Harry S. Dent Jr.'s Blog, page 40

October 26, 2018

Predicting the Future Is Easy… Believing It Is Hard

Last night, our keynote speaker Kevin Ashton took the stage…

About 10 minutes into his presentation, he shared what I believe might be the biggest idea of the conference so far…

“Predicting the future is easy… believing it is hard.”

And I think these nine words elegantly summarize what Harry Dent and Neil Howe have been saying for more than three decades.

Cycles are real.

History does repeat itself.

If you want to profit in this era of disruption, the hardest part is believing change is coming (and then taking the appropriate actions).

Kevin Ashton went on to say this as well…

“Whenever I’ve made mistakes in predicting the future, it’s because I wasn’t willing to believe what the data suggested.”

And as Harry has said so many times… people don’t like booms and busts.

They can’t see exponential (and cyclical) change. And they don’t want to believe that something like a major market crash could really be right around the corner.

It’s just human nature.

Which is why we have to trust the data, and the conclusions we make from that data, even if that data shows something that might sound ridiculous.

Like some of the predictions Kevin Ashton made…

You will own a self driving car by 2030.

When Kevin made this prediction several years ago, it was laughed at. Now, it seems like people wonder why they aren’t going to get it faster.

Your great-grandchildren will have a triple-digit life expectancy.

Consider this: In 1800, the global life expectancy was 32 years old. And depending on how old you are right now, your grandchildren (or great grandchildren) will live to more than 100 years.

We will discover extraterrestrial life in this century.

This one blew me away. In the 60s, the scientific consensus was that we are most certainly alone in this universe. Now, the scientific community is almost unanimous in believing the universe is ripe with conditions for other life.

Now, Kevin isn’t predicting we’re gonna have aliens hovering above the White House a la Independence Day… but likely that we’ll find some kind of microbial organism via a telescope, or atmospheric samples of neighboring planets.

Within the next 100 years, possibly in our lifetimes, a human being will be born on another planet (or at least not on this planet).

And this moment will be as significant as the day our ancestors stepped off the African plains into Asia and we became an inter-continental species.

Which brings up some interesting issues! Does that mean that human is an alien? Would they even want to come visit their home planet? And would they even be welcome?

But maybe his most incredible prediction…

Soon, most computers will power themselves.

Now, you’ve probably heard of Moore’s Law… which roughly says that computer power will double every 18 months to 2 years.

But you probably haven’t heard of Koomey’s Law… which roughly states the amount of energy required to make a computation will half every 18 months.

Which means, according to Kevin, we will soon see a day where batteries don’t EVER need to be replaced or recharged.

In fact, it’s already happening.

Now, I won’t be able to do this part justice in this post… which is why you should click here and get your copy of the 2018 Irrational Economic Summit Livestream and digital replay kit so you can watch it….

But Kevin is one of the leading experts in the world about radio frequency identification (RFID) chips… which, if you don’t know, sends ONE radio frequency in ONE direction.

Which is how things like your hotel room key opens those doors… yet don’t need any kind of power source to do it.

And as we move into the future of the Internet of Things… more and more devices will be connected and constantly sending data.

Well, if you’ve ever asked yourself, “How the hell are all of these devices going to get powered?”

The answer? They won’t need any external powersource. They’ll power themselves.

A big, massive, world changing idea indeed.

Today’s Schedule

This morning, at 7:45 AM CT, we had a special bonus section called Options 101 with Adam O’Dell… who is a brilliant investor here on our team who has helped our members make some extraordinary gains with his services, like Cycle 9 Alert.

At 8:30 AM CT, Richard Smith, founder of TradeSmith, showed how he’s helping regular investors get a massive competitive advantage by using his TradeStops software.

And he finished his presentation with one of his best stock ideas for 2018.

Be sure to click here and sign up for the Irrational Economic SummitLivestream and replay kit to find out what it was.

At 9:20 AM CT… Andrew Swan talked about how is company Likefolio uses social media data to predict stock prices.

Rodney Johnson took the stage at 10 AM CT, and gave a killer presentation on the cannabis industry. (There will be more on this in a future post.)

And Elliot Gue will wrap up the morning by discussing the coming oil shock (which will be at 11:10 AM CT)… and what will sure to be an incredible presentation from Lacy Hunt (at 11:50 AM CT).

Make sure to check your inbox later today! I’ll have more big ideas coming your way.

-Jake Hoffberg

The post Predicting the Future Is Easy… Believing It Is Hard appeared first on Economy and Markets.

How to Make More Money

There’s a reason why we have more than 350 people in this room…

It’s because they trust and respect the brilliant thinkers at the 2018 Irrational Economic Summit here in Austin, Texas.

But the reason why they do might surprise you…

Right before the main session started, I had the chance to talk to one of our members who’ve been following our research for almost 10 years.

“You know, Jake,” he said to me, “I’ve subscribed to a lot of newsletters. But what I love about Harry, and why Dent Research is my main source of information, is he’s willing to change his mind when the conditions change.”

And if you’ve been paying attention… you already know that times are a changin.

“Disruption” is here, and things aren’t what they used to be because of it.

And if you want to profit from the huge disruption ahead of us… you can’t live in the past.

You have to open your mind to new ideas. If you don’t, you’re going to miss the next big opportunity.

And you’re going to miss the warning signs that tell us when danger is approaching.

The Power of Big Ideas

We talk a lot about “big ideas” here at Dent Research.

They’re more than just bold predictions (which we make plenty of). And they’re more than the promise of getting rich (which is the point of investing).

The true power of a big idea is this…

A big idea fundamentally changes our perception of the world around us.

Big ideas inspire us to rethink what’s possible for the future.

And most importantly, big ideas give us a chance to make big-time profits.

That’s what makes the Irrational Economic Summit so great!

This is a conference for people who think big, and want to think bigger.

It’s for people who are willing to reject the status quo and look for a better way.

It’s a place where we can share our boldest, and most controversial ideas WITHOUT being marginalized by mainstream bias.

It’s why our members keep coming back.

And it’s why almost every single speaker wants to return each year.

They are so impressed by the intelligence and open-mindedness of our members.

Today, we’ve got some of our greatest contrarian thinkers sharing their ideas.

At 1:30 PM CT, Harry Dent took the stage with his opening talk: Disrupting Economics… and the Economics of Disruption.

And even though I’m intimately familiar with his research, I learned something brand new hearing him give this presentation.

Then, geopolitical expert George Friedman gave an incredible talk called The World Under Stress.

Now, I’m a complete newbie when it comes to geopolitics, but hearing how he sees the world was profound… and already has me rethinking my views on the way things work (and how to invest).

And if you missed either of these talks, don’t worry, you can still catch the replays when you sign up for the 2018 Irrational Economic Summit LIVESTREAM.

But we still have a whole roster of incredibly big thinkers coming up!

Today, at 4:30 PM CT, the one and only Neil Howe takes the stage with his Generations and the Rhythms of History: What’s Ahead for Our Lifestyles, Our Workstyles, and Our Financial Assets presentation.

At 5:30 PM CT, our keynote speaker Kevin Ashton will be telling us all about The Future of the Internet of Things.

Tomorrow morning, at 8:45 AM CT, Kevin Smith — founder of TradeSmith — is revealing his big idea… and what he believes is the most profitable investment you can make today.

At 9:20 AM CT, Andy Swan is showing us how to profit from social media data.

Rodney Johnson is enjoying himself a “wake-and-bake” by talking about growing a fortune with pot stocks at 10 AM CT…

Elliot Gue is talking about the coming oil shock at 11:00 AM CT…

And last, but certainly not least, Lacy Hunt will be exposing the dirty truth about the Federal Reserve’s impact on the global economy at 11:50 AM CT.

Here’s to thinking big (and bigger profits from the era of disruption).

-Jake Hoffberg

The post How to Make More Money appeared first on Economy and Markets.

The Irrational Economic Summit Is Underway

I’ll keep this short and sweet as we’re in the midst of a busy week…

Today kicked off our annual Irrational Economic Summit in Austin, Texas.

Harry, Rodney, and the entire team have been — and will continue to be — hard at work with their presentations, all while watching, along with all of you, what’s happening in the markets and in U.S. politics today….

“Disruption” it is.

The Dow Jones Industrial Average shed another 600 points Wednesday, and but it’s up another 500 today.

We’re starting to talk about serious moves, up and down, every day.

Even after today’s rally, the Dow’s still down 7% from its highs.

The S&P 500 Index was off more than 3% Wednesday, the Nasdaq Composite almost 4.5%. They’ve bounced too, with the tech-heavy Nasdaq up more than 3%.

The S&P’s overall slide from its highs is still close to double-digit territory. And the Nasdaq is 10% below its peak. The Russell 2000 — America’s small and mid-sized companies — is 14% off its highs.

I’m still relatively new to this game, and I’m not sure exactly what number constitutes a “correction” for which particular index.

But even I know there’s something happening here…

And, yeah, I’m pretty sure I — bearing closely in mind that very recent admission to veritable babe proverbial woods status as well as my “familiarity” bias — might get a better idea of what exactly it is at this week’s Summit.

Folks, we’ve been saying it for a while now. Harry’s literally turned purple in the face arguing his case.

As we can clearly see, it’s not a matter of “if” but “when” for the next bust.

And things aren’t looking so hot.

You know, this year’s Irrational Economic Summit ought to be one for the books…

Right on time, we have the greatest collection of contrarian thinkers all in one place — literally, down in Austin, and virtually, via our “Live Stream Pass.”

It’s the kind of market-financial-economic-political smorgasbord curious folks like us devour.

How’s that for a slice of fried gold?

Later this evening, Jake will be bringing you some news from today’s presentations at IES.

Stay tuned.

Coty

The post The Irrational Economic Summit Is Underway appeared first on Economy and Markets.

October 25, 2018

The 2018 Irrational Economic Summit Has Begun!

I’ve been waiting for this moment for months…

Because today, I’m flying to sunny Austin, Texas, for what I believe is going to be the best investing conference I’ve ever been to…

The 2018 Irrational Economic Summit.

And my job for the next several days is to be your eyes and ears on the ground here at the conference.

If you weren’t able to be with us in person, if you’re joining us via livestream, or even if you’re one of the hundreds of readers enjoying the fine Texas weather with us…

My emails over the next several days will be your window into the world of IES 2018.

You’ll hear from me twice a day (at noon CST and 4 PM CST) on Thursday, Friday, and Saturday… and again on Sunday at 4 PM CST to wrap things up.

I’ll be giving you daily recaps of what happened during the day, as well as previews for the speakers that are still coming up.

And if you haven’t already, make sure you click here, right now, and sign up for the 2018 IES Livestream.

Because this is, without a doubt, the single best lineup of speakers we’ve ever had at IES…

Each one is a bona fide titan in their respective areas of expertise.

Neil Howe – Easily one of the most brilliant thinkers alive today. His book The Fourth Turning is a testament to the power of understanding demographic cycles… something I’ve learned so much about working alongside Harry Dent these past three years.

Dr. George Friedman – I had the pleasure of meeting George and his wife Meredith a few years ago at another conference. His geopolitical analysis and forecasting is unlike anything I’ve ever heard. Everytime I hear him speak (or read his work), I’m always left with a mixture of pure awe for how someone can be this smart… and of creeping terror that what he predicts will actually happen.

David Stockman – When you’re in a room with the former economic advisor to Ronald Reagan, it’s hard NOT to be impressed with everything he says about economics. And reading his insights every day in Deep State: Declassified has opened my eyes up to a political reality I didn’t know existed.

Michael Terpin – I’ll be the first to admit that I’m a cryptocurrency skeptic. But having the opportunity to hear first hand from one of the most connected people in the blockchain community. He wowed our audience last year with his presentation… and based on my speaker notes, this is going to blow his 2017 speech out of the water.

Our keynote speaker Kevin Ashton – There’s something undeniably cool about getting to hear about the future of the Internet of Things from the man who invented the term.

Not to mention Lacy Hunt, Lou Basenese, Elliot Gue, Seth Shapiro, and the entire editorial team here at Dent Research.

And as we are approaching the midterm elections… literally anything could happen in this record long bull market!

Which is why I can’t wait to hear what all these experts have to say about the near term future of the markets.

But more important, I’m personally looking forward to learning more about all of the innovative and disruptive trends that are emerging right now…

And what I can do to start profiting from the exciting future ahead of us.

So keep an eye on your inbox for my email tomorrow (and the rest of this week)!

Again, you’ll be getting two emails a day, Thursday through Saturday, from me… one at noon CST and another at 4 PM CST.

So, make sure you keep an eye out for my next email.

I’ll be giving you a preview of the opening day’s speakers…

AND, I’m going to be revealing a little known secret about this conference.

See you tomorrow at noon,

Jake

The post The 2018 Irrational Economic Summit Has Begun! appeared first on Economy and Markets.

October 23, 2018

What Did the Refrigerator Say to the Toaster?

I have no idea, but I think I’ll find out later this week at the fifth annual Irrational Economic Summit in Austin.

I’ll also get insight into the current geopolitical climate and learn more about how our population is changing. And with the recent market volatility we’ve seen, including today, I’m sure even more talking points will come up.

In short, it’s going to be a full schedule.

If you’re not going to be there in person, be sure to follow along on our livestream and here in Economy & Markets starting Wednesday night.

Kevin Ashton, one of our featured speakers, coined the term internet of things (IoT) and has written about technology and innovation for years.

As we just start to get internet-connected gadgets into our homes, we’re on the cusp of collecting data in ways that were once unimaginable. We’ve all seen the fridge on television that allows you to see what’s inside through your phone.

Just a note, my refrigerator is never that tidy. And I wonder what useable information one can get by looking at the outside of containers? If the eggs are in the carton how do you know how many are left? But this approach is just poking around the edges. For industrial uses, the sky is the limit.

Imagine a company that holds raw material in bins on scales. The firm could know in real time exactly how much of each material remained, and tie that information into its order system.

Or consider a company that relies on transportation within its facility. By connecting vehicles to its network, the firm can keep them on the road until maintenance is required instead of putting all of them on the same schedule, thereby squeezing more efficiency out of its fleet.

Back in the home, I’m just hoping for smoke detectors that ping my phone when the batteries run down instead of screeching, which always seems to happen in the middle of the night.

In addition to Kevin Ashton, we’ll also hear from George Freidman, a noted geopolitical analyst and foreign affairs expert. I’m interested to hear his take on our trade war with China.

It’s no secret that the Middle Kingdom has created two initiatives meant to cement their place in the world: the One Belt, One Road Initiative (OBR); and the China 2025 push.

OBR is in the news for lending money to developing countries that can’t pay it back, making them debtor nations to China. This gives China strategic leverage and a foothold in many faraway places.

China 2025 calls for 40% to 70% of goods consumed in China to be made domestically, depending on the industry. The country is putting government funds behind the effort.

Where does that leave China’s trading partners? And what about China asserting itself in the South China Sea? I’m looking to George for his analysis and views.

We’ll also hear from Neil Howe, a long-time favorite source of Dent Research. For decades Harry has pointed to The Fourth Turning by William Strauss and Howe as one of the premier works on changing demographics.

Howe coined the term Millennial Generation, and provides some of the foundation for our research on how consumers change their spending over time.

And, of course, Lacy Hunt will give us his current views on the U.S. and world economy, and where he thinks interest rates are headed next.

For anyone who’s had the pleasure of hearing Lacy speak, you know that his work is informative and powerful. He’s remained bullish on bonds for decades, pointing to economic problems that have never been resolved and the need for a global belt-tightening. And he’s been right.

With so much going on in the markets and in politics, I’ll be glad to take a few days to absorb some new ideas and hear some of the best research available! Harry’s said this is one of our best speaker lineups ever, and I agree.

I hope to see you there, but if not, you can see these presentations and more from the Dent Research team on our live stream.

Rodney

The post What Did the Refrigerator Say to the Toaster? appeared first on Economy and Markets.

October 22, 2018

Peak Irrationality Begging for Disruption

It’s Irrational Economic Summit week! We open the conference on Thursday, in Austin, Texas, and we have a kick-ass line up of speakers. I talked about some of them on Friday in my video.

As has been the case with most of our previous summits, it looks like we nailed the timing on this one! Volatility has stormed onto the scene like an angry wife, markets are teetering on the edge of the abyss (and even Adam O’Dell warned us last week that he’s watching some indicators that seem to be turning ugly), and the political situation is a cluster…

I’m not surprised, and as I’ll explain on Thursday, today we have a powerful collision of the 250-year Revolution Cycle, this 90-year Great Reset Cycle, an 84-year Populist Revolution Cycle, and a 28-year Financial Crisis Cycle… not to mention a global demographic slowdown across the developed world, and now China since 2011.

But, really, the one we need to pay attention to is that 90-year Bubble Buster. Here’s why…

Andrew Pancholi and I have many cycles in common, coming from different research approaches (which is one of the reasons we wrote Zero Hour together). But he had the 45- and 90-year cycles before I discovered them from my fundamental research in early 2014.

Well, this cycle has morphed into THE most important in this great bubble and reset to come… and perhaps the most important longer term.

It indicates that late 2019 is most likely to be the line in the sand for this bubble to finally start bursting, and possibly sooner.

It would also predict that the next major stock bubble peak would come around 2064 on a seven to nine-year lag to its natural peak around 2055, which I’ll explain more just ahead.

The Next Evolution:

2 X 45 = Bada Boom, Bada Bust!

Steamships peaked in 1875 and then fell off a cliff as railroads first emerged.

Forty-five years later the same thing happened (in 1920) equally dramatically with railroads as cars first emerged.

Forty-five years later, in 1965, cars saturated households across the board in cities, suburbs, and rural areas. The Interstate Highway system was completed.

Everyone had TVs and homes full of electric appliances.

Women were largely freed from housework and had started entering the workforce in mass (first in World War II out of necessity).

While demographics impacts productivity, I’ve discovered that technologies, and new ways of producing and consuming goods, have the biggest impact on productivity and our standard of living!

Over two 45-year Innovation Cycles (from 1900 to 2000), our standard of living adjusted for inflation went up more than eight times and our life expectancy increased from 47 to 78!

And when you add two of these 45-year cycles together…

You get a doozy of a cycle that impacts massively on practically every aspect of our lives.

In short, every other 45-year cycle is more powerful, building on the one before.

That NOW makes late 2019 the projected peak of this 45- and 90-year cycle.

Expect the next great reset — one to rival the late 1929-32 mega crash cycle (and 1837 to 1842).

Also expect a second Great Depression, this time from around late 2019 into late 2022 for stocks and into 2023-plus for the economy.

And tune in to our Irrational Economic Summit next week via Live Stream because we’re at peak irrationality and our speakers are experts in the disruptors that will change everything.

Harry

The post Peak Irrationality Begging for Disruption appeared first on Economy and Markets.

October 20, 2018

The Irrational Economic Summit

It’s almost that time again.

By this time next week, our Irrational Economic Summit will be in full swing.

For those of you making the journey to Austin, Texas to listen to some of the most brilliant contrarian thinkers of our time talk about the status of our economy, future technologies, and demographic trends that could serve to disrupt, you’re in for a grand ole’ time in one of America’s favorite cities.

For those of you who wanted to go, but maybe couldn’t, fret not. We get it. Life just simply is too busy; that annual family reunion with cousins you’d rather not see, in-laws who do nothing but nag, or nieces and nephews who — despite being an adorable joy — seem to always wear your nerves thin while simultaneously destroying a small portion of the room they’re playing in.

So, because we still want you to enjoy the benefits of hearing the great minds we’ve gathered together, even if you can’t be with us in person, we’re live streaming the entire event.

And it gets better.

We’re running a little contest for free access to the Live Stream for free.

To enter, like us on Facebook and then click the LEARN MORE button on the cover image.

Simple, right?

Here’s What You Missed…

Is Trump Right About the Fed Being Crazy?

By Harry Dent, Founder, Dent Research

Trump believes that the Fed is trying to wreck his gravy train economy… but sustaining growth at the current levels is demographically impossible!

The New King of Pot?

By Rodney Johnson, Senior Editor, Economy & Markets

The national government and the states are on a collision course when it comes to marijuana, and the impending crash means one thing… opportunity.

Will the Red Read the Data?

By Lance Gaitan, Editor, Treasury Profits Accelerator

Things are choppy at the moment. But amid all of this activity, we’re going to see some opportunities to profit.

Treasury Bonds Aren’t the Only Ones Spiking

By Harry Dent, Founder, Dent Research

Italy has seen the biggest spike in bonds lately… and here’s why.

Irrational Economic Summit Preview [Video]

By Harry Dent, Founder, Dent Research

With our Irrational Economic Summit coming up, Harry decided to share the reason he’s excited for the event, and why you should be too.

That’s all for this week.

And keep in mind that with IES next week, our normal mailing schedule will be slightly modified to accommodate for the event.

Take care, take care.

The post The Irrational Economic Summit appeared first on Economy and Markets.

October 19, 2018

Disruption Just Got Real [Video]

Best speaker line up ever!

And talk about disruption!

Not only is the speaker roster for next week’s Irrational Economic Summit better than previous years, but that’s the theme of this year’s conference.

Because disruption is what has allowed life as we know it today.

Disruptive thought and technology set the world on fire in the late 1800s, on every factor.

Global GDP has gone up eight times since then in the emerging world… and 10 times in developed countries.

Life expectancies have more than doubled.

Population has exploded from one billion in the 1800s to seven billion (heading toward 11 billion).

Global trade has expanded from 12% to 60% of GDP!

Urbanization, which could only be made possible with new technology, has risen from 12% to 55%. By 2120, it’ll be at 90%!

Next Thursday, I’m giving attendees and Live Stream viewers of IES an incredible update to my latest 45-year innovation cycle, which I recently discovered has an explosive impact every second turn.

Listen to my video now to get a few initial details on this… as well as on what some of our incredible speakers will be sharing with you next week.

See you at the Irrational Economic Summit next week.

Harry

Follow me on Twitter @HARRYDENTJR

The post Disruption Just Got Real [Video] appeared first on Economy and Markets.

October 18, 2018

Treasury Bonds Aren’t the Only Ones Spiking

I’ve been waiting for the recent spike in T-bonds in the U.S.

A similar spike occurred in the early 1930s crash. Ten-year yields first jumped from 4.5% to 5.5% in 1931 and then fell all the way down to 2% – to the lowest level ever until recent years.

Imagine locking in a near 5.5% interest rate for 10 years and then watching your bonds appreciate as rates fell! Talk about the fixed income trade of the century… like a bond orgasm!

Treasury bonds roughly doubled in total returns in the 1930s when everything else (except AAA corporates) was crashing – stocks, high yield bonds, real estate, and commodities.

As I showed my 5 Day Forecast readers on Monday, the best target is about 4.0% on the 10-year and 4.3% on the 30-year T-bond sometime into 2019.

But why this spike?

There are many reasons, foremost of which are: rising deficits from tax cuts, the Fed selling off its stock of bonds, foreign central banks selling as well to prop up their currencies as the dollar rises, and late-stage inflation from so much stimulus and now temporarily higher growth.

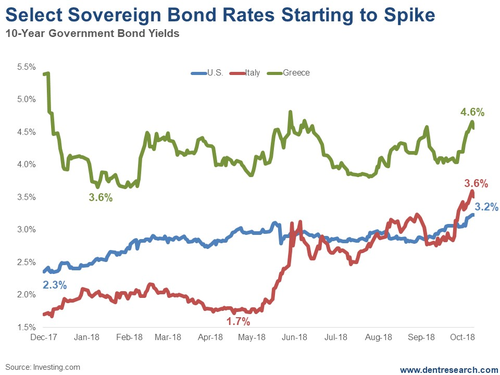

Yet its’s been Italy that has seen the biggest spike lately, for different reasons.

I’ve been beating on the table for the past few years that it’s insane that Italy’s 10-year bonds yielded less than the U.S. when it has much higher public debt and the highest level of non-performing loans in Europe outside of Greece.

The country is technically and clearly bankrupt.

But yielded less they did because Mario Draghi of the ECB (European Central Bank) has been buying European sovereign bonds aggressively, while the U.S. stopped doing that after 2014, eventually becoming bond sellers.

Well, that crazy Italian bond situation has finally changed.

Italy’s 10-year bond, at 3.60%, is finally higher than the U.S… yes, there is a God!

And unlike the U.S., it will NOT be the fixed income trade of the decade until yields go much higher and much longer. After all, they’re like the junk bonds of the sovereign sector.

In the last crisis, Greece was the basket case and its yields spiked up to 11.5% before the ECB bailouts and QE kicked the crisis-can down the road.

Well, now Greece AND Italy have caught up to that can again… with Portugal and Spain right behind… and Germany and France will be the ones to bear the brunt of bailing these countries out again.

U.S. 10-years are up 0.9% from the bottom of 2.3% in December. Greece is up 1.0% to 4.6% since January. Italy is up 1.9% from a massively undeserved 1.7% in April. Portugal and Spain are starting to spike as well.

Italy is leading the way higher as its right-wing faction, the League, is rising fast. It’s the anti-immigrant and anti-euro faction. Since April its polls have risen from 19.5% to 33.8%… and they’re still rising. The far left 5 Star has fallen from 32.7% to 28.5% and the middle Democratic party has fallen a bit from 19.5% to 17.1%.

This makes the bond markets nervous. They fear they won’t adhere to payments and/or austerity targets, and may well push to leave the euro at some point as the public sentiment continues to sour against the union (Italians always had the highest disapproval rating of the euro)…

So, don’t think this is the end of the bond spike for Italy or Greece or Portugal or Spain.

I expect Italy and Greece sovereign bonds to hit something like 15% rates in the next few years. Then they could be worth buying… maybe.

The good old U.S. Treasurys, like the dollar, will end up being the safe haven again when the shit hits the fan likely somewhere between late 2019 and 2022.

We’re monitoring this situation closely with an eye to recommending to our Boom & Bust subscribers that they buy them and AAA corporates on this spike in the months ahead , and then the lesser quality sovereigns and corporate bonds at the worst when stocks will also likely be bottoming.

That’s a few years from now.

First things first!

Harry

Follow me on Twitter @HARRYDENTJR

The post Treasury Bonds Aren’t the Only Ones Spiking appeared first on Economy and Markets.

October 17, 2018

Will the Fed Read the Data?

Things have changed.

What was well in the green yesterday was back in the red today… And the Dow Jones Industrial Average has already clawed back most of the more than 200 points it was down again in early Wednesday trading.

So, things are choppy.

That goes for yields, too. We’re still well above 3% on the 10-year U.S. Treasury note, and the long bond is also still just below near-term highs.

But yields have backed up a bit this week, as the market weighs the implications of tighter money, trade wars, and innumerable other factors.

Consider, too, the latest batch of economic data.

September retail sales were up just 0.1% against an expectation of 0.6%. To make matter worse, August’s already disappointing 0.1% rise was revised lower.

And sales were actually down 0.1% if you take out volatile components like autos and gas.

Consumer spending basically drives our economy. As it was, replacement demand created by Hurricane Florence probably prevented a stronger market reaction and a much more dramatic move lower for Treasury yields.

I’m actually pretty excited because the trading system I use for Treasury Profits Accelerator doesn’t care about “direction.” I couldn’t care less if the market goes up or down. I want it to move.

And, amid all this activity, we’re going to see some opportunities to profit .

The ’Flation and the Fed

I do have a pretty good idea about the cause of this recent drama, but let’s look at recent inflation data first…

The Consumer Price Index (CPI) was up 0.1% in September, but that was well short of a forecast 0.2% gain. Year over year, CPI was up 2.3%, easing back from a 2.7% rise in August.

More important, “core” prices – excluding volatile food and gas components – were also up 0.1% against an expectation of 0.2%. Core prices were up 2.2% year over year, below a 2.3% consensus forecast.

The Producer Price Index (PPI) followed up August’s 0.1% decline with an expectations-meeting 0.2% gain in September. “Core” wholesale prices were also up 0.2%, as expected.

So, what’s happening here?

Blame the Federal Reserve.

After keeping rates artificially low for the past 10 years, the Fed started ratcheting up the federal funds rate in December 2015. It’s also shedding assets from its balance sheet, reversing its “quantitative easing” (QE) stimulus experiment.

With QE, the Fed bought long-term assets to push long-term interest rates lower during and after the Global Financial Crisis of 2008-09. It also set its overnight lending rate to 0%.

The Fed is no longer reinvesting maturing assets; this is “quantitative tightening.” At the same time, it’s raising the federal funds rate.

Initially, the Treasury market didn’t react to the Fed’s “normalization” of monetary policy. But – after eight rate hikes, with plans for four more on the books – we’re finally starting to see a reaction.

We’ll see how long the Fed can maintain its course.

The housing market is clearly weakening. Employment seems strong, but wages still lag. Inflation hit the Fed’s 2% target but is slowing. The Trump tax cut helped prop up the economy and stimulate manufacturing, but those are probably temporary effects.

Here’s the bottom line: Higher rates will slow economic growth. It’s already happening in the housing market. Soon, they’ll cut into corporate profits.

That’s what has markets spooked.

So far, the Fed has given no indication it’ll change course.

That’s despite the fact that “normalization” could trigger a major collapse.

Lance

The post Will the Fed Read the Data? appeared first on Economy and Markets.