity rolls over, but we could get a spike between here and there as some of the worries above weigh on the markets.

As Harry has often said, bubbles don’t gently deflate, they pop, causing damage to everything around them. The equity and bond markets will be no different.

Rodney

Effectively, the bond market lost the biggest buyer. No one likes it when that happens.

The bankers at the Fed try to move in long waves. They don’t like to change course quickly because it can disrupt the markets by sending mixed messages and sew confusion.

With that as background, investors expect the Fed in December to raise the overnight short-term rate from a range of 2.00% to 2.25%, to a range of 2.25% to 2.50%, setting the stage to raise rates another 0.75% next year, and reduce their bond holdings by $600 billion in 2019.

How much higher does that push rates? Beats me.

In addition to the positives and negatives listed above, there are several factors that should hold the Fed back next year.

U.S. and global growth should slow, housing and auto sales are weak, and interest rates in other developed nations remain exceptionally low. Oddly, the U.S. remains the “high yield” offering in the developed world, with our 10-year Treasury bond trading 2.60% higher than German bunds.

But there is always the wild card of U.S. debt. We’re not issuing a little bit more, we’re pumping out gobs of it as we run $1 trillion deficits. As we sell more debt to finance our profligate spending, we run the risk of flooding the market a bit, weakening demand, and pushing up interest rates.

Our long-term view is that rates go lower as economic activity rolls over, but we could get a spike between here and there as some of the worries above weigh on the markets.

As Harry has often said, bubbles don’t gently deflate, they pop, causing damage to everything around them. The equity and bond markets will be no different.

Rodney

The post The Fed Taketh Away… And It’s Not Just Rates appeared first on Economy and Markets.

October 8, 2018

The Next Financial Crisis is Starting in Emerging Markets

The 2008 financial crisis was well overdue, what with predictably slowing demographics, especially in the U.S. at first, and an unprecedented debt bubble in the developed countries.

The trigger was the subprime crisis – a small, but high-risk sector of really bad loans that started to blow up when everyday households started to default on mortgages they could never afford in the first place. But that was only the trigger.

Since early 2009, we’ve seen unprecedented money printing to save the banking system and economy from a depression, and most of the new debt has accumulated in the third world. A McKinsey study shows that emerging markets have taken on $57 trillion in additional debt through 2014, with more to follow.

Like 2008, this too will blow. The trigger this time looks to be corporate loan failures in emerging countries, starting with Turkey and the worst, Venezuela.

Turkey, like China, greatly over-expanded after 2008 with cheap dollar-based loans. Such foreign loans aren’t in their control and makes them more vulnerable to defaults.

And now, with the dollar and U.S. interest rates rising, Turkey is getting into trouble quickly.

Venezuela’s over-spending on social programs, from oil revenues when they were high and dependence on foreign debt, was more extreme and that’s the classic scenario where you get hyperinflation. You must print large amounts of money to pay off increasingly expensive foreign debt – but unlike the developed countries, that money doesn’t go back into the economy to help prop it and the banks up.

Rather, the currency keeps crashing from such outflows creating internal inflation from imports, and it makes those foreign loans massively more expensive… so they print much more money until they approach one million percent inflation. Welcome to Venezuela today.

This chart tells the story.

The developed countries debt spree, especially corporate, peaked in 2008. It’s been flat ever since, with a brief drop as a percentage of GDP in 2014. It was 94% in early 2008 and is 92% today. They didn’t de-leverage, nor leverage back up further.

As the McKinsey study showed, all the action shifted to the emerging countries when cheap dollars (and euro and yen) made foreign borrowing easier and cheaper.

Emerging countries went from 55% of GDP in late 2008 to 108% – doubling – today, with the strongest surge after 2011 when Europe joined the U.S. and Japan with all guns blazing in money printing together.

But China, with its unprecedented 64 times debt since 2000, was the race horse. It’s gone from 97% corporate debt in late 2008 to a 166% peak in early 2016 and is currently at 164%!

Emerging countries normally don’t have corporate, or any sector, debt ratios nearly as high as developed countries because they’re not as wealthy or credit-worthy. But now China and emerging countries corporations are the most in debt… and they tend to default first.

China’s stock market has been down as much as 25% recently and the emerging market indices have been down 22%, with Turkey down 30% and Venezuela down 40%.

This is a major divergence, warning something is wrong, and the next crash is coming.

But even in developed countries, the risks are rising. The percentage of BBB (near junk) ratings on U.S. corporate bonds has risen from 32% to 48%, currently at 47%.

And there’s a wall of high-yield (actual junk) debt to be re-financed between 2019 and 2024 as I cover in the November Boom & Bust newsletter.

Europe has seen a more ominous trend going from 18% BBB to 48% since late 2008 and their economy has and will be weaker than ours. European stocks have not made new highs in recent months, creating another divergence with U.S. stocks.

Corporate debt, especially in emerging countries, is likely the biggest trigger for the next crash and financial crisis… and its already clearly in motion.

China will be last to get hit because it’s much more massive debt is internally-driven, and not foreign. Regardless, it will fall the hardest when the shit does hit the fan!

Harry

Follow me on Twitter @harrydentjr

The post The Next Financial Crisis is Starting in Emerging Markets appeared first on Economy and Markets.

Practice Makes Perfect

Democracy has been under fire for some time now.

People are looking to blame the system for the current political state of our government and nation.

Some have looked past democracy and have claimed that this is all the result of capitalism.

Harry has his own opinions on this matter. So, as I sat down to write this email to you, I phoned Harry to discuss my thoughts.

He explained how he believes special interests have played a big part in subverting democracy with their massive lobbying and political contributions. The Supreme Court allows them be treated like citizens, which they’re not. They are mammoth corporations.

He related the example of how two billionaire brothers vetoed Mitt Romney from running in the last Republican primary…

That’s not democracy.

He believes that central banks have taken over free markets and rigged the system to favor the banks and the rich, while everyday people see little or no progress in their standard of living. The rich, major corporations and Wall Street then heavily lobby with their massive power.

“Capitalism works fine,” he told me, “when it has simple rules set by a democratic political system. That is not what is occurring effectively today.”

After reading more on the decline of democracy over the years, I agree with Harry. We can’t solely blame capitalism for where our nation and government is today. It’s been perverted by the lack of the democratic system to hold it accountable and to make sure that the people benefit, not just the capitalists.

Of course, there are a number of reasons as to why things are the way they are now. But right now, I’m only concerned with one…

It’s All in the System

Democracy is aimed to empower and place all on an equal playing field; each voice is meant to be heard, and the many get to vote on the most popular opinions/ideas.

It’s known by now that this system is not without fault… Just flip on the news and you can hear and see the many ways it has failed.

Yet, it’s not democracy that has failed so much as its we, the people, who have.

Democracy is a habitual form of government at best.

Selflessness is not an intrinsically human trait. Rather, it’s best practiced through repetition.

Do You Practice Democracy?

Over the years, civic leagues and student-run organizations have fallen from the limelight. There just isn’t much emphasis on their importance, and that’s in part because we no longer need to group together to see one another.

With social media and smartphones at our disposal, all friends and family are within reach. Public appearances have been replaced with lengthy phone calls while grocery shopping.

The process of election has been replaced with the process of selection. We pick who we wish to keep around rather than having to endure mingling with countless others, limiting our exposure to… well… anyone, really.

The sense of community has been whittled down.

Without the youth of each generation practicing and engaging in proper democracy — think student governments and that electoral process they go through — it will fall to the wayside and continue to crumble in its foundation.

In part, it’s why younger voters aren’t turning up at the poles as much. They don’t know why they should care because they don’t understand the importance of democracy, nor do they know the proper form of democracy that existed long before they, and perhaps even myself, were born.

Trust Me, This Matters…

Now, this has to get a bit political to get my point across.

The whole ordeal with Brett Kavanaugh is a portrait of how democracy is in deep decline.

Whether you believe Ford’s allegations or not isn’t relevant to my point, which is that the hearing revealed the great divide between Democrats and Republicans, even at a level where they swore to not be swayed by their political parties.

The great lack of transparency, the reluctance to hear the voice of the people who were willing to corroborate, and the long list of various other offenses add to the lack of democracy that was displayed in the hearing.

Politics have been engulfed by partisanship. The divide could not be greater. And this is something Harry talks about often… something he focused on in his book Zero Hour.

The Dent Way

I could go on and on about the many ways that we at Dent Research strive to give you the best, least bias research. But I’ll spare you the details and cut to the chase…

We aim to create a community that benefits our readers.

It’s why we have our annual Irrational Economic Summit (which is happening in less than three weeks’ time), and why we love hearing from you.

Though not all may be responded to, we chew on each nugget of information tossed our way and try to produce something useful from it.

Democracy may be in decline for the greater portion of our nation. But we still believe in it.

So, talk to us economyandmarkets@dentreserch.com.

We’ll listen.

Here’s What You Missed…

The “New NAFTA” Isn’t the Holy Grail of Trade

By Rodney Johnson, Senior Editor, Economy & Markets

The agreement with Canada and Mexico will replace NAFTA, which has driven the markets higher, but that isn’t the solution to a much larger trade issue.

There Are Way More Illegal Immigrants in the U.S. Than Previously Thought

By Harry Dent, Founder, Dent Research

Following more thorough methods of research, it’s been revealed that there are twice the number of illegal immigrants in the U.S than previously thought.

Start the Trade War Without Me…

By Lance Gaitan, Editor, Treasury Profits Accelerator

The September Institute for Supply Management (ISM) manufacturing index came in at 59.8, lower than August’s 61.3 and below the 59.9 forecast. A strong enough number to, along with positive developments on the trade war front, sent stocks and Treasury yields jumping at Monday’s open.

Running Out of Affordable Homes

By Harry Dent, Founder, Dent Research

The real estate bubble has driven housing prices up, limiting the number of affordable homes.

Setting the Record Straight [Video]

By Harry Dent, Founder, Dent Research

Living life in Puerto Rico has many benefits, tax being only one minor one.

That’s all for this week.

Take care, take care.

The post Practice Makes Perfect appeared first on Economy and Markets.

October 5, 2018

Setting the Record Straight

Two years ago I moved to Puerto Rico. Sure, there are great tax advantages to being here now, but that was NOT why I moved here.

I visited Puerto Rico for the first time in 1993. After falling in love with one of its islands – Culebra – I came back in 1996 and bought the most spectacular piece of property there.

I held onto that land for a long time and eventually started building a house on it. That took longer than I ever imagined it would, but eventually we reached a point where we were visiting the island frequently to handle construction issues. At the same time, we were in limbo in Florida, needing to move but unsure where to go. So we figured it would be a great opportunity just to move to Puerto Rico.

Moving here just made sense.

But that’s not what the September GQ article made it sound like. And while the article had some good points, it was also littered with misrepresentations about my intentions and those of many of the other people the journalist interviewed.

It upset me enough for me to want to retaliate, which I do in today’s video. Listen now to hear all the many other reasons I moved to Puerto Rico, and why you should consider doing so too, not just for business, but for retirement as well…

Harry

Follow me on Twitter @harrydentjr

The post Setting the Record Straight appeared first on Economy and Markets.