Harry S. Dent Jr.'s Blog, page 38

November 15, 2018

Laugh… Cry… Profit Your Way to “Normal”

“So, ‘Count’ and ‘Recount’ are sitting at a bar in Florida…”

By now, of course, that joke really needs no punch line.

Ballots in the Sunshine State – and neighboring Georgia, too – are still being counted… and re-counted.

As if more of that kind of uncertainty weren’t enough, equity markets took a steep plunge Monday. The Dow Jones Industrial Average was down as much as 619 points and finished the day more than 2% lower than it started.

What’s so unusual is that markets are typically quiet when the Treasury market is closed and currencies don’t trade, as was the case in observance of Veterans Day.

And it was just the beginning…

It’s now been four straight losing sessions in a row for stocks heading into Thursday, November 15, 2018.

And recent data continue to bolster the Federal Reserve’s “normalization” plan. So, things are actually getting a little more serious.

The Federal Open Market Committee (FOMC) met last week for what was widely understood to be a “dead” meeting.

As expected, the FOMC kept the federal funds rate unchanged at 2% to 2.25%.

The central bank’s policy-making arm also signaled it will continue on its path of gradual rate increases.

Its post-meeting statement did change, as members noted that business capital investment “moderated from its rapid pace earlier in the year.” Consumer spending, meanwhile, “has continued to grow strongly.”

There was no mention of recent market volatility.

Fortunately for us, there’s enough uncertainty out there – even if Florida gets its counts together – to create the kind of volatility we can profit from…

The Fed Kills

Wednesday morning’s release of the Consumer Price Index (CPI) for October provided more evidence for the Fed’s case.

The headline number was up 0.3% month over month, accelerating from 0.1% in September. That’s in line with expectations, but it’s also the biggest move in nine months.

The CPI was up 2.5% on a year over year basis in October, accelerating from a 2.3% rise in September.

“Core” CPI – which takes out volatile food and energy prices – was up 0.2% on the month, in line with the consensus forecast.

On a year over year basis, “core” CPI actually decelerated from 2.2% to 2.1%.

After a “green” open, stocks sold off all the way into Wednesday’s close.

Midterm elections are – for the most part – behind us. So, we can rest a little easier with no political ads lighting up literally all our screens. Thankfully! Rodney’s relieved as well, as he’s mentioned last week when he emailed you about pot.

Equities rallied hard last Wednesday in the aftermath of midterm elections that turned out largely as expected. But stocks turned ugly again late last week.

And that trend has continued this week.

It looks like the market’s starting to reflect the reality of what lies ahead…

Stick with us, though. We haven’t even gotten out of the “accommodative” phase.

The post Laugh… Cry… Profit Your Way to “Normal” appeared first on Economy and Markets.

November 14, 2018

Sharp, Deep Crash Possible in Next Few Weeks

I’ve warned for years, and with increasing frequency of late, that the first crash when a major stock bubble of this magnitude finally tops is 42% in the first 2.6 months.

That’s the average of seven bubble crashes in the last century.

The 1929 crash started off with a 49% crash in just over two months – the most extreme.

Look at this correction thus far, compared to 1929 for the Dow…

If it continues to follow the dramatic crash pattern of early September to early November 1929 then the most violent wave down could be starting now… and this first overall crash could be over by early December or as late as early January.

The target in that scenario would be at February’s crash low of around 15,500 on the Dow, down 42.5% from the late September top.

But here’s a scarier chart than that.

This one suggests that the smart money hasn’t been buying into the rally from February through September 2018 and could be leading the selling here, which would be ominous and increase the likelihood of such a 40% or so crash just ahead.

Look at this…

This index measures the buying into the close (calculated smart money) versus the buying right after the open (dumb money reactions).

This is both the sharpest and deepest crash in this indicator.

The drop in this index was 20% just before and into the early part of the 2000 tech crash. It was down 24% just prior and into the 2007-08 crash.

This decline is 38% and straight down!

If that is a correct measure of the smart money sentiment, then they not only didn’t buy into the rally that peaked in September while the dumb money was piling in the most, but they would be selling and shorting into this decline and on any bounces.

All of this is to warn you that the next two or three weeks is a dangerous period.

Looking ahead…

If late September was a major top, then we should see a sharper deeper wave down any day and it may already have started. This continues to be a good time to hedge through options near term, as Rodney proposed in the November issue of Boom & Bust.

If we don’t see such a sharp crash by early December, it isn’t likely to happen. That would be the time to exit such option strategies as December is otherwise a good month.

Even if this imminent crash doesn’t happen, your hedging options could have some profits if the markets just go down more modestly. But you’d have to be willing to lose your premium if the markets head back up strongly instead.

Make sure you’ve read the latest issue of Boom & Bust for the details.

P.S. Check out the program that Rich Dad, Poor Dad author, Robert Kiyosaki, has developed. He and I have spoken at conferences together for many years. And we see eye to eye on the unprecedented economic danger ahead. You’ll find all the details you need about his program for generating impressive weekly cash flow here.

The post Sharp, Deep Crash Possible in Next Few Weeks appeared first on Economy and Markets.

November 13, 2018

Made Up Names, Made Up Prosperity

I hate Verizon, but only when I think of them.

I recently had to upgrade my cell phone, so I logged into my Verizon account and clicked on “trade-in.” The decision tree took me through several steps and then asked what new plan I wanted.

I didn’t want a new plan, just a new phone. I clicked on the chat feature. A very helpful person assisted me until she ran into a roadblock, and then she told me to call a number. At that point, I’d spent an hour on the project.

On the phone, an upbeat Jamaican man walked me through the process, but he too hit several road blocks. At one point I was on hold for 18 minutes. That gave me time to think.

Verizon?

What a meaningless, made-up name

They could’ve stuck with their first name after the breakup of AT&T, which was Bell Atlantic. Or even taken on GTE after one of the mergers. I guess I know why they didn’t keep the name World.com, which will forever be linked to scandals.

But Verizon?

Apparently, the name is a mash up of veritas (truth) and horizon. I think that speaks volumes. The truth about your account and how to get what you want will always be on the horizon.

What about Accenture?

It used to be Anderson Consulting, which grew out of Arthur Anderson, the accounting firm. But after surviving the Enron scandal, I guess they wanted to jettison the past. The name, submitted by a Danish employee, is a combination of accent on the future.

Again, this makes sense. The company gave Enron a big thumbs-up on its annual audit for years, never suspecting a huge accounting fraud that cost investors billions of dollars. I guess if that was my work history, I’d choose to accentuate the future as well.

The list goes on, with companies like Altria, Cingular, Lucent, and Agilent. But sometimes the name isn’t made up, it’s just a dumb choice, like when PriceWaterhouseCoopers (PwC) renamed its consulting arm Monday.

No, they didn’t name it on a Monday, they actually named it Monday. The name mercifully died, but not the sentiment.

When PwC bought Booz & Company, it renamed the consulting arm Strategy&.

Strategy and what? Is this the part where they surprise you with the bill?

Back to Verizon…

After an hour and 40 minutes, we were mercifully done with the transaction.

My new Jamaican friend asked if there was anything else he could do. I asked him to make what should be a simple process – upgrading my phone – a less excruciating experience, and not an utter waste of the client’s time (I did note to him that I didn’t blame him personally). He responded warmly and told me that for my troubles he would credit my account to the full extent of his authority… $20.

This man was genuine and friendly. I did not laugh or say anything dismissive, as it would have been rude. But it got me thinking. Twenty bucks? That’s the price of service? That’s the value of this man’s judgment?

Maybe it is. Maybe the rough and tumble American employment scene isn’t the sunshine and roses we see in the monthly employment numbers. Maybe we’re digging a canyon between those who own assets and have enjoyed quite the boom since 2009, and those who work customer service jobs for $10 per hour (as listed on www.Indeed.com), or $20,000 per year.

Which brings up another firm with a questionable past. OK, not really a firm, but an entity.

The Fed

Since it’s inception in 1913, the central bank was supposed to calm the banking sector and rid us of asset panics.

Right.

That was almost 20 years before the depression.

By 1930, the bank had taken on the job of smoothing out the business cycle. How has that worked out?

And for the last nine years, the Fed has held interest rates near zero while pumping free cash into bank coffers via the interest on excess reserves (IOER). No other sector of the economy gets paid to do nothing by the group that controls the printing press. That must be nice.

Maybe it’s time for the Fed to change its name to something completely meaningless that doesn’t signify its actual operation.

Oh, wait a second, it already has that name.

Because it isn’t Federal (operated by the national government), it isn’t a reserve (by its own accord it sends extra cash to the U.S. Treasury), it might be central (but it does have 12 regional centers that operate independently), and it isn’t a bank (it doesn’t have to maintain a capital cushion or subject itself to audits and oversight).

Maybe we should go backward with the Fed and just name it for what it does, the Bank of Salvation for Other Banks. We could call it B.S. for short.

While we’re at it, we should call Altria The Cigarette Company, and Verizon the Pain in Telecom firm.

I see a movement in our future!

The post appeared first on Economy and Markets.

November 12, 2018

The Dow Construction Index Led Stocks By 26 Months in 2006… What Is It Saying Now?

I was one of the few, along with Robert Shiller, predicting that the real estate bubble in the U.S. was getting ready to burst back in late 2005.

Home sales had peaked in July 2005.

Home prices peaked nine months later, in April 2006.

The Fed and most analysts bullshitted that the subprime loan crisis was containable and no big deal. Ha! What a joke. And typical of those idiots.

What they missed was that real estate spending on trade-up homes peaks around age 41. Overall spending peaks at age 46.

In fact, the infamous Roaring 20s bubble saw real estate prices and home starts peak in 1925, five years ahead of the stock market and peak in late 1929… the same five-year lag for peak spending overall versus real estate.

But, for the Boomers, there was an additional trend the “experts” missed…

That is, the Boomers were offered the most aggressive lending for home buying in history.

All types of teaser rates that converted higher later, no-doc loans, little or no money down, and the worst, affordable rates on subprime loans that were bundled up into seemingly low-risk mortgage securities sold to unsuspecting institutional funds and everyday households.

Falling inflation and mortgage rates also added to the trend – another thing I predicted would happen into 2007 while the “experts” missed it.

These factors extended that boom and bubble into late 2005/early 2006 when it would have naturally peaked by late 2002.

The downturn between 2000 and 2002 would have also crimped home buying demand and created much pent-up demand at first in the boom from 2003 forward.

Now look at this…

Look how housing started to fall ahead of stocks and the economy.

That red line follows the Dow U.S. Home Construction Index. It peaked on July 28, 2005, 26 months before the Dow peaked on October 9, 2007, by which time it was already down by a whopping 65% on its way to a bottom down 73% in early 2009.

Don’t you think that should have been a warning about the subprime crisis not being containable?

Yup. So. Do. I.

But then you and I are smarter than the “experts” because we’ve got nothing to gain from calling a spade a spade!

The important point NOW is that the Home Construction Index peaked in late January. Since then, it’s fallen 36% into late October.

I believe this second bubble burst will be worse than the last one so this ETF could end up falling close to 80% or 90% in the years ahead.

The trillion-dollar question is: Did this ETF peak just eight months ahead of the recent peak in stocks, or…

Can we expect more like that 26-month lag we saw last time?

It’s probably more likely to be the latter, which would signal a stock peak by March of 2020.

That would be more in line with my Second Scenario for the huge bubble top and burst ahead in late 2019.

Of course, it’s still possible that we’ve seen that major peak already (right before the markets freaked out in October).

If that is the case, there should be a sharp crash down 40% or so from the top by around the end of this year.

If we don’t see that kind of market slap down within that time frame, then my money is on that 26-month lag into late 2019/early 2020.

Either way, we’re still heading toward the greatest crash – in stocks and real estate – of our lifetimes.

The Most Expensive Auction

Have you heard about this one?

A mansion in Hillsboro Beach, Florida is up for auction with no minimum or reserve price.

In 2015, the South Florida Business Journal called it the most expensive home in the U.S. Forbes listed it in 2017 as one of the 18 homes over $100 million, and it was originally listed at $139 million.

“Le Palais Royal” is a 60,000-square-foot Versailles-inspired mansion is, and has been, one of the most expensive homes in the U.S., and with this no minimum, no reserve price auction, it could potentially be purchased for significantly less than its value. It’s absurd!

Even if someone was to buy this multi-pool, 11-bedroom, 22-bathroom, 22-karat gold lead detailed mansion with a private theater and putting green for less than it’s worth, how in the hell could anyone even afford the upkeep for this massive home?

Regardless, for those in the market for a mansion, digital bidding starts today, and the live auction begins on November 15. I wouldn’t be surprised to see this go for something like half of the original price.

Harry

Follow me on Twitter @harrydentjr

The post The Dow Construction Index Led Stocks By 26 Months in 2006… What Is It Saying Now? appeared first on Economy and Markets.

November 9, 2018

Diversity and Equality Walk into a Bar…

It’s passed.

The Democrats took the House, while the Republicans took the Senate. All ended as all was predicted.

We’ve managed to make it through the midterm elections scot-free.

Well, almost…

There was Scott Walker’s frustration with the inability to ask for a recount in a close race in Wisconsin due to a law that he put into place the previous year.

Then there was Stacey Abrams reluctance to concede to Brian Kemp, who has already started the process of moving into his new office despite the demand to wait until all votes are accounted for, which won’t be until sometime next week.

And let’s not forget the lawsuit filed by the GOP in the Arizona on Wednesday that accuses inconsistent and improper handling of mail-in ballots. The Democrats called it as an attempt at voter suppression.

Meanwhile the markets are unfazed by the outcome. For now, anyway…

In a Perfect World…

Last weekend, as we moved into the midterm elections, I left you with some food for thought.

It was a poem that I felt relevant to the times as we move forward.

And I mentioned it to one of my friends over the weekend.

We were at the bar when the topic of politics came up, briefly.

Now, we know better than to mix politics and drinks. Still, a quick conversation seemed inevitable…

We shared our thoughts about the poem, and what could be one of many solutions to some of the issues in the U.S. right now.

Now, we both don’t agree on everything. It’d be an awful friendship if we did. And we have a tendency to think deeply about the questions presented to one another (if not to seem like a fool when answering).

Before we moved away from the topic he said, “Everyone just needs to be equal — everyone works for what they have, and everyone suffers the same.”

We laughed at that, ordered another round, and moved on to talking about the upcoming Capitals game.

Of course, his answer was not a serious one. Diversity is what makes the world go round. It brings about changes and revolutions.

If things did ever shift to how my friend suggested, then we’d end up like poor Harrison Bergeron.

Stay in the Know

The most important (and beneficial) thing you can do is read and keep yourself in the know.

Have an open mind when it comes to topics you know little or nothing about. Sometimes, those things that seem overwhelming aren’t so bad once you get to know them…

Take put options, for example. There is this stigma that surrounds them…

Many people don’t believe that they can trade put options due to a lack of skill. And if you buy into that belief, then you will certainly never learn how to trade them.

Or take active investing…

It’s an intimidating thing, actively buying and selling, trying to avoid losses.

Many will side for passive investing, which doesn’t generate much profit in the short- or long-term. Adam talks of this often, and you can check out some of his thoughts on this at therichinvestor.com.

Adam does more than talk though. He’s developed several proven strategies…

The market-timing strategy of his 10X Profits service has the ability to earn you major profits, while minimizing risk regardless of the status of the market.

Things may be calm now… but no one knows how they’ll be a week from today, let alone tomorrow.

Not only does Adam strive to educate you about smart investing, but he offers you an on/off switch that allows you to invest with almost unbelievable ease.

Here’s What You Missed…

What Will the Election Tomorrow Do to the Markets?

By Harry Dent, Founder, Dent Research

Emotions will be running high, and I think the markets are going to reflect this, one way or another.

Pot: One Thing We Can All Agree On

By Rodney Johnson, Senior Editor, Economy & Markets

Marijuana is on the ballot in four states. Other jurisdictions are voting to decriminalize pot. It seems on this issue that most Americans agree.

By Lance Gaitan, Editor, Treasury Profits Accelerator

Trump plus “normalization” by the Federal Reserve could translate into a lot of volatility in the U.S. Treasury market. And we’re prepared to profit from it.

The Trump Bump and the Midterm Election Referendum

By Harry Dent, Founder, Dent Research

Democrats just didn’t turnout in the numbers they need to make a bigger win.

But I judge it by the markets, and the Dow Futures the day after election looked to an open nearly 200 points up. That means the Republicans had a modest victory.

Cracks in the Land Down Under [Video]

By Harry Dent, Founder, Dent Research

There are concerning issues about Australia’s real estate market. And even though it’s far from America, you should still be concerned…

The post Diversity and Equality Walk into a Bar… appeared first on Economy and Markets.

Cracks in the Land Down Under

Next Wednesday I’m off to Australia – one of my favorite places on Earth – where I’ll be doing a five-city tour starting in Perth and ending in Brisbane.

The thing is, usually we do this annual tour in May, and I was indeed in Australia earlier this year (thanks again to my Australian friend Naomi for her tips on dealing with the jet lag). But I’m going back because real estate there has started to crack.

In today’s video, I share the concerning details about this issue. How big are the cracks? Why are Australians so worried about it? Listen now for the details…

And, of course, if you want to learn more about this tour, and maybe even catch a bit of it, you’ll find all the details on www.goko.com.au.

Harry

Follow me on Twitter @harrydentjr

The post Cracks in the Land Down Under appeared first on Economy and Markets.

November 8, 2018

The Trump Bump and the Midterm Election Referendum

Well, the election turned out close to what was predicted. The Democrats took over the house, but by a modest margin. The Republicans picked up at least two and likely three senate seats, making their control there more solid.

The truth is that the Democrats should have done better with a first-term president who is wildly unpopular and their focus on the number one issue of health care.

I warned on Monday that the Democrats just don’t seem to have the energy and anger that the Republicans do. They didn’t turnout in the numbers they need to make a bigger win.

I judge it by the markets.

The Dow Futures the day after election looked to an open nearly 200 points up. That means the republicans had a modest victory.

Trump had almost everything going for him going into these midterms. The economy is going gangbusters thanks to his tax cuts, cash repatriation, and pro-business policies. Yet he chose to focus more on immigration and the caravan threat, throwing out more hyperbole and exaggeration.

In short, the Democrats AND the Republicans were their own worst enemies!

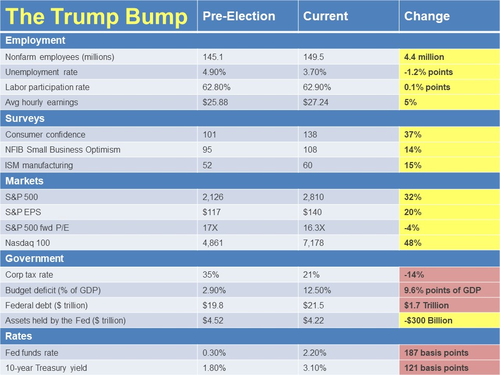

If we look at this table, you’ll see I try to quantify the “Trump Bump.” This is what we get looking at now compared to pre-election…

This table shows the economic changes since Trump was elected, and they’re mostly positive in the short term. The positive impacts are highlighted in yellow and the negative in red.

This table shows the economic changes since Trump was elected, and they’re mostly positive in the short term. The positive impacts are highlighted in yellow and the negative in red.

On the economic front, it’s all positive: 4.4 million added employment, the unemployment rate down by 1.2 percentage points (from 4.9% to 3.7%), and best of all for Main Street, hourly wages up 5% after being stagnant for almost two decades.

The labor participation rate went up only 0.1 percentage point, but I would call that a modest plus because that number is slowing heading down due to Baby Boomer retirement.

The only negative is those rising wages are stirring up inflation and interest rates.

In general, surveys were very positive. Consumer confidence is near the high in 2000 and is up a whopping 37%.

People weren’t feeling that good about the recovery before Trump.

Small Business Optimism is also up 14%. And the ISM manufacturing index is up 15%.

All good!

Maybe too good…

The stock markets, of course, go gangbusters in a stimulus driven bubble… and this one is the one to end all bubbles.

The Nasdaq is up 48%, the S&P 500 32%, and S&P EPS up 20%. Somehow the forward P/E (prince/earnings) ratio went down a bit. That’s also a plus for slightly less overvaluation.

But…

Yes, corporate tax rates are down 14 percentage points (a whopping 40%). That’s good for corporations and the top 1% to 10% of the population that largely own them. But they do little good for Main Street.

And the budget deficit as a percentage of GDP is up from 2.9% to 12.5%, or 9.6 percentage points. That’s horrible! In fact, it’s a record in boom times. Just imagine how devastating it’s going to be in a deep recession or depression ahead.

The Federal debt is up 9% in two years. At that rate, it’ll be $33 trillion by the end of 2024 (assuming Trump has a second term), and much more if we have the great downturn I see.

Unfortunately for us all, my original forecast of another doubling of Federal debt in eight years, to near $40 trillion by the end of 2024, is possible!

And short- and long-term borrowing costs are rising.

Up 1.87% points (187 basis points) for Fed funds.

Up 1.12% for corporate and mortgage, long-term borrowing (and likely to rise another 0.9 percentage points in the next year, by my best calculations).

It’s these negatives that continue to reinforce my belief that now is NOT the time to continue the greatest over-stimulus program in history.

Like any addiction, financial drugs never work out well when taken to excess…

And at this point, we’re well beyond excess.

We should see the real costs from debt deleveraging and financial bubbles bursting come due between 2020 and 2023.

Harry

Follow me on Twitter @HARRYDENTJR

The post The Trump Bump and the Midterm Election Referendum appeared first on Economy and Markets.

November 7, 2018

This Calm Shall Pass, Too

Equity futures buckled a bit after the first congressional race was called for the Democrats – early, and with a wide margin that maybe said this “blue wave” was real.

As more results came in, futures recovered ground, steadied, and started to point to a positive open.

After all, what happened was basically in line with expectations. Democrats did take control of the House of Representatives, and that presents a challenge to President Trump.

But he’ll respond as he’s always responded, and that means a lot of unpredictability from the Commander-in-Chief of the most powerful nation on the planet.

I, for one, am ready for whatever he stirs up; indeed, Trump plus “normalization” by the Federal Reserve could translate into a lot of volatility in the U.S. Treasury market.

And we’re prepared to profit from it.

It’s Like the Eye of a Storm…

It’s actually a little quieter this “morning after” than I’d anticipated. Indeed, stocks are well into positive territory, and bond yields continue along this still-new uptrend.

It certainly stands in stark contrast to the run-in to the midterms, including last Monday’s 900-point intraday swing for the Dow Jones Industrial Average.

By Friday, however, stocks had come well off those lows. And the release of the October employment report by the Bureau of Labor Statistics (BLS) added additional fuel to the “strong economy” narrative.

At the same time, those fresh BLS numbers support the Federal Reserve’s current policy track, so another rate hike in December is a near-certainty.

I guess we can forget about September’s paltry gain of 134,000 new non-farm jobs. That dud drove expectations for October down to 190,000, but this economy created 250,000.

It’s an all-around winner: Private payrolls increased by 246,000 versus a forecast of 181,000, and manufacturing jobs grew by 32,000 against an expectation of 13,000.

The unemployment rate was steady-as-expected at 3.7%. And the labor force participation rate surpassed the forecast of 62.8% and crept up to 62.9%.

The pace of growth of average hourly earnings slowed to 0.2% from 0.3%, as expected. Year-over-year wage growth provided a substantial surprise by accelerating to 3.1% from 2.8%.

It seems as if everyone who wants one has a job.

The yield on the long U.S. Treasury bond surged on the BLS release, rising from 3.39% to 3.45% at Friday’s close.

We’re seeing some considerable easing this morning, with the yield on the 30-year back to 3.39%.

As I’ve noted, we don’t care about “direction.” We care about “movement.”

“Movement” creates “opportunity.”

We Need To Talk About Manufacturing

Let’s be real: The U.S. manufacturing sector’s been on fire for over a year.

That’s important to keep in mind in the aftermath of last Thursday’s release of the Institute for Supply Management (ISM) Manufacturing Index for October.

It came in at 57.7. The market wanted 59.1.

Here’s the thing: Any reading above 50 indicates “expansion.”

The good news, of course, is we’re still well above 50. Of course, underlying data suggest we need to keep a close eye on the longer-term trend; is it changing?

New orders came in at 57.7. That’s down 4.4%, and it’s the first sub-60 reading since April 2017.

But prices paid jumped 4.7% to a reading of 71.6, and tariffs seem to be causing shortages as the result of “pre-buying.” We’ll see if this persists and begins to impact consumer prices.

Production slowed by four points, and employment slowed by two points but, both are coming off very high levels.

Overall, the October ISM is a disappointment. The question is whether the Fed will take notice.

We won’t find out until December. The Federal Open Market Committee (FOMC) is meeting tomorrow, but this is a “dead” meeting, with no policy moves, statements, or press conference.

The ISM number is not cause for panic, or even “concern.” But it is a sign of potential trouble ahead.

Lance

The post This Calm Shall Pass, Too appeared first on Economy and Markets.

November 6, 2018

Pot: One Thing We Can All Agree On

Thank goodness it’s finally election day!

Maybe we’ll get a reprieve from all the idiot, hype-infested political advertising. This election season has done something I thought was impossible. It’s made me long for traditional advertising, where retailers tell me that I’ll be smarter/better/thinner/richer/whatever if I just buy their product.

We need a new gizmo, a political TiVo. It doesn’t have to skip over the political ads, although that would be nice. It could simply replace the ads with a more soothing sound, like crying babies or chainsaws at full throttle.

And it’s not just television. I get ads all day across my computer when surfing the net, and even on my cell phone.

I realize that the price of using web browsers for free is that I give up my soul to digital marketing, but my phone? That’s not free. I pay dearly for it.

It’s not right that I can be hounded incessantly by marketers that I’ve tried to block. We need a product for this as well. Maybe something that includes a cattle prod and high voltage.

But I’m off topic…

It’s election day, and we have all of those ads because we’re a house that’s almost evenly divided. And neither side shows much interest in shuffling toward the middle.

Almost every issue is a point of contention, but not all.

Marijuana is on the ballot in four states, with North Dakota and Michigan voting on recreational adult use, while Utah and Missouri vote on access to medical marijuana. Other jurisdictions, such as Ohio and some counties in Wisconsin, are voting to decriminalize pot. It seems on this issue that most Americans agree.

In 2011, 50% of us thought marijuana should remain illegal, while just over 40% wanted to legalize the drug. The rest were undecided.

Now, more than 60% want to legalize pot, with less than 40% against.

Even at our recent Irrational Economic Summit, the crowd was overwhelmingly in favor. During an electronic poll, 53% of the attendees voted for medical marijuana, 40% for recreational, and only 7% against any legal access. Lumping the medical and recreational together, that was a 93% vote for legal pot.

Recreational marijuana is already legal nine states and the District of Columbia, while 31 states and D.C. have approved medical marijuana. The votes in the four states mentioned above will certainly add at least two more to those numbers.

As I told the audience at our conference two weeks ago, marijuana has not changed. It’s the same plant, same drug, that has been used (and abused) by people for more than 5,000 years.

Instead, we have changed. Or should I say, our attitude has changed. We’re learning, or possibly relearning, some of the benefits of medical marijuana, and many of today’s decision makers were yesterday’s hippies. They used marijuana in their youth, lived to tell the tale, and think of it as on par with alcohol, not crack or LSD.

Because the U.S. government still classifies marijuana as a Schedule I drug, we don’t have a lot of research on its long-term effects. As voters legalize it around the country, we’ll find out more.

We’ll also see many businesses spring up to take advantage of the newly opened markets, eventually giving us investing opportunities. I’ll be following these closely in the months ahead.

That’s one good thing that might come out of this year’s hard-fought election cycle. It’s enough to make some people want to smoke pot… and watch television.

Rodney

The post Pot: One Thing We Can All Agree On appeared first on Economy and Markets.

What Will the Election Tomorrow Do to the Markets?

It’s an important day tomorrow.

Emotions will be running high, and I think the markets are going to reflect this, one way or another.

If the Republicans hold the Senate and/or only lose the House to a minor extent, then the markets should like that. If the Republicans hold the House as well – that should be very bullish near term.

If the Democrats do better than expected, of course the markets aren’t going to like that, which is different from normal.

Normally, the market likes gridlock, but this time around they don’t want anything that’ll jeopardize the gravy train they’ve been enjoying since President Trump’s election.

I break this down in a special election video today. Watch it now…

I explain why I expected the bounce we’ve seen in the market and what I expect we’ll see in the next few months, particularly post-election.

I explain why I expected the bounce we’ve seen in the market and what I expect we’ll see in the next few months, particularly post-election.

I also explain what I’m seeing when I compare recent market activity to what happened in the first stage of the 1929 and 2000 major bubble crashes.

And I discuss the hedging strategy we’re encouraging readers to consider.

Harry

Follow me on Twitter @HARRYDENTJR

The post What Will the Election Tomorrow Do to the Markets? appeared first on Economy and Markets.