Harry S. Dent Jr.'s Blog, page 37

December 1, 2018

The Never-Ending Bull Market Is Back

Hey there.

It’s been a little bit since you’ve heard from me, as Teresa and Coty have been holding down the Economy & Markets editorial fort, but I come to you this Saturday by request.

You see, I work pretty closely with Charles Sizemore, who in turn has worked with Harry and Rodney for years. You hear from Charles, who is Dent Research’s Chief Retirement Strategist, here occasionally and now more regularly in The Rich Investor free e-letter.

Well, Charles is now getting ready to share details of the exciting trading service he’s been running for just about a year.

He calls it “The Never-Ending Bull Market.”

One of my jobs is to read every word Charles writes about the markets, investing, or whatever, and edit as necessary, which he might joke is kind of scary — to be inside his mind — or to read that many words. Or maybe he’ll just make a joke about Texas or Peru, where he splits time living with his family.

This gets to my point…

Charles is as straight a shooter as they come, while keeping a pretty damn good sense of humor and a fantastic pulse on the markets. Sometimes, he might be too honest, if you know what I mean.

His latest doctor’s visit.

Music tastes from before my time.

TCU football score updates.

Even what other Charles Sizemores on the internet are doing. Hint: If they show up on a Google news alert, it’s generally not good.

I say this in the nicest way possible, and maybe it’s more indicative of my assumptions than anything, but you’d have no idea Charles graduated from the prestigious London School of Economics, until you start listening to him talk about the markets, and his perspective on history.

For that reason, he’s a guy I trust, and he’s completely approachable at the same time. He’s also an entertaining and informative writer.

I don’t like to impose more than I think necessary, but every so often I’ll ask Charles an “offline” question, like how best to pay less taxes when saving for retirement, one of his favorite topics, or I’ll seek his thoughts on the stock price of streaming media service Roku (Nasdaq: ROKU), a favorite of mine.

The point is this: I’d read Charles’ stuff even if I didn’t have to. His responses to me are just the same as he gives his readers in frequent Q-and-A sessions. He tries to respond to each and every reader, which a lot of people don’t do.

So, consider yourself lucky that all you have to do is pay attention to this space over the next few weeks, and when you see a link for his Never-Ending Bull Market presentation, click it and hear what he has to say.

The market is going through some crazy times right now. Even I know that, but Charles was on top of it before most. His value and momentum trading system signaled to go into hedge mode more than a month ago.

That move was designed to not only protect readers from this potentially perilous time in the markets, but also to make money all the while, an idea that Harry and Rodney have shared here and in Boom & Bust recently, too.

That’s the idea behind Charles’ Never-Ending Bull Market, so don’t miss your ticket to join the ride.

Stay here for more details. And in the meantime, answer this question for me:

What are you doing right now to prepare for retirement? Are you…

Investing in the stock market?

Scrimping and saving every penny you can?

Finding as many income streams as possible?

Losing sleep over market volatility and its impact on your retirement savings?

Ignoring the problem hoping it will go away?

Email us at economyandmarkets@dentresearch.com, and share details.

Now onto the week that was in Economy & Markets…

Net Worth Is About to Collapse

By Harry Dent

Unfortunately, people fat, drunk, and high on free-money crack don’t see the bubbles that have formed all around us… and that threaten to destroy life as we know it when they burst. In particularly, Americans’ net worth faces a devastating crisis…

Big Brother Is Listening (Again)

By Rodney Johnson

You know what I’m talking about? The Amazon Echo, Google Home, and Apple Whatever. Those darn little devices can be very handy when you want to know something… but they come with an insidious character flaw…

Will Housing Be the First Domino to Fall?

By Lance Gaitan

New home sales are crucial to our economy because of the ripple effect they create for builders, mortgage servicers, real estate brokers, and home-furnishing retailers. The thing is, new homes sales for October disappointed big time…

A Falling Home Supply Leads to Rising Prices and…

By Harry Dent

As I talked to you about recently, home sales and homebuilder stock prices peaked 26 months before stock prices did. This time around, we have a different scenario…

[Video] Real Estate Turning Belly Up Down Under

By Harry Dent

Usually I visit Australia – my favorite country in the world – only once a year. The travel and jetlag are just brutal. But, this year, they asked me to come back a second time because of what’s going on there…

Corey

The post The Never-Ending Bull Market Is Back appeared first on Economy and Markets.

November 30, 2018

Real Estate Starting to Go Belly Up Down Under

I just got back from Australia…

A five-city tour: Sydney, Perth, Melbourne, Adelaide, Brisbane…

I was gone for 11 days… eight on the ground.

And man! What a trip.

Never mind the endless travelling or the horrific jetlag…

This was one of my best tours yet; and a particularly unusual one because I was there earlier in the year. Usually I visit Australia – my favorite country in the world – only once a year. This year, they brought me back TWICE because of what’s going on there.

“What’s going on there?”

Glad you asked…

Australia’s real estate market is now the second most overvalued in the world, with China taking first place. But cracks are growing rapidly wider and Australians are sitting up and taking notice.

It’s something we in the U.S. should worry about as well. I explain why in my video.

Harry

Follow me on Twitter @harrydentjr

The post Real Estate Starting to Go Belly Up Down Under appeared first on Economy and Markets.

November 29, 2018

The Falling Supply of Homes Leads to Rising Prices… and Falling Sales

Did you watch my video two Fridays ago? If not, check it out here. I explained how gold bugs are giving you dangerous advice about gold as an investment.

But gold isn’t the only investment that people mistakenly make because they’re told the wrong thing.

Real estate is another one.

In fact, I’d go as far as to say that buying real estate because its value “always goes up” is possibly even more dangerous than buying gold as a hedge during a deflationary season like the one we’re in now. That’s because housing becomes illiquid in the blink of an eye!

But, as usual, people get suckered into the real estate myth because they’re desperate to get something for nothing. They just don’t realize they’re about to be handed the bill…

In the last real estate bubble, we saw both rising demand and rising supply driven by ultra-strong demographics, falling interest rates, and ultra-liberal (a.k.a. idiotic) lending practices.

As I talked to you about recently, home sales and homebuilder stock prices peaked 26 months before stock prices did.

This time around we have a different scenario…

The Millennial demographics aren’t as strong as the Baby Boom and the environment doesn’t look as attractive for housing and appreciation prospects.

Plus, lending standards are tighter and mortgage rates have been rising since September 2017.

But there is something else going on…

Homebuilders have been much more conservative in building new homes. I’m not surprised after they got their asses whacked in the 2006 to 2012 bubble burst.

But to add insult to injury, older Baby Boomers are holding onto their homes for longer, which is exactly what I’d expect older people to do.

Both these things are limiting supply.

That’s caused prices to rise while mortgages are costing more.

This, in turn, has caused sales to fall…

There’s just not enough inventory of affordable homes.

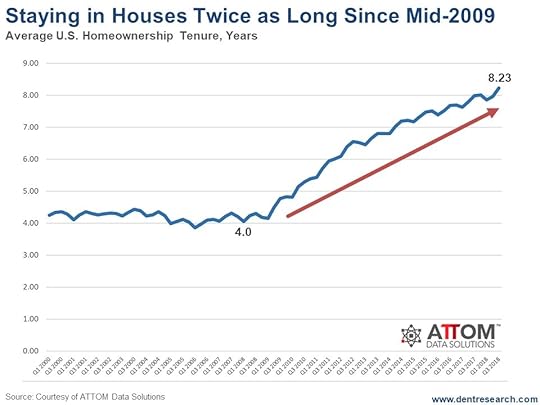

Look at this chart. It shows something very interesting…

The average tenure for homeowners before selling, from 2000 through mid-2009, was about 4.2 years (rangebound between 3.9 and 4.4).

The average tenure for homeowners before selling, from 2000 through mid-2009, was about 4.2 years (rangebound between 3.9 and 4.4).

Since then, that tenure has shot straight up into 2018. It’s now about twice as long, at 8.23 years…

Why?

The biggest part of this surge occurred between mid-2009 and mid-2012 when home prices were still scraping bottom, so it wasn’t the rising prices and appreciation that tempted buyers.

At first it was a better economy and existing households felt better about keeping their house. But by 2012 forward, it was simply the Baby Boomers aging and doing the predictable thing – not moving.

It’s no secret that younger households move much more than older ones. They’re seeking career opportunities and better neighborhoods for their kids. Us geriatrics don’t need to bother and the hassle of moving gives us the shits.

In 2009, the peak Boomers were 48 years old.

Between the ages of 46 (high school graduation) and 51 (peak college tuition), our kids are leaving the nest. After that, we either keep our home forever, or we downsize into a smaller home… which we then keep forever…

And here’s the thing…

This trend of Boomers staying in their homes is NOT going to slow down, except for some forced selling due to defaults in the next downturn ahead.

On the other hand, the last Boomer trend, of dying and becoming sellers, is just starting to accelerate. That changes everything.

My point is this: While this latest real estate bubble formed for different reasons than the last one, it’ll have the same outcome. The Baby Boomers will make sure of that.

This present bubble is peaking because of limited supply in a still-overstimulated economy.

Once that ends, by early 2020 at the latest, supply will explode… and prices will get buried along with later stage aging Baby Boomers who sell because they die!

In other words, this under-supply is going to rather quickly switch to oversupply. How many people are going to see that coming?

If you know of any young families who want to own a home, offer them this suggestion: wait to buy one much cheaper about three to five years from now.

And for us older folds, seriously consider selling and downsizing NOW while the sun is still shining on prices!

Do yourself a favor: Do the opposite of what everyone is doing at your age. Don’t listen to your neighbors at cocktail parties.

The post The Falling Supply of Homes Leads to Rising Prices… and Falling Sales appeared first on Economy and Markets.

November 28, 2018

Will Housing Be the First Domino to Fall?

Early this week, the market shook off Thanksgiving blues and started with a bang!

Stocks bounced sharply, and Treasury yields moved up in tandem.

Last week’s start was a different story.

Stocks fell sharply. Treasury bonds were mostly steady; despite the sell-off in stocks, they didn’t rally much on the long end of the yield curve.

There was a persistent move to the safety of bonds, but that didn’t match the sharp sell-off in stocks.

A rumor last Wednesday, that the Fed might be considering an early 2019 pause to its current plan to rate hikes – up to four times more –helped stocks bounce off levels from the day before. Long-term Treasury bond yields also rose.

After all was said and done, the markets ended the day before Thanksgiving mostly unchanged. They ended Black Friday lower again while long-term Treasury yields hovered around 3.30%.

The Fed is focused on “normalizing” interest rates.

The markets are focused on holiday sales forecasts.

I’m focused on the state of the housing market.

The Housing Dilemma

New home sales are crucial to our economy because of the ripple effect they create for builders, mortgage servicers, real estate brokers, and home-furnishing retailers.

This morning, new home sales for October were expected to rebound, but disappointed… yet again.

The consensus estimate was a rebound to 575,000 annual rate. The actual was a measly 544,000.

The only good news out of this is that September sales were revised higher by over 40,000 units.

October existing home sales figures have disappointed consensus estimates for six months in a row now, and I don’t expect a turnaround anytime soon.

Existing home sales are a much larger share of the housing market, but are less important to the broader economy. They do, however, give us a good look at overall housing trends.

The seasonally adjusted sales figures were slightly ahead of estimates on the month. The year-over-year figures slightly declined to -5.1% from September. Single-family home sales were down 5.3%, while condo sales were down 3.2%.

Last Monday, the National Association of Home Builder’s updated its housing market index…

Looking Bleak…

It surveys its members, asking them to rate the general economy and housing market conditions. It rates present sales of homes, sales of new homes expected in the next six months, and traffic of prospective buyers in new homes.

The October index bounced slightly to 68 from 67 and was expected to hold steady this month after peaking last December. It didn’t. In fact, it plummeted to 60, a level not seen since August 2016.

In other words, builders are beginning to comprehend the weakness that lies ahead.

Last Thursday, October housing starts and permit numbers were released.

New home starts disappointed slightly, coming in at 1.228 million on an annualized rate and permits were issued at a 1.263 million rate. That was a bit higher than the 1.260 million expected, but a drop from last month’s 1.270 million.

It goes to show how confident builders are to complete projects since the excavation for foundations have begun. Permits can be a little less certain in respect to future projects.

The bottom line: Mortgage rates are rising because of Federal Reserve policy. That puts a damper on an important driver of our economy.

Will housing be the first economic domino to fall?

Maybe…

Regardless, we’ll use any and all uncertainty to our advantage. That’s how we profit in the Treasury bond market with Treasury Profits Accelerator. You can too…

Lance

The post Will Housing Be the First Domino to Fall? appeared first on Economy and Markets.

November 27, 2018

Big Brother Is Listening (Again)

I have the best deal at Christmas. I must buy gifts for just one person: my lovely wife. As long as I do that well, everything goes smoothly.

She handles the gifts for everyone else, including my extended family. But we always get into trouble when it comes down to gifts for me. My wife buys me gifts that I would love to return. It’s not because they aren’t nice things; I just don’t really want anything.

Luckily, this year, there’s one thing we both agree will not enter our home.

We have vowed never to have a smart speaker.

You know what I’m talking about? The Amazon Echo, Google Home, and Apple whatever. Those darn little devices can be very handy when you want to know something.

What’s the weather like?

Is there traffic on my route to work?

Order a new box of tissues.

Who performed the song “No Parking on the Dance Floor?” (It was the band, Midnight Star.)

These are important questions that everyone must know the answers to, and those darn little speakers make it really easy to find them.

But they come with an insidious character flaw.

They listen to, and record, everything.

I mean, everything.

Recently, a New Hampshire judge demanded Amazon turn over two days’ worth of Echo Dot recordings in a home where a double murder had occurred. The judge wants to know if the recordings on the device hold any clues as to what had happened.

It’s really nifty that such information might be available, and also scares the snot out of me.

Today, it’s a judge investigating a murder.

Tomorrow, what could it be?

Perhaps someone wants to know your political leanings, or maybe they want to know your views on social changes, or maybe they just want to know the combination to your phone or something else that you might say out loud.

You might point out that in the first instance in New Hampshire, we’re talking about a crime, whereas the other information doesn’t involve illegal activity. True, but would you want it posted on the internet?

No matter what it is, when it happens in the confines of your home, you have an expectation of privacy. Or perhaps, you did until you invited these pesky little things into your house.

We’re inviting Big Brother technology into our homes for our convenience and then pretending we control the data.

News Flash: we don’t.

The amount of information we’re putting out there is astounding.

Think of it! Every single thing you say in your home is recorded by a company whose sole purpose is to sell you stuff. And that’s just the legal use of the data.

What about the illegal use?

Remember, these are companies that can’t keep your payment information secret, as we learn every time there’s a new breach. What happens when your everyday conversation data is leaked or otherwise taken by bad actors?

Suddenly, they have the ability to look through everything you say in your home in search of something useful.

And don’t get me started on home security systems that are easily hacked so that others can stream live video from your home!

The idea of private data remaining, you know, private, is suddenly coming into vogue. We see it as the shares of Facebook take a face plant on such concerns, and the recent legislative changes in Europe.

But it’s an uphill battle, because we’re so addicted to convenience and the idea of getting things for “free.”

Think of the things that are already listening to our lives. We have our cars, our phones, our smart speakers, our televisions, and voice-controlled remote controls.

All of these devices are meant to provide us with a service that we find engaging and indispensable. But they come with a cost. We give up the privacy of all of the data that we transmit through such devices. That seems pretty creepy.

So, as the holiday shopping season gets into full swing, with Black Friday online sales up more than 20% and Cyber Monday looking pretty good, I can be sure of what I won’t get this Christmas.

Call me old-fashioned, or even paranoid. Maybe I’ll ask for something specific, like a watch. But I’ll have to be specific so that I don’t end up with a smart watch, which is essentially a voice recorder on your wrist.

Maybe I’ll get one that has to be wound, if they still exist.

If that doesn’t pan out, there’s always socks.

Rodney

The post Big Brother Is Listening (Again) appeared first on Economy and Markets.

November 26, 2018

Net Worth is About to Collapse

Have I mentioned that this bubble in stocks – the one that most economists and analysts still claim “is not a bubble” – is now the greatest by far in its numerical advance, its percentage gains, and time frame?

You’re damn right I have!

I’m broadcasting the warning far and wide, to any who will listen. Hopefully I can save a few, including you…

Unfortunately, people fat and drunk and high on free-money crack don’t see any bubble (nor do they want to, even if they could)!

They especially don’t see the double bubble that has formed.

Real estate and stocks have both bubbled together strongly in similar time frames since 2012. They continue to do so, although the Dow Home Construction Index is signaling a warning, as I shared with you here.

Look at this chart…

It shows household net worth as a percentage of GDP as far back as it was measured in 1951.

It shows household net worth as a percentage of GDP as far back as it was measured in 1951.

We’re in uncharted territory for sure.

The peak in the last generational wave and long-term bull market was in early 1961 at 393% net worth to GDP. I’m sure it wasn’t as high even in the great 1929 bubble top. Back then fewer people owned homes or stocks.

The bottom hit in 1978 at 321%, down 18%.

It took until late 1989 to get back to the historical average of 379% and until 1997, or 19 years, to get back to that 1961 high.

Then the first bubble, driven more by the tech stock bubble, saw new highs of 445% between 2006 and 2007. That fell 10% back to around 400% in 2009… not so bad because real estate held up, cushioning the fall.

The second bubble was driven more by real estate, as it bubbled for the first time, and accelerated to 485% in early 2000. It then dropped a more serious 18%, back to 400%. That time around, both sectors were down, and net worth was slower to accelerate again because housing didn’t bottom until mid-2012.

But from 2012 into recently, we’ve seen the greatest net worth bubble ever! It’s reached a staggering 524% of GDP… we’re rich!

Stocks and housing have been on a strong tear together, with stocks off the chart from QE crack that has benefited market investors more than any other financial sector.

The scenarios…

If this current correction does stay more modest in late 2018, and heads up one more time, that figure could get to 550%-plus by late 2019 (housing would level off or appreciate more slowly at this late stage).

Of course, after that, there’s the big crash for sure.

Even from this peak, the minimum crash in net worth as a percentage of GDP would be back down to that 400% level in 2002 and 2009, down 24% from here…

That will be brutally painful for our long-term savings, with larger declines ahead than what we saw 2008 and 2009 in both stocks and real estate.

If it falls to the historical average, at 379%, that’s a loss of 28%.

BUT…

Given that this is both a generational and a 90-year Great Reset or Bubble Buster Cycle low ahead…

The average net worth could decline back to that 1978 low of 321%… or worse!

That would mean a loss of 39%!!!

STILL believe in “buy and hold?”

We absolutely don’t. Neither does my friend and colleague, Adam O’Dell, and he has a litany of reasons to share with you (in case the one I’ve just offered isn’t enough).

The post Net Worth is About to Collapse appeared first on Economy and Markets.

November 19, 2018

Have Gold and Bitcoin Seen the Worst of Their Bubble Bursts?

You know I’ve been fighting the gold bugs for a long time. Gold is an inflation hedge, not a deflation hedge. Turn to gold for safety during a deflationary period and you’ll get your ass handed to you on a golden platter!

Gold is simply another commodity and it burst in the 30-year cycle top between 2008 and 2011, just like it did after the 1980 top.

But my bubble model projected that gold would fall to at least $700 and possibly as low as $400 to $450 per ounce…

If that were going to happen, it should have happened by now.

It hasn’t.

Instead, gold has formed a strong base at $1,050, moving sideways for three years now.

Same with Bitcoin…

Bitcoin bubble burst in December 2017. My model suggested that the crypto could have dropped to $1,000 by now, but it hasn’t. It has formed an even more convincing base at around $6,000.

Look at this chart, but when you do, note that bitcoin and gold are on very different time scales.

Does this mean my model doesn’t work?

No.

There are always exceptions to the rule. And my bubble models, since I introduced them in The Sale of a Lifetime’s Lost Chapter and Zero Hour, have been working very well for almost all stock, commodity, and real estate markets.

Besides, my model is more sophisticated than the simple “orgasm” trajectory I showed on the chart above.

So, what is this potentially telling us?

It’s telling us that gold still has some perceived value as a money or crisis hedge… and bitcoin/cryptocurrencies are the new up-and-comers in this arena, and competing with gold.

The markets haven’t sorted this out yet, but these two commodities are trading differently than the others and that’s potentially bullish.

Gold could still falter to a greater degree in the next financial crisis, when deflation rears its ugly head much more than it did last time. In that case, my new target would be more the $700 level rather than $450.

But…

I think a NEW likely scenario is that gold continues to base between $1,000 and $1,375 into 2020-22 and then begins its next long-term bull market into the next commodity cycle peak between 2038 and 2040 at a target of $4,000-plus (maybe even $5,000).

Gold has just more than doubled on every major top in the past ($850 to $1,934 to $4,400?).

If gold does hold more sideways for the next few years and retests that $1,050 support… that could be the time to buy and hold for the long-term again.

So yeah! Gold bugs will get their gold $5,000… when they’re dead!

When gold hits that point, it would represent a 5th wave long-term top after a 1st wave top in 1980 and a 3rd wave top in 2008-11, all peaking on the 30-Year Commodity Cycle.

I know many of our subscribers still have an affection for the illustrious metal – maybe you’re one of them – so this should be good news for long-term holders.

But to be clear: I am NOT forecasting that gold will suddenly catapult to $5,000-plus when the dollar collapses, and gold becomes real money again! That will NEVER happen!

As for bitcoin…

It faces a different scenario.

It just briefly shot down to $5,500, about as far down as it should go in this basing and bottoming out process. It then bounced back above $6,000. It if continues to hold near $5,500, then it could see another rocket shot – like it did in mid- to late 2017 – to a new high of $25,000 or so by late 2019.

And that’s what my friend and cryptocurrency master mind, Michael Terpin, has set as his next target (although he’s envisioning this could happen as late as 2022, which is a possibility if cryptocurrencies do get a big boost from the next financial crisis… although this isn’t my most-favored scenario because I see it as the last extreme bubble to peak and crash).

Such a Bitcoin surge would be the 5th wave top, with the 1st wave peak in late 2013 and the 3rd in late 2017. That would complete the first “Hype Cycle,” as Louis Basenese called it at our Irrational Economic Summit this year.

Then we would see a bigger bubble burst back to $6,000 or so again.

After that, bitcoin and blockchain would follow the long-term scenario of the internet and see a fundamental long-term bull market into around 2035 – 2037… becoming the next” big thing” in the internet space for security, speed, cost, and currency for dealing with money and things of value.

Bitcoin could be a good buy here, near $6,000, and then again in 2020 if it retests this area again, assuming it does hold this level in the months ahead.

If it hits $25,000, and you don’t sell at that point… well, I’ll spare you my tirade. I think you can already hear it in your head!

The post Have Gold and Bitcoin Seen the Worst of Their Bubble Bursts? appeared first on Economy and Markets.

The Results of an Economic Acid Test

I recorded this video at our Irrational Economic Summit this year but decided to only share it today because I wanted to see how the midterms shook out.

They shook out as I expected.

So, today’s a good day to talk to you about the acid test for any economy in the world.

Dr. Lacy Hunt is one of my favorite classically trained economists, and yet he really understands the economy, which is why we ask him to speak at our conference every year.

He understands how debt bubbles build and how they deleverage.

He’s not one of those heads-in-the-clouds, never-had-sex kind of economists! He genuinely gets it.

And he always wows the audience!

He is the creator of this acid test and it offers an incredibly disturbing insight into the economy right now. Listen to my latest video for the details…

And then look out for an email from me soon on how third world economies are faring on this acid test.

Harry

Follow me on Twitter @harrydentjr

The post The Results of an Economic Acid Test appeared first on Economy and Markets.

November 17, 2018

Berea College: Small, But Strong

A couple of weeks ago I read about Berea College.

For those not familiar with the school, it’s the only college in America that offers students a no-tuition promise.

Now, that sounds absurd by today’s standards, considering the massive amount of debt many Millennials — including myself — have managed to accumulate all in the pursuit of higher education (and higher paying jobs).

Founded in 1855, it was one of the first integrated, co-education colleges in the south. Of course, being in Berea, Kentucky, this surely rubbed a few folks the wrong way. But this didn’t stop the founders from pursuing their vision of available education for all.

Working to study…

The college provides labor programs much like work-study operations. Older students hold jobs within the labor program that align with their degrees, while the younger students take on the labor jobs. By doing this, students can work to pay for their food and housing while gaining real-work experience that will help them in landing that first break.

Forty-five percent of graduates pass through the university without debt. If any do manage to accumulate debt, it typically doesn’t exceed $7,000.

When I first read about this place, I was amazed. The idea of having, on average, students graduating with $7,000 of debt compared to the national average of $37,000, or my own debt, which doesn’t need to be mentioned, seems like a thing of dreams.

It’s worth noting that Berea’s system is highly reliant on the stock market for the continuation of the tuition-free promise.

Much of the schools funding since its founding has come from endowments, about $1.2 billion worth.

Tax reform pain…

If there were any tax reforms, which colleges have been targeted for in the past, then the tuition-free promise would be ended due to the hit that $1.2 billion in endowments would take.

And it’s this kind of tax reform that yet again caused a divide between the Democrats and the Republicans.

Now, tuition-free college is a hot topic for many. Some think the idea preposterous. Others think it non-negotiable.

After all, tuition has done nothing but increase.

From 1980 to 2010, the national average of college tuition went up by almost 250%.

But back to Berea College…

They rely on the stock market, and are at the mercy of politics — much the same as you and me — but have been able to keep the college going, tuition-free promise intact, for so long because they have a system in effect that they believe in.

This is, of course, a small-scale college. But the size should not belittle their success.

It goes to show how far one can go when there are people there to support, to aide, to come together for a common belief, with a system that works.

Berea College, in a way, is a place built around hope and hard work.

It’s a place that moved me to believe that things can function in a better capacity, if we come together.

And it reminded me of the importance of what we do here at Dent Research.

Take care, take care.

Coty

The post Berea College: Small, But Strong appeared first on Economy and Markets.

November 16, 2018

[Video] Gold’s Little Secret

There’s a crisis coming.

We face massive loss in net-worth-to-GDP when the double bubbles in stocks and housing go tits up (I plan to talk to you more about this on Monday, so watch out for that email from me).

But possibly worse is that the few other analysts who see this crisis coming are telling you to turn to gold as protection.

Man are they wrong!

And that advise is downright dangerous.

That’s why I recorded today’s video.

Listen to my explanation of why they’re making this mistake, and why gold is not your savior for the next several years.

And I’ll let you in on a little secret you need to know about gold. I may not be a gold bug… but I will make a concession.

Harry

Follow me on Twitter @harrydentjr

The post [Video] Gold’s Little Secret appeared first on Economy and Markets.